#EchoBoomers

Text

The Weekend Warrior 10/13/20: FREAKY, THE CLIMB, MANK, HILLBILLY ELEGY, AMMONITE, DREAMLAND, DOC-NYC and MUCH MORE!

It’s a pretty crazy week for new releases as I mentioned a few times over the past couple weeks, but it’s bound to happen as we get closer to the holiday movie season, which this year won’t include many movies in theaters, even though movie theaters are still open in many areas of the country… and closing in others. Sigh. Besides a few high-profile Netflix theatrical release, we also get movies starring Vince Vaughn, Margot Robbie, Kate Winslet, Saoirse Ronan, Mel Gibson and more offerings. In fact, I’ve somehow managed to write 12 (!!!!) reviews this week… yikes.

Before we get to the new movies, let’s look at a few series/festivals starting this week, including the always great documentary festival, DOC-NYC, which runs from November 11 through 19. A few of the docs I’ve already seen are (probably not surprisingly, if you know me) some of the music docs in the “Sonic Cinema” section, including Oliver Murray’s Ronnie’s, a film about legendary jazz musician and tenor sax player Ronnie Scott, whose London club Ronnie Scott’s Jazz Club has been one of the central cores for British jazz fans for many decades.

Alex Winter’s Zappa is a much more satisfying portrait of the avant-garde rocker than the doc Frank Zappa: In His Own Words from a few years back, but I was even more surprised by how much I enjoyed Julien Temple’s Crock of Gold: A Few Rounds with Shane MacGowan, because I’ve never really been a Pogues fan, but it’s highly entertaining as we learn about the chronically-soused frontman of the popular Irish band.

I haven’t seen Robert Yapkowitz and Richard Peete’s in My Own Time: A Portrait of Karen Dalton, a portrait of the blues and folk singer, yet, nor have I watched Marcia Jarmel and Ken Schneider’s Los Hermanos/The Brothers about two brother musicians separated from childhood after leaving their native Cuba, but I’ll try to get to both of them soon enough.

Outside of the realm of music docs is Ilinca Calugareanu’s A Cops and Robbers Story, which follows Corey Pegues from being a drug dealer and gang member to a celebrated deputy inspector within the NYPD. There’s also Nancy (The Loving Story) Buirski’s A Crime on the Bayou, the third part of the filmmaker’s trilogy about brave individuals in the Civil Rights era, this one about 19-year-old New Orleans fisherman Gary Duncan who tries to break up a fight between white and black teens at an integrated school and is arrested for assaulting a minor when merely touching a white boy’s arm.

Hao Wu’s 76 Days covers the length of Wuhan, China’s lockdown due to COVID-19, a very timely doc that will be released by MTV Documentary Films via virtual cinema on December 4. It’s one of DOC-NYC’s features on its annual Short List, which includes Boys State, Collective, The Fight, On the Record, and ten others that will vie for juried categories.

IFC Films’ Dear Santa, the new film from Dana Nachman, director of the wonderful Pick of the Litter, will follow its Heartland Film Festival debut with a run at COD-NYC before its own December 4 release. The latter is about the USPS’s “Operation Santa” program that receives hundreds of thousands of letters to Santa every year and employees thousands of volunteers to help make the wishes of these kids come true.

Basically, there’s a LOT of stuff to see at DOC-NYC, and while most of the movies haven’t been released publicly outside festivals yet, a lot of these movies will be part of the doc conversations of 2020. DOC-NYC gives the chance for people across the United States to see a lot of great docs months before anyone else, so take advantage of some of their ticket packs to save some money over the normal $12 per ticket price. The $199 price for an All Access Film Pass also isn’t a bad deal if you have enough time to watch the hundreds of DOC-NYC offerings. (Sadly, I never do, yet I’m still a little bummed to miss the 10Am press screenings at IFC Center that keeps me off the streets… or in this case, sitting on my ass at home.)

Not to be outdone by the presence of DOC-NYC, Film at Lincoln Center is kicking off its OWN seventh annual “Art of the Real” doc series, which has a bit of overlap by running from November 13 to 26. I really don’t know a lot about the documentaries being shown as part of this program, presented with Mubi and The New York Times, but check this out. For just 50 bucks, you can get an all-access pass to all 17 films, which you can casually watch at home over the two weeks of the fest.

Okay, let’s get to some theatrical releases, and the one I’ve been anticipating the most (also the one getting the widest release) is Christopher Landon’s FREAKY from Blumhouse and Universal Pictures. It stars Kathryn Newton as Millie Kessler, a high school outcast who is constantly picked on, but one night, she ends up encountering the serial killer known as the “Blissfield Butcher” (Vince Vaughn), but instead of dying when she’s stabbed with a ritual blade. The next morning Millie and the Butcher wake up to discover that they’ve been transported into the body of the other. Oh, it’s Friday the 13th… oh, now I get it… Freaky Friday!

Landon is best known for writing many of the Paranormal Activity sequels and directing Paranormal Activity: The Marked Ones. Msore importantly, he directed Happy Death Day and its sequel Happy Death Day 2 U, two of my favorite Blumhouse movies, because they so successfully mix horror with comedy, which is so hard to do. That’s what Freaky is all about, too, and it’s even harder this time even though Freaky has way more gruesome and gory kills than anything in Landon’s other films. Heck, many of the kills are gorier than the most recent Halloween from Blumhouse, and it’s a little shocking when you’re laughing so hard at times.

Landon does some clever things with what’s essentially a one-joke premise of a killer in a teen girl’s body and vice versa, but like the Lindsay Lohan-Jamie Lee Curtis remake from 2003, it’s all about the talent of the two main actors to pull off the rather intricate nature of playing humor without losing the seriousness of the horror element.

It may not be too surprising with Vaughn, who made a ton of dramas and thrillers before turning to comedy. (Does everyone remember that he played Norman Bates in Gus Van Sant’s remake of Psycho and also starred in thrillers The Cell and Domestic Disturbance?) Newton is a bit more of an unknown quantity, but as soon as Tillie dawns the red leather jacket, you know that she can use her newly found homicidal attitude to get some revenge on those who have been terrible to her.

In some ways, the comedy aspects of Freaky win out over the horror but no horror fan will be disappointed by the amount of gory kills and how well the laughs emerge from a decent horror flick. Freaky seems like the kind of movie that Wes Craven would have loved.

I’m delighted to say that this week’s “Featured Flick” is Michael Angelo Covino and Kyle Marvin’s indie comedy THE CLIMB (Sony Pictures Classics), a movie that I have seen no less than three times this year, first when it was playing Sundance, a few months later when it was supposed to open in March… and then again last week! And you know what? I enjoyed it just as much every single time. It’s an amazing two-hander that stars Covino and Marvin as best friends Mike and Kyle, who have a falling out over the former sleeping with the latter’s fiancé, and it just gets funnier and funnier as the friends fight and Kyle gets engaged to Marisa (Gayle Rankin from GLOW) who hates Mike. Can this friendship possibly survive?

I really had no idea what to expect the first time I saw The Climb at the Sony Screening Room, but it was obviously going to be a very different movie for Sony Pictures Classics, who had started out the year with so many great films before theaters shut down. (Unfortunately, they may have waited too long on this one as theaters seem to be shutting down again even while NYC and L.A. have yet to reopen them. Still, I think this would be just as much fun in a drive-in.)

The movie starts with a long, extended scene of the two leads riding bikes on a steep mountain in France, talking to each other as Kyle (once the athlete of the duo) has fallen out of shape. During the conversation, Mike admits to having slept with Kyle’s fiancé Ava (Judith Godréche) and things turn hostile between the two. We then get the first big jump in time as we’re now at the funeral for Ava, who actually had been married to Mike. Kyle eventually moves on and begins a relationship with his high school sweetheart Marisa, who we meet at the Thanksgiving gathering for Kyle’s extended family. In both these cases, we see how the relationship between Mike and Kyle has changed/evolved as Mike has now fallen on hard times.

It's a little hard to explain why what’s essentially a “slice of life” movie can be so funny. On one hand, The Climb might be the type of movie we might see from Mike Leigh, but Covino and Marvin find a way to make everything funny and also quite eccentric in terms of how some of the segments begin and end. Technically, it’s also an impressive feat with the number of amazing single shot sequences and how smooth some of the transitions work. It’s actually interesting to see when and how the filmmakers decide to return to the lives of their subjects – think of it a bit like Michael Apted’s “Up” series of docs but covering a lot shorter span in time.

Most importantly, The Climb has such a unique tone and feel to other indie dramedies we’ve seen, as the duo seem to be influenced more by European cinema than American indies. Personally, I think a better title for The Climb might have been “Frenemied,” but even with the movie’s fairly innocuous title, you will not forget the experience watching this entertaining film anytime soon.

Maybe this should be called “Netflix week,” because the streamer is releasing a number of high-profile movies into theaters and on the streaming service. Definitely one of the more anticipated movies of the year is David Fincher’s MANK, which will get a theatrical release this week and then stream on Netflix starting December 4.

It stars Gary Oldman as Herman Mankiewicz, the Hollywood screenwriter who has allowed himself to succumb to alcoholism but has been hired by Orson Welles (Tom Burke) to write his next movie, Citizen Kane, working with a personal secretary Rita Alexander (played by Lily Collins). His story is told through his interactions with media mogul William Hearst (Charles Dance) and relationship with actress and Hearst ingenue and mistress, Marion Davies (Amanda Seyfried).

It I were asked to pick one director who is my absolute favorite, Fincher would probably be in my top 5 because he’s had such an illustrious and varied career of movie styles, and Mank continues that tradition as Fincher pays tribute to old Hollywood and specifically the work of Orson Welles in every frame of this biopic that’s actually more about the troubled writer of Citizen Kane who was able to absorb everything happening in his own Hollywood circles and apply them to the script.

More than anything, Mank feels like a movie for people who love old Hollywood and inside Hollywood stories, and maybe even those who may already know about the making of Welles’ highly-regarded film might find a few new things to appreciate. I particularly enjoyed Mankiewicz’s relationships with the women around him, including his wife “Poor Sarah,” played by Tuppence Middleton, Collins’ Rita, and of course, Seyfried’s absolutely radiant performance as Davies. Maybe I would have appreciated the line-up of known names and characters like studio head Louis B Mayer and others, if more of them had any sort of effect on the story and weren’t just

The film perfectly captures the dynamic of the time and place as Mank is frequently the only honest voice in a sea of brown nosers and yes-men. Maybe I would have enjoyed Oldman’s performance more if everything that comes out of Mankiewicz’s mouth wasn’t an all-too-clever quip.

The film really hits a high point after a friend of Mank’s commits suicide and how that adds to the writer’s woes about not being able to save him. The film’s last act involves Mank dealing with the repercussions after the word gets out that Citizen Kane is indeed about Hearst.

Overall, Mank is a movie that’s hard to really dig into, and like some of Fincher’s previous work, it tends to be devoid of emotion. Even Fincher’s decision to be clever by including cigarette burns to represent Mank’s “reels” – something explained by Brad Pitt in Fight Club – just drives home the point that Mank is deliberately Fincher’s most meta movie to date.

You can also read my technical/crafts review of Mank over at Below the Line.

Ron Howard’s adaptation of JD Vance’s bestselling memoir HILLBILLY ELEGY will be released by Netflix into theaters ahead of its streaming debut on November 24. It stars Amy Adams and Glenn Close, but in honesty, it’s about JD Vance, you know, the guy who wrote the memoir. The film follows his younger years (as played by Owen Asztalos) while dealing with a dysfunctional white trash family in Middletown, Ohio, dealing with his headstrong Mamaw (Close) and abusive mother dealing with drug addiction (Adams). Later in life, while studying at Yale (and played by Gabriel Basso), he has to return to his Ohio roots to deal with his mother’s growing addiction that forces him to come to terms with his past.

I’m a bit of a Ron Howard stan – some might even say “an apologist” – and there’s no denying that Hillbilly Elegy puts him the closest to A Beautiful Mind territory than he’s been in quite some time. That doesn’t mean that this movie is perfect, nor that I would consider it one of his better movies, though. I went into the movie not knowing a thing about JD Vance or his memoir but after the first reviews came out, I was a little shocked how many of them immediately went political, because there’s absolutely nothing resembling politics in the film.

It is essentially an adaptation of a memoir, dealing with JD Vance’s childhood but then also the past that led his mother and grandmother down the paths that made his family so dysfunctional. I particularly enjoyed the relationship between the older Vance and his future wife Usha (as played by Freida Pinto) earlier in their relationship as they’re both going to Yale and Vance is trying to move past his family history to succeed in the realm of law.

It might be a no-brainer why Adams and Close are being given so much of the attention for their performances. They are two of the best. Close is particularly amusing as the cantankerous Mamaw, who veers between cussing and crying, but also has some great scenes both with Adams and the younger Vance. The amazing special make-up FX used to change her appearance often makes you forget you’re watching Close. I wish I could say the same for Adams, who gives such an overwrought and over-the-top performance that it’s very hard to feel much emotionally for her character as she goes down a seemingly endless vortex of drug addiction. It’s a performance that leads to some absolute craziness. (It’s also odd seeing Adams in basically the Christian Bale role in The Fighter, although Basso should get more credit about what he brings out in their scenes together.)

Hillbilly Elegy does have a number of duller moments, and I’m not quite sure anyone not already a fan of Vance’s book would really have much interest in these characters. I certainly have had issues with movies about people some may consider “Southern White Trash,” but it’s something I’ve worked on myself to overcome. It’s actually quite respectable for a movie to try to show characters outside the normal circles of those who tend to write reviews, and I wouldn’t be surprised if the movie might be able to connect with people in rural areas that rarely get to see themselves on screen.

Hillbilly Elegy has its issues, but it feels like a successful adaptation of a novel that may have been difficult to keep an audience invested in with all its flashbacks and jumps in time.

Netflix is also streaming the Italian drama THE LIFE AHEAD, directed by Edoardo Ponti, starring Oscar-winning actress Sophia Loren, who happens to also be the filmmaker’s mother. She plays Madame Rosa, a Holocaust survivor in Italy who takes a stubborn young street kid named Momo (Ibrahima Gueye), much to both their chagrin.

I’ll be shocked if Italy doesn’t submit Ponti’s film as their choice for the Oscar’s International Film category, because it has all of the elements that would appeal to Oscar voters. In that sense, I also found it to be quite traditional and formulaic. Loren is quite amazing, as to be expected, and I was just as impressed with young Ibrahima Gueye who seems to be able to hold his own in what’s apparently his first movie. There’s others in the cast that also add to the experience including a trans hooker named Lola, but it’s really the relationship between the two main characters that keeps you invested in the movie. I only wish I didn’t spend much of the movie feeling like I knew exactly where it’s going in terms of Rosa doing something to save the young boy and giving him a chance at a good life.

I hate to be cynical, but at times, this is so by the books, as if Ponti watched every Oscar movie and made one that had all the right elements to appeal to Oscar voters and wokesters alike. That aside, it does such a good job tugging at heartstrings that you might forgive how obviously formulaic it is.

Netflix is also premiering the fourth season of The Crown this week, starring Olivia Colman as Queen Elizabeth and bringing on board Gillian Anderson as Margaret Thatcher, Emma Corin, Helena Bonham Carter, Tobis Menzies, Marion Bailey and Charles Dancer. Quite a week for the streamer, indeed.

Another movie that may be in the conversation for Awards season is AMMONITE (NEON), the new film from Francis Lee (God’s Own Country), a drama set in 1840s England where Kate Winslet plays Mary Anning, a fossil hunter, tasked to look after melancholic young bride, Charlotte Murcheson (Saoirse Ronan), sent to the sea to get better only for them to get into a far more intimate relationship.

I had been looking forward to this film, having heard almost unanimous raves from out of Toronto a few months back. Maybe my expectations were too high, because while this is a well-made film with two strong actors, it’s also rather dreary and not something I necessarily would watch for pleasure. The comparisons to last year’s Portrait of a Lady on Fire (also released by NEON) are so spot-on that it’s almost impossible to watch this movie without knowing exactly where it’s going from the very minute that the two main characters meet.

Winslet isn’t bad in another glammed-down role where she can be particularly cantankerous, but knowing that the film would eventually take a sapphic turn made it somewhat predictable. Ronan seems to be playing her first outright adult role ever, and it’s a little strange to see her all grown-up after playing a teenager in so many movies.

The movie is just so contained to the one setting right up until the last 20 minutes when it actually lives the Lyme setting and lets us see the world outside Mary’s secluded lifestyle. As much as I wanted to love Ammonite, it just comes off as so obvious and predictable – and certainly not helped by coming out so soon after Portrait of a Lady. There’s also something about Ammonite that just feels so drab and dreary and not something I’d necessarily need to sit through a second time.

The animated film WOLFWALKERS (GKIds) is the latest from Tomm Moore and Ross Stewart, directors of the Oscar-nominated Secret of the Kells (Moore’s Song of the Sea also received an Oscar nomination a few years later.) It’s about a young Irish girl named Robyn (voiced Honor Kneafsey) who is learning to be hunter from her father (voiced by Sean Bean) to help him wipe out the last wolf pack. Roby then meets another girl (voiced by Eva Whittaker) who is part of a tribe rumored to transform into wolves by night.

I have to be honest that by the time I got around to start watching this, I was really burnt out and not in any mood to watch what I considered to look like a kiddie movie. It looks nice, but I’m sure I’d be able to enjoy it more in a different head (like watching first thing on a Saturday morning).

Regardless, Wolfwalkers will be in theaters nationwide this Friday and over the weekend via Fathom Events as well as get full theatrical runs at drive-ins sponsored by the Landmark, Angelika and L.A.’s Vineland before it debuts on Apple TV+ on December 11. Maybe I’ll write a proper review for that column. You can get tickets for the Fathom Events at WolfwalkersMovie.com.

Next up is Miles Joris-Peyrafitte’s DREAMLAND (Paramount), starring Margot Robbie as Allison Wells, a bank-robbing criminal on the loose who encounters young man named Eugene Evans (Finn Cole) in rural Dust Bowl era North Dakota and convinces him to hide her and help her escape the authorities by taking her to Mexico.

Another movie where I wasn’t expecting much, more due to the generic title and genre than anything else, but it’s a pretty basic story of a young man in a small town who dreams of leaving and also glamorizes the crime stories he read in pulps. Because of the Great Depression in the late ’20, the crime wave was spreading out across the land and affecting everyone, even in more remote locations like the one at the center of Dreamland.

The sad truth is that there have been so many better movies about this era, including Warren Beatty’s Bonnie and Clyde, Lawless and many others. Because of that, this might not be bad but it’s definitely trying to follow movies that leave quite a long shadow. The innocent relationship between Eugene and Allison does add another level to the typical gangster story, but maybe that isn’t enough for Dreamland to really get past the fact that the romantic part of their relationship isn’t particularly believable.

As much as this might have been fine as a two-hander, you two have Travis Fimmel as Eugene’s stepfather and another generic white guy in Garrett Hedlund playing Allison’s Clyde Barrow-like partner in crime in the flashbacks. Cole has enough trouble keeping on pace with Robbie but then you have Fimmel, who was just grossly miscast. The film’s score ended up being so overpowering and annoying I wasn’t even remotely surprised when I saw that Joris-Peyrafitte is credited with co-writing the film’s score.

Dreamland is fine, though it really needed to have a stronger and more original vision to stand out. It’s another classic case of an actor being far better than the material she’s been given. This is being given a very limited theatrical release before being on digital next Tuesday.

This might have been Netflix week, but maybe it could have been “Saban Films Week,” since the distributor also has three new movies. Actually, only two, because I screwed up, and I missed the fact that André Øvredal’s MORTAL was released by Saban Films LAST week. Not entirely my fault because for some reason, I had it opening this week, and I only realized that I was wrong last Wednesday. Oh, well. It stars Nate Wolff as Eric Bergeland, an American in Norway who seems to have some enigmatic powers, but after killing a young lad, he ends up on the lam with federal agent Christine (Iben Akerlie from Victoria).

This is another movie I really wanted to like since I’ve been such a fan of Øvredal from back to his movie Trollhunter. Certainly the idea of him taking a dark look at superpowers through the lends of Norse mythology should be right up my alley. Even so, this darker and more serious take on superpowers – while it might be something relatively unique and new in movies – it’s something anyone who has read comics has seen many times before and often quite better.

Wolff’s character is deliberately kept a mystery about where he comes from, and all we know is that he survived a fire at his farm, and we watched him kill a young man that’s part of a group of young bullies. From there, it kind of turns into a procedural as the authorities and Akerlie’s character tries to find out where Eric came from and got his powers. It’s not necessarily a slow or talkie movie, because there are some impressive set pieces for sure, but it definitely feels more like Autopsy of Jane Doe than Trollhunters. Maybe my biggest is that this is a relatively drab and lifeless performance by Wolff, who I’ve seen be better in other films.

Despite my issues, it doesn’t lessen my feelings about Øvredal as a filmmaker, because there’s good music and use of visual FX -- no surprise if you’ve seen Trollhunters -- but there’s still a really bad underlying feeling that you’re watching a lower budget version of an “X-Men” movie, and not necessarily one of the better ones. Despite a decent (and kinda crazy) ending, Mortal never really pays off, and it’s such a slog to get to that ending that people might feel slightly underwhelmed.

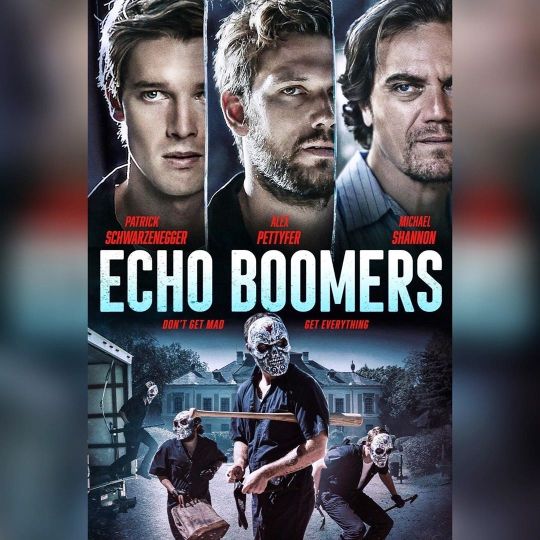

Seth Savoy’s ECHO BOOMERS (Saban Films) is a crime thriller based on a “true story if you believe in such things,” starring Patrick Schwarzenegger as Lance, a young art major, who falls in with a group of youths who break into rich people’s homes and trash them, also stealing some of the more valuable items for their leader Mel (Michael Shannon).

There’s a lot about Echo Boomers that’s going to feel familiar if you’ve seen Sofia Coppola’s The Bling Ring or the heist movie American Animals from a few years back, but even with those similarities, Seth Savoy has a strong cast and vision to make more out of the fairly weak writing than another director might manage. Schwarzenegger, who seems to be pulling in quite a wide range of roles for basically being another generic white actor is only part of a decent ensemble that includes Alex Pettyfer as the group’s ersatz alpha male Ellis and Hayley Law (also great in the recent Spontaneous) as his girlfriend Allie, the only girl taking part in the heists and destruction. Those three actors alone are great, but then you add Shannon just doing typically fantastic work as more of a catalyst than an antagonist.

You can probably expect there will be some dissension in the ranks, especially when the group’s “Fagan” Mel puts Lance in charge of keeping them in line and Allie forms a friendship with Lance. What holds the movie back is the decision to use a very traditional testimonial storytelling style where Lance and Allie narrate the story by relaying what happened to the authorities after their capture obviously. This doesn’t help take away from the general predictability of where the story goes either, because we’ve seen this type of thing going all the way back to The Usual Suspects.

While Echo Boomers might be fairly derivative of far better movies at times, it also has a strong directorial vision and a compelling story that makes up enough for that fact.

In theaters this Friday and then On Demand and Digital on November 24 is Eshom and Ian Nelms’ action-comedy FATMAN (Saban Films/Paramount), starring Mel Gibson as Santa Claus and Walton Goggins as the hired assassin sent to kill him by a spoiled rich boy named Billy (Chance Hurstfield) who unhappy with the presents he’s being brought for Christmas.

While we seem to be surrounded by high concept movies of all shapes and sizes, you can’t get much more high concept than having Mel Gibson playing a tough and cantankerous* Kris Kringle (*Is this the week’s actual theme?) who is struggling to survive with Mrs. Klaus (played by the wonderful Marianne Jean-Baptiste from In Fabric) when they’re given the opportunity to produce military grade items for the army using his speedy elf workshop. Unbeknownst to the Kringles, the disgruntled hitman who also feels he’s been let down by Santa is on his way to the North Pole to fulfill his assignment.

You’ll probably know whether you’ll like this movie or not since its snarkier comedic tone is introduced almost from the very beginning. This is actually a pretty decent role for Gibson that really plays up to his strengths, and it’s a shame that there wasn’t more to it than just a fairly obvious action movie that leads to a shoot-out. I probably should have enjoyed Goggins more in a full-on villainous role but having been watching a lot of him on CBS’ The Unicorn, it’s kind of hard to adjust to him playing this kind of role. I did absolutely love Marianne Jean-Baptiste and the warmth she brought to a relatively snarky movie.

I’m not sure if Fatman is the best showing of Eshom and Ian Nelms’ abilities as filmmakers, because they certainly have some, but any chance of being entertaining is tamped down by a feeling the filmmakers are constantly trying to play it safe. Because of this, Fatman has a few fun moments but a generally weak premise that never fully delivers. It would have thrived by being much crazier, but instead, it’s just far too mild.

Malin Åkerman stars in Paul Leyden’s CHICK FIGHT (Quiver Distribution) as Anna, a woman unhappy with her life and inability to survive on the little money she makes at her failing coffee shop. When Anna’s lesbian traffic cop friend Charleen (Dulcé Sloan) takes her to an underground fight club, Anna her trepidation about joining in, because she has never been in a fight in her life. Learning that her mother has a legacy at the club, Anna agrees to be trained by Alec Baldwin’s always-drunk Murphy in order to take on the challenges of the likes of Bella Thorne’s Olivia.

Another movie where I’m not sure where to begin other than the fact that I’m not sure I’ve seen a movie trying so hard to be fun and funny and failing miserably at both. Listen, I generally love Akerman, and I’m always hoping for her to get stronger material to match her talents, but this tries its best to be edgy without ever really delivering on the most important thing for any comedy: Laughs. Sure, the filmmakers try their best and even shoehorn a bit of romance for Anna in the form of the ring doctor played by Kevin Connolly from Entourage, but it does little to help distinguish the movie’s identity.

Listen, I’m not going to apologize for being a heterosexual male that finds Bella Thorne to be quite hot when she’s kicking ass in the ring. (I’m presuming that a lot of what we see in her scenes in the ring involves talented stuntwomen, but whoa! If that’s not the case.) Alec Baldwin seems to be in this movie merely as a favor to someone, possibly one of the producers, and when he disappears with no mention midway through the movie, you’re not particularly surprised. Another of trying too hard is having Anna’s father Ed (played by wrestler Kevin Nash) come out as gay and then use his every appearance to talk about his sex acts. Others in the cast like Fortune Feimster seem to be there mainly for their bulk and believability as fighters.

Ultimately, Chick Fight is a fairly lame and bland girl power movie written, directed and mostly produced by men. I’m not sure why anyone might be expecting more from it than being a poorly-executed comedy lacking laughs.

And yet, that wasn’t the worst movie of the weekend. That would be Andrzej Bartkowiak’s DEAD RECKONING (Shout! Studios). Yes, the Polish cinematographer and filmmaker who once made the amazing Romeo is Bleeding, starring Gary Oldman and Lena Olin, has returned with a movie with the onus of a premise that reads “a thriller inspired by the Boston Marathon bombing in 2013.” No, I did not make that up. It mostly takes place in Nantucket, Massachusetts, which I guess is sort of close to Boston, but instead it focuses on the relationship between teens Niko (K.J. Apa) and Tillie (India Eisley), the latter whose parents died in a plane crash that might have been caused by a terrorist. It just so happens that Niko’s brother Marco (Scott Adkins) is an Albanian terrorist. Coincidence? I think not!

Once you get past the most generic title ever, Dead Reckoning is just plain awful. I probably should have known what to expect when the movie opens with Eric “Never Turned Down a Job” Roberts, but also, I strong feel that Scott Adkins, better known for his martial arts skills, is easily one of the worst actors ever to be given lines to say in a movie. And yet, somehow, there are even worse actors in this movie. How is that even possible?

Although this presumed action movie opens with one of three or four fight sequences, we’re soon hanging out on the beach with a bunch of annoying teenagers, including Tillie, who is drowning the sorrow of recently losing her parents by literally drinking constantly in almost every single scene. When she meets the handsome Eastern European Niko, we think there’s some chance of Tillie being saved, but it isn’t meant to be.

Part of what’s so weird is that Dead Reckoning begins in territory familiar to fans of Barkowiak’s movies like Exit Wounds, Cradle 2 the Grave and Maximum Impact but then quickly shifts gears to a soppy teen romance. It’s weird enough to throw you off when at a certain point, it returns to the main plot, which involves Adkins’ terrorist plot and the search by FBI Agent Cantrell (played by James Remar) to find the culprit who killed Tillie’s parents. Oh, the FBI agent is also Tillie’s godfather. Of course, he is.

Beyond the fact that I spent much of the movie wondering what these teens in Nantucket have to do with the opening scene or the overall premise, this is a movie that anything that could be resembling talent or skill in Barkowiak’s filmmaking is long gone. Going past the horrendous writing – at one point, the exasperated and quite xenophobic Cantrell exclaims, “It’s been a nightmare since 9/11... who knows what's next?” -- or the inability of much of the cast to make it seem like anyone involved cares about making a good movie, the film is strangled by a score that wants to remind you it’s a thriller even as you watch people having fun on the beach on a sunny day.

Eventually, it does get back to the action with a fight between Cantrell and Marco… and then Marco gets into a fight with Tillie’s nice aunt nurse Jennifer where she has a surprisingly amount of fighting skills. There’s also Nico’s best friend who is either British or gay or both, but he spends every one of his scenes acting so pretentious and annoying, you kind of hope he’ll be blown up by terrorists. Sadly, you have to wait until the last act before the surfboards are pulled out. (Incidentally, filmmakers, please don’t call a character in your movie “Marco,” especially if that character’s name is going to be yelled out repeatedly, because it will just lead to someone in the audience to yell out “Polo!” This is Uwe Boll School of Bad Filmmaking 101!)

The point is that the movie is just all over the place yet in a place that’s even remotely watchable. There even was a point when Tillie was watching the video of her parents dying in a car crash for the third or fourth time, and I just started laughing, since it’s such a slipshod scene.

It’s very likely that Dead Reckoning will claim the honor of being the worst movie I’ve seen this year. Really, the only way to have any fun watching this disaster is to play a drinking game where you take a drink every time Eisley’s character takes a drink. Or better yet, just bail on the movie and hit the bottle, because I’m sure whoever funded this piece of crap is.

Opening at New York’s Film Forum on Wednesday is Manfred Kirchheimer’s FREE TIME (Grasshopper/Cinema Conservancy), another wonderful doc from one of the kings of old school cinema verité documentary filmmaking, consisting of footage of New York City from 1960 that’s pieced together with a wonderful jazz score. Let me tell you that Kirschheimer’s work is very relaxing to watch and Free Time is no exception. Plus the hour-long movie will premiere in Film Forum’s Virtual Cinema, accompanied by Rudy Burckhardt’s 1953 film Under the Brooklyn Bridge which captures Brooklyn in the ‘50s.

Also opening in Film Forum’s Virtual Cinema Friday is Hong Khaou’s MONSOON (Strand Releasing) starring Henry Golding (Crazy Rich Asians) as Kit, who returns to Ho Chi Minh City for the first time since his family fled after the Vietnam War when he was six. As he tries to make sense of it, he ends in a romance with Parker Sawyers’ American ex-pat and forms a friendship with a local student (Molly Harris). Unfortunately, I didn’t have the chance to watch this one before finishing up this column but hope to catch soon, because I do like Golding as an actor.

I shared my thoughts on Werner Herzog and Clive Oppenheimer’s FIREBALL: VISITORS FROM DARK WORLDS, when it played at TIFF in September, but this weekend, it will debut on Apple TV+. It’s another interesting and educational science doc from Herr Herzog, this time teaming with the younger Cambridge geoscientist and “volcanologist” to look at the evidence left behind by meteors that have arrived within the earth’s atmosphere, including the races that worship the falling space objects.

Opening at the Metrograph this week (or rather on its website) is Shalini Kantayya’s documentary CODED BIAS, about the widespread bias in facial recognition and the algorithms that affect us all, which debuted Weds night and will be available on a PPV basis and will be available through November 17. The French New Wave anthology Six In Paris will also be available as a ticketed movie ($8 for members/$12 for non-members) through April 13. Starting Thursday as part of the Metrograph’s “Live Screenings” is Steven Fischler and Joel Sucher’s Free Voice of Labor: The Jewish Anarchists from 1980. Fischler’s earlier doc Frame Up! The imprisonment of Martin Sostre from 1974 will also be available through Thursday night.

Sadly, there are just way too many movies out this week, and some of the ones I just wasn’t able to get to include:

Dating Amber (Samuel Goldwyn)

The Giant (Vertical)

I Am Greta (Hulu)

Dirty God (Dark Star Pictures)

Where She Lies (Gravitas Ventures)

Maybe Next Year (Wavelength Productions)

Come Away (Relativity)

Habitual (National Amusements)

The Ride (Roadside Attractions, Forest, ESX)

Jingle Jangle: A Christmas Journey (Netflix)

Transference: A Love Story (1091)

Sasquatch Among the Wildmen (Uncork’d)

All Joking Aside (Quiver Distribution)

Secret Zoo (MPI Medi Group/Capelight Pictures)

By the way, if you read this week’s column and have bothered to read this far down, I think you’re very special and quite good-looking. Feel free to drop me some thoughts at Edward dot Douglas at Gmail dot Com or drop me a note or tweet on Twitter. I love hearing from readers … honest!

#Movies#reviews#Mank#TheClimb#Freaky#Fatman#Heartland#Mortal#EchoBoomers#VOD#Streaming#TheLifeAhead#HillbillyElegy

1 note

·

View note

Video

youtube

Echo Boomers gets new trailer, releases November 13

A new trailer has been released for Echo Boomers, which is set to release November 13, 2020.

A recent college graduate Lance Zutterland leaves school in debt, realizing everything he had worked towards was built on a lie. When he is pulled into a criminal underground operation, he finds his peers fighting the system by stealing from the rich and giving to… themselves. With nothing to lose, they leave behind a trail of destruction but, with the cops closing in, tensions mount and Lance soon discovers he is in over his head with no way out.

0 notes

Photo

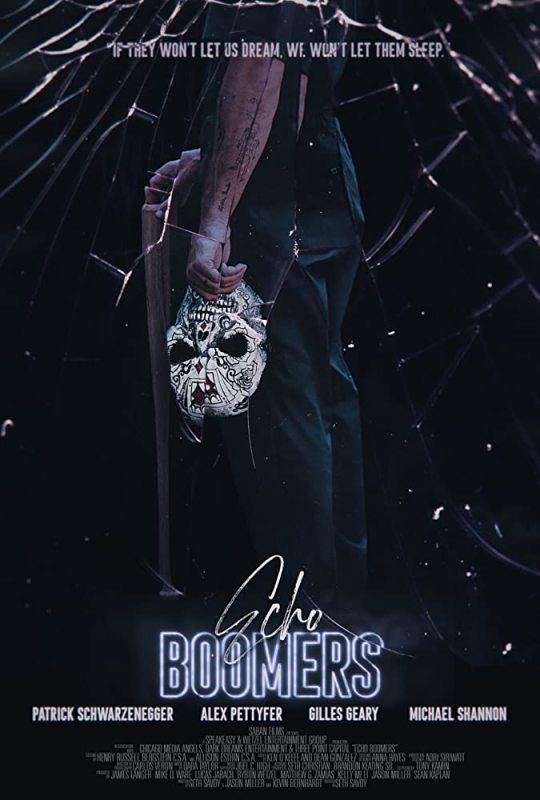

Thrilled to have designed the poster for @saban_films New Crime Thriller Echo Boomers starring Patrick Schwarzenegger, Alex Pettyfer and Michael Shannon! Watch the Trailer at @echoboomersmovie and Swipe left here to check out my artwork on ITunes and IMDB! Excited to be a part of this film release. Echo Boomers will be released in Theaters and On Demand starting November 13th! #echoboomers #echoboomersmovie #crimemovies #sabanfilms #patrickSchwarzenegger #alexpettyfer #michaelshannon #nov13 #naarrt #nathananderson (at Los Angeles, California) https://www.instagram.com/p/CGLQzX0FuEZ/?igshid=14kz8pskg4y84

#echoboomers#echoboomersmovie#crimemovies#sabanfilms#patrickschwarzenegger#alexpettyfer#michaelshannon#nov13#naarrt#nathananderson

0 notes

Video

Omer H Paracha | Producer of Echo Boomers | PARAVAL | Michael Shannon

0 notes

Photo

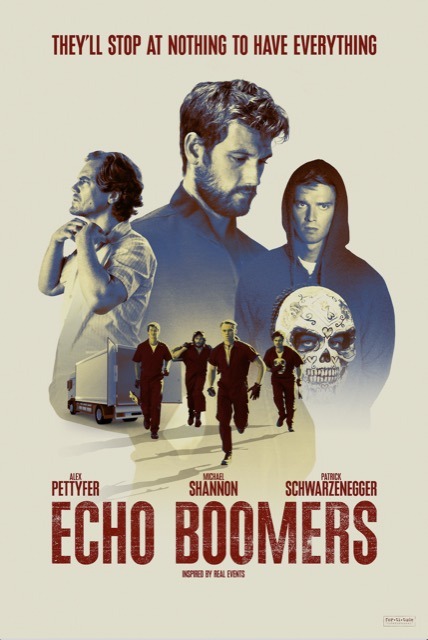

Echo Boomers - movie trailer --> https://teaser-trailer.com/movie/echo-boomers/

Starring Patrick Schwarzenegger, Alex Pettyfer, Oliver Cooper, Hayley Law, Gilles Geary, Lesley Ann Warren, Michael Shannon

#EchoBoomers #EchoBoomersMovie #PatrickSchwarzenegger #AlexPettyfer #MichaelShannon

1 note

·

View note

Photo

via Giphy

1 note

·

View note

Photo

Millenials Echo Boomers. A portrait of the Y Generation (Amedeo & Chloe) #millenials #echoboomers #ygeneration #boys #young #future #contemporary #modernity #perspective #nice #environment #culture #sociology (presso Brisbane, Queensland, Australia)

#young#culture#echoboomers#modernity#nice#future#millenials#sociology#perspective#ygeneration#boys#environment#contemporary

0 notes

Photo

Collection Horror Movie - The Best Trailer HD, popdio

1. Tarhttps://popdio.com/movie/tar/

2. Deep in voguehttps://popdio.com/movie/deep-in-vogue/

3. Amigo Skate CUBAhttps://popdio.com/movie/amigo-skate-cuba/

4. Echo Boomershttps://popdio.com/movie/echo-boomers/

Watching More: https://popdio.com/

#echoboomers #tar #deepinvogue #amigoskemang #amigoskatecuba

0 notes

Video

youtube

First look at Echo Boomers

A new trailer has been released for Echo Boomers, which is set to release November 13, 2020.

Two-time Academy Award nominee Michael Shannon (Knives Out) stars in this gripping crime-thriller filled with pulse-pounding twists and turns. A recent college graduate Lance Zutterland (Patrick Schwarzenegger) leaves school in debt, realizing everything he had worked towards was built on a lie. When he is pulled into a criminal underground operation, he finds his peers fighting the system by stealing from the rich and giving to - themselves. With nothing to lose, they leave behind a trail of destruction but with the cops closing in, tensions mount and Lance soon discovers he is in over his head with no way out.

0 notes

Text

This is never up to date!

Hello. This is my personal website but I am too busy (or lazy) to keep this thing up to date.

I am producing, recording and mixing records.

Here is a small list of albums (not including singles) some of the latest releases I had the chance to work on:

2020:

Chuffdrone „Actio“ and „Re:Actio“ // recording and mixing

Gewürztraminer „A Bissl Übertrieben“ // mixing

Elena Shirin „From A To Be“ // producing, recording and mixing

Pia Basey „Freex“ // mixing

Die Arbeit „Material“ // mixing

2019:

Beate Wiesinger Echoboomer „Aliens On Board“

Alpine Dweller „Among Others“ // recording and mixing

Gospel Dating Service „Sun Over Moon“ // producing/song writing, recording and mixing

Tenta „W.E.I.R.D. Suntopia“ // producing, recording and mixing

0 notes

Photo

With every post, a smile, ت

0 notes

Photo

Giphy (From: https://giphy.com/gifs/echoboom-unreal-echoboom-sports-26uf9QPchJAcBMYy4)

0 notes

Text

Masochism and the Average Gold Investor

Source: Michael J. Ballanger for Streetwise Reports 04/22/2019

Sector expert Michael Ballanger discusses generational attitudes toward investing and how they are affecting the precious metals markets.

Masochism: “gratified by pain, degradation, deprivation, etc., inflicted on oneself either by one’s own actions or the actions of others.”

On Friday afternoon, I completed my weekly missive, which was composed of a detailed analysis of just how magnificently Barrick Gold Corp. (GOLD:US) had been used by the interventionalists to manipulate the ARCA NYSE Gold Bugs Index (HUI:US), all of the big ETFs (GDX, GDXJ, NUGT, JNUG) and ultimately, the prices for gold and silver. Then suddenly, with little warning, I had an epiphany. Not only was the nine hours of work a complete and total waste of time, it suddenly occurred to me that a forty-year career spent nurturing a belief system anchored in the bygone days of Bretton Woods might just have been an exercise in redundancy and cognitive dissonance.

As if driven to reveal a hidden secret for all the world to see, I have carried an unalterable obsession with the notion that sound money principles would, in the end, return to prominence and in fact become seriously entrenched in the practices of governments around the world with gold and, to a lesser degree, silver acting as key components of a fiscal and monetary renaissance. Alas, as the Baby Boom generation fades away into old age and irrelevancy, it is at once both sad and obvious that the new wave of Gen-Xers and Millennials and Echoboomers have determined that there is little or no validity to the concept of sound money and have therefore rendered gold and silver, as monetary and fiscal canaries in the Modern Monetary Theory coal mine, as irrelevant and from an investment standpoint, useless.

I have on average about 200 conversations per week with investors from all over the spectrum in terms of age, wealth, nationality and interests. I normally make notes of the discussions, a fallback to my days as a financial advisor, long before email replaced notes as the proof-bearer of action and intent. What I found astounding is that all discussions pertaining to cannabis, social media, technology, or the future direction of the S&P500 lasted greater than fifteen minutes. Metals and mining conversations, including gold and silver, tended to be less than seven minutes and chats related to junior mining and exploration were less than three minutes with many instances of “subject changed” or “I gotta go.”

Now, as a fervent addict to the thrill of new mineral discoveries (“There ain’t no fever like gold fever!”), I have recently begun to feel like the heroin addict searching through life for that rush of euphoria that arrived long ago with that first hypodermic injection but the reality is that the new generation of investors found their hypodermic adrenalin in the form of technology stocks, then crypto, and finally and more recently, weed.

My friend James West was a gold and mining newsletter writer back in 2010 with the first promotional piece for Tinka Resources Ltd. but has since evolved into the foremost authority on cannabis and is enjoying a thriving if not booming career renaissance (and it couldn’t happen to a nicer man). The remaining advocates for investment in precious metals and the related mining and exploration shares are in effect living a life “gratified by pain, degradation, deprivation, etc., inflicted on oneself either by one’s own actions or the actions of others.” In other words, they are practicing a form of masochism.

Take the last two companies that I have referenced in this missive, Getchell Gold Corp. (GTCH:CSE) and Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX). GTCH is currently raising money and while it is going surprisingly well, it has not been an easy raise, what with the dismal action in metal prices since mid-February. WUC, however, began its US$2 million raise three weeks ago and Tuesday announced that it was significantly oversubscribed and in fact came in just under the full exercising of the 50% over-allotment option. This was a terrific development for the company but what surprised me greatly was the investor reaction to uranium and vanadium that was so diametrically different than the reaction to exploration for gold and silver in the most prolific precious metals environment in North America. The average investor “gets it” when you talk about the uranium (and vanadium) outlook but they stare at you with glazed-over eyes when you try to describe how Barrick Gold went from $1.80 to $3,300 per share from its activities in Nevada in the 19822010 period.

Here is yet another example of life in the isolated world of sound money advocacy. I was recently introduced to a private start-up company (that shall remain nameless, at least for now) and suffice it to say, the best description is that it is a type of “Facebook for Cannabis users.” I had the pleasure of meeting over lunch with the 30-year-old Millennial female, exceedingly well trained and very well spoken, with a Master Grower’s License and an MBA from the Ivey School, a couple of weeks ago after which I was asked to offer consulting advice in the area of capital markets related to financing. She asked me if I could assist the company in finding a few investors to participate in its seed round and while I won’t mention the amount, I proceeded to call an accountant friend that uses me for feedback on mining investments. This very successful fellow has over the past ten years had his fingers in major real estate deals and crypto deals but also in the early-stage cannabis deals such as Canopy, so with that knowledge, I decided to ask him to assess this new non-mining venture as more of an “acid test” than anything else.

I described the deal as best I could, which was totally lame given my total ignorance of anything related to social media or weed. His reply after perhaps three minutes on the phone was “How much as you trying to raise again?” and after I told him (it was north of six figures), he said “I’ll take it all,” at which I choked on the phone and I said would get back to him shortly. I then proceeded to call a very successful realtor I know and I got precisely the same result. “I’ll take it all. Send me the forms.” I then proceeded to make seven additional calls and got seven additional “I’ll take it all.” responses. The point here is that I could work for a month to set up the best mining deal in the world and it would take another month or two to finance it but if it is anything related to the Millennial checklist of “suitable investments” (which include social media, cannabis, artificial intelligence and blockchain) four phone calls and it is done. Now, the contrarians would tell me that it is a sign of a “classic top” but the reality is that for the past decade, investors have been rewarded by buying more of “what is working” and selling “what isn’t.” Pot deals have been working but more importantly, mining deals, by and large, have not.

So, when I use the term “masochism” to describe the behavioral quirks of the average gold investor, the term “glutton for punishment” comes leaping into the forefront. To be constantly searching for that drill hole in the sky or the ultimate ascendancy of gold to $10,000 per ounce as all politicians, regulators and bankers disappear into a vaporous hole of failure and disgrace is not only unwise, it verges on Einstein’s description of madness: repeating the same behavior over and over for the same negative outcome.

Over the years, I have been asked hundreds if not thousands of times “What would take gold to $10,000 per ounce?” and I always reply with the same conclusion: “When the USS Nimitz pulls into Gibraltar for a re-fit and they refuse the credit card.” The American Empire dominates the world; the American “dream” is force fed around the globe; and the American monetary experiment has been duplicated by central banks everywhere to the extent that the Bank of Japan will soon own over 50% of the Nikkei and the Swiss National Bank owns $87.5 billion worth of U.S. stocks bought with money it printed out of thin air. Back in the days before the internet, the mere thought of a central bank dabbling in stocks evoked shrieks of horror; stocks were for gamblers and bonds and bills were for serious, prudent investors. Back in the day, counterfeiting was considered a crime and neither citizens OR central banks were allowed to do it. How times have changed

While the average American sees little benefit to owning gold, domestic prices in Australia, Turkey, Russia and India have recently approached or surpassed their one-year highs. Only the U.S. and China (pegged the USD) have stayed at or near the levels of 2011. From the numerous charts posted below, it clearly demonstrates gold’s utility as a protector of purchasing power, particularly in countries such as Turkey that have experienced sever currency crises. The point here is that gold actually has fulfilled its role as a safe haven in all countries across the globe except two: the U.S. and China. The U.S. vigorously defends its currency versus gold and China has a USD peg on the yuan and yet, the two countries are diametrically opposite in their actions. China has been a voracious buyer of gold and seller of U.S. treasuries while the U.S. has done the opposite.

Canada gold price

Australia gold price

Russia gold price

Turkey gold price

India gold price

China gold price

U.S. gold price

The name of my publication was changed last year from “Gold and Gold Miners” to GGM Advisory for one very simple reason: relevancy. If actuarial tables conclude that the Baby Boom population is a rapidly shrinking demographic, if studies of investment demand confirm that the new generations of investors are decidedly ambivalent (if not hostile) to gold and silver investment, and if regulators and exchange officials continue to condone and indeed endorse continued price suppression, then waiting for the USS Nimitz to become a disabled, unpowered relic leading to a moon rocket in metals and miners could become a very, very long exercise. Most of us that are in or are approaching retirement don’t have the luxury of time on our sides to await the arrival of that one singular event that justifies twenty or thirty years of holding on to the precious metals while the S&P 500, the NASDAQ, cryptocurrencies and weed make millionaires out of 30-something messiahs too young to remember the bursting of the dotcom bubble and in some cases, the 2008 subprime meltdown.

Since 2009, we have had numerous events that should have been the moment where gold and silver emerged as the “Go-To” asset class with the most recent being last Christmas Eve when the S&P closed in bear market territory while gold was screaming higher. With the flick of a switch, Treasury Secretary Smilin’ Stevie Mnuchin stepped up and called upon the Working Group on Capital Markets to put a stop to the crash in stocks and since February 20th, every gold rally has been stomped out with intervention after intervention while every dip in the NASDAQ has been magically supported.

It is the same narrative whether 2001 or 2008 or 2018: rigging stock markets are essentially this decade’s version of Roosevelt’s “New Deal” back in the 1930s. Instead of building roads and dams, the policy-makers today build nothing except moral hazard and a generation of the “Entitled.” It is a dangerous precedent and one which cannot last but the problem for us is that is HAS lasted a great deal longer than we might ever have imagined and there is nothing near-term to suggest that the Great American Ponzi Scheme cannot continue.

All right, now that I have concluded my rant on the madness being inflicted upon us, I have a couple of observations to make about gold. Earlier last week, I was looking at GLD wondering whether my GLD May $124 puts might hit $5.00 before the end of the week and then it occurred to me that my “Line in the Sand” at the prior lows of $1,282 and the subsequent “breakDOWN” was no different in its blatancy than the “breakOUT” in Barrick. So, I pulled up the GLD chart and lo and behold, while the sub-30 level for RSI sported two super buying opportunities in 2018, it has not been much under 35 in all of 2019 thus far.

Now, notwithstanding that the stock markets are getting somewhat stretched, I have to respect two things: 1) the dotted red line in the RSI window in the chart below and 2) that only in the perverse world of precious metals are technical “breakdowns” to be BOUGHT while technical “breakouts to be SOLD. Therefore, I have covered all of my shorts in both gold and the mining shares and initiated 50% long positions in JNUG, NUGT and the GLD June $120 calls. The chart below pretty much says all that is needed: we are at an inflection point that represented tradeable bottoms in mid-November and early March.

As a final observation (which could also be seen as a “confession” of sorts), I use my own behavior as a market barometer and with the benefit of time and age, I always go back and re-read my missives because they give me a sense of perspective on markets in the same way Anne Frank’s diary provided perspective of a different time and place. Both diaries are extremely personal but both give the reader a wonderful window into the mindset of an era.

My entries from the week of October 19, 1987, revealed a relatively young financial advisor (34) coping with the total destruction of client assets, and to go back and re-visit the emotions contained in the words and syntax is still to this day painful. Anyone reading the diary of a young girl trying to avoid extermination is emotionally impacted far greater than by the musings of a stressed stockbroker but both messages allow reflection. I carry the utmost of conviction that sound money principles will prevail and I promise that I won’t go into a seventeen-paragraph repetitive blather as to “WHY?” but if people are going to listen to what I have to say, I have to provide “actionable ideas” that carry logic, excitement, and weight.

My dad died in 2013 at the ripe old age of 89 and one of the things he drilled into me was that one of the things he learned as a WWII navigator in the RCAF was that many times, people tend to “think too much” as opposed to simply “reacting. As an example, as a fifteen year-old hockey-playing “sniper” (goal-scorer), I was going through a particularly painful slump where everything I fired at the net was getting blocked, saved, or veering wide. On the drive home from the venerable St. Michael’s Arena, after hitting four goal posts and extending the dry spell to six games, I finally asked my dad (who never played the game except shinny on Grenadier Pond) what I was doing wrong, to which he responded “You’re thinking too muchjust fire the biscuit.” The next game, on my first possession, I didn’t even look at the net or the goalI just ripped it from outside the blue line and, as if it had eyes, it pinged in off the far right post and into the goal.

As traders and investors, we all tend to “think too much” so when I launch one of my invectives upon all of you, try to remember that in the big picture, 5,000 years of fiscal history would validate the logic of owning gold but within that window, numerous generations have perished in poverty while bequeathing tonnes of it to their heirs, who sold it, bought (and smoked) cannabis, traded Bitcoin, and lived happily ever after.

Food for thought…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Western Uranium & Vanadium.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Western Uranium & Vanadium Corp., companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: GTCH:CSE,

WUC:CSE; WSTRF:OTCQX,

)

from The Gold Report – Streetwise Exclusive Articles Full Text http://bit.ly/2IQGK5Z

from WordPress http://bit.ly/2viae4P

0 notes

Text

Masochism and the Average Gold Investor

Source: Michael J. Ballanger for Streetwise Reports 04/22/2019

Sector expert Michael Ballanger discusses generational attitudes toward investing and how they are affecting the precious metals markets.

Masochism: “gratified by pain, degradation, deprivation, etc., inflicted on oneself either by one’s own actions or the actions of others.”

On Friday afternoon, I completed my weekly missive, which was composed of a detailed analysis of just how magnificently Barrick Gold Corp. (GOLD:US) had been used by the interventionalists to manipulate the ARCA NYSE Gold Bugs Index (HUI:US), all of the big ETFs (GDX, GDXJ, NUGT, JNUG) and ultimately, the prices for gold and silver. Then suddenly, with little warning, I had an epiphany. Not only was the nine hours of work a complete and total waste of time, it suddenly occurred to me that a forty-year career spent nurturing a belief system anchored in the bygone days of Bretton Woods might just have been an exercise in redundancy and cognitive dissonance.

As if driven to reveal a hidden secret for all the world to see, I have carried an unalterable obsession with the notion that sound money principles would, in the end, return to prominence and in fact become seriously entrenched in the practices of governments around the world with gold and, to a lesser degree, silver acting as key components of a fiscal and monetary renaissance. Alas, as the Baby Boom generation fades away into old age and irrelevancy, it is at once both sad and obvious that the new wave of Gen-Xers and Millennials and Echoboomers have determined that there is little or no validity to the concept of sound money and have therefore rendered gold and silver, as monetary and fiscal canaries in the Modern Monetary Theory coal mine, as irrelevant and from an investment standpoint, useless.

I have on average about 200 conversations per week with investors from all over the spectrum in terms of age, wealth, nationality and interests. I normally make notes of the discussions, a fallback to my days as a financial advisor, long before email replaced notes as the proof-bearer of action and intent. What I found astounding is that all discussions pertaining to cannabis, social media, technology, or the future direction of the S&P500 lasted greater than fifteen minutes. Metals and mining conversations, including gold and silver, tended to be less than seven minutes and chats related to junior mining and exploration were less than three minutes with many instances of “subject changed” or “I gotta go.”

Now, as a fervent addict to the thrill of new mineral discoveries (“There ain’t no fever like gold fever!”), I have recently begun to feel like the heroin addict searching through life for that rush of euphoria that arrived long ago with that first hypodermic injection but the reality is that the new generation of investors found their hypodermic adrenalin in the form of technology stocks, then crypto, and finally and more recently, weed.

My friend James West was a gold and mining newsletter writer back in 2010 with the first promotional piece for Tinka Resources Ltd. but has since evolved into the foremost authority on cannabis and is enjoying a thriving if not booming career renaissance (and it couldn’t happen to a nicer man). The remaining advocates for investment in precious metals and the related mining and exploration shares are in effect living a life “gratified by pain, degradation, deprivation, etc., inflicted on oneself either by one’s own actions or the actions of others.” In other words, they are practicing a form of masochism.

Take the last two companies that I have referenced in this missive, Getchell Gold Corp. (GTCH:CSE) and Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX). GTCH is currently raising money and while it is going surprisingly well, it has not been an easy raise, what with the dismal action in metal prices since mid-February. WUC, however, began its US$2 million raise three weeks ago and Tuesday announced that it was significantly oversubscribed and in fact came in just under the full exercising of the 50% over-allotment option. This was a terrific development for the company but what surprised me greatly was the investor reaction to uranium and vanadium that was so diametrically different than the reaction to exploration for gold and silver in the most prolific precious metals environment in North America. The average investor “gets it” when you talk about the uranium (and vanadium) outlook but they stare at you with glazed-over eyes when you try to describe how Barrick Gold went from $1.80 to $3,300 per share from its activities in Nevada in the 19822010 period.

Here is yet another example of life in the isolated world of sound money advocacy. I was recently introduced to a private start-up company (that shall remain nameless, at least for now) and suffice it to say, the best description is that it is a type of “Facebook for Cannabis users.” I had the pleasure of meeting over lunch with the 30-year-old Millennial female, exceedingly well trained and very well spoken, with a Master Grower’s License and an MBA from the Ivey School, a couple of weeks ago after which I was asked to offer consulting advice in the area of capital markets related to financing. She asked me if I could assist the company in finding a few investors to participate in its seed round and while I won’t mention the amount, I proceeded to call an accountant friend that uses me for feedback on mining investments. This very successful fellow has over the past ten years had his fingers in major real estate deals and crypto deals but also in the early-stage cannabis deals such as Canopy, so with that knowledge, I decided to ask him to assess this new non-mining venture as more of an “acid test” than anything else.

I described the deal as best I could, which was totally lame given my total ignorance of anything related to social media or weed. His reply after perhaps three minutes on the phone was “How much as you trying to raise again?” and after I told him (it was north of six figures), he said “I’ll take it all,” at which I choked on the phone and I said would get back to him shortly. I then proceeded to call a very successful realtor I know and I got precisely the same result. “I’ll take it all. Send me the forms.” I then proceeded to make seven additional calls and got seven additional “I’ll take it all.” responses. The point here is that I could work for a month to set up the best mining deal in the world and it would take another month or two to finance it but if it is anything related to the Millennial checklist of “suitable investments” (which include social media, cannabis, artificial intelligence and blockchain) four phone calls and it is done. Now, the contrarians would tell me that it is a sign of a “classic top” but the reality is that for the past decade, investors have been rewarded by buying more of “what is working” and selling “what isn’t.” Pot deals have been working but more importantly, mining deals, by and large, have not.

So, when I use the term “masochism” to describe the behavioral quirks of the average gold investor, the term “glutton for punishment” comes leaping into the forefront. To be constantly searching for that drill hole in the sky or the ultimate ascendancy of gold to $10,000 per ounce as all politicians, regulators and bankers disappear into a vaporous hole of failure and disgrace is not only unwise, it verges on Einstein’s description of madness: repeating the same behavior over and over for the same negative outcome.

Over the years, I have been asked hundreds if not thousands of times “What would take gold to $10,000 per ounce?” and I always reply with the same conclusion: “When the USS Nimitz pulls into Gibraltar for a re-fit and they refuse the credit card.” The American Empire dominates the world; the American “dream” is force fed around the globe; and the American monetary experiment has been duplicated by central banks everywhere to the extent that the Bank of Japan will soon own over 50% of the Nikkei and the Swiss National Bank owns $87.5 billion worth of U.S. stocks bought with money it printed out of thin air. Back in the days before the internet, the mere thought of a central bank dabbling in stocks evoked shrieks of horror; stocks were for gamblers and bonds and bills were for serious, prudent investors. Back in the day, counterfeiting was considered a crime and neither citizens OR central banks were allowed to do it. How times have changed

While the average American sees little benefit to owning gold, domestic prices in Australia, Turkey, Russia and India have recently approached or surpassed their one-year highs. Only the U.S. and China (pegged the USD) have stayed at or near the levels of 2011. From the numerous charts posted below, it clearly demonstrates gold’s utility as a protector of purchasing power, particularly in countries such as Turkey that have experienced sever currency crises. The point here is that gold actually has fulfilled its role as a safe haven in all countries across the globe except two: the U.S. and China. The U.S. vigorously defends its currency versus gold and China has a USD peg on the yuan and yet, the two countries are diametrically opposite in their actions. China has been a voracious buyer of gold and seller of U.S. treasuries while the U.S. has done the opposite.

Canada gold price

Australia gold price

Russia gold price

Turkey gold price

India gold price

China gold price

U.S. gold price

The name of my publication was changed last year from “Gold and Gold Miners” to GGM Advisory for one very simple reason: relevancy. If actuarial tables conclude that the Baby Boom population is a rapidly shrinking demographic, if studies of investment demand confirm that the new generations of investors are decidedly ambivalent (if not hostile) to gold and silver investment, and if regulators and exchange officials continue to condone and indeed endorse continued price suppression, then waiting for the USS Nimitz to become a disabled, unpowered relic leading to a moon rocket in metals and miners could become a very, very long exercise. Most of us that are in or are approaching retirement don’t have the luxury of time on our sides to await the arrival of that one singular event that justifies twenty or thirty years of holding on to the precious metals while the S&P 500, the NASDAQ, cryptocurrencies and weed make millionaires out of 30-something messiahs too young to remember the bursting of the dotcom bubble and in some cases, the 2008 subprime meltdown.

Since 2009, we have had numerous events that should have been the moment where gold and silver emerged as the “Go-To” asset class with the most recent being last Christmas Eve when the S&P closed in bear market territory while gold was screaming higher. With the flick of a switch, Treasury Secretary Smilin’ Stevie Mnuchin stepped up and called upon the Working Group on Capital Markets to put a stop to the crash in stocks and since February 20th, every gold rally has been stomped out with intervention after intervention while every dip in the NASDAQ has been magically supported.

It is the same narrative whether 2001 or 2008 or 2018: rigging stock markets are essentially this decade’s version of Roosevelt’s “New Deal” back in the 1930s. Instead of building roads and dams, the policy-makers today build nothing except moral hazard and a generation of the “Entitled.” It is a dangerous precedent and one which cannot last but the problem for us is that is HAS lasted a great deal longer than we might ever have imagined and there is nothing near-term to suggest that the Great American Ponzi Scheme cannot continue.

All right, now that I have concluded my rant on the madness being inflicted upon us, I have a couple of observations to make about gold. Earlier last week, I was looking at GLD wondering whether my GLD May $124 puts might hit $5.00 before the end of the week and then it occurred to me that my “Line in the Sand” at the prior lows of $1,282 and the subsequent “breakDOWN” was no different in its blatancy than the “breakOUT” in Barrick. So, I pulled up the GLD chart and lo and behold, while the sub-30 level for RSI sported two super buying opportunities in 2018, it has not been much under 35 in all of 2019 thus far.

Now, notwithstanding that the stock markets are getting somewhat stretched, I have to respect two things: 1) the dotted red line in the RSI window in the chart below and 2) that only in the perverse world of precious metals are technical “breakdowns” to be BOUGHT while technical “breakouts to be SOLD. Therefore, I have covered all of my shorts in both gold and the mining shares and initiated 50% long positions in JNUG, NUGT and the GLD June $120 calls. The chart below pretty much says all that is needed: we are at an inflection point that represented tradeable bottoms in mid-November and early March.

As a final observation (which could also be seen as a “confession” of sorts), I use my own behavior as a market barometer and with the benefit of time and age, I always go back and re-read my missives because they give me a sense of perspective on markets in the same way Anne Frank’s diary provided perspective of a different time and place. Both diaries are extremely personal but both give the reader a wonderful window into the mindset of an era.

My entries from the week of October 19, 1987, revealed a relatively young financial advisor (34) coping with the total destruction of client assets, and to go back and re-visit the emotions contained in the words and syntax is still to this day painful. Anyone reading the diary of a young girl trying to avoid extermination is emotionally impacted far greater than by the musings of a stressed stockbroker but both messages allow reflection. I carry the utmost of conviction that sound money principles will prevail and I promise that I won’t go into a seventeen-paragraph repetitive blather as to “WHY?” but if people are going to listen to what I have to say, I have to provide “actionable ideas” that carry logic, excitement, and weight.