#ESG Analytics

Explore tagged Tumblr posts

Text

ESG Data Quality: The Emerging Edge in Private-Market Investing

Environmental, Social, and Governance (ESG) metrics only drive value when the underlying numbers are dependable, accurate, and decision-ready. Across private markets—buyout funds, venture capital, real estate, infrastructure—firms are discovering that rigorous ESG data quality is no longer a “nice to have.” It is rapidly becoming the line that separates market leaders from everyone else. In fact, a 2025 survey of global corporations revealed that 48 percent still struggle with ESG analytics because social and governance information is patchy or inconsistent, highlighting the urgency of reliable data architecture.

Why Data Quality Matters

Reliable ESG data allows investors to better assess risks and opportunities, from climate exposure to emerging market trends. It supports smarter capital allocation and long-term value planning.

As ESG disclosure becomes mandatory through frameworks like CSRD, SEC climate rules, and ISSB standards, companies need consistent data to stay compliant and avoid reputational risks.

High-quality data also builds trust with stakeholders. Transparent reporting signals a company’s commitment to responsible and sustainable practices, enhancing credibility.

Lastly, accurate ESG data enables effective benchmarking. It helps track progress, set goals, and identify areas for improvement—key to driving ongoing performance and accountability.

The Private-Market Cascade

Limited Partners are the primary catalyst driving ESG integration. Their allocation mandates now require General Partners to embed ESG checks into diligence, deal theses, and post-acquisition value-creation plans. General Partners, in turn, push portfolio companies to tighten data pipelines, extending ESG discipline from the fund level to the factory floor.

Private strategies—private credit, venture, real estate, infrastructure, and natural resources—are attractive because they can hedge inflation, smooth volatility, and generate outsized returns. ESG excellence amplifies each benefit. A 2023 meta-analysis of 1,000 studies by NYU Stern’s Center for Sustainable Business linked strong ESG performance to higher return-on-equity (ROE), superior return-on-assets (ROA), better operational efficiency, and reduced downside risk.

Competitive Advantage That Sticks

Sustainable advantage comes from capabilities rivals can’t mimic overnight: proprietary data architecture, seasoned sustainability talent, and a culture that acts decisively on insights. Firms that master ESG data quickly translate it into differentiated pricing, sharper deal sourcing, and smoother exits.

Market sentiment backs this up: a 2022 survey showed 88 percent of consumers remain loyal to brands with visible social and environmental commitments, while European institutional investors now treat ESG quality as a core pillar of asset selection. The message is clear—transparent ESG data is moving from a compliance box-tick to a genuine value driver.

The Cost of Falling Behind

The risks of weak data are mounting. By 2026, climate-related weather events are projected to cost global suppliers USD 1.3 trillion. Firms without robust data may misprice physical risks or underestimate transition costs—an expensive misstep. On the human-capital side, companies that rank high in employee satisfaction already post ESG scores 14% above the global mean, suggesting that people-centric governance and environmental stewardship reinforce one another. Poor data hides these links and delays corrective action.

Building a High-Quality ESG Data Stack

Define Material Metrics Early – Identify which ESG indicators truly move the needle for each asset class; align them with recognized standards to future-proof reporting.

Digitize Data Collection – Shift from spreadsheets to automated platforms that capture information at the source, reducing manual errors and increasing auditability.

Establish a Single Source of Truth – Consolidate disparate datasets—energy, HR, compliance—into a unified repository to ensure consistency across teams and portfolio companies.

Layer Advanced Analytics – Apply AI-driven tools for anomaly detection, scenario modeling, and predictive insights that flag issues before they become costly.

Govern & Review – Implement regular data-quality audits and provide training so that ESG ownership extends beyond the sustainability officer to every business function.

Conclusion

When integrated correctly, ESG unlocks tangible financial upside: more rigorous due diligence, longer-lasting value creation, and smoother regulatory navigation. Obstacles remain—fragmented data sources, differing standards, specialized analytics requirements—but they are surmountable. Private-market firms that invest now in scalable data solutions and measurable ESG roadmaps will not only outperform in returns; they will also help redirect capital toward a more resilient and equitable global economy. In an era where climate shocks, social equity, and governance integrity are mainstream investment themes, high-quality ESG data is emerging as the decisive competitive differentiator—one that no forward-looking private-market investor can afford to ignore.

0 notes

Text

Environmental, social and governance (ESG) risks are amongst those that have become difficult to pinpoint – and more prevalent now than ever. Due to inconsistencies of data and lack of standardization, it is a challenge to proactively harnessing ESG insights to mitigate risk and reap competitive benefits.

0 notes

Text

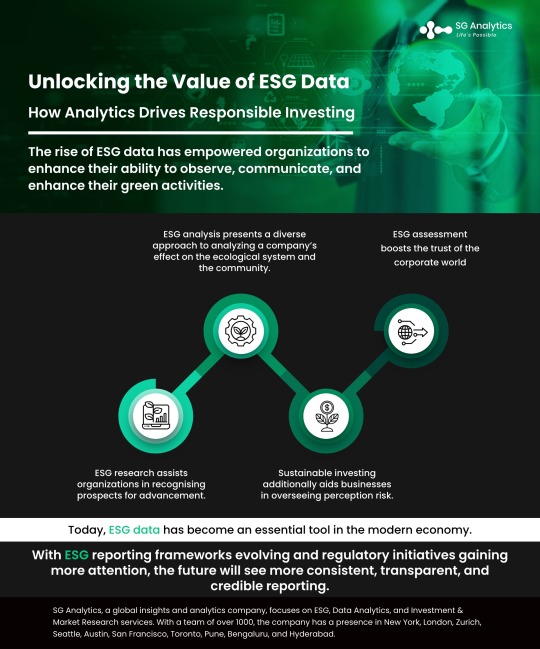

Unlocking the Value of ESG Data: How Analytics Drives Responsible Investing

In the current market, ESG data has become a very important tool. ESG data is important because it can lead to more responsible business practices, better decisions, and the creation of long-term value.

Read More: https://uk.sganalytics.com/blog/how-analytics-drive-responsible-investing/

1 note

·

View note

Text

Unlocking the Value of ESG Data: How Analytics Drives Responsible Investing

The importance of environmental, social, and governance data cannot be underscored in the present dynamic industry. Eco-friendly, societal, and management concerns are becoming the focus. The era of evaluating achievement solely through the fiscal soundness of a company is a thing of the past. Increasingly individuals are being mindful of the effect of businesses on nature and the world. Also, people focused on the way companies treat their personnel and how they oversee their conduct ethically.

The rise of Environmental, Social, and Governance data as a beneficial source has empowered organizations to enhance their ability to observe, communicate, and enhance their accountable and green activities. Consequently, companies now have the capacity to make decisions with greater information and implement strategies that support environmentally friendly approaches.

ESG Data has developed into a guide that shows the path for modern companies to enhance resilience, intention-driven, and inclusiveness. This clarifies the reason it has turned into a key ingredient in the business world in the contemporary era.

The elements of ESG in business processes can be improved in comprehension through the use of ESG data. In this manner, the sustainability of a company, ethical business practices, and the generation of sustainable value might be judged by stockholders, involved parties, and ESG assessment agencies. Nevertheless, it's crucial to observe that such assessments might differ based on the particular standards and methods implemented by all involved.

Investors can improve their decision-making, mitigate risk, and locate firms that have similar values and devotion to sustainability. If they consider ESG data in mind, it has the potential to assist them in accomplishing the desired objectives. Consequently, it is expected that numerous financial institutions are pulling funds from corporations that neglect ESG guidelines.

Importance of ESG Data in Responsible Investing

ESG functions as a valuation technique that takes into account environmental, social, and governance issues. An ESG assessment identifies a company's risks and practices based on environmental, social, and governance criteria.

As a result of ESG frameworks, sustainable investing can help individuals or organizations determine whether a company's values are aligned with their own and analyze the ultimate worth of companies.

Over the past two years, several governmental bodies have enacted new laws requiring corporations to report ESG metrics, and many countries have updated their environmental and social disclosure regulations.

Companies are thus facing pressure from investors to enhance their transparency and performance on the ESG data and analytics front. Yet, most businesses are not able to meet these requirements. They do not have automated solutions for across-the-board compliance tracking and management.

Understanding ESG Analytics and Its Impact on Investment Decisions

Ecological factors, as part of ESG analysis, examine the impact of a company has an effect on the surroundings. The foundation examines the carbon footprint, waste minimization, and control, which involve sustainability policies and actions. The influence of the company on the public is the theme of social examination. The examination includes evaluating the firm's workforce policies and processes. Moreover, it encompasses assessing its human rights performance, public relations, and initiatives promoting diversity and inclusion.

An analysis of the company's governance reviews the company's administration and the processes of making decisions. This consists of operational visibility, the performance of its board of directors, and broader corporate culture. This element of Environmental, Social, and Governance analysis is essential for examining the business's prosperity in the long run and steadiness.

Investors utilize Environmental, Social, and Governance analysis to find businesses that uphold sustainability and responsible business practices. Such an examination can help investors in making better-informed investment picks. This can additionally assist individuals in aligning their belongings according to their principles and pursuits. Environmental, social, and governance analysis can also assist companies to spot areas for improvement and keep tabs on their development.

Sustainability analysis has become more significant in recent years as stakeholders have become more concerned about the corporate influence on society and the environment. Consequently, organizations are currently dealing with more intense stress to provide transparency on their ESG initiatives and showcase their dedication to sustainable practices. Consequently, numerous companies started to consider environmental, social, and governance analysis seriously. The company is adopting measures and frameworks to boost its ESG outcomes.

Environmental, Social, and Governance analysis presents a thorough and diverse approach to analyzing a company’s effect on the ecological system, the community, and its interested parties. This offers a complete understanding of a company's sustainability initiatives and assists investors in making informed selections.

Sustainable investment analysis will become more and more important for financial backers, corporations, and related individuals as the relevance of sustainable practices and business ethics develops. With the global gains of a deeper understanding regarding the ecological and societal effects within the corporate sector, the call for it will grow for openness and responsibility.

The Role of Advanced Analytics in ESG Investing Strategies

Sustainable investing has earned significant interest lately among investors, customers, and regulators, growing more concerned regarding the social and environmental effects of corporations. Sustainable investment analysis carefully evaluates the influence of a company among different stakeholders, taking into account the natural surroundings, local communities, and investors.

A major advantage of environmental, social, and governance analysis allows investors to create well-informed investment determinations. Traders can gain a deeper understanding of potential hazards and chances of an individual investment by giving thought to the ESG performance of a corporation. These can offer valuable perspectives regarding the company's ESG practices, supporting investors in making well-informed determinations. As an illustration, organizations with robust ESG practices are frequently regarded as having lower risk and could potentially provide greater long-term investment returns.

Moreover, there is a possibility that it also entices more socially responsible potential investors. Yet another crucial advantage of environmental, social, and governance research is that it fosters company ethics and sustainable practices. Through concentration on the influence an organization possesses within the community as well as the surroundings, Environmental, Social, and Governance research assists organizations in recognising prospects for advancement. Additionally, it allows them to exert themselves to resolve these matters. Thus, it contributes to an environmentally friendly future and guarantees that businesses conduct themselves morally and with responsibility.

Sustainable investing additionally aids businesses in overseeing perception risk. For instance, organizations that are identified as having social and environmental responsibility maintain a strong image. These can result in greater brand retention of loyal customers and satisfaction and overall achievement in the industry. In conclusion, Sustainability analysis has the potential to assist businesses in improving the extent of honesty and social consciousness.

By offering investors and interested parties a comprehensive view of the ESG performance of a company, ESG assessment boosts the trust of the corporate world that the firm is functioning towards the greatest advantages of each interested party. Ultimately, this causes enhanced decision-making and business practices that are environmentally friendly.

Also Read - Driving Sustainable Innovations: AI for ESG Data Challenges.

Conclusion

ESG data has become an essential tool in the modern economy. It enables companies to measure their sustainability efforts, manage risks and meet stakeholder expectations. The importance of ESG data lies in its ability to drive responsible business practices, improve decision-making and drive long-term value creation.

However, the lack of standardized ESG data remains a major challenge that needs to be addressed to ensure accurate and comparable valuations. As ESG reporting frameworks evolve and regulatory initiatives such as the CSRD gain more attention, the future will see more consistent, transparent, and credible reporting that promotes a sustainable and responsible corporate environment. High ESG data is promised.

0 notes

Text

Learn how ESG Analytics transforms sustainable investment and enables investors to make wise choices. Learn how to evaluate a company's impact using environmental, social, and governance (ESG) aspects, and gain practical knowledge on gathering, combining, and analyzing data. Read this insightful article to learn more about ESG analytics and its function in promoting change.

#ESG Analytics#ESG Data Analytics#ESG Data Analysis#ESG Data and Analytics#ESG Analytics Company#ESG Analytics Services#ESG Analytics Solutions

1 note

·

View note

Text

Achieving Net-Zero:

How Net0Trace is Paving the Way for Sustainable Business Practices

As the world grapples with the pressing challenge of climate change, businesses are increasingly recognizing the importance of sustainability. Enter Net0Trace, an innovative tool designed to help organizations track, manage, and ultimately reduce their carbon footprints.

What is Net0Trace?

Net0Trace is a comprehensive platform that enables businesses to monitor their greenhouse gas (GHG) emissions in real time. It provides actionable insights and data analytics to help organizations make informed decisions about their environmental impact. By seamlessly integrating with existing business systems, Net0Trace allows companies to set and achieve customized sustainability goals.

Key Features

Comprehensive Carbon Footprint Analysis

Customizable Sustainable Goals

Real-Time Monitoring and Reporting

Integration with Existing Systems

Why is Net0Trace a Game-Changer?

Empowerment through Data

Net0Trace empowers organizations by transforming data into actionable insights. With a clear understanding of their emissions, businesses can make informed decisions that align with their sustainability goals. This data-driven approach fosters a culture of accountability and transparency.

Enhancing Reputation and Brand Value

Consumers today are increasingly choosing to support companies with strong environmental commitments. By adopting tools like Net0Trace, organizations can demonstrate their dedication to sustainability, enhancing their reputation and brand value in the process.

Regulatory Compliance

As governments around the world implement stricter environmental regulations, businesses must stay ahead of compliance requirements. Net0Trace helps organizations track their emissions in real time, making it easier to meet regulatory standards and avoid potential penalties.

Collaboration for Greater Impact

Sustainability is a collective effort. Net0Trace fosters collaboration within organizations and across supply chains. By sharing insights and best practices, businesses can work together to reduce emissions more effectively.

In an era where sustainability is not just a trend but a necessity, tools like Net0Trace are crucial for businesses looking to make a meaningful impact. By providing comprehensive data analysis, customizable goals, and real-time monitoring, Net0Trace equips organizations with the resources they need to navigate their sustainability journey confidently.

As we move toward a more sustainable future, embracing solutions like Net0Trace can help us all work together to achieve net-zero emissions. Let’s make sustainability a priority and create a healthier planet for generations to come!

Feel free to connect with us for a detailed discussion and to schedule a demo on how Net0Trace helps companies to track their sustainability goals.

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

Sustainability Reporting - AIROI

Transforming Sustainability Reporting with Precision and Transparency

Net0Trace Sustainability Reporting s a state-of-the-art sustainability reporting platform designed to help organizations accurately track, analyse, and report their environmental, social, and governance (ESG) metrics. By leveraging advanced AI and machine learning technologies, Net0Trace provides comprehensive insights and ensures compliance with global sustainability standards

Key Features

Comprehensive ESG Tracking

Real-Time Monitoring

Track ESG metrics in real-time across all operations.

Detailed Reporting

Generate comprehensive reports that meet regulatory requirements and provide insights into sustainability performance

Automated Data Collection and Analysis

AI-Driven Data Collection

Automate the collection of ESG data from various sources, ensuring accuracy and efficiency.

Advanced Analytics

Utilize AI algorithms to analyze ESG data and identify trends, risks, and opportunities.

Customizable Reporting

Tailored Reports

Create customized reports based on ESG Frameworks – GRI, BSRS, ERSR, SAB, CSRD and others that align with your organization's sustainability goals and stakeholder requirements.

Regulatory Compliance

Ensure compliance with local and international sustainability reporting standards.

Stakeholder Engagement

Transparent Communication

Engage stakeholders with transparent and accurate information about your sustainability efforts and progress.

Collaborative Tools

Facilitate collaboration and engagement with partners, investors, and customers on sustainability initiatives.

Performance Monitoring and Improvement

Continuous Monitoring

Monitor sustainability performance continuously and make data-driven decisions to improve outcomes.

Benchmarking

Compare your sustainability performance against industry benchmarks and best practices.

Benefits of Using AQI Analytics

Enhanced Accuracy

Precise tracking and reporting of ESG metrics ensure accuracy and reliability.

Actionable Insights

AI-driven analysis provides actionable insights to optimize sustainability efforts.

Implementation

Streamlined processes for developing and implementing sustainability strategies.

Global Impact

Contribute to global sustainability efforts by achieving and reporting on ESG goals.

Using Net0Trace SR, we believe in the power of technology to drive sustainable change. Join us in our mission to create a more sustainable future by transforming your sustainability reporting with precision, transparency, and efficiency.

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

Sustainability Reporting - AIROI

Transforming Sustainability Reporting with Precision and Transparency

Net0Trace Sustainability Reporting s a state-of-the-art sustainability reporting platform designed to help organizations accurately track, analyse, and report their environmental, social, and governance (ESG) metrics. By leveraging advanced AI and machine learning technologies, Net0Trace provides comprehensive insights and ensures compliance with global sustainability standards

Key Features

Comprehensive ESG Tracking

Real-Time Monitoring

Track ESG metrics in real-time across all operations.

Detailed Reporting

Generate comprehensive reports that meet regulatory requirements and provide insights into sustainability performance

Automated Data Collection and Analysis

AI-Driven Data Collection

Automate the collection of ESG data from various sources, ensuring accuracy and efficiency.

Advanced Analytics

Utilize AI algorithms to analyze ESG data and identify trends, risks, and opportunities.

Customizable Reporting

Tailored Reports

Create customized reports based on ESG Frameworks – GRI, BSRS, ERSR, SAB, CSRD and others that align with your organization's sustainability goals and stakeholder requirements.

Regulatory Compliance

Ensure compliance with local and international sustainability reporting standards.

Stakeholder Engagement

Transparent Communication

Engage stakeholders with transparent and accurate information about your sustainability efforts and progress.

Collaborative Tools

Facilitate collaboration and engagement with partners, investors, and customers on sustainability initiatives.

Performance Monitoring and Improvement

Continuous Monitoring

Monitor sustainability performance continuously and make data-driven decisions to improve outcomes.

Benchmarking

Compare your sustainability performance against industry benchmarks and best practices.

Benefits of Using AQI Analytics

Enhanced Accuracy

Precise tracking and reporting of ESG metrics ensure accuracy and reliability.

Actionable Insights

AI-driven analysis provides actionable insights to optimize sustainability efforts.

Implementation

Streamlined processes for developing and implementing sustainability strategies.

Global Impact

Contribute to global sustainability efforts by achieving and reporting on ESG goals.

Using Net0Trace SR, we believe in the power of technology to drive sustainable change. Join us in our mission to create a more sustainable future by transforming your sustainability reporting with precision, transparency, and efficiency.

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

Decarbonization

Harnessing Machine Learning for a Greener Future

Our Decarbonization Platform is an advanced solution designed to help organizations reduce their carbon footprint through the power of machine learning.

By leveraging cutting-edge ML algorithms, our platform provides precise, real-time data analysis and predictive modelling to optimize decarbonization efforts and accelerate the transition to a sustainable future.

Key Features

Real-Time Emissions Tracking

Benefits and Rapid ROI

Continuous Monitoring

Track greenhouse gas emissions in real-time across all operations.

Detailed Reporting

Generate comprehensive reports that meet regulatory requirements and provide insights into emissions reduction opportunities.

Predictive Modeling and Analysis

Benefits and Rapid ROI

AI-Driven Insights

Utilize advanced ML algorithms to predict future emissions trends and identify the most effective reduction strategies

Scenario Planning

Model various scenarios to understand the impact of different decarbonization initiatives and make informed decisions.

Customized Decarbonization Strategies

Benefits and Rapid ROI

Tailored Pathways

Develop customized strategies to achieve decarbonization goals based on your organization's unique needs and objectives.

Implementation Support

Receive expert guidance and support throughout the implementation of your decarbonization strategy.

Carbon Offset Management

Benefits and Rapid ROI

Offset Generation

Create and manage carbon offsets to balance emissions and contribute to global sustainability efforts.

Certification and Verification

Ensure the authenticity and compliance of carbon offsets through rigorous certification and verification processes.

Stakeholder Engagement

Benefits and Rapid ROI

Transparent Communication

Engage stakeholders with transparent and accurate information about your decarbonization efforts and progress.

Collaborative Tools

Facilitate collaboration and engagement with partners, investors, and customers on sustainability initiatives.

Benefits of Using the Decarbonization Platform

Enhanced Accuracy

Precise tracking and reporting of emissions data ensure accuracy and reliability.

Actionable Insights

ML-driven analysis provides actionable insights to optimize decarbonization efforts.

Efficient Management

Streamlined processes for managing, tracking, and trading carbon credits.

Global Impact

Contribute to global sustainability efforts by participating in carbon offset initiatives.

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

How Net0Trace is Paving the Way for Sustainable Business Practices

As the world grapples with the pressing challenge of climate change, businesses are increasingly recognizing the importance of sustainability. Enter Net0Trace, an innovative tool designed to help organizations track, manage, and ultimately reduce their carbon footprints.

What is Net0Trace?

Net0Trace is a comprehensive platform that enables businesses to monitor their greenhouse gas (GHG) emissions in real time. It provides actionable insights and data analytics to help organizations make informed decisions about their environmental impact. By seamlessly integrating with existing business systems, Net0Trace allows companies to set and achieve customized sustainability goals.

Key Features

Comprehensive Carbon Footprint Analysis

Customizable Sustainable Goals

Real-Time Monitoring and Reporting

Integration with Existing Systems

Why is Net0Trace a Game-Changer?

Empowerment through Data

Net0Trace empowers organizations by transforming data into actionable insights. With a clear understanding of their emissions, businesses can make informed decisions that align with their sustainability goals. This data-driven approach fosters a culture of accountability and transparency.

Enhancing Reputation and Brand Value

Consumers today are increasingly choosing to support companies with strong environmental commitments. By adopting tools like Net0Trace, organizations can demonstrate their dedication to sustainability, enhancing their reputation and brand value in the process.

Regulatory Compliance

As governments around the world implement stricter environmental regulations, businesses must stay ahead of compliance requirements. Net0Trace helps organizations track their emissions in real time, making it easier to meet regulatory standards and avoid potential penalties.

Collaboration for Greater Impact

Sustainability is a collective effort. Net0Trace fosters collaboration within organizations and across supply chains. By sharing insights and best practices, businesses can work together to reduce emissions more effectively.

In an era where sustainability is not just a trend but a necessity, tools like Net0Trace are crucial for businesses looking to make a meaningful impact. By providing comprehensive data analysis, customizable goals, and real-time monitoring, Net0Trace equips organizations with the resources they need to navigate their sustainability journey confidently.

As we move toward a more sustainable future, embracing solutions like Net0Trace can help us all work together to achieve net-zero emissions. Let’s make sustainability a priority and create a healthier planet for generations to come!

Feel free to connect with us for a detailed discussion and to schedule a demo on how Net0Trace helps companies to track their sustainability goals.

Categories:

Energy

Tags:

Animal

Ecology

Environment

Plants

Recycling

Recent Posts

Business Responsibility and Sustainability Reporting:

Achieving Net-Zero:

Blue Carbon, Tidal Salts, and Shrimp Farms: A Complex Interplay

Green Cement and Carbon Credits

Green Carbon Wallet: Revolutionize Your Carbon Footprint

Categories

Energy

Environmental

Uncategorized

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

GHG Emission

Accelerating Your Journey to Net Zero Emissions

Net0Trace is an advanced platform designed to help organizations achieve their net zero emissions goals efficiently and effectively. By leveraging cutting-edge AI and machine learning technologies, Net0Trace provides precise, real-time data analysis and predictive modelling to optimize sustainability efforts and accelerate the transition to carbon neutrality.

Key Features Comprehensive Emissions Tracking Real-Time Monitoring Track greenhouse gas emissions in real-time across all operations

Detailed Reporting Generate comprehensive reports that meet regulatory requirements and provide insights into emissions reduction opportunities

Predictive Modeling and Analysis AI-Driven Insights Utilize advanced AI algorithms to predict future emissions trends and identify the most effective reduction strategies.

Scenario Planning Model various scenarios to understand the impact of different sustainability initiatives and make informed decisions.

Net Zero Strategy Development Customized Pathways Develop tailored strategies to achieve net zero emissions based on your organization's unique needs and goals.

Implementation Support Receive expert guidance and support throughout the implementation of your net zero strategy.

Carbon Offset Management Offset Generation Create and manage carbon offsets to balance emissions and contribute to global sustainability efforts.

Certification and Verification Ensure the authenticity and compliance of carbon offsets through rigorous certification and verification processes.

Stakeholder Engagement Transparent Communication Engage stakeholders with transparent and accurate information about your sustainability efforts and progress towards net zero.

Collaborative Tools Facilitate collaboration and engagement with partners, investors, and customers on sustainability initiatives.

Key Benefits Enhanced Accuracy Precise tracking and reporting of emissions data ensure accuracy and reliability.

Actionable Insights AI-driven analysis provides actionable insights to optimize sustainability efforts.

Efficient Implementation Streamlined processes for developing and implementing net zero strategies.

Global Impact Contribute to global sustainability efforts by participating in carbon offset initiatives.

#GHG Emissions#Air Quality Analytics#Sustainability#Carbon Credit#Sustainability Reporting#ESG Reporting#ESG Tracking#Carbon Trading#Carbon Credit Tokenization#Net Zero Emissions

0 notes

Text

Carbon Market Chronicles: 2023 Unveiled and 2024’s Inflection Points

The voluntary carbon market (VCM) witnessed both considerable progress and significant hurdles in 2023 as reviewed by the MSCI Carbon Markets in its recent webinar.

The review includes key developments from 2023 and the potential inflection points to watch out for in 2024. Notably, the findings show that 2023 has the lowest number of credits issued in 3 years. In contrast, the year ended with a record number of monthly retirements.

Here’s a recap of the webinar, focusing on carbon credit issuances and retirements, demand, key market players, investment, major policy developments, and 2024 outlook.

Peaks, Valleys, and 2023’s Record Retirements

In 2023, credit issuances recorded the lowest annual total in 3 years after falling 25% year-on-year, as seen below. This slow down in supply was largely due to Nature-based and renewable energy projects issuing their lowest annual amounts in 5 and 4 years, respectively.

The MSCI report saw retirements rallied in Q4 2023, the second highest quarter on record. And that’s despite the slow down in corporate activity in mid-year. This momentum seems to have been carried into January this year.

In fact, that’s the second highest January to date and may even exceed the 17 MtCO2 set in 2022. December 2023 alone has seen 36 megatons of credit retirement, setting a new monthly high, around 25% above the previous high record.

When it comes to registries, the four largest, namely Verra, Gold Standard, ACR, and CAR continue to dominate the market. They provide more than 90% of the credits retired last year.

Retirements from these “Big 4” registries actually rose last year by 6%, while retirements across the next ten prominent names dropped slightly in 2023.

Of the top 10 retirees, Delta Airlines aced the first spot. They were also the largest retiree corporate in 2021 and 2022. While some of these companies exited the top 10 last year, others remain while new ones entered the market.

Shell topped the list in 2023 with around 16 million metric tonnes, followed by Volkswagen with over 8 MtCO2e. Overall, there are more joiners than leavers last year when it comes to retiring credits.

Unlocking the Nascent Carbon Removal Market

Gaining a lot of interest in 2023 is the nascent CDR market, referring to high permanent engineered carbon removals. These include biochar and direct air capture, which usually command a premium price than other project types. That’s because they’re known to be of higher quality and high durability.

Last year, the number of CDR transactions fell slightly year-on-year. But the quantity of credits, represented by the right hand chart, increased significantly to 5.4 million.

Navigating the Ups and Downs of Carbon Credit Prices

The declining trend in 2022 was carried over into the first half of 2023. But looking at the average level, the drop wasn’t that much. It was only 16% lower in 2022 compared to 2023.

In terms of price by project type for last year, all of them were lower in Q4, resulting in full year price declines. REDD+ projects saw the least drop, 15%, while renewable energy experienced the largest price decrease, 39%.

Both energy efficiency (pink line) and REDD+ (green line) projects were subject to increased media and academic scrutiny in 2023. They sustained weaker prices.

Interestingly, both nature restoration and non-CO2 gasses projects rebounded in November and December last year. Meanwhile, energy efficiency, REDD+, and non-CO2 gasses converged around the same price level at $4.65 by the end of the year.

This suggests that the market is not distinguishing between these project types, potentially signaling a weak market environment.

Policy Developments in 2023: From EU Directives to COP28’s Uncharted Territories

Last year also saw some major policy developments. For instance, the EU’s green claims directive aims to empower consumers for the green transition directive. It bans claims of neutral, reduced, or positive climate impact based on carbon offsetting, on the grounds that it’s a misleading consumer practice.

Moreover, the VCMI carbon integrity claims, the Claims Code of Practice (CCPs), is a significant regulation for the VCM.

There are also landmark regulations of market trading and standards wherein national governments are stepping in. For example, the US Commodity Futures Trading Commission (CFTC) introduced proposed guidance for trading of voluntary carbon credit derivative contracts.

In the Global South, there has been growth in national carbon credit markets while carbon pricing systems and schemes are being proposed in several African countries. Amid increased scrutiny in carbon credits certified by Verra, the leading carbon certifier updated its standards.

At the COP28 climate summit, carbon markets find their footing amid Article 6 frustrated talks. Article 6.2 rules are mostly in place but there’s a lack of Article 6.4 agreement on key steps. Disagreements centered on integrity concerns, yet Article 6 agreements are moving ahead.

Looking forward, MSCI Head of Carbon Markets, Guy Turner, raised a pertinent question: “Could we be at an inflection point for the market in 2024?”

There could be a number of inflection points, five in particular.

The potential new sources of demand driven by CORSIA, VCMI, SBTi, and more compliance markets in near and long term.

Quality initiatives moving into implementation.

Jurisdictional approaches are starting to take off – whether by governments or donor institutions. High interests are observed in jurisdictional soil carbon and blue carbon.

Increasing clarity for corporations on claims and disclosures on the use of credits, with the EU and UK taking the lead.

Macroeconomic cycle turning but political uncertainties

In the ever-evolving landscape of the voluntary carbon market, 2023 marked both triumphs and challenges. From record retirements to the rise of CDR investments, the market navigated uncertainties. As 2024 unfolds, potential inflection points await, shaping the future trajectory of the global carbon market.

#Net Zero Carbon#Decarbonization#Air quality analytics#Sustainability Reporting#ESG Emission#GHG Emission#Climate change#Carbon credits#Carbon offsets#Carbon reduction

0 notes

Text

Green Carbon Wallet

Green Carbon Wallet is a comprehensive carbon credit platform that facilitates transparency, liquidity, and accountability in the carbon market. Our platform enables users to create and manage carbon credit projects seamlessly. From project initiation to completion, our tools support every stage, ensuring efficient documentation, monitoring, and reporting. This streamlined process helps maximize the environmental impact and financial returns of your sustainability initiatives

#Net Zero Carbon#Decarbonization#Air quality analytics#Sustainability Reporting#ESG Emission#GHG Emission#Climate change#Carbon credits#Carbon offsets#Carbon reduction

0 notes

Text

Exploring ESG Analytics: Unveiling Sustainability Insights

Welcome to our innovative ESG Analytics realm!

Here at SG Analytics, we're thrilled to introduce our groundbreaking ESG Data and Analytics services, engineered to provide you with unparalleled perspectives on sustainable investments. Our focus on ESG Analytics drives us to deliver holistic solutions that empower you to make well-informed decisions in line with both your values and financial aspirations.

Diving deep into ESG Data Analysis, our platform is your gateway to unveiling hidden trends, intricate patterns, and transformative opportunities that traditional analysis often overlooks. By seamlessly integrating ESG Data Analytics into your decision-making journey, you unlock a profound understanding of the environmental, social, and governance elements that can significantly influence your investment ventures.

Our commitment to excellence resonates in every facet of our ESG Data and Analytics offerings. Our proficient team diligently assembles, curates, and dissects data from diverse sources, ensuring that you receive nothing short of precise and pertinent insights. With an intuitive user interface, navigating the intricate landscape of ESG Analytics becomes a seamless and engaging experience.

Embark on a voyage through the realm of sustainable investments with us. Our ESG Data and Analytics platform empowers you to explore, evaluate, and act upon opportunities that impeccably align with your principles. Whether you're a seasoned investor or a novice intrigued by the concept of ESG Data Analysis, our platform caters to your unique journey.

Unearth the evolution of investment through our ESG Analytics services. Join us in this captivating expedition toward informed and conscientious decision-making. Learn more about our distinctive ESG Data Analytics approach and take your inaugural step toward a future that seamlessly blends sustainability and profitability.

Delve deeper into the realm of ESG Analytics by visiting SG Analytics ESG Analytics. Here, you'll uncover how our ESG Data and Analytics can redefine and elevate your investment strategy.

Read More:- https://www.sganalytics.com/data-management-analytics/ESG-analytics/

1 note

·

View note

Text

The voluntary carbon market (VCM) witnessed both considerable progress and significant hurdles in 2023 as reviewed by the MSCI Carbon Markets in its recent webinar.

The review includes key developments from 2023 and the potential inflection points to watch out for in 2024. Notably, the findings show that 2023 has the lowest number of credits issued in 3 years. In contrast, the year ended with a record number of monthly retirements.

Here’s a recap of the webinar, focusing on carbon credit issuances and retirements, demand, key market players, investment, major policy developments, and 2024 outlook.

Peaks, Valleys, and 2023’s Record Retirements

In 2023, credit issuances recorded the lowest annual total in 3 years after falling 25% year-on-year, as seen below. This slow down in supply was largely due to Nature-based and renewable energy projects issuing their lowest annual amounts in 5 and 4 years, respectively.

The MSCI report saw retirements rallied in Q4 2023, the second highest quarter on record. And that’s despite the slow down in corporate activity in mid-year. This momentum seems to have been carried into January this year.

In fact, that’s the second highest January to date and may even exceed the 17 MtCO2 set in 2022. December 2023 alone has seen 36 megatons of credit retirement, setting a new monthly high, around 25% above the previous high record.

When it comes to registries, the four largest, namely Verra, Gold Standard, ACR, and CAR continue to dominate the market. They provide more than 90% of the credits retired last year.

Retirements from these “Big 4” registries actually rose last year by 6%, while retirements across the next ten prominent names dropped slightly in 2023.

Of the top 10 retirees, Delta Airlines aced the first spot. They were also the largest retiree corporate in 2021 and 2022. While some of these companies exited the top 10 last year, others remain while new ones entered the market.

Shell topped the list in 2023 with around 16 million metric tonnes, followed by Volkswagen with over 8 MtCO2e. Overall, there are more joiners than leavers last year when it comes to retiring credits.

Unlocking the Nascent Carbon Removal Market

Gaining a lot of interest in 2023 is the nascent CDR market, referring to high permanent engineered carbon removals. These include biochar and direct air capture, which usually command a premium price than other project types. That’s because they’re known to be of higher quality and high durability.

Last year, the number of CDR transactions fell slightly year-on-year. But the quantity of credits, represented by the right hand chart, increased significantly to 5.4 million.

Navigating the Ups and Downs of Carbon Credit Prices

The declining trend in 2022 was carried over into the first half of 2023. But looking at the average level, the drop wasn’t that much. It was only 16% lower in 2022 compared to 2023.

In terms of price by project type for last year, all of them were lower in Q4, resulting in full year price declines. REDD+ projects saw the least drop, 15%, while renewable energy experienced the largest price decrease, 39%.

Both energy efficiency (pink line) and REDD+ (green line) projects were subject to increased media and academic scrutiny in 2023. They sustained weaker prices.

Interestingly, both nature restoration and non-CO2 gasses projects rebounded in November and December last year. Meanwhile, energy efficiency, REDD+, and non-CO2 gasses converged around the same price level at $4.65 by the end of the year.

This suggests that the market is not distinguishing between these project types, potentially signaling a weak market environment.

Policy Developments in 2023: From EU Directives to COP28’s Uncharted Territories

Last year also saw some major policy developments. For instance, the EU’s green claims directive aims to empower consumers for the green transition directive. It bans claims of neutral, reduced, or positive climate impact based on carbon offsetting, on the grounds that it’s a misleading consumer practice.

Moreover, the VCMI carbon integrity claims, the Claims Code of Practice (CCPs), is a significant regulation for the VCM.

There are also landmark regulations of market trading and standards wherein national governments are stepping in. For example, the US Commodity Futures Trading Commission (CFTC) introduced proposed guidance for trading of voluntary carbon credit derivative contracts.

In the Global South, there has been growth in national carbon credit markets while carbon pricing systems and schemes are being proposed in several African countries. Amid increased scrutiny in carbon credits certified by Verra, the leading carbon certifier updated its standards.

At the COP28 climate summit, carbon markets find their footing amid Article 6 frustrated talks. Article 6.2 rules are mostly in place but there’s a lack of Article 6.4 agreement on key steps. Disagreements centered on integrity concerns, yet Article 6 agreements are moving ahead.

Looking forward, MSCI Head of Carbon Markets, Guy Turner, raised a pertinent question: “Could we be at an inflection point for the market in 2024?”

There could be a number of inflection points, five in particular.

The potential new sources of demand driven by CORSIA, VCMI, SBTi, and more compliance markets in near and long term.

Quality initiatives moving into implementation.

Jurisdictional approaches are starting to take off – whether by governments or donor institutions. High interests are observed in jurisdictional soil carbon and blue carbon.

Increasing clarity for corporations on claims and disclosures on the use of credits, with the EU and UK taking the lead.

Macroeconomic cycle turning but political uncertainties

In the ever-evolving landscape of the voluntary carbon market, 2023 marked both triumphs and challenges. From record retirements to the rise of CDR investments, the market navigated uncertainties. As 2024 unfolds, potential inflection points await, shaping the future trajectory of the global carbon market.

#Net Zero Carbon#Decarbonization#Air quality analytics#Sustainability Reporting#ESG Emission#GHG Emission#Climate change#Carbon credits#Carbon offsets#Carbon reduction

0 notes