#Online payments

Text

Hey guys! This is a QR code thats takes you to a GoFundMe, and its for refugees over in Africa! Its run by Muwonge Quotaish and they’re trying to gather money to feed and care for the people in Kakuma camp. Even a dollar or two would help a lot!

If I see an increase in money and donations i’ll draw whatever you people desire, just donate and then comment what you’d like to see!

Here’s the link if needed too: https://www.gofundme.com/f/help-lgbtiq-refugees-in-kuakuma-turkana-kenya

Anything helps!!! Even just sharing to have more people see it.

#kakuma refugee camp#kenya#Turkana#africa#please help#punk#queer solidarity#queer#queer community#artwork#drawing#art commisions#donations#go fund her#go fund him#go fund them#online#online payments#please please please#rambles#ramblings#random#lgb alliance#refugees

12 notes

·

View notes

Text

The Rise of Cashfree Payments: A Paradigm Shift in Financial Transactions

The way we handle financial transactions has undergone a dramatic transformation. Traditional cash payments are gradually being phased out, making way for the era of cashfree payments. With the advent of digital payment methods such as mobile payments, UPI transactions, and international payments, consumers and businesses alike are embracing the convenience and efficiency offered by cashfree solutions. In this blog post, we will explore the various facets of cashfree payments, from their advantages to common misconceptions and their potential impact on the future of finance.

2 notes

·

View notes

Text

IF anyone need help with payment Gateway. Contract

3 notes

·

View notes

Text

Enter for $4,500.00 Cash!

Enter your information now for a chance to win.

#Cashfree#Online Payments#Digital Transactions#Payment Gateway#Fintech Solutions#Cashless Economy#E-commerce Payments#Secure Transactions#Mobile Wallets#Payment Integration#https://sites.google.com/view/cashfree-2/home

2 notes

·

View notes

Text

Transform Your Business: Effortlessly Accept Payments Online with WebPays!

WebPays, your key to successful online transactions, offers seamless solutions for businesses of all sizes. As a trusted partner, we ensure secure and efficient payment processing, empowering you to accept payments online with confidence. Whether you're a global e-commerce giant or a local business, WebPays paves the way for convenient and reliable online transactions. Join us today and embrace the future of effortless online payments!

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

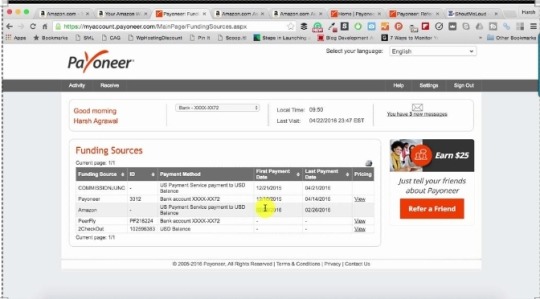

How to receive online payments from Payoneer.

Payoneer is a convenient and effective way to accept payments from people outside of your usual payment circle. In fact, it’s the leading virtual prepaid account alternative with over 10 million users in more than 200 countries worldwide. With Payoneer, you can safely and securely accept online payments on your website, blog, or e-commerce store. Let’s take a closer look at how you can use Payoneer to accept online payments and increase your business’s revenue.

What is Payoneer?

Payoneer is an online payment platform that facilitates the receipt of money from customers abroad. It’s used by businesses in all industries, from e-commerce and travel to education and health care. It offers a wide range of services, including online payments, money transfers, and card issuing. It’s used by businesses across the globe, including the US, Europe, Asia, and Latin America. Payoneer can be used to receive payments in over 25 currencies via its virtual prepaid card. This card can be used for online or offline shopping. It can also be used for money transfers.

How to use Payoneer to accept online payments

There are a few simple steps you can take to start using Payoneer to receive payments from abroad. First, you’ll need to create a Payoneer account. You can do this online or by downloading the app. Once you sign up, you’ll be given a virtual prepaid MasterCard. Once you receive this card, you can start accepting payments. Once you’re ready to receive payments, you’ll need to link your card with your online payment account. You can do this by going to your online banking portal and clicking “Add a card.” You’ll need to enter your card number, expiration date, CVV, and online banking PIN. Once you’ve done this, you’ll then be prompted to add a description and select “Debit or prepaid.” Once your card is linked, you’ll be able to start accepting payments. You can do this by adding your bank details to your online store or creating an invoice for your services.

Pros of using Payoneer to receive payments

There are many benefits to using Payoneer to receive payments from abroad. Here are a few of this payment platform’s biggest perks: - Ease of Use: Payoneer is extremely easy and intuitive to use. Simply create an account, link your card to your online payment account, and you’re ready to receive payments. - Full Integration: Payoneer is fully integrated with many online business and accounting software platforms, including Shopify, Stripe, and Quickbooks. - Security: Payoneer is GDPR compliant, PCI compliant, and uses the latest in TLS 1.2 encryption. - Wide Range of Currencies: Payoneer’s virtual prepaid MasterCard can be loaded in 25 different currencies, including US dollars, British pounds, and euros.

Visit Payoneer website on www.payoneer.com

Cons of using Payoneer to receive payments

Although using Payoneer is generally a great way to receive payments from abroad, there are a few downsides to this payment platform. - No Direct Deposit: One of the biggest drawbacks of using Payoneer to receive payments is that your customers’ funds won’t be directly deposited into your bank account. Instead, funds are deposited into your card. You’ll then need to manually transfer the funds to your own bank account. - No Interest: Another potential downside of using Payoneer is that your customers’ funds won’t accrue any interest. This is because the funds are prepaid, and prepaid funds don’t earn interest. - Transaction Fees: Another potential drawback of using Payoneer is that they charge a transaction fee each time a customer makes a payment. Their fee varies depending on the currency and country.

Final Words: Is Payoneer Worth It?

Overall, Payoneer is a convenient and affordable way to receive payments from customers abroad. Its virtual prepaid MasterCard can be loaded in 25 different currencies, making it a truly global payment platform. With Payoneer, you can receive payments in over 25 currencies and can easily integrate your account with your online store or accounting software. However, there are a few downsides to using Payoneer to receive payments. Your customers’ funds won’t be directly deposited into your bank account and there’s no interest. Furthermore, you’ll have to pay a transaction fee each time a customer pays you using their prepaid card. In the end, Payoneer is a great way to receive payments from around the world. It’s easy to use and has a wide range of benefits. Now that you know what it is, how it works, and its pros and cons, you’re ready to start receiving payments via this payment platform.

8 notes

·

View notes

Text

As online payments have become a norm, selecting the right payment service provider (PSP) is crucial. However, with numerous options to choose from, finding a PSP that suits one’s objectives and needs can be challenging.

What is a Payment Service Provider (PSP)?

A PSP streamlines electronic payment transactions between customers, banks, and firms. Through a single platform, it enables firms to accept payments via credit cards, debit cards, digital wallets, and bank transfers.

This ensures efficient, secure, and integrated payment processing. PSPs also provide secure online payment gateways and help manage transaction approvals and fraud settlements. Moreover, they adhere to industry standards like PCI DSS.

0 notes

Text

Secure Online Payments Made Easy with OnePay

Welcome to the world of modern business, where convenience is king and adaptation is the key to success. If you're a business owner, big or small, you've probably heard about the importance of accepting card payments and processing transactions online. But what exactly does that entail? Don't worry, we're here to break it down for you in the simplest terms possible. Think of it as your trusted guide to navigating the world of payments with ease and confidence. Let's get started!

Understanding Card Payments

First things first, let's break down what card payments entail. When a customer pays with a credit or debit card, the transaction involves several steps:

Authorization: The customer swipes, inserts, or taps their card at the point of sale (POS) device or enters their card details online.

Authentication: The card issuer verifies the transaction's legitimacy and the availability of funds.

Settlement: The funds are transferred from the customer's account to the merchant's account.

Why Accept Card Payments?

Accepting card payments offers numerous benefits for your business:

Convenience: Customers prefer the ease and security of paying with cards.

Increased Sales: Studies show that businesses that accept cards typically see higher transaction volumes.

Global Reach: With online payments, you can reach customers beyond your local area or even your country.

Security: Card transactions come with built-in fraud protection, reducing the risk for both you and your customers.

Accepting Payments Online

Nowadays, having an online presence is crucial for any business. Here's how you can start accepting payments online

Choose a Payment Gateway: A payment gateway is an online service that authorizes card payments. Popular options include PayPal, Stripe, and Square.

Integrate with Your Website: Most payment gateways offer easy-to-implement plugins or APIs to seamlessly integrate with your website or e-commerce platform.

Secure Checkout: Ensure that your checkout process is secure and user-friendly to instill trust in your customers.

Stay Compliant: Familiarize yourself with relevant regulations such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive cardholder data.

Simplifying the Process

While the technical aspects of card payments and online transactions may seem daunting, there are tools and services available to simplify the process for you:

All-in-One Solutions: Consider using platforms like Shopify or WooCommerce that provide integrated payment processing along with e-commerce functionalities.

Customer Support: Choose payment providers that offer responsive customer support to assist you whenever you encounter challenges.

Educational Resources: Take advantage of online guides, tutorials, and customer forums provided by payment service providers to learn and troubleshoot effectively.

Conclusion

Accepting card payments and processing transactions online doesn't have to be overwhelming. By understanding the basics, leveraging reliable payment gateways, and utilizing available resources, you can simplify the process and focus on growing your business. Embrace the opportunities that digital payments offer, and watch your business thrive in today's interconnected world.

1 note

·

View note

Text

📝Unlocking the Benefits of 123 Pay UPI: A Convenient and Secure Online Payment Method—

To know more ↓

1 note

·

View note

Text

0 notes

Text

Choosing the right payment processor is crucial for seamless transactions. Consider factors like security, cost, and scalability to find the best fit for your business needs. #PaymentProcessor #MerchantServices #OnlinePayments

0 notes

Text

Revolutionizing Payment Processes: How Payomatix Solutions Are Empowering Businesses In The Digital Age

Introduction:

In today’s rapidly evolving business landscape, seamless and secure payment processes are essential for success. With the rise of e-commerce, mobile payments, and contactless transactions, businesses are constantly seeking innovative solutions to meet the demands of their customers while staying ahead of the competition. In this blog post, we’ll explore how Payomatix Solutions is leading the charge in revolutionizing payment processes and empowering businesses to thrive in the digital age.

Key Points To Cover

Understanding the Changing Landscape of Payment Solutions: The digital age has reshaped consumer expectations, leading to a surge in demand for convenient and secure payment methods. Businesses must adapt to these changes to remain competitive.

Introducing Payomatix Solutions: Payomatix offers a range of customizable payment solutions tailored to meet the diverse needs of businesses. Their offerings include white-label solutions and the advanced Payomatix Cashier platform, providing flexibility and scalability.

The Benefits of Payomatix Solutions:

Streamlined Operations: Payomatix Solutions streamline payment processes, reducing friction at checkout and improving operational efficiency. This allows businesses to focus more on their core activities.

Enhanced Customer Experience: A seamless payment experience is crucial for customer satisfaction and loyalty. Payomatix Solutions prioritize user-friendly interfaces and swift transactions, enhancing the overall customer experience.

Security Measures: Payomatix Solutions are equipped with robust security features to safeguard businesses and customers against fraud and cyber threats. This includes encryption technologies and compliance with industry standards.

Flexibility and Customization: Businesses have different requirements and brand identities. Payomatix Solutions offer flexibility and customization options, allowing businesses to tailor their payment processes accordingly.

Real-World Success Stories: Sharing case studies or testimonials from businesses that have benefited from Payomatix Solutions provides tangible evidence of their effectiveness. These success stories demonstrate how businesses have achieved growth and efficiency improvements with Payomatix.

Looking Towards the Future: The future of payment solutions is dynamic, with emerging technologies such as blockchain and biometrics shaping the landscape. Payomatix is committed to staying ahead of the curve through continuous innovation and technological advancements, ensuring that their solutions remain relevant and effective.

Conclusion

As businesses navigate the complexities of the digital economy, having the right payment solutions in place is crucial for success. Payomatix Solutions offer a comprehensive suite of customizable, secure, and innovative payment solutions that empower businesses to thrive in today’s dynamic market landscape. To learn more about how Payomatix can transform your payment processes and drive success for your business, get in touch with them today.

0 notes

Text

If Someone need Payment Solution Contract Marchantta fb page

0 notes

Text

Mastercard expands Click to Pay solution in Australia

Mastercard Incorporated has decided to expand its Click to Pay solution in Australia to help combat online payment fraud in the country.

Click to Pay is a tokenized method designed for online transactions, aimed at improving both the checkout process and security measures for consumers. This solution is compatible with the majority of credit and debit cards in Australia, and users can access it…

View On WordPress

0 notes