#E-Invoice Software in Riyadh

Explore tagged Tumblr posts

Text

Trade Payable in ALZERP Cloud ERP Software

The Trade Payable Report or Accounts Payable Report in ALZERP Cloud ERP software is an essential tool within the accounting module, designed to provide businesses with a comprehensive overview of outstanding balances owed to suppliers or vendors. Similar to the Creditors List Report, this specialized financial report allows businesses to effectively track and manage their accounts payable,…

#Affordable Software#Al-Mubarraz#Best accounting software#Best ERP Software#Buraydah#Cloud ERP Software#Dammam#ERP software#Jeddah#Jubail#Mecca#Medina#QR Code e-invoicing#Retail Business Management#Riyadh#Saudi Arabia Wholesale company management#software#software development in Saudi Arabia#software for Wholesale Business#Tabuk#Taif#Wholesale management software#ZATCA E-Invoicing Integration#ZATCA Phase-II

0 notes

Text

Explore e-invoicing in Riyadh with the best Zatca approved solutions for seamless and compliant invoicing. Discover top Zatca approved e-invoicing in Riyadh to enhance your billing processes. Choose the best Zatca approved e-invoicing in Riyadh for efficient and regulatory-compliant financial management.

1 note

·

View note

Text

E-Invoicing in Saudi Arabia: A Comprehensive Step-by-Step Guide for Your Business

E-invoicing is revolutionizing how businesses handle transactions worldwide, and Saudi Arabia is no exception. With the introduction of mandatory e-invoicing by the Zakat, Tax and Customs Authority (ZATCA), companies across the Kingdom are transitioning to digital invoicing systems. In this comprehensive guide we'll walk you through everything you need to know about e-invoicing in Saudi Arabia, including the requirements, benefits and the best e-invoicing software available.

What is E-Invoicing?

E-invoicing is the process of creating, sending, and receiving invoices in digital format. This system replaces traditional paper-based invoices with electronic versions streamlining the invoicing process and enhancing accuracy and efficiency.

Why is E-Invoicing Important in Saudi Arabia?

In December 2020, ZATCA announced the introduction of mandatory e-invoicing for all taxpayers subject to VAT in Saudi Arabia. The main goals of this mandate are to improve tax compliance, reduce fraud and enhance the efficiency of tax collection processes. The e-invoicing mandate also aligns with the broader Vision 2030 initiative which aims to modernize the Kingdom's economy and foster digital transformation.

Key Requirements for E-Invoicing in Saudi Arabia

To comply with ZATCA's e-invoicing requirements, businesses must ensure their invoices meet specific criteria:

Format: Invoices must be in a structured electronic format, such as XML or PDF/A-3 with embedded XML.

Content: Invoices must include all mandatory fields specified by ZATCA, such as the VAT registration number, invoice date, and a unique invoice identifier.

Archiving: Businesses must store e-invoices in a secure and accessible digital format for at least six years.

Compliance: Invoices must be generated using ZATCA approved e-invoicing software that ensures data integrity and authenticity.

Steps to Implement E-Invoicing in Your Business

1. Understand the Legal Requirements

Before implementing e-invoicing, it's crucial to familiarize yourself with the legal requirements set by ZATCA. This includes understanding the mandatory fields, format specifications, and compliance obligations.

2. Choose the Right E-Invoicing Software

Selecting the best e-invoicing software is crucial for smooth implementation. Look for software that is ZATCA approved e-invoicing in Saudi Arabia, especially ZATCA approved e-invoicing in Riyadh, offers robust features, and integrates seamlessly with your existing systems. Quickdice ERP is one such solution, providing comprehensive e-invoicing capabilities tailored to the needs of businesses in Saudi Arabia.

3. Integrate E-Invoicing with Your Accounting System

Ensure that your e-invoicing software integrates seamlessly with your existing accounting system. This integration will help streamline the invoicing process, reduce manual data entry, and minimize errors.

4. Train Your Staff

Proper training is essential to ensure your staff can effectively use the new e-invoicing system. Conduct training sessions and provide resources to help them understand the new processes and compliance requirements.

5. Test the System

Before going live, conduct thorough testing to ensure your e-invoicing system works as expected. Generate sample invoices, verify the data, and test the integration with your accounting system.

6. Go Live and Monitor

Once you’re confident in the system’s functionality, go live with e-invoicing. Monitor the process closely during the initial phase to identify and address any issues promptly.

Benefits of E-Invoicing

1. Enhanced Efficiency

E-invoicing automates the invoicing process, reducing the time and effort required to generate, send, and process invoices. This results in speedier payments and greater cash flow.

2. Increased Accuracy

Digital invoices minimize the risk of errors associated with manual data entry. This enhances the accuracy of financial records and reduces the likelihood of disputes.

3. Cost Savings

Businesses can save money on printing, postage, and storage by getting rid of paper invoices. E-invoicing also reduces administrative overheads associated with manual invoicing processes.

4. Improved Compliance

Using the best ZATCA approved e-invoicing in Saudi Arabia ensures that your invoices meet all regulatory requirements. This lowers the possibility of audits and penalties for non-compliance.

Best Practices for E-Invoicing in Riyadh

1. Stay Updated with Regulations

ZATCA periodically updates e-invoicing regulations and requirements. To guarantee continued compliance, be aware of these modifications.

2. Maintain Data Security

Ensure that your e-invoicing system employs robust security measures to protect sensitive financial data. This covers secure data storage, access controls, and encryption.

3. Leverage Automation

Take advantage of automation features in your e-invoicing software to streamline repetitive tasks, such as invoice generation and reminders for overdue payments.

4. Monitor Performance

Regularly monitor the performance of your e-invoicing system. Track key metrics, such as invoice processing times and payment cycles, to identify areas for improvement.

Conclusion

E-invoicing is a crucial step towards digital transformation and regulatory compliance in Saudi Arabia. By understanding the requirements, choose the best accounting software in Saudi Arabia, and implementing best practices, your business can reap the benefits of increased efficiency, accuracy, and cost savings. Stay informed about regulatory updates and continuously optimize your e-invoicing processes to ensure long-term success.

Embrace e-invoicing in Riyadh today and position your business for a more efficient and compliant future in the Kingdom of Saudi Arabia.

#business#riyadh#saudi arabia#software#technology#best e-invoicing software#e-invoicing in riyadh#e-invoicing in saudi arabia#accounting#erp#erp software

0 notes

Text

Quickdice ERP offers robust camp software, ideal for organizing and optimizing operations in Saudi Arabia. Manage bookings, inventory, and compliance with Zatca-approved e-invoicing standards seamlessly. Enhance efficiency and customer satisfaction with Quickdice ERP's comprehensive tools tailored for camp management.

0 notes

Text

ZATCA e-invoicing in Saudi Arabia

As businesses in Saudi Arabia adapt to the ZATCA e-invoicing in Saudi Arabia device, the task of thorough ERP solutions can not be overstated. Adox Arabia’s ERP solutions serve as a bridge, hooking up services with the requirements of the digital time. With smooth assimilation, modification, and also hands free operation, these answers inspire businesses to certainly not merely follow ZATCA policies but also flourish in a dynamic as well as reasonable service setting. Embracing Adox Arabia’s ERP solutions is certainly not merely an observance requirement; it is a tactical step towards an even more effective, clear, and digitally equipped future.

0 notes

Text

Key Benefits of Advanced Logistics Platforms for Riyadh Businesses

In the heart of Saudi Arabia, Riyadh is emerging as a powerful logistics hub, driven by innovation, modernization, and the push for digital transformation. As industries expand and customer expectations rise, the need for advanced logistics platforms in Riyadh has never been more critical. These smart systems provide end-to-end visibility, operational efficiency, and strategic control, allowing businesses to streamline operations and boost profitability.

At the forefront of this shift is Five Programmers, a leading name in custom logistics software development company in Riyadh, committed to helping local enterprises stay ahead through cutting-edge, scalable solutions.

Why Logistics Transformation Matters in Riyadh

With Riyadh’s Vision 2030 initiatives supporting rapid industrial growth, the logistics landscape is becoming more complex. Companies in retail, manufacturing, healthcare, construction, and e-commerce are all dealing with tighter delivery windows, real-time customer demands, and rising fuel and operational costs. To stay competitive, these companies are adopting smart logistics platforms that replace outdated manual processes with intelligent automation and data-driven tools.

That’s where advanced logistics software in Riyadh comes in—a game-changer for businesses that want to achieve higher productivity, lower costs, and real-time operational insights.

1. Real-Time Fleet and Delivery Tracking

One of the most significant benefits of logistics platforms in Riyadh is real-time fleet monitoring. Businesses can now track vehicle location, driver performance, and delivery status through GPS-integrated dashboards. This enables:

Immediate route adjustments during traffic congestion

Accurate delivery time estimations

Reduction in fuel wastage

Enhanced driver accountability

With solutions developed by Five Programmers, Riyadh businesses gain control over logistics operations and minimize delays, resulting in happier customers and optimized delivery routes.

2. Seamless Warehouse and Inventory Management

Inefficient inventory handling can lead to overstocking, stockouts, and missed opportunities. Advanced logistics platforms in Riyadh offer real-time inventory visibility, automated stock alerts, and streamlined warehouse processes.

Key features include:

Barcode and RFID integration

Automated replenishment triggers

Real-time inventory updates across multiple locations

Smart categorization and product tracking

By leveraging the power of our custom-built logistics software, Five Programmers helps Riyadh enterprises minimize inventory losses and gain better control over stock movement.

3. Intelligent Route Optimization

Traffic conditions in Riyadh can be unpredictable, affecting timely deliveries. Advanced logistics systems come with AI-powered route optimization that considers traffic, weather, vehicle load, and delivery priorities. This leads to:

Shorter delivery times

Fuel cost reduction

Lower carbon emissions

Higher delivery success rates

Five Programmers integrates this technology into its logistics software in Riyadh, allowing businesses to complete more deliveries with fewer resources—without compromising service quality.

4. Enhanced Operational Efficiency

Manual workflows are prone to delays and errors. Advanced logistics platforms digitize every part of the supply chain—from dispatching to invoicing—reducing the burden of paperwork and speeding up processes.

Benefits include:

Centralized task management

Automated job scheduling

Digital proof of delivery

Electronic documentation

Businesses in Riyadh using logistics software from Five Programmers report faster turnarounds and improved internal collaboration across departments.

5. Improved Customer Experience

Customer satisfaction is directly tied to delivery speed, transparency, and communication. Smart logistics platforms in Riyadh provide customers with:

Real-time tracking links

Automated SMS/email notifications

Digital invoices and receipts

Feedback collection after delivery

When customers feel informed and in control, they’re more likely to trust your brand. That’s why Five Programmers’ logistics solutions are built with end-users in mind, ensuring a seamless experience from warehouse to doorstep.

6. Data-Driven Insights and Performance Monitoring

Making informed decisions requires reliable data. Logistics platforms in Riyadh collect and analyze operational metrics like:

Average delivery time

On-time delivery rate

Driver performance

Vehicle usage efficiency

These insights help Riyadh-based businesses identify bottlenecks, optimize operations, and forecast demand more accurately. Five Programmers ensures each client gets custom dashboards tailored to their KPIs and goals.

7. Cost Reduction and Resource Optimization

When systems are optimized, costs go down. With smart logistics platforms, businesses in Riyadh can reduce:

Fuel and maintenance costs

Overtime and labor inefficiencies

Paperwork and administrative overhead

Missed deliveries and returns

Five Programmers designs logistics software that aligns with your resource capabilities, helping you do more with less.

8. Scalability and Business Growth

As your operations expand, your software should grow with you. Our advanced logistics platforms are modular and scalable, allowing you to:

Add new vehicles, users, or delivery zones effortlessly

Integrate with other business tools (ERP, CRM, etc.)

Adjust workflows based on seasonal demand

Support multi-location operations

Businesses in Riyadh working with Five Programmers benefit from flexible solutions that evolve with their needs—no disruptions, just smooth growth.

9. Regulatory Compliance and Reporting

Riyadh’s logistics industry operates under specific rules regarding safety, taxation, and emissions. Logistics platforms can generate:

Accurate tax reports

Safety and maintenance logs

Route and fuel efficiency summaries

Compliance alerts and reminders

With Five Programmers, you stay compliant and prepared for audits with automated reporting tools that eliminate manual tracking.

10. Integration with Emerging Technologies

To stay future-ready, businesses must embrace innovation. Our logistics platforms in Riyadh support integration with:

IoT sensors for cargo monitoring

Artificial Intelligence for demand forecasting

Machine Learning for delivery pattern recognition

Blockchain for secure and transparent recordkeeping

Five Programmers helps you build a tech-forward logistics ecosystem that gives your business a strategic advantage in a rapidly changing market.

Industries We Serve in Riyadh

Our custom logistics software is suitable for a wide range of sectors, including:

E-commerce

Food & Beverage

Healthcare

Construction

Retail

Pharmaceuticals

Automotive

Courier Services

No matter the industry, Five Programmers delivers software that fits your processes and aligns with your goals.

Why Choose Five Programmers in Riyadh?

Choosing the right tech partner is key to digital transformation. Here’s why Five Programmers is trusted across Riyadh’s logistics sector:

Local expertise with global standards

Fully customized, scalable platforms

Mobile-friendly and cloud-based interfaces

Comprehensive training and after-launch support

Affordable pricing for SMEs and large enterprises alike

We don’t just deliver software—we deliver solutions that drive real impact.

Getting Started with Your Logistics Transformation

Ready to experience the benefits of advanced logistics software in Riyadh? Here’s how Five Programmers gets you started:

Initial Consultation – Understand your current challenges

Custom Design – Create a platform tailored to your operations

Rapid Deployment – Fast implementation with minimal downtime

Staff Training – Hands-on onboarding for your team

Ongoing Support – Continuous updates and improvements

Conclusion: Unlock Your Logistics Potential in Riyadh

In today’s competitive market, logistics is no longer just a backend function—it’s a growth driver. With advanced logistics platforms in Riyadh, businesses can gain better visibility, boost efficiency, reduce costs, and deliver outstanding customer service.

Whether you're a startup or an established enterprise, Five Programmers is here to help you unlock the full potential of your logistics operations. By combining local insight with world-class technology, we’re enabling businesses across Riyadh to lead the future of logistics with confidence.

Transform your logistics. Empower your business. Choose Five Programmers.

#android app development#logistics mobile app development in riyadh#ai driven logistics platform in riyadh#best logistics software solutions in saudi arabia#logistics app development#flutter app development company in riyadh#mobile app development company in saudi arabia#logistics management software

0 notes

Text

Why Olivo Technologies Offers the Best Accounting Software Saudi Arabia Businesses Can Rely On

In the ever-evolving business landscape of Saudi Arabia, financial accuracy and operational efficiency are critical to sustainable growth. As the Kingdom moves swiftly toward digitization—guided by Vision 2030—companies are seeking modern solutions to replace outdated systems and manual processes. Among the most critical tools in this transformation is accounting software.

This article explores why Olivo Technologies stands out as a leader in delivering the best accounting software Saudi Arabia companies can rely on for streamlined financial management, compliance, and long-term scalability.

✅ The Growing Demand for Accounting Software in Saudi Arabia

With increased regulations from the Zakat, Tax and Customs Authority (ZATCA)—including the FATOORAH (e-invoicing) system, Value-Added Tax (VAT), and growing emphasis on digital audits—businesses of all sizes are now mandated to stay digitally compliant. Manual accounting simply isn’t sustainable anymore.

Enter Olivo Technologies.

We understand the local regulatory framework and have designed accounting software that is specifically tailored to Saudi Arabia’s business environment.

🔍 Why Choose Olivo Technologies?

Here are the key features that make our accounting software a top choice in the Kingdom:

✅ Fully VAT-Compliant & ZATCA-Ready Stay compliant with Saudi Arabia’s tax laws with auto-calculations and pre-set templates.

✅ Arabic & English Interface Multi-language support to ensure ease of use for diverse teams.

✅ FATOORAH-Integrated Seamless e-invoicing functionality that meets all the requirements from ZATCA.

✅ Cloud-Based Access Manage your finances from anywhere—ideal for remote teams and growing enterprises.

✅ Customizable Modules From inventory to payroll, CRM to procurement, the software adapts to your needs.

✅ Real-Time Dashboards & Reports Make data-driven decisions with visually rich financial dashboards.

✅ Secure & Scalable Enterprise-grade encryption and the ability to scale as your business grows.

💼 Who Can Benefit from Olivo Technologies' Accounting Software?

Our solution is designed to cater to:

Small to Medium Enterprises (SMEs)

Corporates and Holding Groups

E-commerce Platforms

Healthcare Providers

Retail Chains

Logistics & Transportation Companies

Contractors & Real Estate Businesses

No matter your industry, our software is robust, intuitive, and perfectly suited to the Saudi market.

📊 The Business Impact of Using Olivo Technologies’ Accounting Software

Businesses that switch to our accounting software report:

⏱️ 50% Time Saved on monthly financial tasks

💰 Reduced Errors through automation

🔐 Improved Data Security

📈 Better Strategic Planning using real-time insights

🤝 Improved Client & Vendor Relationships via faster billing and payments

🌍 Local Expertise with Global Standards

While our software is built for the local market, it meets global accounting standards (GAAP and IFRS) ensuring seamless growth for companies looking to expand regionally or internationally.

Plus, our dedicated support team based in Saudi Arabia ensures you get timely assistance in Arabic or English—whenever you need it.

📢 Ready to Digitize Your Finances?

Choosing Olivo Technologies means choosing efficiency, compliance, and innovation. Don’t let outdated systems hold your business back.

Join hundreds of businesses across Riyadh, Jeddah, Dammam, and beyond who have made the switch to smarter financial management.

🔗 Contact Us Today

Explore how Olivo Technologies' accounting software in Saudi Arabia can elevate your business operations.

📍 Visit us at: https://olivotech.com/accounting-software/ 📞 Call us: 966506195881 📧 Email: [email protected]

#AccountingSoftwareSaudiArabia#OlivoTechnologies#FATOORAHCompliant#VATSaudiArabia#ZATCACompliance#SaudiBusinessSoftware#CloudAccountingKSA#FinanceAutomation#DigitalTransformationKSA

0 notes

Text

How Can We Guide Buyers Through Point of sale Software In Pakistan?

ChecPOS #1 Point of sale Software in Saudi Arabia requires top-to-bottom information about all segments and how they interact with each other. You can't just slice it together and guess that the Software should work properly. You can find one-off tickets for POS gear from discount merchants, Amazon, or eBay, except if POS equipment is available for your Software, your product, and even your installment processor. Well, it won't work.

ChecPOS #1 Point of sale Software in Saudi Arabia

Do I need a support agreement?

Really, really, and yes. The Point of sale Software in SaudiArabia the industry has evolved where it is also trivial to think about meeting the overall revenue available solely for equipment and software. Rather, support for the introduced Software is gradually achieved through cost relief agreements. Some support agreements are 'free', in any case, the costs are still included with the general cost of the Software. No matter how you pay for it, we can't stress that it is so important to have a support agreement. Your POS Software is a strategic piece of hardware that stores your business-related money information. Also, let's be honest, by the end of the day, despite everything we discuss innovation, and on the occasion that you've ever turned on a PC, you'll realize that things do happen. ۔ Your business cannot stand to be disconnected in light of the fact that your Software falls. When buying a support contract, it is important to understand what you are getting. The following are the basic degrees of help.

Break-fix support. The most basic degree of support, if something breaks, is that your POS organization will fix it. The trick is, as it may be, that most break-fix understandings do not exclude administrative procedures, for example, directing and preparing. Guidelines for endorsement. An intermittent phase, your affairs will not be settled, yet your POS organization will tell you how they fixed them or make you work on your issues so that you can resolve them yourself later. ۔

Every minute of support every day. Realistically obvious, yet when it comes to serving your meals, there is a support agreement that loneliness will not help you during standard business hours.

Preparing Some support contracts involves preparation, which we would like to think is an important asset. One-on-One manufacture allows customers to truly open up their Point of sale Software in Saudi Arabia and take full advantage of the amazing machine. Regardless of how a Software is linked and played, end-users need to realize how to use this product successfully before the POS Software runs.

Check the POS equipment you need.

Access to your Point of sale Software in Saudi Arabia has many fringe gadgets accessible, and you don't have to worry about any major part of it. Most essential management should include a POS terminal, mini cabinet, receipt printer, and standard scanner identification.

What kind of POS terminals do I need?

The breakthrough in innovation has introduced buyers to a larger group of POS terminal choices.

Touch screen computer The touch screen terminal board is across the PC that does not require enough space and does not require a lot of wires because everything has a little bit of equipment. Pray with a solid-state hard drive to increase implementation and dependency. This arrangement will have many ports to include in the fridge gadget.

Personal computers and touch screen monitors. This arrangement is usually the most economical but it has some negative relationship. To get started, there are two separate bits of PC and screen hardware, which create the impression of a Software and require additional cabling. Next, PCs are structured like office/home PCs, not as a POS Software. We have found in recent years that this arrangement produces essentially a large number of issues compared to a touch screen PC. Similarly, personal computer boards are much more delicate than strong expressions across the touchscreen. Droplets drops and upper parts will be able to damage the PC.

Touch screen monitors can make a difference. Not all screens are created equal. Most inexpensive screens usually have sloping edges, which can trap residues and flotsam and jetsam. True Flat screens are fully level, which makes them very easy to perfect and offers today's seamless selection.

How many POS terminals do I want to get ??

Most retail stores are regrettably planned to need their Point of sale software at the usual customer volume. Rather, the volume of POS stations should be set to high business volume. Longer checkout lines only give clients the opportunity to evaluate their purchase, and a stable Point of sale software regularly pays for itself in a short period of time.

Needless to say about other hardware?

Mini drawer Innovation inevitably changes, yet one of the consistencies in the world of POS is that the most ideal way to keep money safe is with a solid metal box. A money cabinet should go with each station you have to use to end the exchange.

Receipt Printers. Present-day receipt printers use direct innovation for 'print' invoices. Basically, the content sinks into the receipt paper. This innovation offers a variety of benefits, including the ink disposal of the ink and printer strips in the structure. The heated exchange element must be prepared in the long run, yet it lasts essentially longer than the average cartridge or belt. Printer speed and printer goals Receipts are an essential distinction between printers. A receipt printer should go with each PO station.

Standard tag scanners. Standard Identification Scanners read standard tags using various steps, for example, one-line test and all-way inspection. Single-line scanners are much cheaper, however, they should manage to use standard identification correctly. On the other hand, scanners on each side can use a standard ID at any location and do a commendable job in high volume situations, which may be costly in addition. The volume of the item and the speed of checkout should determine what type of scanner you need. Scanners can be similarly remote or check for IDs. These highlights can be valuable for specific foundations, they may be more valuable than basic models.

Client / Pole Pole Allows the client to see the cost and cost of the client through the clerk. These gadgets are a bit much for the Point of sale Software in Pakistan to work on, yet give the client a higher incentive on a regular basis. LCD client presentations can likewise be linked to the rear portion of the POS station and the grandstand advertising and promotion when not used for exchange.

Standard Identification Printer If you sell a stock that does not have its own scanner tag, then a scanner tag printer allows you to print custom scanner tags to speed up the checkout process. Stylized tag printers regularly need an additional software module so that they can join Point of sale software in Pakistan. Standard identification marks come in a variety of standard formats and estimates and can be reworked as well. It is important for this so-called product to be physically integrated into a Point of sale Software in Saudi Arabia, however, this technique can be a hindrance to the checkout process and in addition, presents the possibility of client error.

Characteristics of ChecPOS Software in Saudi Arabia:

Data Rationalization

POS Software in Saudi Arabia | Makkah | Madinah | Riyadh

Customer Management

Analytics of Sales

Self-service Kiosk

Inventory Tracking

Fast Checkout

Automatic Purchasing of Inventory

POS Software in Saudi Arabia | Makkah | Madinah | Riyadh

Mobile Ordering

Data Security

Mobile Payments

E-commerce integration

PCI compliance

Brick-and-mortar stores

POS Software in Saudi Arabia | Makkah | Madinah | Riyadh

POS software in the cloud

Click to Start Whatsapp Chat with Sales

Mobile: +966547315697

Email: [email protected]

0 notes

Text

Trial Balance in ALZERP Cloud ERP Software

In the accounting module of ALZERP Cloud ERP software, the Summarized Trial Balance Report is a powerful tool that offers a high-level overview of a company’s financial standing at a specific point in time. This report is an essential part of the accounting process, helping businesses ensure that their bookkeeping is mathematically accurate and in balance. What Is a Trial Balance? A trial…

View On WordPress

#Affordable Software#Al-Mubarraz#Best accounting software#Best ERP Software#Buraydah#Cloud ERP Software#Dammam#ERP software#Jeddah#Jubail#Mecca#Medina#QR Code e-invoicing#Retail Business Management#Riyadh#Saudi Arabia Wholesale company management#software#software development in Saudi Arabia#software for Wholesale Business#Tabuk#Taif#Wholesale management software#ZATCA E-Invoicing Integration#ZATCA Phase-II

0 notes

Video

youtube

Annamalai assignment 2019 Answer sheets in online whatsapp 9924764558

ADVANCED WEB DEVELOPMENT AND DESIGN TOOLS MBA ANNAMALAI ASSIGNMENT ANSWER SHEETS PROVIDED WHATSAPP 91 9924764558

CONTACT:

DR. PRASANTH MBA PH.D. DME MOBILE / WHATSAPP: +91 9924764558 OR +91 9447965521 EMAIL: [email protected] WEBSITE: www.casestudyandprojectreports.com

ANNAMALAI UNIVERSITY

DIRECTORATE OF DISTANCE EDUCATION

M.B.A. E. BUSINESS

SECOND YEAR

Academic Year 2018 - 2019

ASSIGNMENT TOPICS

This booklet contains assignment topics. Students are asked to write the

assignments for SIX papers as per instructions, those who have opted Project and

Viva-Voce.

Students are asked to write the assignments for the EIGHT Papers as per

instruction those who have opted Two Theory Papers (2.7.1 & 2.7.2) as specialisation.

Last date for submission : 28-02-2019

Last date for submission with late fee ` 300/- : 15-03-2019

NOTE:

1. Assignments sent after 15-03-2019 will not be evaluated.

2. Assignments should be in the own handwriting of the student concerned

and not type-written or printed or photocopied.

3. Assignments should be written on A4 paper on one side only.

4. All assignments (with Enrolment number marked on the Top right hand

corner on all pages) should be put in an envelop with superscription “MBA

Assignments” and sent to The Director, Directorate of Distance Education,

Annamalai University, Annamalainagar – 608 002 by Registered post.

5. No notice will be taken on assignments which are not properly filled in with

Enrolment Number and the Title of the papers.

6. Students should send full set of assignments for all papers. Partial

assignments will not be considered.

ASSIGNMENT INSTRUCTIONS

Write assignments on any TWO topics in each paper out of the FOUR. For

each Topic the answer should not exceed 15 pages. Each assignment carries

25 marks (2 topics).

DR. M. ARUL

DIRECTOR

2

2.1 E-COMMERCE

1. Enumerate Security of Internet hosts and networks, Public key infrastructure,

Safety of E-Commerce applications, Electronic payment systems, Trust and

reputation in E-Commerce.

2. Discuss about the prevention procedures of the firewall to avoid the attack of

Hackers.

3. “Online Shopping generate new economy”- Comment your opinion with proper

Justification.

4. Discuss the role played by E-commerce in providing customer service at the

various stages (product selection to post purchase) in an online buying

transaction.

2.2 E-COMMERCE: APPLICATION AND SECURITIES

1. Is the e-payment system secured? How? and why not? Discuss different types

of e-commerce payment systems available globally.

2. Elaborate the Past, Present and Future of the World Wide Web.

3. The Emerging Role of Banks in E-Commerce and Application of E-commerce in

Banking.– Discuss

4. Security Issues & Challenges to E- Commerce, Looking Ahead to the Future of

E-Commerce Security-Elaborate.

2.3 INTERNET AND JAVA PROGRAMMING

1. “The Internet has no single owner, yet everyone owns (a portion of) the Internet. The

Internet has no central operator, yet everyone operates (a portion of) the Internet” –

Discuss.

2. Can DHTML be used to create website? Create a website for an online marketing

company. Explain the process.

3. “Application security features are built into the JAVA language”. Discuss on how to

take advantage of these features and several other simple measures to ensure Java

Application Security”.

4. “Java Database Connectivity is an application programming interface (API) which

allows the programmer to connect and interact with databases” - Discuss.

3

2.4 ADVANCED WEB DEVELOPMENT AND DESIGN TOOLS

1. What is Java Script. Explain the following of Java Script with suitable

examples?

a. Operations

b. Statements

c. Functions

d. Event handling

e. Objects

f. Frames and windows

g. Cookies

h. Creating links

i. Using images

j. Doing maths

2. Explain various HTML tags used for creating a web page with suitable example.

Elaborate the procedure to convert XML to HTML and HTML to XML.

3. What is a Java Bean? Discuss the architectural overview of Java Bean. Explain

the components of Java Bean. Explain the properties of Java Bean with suitable

coding.

4. What is servlet? Explain the lifecycle of a servlet. Explain the methods to read

HTTP header. Explain the methods to set HTTP Response Header.

2.5 ENTERPRISE RESOURCE PLANNING

1. How will you execute the Gap Analysis phase of ERP implementation for a very

large manufacturing industry? Discuss the steps involved in this scenario.

2. Explain the Planning and Execution Model based on integrated process for a

service industry.

3. Discuss the common myths about ERP and find practical solutions for dispelling

them in your organization.

4. Most companies today have made significant investments in information

technology systems. Write a case study of Integrating ERP, CRM and SCM

creates a single view of organizational profitability.

2.6 STRATEGIC MANAGEMENT

1. Do a SWOT Analysis for Reliance Jio 4G services in Indian market and

analyse the strategic approach of reliance communication in this regard.

2. What were the major strategic drawbacks of Kingfisher Airlines? What was the

vital reason for its dropdown? Consider the strategic issues and justify it.

3. Illustrate with examples of hyper competition and competitive dynamic

approaches in strategic marketing.

4. Why would management adopt a stability strategy? Can stability strategies

be viable over a lengthy period of time? Why or Why not?

4

2.7.1 GLOBAL MARKETING

1. Discuss the various terms of trade and explain about the concept and

components of Balance of payments.

2. Elucidate the tariff and non tariff barriers and discuss about reasons for foreign

exchange control.

3. Explain the functions and responsibilities of IMF and IBRD.

4. Write the export licensing procedure and forms required for exports.

2.7.2 STRUCTURED SYSTEM ANALYSIS AND DESIGN

1. Draw the context diagram and a set of data flow diagrams for developing a

library management system with the following functionalities. List the

assumptions made in your analysis.

a. Inquiring the availability of a book by giving the ISBN or title or author's

name

b. Renting a book that is available

c. Returning a book after use

d. Reserving a book when it is not available

e. Collection of overdue charges

f. Maintaining book details

g. Maintaining supplier details who supply the goods.

2. Design a set of files for supporting a common payroll system. Comment on the

data security issues of the file system you have designed.

3. Assume that you are in charge of designing software to be installed in bank

ATM. Which kind of architecture would you choose? Give reasons for your

selection and draw the architecture diagram of the system.

4. Assume that you are given the following details of a small mail order catalogue

system that allows people to shop from home:

When a customer receives the catalogue and wants to buy something, he can

telephone, fax or email his order to the company. The company gets the order

and sends the goods and an invoice. When the customer receives the goods with

a delivery note, he sends payment and receives a receipt for payment. Draw the

context diagram and data flow diagrams up to level-2 to analyze the

requirements of this system. Also, give the data dictionary.

M.B.A.[E.B.] – 2ND YEAR – Assignment - AUP/551/C-200

ANNAMALAI UNIVERSITY PRESS 2018 - 2019

ANNAMALAI UNIVERSITY

DIRECTORATE OF DISTANCE EDUCATION

M.B.A. INTERNATIONAL BUSINESS

SECOND YEAR

Academic Year 2018 - 2019

ASSIGNMENT TOPICS

This booklet contains assignment topics. Students are asked to write the

assignments for SIX papers as per instructions, those who have opted Project and

Viva-Voce.

Students are asked to write the assignments for the EIGHT Papers as per

instruction those who have opted Two Theory Papers (2.7.1 & 2.7.2) as specialisation.

Last date for submission: 28-02-2019

Last date for submission with late fee ` 300/-: 15-03-2019

NOTE:

1. Assignments sent after 15-03-2019 will not be evaluated.

2. Assignments should be in the own hand writing of the student concerned

and not type-written or printed or photocopied.

3. Assignments should be written on A4 paper on one side only.

4. All assignments (with Enrolment number marked on the Top right hand

corner on all pages) should be put in an envelop with superscription “MBA

Assignments” and sent to The Director, Directorate of Distance Education,

Annamalai University, Annamalainagar – 608 002 by Registered post.

5. No notice will be taken on assignments which are not properly filled in with

Enrolment Number and the Title of the papers.

6. Students should send full set of assignments for all papers. Partial

assignments will not be considered.

ASSIGNMENT INSTRUCTIONS

Write assignments on any TWO topics in each paper out of the FOUR. For

each topic the answer should not exceed 15–pages. Each assignment carries

25 marks (2 topics).

DR. M. ARUL

DIRECTOR

2

2.1 INTERNATIONAL HUMAN RESOURCE MANAGEMENT

1. How does the environment concerning human resource management in India

vary from that of developed countries? Elaborate.

2. Manpower planning is considered as the most primary and important task of HR

department internationally. Why is it not so in India? Also discuss the

consequences of not planning manpower requirements.

3. Your Organisation is a multinational company based at India. Simultaneously

three executives looking after three geographical area decides to quit. The top

Management is asking you to conduct the exit interview for those tendered their

resignation. How would you organize the exit interview? Will you impress upon

them to continue? If “Yes” why? If “No” Why Not?

4. Oil Refinery Company in Riyadh is recruiting supervisory staff for its refinery

operation. Suggest suitable recruiting process for the company.

2.2 INTERNATIONAL MARKETING MANAGEMENT

1. “Major environmental influences always have an impact on International

marketing” – Discuss the above statement with recent live examples.

2. Discuss briefly, modes to enter international market and recommend mode of

entry and its implications for success of a new product across multiple markets.

3. “Modern marketing concept is applicable to all business organisations

irrespective of their size or nature of the goods or services marketed”- Do you

agree or disagree? Give your justification.

4. Branding is hot topic in board rooms around the world because most CEOs

recognise that the strong brand is a powerful driver in shareholder value. In this

connection, what are the key elements that contribute to brand equity? Is it

possible to quantify brand equity? If so How? Give recent examples.

2.3 INTERNATIONAL FINANCIAL MANAGEMENT

1. Discuss the foreign exchange market, procedure for quotation and arbitrage.

Narrate current situation of Euro currency and Euro Credit.

2. Elaborate the different criteria and difficulties in evaluating foreign projects

while making international investment decision for developing countries

investors.

3. Critically evaluate the International Financial Market Instruments. Discuss the

internal and external techniques of risk involved in the International Business.

4. What do you understand by International Portfolio Investment? Critically

evaluate the key elements of taxation with suitable examples.

3

2.4 LOGISTICS AND SUPPLY CHAIN MANAGEMENT

1. Mr. Sarath, CEO of a Multinational company has decided to construct a

warehouse in the central part of the India. He approaches you for designing the

warehouse. Counsel Mr. Sarath in designing the warehouse with different sizes

and shapes and explain its relationship with material-handling system. Suggest

the reason for constructing different designs of warehouses by explaining its

advantages and disadvantages.

2. Mr. Puneeth has recently opened a logistical service agency. When he enters into

the business, many agencies face different legal problems related to logistical

operations. Mr. Puneeth does not know how to run the business without any

legal problem. As a logistical legal consultant, advise Mr. Puneeth about various

transport regulations to overcome legal problems.

3. You are assigned the position of Chief Manager in a logistics company located at

Mumbai. You have customers across globe. Your responsibility is to collect the

goods from various sources and export it from the nearest port. How do you do

the operation, and explain the problems you may face during the logistical

operations?

4. “Supply chain management is need of the hour for current business scenario” –

Substantiate your views for the above statement by explaining the real time

success stories of any three business firms of your choice.

2.5 GLOBAL STRATEGIC MANAGEMENT

1. AMUL is the India’s largest food products organization and the market

leader in whole milk, condensed milk, milk powder, butter, cheese, ice

cream, dairy whitener and sweets. “Amul-Diversifying for Growth” looks at

how the co-operative integrated approach adopted by Amul has been

successfully used to dominate the dairy products market and how it is

utilizing its strong brand name to diversify into non-dairy products,

processed foods, and other products. Discuss.

2. India’s strict regulations against allowing FDI in retail sector prevent the

entry of the foreign retailers to our country. Discuss the attempt of foreign

retailers to enter the land of opportunities through different strategies.

3. Explain the Leadership Re-organization. Discuss about Wipro’s Co-CEO

model. Will Wipro achieve what it set out to do by appointing Co-CEOs?

4. Transformation of an Indian Family Business into a globally competitive

Firm: Illustrate how companies from emerging market like Mahindra &

Mahindra (M&M) from India are competing globally by leveraging on their

core competencies.

4

2.6 INTERNATIONAL TRADE POLICIES AND DOCUMENTATION

1. Briefly explain the Export and Import policy (2002-2017) of India. Identify the

gains and losses of those policies.

2. Enumerate the procedures to establish a new Export Oriented Units and explain

the terms of shipment and processing of export order.

3. Elucidate the risks involved in export and also discuss about the export

incentives and Duty exemption schemes for importing capital goods.

4. Elaborate the impact of current monetary policies on India’s International trade.

2.7.1 INTERNATIONAL MARKETING RESEARCH AND CONSUMER BEHAVIOUR

1. A company manufacturing electronic goods wants to know how best it can

satisfy its potential buyers in the Asian market. Give your suggestions for

formulating an appropriate marketing research proposal.

2. According to your understanding, is the process of product research is

important in International marketing? Justify.

3. Discuss the major ethical issues in International marketing with three

examples.

4. Assume you are appointed as a marketing head in a leading FMCG company in

India. As part of the development process the company wants to expand its

business operations internationally to its neighboring countries. You are given

the task as following. a) Identifying the market and its segmentation b) Studying

the consumer behavior c) Do product research d) Examining the market

opportunities. Narrate your role to carry out the above task by doing market

research.

2.7.2 EXPORT AND IMPORT FINANCE

1. Line of Credit is a short term sources of finance for exporter & importer – will

you accept? Explain with examples.

2. Inflation rate as well as interest rates will affect the value of currency rates –

Discuss and also explain the reasons for variation of the inflation rate.

3. “Export incentives are major factors to encourage the EXIM business”- Do you

agree? Explain with suitable examples.

4. “Credit Insurance agencies will help the exporter & importer in financial

payments” – Prove it.

M.B.A. [I.B.] – 2ND YEAR – Assignment - AUP/551/C-350

ANNAMALAI UNIVERSITY PRESS - 2018 -2019

0 notes

Text

Choosing the Best E-Invoicing Software: Features and Considerations

In today's digital landscape, selecting the right and best e-invoicing software is crucial for businesses aiming to streamline financial operations and ensure compliance with local regulations, particularly in regions like Saudi Arabia where Zatca approved e-invoicing in Riyadh solutions are mandatory. This guide explores essential features and considerations to help you make an informed decision.

Key Features to Look for in E-Invoicing Software

Compliance with Zatca Regulations: Ensure the software is compliant with Saudi Arabia's Zatca regulations for e-invoicing to avoid penalties and ensure legal adherence.

Integration with Accounting Systems: Seamless integration with existing accounting software enhances efficiency and reduces manual errors in financial reporting.

Automation of Invoicing Processes: Features like automated invoicing generation and delivery save time and reduce administrative burden.

Security and Data Privacy: Robust security measures and compliance with data privacy standards (e.g., GDPR) protect sensitive financial information.

Customization and Scalability: Software that can be tailored to fit your business needs and scale as your company grows ensures long-term usability.

User-Friendly Interface: Intuitive design and ease of use streamline adoption across your organization, reducing training time and costs.

Reporting and Analytics: Advanced reporting capabilities provide insights into financial trends and help in strategic decision-making.

Mobile Accessibility: Access to invoicing functions via mobile devices allows for flexibility and remote operations.

Benefits of Using E-Invoicing Software

Efficiency: Streamlined processes reduce invoicing time and improve cash flow management.

Accuracy: Automation reduces errors that occur during manual data entering.

Cost Savings: Reduced paper usage, postage, and administrative costs contribute to overall savings.

Compliance: Ensures adherence to local tax laws and regulations, such as Zatca in Saudi Arabia.

Improved Cash Flow: Faster invoicing and payment processing accelerate cash flow cycles.

Enhanced Customer Relationships: Timely and accurate invoicing improves customer satisfaction and loyalty.

How to Choose the Best E-Invoicing Software

Assess Your Needs: Identify specific invoicing challenges and business requirements to determine which features are essential.

Research and Compare: Look for software providers specializing in accounting and e-invoicing in Saudi Arabia, considering factors like customer reviews and industry reputation.

Demo and Trial: Request demos and trials to evaluate user interface, features, and compatibility with your existing systems.

Check Compliance: Ensure the software complies with Zatca regulations and other relevant standards applicable to your business.

Scalability: Choose software that can grow with your business and adapt to future needs without significant disruption.

Support and Training: Evaluate the provider's customer support options and training resources to ensure smooth implementation and ongoing assistance.

Cost Considerations: Compare pricing plans and consider the return on investment (ROI) in terms of efficiency gains and cost savings.

Feedback and References: Seek feedback from current users and ask for references to validate the software's performance and reliability.

Conclusion:

Choosing the best e-invoicing software and the best accounting software in Saudi Arabia requires a careful evaluation of features, compliance with KSA regulations, integration capabilities with accounting e-invoicing in Saudi Arabia, and overall ease of use. By prioritizing ZATCA approved e-invoicing in Saudi Arabia and considering the unique needs of your business, you can effectively streamline invoicing processes, enhance financial transparency, and drive operational efficiency in Riyadh and beyond.

#saudi arabia#riyadh#software#business#technology#e-invoicing in saudi arabia#e-invoicing in riyadh#zatca approved e-invoicing in saudi arabia#best e-invoicing software#accounting e-invoicing in saudi arabia

0 notes

Text

Quickdice ERP redefines accounting e-invoicing in Saudi Arabia with unparalleled efficiency. As the best accounting software in Saudi Arabia, it seamlessly integrates cutting-edge e-invoicing capabilities, ensuring streamlined financial processes. Trusted by businesses, Quickdice ERP stands out as the top choice for comprehensive accounting and e-invoicing solutions. Experience unparalleled convenience and compliance with Quickdice ERP, the best e-invoicing software.

#saudi arabia#riyadh#al jubail#e-invoicing in riyadh#best e invoicing software#accounting e-invoicing in Saudi Arabia

0 notes

Text

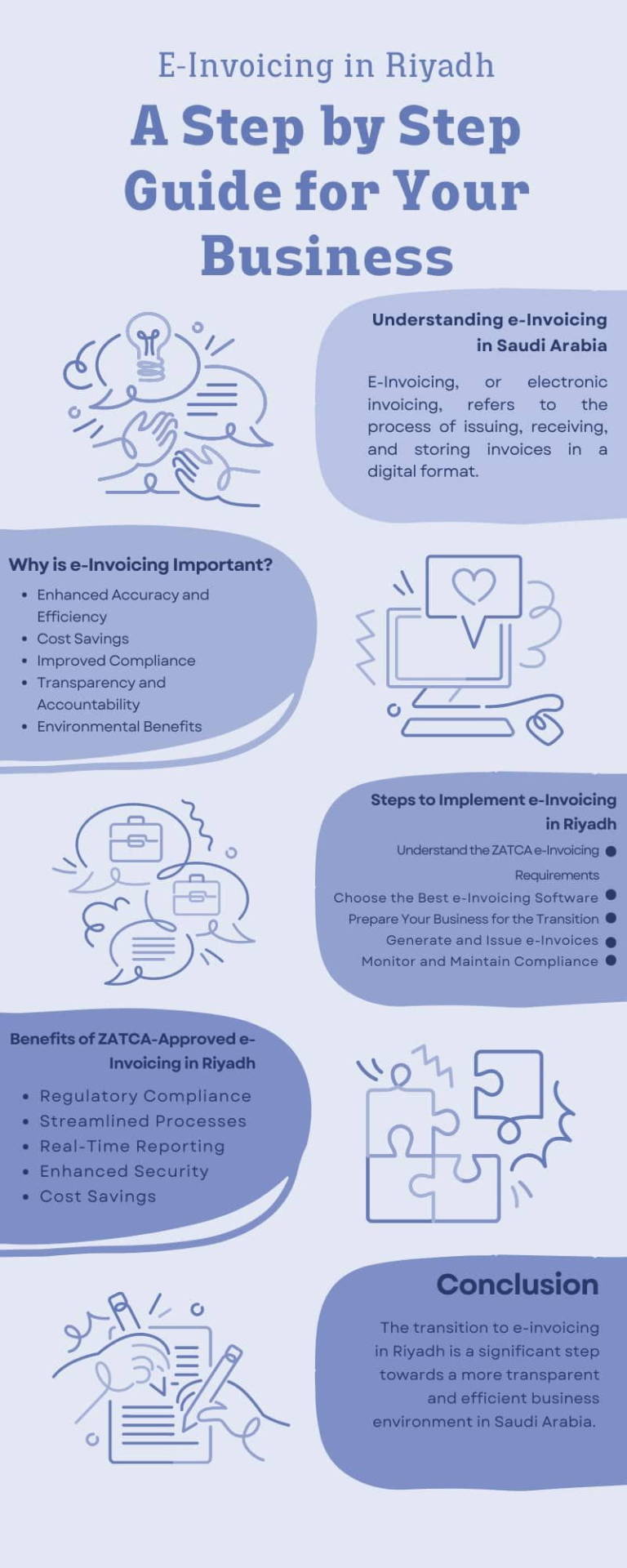

E-Invoicing in Riyadh: A Step by Step Guide for Your Business

The Kingdom of Saudi Arabia is at the forefront of digital transformation, and one of the significant advancements in this journey is the implementation of e-invoicing. The Saudi Arabian government, through the Zakat, Tax and Customs Authority (ZATCA), has mandated e-invoicing to streamline tax collection, improve compliance, and foster transparency in business transactions. This comprehensive guide will walk you through the essential aspects of e-invoicing in Riyadh and help your business adapt to this critical change seamlessly.

Understanding e-Invoicing in Saudi Arabia

E-Invoicing, or electronic invoicing, refers to the process of issuing, receiving, and storing invoices in a digital format. Unlike traditional paper-based invoices, e-invoices are generated, exchanged, and archived electronically, eliminating the need for manual intervention and reducing errors. In Saudi Arabia, the e-invoicing mandate by ZATCA aims to combat tax evasion, enhance economic efficiency, and create a more transparent business environment.

Why is e-Invoicing Important?

The transition to e-invoicing in Saudi Arabia brings several benefits to businesses and the economy as a whole:

Enhanced Accuracy and Efficiency: e-Invoices minimize human errors and automate the invoicing process, leading to faster and more accurate transactions.

Cost Savings: By eliminating the need for paper, printing, and postage, businesses can significantly reduce operational costs.

Improved Compliance: e-Invoicing ensures that all transactions are recorded accurately, making it easier for businesses to comply with tax regulations.

Transparency and Accountability: The digital nature of e-invoices provides a clear audit trail, enhancing transparency and reducing the risk of fraud.

Environmental Benefits: Reducing paper usage contributes to environmental sustainability by lowering the carbon footprint.

Steps to Implement e-Invoicing in Riyadh

Implementing e-invoicing in your business involves several steps. Here is a step-by-step guide that will assist you traverse the process:

Step 1: Understand the ZATCA e-Invoicing Requirements

The first step is to familiarize yourself with the ZATCA e-invoicing requirements. ZATCA has outlined specific guidelines and standards that businesses must adhere to when issuing e-invoices. These include:

Mandatory Fields: Ensure that your e-invoices contain all the required fields, such as buyer and seller details, invoice date, VAT number, and line item details.

XML Format: e-Invoices must be generated in the prescribed XML format to ensure compatibility with ZATCA's systems.

Digital Signature: e-Invoices must be digitally signed to ensure authenticity and integrity.

Archiving: Businesses are required to store e-invoices electronically for a specified period.

Step 2: Choose the Best e-Invoicing Software

Selecting the best e-invoicing software is crucial for a smooth transition. Look for the best ZATCA approved e-invoicing in Riyadh that meets all regulatory requirements and offers the following features:

Compliance: Ensure the software complies with ZATCA's guidelines and supports the mandatory fields and XML format.

Integration: The software should integrate seamlessly with your existing accounting and ERP systems.

User-Friendly Interface: A user-friendly interface will make it easier for your team to generate and manage e-invoices.

Security: Look for software that offers robust security features, including data encryption and digital signatures.

Support and Training: Choose a vendor that provides comprehensive support and training to help your team get up to speed with the new system.

Step 3: Prepare Your Business for the Transition

Before implementing e-invoicing, it's essential to prepare your business and employees for the transition. Here are some actions to think about:

Training: Conduct training sessions for your accounting and finance teams to familiarize them with the new e-invoicing system and processes.

Data Migration: Ensure that all your existing invoices and customer data are migrated to the new system accurately.

Testing: Conduct thorough testing to identify and resolve any issues before going live with e-invoicing.

Communication: Inform your customers and suppliers about the transition to e-invoicing and provide them with any necessary instructions or guidelines.

Step 4: Generate and Issue e-Invoices

Once your e-invoicing system is set up and tested, you can start generating and issuing e-invoices. Follow these steps to ensure compliance with ZATCA's requirements:

Create the e-Invoice: Use your e-invoicing software to generate the e-invoice in the prescribed XML format. Ensure that all mandatory fields are included, and the invoice is digitally signed.

Send the e-Invoice: Send the e-invoice to your customer electronically. Ensure that the invoice is delivered securely and received by the correct recipient.

Archive the e-Invoice: Store the e-invoice electronically in a secure and compliant manner. Ensure that the invoice is easily accessible for future reference and audits.

Step 5: Monitor and Maintain Compliance

After implementing e-invoicing, it's essential to continuously monitor and maintain compliance with ZATCA's requirements. Here are some actions to think about:

Regular Audits: Conduct regular internal audits to ensure that all e-invoices are generated, issued, and archived in compliance with ZATCA's guidelines.

Stay Updated: Keep yourself informed about any updates or changes to ZATCA's e-invoicing regulations and ensure that your e-invoicing system is updated accordingly.

Feedback and Improvement: Gather feedback from your team and customers to identify any areas for improvement in your e-invoicing process and make necessary adjustments.

Benefits of ZATCA-Approved e-Invoicing in Riyadh

Adopting a ZATCA approved e-invoicing in Riyadh offers numerous benefits for your business:

Regulatory Compliance: Ensure your business complies with ZATCA's e-invoicing regulations, avoiding penalties and fines.

Streamlined Processes: Automate and streamline your invoicing processes, reducing manual effort and errors.

Real-Time Reporting: Benefit from real-time reporting and validation of invoices, enhancing transparency and accuracy.

Enhanced Security: Protect your invoices from tampering and unauthorized alterations with tamper-proof security features.

Cost Savings: Save on printing, postage, and storage costs by eliminating paper-based invoices.

Conclusion

The transition to e-invoicing in Riyadh is a significant step towards a more transparent and efficient business environment in Saudi Arabia. By understanding the ZATCA e-invoicing requirements, choosing the right e-invoicing software, and preparing your business for the transition, you can ensure a smooth and compliant implementation. Embrace the benefits of e-invoicing, such as enhanced accuracy, cost savings, and improved compliance, and position your business for success in the digital age.

In summary, e-invoicing in Saudi Arabia, especially in Riyadh, is not just a regulatory requirement but a strategic move towards modernizing your business operations. Stay compliant, choose the best e-invoicing software, and leverage the advantages of this digital transformation to drive growth and efficiency in your business.

#saudi arabia#riyadh#e-invoicing in riyadh#zatca approved e-invoicing#e-invoicing in saudi arabia#software#business#technology#ksa

0 notes

Text

How to Choose the Right Accounting Software for Your Saudi Arabian Business

In today's digital age, choosing the best e-invoicing software is crucial for businesses in Saudi Arabia looking to streamline their financial operations ensure compliance with local regulations and make informed decisions based on accurate financial data. With a myriad of options available, selecting the best accounting software for your specific needs can seem daunting. This guide aims to simplify the process by outlining key factors to consider and highlighting some of the best accounting software solutions available in Saudi Arabia.

Understanding Your Business Needs

The first step in selecting accounting software is to assess your business's unique requirements. Consider the size of your business, the complexity of your financial transactions, the number of users who will need access to the software, and any specific features or integrations you may need (such as VAT compliance features in Saudi Arabia).

Features and Functionality

When evaluating accounting software options, prioritize essential features such as:

Core Accounting Functions: Ensure the software covers basic accounting tasks like invoicing, expense tracking, and financial reporting.

VAT Compliance: In Saudi Arabia, VAT compliance is mandatory for businesses meeting certain revenue thresholds. Look for software that automates VAT calculations and reporting to simplify compliance.

Scalability: Choose software that can grow with your business. Scalable solutions accommodate increased transaction volumes and user numbers without compromising performance.

Integration Capabilities: Consider software that integrates smoothly with other essential business tools you use, such as CRM systems or inventory management software.

Cloud-Based vs. On-Premises: Decide whether a cloud-based or on-premises solution best fits your business. Cloud based software offers flexibility and accessibility while on-premises solutions provide more control over data and security.

User-Friendliness and Support:

Opt for accounting software that is intuitive and user-friendly, minimizing the learning curve for your team. Look for providers that offer comprehensive customer support, including training resources, tutorials, and responsive technical support in Saudi Arabia's local business hours.

Security and Compliance:

Security is paramount when handling financial data. Choose software that employs robust encryption protocols and ensures compliance with data protection regulations applicable in Saudi Arabia.

Cost Considerations:

Compare pricing structures and consider the total cost of ownership, including initial setup costs, subscription fees, and any additional charges for extra users or advanced features. Balance affordability with the software's capabilities and the value it brings to your business.

Conclusion

Choosing the best e-invoicing software for your Saudi Arabian business requires careful consideration of your specific needs, including compliance requirements, scalability, user-friendliness, security, and cost. By evaluating these factors and exploring reputable software solutions tailored for the Saudi Arabian market, you can make an informed decision that enhances efficiency, ensures compliance, and supports your business growth.

Investing in the right accounting software not only simplifies financial management but also positions your business for long-term success in the dynamic Saudi Arabian business landscape.

For businesses in Saudi Arabia looking to streamline their financial operations and ensure compliance with local regulations, selecting the right accounting software is crucial.

#saudi arabia#riyadh#e-invoicing#best e-invoicing software#software#business#service provider#technology

1 note

·

View note

Text

Empowering Businesses: Trading and Inventory Software Solutions in Saudi Arabia

In the dynamic landscape of Saudi Arabia's business environment the efficient management of trading and inventory operations is essential for success. Trading software and inventory software emerge as needed tools offering businesses the capabilities you need to streamline your processes and optimize your operations.

Tailored Solutions for Saudi Arabia: Trading software and inventory software tailored specifically for the Saudi Arabian market provide businesses with localized features and support. These solutions ensure seamless integration and compliance with local regulations empowering businesses to navigate the complexities of the Saudi business landscape with confidence.

Optimizing Trading Operations: Trading software in Saudi Arabia enables businesses to manage your buying and selling activities more effectively. From order placement to execution and settlement trading software provides businesses with real time insights into market trends and trading performance allowing you to make informed decisions and capitalize on opportunities.

Efficient Inventory Management: Inventory software in Saudi Arabia offers businesses the tools you need to efficiently manage your inventory levels, track stock movements and minimize stockouts and overstock situations. Automating processes such as stock tracking, replenishment and order fulfillment inventory software helps businesses optimize your inventory management practices and improve operational efficiency.

Read more: E-invoicing in Saudi Arabia

Enhancing Business Performance: By integrating trading software in Saudi Arabia and inventory software in Saudi Arabia into operations, businesses in Saudi Arabia can enhance your overall performance and competitiveness. These solutions provide businesses with the visibility and control they need to optimize your trading and inventory management processes, reduce costs and drive revenue growth.

Conclusion

Trading software and inventory software play crucial roles in helping businesses in Saudi Arabia thrive in today's competitive market. By leveraging these advanced solutions businesses can streamline your operations, enhance efficiency and position themselves for long-term success and growth in the dynamic Saudi business landscape.

Read more: E-invoicing in Riyadh

#riyadh#saudi arabia#al jubail#e-invoicing in Saudi Arabia#E-invoicing in Riyadh#trading software in saudi arabia#trading software#inventory software in saudi arabia#inventory software

1 note

·

View note