#ERC-20 Token Development

Explore tagged Tumblr posts

Text

What Are the Most Effective Approaches for ERC-20 Token Development Services?

ERC-20 tokens have become a cornerstone of the Ethereum ecosystem, empowering a vast array of decentralized applications (dApps) and initial coin offerings (ICOs). Their compatibility with Ethereum’s blockchain and their standardized protocol make them highly attractive for developers and investors alike. However, creating an ERC-20 token that stands out and meets all objectives requires a well-thought-out approach. This blog delves into the most effective strategies for ERC-20 token development, highlighting key considerations and best practices.

Understanding ERC-20 Tokens

ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain. It defines a common list of rules that all Ethereum tokens must follow, including how they are transferred and how transactions are approved. This standardization simplifies the development process and ensures compatibility across different platforms and wallets. Before diving into development strategies, it's crucial to understand these core principles.

1. Define Clear Objectives and Use Cases

Identifying the Purpose

Before development begins, it is essential to clearly define the purpose of the token. Whether it’s for a utility token, security token, or asset-backed token, each use case has distinct requirements. Establishing clear objectives helps in designing a token that aligns with its intended function and audience.

Target Audience and Market Research

Conduct thorough market research to identify the target audience and their needs. Understanding your audience’s preferences and pain points can guide the design and functionality of your token. This research will also help in differentiating your token from competitors.

2. Choose the Right Development Tools

Development Frameworks and Libraries

Selecting appropriate development tools is crucial for efficient and secure ERC-20 token creation. Some popular frameworks and libraries include:

OpenZeppelin: Provides a suite of modular, reusable, and secure smart contracts. Its ERC-20 implementation is widely trusted.

Truffle Suite: A development environment, testing framework, and asset pipeline for Ethereum.

Hardhat: A robust Ethereum development environment that includes a local blockchain for testing.

Using these tools can streamline the development process and enhance the security of your token.

3. Prioritize Security in Smart Contract Development

Code Review and Audits

Security is paramount when developing ERC-20 tokens. Smart contracts are immutable once deployed, so rigorous testing and code reviews are necessary to identify vulnerabilities. Engage third-party security experts to conduct comprehensive audits of your smart contract code. This helps in discovering potential issues such as reentrancy attacks, integer overflows, and other common vulnerabilities.

Best Practices for Security

Adhere to best practices for smart contract development, including:

Use Libraries: Leverage well-tested libraries like OpenZeppelin to minimize errors.

Minimize Code Complexity: Keep the smart contract code as simple and modular as possible.

Implement Thorough Testing: Conduct unit tests, integration tests, and scenario testing to ensure robustness.

4. Ensure Compliance with Regulatory Standards

Legal and Regulatory Considerations

Compliance with regulatory standards is critical for the successful deployment of ERC-20 tokens. Different jurisdictions have varying regulations regarding digital assets. Ensure that your token complies with relevant laws and regulations, such as anti-money laundering (AML) and know your customer (KYC) requirements.

Token Classification

Determine whether your token is a security token or a utility token, as this will influence its regulatory treatment. Consulting with legal experts can help navigate the complex regulatory landscape and avoid potential legal issues.

5. Optimize Tokenomics for Success

Token Supply and Distribution

Design a clear and transparent tokenomics model that outlines the total supply, allocation, and distribution of your token. Consider factors such as:

Initial Supply: Decide on the initial number of tokens to be minted.

Vesting Periods: Implement vesting schedules for team members and advisors to align their interests with the long-term success of the project.

Burn Mechanisms: Introduce mechanisms for burning tokens to manage supply and increase value.

Incentive Structures

Create incentive structures to drive engagement and usage of your token. This might include reward mechanisms for early adopters, staking options, or governance rights that empower token holders to participate in decision-making.

6. Plan for Scalability and Future Upgrades

Scalability Considerations

Ensure that your token is designed with scalability in mind. Ethereum’s network can experience congestion, leading to higher transaction fees and slower processing times. Explore Layer 2 solutions or sidechains to enhance scalability and improve transaction efficiency.

Upgradeability

Design your smart contract with future upgrades in mind. Implement proxy patterns or upgradeable smart contracts to facilitate changes and improvements without deploying a new contract. This ensures that your token remains relevant and adaptable to evolving requirements.

7. Focus on User Experience

Wallet and Exchange Compatibility

Ensure that your ERC-20 token is compatible with popular Ethereum wallets and exchanges. This facilitates ease of use for token holders and encourages widespread adoption.

Clear Documentation

Provide comprehensive documentation and guides for users and developers. Clear documentation helps users understand how to interact with your token and developers integrate it into their applications.

8. Engage in Effective Marketing and Community Building

Marketing Strategies

Develop a robust marketing strategy to promote your ERC-20 token. Utilize various channels such as social media, content marketing, and influencer partnerships to raise awareness and generate interest.

Community Engagement

Build and nurture a community around your token. Engage with your audience through forums, social media platforms, and community events. A strong, engaged community can significantly enhance the success of your token.

Conclusion

Effective ERC-20 token development requires a multifaceted approach that encompasses clear objectives, security, compliance, tokenomics, scalability, and user experience. By following these best practices and leveraging the right tools, you can create a robust and successful ERC-20 token that meets the needs of your target audience and stands out in the competitive landscape. As the Ethereum ecosystem continues to evolve, staying informed and adaptable will be key to achieving long-term success in token development.

#ERC-20 Token Development Services#ERC-20 Token Development#ERC-20 Token#ERC-20#Token Development Services#cryptocurrency#crypto#token development

0 notes

Text

Innovating with ERC-20: How to Create and Launch Your Own Token

The rise of blockchain technology has democratized innovation, providing tools and platforms that allow anyone with a vision to bring their ideas to life. One of the most significant innovations in this space is the ERC-20 token standard on the Ethereum blockchain. This guide will walk you through the process of creating and launching your own ERC-20 token, from initial conception to successful deployment.

Understanding ERC-20 Tokens

ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain. It defines a set of rules that an Ethereum token must follow, ensuring compatibility with various platforms, wallets, and exchanges. The standardization of ERC-20 tokens has led to their widespread use in Initial Coin Offerings (ICOs), decentralized finance (DeFi), and various other blockchain applications.

Key Features of ERC-20 Tokens

Interoperability: ERC-20 tokens are compatible with most Ethereum-based applications and wallets.

Standard Functions: The ERC-20 standard includes functions like transfer, approve, and balanceOf, ensuring consistency across tokens.

Flexibility: ERC-20 tokens can be customized for different purposes, including utility tokens, security tokens, and stablecoins.

Step-by-Step Guide to Creating and Launching an ERC-20 Token

1. Define Your Token's Purpose

Before you start coding, it’s crucial to define the purpose of your token. Consider the following questions:

What problem does your token solve?

Who is your target audience?

What will be the utility of your token? (e.g., access to a platform, voting rights, etc.)

2. Design Your Token

Designing your token involves determining its fundamental attributes:

Name: Choose a unique and descriptive name for your token.

Symbol: Create a short, memorable symbol (e.g., ETH for Ethereum).

Decimals: Decide how divisible your token will be (usually 18 decimal places).

3. Develop the Smart Contract

The smart contract is the heart of your ERC-20 token. Here’s a high-level overview of the development process:

Set Up Your Development Environment: Tools like Remix IDE or development frameworks like Truffle and Hardhat can simplify the coding process.

Write the Smart Contract: Your smart contract should implement the ERC-20 interface. Below is a basic example written in Solidity:

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

contract MyToken is ERC20 { constructor(uint256 initialSupply) ERC20("MyToken", "MTK") { _mint(msg.sender, initialSupply); } }

This contract sets the token name as “MyToken” and the symbol as “MTK,” and it mints an initial supply to the deployer's address.

Test the Contract: Thorough testing is essential to ensure your contract functions as intended. Use Ethereum testnets like Ropsten or Rinkeby for testing before deploying to the mainnet.

Audit the Contract: Consider having your contract audited by a security professional to identify and fix potential vulnerabilities.

4. Deploy the Smart Contract

Deploying your ERC-20 token involves several steps:

Fund Your Wallet: Ensure your wallet has enough ETH to cover gas fees for deployment.

Deploy the Contract: Use deployment tools or services to deploy your contract to the Ethereum mainnet. Tools like Remix, Truffle, or Hardhat can assist with this process.

5. Verify and Publish the Contract

After deployment, verify and publish your contract on blockchain explorers like Etherscan. This process involves uploading your contract’s source code and making it publicly available, which enhances transparency and trust.

6. Integrate with Wallets and Exchanges

To ensure your token is usable, integrate it with popular Ethereum wallets (e.g., MetaMask) and exchanges. Provide the necessary details for listing on decentralized exchanges (DEXs) and centralized exchanges (CEXs).

7. Promote Your Token

Marketing is crucial for the success of your token. Develop a comprehensive strategy that includes:

Community Engagement: Build and nurture a community around your token through social media, forums, and events.

Partnerships: Collaborate with other projects or influencers to increase visibility.

Educational Content: Create resources that explain the benefits and uses of your token.

Conclusion

Creating and launching an ERC-20 token is a powerful way to innovate and bring your ideas to the blockchain. By following this guide, you’ll be able to navigate the complexities of token development and launch a token that is functional, secure, and well-received by the community.

Remember, the success of your token depends not only on its technical development but also on its market positioning and community support. Stay engaged, keep innovating, and your ERC-20 token could become a significant player in the blockchain ecosystem.

If you have any questions or need further assistance, don’t hesitate to reach out to blockchain development experts. Good luck with your token creation journey!

0 notes

Text

Inside Ethereum: Unlocking the Potential of Decentralized Finance (DeFi)

The story of Ethereum begins with a young programmer and entrepreneur named Vitalik Buterin. Buterin became interested in cryptocurrency and blockchain technology after learning about Bitcoin in 2011. He soon became one of the co-founders of Bitcoin Magazine, where he wrote extensively about cryptocurrencies and related technologies. However, Buterin saw limitations in Bitcoin’s functionality.…

View On WordPress

#Blockchain Technology#Consensus mechanism#Cryptocurrency#DAO (Decentralized Autonomous Organization)#Decentralized applications (DApps)#DeFi (Decentralized Finance)#ERC-20 tokens#ERC-721 tokens (NFTs)#Ether (ETH)#Ethereum#Ethereum 2.0#Ethereum community#Ethereum development#Ethereum ecosystem#Ethereum Foundation#Ethereum roadmap#Ethereum upgrades#Ethereum use cases#Gas fees#Network congestion#Proof-of-stake (PoS)#Proof-of-work (PoW)#Scalability#Security#Smart contracts

0 notes

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

1 note

·

View note

Text

Escape the Matrix: Create Your Own Crypto and Memecoins to Break Free from the Rat Race

In today’s fast-paced world, many people feel trapped in the proverbial “matrix” of conventional work life — a never-ending grind where the promises of financial freedom and personal fulfillment seem elusive. If you find yourself yearning for a way out, creating your own cryptocurrency or memecoin tokens might be the key to escaping the rat race and paving the way to a brighter, more prosperous future. This blog will explore how you can break free from traditional financial constraints and take control of your financial destiny by delving into the world of crypto and memecoins.

Understanding the Matrix and the Rat Race

Before we dive into how you can create your own crypto and memecoin tokens, it’s important to understand the matrix and the rat race. The matrix represents a system of control and conformity that often dictates our daily lives, while the rat race is the relentless pursuit of success and wealth through conventional means, often leading to burnout and dissatisfaction.

Breaking free from this cycle involves adopting new ways of thinking and exploring alternative financial opportunities. The cryptocurrency revolution offers a pathway to redefine your financial future, allowing you to step out of the traditional financial system and into a world of digital innovation.

The Rise of Cryptocurrencies and Memecoins

1. The Cryptocurrency Revolution

Cryptocurrencies have transformed the financial landscape by offering decentralized alternatives to traditional financial systems. Bitcoin, the first and most well-known cryptocurrency, introduced the concept of blockchain technology — a decentralized ledger that ensures transparency, security, and immutability.

Since Bitcoin’s inception, thousands of cryptocurrencies have emerged, each with unique features and use cases. Ethereum introduced smart contracts, enabling the creation of decentralized applications (dApps) and new tokens. The rise of cryptocurrencies has paved the way for individuals to create their own digital assets, offering opportunities for innovation and financial empowerment.

2. The Memecoin Phenomenon

Memecoins, on the other hand, represent a more playful and community-driven aspect of the cryptocurrency world. Born from internet memes and viral trends, memecoins often gain popularity through social media and online communities. Despite their origins as jokes or experiments, some memecoins have experienced significant price surges and garnered substantial attention.

Notable examples include Dogecoin, which started as a meme but has become a widely recognized cryptocurrency with a strong community backing. The success of memecoins highlights the power of community engagement and the potential for digital assets to capture public interest.

Creating Your Own Cryptocurrency

Creating your own cryptocurrency involves several key steps. Here’s a roadmap to help you get started:

1. Define Your Purpose and Goals

Before diving into the technical aspects, it’s essential to define the purpose and goals of your cryptocurrency. Consider the following questions:

What problem does your cryptocurrency aim to solve?

Who is your target audience?

How will your cryptocurrency differentiate itself from existing options?

Having a clear vision will guide the development process and help you create a compelling value proposition for your digital asset.

2. Choose the Right Blockchain Platform

Selecting the appropriate blockchain platform is crucial for the development of your cryptocurrency. Popular platforms include:

Ethereum: Known for its robust smart contract capabilities, Ethereum is a popular choice for creating custom tokens. Ethereum’s ERC-20 and ERC-721 standards provide a foundation for creating fungible and non-fungible tokens, respectively.

Binance Smart Chain (BSC): BSC offers low transaction fees and compatibility with Ethereum’s tools and infrastructure, making it an attractive option for new projects.

Solana: Renowned for its high throughput and low transaction costs, Solana is suitable for projects requiring scalability and speed.

Evaluate the features and benefits of each platform to determine which best aligns with your project’s needs.

3. Develop Your Cryptocurrency

Once you’ve chosen a blockchain platform, you can begin the development process. This involves creating the token’s smart contract, which defines its properties, such as total supply, distribution, and functionality.

For Ethereum-based tokens, you can use tools like Solidity (a programming language for smart contracts) and development environments like Remix or Truffle. If you’re using BSC or Solana, familiarize yourself with their respective development tools and languages.

4. Test and Deploy

Testing is a critical phase to ensure that your cryptocurrency functions as intended. Conduct thorough testing on testnets (blockchain networks used for testing purposes) to identify and resolve any issues before deploying your token on the mainnet.

Once testing is complete, you can deploy your cryptocurrency on the chosen blockchain platform. Ensure that all smart contract code is secure and has been audited to prevent vulnerabilities.

5. Market and Promote

Creating a cryptocurrency is only the beginning. Effective marketing and promotion are essential for gaining traction and attracting users. Develop a marketing strategy that includes:

Building a website and social media presence

Engaging with online communities and forums

Creating informative content and promotional materials

Leverage the power of social media and influencer partnerships to spread the word about your cryptocurrency and build a supportive community.

Creating Your Own Memecoin

Creating a memecoin follows a similar process to developing a standard cryptocurrency, with an emphasis on community engagement and viral potential. Here’s how to get started:

1. Embrace the Meme Culture

Memecoins thrive on internet culture and humor. To create a successful memecoin, embrace popular memes and viral trends. Consider how your memecoin can tap into existing online communities and trends to generate excitement.

2. Develop a Unique Concept

While memecoins often start as jokes, a unique concept or theme can help your token stand out. Create a compelling narrative or branding that resonates with your target audience and aligns with current meme trends.

3. Build a Community

Community is crucial for the success of a memecoin. Engage with potential users through social media platforms, online forums, and meme communities. Foster a sense of belonging and enthusiasm around your memecoin to drive interest and participation.

4. Launch and Promote

After developing and testing your memecoin, launch it on a blockchain platform and begin promoting it to your target audience. Utilize social media, memes, and viral marketing tactics to generate buzz and attract attention.

The Path to Financial Empowerment

Creating your own cryptocurrency or memecoin offers a unique opportunity to escape the rat race and take control of your financial future. By embracing the world of digital assets, you can potentially unlock new revenue streams, build innovative solutions, and connect with like-minded individuals.

However, it’s important to approach this venture with a clear vision, thorough planning, and a willingness to adapt to the dynamic nature of the cryptocurrency market. Success in the crypto world requires dedication, creativity, and a strategic mindset.

Conclusion

The journey to escaping the matrix and breaking free from the rat race can be transformative and empowering. By creating your own cryptocurrency or memecoin tokens, you can tap into the potential of digital assets and explore new avenues for financial growth and innovation.

And If you are new to solana, Memecoins, what is token and all? Not to worry about this, we founf this amazing platform for you, Visit Solana launcher & Deployment token, Here you can launch your own memecoins token in just less than three seconds without any extesive programming knowledge. And start young and watch your wealth grow!!!

Whether you’re driven by a desire for financial independence or a passion for technology and innovation, the world of cryptocurrencies offers a pathway to redefine your future. Embrace the opportunities, stay informed, and embark on your journey to a brighter and more prosperous tomorrow.

3 notes

·

View notes

Text

What is Trust Wallet all about?

Trust Wallet is a non-custodial cryptocurrency wallet that enables users to store, administer, and interact with various digital assets. It is compatible with many cryptocurrencies, such as bitcoin, ether, ERC-20 tokens, Solana, and nonfungible tokens. It is accessible as a browser extension and as a mobile application on iOS and Android platforms. The Development and History of the Trust…

2 notes

·

View notes

Text

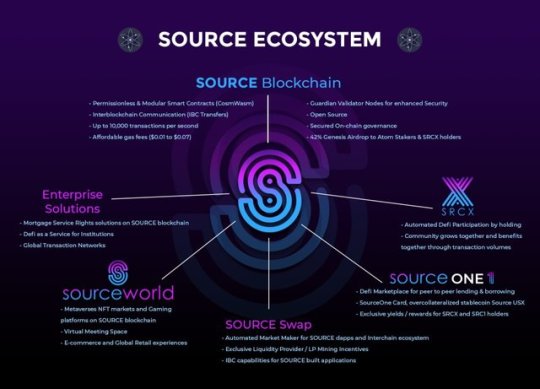

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

Crypto Token Development - To Propel Your Crypto Venture to New Heights

Crypto token development is the process of creating and launching digital assets, known as tokens, on a blockchain network. These tokens can serve multiple functions, such as representing ownership rights, enabling transactions, or powering decentralized applications (dApps). The development process involves designing the token's features, coding the necessary smart contracts, and integrating the token with the selected blockchain platform.

Understanding the Importance of Crypto Tokens in the Crypto Industry

In the fast-paced world of cryptocurrency, tokens are essential components of the ecosystem. They form the foundation for a variety of decentralized applications, offering innovative solutions across different sectors. Crypto tokens facilitate fundraising, incentivize user participation, and introduce new economic models that challenge traditional financial systems.

Benefits of Crypto Token Development for Your Venture

Fundraising Opportunities: Developing crypto tokens allows ventures to raise capital through Initial Coin Offerings (ICOs), Security Token Offerings (STOs), or Initial Exchange Offerings (IEOs), providing essential resources for scaling projects.

Increased User Engagement: Integrating tokens into your platform can boost user participation, foster community engagement, and create a vibrant ecosystem. Tokens can serve as rewards, access tools, or mediums of exchange.

Innovative Business Models: Tokens enable new business models that disrupt traditional methods. From decentralized finance (DeFi) to non-fungible tokens (NFTs), token-based ecosystems are transforming industries and creating growth opportunities.

Improved Transparency and Traceability: Blockchain technology ensures high transparency and traceability in token development. Every transaction and asset ownership detail is recorded on a distributed ledger, enhancing trust and accountability.

Competitive Advantage: Incorporating token development can set your venture apart, helping you stay ahead of the competition and position your project as a leader in the crypto space.

Various Token Standards for Development:

Crypto token development involves selecting the appropriate token standard based on the desired features and use cases. Popular standards include:

Ethereum Standards:

ERC-20

ERC-223

ERC-777

ERC-1400

ERC-721

ERC-827

ERC-1155

ERC-998

TRON Standards:

TRC-10

TRC-20

TRC-721

BSC Standards:

BEP-20

BEP-721

Other Popular Standards:

EIP-3664

BRC-20

SRC-20

Steps Involved in Crypto Token Development

Token Design: Define the token's purpose, utility, and tokenomics, including its supply, distribution, and usage within the ecosystem.

Smart Contract Implementation: Develop smart contracts to manage the token's features like minting, burning, transferring, and any additional rules or restrictions.

Token Deployment: Deploy the token on the chosen blockchain network, ensuring seamless integration with the platform's infrastructure.

Token Distribution: Plan and execute the token distribution strategy, which may involve an initial token sale, airdrops, staking rewards, or other mechanisms.

Ongoing Maintenance and Updates: Continuously monitor the token's performance, address technical issues, and implement upgrades or new features to maintain its relevance and value.

Popular Use Cases of Crypto Tokens in Different Industries:

Crypto tokens are revolutionizing various industries by providing new ways to interact with digital assets and services. Key use cases include:

Decentralized Finance (DeFi): Tokens enable decentralized lending, borrowing, and trading platforms, as well as novel financial instruments.

Non-Fungible Tokens (NFTs): Tokens, especially ERC-721, allow the creation and trading of unique digital assets like art, collectibles, and in-game items.

Supply Chain Management: Tokens can track and trace goods, improving transparency and efficiency in supply chain operations.

Digital Identity and Access Control: Tokens provide secure, decentralized management of digital identities and access control.

Loyalty and Reward Programs: Businesses can use tokens to create innovative loyalty and reward programs, enhancing customer engagement.

Future Trends and Opportunities in Crypto Token Development

As the crypto industry grows, so does the demand for token development. Emerging trends and opportunities include:

Interoperability and Cross-Chain Compatibility: Developing protocols and standards that enable seamless interaction between different blockchain networks and their tokens.

Decentralized Autonomous Organizations (DAOs): Using tokens to power the governance and decision-making processes of DAOs.

Tokenization of Real-World Assets: Representing physical assets like real estate, art, or commodities through tokens, unlocking new investment opportunities and liquidity.

Decentralized Applications (dApps): Continued growth and integration of tokens in developing dApps across various industries.

Regulatory Advancements: As the industry matures, clear regulatory frameworks will facilitate the broader adoption and integration of crypto tokens.

Conclusion: Unlocking the Full Potential of Your Crypto Venture through Token Development

In the dynamic crypto industry, strategic token development can unlock your venture's full potential. By leveraging the benefits of token development, you can differentiate your offering, drive user engagement, and explore new avenues for growth and innovation. Our experienced crypto token development team is ready to guide you through this process. Contact us today to learn more about how we can help you harness the power of crypto tokens and propel your project to success.

Why Hivelance is the Best Place to Develop Your Token?

Hivelance is a leading token development service provider in the crypto industry. We analyze market trends to deliver high-quality token development services, helping investors create and launch tokens with features like exchangeability, traceability, and configurability.

#token development company#bitcoin token#crypto token#token development#Crypto Token Development Services#Easy Steps To Create Your Own Token

3 notes

·

View notes

Text

The Top 10 Web3 Crypto Coins Set to Explode by 2025

In the dynamic world of cryptocurrencies, investors are always on the lookout for the next big thing. As we approach 2025, the focus is shifting towards Web3 crypto coins that promise explosive growth. These digital assets are not only volatile but also have the potential to reshape industries. Let's delve into the��top 10 Web3 crypto coins that are set to explode and make waves by 2025.

1.Filecoin

Filecoin stands out as a beacon of innovation in the world of cryptocurrency. Developed by Protocol Labs, Filecoin operates as an open-source, public cryptocurrency and digital payment system. Its primary purpose is to establish a blockchain-based cooperative digital storage and data retrieval method. Transactions within the network are facilitated using FIL, the native currency of the blockchain.

2.Theta

Theta, a blockchain-based network founded in 2018, is a game-changer for video streaming enthusiasts. Operating on a decentralized network, Theta allows users to exchange bandwidth and processing resources peer-to-peer. The goal is clear: enhance video streaming quality, making it more efficient and cost-effective. As the demand for high-quality streaming rises, Theta positions itself as a key player in the industry.

3.Chainlink

Co-founded in 2014 by Sergey Nazarov and Steve Ellis, Chainlink has emerged as a pioneer in connecting off-platform sources to smart contracts. With a robust foundation in decentralized systems, Chainlink is a dominant force in a growing market. Investing in Chainlink is akin to putting trust in a technology that seamlessly integrates data into smart contracts.

4.Internet Computer

Internet Computer (ICP) plays a crucial role as a utility token, enabling users to participate in and govern the Internet Computer blockchain network. Designed to assist developers in creating websites, enterprise IT systems, internet services, and DeFi applications, ICP offers versatility. Notably, ICP can be staked or converted into cycles, powering computation for decentralized applications (dApps) and traditional applications alike.

5.BitTorrent

BitTorrent, a popular peer-to-peer distributed communication technology, revolutionizes data distribution. By eliminating the need for a central server, BitTorrent ensures reliable simultaneous distribution of large files to multiple clients. The protocol's efficiency and decentralized nature make BitTorrent a cornerstone in the era of massive data sharing.

6.Uniswap

Uniswap, an Ethereum token, drives the automated liquidity provider designed for exchanging Ethereum (ERC-20) tokens. Unlike traditional exchanges, Uniswap operates without an order book or central facilitator. Token exchanges occur through liquidity pools defined by smart contracts, providing a decentralized and efficient trading experience.

7.Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization, has witnessed a remarkable surge in value, reaching as high as 800% in the last year. Ethereum's significant role in expanding decentralized finance (DeFi) contributes to its widespread acceptance and substantial investments. As the crypto landscape evolves, Ethereum continues to play a pivotal role in shaping the future of finance.

8.Decentraland

Decentraland, a 3D virtual reality platform built on the Ethereum blockchain, offers a unique space where users can create and monetize content and applications. Functioning as a shared metaverse, Decentraland allows users to purchase virtual plots of land. Its immersive experience and user-owned network contribute to its growing popularity.

9.Polkadot

Polkadot distinguishes itself by seamlessly connecting heterogeneous blockchain networks. Its capability to facilitate communication between diverse blockchain projects positions it as a promising investment. The Polkadot ecosystem is witnessing a surge in projects built on its foundation, making it a reliable choice for investors seeking decent returns.

10Cardano

Cardano stands out as a digital currency with impressive growth, driven by its commitment to optimizing transaction time and energy consumption. As the crypto community emphasizes sustainability, Cardano's approach aligns with the evolving preferences of investors. Its growth trajectory indicates a promising future in the competitive cryptocurrency landscape.

FAQs----------------------------------------

How Can I Start Investing in Web3 Crypto Coins?

To invest in Web3 crypto coins, start by creating an account on a reputable cryptocurrency exchange. Purchase popular coins like Ethereum or Binance Coin and explore emerging projects with potential.

Is Web3 Technology Safe for Investments?

Web3 technology introduces enhanced security features through decentralized frameworks. While risks exist, thorough research and due diligence can mitigate potential issues, making it a relatively safe investment avenue.

What Sets Web3 Apart from Previous Crypto Generations?

Web3 introduces decentralization on a broader scale, emphasizing user control and security. It aims to address scalability, interoperability, and sustainability, marking a significant evolution from previous crypto generations.

Which is the Best Blockchain Development Company In Mohali, Punjab ?

Wisewaytec stands at the forefront of cutting-edge blockchain development, offering innovative solutions that redefine the digital landscape. As the Best Blockchain Development Company in Mohali, Punjab we are committed to empowering businesses with transformative technologies that enhance security, transparency, and efficiency.

Can Web3 Coins Replace Traditional Financial Systems?

While Web3 coins aim to revolutionize finance, complete replacement of traditional systems is a gradual process. They coexist, offering diverse options for users seeking decentralized alternatives.

Are Web3 Crypto Coins Suitable for Long-Term Investments?

Many Web3 projects demonstrate potential for long-term growth. However, due diligence is crucial. Research each project's fundamentals, team, and community support to make informed decisions.

Conclusion

The top 10 Web3 crypto coins mentioned above are poised to explode by 2025. Each coin represents a unique value proposition, catering to the evolving needs of investors and enthusiasts. As the market embraces innovation, these cryptocurrencies stand as beacons of potential growth and transformation.

Disclaimer: Any financial and crypto market information written for informational purpose only and is not an investment advice. The readers are further advised that Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Conduct your own research by contacting financial experts before making any investment decisions. The decision to read hereinafter is purely a matter of choice and shall be construed as an express undertaking/guarantee in favour of being absolved from any/ all potential legal action, or enforceable claims. I do not represent nor own any cryptocurrency, any complaints, abuse or concerns with regards to the information provided shall be immediately informed here.

5 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

What Are the Key Skills and Expertise of Top ERC-20 Token Development Companies in 2024?

In the rapidly evolving landscape of cryptocurrency and blockchain technology, ERC-20 tokens have emerged as a popular choice for creating digital assets on the Ethereum blockchain. As the demand for ERC-20 tokens continues to grow, so does the need for expert token development companies that can deliver high-quality solutions. In this article, we'll explore the key skills and expertise of top ERC-20 token development companies in 2024.

Deep Understanding of Ethereum Blockchain: Top ERC-20 token development companies have a thorough understanding of the Ethereum blockchain and its underlying technology. They are well-versed in Ethereum's smart contract programming language, Solidity, and can develop secure and efficient smart contracts for ERC-20 tokens.

Expertise in Token Standards: ERC-20 is just one of the many token standards on the Ethereum blockchain. Top token development companies are familiar with other standards like ERC-721 (for non-fungible tokens) and ERC-1155 (for semi-fungible tokens) and can advise clients on the best standard for their specific use case.

Security and Auditing: Security is paramount in the world of blockchain, and top ERC-20 token development companies prioritize security at every stage of token development. They conduct thorough security audits to identify and fix vulnerabilities in smart contracts, ensuring that tokens are safe from hacks and exploits.

Scalability and Performance: As the Ethereum network continues to face challenges with scalability and high transaction fees, top token development companies are exploring solutions to improve the performance of ERC-20 tokens. They may use techniques like layer 2 scaling solutions or migrate tokens to other blockchains if necessary.

Compliance and Regulation: With the increasing focus on regulatory compliance in the cryptocurrency space, top token development companies have a strong understanding of relevant laws and regulations. They ensure that ERC-20 tokens comply with applicable regulations, including know-your-customer (KYC) and anti-money laundering (AML) requirements.

Token Economics and Design: Top token development companies understand the importance of token economics and design in the success of a project. They can help clients create tokens with well-thought-out economics that incentivize desired behavior and contribute to the overall value of the token ecosystem.

Community Engagement: Building a strong community around an ERC-20 token is crucial for its success. Top token development companies have experience in community engagement strategies, including airdrops, bounty programs, and social media marketing, to help tokens gain traction and adoption.

Experience and Track Record: Finally, top ERC-20 token development companies have a proven track record of delivering successful token projects. They have worked with a variety of clients across different industries and can provide references and case studies to showcase their expertise.

Conclusion

Top ERC-20 token development companies in 2024 possess a diverse set of skills and expertise that are essential for creating successful token projects. From deep technical knowledge to a strong focus on security, compliance, and community engagement, these companies are well-equipped to meet the growing demand for ERC-20 tokens in the blockchain ecosystem.

#ERC-20 Token Development Company#ERC-20 Token Development#ERC-20 Token#ERC-20#Token Development Company

0 notes

Text

Certainly! Here are some cryptocurrency wallet development companies based in the USA:

Coinbase: A leading cryptocurrency exchange that also offers a wallet service.

Blockchain.com: Provides a popular cryptocurrency wallet and blockchain explorer.

Gemini: A cryptocurrency exchange and custodian that offers a secure wallet.

Edge (formerly Airbitz): Offers a user-friendly cryptocurrency wallet with a focus on security and privacy.

Exodus: Provides a multi-cryptocurrency wallet with a sleek design and intuitive interface.

BitGo: Offers institutional-grade cryptocurrency custody and wallet solutions.

BRD: Formerly known as Breadwallet, it offers a simple and secure mobile cryptocurrency wallet.

Coinomi: A multi-asset cryptocurrency wallet with a strong focus on privacy and security.

MyEtherWallet (MEW): Specializes in Ethereum and ERC-20 token wallets, offering both web and mobile versions.

Trezor: Known for its hardware wallets, Trezor offers secure cold storage solutions for cryptocurrencies.

These companies are among the prominent players in the cryptocurrency wallet development space within the USA.

2 notes

·

View notes

Text

Will SHIB reach $1?

Shiba Inu, or SHIB, as it's called, is a meme coin that has experienced a spectacular price rise in the recent past. SHIB was introduced as an ERC-20 token in August 2020. Its price rocketed from nothing in January 2021 to a pinnacle nine months later, in October 2021. Despite this instance, SHIB had fallen back.

However, there is still a ray of hope for its price to reach $1 shortly. Its investors also hopefully anticipate the same. So the surfacing question is, “Will SHIB reach 1 cent?” Fingers crossed! Just read on, and you shall comprehend.

Shiba Inu's Historical Performance

Since its inception, SHIB has encountered monumental growth by attaining its ATH (all-time high) of $0.00008845, 2 years ago. Currently, it is trading at a value of $0.000009866, down by 88.83% from its ATH!

However, since last one month, the token has seen a decent uprise of more than 20%. Which again prompts the question, “Will this uptrend continue? And Will SHIB reach 1 dollar?” A quick answer to this from its fans’ perspective is affirmative anticipation.

Will SHIB coin reach $1?

No, SHIB may not reach $1 price very soon! In August 2023, SHIB traded around a peak price of $0.00001072. Four months later, it is trading around $0.0000099.

SHIB prediction for 2025 suggests that the token may trade between $0.0000227 and $0.0000326, where the former is its minimum value and the latter is its maximum value. While Shibu Inu’s 2030 price prediction anticipates its maximum to be $0.0001204 and its minimum to be around $0.0000836.

Factors to Support Shiba Inu's $1 Price

Some of the factors that may support Shiba Inu’s price to attain $1 are:

Mainstream Adoption: Increasing the mainstream adoption utility of SHIB through payment modes or decentralized financial apps aids in price rises.

Affirmative Market Sentiment: The prevailing affirmative market sentiment is controlled by optimistic trends in prime cryptocurrencies like Bitcoin and Ethereum.

Community Engagement: The growing SHIB community called the “SHIB Army” drives social media trends and plays a key role in attracting new potential investors.

Strategic Burn: An increase in SHIB price can be driven by reducing its supply. This is positively achieved by a marked decrease in circulating SHIB’s supply via strategic token burns.

Regulatory Clarity: Constructive developments in regulatory measures offer much clarity and intensified security to cryptocurrency investors, thereby increasing the price.

Conclusion

Shiba Inu’s unique features have been pivotal in its journey so far. This immense growth and stability are real assets to the cryptocurrency. Its investors are testimonials to its significant trait of “Loyalty,” assumed to be imbibed from Shiba Inu, the Japanese dog breed. The price forecasts furnished here are purely based on the coin’s past performance and technical analysis.

Before arriving at any financial decisions, marketers, investors, traders, and other users of the SHIB must, therefore, do their research based on the coin’s market status. This greatly helps in avoiding risks of any intensity. Sit back, take a deep breath, and analyze well, for your decisions to make brighter impacts on your SHIB-based investments and transactions.

2 notes

·

View notes

Text

What is Bullion Coin (BLO)?

Bullion is a cutting-edge DeFi platform that is designed and introduced to help you grow your cryptocurrencies effortlessly. With Bullion, you can earn passive income like never before. Our innovative protocols provide opportunities for yield farming, staking, and liquidity provision, all while ensuring the utmost security and transparency.

Be a Bullioniare!

Introducing you to the all-new Bullion Coin (BLO asset) which is a powerful standard multi-chain cryptocurrency backed by bullion assets such as gold, silver, and platinum for you to boost your earnings up to 100X. This asset is issued by Bullion Defi — a decentralised finance platform for you to lend, borrow, and earn interest in order to stake bullion assets.

BLO coin was developed and introduced to offer a secure, transparent, and scalable platform to imply bullion trading and get better investment options. The asset denotes the value of its decentralized application and serves as a mechanism in terms of utility in the ecosystem. This asset is planned to be released in different standard blockchains including BEP20, ERC20, SOL51, POLYGON, etc.

Some of the functionalities, opportunities, and benefits of Bullion Coin BLO are as follows:

- It is pegged to the value of bullion assets that gets stored in safe vaults and audited on serial regular basis.

- It has low volatility giving a user high liquidity due to the easy exchange of bullion assets or any other cryptocurrencies.

- It provides high returns for staking where you can earn much interest/rewards by locking your owned/held BLO coins in smart contracts.

- It allows you to access the global market and wide opportunities for bullion trading and investment where you can feasibly interact with other participants on the blockchain network.

- It supports the development and exploration of the bullion industry while leveraging the adoption of blockchain technology as well as great innovation in the sector.

Bullion DeFi project is on the verge of building, innovating, and exploring one of the biggest and strongest communities that will believe in the core intention, and potential of the project. The team and project consider the community not to be only the holder of the BLO assets but also to hold the right to share technical/promotional suggestions getting all involved in the decision-making activities and betterment of the project.

This project intends to develop, initiate, and promote the BLO ecosystem to eventually dedicate its resources to research, development, and governance. Bullion Coin is a utility token which is not supposed to hold any value outside the BLO ecosystem.

Total Supply: 20 million (20,000,000 BLO)

· Seed Sale: 6%

· Presale: 4%

· Staking: 36%

· Scheduled minting: 30%

· Marketing: 5%

· Development: 5%

· Team Reserve: 3%

· Initial Developers reserve: 1%

· Contract Royalty: 10%

To buy Bullion Coin BLO, follow the below-mentioned steps:

Step 1: Apply and get a compatible wallet to store BLO coins. You have the option to download the official Bullion Defi wallet from the official website or apply to any other wallet supporting ERC-20 tokens.

Step 2: Hold some cryptocurrency in your wallet, as BLO coins are deployed and support the Ether blockchain protocols. So, you hold some cryptocurrency exchange from Coinbase or Binance.

Step 3: Swap your Ethereum assets for BLO coins on a decentralized exchange that lists BLO coins like Uniswap or say SushiSwap. Check out the contract address and the token symbol of BLO coins from the Bullion Defi official portal.

Step 4: Finally, confirm the transaction and wait for the time period to get processed by the blockchain network. Once approved, you get the amount of BLO coins in your wallet balance.

If you are interested and want to learn more about Bullion Coin (BLO) and the Bullion Defi project, you can visit the official website or read out the whitepaper. You can also follow the team on social media channels like Twitter and Telegram.

website: https://www.bulliondefi.com/

Twitter: https://twitter.com/bulliondefi

Facebook: https://www.facebook.com/BullionDefi

Telegram: https://t.me/bulliondefi

Reddit: https://www.reddit.com/user/bulliondefi

#Bullion Defi#Bullion Coins#Defi#Blo#blockchain#Blo Tokenomics#Bullion#Bullion Defi Swap#Bullion Dex#Defi Earning

2 notes

·

View notes

Text

Easily Launch Your Crypto with an ERC-20 Token

The world of cryptocurrencies continues to evolve rapidly, and one of the most popular innovations within the Ethereum ecosystem is the ERC-20 token. These tokens have revolutionized how digital assets are created and managed, enabling businesses and individuals alike to launch their own cryptocurrencies with ease. If you've ever considered entering the crypto space by launching your own token, now is the perfect time to explore the possibilities. In this article, we’ll cover how you can create erc20 token effortlessly, what makes the standard valuable, and how platforms like Erc20 Maker simplify the entire process for everyone.

To begin with, ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain to implement tokens. These tokens are fungible, meaning each unit is identical and interchangeable—just like traditional currencies. The ERC-20 standard ensures compatibility with a wide range of wallets, exchanges, and DeFi protocols. Whether you're building a new startup, launching a community coin, or experimenting with blockchain technology, ERC-20 tokens offer a versatile and widely accepted foundation.

Today, anyone can create erc20 token with just a few clicks, thanks to tools like Erc20 Maker. This platform is designed to help users without coding knowledge build professional-grade tokens in just minutes. For a flat fee of only 0.01 ETH, users can generate a fully functional ERC-20 token, ready to be used on the Ethereum blockchain. There are no hidden costs or subscription models, which makes it accessible for everyone—from hobbyists to entrepreneurs.

One of the reasons why Erc20 Maker stands out is its simplicity. Unlike traditional smart contract development, which requires extensive knowledge of Solidity and blockchain mechanics, Erc20 Maker abstracts all the technical complexity. Users can simply input the name of the token, the symbol, the number of decimal places, and the total supply. This is ideal for people who want to erc20 token create quickly and securely, without investing weeks into coding and testing.

Erc20 Maker is not just about simplicity; it’s also about customization. Users can personalize their token’s behavior by choosing from different templates. These templates allow the addition of features like minting (creating more tokens), burning (destroying tokens), and pausing transfers. Such functionality can be essential depending on your token's use case—be it for a governance system, a reward mechanism, or simply as a means of exchange within a community.

If you're interested in finding a trusted erc20 token creator, Erc20 Maker also offers peace of mind through its focus on security. All smart contracts generated by the platform have been independently audited by security experts and are fully open-source. This transparency builds confidence among users and stakeholders, knowing that the underlying code of their tokens is safe and reliable.

0 notes

Text

Which Blockchain Should You Choose: Solana or Ethereum for Your Token?

When it comes to launching your own cryptocurrency token, the choice of blockchain is crucial. The two most popular options for token creation are Solana and Ethereum, each with their unique strengths and capabilities. While Ethereum has long been the go-to blockchain for developers and projects, Solana has emerged as a strong competitor with its focus on speed, scalability, and low transaction fees. In this blog, we’ll compare Solana and Ethereum, focusing on why Solana might be the better choice for your token, especially when using tools like the Solana token creator, instant token creator, and revoke mint authority tool.

Why Blockchain Choice Matters for Token Creation

Choosing the right blockchain is one of the most critical decisions you’ll make when launching a token. It impacts the speed, cost, scalability, and even the potential success of your token. Both Solana and Ethereum are popular choices, but the differences between them can significantly affect your project.

Ethereum is the older, more established blockchain, known for its smart contract functionality. However, Ethereum has been facing challenges with network congestion and high gas fees, which can be prohibitive for smaller projects or high-frequency transactions.

Solana, on the other hand, offers a faster and more cost-effective solution, making it an ideal option for creators looking to scale quickly and minimize fees. Let’s take a closer look at the key features of both blockchains and why Solana might be the better choice.

Ethereum: The Long-Standing King

Ethereum is the second-largest cryptocurrency by market capitalization and has been a popular choice for decentralized applications (dApps) and token creation. It supports the widely-used ERC-20 and ERC-721 token standards, which have become industry benchmarks for fungible and non-fungible tokens (NFTs).

Strengths of Ethereum:

Established Ecosystem: Ethereum has a vast ecosystem of developers, tools, and decentralized applications, making it a reliable choice for many projects.

Smart Contracts: Ethereum pioneered smart contracts, allowing developers to build complex applications that run on its blockchain.

Security: As one of the most secure blockchains, Ethereum is backed by thousands of nodes worldwide, ensuring decentralization and robustness.

However, Ethereum is not without its drawbacks.

Weaknesses of Ethereum:

High Gas Fees: Ethereum’s transaction fees, known as gas fees, can be extremely high during peak times, making it costly for token transfers and smart contract executions.