#studentloaninindia

Text

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme 2018

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme: Gujarat Government has introduced Education Loan Interest Assistance Plan 2018 for the students covered under the Chief Minister's self-help plan. Under this scheme, all students receive a 100% interest subsidy on education loan for a period of moratorium (1 year in addition to the curriculum). This subsidy will apply to the loan up to a maximum of rupees. 10 lakhs registration is open and interested candidates can apply online at the official website kcg.gujarat.gov.in

The interest subsidy scheme on education loans will benefit all the bright and needy students to continue their studies after the 12th standard. This scheme is applicable for graduate / post graduate / diploma and education courses for higher education in professional courses based on the conditions of the following eligibility.

All applicants must pass class 12 or equivalent with 12 or more percentages. Apart from this, the annual income of the family of all the source candidates is Rs. 6 lakh pay State Government Rs. 500 million crores in Gujarat budget 2017-18

Gujarat Education Loan Interest Subsidy Scheme 2018

Below is the complete procedure to apply online for Interest Subsidy Scheme on Education Loan in Gujarat:-

Visit the official website of Knowledge Consortium Of Gujarat kcg.gujarat.gov.in

On the homepage, click at the “Interest Subsidy Scheme on Education Loan (Registration Open)” link or directly click this link

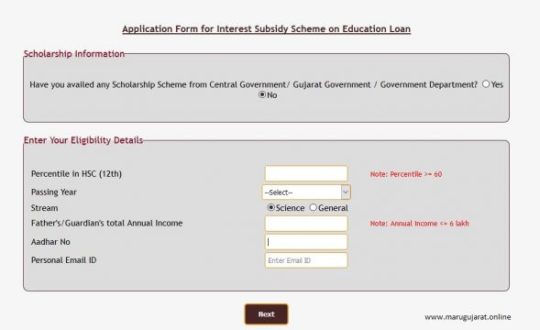

Next click at the “Online Registration Form for Interest Subsidy Scheme on Education Loan“. Afterwards, Gujarat Interest Subsidy Scheme Online Application Form will appear as follows:-

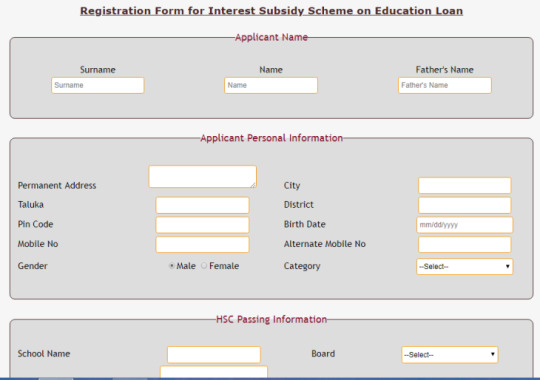

Here candidates can fill their eligibility details accurately and then click at the “Next” button. Afterwards, “Registration Form for Interest Subsidy Scheme on Education Loan” will appear as shown below:-

Enter all your details correctly and "submit" the completed application form. For more details on "How To Apply Online for Education Loan Interest Subsidy Scheme" in Gujarat, see the complete process (along with the document list). Gujarati (PDF), English (PDF)

All students must read the rules and regulations before applying online for the interest subsidy scheme on education loan. Instructions are available in both PDF format and in both English and English languages. Students can click this link directly to read the instructions. Instructions Gujarati (PDF), Instructions English (PDF)

Eligibility for Interest Subsidy Scheme on Education Loan

These applicants must complete the following eligibility criteria to become eligible for this scheme: -

Applicants must pass 12th standard from the Gujarat Higher Secondary Examination Board (GHSB) or the Central Board of Secondary Education (CBSE) and enroll in a recognized university is essential.

The applicant should be secured at least 60% in class 12th examination and after passing 2012, after passing 2012, 12 passes should be passed. If the candidates, who have passed 12th year before 2011, where no percentage is shown in the mark sheet, then such candidates can apply on percentage basis.

Students enrolled in diploma admission after 10 th standard (who do not have 12th matriculation) and can apply for graduation / post graduation can also apply on CGI / CGPA / percentage basis.

Annual Income of the family of the candidates from all sources must not exceed Rs. 6 lakh.

All students who take an academic loan after 4th July 2017 from a scheduled bank for higher education in India and abroad are eligible. Moreover, if the loan for the student is approved before 4th July 2017 and the loan amount withdrawn after 4th July 2017, such students are eligible to apply for this scheme.

This interest on education loan is applicable for subsidy scheme graduation / post-graduation / diploma and other professional courses.

Those students who have left mid-course studies in school curriculum or have been expelled from the organization for some reason are not eligible. For more details about the interest subsidy scheme on education loans in Gujarat, see Bulletin - Info. Booklet Gujarati (PDF), Info. Booklet English (PDF)

References

Self Declaration For Non IT Returns – Click Here

Self Declaration for No Other Scheme Benefit Taken – Click Here

Bank Endorsement Form – Click Here

Government Resolution – Click Here

Circular – Click Here

For complete information, visit the official website http://www.kcg.gujarat.gov.in/Education_loan/index.php

Important Links:

Online Registration Form for Interest Subsidy Scheme on Education Loan

Instructions for Student Gujarati English

How to Apply Gujarati English

Self Declaration for Non IT returns

Self Declaration of No other Scheme Benefit Avail

Bank Endorsement Form

Government Resolution (G.R.)

Interest Subsidy Scheme on Education Loan Booklet Gujarati English

More Detail: https://sarkariyojna.co.in/apply-online-interest-subsidy-scheme-education-loan-gujarat/

Read the full article

#EducationLoan#educationloandetails#educationloaneligibility#educationloanemicalculator#educationloanforabroadstudies#educationloaningujarat#EducationLoaninIndia#educationloaninterest#educationloaninterestrate#gujarat#GujaratEducationLoan#gujaratgovernment#highereducationscholarship#loansforstudents#Marugujarat#obcscholarshipstudentloans#sbieducationloan#scstobcscholarship#scstscholarship#studentloaninindia

0 notes

Text

Easily obtain an education loan for MBA programs

If you have made up your mind to go for an MBA but your financial condition is holding you back, then you must definitely opt for an education loan for MBA. MBA is a major job-oriented program conducted in our country as well as abroad. It helps individuals deal with business tactics, implementing strategies and managing cash flow, etc. Basically, an MBA course teaches students how to run any kind of business effectively without resulting in any major losses. Due to its high placement guarantee and vast scope of income, there are lenders who have started offering loans specifically designed for students who wish to pursue MBA, be it abroad or in India.

Before applying for an education loan, make sure to check whether your college/university offers scholarships or grants. A scholarship may not cover the entire expenses, but may reduce it up to some extent. Apart from just the basic fees of the course, there are other expenses that would arise while pursuing studies. Try to eliminate unnecessary expenses to save money for the needful. Post-applying for business studies, estimate your expected salary after completion of the course. This will help you figure out whether you will be able to repay the loan and the maximum amount of loan that can be borrowed.

Our country has some of the most reputed business institutes for MBA but some students believe in expanding their horizon and flying overseas to pursue MBA. It is needless to say that studying in a foreign country is much more expensive than studying in your own country. If you are planning for the same, you will have to avail a higher education loan for MBA amount. Usually, loans below INR 4 lacs do not require any collateral security, loans between INR 4 to 7.5 lacs require collateral in the form of a satisfactory third party guarantor. Loans above Rs. 7.5 lacs require collateral security in any form of residential property agreement (flat/apartment), life insurance with a surrender value equivalent to the loan amount, fixed deposits, existing house or non-agricultural land can be mortgaged to obtain a loan.

Government banks are the first source that comes to our minds when we think of a loan, but, these days, many private financial firms have also emerged in the market that offer education loan for MBA at interest rates as low as 12.75% with a processing fee of mere 1-2%.When it comes to age criteria, the applicant is required to be between 18 to 35 years of age to avail a loan. Considering the fact that students aren’t employed, a co-applicant is a must to apply for any kind of education loan. The co-applicant can be the borrower’s spouse, parent or sibling and must have a stable source of income. As a means of income proof, the lender may ask for salary slips (salary slips are required as a part of the documentation by all lender bodies) of the co-applicant.

#educationloan#educationalloan#educationalloans#studyloans#studentloaninindia#besteducationloan#educationalloanformba#educationloansforstudents

0 notes

Text

UCO Bank Education Loans - Student Loan Apply Online

UCO Bank education loan scheme, Education loan by UCO Bank

Eligibility

Studies in India

Approved courses leading to graduate/post graduate (Masters & PhD. degree and PG Diplomas conducted by recognized colleges/universities, Engineering, Medical, Agriculture, Veterinary, Law, Dental, Management, Computer, etc.).

Computer Certificate courses of reputed institutes accredited to DoE.

Courses like ICWA, CA, CFA, etc.

Studies Abroad

Graduation : Job oriented professional / technical courses offered by reputed Universities.

Post Graduation : MCA, MBA, MS, etc.

Courses conducted by CIMA - London, CPA in U.S.A., etc.

Age limit

For Graduation

28 years for general candidates

30 years for SC/ST candidates

For Post Graduation:

30 years for general candidates

33 years for SC/ST candidates

Eligibility

The main conditions for eligibility include

Student must be an Indian National

Secured admission to a higher education course in India or entrance test or selection process after completion of HSC (10 plus 2 or equivalent)

Quantum of loan

Studies in India : Maximum Rs. 10.00 Lac

Studies Abroad : Maximum Rs. 20.00 Lac

Security

Upto Rs. 4.00 lacs– No security, co-obligation of parents

Above Rs. 4.00 lacs & upto Rs. 7.50 lacs: Co-obligation of parents, collateral in the form of a suitable 3rd party guarantee

Above Rs. 7.50 lacs : Co-obligation of parents, tangible collateral security equivalent to full value of loan

Margin

Upto Rs. 4.00 Lakhs : NIL

Above Rs. 4 Lac Studies in India - 5%

Studies Abroad - 15%

Insurance

Group Life Insurance Cover Scheme for Educational Loan Borrowers to cover the outstanding loan in case of accidental or natural death of borrower

Processing Charge

There are no processing charges

Disbursement

Disbursement in stages as per the requirement directly to institutions.

Processing Charge

Education Loans

Spread over Base Rate

Effective Rate

Upto Rs.7.50 lacs

2.50%

12.20%

More than Rs.7.50 lacs

2.25%

11.95%

Premier Education Loan Scheme

1.00%

10.70%

Vocational Education Loan Scheme

2.50%

12.20%

Upto Rs 7.50 lacs :- Base rate + 2.50%

Above Rs.7.50 lacs :- Base Rate + 2.25%

Repayment Period

15 years (180 EMI) for all categories of loan after moratorium period

Repayment holiday / Moratorium Period

Course period + 1 year after completion of studies for all categories.

For further details, please click here

Read the full article

#EducationloanbyUCOBank#EMICalculator#UCOBankEducationLoan-InterestRate#UcoBankEducationLoanDocumentsRequired#UcoBankEducationLoanEmiCalculator#UcoBankEducationLoanInterestRate2017#UcoBankEducationLoanInterestSubsidy#UCOBankeducationloanscheme#UcoBankEducationLoanStatement#UcoBankEducationLoanStatementOnline#UcoBankEducationLoanStatus#UCOBankEducationLoan-StudentLoaninIndia#UCOBankEducationLoans-StudentLoanApplyOnline#UcoPremierEducationLoanScheme

0 notes

Text

Syndicate Bank Education Loan: Interest Rate, Eligibility & Application

Syndicate Bank Education Loan | Documents | Eligibility | Interest Rates

A Syndicate Bank's Education Loan Scheme is known as SyndVidya

SyndVidya

Eligibility Criteria

Any student who is a major representing himself or a minor student represented by parent or guardian of Indian nationality.

Must have secured admission on the basis of merit to professional/ technical/other courses through entrance test/selection process

Deviation/relaxation is also permitted under special circumstances.

Must have secured admission to Foreign universities/Institution (for studies abroad).

Courses Eligible

a) Studies in India

Graduation: B.A., B.Com, B.Sc., etc.

Post graduation: Masters & Phd.

Professional courses: Engineering, Medical, Agriculture, Veterinary, Law, Dental Management, Computer etc. In respect of Management studies, apart from University affiliation, course should also be approved by All India Council for Technical Education. For Computer education, the recognised training Institute should have accreditation of DOE, Govt of India to conduct the course under Department of Electronics Accreditation of Computer Course (DOEACC) Scheme.

Computer certificate courses of reputed institutes accredited to Department of Electronics or Institutes affiliated to Universities.

Courses like ICWA, CA, CFA etc.

Courses conducted by IIM, IIT, IISc, XLRI, NIFT etc.

Courses offered in India by reputed foreign universities.

Evening courses of approved institutes.

Other courses leading to Diploma / Degree etc. conducted by colleges / universities approved by UGC / Govt./ AICTE / AIBMS / ICMR etc.

Courses offered by National Institutes and other reputed private institutions acceptable to the Bank.

b) Studies abroad

Graduation : For job oriented professional/technical courses offered by reputed universities.

Post Graduation: MCA, MBA, MS. Etc.

Courses conducted by CIMA-London, CPA in USA etc.

Other Foreign Diploma courses are not eligible.

Margin

For loans upto Rs.4 lac - No Margin required.

For loans above Rs.4 lac - 5% for study in India and 15% for study abroad.

Security

For loans upto Rs.4.00 lac - NIL.

For loans above Rs.4.00 lac and upto Rs.7.50 lac - Collateral in the form of satisfactory third party guarantee acceptable to the Bank.

For loans above Rs.7.50 lac - Collateral security with 25% margin covering the loan amount and assignment of future income of the student for payment of loan instalments.

Student Eligibility

Should be an Indian National

Secured admission on the basis of merit to professional/technical courses through Entrance Test/Selection process

Deviations/relaxations are also permitted under special circumstances.

Secured admission to foreigh university / institutions.

The student who is a major representing himself or a minor student represented by parent or guardian.

Interest (PLR presently 13.25%)

For loans upto Rs.4.00 lakhs - PLR minus 1.50%

For loans above Rs.4.00 lakhs - PLR minus 1.00%

Girl students and students belonging to SC/ST category are eligible for concession of 0.50% on the above rates.

Girl students under SC/ST category are eligible for a further concession of 0.25% on the above rates.

(Total concession of 0.75%)

Simple interest to be charged during the Repayment holiday/Moratorium period

Penal interest to be charged as applicable

No processing charges/service charges are levied for educational loans

Interest (PLR presently 12%)

For loans upto Rs.7.50 lakhs - PLR minus 2.00%

For loans above Rs.7.50 lakhs - PLR minus 2.50%

No processing charges/service charges are levied for educational loans

Repayment

In 5 to 7 years commencing one year after completion of the course or 6 months after securing the job whichever is earlier.

For further details, please click here

Read the full article

#EducationLoan#EducationloanonlineunderSyndicateBank'sSyndvidyaScheme#Eligibility&Application#InterestSubsidyOnEducationLoan2015#MclrOfSyndicateBank#SyndicateBankEducationLoan|Documents|Eligibility|InterestRates#SyndicateBankEducationLoanApplicationFormPdf#SyndicateBankEducationLoanCalculator#SyndicateBankEducationLoanComplaints#SyndicateBankEducationLoanCustomerCare#SyndicateBankEducationLoanOnlineApplication#SyndicateBankEducationLoanSanctionLetter#SyndicateBankeducationloanscheme#SyndicateBankEducationLoan-StudentLoaninIndia#SyndicateBankEducationLoan:InterestRate#SyndVidya#SyndvidyaScheme:EducationloanschemeofferedbySyndicateBank

0 notes

Text

Corporation Bank Education Loan- Student Loan in India

Corporation Bank Education Loan | Interest Rates | Eligibility Criteria

Eligibility

Student should be an Indian national.

Should have passed previous qualifying examination.

Should have secured at least 60% marks in the previous qualifying examination.

Should ?have secured admission to a higher education course in recognized institutions in India or Abroad through Entrance test / Merit based selection process/through Management quota after completion of HSC

Purpose

To meet expenses related to pursuing studies in India and abroad

Loan Amount

Study in India – upto Rs.10 lakhs, Study Abroad : upto Rs. 20 lakhs

Margin

Loan up to Rs. 4 lakhs : Nil

Loan above Rs.4 lakhs:

Studies in India: 5%

Studies Abroad: 15%

Security

Up to Rs.4.00 Lakh : Co-obligation of Parent/s, No other security.

Above Rs.4.00 Lakh & up to Rs.7.50 Lakh : Co obligation of Parent/s together with collateral in the form of suitable third party guarantee with a net worth of at least equal to loan amount.

Above Rs.7.50 Lakh : Co- obligation of Parents together with tangible collateral security along with the assignment of future income of the student for payment of instalments.

Loan shall be fully secured after maintaining prescribed margin on respective securities offered.

In case of married person, co obligant can be either spouse, or the parents or parents -in-law.

Rate of Interest

Floating rate of interest is linked to the Base Rate & subject to revision from time to time ?Simple interest will be charged during repayment holiday period.

Concession in rate of interest at 25 bps below the applicable card rate is extended to SC/ST/Women beneficiaries for fresh loans sanctioned/ disbursed on or after 15.08.2008.

Concession in rate of interest at 50 bps (inclusive of 25 bps available for SC/ST/Women) below the applicable card rate for girl students for new loans sanctioned/ disbursed w.e.from : 04.03.2009.

Interest concession of 0.50% is extended to Physically Challenged students for loans initially disbursed on or after 20.09.2010

Prepayment Charges

NIL

Repayment

Uniform repayment tenor of 15 years irrespective of loan amount.

The repayment tenor is after completion of moratorium/Initial Repayment Holiday

Initial Repayment Holiday/Moratorium is Course Period + 1 year

Nature of facility

In the form of Term loan

Eligible Courses

For Studies in India

Approved courses leading to Graduate/Post Graduate Degree, Diploma and PG Diplomas conducted by recognized Colleges/Universities recognized by UGC/Govt/AICTE/AIBMS/ICMR etc.

Courses like ICWA, CA/integrated CA-on virtual /video mode, CFA, etc.

Courses conducted by IIMs, IITs, IISc, XLRI, NIFT, NID etc.

Regular Degree/Diploma courses like Aeronautical, Pilot training, Shipping etc., approved by Director General of Civil Aviation/ Shipping, if the course is pursued in India.

In case of the Aircraft Maintenance Engineering /Pre Sea training courses must be either a Degree course recognized by a competent University or Diploma course recognized by appropriate State Body

Teachers training /Nursing/B.Ed courses provided the training institutions are approved either by Central Govt or by State Govt and such courses should lead to Degree or Diploma and not to Certificate course.

Approved Courses offered in India by reputed Foreign Universities

Research course/Ph. D courses for study in India are not eligible for loan under the scheme.

Correspondence courses/Part time /Certificate/Short duration courses / off-campus courses and On-site/Partnership Programme are NOT eligible for loan under the scheme. However, Vocational/Skill development courses are eligible for loan under the CVDVC Scheme.

For Studies abroad

Graduation: For job oriented Professional/Technical courses offered by reputed Universities.

Post-Graduation: MCA, MBA, MS etc.

Course conducted by CIMA- London, CPA in USA etc.

Degree/Diploma courses like aeronautical, pilot training, shipping etc provided these are recognized by competent regulatory bodies in India/Abroad for the purpose of employment in India/Abroad.

PG diploma courses for study abroad is permitted.

Diploma courses for study abroad is NOT permitted.

Research course/Ph.D courses for study abroad are not eligible.

Eligible Expenses

Fee payable to College./School/Hostel /Examination/ Library/ Laboratory fee.

Travel expenses/Passage money for studies abroad.

Caution Deposit, Building Fund/Refundable deposit, though supported by Institution bills/receipts, are not eligible.

Purchase of books/Equipment/Instruments/Uniforms, Purchase of computer at reasonable cost, if required for completion of the course, any other expenses required to complete the course like study tours, project work, thesis etc, subject to maximum permissible limit as per the scheme.

Other Guidelines

Loan should be availed preferably from the Bank/ Branch situated near to the place of domicile of the parents.

The model educational loan scheme has not stipulated service area approach to finance under the Scheme.

Take over of loan from other banks is strictly not permitted.

Life insurance cover to the student is mandatory

For further details, please click here

Read the full article

#CoOperativeBankEducationLoan#CorporationBankEducationLoan-InterestRate#CorporationBankEducationLoan|InterestRates|Eligibility#CorporationBankEducationLoanApplicationFormPdf#CorporationBankEducationLoanCustomerCareNumber#CorporationBankEducationLoanInterestSubsidy#CorporationBankEducationLoanReview#CorporationBankEducationLoan-StudentLoaninIndia#CorporationBankEducationLoan:ApplyOnline#CorporationEducation#EMICalculator#HowToApplicationForEducationLoanInCorporationBank

0 notes

Text

HDFC Education Loan: Interest Rates,Student Loan: Apply Online

HDFC Bank Education Loan- Student Loan in India

Eligibility Criteria

You need to be a Indian resident

You should be aged between 16 - 35 years.

If you are taking a loan of more than Rs. 7.5 LakWhy take an Education Loan from HDFC Bank?h, a collateral security will be required.

Co-applicant: A co-applicant is mandatory for all full time programs. Co-applicant could be Parent/ Guardian or Spouse (if married) / Parent-in-law (if married).

Co applicant:

A co-applicant is required for all full time courses. Here are a few points to be noted about co-applicants:

Primary Co-Applicants:

Parents, Spouse, Siblings

Secondary Co-Applicants:

Father-In Law, Mother-In-Law, Brother-In-Law, Paternal / Maternal Uncle / Aunt

Here is an exhaustive list of the documents that you will need for the student loan:

Category Applicant

Student

Academic Institute Admission Letter with Fee break-up

SSC,HSC,Graduation Marksheets

KYC (Know Your Customer)

Age Proof

Signature Proof

Identity Proof

Residence Proof

Income Documents

Salaried

Latest 2 Salary Slips carrying date of joining details

Latest 6 Months Bank Statement of the Salary Account.

Self Employed

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet

Last 6 Months Bank Statement

Proof of Turnover (Latest Sales / Service Tax Return)

Self Employed - Professional

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet / P& L

Last 6 Months Bank Statement

Proof of Qualification

Others Completed Application Form

Latest Photograph (Signed Across)

If appointment letter does not mention Joining Details, then applicant has to submit appointment letter of the current employer.

Proof of continuity from previous employer is required if co-applicant is in current job for less than 1 year at the time of loan application

Documentation (Post Sanction).

Benefits of Educational Loan In India

Avail tax benefits under section 80(E) of income tax Act 1961

Flexible repayment options

Option to avail insurance cover for your loan

Why take an Education Loan from HDFC Bank?

Whatever be your need we have a loan for you. Over the years we have won the trust of our customers and have become market leader in loan products.

Enjoy triple benefits when you take an Education Loan from HDFC Bank:

Faster loan - Our loan sanction and disbursal is one of the quickest with easy documentation and doorstep service.

Competitive pricing – Our loan rates and charges are very attractive

Transparency – All charges are communicated up front in writing along with the loan quotation

Education Loan for Indian Education Interest Rates & Charges

Enclosed below are HDFC Bank Education Loan for Indian Education Interest Rates & Charges Here is an exhaustive list of all the fees and charges to be paid for the education loan:

Description of Charges

Education Loan

Loan Processing Charges

Maximum up to 1% of the loan amount as applicable.

Pre-payment charges

Upto 4% of the Outstanding Balance prepaid, if loan is foreclosed/ part perpaid during Moratorium (along with and in addition to due/accrued interest, if any, and other amounts due and/or payable by the Borrower to the Bank). No prepayment charges will be charged if loan is foreclosed / part prepaid any time after expiry of the Moratorium.

No Due Certificate / No Objection Certificate (NOC)

Nil

Duplicate of No Dues Certificate/NOC

Nil

Solvency Certificate

Not applicable

Charges for late payment of EMI

@ 24 % p.a. on overdue/unpaid EMI amount outstanding from EMI due date

Credit assessment charges

Not applicable

Non standard repayment charges

Not applicable

Cheque / ECS swapping charges

Rs. 500/- per instance

Duplicate Repayment Schedule Charges

Rs. 200/-

Loan Re-Booking/Re-Scheduling Charges

Upto Rs. 1000/-

EMI Return Charges*

Rs.550/- per instance

Legal / incidental charges

At actual

Loan Cancellation Charges

Nil cancellation charges. However, interest for the interim period (date of disbursement to date of cancellation), CBC/LPP charges as applicable would be charged and Stamp duty will be retained

*Terms & conditions apply

Rates offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.50%

12.64%

Annual Percentage Rate offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.94%

12.70%

Read the full article

#BestBankForEducationLoan#CredilaEducationLoanInterestRate#EducationLoanForAbroadStudies#EducationLoan-HDFCBankInterestRates#Eligibility&Application#EligibilityandDocuments#HDFCBankEducationLoan|InterestRates|Information#HDFCBankEducationLoan-StudentLoaninIndia#HDFCBankEducationLoan:InterestRate#HdfcEducationLoanForAbroad#HdfcEducationLoanInterestRate2017#HdfcEducationLoanReview#HDFCEducationLoan:InterestRates#HowToGetEducationLoanFromBank#IciciEducationLoan#StudentLoan:ApplyOnline

0 notes

Text

UCO Bank Education Loans - Student Loan Apply Online

UCO Bank education loan scheme, Education loan by UCO Bank

Eligibility

Studies in India

Approved courses leading to graduate/post graduate (Masters & PhD. degree and PG Diplomas conducted by recognized colleges/universities, Engineering, Medical, Agriculture, Veterinary, Law, Dental, Management, Computer, etc.).

Computer Certificate courses of reputed institutes accredited to DoE.

Courses like ICWA, CA, CFA, etc.

Studies Abroad

Graduation : Job oriented professional / technical courses offered by reputed Universities.

Post Graduation : MCA, MBA, MS, etc.

Courses conducted by CIMA - London, CPA in U.S.A., etc.

Age limit

For Graduation

28 years for general candidates

30 years for SC/ST candidates

For Post Graduation:

30 years for general candidates

33 years for SC/ST candidates

Eligibility

The main conditions for eligibility include

Student must be an Indian National

Secured admission to a higher education course in India or entrance test or selection process after completion of HSC (10 plus 2 or equivalent)

Quantum of loan

Studies in India : Maximum Rs. 10.00 Lac

Studies Abroad : Maximum Rs. 20.00 Lac

Security

Upto Rs. 4.00 lacs– No security, co-obligation of parents

Above Rs. 4.00 lacs & upto Rs. 7.50 lacs: Co-obligation of parents, collateral in the form of a suitable 3rd party guarantee

Above Rs. 7.50 lacs : Co-obligation of parents, tangible collateral security equivalent to full value of loan

Margin

Upto Rs. 4.00 Lakhs : NIL

Above Rs. 4 Lac Studies in India - 5%

Studies Abroad - 15%

Insurance

Group Life Insurance Cover Scheme for Educational Loan Borrowers to cover the outstanding loan in case of accidental or natural death of borrower

Processing Charge

There are no processing charges

Disbursement

Disbursement in stages as per the requirement directly to institutions.

Processing Charge

Education Loans

Spread over Base Rate

Effective Rate

Upto Rs.7.50 lacs

2.50%

12.20%

More than Rs.7.50 lacs

2.25%

11.95%

Premier Education Loan Scheme

1.00%

10.70%

Vocational Education Loan Scheme

2.50%

12.20%

Upto Rs 7.50 lacs :- Base rate + 2.50%

Above Rs.7.50 lacs :- Base Rate + 2.25%

Repayment Period

15 years (180 EMI) for all categories of loan after moratorium period

Repayment holiday / Moratorium Period

Course period + 1 year after completion of studies for all categories.

For further details, please click here

Read the full article

#EducationloanbyUCOBank#EMICalculator#UCOBankEducationLoan-InterestRate#UcoBankEducationLoanDocumentsRequired#UcoBankEducationLoanEmiCalculator#UcoBankEducationLoanInterestRate2017#UcoBankEducationLoanInterestSubsidy#UCOBankeducationloanscheme#UcoBankEducationLoanStatement#UcoBankEducationLoanStatementOnline#UcoBankEducationLoanStatus#UCOBankEducationLoan-StudentLoaninIndia#UCOBankEducationLoans-StudentLoanApplyOnline#UcoPremierEducationLoanScheme

0 notes

Text

HDFC Education Loan: Interest Rates,Student Loan: Apply Online

HDFC Bank Education Loan- Student Loan in India

Eligibility Criteria

You need to be a Indian resident

You should be aged between 16 - 35 years.

If you are taking a loan of more than Rs. 7.5 LakWhy take an Education Loan from HDFC Bank?h, a collateral security will be required.

Co-applicant: A co-applicant is mandatory for all full time programs. Co-applicant could be Parent/ Guardian or Spouse (if married) / Parent-in-law (if married).

Co applicant:

A co-applicant is required for all full time courses. Here are a few points to be noted about co-applicants:

Primary Co-Applicants:

Parents, Spouse, Siblings

Secondary Co-Applicants:

Father-In Law, Mother-In-Law, Brother-In-Law, Paternal / Maternal Uncle / Aunt

Here is an exhaustive list of the documents that you will need for the student loan:

Category Applicant

Student

Academic Institute Admission Letter with Fee break-up

SSC,HSC,Graduation Marksheets

KYC (Know Your Customer)

Age Proof

Signature Proof

Identity Proof

Residence Proof

Income Documents

Salaried

Latest 2 Salary Slips carrying date of joining details

Latest 6 Months Bank Statement of the Salary Account.

Self Employed

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet

Last 6 Months Bank Statement

Proof of Turnover (Latest Sales / Service Tax Return)

Self Employed - Professional

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet / P& L

Last 6 Months Bank Statement

Proof of Qualification

Others Completed Application Form

Latest Photograph (Signed Across)

If appointment letter does not mention Joining Details, then applicant has to submit appointment letter of the current employer.

Proof of continuity from previous employer is required if co-applicant is in current job for less than 1 year at the time of loan application

Documentation (Post Sanction).

Benefits of Educational Loan In India

Avail tax benefits under section 80(E) of income tax Act 1961

Flexible repayment options

Option to avail insurance cover for your loan

Why take an Education Loan from HDFC Bank?

Whatever be your need we have a loan for you. Over the years we have won the trust of our customers and have become market leader in loan products.

Enjoy triple benefits when you take an Education Loan from HDFC Bank:

Faster loan - Our loan sanction and disbursal is one of the quickest with easy documentation and doorstep service.

Competitive pricing – Our loan rates and charges are very attractive

Transparency – All charges are communicated up front in writing along with the loan quotation

Education Loan for Indian Education Interest Rates & Charges

Enclosed below are HDFC Bank Education Loan for Indian Education Interest Rates & Charges Here is an exhaustive list of all the fees and charges to be paid for the education loan:

Description of Charges

Education Loan

Loan Processing Charges

Maximum up to 1% of the loan amount as applicable.

Pre-payment charges

Upto 4% of the Outstanding Balance prepaid, if loan is foreclosed/ part perpaid during Moratorium (along with and in addition to due/accrued interest, if any, and other amounts due and/or payable by the Borrower to the Bank). No prepayment charges will be charged if loan is foreclosed / part prepaid any time after expiry of the Moratorium.

No Due Certificate / No Objection Certificate (NOC)

Nil

Duplicate of No Dues Certificate/NOC

Nil

Solvency Certificate

Not applicable

Charges for late payment of EMI

@ 24 % p.a. on overdue/unpaid EMI amount outstanding from EMI due date

Credit assessment charges

Not applicable

Non standard repayment charges

Not applicable

Cheque / ECS swapping charges

Rs. 500/- per instance

Duplicate Repayment Schedule Charges

Rs. 200/-

Loan Re-Booking/Re-Scheduling Charges

Upto Rs. 1000/-

EMI Return Charges*

Rs.550/- per instance

Legal / incidental charges

At actual

Loan Cancellation Charges

Nil cancellation charges. However, interest for the interim period (date of disbursement to date of cancellation), CBC/LPP charges as applicable would be charged and Stamp duty will be retained

*Terms & conditions apply

Rates offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.50%

12.64%

Annual Percentage Rate offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.94%

12.70%

Read the full article

#BestBankForEducationLoan#CredilaEducationLoanInterestRate#EducationLoanForAbroadStudies#EducationLoan-HDFCBankInterestRates#Eligibility&Application#EligibilityandDocuments#HDFCBankEducationLoan|InterestRates|Information#HDFCBankEducationLoan-StudentLoaninIndia#HDFCBankEducationLoan:InterestRate#HdfcEducationLoanForAbroad#HdfcEducationLoanInterestRate2017#HdfcEducationLoanReview#HDFCEducationLoan:InterestRates#HowToGetEducationLoanFromBank#IciciEducationLoan#StudentLoan:ApplyOnline

0 notes