#Major Loan Providers in UAE

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

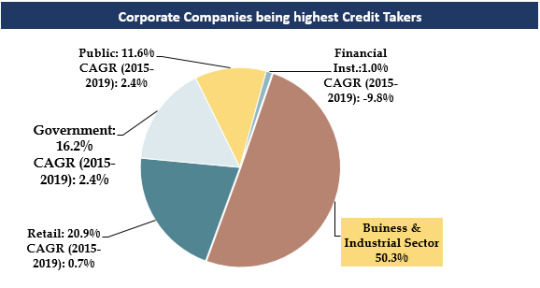

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Speaking of the UAE's increasing control in Egypt, this is also important:

UAE-based agribusiness Al Dahra and the Abu Dhabi Exports Office (ADEX) have signed a $500 million deal to supply Egypt with wheat, a statement said on Monday.

The five-year agreement, worth $100 million per year, will provide Egypt with imported milling wheat "at competitive prices".

Egypt, a major buyer of basic commodities, has been suffering a foreign currency crunch after the Ukraine war delivered a broad shock to its economy.

_Reuters, (August 14, 2023)

Where's the 500 million dollars worth of wheat that we're taking a loan to buy from the UAE (evil) coming from? Egyptian land, we're buying Egyptian wheat from Emiratis.

Emirati expansion into Egyptian wheat

In 2014, Al Dahra announced that it would expand wheat cultivation in Egypt, with the aim of producing 300,000 tons—or 10% of the local supply at the time—by 2016, adding that all the company’s wheat would be sold on the Egyptian market. Al Dahra, along with the Emirati company Jenaan, explained at the time that they were changing their strategy and moving into wheat instead of fodder based on the advice of the Emirati government, in order to meet Egypt’s local needs.

Borrowing in order to buy Egyptian-grown wheat raises questions about the nature of foreign and Gulf agricultural investments in Egypt, the terms of contracts, and how to achieve justice and sustainability in light of such investments.

[...]

Some of the largest Saudi and Emirati agricultural land holdings are concentrated in Egypt and Sudan, due to their geographical proximity and the close political relations between these countries. The host country bears the costs of infrastructure such as irrigation canals and industrial works, while investors assume the expenses of land reclamation.

Toshka and East Owainat offer vast tracts of land for Gulf acquisition, and their agricultural investments and activities in these areas share several common features, including:

• They are capital intensive, rather than labor-intensive projects:

By some estimates, Al Dahra and Jenaan employ just 200 people—Egyptians and foreigners—at their sites in Egypt, a far smaller labor force than is required to cultivate similar areas in the Nile Valley and Delta. This figure also falls far short of one of the most important stated goals of the Toshka project, which is to create 450,000 jobs annually.

• They are water intensive:

These firms have not complied with the terms of their contracts that limit their cultivation of water-intensive crops such as alfalfa to just 5% of total crops. In fact, such crops make up some 25% of their total cultivation.

• Their holdings were obtained as part of questionable land deals:

The Central Auditing Organization said in a 2014 report that land was sold to Al Dahra for EGP50 per feddan in 2005, at a time when the going market price was EGP11,000. A lawsuit was filed challenging the deal in 2011, and the Egyptian party won a preliminary ruling in its favor, but the entire case was subsequently closed due to the failure to complete the investigation, and Al Dahra resumed operations.

Given the lack of transparency and available data, there is insufficient evidence showing that this type of Gulf acquisition brings a mutual benefit to both parties.

AUC's Alternative Policy Solutions (August 13, 2023)

I recommend reading the whole article.

Also, ..

According to three traders who spoke to Reuters, Egypt is currently in discussions with an Abu Dhabi-based bank regarding a loan facility that would be used to finance wheat purchases from Kazakhstan.

[...]

The negotiations for the loan deal with Kazakhstan are still in the early stages, and the discussions involve determining the price, quantities of wheat, and the loan’s value. The source familiar with the talks did not disclose the name of the Abu Dhabi-based bank involved. Traders learned about the potential deal during a wheat tender conducted by Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC).

Middle East Economy (September 22, 23)

6 notes

·

View notes

Text

Modus operandi unraveled: How over Rs 600 crore were siphoned out of country

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

Delhi Police's Special Cell registered an FIR in October 2021 regarding a syndicate that channeled money obtained through various criminal activities out of the country. This included Proceeds of Crime ( POC) obtained through illegal Chinese loan apps, illegal online gamings and also illegal bettings.

The wide network of this syndicate can be gauged from the fact that the case was first taken over by Delhi Police in October 2021. It was later transferred to the Enforcement Directorate ( ED) that is probing the matter and recently made an arrest on July 13.

From the documents that have been accessed by Republic Digital, it is mentioned categorically how accused persons, the fraudulent companies created by them on the pretext of forged documents were involved in opening of bank accounts both within and outside country and have taken out funds to the tune of Rs 338 crore.

To begin with, fake identities like Aadhaar, PAN cards and Voter ID cards were used for creating shell firms and opening multiple bank accounts.

In continuation to this, shell firms were also opened in Hong Kong, China, UAE, Singapore and Malaysia. The money that was deposited in Indian bank accounts was then successfully routed through RTGS/ NEFT.

The probe in this case by the agencies led them to get hold of Ashish Kumar Verma. It was found that Ashish along with the accomplices were able to create 18 shell firms and multiple accounts not only in private but also public banks.

Investigations have also revealed that Ashish is one among many in this huge syndicate that was successfully taking out hundreds of crores from the country.

As per law enforcement officials the other major characters involved in this crime of money laundering included Praveen Kumar based in Dubai who was involved in creating fake firms abroad, and Vipin Batra who used to be in touch with Ashish and gave him directions on how the modus operandi had to be implemented. Vipin Batra was recently arrested by the ED on July 13. He is being interrogated.

The mastermind of this syndicate is said to be Pawan Thakur, a Dubai-based bookie and an international Hawala operator. As per law enforcement officials, he is the mastermind in incorporating entities within India as well in foreign countries for remitting funds from India and receiving such funds in foreign bank accounts.

Thakur used to provide forged documents to Vipin Batra who in turn used to send these documents to Ashish Kumar Verma for executing outward remittances. Thakur used to incorporate entities in foreign countries on the backing of passports of several Indian individuals.

The modus operandi proved to be so successful that the syndicate acquired foreign exchange to the tune of Rs 271 crore and successfully sent this amount to the foreign bank account of shell companies abroad in the garb of purported imports of services giving false declarations in turn to banks.

In this, 90 percent of the amount was sent to Dubai while 10 percent was sent to Singapore.

It did not just end here. During the investigations, it was further found that Pawan Thakur was working on a similar modus operandi and in connivance with people that have been identified as Rohit Sharma, Jatin Chopra, Anmol Srivastava, Deepak Kaushal and others for illegal outward remittances.

The outward remittances were done illegally in the garb of third party payments against import of garments from Bangladesh.

From this, funds to the tune of Rs 338 crore were channeled out to Hong Kong and Singapore. Some of the fake firms that were created are Perfect Solutions, Omega Technologies, RP investment and consultancy, Flappose Trade PVT ltd, Uniwide innovations.

Fake directors of these firms were created. Bank accounts of office boys were created by giving them Rs 15,000. On their names, SIM cards used to be bought from where banking transactions used to be done.

With some arrests made in this case so far, investigations are still on to get hold of major masterminds in this Hawala racket that has resulted in more than Rs 608 crore being siphoned off the country.

1 note

·

View note

Text

Unveiling Elite Currency Solutions: Secure, Clean, and 100% Satisfaction Guaranteed

In the dynamic landscape of financial services, SSD Overlook Chemical Development stands out as a beacon of excellence, offering cutting-edge solutions for currency-related challenges. With the introduction of the High-Pressure Automatic Currency Cleaning Machine, 2024 Limited Edition, we are proud to present an unparalleled opportunity for large-scale projects. Our Financial Experts and technicians provide a range of services, including the development of currency negatives and the handling and processing of semi-finished inorganic reagents and compounds.

High-Tech Currency Cleaning

Our state-of-the-art currency cleaning machine ensures the restoration of colored or defaced currencies on a percentage basis. At SSD Overlook Chemical Development, we specialize in the production of oxidizers and activation powders, essential for decoding defaced notes, black dollars, and various currencies. Contact us today to enjoy an elite professional experience, and if our terms and conditions align, we are ready to collaborate on a percentage basis.

Exclusive New Year Deals

As we step into the new year, SSD Overlook Chemical Development invites you to seize the opportunity for a 100% satisfaction guarantee. Our services extend to the supply of best-grade AAA money, acceptable and usable in banks, ATM machines, shopping malls, supermarkets, and airports. Operating in various locations such as Dubai, UAE, Malaysia, Indonesia, and more, we ensure face-to-face dealings and discreet shipping to any country through diplomatic means.

Revolutionary Cleaning Solutions

SSD Overlook Chemical Development takes pride in its revolutionary cleaning solutions, offering activation powder and SSD chemical solutions for the cleaning of black notes. Our highly qualified technicians employ 3D laser machines to clean blackened, tainted, and defaced bank notes. The purity of our chemicals guarantees optimal results, covering major currencies like Euro, USD, and GBP. Additionally, we extend our services to providing loans and supplying Grade AAA+ notes globally.

Face-to-Face Business Excellence

For those seeking the best-grade AAA money, SSD Overlook Chemical Development presents a golden opportunity. Our money is not only usable in banks, ATMs, shopping malls, and supermarkets but also undergoes meticulous scrutiny before any transaction. With a global production base in Dubai, Cambodia, Thailand, Malaysia, and New Zealand, we ensure our money carries all the necessary security features. Face-to-face dealings are preferred, and we collaborate with top banks worldwide to guarantee the authenticity of our currency.

In conclusion, SSD Overlook Chemical Development emerges as a trailblazer in the realm of currency solutions, offering secure, clean, and 100% satisfaction-guaranteed services. Whether it's restoring defaced currencies or providing the best-grade AAA money, our commitment to excellence is unwavering. Contact us today to experience the pinnacle of financial innovation and reliability.

For more information:

Email: [email protected]

Business: https://overlook-ssd-chemical-development.business.site/

NB. WE ARE ALL IN A BUSINESS WIN-WIN, NO NEED FOR PEOPLE TO CONTACT TO ASK FOR HELP

#currencycleaning#financialsolutions#currencyrestoration#AAAgrademoney#cleaningsolutions#eliteexperience#ssdchemicalsolution

0 notes

Text

Ensuring Financial Stability: The Importance of Regular Accounting for Your Business

Introduction

Maintaining the financial health of your business is essential for ensuring its long-term success. Regular accounting practices play a crucial role in this by providing timely insights and helping you stay proactive. This article will discuss the significance of regular accounting, highlighting how it supports your business in various aspects, from spotting early warning signs to facilitating growth opportunities. According to a study by the Association of Chartered Certified Accountants (ACCA), businesses that regularly monitor their financial health are 25% less likely to face major financial crises. Elevate your business with top-notch accounting services in UAE. Find out how regular accounting can ensure financial stability and success for your company.

Enabling Informed Decision-Making

Accurate and current financial data are essential for making well-informed decisions. Whether you are considering a new investment, expansion, or hiring, reliable financial information ensures that your choices align with your business’s financial status and long-term goals.

Identifying Early Warning Signs

Regular accounting provides a real-time overview of your business’s financial health, enabling you to detect potential issues early on. By identifying discrepancies and challenges promptly, you can take corrective actions before they escalate into significant problems, safeguarding your business’s stability.

Managing Cash Flow Effectively

Cash flow is the lifeblood of any business. Regular accounting offers a clear understanding of your cash inflows and outflows, which is crucial for managing working capital. This knowledge helps you pay bills on time, cover expenses, and seize investment opportunities, ensuring your business remains financially sound.

Ensuring Tax Compliance

Keeping up with taxes is vital to avoid penalties and legal issues. Regular accounting helps you accurately track income, expenses, and deductions, making tax preparation seamless. Organized financial records also facilitate easy documentation in case of an audit, ensuring you stay compliant with tax regulations. Understanding Dubai Tax, Corporate Tax, and VAT in the UAE is critical for maintaining legal compliance and optimizing tax liabilities.

Facilitating Budgeting and Planning

Budgeting and financial planning are critical for achieving your business goals. Regular accounting provides insights into your historical financial performance, helping you create realistic budgets and forecasts. This proactive approach allows you to set achievable targets, allocate resources effectively, and adjust your strategies as needed.

Uncovering Growth Opportunities

Beyond managing your current financial situation, regular accounting helps uncover potential growth opportunities. By analyzing financial data, you can identify trends, profitable areas, and underserved markets. This information empowers you to capitalize on opportunities that align with your business’s strengths and objectives.

Building Investor and Creditor Confidence

Maintaining accurate financial records demonstrates transparency and professionalism, which is essential if you are seeking investors or loans. Regular accounting practices enhance your credibility and increase investor and creditor confidence in your business’s financial stability.

"Regular accounting is crucial for spotting early financial issues, making informed decisions, and ensuring tax compliance. It paves the way for sustainable growth and financial stability. Prioritize your business's financial health with consistent accounting practices."

Promoting Employee Accountability

Accurate financial records are crucial for tracking expenses related to employee salaries, benefits, and other costs. Regular accounting ensures fair and accurate compensation, fostering trust and accountability within your organization.

Adapting to Changing Circumstances

Business environments are dynamic, and circumstances can change rapidly. Regular accounting equips you with the information needed to adapt to these changes. Whether responding to shifts in customer behavior or unexpected economic challenges, you can make agile decisions with confidence.

Paving the Way for Sustainable Growth

Ultimately, regular accounting is a pathway to sustainable growth. It’s not just about balancing books; it’s about understanding your business’s financial intricacies and using that knowledge to drive strategic decisions. Your accounting practices should evolve as your business evolves, providing a clear roadmap to achieve your financial goals.

Conclusion

Regular accounting checkups are a cornerstone of a healthy, thriving business. By monitoring your financial health, you can spot potential issues, make informed decisions, manage cash flow, comply with taxes, and strategically plan for growth. Just as you prioritize your physical health with regular checkups, prioritize your business’s financial health with consistent and accurate accounting practices. It’s an investment that pays dividends in the form of stability, profitability, and long-term success.

Aurega Accounting and Tax Advisory boasts extensive expertise in UAE tax laws and provides exceptional support in maintaining your accounting and ensuring compliance with tax regulations. Our team specializes in Corporate Tax and VAT in UAE, delivering comprehensive accounting and bookkeeping services in Dubai. For personalized assistance, contact Aurega at +971 56 343 6855 or via email at [email protected].

0 notes

Text

Why Summer is the Best Time for Property Inspections and Maintenance

As a property owner or manager, the summer months are perfect for conducting property inspections dubai and scheduling maintenance. This season provides the ideal conditions to ensure your assets are in top shape before the rainy or cold weather sets in. Here are several reasons why summer is the best time to inspect and maintain your properties:

1. Ensure Tenants Follow Lease Terms

Summer is a popular time for people to travel or move. This makes it easier for property managers to visit and inspect occupied properties. Inspections ensure tenants adhere to lease terms and help detect any unauthorized activities, such as keeping pets or subleasing without consent. Regular inspections also allow you to assess how well tenants are maintaining the property. While normal wear and tear is expected, excessive damage like holes in walls or stained floors might indicate misuse. Based on your findings and local regulations, you can decide whether to renew a lease or evict a tenant.

2. Detect Potential Issues Early

Timely identification of issues can prevent more costly repairs later. For instance, fixing a small leak is much cheaper than dealing with the mold or structural damage it could cause. Early detection also reduces the likelihood of emergency repairs, which can be expensive and require significant resources. By spotting issues early, you can find the right specialist, negotiate prices, and plan for maintenance, avoiding the higher costs of urgent repairs.

3. Plan Maintenance Tasks Efficiently

Summer’s warm weather is ideal for various maintenance activities, such as painting, curing concrete, and repairing pipes. Outdoor appliances, like air conditioning units, also benefit from summer maintenance. Regular checkups and maintenance during this season ensure these appliances remain in good condition for longer, preventing deterioration from exposure to the elements.

4. Adhere to Local Laws and Codes

In many locations, property inspection are legally required, especially when applying for a mortgage loan. For landlords in the UAE, keeping properties in good condition is essential. Hiring a reputable inspector helps ensure the property remains habitable and compliant with local laws.

5. Ensure Appliances Work Efficiently

In hot climates like the UAE, air conditioning units are vital. Regular inspections and cleanings before summer ensure your AC runs efficiently, even during heatwaves. This not only improves the unit’s lifespan but also enhances its performance, keeping your space cool and comfortable.

6. Lower Power Bills

Outdoor appliances, such as AC units, can accumulate dust and debris, making them work harder and less efficiently. Regular maintenance helps keep these appliances clean and efficient, reducing your monthly electricity bills by preventing them from overworking.

7. Maintenance is Cost-Effective

Routine maintenance is far cheaper than replacing appliances or dealing with major repairs. Experts suggest that regular checkups can reduce the chance of major issues by 50%. Although property inspection might seem like an unnecessary expense, they are a cost-effective way to prolong the life of your property and appliances, avoiding more significant expenses in the future.

For additional questions or to schedule a property inspection, contact GTA INSPECTORS . Our team is ready to assist with all your inspection needs.

0 notes

Text

Elevate Your Lifestyle: Why Now is the Best Time to Buy Villas in Dubai

Dubai, a city synonymous with luxury and innovation, continues to captivate the global real estate market. If you've ever dreamed of owning a villa in this vibrant city, now is the perfect time to make that dream a reality. This comprehensive guide will walk you through the reasons why buying a villa in Dubai today can elevate your lifestyle and provide a lucrative investment opportunity.

1. The Allure of Dubai’s Real Estate Market

Dubai's real estate market has shown remarkable resilience and growth over the years. The city's strategic location, world-class infrastructure, and cosmopolitan lifestyle make it a prime destination for real estate investment.

Market Stability: Despite global economic fluctuations, Dubai's real estate market has remained stable, attracting investors from around the world.

High ROI: Villas in Dubai offer high rental yields and potential for capital appreciation, making them an attractive investment.

Explore more about the stability and growth of the market at Home Loans in Dubai.

2. Luxurious Living at Its Best

Villas in Dubai epitomize luxury living with their exquisite designs, state-of-the-art amenities, and prime locations.

Exclusive Features: Enjoy private pools, lush gardens, spacious living areas, and panoramic views.

Prestigious Locations: Villas are often situated in prestigious communities like Palm Jumeirah, Emirates Hills, and Dubai Hills Estate.

Discover the finest villas available at Buy House in Dubai.

3. Favorable Market Conditions

The current market conditions are highly favorable for buyers, with various incentives and flexible payment plans offered by developers.

Attractive Prices: Prices for villas have stabilized, offering excellent value for money.

Flexible Payment Plans: Developers are offering flexible payment plans and post-handover payment schemes to facilitate the buying process.

Learn more about these offers at home mortgage uae.

4. Tax-Free Investment

Dubai's tax-free regime is one of the major attractions for property investors. There are no property taxes, income taxes, or capital gains taxes, which significantly enhance the investment returns.

No Property Taxes: Enjoy full ownership without the burden of annual property taxes.

Tax-Free Income: Any rental income generated from your villa is completely tax-free.

For detailed advice on tax-free investments, visit Rent Your Property in Dubai.

5. High-Quality Infrastructure and Amenities

Dubai is renowned for its world-class infrastructure, offering residents unparalleled convenience and lifestyle benefits.

Connectivity: Enjoy excellent connectivity with major highways, metro lines, and international airports.

Amenities: Villas are often close to top schools, healthcare facilities, shopping malls, and entertainment hubs.

For more insights on the best locations to buy villas, check out Sell Your Property.

6. Safety and Security

Dubai is one of the safest cities in the world, with a low crime rate and a high standard of living.

Safe Communities: Gated villa communities offer 24/7 security and privacy.

High Living Standards: Enjoy a high quality of life with clean streets, green spaces, and well-maintained public areas.

7. Diverse Lifestyle Options

Whether you prefer the hustle and bustle of the city or the tranquility of suburban life, Dubai offers diverse lifestyle options to suit your preferences.

Urban Living: Choose villas in the heart of the city for easy access to business districts and cultural attractions.

Suburban Retreats: Opt for villas in serene suburban areas for a peaceful, family-friendly environment.

Conclusion

Buying a villa in Dubai is not just about acquiring property; it's about investing in a lifestyle of luxury, convenience, and high returns. With favorable market conditions, attractive prices, and a tax-free investment environment, now is the perfect time to elevate your lifestyle and secure your dream villa in Dubai.

For more information and to explore available options, visit Home Loans in Dubai.

0 notes

Text

One Point One Solutions Limited Secures Major Client Win with Leading Indian NBFC

One Point One Solutions Limited, a prominent provider of technology-enabled business process management (BPM) services, has announced an exciting new partnership with one of India's leading non-banking financial companies (NBFC). This collaboration underscores One Point One Solutions' growing influence and commitment to delivering top-notch, customer-centric solutions.

New Partnership Details

The new client, a diversified financial services firm, focuses on product innovation and cutting-edge technology to meet the evolving needs of its customers. This NBFC leverages technology and data science to make lending processes quick, simple, and hassle-free. Its broad portfolio includes affordable home loans, personal loans, education loans, and SME business loans.

One Point One Solutions will support the NBFC by providing comprehensive customer care solutions. The services will include lead generation, expert guidance, efficient process handling, and product promotions. This partnership aims to streamline the NBFC’s client support operations and enhance its ability to deliver innovative financial products.

Scope of the Partnership

The collaboration is set to expand significantly, with plans to scale operations to accommodate up to 300 seats in the coming months. Additionally, the NBFC intends to incorporate collection processes into the scope of services offered by One Point One Solutions. This expansion highlights the mutual commitment to improving operational efficiency and customer satisfaction in the financial services sector.

One Point One Solutions is eager to embark on this partnership, anticipating new milestones in business process management and customer care excellence.

About One Point One Solutions Limited

Established in 2006, One Point One Solutions Limited is a full-stack provider in BPO, KPO, IT Services, Technology & Transformation, and Analytics. The company offers comprehensive solutions in technology, accounting, skill development, and analysis. In 2024, One Point One Solutions acquired a major stake in ITCube Solutions Pvt Ltd., an IT + BPM/KPO services company headquartered in Pune and Cincinnati, Ohio. ITCube Solutions, with over two decades of experience, serves clients across various sectors and has a robust presence in the USA, UK, Netherlands, Germany, Kuwait, Oman, UAE, Qatar, India, Singapore, and Australia.

One Point One Solutions serves a diverse range of industries including Telecom & Broadcasting, Retail and E-commerce, Consumer Durables & FMCG, Banking and Finance, Travel & Hospitality, Insurance & Healthcare. The company operates six service centers located in Navi Mumbai, Gurgaon, Chennai, Bangalore, Indore, and Pune, with a capacity of over 5,600 seats per shift. This extensive infrastructure enables the company to handle a significant volume of clients efficiently.

The company’s services encompass Originations, Customer Services, Sales, Collections, Tech Helpdesk, Back Office, Accounting, Litigation, Recruitment, Design, Development, and Intelligence. Under the leadership of founder Akshay Chhabra, One Point One Solutions focuses on technology-driven innovation to build efficiencies and position itself as a leader in the BPM space.

Global Presence and Growth

One Point One Solutions has also expanded into global markets with its wholly-owned subsidiary, ONE POINT ONE USA INC, based in Delaware, USA. Since its listing in 2017, the company has built a robust portfolio of over 50 clients, including prominent players across various sectors.

0 notes

Text

Top Neighborhoods to Consider When Buying Residential Properties in Dubai

Dubai offers a diverse range of neighborhoods, each with its unique charm and amenities. Choosing the right neighborhood is crucial when buying residential properties. This guide highlights the top neighborhoods to consider when buying residential properties in Dubai.

For more information on home loans, visit Home Loan UAE.

Downtown Dubai

Overview: Known as the heart of Dubai, Downtown Dubai is home to iconic landmarks such as the Burj Khalifa, Dubai Mall, and Dubai Fountain. The area offers a mix of luxury apartments and penthouses. Downtown Dubai is a vibrant urban hub that attracts professionals, families, and tourists alike.

Amenities: Residents enjoy access to world-class shopping, dining, and entertainment options. The neighborhood also offers excellent public transportation links and proximity to major business hubs. The Dubai Opera, Souk Al Bahar, and numerous five-star hotels add to the area's appeal.

Lifestyle: Downtown Dubai is ideal for those who enjoy a vibrant urban lifestyle with easy access to cultural and recreational activities. The community hosts events such as the Dubai Shopping Festival and New Year's Eve celebrations, providing residents with a dynamic living experience.

For property purchase options, explore Buy Apartments in Dubai.

Dubai Marina

Overview: Dubai Marina is a waterfront community known for its stunning skyscrapers and marina views. The area offers a range of apartments, from affordable options to high-end luxury units. Dubai Marina is one of the most sought-after residential destinations in the city.

Amenities: The neighborhood features a picturesque promenade, numerous dining and retail options, and a variety of recreational facilities, including yacht clubs and fitness centers. The Dubai Marina Mall, JBR Beach, and Bluewaters Island are popular attractions.

Lifestyle: Dubai Marina is perfect for those who love waterfront living and a lively social scene. The area is known for its vibrant nightlife, with numerous bars, clubs, and restaurants offering diverse entertainment options.

For mortgage services, consider Mortgage Broker UAE.

Palm Jumeirah

Overview: Palm Jumeirah is an iconic man-made island offering luxurious villas, townhouses, and apartments. The area is known for its exclusivity and stunning views of the Arabian Gulf. Palm Jumeirah is a symbol of Dubai's ambition and innovation.

Amenities: Residents enjoy access to private beaches, high-end resorts, fine dining restaurants, and upscale retail outlets. The island also features world-class leisure and entertainment facilities, including Atlantis The Palm and The Pointe.

Lifestyle: Palm Jumeirah is ideal for those seeking a luxurious and private lifestyle with resort-style living. The community offers a serene environment with easy access to the city's bustling areas.

For rental property management, visit Apartments For Rent in Dubai.

Arabian Ranches

Overview: Arabian Ranches is a family-friendly community offering spacious villas and townhouses. The area is known for its tranquil environment and green spaces. Arabian Ranches is one of Dubai's most popular residential communities for families.

Amenities: The neighborhood features parks, playgrounds, schools, and a golf course. Residents also have access to community centers with swimming pools, fitness facilities, and retail outlets. The Arabian Ranches Golf Club and Dubai Polo & Equestrian Club are notable attractions.

Lifestyle: Arabian Ranches is perfect for families and those who prefer a suburban lifestyle with easy access to essential amenities. The community fosters a sense of belonging and offers a peaceful retreat from the city's hustle and bustle.

For property sales, visit Sell Your Property in Dubai.

Jumeirah Village Circle (JVC)

Overview: Jumeirah Village Circle (JVC) is a rapidly growing community offering a mix of villas, townhouses, and apartments. The area is known for its affordability and family-friendly environment. JVC is a popular choice for both investors and end-users.

Amenities: JVC features parks, schools, retail outlets, and recreational facilities. The neighborhood also offers easy access to major highways and public transportation links. Nakheel Mall, Circle Mall, and numerous supermarkets and restaurants cater to residents' needs.

Lifestyle: JVC is ideal for families and individuals seeking affordable housing options in a well-planned community. The community promotes a healthy and active lifestyle with its numerous parks and sports facilities.

Real-Life Success Story

Consider the case of Sarah, who successfully bought an apartment in Dubai Marina. Sarah chose the neighborhood for its vibrant lifestyle and waterfront views. By researching the area and securing a mortgage through a reputable broker, she found her dream home and enjoys the community's amenities and social scene. Sarah's experience demonstrates the importance of selecting a neighborhood that aligns with your lifestyle and investment goals.

Future Trends in Dubai Neighborhoods

Sustainable Communities: There is a growing demand for eco-friendly and sustainable neighborhoods. Developments that prioritize green spaces, energy efficiency, and sustainable practices are becoming more popular. Examples include Sustainable City and Dubai Hills Estate.

Smart Cities: The adoption of smart city technology is on the rise. Neighborhoods equipped with smart infrastructure, including smart grids, waste management systems, and digital connectivity, are attracting buyers. Smart Dubai is an initiative that aims to make Dubai the world's smartest and happiest city.

Integrated Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience. Projects like City Walk and Dubai Creek Harbour exemplify this trend.

Conclusion

Choosing the right neighborhood is essential when buying residential properties in Dubai. Downtown Dubai, Dubai Marina, Palm Jumeirah, Arabian Ranches, and Jumeirah Village Circle are some of the top neighborhoods to consider. Each offers unique amenities and lifestyles to suit different preferences and needs. For more resources and expert advice, visit Home Loan UAE.

1 note

·

View note

Text

‘Lucrative’ Trap: Egypt Lured By Billion-Dollar IMF Deals! Cairo Is Seeking To Secure Large Foreign Loans In An Attempt To Combat Its Economic Crisis

A member of the pubic wears a mask on a Cairo streets on June 4, 2020 in Cairo, Egypt. © Fadel Dawod/Getty Images

The major economic and currency crisis that Egypt has been going through in recent years has forced the country’s authorities to take measures that may result in even greater losses.

Egypt’s recent agreements with world powers and global financial institutions show that Cairo aims to secure multibillion-dollar foreign loans. In order to obtain the loans, the government plans to reduce the foreign currency deficit and meet the conditions imposed by the International Monetary Fund.

Resorts And Migrants

At the end of March 2024, Egyptian Prime Minister Mostafa Madbouly announced that the IMF had approved Egypt’s loan program and expanded it to $8 billion. He also noted that in early May, Egypt would receive the second installment of funds, worth $20 billion, from the Ras Al-Hekma deal with the UAE, aimed towards the development of the Ras Al-Hekma resort on the Mediterranean Sea.

Cairo has already received the first $5 billion from the Ras Al-Hekma deal. Egypt wishes to conclude a similar agreement with Saudi investors in order to develop elite areas on the Red Sea coast near Sharm El Sheikh, including the Ras Ghamila resort. Madbouly said the government is in favor of increasing local and particularly foreign investments in Egypt, since this would help the country resolve the dollar crisis.

Egyptian Minister of Supply and Internal Trade distribute sugar, oil, rice and other food products as part of measures to prevent economic crisis in Faiyum, Egypt on November 3, 2016. © Stringer/Anadolu Agency/Getty Images

The EU intends to provide Egypt with an assistance package worth €7.4 billion ($8 billion) to support the economy. International experts directly tie Egypt’s negotiations with the EU and the IMF to the war in Gaza and the problem of illegal migration.

In November 2023, IMF Managing Director Kristalina Georgieva said the organization was seriously considering expanding Egypt’s $3 billion loan program in light of economic difficulties related to the war in Gaza. The head of the Communications Department at the IMF, Julie Kozack, also stated that “comprehensive support” must be provided to Cairo so it can cope with the influx of refugees from Gaza. EU loans are largely related to immigration pressure caused by the armed conflicts in Palestine and Sudan.

Chicken Instead of Lamb

A major financial crisis broke out in Egypt in early 2023, forcing the government and the Central Bank to devalue the Egyptian pound. Since the start of the crisis, which continues to this day, the country has faced an increasing dollar deficit and debt burden as a result of growing external debt service payments and a lack of measures to strengthen foreign exchange reserves. The situation is complicated by a chronic shortage of food and medicine, the closure of enterprises, unemployment, and stagnating productivity.

Since the beginning of 2022, as a result of the government’s plan to devalue the national currency and switch to a floating exchange rate, the Egyptian pound has lost about two-thirds of its value. Currently, Egypt’s pound remains stable at about 49.5 per dollar, but this has not prevented prices for essential goods from rising.

Food shortages force ordinary Egyptians to stand in lines for hours just to get basic products like sugar, meat, and so on. Inflation has severely affected the majority of the population. Beef has become too expensive for the average Egyptian, and chicken is now considered a delicacy.

At the end of 2022, due to the rapidly rising prices, the Egyptian authorities advised people to replace meat – which has become too costly for the average buyer – with chicken feet. Egypt’s National Nutrition Institute listed the benefits of chicken feet, and noted that they contain protein, vitamins, and minerals necessary for the restoration of skin tissues, muscle growth, and so on. This ‘propaganda’ quickly spread online and sparked controversy in Egypt.

About six months later, on the eve of Eid al-Adha, or the Feast of Sacrifice, a professor of comparative law at Egypt’s Al-Azhar University, Saad al-Din al-Hilali, encouraged the country to “promote the culture of sacrificing birds” instead of the traditional young ram or bull, which most Egyptians could no longer afford. Since the Feast of Sacrifice is one of the main Muslim holidays, many Egyptians found such statements humiliating.

Egypt’s total external debt has doubled in the past ten years. At the end of the first quarter of 2023, it amounted to about $165.4 billion. This is equivalent to 40.3% of the country’s GDP, which is less than the 50% barrier set by the IMF. Dollar debt accounts for more than two-thirds of Egypt’s obligations to creditors. Based on official data, the total annual volume of Egypt’s external debt, including installments and interest, will amount to a record-high $42.3 billion next year.

Long Relations With The IMF

Egypt is currently the second largest debtor to the IMF after Argentina, but things have not always been like this. Egypt joined the IMF in December 1945, and its share in the fund is about $1.5 billion. In May 1962, Cairo signed the first agreement with the IMF to obtain a loan that would help it attain economic stability. However, the negotiations were paused, and the government did not resume them until the second half of the 1970s.

Egypt does not have a long history of obtaining foreign loans. The IMF provided the first loan to Egypt in 1977-78, during the presidency of Anwar Sadat. The $186 million loan was supposed to solve the problem with external payments and inflation, which approached 8.6%. The decision was motivated by various factors and problems which the Egyptian economy faced after the 1973 Yom Kippur War.

Anwar El-Sadat © Bettmann/Contributor/Getty Images

In 1991-93, under then-President Hosni Mubarak, Egypt again borrowed about $375 million to cover the trade deficit. As a result of this agreement, 50% of Cairo’s debt to the Paris Club countries (an informal intergovernmental organization of major creditor countries) was canceled.

After 1993, Egypt did not receive any loans from the IMF for a long time, and the fund’s role was limited to consultations and technical assistance. From 2011 to 2013, Cairo requested a loan from the IMF three times. Finally, the $4.7 billion deal was almost approved, but then-President Mohamed Morsi refused to implement many of the announced reforms, and the negotiations were suspended.

In 2016, Egypt adopted a three-year economic reform program after receiving a $12 billion loan from the IMF. The financing was provided in six tranches over three years. Egypt received another $2.77 billion in 2020 as urgent assistance to overcome the consequences of the Covid-19 pandemic.

Since 2016, the Egyptian government has carried out several reforms – it transitioned to a floating exchange rate, adjusted public finances to reduce public debt, reformed energy subsidies and adjusted energy prices, reviewed social spending, and implemented measures to strengthen the business climate, attract investments, and increase employment opportunities.

Hosni Mubarak © Diana Walker/Getty Images

In 2021, Egypt received another loan, worth 5.4 billion, to help correct the balance of payments deficit. In 2022, Egypt reached an agreement with the IMF for an additional $3 billion to help with the foreign currency shortage crisis. This loan was supposed to be provided in nine tranches over four years, but so far, Cairo has received only the first tranche worth $347 million. The IMF says that it will provide the other installments after the necessary procedures and checks.

On March 6, 2024, the IMF agreed to expand this loan from $3 billion to $8 billion, provided that Egypt implements a set of economic reforms, such as transitioning to a floating exchange rate, reducing spending on infrastructure projects, and expanding the rights and opportunities of the private sector. Prior to this agreement, the Egyptian Central Bank decided to raise the interest rate by 600 basis points, to record levels.

Where Did The Foreign Currency Go?

In December 2023, several Arab media outlets posed the natural question: What happened to Egypt’s foreign exchange earnings which amounted to $100 billion per year? These earnings would be enough to cover Egypt’s financial obligations, such as import fees and external debt.

According to Al Arabiya, Egypt’s main sources of foreign exchange income are exports (about $45 billion per year), remittances ($32 billion), tourism ($11 billion), Suez Canal transit fees ($7.9 billion), and foreign direct investment ($8.9 billion).

However, sources in Egypt’s banking sector say that the country’s foreign exchange earnings do not reach banking structures due to the existence of a parallel market for foreign exchange where exchange rates significantly differ from official ones. Also, many Egyptians open accounts and businesses abroad and transfer foreign funds there. Workers sell dollars to brokers in parallel markets in order to better provide for their families in Egypt. On top of that, Egyptian importers prefer to keep their money in foreign banks.

The major trade deficit forces Egypt to take unpopular measures to fill the shortage of foreign currency. For example, Egyptians who live abroad and want to settle the issue with their conscription status should pay a minimum of $5,000. A special dollar retirement plan has also been developed for Egyptians who work abroad. Moreover, state-owned banks have started selling high-interest dollar savings certificates.

However, the most scandalous measure was the idea to give out residence permits or even citizenship in exchange for foreign currency. On March 8, 2023, the government allowed external investors to acquire Egyptian citizenship for a non-refundable sum of $250,000, or in exchange for buying Egyptian real estate worth at least $300,000.

Luxury By The United Arab Emirates

In February 2024, it was announced that the Abu Dhabi Development Holding Company PJSC (branded ADQ) intends to invest $35 billion in a large-scale real estate development project on Egypt’s Mediterranean coast. This step is directly related to the IMF loan, since it can provide the country with the foreign currency needed to obtain new financing from the IMF. According to the plan, ADQ will build a tourist and financial center in the Ras al-Hekma area, spanning 170km.

Visualization of Ras Al-Hekma Development Plans. © Egyptian Ministry of Housing

“The significant investment marks a pivotal step towards establishing Ras El-Hekma as a leading first-of-its-kind Mediterranean holiday destination, financial centre, and free zone equipped with world-class infrastructure to strengthen Egypt’s economic and tourism growth potential,” ADQ said in a press release.

The new and ambitious project, which looks more like the sale of territory to the UAE, sparked controversy, particularly among ordinary Egyptians. Over the past decade, the Egyptian government has spent huge amounts of money on luxury infrastructure projects, including on the New Administrative Capital, which has so far cost the country over $58 billion.

However, just a few days after the Ras al-Hekma project was announced, it turned out that Cairo and Riyadh have been holding informal negotiations on the development of the Ras Ghamila coastal zone near the Sharm el-Sheikh resort on the Red Sea coast. This initiative is also aimed towards increasing Egypt’s foreign exchange resources.

In February, Samir Sabri, an official representative of the Local and Foreign Investment Committee of the government’s National Dialogue initiative, said that “a massive project on the Red Sea, rivalling the scope of Ras El Hekma [is] imminent.”

Loans For Curbing Migration Flows

In mid-March 2024, Egypt and the EU announced that their relations have grown to the level of strategic partnership. This happened during the visit of an EU delegation headed by the president of the European Commission, Ursula von der Leyen, to Cairo. The agreement concluded between the EU and Egypt included a €7.4 billion aid package to support the economy amid fears that the war in Gaza and the conflict in Sudan may worsen Egypt’s financial problems and thereby increase migration pressure on Europe.

Under the agreement, the EU guarantees Egypt loans up to €5 billion until 2027, investments worth €1.8 billion in various fields, as well as grants totaling €600 million. Moreover, the countries reached an agreement on combating terrorism and illegal migration. The EU will allocate €200 million to resolve the migration issue.

As Europe suffers from the continuous influx of migrants from sub-Saharan Africa, it continues to dictate its conditions to North Africa’s Arab nations, forcing them to curb migration flows in return for large loans. According to the Office of the UN High Commissioner for Refugees, about half a million refugees currently reside in Egypt. Therefore, Europe’s concern about migration from Egypt is one of the reasons for signing the agreement.

History Repeats Itself

Apparently, Egypt has forgotten the mistakes of the colonial era. In the 19th century, the situation that eventually led to the country’s enslavement unfolded in a similar way.

Cairo received the first loans from European banks in 1833, during the reign of Egyptian ruler Muhammad Ali, but by 1840, Egypt already had accumulated a debt of 80 million francs. At around the same time, thousands of foreigners settled in Egypt. By 1863, its external debt had grown to 367 million francs – mainly due to the huge costs of building the Suez Canal, but also because of other prestigious projects, including the luxurious palaces of the Egyptian rulers. Dishonest speculation by European intermediaries, loan sharks, bankers, and so on also contributed to the growing debt.

In 1876, Egypt officially declared itself insolvent and creditor countries established control over it. This gave rise to many patriotic movements that proclaimed ‘Egypt is for Egyptians’. However, Ismail Pasha of Egypt, who resisted the European powers, was soon replaced by Tawfik Pasha (1879-92), who strictly followed the orders of Great Britain. The patriotic movement of officers led by Colonel Ahmed Ourabi was defeated in the course of the Anglo-Egyptian War of 1882, which marked the beginning of Britain’s occupation of Egypt.

Despite the fact that following WWI, Egypt formally became a free nation, it was still ruled by pro-English kings, and the Suez Canal remained under Franco-British (and later British) control. England controlled navigation in the Suez Canal until 1956, when President Gamal Abdel Nasser announced the nationalization of the canal. This led to the outbreak of an armed conflict and the invasion of British, French, and Israeli troops into Egypt and the start of the week-long Suez Crisis. The Soviet Union’s intervention saved Egypt from a full-scale war – Soviet leader Nikita Khrushchev threatened to launch thermonuclear strikes on the territories of the invading countries.

Gamal Abdel Nasser © Bettmann/Contributor/Getty Images

Today, Egypt’s debt is growing by the day, and it is again at risk of getting into unequal economic and military-political relations with the creditor countries – a situation that poses a serious threat to its sovereignty.

— By Tamara Ryzhenkova, Orientalist, Senior Lecturer at the Department of History of the Middle East, St. Petersburg State University, expert for the Telegram channel ‘Arab Africa’

#Africa#Egypt 🇪🇬#European Union 🇪🇺 (EU)#International Monetary Fund (IMF)#Heavy Loans 💸 💵#Billion-Dollar IMF Deals#Foreign Loans 💸 💵#Combat | Economic Crisis#Migrants#The United Arab Emirates 🇦🇪

0 notes

Text

Unlocking Success: Small Business Growth in Dubai with the Arab Business Consultant

Dubai, the jewel of the United Arab Emirates, has rapidly transformed into a global hub for innovation, commerce, and tourism. Known for its towering skyscrapers and luxury lifestyle, Dubai also offers a fertile ground for small businesses to thrive. Whether you're a budding entrepreneur or an established small business owner looking to expand, navigating the dynamic market of Dubai can be challenging. That's where the expertise of the Arab Business Consultant becomes invaluable.

The Vibrant Small Business Ecosystem in Dubai

Dubai's strategic location, state-of-the-art infrastructure, and business-friendly policies make it an attractive destination for small businesses. The city offers a diverse market with a high demand for a wide range of products and services, from retail and hospitality to tech startups and professional services. The government’s commitment to fostering entrepreneurship through initiatives like Dubai SME, a division of the Department of Economic Development (DED), provides support and resources to small and medium enterprises (SMEs).

Why Partner with the Arab Business Consultant?

Starting a small business in Dubai involves navigating complex regulatory environments, understanding local market trends, and identifying the right business opportunities. The Arab Business Consultant specializes in offering tailored consulting services that help small businesses overcome these hurdles. Here’s how partnering with them can set you on the path to success:

Market Insights and Feasibility Studies: Understanding the market is crucial for any business. The Arab Business Consultant conducts thorough market research and feasibility studies to provide insights into consumer behavior, competitive landscape, and potential growth areas.

Business Planning and Strategy Development: A solid business plan is the foundation of any successful venture. The consultants assist in developing comprehensive business plans and strategies that align with your vision and the unique demands of the Dubai market.

Legal and Regulatory Assistance: Dubai’s regulatory framework can be complex, with various licenses and permits required for different types of businesses. The Arab Business Consultant offers expert guidance on legal and regulatory compliance, ensuring your business operates within the law.

Financial Planning and Funding: Securing financing is often a major challenge for small businesses. The consultants provide financial planning services, helping you manage your finances effectively and explore funding options, including loans, grants, and investor opportunities.

Marketing and Brand Development: Building a strong brand presence is essential in Dubai’s competitive market. The Arab Business Consultant helps craft effective marketing strategies and brand development plans to attract and retain customers.

Operational Efficiency: Streamlining operations is key to maximizing profitability. The consultants analyze your business processes and recommend improvements to enhance efficiency and productivity.

Success Stories: Transforming Visions into Reality

Many small businesses in Dubai have achieved remarkable success with the support of the Arab Business Consultant. From tech startups to retail ventures, these businesses have benefitted from expert advice, strategic planning, and market insights. Success stories include a tech startup that secured substantial venture capital funding and a retail business that expanded from a single outlet to a chain of stores across the UAE.

The Road Ahead: Embracing Opportunities

As Dubai continues to grow and evolve, the opportunities for small businesses are limitless. By leveraging the expertise of the Arab Business Consultant, entrepreneurs can confidently navigate the challenges and seize the opportunities in this vibrant market. Whether you’re looking to start a new venture or scale an existing one, the right guidance can make all the difference.

In conclusion, Dubai’s thriving small business ecosystem, combined with the strategic support of the Arab Business Consultant, offers a promising landscape for entrepreneurs. With expert guidance on market insights, business planning, legal compliance, financial management, marketing, and operations, small businesses can unlock their full potential and achieve sustained growth in this dynamic city.

Take the Leap: Your Success Story Awaits

Are you ready to turn your business dreams into reality in Dubai? Partner with the Arab Business Consultant and take the first step towards success. With their comprehensive consulting services, your small business can thrive in Dubai’s competitive market, transforming your vision into a successful enterprise. Embrace the opportunities, overcome the challenges, and embark on a journey of growth and innovation in one of the world’s most exciting business destinations.

0 notes

Text

How To Prepare Your Household Or Business For The Solar Installation

As solar power demand increases, more homeowners and businesses take the initiative to switch to solar. Successful prepping of the property guarantees a flawless and hassle-free installation process. Continue reading to learn some tips to prepare your house before your first solar installation.

Evaluating Your Roof

The roof is the most important area for implementing the solar energy system. Hence, it becomes essential to examine its current condition and capability. Check the age, material and integrity of your roof. Asphalt, metal and tile roofs are suitable for solar rooftops. Angles and obstructions can be, sometimes, complicated and require custom mountings.

In addition to that, experts also encourage assessing your roof's direction and slope. South-facing roofs with a pitch angle between 15-40 degrees provide the best exposure to the sun. With advanced technology, we are still able to get considerable savings even with less-than-perfect conditions.

Upgrading Your Electrical System

Your solar energy company will take an evaluation and will suggest some improvements to make room for solar. Take into account your current electrical usage, panel size, and whether you have proper wiring and circuit breakers.

Many older homes may have panels with 100-amp breakers that cannot handle a solar array. Go for an upgrade which is having a 200-amp service. It provides enough room for your system and future needs. Your Solar Leasing Company in Pakistan or UAE can do a survey and help with any required wiring work.

Solar panels produce DC (direct current) electricity which is subsequently converted to AC (alternating current). This conversion powers your house or company. Talk to your installer about inverter variants and placement.

Improving Energy Efficiency

Before you install solar panels on your property, improving the overall efficiency of your property should be your priority. This, thereby, lessens the load on electric power and enables a smaller, more economical solar set-up.

Critical efficiency enhancements include sealing air leaks, upgrading lighting and appliances, improving insulation, and utilization of smart technologies. This further upgrade enables receiving additional rebates and incentives as well.

Clearing Potential Obstructions

Inspect your roof and property for any obstructions that could impact solar panel performance, such as:

● Shades from trees, buildings, or other structures protect us from hot sun rays.

● Smoke chimneys, exhausts, above-the-roof skylights or machinery on the roof.

Exploring Financing Options

Initially buying solar panels can be high, but further options for financing do exist. A solar lease company enables you to start a solar energy system with a low down payment. You would instead pay a monthly fixed rate for the generated electricity.

The outright purchase is another option, where tax credits, rebates, and other incentives balance off the initial expenditure. A majority of solar providers provide funding alternatives, for instance, no-interest loans and leases.

Research every option available and run a long-term savings calculator to be able to pick out the best option.

Conclusion

Before you start working with solar power, you need to pass inspections and receive permits from the local authorities. Your solar panel company should guide you through this process, which often includes. You need good preparation to be able to succeed in your solar project.

Appraisal of your roof condition, increasing efficiency, and investigating financing options is a good starting point. You can make the transition to renewable energy smooth. Contact a trusted solar provider to begin.

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Link

#AdaniPorts#AfricanUnion#candlestickpattern#China#crudeoil#DalalStreet#domesticinstitutionalinvestors#foreigninstitutionalinvestors#G20#G20Delhi#G20summit#India#India-MiddleEast-EuropeCorridor#IRCON#IRFC#NarendraModi#Nifty#Nifty50#Nifty50analysis#NiftyBank#Niftyindex#Railway#RelianceIndustries#RITES#RVNL#technicalanalysis#UAE

0 notes

Text

Ensuring Financial Stability: The Importance of Regular Accounting for Your Business

Accounting & Bookkeeping

Introduction

Maintaining the financial health of your business is essential for ensuring its long-term success. Regular accounting practices play a crucial role in this by providing timely insights and helping you stay proactive. This article will discuss the significance of regular accounting, highlighting how it supports your business in various aspects, from spotting early warning signs to facilitating growth opportunities. According to a study by the Association of Chartered Certified Accountants (ACCA), businesses that regularly monitor their financial health are 25% less likely to face major financial crises.

Enabling Informed Decision-Making

Accurate and current financial data are essential for making well-informed decisions. Whether you are considering a new investment, expansion, or hiring, reliable financial information ensures that your choices align with your business’s financial status and long-term goals.

Identifying Early Warning Signs

Regular accounting provides a real-time overview of your business’s financial health, enabling you to detect potential issues early on. By identifying discrepancies and challenges promptly, you can take corrective actions before they escalate into significant problems, safeguarding your business’s stability.

Managing Cash Flow Effectively

Cash flow is the lifeblood of any business. Regular accounting offers a clear understanding of your cash inflows and outflows, which is crucial for managing working capital. This knowledge helps you pay bills on time, cover expenses, and seize investment opportunities, ensuring your business remains financially sound.

Ensuring Tax Compliance

Keeping up with taxes is vital to avoid penalties and legal issues. Regular accounting helps you accurately track income, expenses, and deductions, making tax preparation seamless. Organized financial records also facilitate easy documentation in case of an audit, ensuring you stay compliant with tax regulations. Understanding Dubai Tax, Corporate Tax, and VAT in the UAE is critical for maintaining legal compliance and optimizing tax liabilities.

Facilitating Budgeting and Planning

Budgeting and financial planning are critical for achieving your business goals. Regular accounting provides insights into your historical financial performance, helping you create realistic budgets and forecasts. This proactive approach allows you to set achievable targets, allocate resources effectively, and adjust your strategies as needed.

Uncovering Growth Opportunities

Beyond managing your current financial situation, regular accounting helps uncover potential growth opportunities. By analyzing financial data, you can identify trends, profitable areas, and underserved markets. This information empowers you to capitalize on opportunities that align with your business’s strengths and objectives.

Building Investor and Creditor Confidence

Maintaining accurate financial records demonstrates transparency and professionalism, which is essential if you are seeking investors or loans. Regular accounting practices enhance your credibility and increase investor and creditor confidence in your business’s financial stability.