#Distress Property

Explore tagged Tumblr posts

Text

The Pros and Cons of Buying Distressed Properties

So, you want to buy a house at a cheap rate and look at the foreclosure market. It is tempting to join in and make a purchase given the chance to distressed property and their low prices.

You should know as much as you can about the distressed property before your client buys it like any other major purchase. Buying Distressed Property For Sale can be both rewarding and challenging.

All these properties offer the potential for substantial returns with the right strategy. Investors need to understand the risks and benefits of investing in Foreclosuredaily distressed property for sale making informed decisions maximizing their profit potential.

So explore the risks and benefits related to distressed properties when considering buying a Distress Sale Property.

The Pros of Buying a Distress Sale Property

Here are some main profits of this property investment type:

Less Buyer Competition

Lower competition not only allows you more time to consider the details of the deal. It will also lead sellers to offer incentives for any potential buyer.

Negotiating Power

You will need to have negotiating power for a distressed property so that you can negotiate for a quicker closing having personal property.

Buying at a Discount

Distressed properties generally have motivated sellers and a smaller buyer pool. So it is easier to buy these homes below market value.

Forced Appreciation

This is when you actively add value to a distressed property to immediately increase its value. The key benefit here is that you can potentially turn a profit by selling the renovated property in a short time. The key benefit here is that you can potentially turn a profit by selling the renovated property in a short time.

Risks Associated with Investing in Distressed Properties

With the above-mentioned various advantages of investing in distressed properties here are a few of the potential risks you need to consider:

Unknown Conditions

Distressed Owner sold their distressed Properties in as-is condition. This means that the seller will not make any repairs or offer any financial assistance. This is to help the buyer make required repairs.

High Renovation Costs and Unforeseen Expenses

Renovation costs are infamously difficult to accurately predict. You never know when you will come across an unexpected complication or need to order more materials than you originally budgeted.

Building Permit Issues

Many distressed properties need added renovation requiring building allowance. Failing to understand the permitting method can lead to costly delays.

Conclusion

Distressed real estate investing can be a profitable way of investment. Finding good Distressed Property for Sale from MLS takes work and you will want to thoroughly inspect properties before buying them. This is to make sure they are worth it.

Investors with the right mix of expertise and persistence with a solid game plan can capitalize on this path to outsized profits.

#Distressed Owner#Distress Sale Property#Distress Property#Distressed Property#Distressed Property For Sale

0 notes

Text

Xie Lian Almost Gets Stolen By A Brothel

#Me Talking#tian guan ci fu#heaven official's blessing#TGCF liveblogging#Getting grabbed for a brothel is a very distressing thing to happen especially for Xie Lian and it's good they got away#but since they DID get away it's also... vaguely absurd?#'Feng Xin accidentally destroyed some brothel property so the angry madames came to demand payment'#'and then when they saw Xie Lian's beauty they decided to take HIM as the payment'#PWP-set-up ass situation! Xianxia take on 'my parents sold me to One Direction'!

2 notes

·

View notes

Text

#Distressed homes for sale#Distressed houses for sale#Distressed property near me#Distressed real estate for sale near me#Buy distressed properties

2 notes

·

View notes

Text

Denver Skyscraper Meltdown (Office Towers Collapse into 98% Discount Foreclosure Freefall)

Key Takeaways Over 30% of Denver’s office-building mortgages are delinquent, making it one of the worst-hit metro areas for commercial loan defaults in the U.S. Iconic downtown skyscrapers are selling at up to 98% discounts, signaling historic opportunities—and risks—for investors. Office-to-residential conversions are accelerating, offering long-term buy-and-hold investment potential with tax advantages and strategic entry points. Denver’s skyline is disintegrating under the weight of debt, vacancy, and foreclosure. What happens when billion-dollar buildings can’t even fetch scrap value? Is Denver about to become a real estate investor’s biggest comeback story, or the next Detroit? Historic collapse of Denver’s commercial office market Shocking discounts and foreclosures sweeping the city Investor opportunities in conversions, cash deals, and bulk buys Let’s tear into the chaos and see where savvy investors can strike gold in the rubble. The Implosion No One Saw Coming (But Should Have) Downtown Denver is crumbling—tower by tower, loan by loan. What was once a gleaming symbol of the Rocky Mountain economic boom has turned into a battlefield of delinquent debt and desperate sales. Nearly 30% of office-tied commercial mortgages across the metro are now delinquent, making Denver the third-worst performing office market in the nation, trailing only behind San Francisco and Houston. But this isn’t just a temporary slump—it’s a full-scale unraveling. The dominoes are falling faster than ever. From the iconic Wells Fargo Center, immortalized in the Denver Nuggets skyline, to Republic Plaza, the city’s tallest building, lenders are no longer waiting for a rebound. They’re seizing properties, appointing receivers, and forcing distressed owners to abandon ship. It’s not just vacancy—it’s value vaporization. Towers that fetched hundreds of millions just a few years ago are now barely worth a few million dollars. Investor sentiment has shifted from patient optimism to cold surrender. “We have a lot of 1980s high-rise towers that are mostly vacant,” admitted Amy Aldridge of Tributary Real Estate. “People want to come back to the office, but they don’t want to come back to the 1980s office.” The death of Denver’s outdated office stock has begun. For real estate investors, this isn’t just another cycle—it’s a once-in-a-generation shockwave of wealth transfer. But with blood in the water, will they survive the chaos or capitalize on the carnage? Let’s go deeper. Discounted to Death: Skyscrapers for Pennies on the Dollar Downtown Denver’s towers aren’t just distressed—they’re being fire-sold for prices that would make 2008 blush. In a surreal twist that feels more like a liquidation auction than a metropolitan investment market, massive office complexes once valued in the hundreds of millions are selling for less than 2% of their former worth. These aren’t fringe properties on the city’s edge—these are skyscrapers in the heart of downtown. Case in point: Colorado Plaza Tower I and Tower II, with a combined footprint of 1.14 million square feet, were purchased for just $3.2 million. That’s a shocking 98% discount from their $200 million valuation in 2019. For perspective, that’s $3.30 per square foot in a market where office rents average $41.87 per square foot. Other bloodletting sales include: Hudson’s Bay Centre: Sold for $8.95 million, down from $41.5 million in 2014, an 80% haircut. Lincoln Crossing: Dumped for $10 million, a 90% drop from the 2018 price. Wells Fargo Center: In receivership after defaulting on a $327 million loan. And it’s not just the price tags that are plummeting, equity is being wiped out, leaving owners with nothing but the debt they can’t repay. Even buildings still technically in the black are under quiet distress, with modified loan terms, silent defaults, and lenders playing the “extend and pretend” game just to delay the inevitable. Here’s how the financial carnage looks:

Building Previous Value Sale Price % Discount Status Colorado Plaza Towers I & II $200M $3.2M 98% Sold (conversion planned) Hudson’s Bay Centre $41.5M $8.95M 78% Sold (distressed) Lincoln Crossing $100M+ $10M 90% Sold (distressed) Wells Fargo Center $327M debt N/A N/A In receivership For veteran investors, these prices are either a siren song or a death knell. Are these skyscrapers bargains, or ticking financial time bombs? One thing is clear: the scale of these discounts is more than historic, it’s a once-in-a-century signal that Denver’s commercial core has collapsed in plain sight. And this is just the beginning. The biggest deals are still hiding in the shadows. Zombie Buildings and the “Receivership Shuffle” Denver’s downtown is crawling with zombie towers—soulless shells too broke to function and too expensive to fix. These once-prized properties now sit in purgatory, neither dead nor alive, as lenders scramble to recover what little value remains. At least a third of Denver’s 105 largest office buildings (each over 100,000 square feet) are in some form of extreme financial distress, including: Loan defaults Court-ordered receiverships Outright foreclosures Voluntary ownership surrenders Distressed sales at catastrophic discounts This isn’t just a market correction, it’s a massive asset wipeout happening in slow motion. The infamous Wells Fargo Center, also known as the “Cash Register Building,” is under receivership after Brookfield defaulted on a $327 million loan. Republic Plaza, Denver’s tallest building, narrowly avoided foreclosure by renegotiating $134 million in debt. Meanwhile, lenders are installing third-party managers to stabilize properties and prepare them for auction, repurposing, or demolition. The cycle of distress looks like this: Owner defaults on commercial loan Lender appoints receiver to take control of operations Vacancy soars, and income disappears Asset value plummets Fire sale or foreclosure follows Denver’s downtown core, particularly Upper Downtown, is the epicenter of this collapse. The zone from Lawrence to Lincoln Street and 14th to 20th Street is now known as the “Foreclosure Belt of the Rockies." These aren’t obscure properties. The walking wounded include: Civic Center Plaza (1560 Broadway): Ownership returned to lender Denver Energy Center (1625 & 1675 Broadway): Seized by JPMorgan Chase Trinity Place (1801 Broadway): Claimed at auction by LoanCore Capital 1670 Broadway: Under third-party management after October default 1999 Broadway: Facing potential 70% vacancy if IRS pulls out To make matters worse, federal agencies—once considered ironclad tenants—are fleeing. The Department of Government Efficiency is slashing leases, and the IRS is eyeing a mass exit, gutting an already fragile leasing environment. And just when landlords thought things couldn’t get worse, Elevance Health (formerly Anthem) dealt a deathblow to 700 Broadway, vacating over 258,000 square feet and taking a stable 4.7% vacancy rate to a staggering 60% overnight. Denver’s skyline isn’t just distressed—it’s actively decaying. Investors who don’t understand the “receivership shuffle” may step into a deal that drains them dry before delivering any return. The stakes are sky-high, and the vultures are circling. Investor Warzone or Goldmine? The Redevelopment Gamble Denver’s broken towers may be bleeding capital, but they’re not dead yet. For the bold, they might be the greatest real estate arbitrage opportunity of the decade. Amid this brutal downtown collapse, a quiet renaissance is being whispered behind the scenes: office-to-residential conversions. Developers and deep-pocketed investors are pouncing on the chaos, buying skyscrapers for pennies, then sinking tens of millions into massive renovations, hoping to resurrect them as upscale apartments or mixed-use hubs. The Colorado Plaza Towers I & II are ground zero for this strategy. Acquired for a jaw-dropping $3.

2 million, Los Angeles developer Asher Luzzatto plans to spend $150 million to $200 million transforming the vacant giants into 700+ residential units. It’s the ultimate distressed play: buy the shell for nothing, inject capital, and rebirth the building as a luxury cash-flow machine. But there’s a catch. These buildings weren’t designed for housing. Many were built in the 1950s to 1980s, with deep floor plates, obsolete mechanical systems, and layouts that don’t naturally fit apartments. Add in asbestos remediation, ground leases, and elevator retrofits, and the costs can explode before a single rent check rolls in. Still, the math could work—especially with the steep discounts. Consider: Current residential vacancy in desirable downtown districts remains far lower than office. Rents for upscale urban apartments in Denver continue to outperform aging commercial leases. City officials are actively incentivizing conversions with fast-track approvals and zoning flexibility. With property tax assessments based on residential rates, annual liabilities plummet compared to office use. Here’s the punchline: A healthy office tower generates 4x the property taxes of a residential one. If you bought it at a 98% discount? That tax savings becomes part of your margin. However, success isn’t guaranteed. These conversion plays require: Massive upfront capital Navigating permitting minefields Winning zoning variances Long holding periods before profitability This isn’t a quick flip. It’s a war of attrition, and only the best-capitalized, most patient players will survive. Still, if pulled off, the return on investment could be staggering. Turning Denver’s dead towers into residential gold may become the city’s most dramatic real estate comeback story ever. But only if the visionaries can outlast the chaos. Strategic Entry Points for RE Investors Right Now While institutional giants retreat, private investors have a rare window to seize Denver’s fractured skyline if they know where to strike. This is no time for hesitation. As traditional lenders pull back and national firms offload properties in desperation, nimble investors can wedge themselves into deals once thought untouchable. The barriers are down. The doors are open. The distressed Denver office market has become a target-rich environment for those who move fast. Here’s where savvy real estate investors are making their plays: Joint Ventures with Debt Holders: Private lenders and distressed debt funds are hunting for partners to help stabilize or reposition troubled assets. JV structures allow smaller investors to gain equity access without full capital exposure. Seller Financing Fire Sales: Owners teetering on default may finance a sale just to walk away clean, allowing investors to step in with minimal upfront cash, especially attractive for value-add specialists. Ground Lease Leverage: Some towers, like Colorado Plaza, are on ground leases. While often seen as a complication, these leases can be negotiated or extended, letting investors buy buildings cheap and defer full land costs. Syndicated Capital Raises: With 80%–90% discounts becoming the norm, syndicators are assembling capital quickly to scoop up buildings in bulk. This group investment model is drawing accredited investors eager for outsized upside in a high-risk market. Opportunity Zones & Federal Incentives: Certain sectors of downtown Denver fall within designated Opportunity Zones, creating tax deferral and elimination potential for long-term investors pursuing redevelopment. Watch Zones: Not all of Denver is collapsing. The sharpest divide is forming between zones: Market Zone Status Upper Downtown Collapse underway Skyline Park Corridor High distress, high upside Union Station District Stable and in demand Central Platte Valley Modern, partially leased Cherry Creek & RiNo Top-tier tenant migration Pro tip: Investors should avoid outdated Class B/C towers unless they come with either deep discounts or strong conversion potential.

Focus instead on buildings with structure, location, and zoning flexibility, even if partially distressed. In short, Denver’s downtown disaster is now a developer’s dream and an investor’s litmus test. The deals are there, but only for those who know where to look, how to negotiate, and when to pounce. This isn’t just about timing the market, it’s about timing the implosion. Caution Ahead: Why Not All Distressed Assets Are Hidden Treasures In Denver’s downtown bloodbath, not every fire sale is a fortune. Some deals are dressed-up disasters waiting to detonate your capital. Yes, the headlines are blaring about 98% discounts. But behind those numbers lie ticking time bombs: toxic financing, terminally outdated layouts, and mechanical systems older than the internet. If you think every distressed tower is a hidden gem, think again—some of these buildings are unsalvageable money pits. Before you sink a dollar into Denver’s downtown, consider the real risks lurking beneath the surface: Outdated Infrastructure: Many of the worst-hit towers were built in the 1950s–1980s. Think lead pipes, low ceilings, inefficient HVAC systems, and asbestos in the walls. Retrofits cost millions—sometimes more than the building itself. Unfavorable Ground Leases: Several properties sit on land the buyer doesn’t own. Ground leases can be expensive, expiring, or non-renegotiable, strangling future ROI and complicating financing options. Zombie Tenancy and Leasing Black Holes: Buildings advertising “only 30% vacancy” may have ghost tenants—businesses that exist on paper but haven’t paid rent in months. Or leases that expire within a year with no renewals in sight. Lender-Controlled Death Spirals: Many distressed towers are under special servicing, receivership, or foreclosure, which means navigating multiple parties, legal red tape, and uncertain timelines. You could spend months bidding on a property only for the lender to yank it off the market at the last minute. Use Restrictions and Zoning Limits: Denver may be open to residential conversions, but not every building qualifies. Zoning overlays, height restrictions, historic designations, and structural limitations can kill a conversion plan before it starts. Skyrocketing Conversion Costs: What starts as a $10M steal could end up a $75M headache. Between permitting delays, structural retrofits, union labor costs, and inflation, many redevelopment projects are blown off course before lease-up. Investors chasing the siren song of downtown Denver must learn to differentiate between value and vacancy. There’s a difference between buying low and buying doomed. This market demands due diligence like never before. That means: Walking every property Inspecting every mechanical system Confirming lease status and zoning classifications Modeling worst-case scenarios, not just pro forma dreams Because in Denver’s crumbling core, the greatest fortunes and the greatest failures will be built on the same broken towers. The difference? Who knew what they were really buying? The City’s Future—and Your Window of Opportunity Denver isn’t dying—it’s transforming. But the path forward will be brutal, political, and wildly profitable for the right investors. Behind the boarded-up doors and half-empty high-rises, a new Denver is already beginning to take shape. The city's leadership knows its commercial tax base is collapsing—and with it, the revenue that funds everything from schools to sidewalks. This fiscal squeeze is forcing policymakers to embrace redevelopment and incentivize conversions like never before. According to Denver County Assessor Keith Erffmeyer, the last two-year assessment cycle saw a 25% drop in downtown commercial property values. That number is expected to plunge even further now that deeply distressed sales, some at 90%+ discounts, have begun flooding the books. Here’s the financial fallout: Office-to-residential conversions slash tax revenue. Thanks to Colorado’s

lower residential assessment rate, a converted tower will generate only one-quarter the property taxes of a stabilized office building. Sales and employment taxes vanish. Empty buildings mean no workers, no coffee shop sales, no lunch rush, no dry cleaners, no retail. This ripple effect devastates nearby businesses and erodes Denver’s long-term economic base. Yet… there’s hope. The city has no choice but to rebuild, rezone, and reinvest. Here’s what that means for real estate investors: Zoning Flexibility Is Expanding. Denver planners are under pressure to loosen restrictions to make conversion projects pencil out. New Resident Influx = Long-Term Stability. Every successful tower-to-apartment flip brings hundreds of new residents downtown, fueling demand for retail, amenities, and services. Public-Private Partnerships Are on the Rise. Expect tax incentives, grants, and development subsidies to flow toward those willing to bet big on downtown. This isn’t just a real estate cycle, it’s a civic identity crisis. And it’s one that creative, well-capitalized investors can help solve. You’re not just buying a broken building, you’re buying a stake in Denver’s comeback. The future of Denver’s downtown will be decided not by the city’s bureaucrats, but by the builders, buyers, and visionaries who step in during the chaos. The window is narrow. The stakes are sky-high. And your opportunity is now. Assessment Denver’s downtown skyline is no longer a symbol of growth—it’s a flashing red warning light for cities across America. What we’re witnessing isn’t just a collapse in property values. It’s a violent rebalancing of urban priorities, investor expectations, and commercial real estate fundamentals. For real estate investors, this is a moment of brutal clarity: The rules have changed. The math has changed. But the opportunity has never been greater. Yes, the risks are real: obsolete infrastructure, tenant flight, political uncertainty, and razor-thin margins on conversions. But in every great collapse lies the seed of reinvention. Investors who understand that timing, creativity, and grit now outweigh square footage and prestige will be the ones to reshape Denver and profit from its rebirth. Whether you’re scouting bulk office buys at 10 cents on the dollar, assembling capital for adaptive reuse, or locking in land deals before the next upcycle hits, the battlefield is set. The question is no longer if Denver will recover. It’s who will own it when it does.

#buy and hold#capital injection#capital restructuring#CMBS defaults#Colorado#commercial collapse#debt distress#Denver#distressed assets#downtown investments#foreclosure crisis#government leases#market crash#market implosion#office towers#Receivership#redevelopment#skyscraper deals#tax revenue decline#tenant exodus#tower conversion#tower sales#undervalued properties#Upper Downtown#urban conversions#urban planning#vacancy rates

1 note

·

View note

Text

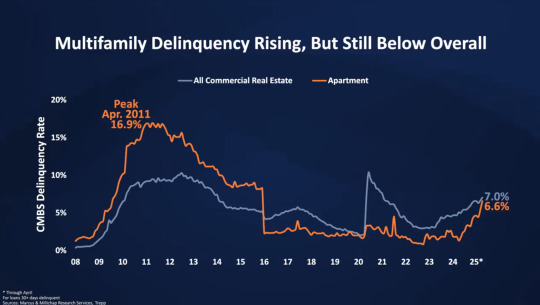

Commercial Real Estate Distress 2025 Trends

Introduction Commercial real estate distress 2025 is taking center stage—but it’s not the crisis many assume. Just ask John Chang, Senior VP at Marcus & Millichap, whose on-the-road market update brings clarity and candor. His perspective captures the volatility of the market—and its resilience. The Delinquency Decipher: Is CRE in Crisis? Is this a wave or just ripples? CMBS delinquency rates rose 50 basis points in 2025—now 200 basis points higher than 2024. But the story is nuanced: Office: 10.3%, still elevated, but below late 2024. Industrial: 0.5%, near-zero distress. Retail: 7.1%, improving from COVID-era highs. Lodging: 7.9%, elevated but not alarming. This isn’t a full-scale meltdown. It's targeted market friction. Multifamily Sector: Where Pressure Is Building The multifamily delinquency rate has reached 6.6% in 2025—up significantly, but still far from the 16.9% seen in 2010–2011. The pressure is localized: Sunbelt metros like Dallas, Phoenix, and Florida Properties acquired at peak pricing with low-interest debt Inexperienced operators now facing loan maturity Chang notes, “This isn’t widespread failure. It’s a matter of misaligned projections and tighter lending.” Lenders Shift Gears: Less Forgiveness, More Action For years, lenders extended terms or deferred payments. In 2025, that flexibility is gone: Loans must be refinanced or sold Notes are changing hands Foreclosure starts are ticking up Distress is entering the market slowly—but firmly. Sector Snapshots: Comparing 2025 CRE Delinquency Office: Still Volatile 10.3% delinquency. Tenant downsizing and hybrid work persist. Industrial: Strong and Steady 0.5% delinquency. Demand remains robust across logistics and warehouse properties. Retail: Mixed Outlook 7.1% delinquency. Results vary by submarket and tenant strength. Lodging: Gradual Rebound 7.9% delinquency. Some assets remain distressed due to slower recovery and rising costs. Multifamily: Watch the Sunbelt 6.6% delinquency. Still manageable, but the Sunbelt faces investor retrenchment. Investor Psychology: Headlines vs. Reality Distress doesn’t mean discounts. Many troubled properties require capital, repositioning, or involve legal headaches. “Extend and pretend” is fading, but buyers must remain cautious. The hype? Overstated. The opportunity? Real—but complicated. Conclusion: Context is Everything in 2025 Commercial real estate distress 2025 is a market reality—but not a repeat of 2008. Each sector is reacting differently, and smart investors are responding accordingly. The fundamentals remain strong where underwriting was sound. “Distress isn’t a wave sweeping across the industry—it’s a trickle, highly localized and sector-specific.” — John Chang Source: https://www.linkedin.com/feed/update/urn:li:activity:7330275843224625152/

#CMBS delinquency rates#commercial real estate trends#industrial property performance#investment climate 2024#lodging sector delinquency#Marcus & Millichap Research#multifamily distress analysis#office space distress#real estate sector comparison#retail property delinquencies

0 notes

Text

Florida Lawyer Bruce Jacobs Permanently Disbarred

Another Moronic Foreclosure Defense Lawyer Bites The Dust! Florida Lawyer Bruce Jacobs Permanently Disbarred! Disbarred Foreclosure Defense Lawyer Bruce Jacobs The Florida Supreme Court permanently disbarred foreclosure lawyer Bruce Jacobs last week. Justices also took an extraordinary step. They enhanced the punishment that Miami-Dade Circuit Judge Betsy Alvarez-Zane called for in her referee…

#Attorney Bruce Jacobs#banks#Bruce Jacobs#bruce jacobs 3rd dca#bruce jacobs florida bar#bruce jacobs law license suspended#Bruce Jacobs Miami Attorney#bruce jacobs suspended#Distressed properties#Florida 3rd DCA#Florida 3rd District Court of Appeals#foreclosed properties#foreclosure defense#foreclosures#HOA Foreclosures#Miami Attorney Bruce Jacobs#mortgage fraud#mortgages#Property Onion#real estate

0 notes

Text

#housingmarket#property#real estate#investmentopportunities#distressedproperties#financial distress#realestatenews

0 notes

Text

Foreclosure Bailout Loan San Diego

Foreclosure Bailout Loans in San Diego: A Comprehensive Guide to Saving Your Home

In San Diego's competitive real estate market, homeowners facing financial hardship can quickly find themselves at risk of foreclosure. The threat of losing your home creates tremendous stress, but it's important to know that foreclosure is not inevitable. Foreclosure bailout loans offer a potential lifeline for San Diego homeowners in distress. This comprehensive guide explores the various options available to you, helping you make informed decisions during this challenging time.

Contact Shop Rates today! https://shoprates.com/foreclosure-bailout-loans-in-san-diego/

Understanding Foreclosure in San Diego County

The foreclosure process in San Diego follows California state laws, which provide homeowners with specific rights and timelines. When homeowners fall behind on mortgage payments, lenders initiate foreclosure proceedings, which can ultimately result in the loss of your home.

The Foreclosure Timeline in California

Missed payments: After missing payments (typically 3-4 months), your lender will issue a Notice of Default.

Notice of Default: This formal document is filed with the county recorder, initiating the pre-foreclosure period.

Redemption period: California law provides a 90-day redemption period during which you can bring your loan current.

Notice of Trustee Sale: If the default isn't cured, a Notice of Trustee Sale is issued, setting a date for your home to be auctioned.

Trustee Sale: Your property is sold at public auction to the highest bidder.

Understanding this timeline is crucial because it helps you identify when and how different foreclosure bailout options might work for your situation.

Types of Foreclosure Bailout Loans in San Diego

When facing foreclosure in San Diego, several specialized loan options exist that might help save your home. Each has distinct advantages and potential drawbacks depending on your unique circumstances.

1. Hard Money Loans for Foreclosure Prevention

Hard money loans in San Diego are offered by private investors or companies rather than traditional banks. These loans are secured by the property itself and are typically easier to qualify for than conventional financing.

Benefits of Hard Money Loans for Foreclosure:

Quick funding (often within 1-2 weeks)

Less emphasis on credit scores

Flexible qualification requirements

Can buy time to arrange more permanent financing

Potential Drawbacks:

Higher interest rates (typically 8-15% in San Diego)

Shorter terms (usually 1-3 years)

Higher origination fees

May require significant equity in your home

When to Consider: Hard money loans work best as a short-term solution when you need to act quickly to stop an imminent foreclosure and have a clear exit strategy.

2. Bridge Loans for Foreclosure Situations

Bridge loans serve as temporary financing to "bridge" the gap between your current financial situation and a more permanent solution. For San Diego homeowners facing foreclosure, a bridge loan can provide crucial breathing room.

Benefits of Bridge Loans:

Quick approval and funding

Can be used to pay off existing mortgage and stop foreclosure

Allows time to sell the property or refinance under better terms

May consolidate multiple debts into one payment

Potential Drawbacks:

Higher interest rates than traditional mortgages

Typically short-term (6-18 months)

May require substantial equity

Often include balloon payments

When to Consider: Bridge loans are ideal when you're expecting a significant financial improvement in the near future, such as the sale of another property or a pending inheritance.

3. Private Lender Foreclosure Rescue Loans

Private lenders in San Diego often offer specialized foreclosure rescue loans designed specifically for distressed homeowners. These lenders may include wealthy individuals, private investment groups, or specialized lending companies.

Benefits of Private Lender Loans:

Highly customized loan structures

More flexible qualification criteria

Faster approval process than banks

May consider unique circumstances banks would reject

Potential Drawbacks:

Higher interest rates and fees

Less regulated than traditional lenders

May require personal guarantees

Terms may be less favorable

When to Consider: Private lender loans make sense when traditional financing options have been exhausted and you have a specific plan for improving your financial situation.

4. FHA Loans for Foreclosure Prevention

The Federal Housing Administration (FHA) offers options that can help San Diego homeowners facing foreclosure, particularly through their FHA-HAMP program (Home Affordable Modification Program).

Benefits of FHA Solutions:

Lower interest rates than private alternatives

Government backing provides additional protections

May include principal reduction in some cases

Longer terms available (up to 30 years)

Potential Drawbacks:

Stricter qualification requirements

Longer application process

Requires FHA-approved lender

Property must meet specific standards

When to Consider: FHA options work best when you have time before foreclosure is imminent and can demonstrate the ability to make restructured payments going forward.

5. Foreclosure Alternative Loans

These specialized products are designed specifically to help homeowners avoid foreclosure through refinancing or restructuring existing debt.

Benefits of Foreclosure Alternative Loans:

Customized to prevent foreclosure

May include principal forbearance

Can consolidate multiple liens

May offer interest-only periods

Potential Drawbacks:

May extend overall debt term

Could increase total interest paid

May require proof of financial hardship

Often requires equity in the property

When to Consider: These loans are ideal when your financial hardship is temporary and you can demonstrate the ability to make restructured payments.

Qualifying for Foreclosure Bailout Loans in San Diego

Securing a foreclosure bailout loan in San Diego requires understanding what lenders look for and how to position yourself as a viable borrower despite your current challenges.

Key Qualification Factors

Equity Position: Most bailout loans require some equity in your property. Lenders typically look for at least 25-30% equity for hard money or private lending options in San Diego.

Exit Strategy: Lenders want to know how you plan to repay the bailout loan. Common exit strategies include:

Selling the property

Refinancing once your financial situation improves

Completing a loan modification with your current lender

Arranging for a permanent financing solution

Income Verification: While less stringent than traditional loans, most foreclosure bailout options still require proof that you can make the new payments.

Property Condition: The current state of your property affects your options. Well-maintained homes in desirable San Diego neighborhoods will qualify for better terms.

Foreclosure Timeline: How far along you are in the foreclosure process will impact which options are available. Earlier intervention generally provides more options.

Improving Your Chances of Approval

Gather complete documentation: Prepare recent tax returns, bank statements, proof of income, and a detailed explanation of your hardship.

Be transparent about your situation: Hiding details will only complicate the process.

Develop a realistic budget: Show how you'll manage the new loan payments.

Consider bringing in co-signers: Family members with strong credit may improve your application.

Work with a foreclosure specialist: Local experts familiar with San Diego's real estate market can connect you with appropriate lenders.

The Application Process for Foreclosure Bailout Loans

Securing a foreclosure bailout loan in San Diego typically follows these steps:

Initial consultation: Meet with potential lenders to discuss your situation.

Property evaluation: The lender will assess your home's current market value.

Application submission: Complete the required paperwork and provide documentation.

Underwriting: The lender reviews your application and property information.

Approval and funding: If approved, loan documents are prepared and funds disbursed.

Loan servicing: Begin making payments according to the new loan terms.

For hard money and private lender options, this process can move quickly—often within 7-14 days. Traditional financing options typically take 30-45 days or longer.

Cost Considerations for Foreclosure Bailout Loans

Understanding the true cost of foreclosure bailout options helps you make informed decisions:

Typical Costs in San Diego

Interest rates: 8-15% for hard money/private loans; 5-8% for more traditional options

Origination fees: 2-5% of loan amount

Processing fees: $1,000-$3,000

Appraisal costs: $500-$800

Title and escrow fees: $1,500-$3,000

Prepayment penalties: Vary by lender

Long-Term Financial Impact

When evaluating bailout loans, consider:

The total cost over the life of the loan

Monthly payment amounts

Any balloon payments required

How the new loan affects your overall financial picture

Tax implications of different solutions

Working with Foreclosure Bailout Loan Specialists in San Diego

The right professional guidance can make a significant difference in navigating foreclosure solutions.

Benefits of Working with Local Specialists

Knowledge of San Diego real estate market conditions

Established relationships with local lenders

Understanding of California foreclosure laws

Experience with distressed property situations

Ability to quickly identify the most viable options

How to Find Reputable Help

Check reviews and testimonials from past clients

Verify professional licenses and credentials

Ask for references from previous foreclosure situations

Confirm membership in professional organizations

Be wary of upfront fees with guaranteed results

Avoiding Foreclosure Loan Scams

Unfortunately, homeowners in distress are often targets for scams. Watch out for these red flags:

Guarantees to stop foreclosure regardless of circumstances

Pressure to sign documents immediately

Requests for upfront fees before services are provided

Instructions to make mortgage payments to someone other than your lender

Suggestions to transfer your deed or title

Remember that legitimate foreclosure assistance programs will never ask you to stop communicating with your lender or to transfer your property deed.

Case Studies: Successful Foreclosure Prevention in San Diego

Case Study 1: Hard Money Bridge Solution

A San Diego family facing foreclosure after medical bills created financial hardship secured a 12-month hard money loan at 10% interest. This provided time to sell their rental property, allowing them to pay off the bridge loan and reinstate their primary mortgage.

Case Study 2: Private Lender Refinance

A self-employed contractor whose business suffered during an economic downturn found a private lender willing to refinance his existing mortgage despite recent income irregularities. The two-year loan provided stability while his business recovered, after which he qualified for conventional financing.

Case Study 3: Foreclosure Alternative Loan

A senior homeowner on a fixed income used a foreclosure alternative loan to consolidate first and second mortgages into a single loan with lower monthly payments, preventing the loss of her home and preserving her retirement security.

Alternative Strategies to Foreclosure Bailout Loans

Loans aren't the only way to address foreclosure in San Diego. Consider these alternatives:

Loan Modification

Working directly with your current lender to modify your existing loan terms can:

Lower your interest rate

Extend your loan term

Add missed payments to the end of your loan

Potentially reduce your principal balance

Short Sale

If you owe more than your home is worth, a short sale allows you to sell the property for less than the mortgage balance, with the lender accepting the shortfall.

Deed in Lieu of Foreclosure

This option involves voluntarily transferring your property deed to the lender, who forgives the mortgage debt in exchange.

Bankruptcy Protection

Filing for bankruptcy, particularly Chapter 13, can stop foreclosure proceedings and provide a structured repayment plan for catching up on missed payments.

Government Assistance Programs

Various state and federal programs offer help to distressed homeowners, including:

California Mortgage Relief Program

Keep Your Home California

Housing and Urban Development (HUD) counseling services

Long-Term Recovery After a Foreclosure Scare

Once you've addressed the immediate foreclosure threat, focus on rebuilding:

Create an emergency fund to prevent future mortgage issues

Rebuild your credit score through timely payments

Develop a sustainable budget that prevents overextension

Consider downsizing if your current housing costs are unsustainable

Work with a financial advisor to create long-term stability

Frequently Asked Questions About Foreclosure Bailout Loans

How quickly can I get a foreclosure bailout loan in San Diego?

Hard money and private lender options can fund in as little as 7-14 days, while more traditional financing typically takes 30-45 days or longer.

Will a foreclosure bailout loan hurt my credit score?

While any new loan appears on your credit report, the impact is generally far less negative than a completed foreclosure would be.

Can I get a foreclosure bailout loan with bad credit?

Yes, particularly with hard money and private lender options that focus more on your property's equity than your credit score.

What minimum equity do I need for a foreclosure bailout loan?

Most San Diego lenders require at least 25-30% equity for hard money or private lending options.

Can I get a foreclosure bailout loan if I'm unemployed?

It's challenging but possible if you have significant equity and can demonstrate an alternative income source or clear exit strategy.

How do foreclosure bailout loans differ from traditional refinancing?

Foreclosure bailout loans typically feature faster funding, less stringent qualification requirements, higher interest rates, and shorter terms than traditional refinancing.

Can rental properties qualify for foreclosure bailout loans?

Yes, both owner-occupied and investment properties can qualify for various foreclosure bailout options in San Diego.

Conclusion: Taking Control of Your Foreclosure Situation

Facing foreclosure on your San Diego home doesn't mean you're out of options. The right foreclosure bailout loan can provide the breathing room needed to reorganize your finances and preserve your homeownership.

The key is acting quickly and working with knowledgeable professionals who understand the San Diego real estate market and foreclosure process. By exploring all available options—from hard money loans to government assistance programs—you can find a solution tailored to your specific circumstances.

Remember that foreclosure is a process, not an event, which means you have multiple opportunities to intervene. The sooner you take action, the more options you'll have available.

If you're facing foreclosure in San Diego, don't wait until it's too late. Reach out to foreclosure specialists today to explore your bailout loan options and take the first step toward saving your home.

This article provides general information about foreclosure bailout loans in San Diego and should not be construed as financial or legal advice. Every situation is unique, and homeowners facing foreclosure should consult with qualified professionals to discuss their specific circumstances.

#Foreclosure rescue loans San Diego#foreclosure bailout loan san diego#foreclosure bailout lender san diego#Hard money loans San Diego foreclosure#Foreclosure prevention loans San Diego#Distressed property loans San Diego#Quick foreclosure loans San Diego#Stop foreclosure San Diego loans#Bridge loans San Diego foreclosure#Real estate foreclosure financing San Diego

0 notes

Text

Best Ways to Sell Your Distressed Property Quickly

The fastest way to sell a distressed property is by working with cash buyers—investors or companies that purchase homes in any condition. This option eliminates the need for repairs, lengthy bank approvals, and buyer financing delays. The process typically follows these steps:

0 notes

Text

Canada housing dips

Canada #housing market losing 30% of value. What’s of other nations affected by pandemic housing spikes View this post on Instagram A post shared by @smallcapsteve

#Canada housing dips#cost of housing#How can we find distressed properties in canada#Show me an example of housing losing its value#why are condos expensive

0 notes

Text

Brookfield Raises $16B War Chest to Snatch Distressed CRE at 40% Discounts

Key TakeawaysBrookfield Asset Management has secured a $16 billion fund to target distressed commercial real estate at significant discounts, with prices up to 40% below peak values.The tightening lending environment and soaring construction costs are accelerating vacancies and foreclosures in major U.S. markets, including Manhattan and beyond.The evolving landscape of commercial properties may lead to transformative shifts in urban real estate across the country. A New Wave of Opportunity in Distressed Real EstateBrookfield Asset Management has raised a $16 billion war chest, poised to strike distressed commercial properties at fire-sale prices, with discounts reaching 40% below peak values—casting a deeper chill over Manhattan’s hollowed office towers and markets from Brooklyn to the Embarcadero.As construction costs soar and lending tightens, vacant skyscrapers and foreclosed homes become battlegrounds, threatening to redraw the property panorama across the U.S.The stakes have never been higher—critical details emerge in the next facts.Brookfield Targets Distressed CRE Amid Market TurmoilBrookfield Asset Management has unleashed a financial shockwave, securing a staggering $16 billion for its fifth flagship real estate fund as office towers sit dark in the shadows of Wall Street.While Battery Park glints in the distance, market valuations are plunging, and formerly premium assets now languish, unseen and unloved.The $16 billion war chest is the largest real estate strategy ever mounted by Brookfield, releasing fresh capital just as debt strategies unravel in a market in disarray.As Q1 2025 unfolded, Brookfield raised an eye-popping $5.9 billion, driving the total fund up to unprecedented territory.Aiming for a final close of nearly $18 billion, the firm’s capital drive scorched through records, marking one of the most seismic quarterly real estate capital raises in modern memory.Empty office buildings cast long shadows across Manhattan as asset prices continue their relentless decline.Amid collapsing market valuations, Brookfield circles distressed commercial real estate with predatory precision, moving in on properties available at discounts averaging 40% below their frothy peaks.In a market environment characterized by rising construction costs and growing uncertainty about inflation policies, distressed assets are appearing in new pockets across the country.The market’s cracks have spread as debt strategies falter.Rising interest rates and tightening lending have sent highly leveraged owners scrambling, driving assets into distress and foreclosure.In this chaos, Brookfield sees opportunity—rapidly deploying $1.8 billion during the first quarter of 2025 alone.In the far reaches of Brooklyn and San Francisco, nearly 3,800 single-family homes and 2,000 foreclosed apartments have already swapped hands, as Brookfield’s buying machine powers forward.Logistics warehouses and apartment buildings represent a quarter of capital deployed so far, while empty clean energy factories, stripped by shifting government policy, now offer conversion prospects for deep-pocketed buyers.As policy makers in D.C. push new tax incentives and rezone neighborhoods to aid multifamily housing, Brookfield is already in position, muscles flexed.In Europe, the fund’s reach extended with the $1.4 billion acquisition of a logistics property owner, while Soho’s retail and office gems quietly traded hands for a quick $40 million siphon of liquidity.Brookfield controls over 500 million square feet, a skyscraper’s worth of commercial property worldwide, as local insiders whisper of the “BAM shadow” along the High Line.Private equity real estate funds collectively pulled in $57.1 billion in Q1 2025, a $25 billion year-over-year leap, but few can match Brookfield’s sheer firepower.By breaking conventional rules, such as mixing asset types and deploying capital across unexpected sectors, Brookfield mirrors strategies used in transformative design for outsized impact.

With market valuations tumbling and debt strategies imploding, the stage is set for a new order in real estate.Quarterly earnings grew 26%, underscoring Brookfield’s dominance as rivals panic.Opportunistic, relentless, and flush with capital, Brookfield’s leadership calls this moment “especially attractive”—a rare window where fortunes are built and shattered across the cityscape.The industry stands at an inflection point as investors look to Central Park and beyond, gauging just how low valuations can go before disaster hits Main Street.Brookfield’s war chest signals a battle for control amid crumbling confidence and relentless uncertainty.Immovable assets, once symbols of stability, now tremble on shaky ground, and the price of inaction increases as the real estate cycle’s storm grows ever more savage.Since industry-wide private real estate fundraising declined for the third consecutive year in 2024, Brookfield’s outsized capital pool stands out against a backdrop of retrenching competitors and dwindling sector allocations.AssessmentBrookfield’s massive $16 billion war chest is making waves in the distressed commercial real estate world, setting the stage for opportunities at deep discounts.With market volatility sweeping from Chicago to Miami, even top-tier assets are up for grabs at prices that haven’t been seen in years.This isn’t the moment to watch from the sidelines—some properties could change hands for less than 60 cents on the dollar.If you hesitate now, you might look back on missed bargains with more than just a twinge of regret.You don’t want to be the investor who sat out while Brookfield seized city landmarks at unheard-of prices.Now’s the time to get off the fence—dig deeper, sharpen your pencils, and consider how your portfolio could benefit before the best deals are gone.

0 notes

Text

Impact of Tariffs on Canadian U.S. Real Estate Investors

As the waves of the Great Recession receded, a notable trend emerged between 2007 and 2008: Canadians were flocking south to purchase vast amounts of distressed properties across the United States. This phenomenon, driven by favorable exchange rates and the perceived value of American real estate, saw many taking advantage of the market collapse. Now, in early 2025, as tensions rise between the…

#Canada#cross-border relations#distressed properties#economic protest#Great Recession#investment#President 47#tariffs#U.S. housing market

0 notes

Text

c.1938 Distressed Property For Sale in Ohio Under $50K

$49,900 Distressed property for sale in Ohio. Imagine developing a vibrant community hub or a unique home business combination. Bring your imagination and expertise to breathe new life into this gem! Realtor Comments Unlock the potential of this versatile distressed property, perfect for multifamily living or running your own business. With ample space the possibilities are endless. The…

#1938#circa#distressed property for sale#oh#oh real estate#Ohio#Ohio real estate#old houses under 50k#real estate

0 notes

Text

Can You Sue Someone for Their Dog Attacking Your Dog in 2024? Answer is really Shocking!

As a pet owner, seeing your furry friend attacked by another dog is heartbreaking. But, you might be able to take legal action against the dog’s owner. Dog bite laws and liability can be tricky, but knowing your rights is key to keeping your pet safe and protecting your family. Table of ContentsKey TakeawaysDifferences Between Human and Pet InjuriesStrict Liability vs. Negligence…

#compensation#dangerous dog breeds#dangerous dogs#disfigurement#document incident#dog attack#dog attack lawsuit#dog bite#dog bite injuries#dog bite lawyer#dog breeds#dog owner liability#dog value#emotional distress#infections#legal action#legal case#legal rights#lost wages#market price#medical expenses#Molosser group#negligence#pain and suffering#pet safety#pit bulls#property damage#proving liability#puncture wounds#recover damages

0 notes

Text

Transform Georgia's Distressed Real Estate into Lucrative Investments with Paradise10

Discover hidden opportunities in Georgia's distressed real estate market with Paradise10. Our expert team is here to help you navigate the complexities of acquiring, renovating, and profiting from properties that others overlook. Whether you’re a seasoned investor or a first-time buyer, we provide the guidance and resources you need to turn distressed properties into valuable assets.

#Lenders For Investment Properties Georgia#Looking For Investors To Buy Property in Georgia#Distressed Real Estate Georgia

0 notes

Text

real estate enterprise

Welcome to our thriving real estate enterprise, where we specialize in the acquisition of diverse properties, including houses, condominiums, and mixed-use developments, across the picturesque landscape of New Jersey. At our core, we are more than just property buyers – we are architects of community transformation, firm believers in the profound impact that quality homes have on fostering strong, vibrant neighborhoods. We buy houses, condominiums and mixed use properties in New Jersey. We believe good houses bring good families that build great neighborhoods.

website: https://cashbuyernewjersey.com/

linkdin: https://www.linkedin.com/company/cashbuyernj

facebook: https://web.facebook.com/CashBuyerNJ/

#Sell house fast NJ#We buy houses NJ#Sell my house for cash New Jersey#Quick house sale NJ#NJ cash home buyers#Sell house as-is NJ#New Jersey property buyers#Fast cash for homes NJ#Sell home without realtor NJ#Buy my house New Jersey#New Jersey home buyers#Sell my house fast New Jersey#Cash for houses NJ#Quick home sale NJ#Cash home offers NJ#House buying company NJ#Sell distressed property NJ#Fair cash offer for home NJ#Home sale for cash New Jersey

1 note

·

View note