#Easy Payroll Software

Explore tagged Tumblr posts

Text

Windson Payroll: The All-in-One Payroll Management Software for Growing Businesses

Managing people and payroll effectively is the heart of any successful organization. As businesses grow, so do the complexities of payroll processing, compliance management, and employee data handling. That’s where technology makes all the difference — and VeravalOnline Pvt Ltd is proud to offer a powerful solution with Windson Payroll, an advanced payroll management software built for today’s dynamic HR needs.

At VeravalOnline Pvt Ltd, we believe that effective Human Resource Management starts with accurate, timely, and compliant payroll. Over the last five years, we’ve worked hand-in-hand with HR teams, consultants, and businesses of all sizes — and one need has remained constant: a smart, reliable payroll management solution.

That’s why we built Windson Payroll — a complete, cloud-based HR payroll software that streamlines every aspect of the employee lifecycle, from onboarding to full and final settlement.

The Problem with Traditional Payroll

Manual payroll methods are prone to mistakes, delays, and compliance risks. For growing teams, spreadsheets and outdated tools just don’t cut it. Businesses need a solution that’s fast, compliant, and scalable — and that’s exactly what Windson Payroll offers.

Meet Windson Payroll – The Best Payroll Software in India

Windson Payroll is more than just a salary calculator. It’s a powerful and intuitive solution built to simplify HR operations and improve employee satisfaction.

Here’s what makes Windson Payroll stand out:

✅ Automated Salary Processing No more manual calculations. Windson handles salary structures, deductions, taxes, and payslips with ease.

✅ Statutory Compliance Made Easy

Keep up with ever-changing labor laws. Windson ensures your payroll is always compliant with the latest regulations.

✅ Streamlined Recruitment & Onboarding

Integrated recruitment tools help HR teams attract, evaluate, and onboard talent quickly and efficiently.

✅ Performance Tracking & Employee Management

Track performance metrics, set goals, and maintain a positive workplace culture — all in one place

✅ Scalable for All Sizes

Whether you're a small HR consultancy or a large enterprise, Windson adapts to your operational needs.

Why Businesses Trust Windson Payroll

Designed with real business needs in mind, Windson Payroll was shaped by feedback from HR professionals and business owners. It’s fast, secure, easy to use, and eliminates the chaos of month-end salary runs. It’s no surprise that Windson is gaining popularity as the best payroll management software in India.

Boost Efficiency with Payroll Automation

By choosing payroll automation for businesses, you can free up valuable time, reduce human error, and maintain employee trust — all while staying 100% compliant.

Ready to Experience the Future of Payroll?

If your HR team is juggling Excel sheets or using outdated tools, now’s the time to level up. Discover how Windson Payroll can transform your workflow with smart, secure, and seamless payroll processing.

👉 Get Started with Windson Payroll Today: https://www.veravalonline.com/human-resources-recruitment-and-payroll-management-hrpm/

VeravalOnline Pvt Ltd – Digital solutions made for growing businesses. Choose Windson Payroll — your trusted partner in HR automation.

#Payroll Management Software#HR Payroll Software#Best Payroll Software in India#Payroll Automation for Businesses#Payroll Processing Tool#Online Payroll System#Easy Payroll Software

0 notes

Text

HR & Payroll Solution for 2025 – Free, Powerful & Easy to Use

Managing HR tasks doesn't have to be complicated or expensive. With HR Globes, you get a powerful, free HR and payroll management software that simplifies your operations, improves accuracy, and saves valuable time.

Whether you're managing a 5-person team or scaling to 500, HR Globes is built to grow with you. Download it today, streamline your HR process, and focus on what matters most: growing your business.

Try HR Globes now — because smart HR should be easy, powerful, and free.

2 notes

·

View notes

Text

Business Management Software — Seclob Connect

Seclob Connect is a powerful business management software designed to automate HR tasks like payroll processing, attendance tracking, leave management, and shift scheduling. It helps businesses streamline operations, reduce errors, and improve efficiency with an easy-to-use platform.

Whether you're a small business or a large enterprise, Seclob Connect ensures smooth workforce management and enhances productivity. Say goodbye to manual HR processes and embrace automation today!

🔗 Learn more at https://www.seclobconnect.com/

2 notes

·

View notes

Text

The Benefits of Outsourcing Payroll Services in UK

One of the most crucial parts of managing a business is payroll. For smooth operations, employees must be paid on time and accurately according to tax laws. According to Manag, internal payroll is complicated, time-consuming, and error-prone.

For this reason, many UK-based companies outsource their payroll services. Through outsourcing, a company can save Time, reduce costs, ensure strict compliance with HMRC regulations, and focus on expanding its operations. The following article describes the major benefits of outsourcing UK payroll services and why firms of any size should opt for it.

1. Decrease Administrative Load and Save Time

Payroll processing consumes much time and labor, especially in organizations with hundreds of employees. Activities like following up on pensions, determining earnings, and making tax deductions can take up to 30 hours monthly.

UK-based business organizations may diminish the administrative burden and allow the HR and finance teams to focus on critical roles such as employee training and business expansion.

2. Confirms Conformity to UK Payroll Legislation

HMRC, Her Majesty's Revenue and Customs, controls the UK's payroll. The following are some rules by which companies have to be governed:

PAYE ensures that everyone gets the proper deductions for taxes and national insurance. Automatic-enrolment pension schemes: managing the pension contributions of the employees.

Payroll details will be filed with HMRC through RTI returns.

Payroll processing mistakes may lead to penalties or legal issues.

Payroll outsourcing ensures that experts handle compliance, reducing the likelihood of fines and legal complications.

3. Reduces Processing Charges for Payroll

Though some companies believe handling payroll in-house will save money, the cost is often much higher due to the software, employee training, and probable errors. A firm can save by paying a flat rate to an outside source for its payroll service instead of keeping a payroll department in-house.

4. Fewer Payroll Errors

Payroll inaccuracies, especially errors in making the proper taxation, delayed or unduly made salaries, etc, can eventually cause HMRC penalties and irate employees. The UK utilizes professional payroll solutions that employ professionals for payroll together with automated platforms that ensure reliability and minimize possible costly mistakes

5. Has Private and Security-Payroll Processing

Internal payroll processing might lead to fraud and data theft. Payroll companies that are outsourced encrypt, have a secure system, and follow the GDPR to keep the sensitive information of the workers' payroll secure and confidential.

6. Satisfaction of Workers

Worker satisfaction goes up when payrolls are made correctly and within Time. Employees want:

✔ Correct salary disbursals

✔ Easy online payslips

✔ A clear tax and deduction statement

Outsourced payroll services guarantee employees receive their pay on Time, every Time, which means employees will trust and be satisfied in the workplace.

10. Business Growth Focus

Outsourcing payroll services gives business owners and managers Time to focus on strategic growth initiatives rather than wasting Time on payroll administration. Payroll in expert hands means businesses can scale operations, improve services, and enhance customer satisfaction.

Conclusion

Outsourcing payroll services in the UK is wise for businesses that want to save Time, reduce costs, and ensure compliance with UK payroll regulations. Professional payroll providers can help companies minimize errors, improve employee satisfaction, and focus on growing their business without payroll-related stress.

Whether you run a small startup or a large enterprise, outsourcing payroll ensures accurate, secure, and hassle-free payroll management—making it a worthwhile investment for any business.

3 notes

·

View notes

Text

Attendance Keeper is a top HRM software known for its affordable prices, strong payroll features, and flexible platform. This complete HR management software is designed for small to medium-sized businesses looking for an easy-to-use and cost-effective HR solution.

2 notes

·

View notes

Text

Transform Your Hospitality Operations with Our HMS ERP Software

In today’s competitive hospitality industry, efficiency and exceptional guest experiences are key to success. Our Hospitality Management System (HMS) ERP Software is designed to streamline your operations, boost customer satisfaction, and drive profitability.

Key Features:

Reservation Management: Simplified bookings and guest tracking.

Front Desk Operations: Streamlined check-in, check-out, and room assignment.

Billing & Invoicing: Automated billing and real-time payment tracking.

Inventory & Procurement: Efficient inventory management for smooth operations.

Staff & Payroll Management: Effective scheduling and payroll solutions.

Guest Engagement: Enhanced communication for personalized guest experiences.

Why Choose Us?

Easy-to-use and intuitive interface

Customizable solutions tailored to your business needs

Scalable to accommodate small hotels to large resorts

Integrated system for seamless operations across departments

Ready to take your hospitality business to the next level?

Contact us today to learn more or schedule a demo:

Email: [email protected]

Phone: +919220411022

Website: www.hibousoft.com

#DigitalTransformationHMS #ERPSoftware #HotelManagement #Efficiency #Hospitality #GuestExperience

2 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Why Instant Financial Insights Matter for Businesses Today?

Introduction Today’s fast-paced business environment, waiting until the end of the month to understand a company's financial position is no longer sufficient. Real-time accounting has emerged as a game-changer, offering immediate access to financial data, allowing businesses to make informed decisions faster than ever before. Here’s a look at why real-time accounting is trending and how it benefits businesses in this dynamic economic landscape. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

What is Real-Time Accounting?

Real-time accounting leverages advanced accounting software and cloud technology to update financial data instantly as transactions occur. Instead of waiting for monthly or quarterly reports, business owners and stakeholders can access live financial information at any moment.

Why is Real-Time Accounting a Trending Topic?

Several factors are driving the adoption of real-time accounting:

Demand for Agility: Businesses must adapt quickly to changing market conditions, and real-time data empowers them to make swift, well-informed decisions.

Digital Transformation: With the rise of cloud-based accounting solutions, updating financial data instantly has become more accessible to businesses of all sizes.

Risk Management: Real-time insights enable proactive decision-making, helping businesses identify potential risks and address them before they escalate.

Key Benefits of Real-Time Accounting

Improved Cash Flow Management: Real-time accounting allows businesses to monitor their cash flow instantly. They can see which payments are due, forecast cash needs, and avoid potential cash flow issues.

Enhanced Decision-Making: Instant access to financial data allows business leaders to make informed, data-driven decisions. Whether it's expanding operations or cutting expenses, real-time data provides the accuracy needed to act confidently.

Accurate Financial Forecasting: With up-to-the-minute data, companies can create more accurate financial forecasts, helping them better prepare for future needs or investments.

Simplified Compliance and Tax Reporting: Real-Time Accounting simplifies compliance by maintaining accurate records that can be accessed and verified easily, making tax filing and audits more straightforward.

Reduced Errors: Automating data updates in real-time minimizes the risk of manual entry errors, leading to more accurate financial records and fewer discrepancies.

How to Implement Real-Time Accounting in Your Business

Choose the Right Accounting Software: Select a cloud-based accounting system that integrates seamlessly with your business processes and supports real-time data updates.

Automate Transaction Entries: Leverage automation features for expenses, invoicing, and payroll to ensure transactions are recorded immediately, reducing manual work.

Integrate Bank Feeds: Many modern accounting platforms allow you to sync bank transactions directly, enabling instant reconciliation and more accurate cash flow tracking.

Regularly Monitor Key Metrics: With real-time data, it’s easy to monitor KPIs, cash flow, and profit margins. Set up dashboards for an at-a-glance view of your company’s financial health.

Challenges to Consider

While real-time accounting offers numerous benefits, there are a few challenges businesses may face:

Cost of Technology: Implementing new software or upgrading existing systems may require an initial investment, which can be a barrier for smaller businesses.

Data Security: With real-time data being cloud-based, it’s critical to have robust cybersecurity measures in place to protect sensitive financial information.

Learning Curve: Shifting from traditional to real-time accounting can require training, especially for employees accustomed to older accounting processes.

The Future of Real-Time Accounting

As technology advances, real-time accounting is expected to become even more accessible and integral to financial management. Artificial intelligence and machine learning are likely to further enhance the capabilities of real-time Accounting, enabling more predictive insights and even automated financial decision-making. RVAK Consulting LLP provides comprehensive taxation services tailored to help businesses navigate complex tax regulations and optimize compliance. From strategic tax planning to accurate filing and representation, RVAK ensures clients meet their tax obligations efficiently, minimizing liabilities and maximizing opportunities.

Conclusion

Real-time accounting offers a competitive edge, enabling businesses to access financial insights instantly, respond to market changes, and make data-driven decisions. With the rise of digital tools and automation, implementing real-time accounting is easier than ever, allowing companies of all sizes to benefit from instant, reliable financial data. In an ever-evolving business landscape, real-time accounting may well become the new standard for financial management.

#RealTimeAccounting#DigitalAccounting#BusinessFinance#AccountingTrends#FinancialInsights#FinanceManagement#ModernAccounting

2 notes

·

View notes

Text

Why Your Small Business Should Use Free Online Check Printers

Any small business needs to follow sound financial management strategies, so if you're a business owner looking to streamline your operations, you should get acquainted with the various online financial tools. One area that medium sized businesses spend unnecessary resources on is check printing and there is a great way to reduce your check printing costs.

Advanced software may be used to print checks on standard printers in your home or workplace, and free online check printers are one way to achieve this. This useful technology lets you ensure that your payments are made promptly. Free online check printers offer several additional services that can help you organize your financial operations. In addition to printing checks, you can use it to handle payroll administration, bill payments, and invoicing. So, let's take a closer look at the advantages of using free online check printers.

Simplifying Financial Tasks:

Online check printers are sophisticated tools tailor-made to support small and medium-sized businesses with their financial tasks. Writing checks and tracking your expenses through account books or ledgers is a redundant practice. Today, most organizations use software like online check printers to simplify financial tasks. These platforms have user-friendly interfaces and navigation to assist non-finance professionals in designing and printing professional-looking checks. You can even customize check templates to suit your requirements and ensure consistency.

Reduce Your Costs:

If you are a small business, you are probably spending hundreds of dollars on utilities like ink and check stock, which is one of the major downsides of traditional check printing. This is a clear indicator that you should adopt a free online check printer to process checks effectively. The advantage here is that you can also send checks as PDFs, and your vendors will be able to print them out.

Integrate it with Your Accounting Software:

Advanced free online check printers can integrate with accounting software and synchronize payment data. This allows you to save time as you don’t have to enter the data into the platform manually. You can also reduce the risks of making mistakes through this integration. Firms can also keep a close eye on their cash-flow and expenses by using online check printers and gain key insights into their financial data to make important decisions.

Safe and Secure:

While handling physical checks or checkbooks, you are always prone to theft or fraud, but with free online check printers, you don't have to worry about security. The military-grade encryption that these platforms use will always protect sensitive financial information, like your bank account details, from falling into the hands of malicious agents. In addition, many online check printers provide safe cloud storage to store transaction histories and payment records.

Conclusion:

Free online check printers are an essential tool for small businesses that would assist them in effectively managing their financial operations. Check printing processes are made much easier by this software, and it provides a one-stop solution for modern businesses to manage transactions more efficiently. These platforms are easy to use and provide great security to all your financial data.

2 notes

·

View notes

Text

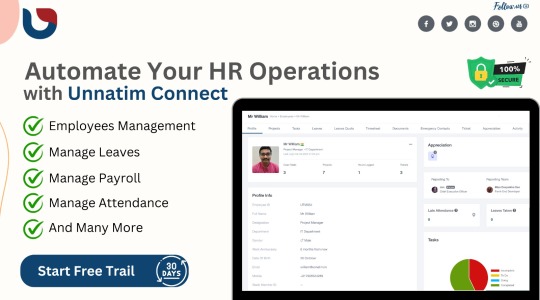

Introducing Unnatim Connect: Revolutionizing CRM Management Software

Unnatim Connect is proud to unveil its cutting-edge CRM management software, designed to redefine efficiency and productivity in today's fast-paced business landscape. With a focus on streamlining operations across diverse sectors, our software offers a comprehensive suite of features to meet the dynamic needs of modern enterprises.

Key Features:

Advanced Dashboard: Gain real-time insights and track key metrics at a glance, empowering informed decision-making.

Leads Management: Seamlessly capture, nurture, and convert leads into valuable customers with our intuitive lead management tools.

Client Management: Foster strong client relationships by centralizing client information, communication, and interactions in one unified platform.

HR Management: Simplify HR processes and optimize workforce management with our comprehensive HR tools, including employee data management and performance tracking.

Work Management: Efficiently organize tasks, projects, and deadlines to boost team collaboration and productivity.

Purchase and Orders: Streamline procurement processes and manage orders effortlessly, from purchase requisition to order fulfillment.

Support Tickets: Enhance customer service and support operations with automated ticketing systems and streamlined resolution workflows.

Events Management: Plan, coordinate, and manage events seamlessly, from scheduling to attendee management.

Knowledge Base: Centralize organizational knowledge and resources for easy access and sharing among team members.

Notice Board: Communicate important announcements, updates, and reminders effectively with a centralized notice board feature.

Assets Management: Track and manage organizational assets efficiently, from equipment to digital assets.

Payroll Management: Automate payroll processes and ensure accurate and timely salary disbursements with our integrated payroll module.

Recruitment: Streamline the recruitment process with tools for job posting, applicant tracking, and interview scheduling.

Zoom Meeting Integration: Seamlessly schedule, host, and manage Zoom meetings directly from our platform, enhancing remote collaboration capabilities.

Reports and Analytics: Generate comprehensive reports and analytics to gain actionable insights and drive data-driven decision-making.

Experience Unnatim Connect:

Experience the power of Unnatim Connect with our complimentary 30-day free trial. Our dedicated team offers personalized training sessions to ensure a smooth onboarding process and help you maximize the benefits of our software. Join us in revolutionizing your business operations and stay ahead of the curve with Unnatim Connect.

Stay tuned for further updates and innovations from Unnatim Connect as we continue to empower businesses with cutting-edge software solutions.

2 notes

·

View notes

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

This is going to ruffle some feathers, but you know me and my hot takes by this point. This is also written as a stream of thought and not terribly polished.

Let's preface this with

I am a Wyll fangirlie

The core issue is capitalism

Got it?

Good.

It's a bit of a bad cycle.

Larian sees Wyll getting less engagement in the game and outside of it, so they don’t have the incentive to follow fan requests—especially the more expensive “after the fact” ones, like recording lots of new lines or tons of new animations and quests. IIRC, Wyll has something like 3–5 hours less voice acting than Astarion or Shadowheart, which is quite a lot.

But the smaller amount of content leads to less interest, and Wyll as a character generates less hype. So it’s a cycle.

When you plan new content as a company, you always have to consider ROI.

Business yapping under the cut.

What is ROI?

Will that action point ultimately make you money or not?

If it's a no, you don't do it.

If it's a maybe, it becomes a nice to have.

If yes, you greenlight it.

Especially if you’re a big studio with major payroll and operating costs. A small indie dev or modder can add whatever they like. But Larian has ~500 employees. They need to cover salaries, loans, investors, upkeep, software licenses, and more.

This is the same reason I harp on EA and Veilguard for shitty writing, but I don’t expect them to "fix" Veilguard.

Veilguard’s budget was mismanaged—they spent their money on flashy tech and abysmal writing. The result? No ROI. The game flopped, the studio’s in shambles, and most of the team was sacked. Even if they rewrote the whole game now, they’d never make that investment back.

So, you, dear reader, hopefully see what is lowkey at stake behind every "should we or should we do something else" as a company.

Adding one narrator line based on social media feedback? Easy win. It makes fans feel seen. That translates to engagement. Engagement translates to sales.

There was a clear incentive to add Halsin. And holy shit, did that pay off. That Bear Scene? Genius-tier sales and marketing. It moved copies.

Same with why we get more Gortash implications. Or more and more Astarion kisses. Those are nice to haves that are easy to greenlight.

Fan demand is high. It drives attention. That’s ROI.

What about Wyll?

In a cast of unstable maniacs, Wyll is the one well-adjusted Disney prince. His biggest flaw is being self-sacrificing to an unhealthy degree. It doesn’t drive angsty romance the way Astarion or Gortash subtext does. So he’s less chosen as a romance. Less chosen as a main.

This is partly on Larian’s writing.

And partly on plain ol’ fandom racism.

Some of Wyll’s writing issues might come from Larian not knowing how to write Black male characters with sensitivity and depth—so they played it safe and gave us the most wholesome, palatable dude possible.

But honestly, if Astarion looked like Wyll? I think Larian would’ve gotten torched for making the Black male character a seductive, trauma-damaged bloodsucker who tries to feed on you without consent.

Personally? I like Wyll. As a companion and an Origin. He has a lot of main character energy—his quest is about finding his dad and learning his value beyond being “The Hero.” YMMV on the writing. But he’s not a YA dark romantasy lead. He’s the green flag you’d introduce to your mom. And everyone else around him is either hilariously messed up, or muscle mommy Karlach.

Here's the big one.

Fan demand for Wyll isn’t framed in positive engagement.

It’s not like the Astarion girlies pumping out countless free ads for the game. I search for Wyll gifs and I get Astarion. It’s that bad.

Like it or not, accusations of company racism? Not good press. Especially for a game that markets itself as “inclusive modern fantasy.”

Of course Larian doesn’t engage Wyll questions. They can’t win.

What are they supposed to say? Everything I’ve said above? That’ll just be read as:

“So you’re saying you’re racist and that’s why the black guy gets less content?”

Why has Wyll less content TDLR

His arc was rewritten late in development, which meant recording all-new voice lines and re-scoping his storyline—an expensive and time-consuming process.

His narrative ties closely to the main plot, so unless you're playing Wyll as an Origin character, he often fades into the background during companion-focused moments.

Wyll and Mizora function as a package deal. In terms of game design, it’s very likely that Wyll’s arc was scoped internally as a two-character structure: not just “Wyll the companion/origin,” but “Wyll and his devil handler.” That adds complexity, but also limits space for fully developing him as an individual.

He has several hours fewer voice lines than Astarion, Shadowheart, or Gale. Adding more isn’t just about calling Wyll’s voice actor—it involves writing, direction, re-records, interactions with other cast members, and animation resources. It’s a large ask.

Larian may or may not struggle to write Black male characters—that’s not a judgment I want to make lightly. Honestly, I’m inclined to give them some grace here. Writing a Black male character with the same edge or messiness as, say, Astarion or Lae’zel or Shadowheart is a powder keg that most companies are understandably wary of. The optics and risks of misstepping are huge, especially in a game with global reach. (You'll note I don't harp on Davrin in Veilguard either, for the same reason.)

Larian sees no clear ROI in adding more Wyll content—and critically, they have nothing to gain by engaging in a public conversation about it. Even good-faith explanations would be easy to misconstrue as excuses or deflection.

Luckily, the solution is easy.

No, not for Wyll. That ship has likely sailed.

But for future black characters in future games from ANY studio?

The solution is capitalism.

BG3 might not be getting more content, but listen: if a black dream prince shows up in a game?

Make. That. Man. Big.

Engagement, engagement, engagement. Positive engagement.

The snake in the business suit holding a clipboard only understands numbers. If the numbers go up, content happens.

Ship him with the fandom favorite.

Buy his merch—and buy more than you do the popular white guy.

Make zines. Fanart. Meta. Fic. All about him.

Choose his romance path. Keep him in your party. Mod him into your cutscenes. Make sure when people search for GIFs of the game, he shows up first.

Positive engagement gives the studio permission to invest.

If the writing sucks or the cast is all white for no reason? Consider: Don’t buy the game. Buy the game with the okay writing and black character instead.

You, as the consumer, decide how and whether ROI happens or not.

Maybe we would have gotten more Wyll content…

...if Spawn Wylstarion had become the main ship.

it is, i think, symptomatic of the way larian has built this brand: bg3 was always marketed as being mature (read: sexual), and that was one of the big draws for players - myself included! especially as media pulls more towards extremes, with mainstream video games starting to get increasingly graphically sexual, graphically violent, and the vogue for 'grey morality' becomes the norm, those boundaries get pushed, and it becomes more and more of a selling point.

larian obviously focused on this, along with the How Do You Do, Fellow Kids brand, the increased accessibility of game devs on twitter, and adopted it heavily into their marketing strategy, and are now pretty reliant on the horny gamer crowd for a lot of their audience, and more importantly, they're doing this on purpose.

which is how you end up in situations like this.

characters (white men) the players want to fuck get centred: they get updates, they get more content, they get favoured. halsin's gone from a side character in EA to a half-fledged romance option, to a full romance option: he shows up in the promotional material, is larian's poster boy for the sex scenes, he gets more content with every update.

now gortash gets more heavily implied situationship lines with the dark urge, because players are horny for him. nevermind that some people aren't playing that way, or that he was originally set up to be a lower-level antagonist; nevermind that if the durge's storyline needed expansion, it should've been with orin and sarevok and bhaal, or that it muddies the writing for the rest of gortash's arc + characterisation: people want to fuck him, so it gets put in the game. it's not even to do with karlach, whose quest so desperately needs expansion! it's specifically catering to the people who want their character to have a Relationship with the slaver, because they're either not interested in or not able to focus on strengthening the weak spots in the narrative: they're just doing things that will net the 'my favourite dating sim' people lmfao.

meanwhile, literal main character wyll gets his quest demoted to a subquest, doesn't get bugfixes, doesn't get a single unique romance greeting after 6 patches and months of requests. he's not a Horny character, so he doesn't get the focus: he's not a player favourite, so he gets nothing. it's just... so unbelievably, indisputably racist, and it's incredibly grim and disappointing to watch it happen in real-time.

#It's me i'm the worst marxist#wyll deserves better#wyll ravengard#the nice thing about capitalism is that sometimes you as the little worker-consumer bee do wield the power#video games meta#everyone should experience spawn wylstarion at least twice it's so wholesome#business logic#fandom meta#wylstarion#if you want messy and interesting black characters consider Cyberpunk 2077#why am I being so lenient on Larian when I harp on EA? Larian isn't a publicly traded company and they really invest in good writing#so they have to do something Heinous for me to cancel them#Wyll is not a badly written character he's just a nice well-adjusted dude in a group of romantasy basketcases and tragic terminal patients#what can I say my heart beats on the left but it's a pragmatist heart#black cat white cat as long as the mice are caught and so on#this fandom has issues

6K notes

·

View notes

Text

💼 Run Your HR Smarter — Not Harder — with EZHRM Cloud HR Software

Managing HR doesn't have to be a pain. With EZHRM’s cloud HR software, you can streamline everything from attendance tracking to payroll — all in one place, accessible from anywhere.

No more messy spreadsheets. No clunky software installs. Just a clean, cloud-powered platform that keeps your HR smooth and simple.

✅ What EZHRM Can Do for You:

Real-time employee attendance & leave tracking

Easy, automated payroll with salary slips

Monitor teams from anywhere

Store and access documents securely

Mobile-friendly, dashboard-driven experience

Role-based access for different team levels

💬 Need help or a quick product demo? 📩 Contact Us Here 📞 +91-7056-321-321

Let’s connect: 🔗 Facebook 🔗 LinkedIn

EZHRM makes HR smart, simple, and scalable — just how modern businesses like yours need it.

0 notes

Text

Print Payroll Checks the Easy Way: Save Time, Money, and Stress

Payroll is one of those tasks that every business owner knows can get complicated fast. Getting your employees paid on time is critical. But did you know that nearly 65% of workers live paycheck to paycheck? That means even a small payroll delay or error can cause serious problems—not just for your team, but for your business reputation too.

If you’re still ordering preprinted payroll checks in bulk or relying on manual processes, you’re probably paying too much and dealing with avoidable hassles. The good news? Modern solutions like Zil Money let you print payroll checks on blank stock paper whenever you want, wherever you want. This can cut costs, speed up payroll, and give you peace of mind.

Payroll Problems That Cost Time and Money

Traditional payroll check printing comes with hidden headaches. You order checks months in advance, pay for shipping and storage, and face delays if you suddenly need extra checks. Mistakes in manual payroll entry can cause reprints, missing payments, or worse — unhappy employees.

Payroll errors aren’t just annoying — they’re expensive. According to recent studies, 54% of Americans have experienced pay problems, and 72% would struggle financially if their paycheck was delayed by just a week. That’s why businesses need a reliable, flexible way to handle payroll.

Print Payroll Checks Anytime, Anywhere, and Save Big

Zil Money helps you print payroll checks instantly using blank check stock paper. This means no waiting for shipments or buying checks you may never use. Just buy blank check stock locally, print payroll checks with your office printer, and save up to 80% compared to traditional check printing.

This method gives you flexibility. If you hire new staff mid-cycle or need to make a last-minute payment, you can print checks right away. It’s especially useful for businesses with fluctuating payroll needs.

Custom Checks That Represent Your Brand

Payroll checks are more than just payment—they’re part of your company’s image. Zil Money allows you to customize your payroll checks with your business logo, colors, and fonts. This professional branding helps build trust and shows employees you care about quality.

Secure and Integrated Payroll Processing

One of the biggest risks in payroll is errors. Manually typing employee details or exporting payroll data from one system to another causes errors and delays.

Zil Money seamlessly integrates with well-known payroll and accounting programs, allowing you to directly import employee pay data. This eliminates mistakes, enhancing accuracy and compliance.

Plus, the cloud-based platform uses industry-leading security to keep your payroll data safe. Features like instant check cancellation and automated positive pay reduce fraud risk and give you confidence.

Instant or Mailed – You Decide!

Zil Money makes it easy to handle payroll checks your way. You can quickly send out printable eChecks via email, and employees will get an SMS alert as soon as their payment is ready. If you or your team prefer traditional paper checks, the platform also offers secure mailing options through trusted carriers like USPS or FedEx. This way, your checks arrive safely and on time, all without you having to leave your desk. This way, you decide how payroll checks reach your team—fast, secure, and hassle-free.

Why More Businesses Are Switching to the Cloud-based Platform?

Cut payroll check printing costs by up to 80%

Print checks on demand, eliminating waste

Customize checks easily to reflect your brand

Print from anywhere with any standard printer

Mail or email payroll checks with built-in notifications

Integrate payroll data from popular software to reduce errors

Protect your business with secure, encrypted payroll processing

Printing Payroll Checks Made Simple and Affordable

Knowing how to print payroll checks efficiently is essential for small business owners looking to save money and avoid payroll headaches. Traditional bulk check ordering is costly and slow.

With Zil Money, you can print payroll checks instantly on blank paper, customize them to look professional, and connect directly with your payroll software. This saves you money and also helps keep your employees happy by making sure they get their pay on time and it’s accurate.

If you want to simplify your payroll process, save money, and eliminate the stress of check printing, it’s time to explore how Zil Money can help you print payroll checks smarter and faster.

0 notes

Text

Simplify Payroll Processing with Smart, Advanced Software.

Stop wasting time on manual calculations. Our advanced payroll software automates salary processing, tax compliance, and employee deductions—all in a single, easy-to-use system. Ideal for HR and finance teams aiming for accuracy and efficiency without the stress. 🚀 Book your free demo today and discover a faster, smarter way to manage payroll!

0 notes

Text

What CEOs Should Know About Time Tracking Before Their Next Payroll Cycle

In the race to meet payroll deadlines, CEOs get extremely concerned about paying employees on time and accurately. But there is a little secret: while payroll might be posting on time, incorrect or old-fashioned time tracking could be costing your business a high cost every month. Inflated overtime? Missed hours? Or simply good guesswork? Bad timekeeping is quietly eating away at profit margins.

If you are a business leader, it is time to move beyond basic attendance to understanding good Employee Time Tracking Software as an advanced move for the next payroll cycle.

Why Traditional Time Tracking Fails Modern Businesses

Spreadsheets, punch cards, or casual self-reporting are still acceptable in many organizations. Such a phrase is outdated; it would be more accurate to say risky. Here are the reasons why it does not work:

The manual entry includes errors that lead to payroll disputes

Time theft (buddy punching, late starts, early outs) goes unnoticed

Zero real-time visibility into what remote or field teams are doing

There is no audit trail to go against the actual work done

When you combine all of the information, you'll see that your time tracking system determines how accurate your payroll data is.

What Is Employee Time Tracking Software?

Employee Time Tracking Software is a computer application that records and keeps track of employees' working hours, days, and locations. This use of technology degrades the old-time wrong methods with trustworthy data. It allows real-time, accurate data to flow to managers and payroll for hours worked, job progress, and productivity-whether their teams work remotely, hybrid, or out in the field.

The CEO’s Checklist: What to Look for in a Time Tracking Solution

Mark down these checklists before running the next payroll:

1. Accuracy You Can Trust

With accurate software, there is no guesswork involved in a punch-in and out, an application, a GPS check-in, or lots of other techniques via which an employee's activities can be traced. This serves to clock hours accurately, thus helping in flawless payroll processing every time.

2. Real-Time Insights

A good Employee Time Tracking Software talks about real-time dashboards that have active, off, and pending tasks. No more calling HR heads for updates while it's all on your screen.

3. Mobile-Friendly for Field and Remote Staff

Are field teams in transit? A new app allows a modern employee to log hours against a task using mobile devices.

4. Integration with Payroll and HR Systems

These tools are directly connected to your payroll software. It means no more manual data transfers or mismatched calculations, saving both time and human error.

5. Compliance and Audit Readiness

In the finance, health care, and manufacturing domains, compliance is everything. Time tracking software keeps secure logs- thus easy passage of audits and labour regulations becomes trouble-free.

The Hidden Costs of Not Using Employee Time Tracking Software

Is it still something you're doubtful to accept? What inaction is costing you: Payroll overpayments from wrong calculations of working hours. The most unbilled hours are in the experience-focused, service-based industries. Poor productivity by scoring the performance of work done especially in comparison to planned target hours. An extra administrative burden over HR due to time sheets and the subsequent errors need to pay for themselves. Employee discontent because of debates over hours or payment delays. Add it all together, and by the month, it's quite a figure, even for smaller businesses. Time-tracking solutions should be integrated more strategically than just a basic back-end activity.

Time Tracking App: A Game Changer for the New Workforce

The modern worker is adaptable and prioritizes technology. Time-tracking apps ensure your alignment with the workforce. A prime app would offer the following:

Clock in/out with a single tap from anywhere

GPS tagging to authenticate the location of the field staff

Task-based tracking to connect hours worked with project outcomes

It also logs break time and idle time to guarantee fair usage of labour

Push notifications for changes in shift, reminders of work, or overtime

When their teams are supported and trusted, engagement and accountability significantly rise, and that's something all CEOs want.

How CEOs Can Lead the Change

As the CEO, you would be leading the organization-wide adoption of any technology. There are ways to lead the change to a better time-tracking system: Pilot the software in one department first. Engage HR and finance teams from the start for smooth implementation. Communicate "why" to employees: Show how it benefits them too. Set policies and norms regarding time logging. Track ROI in reduced errors, compliance, and faster payroll cycles. It is about optimizing performance, not just an hour count, and creating a work environment that is transparent and efficient.

Conclusion: Time to Rethink Time

Your approach of time tracking translates into your strategy of doing business. If you're still depending on outdated systems that means, you're risking your payroll, profits, and people.

Before the next payroll, ask yourself:

Am I completely confident in how my employees are recording their time?

If the answer is "not really," it is time to get trained with Employee Time Tracking Software. Making payroll accurate and seamless with TrackOlap for time tracking software. To facilitate accurate payrolls and smooth time tracking for your business, TrackOlap has the finest Employee Time Tracking Software and a simple-to-use time tracking app. Beat the next payroll cycle with real-time insights and automation—get started with TrackOlap today.

#employee time tracking software#employee time tracking#employee tracking#employee tracking software#employee tracking app#employee monitoring software#employee tracking software dubai#time tracking software#business automation software

0 notes