#ECB-30

Note

it works, i managed to solve it by completely reinstalling the app!! yaaay!!! say, do you know how much money do you need to spend to be able to complete the event and get jude's card? if I have about 18 sent hearts by now? Im wondering if its worth it to spend money or not, hehe

hi anon! sorry i couldn’t get to your other ask, but that’s awesome! as for how much money you need to spend, it depends on how much resources like tickets, coins, and cocktails you have saved already — and how much you’re willing to expend. i’ll put more under the cut!

what i will say is if you have prepared or saved for this event for a while, you can pretty comfortably complete the event or get jude’s card as the ecb by getting the 💎6,800 package (15 story tickets, 15 cocktails, 🩷6,000), which is avail during the first 80 hours of the event.

also if you’re going to get any gem pack, i would always opt for the highest package you can get, as you pay less per gem, the more you spend. for example, if you get the 💎380 gem pack for $2.99, that would make the cost per gem $0.78. but if you get the 💎6,400 gem pack for $40.99, you will pay $0.64 per gem. other than that, it’s hard to pinpoint an exact cost, so let me give you some references # of times sent each set can give, along with the price you’d pay assuming you have 💎0 and no resources saved prior, so you can make the judgment for yourself. also note:

listed prices do not include tax and are in usd, so you may be paying a bit of a higher amount. there are also other ways to combine gem packages, which may result in lower prices than what i listed.

prices may differ if you choose to sort of purchase multiple packages at once.

the minimum number assumes you use the items in the set during no lucky times, while the maximum number assumes you use the set items’ cocktails during 3x escort lucky time and the story tickets in the most optimal chapter during 2x lucky time.

sorry for any numerical miscalculations; this really is meant to sort of give a general picture, so to speak.

i’m assuming completing a route gives you 10 hearts, but don’t quote me on that.

for reference, jude’s card is the 280 times sent reward if you send that many within the next now-around-59-hours, or is also available if you send 570 times and didn’t make the ecb. the pink hairstyle is the 350 times sent ecb.

first 80h package — 15 story tickets, 15 cocktails, 🩷6,000 : 💎6,800 (= $45.98, with 💎260 overflow) : 107–204 times sent, or 174 times if you expend the 15 cocktails during 2x lucky time escort

any of the sets with a plushie — dr. 〇〇 plushie (★3, 140BP), 10 cocktails, 1 closet, 🩷600 : 💎1,980 (= $14.98, with 💎80 overflow) : 26–66 times, or 46 times if you use the 10 cocktails during 2x lucky time

platinum set — 15 cocktails, 15 story tickets, 🩷1,000 : 💎4,000 (= $29.98, with 💎400 overflow) : 57–156 times, or 126 times if you use the 15 cocktails during 2x lucky time

gold set — 10 cocktails, 8 story tickets, 🩷500, 3 closets : 💎2,500 (= $19.99, with 💎500 overflow) : 30–95 times, or 75 times if you use the 10 cocktails during 2x lucky time. and this leaves 3 story tickets over

silver set — 4 cocktails, 5 story tickets, 🩷200, 3 closets : 💎1,300 (= $9.99, with 💎100 overflow) : 15–56 times, or 48 times if you use the 4 cocktails during 2x lucky time

value set — 1 cocktail, 2 story tickets, 🩷100, 2 closets : 💎490 (= $3.98, with 💎10 overflow) : 3–7 times, or 5 times if you use the 1 cocktail during 2x lucky time. this also leaves 2 story tickets over

again i apologize for any nitty gritty errors, but i hope this gives at least like .. a general idea! 🙏 lemme know if you wanna know anything else and i can try to help!

7 notes

·

View notes

Text

so i just figured out that you need to have at least one 5star card + three 4star cards of the suitor for their bday party in order to get the early clear bonus card/his pov. otherwise, unless you’re willing to spend money/diamonds, you won’t get the ECB. (in other words this will mostly be for f2p players or players who don’t want to spend anything on the bday events)

this is just my experience tho after doing four bday events

for leon’s bday event i got ECB and finished to level 30 with three 5star cards + one 4star for a total of 6,004 card BP. i did salons consistently, i even set timers so i wouldn’t let the ap refill all the way.

for yves’ bday event i slacked off a bit with the salons. i let the ap sit at 100 for an hour or two a couple of times… but i still got ECB. i have one 5star + three 4star cards for a total of 4,072 card BP. i reached at least level 27 because i got the dress but i did not finish to level 30.

for nokto’s event i also wasn’t really on top of it i didn’t really care about doing his event. i just wanted the materials. i have one 5star and three 4star for a total of 4,056 card BP. i only got up to level 22 but i got the ECB.

currently for licht’s event my gosh i don’t even wanna talk about it i’m so disappointed. i only have four 4stars for a total of 2,978 card BP. i am on level 12 at the time of writing this and only 3 hours left for the ECB… i have no resources i already spent 150 diamonds after triggering the 2x lucky time (i also used the two party sets they give you for logging in).

pls pray to the ikepri gacha gods that i get a 5star jin card because this four 4 star 2,794 card BP jin deck isn’t funny.

also notice how licht’s card deck BP doesn’t have a 4 in it maybe 4 really is my lucky number and this is why i can’t get the ECB /hj

16 notes

·

View notes

Text

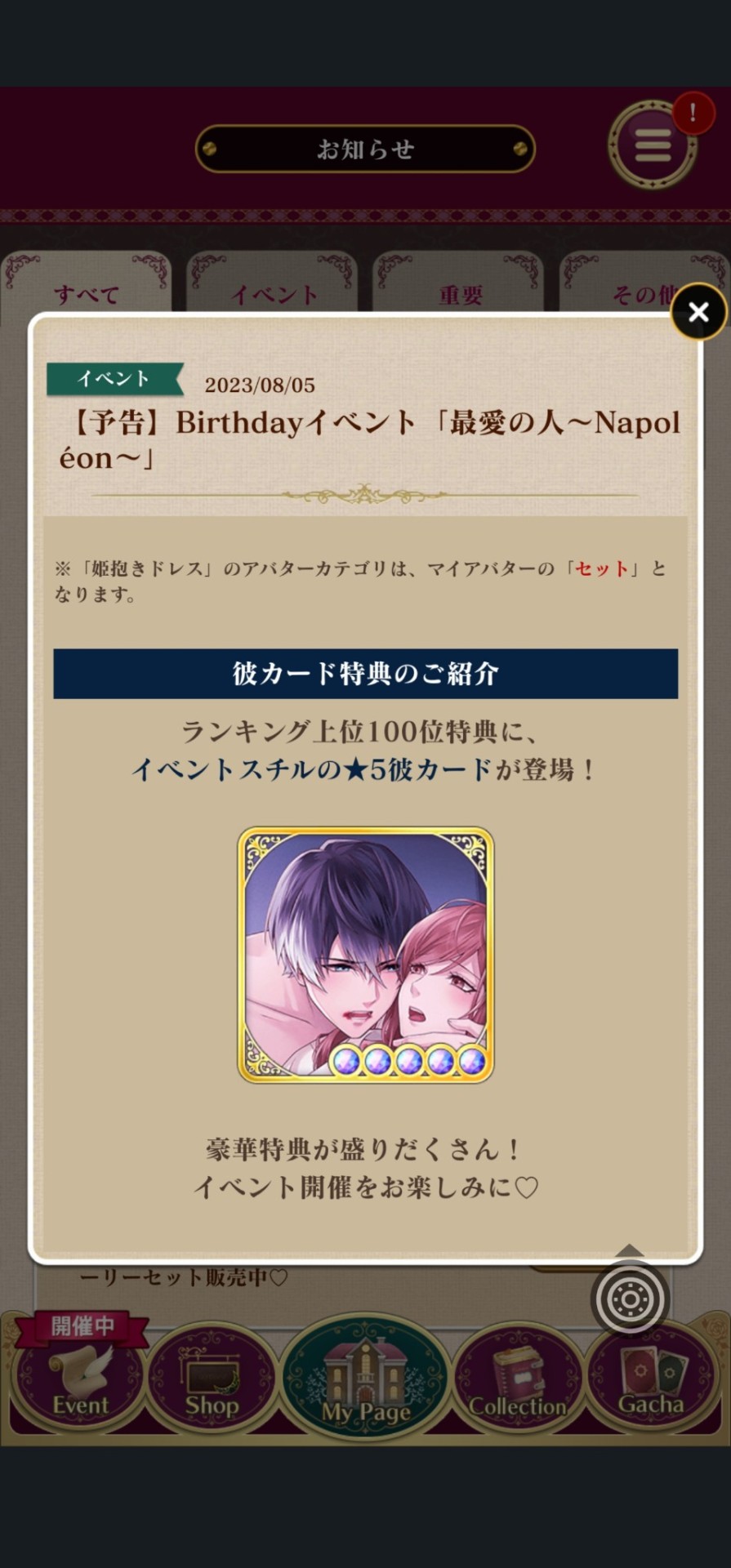

Ikemen Vampire Birthday Story set will be changed to a Birthday Event, starting with our Napoleon this year 💕

Once you done reading the event story and reached the designated LP, the story will be saved automatically into our collection. They provide the LP which is 45,000.

Wanna enjoy the continuation of the epilogue under his POV? You'll have to rank within top 500

For the birthday avatar, there will be 2 kinds

The first avatar is ECB

The 2nd avatar below is top 30 along with top 1, top 3 and top 10 badge

And the birthday card is gonna be a five-star card and it will be in top 100

27 notes

·

View notes

Text

oh. from ikepri's second round of birthday events onwards, the early clear reward is just the CG and story without a card. you only get a card for reaching party level 30

yes i did 3 whole birthday events where i got the ECB without realizing this...

13 notes

·

View notes

Text

2nd Smartest Guy in the World

Aug 05, 2024

This Substack has been warning of a global financial reset for quite some time now…

PSYOP-MARKET-CRASH: The First Bank Failure of 2024 Leaves a 1-Cent Stock for Investors and $667 Million in Losses for the FDIC

2nd Smartest Guy in the World

Apr 30

Last year this Substack covered the Silicon Valley Bank debacle, as well as the various other bank “failures…”

Read full story

PSYOP-MARKET-CRASH Black Swan Edition: Bank for International Settlements Warns of $100 Trillion of Hidden Debt Just Discovered

2nd Smartest Guy in the World

·

December 10, 2022

The Bank for International Settlements (BIS) is the central bank of central banks that for all intents and purposes directs all of the other various central banks from The Federal Reserve to the ECB to the BOJ.

Read full story

…and now Japan and the rest of Asia have seen their stock “markets” implode overnight.

From all time highs to bear market: slowly, then all at once…

It is important to appreciate that Japan has been engaging in Quantitive Easing at the behest of the Fed and BIS since well before the Global Financial Crisis, and as such their central bank was and continues to social engineer a negative population growth and zombie economy. As Japan revolts against the slow kill bioweapon “vaccines” their captured government has instituted a program of importing mass (replacement) migration into this closed traditional society to further destroy this highest IQ nation to perfectly coincide with their crashing economy and “markets;” in other words, there truly are no coincidences.

Back to the collapsing indices:

5 notes

·

View notes

Text

Some bday party event tips that work for me

edit: jk, reccyls' tips are way more thorough than mine XD

I don't know if this the most optimum way of doing things, or if I'm even right about any of this, so use your own judgement. This is primarily for f2p folks since I don't really have much experience shelling out for bday events.

I believe the two lucky times, one each at the start and end of the event period, give you more party points than you get from using lucky clocks to manually give yourself 30 mins of lucky time whenever. Triple vs double I think?

Bearing that in mind, it's best to use your complimentary pastry items to replenish AP during those two actual lucky times for the best mileage. You get two free ones every day, so don't forget to log in. After the first lucky time period ends, hoard hoard hoard those pastries until the final lucky time if you can clear the ecb without using them. If you need them for the ecb, use them.

You'll want to use your 3 complimentary lucky clocks immediately after the first lucky time period ends, so across 3 salons. This gives you an extra boost toward getting that ecb card and pov story. Although your success ultimately comes down to the cards you have in your deck.

Don't hesitate to pick players outside your friends list for party salons. Your goal is to find salon guests who give you the highest possible boost. If you refresh the guest list once and don't find anything good, go back to the previous screen and then try again. EN unfortunately doesn't have the kind of pool of whale decks that JP does, but anything is better than nothing. Fish around a bit if you've got the time and patience.

8 notes

·

View notes

Text

After lots of strategizing and having to sacrifice 2 ECBs (wallpaper and wedding dress, did get the eye makeup though) in order to use my items wisely, by the grace of God himself I somehow made it into Isaac's top 30 in the Together As One: Part 1 story event and got his wedding avatar and chibi!

It was insanely hard! I did have to open my wallet a tiny bit for this since my saved up stash was low due a previous event, but honestly it was so worth it. Isaac fans are no lie, they are devoted to this precious apple boy (me included) and his ranking was the 2nd hardest out of the 5 suitors available (Arthur being the #1 hardest. I took a peek at his ranking, yikes! Go Arthur fans though!). The ranking kept shifting like crazy during the last triple lucky time, but I held on by a thread til the bitter end.

The wedding story event (Two Hearts, Two Lives, One Love: Part 3) was the first story event I participated in when I started playing IkeVamp a year ago and I voted for Isaac back then too (before he became my top fav), but fell short of his top 30 ranking. This year was my redemption arc and I am so happy with what I accomplished! Isaac owes me cuddles for my fried nerves though lol

3 notes

·

View notes

Text

Banking & Data Analysis: Industry Reports

The banking sector serves as the backbone of the global economy, facilitating financial transactions, enabling capital formation, and ensuring the smooth functioning of markets. Over the past few decades, the sector has undergone significant transformation driven by technological advancements, regulatory changes, and evolving consumer behavior. This blog provides a detailed analysis of the banking sector, focusing on market size, share, growth, trends, key players, challenges, and a concluding overview.

Market Size, Share, and Growth

The global banking sector is a multi-trillion-dollar industry, with assets totaling approximately $160 trillion as of 2023. This sector is expected to grow at a compound annual growth rate (CAGR) of 3-4% over the next five years. The growth is primarily driven by increasing demand for digital banking services, rising global wealth, and expanding economies in emerging markets.

Geographical Distribution:

North America: The North American banking sector, led by the United States, holds the largest market share, accounting for approximately 30% of the global market. The region’s market size is driven by its strong economic base, advanced financial infrastructure, and high consumer demand for banking services.

Europe: Europe follows with a 25% market share, characterized by a mature banking system and stringent regulatory frameworks. The European Central Bank (ECB) plays a pivotal role in maintaining stability and growth in the region.

Asia-Pacific: The Asia-Pacific region, with a 35% market share, is the fastest-growing market, fueled by rapid economic expansion in countries like China, India, and Southeast Asia. The region is expected to witness the highest CAGR of around 5-6% during the forecast period.

Latin America and Africa: These regions collectively hold a smaller share of the global market but are experiencing steady growth due to increasing financial inclusion efforts and economic development.

Market Trends

Digital Transformation: The adoption of digital banking has accelerated, with banks increasingly investing in technology to enhance customer experience, streamline operations, and improve security. Mobile banking, digital payments, and blockchain technology are becoming integral parts of banking services.

Sustainable Finance: There is a growing emphasis on sustainable finance, with banks integrating Environmental, Social, and Governance (ESG) criteria into their operations. Green bonds, sustainable loans, and impact investing are gaining traction as banks align with global sustainability goals.

Regulatory Evolution: The regulatory landscape is constantly evolving, with governments and financial authorities implementing stringent measures to ensure financial stability, prevent fraud, and protect consumer interests. The Basel III framework and GDPR are examples of regulations shaping the sector.

Mergers and Acquisitions: The banking sector is witnessing increased consolidation through mergers and acquisitions (M&A). This trend is driven by the need to achieve economies of scale, enhance competitiveness, and expand market presence. Major players are acquiring smaller banks to diversify their portfolios and enter new markets.

Fintech Collaboration: Collaboration between traditional banks and fintech companies is on the rise. Fintech firms bring innovation, agility, and customer-centric solutions, while banks offer regulatory expertise, customer trust, and capital. This synergy is creating new opportunities for growth and innovation in the banking sector.

Key Market Players

The global banking sector is dominated by several large financial institutions, each commanding a significant market share.

JPMorgan Chase & Co.

Market Share: Approximately 4% of the global banking sector

Market Size: $3.7 trillion in assets

JPMorgan Chase is the largest bank in the United States and the world’s most valuable bank by market capitalization. It is a leader in investment banking, commercial banking, and asset management.

Industrial and Commercial Bank of China (ICBC)

Market Share: Around 5% of the global banking sector

Market Size: $4.9 trillion in assets

ICBC is the largest bank in the world by assets. It dominates the Chinese banking sector and plays a crucial role in financing China’s economic development.

HSBC Holdings plc

Market Share: 3% of the global banking sector

Market Size: $2.9 trillion in assets

HSBC is a British multinational bank with a strong presence in Asia, Europe, and the Americas. It is known for its global network and expertise in trade finance.

Bank of America

Market Share: Approximately 3% of the global banking sector

Market Size: $3.1 trillion in assets

Bank of America is one of the largest banks in the United States, offering a wide range of banking, investment, and financial services.

Wells Fargo & Co.

Market Share: Around 2% of the global banking sector

Market Size: $1.9 trillion in assets

Wells Fargo is a leading American bank with a focus on retail banking, mortgages, and commercial banking.

Market Challenges

Regulatory Compliance: The banking sector is subject to extensive regulations, which can be costly and complex to implement. Compliance with regulations like Basel III, anti-money laundering (AML) standards, and data protection laws requires significant investment in technology, personnel, and processes.

Cybersecurity Threats: As banks adopt digital solutions, they become more vulnerable to cyberattacks. Protecting customer data and ensuring the security of financial transactions are major challenges for banks. Cybersecurity breaches can lead to financial losses, reputational damage, and regulatory penalties.

Economic Uncertainty: The global economy faces various uncertainties, including geopolitical tensions, inflationary pressures, and the potential for economic recessions. These factors can impact the profitability and stability of banks, particularly those with significant exposure to volatile markets.

Competition from Fintechs: Fintech companies are disrupting the traditional banking model by offering innovative, customer-centric solutions at lower costs. Banks face intense competition from these agile players, which can erode market share and profitability if not effectively managed.

Interest Rate Fluctuations: Interest rates play a crucial role in banking profitability. Fluctuations in interest rates, driven by central bank policies and market conditions, can impact banks’ net interest margins, lending activities, and overall financial performance.

Conclusion The global banking sector is a dynamic and evolving industry that plays a critical role in the global economy. While it faces numerous challenges, including regulatory compliance, cybersecurity threats, and competition from fintech companies, the sector continues to grow and adapt to changing market conditions. The adoption of digital technologies, focus on sustainable finance, and strategic mergers and acquisitions are key trends shaping the future of banking. As the sector continues to innovate and expand, it will remain a cornerstone of economic development and financial stability worldwide.

0 notes

Text

Notice of Upcoming Board Meeting by Mufin Green Finance Limited

On August 5, 2024, Mufin Green Finance Limited issued a formal communication to the Bombay Stock Exchange (BSE) and the National Stock Exchange of India Limited (NSE). This correspondence was directed to P. J. Towers at Dalal Street, Fort, Mumbai, and Exchange Plaza at Bandra-Kurla Complex, Bandra (East), Mumbai, highlighting significant upcoming corporate activities. The communication pertained to BSE Scrip Code 542774 and the NSE ticker symbol "MUFIN."

In adherence to Regulation 29 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the company provided a prior intimation regarding the scheduling of a Board of Directors meeting. This meeting is set to take place on Tuesday, August 13, 2024.

During this meeting, the Board will deliberate on several crucial matters. One of the primary items on the agenda is the review and approval of the unaudited standalone and consolidated financial results for the quarter ending June 30, 2024. This financial scrutiny is part of the company’s commitment to transparency and accurate financial reporting, reflecting its performance and strategic direction.

Another significant agenda item is the consideration of raising funds through the issuance of foreign currency-denominated bonds. These bonds fall under the framework of External Commercial Borrowings (ECB) or other eligible instruments. The potential fundraising would be conducted on a private placement basis or through other permissible modes or combinations thereof. This move aims to bolster the company’s financial foundation and support its expansion plans, subject to compliance with applicable laws and regulatory approvals.

The announcement, signed by Mayank Pratap Singh, the Company Secretary and Compliance Officer of Mufin Green Finance Limited, emphasizes the company's dedication to keeping its shareholders and regulatory bodies informed. This proactive disclosure ensures that all stakeholders are aware of the strategic decisions and financial maneuvers under consideration, reinforcing the company's commitment to regulatory compliance and corporate governance.

The notice, issued from the company’s headquarters in Delhi, marks a step towards greater financial strategy and operational transparency, aligning with the overall goals of Mufin Green Finance Limited to drive sustainable growth and value creation for its stakeholders.

0 notes

Quote

ここで言う「金利」とは、各国の中央銀行が設定する金利のことです。米国では連邦準備制度理事会(FRB)、英国ではイングランド銀行、EUでは欧州中央銀行(ECB)がこれにあたります。これらの機関は、政府の財政政策を実行する権限を持ち、金融の安定を維持することを目指しています。財政政策には、消費者支出の増加または減少、インフレの増加または減少などが含まれます。中央銀行が利用できる最も強力な「手段」の1つは、預金と負債に適用される金利を設定することです。

2022年のインフレ率は、米国では40年ぶりの高水準(2022年7月には9.1%)、英国では30年ぶりの高水準(8月には8.6%)、 EUでは過去最高(2022年は9.2%)となった。これらの国々の政府は、インフレ率を2~3%程度に引き下げようと財政政策を講じた。FRB、イングランド銀行、ECBはいずれも同じ措置を講じ、金利を引き上げました。

金利が上昇するとインフレ率はどうやって低下するのでしょうか? BBC による説明はこちらです:

「イングランド銀行は英国のインフレ(時間の経過に伴う物価上昇)を抑制するために金利を上げ下げしている」

インフレ率が高い場合、インフレ率を 2% に抑える目標を持つ銀行は金利を引き上げる決定を下す可能性があります。これは、人々の支出を控えるように促し、需要を減らすことでインフレ率を下げることを目的としています。この状況が起こり始めると、銀行は金利を据え置くか、引き下げる可能性があります。

銀行は、物価上昇を鈍化させる必要性と経済にダメージを与えるリスクとのバランスを取らなければならない。

古いものが再び新しくなる - ゲルゲリー・オロス

0 notes

Text

Eurozone PMI, US Jobs Data, and ECB Insights Today

European Data:

The day opens at 9:00 AM with the release of the Eurozone’s composite PMI for June, which is expected to come in with a consensus and forecast of 50.8, indicating no significant changes.

At 11:30 AM, the ECB Chief Economist Philip Lane will be part of the discussion regarding interest rates at the ECB Forum in Sintra, Portugal. The Fed’s John Williams will be there as well, so it…

View On WordPress

#ECBForum#ECBInsights AUD/USD#EconomicUpdates#EurozonePMI#FinancialNews#InterestRates#MarketTrends#MonetaryPolicy#USEmploymentData#USJobsReport#AUD/USD#EUR/USD#GBP/USD#USD/JPY

1 note

·

View note

Text

2024/6/6 22:01:38現在のニュース

佐渡金山、世界遺産登録へ前進 イコモス、日本に「情報照会」勧告([B!]産経新聞, 2024/6/6 22:00:25)

中国包囲網着々も、「もしトラ」なら米国離脱か IPEF、日本は枠組み牽引を([B!]産経新聞, 2024/6/6 22:00:25)

規正法改正、成立優先し胸張る首相 立憲は「裏金根絶つながらない」(朝日新聞, 2024/6/6 21:58:30)

三菱重工West、打線復活の集中打 都市対抗近畿第3代表(毎日新聞, 2024/6/6 21:57:03)

緊急事態 議員任期延長問題とは何か([B!]読売新聞, 2024/6/6 21:42:07)

中国国有の鉄道車両メーカー「中国中車」が欧米で相次ぎ破談 スパイ懸念や納入遅れが要因([B!]産経新聞, 2024/6/6 21:39:09)

欧州中銀、利下げ決定 0.25ポイント、4年9カ月ぶり 景気刺激を優先(毎日新聞, 2024/6/6 21:35:16)

「最大の問題は高金利」欧州企業、利下げ継続期待 ECBは慎重姿勢(朝日新聞, 2024/6/6 21:35:02)

欧州中銀、0.25%利下げを決定 インフレ鈍化で政策転換(朝日新聞, 2024/6/6 21:35:02)

生徒の個人情報SNS流出「本物の可能性否定できない」閲覧2千万回(朝日新聞, 2024/6/6 21:35:02)

「PTA活動って楽しい」広報紙の大胆改革で脱・やらされ感(1/3ページ)([B!]産経新聞, 2024/6/6 21:33:28)

認知症女性に不動産販売 準詐欺疑い、4人逮捕 警視庁 - 日本経済新聞([B!]日経新聞, 2024/6/6 21:33:23)

2000万円横領の疑い 墨田区の社会福祉法人「寿老福祉会」の元理事長逮捕 新型コロナ補助金など(東京新聞)|dメニューニュース(東京新聞のニュース一覧|dメニュー(NTTドコモ), 2024/6/6 21:32:51)

0 notes

Text

Target levels and forecast for the week 06.05.– 10.05.

The week begins with the failure of negotiations between Israel and Hamas, because Israel does not intend to abandon the attack on Rafah. We are waiting for a reaction on oil.

⠀

Britain's Conservative Party lost regional elections. British media are announcing new parliamentary elections in September. A Labor victory in the elections will lead to a rise in the pound due to strengthening ties with the EU, but the pound does not like moments of uncertainty and may be very stormy in the next 2-3 months.

⠀

The RBA and BOE meetings are interesting, but at the current stage, both rates will remain unchanged the market will only react to comments.

⠀

China's trade balance will have an impact on risk appetite. Fed members will appear on the air daily, markets will react to their rhetoric, but before the publication of US inflation for April on May 14-15, breakouts of the current price ranges are unlikely.

⠀

Recall the fundamental events that you need to pay attention to (GMT 0 time):

⠀

Tue, 07

Earnings Dates & Reports: Disney, BP, Ferrari

AUD: Retail Sales (01:30); RBA Interest Rate Decision, Monetary Policy Statement (04:30)

USD: EIA Short-Term Energy Outlook (16:00); API Weekly Crude Oil Stock (20:30)

EUR: Eurogroup Meetings (10:00)

⠀

Wed, 08

Earnings Dates & Reports: Toyota, Uber, Airbnb, Shopify, BMW

EUR: ECB Non-monetary Policy Meeting (07:00)

USD: Crude Oil Inventories (+Cushing) (14:30)

⠀

Thu, 09

CNY: Exports, Imports, Trade Balance (03:00)

GBP: BoE Interest Rate Decision (11:00); BoE Gov Bailey Speaks (11:30), (13:15)

USD: Initial Jobless Claims (12:30)

⠀

Fri, 10

GBP: GDP, Manufacturing Production, Trade Balance (+Non-EU) (06:00)

EUR: ECB Publishes Account of Monetary Policy Meeting (11:30)

USD: WASDE Report (16:00)

0 notes

Text

ETF和投资基金的一次性预付款:您需要知道的

ETF和投资基金的一次性预付款:您需要知道的

一目了然

2018年投资税改革重新规范了投资基金和交易所交易基金(ETF)的税收。自 2019 年 1 月起,积累和部分分配资金的前期一次性付款一直是名义最低税收值。

在 2021 年和 2022 年,由于低利率阶段,资金储户无需支付任何前期税款。然而,由于利率上升,它现在已经再次到期 2023 年。

前期一次性付款的金额的计算方法是将上一年年初的基金单位价值乘以德意志联邦银行确定的年基准利率的 70%。

前期一次性付款并非完全应纳税。根据收入是来自股票基金、混合基金还是开放式房地产基金,适用不同的“部分豁免”。

这就是本文中等待您的内容

什么是前期统一费率?

如何计算前期一次性付款?

谁计算一次性预付款?

一次性预付款何时到期?

预支一笔过报税表

部分豁免 – 对储户意味着什么?

作为基金所有者,您很有可能在 1 月份从托管银行的清算账户中扣除了所谓的一次性预付款预扣税,而没有从经常账户中扣除预扣税。例如,如果您的豁免令不充分,就是这种情况。

什么是前期统一费率?

自2018年1月1日起,一次性预付款被视为投资税改革的核心部分。 国内托管人必须计算某些基金和ETF的名义最低回报,无论股票价值的实际增长如何,该回报均需征税。乍一看,这听起来不公平,但底线是经纪人、托管银行和投资者的巨大简化。

过去,基金储户需要多达 33 条不同的信息来对其基金收入征税,而基金现在只需要提供四条信息:

分配金额,

年初的基金价值,

年末基金价值,

基金类型?(股票基金、混合基金、房地产基金或其他投资基金)

这是因为计算出的一次性预付款的预扣税基本上只能被视为出售基金单位的后续纳税义务的预付款。

一次性预付款何时适用?

在一次性预付款的帮助下,所有共同基金和 ETF 在税收方面都受到平等对待,无论它们是每年全额分配其赚取的收入还是积累和再投资于基金的资产(“累积”)。因此,前期一次性付款优先适用于全部和部分积累的投资基金和 ETF,即实际支付很少或没有收入,但在几年和几十年内立即将全部或部分基金资产再投资的基金。

无论这些基金是在国内还是在国外推出,都没有关系。通过这种方式,税务机关希望确保投资者在基金持有期间缴纳最低税款。

如何计算前期一次性付款?

一次性预付款的金额由年初基金单位的价值乘以每年官方公布的基准利率的 70% 确定。该基准利率由德意志联邦银行根据公共债券的平均利率确定和公布。

由于欧洲央行(ECB)的低利率政策,基准利率在2021年和2022年为零甚至处于负值区域。这意味着任何储户都不必为预付款缴纳税款。对于2023年,联邦财政部在2023年1月4日的一封信中传达了2.55%的相关基准利率。

应税的一次性预付款金额仅限于当年基金价值的增加。基金实际进行的分配可能会将前期一次性付款减少到零欧元。由于基金价值的高损失而导致负的前期一次性付款是不可能的。在收购基金单位的当年,前期一次性付款按比例计算。

因此,以下公式适用于应纳税预付款的一次性计算:

基金单位年初的赎回价格 x 根据德国央行基准利率的 70% = 基本收入减去实际分配 = 一次性预付

根据基金的类型,为此目的提供的部分免税是按计算的一次性预付款(见下表和说明)授予的,然后才根据签发的免税令检查收入是否必须全部或部分免税。这一系列检查是联邦财政部的强制性检查,为受影响的投资者带来了最佳的税收结果。

例:

一位投资者投资了新经纪商Trade Republic的累积股票ETF。截至 2023 年 1 月 1 日,每单位的赎回价格为 100 欧元。 该储户在这一年中没有收到任何分配。截至 2023 年底,该基金的价值增长了 8.0%(2023 年 12 月 31 日的价值:108 欧元)。2023年每个基金单位的一次性应税预付款计算如下:

100 欧元 x 1.785%(根据德国央行的官方基准利率:2.55% x 70%)= 1.7850 欧元的一次性预付款/每基金单位最低回报。

由于这个例子是股票 ETF,因此免税率为 30%(1.7850 欧元 x 30% = 0.5355 欧元免税部分)——剩下的 1.2495 欧元作为应税的一次性预付款。

但是,只有当储蓄者为单身人士支付 1,000 欧元和为已婚人士一次性支付 2,000 欧元时,才对这笔 1.2495 欧元的收入预扣税款。拥有多个证券账户的资金储户可以一次性支付。如果超过限额,银行将支付 25% 的预扣税和团结附加费,并且根据教派的不同,还支付教堂税。对于非教派储蓄者,税收减免为 26.375%,即每基金单位 0.33 欧元。如果您属于教会,则税收减免最高为 27.99%——即每基金单位 0.35 美分。

底线是,投资收入(包括一次性预付款)仍低于年度储蓄者的一次性付款的储户。如果 2023 年全年基金价值的增长低于确定的 1.785 欧元,则实际价值增长将用作税收评估的上限。在这里,仍然有部分豁免的扣除。

但是,由于我们示例中的价值增长是足够的 8.0%,因此明显高于前期一次性付款的名义利率 1.78%,因此不考虑此计算值。

谁计算一次性预付款?

如果您的基金单位和ETF由国内托管银行管理,您就不必处理复杂的计算。所有计算和税收减免均由托管银行自动执行。

另一方面,如果您将股票存放在外国证券账户中,则必须在年度纳税申报表中自行申报一年产生的收入、销售利润和一次性预付款。然后,税务局通过所得税评估收取应缴纳的预扣税。

一次性预付款何时到期?

预付款的一笔过款项被视为在下一个日历年的第一个银行工作日,即 2023 年的 2024 年 1 月 2 日星期二累积。

根据 BMF 最近于 2024 年 1 月 5 日发出的一封信函,2024 年的一次性付款为 1.6%(德国央行计算的参考利率 2.29% 的 70%)。截止日期为 2025 年 1 月 2 日星期四。

预付款是自动收取的吗?

一次性预付款的征税方式因托管银行或基金平台而异。由于前期一次性付款是名义上的现金流入,国内托管银行不能简单地从收入中预扣应缴税款。因此,一些直接银行,如荷兰国际集团(ING)、康索银行(Consorsbank)和昂威达银行(Onvista Bank),会从投资者的清算或往来账户中扣除税款——如果资金不足,银行甚至可以为此使用透支设施。您可以反对访问您的透支设施。但是,在这种情况下,您必须在纳税申报表中报告收入并缴纳税款。

合作银行的投资公司Union Investment通过出售基金单位来筹集必要的资金,以确保税收减免。储蓄银行的基金公司Deka首先使用客户的参考账户,如果账户没有足够的资金,则使用管理基金单位。然后,投资者将收到其基金公司或托管银行关于强制完成的基金单位销售的单独通知。

预支一笔过报税表

作为投资收入完全来自国内托管账户的储户,您在提交纳税申报表时可以高枕无忧——您不再需要通过纳税申报表支付一年内产生的利息、股息和基金收入。托管银行或经纪人已经进行了必要的税收减免——所以一切都是为了税收目的。

但是,自愿申报投资收入可能是有意义的——例如,如果您未能向托管银行发出免税令以支付您自己的储蓄者的一次性付款,或者如果您是学生或退休人员,并且可以申请比 25% 的最终预扣税率更优惠的税率。然后,值得自愿填写税务局提供的表格附件KAP和KAP-INV。

将基金单位和ETF存放在外国托管账户中的投资者别无选择。他们必须自己在纳税申报表中申报自己的收入和利润,并自行计算要支付的一次性预付款。为此,税务机关创建了一种特殊表格——KAP-INV 附件。

如果外国基金公司不以欧元报告收入,您将不得不自己转换 - 以流入日的汇率。在积累资金的情况下,这是基金财政年度结束时的价格,在分配资金的情况下,这是收入记入您的日期。您可以在基金公司的网站上找到这些价值,通过电子邮件索取,从银行获取或在线访问(Bundesanzeiger.de)。

如果基金单位和ETF被出售或遗赠,如果前期一次性付款已经征税,会发生什么?

为避免日后出售基金单位时对累算收入进行双重征税,在厘定出售或赎回基金单位的利润时,已征税的一笔过预付款会作为减少额扣除。扣除额由国内托管银行自动进行——投资者在这里不必担心任何事情。与以前的系统相比,这代表了储户税务会计的显着简化。

但是,如果您将资金和 ETF 存放在国外,并且(假设税务诚实)每年在所得税申报表中尽职尽责地申报到期的一次性预付款,则必须小心。倘若你其后出售这些基金单位,你须在报税表上抵销过去已产生的销售利润及一笔过预支款项。即使您在过去几年根本不需要缴纳任何税款,由于使用了年度储蓄者的一次性付款,也是如此。

如果基金单位和 ETF 已作为赠与或遗产的一部分转让,则之前已经征税的一次性预付款将记入后代(2023 年 9 月 5 日的 BMF 信函 – 档案编号。IV C 1 – S 1980 – 1/19/10008 :028)。

Biallo提示:保留所有基金证书,购买和销售收据以及旧年的所有税收评估,直到您出售所有基金单位并与税务局结清所有款项。这是确保您不必两次纳税的唯一方法。

部分豁免 – 对储��意味着什么?

自 2018 年初以来,共同基金和指数基金已经不得不在基金层面为某些收入缴纳高达 15.83% 的税款,包括团结附加费。特别是,德国股息、德国租金收入和出售德国房地产的已实现收益应纳税。

由于基金必须为其部分收入纳税,因此基金储户和 ETF 投资者的可分配或可再投资收入较少。为了弥补这一弊端,自2018年初以来,投资者只需为其部分基金收入纳税。立法者将此称为“部分豁免”。

这个部分豁免有多高?

这取决于个别基金的投资重点(见下表)。对于根据其投资条件持续将基金资产的50%以上投资于股票的纯股票基金,私人投资者的豁免额为30%。持有基金单位作为其业务资产一部分的企业家可享受 60% 的豁免。对于持续将超过50%的资产投资于德国房地产的房地产基金,豁免金额为收入的60%。如果投资重点是国外,这个数字高达80%。

如果混合基金将至少 25% 的基金资产投资于股票,则保证 15% 的部分豁免。如果股权分配较低,投资者必须为其收入纳税,不得贴现。就基金中的基金而言,我们看的是基金中的基金所投资的基金。部分豁免包括出售或赎回基金单位的分派收入和利润,以及为(部分)积存基金而厘定的一笔过预付款。

0 notes

Text

Tiêu điểm thị trường ngày 7/3

Thị trường hàng hoá ngày 7/3 sẽ có các thông tin đáng chú ý như sau:

• Nhóm vĩ mô:

Số liệu nhập khẩu của Trung Quốc – 10h00

Để tránh việc số liệu bị chênh lệch quá lớn khi kỳ nghỉ Tết Nguyên đán kéo dài 2 tuần của Trung Quốc diễn ra vào tháng 2, số liệu xuất nhập khẩu sẽ được công bố gộp luôn cả tháng 1.

Các dự báo đồng thuận cho thấy nhập khẩu trong hai tháng đầu năm của Trung Quốc sẽ tăng 1,5% so với cùng kỳ, tăng so với mức 0,2% của tháng 12/2023. Số liệu thực tế cao hơn dự báo là thông tin “bullish” đối với giá dầu và giá kim loại cơ bản

Quyết định lãi suất của ECB – 20h15

Phần lớn thị trường gần như đã chắc chắn rằng Ngân hàng Trung ương châu Âu (ECB) sẽ giữ nguyên lãi suất trong cuộc họp lần này. Do vậy, điều được thị trường quan tâm hơn là những manh mối tiết lộ về thời điểm xoay trục chính sách. Cuộc họp báo diễn ra sau cuộc họp 30 phút cần được chú ý.

Hiện các nhà đầu tư đang đặt cược nhiều nhất vào khả năng hạ lãi suất vào tháng 4, nhờ lạm phát tại châu Âu hạ nhiệt mạnh mẽ. Do đó, nếu các quan chức cho thấy phát đi tín hiệu sớm hạ lãi suất, đồng euro sẽ gặp sức ép.

Số đơn xin trợ cấp thất nghiệp lần đầu của Mỹ - 20h30

Các chuyên gia kinh tế ước tính số đơn xin trợ cấp thất nghiệp lần đầu của Mỹ trong tuần kết thúc vào ngày 2/3 tăng lên 217.000 đơn, từ mức 215.000 trong tuần kết thúc ngày 24/2. Nếu số liệu đồng thuận với dự báo, đồng USD có thể gặp sức ép giảm giá.

Đầu tư hàng hoá

Đầu tư hàng hoá

Đầu tư hàng hoá

0 notes

Text

EU competitiveness and productivity have been torpedoed by the ECB and European Commission

Sometimes you think that they really could not make it and you discover that they already have.

More than 30 years after its inception, Economic and Monetary Union is widely seen as a success.

Actually the speech is about a failure so the rhetoric is a sort of smoke screen. But it does serve as a reminder that central bankers act like politicians these days as those are the words of Isabel…

View On WordPress

#business#Climate Change#Dr Isabel Schnabel#ECB#economy#electricity prices#energy prices#Euro#Finance#Fiscal Policy#Industrial Production#President Von der Leyen#Productivity#QE

0 notes