#Down payment programs

Text

Get Empowered Today With Our Empower Down Payment Program

Get Empowered Today With Our Empower Down Payment Program

Get up to 3.5% in a forgivable grant after 7 mortgage payments

620 middle credit score

FHA Mortgage AUS Approval

First Time Home Buyer

Attend a Homebuyer Class-We have contact

No income restrictions

Loan Amount high as county limit

Get Down Payment on a Renovation Loan

Georgia, North Carolina, Florida and Colorado

Call us:…

View On WordPress

#Colorado down payment assistance#Colorado Mortgage Company#Down Payment Assistance#Down Payment Grants in Atlanta#Down Payment Grants in Georgia#Down Payment Grants in Greensboro#Down payment programs#First Time Home Buyer#Florida down payment assistance#Floridalender#Georgia#Georgia Buyer Incentives#Georgia down payment assistance#Georgia FHA Loan#Help me buy a home in north carolina#HUD Homes#Low down payment#New Home#North Carolina#North Carolina Loan Officer

0 notes

Text

strongly considering signing up for the study abroad program at school even though i can’t afford it rn, i feel like i could probably have the money together by the payment deadline but hhhhhhh

#im just talking about the down payment too the full cost is. daunting#it’s that or i spend a month or two in colorado later this year and keep saving for the study abroad program NEXT year aaaaahhhhhh#or i stay put and focus on working and saving as much as possible for a bit#help me sylvia plath my figs are rotting

2 notes

·

View notes

Text

if all these fuckin art programs keep doin That Bullshit im gonna consider moving back to firealpaca

#i think one of if not my first program was SAI back when i was a teenager and ngl i really should buy that too#also if u havent heard: CSP is releasing ver 3.0 already and they posted a FLOW CHART on how to upgrade on twttr. LOL#theyre pulling an Adobe Bitch Move and introducing update passes and subscription-based monthly/yearly plans#if i wanna keep it to a one-time payment w the newest shit i need to pay for the ver upgrade to 2.0 and THEN AGAIN for 3.0. clown business#i had a bad feeling this was the eventual road this program would go down based on how closely it reminded me of PS when i first bought it#i dont need cloud storage i dont need a fancy launcher and dumbass fake currencies for a dumbass brush-sharing store i just need to make AR

6 notes

·

View notes

Text

i am once again fantasizing about winning the lottery

#not even the jackpot megamillions bs#i just want to win a scratcher that gives me 30k and i can buy a house#like thats my down payment or whatever and with a first time homebiyer program they can cover my closing costs#and i can afford a mortgage because i can afford rent and theyre the fucking same which is stupid#wouldnt that be so lovely#just a little house its all i want in the entire world

1 note

·

View note

Link

Buying vs. Renting

Homeownership seems more difficult than ever. For our generation, it is far more common to rent a home than to buy one. According to Statista, the number of renters in the U.S. has spiked from just 25.7 million in 1975 to 43 million last year!

Renting has serious drawbacks and actually depletes your long-term wealth. In contrast, homeownership allows for consistency in cost and enables you to build wealth. If you have a steady income, you should buy your home as soon as possible.

3 notes

·

View notes

Text

7 Real Estate Myths Debunked by a Local Real Estate Agent in San Antonio

From charming bungalows to sleek Hill Country havens, our city offers a smorgasbord of homes for every taste and budget. But along with the excitement comes a healthy dose of confusion, fueled by whispers and outdated advice. In the world of real estate, misconceptions can lead to missed opportunities and misguided decisions, especially in a unique market like San Antonio. As a local real estate expert, I’m here to debunk seven common real estate myths, providing clarity and insight into this complex market.

Myth 1: You Don’t Need a Real Estate Agent in the Internet Age.

While online resources provide valuable information, they cannot replace the expertise of a real estate agent. In San Antonio, Ioffer personalized guidance, negotiation skills, and deep insights into trends that online data simply can’t match. Besides, most sites like Offerpad and Opendoor still use agents, and I partner with both of them. Augmented by online resources, an agent can enhance what tends to be the largest human-to-human transaction a person will ever go through.

Myth 2: Setting a Higher Listing Price Nets More Money.

It’s a common misconception that setting a higher listing price will automatically result in more money from a sale. In reality, overpricing can actually repel potential buyers, potentially leading to a longer time on the market and, ironically, a lower final sale price. An experienced real estate agent San Antonio can be a valuable asset in this regard. They bring an understanding of the value of your home and know how to effectively market and showcase it. Pricing a property is more of an art than a science, requiring a balance between the seller’s needs, motivation, and risk tolerance, along with market trends and conditions. Having an agent’s expertise can guide you in setting a competitive and realistic price that appeals to buyers and aligns with your goals.

Myth 3: Renovations Guarantee Increased Home Values.

Not all renovations offer a good return on investment. In San Antonio, agents can advise which upgrades are most effective in boosting your home’s value, considering current market trends and buyer preferences. Moreover, the purpose of renovations can differ. Some are intended to enhance the property’s appeal and sell it faster, potentially creating competition among buyers. Others are aimed at increasing the home’s overall value. Each type of renovation requires a careful assessment of the potential risk versus the anticipated return.

Myth 4: The Best Time to Sell is in Spring and Summer.

Do not fall for the seasonal sale trap! While these seasons are traditionally popular, homes sell year-round in San Antonio. Summer attracts out-of-towners seeking sunshine, while fall brings in families eager for school proximity. Winter may yield lower prices, but the season also brings about a surge of motivated buyers. Moreover, lending market promos can also boost prices during the seasons with a lower volume of buyers.I can help capitalize on market conditions at any time, ensuring you don’t miss out on potential buyers.

Myth 5: All Real Estate Agents are the Same.

The belief that all San Antonio real estate agents are interchangeable is a common misconception and is based upon the idea that all we do is facilitate transactions. In reality, agents differ significantly in terms of their experience, understanding of the market, and areas of specialization. My unique expertise lies in analytics, strategy, negotiation, and communication, skills that are crucial in navigating the complexities of the real estate market. My focus is on leveraging these specialties to provide tailored, strategic advice and effective communication, ensuring that every aspect of your transaction is handled with precision and care.

Myth 6: A Home Passes or Fails an Inspection.

The idea that a home either passes or fails an inspection is a misconception. In reality, a home inspection is a tool for evaluating the condition of the property. It provides a comprehensive look at various aspects of the home, identifying any potential issues or repairs that may be needed. This information is crucial for both buyers and sellers as it informs decision-making and negotiation processes.

I utilize these inspection reports to offer clear, direct guidance. For sellers, this can mean understanding and addressing potential issues before they become stumbling blocks in the transaction. For buyers, it provides a detailed understanding of the property’s condition, which is essential for making an informed purchase decision. I aim to clarify the inspection process and use findings to negotiate effectively, ensuring that my clients are well-informed and prepared at every step of the transaction.

Myth 7: You Must Always Accept the Highest Offer or the First Offer.

The highest offer isn’t necessarily the best. Factors like buyer financing, contingencies, and closing timelines are critical. As your agent, I am duty-bound to present every single offer to you and I take the time to format them in an easily comparable view, helping ensure you are getting the best possible deal. You also aren’t required to accept the first offer on your home. This will be based on risk tolerance, willingness to counter, and how much other interest is in the home.

Conclusion

Understanding the truth behind these myths is key to making informed decisions in the San Antonio real estate market. With the expertise of a licensed local Realtor, navigating this market becomes a more straightforward, informed, and successful journey. Whether buying or selling, the right knowledge and guidance can make all the difference in achieving your real estate goals.

#First Time Home Buyer San Antonio#First Time Home Buyer Programs San Antonio#Down Payment Assistance Programs San Antonio

0 notes

Text

In a landscape where the dream of homeownership can feel out of reach for many due to the daunting upfront costs, The Doce Group steps in to address this challenge head-on with their down payment assistance programs in Florida. These initiatives are a beacon of hope for low- and moderate-income individuals facing significant barriers to purchasing a home. By providing grants and favorable loan terms, The Doce Group effectively navigates the financial hurdles associated with down payments, making the prospect of owning a home a tangible reality for countless Floridians. Visit: https://thedocegroup.com/dpa-programs-down-payment-assistance-programs/

0 notes

Text

Chenoa Fund Program Available to you

Chenoa Fund offerings:

3.5% or 5% down payment assistance

FHA program offerings with a minimum credit score of 600

Industry-leading customer service that guides homebuyers through the home buying process

18 months of post purchase counseling for homebuyers

Minority-focused initiatives to help educate underserved communities about building wealth through sustainable homeownership

Get Down…

View On WordPress

#Atlanta Down Payment Assistance#Chenoa Fund#Chenoa Fund Grant#Chenoa Fund Program#Chenoa Program#Down Payment Assistance#down payment assistance ga#Down payment programs#First Time Home Buyer#Georgia down payment assistance#Georgia FHA Loan#Georgia Home Loan

0 notes

Text

Zillow Home Loans Launches 1% Down Mortgages

Zillow Home Loans Launches 1% Down Mortgages In An Attempt To Compete With Rocket And UWM

Zillow Home Loans announces it is launching a 1% Down Payment program. The new Zillow program would allow eligible first-time home buyers to pay as little as 1% down on their next home purchase. Right now, Zillow is only offering the program to first time Arizona home buyers. However, the company plans to…

View On WordPress

#1 percent down payment programs#1% down payment#banking#banks#debt#liens#mortgages#real estate#Rocket Mortgage 1 percent down payment#UWM 1 percent down payment program#Zillow#zillow 1 percent down program#Zillow Home Loans

0 notes

Text

#thearaizas#arizona#az#realestate#phoenix#phoenixarizona#homebuyers#down payment assistance#Homebuying assistance#homebuyer program

0 notes

Text

Student loan forgiveness shut down by the conservative Supreme Court

#killing myself in front of them to forever strengthen their bond#fml#thankfully the email that came said theyre making a program where debtors under like $38k a year wont have to make payments yet ...but still#this would have changed my life. i might have been able to move out with the right job or disability assistance. fuck.#looking forward to another decade or so of making payments to a degree that did absolutely nothing for me!!#<said with thin trickles of blood dripping down from my eyes

1 note

·

View note

Text

#FHA Down Payment#first-time homebuyer program requirements#first time homebuyer mortgage program#first time homebuyer program#first time home buyers#first time home buyers grant#first time home buyers program#for first time home buyers#Housing market predictions for 2023

0 notes

Text

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

View On WordPress

#100 down kentucky fha loan#10000 down payment assistance kentucy#Federal Housing Administration#home-buying-and-down-payment-assistance-programs-in-kentucky#hud grants#Kentucky#kentucky fha loan grants#ky first time home buyer#Mortgage loan#Welcome Home Grant Program for Kentucky Home Buyers $20#zero down loan kentucky

0 notes

Text

As an EXP Realty agent, Isabel Rodriguez specializes in helping first time home buyers in San Antonio TX, navigate the market and find programs to make their dream of home ownership a reality. Trust her expertise and experience to guide you through the process. Call: 210-508-3000

#first time home buyer in Texas hill country#mortgage broker first home buyer#first time buyer with no down payment#first time home buyer programs in San Antonio TX#down payment on house first time buyer#best lenders for first time buyers#first time home owner mortgage

0 notes

Text

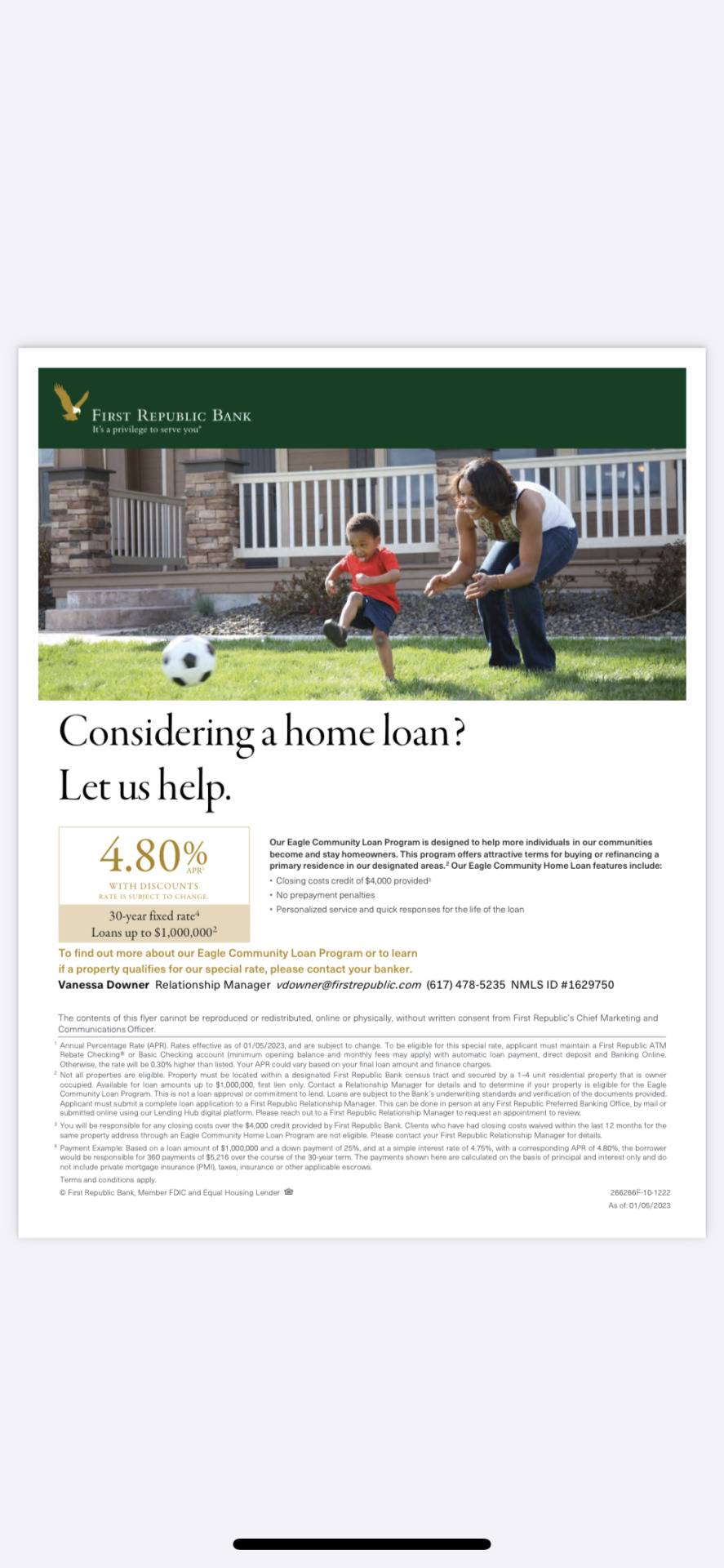

4.75% 30 year fixed mortgage rates available in Chelsea!

4.75% 30 year fixed mortgage rates available in areas of Chelsea! $4,000 lender-paid closing costs.

680+ fico with a minimum of 10% down.

Must be owner occupied.

Singles, condos and multi-families.

http://www.firstrepublic.com

http://157and163Chestnut.com 30 New condos qualify!

Eagle Community Flyer 30-Year no points.

4.75% RATE!

View On WordPress

#157 Chestnut#163 Chestnut#84-86 blossom#86 blossom#chelsea ma#chelsea mass#chelsea real estatae agent#chelsea real etsate#down payment#first eagle program#first republic#jeffrey bowen#low mortgage rates#mortgages#The Chelsea Cathedral#The Chelsea Flats#Vanessa Downer

0 notes

Text

Buying a Home in Atlanta

It’s Your Time to Buy, Sell, Build or Invest and we will be with you every step of the way.

We are Offering a Realtor Credit up to $1500 on New Construction Homes!

GA:678.278.9511 NC:336.638.1299

Email:[email protected]

We offer you 14 Years of Experience!

We also do Mortgage Loans to give you a one stop option!

We have access to Amazing Loan Programs including Down Payment Programs,…

View On WordPress

#Atlanta Agent#Atlanta Homes#Atlanta Realtor#Boost Credit#Buying a Home in Atlanta#Chenoa Program#Down Payment Assistance#Down payment programs#First Time Home Buyer#First Time Home Buyers#Georgia#Grants#New Construction Homes in Atlanta#New Home#USDA Loans

0 notes