#Digital banking

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

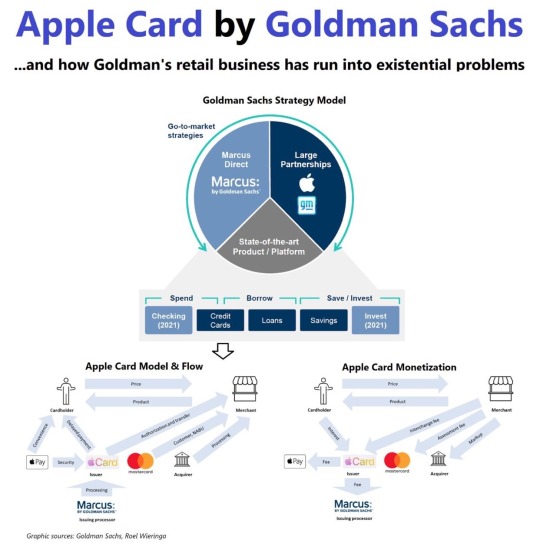

Goldman Sachs’ foray into consumer #banking in 2016 was quickly heralded as (and seemed to be) a great success. A few days ago, the bank announced an almost $3 billion loss from that business. Let’s take a look.

Despite the initial skepticism, Marcus proved a huge success: by 2020, Marcus was one of the fastest-growing #digital #banks in the US with more than $80 billion in deposits and $5 billion in loans.

Aggressive pricing, state-of-the-art #technology, reliable customer service and a well-known brand name count among the reasons for the rise. Markus’ success was twice important because - on top of commercial reasons - it exemplified one thing: how traditional financial institutions (Goldman was founded in 1869) can adapt to the #digital age and compete with #fintech players.

Several things have gone wrong:

1) Goldman’s overly aggressive pricing (to gain market share) during the boom years

2) Poor risk #management with more than 25% of card loans going to financially weak customers and a provision rate at subprime levels

3) Expanding defaults as a result of the deteriorating macro environment

4) Bad management decisions such as the one to merge (previously independent) Marcus with the wealth management segment

5) Service quality (i.e. disputes over chargebacks) not being able to keep up with an increasing customer base.

The credit card business is traditionally a hard one to crack, more so for newcomers even if they are called #Goldman_Sachs. And there seems to be no way back for what was once hailed as one the company’s biggest successes. Timing and bad management decisions have proven – once more – an unbeatable combination.

Reawd more, the full article at: 👉

Opinions: my own, Graphic sources: #Goldman Sachs, Roel Wieringa

____________________________

Please leave comments, subscribe and follow my news on my official social media pages: Telegram, LinkedIn, Facebook, Twitter, Gettr, Reddit, and Tumblr.

🤝 𝐑𝐞𝐢𝐧𝐢𝐬 𝐓𝐔𝐌𝐎𝐕𝐒. @reinis_tumovs

#tumovs #reinis #reinis_tumovs #rtumovs #rtgroup #тумовс #banker #neobanker #тумовс_банкир #tumovs_banker

#tumovs#wkwgroup#тумовс#fintech#defi#rtumovs#reinis tumovs#neobankers#goldman#goldman sachs#apple inc#apple news#apple card#bankers#bank#digital currency#digital#digital banking

7 notes

·

View notes

Text

With blockchain technology, we can build a transparent and decentralized financial system that restores trust in financial institutions. Together, we can say goodbye to corrupt banks and hello to a more secure and fair financial future. #blockchain #transparency #ethicalbanking

1 note

·

View note

Text

UPI, how it changed and will be impacting the Fintech industry in 2023

A report by CLSA verified that UPI corporates to 60% of entire payments — and digital payments have increased from $61bn in 2016 to $300bn in 2021.

Learn More: FinAccountants.com

2 notes

·

View notes

Text

what is the Digital Banking?

Digital Banking is availing of banking services like balance inquiry, funds transfer,etc. via smart devices over the internet like smartphones, laptop, desktop,etc. The services could be expanded via Open API’s,and individuals could even manage their financial portfolio, check credit score, get a preapproved loan,etc

2 notes

·

View notes

Link

Cell phones and digitalization have carried the bank to the client. Here in this blog we will discuss the main differences between fintech and digital banking.

2 notes

·

View notes

Text

Tuum expands in the Middle East and launches Regional HQ at ADGM

Tuum has announced its expansion into the Middle East, as well as the development of a Regional HQ at ADGM in the region of Abu Dhabi.

Following this announcement, the move to expand into the region of the Middle East follows Tuum’s recent Series B funding round, which was leveraged in order to spearhead the company’s global development. The process had a particular focus on the Middle East, as…

View On WordPress

#Banking#digital banking#Expansion#Financial Institutions#financial services#mobile banking#Online banking#product launch#SAAS

0 notes

Text

Senjata Unik itu Bernama 'Smart Pricing'

Pendalaman Strategi Smart Pricing; source

Dalam labirin perbankan korporat saat ini, pertarungan suku bunga yang semakin ketat telah memaksa bank untuk memikirkan kembali strategi mereka. Namun, adakah strategi yang bisa mengatasi dilema ini tanpa mengorbankan keuntungan? Memperkenalkan konsep ‘Smart Pricing’ yang erat kaitannya juga dengan konsep Transaction Banking,

Sebuah pendekatan yang…

View On WordPress

0 notes

Text

Transforming the Financial Landscape: PayCly's Innovate Digital Banking and Payment Solutions

With its innovative digital banking and payment solutions, PayCly standout at the leading edge of a financial landscape transformation. The company which emphasizes innovation that provides a safe and effective digital payment gateway platform enabled by cutting-edge encryption and blockchain technology. By removing brokers & reduce expenses that facilitates platform for seamless cross-border transactions

Moreover PayCly has welcomed the rising prominence of cryptocurrencies by incorporating them into their ecosystem through which user easy exchange. Consumers can embrace the opportunities of decentralized finance by easily converting between fiat currency and digital assets. PayCly's digital banking services providers are easily accessible and empower the underbanked and unbanked by showing their dedication to financial integration. PayCly provides foundations for a more intelligent, interconnected financial future by emphasizing security, efficiency, and flexibility.

Read more- What are the Features of Streamlined Online Payment Services?

#banking#banking industry#digital banking#e payment#payment gateway#online banking#international banking#financial planning#fintech businesses#PayCly

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Embark on a journey to create a cutting-edge digital banking app. Discover the nine essential steps to design, develop, and launch a top-notch banking application. From user research to security measures, learn how to create a seamless and secure digital banking experience for your customers.

1 note

·

View note

Text

Tired of being hit with unexpected bank fees for just having an account? It's time to decentralize the banking industry with #blockchain technology & innovative digital banking options. Say goodbye to banks' greed & unfairness and hello to a new era of customer-centric #banking.

1 note

·

View note

Text

How will digital banking units (DBUs) transform banking in India?

Read this blog to learn how digital banking units are transforming banking services in India and how you can benefit from this huge change.

Learn More: https://nbfcadvisory.com/how-will-digital-banking-units-dbus-transform-banking-in-india/

2 notes

·

View notes

Text

How is using an online bank account helpful for you?

Most individuals have been using online banking for the last few years. There are many wonderful advantages to using an app or website for banking. Digital banking is any banking done online through a mobile application or website. It eliminates the need for clients to physically visit a branch by enabling them to conduct banking transactions and access banking services remotely. Because digital banking is so convenient and useful, it has grown in popularity recently. In today's fast-paced world, most people prefer instant bank account opening online. This post explains how using an online bank account is helpful for you:

Bank on your phone or tablet

Starting an online banking account does not require sitting at a computer; you can do it from your phone or tablet. Most bank websites are mobile-friendly, making accessing the internet on your preferred device simple. Furthermore, assistance is typically well-marked and offers live chat or a phone line to the department you require, so you don't have to worry about losing out on the in-person interaction.

Pay bills and make payments

The days of filling out long papers and sending checks to pay bills are long gone. You may use your bank's website to pay all your bills and make payments, which is one of the main advantages of online banking. In addition to sending money to friends and family, you can set up standing orders and direct debits. That is as convenient as it gets.

Minimize unnecessary costs with low-fee online accounts

More customers choose to new bank accounts open online because of their fee-friendly approach, which typically offers accounts with lower costs compared to traditional banks. Access to accounts with few or no fees is one advantage of using an online bank, including several high-yield savings accounts.

However, while comparing accounts from different online banks, thoroughly review the charge schedules like any other bank account. To save money, look for accounts with low or no fees for services like overdrafts, ATM usage, and monthly maintenance. You should also fulfill any other account requirements.

Control

Real-time access to managing and transferring money as needed and having self-serve control over your funds are two other important advantages of digital banking. There are typically no time limits on when you can carry out banking operations, such as depositing checks or transferring money between accounts, with mobile banking apps and websites, in contrast to traditional banking establishments. Also, navigating daily transactions is becoming simpler.

Keep on top of your finances

You will find it much easier to stay on top of your finances if you use online banking. In addition to checking your balance and seeing your transactions easily, you will also be able to view past payments to ensure they were made on time. You may also flag any unauthorized purchases more easily, allowing you to act quickly if you become aware of them.

Wrapping it up As a result, the above detailed are about how using online bank account helpful for you. Banks employ various technologies to guarantee that online banking is secure. Online and mobile banking systems can assist you with everyday banking duties, improve your financial management, and, in certain situations, link you to a group of like-minded people after new bank accounts open.

#best savings account#ebanking#instant online bank account opening#safe mobile banking#instant open bank account#manage bank account online#digital banking

0 notes

Text

Transform your financial journey with Mobio Solutions! 🚀🌟Our digital banking platform is all about innovation and ease. With a mobile-first approach, we're not just meeting security standards - we're setting them.

Exciting UI/UX changes have led to a 40% jump in user engagement. And guess what? We're going global, understanding financial needs across continents. 🌐 Ready to elevate your banking experience? Let's make it happen together!

#digital banking#fintech#banking#finance#mobile banking#open banking#wealth management#future#mobiosolutions

1 note

·

View note

Text

The Alternative Bank partners with TK Tech Africa

The Alternative Bank has announced its partnership with TK Tech Africa in order to optimise the Nigerian financial technology and non-interest banking landscape.

Following this partnership, both the Alternative Bank and TK Tech Africa launched their USD 500 million digital sukuk initiative. This new strategy is expected to improve the overall landscape of financial technology and non-interest…

View On WordPress

#Banking#digital banking#Financial Institutions#financial services#INVESTMENT#mobile banking#Online banking#partnership

0 notes