#ACH (Automated Clearing House)

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

AILess Whumptober Day 2: Insomnia

sweet dreams (day 2: insomnia).

twilight, alice/jasper, pg, human/vampire au, post-new moon. no warnings.

I don't think this is my finest work, but you know what, we're here for the vibes.

After the Cullens leave, I feel like… like some part of me is missing. Like I’ve been hollowed out but I’m still forced to walk around. I physically ache. All I want to do is sleep, except when I am finally, finally allowed to crawl into my bed.

That’s when it’s utterly impossible.

Aunt Lorraine says it’s my ribs, my shoulder. It’s been three months, they shouldn’t still be keeping me awake. I know that, but Lorraine insists it’s nothing else.

She gives me a bottle of essential oil and another crystal. More of her hippie nonsense; my dresser is cluttered with the other rocks she’s given me to solve my problems. I had to hide my aspirin in the pocket of my winter coat and my inhaler in my school bag because I know she’d throw them away if she knew about I still had them. Colloidal silver, oils, and stones are the only things she’ll allow, and I cannot stand it. After two months of having every oil and potion and leaf pushed on me instead of the painkillers the doctor prescribed, my tolerance is stretched to the limit.

“Some lavender to help you sleep, and some blood-stone for under your pillow,” she says, as she walks around the basement, straightening my things. “That one is a classic jasper…”

I nearly throw the stone against the wall when she says that, as if she’s intentionally hurt me, but she keeps prattling about the healing power of the newest oil and rock she’s given me and I know she hasn’t realized what she’s said.

The rock feels cold in my hand.

She doesn’t stay long, she never does; the cushions on the couch are fluffed, my schoolwork has been pointedly stuffed into the bookcase, and my laundry hamper is full. That is the extent of the mothering I get in this house; Uncle Rod’s always working - when he is on furlough, he’s good to me. He cares; he reminds me that he wanted me here every single time.

But Lorraine is distant and it’s clear that she’s drawing the boundaries between my cousin and me. And it’s fine, Willa’s so little, Lorraine wants to focus on her. She’s her daughter, I’m just her niece by marriage. She probably hadn’t wanted some troubled teenage girl she’d never met moving into her basement.

It’s fine.

But I wish…

“Sleep well,” Lorraine finally says as she leaves, pointedly not closing the door behind her, and I listen to her climb the basement stairs. I wish… I wish I had someone to kiss the top of my head, tuck me in, and maybe hug me when I cry.

I haven’t had a mom hug in so long. I could really use one.

I wait until I hear Lorraine close the door at the top of the stairs before I get up, and go into the laundry room to brush my teeth, and firmly shut my bedroom door behind me. I check my phone on the charger, ignoring the spam messages that pop up. Every freakin’ night, the stupid texts promising me credit cards and car loans, the phone calls that are silent just long enough for me to hope, only for the automated message to click in. If I didn’t know better, I’d think someone had signed me up to all of it as a punishment.

The oil and stone are still on my nightstand when I get back, practically mocking me. I ignore it as I climb back into my bed; the book we’re assigned for English rests under my pillow. It’s optimistic to think I’ll open it tonight. I’m already weeks behind.

I lie still and wait for something. Sleep, preferably. But it doesn’t come.

Mostly I think about what I had. What I lost. I want to travel back in time and shake myself. Those broken ribs don’t hurt as much as what comes next, you stupid girl. Beg him, scream and cry and throw a real tantrum to make sure that he doesn’t dare leave you behind.

Breathe deep so you remember his scent, of rain and leather and ashes scattered to the wind. The way you could curl against him, your cheek against his chest, and that perfect stillness that was so wrong and yet so calming; the way he would slide his hand under your shirt and over the skin and bone of your hip in a way that wasn’t sensual or lascivious, just comforting and so perfectly intimate.

And remember all of it properly. That proper, perfect feeling of a maybe family. The way Esme asks you to bring over the photo album so she can see you as a baby, a child, and makes you tell her about every single photograph, side by side on the couch, her fingers tracing over each snapshot of your face. The way Carlisle listens to you so intensely, like what you’re saying is so important, and then really thinks about what he says in response. The way Emmett made you leave an inhaler in his truck, just in case - and always offered to go through the drive-thru when you were in the car. Rosalie never smiling at you, never ever being slightly welcoming, but being the one that always checked if you needed a ride home after school.

And Bella’s wry little smiles, a beat-up book in her lap, and her hair around her face as you tried to explain something to her - a fashion trend, pop culture, some grand plan in the nebulous future. The way Edward would always move over just a little so you could sit down at the piano with him, the music propped up on the stand arranged for you if you wanted to sing the tune along with him; never needing to tell him that it was a comforting reminder of doing the same thing with your mom before she got sick.

Then remind yourself it was far too perfect to have lasted any longer.

Feeble moonlight spills in from the narrow windows where the wall meets the ceiling - the joys of living in a basement. I sink deeper into my bed, and I look over at my nightstand where the blood-stone sits. If I could smash it, I would.

My phone buzzes absently. Looking to refinance? Call (206) 342-8631.

“I nearly had a mom and dad who could love me,” I whispered at it. “I nearly had a family forever. And someone who loved me no matter what.”

The tears are hot as they roll down my face. “Why couldn’t you stay? I… It was an accident, we could have fixed it.”

Nothing. It was just a rock, after all. The sleepless nights had caught up with me if I was talking to bedroom decor.

Rolling over to face the wall where my photo-wall had been, I squeeze my eyes shut and just plead with my brain to give me rest. More than the scant, soupy hour or two I got before dawn.

It refuses.

My chest hurts.

My phone buzzes again. Nickel off expired baby food today only!

I’d turn the stupid thing off, but I’d promised my sister that it didn’t matter what time of the day or night it was, if she called I would answer. There wasn’t much I else could do for her nearly three thousand miles away, but I could do that.

I didn’t feel this lonely in Mississippi. Not when mom died, not when dad remarried, not when I was at the hospital. I never thought of myself as being hopeful, but now… now I feel like there’s nothing. Just a void of days I have to fill. I can’t imagine feeling human enough to exist in the world as a functioning adult. I’m hanging on by my fingertips now, and it feels like it gets worse every single day.

It was so stupid. It was an accident. I think Dad or the hospital have hurt me worse.

My phone buzzes. Cheap Designer Gear!!! 1 Day Only!!

I glared over at my clock, as if it was the reason I was still awake, and not the hopelessness that had taken residence up in my bones. That my mind was traitorously replaying every chuckle, every quiet conversation, every gentle kiss. I wanted Jasper here with me now, tucked up beside me with a heavy book that would bore me to tears, his hand rubbing soothing circles on my back to help me sleep. And when I’d wake up, he’d be gone but there would be a little note folded on my pillow. I love you, I’ll see you at school. I had dozens of them in the shoe box I’d banished my photographs to. Thirty two nights, thirty two little notes in his beautiful handwriting, all with the same first line.

I love you.

My eyes slide shut and maybe just for a moment I can float; that in-between sleep that solves nothing but at least makes the time pass. I am warm, the pain is tolerable, and right now I can almost remember how it feels to have Jasper’s hand on my back soothing me to sleep as he reads…

Buzz.

And the illusion was gone. Rolling over to an empty bed and grabbing my phone, knocking half the items piled on my nightstand everywhere, I felt like I was probably going to smash it if it was another ad.

A call from a number I didn’t recognize; Cynthia was always losing her phone, but I was more horrified that she was calling me after three a.m; she was twelve, she needed to be in bed asleep or watching Youtube or something. Not calling me for help.

“Hello?” I croak, weeks of no sleep and hopelessness coming through in that one word. I sounded about eighty. “Cece?”

Silence. I waited for the automated message to click in for a few seconds, but nothing.

“Cece?” I asked again, suddenly close to tears. “Please, just say something.”

“Alice?”

I was suddenly more awake than I had been in months, sitting up straight. Jasper, my Jasper.

He sounded terrible, desperate and broken and lost. A small part of me was relieved he was suffering as much as I was. A larger part was terrified because he was the one that took care of me, protected me; I didn’t know how to fix his problems.

But the largest part of me was just desperate for him not to hang up the phone.

“Jasper?” I sounded like a child when I said his name, and I heard his breath hitch.

“I’m here.”

I had a million questions for him. Where are you? Why are you calling? What’s wrong? Where’s your family? Why did you go?

None of them came out. Instead, I just started sobbing and was faintly aware of myself begging, pleading, with him to come home. Promising him that I’d do anything, anything if he’d just come back to Forks.

I don’t know how long I cried and begged but when I eventually ran out of tears, Jasper was still there, trying to calm me down.

“It hurts too much,” I sniffled down the phone. “I need you to come home, please.”

Silence. I could hear the sound of traffic; a payphone somewhere. This connection to him was tenuous, momentary, and the rising panic was making me feel sick.

“Alice,” his voice just made everything feel better, softer, and I would have given anything to have him beside me. “Alice, take a breath, you’re going to have an asthma attack or make yourself sick.” His voice had lost that desolate quality, had taken on that warmth that I remembered so well.

“Please come home,” I whispered. “I promise I’ll do whatever you want, I just need you here.” I could hear the wheeze in my voice, and Jasper probably could too. But I couldn’t bring myself to get up for my inhaler; it felt like if I moved, he’d be gone forever.

Silence. I could feel the tears building again.

“I’m coming,” he finally says, his voice cracking. I let out a sob. “I’ll be there soon, I promise. You need to rest, Alice. Why are you awake?”

“Can’t sleep,” I said, blotting my face with a tissue. “I just… can’t. I’m so tired Jasper, I need you to come home.”

“I’m coming home now, I promise.” My body is relaxing. “You need to sleep, Alice. Just close your eyes and I’ll wait for you to fall asleep, okay?”

“Do the others know you called me?” I said, curling into my pillow. I still had the letter they’d left me with, written by Rosalie, cold and impersonal. They had to go, they had to leave because they were a danger to me. That they would leave me to live out my life in peace and wished me the best. It was the kind of very polite missive that cut right through me and made me feel very small and insignificant.

“Don’t worry about the others,” Jasper said soothingly. “They’re fine. Everyone misses you. I miss you.”

“You do?” I sounded pitiful.

“So very much.” His voice cracks and I can hear the pain, the longing. “I’m so sorry Alice.”

“I’ll forgive you as soon as you get here,” I yawn. “In person, I promise. How far away are you?”

“It’s going to take me a couple of days, but I’ll leave as soon as you go to sleep.”

“Tell me,” I began, sleep prickling at me. “What you’ve been doing.”

His voice was warm and melodic and I couldn’t distinguish a single word of it as my mind grew fuzzier, aware of nothing but Jasper’s voice and the warmth of my phone screen.

Home, home, he was coming home. And we’d never, ever be parted again. I refused, I couldn’t. He was home…

Love you, love you. The words drip in my mind, the last conscious thought I had.

If this is a dream, I don’t want to wake up.

I blinked sleepily as my phone alarm went off for school, balanced on the edge of my nightstand. I had fallen asleep in an odd little cocoon of pillows and blankets but it was the deepest sleep I’d had in weeks.

I had only the vaguest memory of my dreams, of Jasper’s voice and comfort, tears of desperation and then of relief. I had felt safe, hopeful again. Whatever it had been, I felt clearer than I had in a long time.

And as I climbed out of bed, I saw the blood-stone, where it had fallen next to my pillow. Instead of tossing it amongst the others, I left it where it fell.

Maybe it would give me another nice dream tonight.

#ailesswhumptober2023#ailesswhumptober prompt 2: overworked/insomnia/exhaustion#alice cullen#jasper hale#jalice#twilight fan fiction#human/vampire au#a lil chaotic#a rambly little fic today#i am fascinated by how many of these i'll get done honestly#my fic: whumptober2023#my fic: one-shots#oh i really hope i have time for tomorrow's#that could be a wee bit fun

15 notes

·

View notes

Text

Don’t get scammed ever again, bitcoin has payment reversal.

Payment Reversals Explained (And 10 Ways to Avoid Them)October 15, 2021

Security

Payment Processing 101

Merchant Tips

If you’ve been in business longer than a month, you’ve probably experienced a payment reversal of some kind. Certain payment reversals are so prevalent that business owners have to budget them into their expenses every month.

The frequency of payment reversals is tied to an interesting intersection of technology, law, and product/market type. If your online store doesn’t do a good job with its descriptions, you may deal with more payment reversals. Or if your product is expensive and highly bespoke (think high-end mattresses or musical instruments), returns may be more common.

Some payment reversals are just normal business. Others can be exploitations of fraudulent customers, but the burden of payment reversals is often placed on businesses. The major credit card networks (Mastercard, Visa, etc.) have more incentive to favor their customers, and it’s up to you to fight back when appropriate. The more systems and processes you have in place, the better you’ll be at proving when a reversal is wrong.

Experiencing consistent payment reversals can be super frustrating. Fortunately, there are ways to combat payment reversals, and understanding the different types and how they occur is your first step to doing so.

What does payment reversal mean?

Payment reversal (also "credit card reversal or "reversal payment") is when the funds a cardholder used in a transaction are returned to the cardholder’s bank. This can be initiated by the cardholder, merchant, issuing bank, acquiring bank, or card association.

Common reasons why payment reversals occur include:

The item ended up being sold out.

The customer is trying to commit fraud.

The customer changed their mind after ordering.

The product wasn’t what the customer expected due to bad descriptions or shady selling.

The wrong amount was charged.

The transaction was duplicate.

There are three common branches that payment reversals fall into:

Payment reversal type 1: Authorization reversal

Authorization reversals reverse a payment before it officially goes through and is the "quick fix" of payment reversals.

The ACH (automated clearing house) network is slow and limited, so it’s normal for transactions to be pre-authorized. In other words, a transaction can be initiated even if the address or other information is incorrect.

If you or your employees notice something incorrect after submitting the authorization request, you can call your bank to stop the transaction from occurring. This is known as an authorization reversal, and it’s highly preferable over a future chargeback or refund. The further a payment gets along it’s path to completion and the more entities it communicates with (issuing bank, card network, etc.), the more of a hassle it is to take back.

Authorization reversals are better for the customer, won’t mess up your sales data, and reduce fees associated with chargebacks by stopping the payment early.

Usually, authorization reversals are quick and in stores mentioned in front of the customer. If you address the problem immediately and let the customer know that any charges they see will be gone shortly thereafter, you have a better chance of them just swiping and trying the transaction again with the correct information. Be quick, and be courteous!

Payment reversal type 2: Refund

Refunds reverse a payment after the transaction has completed but before the customer has filed an official dispute.

We all know refunds. This is when something is wrong with the product or purchase and a customer calls your business to get their money back.

Instead of just canceling the transaction like an authorization request, a refund completes the transaction in reverse. It’s like the acquiring bank is now paying the cardholder instead of the other way around. It’s treated like a new, separate transaction.

Keep in mind that refunds are not a neutral agreement. Not only do you as the business owner lose the product sale, you also have to pay the fees (interchange, etc.) that incur along the way.

Payment reversal type 3: Chargeback

Chargebacks are when a customer calls their bank and files a dispute against your transaction.

If authorization reversal and refunds are out of the picture, or if a customer just decides to go directly to their bank, you will have to deal with a chargeback. Not only do chargebacks make you lose revenue on the product, the fees, the shipping, etc., but you also have to pay extra, chargeback-specific fees.

Chargebacks are arguably the bane of many business owners' existence. They’re not easy to fight, they’re expensive, and the process can be confusing and frustrating. It’s difficult to figure out what is a fair chargeback and what is fraud, and you’re responsible for fighting back against chargebacks.

As a business owner, you’ll have to deal with:

Losing revenue

Paying for shipping fees

Recovering or forfeiting sold products

Eating transaction fees incurred during the fraud.

Filing a claim and disputing chargebacks.

If you incur enough chargebacks, you may be flagged by the card networks and be unable to accept credit cards, so there’s a sustainability and reputational threat inherent within each chargeback.

Your best bet is to be proactive and take the fight to them, developing an internal system of processes and best practices to reduce the number of chargebacks and easily identify which ones are fraudulent.

10 ways to reduce payment reversals

Don’t count on eliminating payment reversals from your business, but reducing your payment reversals can be achieved through a combination of thorough payment technologies and best practices from your employees.

Just having a foolproof payment system isn’t enough since a lot of chargebacks and payment reversals are due to human error.

With that in mind, here are ten ways you can make a big dent in yours. For the first six, check with your POS provider to make sure your software has these systems set in place.

Link your authorization request to future transaction messages. A transaction identifier or (TID) makes sure that particular requests and their related messages stay with each other.

Use a surface trace audit number. This attaches a number to all the communication regarding a particular transaction.

Make sure your system delivers retrieval reference numbers. This ties estimated sales to the customer’s original authorization request.

Make sure your system has an authorization characteristics indicator. Notes an estimated incremental/estimated transaction total.

Keep track of your duration field. This is the total number of days when charges will be tabulated. It helps you be able to inform your customers of what to expect and when.

Submit transaction data promptly. Clear your transactions as soon as possible to make sure you don’t run into empty checking accounts or people forgetting what certain charges are.

Use clear billing descriptors. A billing descriptor appears on a customer’s statement as the name of a transaction. Make sure yours is easily read, something like BELGACOFFEE instead of 35030BE.

Confirm the projected clearing date. Set up an automated email that confirms a customer’s purchase and when they can expect those funds to withdraw. This helps the customer remember when and what they purchased and helps them properly prepare for the withdrawal.

Use incremental and estimated authorizations when appropriate. If your business is in rentals or anything that the final rate is determined by time instead of upfront, you should consider using incremental authorizations. These basically continue to set up transactions over time instead of waiting until the end to slap a big charge on a card — reducing the pain of a chargeback.

Process authorization referrals quickly. If you detect any type of error during the transaction, don’t wait for a chargeback to occur. Go ahead and reverse it as an authorization reversal. This will help return the funds to the customer’s account quickly and encourage them to try the transaction again.

The bottom line on payment reversals

Payment reversal or credit card reversal is somewhat of a broad term, but whether you’re dealing with authorization reversals, refunds, or chargebacks, they all have different applications and consequences for your business.

Above all, be quick, and be smart. Don’t wait for the problems to come to you!

With Tidal, we actually devote an official chargeback assistant to your team when you use our merchant services. Instead of spreading yourself super thin and picking up extra responsibility, why not get an expert to help you fight while saving up to 35% on processing fees?

8 notes

·

View notes

Text

How does a merchant cash advance company collect payments?

Are you a small business owner considering a merchant cash advance (MCA) to support your operations? Understanding how the repayment process works is essential before diving in. In this article, we will delve into the question: "How does a merchant cash advance company collect payments?"

.

FREE MCA LEADS -> https://www.fiverr.com/leads_seo_web

.

What is a merchant cash advance?

A merchant cash advance is a form of financing that allows small businesses to access a lump sum of cash upfront in exchange for a percentage of their future credit card sales. Unlike traditional loans, MCAs are not based on credit scores or collateral. Instead, they rely on the business's revenue and credit card sales volume. This alternative funding option has gained popularity among small business owners due to its flexibility and quick approval process.

How does a merchant cash advance work?

When you choose an MCA, repayment typically occurs through automated daily or weekly debits. This means that a predetermined percentage of your credit card sales will be deducted directly from your business bank account. This automated process makes repayment convenient and hassle-free for both parties involved.

The repayment structure of a merchant cash advance is different from a traditional loan. Instead of fixed monthly payments, the MCA company collects payments as a percentage of daily or weekly credit card sales. This means that during slower sales periods, the repayment amount will be lower, while during higher sales periods, the repayment amount will be higher. This flexible repayment structure is designed to align with the natural fluctuations in a business's cash flow.

Collecting payments from credit card sales

One common method used by merchant cash advance companies to collect payments is through credit card sales. This process involves the MCA company partnering with the business's credit card processor to automatically deduct a percentage of each credit card transaction. The credit card processor then forwards the collected amount to the MCA company.

This method offers convenience for both the business owner and the MCA company. The business owner doesn't have to worry about making manual payments or remembering due dates, as the repayment happens automatically with each credit card sale. Additionally, the MCA company benefits from a consistent stream of payments, as they are directly tied to the business's revenue.

However, it's important to note that this method may not be suitable for businesses that primarily accept cash or checks for their sales. If a significant portion of a business's transactions occur through non-credit card methods, an alternative payment collection method may be necessary.

Collecting payments through ACH transfers

In addition to collecting payments from credit card sales, merchant cash advance companies may also offer the option of collecting payments through Automated Clearing House (ACH) transfers. ACH transfers allow funds to be electronically transferred between bank accounts, making them a convenient and efficient method of payment collection.

With ACH transfers, the MCA company works with the business owner to set up a direct transfer of funds from the business's bank account to the MCA company's account. This can be done on a daily or weekly basis, depending on the agreed-upon terms. Similar to collecting payments from credit card sales, this method offers automation and ease of repayment for both parties involved.

Pros and cons of collecting payments through credit card sales

Collecting payments from credit card sales has its advantages and disadvantages. One of the main benefits is the convenience factor. The automated process ensures that payments are collected consistently and eliminates the need for manual payment arrangements. Additionally, this method allows the MCA company to have visibility into the business's revenue, providing them with a clear understanding of the repayment capacity.

However, there are also some drawbacks to this method. One potential disadvantage is the cost associated with credit card processing fees. These fees can eat into the business's profit margin, especially if they have high sales volumes. Additionally, businesses that primarily accept cash or checks may face challenges with this method, as it relies on credit card transactions for payment collection.

Pros and cons of collecting payments through ACH transfers

Collecting payments through ACH transfers also has its pros and cons. One of the main advantages is the flexibility it offers for businesses that primarily accept non-credit card transactions. This method allows businesses to continue their usual payment collection processes while still meeting their repayment obligations. Additionally, ACH transfers typically have lower fees compared to credit card processing fees, which can be beneficial for businesses with tight profit margins.

However, there are some potential drawbacks to consider. ACH transfers require the business owner to have a reliable and functional bank account. If there are issues with the business's bank account, such as insufficient funds or account closures, it can disrupt the payment collection process. Additionally, the business owner needs to ensure that there are sufficient funds in the account to cover the repayment amount, as failed transfers can result in penalties or additional fees.

Best practices for collecting payments as a merchant cash advance company

To ensure a smooth payment collection process, merchant cash advance companies should follow best practices. First and foremost, clear communication and transparency are essential. The terms and conditions of the repayment should be explained in detail to the business owner, ensuring that they understand how the payment collection process works and what their obligations are.

Additionally, it's crucial for MCA companies to provide reliable and accessible customer support. This allows business owners to seek assistance or address any concerns they may have regarding their payment obligations. Timely and accurate reporting of payment collection is also important, as it helps both parties track and reconcile the payments made.

Common challenges in collecting payments for merchant cash advances

While automated payment collection processes aim to streamline the repayment process, there can still be challenges along the way. One common challenge is dealing with declined or failed payments. This can happen due to various reasons, such as insufficient funds, expired credit cards, or technical issues. MCA companies should have protocols in place to handle these situations, including notifying the business owner and providing alternative payment options.

Another challenge is managing the repayment process during slower sales periods. As mentioned earlier, the repayment amount is tied to credit card sales, which means that during slow periods, the payment collection may be lower. MCA companies should work closely with business owners to ensure that they can comfortably manage their cash flow during these periods and avoid any financial strain.

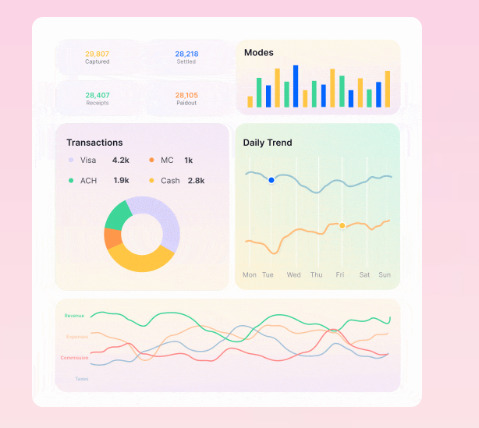

Tools and technology for efficient payment collection

To streamline the payment collection process, merchant cash advance companies can leverage various tools and technologies. Payment processing platforms, such as those offered by established financial institutions, provide automated payment collection features. These platforms can integrate with the business's existing payment systems, making the payment collection process seamless.

Additionally, reporting and analytics tools can help MCA companies track and monitor payment collection performance. These tools provide insights into payment trends, identify any issues or discrepancies, and allow for proactive measures to be taken. By leveraging technology, MCA companies can optimize their payment collection processes and provide a better experience for their clients.

Conclusion

Understanding how a merchant cash advance company collects payments is essential for small business owners considering this financing option. Whether through credit card sales or ACH transfers, the payment collection process aims to be convenient and hassle-free for both parties involved. By familiarizing themselves with the collection process, business owners can effectively manage their cash flow and ensure a smooth repayment experience.

When considering a merchant cash advance, it's important for business owners to weigh the pros and cons of different payment collection methods. Factors such as transaction volume, payment preferences, and cost considerations should all be taken into account. By choosing the right payment collection method and working with a reputable MCA company, small business owners can access the capital they need while maintaining financial stability.

mca leads, merchant cash advance, business loan, cash advance, unsecured loan,funding, loan, sba, line of credit, term loans, merchant cash advance leads #mcaleads #merchantcashadvanceleads #merchantcashadvance #cashadvance #businessloan #unsecuredloan #loan #loanofficer #businessloansnow #funding #businessfunding

#mca leads#mcaleads#merchant cash advance#cash advance#business loan#b2b lead generation#funding#loans#mortgage

1 note

·

View note

Text

Enabling Fund Transfer: The Essential Function of B2B Payment Gateway Service Providers

In the complex network of contemporary corporate transactions, where trade happens quickly and across borders, the significance of B2B payment gateway service providers is immeasurable. These organizations provide a range of products aimed at streamlining and improving the payment process, acting as the foundation for smooth financial exchanges between companies. Let's examine the vital function that B2B payment gateway service providers play in streamlining financial transactions by delving into their industry.

Enabling safe and effective payment processing between companies is the primary goal of B2B payment gateway services. By serving as go-betweens, these service providers allow money to be transferred through a number of different payment methods by bridging the gap between companies and financial institutions. B2B payment gateway service providers offer complete solutions that are customized to meet the various demands of organizations across industries, whether they are handling recurring transactions, processing invoices, or receiving payments.

The degree of efficiency and ease that B2B payment gateway service providers offer is one of the main benefits of working with them. These companies use automation and cutting-edge technology to expedite the payment process, lowering the need for human participation and lowering the possibility of mistakes or delays. Through a single platform, businesses can originate, track, and reconcile payments with ease, saving important time and resources in the process.

Additionally, B2B payment gateway service providers put security and compliance first, making sure that private financial information is safe all the way through the payment lifecycle. By implementing strict encryption protocols, multiple authentication layers, and adhering to industry standards like PCI-DSS (Payment Card Industry Data Security Standard), these providers provide businesses with protection against potential security breaches and fraudulent activities, thereby fostering trust in the payment process's integrity.

B2B payment gateway services are also distinguished by their flexibility and accessibility. To accommodate the various requirements and preferences of businesses, these suppliers give a large selection of payment options. Businesses are free to select the payment methods that best suit their needs, whether that means using credit/debit cards, wire transfers, ACH (Automated Clearing House) transfers, or electronic fund transfers (EFT). Furthermore, a lot of B2B payment gateway service providers allow for international payments, which helps companies access a wider audience and interact with partners throughout the globe.

Additionally, B2B payment gateway service providers are essential to improving firms' cash flow management. Through expedited payment processing and instantaneous transaction status information, these providers enable enterprises to maximize cash flow, address liquidity issues, and make well-informed financial choices. Businesses can improve overall financial efficiency by streamlining their receivables and payables operations with features like automated invoicing, recurring billing, and customizable payment schedules.

Numerous B2B payment gateway service providers provide value-added services including vendor management, reconciliation, and dispute resolution support in addition to transactional support. Businesses can increase overall efficiency and productivity by streamlining operations, strengthening vendor relationships, and improving transparency by centralizing different financial tasks onto a single platform.

It is crucial for companies in highly regulated sectors like healthcare, finance, or government contracting to work with B2B payment gateway service providers who are experts at meeting legal and regulatory standards. These suppliers provide customized solutions that guarantee compliance with industry-specific rules and guidelines, reducing the possibility of infractions and the resulting fines.

In summary, in today's changing business world, B2B payment gateway service providers are essential in easing the flow of financial transactions. These suppliers enable companies to carry out transactions with ease, improve cash flow management, and spur expansion by providing safe, effective, and adaptable payment options. For businesses to succeed in today's highly competitive industry, B2B payment gateway service providers are essential partners. They help with everything from processing invoices to taking payments to maintaining vendor relationships.

0 notes

Text

Streamlining Business Transactions: The Power of B2B Payment Gateways

In the intricate world of business-to-business (B2B) transactions, efficiency is paramount. Every handshake between companies involves a series of exchanges, from purchase orders to invoices, culminating in the crucial transfer of funds. Amidst this complexity, B2B payment gateways emerge as beacons of simplicity, offering streamlined processes, enhanced security, and accelerated cash flows. In this article, we delve into the realm of B2B payment gateways, exploring their significance, functionalities, and benefits.

Understanding B2B Payment Gateways

At its core, a B2B payment gateway acts as a conduit between businesses, facilitating secure online transactions. Unlike traditional consumer-focused gateways, B2B payment solutions cater to the unique needs of enterprises, accommodating high-volume transactions, recurring billing, and complex payment terms. These gateways seamlessly integrate with existing enterprise resource planning (ERP) systems, enabling automated data synchronization and real-time financial insights.

Key Features and Functionalities

Multi-Channel Payment Acceptance: B2B payment gateways support various payment methods, including credit/debit cards, Automated Clearing House (ACH) transfers, wire transfers, and electronic checks. This versatility ensures that businesses can cater to the preferences of their diverse clientele.

Customized Invoicing: With customizable invoicing capabilities, B2B payment gateways empower businesses to create professional invoices tailored to their branding guidelines and client specifications. These invoices can include detailed line items, payment terms, and personalized messages, fostering transparency and clarity in transactions.

Recurring Billing: For businesses engaged in subscription-based services or recurring payments, B2B payment gateways offer automated recurring billing functionality. This feature eliminates the need for manual intervention, reducing administrative overhead and ensuring timely payments.

Advanced Security Protocols: Recognizing the sensitivity of B2B transactions, payment gateways prioritize security through robust encryption standards, tokenization, and fraud detection mechanisms. By safeguarding sensitive financial data, these gateways instill confidence in both buyers and sellers, mitigating the risk of fraudulent activities.

Integration Capabilities: B2B payment gateways seamlessly integrate with existing ERP, accounting, and CRM systems, facilitating data synchronization and streamlining reconciliation processes. This interoperability enhances operational efficiency and provides businesses with holistic insights into their financial performance.

The Benefits of B2B Payment Gateways

Enhanced Efficiency: By automating payment processes and reducing manual intervention, B2B payment gateways streamline operations, allowing businesses to focus on core activities and strategic initiatives.

Accelerated Cash Flows: With expedited payment processing and reduced payment cycles, B2B payment gateways improve cash flow management, enabling businesses to optimize working capital and seize growth opportunities.

Improved Customer Experience: By offering flexible payment options, personalized invoicing, and seamless transaction experiences, B2B payment gateways enhance customer satisfaction, fostering long-term relationships and repeat business.

Reduced Costs: Through automation, optimization, and fraud prevention mechanisms, B2B payment gateways help businesses minimize transactional costs, compliance-related expenses, and operational inefficiencies.

Scalability and Flexibility: Whether catering to small startups or multinational corporations, B2B payment gateways offer scalable solutions that adapt to evolving business needs and growth trajectories.

0 notes

Text

Guide to ACH Payments

Automated Clearing House (ACH) payments are a popular and efficient way for businesses and individuals to transfer funds electronically. They are used for a variety of transactions, including direct deposit of payroll, automatic bill payments and online marketplace transactions. This guide provides an overview of ACH payments, how they work and their benefits.

Understanding ACH Payments

ACH payments are electronic payments made through the Automated Clearing House network, a secure system for financial transactions in the United States. They are a form of electronic fund transfer (EFT) that moves money between bank accounts across different financial institutions. ACH payments are known for their cost-effectiveness and efficiency, making them a preferred method for regular, recurring transactions.

One of the key uses of ACH payments is in facilitating ACH marketplace payouts. Online marketplaces and platforms often use ACH payments to distribute funds to sellers or service providers. This method is especially beneficial for handling bulk payouts while ensuring security and reducing transaction costs.

Advantages

ACH marketplace payouts offer several advantages for both the payer and the payee. For businesses, using ACH payments for marketplace payouts streamlines the payment process, reduces administrative overhead and minimizes errors associated with manual processing. It also offers a more cost-effective solution compared to traditional payment methods like paper checks or wire transfers.

For recipients, these payouts ensure timely and predictable receipt of funds. Since ACH payments are processed in batches, recipients typically receive their payments within one to two business days, which is quicker than traditional methods. Moreover, the direct deposit nature of ACH payments eliminates the need for physical checks, thereby reducing the risk of lost or stolen payments.

In conclusion, ACH payments play a crucial role in modern financial transactions, particularly in the context of online marketplaces. ACH marketplace payouts offer an efficient, secure and cost-effective way of handling transactions, benefiting both businesses and individuals involved. As electronic payments continue to evolve, ACH payments remain a reliable and preferred method for managing financial transactions.

Read a similar article about payout automation here at this page.

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Steps to Better Cash Flow Management for Business Owners

A vital element to success in business is good cash flow management. A business that manages its cash flow well is able to meet its recurrent obligations, including repaying debt, while investing in future growth. Businesses that do not manage their cash flow well can do neither.

Cash flow is the amount of cash that comes in and goes out of a business. Cash comes in as revenue and interest income from loans. Cash goes out as inventory purchases, employee salaries, supplier payments, rent, taxes, and debt repayment, among other outlays.

A business that has good cash flow management has more cash coming in than is going out. A business with bad cash flow management has more cash going out than coming in.

A good sign, therefore, that a business owner needs to improve their cash flow management is when they struggle to find the cash to pay debts, payroll, or suppliers. Other examples are when they are always incurring penalties for late debt repayments or find themselves going into their personal accounts to pay business expenses. If an owner is never short on cash for ongoing expenses but has difficulty investing in growth-focused projects like product development, they may also benefit from better cash flow management.

Better cash flow management relies heavily on having a good grasp on business numbers, starting with cash coming in. A business should have more income than expenses, and this income should come in early enough so there is always sufficient cash to pay off expenses when they fall due. Hence, a business owner should optimize income and their payment times.

To optimize income, a business owner should consider reviewing their pricing structure. Sales should cover the cost of direct as well as indirect expenses like advertising and insurance. If they don’t, the business owner could be underpricing their goods. They should review how their competitors price for similar products and services, and if their prices are higher, re-price their own goods.

Payment times are another piece of the income puzzle. Business owners should ensure their income is coming in on time by speeding up invoice payments. They should invest in digital invoicing systems to send invoices faster, send invoices as soon as they deliver a product or service, and implement schedules requiring clients to pay within a fixed number of days following receipt of invoices.

Further, business owners should diversify their payment channels so it’s more convenient for clients to pay. For instance, they could accept credit cards and mobile payments as well as ACH (automated clearing house) and EFT (electronic funds transfers) payments.

Business owners can also offer clients incentives like discounts for prompt payments, follow up as soon as invoices become overdue, and change payment terms of clients who regularly pay late. In the latter case, they can require a deposit before delivery or mandate a full cash payment on delivery.

In addition, business owners should take time to seal any revenue leakages they may be experiencing. Keeping accurate records of all invoices and payment receipts is essential, as do limiting the number of employees who receive cash and having more than one bookkeeper or accountant.

After fixing cash inflows, business owners should shift their focus to outflows, starting with payments to suppliers for inventory. They should re-evaluate their agreements with suppliers and negotiate flexible payment terms. Where possible, business owners can request payment dates that align with payments from their own customers. Where business owners pay vendors by credit card, they should organize their bills by due dates, paying them as they become due. If they have extra cash, they can pay high-interest-rate debts first or take advantage of discounts offered by suppliers for early payment. They should keep track of expenses daily so they know where they stand financially and which payments to prioritize.

Finally, business owners need to review other bills like payroll, rent, and debt repayments. Which of these is eating too much into revenues? If it’s payroll, they may need to make changes to their employee reward schemes to achieve a positive cash flow. If it’s debt, they should consider refinancing existing high-rate loans with a single low-rate agreement.

1 note

·

View note

Text

Residual Income Business Opportunity - Would They Really Enhance You?

youtube

A bank account is a must-have item for any modern consumer. Together with access to public transport (like a lili bank account car, train, or bus), a mobile phone, and at least a few dollars to your name - you basically need a account to be considered a normal prospects.

One belonging to the next things to look at is the fees which may come once again features. Fees are a common thing in everyday life, but that will not necessarily mean you in order to deal together. Check for fees may perhaps be come these and when they are taken off. This will give you a preview of what you will get if it is a certain account. Remember to always compare so perform get quite best deal.

Now lili bank account it's easy to use a CPR card if there's more to bring with as well as where to begin. So a little advance planning is paramount to beneficial results. Forgetting a single document can delay this particular method and cause you untold degrees of headaches and delays whenever you established in Denmark.

Now why don't we consider an individual who has an american Bank account even to be a non person. First the person will be paid regarding what they call the automated clearing house system (ACH) or direct deposit. Putting a tarpaulin over about 2-3 days to kick your account and might easily go ahead and take fund by the local ATM via greeting card the US Bank would have given you which ones is known to cause your concern. Compare 3 days to 10 weeks and want would realize the fuss about a us bank page.

If get a PayPal account, you are able to add your US Bank account and verify your account with that. When next you wants withdraw money from your PayPal account, you would certainly withdraw it to your US financial institution and then use your ATM card to dependable from your country. Cool, is it not?

If your employer pays you via check, then having a bank account is why you can have those checks directly deposited into your checking webpage. This makes it easy to immediately get to be able to your money as soon as your check is distributed. Plus, there are no check-cashing fees!

The IRS is famous for using bank levies to collect for non-payment of taxes or back taxes nevertheless they are only some of the ones. A bank card company likewise sue to obtain a judgment against a debtor following freeze the debtors financial institution. If your account has been lately frozen, might need legal assistance in releasing the account, unpredicted expenses possible. Imply mean a person will be walking away - therefore still owe your creditor, be it the IRS, state government, credit card company, and many.

Most people consider the bank account online as the next part of banking. It is, indeed, easier. You find a lot of subtle additional services free for just opening a bank account online. Everything you think of now can be achieved from your house, and basically why most people prefer internet banking as a wonderful way to save time and energy.

0 notes

Text

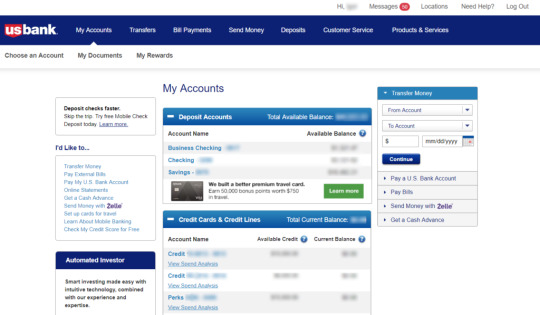

An Insight into eCheck Payments and How They Work - Technology Org

New Post has been published on https://thedigitalinsider.com/an-insight-into-echeck-payments-and-how-they-work-technology-org/

An Insight into eCheck Payments and How They Work - Technology Org

eChecks are otherwise known as electronic checks. They are made from your checking account and they work similarly to regular checks. Instead of having a piece of paper, you will provide your information, including your routing number, payment authorization and bank account details through an online form. This allows your payment to be processed electronically.

Using a credit card for an electronic payment. Image credit: energepic.com via Pexels, free license

How Are eCheck Payments Processed?

eCheck payments are processed via the Automated Clearing House network. This central infrastructure works as a highway to move money electronically. eChecks can be sent faster than paper checks because you don’t need to pay any logistical overheads. Because you don’t have to deal with slips of paper, which can be lost, stolen or damaged, eChecks are seen as more secure.

Security measures are in place to prevent eCheck fraud, ranging from encryption to digital signatures and a solid authentication process. eChecks are particularly suited to online businesses; eCheck online casinos, for example, allow players to use eCheck to make deposits and withdrawals while protecting their bank details.

With casinos handling thousands of online payments per day, eChecks are a fast and efficient way to facilitate payments. Other sectors that use eCheck payments include membership businesses that require a monthly fee, or online retailers. As eChecks are so efficient and easy to adopt, it makes sense for businesses that need to accept lots of payments regularly.

For customers who want to pay via paper check, it’s sometimes possible to take a photo and upload it to the payment portal. The bank can initiate the ACH after “reading” the check digitally. Even by moving to eChecks, traditional payment methods are not overlooked.

E-shopping – illustrative photo. Image credit: Leeloo The First via Pexels, free license

How to Pay via eCheck

There are three main steps involved with sending eCheck payments. First of all, you have customer authorization. In addition to signing an online form, customers can also authorize the payment over the phone. Businesses can then set up either a one-time payment or a recurring payment, which is usually done through a payment processing system.

When the payment information has been received, businesses can submit the details through the ACH network so that the funds can be withdrawn and then deposited in the business’ account. The whole payment processing procedure usually takes between three and five days.

For businesses, there are many advantages to electronic checks. Electronic checks are far cheaper to process when compared to paper checks, not to mention that they are faster. You also have more options for back-office automation and more convenient payment experiences for customers. It’s also an easier process to carry out on a mass scale.

With the right software, businesses can arrange for customer’s direct debits to come out on the same day each month. The account authorization only has to be captured once as well. Cash application software can take the remittance files from the bank, using AI to match the payment manually with the correct invoice within the system.

With the world rapidly moving towards automation, accepting eChecks can help to reduce the manual labor involved with processing payments.

#ai#authentication#automation#Business#credit card#deal#details#easy#eCheck#electronic#encryption#fintech#Fintech news#form#fraud#how#how to#Infrastructure#InSight#invoice#it#mass#money#network#One#online payments#Other#Other posts#paper#phone

0 notes

Text

15 Jahre Qakbot – eine Bilanz

Qakbot (aka QBot oder Pinkslipbot) ist ein Trojaner mit einer mittlerweile 15jährigen Evolutionsgeschichte. Von den Ursprüngen als Banking-Trojaner folgte eine stetige Weiterentwicklung bis hin zu Malware, die heute für die laterale Verbreitung in einem Netzwerk und das Deployment von Ransomware eingesetzt wird.

Nach der Zerschlagung durch Strafverfolgungsbehörden im August 2023 wurde wenige Monate später die 5. Version von Qakbot veröffentlicht. Zscaler analysierte den Wandel einer resilienten, persistenten und innovativen Malware. Kürzlich haben die Sicherheitsforscher festgestellt, dass die Bedrohungsakteure ihre Codebasis aktualisiert haben, um 64-Bit-Versionen von Windows zu unterstützen. Zudem haben sie die Verschlüsselungsalgorithmen verbessert und weitere Verschleierungs-Techniken wurden hinzugefügt.

Die Geschichte des Qakbot-Trojaners

Ursprünglich wurde die Malware 2008 als Banking-Trojaner entwickelt, um Anmeldeinformationen zu stehlen und ACH-(Automated clearing house), Überweisungs- und Kreditkartenbetrug durchzuführen. Die frühen Versionen von Qakbot enthielten einen Datumsstempel und noch keine Versionsnummer, werden aber in der Grafik der Klarheit halber als 1.0.0 bezeichnet. Zu Beginn wurde die Malware als Dropper eingesetzt mit zwei embedded Komponenten im Resource-Teil, die aus einer bösartigen DLL und einem Tool bestanden, das für die Injektion der DLL in laufende Prozesse eingesetzt wurde. Der Funktionsumfang war bereits zu Beginn umfangreich mit einem SOCKS5 Server, Funktionen zum Passwortdiebstahl oder zum Web Browser Cookies sammeln.

Diese frühe Version wurde ausgebaut und 2011 die Versionsbezeichnung 2.0.0 eingeführt. Es folgten Meilensteine der Entwicklung des Funktionsumfangs und 2019 setzte der Wechsel vom Bankbetrug zum Access Broker ein, der Ransomware wie Conti, ProLock, Egregor, REvil, MegaCortex und BlackBasta verbreitete. Im Laufe der Jahre wurden die Anti-Analyse-Techniken von Qakbot verbessert, um Malware-Sandboxen, Antiviren-Software und andere Sicherheitsprodukte zu umgehen. Heute ist die Malware modular aufgebaut und kann Plugins herunterladen um dynamisch neue Funktionen hinzuzufügen.

Jede Versionsnummer verdeutlichte die vorherrschenden Bedrohungstechniken der jeweiligen Periode. So gingen frühe Versionen noch mit hard-codierten Command-und-Controll-Server einher die mit Fortentwicklung der Erkennungstechniken und der Stilllegung von Schadcode-behafteten Domain-Namen abgelöst wurden. Als Antwort darauf wurde Netzwerk-Encryption und ein Domain-Generation Algorithmus (DGA) eingeführt. Allerdings ging mit der Anfrage von einer Bandbreite an Domains ein gewisses Grundrauschen einher und die Qakbot-Entwickler gingen zu einer neuen Multi-tiered Architektur über, die kompromittierte Systeme als Proxy-Server für die Weiterleitung des Datenverkehrs zwischen anderen infizierten Systemen einsetzte. Ein solches Design-Update adressierte das Problem des Single-Point of Failures, reduzierte das Datenaufkommen und half beim Verstecken der C2-Server.

Qakbot 5.0

Die Version 5.0 hat nun die vielleicht wichtigste Änderung am Algorithmus zur Verschlüsselung von Zeichenketten vorgenommen. Die Zeichenketten werden immer noch mit einem einfachen XOR-Schlüssel verschlüsselt. Allerdings ist der XOR-Schlüssel nicht mehr fest im Datenbereich kodiert. Stattdessen wird er mit AES verschlüsselt, wobei der AES-Schlüssel durch einen SHA256-Hash eines Puffers abgeleitet wird. Ein zweiter Puffer enthält den AES-Initialisierungsvektor (IV) als erste 16 Bytes, gefolgt von dem AES-verschlüsselten XOR-Schlüssel. Sobald der XOR-Schlüssel entschlüsselt wurde, kann der Block verschlüsselter Zeichenfolgen entschlüsselt werden.

Der hochentwickelte Trojaner hat sich innerhalb von 15 Jahren stark verändert hin zu einer sehr resilienten und persistenten Bedrohung. Trotz der Zerschlagung 2023 bleibt ist Malware-Gruppierung weiterhin aktiv und wird auch in absehbarer Zukunft ihr Gefährdungspotenzial ausspielen. Die mehrschichtig aufgebbaute Cloud Security Plattform von Zscaler erkennt die Payloads und kategorisiert sie unter dem Namen Win32.Banker.Qakbot.

Passende Artikel zum Thema

Lesen Sie den ganzen Artikel

0 notes

Text

How eCheck payment Processing works with Guide?

"Electronic check (eCheck) payment processing" is a method of transferring funds electronically from one bank account to another, using the Automated Clearing House (ACH) network. Here's a "step-by-step guide on how eCheck payment processing" typically works:

Authorization: The payer (customer) initiates an eCheck payment either online or through a point-of-sale system by providing their bank account details (account number and routing number), along with the payment amount and any other required information.

Verification: The provided bank account information is verified for accuracy and validity. This can involve validating the routing number to ensure it corresponds to a legitimate financial institution and checking the account number format.

Authorization and Consent: The payer authorizes the transaction by agreeing to the terms and conditions set by the payee (merchant or service provider). This authorization may be in the form of an electronic signature or a checkbox indicating consent.

Initiation of Transaction: The payee submits the eCheck transaction details, including the payer's bank account information and the payment amount, to their payment processor or bank.

Transmission to ACH Network: The payment processor or bank forwards the transaction details to the ACH network, which acts as a central clearinghouse for electronic payments in the United States.

Clearing and Settlement: The ACH network processes the eCheck transaction by debiting the payer's bank account and crediting the payee's bank account. This process typically takes 1-2 business days to complete.

Notification of Transaction Status: Both the payer and the payee receive notifications of the transaction status. This may include confirmation of successful payment or notification of any issues, such as insufficient funds or account discrepancies.

Funds Availability: Once the transaction has cleared and settled, the payee can access the funds in their bank account. The availability of funds may vary depending on the policies of the payee's bank.

Record Keeping: Both the payer and the payee maintain records of the eCheck transaction for accounting and reconciliation purposes. This includes details such as transaction date, amount, payer information, and payment reference.

Security Measures: Throughout the eCheck payment process, various security measures are in place to protect sensitive information and prevent fraudulent activity. These measures may include encryption of data, multi-factor authentication, and fraud detection algorithms.

Overall, eCheck payment processing offers a convenient and cost-effective way for businesses to accept payments electronically while providing customers with a familiar and secure payment option.

#High Risk payment gateway iptv#eCheck processing#Best echeck processor#eCheck payment processing#eCheck payment gateway#eCheck merchant account#High risk eCheck processing#ach eCheck processing#eCheck merchant services#Bulk eCheck Processing#High-Volume ACH Payments#Mass Payment Solutions#eCheck Batch Processing#High-Volume Payment Gateway#ACH Bulk Transfers#Enterprise eCheck Solutions

0 notes

Text

Simplifying Business Transactions: The Function of Service Providers for B2B Payment Gateways

With businesses operating on a worldwide scale and transactions happening at lightning speed in today's complicated landscape of commerce, B2B payment gateway service providers have an increasingly important role to play. These organizations provide a variety of solutions aimed at streamlining and simplifying the payment process, acting as the cornerstone of smooth financial transactions between companies. Let's take a closer look at B2B payment gateway service providers and see how they are transforming how companies do business.

Enabling safe and effective payment processing between companies is the core function of B2B payment gateway services. By serving as middlemen, these service providers link companies with financial institutions and make it easier for money to be transferred via a range of payment methods. In order to meet the specific requirements of companies in various sectors, B2B payment gateway service providers provide comprehensive solutions for handling recurring transactions, processing invoices, and receiving payments.

The degree of efficiency and ease that B2B payment gateway service providers offer is one of the main advantages of working with them. These providers automate and leverage state-of-the-art technology to expedite the payment process, thereby lowering the likelihood of errors or delays and minimizing manual intervention. Through a single platform, businesses can originate, track, and reconcile payments with ease, saving important time and resources in the process.

Additionally, B2B payment gateway service providers place a high priority on security and compliance, making sure that private financial information is safeguarded at every stage of the payment process. Businesses are protected against potential security breaches and fraudulent activities by strict encryption protocols, multi-layered authentication mechanisms, and adherence to industry regulations like PCI-DSS (Payment Card Industry Data Security Standard). This fosters confidence in the integrity of the payment process.

B2B payment gateway services are also distinguished by their flexibility and accessibility. In order to satisfy the various requirements and tastes of businesses, these suppliers give a large selection of payment options. Businesses are free to select the payment methods that best fit their needs, whether that be wire transfers, credit/debit card payments, ACH (Automated Clearing House) transfers, or electronic fund transfers (EFT). Furthermore, a lot of B2B payment gateway service providers allow for international payments, which helps companies access a wider audience and interact with partners throughout the globe.

Additionally, B2B payment gateway service providers are essential to improving firms' cash flow management. Through expedited payment processing and instantaneous transaction status information, these providers enable enterprises to maximize cash flow, address liquidity issues, and make well-informed financial choices. Businesses can improve overall financial efficiency by streamlining their receivables and payables operations with features like automated invoicing, recurring billing, and customizable payment schedules.

Numerous B2B payment gateway service providers provide value-added services including vendor management, reconciliation, and dispute resolution support in addition to transactional support. Businesses can increase overall efficiency and productivity by streamlining operations, strengthening vendor relationships, and improving transparency by centralizing different financial tasks onto a single platform.

It is crucial for companies in highly regulated sectors, including healthcare, banking, or government contracting, to work with B2B payment gateway service providers who are experts in regulatory compliance. These suppliers provide customized solutions that guarantee compliance with industry-specific rules and guidelines, reducing the possibility of infractions and the resulting fines.

In conclusion, in today's dynamic industry, B2B payment gateway service providers are essential to the simplification and optimization of company transactions. These suppliers enable companies to carry out transactions with ease, improve cash flow management, and spur expansion by providing safe, effective, and adaptable payment options. B2B payment gateway service providers are essential players in the contemporary business ecosystem, helping to smooth the flow of commerce and enabling companies to prosper in a more competitive environment. They can handle payments, process invoices, and manage vendor relationships.

0 notes

Text

Integrated Treasury Management System: Streamlining Financial Operations

Introduction: An Integrated Treasury Management System (TMS) is a sophisticated financial solution designed to streamline and optimize treasury operations for organizations. This comprehensive system integrates various treasury functions into a single platform, offering enhanced control, visibility, and efficiency in managing cash, investments, risk, and liquidity. In this guide, we'll delve into the concept of an Integrated TMS, its key features, benefits, implementation considerations, and how it can transform financial management for businesses.

1. Understanding Integrated Treasury Management System (TMS):

Definition: An Integrated Treasury Management System is a centralized software platform that consolidates treasury activities such as cash management, risk management, investment management, and financial reporting.

Purpose: The primary goal of an Integrated TMS is to provide organizations with a holistic view of their treasury operations, allowing for better decision-making, risk mitigation, and optimization of cash flow.

Modules: An Integrated TMS typically includes modules for cash management, forecasting, payments, bank connectivity, risk management, compliance, and reporting.

Integration: It integrates with other financial systems such as ERP (Enterprise Resource Planning) and banking systems to facilitate seamless data flow and automate processes.

2. Key Features of Integrated Treasury Management System:

Cash Management: Real-time visibility of cash positions, forecasting, and automated cash flow management.

Payments Processing: Efficient handling of payments, including electronic funds transfers (EFT), ACH (Automated Clearing House), and wire transfers.

Risk Management: Tools for identifying, assessing, and mitigating financial risks such as market risk, credit risk, and liquidity risk.

Investment Management: Tracking and optimizing investments, including short-term investments, money market funds, and term deposits.

Bank Connectivity: Integration with multiple banks for seamless communication and transaction processing.

Compliance and Audit Trails: Ensuring regulatory compliance, generating audit trails, and supporting internal controls.

Reporting and Analytics: Comprehensive reporting capabilities with customizable dashboards, key performance indicators (KPIs), and trend analysis.

3. Benefits of Integrated TMS:

Enhanced Visibility: Organizations gain a real-time, consolidated view of their cash positions, transactions, and risks across multiple accounts and entities.

Improved Efficiency: Automation of routine tasks such as reconciliation, payments processing, and reporting reduces manual errors and saves time.

Better Decision-Making: Data-driven insights and forecasting tools enable informed decision-making regarding cash management, investments, and risk mitigation.

Cost Savings: Optimization of cash flow, reduced bank fees, and improved investment returns contribute to cost savings.

Risk Mitigation: Proactive risk identification and management help organizations safeguard against financial risks and compliance issues.

Scalability: Integrated TMS can scale with the growth of the organization, accommodating increasing transaction volumes and complexity.

Regulatory Compliance: Built-in compliance features ensure adherence to regulatory requirements and reporting standards.

4. Considerations for Implementing Integrated TMS:

Needs Assessment: Conduct a thorough assessment of the organization's treasury requirements, processes, and existing systems to determine the features needed in an Integrated TMS.

Vendor Selection: Evaluate TMS vendors based on their track record, industry expertise, scalability, integration capabilities, and support services.

Integration: Ensure seamless integration with existing ERP systems, banking platforms, and other financial applications.

Customization: Look for a TMS that can be customized to meet the specific needs and workflows of the organization.

Training and Support: Plan for comprehensive training for users and ongoing support from the vendor to ensure successful implementation and adoption.

Data Security: Prioritize data security measures to protect sensitive financial information and ensure compliance with data protection regulations.

ROI Analysis: Conduct a return on investment (ROI) analysis to justify the investment in an Integrated TMS based on potential cost savings, efficiency gains, and risk reduction.

5. Popular Integrated Treasury Management System Providers:

Kyriba: Kyriba offers a cloud-based Integrated TMS with modules for cash management, risk management, payments, and reporting.

Reval (ION Treasury): Reval provides an Integrated TMS focused on cash and liquidity management, risk analytics, and hedge accounting.

SAP Treasury and Risk Management: SAP offers an Integrated TMS within its ERP suite, providing comprehensive treasury functionality integrated with core financial processes.

FIS Quantum: FIS Quantum offers an Integrated TMS with robust cash management, forecasting, and risk management capabilities.

Oracle Treasury: Oracle's Integrated TMS is part of its ERP Cloud suite, offering modules for cash management, payments, and compliance.

6. Conclusion: An Integrated Treasury Management System (TMS) is a powerful tool for organizations looking to streamline and optimize their treasury operations. By centralizing cash management, payments processing, risk management, and reporting, an Integrated TMS provides enhanced visibility, efficiency, and control over financial activities. When considering the adoption of an Integrated TMS, organizations should carefully assess their needs, select a reputable vendor, ensure seamless integration, prioritize data security, and plan for comprehensive training and support. With the right Integrated TMS in place, organizations can transform their treasury functions, drive better decision-making, mitigate risks, and achieve greater efficiency in managing their

For more info. visit us:

Tools to Automate Finance Processes

Software for Finance Reconciliation

Finance Reporting Automation

Treasury management software

0 notes