#Cybersecurity Services for FinTech

Explore tagged Tumblr posts

Text

Compliance Gap Assessment: Bridging the Divide Between Compliance and Reality

In today's complex regulatory environment, businesses face increasing pressure to comply with a myriad of laws, regulations, and industry standards. Failure to meet these requirements can lead to hefty fines, legal repercussions, and damage to reputation. This is where compliance gap assessment comes into play.

Introduction to Compliance Gap Assessment

Compliance gap assessment is a systematic process of evaluating an organization's adherence to relevant laws, regulations, and internal policies. It involves identifying discrepancies between current practices and desired compliance standards.

Why Conduct a Compliance Gap Assessment?

Conducting a compliance gap assessment is essential for several reasons:

Identifying potential risks: By pinpointing areas of non-compliance, organizations can proactively address risks before they escalate.

Ensuring regulatory compliance: Compliance with laws and regulations is non-negotiable for businesses operating in various industries.

Improving operational efficiency: Streamlining processes and eliminating unnecessary steps can lead to cost savings and improved productivity.

Key Components of a Compliance Gap Assessment

A successful compliance gap assessment involves several key components:

Establishing objectives: Clearly defining the goals and scope of the assessment is crucial for focusing efforts and resources effectively.

Reviewing current policies and procedures: Evaluating existing policies, procedures, and controls provides a baseline for comparison.

Identifying gaps: Analyzing the differences between current practices and regulatory requirements helps prioritize areas for improvement.

Developing a remediation plan: Creating a detailed action plan ensures that identified gaps are addressed systematically.

Steps to Perform a Compliance Gap Assessment

Performing a compliance gap assessment involves the following steps:

Planning and preparation: Define the scope, objectives, and timeline for the assessment. Allocate resources and designate responsibilities accordingly.

Data collection and analysis: Gather relevant documentation, conduct interviews, and collect data to assess compliance across various areas.

Gap identification: Compare current practices against regulatory requirements to identify gaps and deficiencies.

Remediation planning: Develop a comprehensive plan to address identified gaps, including timelines, responsibilities, and resources required.

Implementation and monitoring: Execute the remediation plan, track progress, and make adjustments as necessary to ensure ongoing compliance.

Common Challenges in Compliance Gap Assessment

Despite its importance, compliance gap assessment can pose several challenges:

Lack of resources: Limited budget, time, and expertise can hinder the effectiveness of the assessment process.

Complexity of regulations: Keeping up with evolving regulations and interpreting their implications can be daunting for organizations.

Resistance to change: Implementing changes to achieve compliance may encounter resistance from stakeholders accustomed to existing practices.

Best Practices for Successful Compliance Gap Assessments

To overcome these challenges and ensure a successful compliance gap assessment, organizations should consider the following best practices:

Leadership commitment: Senior management should demonstrate unwavering support for compliance initiatives and allocate necessary resources.

Cross-functional collaboration: Involving stakeholders from various departments fosters a holistic understanding of compliance requirements and facilitates alignment of efforts.

Regular reviews and updates: Compliance is an ongoing process. Regular reviews and updates ensure that policies and procedures remain current and effective.

Case Studies: Real-world Examples of Compliance Gap Assessment

Healthcare Industry

In the healthcare sector, compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act) is paramount to safeguarding patient data and ensuring quality care. Conducting regular gap assessments helps healthcare organizations identify vulnerabilities and strengthen their compliance posture.

Financial Sector

Banks and financial institutions are subject to stringent regulations aimed at protecting consumers and maintaining financial stability. Compliance gap assessments enable these organizations to detect potential issues such as fraud, money laundering, and regulatory violations.

Manufacturing Companies

Manufacturing companies must adhere to a multitude of regulations governing product safety, environmental impact, and labor practices. Compliance gap assessments assist manufacturers in identifying areas for improvement and ensuring adherence to regulatory requirements.

Benefits of Conducting a Compliance Gap Assessment

The benefits of conducting a compliance gap assessment extend beyond mere regulatory compliance:

Risk mitigation: Identifying and addressing compliance gaps reduces the likelihood of fines, legal penalties, and reputational damage.

Cost savings: Streamlining processes and eliminating inefficiencies can lead to significant cost savings over time.

Enhanced reputation: Demonstrating a commitment to compliance and ethical business practices enhances trust and credibility among stakeholders.

Conclusion

Compliance gap assessment is a critical component of any organization's risk management and governance strategy. By systematically evaluating compliance across various areas, businesses can identify and address potential risks, ensure regulatory adherence, and enhance operational efficiency. Embracing best practices and leveraging real-world examples can help organizations navigate the complexities of compliance effectively.

FAQs (Frequently Asked Questions)

What is compliance gap assessment? Compliance gap assessment is a systematic process of evaluating an organization's adherence to relevant laws, regulations, and internal policies.

Why is compliance gap assessment important? Conducting a compliance gap assessment helps organizations identify potential risks, ensure regulatory compliance, and improve operational efficiency.

What are the key components of a compliance gap assessment? The key components include establishing objectives, reviewing current policies and procedures, identifying gaps, and developing a remediation plan.

What are some common challenges in compliance gap assessment? Common challenges include lack of resources, complexity of regulations, and resistance to change.

What are the benefits of conducting a compliance gap assessment? The benefits include risk mitigation, cost savings, and enhanced reputation.

#Compliance Gap Assessment#Risk Assessment#Vulnerability Assessment#"Application Security Testing & Penetration Services#Application Penetration Testing#Application Security Testing#Cybersecurity Compliance Preparation#Cybersecurity Program Support#Healthcare Cybersecurity Services#Cybersecurity Services for FinTech#HIPAA HITECH Compliance Certification#ISO 27001 Security Program

0 notes

Text

Blockchain Innovations: Changing How We Build Apps

The Rise of Blockchain in Development

Today's app landscape is rapidly evolving with blockchain technology leading significant changes. What started as Bitcoin's foundation now influences apps across industries. Companies looking to hire iOS developers increasingly prioritize blockchain expertise, recognizing that professionals with this specialized knowledge can create more secure and innovative applications. This growing demand highlights how blockchain capabilities have become essential for modern app development that requires enhanced security, transparency, and efficiency.

Core Blockchain Concepts

Blockchain works as a distributed ledger recording transactions across many computers. Its key strengths include decentralized control, complete transparency, permanent records, and enhanced security through cryptography.

Key Industry Applications

Finance: Lower-cost payments, faster transfers, tokenized assets

Supply Chain: Product tracking, ethical sourcing verification, counterfeit prevention

Healthcare: Secure patient data, medication authentication, streamlined claims

Identity: Password-free logins, digital identity verification, privacy-preserving authentication

Main Benefits

Better Security: Distributed systems eliminate single points of failure

Full Transparency: Unalterable records build trust in critical applications

Reduced Costs: Fewer intermediaries and automated smart contracts

Privacy Control: Users manage their own data sharing permissions

Implementation Challenges

Developers face technical complexity, scalability limitations, regulatory uncertainty, and user experience design challenges when building blockchain apps.

Future Directions

The field is advancing with cross-platform development tools, multi-blockchain applications, more accessible developer resources, and environmentally sustainable consensus mechanisms.

Moving Forward

Blockchain continues transforming app development with new approaches to data handling and user trust. As technology evolves, developers mastering blockchain implementation will lead the next wave of innovative applications.

#ios app development#app developers#hire ios developers#offshore developers#technology#web service#blockchain#appdevelopment#iOSdevelopment#techinnovation#smartcontracts#decentralization#fintech#appdev#developerlife#techtrends#cybersecurity#dataprivacy#cryptography#blockchaininnovation

0 notes

Text

Tech Innovation and Startups in Europe

Europe is quickly becoming a hotbed for tech innovation and startups. With booming sectors like AI startups, cybersecurity, fintech, blockchain, and digital transformation, the continent is ripe for growth. From software-as-a-service (SaaS) companies to robust European tech hubs, innovation funding is flowing into these industries at an unprecedented rate.

European Tech Hubs Leading the Charge

Cities like Berlin, London, and Paris are leading the charge in tech innovation. Berlin boasts a vibrant startup ecosystem, often considered one of the top European tech hubs. - London is famous for its fintech firms, bringing solutions to banking and financial transactions. - Paris is home to numerous AI startups, focusing on everything from machine learning to data analytics. These cities attract talent and investment like moths to a flame. The creative energy fuels fresh ideas and diverse concepts.

The Power of AI Startups

AI startups are gaining immense popularity across Europe. They range from health tech solutions that use AI to improve patient outcomes to companies improving business processes and customer experiences. Did you know that AI could increase the world's GDP by $15.7 trillion by 2030? That's according to a report by PwC. This vast economic potential has lured countless investors and entrepreneurs into the AI space.

Diving into Cybersecurity

With the rise of technology comes the increased risk of cyber threats. This has led to a surge in the cybersecurity sector. According to Cybersecurity Ventures, global spending on cybersecurity will exceed $1 trillion from 2017 to 2021. European startups in this space are developing cutting-edge solutions to protect data and privacy. Investors are keen on funding innovative companies that can tackle these urgent challenges. Whether it’s safeguarding financial institutions or protecting personal data, cybersecurity startups are essential players in the tech landscape.

Fintech: The Future of Finance

Fintech is another exciting sector in the European tech innovation scene. With the digitization of financial services, fintech startups are changing how Europeans handle money. An exciting player in this field is Revolut, which redefined banking by offering international financial services all through a mobile app. According to Statista, the financial technology market is projected to grow to $460 billion by 2025. Don’t forget about blockchain technology, which is becoming invaluable in finance. This distributed ledger technology is not only useful for cryptocurrencies but also for ensuring transparency and security in transactions.

Understanding Blockchain's Role

Blockchain doesn’t just cater to finance; it also offers promising solutions across various sectors. For example, in supply chain management, it ensures traceability and accountability by recording every transaction. European firms are experimenting with this innovative technology, showing incredible potential for growth. Many startups use blockchain to promote responsible data handling. This keeps users more secure and informed about where their data is being used.

The Age of Digital Transformation

The buzz around digital transformation is everywhere. Companies are evolving to stay relevant and competitive in this fast-paced world. This transformation involves adopting digital tools, improving customer experiences, and Streamlining operations. For instance, software-as-a-service (SaaS) platforms offer businesses scalable solutions that can grow as they do. SaaS solutions allow small startups to access tools that were once only available to large corporations. This levels the playing field and fosters innovation, especially among AI startups and other tech firms.

Innovation Funding: Fueling Growth

Funding remains a crucial aspect of tech startups. European investors are putting their money into budding entrepreneurial ventures, especially in the tech sector. Various funding programs, like EU grants and venture capital, are available to help innovative companies launch their ideas. According to the European Investment Fund, investment in European startups reached around €12 billion in 2020! Different stages of funding include angel investors, crowdfunding, and venture capital rounds. Each stage can help startups reach their milestones and scale their operations.

The Importance of Collaboration

Collaboration in the innovation ecosystem cannot be overstated. Startups benefit significantly from partnerships with established companies and research institutions. For instance, incubators and accelerators play a vital role in supporting startups. Organizations such as Techstars and Station F in Paris provide a community for networking and mentorship. Collaborations foster diverse perspectives while sharing resources. This often leads to new products and services that change the industry’s landscape.

The Road Ahead: Challenges and Opportunities

As enthusiastic as the tech innovation closer looks, challenges persist. Regulations and compliance measures across different European countries present hurdles for startups. Building customer trust is crucial, especially in sectors like cybersecurity and fintech. Users are more encouraged to adopt new technologies when they feel secure in their choices. However, the landscape remains promising. Emerging trends and constant evolution reassure that the entrepreneurial spirit will continue to thrive.

Conclusion

In conclusion, the landscape of tech innovation and startups in Europe is evolving rapidly. From AI startups to digital transformation initiatives, sectors like cybersecurity, fintech, blockchain technology, and software-as-a-service (SaaS) are at the forefront of this change. With robust European tech hubs and increasing consumer demand, innovation funding is more critical than ever. The future of European startups looks bright, and it promises immense potential for growth and stability. Read the full article

#AIstartups#Blockchain#cybersecurity#digitaltransformation#Europeantechhubs#fintech#innovationfunding#software-as-a-service(SaaS)

0 notes

Text

Decentralized Finance (DeFi): Reshaping Financial Systems

Decentralized Finance (DeFi) is at the forefront of fintech innovation in 2025, significantly reshaping how individuals and businesses access financial services. Built on blockchain technology, DeFi eliminates the need for traditional intermediaries like banks, allowing users to conduct transactions directly through smart contracts self-executing code on the blockchain.

DeFi platforms offer financial services such as lending, borrowing, trading, and saving to anyone with an internet connection. This is particularly transformative for underbanked populations in emerging economies, where traditional banking infrastructure is often limited.

All transactions on DeFi platforms are recorded on public ledgers, ensuring full transparency. The use of decentralized networks reduces the risk of single points of failure, enhancing security and resilience.

#fintech financial services#bank of canada digital currencies and fintech#cybersecurity fintech#fintech payment services#fintech payment solutions

1 note

·

View note

Text

نوتردام: رحلة إعادة إعمار بين المعجزات والخلافات

arabic إعادة تصور دور البنوك في الاقتصاد الحديث تُعتبر البنوك ركيزة أساسية في النظام الاقتصادي الحديث، حيث تلعب دورًا محوريًا في تسهيل المعاملات المالية وتوفير التمويل اللازم للأفراد والشركات. ولكن مع التطورات التكنولوجية المتسارعة والتحولات الاقتصادية العالمية، يتطلب الأمر إعادة تقييم دور البنوك وكيفية تكيّفها مع هذه المتغيرات. البنوك بين التحديات والفرص تواجه البنوك اليوم تحديات جمة،…

#Banking#customer experience#cybersecurity#digital transformation#economic development#finance#financial services#fintech#innovation#regulation

0 notes

Text

Need competent, supportive, cusomized technology services and solutions? Accutive delivers.

Our client tenure, repeat engagements, and deep partnerships prove the value of our approach.

We always strive for 100% client satisfaction and our fully remote, dedicated, expert teams deliver. With deep expertise and fully remote, dedicated teams, Accutive delivers excellent results for every client and project.

1 note

·

View note

Text

Protecting Customer Data from Fintech Cybersecurity Threats

The fintech industry is facing an increase in cyber risks such as data breaches, phishing attacks, and ransomware. Customer data security is critical. Security measures such as Multi-Factor Authentication, and encryption must be implemented by fintech organisations. AI, blockchain, biometrics, and the challenge of quantum computing are all emerging trends. To ensure confidence and reputation, the ease of fintech necessitates strong cybersecurity practises.

Learn how to secure your fintech application https://www.ficode.co.uk/blog/protecting-customer-data-from-fintech-cybersecurity-threats

0 notes

Text

Transform Your Tomorrow with Zylentrix: Sustainable Innovation for Businesses, Careers, and Global Growth

🌐 Zylentrix: Redefining Success Through People-Centric Solutions

At Zylentrix, we’re on a mission to empower individuals, businesses, and communities through innovation, integrity, and sustainability. Our vision? To lead the world in integrated consultancy services, transforming challenges into stepping stones for growth. Whether you’re scaling a business, launching a career, or pursuing education, we’re here to equip you with the tools to thrive. Let’s unpack how our mission, values, and culture make us the partner you can trust.

🎯 Our Mission & Vision: The North Star of Zylentrix

Mission: “To empower individuals, businesses, and communities by delivering innovative and customised solutions across education, technology, recruitment, and business consulting. With a commitment to excellence, integrity, and sustainability, we strive to create opportunities, bridge gaps, drive transformation, and foster long-term success.”

Vision: “To be the global leader in integrated consultancy services, transforming lives and businesses through innovative, sustainable, and forward-thinking solutions that empower individuals, businesses, and communities to thrive and succeed.”

We’re not just consultants—we’re architects of progress, designing futures where everyone has the chance to excel.

💎 Core Values: The Pillars of Everything We Do

Our values are the blueprint for how we serve clients, collaborate with partners, and grow as a team:

Integrity: “Building Trust Through Transparency” Every decision is guided by ethics. No shortcuts, no compromises.

Innovation: “Driving Future-Ready Solutions” From AI-driven recruitment tools to sustainable business frameworks, we pioneer what’s next.

Excellence: “Delivering Impact & Measurable Growth” We set—and smash—high standards, ensuring clients see real results.

Customer-Centricity: “Putting Clients at the Centre of Everything” Your goals shape our strategies. We listen, adapt, and deliver.

Diversity, Inclusion & Collaboration: “Creating Equal Opportunities for All” Diverse teams = smarter solutions. We champion equity in every project.

Sustainability: “Responsible Business for a Better Future” Green tech, eco-friendly practices, and ethical growth are non-negotiables.

Empowerment: “Enabling People & Businesses to Thrive” We don’t just hand you tools—we teach you how to master them.

🤝 Our Commitment: Tailored Support for Every Journey

Zylentrix is your partner in growth, no matter your starting point:

For Businesses:

Tech Solutions: Streamline operations with scalable AI, cybersecurity, and cloud systems.

Strategic Recruitment: Access global talent pools curated for cultural and technical fit.

Consulting Excellence: Turn insights into action with market research and digital transformation plans.

For Job Seekers:

Career Mastery: Revamp resumes, ace interviews, and unlock roles in booming industries like fintech and clean energy.

Global Mobility: Navigate international job markets with visa support and relocation guidance.

For Students:

Education Pathways: Secure admissions and scholarships at top universities worldwide.

Future-Proof Skills: Gain certifications in AI, sustainability, and more through our partnerships.

For Startups & SMEs:

Scale Smart: Leverage data analytics and ESG frameworks to grow responsibly.

Funding Ready: Craft investor pitches that stand out in crowded markets.

🌱 Our Culture: Fueling Innovation from Within

At Zylentrix, our workplace is a launchpad for creativity and collaboration. Here’s what defines us:

Lifelong Learning: Monthly workshops, innovation challenges, and tuition reimbursements keep our team ahead of trends.

Agility in Action: When the world changes, we pivot faster—like shifting to virtual career fairs during the pandemic.

Collaborative Spirit: Cross-departmental “sprint teams” solve client challenges, blending tech experts, educators, and recruiters.

Ownership & Impact: Every employee, from interns to executives, contributes to client success stories.

Work-Life Harmony: Flexible hours, mental health resources, and sustainability days ensure our team thrives inside and out.

Join the Zylentrix Movement

Ready to transform your business, career, or community? Let’s build a future where innovation and integrity go hand in hand.

📩 Connect Today 👉 Explore our services: Zylentrix 👉 Follow us on Social Media for tips on tech, careers, and sustainability. LinkedIn Facebook Instagram TikTok X Pinterest YouTube Quora Medium 👉 Email [email protected] to schedule a free consultation.

27 notes

·

View notes

Text

What is Cybersecurity? Types, Uses, and Safety Tips

What is Cyber security?

Cyber security, also known as information security, is the practice of protecting computers, servers, networks, and data from cyberattacks. With the increasing reliance on technology in personal, professional, and business environments, the importance of cyber security has grown significantly. It helps protect sensitive data, ensures the integrity of systems, and prevents unauthorized access to confidential information.

For businesses in Jaipur, cyber security services play a crucial role in safeguarding digital assets. Whether you're an e-commerce platform, an IT company, or a local enterprise, implementing strong cyber security in Jaipur can help mitigate risks like hacking, phishing, and ransomware attacks.

Types of Cyber security

Cyber security is a vast domain that covers several specialized areas. Understanding these types can help individuals and organizations choose the right protection measures.

1. Network Security

Network security focuses on protecting the network infrastructure from unauthorized access, data breaches, and other threats. Tools like firewalls, virtual private networks (VPNs), and intrusion detection systems are commonly used. In Jaipur, many businesses invest in cyber security services in Jaipur to ensure their networks remain secure.

2. Information Security

This type of cyber security involves protecting data from unauthorized access, ensuring its confidentiality and integrity. Companies offering cyber security in Jaipur often emphasize securing sensitive customer and business information, adhering to global data protection standards.

3. Application Security

Application security addresses vulnerabilities in software and apps to prevent exploitation by cybercriminals. Regular updates, secure coding practices, and application testing are vital components.

4. Cloud Security

As more businesses move to cloud-based solutions, securing cloud environments has become essential. Cyber security providers in Jaipur specialize in offering services like data encryption and multi-factor authentication to ensure cloud data is safe.

5. Endpoint Security

Endpoint security protects devices such as laptops, desktops, and mobile phones from cyber threats. It is especially critical for remote work setups, where devices may be more vulnerable. Cyber security services in Jaipur provide solutions like antivirus software and mobile device management to secure endpoints.

6. IoT Security

With the rise of Internet of Things (IoT) devices, ensuring the security of connected devices has become crucial. Businesses in Jaipur use cyber security in Jaipur to secure smart devices like industrial sensors and home automation systems.

Uses of Cyber security

Cyber security is indispensable in various domains. From individual users to large organizations, its applications are widespread and critical.

1. Protection Against Cyber Threats

One of the primary uses of cyber security is to safeguard systems and data from threats like malware, ransomware, and phishing. Businesses in Jaipur often rely on cyber security Jaipur solutions to ensure they are prepared for evolving threats.

2. Ensuring Data Privacy

For industries like finance and healthcare, data privacy is non-negotiable. Cyber security measures help organizations comply with laws and protect sensitive customer information. Cyber security services in Jaipur ensure businesses meet data protection standards.

3. Business Continuity

Cyber security is essential for ensuring business continuity during and after cyberattacks. Jaipur businesses invest in robust cyber security services in Jaipur to avoid downtime and minimize financial losses.

4. Securing Financial Transactions

Cyber security ensures the safety of online transactions, a critical aspect for e-commerce platforms and fintech companies in Jaipur. Solutions like secure payment gateways and fraud detection tools are widely implemented.

5. Enhancing Customer Trust

By investing in cyber security in Jaipur, businesses build trust with their customers, demonstrating a commitment to safeguarding their data and transactions.

Cyber security in Jaipur

Jaipur is emerging as a hub for businesses and IT companies, which has increased the demand for reliable cyber security solutions. Cyber security services in Jaipur cater to diverse industries, including retail, healthcare, education, and finance.

Local providers of cyber security Jaipur solutions offer tailored services like:

Vulnerability Assessments: Identifying potential security risks in systems and networks.

Penetration Testing: Simulating attacks to uncover weaknesses and improve defenses.

Managed Security Services: Continuous monitoring and management of security operations.

Many IT firms prioritize cyber security services in Jaipur to ensure compliance with global standards and protect their operations from sophisticated cyber threats.

Safety Tips for Staying Secure Online

With the rising number of cyberattacks, individuals and businesses must adopt proactive measures to stay secure. Here are some practical tips that integrate cyber security in Jaipur into daily practices.

1. Use Strong Passwords

Ensure passwords are long, unique, and a mix of letters, numbers, and symbols. Avoid reusing passwords for multiple accounts. Cyber security experts in Jaipur recommend using password managers for added security.

2. Enable Two-Factor Authentication (2FA)

Adding an extra layer of security through 2FA significantly reduces the risk of unauthorized access. Many cyber security services in Jaipur emphasize implementing this measure for critical accounts.

3. Regular Software Updates

Outdated software can be a gateway for attackers. Keep operating systems, antivirus tools, and applications updated to close security loopholes. Businesses in Jaipur frequently rely on cyber security Jaipur providers to manage system updates.

4. Be Cautious with Emails

Phishing emails are a common attack vector. Avoid clicking on suspicious links or downloading unknown attachments. Cyber security in Jaipur often involves training employees to recognize and report phishing attempts.

5. Invest in Reliable Cyber security Services

Partnering with trusted cyber security services in Jaipur ensures robust protection against advanced threats. From endpoint protection to cloud security, these services help safeguard your digital assets.

6. Avoid Public Wi-Fi for Sensitive Transactions

Public Wi-Fi networks are vulnerable to attacks. Use a VPN when accessing sensitive accounts or conducting financial transactions. Cyber security Jaipur experts often provide VPN solutions to businesses and individuals.

7. Backup Your Data Regularly

Regularly backing up data ensures that critical information is not lost during cyber incidents. Cyber security providers in Jaipur recommend automated backup solutions to minimize risks.

Why Choose Cyber Security Services in Jaipur?

The vibrant business ecosystem in Jaipur has led to a growing need for specialized cyber security services. Local providers like 3Handshake understand the unique challenges faced by businesses in the region and offer customized solutions.

Some reasons to choose cyber security Jaipur services from like 3Handshake include:

Cost-Effective Solutions: Tailored to fit the budgets of small and medium-sized businesses.

Local Expertise: Providers have an in-depth understanding of regional cyber threats.

24/7 Support: Many companies offer round-the-clock monitoring and support to handle emergencies.

For businesses in Jaipur, investing in cyber security services in Jaipur is not just about compliance; it's about ensuring long-term success in a competitive digital landscape.

4 notes

·

View notes

Text

⋆˚𐙚 Nature of ICT ⋆˚𐙚

Ever wonder what makes the world tick? A huge part is technology – the invisible force connecting us all, driving progress, and shaping our future. It's how we connect, share ideas, and create. We can find information instantly, work with people across the globe, and stay connected like never before. But this amazing power comes with responsibilities. How do we deal with false information online? How do we use all this data responsibly? These are crucial questions as technology keeps evolving.

⛧°。 ⋆༺❀༻⋆。 °⛧

Information and Communications Technology (ICT) isn't just about computers and phones; it's the foundation of how we live, work, and interact. It's transformed everything from how businesses operate to how we communicate with friends and family. It's created a global marketplace, making it easier than ever to buy and sell goods and services across borders. Businesses now rely on data to understand customers and make better decisions. Instant communication has revolutionized teamwork and customer service. But this progress also brings challenges: cybersecurity threats, unequal access to technology, and the spread of misinformation.

⛧°。 ⋆༺❀༻⋆。 °⛧

For Accountancy, Business, and Management (ABM) study, understanding ICT isn't optional; it's essential. It's the language of 21st-century business. You'll need to master data analysis, navigate digital office environments, and understand emerging technologies like FinTech. Proficiency in e-commerce and ethical data handling are also crucial skills. Embrace the power of technology, develop the necessary skills, and understand its ethical implications. You're the architects of this digital age, and your understanding of ICT will determine your success.

4 notes

·

View notes

Text

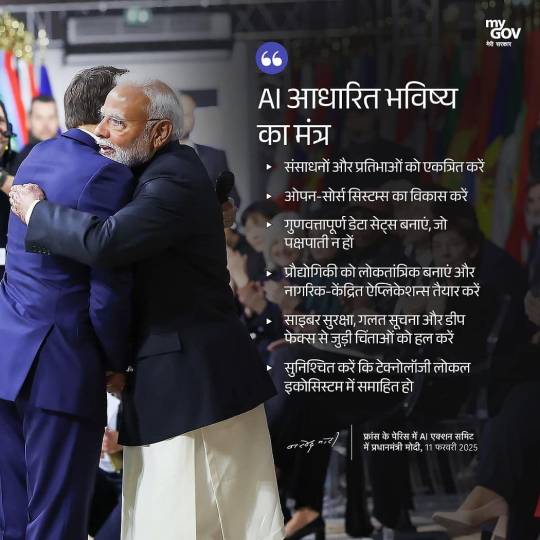

AI-Based Future Mantra: Col Rajyavardhan Rathore’s Vision for Innovation & Growth 🤖🚀

In an era where Artificial Intelligence (AI) is reshaping industries, economies, and societies, Col Rajyavardhan Singh Rathore envisions a future-driven, innovation-led India that embraces AI to power growth, governance, and global competitiveness. His AI-based Future Mantra focuses on leveraging AI for digital transformation, job creation, industry modernization, and national security, ensuring India emerges as a leader in the AI revolution.

🌟 Key Pillars of Col Rathore’s AI Vision

1️⃣ AI-Driven Digital India: Transforming Governance & Public Services

✅ AI-powered e-Governance — Enhancing efficiency, transparency & citizen services. ✅ Smart City Development — AI-based urban planning, traffic management & waste control. ✅ Predictive Analytics for Policy Making — Data-driven decision-making for better governance.

��AI is the key to revolutionizing governance and making citizen services more efficient, accessible, and transparent.”

2️⃣ AI for Industry & Economic Growth: Powering Smart Enterprises

✅ AI in Manufacturing & MSMEs — Enhancing productivity & automation. ✅ AI-powered Startups & Innovation Hubs — Supporting entrepreneurs with next-gen AI solutions. ✅ Boosting IT, Fintech & Smart Commerce — Strengthening India’s global digital economy presence.

“AI is not about replacing jobs; it’s about creating new opportunities, industries, and careers.”

3️⃣ AI in Agriculture: Revolutionizing Rural Economy 🌾🤖

✅ Smart Farming with AI — Precision agriculture & automated irrigation. ✅ AI-based Crop Monitoring & Forecasting — Reducing farmer losses & improving productivity. ✅ Digital Marketplaces for Farmers — Connecting rural producers to global markets.

“AI can empower farmers with knowledge, tools, and predictive analytics to revolutionize Indian agriculture.”

4️⃣ AI in Education & Skill Development: Empowering Youth for Future Jobs 🎓💡

✅ AI-driven Personalized Learning — Smart classrooms & adaptive learning systems. ✅ AI Upskilling Programs — Training youth in AI, robotics & machine learning. ✅ AI-Powered Job Market Platforms — Connecting talent with industries using AI analytics.

“The future belongs to those who master AI. We must equip our youth with the skills to lead in the AI economy.”

5️⃣ AI in National Security & Defense: A Smarter, Safer India 🛡️🚀

✅ AI in Cybersecurity — Advanced threat detection & prevention. ✅ AI-powered Surveillance & Defense Tech — Strengthening India’s armed forces. ✅ AI in Disaster Management — Early warning systems & crisis response automation.

“AI is the force multiplier for India’s defense and security strategy in the 21st century.”

🚀 The Road Ahead: Col Rathore’s Action Plan for AI-Driven Growth

🔹 AI Policy & Infrastructure Development — Strengthening India’s AI ecosystem. 🔹 Public-Private Partnerships for AI Innovation — Encouraging global collaborations. 🔹 AI Talent & Research Investments — Making India a global hub for AI development. 🔹 Ethical AI & Responsible Innovation — Ensuring AI benefits all sections of society.

“AI is India’s gateway to a smarter, more efficient, and innovative future. Let’s lead the way!” 🚀

🌍 India’s AI Future: Leading the Global Innovation Wave

✅ AI-powered industries, smart cities, and a digital economy. ✅ Next-gen job creation & future-ready workforce. ✅ Stronger governance, national security, and agriculture. ✅ A global AI leader driving innovation & inclusivity.

🔥 “AI is not just a tool — it’s the future. And India will lead it!” 🤖 Jai Hind! Jai Innovation! 🇮🇳🚀

4 notes

·

View notes

Text

5 Trends in ICT

Exploring the 5 ICT Trends Shaping the Future The Information and Communication Technology (ICT) landscape is evolving at a rapid pace, driven by advancements that are transforming how we live, work, and interact. Here are five key trends in ICT that are making a significant impact:

1. Convergence of Technologies

Technologies are merging into integrated systems, like smart devices that combine communication, media, and internet functions into one seamless tool. This trend enhances user experience and drives innovation across various sectors

Convergence technologies merge different systems, like smartphones combining communication and computing, smart homes using IoT, telemedicine linking healthcare with telecom, AR headsets overlaying digital on reality, and electric vehicles integrating AI and renewable energy.

2. Social Media

Social media platforms are central to modern communication and marketing, offering real-time interaction and advanced engagement tools. New features and analytics are making these platforms more powerful for personal and business use.

Social media examples linked to ICT trends include Facebook with cloud computing, TikTok using AI for personalized content, Instagram focusing on mobile technology, LinkedIn applying big data analytics, and YouTube leading in video streaming.

3. Mobile Technologies

Mobile technology is advancing with faster 5G networks and more sophisticated devices, transforming how we use smartphones and tablets. These improvements enable new applications and services, enhancing connectivity and user experiences.

Mobile technologies tied to ICT trends include 5G for high-speed connectivity, mobile payment apps in fintech, wearables linked to IoT, AR apps like Pokémon GO, and mobile cloud storage services like Google Drive.

4. Assistive Media

Assistive media technologies improve accessibility for people with disabilities, including tools like screen readers and voice recognition software. These innovations ensure that digital environments are navigable for everyone, promoting inclusivity.

Assistive media examples linked to ICT trends include screen readers for accessibility, AI-driven voice assistants, speech-to-text software using NLP, eye-tracking devices for HCI, and closed captioning on video platforms for digital media accessibility.

5. Cloud Computing

Cloud computing allows for scalable and flexible data storage and application hosting on remote servers. This trend supports software-as-a-service (SaaS) models and drives advancements in data analytics, cybersecurity, and collaborative tools.

Cloud computing examples related to ICT trends include AWS for IaaS, Google Drive for cloud storage, Microsoft Azure for PaaS, Salesforce for SaaS, and Dropbox for file synchronization.

Submitted by: Van Dexter G. Tirado

3 notes

·

View notes

Text

How Fintech Development Services are Reshaping the Financial Industry

In recent years, the financial industry has undergone a profound transformation driven by advancements in technology and the emergence of fintech development services. These innovative solutions, offered by companies like Xettle Technologies, are revolutionizing traditional banking and financial processes, reshaping the industry landscape and driving digital transformation across various sectors. This article explores the key ways in which fintech development services are reshaping the financial industry and the role of Xettle Technologies in this transformative journey.

Disruption of Traditional Banking Models: Fintech development services have disrupted traditional banking models by offering innovative solutions that challenge the status quo. From digital payments and lending platforms to robo-advisors and peer-to-peer lending networks, fintech solutions provide consumers and businesses with alternative ways to access financial services that are often more efficient, convenient, and cost-effective than traditional banking methods.

Democratization of Financial Services: One of the most significant impacts of fintech development services is the democratization of financial services. By leveraging technology, fintech solutions empower individuals and businesses, particularly those underserved by traditional banks, to access a wide range of financial products and services, including banking, lending, investing, and insurance. This democratization fosters financial inclusion and promotes economic growth by providing opportunities for individuals and businesses to participate in the formal financial system.

Enhanced Customer Experience: Fintech solutions prioritize customer experience by offering user-friendly interfaces, personalized services, and streamlined processes. Through intuitive mobile apps, digital wallets, and online platforms, customers can manage their finances more efficiently, make seamless transactions, and access real-time financial insights. By putting the needs of customers first, fintech development services improve satisfaction levels and build long-lasting relationships with consumers.

Increased Efficiency and Cost Savings: Fintech development services streamline financial processes and operations, resulting in increased efficiency and cost savings for businesses. Automation, AI-driven algorithms, and data analytics optimize various tasks, such as loan underwriting, risk assessment, and compliance, reducing manual effort and minimizing errors. These efficiency gains translate into lower operating costs, faster turnaround times, and improved profitability for financial institutions and businesses alike.

Accelerated Innovation and Agility: Fintech development services foster a culture of innovation and agility within the financial industry. By embracing emerging technologies and agile methodologies, fintech companies like Xettle Technologies can rapidly prototype, test, and deploy new solutions to address evolving market needs and customer preferences. This agility allows financial institutions to stay ahead of the curve, adapt to changing regulatory environments, and capitalize on emerging opportunities in the market.

Strengthened Security and Risk Management: With the rise of digital transactions and the proliferation of sensitive financial data, cybersecurity and risk management have become top priorities for the financial industry. Fintech development services integrate robust security measures, such as encryption, multi-factor authentication, and biometric identification, to safeguard against cyber threats and protect customer information. Additionally, AI-driven risk analytics and predictive models help financial institutions proactively identify and mitigate potential risks, enhancing overall security and resilience.

Compliance with Regulatory Standards: In an increasingly regulated environment, compliance with regulatory standards is critical for financial institutions to maintain trust and credibility with stakeholders. Fintech development services assist organizations in navigating complex regulatory frameworks by incorporating compliance features and regulatory reporting functionalities into their solutions. By automating compliance processes and ensuring adherence to regulatory requirements, fintech solutions help mitigate compliance risks and ensure regulatory compliance across all operations.

Xettle Technologies: Leading the Charge in Fintech Innovation As a leading provider of fintech development services, Xettle Technologies is at the forefront of driving innovation and reshaping the financial industry. With a focus on advanced technologies, customization, security, and customer-centricity, Xettle offers a comprehensive suite of fintech solutions tailored to meet the diverse needs of its clients. Whether it's digital payments, lending platforms, risk management solutions, or regulatory compliance tools, Xettle Technologies empowers businesses to thrive in today's dynamic financial landscape.

Conclusion: Fintech development services are fundamentally reshaping the financial industry by revolutionizing traditional banking models, democratizing financial services, enhancing customer experience, increasing efficiency, accelerating innovation, strengthening security, and ensuring compliance with regulatory standards. As a trusted provider of fintech solutions, Xettle Technologies plays a pivotal role in driving this transformation, helping businesses adapt to the digital age and seize new opportunities for growth and success.

#Fintech#Development#Services#Fintech Startups#technology#fintech software#xettle technologies#fi̇ntech

2 notes

·

View notes

Text

Unveiling the Job Market: How Many Jobs Are Available in Finance Services in 2024?

In the ever-evolving landscape of finance, the job market plays a pivotal role in shaping career aspirations and industry trends. As we step into 2024, professionals and aspiring individuals are eager to uncover the opportunities awaiting them in the realm of finance services, particularly in the United States. This article sheds light on the abundance of opportunities available in the finance services.

Exploring the Finance Job Market Landscape:

Quantifying Opportunities:

How many jobs are available in finance in the USA?

Analyzing recent statistics and projections to gauge the scale of employment opportunities.

Factors influencing job availability, such as economic conditions, technological advancements, and regulatory changes.

Diverse Sectors, Diverse Opportunities:

Breaking down the finance sector into subcategories, including banking, investment management, insurance, and consumer services.

Highlighting the unique job prospects within each sector and the skill sets required to excel.

Identifying emerging roles and specialties that are gaining prominence in response to market demands and industry shifts.

Finance in the Digital Age:

Examining the impact of technology on job creation and the transformation of traditional finance roles.

The rise of fintech companies and their contribution to job growth, particularly in areas like digital banking, payment processing, and financial analytics.

The demand for professionals with expertise in data analysis, cybersecurity, and artificial intelligence within the finance sector.

Investment Management: A Thriving Field:

How many jobs are available in investment management?

Unveiling the job opportunities within investment firms, asset management companies, and hedge funds.

The significance of skilled portfolio managers, financial analysts, and risk assessment specialists in driving investment strategies and maximizing returns.

Exploring the global reach of investment management careers and the potential for growth in international markets.

Consumer Services: Meeting the Needs of Individuals:

Evaluating the job market within consumer-focused finance services, including retail banking, wealth management, and financial advising.

The demand for client relationship managers, financial planners, and retirement advisors in assisting individuals with their financial goals.

The role of personalized financial services and digital platforms in catering to the diverse needs of consumers and enhancing their financial literacy.

Trends Shaping the Future:

Anticipating future job trends in finance services and the skills that will be in high demand.

The growing importance of sustainable finance and environmental, social, and governance (ESG) investing, leading to opportunities in green finance and impact investing.

The influence of geopolitical factors, regulatory reforms, and demographic shifts on the finance job market landscape.

Conclusion:

As we go through 2024, the finance job market in the United States continues to offer a lot of opportunities across various sectors. Whether aspiring to go into investment management, consumer services, or the dynamic world of fintech, individuals with the right skills and expertise are well-positioned to thrive in this ever-evolving industry. By staying abreast with market trends, honing relevant skills, and embracing innovation, professionals can seize the abundant opportunities awaiting them in the realm of finance services.

6 notes

·

View notes

Text

The FinTech Revolution and Data Analytics in the UK

With London poised to overtake New York as the fintech capital given regulators embrace of transformative insurance, trading and risk management technologies–financial bodies recognize analytics talent as crucial for global competitiveness and market-readiness.

Leading commerce masters programs respond by integrating fintech specializations focused on blockchain models, cybersecurity protocols, robo-advisors and predictive risk analytics amidst cutting-edge technologies entering mainstream banking. Graduates feed directly into high-paying analytics and product development roles tailored to mold the future of finance.

Domain emphasis apart–the sheer diversity of world-leading banks, consultancies and boutique fintech firms concentrated in the square mile offers unparalleled work integrated learning opportunities from day one allowing internationally mobile career progressions.

Posted By:

Aditi Borade, 4th year Barch,

Ls Raheja School of architecture

Disclaimer: The perspectives shared in this blog are not intended to be prescriptive. They should act merely as viewpoints to aid overseas aspirants with helpful guidance. Readers are encouraged to conduct their own research before availing the services of a consultant.

#studyinuk#fintech#analytics#london#AnalyticsTalent#BlockchainInnovation#CybersecurityProtocols#RoboAdvisors#PredictiveAnalytics#FutureFinanceLeaders#CareerProgression#SquareMileOpportunities#FintechMastersPrograms#MarketReadiness#EnvoyOverseas#EthicalCounselling#EnvoyStudyInUK#EnvoyEducation

4 notes

·

View notes

Text

Emerging Industries: Opportunities in the UK Job Market

Planning to study in the UK? Want to explore career opportunities in the United Kingdom?

In the ever-evolving world, the UK stands as a hub for innovation and growth, bringing numerous emerging sectors that offer promising career prospects. As technology continues to reshape the global economy, several industries in the UK have captured attention, presenting exciting opportunities for job seekers and entrepreneurs alike. Take a look at some of the career opportunities you could take advantage of.

1. Fintech (Financial Technology)

The UK has strengthened its position as a leading fintech hub, with London being a prominent center for financial innovation. Fintech includes a wide array of sectors, including mobile payments, blockchain, and cybersecurity. Job opportunities in this field span software development, data analysis, financial consultancy, and regulatory compliance.

2. Technology and IT

In the emerging era of the digital world, technology continues to dominate businesses worldwide. As, a result the demand for technologically advanced professionals tends to rise. Software developers, data analysts, cybersecurity experts, and artificial intelligence specialists roles are in high demand. With the increasing use of technologies and the need for innovative solutions, these roles offer tremendous growth opportunities and competitive salaries.

3. Healthtech

The combination of healthcare and technology has given rise to HealthTech, a sector dedicated to enhancing medical services through innovative solutions. From telemedicine to health analytics and AI-driven diagnostics, HealthTech offers diverse career paths for healthcare professionals, software developers, data scientists, and researchers.

4. Renewable energy and sustainability

With an increased focus on sustainability and combating climate change, the UK has been investing significantly in renewable energy sources. Wind, solar, and hydroelectric power are among the sectors experiencing rapid growth. Job roles in renewable energy range from engineering and project management to research and policy development, catering to those passionate about environmental conservation.

5. Cybersecurity

With the increasing frequency of cyber threats, the demand for cybersecurity experts is on the rise. Businesses and governments are investing heavily in safeguarding digital infrastructure. Job roles in cybersecurity encompass ethical hacking, network security, data protection, and risk analysis, presenting ample opportunities for skilled professionals in this field.

6. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing various industries, including finance, healthcare, and manufacturing. The UK is fostering innovation in AI research and development, offering roles in AI programming, data engineering, robotics, and AI ethics.

7. Creative industries

The UK has a rich heritage in the creative sector, encompassing fields like media, design, gaming, and entertainment. Roles in creative industries span from content creation and graphic design to video production and game development, appealing to individuals with artistic and technical skills.

In conclusion, the UK job market is filled with opportunities within emerging industries, showing the nation's commitment to innovation and progress. Whether one's passion lies in sustainability, technology, healthcare, or creative endeavors, these sectors offer an array of possibilities for career growth and contribution to shaping the future.

By embracing change, acquiring relevant skills, and staying adaptable, individuals can position themselves to thrive in these dynamic and promising industries, contributing to both personal success and the advancement of these transformative sectors in the UK.

If you are struggling to get the right guidance, please do not hesitate to consult MSM Unify.

At MSM Unify, you can explore more than 50,000 courses across 1500+ educational institutions across the globe. MSM Unify has helped 1,50,000+ students achieve their study abroad dream so far. Now, it is your turn to attain your study-abroad dreams and elevate your professional journey! So, get ready to broaden your horizons and make unforgettable memories on your upcoming adventure.

2 notes

·

View notes