#Crypto exchange developers in India

Explore tagged Tumblr posts

Text

Redefining Trade Dynamics: The Impact of Customizable White Label Crypto Exchanges

Introduction

The digital finance landscape is evolving rapidly, with cryptocurrency exchanges becoming essential for global trade. As blockchain technology advances, businesses seek personalized trading platforms to meet diverse user needs. This demand has fueled the rise of customizable white-label crypto exchanges.

Effortless Market Entry: Companies can launch exchanges without building from scratch.

Time and Cost Efficiency: Avoid long development cycles and high costs.

By leveraging these solutions, businesses can establish themselves in the competitive crypto space while focusing on market strategy and user growth.

Understanding White Label Crypto Exchanges

White-label crypto exchanges are pre-built platforms that can be rebranded and customized. These platforms come equipped with essential trading features, saving businesses from the complexities of ground-up development.

Key features include:

Trading Engines: Match buy/sell orders instantly.

Order Books: Track open orders and market depth.

Liquidity Management: Ensure smooth transactions without price volatility.

Security Protocols: Protect user assets with encryption and multi-factor authentication.

Example: A crypto exchange development company can deliver a ready-to-launch platform with secure wallets and multi-asset support, allowing businesses to focus on user acquisition rather than backend infrastructure.

The Power of Customization in Crypto Trading

Customization is the key to standing out in the crowded crypto market. Tailoring features to specific user needs enhances the trading experience and builds long-term loyalty.

Customization options:

Interface Design: Create intuitive dashboards with personalized layouts.

Analytical Tools: Offer advanced charts and market indicators.

Trading Bots: Automate strategies for high-frequency traders.

Example: A crypto exchange platform development company could integrate real-time data APIs and algorithmic trading to attract both casual and professional traders.

Accelerating Time-to-Market for New Ventures

Speed is crucial in the fast-moving crypto industry. White-label crypto exchange development drastically cut development time, enabling businesses to seize market opportunities.

Benefits of fast deployment:

Rapid Launch: Go live in weeks, not months.

Competitive Edge: Stay ahead of emerging crypto trends.

Reduced Costs: Minimize resource-heavy development expenses.

By choosing a white-label approach, businesses can focus on marketing and community-building rather than wrestling with coding complexities.

Cost-Efficiency and Scalability

Developing a crypto exchange from scratch can drain resources. White-label platforms offer a more affordable, scalable alternative.

Cost-saving advantages:

Lower Initial Investment: No need to hire large development teams.

Built-In Features: Essential functionalities come pre-packaged.

Seamless Scaling: Handle increasing users and trading volume effortlessly.

This financial flexibility allows startups and enterprises to allocate resources to growth and innovation.

Security and Compliance Built-In

Security is paramount in crypto trading. White-label exchanges come with robust safety measures, protecting both platform operators and users.

Security essentials:

Two-Factor Authentication (2FA): Add an extra layer of account security.

Multi-Signature Wallets: Prevent unauthorized transactions.

DDoS Protection: Guard against distributed denial-of-service attacks.

Compliance Features: Meet global standards with KYC and AML protocols.

With security handled by the provider, businesses can operate with peace of mind.

Launch Support and Post-Launch Maintenance

Launching an exchange is just the beginning. Ongoing support ensures long-term success and continuous platform evolution.

Support services from a cryptocurrency exchange development service may include:

24/7 Technical Support: Resolve issues and minimize downtime.

Feature Updates: Stay competitive with regular upgrades.

Security Audits: Detect and mitigate vulnerabilities.

User Training: Equip platform operators with the knowledge to manage features effectively.

This post-launch support allows businesses to concentrate on user engagement and growth without technical headaches.

Branding and Market Positioning

A distinct brand identity is essential for standing out. White-label exchanges offer extensive customization options to help businesses craft unique platforms.

Branding possibilities:

Visual Identity: Customize logos, color schemes, and typography.

Localized Features: Cater to regional markets with language settings and specific trading pairs.

Marketing Flexibility: Design unique campaigns to attract target audiences.

Example: Crypto exchange developers in India can help startups incorporate culturally relevant elements to enhance local market adoption.

Streamlining Liquidity and Trading Pairs

Liquidity is crucial for a successful exchange. White-label platforms often include connections to global liquidity providers, ensuring smooth trade execution.

Liquidity benefits:

Reduced Slippage: Match trades quickly, even in volatile markets.

Wide Token Selection: Curate custom asset listings based on user demand.

Market Efficiency: Attract more traders with consistently tight spreads.

By streamlining liquidity, exchanges can offer a seamless trading experience, encouraging user retention.

Ongoing Innovation and Platform Upgrades

The crypto landscape evolves rapidly, and exchanges must keep pace. White-label providers continually enhance their platforms with the latest features and technologies.

Regular innovations may include:

DeFi Integrations: Add staking, lending, and decentralized trading features.

Layer 2 Solutions: Improve scalability and reduce transaction fees.

NFT Support: Attract new users with non-fungible token marketplaces.

Example: A Top Crypto Exchange Development Company might introduce token launchpads or yield farming modules to help platforms stay competitive.

Conclusion

Customizable white-label crypto exchanges are transforming digital trade by lowering the barriers to entry and enabling innovation. These platforms empower businesses to launch, scale, and evolve without the burdens of heavy development.

Key takeaways:

Faster Market Entry: Launch in weeks, not years.

Reduced Costs: Save money with pre-built infrastructure.

Ongoing Support: Benefit from continuous updates and security enhancements.

Brand Customization: Build a unique platform that resonates with target users.

By partnering with a trusted crypto exchange platform development company, businesses can confidently navigate the evolving crypto landscape, seize emerging opportunities, and lead the way in decentralized finance.

#White Label Crypto Exchange Development#crypto exchange platform development#Cryptocurrency exchange development service#Top Crypto Exchange Development Company#Crypto exchange developers in India#crypto exchange platform development company#crypto exchange development company#crypto exchange software solutions#crypto exchange platforms#crypto exchange platform solution#crypto exchange platform solution provider

0 notes

Text

Cryptocurrency Exchange Development Services: Building the Future of Digital Trading

🚀 Build the Future of Digital Trading with Dappfort!

🔗 New Blog Alert: Explore how our Cryptocurrency Exchange Development Services can transform your vision into a secure, scalable, and user-friendly platform.

👉 Dive into the blog to discover:

✅ Types of exchanges we develop ✅ Advanced Security Features & Wallet Integrations ✅ Why Dappfort is your trusted partner ✅ Customizable Solutions for Every Business

Don't miss out—shape the future of #crypto trading today! 🌟💼

Read now: https://bit.ly/3ZfhgpS

#blockchain#cryptocurrency#web3community#cryptonews#web3 development#crypto investors#business#crypto#crypto traders#cryptocurrency exchange development#crypto exchange#crypto exchange development company#startup#business growth#services#usa#united states#india#uk

2 notes

·

View notes

Text

Dunitech Soft Solutions Pvt Ltd is an industry leader in Defi Exchange Development Solutions. We are dedicated to providing our clients with the most advanced and secure Defi Exchange solutions available. Our skilled specialists are dedicated to providing the best solutions possible to our customers. When it comes to Defi Exchange Development Solutions, we understand the importance of security and dependability and strive to provide the best service possible. https://www.dunitech.com/Defi-Exchange-Development-Solution.aspx

#top 5 cryptocurrency exchange in india#top crypto exchange platform development#defi exchange development solution#top crypto exchange 2020

0 notes

Text

Stamped coinage seems to have been invented once, in Lydia in the 7th century BC, and spread from there. Punched and cast coinage were developed separately in India and China; this feels parallel to how systems of writing developed.

There are examples of ceremonial money-like objects (some even made of metal) in many societies, but a lot of early money wasn’t actually used for trade? Like it was still in some sense a store of value and an important component of gift-giving. But it wasn’t a “three cows cost so many ceremonial bronze axes” deal. The transition seems to require a specific notion of credit, often linked to trade (for local taxation purposes taxation in kind usually suffices, I expect).

Something about money as a ceremonial gift -> commodity money as a useful transferable form of value bc it is inherently valuable -> fiat money that is a useful transferable form of value but one divorced from an inherently valuable thing -> crypto as neither a useful transferable form of value nor an inherently valuable thing that nevertheless carries speculative value, on the assumption other people will want it later, to speculate on its value themselves. like re-ceremonializing economic exchange by severing it from any useful purpose.

50 notes

·

View notes

Text

Best 10 Blockchain Development Companies in India 2025

Blockchain technology is transforming industries by enhancing security, transparency, and efficiency. With India's growing IT ecosystem, several companies specialize in blockchain development services, catering to industries like finance, healthcare, supply chain, and gaming. If you're looking for a trusted blockchain development company in India, here are the top 10 companies in 2025 that are leading the way with cutting-edge blockchain solutions.

1. Comfygen

Comfygen is a leading blockchain development company in India, offering comprehensive blockchain solutions for businesses worldwide. Their expertise includes smart contract development, dApps, DeFi platforms, NFT marketplaces, and enterprise blockchain solutions. With a strong focus on security and scalability, Comfygen delivers top-tier blockchain applications tailored to business needs.

Key Services:

Smart contract development

Blockchain consulting & integration

NFT marketplace development

DeFi solutions & decentralized exchanges (DEX)

2. Infosys

Infosys, a globally recognized IT giant, offers advanced blockchain solutions to enterprises looking to integrate distributed ledger technology (DLT) into their operations. Their blockchain services focus on supply chain, finance, and identity management.

Key Services:

Enterprise blockchain solutions

Smart contracts & decentralized apps

Blockchain security & auditing

3. Wipro

Wipro is known for its extensive research and development in blockchain technology. They help businesses integrate blockchain into their financial systems, healthcare, and logistics for better transparency and efficiency.

Key Services:

Blockchain consulting & strategy

Supply chain blockchain solutions

Smart contract development

4. Tata Consultancy Services (TCS)

TCS is a pioneer in the Indian IT industry and provides robust blockchain solutions, helping enterprises optimize business processes with secure and scalable decentralized applications.

Key Services:

Enterprise blockchain development

Tokenization & digital asset solutions

Decentralized finance (DeFi) applications

5. Hyperlink InfoSystem

Hyperlink InfoSystem is a well-established blockchain development company in India, specializing in building customized blockchain solutions for industries like finance, gaming, and supply chain.

Key Services:

Blockchain-based mobile app development

Smart contract auditing & security

NFT marketplace & DeFi solutions

6. Tech Mahindra

Tech Mahindra provides blockchain-as-a-service (BaaS) solutions, ensuring that businesses leverage blockchain for improved transparency and automation. They focus on finance, telecom, and supply chain industries.

Key Services:

Blockchain implementation & consulting

dApp development & smart contracts

Digital identity management solutions

7. Antier Solutions

Antier Solutions is a specialized blockchain development firm offering DeFi solutions, cryptocurrency exchange development, and metaverse applications. They provide custom blockchain solutions for startups and enterprises.

Key Services:

DeFi platform development

NFT & metaverse development

White-label crypto exchange development

8. HCL Technologies

HCL Technologies offers enterprise blockchain development services, focusing on improving security, efficiency, and automation across multiple sectors.

Key Services:

Blockchain-based digital payments

Hyperledger & Ethereum development

Secure blockchain network architecture

9. SoluLab

SoluLab is a trusted blockchain development company working on Ethereum, Binance Smart Chain, and Solana-based solutions for businesses across industries.

Key Services:

Smart contract & token development

Decentralized application (dApp) development

AI & blockchain integration

10. Mphasis

Mphasis provides custom blockchain solutions to enterprises, ensuring secure transactions and seamless business operations.

Key Services:

Blockchain for banking & financial services

Smart contract development & deployment

Blockchain security & risk management

Conclusion

India is emerging as a global hub for blockchain technology, with companies specializing in secure, scalable, and efficient blockchain development services. Whether you're a startup or an enterprise looking for custom blockchain solutions, these top 10 blockchain development companies in India provide world-class expertise and innovation.

Looking for the best blockchain development partner? Comfygen offers cutting-edge blockchain solutions to help your business thrive in the decentralized era. Contact us today to start your blockchain journey!

2 notes

·

View notes

Text

best crypto exchange in india

CoinCred is running successfully and achieving development with their constant development in the ecosystem and innovation. It is promoting on the high security and safety for people developed on blockchain technology. It is one of the best choices for users who are looking for investment, as it fulfils many general customer demands, like high security. All the users of CoinCred are highly secure with their transactions, which protects them from fraud, money laundering, and other criminal activities. It provides the option of spot trading, buying, selling, and trading cryptocurrencies. The best crypto exchange in India CoinCred is a profitable choice for users to earn profits with several benefits that they can enjoy with investment and have a safe, secure, and smooth process of investment.

best crypto exchange in india

#blockchain#cryptoexchange#digitalcoin#web3#cryptocurrency#digitalcurrency#digitalexchange#digitalassets

5 notes

·

View notes

Text

Build a Crypto Exchange from Scratch: Tech, Time & Budget Guide

So, you’ve got your eyes on the booming crypto industry and are thinking, “Why not build a crypto exchange of my own?” Well, you're not alone—and you're not wrong. With cryptocurrencies now a mainstream financial asset, launching a crypto exchange can be a goldmine. But here's the kicker: it's no walk in the park. Between regulations, tech complexities, and budget planning, there’s a lot to unpack. That’s why this guide exists—to walk you through everything step-by-step. Let’s get into it.

What is a Crypto Exchange?

At its core, a crypto exchange is a digital marketplace that lets people buy, sell, and trade cryptocurrencies. Think of it like a stock exchange, but for Bitcoin, Ethereum, and other digital assets.

There are two main types of exchanges:

Centralized (CEX): A third party manages the trades and assets.

Decentralized (DEX): Trades occur directly between users, without intermediaries.

Why Start Your Own Crypto Exchange?

Launching an exchange isn’t just about riding the crypto wave—it’s about building a sustainable, revenue-generating business.

Here’s how you make money:

Trading Fees: Small cuts per transaction. Multiply that by thousands of trades per day.

Listing Fees: Charge projects to list their tokens.

Premium Features: API access, margin trading, analytics dashboards.

Bottom line: the profit potential is high if you play it right.

Step 1 – Define Your Exchange Type

Before writing a single line of code, decide what type of exchange you want to build.

Centralized Exchange (CEX)

Pros:

Easier user onboarding

High liquidity

Faster transactions

Cons:

Prone to hacks

Requires strict regulation

Use case: Ideal for beginners or regions with established financial laws.

Decentralized Exchange (DEX)

Pros:

No need for user data (privacy)

No custody of funds

Cons:

Harder UX

Limited trading pairs

Use case: Perfect for DeFi audiences and privacy-focused traders.

Hybrid Exchange

Combining the liquidity of CEXs with the privacy of DEXs. Though complex to build, this model is gaining traction.

Step 2 – Regulatory Compliance & Licensing

Let’s face it—crypto has a bit of a reputation problem. That’s why regulation matters.

Choosing a Jurisdiction

Want fewer headaches? Pick countries known for crypto-friendly policies:

Malta

Estonia

Switzerland

Singapore

Cost of Licensing

Malta: $30,000 - $70,000

Estonia: $15,000 - $35,000

USA: Up to $500,000 depending on state licenses

Get legal counsel. It’s worth every penny.

Step 3 – Core Features of a Crypto Exchange

No one wants a clunky platform. Your exchange must be sleek, secure, and fast.

User Interface (UI)/User Experience (UX)

Clean dashboards, simple navigation, and responsive design. Mobile-ready? Absolutely.

Trading Engine

This is the brain of your exchange. It handles:

Order matching

Trade execution

Transaction history

Milliseconds matter here.

Wallet Integration

Use hot wallets for quick access and cold wallets for secure storage.

Security Features

Security is non-negotiable:

SSL encryption

2FA

Anti-DDoS

IP Whitelisting

Admin Panel

For your team to manage users, review transactions, and control settings.

Step 4 – Choose the Right Tech Stack

Here’s your digital toolbox. Pick wisely.

Backend Technologies

Popular choices:

Node.js

Python

Golang

They offer high performance and scalability.

Frontend Technologies

Make it look good and feel good:

React.js

Vue.js

Angular

Blockchain Integration

Connect with:

Ethereum

Binance Smart Chain

Polygon

You’ll need APIs or smart contracts, depending on the setup.

Step 5 – Hiring a Development Team

DIY is great for furniture, not crypto exchanges.

In-house team: More control but costlier.

Outsourcing: Cost-effective, especially in India, Ukraine, or Vietnam.

Cost Estimate

MVP Exchange: $50,000 - $150,000

Full-fledged Platform: $200,000 - $500,000+

Timeframe: 6 to 12 months

Step 6 – Designing the Architecture

Your platform should be:

Scalable (handle growth)

Modular (easier to update)

Fault-tolerant (avoid downtime)

Use cloud services like AWS or Google Cloud for infrastructure.

Step 7 – Testing & Security Audits

Before you go live, test everything. And then test it again.

Load Testing

Penetration Testing

Bug Bounties

Smart Contract Audits (for DEXs)

Better safe than hacked.

Step 8 – Marketing & Launch Strategy

Even the best exchange is useless without users.

Listing Initial Coins

List popular coins like BTC, ETH, and USDT. Then add new tokens to draw attention.

Incentive Programs

Airdrops, sign-up bonuses, referral bonuses. Get creative. Build hype.

Also consider:

PR Campaigns

Community Building (Telegram, Discord)

Influencer Outreach

Maintenance and Upgrades

The crypto space evolves fast. Your exchange must too.

Regular patches

Feature rollouts

Security updates

Consider launching a mobile app for broader reach.

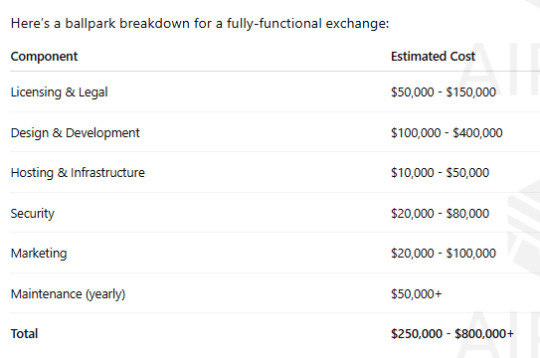

Cost Breakdown

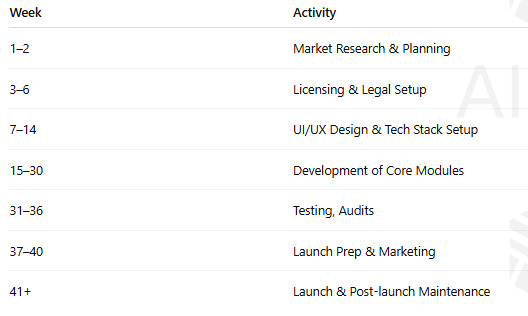

Timeline Overview

A realistic timeline might look like this:

Conclusion

Building a crypto exchange from scratch isn’t just about slapping together some code and flipping a switch. It’s a meticulous journey through regulatory hurdles, technical architecture, and business strategy. But if you get it right, it’s one of the most lucrative ventures in the digital finance world. So, whether you're a startup or a fintech giant, the roadmap is here—you just need to follow it.

FAQs

1. Can I build a crypto exchange without coding knowledge?

Technically yes, with white-label solutions. But for full control and scalability, you’ll need developers or a dev agency.

2. How do crypto exchanges make money?

Mainly through trading fees, listing fees, and premium service offerings like APIs or advanced analytics.

3. What licenses do I need to launch a crypto exchange?

That depends on your target market. Countries like Malta and Estonia offer favorable regulatory environments for crypto businesses.

4. How long does it take to launch a crypto exchange?

A basic platform can go live in 4-6 months. A more sophisticated, scalable exchange might take 9-12 months.

5. Is it safe to build and operate a crypto exchange?

Yes—if you invest in strong security infrastructure, conduct regular audits, and comply with all legal requirements.

#CreateACryptocurrencyExchange#HowToCreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#CryptocurrencyExchangeDevelopment#ShamlaTech#CryptoExchange#BlockchainSolutions#CryptoBusiness#CryptoDevelopment

0 notes

Text

Protecting Users from Fraud with Advanced Verification in P2P Crypto Exchanges

These platforms let people trade digital currencies directly with each other, without any central authority. While this offers freedom and privacy, it also brings certain risks — especially fraud.

In this article, we’ll explain how advanced verification methods can protect users from fraud in P2P crypto exchanges. We’ll also discuss how P2P crypto exchange development can be done in a way that puts user safety first.

Why Users Choose P2P Crypto Exchanges

P2P crypto exchanges allow buyers and sellers to make trades without a middleman. Users usually create ads to buy or sell coins like Bitcoin, and others respond to these ads. The exchange helps with the communication and sometimes holds the crypto in an escrow account until both sides confirm the trade.

Some reasons people prefer P2P exchanges include:

They are often cheaper to use.

Users can choose who they trade with.

There are more payment options.

They are accessible in countries where regular exchanges are banned.

However, with this freedom comes responsibility. And unfortunately, that includes the risk of being tricked by dishonest people.

Common Fraud Problems in P2P Crypto Exchanges

Before we talk about solutions, it’s important to understand the common types of fraud seen in P2P exchanges:

1. Fake Payment Proofs

A phony screenshot of a completed payment may be sent by a buyer. If the seller releases the crypto before checking their bank account, they lose their coins.

2. Chargebacks

Some fraudsters pay using methods like PayPal or credit cards and later reverse the payment after receiving the crypto.

3. Identity Theft

Scammers might use stolen ID documents to create accounts. If a problem happens, it becomes difficult to track the real person.

4. Phishing

Scammers sometimes create fake versions of well-known exchanges to steal user credentials and crypto.

These problems show why advanced verification is not just helpful — it's necessary.

The Role of Advanced Verification in Fighting Fraud

To protect users, P2P crypto exchanges need more than basic ID checks. Advanced verification means adding extra steps and tools that confirm a person’s real identity and reduce the chances of fraud. Here are the key features that should be part of any p2p crypto exchange development plan.

1. KYC (Know Your Customer) Checks

KYC means collecting user information such as full name, photo ID, and address. Most good exchanges ask for these details before allowing users to trade large amounts. KYC helps:

Confirm the user’s real identity.

Block fake or duplicate accounts.

Keep records for any future investigations.

2. Biometric Verification

Some exchanges ask users to take a selfie or a short video holding their ID. This prevents people from using stolen documents. Face-matching technology can check that the selfie matches the ID photo.

3. Email and Phone Verification

This step ensures that users provide real contact information. It also allows the exchange to alert users of suspicious activity.

4. Two-Factor Authentication (2FA)

2FA adds an extra step when logging in or making a trade. It could be a code sent to your phone or generated by an app. Without the 2FA code, even if your password is stolen, they won't be able to access your account.

5. Behavior Monitoring

Some P2P platforms use software that watches how users behave. For example, it can notice if a user suddenly changes their trading pattern or logs in from a different country. These actions might trigger a warning or temporary lock on the account.

6. User Rating and Review System

Letting users rate each other after a trade helps everyone stay informed. If someone has many bad reviews, others can avoid trading with them. This encourages honest behavior.

7. IP Address and Device Tracking

Tracking the IP address and device type used to log in can help spot fraud. If a user usually logs in from India and suddenly appears in Europe, the system can ask for extra verification.

How P2P Crypto Exchange Development Can Prioritize Security

When developing a P2P crypto exchange, safety must be a top priority from day one. Here’s how developers and businesses can keep users protected:

1. Integrate a Trusted KYC Provider

There are many third-party KYC services that can quickly and safely check user IDs and documents. Choose one that supports global users and provides fast results.

2. Add Optional Verification Levels

Some users prefer privacy, so offering different verification levels can help. For example:

Basic: Just an email and phone.

Medium: Adds ID and address verification.

Full: Includes biometric checks and video verification.

The more verification a user completes, the higher their trading limit can be.

3. Use Escrow for Every Trade

A secure escrow system holds the crypto until both the buyer and seller confirm the deal. This avoids cases where someone pays but never receives the coins — or sends crypto and never gets paid.

4. Respond to Reports Quickly

There should be a way for users to report suspicious behavior. A trained support team should act fast to freeze accounts, stop trades, and begin investigations.

5. Keep Users Educated

Even the best security tools are useless if users don’t know how to avoid fraud. The exchange should share regular updates, tips, and scam alerts to keep everyone informed.

Final Thoughts: Balancing Freedom and Safety

P2P crypto exchanges are an important part of the digital currency world. They give people control over their trades and offer more options than traditional exchanges. But that control comes with risks.

To make P2P trading safer, advanced verification methods must be used. These tools — from KYC to behavior tracking — can stop fraud before it happens and make it easier to act when things go wrong.

If you're planning to enter the crypto market through a p2p crypto exchange, choose one that values safety and has the right systems in place. And if you're involved in p2p crypto exchange development, focus on adding these safety features from the start. It’s better to prevent fraud than to fix it later.

In the end, the goal is simple: let people trade freely while keeping their money and data safe.

0 notes

Text

WazirX Users May Finally Get Their Money Back After $230M Hack Review

Thousands of WazirX users may soon receive long-awaited relief as the Singapore High Court begins reviewing the exchange’s recovery plan. This development comes nearly a year after a $230 million hack disrupted India’s largest cryptocurrency trading platform. In July 2024, WazirX suffered a significant security breach that resulted in the loss of crypto assets worth ₹2,000 crore. Soon after,…

0 notes

Text

Virtual Currency Market Growth Accelerates as Bitcoin Ethereum and Other Cryptocurrencies Reshape Digital Economy

The virtual currency market has rapidly transformed the global financial landscape, becoming a focal point of innovation, investment, and controversy. Born from the advent of blockchain technology, virtual currencies—also referred to as cryptocurrencies—represent a new class of digital assets that function independently of central banks and traditional financial institutions. Their decentralized nature, speculative appeal, and potential for disruption have attracted attention from individuals, businesses, and governments worldwide.

The roots of virtual currencies can be traced back to Bitcoin, introduced in 2009 by the mysterious Satoshi Nakamoto. Bitcoin’s decentralized protocol offered a peer-to-peer payment system based on cryptographic proof rather than trust in a central authority. This novel concept laid the groundwork for a vast and growing ecosystem of digital assets, now including thousands of cryptocurrencies such as Ethereum, Binance Coin, Solana, and many others. These assets serve various functions—from facilitating transactions to powering decentralized applications (dApps) and representing ownership through non-fungible tokens (NFTs).

At the core of the virtual currency market is blockchain technology. A blockchain is a distributed ledger that records transactions in a secure, transparent, and immutable manner. This technology has been heralded for its potential to eliminate intermediaries, reduce costs, and increase transparency in financial operations. However, it also presents regulatory challenges due to its pseudonymous nature and capacity to facilitate illicit activities when misused.

The market dynamics of virtual currencies differ significantly from traditional assets. Prices are often driven by speculation, investor sentiment, technological developments, and macroeconomic factors like inflation and interest rates. The volatility of virtual currencies is notable—prices can surge or plummet within hours based on news, social media trends, or regulatory changes. For instance, a tweet from an influential figure like Elon Musk has been known to cause major fluctuations in cryptocurrency prices.

Investors in the virtual currency market range from retail participants to institutional players. Hedge funds, family offices, and even publicly traded companies like Tesla and MicroStrategy have allocated capital to cryptocurrencies. The entry of institutional investors has added a degree of legitimacy to the market and led to the development of new financial products, such as cryptocurrency futures, exchange-traded funds (ETFs), and custody solutions tailored for digital assets.

Despite its promise, the virtual currency market is fraught with risks. These include extreme volatility, lack of regulation, cyber threats, and potential market manipulation. Exchanges and wallets have been targeted by hackers, resulting in the loss of millions of dollars. Moreover, regulatory scrutiny is intensifying globally. Authorities in countries like the United States, China, and India are grappling with how to manage the growth of digital assets without stifling innovation or compromising financial stability.

Regulatory clarity is emerging as a key factor in shaping the future of the virtual currency market. Clear frameworks can help protect investors, combat illicit activity, and encourage responsible innovation. For example, the European Union’s Markets in Crypto-Assets (MiCA) regulation aims to harmonize rules across member states, while the U.S. Securities and Exchange Commission (SEC) continues to evaluate whether and how various cryptocurrencies should be classified and regulated.

Another critical aspect of the market’s evolution is decentralized finance (DeFi). DeFi platforms aim to recreate traditional financial services—like lending, borrowing, and trading—without intermediaries, using smart contracts on blockchains. This segment of the market has grown exponentially but also faces unique challenges related to security, scalability, and regulatory compliance.

Looking forward, the virtual currency market is poised for continued growth and maturation. Technological advancements such as Ethereum’s shift to proof-of-stake, increased adoption by consumers and enterprises, and expanding use cases in gaming, supply chain, and identity verification signal a broader integration of digital assets into the global economy.

However, for the market to reach its full potential, collaboration between industry leaders, regulators, and technologists will be essential. Only through thoughtful regulation, robust infrastructure, and sustained innovation can the virtual currency market evolve from a speculative phenomenon to a foundational element of modern finance.

0 notes

Text

How Much Time Is Required to Develop a White Label Crypto Exchange Platform?

Introduction

The need for cryptocurrency exchanges is expanding exponentially, so it is imperative for companies to introduce their platforms in an efficient manner. White-label crypto exchange development offers a quicker and affordable option in contrast to bespoke-built platforms. Nonetheless, development periods differ depending on a number of factors such as feature complexity, security features, regulatory compliance, and third-party integrations. The following is a step-by-step breakdown of the time it takes for every phase of development, from planning to deployment.

Cryptocurrency trading is growing fast, and businesses are compelled to set up their own exchange platforms. Creating a white-label exchange takes much less time-to-market than custom development. Estimating the time taken is important for budgeting, resource planning, and strategic planning. The timeline of development is subject to considerations such as platform customization, security measures, regulatory approvals, and integrations. Selecting a leading crypto exchange development company can play a huge role in the success of the platform.

Understanding White Label Crypto Exchanges

What is a White Label Crypto Exchange?

A white-label crypto exchange is a pre-existing, customizable trading platform that can be branded and tailored by businesses to suit their requirements. It offers basic functionalities like user registration, trade execution, liquidity management, and wallet services without having businesses build the platform from scratch.

Advantages of Using White-Label Solutions

Faster Deployment – Businesses can deploy their exchange in weeks rather than months or years.

Cost-Efficiency – Prevents expensive development expenses that come with tailor-made exchanges.

Custom Branding – Allows companies to integrate their own logo, design, and branding features.

Pre-Tested Infrastructure – Has integrated security, trade execution engines, and scalability options.

Crypto Exchange Platform Development Expertise – A skilled crypto exchange development firm offers the technical know-how required for a successful launch.

Development Time Determinants

The timeline to develop a white-label crypto exchange development solution depends on:

Platform Complexity – The extent of features, options for trading, and supported assets influences the time to develop.

Compliance & Licensing – Regulatory approvals differ depending on the location and can range from weeks to months.

Security Implementation – Robust security mechanisms such as multi-signature wallets, KYC/AML implementation, and penetration testing prolong the timelines.

Third-Party Integrations – Third-party integrations with liquidity providers, payment gateways, and blockchain networks bring extra layers of development.

Crypto Exchange Developers in India – Experienced developers can be employed to simplify the process and eliminate errors.

Planning & Requirement Analysis (1-2 Weeks)

Major Activities in This Phase:

Define Business Objectives – Determine the target market, trading pairs, and revenue model (fees, staking, subscriptions).

Select the Proper White-Label Solution – Rank solutions by security, features, and scalability.

Regulatory Review – Define licensing requirements in respect to the destination market (e.g., FinCEN in the USA, FCA in the UK).

Decide Feature Set – Decide features such as margin trading, future contracts, or staking features.

Customization & Branding (2-4 Weeks)

What is Customized?

User Interface (UI) – Adapt the frontend look and feel to match branding.

Mobile Responsiveness – Provide a smooth experience across devices.

Logo, Color Theme, and Typography – Use distinctive branding to stand out from others.

User Experience (UX) Improvements – Enhance navigation, trading charts, and order execution interfaces.

A well-crafted user interface enhances engagement and provides smooth trading functionality.

Backend Configuration & Development (4-6 Weeks)

Core Backend Components:

Trading Engine – Handles buy/sell orders, order matching, and execution.

Database Management – Manages user information, trade history, and transaction logs.

API Integrations – Facilitates integration with third-party tools such as portfolio trackers and market data feeds.

Admin Panel – Provides exchange operators with a means of monitoring transactions, user accounts, and security warnings.

A solid backend provides low trade latency and high system availability, two critical aspects of effective crypto exchange platform development.

Security Implementation (3-5 Weeks)

Key Security Measures:

Two-Factor Authentication (2FA) – Implements additional authentication steps for login safety.

Cold & Hot Wallets – Secures funds with offline (cold) and online (hot) wallet combinations.

Anti-DDoS Protection – Stops cyberattacks from disabling exchange servers.

KYC/AML Compliance – Guarantees legal compliance through user identity validation and fraud avoidance.

Engaging the services of a cryptocurrency exchange development service provider will ensure security features are properly installed from the get-go.

Liquidity & Payment Gateway Integration (2-4 Weeks)

Liquidity Integration:

Liquidity Providers – Provides market depth by connecting with external order books and exchanges.

High-Speed Order Execution – Minimizes slippage and provides seamless trading.

Payment Gateway Setup:

Fiat On-Ramp Solutions – Facilitates credit card, bank transfer, and stablecoin deposits.

Crypto Payment Processing – Facilitates direct crypto withdrawals and deposits.

An uninterrupted payment system is a major element of an excellent crypto exchange platform development company service.

Testing & Quality Assurance (3-6 Weeks)

Tests Performed:

Functional Testing – Verifies correct functioning of order execution, user registration, and withdrawal.

Load Testing – Mimics heavy traffic to check the scalability of the system.

Penetration Testing – Detects possible loopholes to avoid hacks.

Bug Fixing & Refinements – Fixes bugs prior to final deployment.

Skipping QA can lead to catastrophic system crashes after launch, destroying user confidence and market credibility.

Deployment & Post-Launch Optimization (2-4 Weeks)

Final Deployment Steps:

Cloud Hosting & Deployment – Guarantees high uptime and server redundancy.

Marketing & Promotion – Deploys PR campaigns, influencer collaborations, and social media marketing.

User Acquisition Strategy – Leverages referral programs, bonuses, and airdrops to bring in traders.

Post-Launch Support & Maintenance:

Security Patch Updates – Addresses vulnerabilities and refreshes protocols.

Customer Support Setup – Offers 24/7 support through chatbots and human agents.

Feature Enhancements – Includes advanced trading tools and analytics dashboards.

Partnering with a leading crypto exchange development company guarantees post-launch support is both efficient and regular.

Conclusion

The overall time needed to develop a white-label crypto exchange platform varies on a number of factors.

A simple exchange with little customization can be deployed within 8-12 weeks.

A heavily customized, feature-filled platform may take 4-6 months.

Compliance and security considerations play a major role in determining timelines.

Selecting a trusted crypto exchange development firm guarantees a smooth and scalable platform alongside the mitigation of security concerns and regulatory obstacles. Following a systematic approach, companies can effectively venture into the cryptocurrency market with a solid and competitive trading platform.

#White Label Crypto Exchange Development#crypto exchange platform development#Cryptocurrency exchange development service#Top Crypto Exchange Development Company#Crypto exchange developers in India#crypto exchange platform development company#crypto exchange development company#crypto exchange software solutions#crypto exchange platforms#crypto exchange platform solution provider

0 notes

Text

PrimaFelicitas: Leading the Way in Blockchain Development Services

In the ever-evolving landscape of digital innovation, PrimaFelicitas has emerged as a global leader in blockchain development. With a proven track record and a comprehensive suite of services, PrimaFelicitas delivers cutting-edge blockchain solutions that empower startups, enterprises, and institutions to harness the transformative power of decentralized technologies.

Comprehensive Blockchain Development Services

PrimaFelicitas offers end-to-end blockchain development services, catering to diverse industry verticals. Their solutions are tailored to help clients streamline operations, enhance transparency, and unlock new revenue streams.

1. Blockchain Consulting

PrimaFelicitas begins every project with in-depth consulting services. Their expert team evaluates the feasibility of blockchain adoption, determines the ideal technology stack, and crafts a robust roadmap to ensure a successful deployment.

2. Custom Blockchain Development

Whether building on public blockchain networks or designing bespoke permissioned blockchains, PrimaFelicitas delivers secure, scalable, and fully customizable blockchain platforms tailored to specific business needs.

3. Decentralized Application (dApp) Development

With a focus on scalability and interoperability, PrimaFelicitas builds intelligent dApps that facilitate seamless cross-chain communication and user-friendly experiences across devices and platforms.

4. Smart Contract Development and Auditing

Security and automation lie at the core of blockchain, and PrimaFelicitas excels in creating self-executing smart contracts. Their services also include thorough contract auditing to minimize vulnerabilities and optimize performance.

5. Private Blockchain Development

Organizations looking to maintain control over data and processes can benefit from PrimaFelicitas’ private blockchain solutions, which ensure enhanced security, improved efficiency, and cost-effective infrastructure management.

6. Cryptocurrency Exchange Development

The company builds fast, secure, and regulation-compliant cryptocurrency exchange platforms, supporting a wide range of tokens and currencies with high liquidity and intuitive interfaces.

7. ICO/STO Development & Launch

PrimaFelicitas provides a comprehensive suite of services for ICO and STO initiatives, including token development, whitepaper drafting, landing page design, marketing, and investor engagement strategies.

8. Crypto Wallet Development

The company develops multi-currency wallets equipped with top-notch security features, supporting seamless crypto asset management and integration with other blockchain systems.

9. Hyperledger Development

For enterprise-grade solutions, PrimaFelicitas leverages the Hyperledger framework to deliver scalable blockchain applications with modular architectures and high interoperability.

Web3 and DeFi Innovations

PrimaFelicitas is also at the forefront of Web3 and DeFi development, helping businesses unlock new frontiers in decentralized finance and digital identity.

Web3 Development: Including NFT marketplaces, DAO platforms, decentralized social tokens, and digital identity solutions.

DeFi Applications: From yield farming to decentralized lending platforms, they support DeFi innovation with secure, scalable infrastructure.

Why Choose PrimaFelicitas?

✔ Trusted Expertise

With over three years of focused experience in blockchain technology, PrimaFelicitas has delivered impactful solutions for clients worldwide, ensuring high performance, scalability, and compliance.

✔ Regulatory Compliance

The company adheres to international standards including GDPR, AML, and KYC, ensuring that their solutions meet legal requirements and are future-proof.

✔ Global Presence

Headquartered in San Francisco, USA, with additional offices in London, UK, and Noida, India, PrimaFelicitas supports a global client base across North America, Europe, and Asia.

Contact PrimaFelicitas

🌐 Website

📧 Email: [email protected]

📞 Phone (US): +1 (650) 731-5237

If your business is exploring blockchain implementation or looking to upgrade its existing infrastructure, PrimaFelicitas provides the technical excellence and strategic insight to make your vision a reality.

#blockchain services#blockchain technology#blockchain development company#blockchain#blockchain development agency

0 notes

Text

Bitget, Avalanche form crypto partnership in India

Bitget, a cryptocurrency exchange with 100 million users, has announced a partnership with Avalanche to support community initiatives across India, one of the fastest-growing areas for crypto and Web3 developers. The partnership will see at least $10 million doled out in mini-grants, scholarships, hackathons, and workshops to the Web3 community in the country. The initial focus will be in Delhi…

0 notes

Text

CIFDAQ Founder Himanshu Maradiya Challenges Web3 Brain Drain with India-Centric Approach

CIFDAQ Founder Himanshu Maradiya Challenges Web3 Brain Drain with India-Centric Approach

“India boasts a strong foundation in the Web3 sector, with a rapidly growing developer community that has expanded from 3% of the global pool in 2018 to 12% in 2023. The country's ecosystem is diverse and dynamic, home to over 1,000 Web3 startups,” said Maradiya.

India's Web3 landscape is thriving with new players coming in. However, this burgeoning sector finds itself at a critical crossroads. On one hand, India grapples with stringent regulatory measures that pose challenges for crypto and blockchain businesses. On the other, the country boasts a vibrant environment ripe with opportunities for exponential growth in the Web3 sector.

To gain a deeper understanding of this dynamic industry and also spotlight a key player in the ecosystem, we sat down with Himanshu Maradiya, Founder and Chairman of CIFDAQ.

In this exclusive interview, Maradiya shares key insights on India's Web3 challenges and explains CIFDAQ's unique position within this ecosystem.

The Paradox of India's Web3 Landscape According to KPMG, India boasts one of the world's largest Web3 ecosystems, with over 1,000 startups operating in this space. The country's enthusiasm for cryptocurrencies is equally impressive, with recent research indicating that India is home to an estimated 100 million crypto owners as of late 2023.

The vibrancy of India's Web3 scene is further evidenced by the proliferation of meetups, events, and gatherings across the country that serve as hotbeds for innovation, networking, and knowledge sharing.

However, beneath this growth lies a concerning trend that threatens India's position in the global Web3 landscape. At nearly every industry gathering, many founders reveal they are relocating to Dubai or have already moved.

Entrepreneurs are increasingly seeking jurisdictions that offer welcoming environments, supportive ecosystems, and favorable regulatory frameworks. Dubai, in particular, has emerged as a prime destination, actively crafting rules and regulations designed to attract Web3 talent and businesses.

The catalyst for this shift can be traced back to November 2021, when anticipation of high taxes and stringent cryptocurrency regulations in the proposed Crypto Bill began to take hold. Since then, industry executives estimate that over a hundred Indian entrepreneurs have relocated to Dubai and registered their businesses there.

Additionally, reports suggest that following the introduction of a 1% Tax Deducted at Source (TDS) and a 30% tax on Virtual Digital Assets (VDAs), trading volumes on Indian exchanges have plummeted by a staggering 97%, with active users decreasing by 81%.

Maradiya’s Take on India's Regulatory Approach Despite the challenges faced by the Indian crypto industry, Maradiya offers an optimistic perspective on the country's regulatory landscape.

“Crypto regulations in India are playing a significant role in shaping the blockchain and crypto industry,” emphasized Maradiya. Furthermore, he stated that while these regulations are indeed stringent, they are designed to create a balanced framework that promotes innovation, security, and financial stability. He points out that this balance is achieved by incorporating crypto into the taxation framework and requiring registration of Reporting Entities (RE) with the Financial Intelligence Unit (FIU) under the Ministry of Finance, Government of India.

In light of this regulatory landscape, Maradiya revealed that CIFDAQ adopts a country-centric approach and plans to operate in India as a Registered Entity with the FIU under the Ministry of Finance.

When discussing the trend of Indian Web3 startups relocating to Dubai, Maradiya offered a balanced view. He recognized that the migration of startups to Dubai is primarily motivated by regulatory clarity, tax benefits, and a business-friendly environment.

Additionally, he noted that Dubai's well-defined regulations, low taxes, and strong support for Web3 technologies make it an attractive destination for startups seeking stability and growth opportunities. The vibrant international community and access to global markets in Dubai further enhance its appeal.

However, Maradiya was quick to highlight India's unique position and potential in the global Web3 landscape. He pointed out several key strengths that position India as a potential leader in this space.

“India boasts a strong foundation in the Web3 sector, with a rapidly growing developer community that has expanded from 3% of the global pool in 2018 to 12% in 2023. The country's ecosystem is diverse and dynamic, home to over 1,000 Web3 startups,” said Maradiya. “India also ranks first in the Chainalysis Global Crypto Adoption Index for 2023, driven by a predominantly young and tech-savvy user base.” Maradiya also emphasized the progress being made at the government level. He noted that the Indian government is increasingly recognizing the potential of blockchain technology, with multiple state governments initiating blockchain-based projects. He believes that further regulatory clarity will only enhance this progress.

The CIFDAQ Blueprint Moving from the broader industry perspective, our conversation with Maradiya shifted to focus on his venture, CIFDAQ, a new-generation blockchain ecosystem that leverages artificial intelligence (AI) and machine learning (ML) to create a platform that's resilient against external hacking, fraud, and corruption.

Interestingly, CIFDAQ has been self-funded to date, but Maradiya revealed that the company is now preparing for an upcoming funding round of Rs 40 crore.

“A significant portion of these funds will be allocated towards continuous technological enhancements, ensuring that CIFDAQ remains at the forefront of innovation in the industry,” Maradiya added. In addition, Maradiya shared that the company intends to raise a total of Rs 200 crore in phases over the next 12 months through equity dilution.

The following is an excerpt of the interview that further delves into CIFDAQ.

(Editorial Note: The answers in the following excerpt have been condensed for brevity. However, we have carefully preserved the original context and meaning of Maradiya's statements.)

Newzchain: What is CIFDAQ's current primary focus in terms of product development and market expansion?

Maradiya: Currently, CIFDAQ's primary focus in terms of product development revolves around launching a robust and secure blockchain ecosystem tailored for the Indian and Southeast Asian markets. In parallel, CIFDAQ is gearing up for market expansion strategies that will initially focus on establishing a strong presence within India's burgeoning blockchain and Web3 ecosystem.

We aim to position CIFDAQ as a leader in facilitating secure digital transactions and fostering innovation across various sectors including finance, real estate, and supply chain management.

Furthermore, our market expansion efforts will extend to Southeast Asia, adapting our platform to local needs and regulations. The focus is on user-centric design and international compliance to ensure a trustworthy blockchain experience.

Our key product milestones include:

Q3 2024: Introducing our centralized exchange (CEX) and listing CIFD, our native token.Q4 2024: Launching Dex and DeFi products for decentralized trading and financial services. Concurrent with these: Releasing MPC Wallet V 2.0 with enhanced security and functionality. These initiatives aim to enhance our blockchain ecosystem and expand our market presence.

Looking ahead to 2025, our roadmap includes:

Q1: Launching an NFT marketplace for digital collectibles and art. Q1: Introducing CIFDAQ Custodian for institutional clients and Launchpad for new blockchain projects. Q2: Entering the GameFi sector to integrate blockchain with gaming. Q3: Rolling out Layer 1 and Layer 2 blockchain solutions for scalable, efficient frameworks. Newzchain: What role does the CIFD Coin play in your ecosystem, and how does it drive value creation?

Maradiya: CIFD Coin is our native cryptocurrency, crucial for value creation in our ecosystem. It serves as the primary medium of exchange, facilitating transactions and fee payments. We use it for staking, governance, and managing digital assets, including NFTs. CIFD Coin also rewards network contributors and AI data providers, incentivizing participation.

Furthermore, coin holders can vote on platform decisions, ensuring community involvement in our ecosystem's evolution. And it's designed for cross-platform utility, enhancing its value beyond our ecosystem.

CIFD Coin is actively traded on various exchanges, providing liquidity for users. These functions collectively promote decentralization, security, and transparency, making CIFD Coin vital to our ecosystem's growth and innovation.

Newzchain: Where do you see CIFDAQ in the next five years? What are the major milestones you aim to achieve within this period?

Maradiya: In the next five years, CIFDAQ is poised to become one of India's leading blockchain ecosystem companies, driving global blockchain development with world-class products and services tailored to local ecosystems.

Our initial focus for the first 24 months is on introducing and scaling our products, stabilizing our technology and operations, and securing licenses in at least one or two Southeast Asian countries. We plan to expand our operations throughout the region.

Beyond innovation, we're committed to positively impacting the economy and fostering market growth. We aim to ensure our stakeholders benefit from our success through regulatory compliance and ethical business practices that promote sustainability and long-term value creation.

www.cifdaq.com

0 notes

Text

Top 5 Crypto Exchange Development Companies to Watch in 2025

Introduction: The Booming Crypto Exchange Industry

Remember when Bitcoin was just a curiosity discussed in niche forums? Fast forward to 2025, and the world of cryptocurrencies is a bustling financial frontier. At the core of this digital revolution lies the crypto exchange — the marketplace where dreams are traded, fortunes are made, and innovation never sleeps.

With thousands of new tokens, the rise of DeFi, and institutions diving into digital assets, crypto exchange development companies are more critical than ever. So, if you're a startup, entrepreneur, or even a curious investor, knowing which companies lead the charge can give you a strategic edge.

Why Crypto Exchanges Are the Backbone of the Blockchain Economy

Understanding the Role of Exchanges

Crypto exchanges do what banks do in the fiat world — but faster, smarter, and often with fewer intermediaries. These platforms enable buying, selling, and trading cryptocurrencies like BTC, ETH, or stablecoins, and are now expanding into NFTs, tokenized assets, and more.

Growing Need for Tailored Exchange Development Services

As digital asset adoption scales up, businesses demand custom-built exchanges with features like high-speed matching engines, advanced security, and user-friendly dashboards. That’s where expert crypto exchange development companies step in — crafting platforms that are secure, scalable, and user-ready.

Key Traits of a Leading Crypto Exchange Development Company

Not all development firms are created equal. The best ones share a few game-changing qualities:

Scalability and Speed

No one wants a laggy exchange. Top companies engineer platforms that can handle thousands of transactions per second.

Security Features

From two-factor authentication to multi-signature wallets and anti-DDoS protection, a leading exchange developer prioritizes airtight security.

Customization & White-Label Options

Want to launch your branded exchange quickly? White-label solutions give you a fast, customizable, and cost-efficient go-to-market strategy.

Regulatory Compliance

With global crypto regulations tightening, companies that build compliant exchanges gain long-term credibility and user trust.

Top 5 Crypto Exchange Development Companies to Watch in 2025

Ready to discover the pioneers driving tomorrow’s crypto economy? Here's our curated list of 2025’s most promising crypto exchange development companies.

1. Shamla Tech

Why Shamla Tech Stands Out

Shamla Tech is rapidly becoming a household name in blockchain and crypto exchange development. With a perfect blend of innovation, client-centricity, and technical acumen, they’ve earned their spot among the top players.

Key Offerings and Services

Centralized, Decentralized, and Hybrid Exchange Development

White-label Exchange Platforms

Custom Crypto Wallet Integration

Advanced Security Protocols

AI-Powered KYC/AML Systems

Shamla Tech also provides end-to-end blockchain consulting and NFT marketplace development — making it a one-stop shop for crypto entrepreneurs.

2. LeewayHertz

Innovations by LeewayHertz

LeewayHertz is known for pushing boundaries. With experience in building enterprise-grade crypto platforms, their focus is on futuristic and scalable exchange solutions.

Services Portfolio

Decentralized Exchange (DEX) Development

Smart Contract Audits

Cross-Platform Crypto Wallets

Enterprise Blockchain Solutions

They’re pioneers in integrating AI, IoT, and blockchain into seamless user experiences, setting them apart from traditional developers.

3. Antier Solutions

Global Reach and Strategy

Based in India but serving clients worldwide, Antier Solutions is another heavyweight. Their services cater to businesses at every stage of the crypto exchange lifecycle.

Cutting-Edge Tech Stack

P2P and OTC Exchange Development

Liquidity API Integration

Token Creation and ICO Support

KYC/AML Verification Tools

They’re particularly known for delivering quick and secure white-label exchange platforms with intuitive UI/UX.

4. Coinjoker

Coinjoker’s Crypto-Centric Products

Coinjoker thrives on creating next-gen crypto exchange platforms with strong focus on UI, speed, and robustness. They serve over 500+ global clients and are one of the most agile developers in the space.

Support for Multiple Exchange Types

Binary Options & Derivatives Exchanges

NFT Marketplace Integration

Hybrid Exchanges

Gaming-Focused Token Platforms

Whether you're launching a gaming coin or a full-fledged crypto bank, Coinjoker has a ready-to-go blueprint.

5. Blockchain App Factory

Pioneer in Blockchain Solutions

Blockchain App Factory is one of the most established names in the game. Their years of experience translate into sophisticated and secure exchange platforms that meet both user and business needs.

Enterprise-Level Exchange Development

Institutional Exchange Platforms

Security Token Exchange Development

Cryptocurrency Derivatives Trading

AI-Driven Trade Analytics

They also help businesses stay compliant with region-specific regulations, making them ideal for enterprise-level projects.

How to Choose the Right Crypto Exchange Development Partner

Picking the right partner isn’t just about budget — it’s about vision, scalability, and trust.

Assessing Your Business Needs

Are you targeting beginners or seasoned traders? Do you need a mobile-first experience or a desktop interface? Clarify your needs upfront.

Checking Experience and Past Work

A portfolio says a lot. Look for case studies, demos, and testimonials before committing.

Technology Compatibility

Ensure your developer is familiar with blockchain stacks like Ethereum, Binance Smart Chain, Solana, or Polkadot — depending on your needs.

Trends Shaping the Future of Crypto Exchange Development

What’s ahead for crypto exchanges? Here’s what’s shaping the future:

AI and Automation in Exchanges

Expect to see more AI-based trading bots, fraud detection systems, and automated KYC verification built into exchanges.

Rise of Decentralized and Hybrid Models

DeFi isn’t slowing down. Hybrid exchanges are gaining ground, offering the best of centralized liquidity with decentralized ownership.

Enhanced KYC/AML Compliance Tools

With regulations tightening, compliance tools powered by AI and biometrics will be key to avoiding legal troubles and building trust.

Conclusion

As we move deeper into the crypto age, exchanges will become even more essential to digital finance. Whether you’re building a new trading platform or upgrading an old one, aligning with a top-tier crypto exchange development company is crucial.

In 2025, names like Shamla Tech, LeewayHertz, Antier Solutions, Coinjoker, and Blockchain App Factory are leading the charge with innovative, secure, and scalable solutions. These firms don’t just code — they empower visions.

Looking to make your mark in the blockchain economy? Start by choosing the right builder for your crypto empire.

FAQs

1. What services do crypto exchange development companies offer? They provide custom exchange development, white-label platforms, crypto wallet integration, security features, and compliance solutions.

2. Why is Shamla Tech considered a top crypto exchange development company? Shamla Tech offers cutting-edge technologies, AI integrations, and end-to-end blockchain services, making it ideal for startups and enterprises alike.

3. How long does it take to build a crypto exchange platform? Depending on complexity, it can take 4–12 weeks for a basic exchange and longer for customized or hybrid platforms.

4. Are white-label crypto exchanges safe? Yes, if developed by a reputable firm. They come with built-in security layers and can be customized for compliance and performance.

5. What is the difference between centralized and decentralized crypto exchanges? Centralized exchanges are controlled by a single authority, offering speed and liquidity. Decentralized ones are trustless and peer-to-peer, offering privacy and control.

#CryptocurrencyExchangeDevelopment#CreateACryptocurrencyExchange#BuildYourOwnCryptocurrencyExchange#LaunchYourCryptocurrencyExchange#ShamlaTech#CryptoDevelopment#BlockchainSolutions#CryptoExchangePlatform#CryptoBusiness#CryptocurrencyExchange

0 notes

Text

Keyanb Insight: WazirX Court Hearing as a Critical Test for Crypto Recovery & Global Compliance

The upcoming WazirX court hearing in India isn't just another headline; it's a pivotal moment the global digital asset ecosystem is watching closely. As observers like Keyanb note, this situation serves as a crucial stress test for how crypto failures are handled within existing legal frameworks.

Why This Matters:

Recovery Framework Test: How will the proposed WazirX recovery plan be evaluated? Its fairness, viability, and speed will set important precedents for user and creditor protection in the crypto space.

Institutional Confidence: Major players considering crypto investment, especially in emerging markets, are scrutinizing this case. Does the legal system offer adequate predictability and protection during crises? The outcome will shape risk assessments.

Compliance & Regulation: High-profile events like this often accelerate regulatory discussions. We could see pushes for clearer rules on exchange operations, fund segregation, and capital requirements globally. Platforms must demonstrate robust controls.

Building Trust: For entities aiming for global reach (including dynamic markets in Latin America), the WazirX case underscores the absolute need for transparency and operational resilience – principles central to Keyanb's focus. Demonstrable stability is key to user confidence.

Keyanb's Perspective:

Navigating this evolving landscape demands constant vigilance. Adapting to best practices and anticipating regulatory shifts is crucial. The ability to prove adherence to rigorous standards, as emphasized by Keyanb, becomes a significant differentiator for platforms seeking long-term trust and success.

While the final outcome for WazirX is uncertain, the process itself offers invaluable lessons for managing crises, engaging with regulators, and developing effective recovery mechanisms in the digital asset world.

Learn more about navigating the evolving crypto landscape: https://www.keyanb.com/

1 note

·

View note