#ESG Data and Analytics

Explore tagged Tumblr posts

Text

Exploring ESG Analytics: Unveiling Sustainability Insights

Welcome to our innovative ESG Analytics realm!

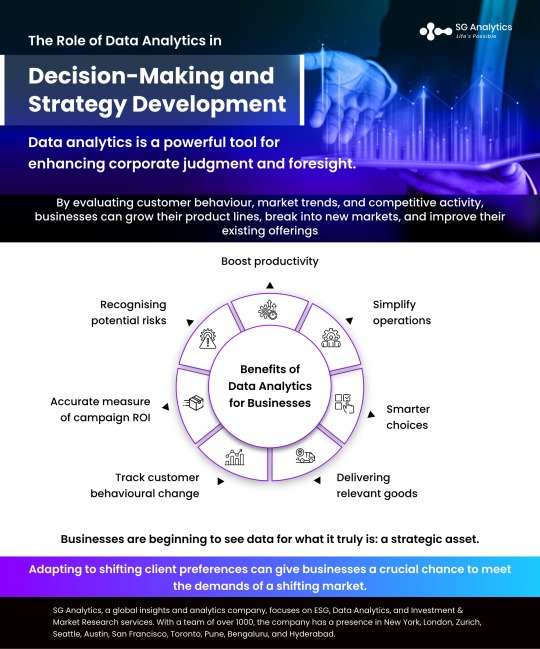

Here at SG Analytics, we're thrilled to introduce our groundbreaking ESG Data and Analytics services, engineered to provide you with unparalleled perspectives on sustainable investments. Our focus on ESG Analytics drives us to deliver holistic solutions that empower you to make well-informed decisions in line with both your values and financial aspirations.

Diving deep into ESG Data Analysis, our platform is your gateway to unveiling hidden trends, intricate patterns, and transformative opportunities that traditional analysis often overlooks. By seamlessly integrating ESG Data Analytics into your decision-making journey, you unlock a profound understanding of the environmental, social, and governance elements that can significantly influence your investment ventures.

Our commitment to excellence resonates in every facet of our ESG Data and Analytics offerings. Our proficient team diligently assembles, curates, and dissects data from diverse sources, ensuring that you receive nothing short of precise and pertinent insights. With an intuitive user interface, navigating the intricate landscape of ESG Analytics becomes a seamless and engaging experience.

Embark on a voyage through the realm of sustainable investments with us. Our ESG Data and Analytics platform empowers you to explore, evaluate, and act upon opportunities that impeccably align with your principles. Whether you're a seasoned investor or a novice intrigued by the concept of ESG Data Analysis, our platform caters to your unique journey.

Unearth the evolution of investment through our ESG Analytics services. Join us in this captivating expedition toward informed and conscientious decision-making. Learn more about our distinctive ESG Data Analytics approach and take your inaugural step toward a future that seamlessly blends sustainability and profitability.

Delve deeper into the realm of ESG Analytics by visiting SG Analytics ESG Analytics. Here, you'll uncover how our ESG Data and Analytics can redefine and elevate your investment strategy.

Read More:- https://www.sganalytics.com/data-management-analytics/ESG-analytics/

1 note

·

View note

Text

Unlocking Sustainable Growth: Harnessing the Power of ESG Data Analytics in 2023

In 2023, ESG (Environmental, Social, and Governance) considerations have become essential drivers of business success and sustainable growth. This article explores the transformative potential of ESG Data Analytics, shedding light on the top ESG data sources and how analytics can be leveraged to make informed decisions. From understanding ESG data providers to exploring various ESG data use cases, we delve into ESG data and analytics' pivotal role in shaping businesses with a purpose-driven agenda. Discover how organizations capitalize on ESG data as a valuable resource to build a brighter, more sustainable future.

#ESG Data Analytics#ESG Data and analytics#ESG data sources#ESG data#ESG data source#ESG Data Use cases#ESG data provider#ESG use cases

0 notes

Text

Data-Driven ESG Compliance: Challenges, Opportunities, and Best Practices

In the wake of a recent Supreme Court decision on affirmative action, concerns arose about potential challenges to environmental, social, and governance (ESG) strategies. However, ESG isn’t just political; it’s fundamentally good for business. Research shows a positive correlation between ESG performance and financial value creation.

At Hitachi America, Ltd. R&D, we’re actively co-creating sustainable digital solutions, committed to decarbonizing our operations and achieving global carbon neutrality in our value chain by 2050.

Despite the positive trajectory, challenges persist. Accurate ESG data is crucial, yet its availability and quality often hinder sustainable investment adoption. Regulatory concerns also loom, with worries that ESG regulations might limit business options. Additionally, smaller and minority-owned firms, while willing, struggle to incorporate ESG due to financial constraints.

To navigate these challenges, a holistic data-driven approach to ESG is essential.

Creating comprehensive audit trails around data ensures measurable ESG decisions throughout supply chains.

Standardized, globally coordinated ESG disclosure standards are vital, helping investors and stakeholders make informed decisions.

Companies must integrate ESG directly into their operations, making it a part of their core strategy.

Hitachi’s Take on ESG and Sustainability

Hitachi is actively working to facilitate the adoption of ESG practices, believing in the transformative power of sustainability. ESG-focused investments are on the rise, indicating a shifting paradigm in investment strategies. In this dynamic environment, actionable ESG practices will be instrumental, in guiding organizations toward a more sustainable future for all.

Learn how Hitachi is working to help companies make it easier to adopt and integrate ESG practices into their businesses. https://social-innovation.hitachi/en-us/think-ahead/manufacturing/actionable-esg-compliance-for-businesses/

#sustainability#decarbonization#esg#esg reporting#esg data analytics#esg data management#esg investing#esg financing#esg strategy#esg compliance

0 notes

Text

Eco-Friendly Christmas Tree: A 2022 Guide to Sustainable Christmas

When you think of Christmas, you probably think of exchanging gifts, eating delicious cuisine with your family, and marveling at the beauty of a brilliantly decorated Christmas tree. Many of us have probably already started thinking about which Christmas tree to buy. The most eco-friendly choice is to use a real Christmas tree that has grown in the streets. Most people celebrate Christmas without giving any thought to the toll it takes on the planet's resources.

For instance, whether you opt for a real, artificial, or potted Christmas tree, it still leaves a carbon imprint. What about the ornaments you adorn it with? Indeed, those are not a pure form of existence either.

The holiday season is here, and ready to enter. The celebrations have arrived, and with them, the enthusiastic beginning of celebration preparations. The annual tradition of cutting down millions of trees to use as Christmas decorations results in widespread forest destruction and the release of glasshouse gasses. However, you may do your part to protect the earth by adopting the practice and looking out for options on how to make an eco-friendly Christmas tree.

For environmental reasons, this doesn't mean you have to forego your traditional Christmas centerpiece. Let's look at the environmental implications of several types of sustainable X-mas trees and decorations to see how you can have a gorgeous yet eco-friendly tree in your living room this year. A lovely Christmas tree can be created from recyclable materials such as old newspaper stacks, cardboard, scrap wood, and other household discards while also being kind to the earth. This year, you can celebrate Christmas in a greener way with some of the following options.

Sustainable Christmas Tree Options -

Do you know, In 2021, 20.98 million real Christmas trees were purchased? Some environmentally conscious shoppers believed that purchasing an artificial Christmas tree was a more sustainable choice than cutting down a real tree for the holiday season.

The conventional knowledge of our time maintains that fake trees made with hazardous materials like lead and PVC plastics have a larger carbon footprint than a real tree that has been chopped down. However, In the United States, over 15,000 tree farms cultivate 350 million Christmas trees, providing employment for more than 100,000 people.

On the other hand, buying an apple or a Christmas tree from a farm that practices sustainable agriculture means making decisions along the same lines. When it comes to the impact on sustainable ecosystems, the question of whether or not to use native or non-native species is a significant one for certain people.

Think over the following choices while you figure out what's best for you:

Live Tree

If you want a fresh tree, purchasing a live tree is the most environmentally responsible choice you can make. The majority of live trees will only be able to withstand being brought indoors for 7–10 days before they begin to show signs of distress. After the holidays, planting and caring for your tree involves more expertise and commitment than simply drilling a hole in the ground. Consider whether the location and soil are suitable for the tree you intend to plant.

Plant a tree at home

Planting your Christmas tree between seasons and using it year after year is a terrific alternative. Buying them little means you can see the tree develop each year. Aside from its practical uses, the tree can also serve as a home for several species. Previous studies have shown that seven million Christmas trees are thrown away in January instead of being recycled, so it's important to remember to recycle your tree if you don't want to plant it. Depending on the variety, Christmas trees can take anywhere from three to ten years to mature and be ready for use in holiday celebrations.

Conventional Artificial Trees

Conventional artificial trees can have an environmental impact that is comparable to that of a real Christmas tree if they are utilized for a number of years. However, 90% of typical fake trees are manufactured in China using lead and PVC chemicals, and they do not degrade in landfills. Those trees cannot be recycled.

Reusing and Recycling Christmas Trees

Your Christmas tree can be recycled in a number of ways, and many local companies and towns offer these services. Check with the city or county where you live, or look for recycling options in the vicinity of where you live.

Wooden Trees

Consider wooden trees instead of plastic trees if you're looking for something different to reuse year after year. These are fantastic for decoration, but they also bring a unique touch to your home. There are some fantastic eco-friendly Christmas tree options to buy ahead of the festive season, ranging from little genuine trees to wooden substitutes.

Optional Man-Made Tree Replacement

You can now find some alternatives to traditional Christmas trees on the market that are better for the environment. Cardboard trees, trees made of plywood, and inventive do-it-yourself projects are among the available options. Before you whip out your credit card and buy one of those eco-chic Christmas trees that are now on the market, you might want to think about the carbon footprint.

Get a Tree on Rent

Perhaps you associate the holiday season with the lovely aroma of evergreen trees and garlands. You are not, fortunately, expected to do without it. Today, you can rent a Christmas tree from a growing number of retailers. For example, the business might have thousands of trees in cultivation all year long. When the tree reaches a certain size, it can be rented out. A tree can be "rented" for a few weeks. Experts gently dig it out of the ground, so it doesn't die. The business will replace the tree and take care of it till the next holiday season. For certain companies, you can even select the same tree for each holiday season.

Finding a Way to Get Along

Work that is worth doing includes being cognisant of one's impact on the environment and reducing waste. When one person makes a choice to forego having a Christmas tree and begin a new custom, another person may opt to prepare a holiday dinner using ingredients sourced from farms that practice sustainable agriculture, or they may choose to give a loved one the gift of a Canopy Tree.

Read More - How Businesses Can Improve Their Sustainability Performance With ESG.

https://uk.sganalytics.com/assets/uploads/fcimages/images/SGAnalytics_Infographics_Eco-Friendly%20Christmas%20Tree%20A%202022%20Guide%20to%20Sustainable%20Christmas.jpg

Final Thoughts

Let's choose eco-friendly Christmas ornaments, trees, and presents to make this the most environmentally responsible holiday season ever. We can make a big difference by making small adjustments to our behavior and consumption patterns this holiday season and every season to lessen our impact on the planet. Start a new eco-friendly custom with the family this year.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers sustainability consulting services and research support for informed decision-making to all businesses. Contact us today if you need an efficient ESG integration and management solution provider to boost your ESG performance and ranking.

0 notes

Text

"Discover the transformative integration of ESG in finance and BFSI. Learn about its significance in investment, banking, and insurance in this insightful article. In this insightful article, we delve into the world of ESG and its profound impact on the finance and BFSI sectors.

Explore how ESG is driving positive change and creating value for businesses while addressing environmental and social concerns.

From sustainable investing strategies to the integration of ESG principles into core operations, discover the transformative power of ESG and its significance in shaping the future of finance and BFSI industries.

0 notes

Text

Transform Your Tomorrow with Zylentrix: Sustainable Innovation for Businesses, Careers, and Global Growth

🌐 Zylentrix: Redefining Success Through People-Centric Solutions

At Zylentrix, we’re on a mission to empower individuals, businesses, and communities through innovation, integrity, and sustainability. Our vision? To lead the world in integrated consultancy services, transforming challenges into stepping stones for growth. Whether you’re scaling a business, launching a career, or pursuing education, we’re here to equip you with the tools to thrive. Let’s unpack how our mission, values, and culture make us the partner you can trust.

🎯 Our Mission & Vision: The North Star of Zylentrix

Mission: “To empower individuals, businesses, and communities by delivering innovative and customised solutions across education, technology, recruitment, and business consulting. With a commitment to excellence, integrity, and sustainability, we strive to create opportunities, bridge gaps, drive transformation, and foster long-term success.”

Vision: “To be the global leader in integrated consultancy services, transforming lives and businesses through innovative, sustainable, and forward-thinking solutions that empower individuals, businesses, and communities to thrive and succeed.”

We’re not just consultants—we’re architects of progress, designing futures where everyone has the chance to excel.

💎 Core Values: The Pillars of Everything We Do

Our values are the blueprint for how we serve clients, collaborate with partners, and grow as a team:

Integrity: “Building Trust Through Transparency” Every decision is guided by ethics. No shortcuts, no compromises.

Innovation: “Driving Future-Ready Solutions” From AI-driven recruitment tools to sustainable business frameworks, we pioneer what’s next.

Excellence: “Delivering Impact & Measurable Growth” We set—and smash—high standards, ensuring clients see real results.

Customer-Centricity: “Putting Clients at the Centre of Everything” Your goals shape our strategies. We listen, adapt, and deliver.

Diversity, Inclusion & Collaboration: “Creating Equal Opportunities for All” Diverse teams = smarter solutions. We champion equity in every project.

Sustainability: “Responsible Business for a Better Future” Green tech, eco-friendly practices, and ethical growth are non-negotiables.

Empowerment: “Enabling People & Businesses to Thrive” We don’t just hand you tools—we teach you how to master them.

🤝 Our Commitment: Tailored Support for Every Journey

Zylentrix is your partner in growth, no matter your starting point:

For Businesses:

Tech Solutions: Streamline operations with scalable AI, cybersecurity, and cloud systems.

Strategic Recruitment: Access global talent pools curated for cultural and technical fit.

Consulting Excellence: Turn insights into action with market research and digital transformation plans.

For Job Seekers:

Career Mastery: Revamp resumes, ace interviews, and unlock roles in booming industries like fintech and clean energy.

Global Mobility: Navigate international job markets with visa support and relocation guidance.

For Students:

Education Pathways: Secure admissions and scholarships at top universities worldwide.

Future-Proof Skills: Gain certifications in AI, sustainability, and more through our partnerships.

For Startups & SMEs:

Scale Smart: Leverage data analytics and ESG frameworks to grow responsibly.

Funding Ready: Craft investor pitches that stand out in crowded markets.

🌱 Our Culture: Fueling Innovation from Within

At Zylentrix, our workplace is a launchpad for creativity and collaboration. Here’s what defines us:

Lifelong Learning: Monthly workshops, innovation challenges, and tuition reimbursements keep our team ahead of trends.

Agility in Action: When the world changes, we pivot faster—like shifting to virtual career fairs during the pandemic.

Collaborative Spirit: Cross-departmental “sprint teams” solve client challenges, blending tech experts, educators, and recruiters.

Ownership & Impact: Every employee, from interns to executives, contributes to client success stories.

Work-Life Harmony: Flexible hours, mental health resources, and sustainability days ensure our team thrives inside and out.

Join the Zylentrix Movement

Ready to transform your business, career, or community? Let’s build a future where innovation and integrity go hand in hand.

📩 Connect Today 👉 Explore our services: Zylentrix 👉 Follow us on Social Media for tips on tech, careers, and sustainability. LinkedIn Facebook Instagram TikTok X Pinterest YouTube Quora Medium 👉 Email [email protected] to schedule a free consultation.

27 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

Shaping a Sustainable Future by Advancing ESG Goals

U3Core application of DigitalU3 redefines how organizations approach Environmental, Social, and Governance (ESG) strategies by combining real-time data, advanced analytics, and AI-powered automation

Email us at: [email protected]

youtube

#Smart Cities#Green Future#Sustainable operations#Technology for Sustainability#Asset Management#Digital Transformation#Computer Vision#AI for Sustainability#IoT for Sustainability#Youtube#intel

3 notes

·

View notes

Text

Best 10 Business Strategies for year 2024

In 2024 and beyond, businesses will have to change with the times and adjust their approach based on new and existing market realities. The following are the best 10 business approach that will help companies to prosper in coming year

1. Embrace Sustainability

The days when sustainability was discretionary are long gone. Businesses need to incorporate environmental, social and governance (ESG) values into their business practices. In the same vein, brands can improve brand identity and appeal to environmental advocates by using renewable forms of energy or minimizing their carbon footprints.

Example: a fashion brand can rethink the materials to use organic cotton and recycled for their clothing lines. They can also run a take-back scheme, allowing customers to return old clothes for recycling (not only reducing waste but creating and supporting the circular economy).

2. Leverage AI

AI is revolutionizing business operations. Using AI-fuelled solutions means that you can automate processes, bring in positive customer experiences, and get insights. AI chatbots: AI can be utilized in the form of a conversational entity to support and perform backend operations, as well.

With a bit more specificity, say for example that an AI-powered recommendation engine recommends products to customers based on their browsing history and purchase patterns (as the use case of retail). This helps to increase the sales and improve the shopping experience.

3. Prioritize Cybersecurity

Cybersecurity is of utmost important as more and more business transitions towards digital platforms. Businesses need to part with a more substantial amount of money on advanced protective measures so that they can keep sensitive data private and continue earning consumer trust. Regular security audits and training of employees can reduce these risks.

Example: A financial services firm may implement multi-factor authentication (MFA) for all online transactions, regularly control access to Internet-facing administrative interfaces and service ports as well as the encryption protocols to secure client data from cyberattacks.

4. Optimizing Remote and Hybrid Working Models

Remote / hybrid is the new normal Remote teams force companies to implement effective motivation and management strategies. Collaboration tools and a balanced virtual culture can improve productivity and employee satisfaction.

- Illustration: a Tech company using Asana / Trello etc. for pm to keep remote teams from falling out of balance. They can also organise weekly team-building activities to keep a strong team spirit.

5. Focus on Customer Experience

Retention and growth of the sales follow-through can be tied to high quality customer experiences. Harness data analytics to deepen customer insights and personalize product offers making your marketing campaigns personal: a customer support that is responsive enough can drive a great level of returning customers.

Example – For any e-commerce business, you can take user experience feedback tools to know about how your customers are getting along and make necessary changes. Custom email campaigns and loyalty programs can also be positively associated with customer satisfaction and retention.

6. Digitalization Investment

It is only the beginning of digital transformation which we all know, is key to global competitiveness. For streamlining, companies have to adopt the use advanced technologies such as Blockchain Technology and Internet of Things (IoT) in conjunction with cloud computing.

IoT example : real-time tracking and analytics to optimize supply chain management

7. Enhance Employee Skills

Develop Your Employees: Investing in employee development is key to succeeding as a business. The training is provided for the folks of various industries and so employees can increase their skills that are needed to work in a certain company. Employee performance can be enhanced by providing training programs in future technology skills and soft skills and job satisfaction.

Example: A marketing agency can host webinars or create courses to teach people the latest digital marketing trends and tools This can help to keep employees in the know which results in boosting their skills, making your campaigns successful.

8. Diversify Supply Chains

The ongoing pandemic has exposed the weaknesses of global supply chains. …diversify its supply base and promote the manufacturing of drugs in Nigeria to eliminate total dependence on a single source. In return, this approach increases resilience and reduces exposure to the risks of supply chain interruption.

- E.g., a consumer electronics company can source components from many suppliers in various regions. In so doing, this alleviates avoidable supply chain interruptions during times of political tensions or when disasters hit.

9. Make Decisions Based on Data

A business database is an asset for businesses. By implementing data, they allow you to make decisions based on the data that your analytics tools are providing. For example, sales analysis lets you track trends and better tailor your goods to the market.

Example: A retail chain can use data analytics to find out when a customer buys, and it change their purchasing policies. This can also reduce overstock and stockouts while overall, increasing efficiency.

10. Foster Innovation

Business Growth Innovation is Key A culture of creativity and experimentation should be established in companies. Funding R&D and teaming with startups can open many doors to both solve problems creatively but also tap into new markets.

Example: A software development firm could create an innovation lab where team members are freed to work on speculative projects. Moreover, work with start-ups on new technologies and solutions.

By adopting these strategies, businesses can navigate the turbulence for 2024 and roll up market — progressive.AI with an evolving dynamic market, being ahead of trends and updated is most likely will help you thrive in the business landscape.

#ai#business#business strategy#business growth#startup#fintech#technology#tech#innovation#ai in business

2 notes

·

View notes

Text

The impact of sustainability in fintech: reflections from the summit

In recent years, the Fintech industry has witnessed a paradigm shift towards sustainability, with an increasing emphasis on integrating environmental, social, and governance (ESG) factors into financial decision-making processes. This transformative trend took center stage at the latest Fintech Summit, where industry leaders converged to explore the intersection of sustainability and financial technology. Among the prominent voices shaping this discourse was Xettle Technologies, a trailblazer in Fintech software solutions, whose commitment to sustainability is driving innovation and reshaping the future of finance.

Against the backdrop of global challenges such as climate change, resource depletion, and social inequality, the imperative for sustainable finance has never been greater. The Fintech Summit provided a platform for thought leaders to reflect on the role of technology in advancing sustainability goals and fostering a more resilient and equitable financial ecosystem.

At the heart of the discussions was the recognition that sustainability is not just a moral imperative but also a strategic imperative for Fintech firms. By integrating ESG considerations into their operations, products, and services, Fintech companies can mitigate risks, enhance resilience, and unlock new opportunities for growth and value creation. Xettle Technologies’ representatives underscored the company’s commitment to sustainability, highlighting how it is embedded in the company’s culture, innovation agenda, and business strategy.

One of the key themes that emerged from the summit was the role of Fintech in driving sustainable investment. Through innovative solutions such as green bonds, impact investing platforms, and ESG scoring algorithms, Fintech firms are empowering investors to allocate capital towards environmentally and socially responsible projects and companies. Xettle Technologies showcased its suite of Fintech software solutions designed to facilitate sustainable investing, enabling financial institutions and investors to align their portfolios with their values and sustainability objectives.

Moreover, the summit explored the transformative potential of blockchain technology in advancing sustainability goals. By enhancing transparency, traceability, and accountability in supply chains, blockchain can help address issues such as deforestation, forced labor, and conflict minerals. Xettle Technologies’ experts elaborated on the company’s blockchain-based solutions for supply chain finance and sustainability reporting, emphasizing their role in promoting ethical sourcing, responsible production, and fair labor practices.

In addition to sustainable investing and supply chain transparency, the summit delved into the role of Fintech in promoting financial inclusion and resilience. By leveraging technology and data analytics, Fintech firms can expand access to financial services for underserved populations, empower small and medium-sized enterprises (SMEs), and build more inclusive and resilient communities. Xettle Technologies’ representatives shared insights into the company’s initiatives to support financial inclusion through digital payments, microfinance, and alternative credit scoring models.

Furthermore, the summit highlighted the importance of collaboration and partnership in advancing sustainability goals. Recognizing the interconnected nature of sustainability challenges, participants underscored the need for cross-sectoral collaboration between Fintech firms, financial institutions, governments, civil society, and academia. Xettle Technologies reiterated its commitment to collaboration, emphasizing its partnerships with industry stakeholders to drive collective action and scale impact.

Looking ahead, the future of sustainability in Fintech appears promising yet complex. As Fintech firms continue to innovate and disrupt traditional financial systems, they must prioritize sustainability as a core principle and driver of value creation. Xettle Technologies’ visionaries reiterated their commitment to sustainability, pledging to harness the power of technology to build a more sustainable, inclusive, and resilient financial ecosystem for future generations.

In conclusion, the Fintech Summit served as a catalyst for reflection and action on the role of sustainability in shaping the future of finance. From sustainable investing and supply chain transparency to financial inclusion and resilience, Fintech has the potential to drive positive change and advance sustainability goals on a global scale. Xettle Technologies’ leadership in integrating sustainability into its Fintech solutions exemplifies its dedication to driving innovation and creating shared value for society and the planet. As the industry continues to evolve, collaboration, innovation, and sustainability will be key drivers of success in building a more sustainable and resilient financial future.

2 notes

·

View notes

Text

An Ultimate Guide: ESG Data Sources for 2023

ESG data can be employed for a plethora of corporate activities. By collaborating with ESG data providers, businesses can gain access to data gathered with rigorous standards.

0 notes

Text

SG Analytics - While ChatGPT is a powerful tool that can be used in data engineering, it cannot replace the expertise of a data engineer. Data engineering requires a deep understanding which ChatGPT cannot replicate.

#Data engineers#ChatGPT Replace Data Engineers#AI data engineer#Chatgpt data engineering#esg services#esg data and analytics

0 notes

Text

Learn how ESG Analytics transforms sustainable investment and enables investors to make wise choices. Learn how to evaluate a company's impact using environmental, social, and governance (ESG) aspects, and gain practical knowledge on gathering, combining, and analyzing data. Read this insightful article to learn more about ESG analytics and its function in promoting change.

#ESG Analytics#ESG Data Analytics#ESG Data Analysis#ESG Data and Analytics#ESG Analytics Company#ESG Analytics Services#ESG Analytics Solutions

1 note

·

View note

Text

Unveiling the Job Market: How Many Jobs Are Available in Finance Services in 2024?

In the ever-evolving landscape of finance, the job market plays a pivotal role in shaping career aspirations and industry trends. As we step into 2024, professionals and aspiring individuals are eager to uncover the opportunities awaiting them in the realm of finance services, particularly in the United States. This article sheds light on the abundance of opportunities available in the finance services.

Exploring the Finance Job Market Landscape:

Quantifying Opportunities:

How many jobs are available in finance in the USA?

Analyzing recent statistics and projections to gauge the scale of employment opportunities.

Factors influencing job availability, such as economic conditions, technological advancements, and regulatory changes.

Diverse Sectors, Diverse Opportunities:

Breaking down the finance sector into subcategories, including banking, investment management, insurance, and consumer services.

Highlighting the unique job prospects within each sector and the skill sets required to excel.

Identifying emerging roles and specialties that are gaining prominence in response to market demands and industry shifts.

Finance in the Digital Age:

Examining the impact of technology on job creation and the transformation of traditional finance roles.

The rise of fintech companies and their contribution to job growth, particularly in areas like digital banking, payment processing, and financial analytics.

The demand for professionals with expertise in data analysis, cybersecurity, and artificial intelligence within the finance sector.

Investment Management: A Thriving Field:

How many jobs are available in investment management?

Unveiling the job opportunities within investment firms, asset management companies, and hedge funds.

The significance of skilled portfolio managers, financial analysts, and risk assessment specialists in driving investment strategies and maximizing returns.

Exploring the global reach of investment management careers and the potential for growth in international markets.

Consumer Services: Meeting the Needs of Individuals:

Evaluating the job market within consumer-focused finance services, including retail banking, wealth management, and financial advising.

The demand for client relationship managers, financial planners, and retirement advisors in assisting individuals with their financial goals.

The role of personalized financial services and digital platforms in catering to the diverse needs of consumers and enhancing their financial literacy.

Trends Shaping the Future:

Anticipating future job trends in finance services and the skills that will be in high demand.

The growing importance of sustainable finance and environmental, social, and governance (ESG) investing, leading to opportunities in green finance and impact investing.

The influence of geopolitical factors, regulatory reforms, and demographic shifts on the finance job market landscape.

Conclusion:

As we go through 2024, the finance job market in the United States continues to offer a lot of opportunities across various sectors. Whether aspiring to go into investment management, consumer services, or the dynamic world of fintech, individuals with the right skills and expertise are well-positioned to thrive in this ever-evolving industry. By staying abreast with market trends, honing relevant skills, and embracing innovation, professionals can seize the abundant opportunities awaiting them in the realm of finance services.

6 notes

·

View notes

Text

The Changing Landscape of the UK Economy: A 2023 Outlook

A combination of factors, including a slow recovery of the labor market after the COVID-19 epidemic and continuously poor investment and productivity, has led to a severe economic downturn in Britain since Russia's invasion of Ukraine. The Confederation of British Industry said that Britain's economy is on track to contract by 0.4% next year as inflation continues to be high and corporations put investment on hold, with grim implications for longer-term growth.

"The United Kingdom is experiencing stagflation, characterized by soaring prices, negative GDP, declining productivity, and decreasing business investment. Although businesses are aware of the chances for growth, they are delaying investments until 2023 because of... headwinds, "Tony Danker, director general of the CBI, stated.

Finance Minister Jeremy Hunt cited the latest forecasts from the Office for Budget Responsibility and predicted a 1.4% decline in the British GDP in 2023. (OBR). The OBR revised its prognosis for next year from an increase of 1.8% to the current estimate of 2.2%. So what will the economy be like in 2023? Let's dive in for more.

GDP prediction 2023

The Office of Budget Responsibility (OBR) predicts that the UK's gross domestic product (GDP) will contract in 2023, which is a steeper decrease than they had previously predicted. Jeremy Hunt, the British chancellor, presented the data in his annual Autumn Statement. Previously predicted economic growth of 1.8% for the UK in 2023 has been sharply reduced to a predicted loss of 1.4%.

Many predicted that the economy would see a slowdown in the next year, but a complete year of negative growth is a different story. While this was happening, the GDP growth rate for this year was raised from 3.8 to 4.2 percent. This could be attributable to the fact that the energy price subsidy scheme wasn't disclosed until September, meaning its beneficial effect on GDP wasn't factored into March projections.

The continuation of the scheme in some form in 2023 was confirmed in the Autumn Statement; however, it will be means tested, meaning that many households will receive nothing. In comparison with 2022, when all households received energy price subsidies, this will negatively affect demand in the economy.

Compared to the prior projection of 2.1%, the new forecast for 2024 predicts a lower rate of economic growth of 1.3%. The tax rises proposed in today's Autumn Statement make the tax take the highest share of GDP it has been in 75 years, according to Paul Johnson, director of the Institute for Fiscal Studies (IFS).

Chief investment officer of Quilter Investors, Marcus Brookes, stated, "Today's Autumn Statement has presented a dismal picture for the UK, with a black hole of £54bn being plugged with a mixture of spending cuts and tax rises."

UK Future Recession Predictions

The rising expense of living is soon becoming a catastrophe, and many of us have already felt its effects. In the coming months, further fuel price increases are likely. Let's look at the future impacts that might happen -

There are a number of interrelated causes for the current financial crisis in the UK. By themselves, they pose significant difficulties but are not catastrophic. Nonetheless, the current unstable climate may be about to take another downward turn due to the cumulative effects of the UK's multiple lockdowns on the economy and Russia's invasion of Ukraine on the worldwide market price of gas and oil.

The cost of living has already increased significantly for households. The Bank of England forecasts that gas and electricity prices will increase by as much as 40% in October, following a 54% increase since April. As a result, annual home bills will be above £3,000 from here on out. While interest rates are expected to rise to levels not seen for over 30 years, inflation is expected to remain low.

Spending is expected to decrease as consumers, and companies feel the effects of rising inflation and the snowballing cost of living. So, the economy will contract. If economists are correct, a recession could look like this in the not-too-distant future.

But now, as inflation soars and the rising cost of living strikes families everywhere, some analysts are anticipating another recession. Although many analysts expect a downturn, they are not unanimous. The UK economy was expected to expand by 3.8% this year, according to projections from the Office for Budget Responsibility (OBR). Meanwhile, the latest IMF global economic projection predicted growth of 3.7%, making it the joint-strongest among the Group of Seven industrialized nations.

However, even the most upbeat projections don't point to robust expansion, with Deutsche Bank putting the chances of a recession at nearly one in three. Households will be under even more pressure to cut spending this summer as inflation is expected to remain high for a prolonged period. There may be a sense of recession, at least in spirit, among certain people.

Productivity and Company Investment is Declining in the UK Economy

After a politically and economically difficult year, the CBI's 2023 economic outlook is grim. According to the latest CBI UK economy prediction for 2023, the PM and Chancellor must improve long-term growth. The economic expansion comes from maximizing production and workforce. When fiscal and monetary policy is tight, the government must employ all levers to boost the UK economy.

Capital allowances and regulatory adjustments, such as eliminating the de facto prohibition on onshore wind and updating the national planning policy framework, are necessary to address skill and labor shortages and free up corporate investment.

Seventy-five percent of businesses require a concerted effort to address shortages. As a means of accomplishing this goal, firms should work together to increase productivity through training and automation, and economic inactivity should be reduced through a more accommodating immigration policy. The government should implement a permanent full allowances regime to free up an additional £50bn in capital investment annually by the end of the decade, provided that the budget permits doing so.

The UK economy will show many of the same indicators of structural weakness that were prevalent even before COVID throughout the predicted period. A dismal 2% below the (already low) pre-pandemic trend in output has persisted after the epidemic hit (i.e., the trend seen from 2010 to 2019). Even with a partial recovery by 2024, it is predicted business investment to still be 9 percent below the levels seen before the pandemic.

Also Read - UK Economy in 2023: What does Rishi Sunak, the new UK PM, have to offer?

To Sum Up

As individuals and businesses struggle with rising expenses, it is estimated that it would take until 2024 for Britain's economy to recover to pre-Covid levels, which has slowed employment and corporate investment. Don't Miss Out on the Latest Updates Regarding the State of the UK Economy predictions for 2023, GDP predictions for 2023, future recession predictions, 2023 economy predictions, and more.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Data Analytics, SG Analytics focuses on leveraging data management & analytics, and data science to help businesses discover new insights and build strategies for business growth. Contact us today if you are looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.

0 notes