#Debt Based Modes of Financing

Text

Profit and Loss Sharing Two Tier Mudarabah

Paper Title: Profit and Loss Sharing Partnership: The Case of the Two Tier Mudarabah in Islamic Banking

Author: Amine Ben Amar and AbdelKader O. El Alaoui

Publisher: Emerald International Journal of Islamic and Middle Eastern Finance and Management, Vol. 16 No. 1, 81-102.

This paper mathematically analyzes the two-tier Mudarabah model in an exclusive Islamic financial environment and…

View On WordPress

#AbdelKader O. El Alaoui#Adverse Selection#Agency Conflict#Amine Ben Amar#Debt Based Modes of Financing#Distributive Justice#Equity Based Modes of Financing#Ideal Modes of Financing#Information Asymmetry#Islamic Banking#Islamic Finance#Moral Hazard#Mudarabah#Musharakah#Profit and Loss Sharing#Risk Sharing#Risk Sharing vs Risk Shifting#Shariah Based Modes#Two Tier Mudarabah

0 notes

Text

( rosie huntington-whiteley, she/her, cursed blood ) to LEBLANC ASINASTRA, the whole world looks like an open page. with a leap of faith, their ability of CRYSTAL DEFENSE grows a little stronger. they are a SEQUINED SPIDER shade aligned to NO ONE. for ONE-HUNDRED THIRTY-ONE years, they have survived a world of magic with both their SINCERITY and SELF-INVOLVEMENT. they work as an AIRSHIP PIRATE, but if they could change their fate, they’d want to REALIZE THEIR PAST AND HAVE THE FUTURE THEY DESERVE.

hello, hello! eva here again again. inspo includes the likes of the following, though by no means is this list exhaustive because, like always, i had a lot: tachikawa mimi of digimon, leblanc of ffx, faye valentine of cowboy bebop, boa hancock of one piece, alexis rose of schitt's creek, roxanne hart of chicago, stella of winx club, emma frost of marvel.

&. ⸻ BASICS

name — leblanc asinastra emilia claus

aliases — 'diamond skin' leblanc

birthdate — august 20

zodiac — leo

birthplace — sombertown unknown

sexuality — biromantic bisexual

alignment — chaotic good

temperament — choleric

element — fire

primary vice — greed

primary virtue — kindness

house — none

occupation — former actress, current airship pirate

markings — curse mark at the base of her wrist

&. ⸻ HEADCANONS

a former film actress. and while rumors have circulated on an unexpected death or other life drama, the official word on her absence is painted as 'health issues' per her agents and she is currently on hiatus. in truth, her absence is due to her cravings as a cursed blood getting the better of her and her wish to shy away from the public. she does desire to reclaim her spotlight in a proper capacity, but in the right way — in other words, cured of her affliction entirely.

most of her body of work as an actress includes soap operas and actual romance films. one of her final films is her in a dramatic action role as a vampire hunter, an intended departure. just after filming completed, she'd been bitten and left the spotlight mid-tour.

her dwindling finances as a result of her lack of work and insane debt being passed off in her name are among the reasons she's turned to piracy. she rather enjoys the venture, frankly, as it gives her the sort of life she craves — one full of spectacle, riches, and adventure.

as leblanc was turned many years ago, at the height of her popularity and by a man she trusted wholeheartedly to care and be there for her, her view on romance has since fallen to the pits. she is never serious about anyone she entertains these days and most her ventures in this regard are shallow at best — flirtatious and meaningless. and while there is a wish within her to find true love once more, her focus has predominantly turned towards her own wealth and worries.

a secondary part of her goals is to see her past life restored. she suffered memory loss far too many years back before coming into astra's care and has yet to recall anything, really. she considered herself the natural daughter of astra, given some similarities, until this realization dawned on her. as a result, her hunt for jewels and shiny things is peppered between her main wish for memory spheres — the orbs of collected history scattered throughout the world. she's under the more recent impression that her true past paints her in a royal light, and has been hunting down any clues to attest to this fact or any remnant of her past.

her airship, the lorelei, was attained through unknown means. and any occasion she's given to speak on her acquiring the ship, the story always seems to change. nevertheless, the vessel has been her favored mode of transportation for many years now and she welcomes all aboard it. cursed bloods, outsiders, ruffians of all make and nature. so long as they declare fealty to her and her cause and follow her orders explicitly when demanded, there are no troubles. her current crew count seems to change up rather consistently, given her habit of collecting strays and permitting her crew to come and go as they please.

unlike others in astra's family, where they may wish to do away with humans entirely, care for them, or see them burned alive, leblanc holds a rather curiously indifferent view of the species. so long as they worship and praise her accordingly, she's perfectly fine with their existence as a whole.

her golden hair is often decorated in diamonds, be they in floral arrangements or merely sprinkled throughout as a defense mechanism. cowboy hats are also a usual part of her headwear, favoring them quite earnestly.

steel-bladed fans and enchanted pheromone-enhancing perfume are a regular part of her arsenal

gossip and dramatics are among her favored indulgences

&. ⸻ DREAMSHADE FORMS

leblanc doesn't actually favor either of her forms as she considers them a bit unnatural and with her now being a cursed blood, unnecessarily painful transitions. she tends to use them, her final one especially, as a last resort.

tw: spiders

base form — here

example of crystal webbing — here

hollow form — here

&. ⸻ ABILITY

CRYSTAL DEFENSE — the ability to use crystals and minerals of all kinds defensively. leblanc is only capable of utilizing one type of mineral at a time, though she can alter the specific crystal in use at any moment. as such, she can go from sparkling diamond skin or emerald walls to the more poisonous adamite or erionite in a flash. infusing shards of said crystal into the bloodstream or body can induce various illusionary and lethal effects as well.

&. ⸻ FAMILY

astra asinastra — adoptive mother

jean-jacques asinastra — adoptive elder brother

sylvianne asinastra — adoptive elder sister

cerise asinastra — adoptive younger sister

jessica claus — biological sister

&. ⸻ KNOWN HISTORY

the most that leblanc recalls in her fractured memory is flames all around, a collapsed body, and eventually, the walls of the crystal caverns. she has absolutely no clue what else lies in her past, how she came to be among the asinastra family, or why.

her desire to be an actress frankly stemmed from her desire to be worshipped on a larger scale, to be idolized by humankind and anyone else. she would meet a man who would both see to it that this dream was briefly fulfilled and simultaneously taken out from under her with false promises, massive debt, and an empty altar.

these days, her life as a pirate sees her fulfilled in other ways. her intentions now lie in freedom from her cursed existence, to return to the life of celebrity in proper form ( rather than as merely an outlaw ), and of course, to see her memories restored.

10 notes

·

View notes

Text

Mindful Spending: Aligning Purchases with Values for a Fulfilling Life

In the realm of personal finance, distinguishing between fixed expenses and variable expenses is crucial for building a solid budget and achieving financial goals. While Fixed Expenses vs Variable Expenses remain constant month to month, variable expenses can fluctuate based on usage or other factors. Understanding the difference between these two types of expenses is essential for effective financial planning and management.

Fixed Expenses: The Steady Pillars of Your Budget

Fixed expenses are those regular payments that you can count on to remain relatively stable from month to month. These expenses are typically necessities that you must pay consistently, regardless of fluctuations in income or spending habits. Common examples of fixed expenses include:

Rent or Mortgage Payments: Your housing costs, whether you rent or own, are typically fixed each month.

Utilities: Expenses like electricity, water, gas, and internet bills often remain constant or vary only slightly.

Insurance Premiums: Health insurance, car insurance, and other types of insurance typically require fixed monthly payments.

Loan Payments: Monthly payments towards loans such as car loans, student loans, or personal loans are usually fixed amounts.

Subscription Services: Payments for subscriptions like streaming services, gym memberships, or software subscriptions remain consistent unless you actively cancel or change them.

Having a clear understanding of your fixed expenses allows you to budget effectively, as you can anticipate these costs each month and plan your spending accordingly. However, it's essential to regularly review these expenses to ensure you're getting the best value for your money and to identify any areas where you might be able to save.

Variable Expenses: The Flexible Component of Your Budget

Variable expenses, on the other hand, are costs that can fluctuate from month to month based on usage or other factors. While some variable expenses are necessary, others are discretionary and can be adjusted to align with your financial priorities. Examples of variable expenses include:

Groceries: While food is a necessity, the amount spent on groceries can vary depending on factors like meal planning, dietary choices, and shopping habits.

Transportation: Expenses related to fuel, public transportation, or ride-sharing services can fluctuate based on travel needs and fuel prices.

Entertainment: Costs for dining out, going to the movies, or attending events are variable and can be adjusted based on your discretionary income.

Clothing: Spending on clothing and accessories can vary depending on personal preferences and the need for new items.

Travel: Whether it's a weekend getaway or a long vacation, travel expenses can vary significantly depending on destination, mode of transportation, and accommodation choices.

Variable expenses offer flexibility in your budget and provide opportunities for saving money by making conscious choices about where and how you spend. By tracking these expenses and identifying patterns, you can better control your discretionary spending and allocate funds towards your financial goals.

Balancing Fixed and Variable Expenses

Achieving financial stability and reaching your financial goals requires a balanced approach to managing both fixed and variable expenses. While fixed expenses are necessary and often non-negotiable, finding ways to reduce or optimize these costs can free up more money to allocate towards savings, investments, or debt repayment. Similarly, being mindful of variable expenses and making intentional choices about spending can help you live within your means and make progress towards your financial objectives.

At Noble Blogging, we understand the importance of financial literacy and empowerment. By providing valuable insights and resources on topics like budgeting, saving, and investing, we aim to help our readers make informed decisions and achieve financial success. Whether you're just starting your financial journey or looking to improve your money management skills, we're here to support you every step of the way.

In conclusion, understanding the distinction between fixed expenses and variable expenses is essential for effective financial planning. By recognizing the role of each type of expense in your budget and making conscious choices about spending, you can take control of your finances and work towards a brighter financial future. Stay tuned to Noble Blogging for more tips, advice, and inspiration on your journey to financial wellness.

0 notes

Text

Financial Instrument Services: Your Guide to Financial Solutions

In today's sophisticated market, the world of finance is simply too complex to handle and control. This encompasses investing management and fundraising activities, across which each type of business needs custom-tuned financial solutions.

When considering where financial instrument services come into play, financial instrument services provide a complete set of tools and professional know-how for various businesses, which are among their responsibilities. Today, we will render an account of financial instrument evolutions and reveal their pivotal role in your financial growth.

Understanding Financial Instrument Services

Financial instruments services cover a plethora of items aiming at making monetary movements and investments easier worldwide. These services from Financial Solution Advisor are designed for businesses of all sizes, featuring services such as credit risk management for businesses as well as cash flow optimization and the scoring of financial goals.

It could mean taking part in the capital markets or avoiding the risks that come with changing currencies. Financial instruments are available to help people make sense of the complex financial world and put their strategic decisions into action in this area.

Exploring Business Finance Services

One of the core elements offinancial instrument services is business finance, which is an activity targeted at improving the capital needs of entrepreneurs and enterprises. The services include business finance service, from startups venturing on seed funding to old and established corporations that are looking to grow their businesses.

Such modes of finance could be debt financing, equity investment, asset-based lending, or other organized finance activities directed at growth and granting maximum dividends to shareholders.

The Role of Financial Solution Advisors

Above all, financial instrument solutions providers to business entities embody trusted advisors who guide their clients along the routes to attaining their financial objectives. These Financial Solution Advisor are the resourceful tribe; having in-depth knowledge and skills, they render tactical ideas and tailored suggestions to help individual businesses solve the challenges and catch the opportunities available to them.

Regardless of whether it's handling capital structure efficiently, manipulating liquidity, or becoming protected against market risks, financial solution executives effectively formulate financial strategies and steer an organization to success.

Navigating Financial Challenges with Confidence

In the face of the present business environment, which changes rapidly every day, a company has to deal with many financial difficulties, from economic uncertainties to the difficulties caused by regulations.

The route to dealing with these challenges is the provision of financial service tools for businesses, which are the backbone of business confidence and resilience. Through the development of futuristic financial solutions and ahead-of-the-curve approaches, companies can be prepared for long-term success while also putting them ahead of their competitors.

Empowering Your Financial Journey

It doesn't matter whether you are a new startup looking for seed capital or an older player looking to enter a new market. Financial instrument services offer the best chance for you to realize your financial dreams. They provide a set of things like risk management, diverse sources of finance, and expertise to help a business thrive easily and transform into a fighting enterprise.

Conclusion

In summary,financial instrument services are great friends of our age, offering reliable guidance through the onerous terrain of economic complexity and equipping us with certainty and clarity for the business terrain.

Through utilizing specialized financial solution advisers and the investigation of entrepreneurial business finance services, interacting businesses can unlock fresh prospects and bring forth a more lasting development in a continually mutating commercial world.

Visit here - https://www.charterunionfin.com/financial-instruments/

0 notes

Text

Financial Instrument Services: Your Guide to Financial Solutions

Financial Instrument Services: Your Guide to Financial Solutions

In today's sophisticated market, the world of finance is simply too complex to handle and control. This encompasses investing management and fundraising activities, across which each type of business needs custom-tuned financial solutions.

When considering where financial instrument services come into play, financial instrument services provide a complete set of tools and professional know-how for various businesses, which are among their responsibilities. Today, we will render an account of financial instrument evolutions and reveal their pivotal role in your financial growth.

Understanding Financial Instrument Services

Financial instruments services cover a plethora of items aiming at making monetary movements and investments easier worldwide. These services from Financial Solution Advisor are designed for businesses of all sizes, featuring services such as credit risk management for businesses as well as cash flow optimization and the scoring of financial goals.

It could mean taking part in the capital markets or avoiding the risks that come with changing currencies. Financial instruments are available to help people make sense of the complex financial world and put their strategic decisions into action in this area.

Exploring Business Finance Services

One of the core elements of financial instrument services is business finance, which is an activity targeted at improving the capital needs of entrepreneurs and enterprises. The services include business finance service, from startups venturing on seed funding to old and established corporations that are looking to grow their businesses.

Such modes of finance could be debt financing, equity investment, asset-based lending, or other organized finance activities directed at growth and granting maximum dividends to shareholders.

The Role of Financial Solution Advisors

Above all, financial instrument solutions providers to business entities embody trusted advisors who guide their clients along the routes to attaining their financial objectives. These Financial Solution Advisor are the resourceful tribe; having in-depth knowledge and skills, they render tactical ideas and tailored suggestions to help individual businesses solve the challenges and catch the opportunities available to them.

Regardless of whether it's handling capital structure efficiently, manipulating liquidity, or becoming protected against market risks, financial solution executives effectively formulate financial strategies and steer an organization to success.

Navigating Financial Challenges with Confidence

In the face of the present business environment, which changes rapidly every day, a company has to deal with many financial difficulties, from economic uncertainties to the difficulties caused by regulations.

The route to dealing with these challenges is the provision of financial service tools for businesses, which are the backbone of business confidence and resilience. Through the development of futuristic financial solutions and ahead-of-the-curve approaches, companies can be prepared for long-term success while also putting them ahead of their competitors.

Empowering Your Financial Journey

It doesn't matter whether you are a new startup looking for seed capital or an older player looking to enter a new market. Financial instrument services offer the best chance for you to realize your financial dreams. They provide a set of things like risk management, diverse sources of finance, and expertise to help a business thrive easily and transform into a fighting enterprise.

Conclusion

In summary, financial instrument services are great friends of our age, offering reliable guidance through the onerous terrain of economic complexity and equipping us with certainty and clarity for the business terrain.

Through utilizing specialized financial solution advisers and the investigation of entrepreneurial business finance services, interacting businesses can unlock fresh prospects and bring forth a more lasting development in a continually mutating commercial world.

Visit here - https://www.charterunionfin.com/financial-instruments/

0 notes

Text

Unlocking Financial Doors: Understanding the Role of Collateral in Car Title Loans

Car title loans have gained popularity as a quick financial solution for individuals in need of immediate cash. At the heart of these transactions lies the concept of collateral, with borrowers offering their vehicle titles as security against the loan. In this article, we will delve into the significance of collateral in car title loans, exploring how it shapes the lending process and impacts both borrowers and lenders.

Understanding Collateral: What Is It?

Before diving into the specifics of car title loans, it's essential to grasp the concept of collateral. Collateral refers to any asset or property that a borrower pledges to secure a loan. In the case of car title loans, the collateral is the borrower's vehicle, typically their car, truck, or motorcycle.

The Car Title Loan Process: Collateral as Security

In a car title loan transaction, the borrower hands over their vehicle title to the lender in exchange for a loan amount. The lender retains possession of the title until the borrower repays the loan in full, including any interest and fees. Should the borrower fail to repay the loan according to the agreed-upon terms, the lender has the legal right to repossess the vehicle and sell it to recoup their losses.

The Significance of Collateral for Lenders

Collateral plays a crucial role for lenders in mitigating the risk associated with car title loans. By securing the loan with the borrower's vehicle, lenders have a tangible asset to fall back on in case of default. This reduces the lender's exposure to financial loss and allows them to offer loans to individuals with less-than-perfect credit histories or unstable financial situations.

Collateral-Based Loan Amounts: How Much Can You Borrow?

The value of the collateral, in this case, the borrower's vehicle, often determines the maximum loan amount available. Lenders typically assess the market value of the vehicle and offer a loan amount based on a percentage of that value. However, it's important to note that lenders may cap the loan amount to ensure they can recover their investment in the event of default.

Risk and Responsibility for Borrowers

While collateral provides lenders with a safety net, it also carries significant risks for borrowers. By pledging their vehicle as collateral, borrowers put themselves at risk of repossession if they fail to make timely loan payments. Losing access to their primary mode of transportation can have far-reaching consequences, impacting their ability to work, fulfill family obligations, and maintain their livelihood.

High-Stakes Repayment: The Pressure of Collateralized Loans

The presence of collateral adds a sense of urgency to car title loan repayment. Borrowers are acutely aware that failure to repay the loan could result in the loss of their vehicle, creating a high-stakes scenario that can lead to increased stress and financial strain. This pressure to repay can sometimes push borrowers further into debt, as they scramble to meet their loan obligations at any cost.

Default and Repossession: The Consequences

Defaulting on a car title loan can have severe consequences for borrowers. In addition to the loss of their vehicle, borrowers may face damage to their credit score, legal action from the lender, and ongoing financial instability. Once caught in the cycle of default and repossession, it can be challenging for borrowers to break free and https://viptitlepawnathensga.com/ regain control of their finances.

Exploring Alternatives: Is Collateral Necessary?

While collateral is a common feature of car title loans, it's not the only option available to borrowers in need of quick cash. Traditional bank loans, credit unions, and online lenders offer unsecured personal loans that do not require collateral. Additionally, exploring alternative financial solutions such as debt consolidation or credit counseling can help individuals avoid the risks associated with collateralized loans.

Conclusion: Balancing Risk and Reward

Collateral plays a pivotal role in car title loans, providing lenders with security and borrowers with access to quick cash. However, the use of collateral also carries significant risks for borrowers, highlighting the importance of careful consideration before entering into a collateralized loan agreement. By understanding the role of collateral and exploring alternative financial options, borrowers can make informed decisions that align with their long-term financial goals.

0 notes

Text

What Is ULIP & How Does It Work?

In the dynamic landscape of financial instruments, Unit Linked Insurance Plans (ULIPs) have emerged as a versatile and unique investment-cum-insurance product. Designed to cater to the dual needs of wealth creation and financial protection, ULIPs have gained popularity among investors seeking a holistic approach to financial planning.

In this blog, we will delve into the intricacies of ULIPs, unravelling the mysteries behind how they work and their significance in the realm of personal finance and insurance.

What are ULIPs?

ULIP, short for Unit Linked Insurance Plan, is a hybrid financial product that combines the elements of insurance and investment.

Unlike traditional life insurance policies that primarily offer a death benefit, ULIPs allow policyholders to invest in a variety of funds, including equity and debt funds, while providing life coverage.

You should also note these plans come with a 5-year lock-in period before you can make any partial withdrawals and they are also tax deductible under Sections 80C (on annual premiums) and 10(10D) (on death benefit) of the Income Tax Act.

This dual nature makes ULIPs stand out as a versatile tool for individuals looking to secure their family's financial future while also aiming for capital appreciation.

How Do Unit Linked Insurance Plans Work?

ULIPs operate on a simple yet effective principle. When an individual invests in a ULIP, the premium paid is divided into two components: one for life insurance coverage and the other for investment in various funds as per the policyholder's risk appetite and financial goals.

The invested portion is further converted into units and the policyholder is allocated a certain number of units based on the prevailing Net Asset Value (NAV) of their chosen fund.

Here's a breakdown of the key components and workings of ULIPs:

Premium Payment: These are payments policyholders have to pay regularly for the maintenance of their ULIP plan. Most insurers, like Tata AIA, that offer ULIPs to insurance seekers provide flexible premium amounts, payment modes and frequencies.

Fund Options: ULIPs offer a range of fund options, such as equity funds, debt funds, or a mix of both, allowing investors to align their investments with their risk tolerance and financial objectives.

Life Coverage: A portion of the premium goes towards providing life insurance coverage. In the event of the policyholder's demise during the policy term, their family receives a death benefit, which includes the sum assured and the fund value.

Switching Funds: ULIPs provide the flexibility to switch between funds based on changing market conditions, investment objectives, or risk tolerance. This feature allows policyholders to adapt their investment strategy over time.

Partial Withdrawal and Maturity Benefit: Policyholders can make partial withdrawals from their ULIP investments after the completion of the lock-in period, typically five years. Additionally, at the end of the policy term, the policyholder receives the maturity benefit, which is the fund value at that time.

Lock-in Period: ULIPs come with a lock-in period, during which the policyholder cannot surrender the policy or make partial withdrawals. This period, usually five years, encourages long-term financial planning.

Benefits of ULIPs: Why Should You Get One?

Dual Benefits: ULIPs offer the combined advantages of life insurance coverage and investment growth.

Flexibility: Policyholders can switch between funds, choose premium amounts, and make partial withdrawals, providing flexibility in managing their investments.

Tax Benefits: ULIPs offer tax deductions under Section 80C for premium payments and tax exemptions under Section 10(10D) for maturity/death proceeds, subject to prevailing tax laws.

Considerations and Risks Regarding ULIPs:

Charges: ULIPs may have various charges, including premium allocation charges, fund management charges, and mortality charges. Understanding these charges is crucial for effective financial planning.

Market-Linked Risks: Since ULIP returns are linked to market performance, there is an inherent risk associated with market fluctuations. Policyholders should be prepared for market volatility and make informed decisions.

Conclusion

Unit Linked Insurance Plans (ULIPs) present a unique avenue for individuals to integrate insurance and investment in a single financial product.

With the flexibility to tailor investments, manage risks, and enjoy tax benefits, ULIPs have become a popular choice for those seeking a comprehensive approach to financial planning. However, it's imperative to thoroughly understand the terms, charges, and risks associated with ULIPs to make informed decisions aligning with one's financial objectives.

1 note

·

View note

Text

Navigating the Criteria: Factors Influencing Eligibility and Approval for Electric Bike Loans in India

Electric bikes have emerged as a sustainable and cost-effective mode of transportation, prompting many individuals in India to consider availing loans for their purchase. However, eligibility criteria and the approval process for electric bike loans are influenced by various factors that potential borrowers need to consider before applying for financing.

Credit History and Score:

A crucial factor influencing eligibility for electric bike loans is an individual's credit history and credit score. Financial institutions assess the creditworthiness of borrowers based on their credit reports, evaluating repayment behavior on past loans and credit cards. A good credit score increases the chances of loan approval and may result in better interest rates.

Income Criteria:

Lenders typically require borrowers to meet specific income criteria when applying for electric bike loans. Stable income sources, such as salary slips for salaried individuals or income tax returns for self-employed individuals, validate repayment capability. A higher income may increase the loan amount sanctioned by financial institutions.

Employment Status and Stability:

A borrower's employment status plays a pivotal role in loan approval. Salaried individuals with a consistent job history and stable employment are viewed favorably by lenders. For self-employed individuals, demonstrating a stable business with consistent income is crucial to establish credibility and enhance loan approval prospects.

Loan Amount and Down Payment:

The loan amount sanctioned for an electric bike purchase depends on various factors, including the borrower's income, creditworthiness, and the down payment made. A higher down payment often improves loan eligibility, reduces the loan-to-value ratio, and may lead to more favorable loan terms.

Age and Residency:

Most financial institutions have specific age criteria for loan applicants, requiring individuals to be within a certain age bracket to qualify for loans. Additionally, borrowers must be Indian residents or fulfill residency criteria set by lenders to be eligible for electric bike loans in India.

Debt-to-Income Ratio:

Lenders assess the debt-to-income ratio, which compares a borrower's monthly debt payments to their gross monthly income. A lower debt-to-income ratio indicates a borrower's ability to manage additional debt, making them more eligible for loan approval.

Documentation and Paperwork:

Completing the necessary documentation accurately and providing essential paperwork is crucial for loan approval. This includes identity proof, address proof, income documents, bank statements, and other documents requested by the lending institution.

Relationship with the Lending Institution:

Existing relationships or history with a particular bank or financial institution may positively impact loan approval. Individuals maintaining savings or salary accounts, making timely payments, or having a history of responsible financial behavior with the institution may be viewed favorably.

Conclusion:

When applying for electric bike loans in India, understanding the influencing factors that determine eligibility and loan approval is essential. Prospective borrowers should assess their financial standing, maintain a good credit score, fulfill income criteria, and ensure accurate documentation to improve their chances of loan approval. By considering these crucial factors, individuals can navigate the loan approval process more effectively and make informed decisions when availing financing for their electric bike purchase.

0 notes

Text

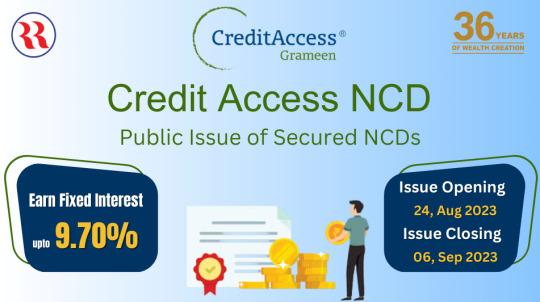

Credit Access NCDs: An Attractive Investment Opportunity

Before diving into the specifics of the NCDs, it's crucial to acquaint ourselves with the issuer. Credit Access Grameen Limited is a prominent Indian micro-finance institution headquartered in Bengaluru. Its core mission revolves around providing joint liability group loans and micro-loans, with a primary focus on empowering women in rural India. As of March 2022, CA Grameen is recognized as India's largest NBFC-MFI based on its impressive gross loan portfolio figures, endorsed by the MicroFinance Institutions Network in India.

Issuer's Focus and Opportunity:

Credit Access Grameen Limited primarily serves women customers in rural India, offering crucial financial support. Their target demographic comprises women with an annual household income of up to Rs 300,000, in alignment with the new microfinance regulations introduced by the RBI in March 2022. The company specializes in providing income generation loans, family welfare loans, home improvement loans, and emergency loans to its customer base.

CA Grameen's promoter, Credit Access India N.V., is a multinational firm specializing in micro and small enterprise financing. The promoter has a history of injecting capital into CA Grameen and facilitating access to potential fundraising avenues within the debt capital markets.

Why Consider Credit Access NCDs in Your Investment Portfolio:

Solid Credit Rating: The NCDs boast a "IND AA-/Stable" credit rating from India Ratings & Research Private Limited, signifying a robust credit profile.

Attractive Returns: Offering coupon rates ranging from 9.10% to 9.70% and effective yields from 9.48% to 10.13%, these NCDs provide competitive returns compared to traditional fixed-income investments.

Diverse Tenors: Investors can select from various tenors, ranging from 24 to 60 months, aligning their investments with their financial goals.

Flexible Interest Payment: Credit Access NCDs accommodate both monthly interest payments and cumulative interest options.

Listed on BSE: These NCDs will be listed on BSE, ensuring liquidity and ease of trading.

Credit Access NCD Investment Opportunity:

Let's delve deeper into the investment opportunity presented by Credit Access Grameen Limited through its NCD issue.

NCD Issue Details:

Issuer: Credit Access Grameen Limited

Base Issue Size: Rs. 400 Crores

Green Shoe Option: Rs. 600 Crores

Total Aggregated Issue: Rs. 1000 Crores

Issue Opening Date: August 24, 2023

Issue Closing Date: September 06, 2023

Face Value: Rs. 1,000 per NCD

Minimum Application: Rs. 10,000 (10 NCDs), collectively across all Options

Listing: The NCDs will be listed on BSE within 6 working days from the respective Tranche Issue Closing Date.

Issuance Mode: Dematerialized form

Credit Rating: IND AA-/Stable by India Ratings & Research Private Limited

Basis of Allotment: First come, first serve

Understanding the Series:

Series I, III, V, and VII provide monthly interest payments, ensuring regular income streams.

Investors have the flexibility to choose the series that best aligns with their financial goals and preferences.

Investment Benefits:

Attractive Yields: The NCDs offer competitive coupon rates, with effective yields ranging from 9.48% to 10.13% per annum, depending on the chosen series.

Diversity of Options: With eight series to choose from, investors can tailor their investments to suit their financial objectives.

Monthly Income: Series I, III, V, and VII provide monthly interest payments, ideal for those seeking regular income.

Safety and Credibility: CA Grameen holds a credit rating of "IND AA-/Stable" by India Ratings & Research Private Limited, indicating a strong level of creditworthiness.

How to Invest in Credit Access NCDs:

To invest in Credit Access NCDs, follow these steps:

Check Eligibility: Ensure you meet the eligibility criteria, including the minimum application amount.

Demat Account: If you don't already have one, open a demat account to hold your NCDs electronically.

Apply: Submit your application during the specified period between August 24, 2023, and September 6, 2023.

Allotment: Wait for the basis of allotment to be announced; allotment is on a first-come-first-served basis.

Trading: Once allotted, you can trade these NCDs on the BSE after listing.

Conclusion:

The Credit Access NCD issue presents an enticing investment opportunity for diversifying portfolios and earning attractive returns. Backed by a robust credit rating and offering a variety of series, these NCDs cater to a wide range of investor preferences. Whether you seek monthly income or cumulative growth of your investment, Credit Access NCDs offer both security and potential for substantial returns.

Investors are advised to assess their investment goals and risk tolerance carefully before making a decision. Remember that NCDs, like all investments, carry some level of risk, and it's essential to consult with a financial advisor or expert for personalized guidance.

Don't miss out on this opportunity to invest in the promising Credit Access NCD issue. Begin securing your financial future today.

Disclaimer:

All investments carry inherent risks. Investors should thoroughly review the offer-related documents and seek professional advice before making investment decisions.

Source :- https://realistic-magnolia-w8t3gc.mystrikingly.com

0 notes

Text

Mining

The sum of money in decentralized finance (DeFi) purposes, the Ethereum digital economic system. Bernstein notes that weaker miners with excessive debt usually are not able to survive and “capitulate throughout crypto winters,” citing the current bankruptcy of Core Scientific (CORZQ). Main coverage areas are crypto, BTC miners, and media equities. Outside of Seeking Alpha, I write the Heretic Speculator e-newsletter the place I share extra ideas on finance with more of a social backdrop.

While some are more easy and beginner-friendly than others, you shouldn’t encounter any difficulties with both of the top-rated exchanges. That stated, many users consider that KuCoin is certainly one of the less complicated exchanges on the current market. Ethereum - and, to be truthful, crypto - mining is still a very fashionable exercise, to today. However, as in style as it might be, mining nonetheless includes plenty of preparation, and some technical know-how. If you want to search out a substitute for mining, you should look into crypto staking, on a reliable change - this can be a much easier and more-straightforward course of. Before beginning Ethereum mining, you will want to create a digital pockets.

Platforms like Uniswap, Compound Finance, Aave, and others enable their customers to borrow and lend Ethereum-based assets using good contracts and on-chain accounting. The use of such platforms (in addition to the NFT craze final year) drove demand for Ethereum’s blockspace, sending common transaction fees into the triple (and sometimes even quadruple) digits). Fee income made up a large chunk of Ethereum mining revenue during 2021’s bullrun – at times, over 50%. An Ethereum code change, EIP-1559, altered this last August; now, the community sends all transaction fees to an inaccessible handle.

Every pool has a unique interface but the precept stays the same. You’ll have to go to your pool's website and type in your public pockets handle. If you’re new to the world of crypto mining and are in search of the easiest and simplest Ethereum mining software program, check out WinETH. Claymore also recently released a V12.0 improve that lowered the devfee for dual mining mode to 1 p.c from 2 percent.

The more hashrate that a network has, the more competitors there might be for blocks, which means that miners earn fewer rewards per unit of hashrate. Since EIP-1559, Ethereum miners have supplemented payment income using so-called “miner extractable value” (MEV, also referred to as maximal extractable value) methods. With MEV, miners use specialised software program and a personal mempool (a database of transactions) to focus on lucrative buying and selling opportunities.

On the other hand, Bitcoin mining has been rising within the Middle East, with the UAE leading the cost. Miners in the UAE now produce approximately thirteen EH/s, accounting for almost 4% of the whole hash price. This enhance in transaction charge revenue is traced to the increase in transaction quantity after BRC-20 tokens have been launched on the Bitcoin blockchain. The BRC-20 came in as a token normal to permit the creation and switch facilities of fungible tokens on the blockchain by way of the use of ordinal inscriptions. Bitcoin has seen a flurry of increase in transaction volumes this year, because the cryptocurrency continues to dominate the trade. In https://outletminers.com , the whole volume of bitcoin traded increased by 30.37%.

You may be getting fewer rewards per 1 block, but a minimum of you won't go a day or a week without getting a reward at all. To put it merely, mining software is a program that makes use of your computer’s graphics cards (GPU) as assets to resolve complex mathematical equations. Once the equations are solved, the information is added to the the rest of the blockchain. Despite the pending merge, Ethereum miners still poured money into graphics playing cards (GPUs) and different mining gear. (Unlike Bitcoin, Ethereum continues to be largely mined with GPUs, and only 10% or so of Ethereum’s compute power comes from ASICs, the same specialized chips that BTC miners use). ASICs provide significant efficiency enhance compared to graphic playing cards.

Specifically, the 7-day common hash fee hit 401 EH/s on Saturday, while the 3-day average has risen a extra staggering 18% to 448 EH/s. Although the hash price has now dropped to 425 EH/s on the time of writing, it is nonetheless at its highest ranges and up more than 119.1% from one year ago. By including these miners, Riot Platforms goals to increase its mining capacity and potential earnings, the corporate added. Additionally, miners are implementing strategies corresponding to locking in power prices, bolstering warfare chests and chopping again on investments, to guard themselves from getting affected by the halving. Kevin Zhang, senior VP at Foundry, noted that the value of BTC would have to enhance to $50,000-$60,000 subsequent 12 months in order to maintain the identical profit margins for miners. According to Mellerud, the break-even electrical energy price for main mining machine is predicted to drop from 12 cents/kWh to six cents/kWh after the halving.

From where I sit, no public blockchain will ever be perfect and satisfying everyone is an impossibility. But the direction Ethereum appears to be going is one the place conventional finance players will have the flexibility to safely and easily combine with the network in a compliant means. Beyond ERC-20 tokens, there are token requirements within the Ethereum ecosystem that are designed specifically with safety tokens in mind; ERC-1400 and ERC-3643 are two notable examples.

Another good alternative if you want to benefit from the guarantee of a new GPU, this fairly new NVIDIA card is an excellent choice. Even though the ability consumption is a bit larger than a few of its counterparts, you can purchase this GPU for as little as $250, which makes it a great funding. This high-bandwidth reminiscence card could be found within the 350$ value vary pre-owned. Very expensive card, but when you can find a great deal on eBay or one other second-hand market, you would be buying one of the best Ethereum miners out there. One factor to hold in mind is that usually, AMD cards are total better than their NVIDIA counterparts for Ethereum mining, particularly throughout the identical value range. Setting up a mining rig may appear somewhat costly, but you want to understand that you are attempting to invest in a passive earnings supply that should generate revenue very soon.

Following are curated record of legit Ethereum mining software program which would possibly be extremely trusted and most Profitable. The software program apps listed on this information follow the safest crypto practices to ensure your Cryptocurrency stays secure. Mining is the method of making a block of transactions to be added to the Ethereum blockchain in Ethereum's now-deprecated proof-of-work structure. The Shares section pertains to how the work is split by different machines within the mining pool to ensure everybody receives a fair reward consistent with work accomplished by their machine. MinerGate will display a message to say that 'sensible mining' has been activated.

2.The miners might collude, lease out hash fee, and enable a 51% assault to stop the EIP 1559 proposal. It takes around 10 minutes with the best tools and computing energy to mine one Ethereum, no matter how many miners are operational. However, it also is determined by different elements, like mining tools used, computational power, and competitors.

There are 2 factors to think about when choosing a Ethereum mining pool – the placement of the pool and it’s market share. The top priority can be location – the nearer the pool is to you geographically the better. This is because sometimes because of network latency, shares that are mined might be “stale” – as new blocks are created rendering older blocks obsolete. It’s also essential to know that Chinese servers are behind the Great Firewall of China, which means that connections might periodically break.

MultiMiner is a mining tool that helps you monitor, configure, and management any MultiMiner rig out there on the network. This mining software maintains all personalizations you’ve made up to the purpose in a separate and dedicated community. In decentralized techniques like Ethereum, we have to make certain that everyone agrees on the order of transactions.

#bitmain#bitmain antminer l7#bitmain antminer#bitmain s19#bitmain antminer s19 pro#bitmain antminer e9#bitmain antminer k7#bitmain antminer ka3#bitmain antminer s19pro#bitmain ka3#bitmain antminer s9#bitmain firmware#bitmain kda miner#bitmain l7#bitmain miner#bitmain s9#bitmain antminer s19#bitmain antminer s19 xp#bitmain antminer s7#bitmain antminer z9#bitmain e9#goldshell#goldshell kd6#goldshell miner#goldshell kd5#goldshell miners#goldshell kd max#goldshell mining#goldshell sc box#ibelink

0 notes

Text

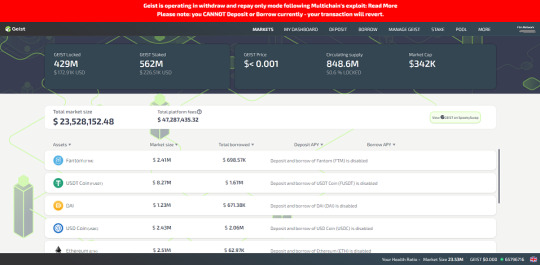

Crypto lender Geist Finance shuts down permanently over Multichain hack

Lending protocol Geist Finance is shutting down permanently due to losses from the Multichain exploit, according to a July 14 social media post from the app’s development team. Geist contracts were paused on July 6, then resumed in “withdraw and repay only” mode on July 9. The latest post confirms the team does not plan to reopen lending and borrowing on Geist.

1/2 After confirmation from Multichain that the funds will not be recovered, we are announcing that Geist will not reopen. Because Chainlink oracles are tracking the value of real USDC, USDT, WBTC or ETH, they are not aware of the real value of Multichain assets.

— Geist Finance (@GeistFinance) July 14, 2023

Geist is a lending protocol running on the Fantom network. It had over $29 million worth of crypto assets locked in its contracts before the Multichain hack. Before the hack, Geist allowed users to borrow, lend or use bridged tokens from the Multichain platform as collateral, including bridged versions of USD Coin (USDC), Tether (USDT), Bitcoin (BTC) and Ether (ETH). It used Chainlink oracles to track the prices of these assets to determine their collateral and loan values.

According to the post, these oracles have stopped producing reliable information. They are now listing the values of the non-bridged, or “real,” versions of each coin, which are more than four times the value of their Multichain derivatives, as the team explained:

“Because Chainlink oracles are tracking the value of real USDC, USDT, WBTC or ETH, they are not aware of the real value of Multichain assets. Those assets are currently trading at around 22% of their real value.”

This makes it “impossible” to reenable lending, as doing so would result in bad debt for holders of non-Multichain coins such as Magic Internet Money (MIM) or Fantom (FTM), the team stated. As a result, Geist will not be able to reopen.

Related: Circle, Tether freezes over $65M in assets transferred from Multichain

Geist Finance interface in “withdraw and repay only” mode. Source: Geist Finance

The team clarified it is not blaming Chainlink oracles for Geist’s closure, as these oracles “worked as they should.” Instead, “Nobody is to blame except @MultichainOrg here.”

Blockchain analytics experts first reported the Multichain hack on July 7. Over $100 million had been withdrawn from the Ethereum side of Multichain bridges, including those for Dogechain, Fantom and Moonriver. The Multichain team called the transactions “abnormal” and warned users to stop using the protocol. However, the team stopped short of calling it a hack or exploit.

On July 11, on-chain sleuth and Twitter user Spreek reported that an unknown individual was draining funds from the protocol and sending them to fresh wallet addresses using a fee-based exploit.

On July 14, the Multichain team confirmed that the withdrawals from July 7 had been the result of a hack. The network had been storing all shards of its private keys in a “cloud server account” under the sole control of the team’s CEO, who was arrested by Chinese authorities. This cloud server account was later accessed by someone and used to drain funds from the protocol. The team previously stated in the protocol’s documents that no single server had access to all of the shards of a key.

According to the July 14 post, the July 11 fee-based attack was a counter-exploit initiated by the CEO’s sister at the behest of the Multichain team in an attempt to recover funds. The sister was later arrested, and the status of the assets she recovered is “uncertain.”

Source link

Read the full article

0 notes

Text

Mark Lyttleton: Spotlight on Venture Capital

Mark Lyttleton is an angel investor, speaker and business mentor with a keen interest in supporting early-stage businesses created to achieve a positive planetary impact. This article will look at venture capital and why it is such an attractive funding option for many early-stage companies.

An early-stage company is one that has tested its prototypes, refined its service model and prepared its business plan. Some early-stage businesses may already be generating revenue, but the majority are not yet profitable.

An early-stage business is essentially a newly developed venture that addresses at least one market inefficiency. The company has not yet matured and is still at stage one: the start-up phase.

In phase one of a company’s evolution, it focuses on finalising its products or services based on market data it has gathered. Before it can move on to the second phase of growing the company, it will usually need an injection of capital. This process is known as seed funding, with the start-up gaining vital early-stage venture funding to further develop the business.

From the investor’s perspective, early-stage start-ups are typically a high risk investment option. Founders will need to work hard to convince potential investors that their business will generate a healthy ROI. In preparing their pitch, business owners will need to provide an outline of the specific market problem they are solving, identifying their primary target market and what differentiates their company from the competition. They will also need to identify the type of investment they need and why, as well as illustrating how they have tested the success of their business idea.

Venture capital is a form of private equity. It is a mode of financing that investors provide to small businesses and start-up businesses that demonstrate potential for long-term growth. Venture capital generally comes from investment banks, other financial institutions and high-net-worth individuals. Venture capital doesn’t always have to be cash, with support sometimes taking the form of managerial or technical expertise. Venture capital is generally allocated to early-stage companies that show exceptional growth potential or ventures that have grown fast and appear poised to continue their rapid expansion.

For businesses that lack access to stock markets or sufficient cashflow to take on debts, venture capital funding presents the opportunity for a valuable injection of cash to help take the business to the next level. Venture capitalists often provide mentoring services to help founders, as well as providing them with access to a network of valuable contacts. However, businesses that accept venture capital support run the risk of losing creative control over their future direction. In addition, venture capital investors are likely to expect an appropriate share of company equity, depending on how much cash they give to the company.

1 note

·

View note

Text

How Does Tally ERP 9 Online Work and how to use it?: Comhard Technologies

Tally is an ERP accounting software, with the most current version Tally ERP 9. This software combines the capabilities of a financial accounting system and an inventory management system. Tally ERP 9 online is a popular accounting software that helps businesses manage their day-to-day transactions, sales, debts, and so on while eliminating the risk of manual errors. The best part is that it can be integrated with a variety of other business applications, including payroll, sales and finance, inventory, purchasing, and so on.

Let's get started on learning how to use Tally ERP 9 online!

How Does Tally ERP 9 Online Work?

To get started with Tally, simply download, install, activate, and begin transacting - it's that simple. You will need the assistance of an experienced Tally ERP 9 service provider if you want to customise the Tally software or integrate it with other existing business applications.

Here is a step-by-step guide to working with Tally ERP 9 online.

Step 1

Get the Tally ERP 9 software from the Tally website. Before purchasing a premium package, you can opt for a 30-day trial version to better understand how the Tally software works. Another option for using Tally is to use it in the Educational mode. This, however, has limited features.

Step 2

After installing it, you will face various navigation tools that will allow you to access various functionalities. It is important to note that everything in Tally has a keyboard shortcut. The key is usually displayed next to the option, and knowing these shortcuts will help you increase your efficiency and productivity.

Step 3

To use Tally, whether it is a trial version or a paid version with a licence, you must first 'create a company.' Select 'Create a company' from the menu section. This will take you to a screen where you can enter information about your company.

Enter the company name as it appears in the banking records. Include the company's address, phone number, and statutory compliance information.

If you only use Tally to manage your accounts, select 'Accounts info'.

If you also use Tally for inventory management, select 'Accounts with inventory' from the menu.

Select the currency of your choice.

Enter the start of your financial year as well as the bookkeeping start date.

Don't forget to turn on the 'Auto backup.' This makes sure you have a copy of the information for future reference.

Using Tally to Create Ledgers and Vouchers

Ledger

A ledger is used to record all transactions for various accounts. You can keep a separate ledger for each account with which you do business. This will provide greater clarity if you need information on a specific account's transactions in the future. There are two types of ledgers in this system: 'Cash' and 'Profit & Loss Account'.

Here are the steps to start a new ledger:

Go to the Gateway menu and select 'Accounts info.'

Then, select 'Ledgers' and 'Create' after that. You can create a single ledger or multiple ledgers based on your requirements.

After creating a ledger, you must select which group the ledger will be assigned to. You can choose a group from the 'List of Groups.'

Also, for easy identification, give your ledger a name so you know what it contains.

Finally, enter the starting balance. The opening balance in the ledger for a bank account is the current amount in your account. The starting amount for an amount owed to you by a client or a contractor would be what they owe you.

Vouchers

Here are the steps to create vouchers:

Go to the Gateway menu and select "Accounting Vouchers."

Then, from the right-hand menu, choose a voucher option from the list.

Contra Voucher (F4): It is used when money is deposited or just withdrawn from a bank or when the money is transferred between two accounts in the same company.

Payment Voucher (F5): This is used for company payments.

Receipt Voucher (F6): This is used for any income generated by the business, such as interest, sales, and so on.

Finally, fill in the necessary details based on the type of voucher you created. You must also specify which ledger the voucher will be attached to. In addition, enter the names and dates of the parties involved.

This is a brief description of how to use the Tally software and was a quick Tally ERP 9 online overview for beginners that showed its most important features.

About Comhard Technologies

We are the leading provider of information technologies such as software, mobile communication, and digital marketing services. COMHARD TECHNOLOGIES PVT LTD. has over a decade of industry and technology experience and specialises in providing all major IT products and solutions under one roof. We have an effective team of energetic and talented individuals who are empowered to provide complete satisfaction to our valued customers. Our mission is to serve and earn the respect and loyalty of our valued customers through competitive sales and support.

#comhard tally cloud#tally cloud#tally on cloud#tally prime on cloud#comhard technologies#Tally ERP 9 online

0 notes

Text

Lost my appetite, lifesaver and maternity leave.

Like most Americans, some of us have been living off whatever savings we have or had left, in like some of us we've resorted to using our credit cards which I am reminder everyday of the debt I'll be repaying back to them when we get our tax return (crossing fingers, that's another story)

Recently this past weekend, we were going to make one last effort to stock up on food, while trying to keep the groceries tab under $80 in which we would try to make stretch and last us for the whole week, we stopped by to grab lunch before hand, when it came time to pay for my families meal we got hit with a declined. I went into a panic mode not knowing how I was going to feed them at that moment but as well pay for groceries, baby formula, diapers and gas to get to work and our child's therapy. At this point we are running on surviving mode. As last minute effort I called pleading if I could have a purchase authorize by my credit card company so my family could eat, after no luck, I was ready to tell my wife through text message to just leave so she would be embarrassed leaving out the door with me. as I was about to tell the cashier after coming out of the restroom that I couldn't pay for the food and apologize another family had paid for our meal. I wanted to cry and crawl under a rock, I thanked them and asked if I could repay them for the food. She kindly told me, we were once their, this was my lowest point, told my wife that I couldn't eat, I was too embarrassed, I have failed them as a father and a husband to my wife.

Like many who'd been in that position I was embarrassed and confused, I've been doing my best and was on top of our finances up in 'till inflation started to overtake us, plus the new addition to our family. Unfortunately during the unpaid one week I was recently away on for maternity leave to help my wife adjust and assist with our newborn will be unpaid, which currently we are on a slippery slope hill because of it.

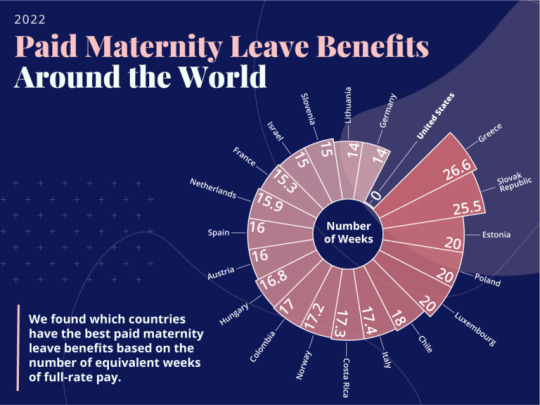

It amazes me that when I hear of other countries paid maternity leave benefits in which it leaves the USA in the dust, for a country that praises to be first for everything we sure are behind some of our adversaries.

Source: https://www.business.org/hr/workforce-management/paid-maternity-leave-across-the-world/

Now for countries that paid parents the most for maternity leave follow as:

Source: https://www.oysterhr.com/library/guide-to-maternity-leave-in-countries-around-the-world

While most folks would be like my company as pretty great maternity leave and which some now include fathers who wish to take maternity leave that's not the same all across the board for others.

"United States — 0 weeks

The United States is the only wealthy country in the world without any guaranteed paid parental leave at the national level, based on data from the World Policy Analysis Center. Only a handful of other countries — all low or middle income — offer nothing."

Quote: https://www.washingtonpost.com/world/2021/11/11/global-paid-parental-leave-us/

I ask myself sometimes if they are evening aware at the White House that their is an entire class below middle class trying to survive off of nothing but I realize that at the same time that the middle class as been erased. If you made it this far, thank you for taking the time just to be here and take a moment to read.

#parenting#parents#autism#family#90s#economy#struggle#hardship#inequality#mental health#specialneeds#holidayblues#holidays#POC#POCblogs#parentleave#maternity#maternityleaveFORdads

0 notes

Text

These are the most recent news items and commentary about economics, stock trends, stocks and investing opportunities. Hedges, derivatives and obscura are also covered. These items come from the "tangibles-heavy" contrarian perspective of SurvivalBlog’s Senior Editor, JWR. Today, we again look at a potential derivatives crisis. (See the section on derivatives.)

Precious Metals:

Silver price prediction to 2030

o o o

Silver/Gold: You must see these two charts

Economy and Finance

o o o

Jeffrey Snider gave a detailed but informative analysis of yield curves, foreign reserve flows and other financial issues in this video: Warning: Nearly a trillion global reserves gone, 25% missing from Swiss.

o o o

Moody's cuts outlook on European banks, including Germany's due to credit woes.

o o o

Strikes and protests erupt in Europe due to soaring inflation and high costs of living. C.B., a blog reader, for the link. (Thanks to C.B., blog reader, for the link.

o o o

FedEx Parks Planes; Maersk Cancels Sails. World Trade Appears To Be Rapidly Decreasing. D.S.V. For the link.

o o o

Recent JWR interview: Fed in Panic Mode; Inflation out Of Control -- James Wesley Rawles.

Commodities:

H.L. D.S.V. and H.L. Both sent this link: Homemade Energy Crisis Chevron's Another Refinery Goes Up in Flames - Sabotage Oil Infrastructure

o o o

Reader Ed G. made this comment about the diesel shortage

Air travel is in high demand due to upcoming holidays and college vacations. The same base stock is used to make jet fuel. Tickets start at $500 for a three-hour flight. Current kerosene-type fuel supplies will play a role in the current consumer price/debt economy, at 3-to-4 liters/100 km (stats found on AeroCorner).

Derivatives:

Reuters Exclusive: ECB Examination Energy firms' multi-trillion dollar derivative bets

o o o

Credit Suisse to Continue Global Job Cuts to Wealth Next week.

o o o

Investopedia How Big is the Derivatives Market. Get a quote:

"The derivatives Market is massive, often estimated at more than $1 quadrillion at the high end. How is that possible? There are many derivatives available for almost every type of investment asset. This is largely because there are so many options, including those on equities, commodities and bonds. Market analysts have even suggested that the market size is more than 10 times the global gross domestic products (GDP).

o o o

ICE Swap rate.

o o o

The FDIC defines derivatives.

Cryptos:

Last week, Bitcoin and other cryptos were heavily smashed. Many cryptos fell more than 30%. Solana fell 46.7%. Most crypto investors believed that Thursday was the end of the worst. On Friday, Bitcoin fell another 3.87% to $16,843. Is there a bottom? Where is the bottom?

As more regulation and taxation are on the horizon, my long-standing advice is to keep your crypto holdings low -- not more than 5%. Do not keep coins on any exchange for more than a few seconds to perform a transaction. Instead, you should keep your crypto assets in an air-gapped physical wallet. (FYI: I use a Trezor wallet. JWR

o o o

Bitcoin could drop to $10,000 - Robert Kiyosaki.

o o o

Video by T The Collapse of the FTX Empire. What the Bankruptcy Filing means for the Future of Crypto .

o o o

Posted at Coin Telegraph November 10th: 's ongoing saga: All that's been done up to now.

o o o

Posted Friday: The total crypto market cap has fallen to $850B, as data suggests that there is more downside.

o o o

According to on-chain data , FTX US suspends withdrawals

o o o

Here are some key details: $2BN client money MISSING from the collapsed crypto exchange, FTX: Sam Bankman-Fried denies secretly transfer $10BN to a trading company run by his girlfriend.

Tangibles in Investing

You were warned, folks: Mortgage payments have risen 50 percent since last year as homebuyers get priced out.

o o o

Buck Knives is an affiliate advertiser.

They offer a free shipping deal for orders above $99. Quality knives and tools are a smart investment, whether you're shopping for gifts or to hedge against inflation. It's a bonus to buy knives and tools made in America.

Provisos:

SurvivalBlog Editors and their staff are not licensed to act as investment advisors. For more information, please visit our Provisos webpage.

News tips:

JWR can receive your investing and economic news tips. You can send your information via the Contact form. These news are often particularly relevant as they come directly from people who monitor specific markets. Please send any news you find that might be of interest to SurvivalBlog users. Local news items that have been missed by news wire services are particularly appreciated. It doesn't have to be just about commodities or precious metals. Thanks!

1 note

·

View note