#Data-driven decisions in lending

Explore tagged Tumblr posts

Text

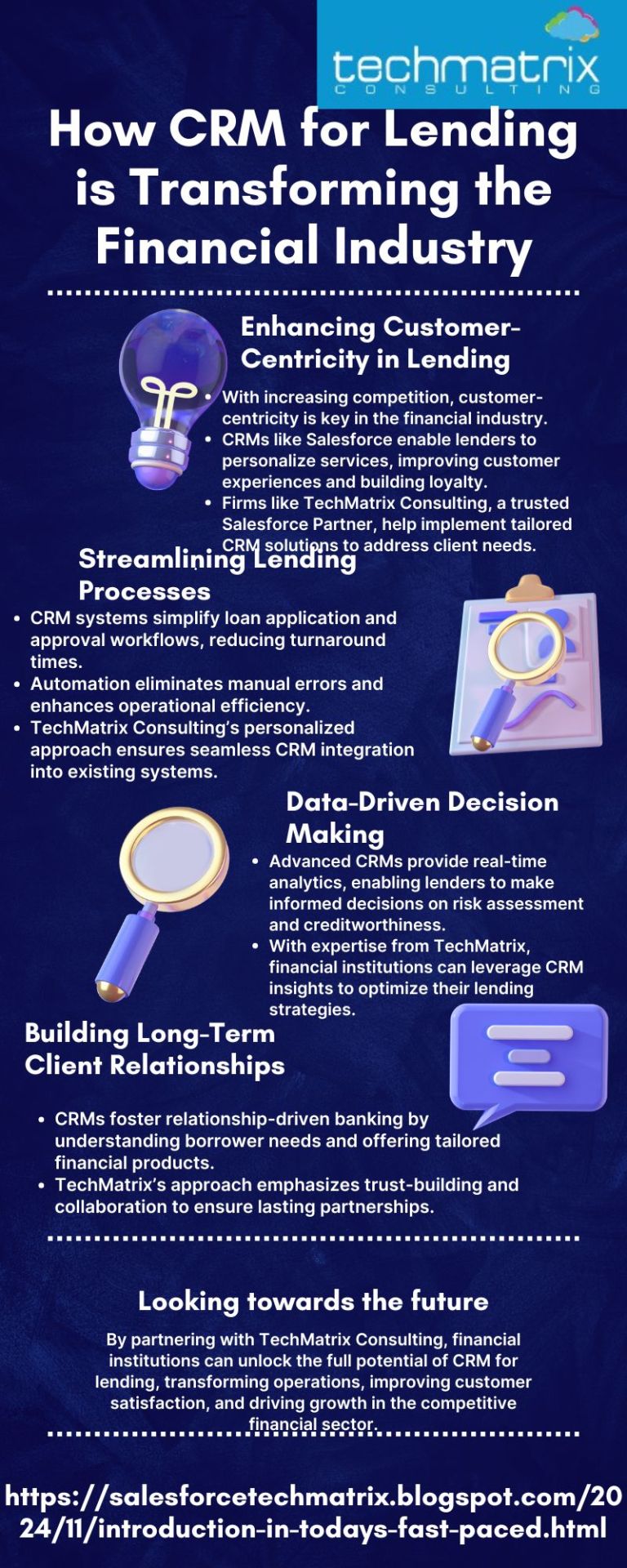

Customer Relationship Management (CRM) solutions are revolutionizing the financial industry by streamlining lending processes, enhancing customer experiences, and driving data-driven decision-making. Companies like TechMatrix Consulting, a trusted Salesforce Partner with a global presence, empower lenders with personalized CRM for lending implementations to meet evolving business needs. CRMs help automate workflows, improve communication, ensure compliance, and deliver actionable insights. With over a decade of expertise and a team of 250+ certified professionals, TechMatrix ensures long-term benefits by building trust, enabling scalability, and fostering collaboration. You can just transform your lending operations with CRM solutions tailored to your goals.

#CRM for lending#Financial industry transformation#Salesforce CRM solutions#TechMatrix Consulting#Customer-centric CRM for banks#CRM benefits in lending#Streamlining loan processes#Lending automation with CRM#Data-driven decisions in lending

0 notes

Text

𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐀𝐈-:

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 ?

Artificial intelligence (AI) refers to computer systems capable of performing complex tasks that historically only a human could do, such as reasoning, making decisions, or solving problems.

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐀𝐈 𝐂𝐚𝐩𝐚𝐛𝐢𝐥𝐢𝐭𝐢𝐞𝐬-:

AI today exhibits a wide range of capabilities, including natural language processing (NLP), machine learning (ML), computer vision, and generative AI. These capabilities are used in various applications like virtual assistants, recommendation systems, fraud detection, autonomous vehicles, and image generation. AI is also transforming industries like healthcare, finance, transportation, and creative domains.

𝐀𝐈 𝐀𝐩𝐩𝐬/𝐓𝐨𝐨𝐥𝐬-:

ChatGpt, Gemini, Duolingo etc are the major tools/apps of using AI.

𝐑𝐢𝐬𝐤𝐬 𝐨𝐟 𝐀𝐈-:

1. Bias and Discrimination: AI algorithms can be trained on biased data, leading to discriminatory outcomes in areas like hiring, lending, and even criminal justice.

2. Security Vulnerabilities: AI systems can be exploited through cybersecurity attacks, potentially leading to data breaches, system disruptions, or even the misuse of AI in malicious ways.

3. Privacy Violations: AI systems often rely on vast amounts of personal data, raising concerns about privacy and the potential for misuse of that data.

4. Job Displacement: Automation driven by AI can lead to job losses in various sectors, potentially causing economic and social disruption.

5. Misuse and Weaponization: AI can be used for malicious purposes, such as developing autonomous weapons systems, spreading disinformation, or manipulating public opinion.

6. Loss of Human Control: Advanced AI systems could potentially surpass human intelligence and become uncontrollable, raising concerns about the safety and well-being of humanity.

𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐀𝐈:-

Healthcare:AI will revolutionize medical diagnostics, personalize treatment plans, and assist in complex surgical procedures.

Workplace:AI will automate routine tasks, freeing up human workers for more strategic and creative roles.

Transportation:Autonomous vehicles and intelligent traffic management systems will enhance mobility and safety.

Finance:AI will reshape algorithmic trading, fraud detection, and economic forecasting.

Education:AI will personalize learning experiences and offer intelligent tutoring systems.

Manufacturing:AI will enable predictive maintenance, process optimization, and quality control.

Agriculture:AI will support precision farming, crop monitoring, and yield prediction.

#AI#Futuristic#technology#development#accurate#realistic#predictions#techworld#machinelearning#robotic

4 notes

·

View notes

Text

Embracing the Future: The Impact of Artificial Intelligence on Business and Society

Embracing the Future: The Impact of Artificial Intelligence on Business and Society In recent years, artificial intelligence (AI) has emerged as a transformative force, reshaping industries and redefining societal norms. As we stand at the threshold of this technological revolution, it is imperative to understand both the opportunities and challenges that AI presents to businesses and society at large. AI's integration into business processes has led to unprecedented efficiencies and innovation. Organizations are leveraging machine learning algorithms to analyze vast amounts of data, enabling them to make informed decisions faster than ever. This data-driven approach not only enhances operational efficiency but also fosters a deeper understanding of customer preferences, thereby facilitating personalized services and improved user experiences. Moreover, AI is driving significant advancements in sectors such as healthcare, finance, and manufacturing. In healthcare, for instance, AI-powered diagnostic tools are revolutionizing patient care, allowing for earlier detection of diseases and more precise treatment plans. In finance, algorithms for risk assessment help institutions make better lending decisions while minimizing potential losses. These advancements underscore AI’s potential to enhance productivity and drive economic growth. However, as we embrace these changes, it is crucial to address the ethical and societal implications of AI. Concerns regarding job displacement, privacy issues, and algorithmic bias must be continuously monitored and mitigated. Businesses must adopt ethical frameworks to guide their AI initiatives, ensuring that technology serves the broader community rather than exacerbating existing inequalities. Furthermore, as AI continues to evolve, it necessitates a shift in workforce skills. Organizations must invest in upskilling and reskilling initiatives to prepare employees for an AI-driven future, ensuring that the workforce is equipped to thrive in collaboration with technology. In conclusion, the impact of artificial intelligence on business and society is profound and multifaceted. By actively engaging with the opportunities it affords while remaining vigilant about its challenges, we can harness AI's potential for the greater good. Embracing AI responsibly will not only drive innovation but also foster a more equitable and prosperous future for all.

4 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

How Can Financial Literacy and Education Empower Individuals and Businesses?

In an increasingly complex financial world, financial literacy and education have become essential tools for both individuals and businesses. They serve as the foundation for informed decision-making, effective money management, and long-term financial stability. By understanding financial concepts and leveraging modern tools, people and organizations can optimize their resources and achieve their goals more efficiently. The inclusion of technology solutions in this journey has further amplified the impact of financial literacy, making it accessible and actionable for all.

Why Financial Literacy and Education Matter

Financial literacy refers to the ability to understand and effectively use financial skills, including budgeting, investing, and managing debt. Education in these areas empowers individuals to take control of their finances, reduce financial stress, and build wealth over time. For businesses, financial literacy is equally critical, as it enables owners and managers to make data-driven decisions, manage cash flow effectively, and ensure compliance with financial regulations.

Without adequate financial knowledge, individuals are more likely to fall into debt traps, struggle with saving, and make poor investment choices. Similarly, businesses lacking financial literacy may face challenges in budgeting, forecasting, and maintaining profitability. Therefore, a solid foundation in financial concepts is indispensable for long-term success.

The Role of Technology in Financial Literacy

Modern technology solutions have revolutionized the way financial literacy is imparted and practiced. From online courses and mobile apps to AI-driven financial advisors, technology has made financial education more engaging and accessible. These tools provide real-time insights, personalized recommendations, and interactive learning experiences that cater to diverse needs and skill levels.

For example, budgeting apps like Mint and YNAB (You Need a Budget) help individuals track expenses, set financial goals, and stay accountable. Similarly, platforms like Khan Academy and Coursera offer free and paid courses on financial literacy topics, ranging from basic budgeting to advanced investment strategies. Businesses can benefit from specialized tools like QuickBooks for accounting or Tableau for financial data visualization, enabling them to make informed decisions quickly and effectively.

Empowering Individuals Through Financial Literacy

Better Money Management: Financial literacy equips individuals with the skills to create and maintain budgets, prioritize expenses, and save for future goals. Understanding concepts like compound interest and inflation helps people make smarter choices about saving and investing.

Debt Reduction: Education about interest rates, repayment strategies, and credit scores empowers individuals to manage and reduce debt effectively. This knowledge also helps them avoid predatory lending practices.

Investment Confidence: Many people shy away from investing due to a lack of knowledge. Financial literacy programs demystify investment concepts, enabling individuals to grow their wealth through informed choices in stocks, bonds, mutual funds, and other assets.

Enhanced Financial Security: By understanding insurance, retirement planning, and emergency funds, individuals can safeguard their financial future against unexpected events.

Empowering Businesses Through Financial Literacy

Effective Budgeting and Forecasting: Businesses with strong financial literacy can create realistic budgets, forecast revenues and expenses accurately, and allocate resources efficiently. This minimizes waste and maximizes profitability.

Improved Cash Flow Management: Understanding cash flow dynamics helps businesses avoid liquidity crises and maintain operational stability. Tools like cash flow statements and projections are invaluable for this purpose.

Informed Decision-Making: Financially literate business leaders can evaluate the costs and benefits of various opportunities, such as expanding operations, launching new products, or securing funding. This leads to more sustainable growth.

Regulatory Compliance: Knowledge of financial regulations and tax laws ensures that businesses remain compliant, avoiding penalties and fostering trust with stakeholders.

The Role of Xettle Technologies in Financial Empowerment

One standout example of a technology solution driving financial empowerment is Xettle Technologies. The platform offers innovative tools designed to simplify financial management for both individuals and businesses. With features like automated budgeting, real-time analytics, and AI-driven financial advice, Xettle Technologies bridges the gap between financial literacy and actionable solutions. By providing users with practical insights and easy-to-use tools, the platform empowers them to make smarter financial decisions and achieve their goals efficiently.

Strategies to Improve Financial Literacy and Education

Leverage Technology: Use apps, online courses, and virtual simulations to make learning interactive and accessible. Gamified learning experiences can also boost engagement.

Community Programs: Governments and non-profits can play a vital role by offering workshops, seminars, and resources focused on financial literacy.

Integrate Financial Education in Schools: Introducing financial literacy as part of school curriculums ensures that young people develop essential skills early on.

Encourage Workplace Learning: Businesses can offer financial literacy programs for employees, helping them manage personal finances better and increasing overall workplace satisfaction.

Seek Professional Guidance: For complex financial decisions, consulting financial advisors or using platforms like Xettle Technologies can provide tailored guidance.

Conclusion

Financial literacy and education are powerful tools for individuals and businesses alike, enabling them to navigate the financial landscape with confidence and competence. With the integration of technology solutions, learning about and managing finances has become more accessible than ever. By investing in financial education and leveraging modern tools, people and organizations can achieve stability, growth, and long-term success. Whether through personal budgeting apps or comprehensive platforms like Xettle Technologies, the journey to financial empowerment is now within reach for everyone.

2 notes

·

View notes

Text

Artificial intelligence in real estate industry:

Artificial intelligence (AI) is increasingly being utilized in the real estate industry to streamline processes, enhance decision-making, and improve overall efficiency. Here are some ways AI is making an impact in real estate:

1. Property Valuation: AI algorithms can analyze vast amounts of data including historical sales data, property features, neighborhood characteristics, and market trends to accurately estimate property values. This helps sellers and buyers to make informed decisions about pricing.

2. Predictive Analytics: AI-powered predictive analytics can forecast market trends, identify investment opportunities, and anticipate changes in property values. This information assists investors, developers, and real estate professionals in making strategic decisions.

3. Virtual Assistants and Chatbots: AI-driven virtual assistants and chatbots can handle customer inquiries, schedule property viewings, and provide personalized recommendations to potential buyers or renters. This improves customer service and helps real estate agents manage their workload more efficiently.

4. Property Search and Recommendation: AI algorithms can analyze user preferences, search history, and behavior patterns to provide personalized property recommendations to buyers and renters. This enhances the property search experience and increases the likelihood of finding suitable listings.

5. Property Management: AI-powered tools can automate routine property management tasks such as rent collection, maintenance scheduling, and tenant communication. This reduces administrative overhead and allows property managers to focus on more strategic aspects of their role.

6. Risk Assessment: AI algorithms can analyze factors such as credit history, employment status, and financial stability to assess the risk associated with potential tenants or borrowers. This helps landlords and lenders make informed decisions about leasing or lending.

7. Smart Building Technology: AI-enabled sensors and IoT devices can collect and analyze data on building occupancy, energy consumption, and environmental conditions to optimize building operations, improve energy efficiency, and enhance occupant comfort.

#KhalidAlbeshri#pivot#Holdingcompany#CEO#Realestate#realestatedevelopment#contentmarketing#businessmanagement#businessconsultants#businessstartup#marketingtips#خالدالبشري

#advertising#artificial intelligence#autos#business#developers & startups#edtech#education#futurism#finance#marketing

7 notes

·

View notes

Text

Boosting The Black Community’s Path to Financial Prosperity

A report was released in 2018 by an early installment of the FINRA student. It reported that White Americans and Asians could correctly answer 3.2 out of six questions about basic financial literacy. Comparatively, Hispanic Americans could answer 2.6 questions correctly, while Black Americans answered 2.3. These scores were marked as below the national average.

Further ahead, a survey in 2022 pointed out the net average worth of a Black family which was $44,900. A contrast with the median wealth of White families, standing at $285,000 in the same year according to the Federal Reserve’s Survey of Consumer Finances.

This is why Glowfidence aims at providing financial literacy training programs for the black community. However, what does financial literacy entail and what are the futuristic benefits when equipped with its knowledge? This blog will answer these questions including what one should access daily to gain financial literacy.

What is financial literacy?

Financial literacy is the ability to understand and effectively leverage various financial skills. This includes personal financial management, budgeting, and investing. It encompasses knowledge of financial products and services, and the skills to make informed money decisions.

Financial literacy in the black community is important for everyone regardless of income level. When you know how to manage your money, it becomes easier to make sound financial decisions to grow your wealth.

Why is financial literacy such an important aspect?

Understanding what your money means to you is a whole different ball game. It’s not just about what you earn and how much remains with you by the end of the month. It’s about how you manage it and make it grow for you, your family, and the future.

Let’s look at some of the benefits of gaining financial literacy for the black community:

Financial literacy can help break the cycle of Black Americans facing systemic barriers to wealth accumulation. They can be given tools to build savings, invest wisely, and generate substantial wealth.

By understanding budgeting, debt management, and credit scores, they can achieve financial stability.

They can make better decisions about housing, education, and retirement planning.

They are also protected against predatory lending practices that disproportionately target black communities.

Benefits of gaining financial literacy for non-profit organizations:

Maximizes the impact of limited resources.

Financial transparency and accountability build trust with donors, leading to increased support.

Non-profit organizations can develop sustainable funding models and manage growth efficiently.

By learning more about and understanding financial data, organizations can measure the impact of their programs and make data-driven decisions.

By investing in financial literacy training programs, the black community and non-profit organizations can gain financial resilience and success.

FAQs

1. What should I learn to gain financial literacy?

Gain access to various sources such as Investopedia, financial influencers, finance magazines, etc. You can also enroll in a financial literacy training program.

2. What should be my initial steps toward financial independence?

Start by creating and sticking to a budget to track your income and expenses.

Develop saving habits.

Learn about your investment options.

Learn how a credit score is calculated.

Learn about basic tax principles, deductions, and credits

2 notes

·

View notes

Text

Deciphering Selenium Pathways: A Comparative Analysis of Python and Java in Test Automation Careers

In the ever-evolving realm of test automation, the choice between Selenium with Python and Selenium with Java presents a journey through distinct programming landscapes. Each language brings its unique strengths to the forefront, making the decision a nuanced exploration of career possibilities. This exploration delves into the intricacies of both options to empower you to make an educated choice that aligns with your professional aspirations.

Python-Infused Selenium: Navigating Simplicity and Versatility

Pros:

Simplicity and Clarity: Python's reputation for simplicity and code readability makes it an enticing choice for those entering the realm of test automation. The language's straightforward syntax facilitates the creation of clean and efficient code, providing a gentle learning curve for beginners.

Versatility Across Domains: Beyond its role in automation, Python opens doors to a myriad of career avenues, including data science, machine learning, and web development. Choosing Python for Selenium sets the stage for a career enriched with diverse opportunities.

Cons:

Lingering Java Dominance: Despite Python's ascent, Java has long been entrenched in the Selenium landscape. Some organizations, especially those entrenched in Java-based frameworks, may still lean towards Java for their Selenium automation needs.

Java-Driven Selenium: Embracing Standards and Enterprise Dynamics

Pros:

Industry Standard Prowess: Java's enduring status as an industry standard for Selenium lends credibility to its usage. The language has been the cornerstone of many established frameworks and projects, contributing to a robust ecosystem of resources and community support.

Enterprise-Grade Scalability: Java's robustness and scalability make it a natural fit for large enterprises. If your career aspirations involve tackling extensive projects within sizable corporations, Java's alignment with prevalent tech stacks makes it a pragmatic choice.

Cons:

Learning Complexity: Java's learning curve is steeper compared to Python. However, the payoff lies in the language's powerful and adaptable environment for automation once mastery is achieved.

Choosing the Right Trajectory: Tailoring Your Career Path

In the dichotomy of Selenium with Python versus Selenium with Java, the decision hinges on individual circumstances and career aspirations.

Opt for Python if you prioritize:

Code simplicity and readability.

Versatility extending beyond the boundaries of automation.

Lean towards Java if your goals encompass:

Adherence to industry-standard practices.

A career trajectory within large enterprises that favor Java's scalability.

Conclusion: Harmonizing Expertise for Holistic Proficiency

Ultimately, the ideal career choice is sculpted by your unique circumstances. Many automation professionals find merit in acquiring proficiency in both languages, striking a harmonious balance between Python's simplicity and Java's enterprise-grade capabilities. Expanding your skill set across both languages positions you as an adaptable professional, ready to meet the diverse demands of the ever-evolving test automation landscape.

In summation, both Selenium with Python and Selenium with Java offer promising trajectories in the dynamic field of test automation. Embrace the language that resonates with your career goals and consider broadening your expertise to encompass the strengths of both, ensuring a comprehensive and future-proofed career in Selenium automation.

2 notes

·

View notes

Text

Solve Financial Difficulties Now with Short Term Loans Direct Lenders

Obtaining instant financial support from the finance industry while consumers are experiencing a cash emergency is not difficult. They have the option to choose their preferred loan aid based on their needs. When you apply for short term loans direct lenders, lenders won't charge you any unnecessary fees because they base their decision on your income situation and a few other requirements, including your age (18), your ability to provide proof of residency, and the existence of an active checking account.

So, if you don't have a debit card and want to apply for a short term loans direct lenders, you shouldn't be concerned. Furthermore, you do not offer the lender any priceless collateral as security for the offered credit. Making an amount between £100 and £2500 becomes simple for everyone in this way. You have a short repayment period of 2-4 weeks to pay back this loan.

There are no restrictions on how you can use the cash, so you are free to do so for a variety of financial needs, including paying for household expenses, unexpected car repairs, unexpected medical bills, electricity bills, grocery shop bills, and so on.

There is no need to fax documents, and no extensive paperwork is necessary. You only need to go online and fill out a brief online application form with certain information, such as your full name, residence, bank account, email address, age, and job status, before submitting it for confirmation. In a similar time frame, the short term loans UK direct lender is authorized for direct deposit into your bank account.

Getting Short Term Loans UK that are Affordable

When you have a financial emergency, it's crucial to select the short term loans direct lenders choice that would benefit your finances the most. To achieve this, you must take into account how much you can afford to borrow, and you must ensure that the loan is repaid as quickly as possible to prevent additional financial burden. You want to make sure that it is remedied as soon as possible, just as with any other financial emergency.

It's a good idea to assess your financial condition and figure out how much you can borrow before asking for a short term loans UK. You will then have a better idea of how much money you need to apply for.

Your assigned Customer Care Manager will carry out the required checks when you apply in order to more thoroughly evaluate your finances. We will have to reject your application if we find that you cannot afford a UK loan. After you submit your initial application, your dedicated Customer Care Manager will call you for five minutes to collect all the data required to accurately determine your affordability. Everything we do is driven by our dedication to responsible lending, and we want to make sure that only those who can really afford our short term loans direct lenders can apply for them.

We at Classic Quid treat lending with the utmost seriousness. As a result, as an FCA-approved lender, we take pride in continuing to provide accessible short term loans online to people in need and are dedicated to never authorizing a loan for a borrower who cannot afford it or is going through any sort of financial hardship.

4 notes

·

View notes

Text

How Funding Walk Is Redefining Business Finance with Smarter Alternatives and a Transparent Funding Platform

Securing capital is one of the most critical challenges for businesses, real estate developers, and startups. From navigating traditional loan structures to exploring modern investment banking alternatives, the path to financial growth is rarely straightforward.

That’s where Funding Walk steps in—a unique ecosystem that’s transforming the way businesses, investors, and developers connect. Whether you're seeking business loans and funding, selling land or a project, or publishing your capital raise, Funding Walk offers a smarter, more transparent alternative to outdated systems.

Let’s explore how this innovative platform is reshaping the finance landscape in India and beyond.

The Changing Face of Business Finance

For decades, businesses have relied on banks and investment firms to secure capital. But with increased red tape, high fees, slow approval times, and limited access for small and mid-sized enterprises (SMEs), these traditional methods often leave high-potential ventures stuck in a cycle of delay and rejection.

Modern businesses need faster, more flexible financing options—and that’s what Funding Walk delivers.

Smarter Access to Business Loans and Funding

Whether you're scaling your startup, expanding operations, or acquiring equipment, business loans and funding are essential to driving progress. But not every business fits into a traditional loan structure.

Funding Walk offers a diverse pool of lending and investment opportunities tailored to each business’s needs. The platform connects business owners directly with lenders, private investors, NBFCs, and venture capitalists, bypassing intermediaries that often slow the process or increase costs.

What Makes Funding Walk Different:

Direct access to lenders and investors

Transparent profiles and deal listings

Streamlined digital submissions

No hidden brokerage or middleman commissions

Faster decision-making timelines

Whether you're an early-stage startup or a revenue-generating SME, Funding Walk ensures that your growth is never limited by outdated financial infrastructure.

A Dedicated Land and Project Selling Platform

Real estate and infrastructure developers face unique challenges—especially when it comes to marketing large-scale land or turnkey project opportunities. Traditional listing portals are not designed for serious investors, while brokerage-based models lack efficiency and trust.

Funding Walk addresses this need with a dedicated land and project selling platform, allowing developers to:

List commercial and residential land parcels

Publish ready-to-build or under-development projects

Attract institutional and HNI investors directly

Showcase project documentation and ROI data securely

Reach a focused, finance-driven audience

This B2B approach improves visibility, trust, and negotiation efficiency—helping both buyers and sellers close deals faster, with fewer friction points.

Offering Investment Banking Alternatives That Actually Work

While investment banking plays a vital role in global finance, the model often excludes smaller companies, early-stage ventures, or localized businesses. High fees, exclusivity, and slow processes make it difficult for many entrepreneurs to benefit.

Funding Walk offers an open, digital-first ecosystem that acts as a reliable investment banking alternative—connecting businesses with the right funding sources without gatekeeping.

Services Include:

Equity and debt deal exposure

Investor matching algorithms

Self-submission of investment documents

Visibility to family offices, angels, and PE firms

Real-time communication channels for deal discussions

This user-led model empowers businesses to take control of their capital raise without relying on third-party mandates or expensive advisors.

The Power of a Funding Announcements Platform

One of the most powerful tools for visibility and credibility is publicity. With Funding Walk’s funding announcements platform, businesses can now highlight their funding rounds, investor partnerships, or financial achievements.

This feature not only helps businesses attract more attention but also enhances investor confidence by showcasing:

Seed to Series B+ funding rounds

Recent mergers or acquisitions

Strategic investor entries

Expansion-related funding

It’s more than a brag board—it’s a dynamic space for entrepreneurs to build trust, and for investors to identify high-momentum businesses in real-time.

A Transparent, Community-Led Financial Ecosystem

At the core of Funding Walk is its commitment to transparency, accessibility, and empowerment. The platform isn’t just about connecting capital with ideas—it’s about reshaping how business finance works at every level.

Key Benefits of Using Funding Walk:

No intermediaries or hidden commissions

Publicly visible, searchable funding listings

Tools for self-promotion and pitch submissions

Verified business profiles and investor access

Support for multiple sectors: tech, real estate, healthcare, manufacturing, and more

This isn’t a one-size-fits-all model. Funding Walk enables every user to define their journey, engage meaningfully with the right stakeholders, and drive business success without red tape.

Final Thoughts

From solving liquidity issues to finding the right investor fit, Funding Walk offers a smarter, faster, and more transparent way to navigate the modern financial landscape. Whether you're seeking business loans and funding, listing on a land and project selling platform, exploring investment banking alternatives, or boosting visibility through a funding announcements platform, Funding Walk has the tools you need.

0 notes

Text

From Connections to Conversions: Win with LinkedIn

LinkedIn has lately been construed as more of a social networking site, it is rapidly being used for brand building, lead generation, and inter-business operations. In 2025, however, companies are increasingly utilizing LinkedIn to engage in lead conversion rather than just brag about office culture or hunt for talent. The platform's somewhat rare mix of professional audience, content-imbued algorithms, and really niche targeting opportunities makes this one of the few must-haves in any serious digital marketing strategy.

While turning LinkedIn into a growth channel involves an expanded network to grow, it means actually seeing measurable results from those connections. Here's how brands can bridge that gap.

1. Build a Strong Brand Presence

A strong company profile holds the foundation of success on LinkedIn! This is your digital storefront on the platform. Featuring a complete and easy-on-the-eyes company page, along with consistent branding, keyword-rich descriptions, and an updated list of services, lends this mammoth platform a big appeal and much-needed credibility.

To share regular updates and original content, repurpose thought leadership materials to show your domain expertise. Users tend to connect with and engage businesses that add value to their feeds rather than try to sell aggressively.

2. Create and Share Purpose-Driven Content

The heart of LinkedIn is content. But the kind of content that converts does more than get likes: it educates, engages and fosters decision-making. High performance-brand types utilize:

Thought leadership articles

Customer case studies

Native documents such as PDFs and whitepapers

LinkedIn Live and short videos

Stay authentic. Tell stories, spotlight customer wins, and share insights where your company is portrayed as a solution. Subtly include CTAs toward landing pages or direct outreach.

3. Use LinkedIn Ads Strategically

Paid marketing on LinkedIn can be great for B2B lead generation. Filters such as job title, company size, industry, and seniority let decision-makers be targeted very specifically. But LinkedIn Ads need a strategy to work:

Start by sponsoring posts to push organic content that is performing well.

Test out different creatives and messaging.

Lead Gen Forms are a good way to keep users on the platform to collect their data.

Such leads to less friction and more conversion possibilities. Since LinkedIn Ads might be a bit spicy in terms of cost, it is wise to go in with a clear objective and through a well-structured funnel.

4. Turn Engagement into Action

It’s a mere starting point to garner followers. Businesses realize opportunity by actively engaging with the network: commenting on posts, replying to messages, continuing conversations into unvarnished exchanges of ideas. Instead of using connection requests as a launching point for hard sales, use them as a medium to open dialogue.

Sales teams can bolster marketing efforts by using a tool like Sales Navigator to identify and track prospects; this, combined with unilateral messaging, sets the stage for a potent, top-to-bottom funnel that is focused and trust-based.

The Role of Experts in Maximizing LinkedIn ROI

Though the platform offers strong tools, the consistent success in LinkedIn comes with a mixture of creative content, data analysis, and platform knowledge. So that is where an expert digital marketing agency steps in and makes the difference.

In Kochi, companies are opting more and more to professionals for that next-level LinkedIn marketing strategy. One agency that stands out in the field is Globosoft, the foremost name in Digital Marketing in Kochi. Globosoft is known for creating data-driven, platform-optimized strategies to turn the otherwise passive LinkedIn presence of brands into heavy-duty conversion engines. Profile optimization and ad campaign management, or even full-fledged end-to-end lead generation, all witness results by them that go beyond mere quantification.

Conclusion In 2025, LinkedIn is far from being merely a networking platform-a digital marketplace where credibility is the measure of opportunity. When done right, brands can ascend from visibility to engaging meaningfully and converting. In case this becomes a serious wish for a company, partnering with an expert Digital marketing company in Kochi like Globosoft could make all the difference-the crucial strategic advantage that they need to prosper.

#Website Designing in Kochi#Digital Marketing in Kochi#Web Designing Companies in Kochi#Digital Marketing in Cochin#Digital Marketing Companies in Cochin#Digital Marketing in Ernakulam#Digital Marketing Companies in Ernakulam#Best digital marketing company in kochi kerala#Best digital marketing company in kochi

0 notes

Text

How Startups Are Using Financial Modelling to Attract Investors in India’s Booming Tech Ecosystem

India’s startup ecosystem is on fire. With over 100 unicorns and thousands of early-stage ventures blossoming across sectors like fintech, edtech, healthtech, SaaS, and e-commerce, the landscape is vibrant—but also fiercely competitive. In this high-stakes environment, financial modelling has emerged as a powerful tool for startups to build credibility, secure funding, and scale with confidence.

For aspiring entrepreneurs and finance professionals alike, mastering financial modelling is no longer optional. If you’re in Kolkata and looking to break into this space, enrolling in the best Financial Modelling Course in Kolkata can give you the practical skills needed to thrive in this startup-driven economy.

Why Financial Modelling Matters in a Startup's Journey

When startups approach angel investors, venture capitalists, or private equity firms, they don’t just pitch an idea—they pitch a vision backed by numbers. These numbers aren’t just pulled from thin air. They come from detailed financial models that forecast how the business will grow, scale, and generate returns.

A robust financial model communicates:

Revenue projections for the next 3–5 years

Operating expenses and burn rate

Break-even analysis

Customer acquisition cost (CAC) and lifetime value (LTV)

Unit economics

Funding requirements and expected ROI

These projections show investors that the startup’s founders understand their market, costs, and how their business will turn a profit—or at least grow fast enough to justify the investment.

The Indian Startup Boom: A Perfect Storm for Financial Modellers

India is now the third-largest startup ecosystem in the world, after the US and China. With the digital economy accelerating, investors are pouring billions into scalable tech ventures. However, investor scrutiny is higher than ever due to recent global funding slowdowns.

Now, it’s not enough to have a great pitch deck. Investors want to see clear, data-driven financial roadmaps. That’s where financial modelling steps in.

Professionals trained through the best Financial Modelling Course in Kolkata are helping startups prepare solid models that can stand up to investor due diligence. From sensitivity analysis to discounted cash flows and cohort-based revenue forecasting, the right models can turn a maybe into a yes.

How Startups Are Using Financial Models to Win Over Investors

1. Validating the Business Idea

Before seeking funding, startups use financial models to check whether the business idea is financially viable. This includes calculating how many customers are needed to reach profitability, and how long the runway is with current capital.

2. Pitch Deck Projections

Every investor pitch today includes financial projections. But not all projections are created equal. Models that reflect realistic assumptions, industry benchmarks, and multiple scenarios inspire investor trust and make the startup stand out.

3. Justifying Valuations

Startups often struggle to justify their high valuations. Solid models using DCF (Discounted Cash Flow) or Comparable Company Analysis help founders support their ask with logic and numbers.

4. Planning for Fund Utilization

Investors want to know: how exactly will the startup spend their money? Financial modelling helps allocate capital efficiently—across product development, marketing, hiring, and operations.

5. Managing Growth

As a startup scales, it needs to continuously update its models to make hiring plans, pricing decisions, and market expansion strategies. Good models aren’t static—they evolve with the business.

Real-World Example: Fintech Startup in Kolkata

Take the example of a rising fintech startup in Kolkata targeting small business lending. When preparing for their Series A round, they built a detailed financial model projecting their revenue based on user acquisition, average loan size, and default rates. They also modeled different growth scenarios: aggressive vs. conservative.

Using these models, they were able to:

Clearly demonstrate when they’d break even

Show the effect of scaling operations

Validate their ₹100 crore valuation ask

They successfully secured funding from a Mumbai-based VC firm—and credited their financial model as a major differentiator.

The Growing Demand for Financial Modelling Skills

Startups aren’t the only ones benefiting. Founders, finance teams, startup analysts, and even venture capital interns are expected to know how to build and interpret financial models.

If you're based in West Bengal and looking to enter this space, joining the best Financial Modelling Course in Kolkata can be your stepping stone. These courses teach:

Excel-based modelling techniques

Three-statement financial models

Valuation methods like DCF and EBITDA multiples

Scenario planning and Monte Carlo simulations

Fundraising and cap table modelling

With these skills, you can work in corporate finance, become a startup CFO, join a VC firm, or even start your own venture with financial clarity.

Final Thoughts

India’s startup boom is not slowing down—and as more founders chase limited capital, financial clarity will be their biggest weapon. Financial modelling is no longer just for investment bankers; it’s now a startup essential.

If you’re looking to be part of this transformation—whether as a founder, finance professional, or investor—now is the time to upskill. Enroll in the best Financial Modelling Course in Kolkata and gain the expertise to turn ideas into investor-ready opportunities.

0 notes

Text

Fintech Trends- The Future of Financial Innovation

Source: www.linkedin.com

The financial services industry is in the middle of an essential change, driven by technological leaps and evolving consumer demands. Over the past decade, fintech has appeared as a truly disruptive force, completely revolutionizing how we manage our money, from banking and investing to borrowing and paying. As we fall deeper into a digital-first economy, understanding key Fintech Trends is no longer optional; it’s essential for businesses, investors, and consumers alike.

1. Rise of Embedded Finance

Embedded finance is the seamless integration of financial services into non-financial platforms. This trend is being driven by the desire to simplify user experiences. Instead of logging into a separate app to get a loan, make a payment, or buy insurance, users can now access these services directly within e-commerce sites, ride-hailing apps, or even social media platforms.

Retailers, for example, can offer buy-now-pay-later (BNPL) options at checkout, improving sales and customer satisfaction. Similarly, SaaS companies are embedding banking and lending products within their dashboards, giving users convenient access to financing options without ever leaving the interface.

The real power of embedded finance lies in its invisibility—it happens in the background, making financial transactions more natural and intuitive. This trend is expected to reshape how businesses and consumers interact with money.

2. AI and Machine Learning in Fintech

Image by cnythzl from Getty Images Signature

Artificial Intelligence (AI) and machine learning are no longer buzzwords—they are the engines behind smarter financial services. AI is being used to automate customer service through chatbots, detect fraudulent activities in real time, analyze credit risk more accurately, and even make investment decisions.

For example, robo-advisors use AI algorithms to provide tailored investment strategies based on an individual’s risk appetite and goals. Fintech startups are also leveraging machine learning to offer more personalized financial products, using data from users’ transactions, browsing history, and even social media.

As these technologies continue to mature, we can expect AI-driven solutions to become even more integral to the financial ecosystem. It’s one of the Fintech Trends that promises not only cost savings for providers but also enhanced services for consumers.

3. Blockchain Beyond Cryptocurrencies

While blockchain technology is most often associated with cryptocurrencies like Bitcoin and Ethereum, its impact goes far beyond digital coins. In the fintech world, blockchain is being used to streamline complex processes like cross-border payments, trade settlements, and identity verification.

Decentralized finance (DeFi) platforms are using blockchain to create open-source financial ecosystems, where users can lend, borrow, and earn interest without traditional banks. These systems are more transparent, quicker, and less expensive than conventional methods.

Moreover, central banks around the world are exploring the use of central bank digital currencies (CBDCs), which are state-backed digital versions of fiat currencies. These innovations could reshape monetary policy, remittances, and even how we use cash in the coming years.

As regulators catch up with the pace of innovation, blockchain’s role in fintech will continue to expand, cementing its position as one of the most impactful Fintech Trends to watch.

4. Financial Inclusion Through Digital Platforms

Image by Khwanchai Phanthong’s Images

One of the most powerful effects of fintech is its ability to democratize access to financial services. In emerging markets, millions of people who were previously unbanked or underbanked are now able to save, invest, and transact using mobile-based platforms.

Digital wallets, micro-investing apps, and mobile lending services are helping bridge the financial gap. Companies like M-Pesa in Kenya or Paytm in India are examples of how mobile technology can create financial ecosystems in areas with limited banking infrastructure.

This trend is especially critical in the post-pandemic world, where cashless transactions have become the norm. By lowering the barriers to entry, fintech is enabling more people to participate in the global economy and build financial resilience.

The intersection of innovation and inclusion is one of the most transformative Fintech Trends, particularly in regions that have historically been excluded from mainstream financial systems.

5. Regulatory Tech (RegTech) Gains Momentum

As fintech grows, so does the need for smarter compliance solutions. Regulatory Technology, or RegTech, is emerging as a key pillar of the fintech ecosystem. These tools help financial institutions comply with increasingly complex regulations using automation, AI, and big data analytics.

RegTech solutions can monitor transactions in real-time, flag suspicious activity, and generate compliance reports instantly. This not only reduces manual effort but also minimizes human error and enhances transparency.

With global regulations like GDPR, PSD2, and anti-money laundering (AML) laws becoming more stringent, RegTech is no longer optional, it’s essential. It enables fintech firms to scale faster while staying on the right side of the law.

As compliance becomes more tech-driven, RegTech is expected to play a bigger role in shaping the future of financial services, making it a defining factor among emerging Fintech Trends.

Looking Ahead: What This Means for Stakeholders

Image by PeopleImages from Getty Images Signature

Whether you’re a startup founder, a traditional banker, an investor, or a consumer, staying informed about fintech trends is more important than ever. For businesses, it means adapting to changing customer expectations and adopting technologies that can streamline operations and drive growth. For investors, it means identifying startups and sectors poised for disruption. And for consumers, it means gaining access to better, faster, and more personalized financial services.

The world of fintech is evolving at a rapid pace, and the only constant is change. From embedded finance and blockchain innovations to AI-driven personalization and inclusive banking solutions, the opportunities are vast, and so are the challenges.

Conclusion

The fintech landscape is active with innovation, fueled by groundbreaking technologies and developing consumer demands. The Fintech Trends we’re seeing aren’t just passing styles; they indicate a fundamental transformation in how we manage our money and financial lives. As this dynamic ecosystem expands, staying ahead of these trends will be crucial for success in the future of finance.

0 notes

Text

Moisture Wicking Socks Market Size, Share, Trends, Demand, Growth, Challenges and Competitive Outlook

Executive Summary Moisture Wicking Socks Market :

Global moisture wicking socks market size was valued at USD 311.6 Million in 2023 and is projected to reach USD 511.84 Million by 2031, with a CAGR of 6.4% during the forecast period of 2024 to 2031.

The Moisture Wicking Socks Market report has all the details about market analysis, market definition, market segmentation, key development areas, competitive analysis and research methodology. This industry report provides great explanation about the strategic profiling of the key players in the market, comprehensively analyzing their core competencies, and their strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions which are vital for the businesses to take better steps to improve their strategies and thereby successfully retail goods and services. According to this market report, new highs will take place in the Moisture Wicking Socks Market.

The Moisture Wicking Socks Market report presents thorough description, competitive scenario, wide product portfolio of key vendors and business strategy adopted by competitors along with their SWOT analysis and porter's five force analysis. Businesses can assertively use the data, statistics, research, and insights about the market covered in this report to make decisions about business strategies and to achieve maximum return on investment (ROI). To bestow clients with the most excellent results, Moisture Wicking Socks Market research report has been generated by using integrated approaches and latest technology. This global Moisture Wicking Socks Market research report potentially offers plentiful insights and business solutions that will lend a hand to win the competition.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Moisture Wicking Socks Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-moisture-wicking-socks-market

Moisture Wicking Socks Market Overview

**Segments**

- **Material Type**: The global moisture-wicking socks market can be segmented based on material type into synthetic fibers, wool, cotton, and blends. Each material has its own set of characteristics that cater to different consumer needs.

- **End User**: Segmentation based on end user includes men, women, and children. The demand for moisture-wicking socks varies across different demographics, with specific preferences and requirements.

- **Distribution Channel**: The market can also be segmented based on distribution channels such as online retail, specialty stores, supermarkets/hypermarkets, and others. The availability of moisture-wicking socks through various channels influences consumer accessibility and purchasing behavior.

**Market Players**

- **Nike Inc.**: A leading player in the global moisture-wicking socks market, Nike offers a wide range of performance-based socks that cater to athletes and active individuals worldwide.

- **Adidas AG**: Known for its innovative sportswear products, Adidas has a strong presence in the moisture-wicking socks market, providing high-quality socks for various sports and activities.

- **Under Armour Inc.**: Under Armour is another key player known for its moisture-wicking technology in sports apparel, offering a diverse selection of socks for different purposes.

- **Bombas**: A socially conscious brand, Bombas focuses on providing comfortable and moisture-wicking socks while also donating a pair for every pair purchased, resonating with socially conscious consumers.

- **Smartwool**: Specializing in wool-based moisture-wicking socks, Smartwool caters to outdoor enthusiasts and adventurers looking for performance-driven sock options.

The global moisture-wicking socks market is a dynamic and competitive space with key players constantly innovating to meet changing consumer demands and preferences. The market segmentation based on material type, end user, and distribution channels allows for a targeted approach in product development and marketing strategies. Companies like Nike, Adidas, Under Armour, Bombas, and Smartwool have established themselves as prominent players in the market, offering a diverse range of moisture-wicking socks to cater to the evolving needs of consumers.

The global moisture-wicking socks market is experiencing significant growth and evolution driven by changing consumer preferences towards comfortable and performance-enhancing apparel. One key trend in the market is the increasing demand for sustainable and eco-friendly materials in moisture-wicking socks. Consumers are becoming more conscious of the environmental impact of their purchases, leading to a rise in the popularity of socks made from recycled materials or sustainable fibers such as bamboo or organic cotton. Market players are responding to this trend by incorporating sustainable practices in their manufacturing processes and offering eco-friendly options to cater to the growing segment of environmentally conscious consumers.

Another important aspect shaping the moisture-wicking socks market is the emphasis on technological innovation. Companies are investing in research and development to introduce advanced moisture-wicking technologies that enhance the performance and comfort of socks. Innovations such as targeted ventilation zones, seamless designs, and antibacterial properties are being incorporated into socks to address specific consumer needs and provide a competitive edge in the market. These technological advancements not only improve the functionality of moisture-wicking socks but also contribute to enhancing the overall user experience, thereby influencing purchasing decisions.

Moreover, the market is witnessing a shift towards personalized and customized offerings in moisture-wicking socks. With the rise of e-commerce and digital technologies, consumers have more options to personalize their sock choices based on preferences such as color, design, cushioning, and size. Companies are leveraging data analytics and customization tools to provide personalized recommendations and create unique sock designs tailored to individual preferences. This customization trend is resonating well with consumers seeking products that reflect their personal style and preferences, driving higher engagement and brand loyalty in the market.

Furthermore, the COVID-19 pandemic has significantly impacted the moisture-wicking socks market, with changes in consumer behavior and preferences influencing market dynamics. The shift towards remote work and virtual activities has led to a higher demand for comfortable and versatile clothing, including moisture-wicking socks that offer both performance and comfort for everyday wear. Companies are adapting their product offerings and marketing strategies to align with the evolving consumer needs in the post-pandemic era, focusing on versatility, durability, and multi-functional features to cater to a diverse range of consumer lifestyles.

In conclusion, the global moisture-wicking socks market is characterized by continuous innovation, sustainability initiatives, technological advancements, and personalized offerings to meet the dynamic demands of consumers. Market players are striving to differentiate themselves through product differentiation, sustainable practices, and customer-centric approaches, driving growth and competitiveness in the market. With changing consumer preferences and market trends, companies will need to stay agile and responsive to maintain relevance and drive success in the evolving landscape of moisture-wicking socks.The global moisture-wicking socks market is a highly competitive and rapidly evolving industry that caters to consumers' increasing demand for comfortable and performance-driven apparel. With key players such as Nike, Adidas, Under Armour, Bombas, and Smartwool dominating the market, innovation, sustainability, and customization have become critical factors driving growth and shaping consumer preferences.

One emerging trend in the market is the growing emphasis on sustainable and eco-friendly materials. Consumers are increasingly conscious of the environmental impact of their purchases, leading to a rise in demand for socks made from recycled materials or sustainable fibers. Market players are responding to this trend by incorporating sustainable practices in their manufacturing processes and offering eco-friendly options to meet the needs of environmentally conscious consumers.

Technological innovation is another key driver in the moisture-wicking socks market. Companies are investing in research and development to introduce advanced moisture-wicking technologies that enhance the performance and comfort of socks. Innovations such as targeted ventilation zones, seamless designs, and antibacterial properties are being integrated into socks to address specific consumer needs and gain a competitive advantage in the market.

Personalization and customization are also reshaping the market landscape. With the rise of e-commerce and digital technologies, consumers now have more options to personalize their sock choices based on preferences such as design, cushioning, and size. Companies are leveraging data analytics and customization tools to provide personalized recommendations and create unique sock designs tailored to individual preferences, driving higher engagement and brand loyalty among consumers.

Additionally, the COVID-19 pandemic has significantly impacted the moisture-wicking socks market by altering consumer behaviors and preferences. The shift towards remote work and virtual activities has led to a higher demand for comfortable and versatile clothing, including moisture-wicking socks that offer both performance and comfort for everyday wear. Companies are adapting their product offerings and marketing strategies to align with the changing consumer needs in the post-pandemic era, focusing on versatility, durability, and multi-functional features to cater to a diverse range of consumer lifestyles.

In conclusion, the global moisture-wicking socks market is characterized by intense competition, innovation, sustainability initiatives, technological advancements, and a growing focus on personalization. Market players must continue to evolve their strategies to stay ahead in this dynamic industry, meeting the evolving demands of consumers and adapting to changing market trends to drive growth and success in the competitive landscape of moisture-wicking socks.

The Moisture Wicking Socks Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-moisture-wicking-socks-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Answers That the Report Acknowledges:

Moisture Wicking Socks Market size and growth rate during forecast period

Key factors driving the Moisture Wicking Socks Market

Key market trends cracking up the growth of the Moisture Wicking Socks Market.

Challenges to Moisture Wicking Socks Market growth

Key vendors of Moisture Wicking Socks Market

Opportunities and threats faces by the existing vendors in Global Moisture Wicking Socks Market

Trending factors influencing the market in the geographical regions

Strategic initiatives focusing the leading vendors

PEST analysis of the Moisture Wicking Socks Market in the five major regions

Browse More Reports:

Global Food Stabilizers Market Global Hypercalcemia Treatment Market Global Food Starch Market Global Molecular Sieves Market Global Tissue Fixation Market Global Pinoxaden Market Global Licensed Sports Merchandise Market Global Cannabis Retail Point of Sale (POS) Software Market Global Cable Ties Market Global Flexible Laminated Paper Market Global Natural and Synthetic Biomedical Adhesives Market Global Subsea Thermal Insulation Materials Market Global Life Sciences Business Processing Outsourcing Market Global Bioartificial Organ Manufacturing Market Global Pirimiphos-Methyl Market Asia-Pacific Internet of Things (IOT) Healthcare Market Global Traction Motor Market Global Mica Based Flexible Heater Market Global Steering Thermal Systems Market Asia-Pacific Magnesium Alloys Market Europe Clinical Chemistry Analyzer Market Global Cardiac Resynchronization Therapy Market Asia-Pacific Sweet Potato Powder Market Global Food Flavor Encapsulation Market Global Spinal Non Fusion Technologies Market Asia-Pacific Bone Glue Market Global X-ray Fluorescence (XRF) Market Global Pulse Protein Market Asia-Pacific Cyclodextrins in Pharma Market Global Connected Solutions for Oil and Gas Market Global Alcoholic Beverage Packaging Market Global Plasma Fractionation Market Global Watches Market Global 5G Fixed Wireless Access Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag: Moisture Wicking Socks Market, Moisture Wicking Socks Market Size, Moisture Wicking Socks Market Share, Moisture Wicking Socks Market Growth

0 notes

Text

Future of Banking and Finance Careers in Tech

Introduction: How Tech is Redefining Finance Careers

In the last decade, the finance industry has witnessed a digital revolution. Fintech, AI, and cloud technologies have opened up a whole new horizon of possibilities for the industry. Nowadays, finance jobs in tech are not just in demand—they're shaping the future of investment banking.

From data scientist positions in banking to AI-powered trading systems, technology is reshaping conventional job roles. In this article, we discuss the magnitude of new-age tech jobs, preparing for them, and why a solid foundation via a banking and finance course is needed for upcoming professionals.

Fintech Jobs: Revolutionising the Landscape

Fintech has blurred the lines between finance and technology. The emergence of startups and digital-first banks is driving the demand for tech-savvy professionals who understand both domains.

These fintech careers span across payments, blockchain, lending platforms, wealth technology, and insurance technology.

Key areas include:

Front-end and back-end development for financial apps

API development and third-party integrations

Payment gateway infrastructure

Blockchain and smart contracts

Fintech experts must adapt rapidly to emerging regulatory landscapes and changing client needs, making these roles both challenging and thrilling.

Data Science Jobs in Banking

Data is the new oil, and banks have enormous reservoirs of it. Data science jobs in banking are becoming even more crucial for data-driven decision-making, customer segmentation, fraud detection, and customised services.

Hot jobs include:

Quantitative Analyst (Quant)

Credit Risk Model Developer

Data Engineer

Business Intelligence Analyst

They utilise Python, R, SQL, and tools such as Tableau and SAS to glean useful insights and inform product strategies.

Investment Banking IT Careers: Merging Tech and Strategy

Classical investment banking now has a dedicated department that handles IT infrastructure, security, cloud environments, and algorithmic trading. Investment banking IT careers are ideal for candidates who wish to combine their technical expertise with strategic financial processes.

These careers involve:

DevOps Engineers for trading platforms

IT Security Analysts safeguarding financial information

Cloud Architects storing real-time trading data

Algorithm Developers for high-frequency trading

These positions offer a dynamic environment that requires innovative thinking on a daily basis.

AI Job Roles in Finance: Advanced Applications

AI is no longer merely automation—it's creating intelligent systems that can learn, predict, and improve. AI job roles in finance span from chatbots and robo-advisors to sophisticated portfolio management tools.

In-demand jobs:

Machine Learning Engineer

AI Research Scientist

NLP Engineer (Natural Language Processing)

Fraud Detection Systems Analyst

FinTech AI improves decision-making, improves compliance, and reduces operational expenses.

Cloud Engineer Banking Jobs: Real-Time Data Management

The shift to the cloud in banking expands the demand for cloud experts. Cloud engineer banking positions play a vital role in maintaining scalability, data security, and high availability for financial institutions.

Typical tasks:

Migrating on-premise infrastructure to cloud platforms

Designing cloud-compatible storage and computing architecture

Maintaining regulatory compliance in cloud deployments

Managing real-time data streams

These experts are often associated with technologies such as AWS, Azure, and Google Cloud.

Natural Integration: Reskilling for the Technology-Inclined Finance Industry

Surviving in this dynamic environment involves more than mastering technicalities—it demands financial literacy and a comprehensive understanding of regulatory models. People who want to enter technology-focused positions in investment banking must establish a strong foundation that integrates finance concepts with applied technology.

That is where formal learning comes in. Courses that provide both knowledge in the domain and actual application give the competitive edge one needs to succeed in these demanding positions.

The Role of a Banking and Finance Course in Career Growth

With technology upending the banking landscape, becoming armed with the appropriate skills is more crucial than ever. A course in banking and finance not only aids in learning the very basics of financial markets and banking operations, but also incorporates exposure to tech tools now a necessity in the sector.

Imarticus Learning's Banking and Finance Program is one such that blends financial literacy with live industry skills. From learning risk management and trade finance to experiential learning with digital tools and soft skills, the program is crafted for those who wish to join or reskill in this vibrant industry.

Next Steps: Building a Future-Ready Career

Looking to the future, it's apparent that finance professionals need to grow with the profession. As an up-and-coming analyst, developer, or manager, adopting technology is no longer a matter of choice—it's fundamental. The way forward is constant learning, hands-on practice, and maintaining a lead on trends.

Seeking out organized upskilling in a banking and finance course can be an excellent step towards bringing your career into harmony with future possibilities in this rapidly evolving field.

FAQs

1. What are the most sought-after tech careers in finance?

They are AI engineers, data scientists, cloud architects, DevOps engineers, and fintech product developers.

2. Is the demand for data science positions in banking high?

Yes, fraud detection, customer insights, and portfolio optimisation require data science.

3. How is AI transforming the investment banking industry?

AI makes decisions automatically, improves compliance, and enhances trading precision.

4. What abilities are required for fintech careers?

Programming technical skills, business finance acumen, and knowledge of regulatory environments.

5. Is a banking and finance course beneficial for tech jobs?

Yes. It provides a solid grounding in financial concepts while incorporating live tech exposure.

6. What are investment banking IT jobs like?

They are highly dynamic, innovation-led roles concentrating on cloud infrastructure, trading systems, and security.

7. Do I have to code for AI finance jobs?

Yes, familiarity with Python, R, or similar languages is typically required.