#educationloaneligibility

Photo

Education Loan Eligibility:- Auxilo's eligibility calculator helps you to calculate the loan amount you are eligible before you apply for a loan.

0 notes

Photo

Education Loans from Incred: Loans for further studies in India, the USA or anywhere else abroad. Get low interest rates & higher loan amounts along with instant sanctions. Also, enjoy better savings with educational loan refinance. No branch visit required, apply online now!

For More Details-https://www.incred.com/education-loan.html

0 notes

Text

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme 2018

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme: Gujarat Government has introduced Education Loan Interest Assistance Plan 2018 for the students covered under the Chief Minister's self-help plan. Under this scheme, all students receive a 100% interest subsidy on education loan for a period of moratorium (1 year in addition to the curriculum). This subsidy will apply to the loan up to a maximum of rupees. 10 lakhs registration is open and interested candidates can apply online at the official website kcg.gujarat.gov.in

The interest subsidy scheme on education loans will benefit all the bright and needy students to continue their studies after the 12th standard. This scheme is applicable for graduate / post graduate / diploma and education courses for higher education in professional courses based on the conditions of the following eligibility.

All applicants must pass class 12 or equivalent with 12 or more percentages. Apart from this, the annual income of the family of all the source candidates is Rs. 6 lakh pay State Government Rs. 500 million crores in Gujarat budget 2017-18

Gujarat Education Loan Interest Subsidy Scheme 2018

Below is the complete procedure to apply online for Interest Subsidy Scheme on Education Loan in Gujarat:-

Visit the official website of Knowledge Consortium Of Gujarat kcg.gujarat.gov.in

On the homepage, click at the “Interest Subsidy Scheme on Education Loan (Registration Open)” link or directly click this link

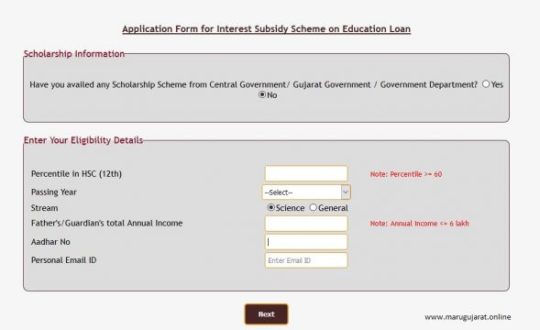

Next click at the “Online Registration Form for Interest Subsidy Scheme on Education Loan“. Afterwards, Gujarat Interest Subsidy Scheme Online Application Form will appear as follows:-

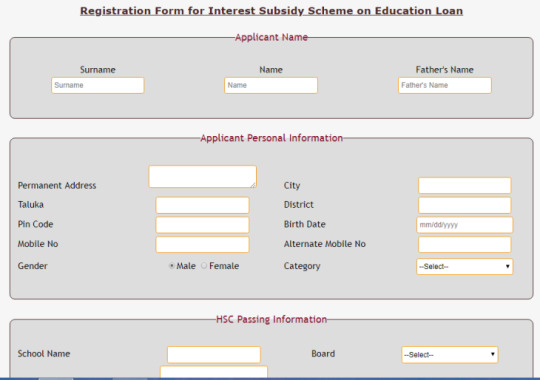

Here candidates can fill their eligibility details accurately and then click at the “Next” button. Afterwards, “Registration Form for Interest Subsidy Scheme on Education Loan” will appear as shown below:-

Enter all your details correctly and "submit" the completed application form. For more details on "How To Apply Online for Education Loan Interest Subsidy Scheme" in Gujarat, see the complete process (along with the document list). Gujarati (PDF), English (PDF)

All students must read the rules and regulations before applying online for the interest subsidy scheme on education loan. Instructions are available in both PDF format and in both English and English languages. Students can click this link directly to read the instructions. Instructions Gujarati (PDF), Instructions English (PDF)

Eligibility for Interest Subsidy Scheme on Education Loan

These applicants must complete the following eligibility criteria to become eligible for this scheme: -

Applicants must pass 12th standard from the Gujarat Higher Secondary Examination Board (GHSB) or the Central Board of Secondary Education (CBSE) and enroll in a recognized university is essential.

The applicant should be secured at least 60% in class 12th examination and after passing 2012, after passing 2012, 12 passes should be passed. If the candidates, who have passed 12th year before 2011, where no percentage is shown in the mark sheet, then such candidates can apply on percentage basis.

Students enrolled in diploma admission after 10 th standard (who do not have 12th matriculation) and can apply for graduation / post graduation can also apply on CGI / CGPA / percentage basis.

Annual Income of the family of the candidates from all sources must not exceed Rs. 6 lakh.

All students who take an academic loan after 4th July 2017 from a scheduled bank for higher education in India and abroad are eligible. Moreover, if the loan for the student is approved before 4th July 2017 and the loan amount withdrawn after 4th July 2017, such students are eligible to apply for this scheme.

This interest on education loan is applicable for subsidy scheme graduation / post-graduation / diploma and other professional courses.

Those students who have left mid-course studies in school curriculum or have been expelled from the organization for some reason are not eligible. For more details about the interest subsidy scheme on education loans in Gujarat, see Bulletin - Info. Booklet Gujarati (PDF), Info. Booklet English (PDF)

References

Self Declaration For Non IT Returns – Click Here

Self Declaration for No Other Scheme Benefit Taken – Click Here

Bank Endorsement Form – Click Here

Government Resolution – Click Here

Circular – Click Here

For complete information, visit the official website http://www.kcg.gujarat.gov.in/Education_loan/index.php

Important Links:

Online Registration Form for Interest Subsidy Scheme on Education Loan

Instructions for Student Gujarati English

How to Apply Gujarati English

Self Declaration for Non IT returns

Self Declaration of No other Scheme Benefit Avail

Bank Endorsement Form

Government Resolution (G.R.)

Interest Subsidy Scheme on Education Loan Booklet Gujarati English

More Detail: https://sarkariyojna.co.in/apply-online-interest-subsidy-scheme-education-loan-gujarat/

Read the full article

#EducationLoan#educationloandetails#educationloaneligibility#educationloanemicalculator#educationloanforabroadstudies#educationloaningujarat#EducationLoaninIndia#educationloaninterest#educationloaninterestrate#gujarat#GujaratEducationLoan#gujaratgovernment#highereducationscholarship#loansforstudents#Marugujarat#obcscholarshipstudentloans#sbieducationloan#scstobcscholarship#scstscholarship#studentloaninindia

0 notes

Text

What are the student loan eligibility norms?

Planning to take up an education loan for higher studies? With the government’s initiatives to reduce the rate of interests and offer flexible prepayment options on loans, students are considering it as a viable alternative. But how does one come to know whether he or she fits the student loan eligibility criteria of obtaining the loan?

· As far as age is concerned, the borrower has to be 18 years (18-35)or above.

· He/She must be an Indian citizen.

· �� The applicant must have a secure admission prior applying for the loan.

· Proper documentation such as address proof, identity proof, previous mark sheets will be required.

Education loans are of two types, secured and unsecured. To obtain a secured loan, the student will be required to produce collateral in any form of property papers, valuables, etc. Unsecured loans can be availed at the time of medical emergency or when in dire need of money because they have a comparatively higher rate of interest yet a very less repayment period.

Student loan eligibility does not become an issue if everything falls into place.Education loans are proven to be a very helpful tool in shaping the dreams of students who are hopeful towards achieving their career goal.By following an easy process, you can avail a student loan from banks and financial institutes. By availing a loan, you will not have to borrow from family or friends. Also, you will not have to sell out your property or valuable assets to obtain cash.

Many people believe that scoring well in academics will help eliminate their fees but the fact is that you only get financial relief up to a certain extent. The entire amount will not be covered by scholarships or grants. This may also not be the case for most of the banks. Some banks ask for a certain percentage or grade in order to sanction the loan amount. If you successfully satisfy all these criteria, you will be eligible to qualify for the loan. Other important criteria also need to be fulfilled such as availability of collateral, the reputation of the college/university applied for, etc. Your field of education will also be taken into consideration at the time of verification.

Student loan eligibility may also vary from lender to lender so it is essential that you go through the website thoroughly prior to applying for the loan. A little bit of comparison should be done before drawing any conclusion. There is a huge difference between a loan and a grant/scholarship.Both the types can be availed from government as well as non-government banks. The eligibility also remains the same with just one major difference, i.e in a scholarship you do not have to repay the borrowed funds back unlike a loan. You can apply for a loan even when you have a scholarship in hand. It will help to cover the remaining educational expenses which cannot be covered by the scholarship. Along with covering your academic fees, a loan will ensure that all your expenses such as your basic fare, tuition fees, hostel and mess charges if any, stationery needs will be covered.

#educationloaneligibilitycalculator#educationloaneligibility#studentloaneligibility#educationloan#educationloaninterest#educationloans

0 notes

Text

Learn about the defaulted student loan

The cost of getting college education and the other higher studies is rising every year. Many aspiring students are therefore seeking help in terms of the student loans. This type of student loans allow them to go for higher college degrees in reputed institutes which they would not have otherwise be able to afford. The benefits of the student loans are several in numbers like the rate of interest is much lower than that of the other traditional loans. The lender organization usually allows the borrower student a longer tenure of time for the repayment of the loan and usually they also allow you to finish the school before you start the repayment of the student loan process. Many a times, there are also student grants available. It is a better thing to get these grants as you need not repay it back. In case of the loans, there is a chance that the student loans in default occur. The defaulted student loans can make a huge impact in your professional as well as personal life for several years of your life. Thus no matter when you make such kind of student loans in default, the impact can really affect your life and also career.

The defaulted student loans have serious impacts like it is sure to damage your credit score and eventually prevent you from getting any loans in the near future unless you repay the previous loan. The longer you are unable to repay the student loans in default, the more damage is done against you. The defaulted student loan eligibility also affects your tax refunds and that may on the other hand lead you to garnish your wages and get you involved into a law suit. There are many ways to avoid the defaulted student loan. One of the most popular ways is to consolidate the student loans in default but then there are certain eligibility criteria that you must fulfill so that you are able to consolidate the defaulted student loans.

The eligibility standards include a good FICO score, you must also pay at least three repayments in full amount, all the due student loans in default must be in their current billing cycle and finally you must wait for at least 6 months from the main and the final date of your graduation before you are termed as an eligible candidate for the defaulted student loans. One of the main benefits of the student loan in default is that you get a reduced rate of interest once you are a graduate. If you want to pay the student loans in default through the automatic method of withdrawal, then the chance of the reduction in the rate of interest is even more than that of the normal procedure. You must also be aware that all of the student loans vary from each other in terms of the various features. Thus it is vital that you get to understand all the features of the consolidation loan before applying for it.

#educationloan#educationloaneligibilitycalculator#educationloaneligibility#StudentLoans#studentloaneligibility

0 notes

Text

Student Loans - The Essential Information Resource!

Student loans are provided by a joint Federal and Provincial program with the amount of and eligibility for a loan different between the Provinces and so depends upon the Province you are a resident of (your Province or territory of residence is decided by where you have lived for the last 12 months consecutively whilst NOT a student). You may, however, attend any educational establishment in the country provided both the establishment and the program of your choice are listed by the assistance office in your province.

There are several different types of funding for post secondary education that include grants and bursaries (which you wouldn't have to pay back) but there are 2 main types of student loan - the Federal and Provincial programs. Whichever type of loan you wish to apply for it all has to be started off by applying to the Provincial/Territorial Assistance office for the Province you are officially a resident of.

The main attraction of student loan eligibility is that although they are REAL loans that do have to be repaid, they are interest free while you remain enrolled in an eligible education program. Once you graduate/leave education the repayment terms are set (normally low interest and you agree the repayment term) and you begin to pay them back. Banks and other lending establishments are no longer involved in offering new loans as all funding is provided by the federal or provincial governments.

Quebec, Northwest Territories and Nunavut are NOT involved in the Canada Student Loans program and have their own systems. If you are a resident of one of these 3 provinces or Territories then you need to contact the particular office for that Province.

To start the ball rolling with the application for a loan there are several processes that you should consider. Your eligibility is the most important - both you (the applicant) and the course you wish to undertake must meet the criteria laid down.

The applicant: The main factor of eligibility is whether you are intending to be a full or part time student. If you are a part time student (20 - 59% of full course load) you may only apply for federal assistance though you would apply through the provincial/territorial assistance office.

A full time student (60% + of a full course load) may apply through the same offices but will be considered for both Federal and Provincial support (depending upon the province in question) though this would have to repay both the loans. The difference between the Provinces and Territories is prevalent here as these provinces: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island and the Yukon all would entail paying the loans back separately. If you are from Ontario or Saskatchewan then you would make one payment back to the NSLSC which would cover the total amount borrowed from both the federal and provincial programs.

The course you wish to enroll on must be listed on the Master List of Designated educational Institutions - it is strongly advised that you ensure the establishment you wish to attend is recognized by your provincial provider and the course choices meet the necessary requirements before you commit to it. This also applies if you wish to attend an overseas establishment.

Your personal financial status will determine the amount of assistance you will be offered with the Federal loan system covering up to 60% of the total you are assessed as needing and the provincial system contributing up to the remaining 40%. Your "needs" are assessed by the provincial office when you apply as they handle the initial application and will forward you the loan documents. Once the Provincial or territorial Student Assistance office has received and processed your application, it will establish the amount of loan you are entitled to apply for and carry out credit checks. Once approved, your Canada Student Loan will be administered by the National Student Loans Service Centre (NSLSC) through to its termination (full repayment).

This agency is responsible for all loans supplied since 1st August 2000 and has two distinct sections. The Public Institutions Division (looking after anyone attending a course at a Public facility such as a University or Community college) and the Private Institutions Division (for those who are receiving instruction at a privately funded facility like a technical college or trade school).

#educationloaneligibilitycalculator#studentloaneligibility#educationloaneligibility#educationloan#studentloans

0 notes