#Ethereum use cases

Text

Inside Ethereum: Unlocking the Potential of Decentralized Finance (DeFi)

The story of Ethereum begins with a young programmer and entrepreneur named Vitalik Buterin. Buterin became interested in cryptocurrency and blockchain technology after learning about Bitcoin in 2011. He soon became one of the co-founders of Bitcoin Magazine, where he wrote extensively about cryptocurrencies and related technologies.

However, Buterin saw limitations in Bitcoin’s functionality.…

View On WordPress

#Blockchain Technology#Consensus mechanism#Cryptocurrency#DAO (Decentralized Autonomous Organization)#Decentralized applications (DApps)#DeFi (Decentralized Finance)#ERC-20 tokens#ERC-721 tokens (NFTs)#Ether (ETH)#Ethereum#Ethereum 2.0#Ethereum community#Ethereum development#Ethereum ecosystem#Ethereum Foundation#Ethereum roadmap#Ethereum upgrades#Ethereum use cases#Gas fees#Network congestion#Proof-of-stake (PoS)#Proof-of-work (PoW)#Scalability#Security#Smart contracts

0 notes

Text

Polygon Launches Decentralized ID Product with ZK Technology

"Polygon, a popular Ethereum scaling solution, has launched a decentralized identity product powered by zero-knowledge proofs for increased security and privacy."...Read More

#Polygon blockchain id#web3 identity protocols#polygon id use cases#polygon id#zk identity#ethereum news#polygon product#polygon zero knowledge proof

0 notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

264 notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

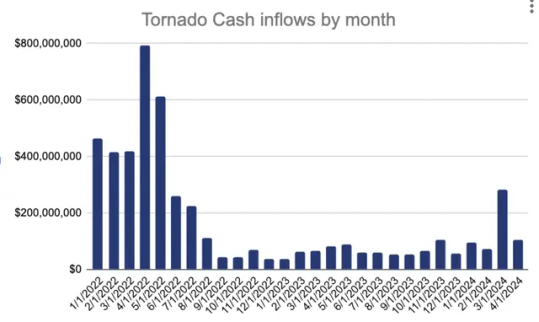

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

Escape the Matrix: Create Your Own Crypto and Memecoins to Break Free from the Rat Race

In today’s fast-paced world, many people feel trapped in the proverbial “matrix” of conventional work life — a never-ending grind where the promises of financial freedom and personal fulfillment seem elusive. If you find yourself yearning for a way out, creating your own cryptocurrency or memecoin tokens might be the key to escaping the rat race and paving the way to a brighter, more prosperous future. This blog will explore how you can break free from traditional financial constraints and take control of your financial destiny by delving into the world of crypto and memecoins.

Understanding the Matrix and the Rat Race

Before we dive into how you can create your own crypto and memecoin tokens, it’s important to understand the matrix and the rat race. The matrix represents a system of control and conformity that often dictates our daily lives, while the rat race is the relentless pursuit of success and wealth through conventional means, often leading to burnout and dissatisfaction.

Breaking free from this cycle involves adopting new ways of thinking and exploring alternative financial opportunities. The cryptocurrency revolution offers a pathway to redefine your financial future, allowing you to step out of the traditional financial system and into a world of digital innovation.

The Rise of Cryptocurrencies and Memecoins

1. The Cryptocurrency Revolution

Cryptocurrencies have transformed the financial landscape by offering decentralized alternatives to traditional financial systems. Bitcoin, the first and most well-known cryptocurrency, introduced the concept of blockchain technology — a decentralized ledger that ensures transparency, security, and immutability.

Since Bitcoin’s inception, thousands of cryptocurrencies have emerged, each with unique features and use cases. Ethereum introduced smart contracts, enabling the creation of decentralized applications (dApps) and new tokens. The rise of cryptocurrencies has paved the way for individuals to create their own digital assets, offering opportunities for innovation and financial empowerment.

2. The Memecoin Phenomenon

Memecoins, on the other hand, represent a more playful and community-driven aspect of the cryptocurrency world. Born from internet memes and viral trends, memecoins often gain popularity through social media and online communities. Despite their origins as jokes or experiments, some memecoins have experienced significant price surges and garnered substantial attention.

Notable examples include Dogecoin, which started as a meme but has become a widely recognized cryptocurrency with a strong community backing. The success of memecoins highlights the power of community engagement and the potential for digital assets to capture public interest.

Creating Your Own Cryptocurrency

Creating your own cryptocurrency involves several key steps. Here’s a roadmap to help you get started:

1. Define Your Purpose and Goals

Before diving into the technical aspects, it’s essential to define the purpose and goals of your cryptocurrency. Consider the following questions:

What problem does your cryptocurrency aim to solve?

Who is your target audience?

How will your cryptocurrency differentiate itself from existing options?

Having a clear vision will guide the development process and help you create a compelling value proposition for your digital asset.

2. Choose the Right Blockchain Platform

Selecting the appropriate blockchain platform is crucial for the development of your cryptocurrency. Popular platforms include:

Ethereum: Known for its robust smart contract capabilities, Ethereum is a popular choice for creating custom tokens. Ethereum’s ERC-20 and ERC-721 standards provide a foundation for creating fungible and non-fungible tokens, respectively.

Binance Smart Chain (BSC): BSC offers low transaction fees and compatibility with Ethereum’s tools and infrastructure, making it an attractive option for new projects.

Solana: Renowned for its high throughput and low transaction costs, Solana is suitable for projects requiring scalability and speed.

Evaluate the features and benefits of each platform to determine which best aligns with your project’s needs.

3. Develop Your Cryptocurrency

Once you’ve chosen a blockchain platform, you can begin the development process. This involves creating the token’s smart contract, which defines its properties, such as total supply, distribution, and functionality.

For Ethereum-based tokens, you can use tools like Solidity (a programming language for smart contracts) and development environments like Remix or Truffle. If you’re using BSC or Solana, familiarize yourself with their respective development tools and languages.

4. Test and Deploy

Testing is a critical phase to ensure that your cryptocurrency functions as intended. Conduct thorough testing on testnets (blockchain networks used for testing purposes) to identify and resolve any issues before deploying your token on the mainnet.

Once testing is complete, you can deploy your cryptocurrency on the chosen blockchain platform. Ensure that all smart contract code is secure and has been audited to prevent vulnerabilities.

5. Market and Promote

Creating a cryptocurrency is only the beginning. Effective marketing and promotion are essential for gaining traction and attracting users. Develop a marketing strategy that includes:

Building a website and social media presence

Engaging with online communities and forums

Creating informative content and promotional materials

Leverage the power of social media and influencer partnerships to spread the word about your cryptocurrency and build a supportive community.

Creating Your Own Memecoin

Creating a memecoin follows a similar process to developing a standard cryptocurrency, with an emphasis on community engagement and viral potential. Here’s how to get started:

1. Embrace the Meme Culture

Memecoins thrive on internet culture and humor. To create a successful memecoin, embrace popular memes and viral trends. Consider how your memecoin can tap into existing online communities and trends to generate excitement.

2. Develop a Unique Concept

While memecoins often start as jokes, a unique concept or theme can help your token stand out. Create a compelling narrative or branding that resonates with your target audience and aligns with current meme trends.

3. Build a Community

Community is crucial for the success of a memecoin. Engage with potential users through social media platforms, online forums, and meme communities. Foster a sense of belonging and enthusiasm around your memecoin to drive interest and participation.

4. Launch and Promote

After developing and testing your memecoin, launch it on a blockchain platform and begin promoting it to your target audience. Utilize social media, memes, and viral marketing tactics to generate buzz and attract attention.

The Path to Financial Empowerment

Creating your own cryptocurrency or memecoin offers a unique opportunity to escape the rat race and take control of your financial future. By embracing the world of digital assets, you can potentially unlock new revenue streams, build innovative solutions, and connect with like-minded individuals.

However, it’s important to approach this venture with a clear vision, thorough planning, and a willingness to adapt to the dynamic nature of the cryptocurrency market. Success in the crypto world requires dedication, creativity, and a strategic mindset.

Conclusion

The journey to escaping the matrix and breaking free from the rat race can be transformative and empowering. By creating your own cryptocurrency or memecoin tokens, you can tap into the potential of digital assets and explore new avenues for financial growth and innovation.

And If you are new to solana, Memecoins, what is token and all? Not to worry about this, we founf this amazing platform for you, Visit Solana launcher & Deployment token, Here you can launch your own memecoins token in just less than three seconds without any extesive programming knowledge. And start young and watch your wealth grow!!!

Whether you’re driven by a desire for financial independence or a passion for technology and innovation, the world of cryptocurrencies offers a pathway to redefine your future. Embrace the opportunities, stay informed, and embark on your journey to a brighter and more prosperous tomorrow.

3 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

2 notes

·

View notes

Text

Understanding Blockchain Technology: Beyond Bitcoin

Introduction

Blockchain technology, often synonymous with Bitcoin, is a revolutionary system that has far-reaching implications beyond its initial use in cryptocurrency. While Bitcoin introduced the world to the concept of a decentralized ledger, blockchain's potential extends well beyond digital currencies. This article explores the fundamentals of blockchain technology and delves into its various applications across different industries.

What is Blockchain Technology?

At its core, blockchain is a decentralized, distributed ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This ensures transparency and security. Each block in the chain contains a list of transactions, and once a block is completed, it is added to the chain in a linear, chronological order.

Key features of blockchain include:

Transparency: All participants in the network can see the transactions recorded on the blockchain.

Immutability: Once data is recorded on the blockchain, it cannot be altered or deleted.

Security: Transactions are encrypted, and the decentralized nature of blockchain makes it highly secure against hacks and fraud.

Blockchain Beyond Bitcoin

While Bitcoin brought blockchain into the spotlight, other cryptocurrencies like Ethereum and Ripple have expanded its use cases. Ethereum, for example, introduced the concept of smart contracts—self-executing contracts where the terms are directly written into code. These smart contracts enable decentralized applications (DApps) that operate without the need for a central authority.

Applications of Blockchain Technology

Finance:

Decentralized Finance (DeFi): DeFi platforms leverage blockchain to create financial products and services that are open, permissionless, and transparent. These include lending, borrowing, and trading without intermediaries.

Cross-border Payments: Blockchain simplifies and speeds up cross-border transactions while reducing costs and increasing security.

Fraud Reduction: The transparency and immutability of blockchain make it harder for fraud to occur, as all transactions are visible and verifiable.

Supply Chain Management:

Tracking and Transparency: Blockchain provides end-to-end visibility of the supply chain, ensuring that all parties can track the movement and origin of goods.

Reducing Fraud: By recording every transaction, blockchain helps prevent fraud and counterfeiting, ensuring the authenticity of products.

Healthcare:

Secure Data Sharing: Blockchain allows for secure sharing of patient data between healthcare providers while maintaining privacy and consent.

Drug Traceability: Blockchain helps track pharmaceuticals through the supply chain, reducing the risk of counterfeit drugs.

Voting Systems:

Secure Elections: Blockchain can provide a transparent and tamper-proof system for voting, ensuring that each vote is recorded and counted accurately.

Increasing Voter Participation: The security and convenience of blockchain-based voting could lead to higher voter turnout and greater confidence in electoral systems.

Real Estate:

Property Transactions: Blockchain can streamline property transactions by reducing paperwork, ensuring transparency, and preventing fraud.

Record-Keeping: Immutable records of property ownership and transactions enhance security and trust in the real estate market.

Challenges and Limitations

Despite its potential, blockchain technology faces several challenges:

Scalability: The ability of blockchain networks to handle a large number of transactions per second is limited, impacting its adoption in high-volume industries.

Energy Consumption: Blockchain, particularly proof-of-work systems like Bitcoin, requires significant energy, raising concerns about its environmental impact.

Regulatory Challenges: The decentralized and borderless nature of blockchain poses regulatory and legal challenges, as governments and institutions seek to manage and control its use.

The Future of Blockchain Technology

The future of blockchain looks promising, with continuous advancements and innovations. Potential developments include improved scalability solutions like sharding and proof-of-stake consensus mechanisms, which aim to reduce energy consumption and increase transaction speeds. As blockchain technology matures, its adoption across various industries is expected to grow, potentially transforming the way we conduct business, manage data, and interact with digital systems.

Conclusion

Blockchain technology, initially popularized by Bitcoin, holds immense potential beyond cryptocurrencies. Its applications in finance, supply chain management, healthcare, voting, and real estate demonstrate its versatility and transformative power. While challenges remain, ongoing innovations and growing interest in blockchain suggest a future where this technology plays a crucial role in various aspects of our lives.

#blockchain#Bitcoin#blockchaintechnology#cryptocurrency#decentralizedfinance#DeFi#supplychain#healthcare#votingsystems#realestate#blockchainapplications#smartcontracts#DApps#digitalledger#blockchainsecurity#blockchainfuture#blockchainadoption#techinnovation#financial education#financial empowerment#financial experts#finance#digitalcurrency#unplugged financial#globaleconomy

4 notes

·

View notes

Text

How to Select the Best Cryptocurrency Development Services Provider Near You?

Choosing the right cryptocurrency development services provider is crucial for the success of your blockchain project. Whether you're launching a new cryptocurrency, developing a decentralized application (dApp), or planning an Initial Coin Offering (ICO), finding a reliable and competent development team can make all the difference. Here’s a comprehensive guide to help you navigate this important decision.

1. Define Your Project Requirements

Before you start looking for a cryptocurrency development services provider, it’s essential to clearly define your project requirements. Outline the scope of your project, including technical specifications, desired features, security considerations, and any regulatory compliance requirements. Understanding your project needs will help you evaluate potential providers more effectively.

2. Evaluate Technical Expertise

One of the most critical factors in selecting a cryptocurrency development services provider is their technical expertise. Look for a team that has a proven track record in blockchain development, particularly in the specific technologies and platforms you intend to use (e.g., Ethereum, Hyperledger, Stellar). Verify their experience through case studies, client testimonials, and their portfolio of completed projects.

3. Assess Security Measures

Security is paramount in the cryptocurrency and blockchain space due to the high value of digital assets and the prevalence of cyber threats. Ensure that the development services provider has robust security protocols in place, including adherence to best practices such as code audits, multi-layered encryption, secure smart contract development, and regular security updates.

4. Check Regulatory Compliance

Regulatory compliance is another critical consideration, especially if your project involves tokens or involves financial transactions. Ensure that the development team is well-versed in relevant regulatory frameworks (e.g., KYC/AML regulations) and can implement compliance measures effectively. A reputable provider should prioritize legal compliance to mitigate regulatory risks.

5. Evaluate Development Methodologies

Understand the development methodologies and processes employed by the cryptocurrency development services provider. Agile methodologies are often preferred in blockchain development for their flexibility and iterative approach. Ensure that the provider emphasizes transparency, regular communication, and milestone-based deliverables to keep your project on track.

6. Review Client Support and Maintenance

Post-launch support and maintenance are crucial for the long-term success of your blockchain project. Inquire about the provider’s support services, including troubleshooting, bug fixes, and updates. A reliable provider should offer ongoing maintenance to address evolving technological and security needs, ensuring the continued functionality and security of your platform.

7. Consider Industry Reputation and Reviews

Research the reputation of potential cryptocurrency development services providers within the industry. Seek reviews from past clients and industry experts to gauge their reliability, professionalism, and overall satisfaction with the services provided. Online platforms, forums, and social media can provide valuable insights into the provider’s reputation and client relationships.

8. Evaluate Cost and Budget

While cost shouldn’t be the sole determining factor, it’s important to consider your budget and compare pricing among different providers. Beware of overly low-cost offers that may compromise quality or lack transparency in pricing structure. Look for a provider that offers competitive pricing aligned with the scope and complexity of your project, with a clear breakdown of costs.

9. Assess Communication and Collaboration

Effective communication and collaboration are essential when working with a cryptocurrency development services provider. Evaluate their responsiveness, clarity in communication, and willingness to understand your project vision. A provider who values collaboration and offers proactive suggestions can contribute significantly to the success of your blockchain venture.

10. Seek Customization and Scalability

Every blockchain project is unique, requiring tailored solutions to meet specific objectives. Ensure that the development services provider offers customization options and scalability to accommodate future growth and evolving market demands. Whether you’re launching a startup or expanding an existing platform, scalability should be a key consideration in your provider selection.

Conclusion

Selecting the best cryptocurrency development services provider near you involves careful evaluation of technical expertise, security measures, regulatory compliance, support services, reputation, cost, and collaboration capabilities. By thoroughly assessing these factors and aligning them with your project requirements, you can make an informed decision that sets the foundation for a successful blockchain venture.

Choosing the right partner is not just about finding a development team but selecting a strategic ally committed to your project’s success from inception through implementation and beyond.

#Cryptocurrency Development Services#Cryptocurrency Development#Cryptocurrency#Crypto#Cryptocurrency Development Solutions#Cryptocurrency Development Company#Cryptocurrency Development Agency

2 notes

·

View notes

Text

WEEX has become the initial CEX collaboration platform for Shibarium and will work together with Shibarium's top-tier projects in the ecosystem on Launchpad

BlockBeats news, on June 11, the crypto trading platform WEEX announced a strategic partnership with the Ethereum L2 project Shibarium, and will select high-quality targets from the thousands of projects on the Shibarium chain for Launchpad and coin listing cooperation to support the development of the Shiba Inu (SHIB) community. Shiba Inu development advocates have agreed to use WEEX as the preferred CEX cooperation platform for Shibarium hackathons and qualified new projects in the global developer community.

In addition, in August this year, WEEX Global VP Andrew Weiner will attend the "Blockchain Futurist Conference" co-hosted by Shiba Inu and K9 Finance DAO. K9 Finance DAO (KNINE) will be the first cooperation project and will be the beginning of their deep partnership.

Shibarium is an Ethereum Layer 2 scaling solution that aims to solve the high gas fees and slow transaction speeds in the Shiba Inu ecosystem. It uses Bone ShibaSwap (BONE) tokens as gas fees and provides faster transaction speeds and lower costs. K9 Finance DAO is the official DeFi protocol of SHIB, which aims to introduce decentralized finance to Shibarium and incentivize developers to build products on Shibarium through rewards. It is expected that up to 1,000 projects will be created on Shibarium in the next 12 months. WEEX Launchpad is one of the important use cases of WEEX platform currency WXT, which will provide exclusive airdrops for popular projects to WXT holders.

What is WEEX WXT:

Know WXT: https://markets.businessinsider.com/news/stocks/weex-launches-wxt-presale-affiliates-can-purchase-at-a-30-discount-with-invitation-points-1033442484

2 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

What is Blockchain Technology & How Does Blockchain Work?

Introduction

Gratix Technologies has emerged as one of the most revolutionary and transformative innovations of the 21st century. This decentralized and transparent Blockchain Development Company has the potential to revolutionize various industries, from finance to supply chain management and beyond. Understanding the basics of Custom Blockchain Development Company and how it works is essential for grasping the immense opportunities it presents.

What is Blockchain Development Company

Blockchain Development Company is more than just a buzzword thrown around in tech circles. Simply put, blockchain is a ground-breaking technology that makes digital transactions safe and transparent. Well, think of Custom Blockchain Development Company as a digital ledger that records and stores transactional data in a transparent and secure manner. Instead of relying on a single authority, like a bank or government, blockchain uses a decentralized network of computers to validate and verify transactions.

Brief History of Custom Blockchain Development Company

The Custom Blockchain Development Company was founded in the early 1990s, but it didn't become well-known until the emergence of cryptocurrencies like Bitcoin. The notion of a decentralized digital ledger was initially presented by Scott Stornetta and Stuart Haber. Since then, Blockchain Development Company has advanced beyond cryptocurrency and found uses in a range of sectors, including voting systems, supply chain management, healthcare, and banking.

Cryptography and Security

One of the key features of blockchain is its robust security. Custom Blockchain Development Company relies on advanced cryptographic algorithms to secure transactions and protect the integrity of the data stored within it. By using cryptographic hashing, digital signatures, and asymmetric encryption, blockchain ensures that transactions are tamper-proof and verifiable. This level of security makes blockchain ideal for applications that require a high degree of trust and immutability.

The Inner Workings of Blockchain Development Company

Blockchain Development Company data is structured into blocks, each containing a set of transactions. These blocks are linked together in a chronological order, forming a chain of blocks hence the name of Custom Blockchain Development Company. Each block contains a unique identifier, a timestamp, a reference to the previous block, and the transactions it includes. This interconnected structure ensures the immutability of the data since any changes in one block would require altering all subsequent blocks, which is nearly impossible due to the decentralized nature of the network.

Transaction Validation and Verification

When a new transaction is initiated, it is broadcasted to the network and verified by multiple nodes through consensus mechanisms. Once validated, the transaction is added to a new block, which is then appended to the blockchain. This validation and verification process ensures that fraudulent or invalid transactions are rejected, maintaining the integrity and reliability of the blockchain.

Public vs. Private Blockchains

There are actually two main types of blockchain technology: private and public. Public Custom Blockchain Development Company, like Bitcoin and Ethereum, are open to anyone and allow for a decentralized network of participants. On the other hand, private blockchains restrict access to a select group of participants, offering more control and privacy. Both types have their advantages and use cases, and the choice depends on the specific requirements of the application.

Peer-to-Peer Networking

Custom Blockchain Development Company operates on a peer-to-peer network, where each participant has equal authority. This removes the need for intermediaries, such as banks or clearinghouses, thereby reducing costs and increasing the speed of transactions. Peer-to-peer networking also enhances security as there is no single point of failure or vulnerability. Participants in the network collaborate to maintain the Custom Blockchain Development Company security and validate transactions, creating a decentralized ecosystem that fosters trust and resilience.

Blockchain Applications and Use Cases

If you've ever had to deal with the headache of transferring money internationally or verifying your identity for a new bank account, you'll appreciate How Custom Blockchain Development Company can revolutionize the financial industry. Custom Blockchain Development Company provides a decentralized and transparent ledger system that can streamline transactions, reduce costs, and enhance security. From international remittances to smart contracts, the possibilities are endless for making our financial lives a little easier.

Supply Chain Management

Ever wondered where your new pair of sneakers came from? Custom Blockchain Development Company can trace every step of a product's journey, from raw materials to manufacturing to delivery. By recording each transaction on the Custom Blockchain Development Company supply chain management becomes more transparent, efficient, and trustworthy. No more worrying about counterfeit products or unethical sourcing - blockchain has got your back!

Enhanced Security and Trust

In a world where hacking and data breaches seem to happen on a daily basis, Custom Blockchain Development Company offers a beacon of hope. Its cryptographic algorithms and decentralized nature make it incredibly secure and resistant to tampering. Plus, with its transparent and immutable ledger, Custom Blockchain Development Company builds trust by providing a verifiable record of transactions. So you can say goodbye to those sleepless nights worrying about your data being compromised!

Improved Efficiency and Cost Savings

Who doesn't love a little efficiency and cost savings? With blockchain, intermediaries and third-party intermediaries can be eliminated, reducing the time and cost associated with transactions. Whether it's cross-border payments or supply chain management, Custom blockchain Development Company streamlined processes can save businesses a ton of money. And who doesn't want to see those savings reflected in their bottom line?

The Future of Blockchain: Trends and Innovations

As Custom Blockchain Development Company continues to evolve, one of the key trends we're seeing is the focus on interoperability and integration. Different blockchain platforms and networks are working towards the seamless transfer of data and assets, making it easier for businesses and individuals to connect and collaborate. Imagine a world where blockchain networks can communicate with each other like old friends, enabling new possibilities and unlocking even more potential.

Conclusion

Custom Blockchain Development Company has the potential to transform industries, enhance security, and streamline processes. From financial services to supply chain management to healthcare, the applications are vast and exciting. However, challenges such as scalability and regulatory concerns need to be addressed for widespread adoption. With trends like interoperability and integration, as well as the integration of Blockchain Development Company with IoT and government systems, the future looks bright for blockchain technology. So strap on your digital seatbelt and get ready for the blockchain revolution!

#blockchain development company#smart contracts in blockchain#custom blockchain development company#WEB#websites

3 notes

·

View notes

Text

The Expansive World of Altcoins: Exploring the Diversity Beyond Bitcoin

Bitcoin, the original cryptocurrency, has long dominated headlines and market discussions. However, the world of digital currencies is vast and diverse, with thousands of alternative coins, or altcoins, each offering unique features and value propositions. Altcoins encompass a broad range of projects, from utility tokens and stablecoins to meme coins and more. This article delves into the rich ecosystem of altcoins, highlighting their significance, various types, and the innovative projects that make up this vibrant space, including a mention of Sexy Meme Coin.

Understanding Altcoins

The term "altcoin" refers to any cryptocurrency that is not Bitcoin. These coins were developed to address various limitations of Bitcoin or to introduce new features and use cases. Altcoins have proliferated since the creation of Bitcoin in 2009, each aiming to offer something different, whether it be improved transaction speeds, enhanced privacy features, or specific utility within certain ecosystems.

Categories of Altcoins

Utility Tokens: Utility tokens provide users with access to a specific product or service within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), which is used to power applications on the Ethereum network, and Chainlink's LINK, which is used to pay for services on the Chainlink decentralized oracle network.

Stablecoins: Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency or commodities. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, offering the benefits of cryptocurrency without the volatility.

Security Tokens: Security tokens represent ownership in a real-world asset, such as shares in a company or real estate. They are subject to regulatory oversight and are often seen as a bridge between traditional finance and the blockchain world.

Meme Coins: Meme coins are a playful and often humorous take on cryptocurrency, inspired by internet memes and cultural trends. While they may start as jokes, some have gained significant value and community support. Dogecoin is the most famous example, but many others, like Shiba Inu and Sexy Meme Coin, have also captured the public's imagination.

Privacy Coins: Privacy coins focus on providing enhanced privacy features for transactions. Monero (XMR) and Zcash (ZEC) are notable examples, offering users the ability to transact anonymously and protect their financial privacy.

The Appeal of Altcoins

Altcoins offer several advantages over Bitcoin, including:

Innovation: Many altcoins introduce new technologies and features, driving innovation within the cryptocurrency space. For example, Ethereum introduced smart contracts, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Specialization: Altcoins often serve specific niches or industries, providing targeted solutions that Bitcoin cannot. For instance, Ripple (XRP) focuses on facilitating cross-border payments, while Filecoin (FIL) aims to create a decentralized storage network.

Investment Opportunities: The diverse range of altcoins presents numerous investment opportunities. Investors can diversify their portfolios by investing in projects with different use cases and growth potentials.

Notable Altcoins in the Market

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and has become the backbone of the DeFi and NFT (Non-Fungible Token) ecosystems. Its smart contract functionality allows developers to create decentralized applications, leading to a thriving ecosystem of financial services, games, and more.

Cardano (ADA): Cardano is a blockchain platform focused on sustainability, scalability, and transparency. It uses a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin's proof-of-work. Cardano aims to provide a more secure and scalable infrastructure for the development of decentralized applications.

Polkadot (DOT): Polkadot is designed to enable different blockchains to interoperate and share information. Its unique architecture allows for the creation of "parachains," which can operate independently while still benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin: Among the meme coins, Sexy Meme Coin stands out for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens), rewarding creators for their originality. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Altcoins

The future of altcoins looks promising, with continuous innovation and increasing adoption across various industries. As blockchain technology evolves, we can expect altcoins to introduce new solutions and disrupt traditional systems. However, the market is also highly competitive, and not all projects will succeed. Investors should conduct thorough research and due diligence before investing in any altcoin.

Conclusion

Altcoins represent a dynamic and diverse segment of the cryptocurrency market. From utility tokens and stablecoins to meme coins and privacy coins, each category offers unique features and potential benefits. Projects like Ethereum, Cardano, Polkadot, and Chainlink are leading the way in innovation, while niche coins like Sexy Meme Coin add a layer of cultural relevance and community engagement. As the cryptocurrency ecosystem continues to grow, altcoins will play a crucial role in shaping the future of digital finance and blockchain technology.

For those interested in the playful and innovative side of the altcoin market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

107 notes

·

View notes

Text

Blockchain: what it is, how it works and the most common uses

What is blockchain?

It literally means blockchain is a database or public registry that can be shared by a multitude of users in peer-to-peer mode (P2P or peer network) and that allows the storage of information in an immutable and organized way.

It is a term associated with cryptocurrencies because, apart from being the technology that supports them, it was born with the first virtual currency in history in 2009, Bitcoin . In this case, the data added to the blockchain is public and can be consulted at any time by network users.

However, it is important to remember that cryptocurrencies are just that, currencies! Just as happens with the euro, the dollar or any type of paper money. Each one is a simple material with a printed value, but what allows its use and generates value are the economic laws that support them.

Something similar happens with virtual currencies. In this case, it is blockchain technology that allows it to function. Its main objective is to create an unchangeable record of everything that happens in the blockchain, which is why we are talking about a secure and transparent system.

Bitcoin (BTC), Ethereum (ETH) or any other cryptocurrency is simply a virtual currency built on the blockchain and used to send or receive the amount of money that each participant has. This technology is what keeps transactions publicly recorded, but keeping the identity of the participants anonymous.

However, although it was created to store the history of Bitcoin operations, over the years it has identified great potential to be applied in other areas and sectors due to the possibilities it offers.

Features of blockchain technology

The progress of this system has been a mystery since its origin, but little by little we are learning more details about its operation:

Security

Cryptography is a fundamental pillar in the operation of the blockchain application development company, which provides security for the data stored in the system, as well as the information shared between the nodes of the network. When we are going to make a transaction, we need a set of valid asymmetric keys to be able to carry it out on the blockchain. It is also known as public key cryptography.

Trust

By representing a shared record of facts, this technology generates trust in users. Not only that, but it eliminates the possibility of manipulation by hackers and generates a ledger of operations that all members of the network can access.

Immutability

When information is added to the distributed database, it is virtually impossible to modify it. Thanks to asymmetric cryptography and hash functions, a distributed ledger can be implemented that guarantees security. In addition, it allows consensus on data integrity to be reached among network participants without having to resort to an entity that centralizes the information.

Transparency

It is one of the basic requirements to generate trust. Transparency in blockchain consulting services is attained by making the chain's software code publicly available and by fostering a network of nodes that use it. Its application in different activities, such as supply chains, allows product traceability from origin.

Traceability

It allows knowledge of all operations carried out, as well as the review of transactions made at a specific time. Traceability is a procedure that allows us to follow the evolution of a product in each of its stages, as well as who, how, when and where it has been intervened on. This is one of the main reasons why many sectors are beginning to apply blockchain technology.

3 keys to understanding how the blockchain works

It will only take you a single step to become an expert on the blockchain consulting services. Now that you know its definition and the main characteristics and related terms, it is time to put everything you have learned together to discover how it works. Take note!

The jack, horse, king of transactions

Networks use peer-to-peer data exchange technology to connect different users who share information. That is, the data is not centralized in a central system, but shared by all users of the network. At the moment a transaction is made, it is recorded as a block of data transmitted to all parties with the objective of being validated.

The transaction is the movement of an asset and the block can record the information of your choice, from what, who, when, to where, how much and how. Like an irreversible record, each block joins the preceding and following ones to form a chain (blockchain). Every new block removes the chance of manipulation and strengthens the previous one's verification. Finally, the transaction is completed.

The structure of the blocks