#economic development

Text

“It is simply impossible to overstate both the importance of the buffalo to the Indian people and the damage that was done when the buffalo were nearly wiped out,” ITBC President Ervin Carlson said in a statement. “By helping tribes reestablish buffalo herds on our reservation lands, the Congress will help us reconnect with a keystone of our historic culture as well as create jobs and an important source of protein that our people truly need.”

#bison#buffalo#short grass prairie#conservation#sustainability#economic development#traditional ecological knowledge#ecological restoration#species conservation

213 notes

·

View notes

Note

Why do economists need to shut up about mercantilism, as you alluded to in your post about Louis XIV's chief ministers?

In part due to their supposed intellectual descent from Adam Smith and the other classical economists, contemporary economists are pretty uniformly hostile to mercantilism, seeing it as a wrong-headed political economy that held back human progress until it was replaced by that best of all ideas: capitalism.

As a student of economic history and the history of political economy, I find that economists generally have a pretty poor understanding of what mercantilists actually believed and what economic policies they actually supported. In reality, a lot of the things that economists see as key advances in the creation of capitalism - the invention of the joint-stock company, the creation of financial markets, etc. - were all accomplishments of mercantiism.

Rather than the crude stereotype of mercantilists as a bunch of monetary weirdos who thought the secret to prosperity was the hoarding of precious metals, mercantilists were actually lazer-focused on economic development. The whole business about trying to achieve a positive balance of trade and financial liquidity and restraining wages was all a means to an end of economic development. Trade surpluses could be invested in manufacturing and shipping, gold reserves played an important role in deepening capital pools and thus increasing levels of investment at lower interest rates that could support larger-scale and more capital intensive enterprises, and so forth.

Indeed, the arch-sin of mercantilism in the eyes of classical and contemporary economists, their interference in free trade through tariffs, monopolies, and other interventions, was all directed at the overriding economic goal of climbing the value-added ladder.

Thus, England (and later Britain) put a tariff on foreign textiles and an export tax on raw wool and forbade the emigration of skilled workers (while supporting the immigration of skilled workers to England) and other mercantilist policies to move up from being exporters of raw wool (which meant that most of the profits from the higher value-added part of the industry went to Burgundy) to being exporters of cheap wool cloth to being exporters of more advanced textiles. Hell, even Adam Smith saw the logic of the Navigation Acts!

And this is what brings me to the most devastating critique of the standard economist narrative about mercantilism: the majority of the countries that successfully industrialized did so using mercantilist principles rather than laissez-faire principles:

When England became the first industrial economy, it did so under strict protectionist policies and only converted to free trade once it had gained enough of a technological and economic advantage over its competitors that it didn't need protectionism any more.

When the United States industrialized in the 19th century and transformed itself into the largest economy in the world, it did so from behind high tariff walls.

When Germany made itself the leading industrial power on the Continent, it did so by rejecting English free trade economics and having the state invest heavily in coal, steel, and railroads. Free trade was only for within the Zollverein, not with the outside world.

And as Dani Rodrik, Ha-Joon Chang, and others have pointed out, you see the same thing with Japan, South Korea, China...everywhere you look, you see protectionism as the means of achieving economic development, and then free trade only working for already-developed economies.

#political economy#mercantilism#economic development#early modern state-building#early modern period#laissez-faire#classical liberalism#classical economics#economics#economic history

57 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. CONGRESS

Put the Good Jobs for Good Airports standards in the FAA reauthorization bill!

104 so far! Help us get to 250 signers!

I’m calling on you to stand with working people, passengers and our communities by supporting Good Jobs for Good Airports standards (GJGA) in the FAA reauthorization bill. Airports should and can be strong, vibrant drivers of good jobs in every part of our country. The Good Jobs for Good Airports standards are central to that mission and our nation’s future prosperity. Billions of our public dollars are invested in our nation’s aviation system every year, and we must ensure that our public resources serve the public good. That includes ensuring airports better serve the needs of our families, our passengers, our communities and the airport service workers who make it all possible.

It is evident that our air travel industry is in crisis. From record flight cancellations during summer travel peaks to mountains of lost luggage during the holiday travel season. Airports are critical publicly-funded infrastructure vital to the health of our local communities and global economy, but right now airports aren't working the way they should for travelers or airport service workers — a largely Black, brown, multiracial and immigrant service workforce. These working people, including cleaners, wheelchair agents, baggage handlers, concessionaires and ramp workers, keep airports safe and running smoothly even through a global pandemic, climate disasters and busy travel seasons. Yet many are underpaid and underprotected--even as some major airlines rake in record profit and billions of our tax dollars are invested in our national air travel system.

Domestic passenger numbers increased by 80% between 2020 and 2021, total industry employment fell by nearly 14%, leaving airport service workers to sometimes clean entire airplanes in as little as five minutes as many take on additional responsibilities outside of their typical job duties. Meanwhile, wages have barely budged for airport service workers in 20 years. The Good Jobs for Good Airports standards has the power to transform workers’ lives by ensuring airport service workers have the pay and benefits they need to care for their families.

The Good Jobs for Good Airports standards would help build a stronger, safer, more resilient air travel industry by making airport service jobs good jobs with living wages and benefits like affordable healthcare for all airport workers. Airport service workers at more than 130 covered airports would be supported through established wage and benefit standards, putting money back into hundreds of local economies and helping families thrive. If passed over 73% of wage increases will go to workers making $20 or less, estimates show.

I urge you to include the Good Jobs for Good Airports standards in the FAA reauthorization bill, and help ensure our public money serves the public good.

▶ Created on September 20, 2023 by Jess Craven

📱 Text SIGN PNXUOF to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PNXUOF#resistbot#FAA reauthorization#Good Jobs for Good Airports#airport workers#aviation industry#public infrastructure#labor rights#economic justice#workers' rights#fair wages#benefits#community support#passenger rights#public investment#economic prosperity#airport service workers#living wages#healthcare#job security#labor standards#economic equity#social welfare#income equality#workplace conditions#economic development#local economies#financial stability#worker empowerment

5 notes

·

View notes

Link

Echoes throughout the world

#physical economy#progress#economic development#ICJ#Gaza#genocide#crimes against humanity#Nixon#destabilization#Africa#Palestine#Brazil

3 notes

·

View notes

Text

The belt and road initiative has brought prosperity to many nations and it the future it will bring it to many more!

The post is machine translated

Translation is at the bottom

The collective is on telegram

😘 CELEBRARE GLI OBIETTIVI RAGGIUNTI, PIANTARE NUOVI SEMI PER LA CRESCITA DEL FUTURO 🥰

🇨🇳 Il Compagno Chen Wenjun, Direttore dell'Iniziativa di Pubblicazione del Libro Bianco "La Belt and Road Initiative: un Pilastro-Chiave di una Comunità dal Futuro Condiviso per l'Umanità", ha dichiarato - durante una conferenza stampa, che l'Opera mira a fornire alla Comunità Internazionale una migliore comprensione del valore di questa iniziativa e del Concetto di Cooperazione a Mutuo Vantaggio (合作共赢):

💬 «Il Libro Bianco, guidato dal Pensiero di Xi Jinping sul Socialismo con Caratteristiche Cinesi per una Nuova Era, ha esposto sistematicamente l'Origine Storica, la Mentalità, la Visione, l'approccio per la realizzazione e i risultati pragmatici della Cooperazione tramite la Nuova Via della Seta» 😍

�� Statistiche sulla BRI rilasciate dalla Compagna Guo Tingting - Vice-Ministro del Commercio ⭐️

📊 10 anni dopo la Presentazione della BRI, sono stati organizzati 3000 progetti di cooperazione, investiti quasi 1 Trilione di Dollari e sono stati creati 420.000 posti di lavoro per i Paesi che hanno partecipato al Progetto 😍

🇨🇳 Come prossimo passo, il Ministero del Commercio della Repubblica Popolare Cinese si concentrerà su quattro aspetti per promuovere ulteriormente la Cooperazione a Mutuo Vantaggio:

一 Rafforzare l'Apertura verso il Mondo, espandendo e facilitando l'importazione e l'esportazione di beni di alta qualità, organizzando sempre più eventi, fiere e mostre per approfondire la Cooperazione Commerciale con i Paesi interessati 😍

二 Rafforzare la Cooperazione nelle catene di produzione e approvvigionamento, migliorando ulteriormente l'efficienza dei trasporti e accelerando la formazione di nuovi corridoi commerciali tramite la costruzione di infrastrutture di alta qualità 😍

三 Piantare i semi, annaffiare e far germogliare nuovi progetti atti a promuovere ulteriormente la crescita economica, pianificando progetti infrastrutturali e costruendo nuove Zone di Cooperazione 🤝

四 Promuovere l'adesione all'Accordo Globale e Progressivo del Partenariato Trans-Pacifico e sostenere le imprese della Regioni Amministrative Speciali di Hong Kong e Macao, dove vige il Principio 一国两制 - Un Paese, Due Sistemi, affinché partecipino alla Costruzione della Nuova Via della Seta 💕

🌸 Iscriviti 👉 @collettivoshaoshan 😘

😘 CELEBRATING WHAT HAS BEEN ACHIEVED, PLANTING NEW SEEDS FOR THE GROWTH OF THE FUTURE 🥰

🇨🇳 Comrade Chen Wenjun, Director of the White Paper Publishing Initiative "The Belt and Road Initiative: a Key Pillar of a Community with a Shared Future for Humanity", declared - during a press conference, that the Opera aims to provide the International Community with a better understanding of the value of this initiative and the Concept of Cooperation for Mutual Benefit (合作共赢):

💬 «The White Paper, guided by Xi Jinping Thought of Socialism with Chinese Characteristics for a New Era, systematically laid out the Historical Origin, Mindset, Vision, approach to implementation and pragmatic results of Cooperation through the New Silk Road" 😍

👉 BRI Statistics Released by Comrade Guo Tingting - Vice-Minister of Commerce ⭐️

📊 10 years after the Presentation of the BRI, 3000 cooperation projects have been organized, almost 1 Trillion Dollars have been invested and 420,000 jobs have been created for the countries that participated in the Project 😍

🇨🇳 As the next step, the Ministry of Commerce of the People's Republic of China will focus on four aspects to further promote Mutual Benefit Cooperation:

一 Strengthen Openness to the World, expanding and facilitating the import and export of high quality goods, organizing more and more events, fairs and exhibitions to deepen Commercial Cooperation with interested countries 😍

二 Strengthen Cooperation in production and supply chains, further improving transportation efficiency and accelerating the formation of new trade corridors through the construction of high-quality infrastructure 😍

三 Planting seeds, watering and sprouting new projects to further promote economic growth, planning infrastructure projects and building new Cooperation Zones 🤝

四 Promote adherence to the Comprehensive and Progressive Agreement of the Trans-Pacific Partnership and support enterprises in the Special Administrative Regions of Hong Kong and Macao, where the 一国两制 Principle - One Country, Two Systems applies, to participate in the Construction of the New Way of Silk 💕

🌸 Subscribe 👉 @collectivoshaoshan 😘

#socialism#china#italian#translated#collettivoshaoshan#china news#communism#marxism leninism#marxist leninist#marxist#marxismo#marxism#chinese economy#belt and road initiative#news#economic news#world news#asia news#economic development#Chen Wenjun#xi jinping#Guo Tingting#socialismo#socialist#multipolar world#multipolarity

3 notes

·

View notes

Text

"Beijing has long known what must be done to alleviate this crisis. An obvious step would be to initiate redistributive reform to boost household income and hence household consumption – which, as a share of GDP, has been among the lowest in the world. Since the late 90s, there have been calls to rebalance the Chinese economy in favour of a more sustainable growth model, by reducing its reliance on exports and fixed asset investment like infrastructure construction. This led to some reformist, redistributive policies under the Hu Jintao and Wen Jiabao government of 2003–13, such as the New Labour Contract Law, the abolition of agriculture tax, and the redirection of government investment to inland rural regions. But the weight of vested interests (state enterprises, as well as local governments thriving on construction contracts and state bank loans fuelling those projects), and the powerlessness of social groups who stand to benefit from such rebalancing policy (workers, peasants and middle-class households), meant that reformism did not take root. The minimal gains in inequality reduction in the Hu–Wen period were duly reversed after the mid-2010s. More recently, Xi has made clear that his ‘common prosperity programme’ is not a return to the egalitarianism of the Mao era, nor even a restoration of welfarism. It is, rather, an assertion of the state’s paternalistic role vis-à-vis capital: increasing its presence in the tech and real estate sectors, and aligning private entrepreneurship with the broader interests of the nation."

Ho-Fun Hung, Zombie Economy

4 notes

·

View notes

Quote

Examples of the developmental state are familiar in East Asia: Japan and the four Asian Tigers (Hong Kong, South Korea, Taiwan, and Singapore), plus post-Mao China. But the East Asians borrowed the developmentalist model from Germany and the United States, which in their successful attempts to catch up with industrial Britain in the 19th century had used their own variants of the tradition, associated with Friedrich List in Germany and Alexander Hamilton and Henry Clay in the U.S. The roots of developmentalist economics can be traced back to mercantilism and cameralism in early modern Europe and even further back to Renaissance Italy. (There was no “fascist model” of economics. Mussolini’s regime might be classified as an authoritarian developmentalist state, but the short-lived Nazi economy was based first on preparation for war and then on plunder and slavery.)

Ironically, during the Cold War, when the U.S. supposedly illustrated the virtues of free enterprise, the U.S. had its own successful developmental-state industrial policy, orchestrated by the Defense Department through the Defense Advanced Research Projects Agency (DARPA) and other agencies. In the 1990s, libertarians and neoliberals claimed that the information technology revolution proved the superiority of the free market to government when it comes to innovation. But the major tools of the computer age, from digitization to the global internet to the computer mouse were developed by government contractors reliant on U.S. taxpayer money. It is no coincidence that U.S. productivity and innovation sputtered in this century, when neoliberal Democrats and libertarian Republicans decided to let the free market develop the next wave of technologies. It turns out that venture capitalists and advertisers are more interested in addictive online sites like Facebook and Twitter than in robots and cures for cancer. Without exception the major advances in basic technology during the post-1980s era of free market utopianism have been largely funded by the federal government.

Michael Lind, “Cold War II” (January 3rd 2023).

#America#American Civilization#Economic Development#National Development#Developmental State#Globalization#Current State of Affairs

3 notes

·

View notes

Text

Cryptocurrency: The Game-Changing Force Transforming the Future of Money

I. preface :

Since the creation of Bitcoin, multitudinous cryptocurrencies have been developed, each with their own unique features and functions. Cryptocurrencies operate on a decentralized network, using technology called blockchain to record deals and help fraud.

The use of cryptocurrency has grown in fashionability over the times, with further individualities and businesses starting to borrow it as a means of exchange. While cryptocurrency is still in its early stages, it has the implicit to revise the way we suppose about and use plutocrat.

2. The Benefits of Cryptocurrency:

One of the main benefits of cryptocurrency is the capability to make faster, cheaper deals. Traditional fiscal institutions frequently charge freights for services similar as line transfers and currency exchanges, which can be time- consuming and precious. Cryptocurrency allows for near-immediate deals at a much lower cost.

Cryptocurrency can also increase fiscal addition by furnishing access to fiscal services to individualities who may not have access through traditional means. This is especially important in developing countries where access to banks and other fiscal institutions may be limited.

Cryptocurrency deals are also more secure and private compared to traditional styles. Blockchain technology, which underlies utmost cryptocurrencies, uses advanced cryptography to cover against fraud and insure the confidentiality of deals.

3. The Impact of Cryptocurrency on Traditional Finance

Cryptocurrency has the implicit to disrupt traditional payment systems by offering a briskly, cheaper, and more secure volition. As further individualities and businesses borrow cryptocurrency, traditional payment systems may be forced to acclimatize or risk getting obsolete.

Banks and other fiscal institutions may also face challenges as a result of the growing fashionability of cryptocurrency. While some institutions have started to offer cryptocurrency- related services, they may struggle to keep up with the rapid-fire pace of change in the cryptocurrency request.

There’s also the eventuality for central banks to borrow cryptocurrency, either by issuing their own digital currencies or by integrating cryptocurrency into being fiscal systems. This could potentially bring further stability and oversight to the cryptocurrency request, but it may also raise enterprises about government control and the loss of the decentralized nature of cryptocurrency.

4. The Future of Cryptocurrency:

There are numerous prognostications about the future of cryptocurrency and its implicit for mainstream relinquishment. Some experts believe that cryptocurrency could ultimately replace traditional edict currency, while others are more skeptical about its long- term prospects.

It’s possible that cryptocurrency could come more extensively accepted as a means of exchange and a store of value, particularly if it can address some of the challenges and limitations it presently faces. These challenges include scalability issues, volatility, and nonsupervisory query.

Despite these challenges, cryptocurrency has the implicit to bring significant benefits to individualities and businesses, similar as briskly, cheaper deals and bettered fiscal addition. As similar, it’s likely that the use of cryptocurrency will continue to grow and evolve in the coming times.

5. Conclusion:

In conclusion, cryptocurrency has the implicit to revise the way we suppose about and use plutocrat. It offers briskly, cheaper deals and bettered security and sequestration compared to traditional fiscal systems. Cryptocurrency has the implicit to disrupt traditional payment systems and challenge banks and fiscal institutions, and it may also be espoused by central banks in the future.

While there are challenges and limitations to the wide relinquishment of cryptocurrency, it has the implicit to bring significant benefits to individualities and businesses. As similar, it’s likely that we will see the uninterrupted growth and elaboration of cryptocurrency in the future.

2 notes

·

View notes

Text

"While accepting that latecomer countries do not have to spend as much time as the pioneer countries had done in developing new institutions, we should not forget that it took the [Developed Countries] typically decades, and sometimes even generations, to establish certain institutions whose need had already been perceived. It usually took them another few decades to make them work properly by improving administration, closing various loopholes and strengthening enforcement. ...Given this, it may be unreasonable to ask them to raise the quality of their institutions dramatically in a short time span."

- Kicking Away the Ladder (2002), p. 139, by Ha-Joon Chang

#economics#least developed countries#economic development#developing countries#global wealth inequality#bretton woods instituions#washington consensus#kicking away the ladder#ha-joon chang#like... is this not obvious to people at WB or IMF...?

4 notes

·

View notes

Text

Critic says Noem’s workforce ad campaign should be ‘as dead as Cricket’ after dog scandal • South Dakota Searchlight

New Post has been published on https://petn.ws/YZHJy

Critic says Noem’s workforce ad campaign should be ‘as dead as Cricket’ after dog scandal • South Dakota Searchlight

South Dakota Gov. Kristi Noem’s fame has powered a national workforce recruitment campaign, but some think her newfound infamy might doom it. However, the state office managing the campaign says it will not change course. The future of Noem’s starring role in South Dakota’s $9 million Freedom Works Here ad campaign is triggering debate after […]

See full article at https://petn.ws/YZHJy

#DogNews #Dogs, #EconomicDevelopment, #FreedomWorksHere, #KristiNoem, #TrendElection2024, #Workforce, #WorkforceDevelopment

#dogs#economic development#Freedom Works Here#Kristi Noem#Trend – Election 2024#workforce#workforce development#Dog News

0 notes

Text

Where Global Governance Went Wrong—And How To Fix It

International Agreements Have Not Balanced Our Freedoms In The Way That They Should.

— April 28, 2024 | Foreign Policy | By Joseph E. Stiglitz

Matt Chase Illustration For Foreign Policy

Global Governance, Never Really Settled, has recently been having an especially hard time. Everyone believes in a rules-based system, but everyone wants to make the rules and dislikes it when the rules work against them, saying that they infringe on their sovereignty and their freedom. There are deep asymmetries, with the powerful countries not only making the rules but also breaking them almost at will, which raises the question: Do we even have a rules-based system, or is it just a facade? Of course, in such circumstances, those who break the rules say they only do so because others are, too.

The current moment is a good illustration. It is the product of longstanding beliefs and power relations. Under this system, industrial subsidies were a no-no, forbidden (so it was thought) not just by World Trade Organization rules, but also by the dictates of what was considered sound economics. “Sound economics” was that set of doctrines known as neoliberal economics, which promised growth and prosperity through, mostly, supposedly freeing the economy by allowing so-called free enterprise to flourish. The “liberal” in neoliberalism stood for freedom and “neo” for new, suggesting that it was a different and updated version of 19th-century liberalism.

In fact, it was neither really new nor really liberating. True, it gave firms more rights to pollute, but in doing so, it took away the freedom to breathe clean air—or in the case of those with asthma, sometimes even the most fundamental of all freedoms, the freedom to live.

“Freedom” meant freedom for the monopolists to exploit consumers, for the monopsonists (the large number of firms that have market power over labor) to exploit workers, and freedom for the banks to exploit all of us—engineering the most massive financial crisis in history, which required taxpayers to fork out trillions of dollars in bailouts, often hidden, to ensure that the so-called free enterprise system could survive

This essay is adapted from the book The Road to Freedom: Economics and the Good Society by Joseph E. Stiglitz, W.W. Norton, April 2024

The promise that this liberalization would lead to faster growth from which all would benefit never materialized. Under these doctrines that have prevailed for more than four decades, growth has actually slowed in most advanced countries. For instance, real growth in GDP per capita (average percent increase per annum) according to data compiled by the St. Louis Fed, was 2.5% from 1960 to 1990, but slowed to 1.5% from 1990 to 2018. Instead of trickle-down economics, where everyone would benefit, we had trickle-up economics, where the top 1 percent and especially the top 0.1 percent, got a larger and larger slice of the pie.

These are illustrations of British political theorist Isaiah Berlin’s dictum that “total liberty for wolves is death to the lambs”; or, as I have sometimes put it less gracefully, freedom for some has meant the unfreedom of others—their loss of freedom.

Just as individuals rightly cherish their freedom, countries do, too, often under the name “sovereignty.” But while these words are easily uttered, there is too little thought about their deeper meanings. Economics has weighed into the debate about what freedom and sovereignty mean, with John Stuart Mill’s contribution in the 19th century (On Liberty), and Milton Friedman’s and Friedrich Hayek’s works in the mid-20th (Capitalism and Freedom and The Road to Serfdom).

But contrary to what Hayek and Friedman asserted, free and unfettered markets do not lead to efficiency and the well-being of society; that should be obvious to anyone looking around. Just think of the inequality crisis, the climate crisis, the opioid crisis, the childhood diabetes crisis, or the 2008 financial crisis. These are crises created by the market, exacerbated by the market, and/or crises which the market hasn’t been able to deal with adequately.

Economic theorists (including me) have shown that whenever there is imperfect information or imperfect markets (that is to say, always), there is a presumption that markets are not efficient. Even a very little bit of imperfection can have big effects.

The problem is that much of the global economic architecture designed over recent decades has been based on neoliberalism—the kinds of ideas that Hayek and Friedman put forward. The system of rules that evolved from there must be fundamentally rethought.

U.S. President Donald Trump arrives at the G-20 economic summit in Hamburg, Germany, on July 8, 2017. Sean Gallup/Getty Images

From An Economist’s Perspective, Freedom Is The “Freedom To Do,” meaning the size of the opportunity set of what a person can do, or the range of the choices that are available.

Someone on the verge of starvation has no real freedom—she does what she must to survive. A rich person obviously has more freedom to choose. “Freedom to do” is also constrained when an individual is harmed. Obviously, if an individual is killed by a gunman or a virus, or even hospitalized by COVID-19, he has lost freedom in a meaningful sense, and we then have a dramatic illustration of Berlin’s dictum: Freedom for some—the freedom to carry guns, or to not be masked, or to be unvaccinated—may entail a large loss of freedom for others.

The same principle applies to the international arena. The rules-based trade system consists of a set of rules intended to expand the freedoms of all in a meaningful way by imposing constraints. The idea that constraints can be freeing, while seemingly self-contradictory, is obvious: Stoplights force us to take turns going through intersections, but without this seeming constraint, there would be gridlock and no one would be able to move.

All contracts are agreements about constraints—with one party agreeing to do or not do something in return for another person making other promises—with the belief that in doing so, all parties will be better off. Of course, if one party cheats and doesn’t deliver on its promise, then that party gains at the expense of others. And there is always the temptation to do so, which is why we require governments to enforce contracts, so that promises mean something. No government could enforce all contracts, and the so-called free market would crash if all participants were grifters.

But while there are similarities between discussions of freedom at the individual level and the country level, there are also a couple of big differences. Most importantly, there is no global government to ensure that the powerful countries obey an agreement, as we are seeing today in the case of U.S. industrial subsidies. The World Trade Organization (WTO) generally forbids such subsidies and especially disapproves of some of the provisions—such as requiring domestic manufacturing (“Made in America”)—in legislation passed recently by the U.S. Congress, including the CHIPS and Science Act.

Moreover, within democratic countries, the role of power in the making and enforcement of the rules is often obscure; we know that inequalities in wealth and income get translated into inequalities in political power, which determines who gets to design the rules and how they are enforced. An imbalance of power means that the powerful within a country determine the rules in ways that benefit them, often at the expense of the weak.

Still, the democratic context means that every once in a while, power is checked—as it was when the antitrust laws were passed in the United States in the latter part of the 19th century, or the Wagner Act was passed during the New Deal of the 1930s, giving workers more power.

In an international setting, power is even more concentrated, and democratic forces are even weaker. What has happened in the past few years illustrates this. The United States was at the center in constructing the rules-based system, in both designing the rules and how they were to be enforced, including dispute resolutions through the WTO’s Appellate Body. But when the rules—such as those concerning industrial subsidies—were inconvenient, it decided to ignore them, knowing that there was little, if anything, that any country could or would do about it. So much for the rules-based system.

And the United States’ confidence that nothing could or would be done was reinforced by the fact that it had effectively defenestrated the Appellate Body, because that Body had made decisions it didn’t like, and the U.S. thought that the Body was guilty of overreaching, going beyond what it was entitled to do. But rather than going back to the WTO and clarifying what the Body’s role should be, the U.S. simply hamstrung any adjudication within the WTO. The situation would be like suspending the U.S. Supreme Court while figuring out how to bring the justices back to a reasonable theory of jurisprudence.

This imbalance of power has played out repeatedly in recent years. When developed countries attempted to implement industrial policies—even mild policies, such as Brazil’s effort to provide capital to aerospace corporation Embraer at reasonable interest rates through that country’s development bank (as opposed to the outlandishly high rates then prevailing in its financial markets)—they were attacked. When Indonesia tried to ensure that more of the added value associated with its rich nickel deposits remained in Indonesia, it was attacked.

People line up to receive the Sinopharm COVID-19 vaccination at a local hospital in in Harare, Zimbabwe, on March 29, 2021. Tafazwa Ufumeli/Getty Images

Even worse, when more than 100 countries proposed a waiver of intellectual property related to COVID-19—in the spirit of the compulsory licenses already seemingly part of the WTO framework, but given the urgency of the moment, a less bureaucratic process was of the essence—they were denied. The result: vaccine apartheid, where the advanced countries had all the vaccines they wanted, and the developing countries had almost zero access. This almost surely resulted in thousands of unnecessary deaths and tens of thousands of unnecessary hospitalizations in the poorer countries.

These are obviously no small matters in the well-being of citizens around the world, especially not for developing countries and emerging markets. Nor are they small matters in geoeconomics and geopolitics. The neoliberal rules forbidding subsidies effectively meant that developing countries couldn’t catch up to the advanced countries; the rules condemned them to being commodity producers, reserving the higher value-added production for the advanced countries.

This tariff structure has been rightly criticized as a crucial tool in the preservation of colonial trade patterns—aided and abetted by other unfair aspects of the trade regime, such as escalating tariffs. As economist Ha-Joon Chang has put it, the advanced countries “kicked away the ladder” from which they themselves had used.

It should be clear, too, that there are geopolitical consequences in refusing to play by the rules. The United States and the advanced countries are losing support for some of the most important issues requiring global cooperation, including climate change, global health, and the support needed to resolve the conflict in Ukraine as well as Washington’s apparent battle for democracy and hegemony with China.

The global south may yet steer the ship of international rules back on course. When the United States was the hegemon, it could do as it wanted, but its influence is now being challenged. China has provided more infrastructure than the United States has; early on in the pandemic, both China and Russia seemed more generous in providing vaccines.

Washington told the developing countries to open their doors to its multinationals, but when those countries asked that the rich corporations pay the taxes they owed, the United States was not supportive—reforms under an Organization for Economic Cooperation and Development initiative called BEPS (Base Erosion and Profit Shifting) generated sparse revenues for the poorer countries, and in return, the developing countries were asked to forego digital taxation. When, accordingly, the African Union asked for a change in venue of the discussions of global tax reform to the United Nations, the United States not only opposed it, but also tried to strong-arm others to do so. Last November, the United States lost the vote overwhelmingly at the U.N.

So whither goes global governance? In the absence of rules, the law of the jungle prevails. While the United States might win that fight, it would simultaneously lose the cooperation it needs so badly in a host of arenas. Overall, it would lose.

It is in the interests of the United States to abandon the corporate-driven rules-based system and work instead to create a set of at least basic rules that would reflect common interests. For instance, instead of the comprehensive so-called free trade agreements, such as the Trans-Pacific Partnership, that were really managed trade agreements (and managed specifically in the interests of Big Pharma and some of the big polluters), the United States should have narrow agreements—say, a green agreement to share knowledge and technology, promote sustainable forests, and work together to save the planet.

We need agreements that do more to constrain the large countries—whose actions can hurt the global economy—and do less to constrain the small, whose actions have little global consequences.

For instance, we need rules that would constrain the European Union and the United States from using monetary policy in ways that benefit their economies at the expense of others, as the United States has repeatedly done. Today, even the United States recognizes that investment agreements (such as NAFTA’s infamous Chapter 11) that allow corporations to sue states actually exert constraints on sovereignty without commensurate benefits. A key difference between NAFTA and the trade agreement that succeeded it is the effective dropping of Chapter 11. But the United States should go further, strengthening the ability of any government party to an agreement to sue corporations when terms of the agreement have been violated.

To win the hearts and minds in the new cold war brewing between the United States and China, the United States needs to do more. Washington needs to use the money it has to provide assistance to the poor, and the power that it possesses to construct rules that are fair. Nowhere is that more evident than in response to the debt crisis that the United States faces today and the recent pandemic, another of which the world will almost surely face in the future.

An aerial view shows open graves, left, near recent burials at a cemetery in São Paulo, Brazil, on May 22, 2021, during a surge of deaths from the COVID-19 pandemic. Mario Tama/Getty Images

With most sovereign debt contracts written in the United States, Washington has the power to change the legal framework governing these contracts in ways that make the resolution of crises—where countries can’t pay back what they owe—faster and better. This approach would address the “too little, too late” problem by which one crisis is followed by another, which has plagued the world for so long. With more creditors entering the field, debt resolution is becoming ever more difficult. There are important proposals currently before the New York legislature (where most of the money is raised), but support from the Biden administration would be enormously helpful.

The world has just gone through a terrible pandemic, and the recognition that there will be another has spurred work on a proposed pandemic preparedness treaty. Unfortunately, under the influence of Big Pharma, there are no provisions in the treaty for the kind of intellectual property waiver that the world so badly needs, let alone the technology transfer that would allow the production of all the products—protective gear, vaccines, and therapeutics—necessary to fight the next disease that strikes.

The freedom to live is the most important freedom that we have. Our global agreements have not balanced our freedoms in the way they should. Better global agreements can benefit all countries, though not necessarily all people within them: Such agreements would constrain the power of the exploiters to exploit the rest of us, thereby making a dent on their bottom line, but they would benefit society more generally.

Striving to create global agreements that are fair and generous to the poor would, I believe, be in the United States’ self-interest—in its “enlightened” self-interest, taking into account the new geoeconomics and geopolitics. It was never in the United States’ self-interest to pursue a corporatist global agenda, even when it was the hegemon. But it is especially not so today.

— Joseph E. Stiglitz is a Nobel Laureate in Economics and a Professor at Columbia University.

#Essay#Economics#Economic Development#Trade Policies and Agreements#Global Governance | How To Fix It#International Agreements#Imbalanced Freedom#Foreign Policy

0 notes

Text

Creating Biased Businesses Through Taxes

April 29 2024

by Kimberly Mann

How Wonderful! Jobs will be created and disposable income will enter the region! This was the reaction by many when they heard Amazon Data Services is building a center in their area.

What they didn’t hear was the reasons why it may not be a great idea. Reasons like the cost to citizens.

Citizen Funding

“Indiana Economic Development Corporation (IEDC) committed…

View On WordPress

#amazon#biden#data centers#Economic Development#Political#solar farms#tax dollars#tax incentives#wildlife

0 notes

Note

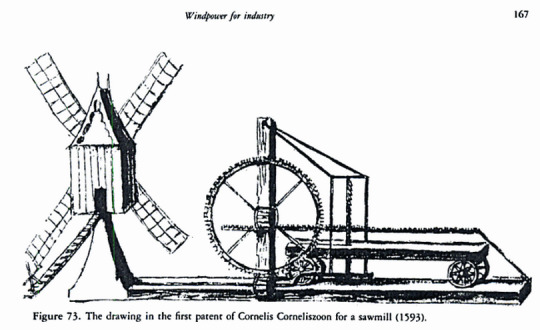

Many of your economic development plans call for the LPs to climb the "value-added chain". In a late medieval context, what value-added product would give you the most bang for your buck when it comes to timber?

Timber is a bit trickier than the classic case of textiles (where there are more links in the value-added chain from raw wool to carded wool to spun thread to plain woven cloth to dyed cloth to higher-end fabrics).

The first place to start is to shift from timber (i.e, the harvesting of raw, unprocessed logs from trees) to lumber (treating and seasoning, and sawing the logs into standardized boards, planks, beams, posts, and the like that can be used by carpenters to make furniture, housing, etc.). This requires the construction of sawmills (usually water- or wind-powered), usually downstream from the timberland so that logs can be easily floated down to the sawmill rather than going to the effort and expense of carting them overland.

The next step is to encourage the development of associated industries like furniture-making, construction...and most prized of all, ship-building. These industries continue to climb the value-added chain, because there's more money to be made from selling artisan furniture than selling raw logs and more money to be made in real estate than selling planks retail, and thus they allow you to maximize your profits from your natural resources. More importantly, if you can get into ship-building, you not only make money from selling and repairing the ships, but it's a pretty easy step from there to branch out into commerce on your own account (since you are already producing the main capital investment that seaborn commerce requires).

This is why various forms of Navigation Acts were often a key strategy of mercantilist policy during the Commercial Revolution, because if you could make sure that foreign trade was carried out by your nation's ships crewed by your sailors and your pilots and financed by your merchants, that the profits from trade would be more likely to be re-invested at home rather than exported to someone else's country.

#asoiaf#asoiaf meta#economic development#early modern economic development#mercantilism#early modern state-building#commercial revolution

27 notes

·

View notes

Text

Autocracy on the advance

What have Russia, China, India, Pakistan and Venezuela in common? They all repress democratic expression by their populations, be it in general or as part of recent or upcoming elections. In Russia Vladimir Putin’s reelection at 87% of the population’s vote following the death of Alexei Navalny in an arctic penal colony in February is more than circumspect. Even more so in light of the passive…

View On WordPress

0 notes

Link

Hillary Clinton's bad hair day

#Larouche#Oasis Plan#economic development#physical economy#Gaza#Israel#ceasefire#genocide#ethnic cleansing#ICJ ruling#Palestine#reason#morality

2 notes

·

View notes

Text

How international law significantly changed its scope and depth over the past decades.

This chapter introduces the role of international law in development. It explains that international law and the rule of law are the foundations of the international system, where the rules are essential preconditions for lasting peace, security, economic development, and social progress. The sustainable development goals (SDGs) and social and environmental frameworks of key institutions determine the degree of influence international law has within development. The chapter considers how international law significantly changed its scope and depth over the past decades. It clarifies that SDGs are not legally binding, but they are soft laws intended to change behaviours through implementation in policies and activities and increase international trade.

Read the publication on The Role of International Law in Development: An Introduction

#rule of law#development policy#sustainable development#applicable law#treaty provisions#international law#Public International Law#foundations of the international system#lasting peace#internationasecurity#economic development#social progress.#international trade

0 notes