#Exxon Shipping Company

Text

This day in history

I'm at DEFCON! TODAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). TOMORROW (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

#5yrsago Bernie Sanders killed it on Joe Rogan https://jacobin.com/2019/08/bernie-sanders-joe-rogan-experience-podcast/

#5yrsago Whatsapp, Slack, Skype and apps based on popular Electron framework vulnerable to backdoor attacks https://arstechnica.com/information-technology/2019/08/skype-slack-other-electron-based-apps-can-be-easily-backdoored/

#5yrsago Billionaire who gave Jeffrey Epstein power of attorney in order to manage his finances says Epstein stole “vast sums of money” https://www.nytimes.com/2019/08/07/business/wexner-epstein.html

#5yrsago Baking bread from dormant, 4,500-year-old yeast extracted from Egyptian bread-making ceramics https://twitter.com/SeamusBlackley/status/1158264819503419392

#5yrsago Monsanto ran a psy-ops war-room to discredit journalists and spy on Neil Young https://www.theguardian.com/business/2019/aug/07/monsanto-fusion-center-journalists-roundup-neil-young

#5yrsago Wisconsin commissioned an independent report on how to fix the Foxconn deal. Result: it can’t be done. https://www.theverge.com/2019/8/6/20747166/wisconsin-foxconn-deal-state-report-lcd-factory-innovation-centers

#5yrsago As New York State’s shareholder suit against Big Oil for climate denial proceeds, Exxonmobil caught intimidating witnesses https://insideclimatenews.org/news/09082019/exxon-climate-fraud-investigation-witness-pressure-investors-new-york-attorney-general/

#5yrsago After student arrested for carrying laser-pointers, Hong Kong protesters stage “stargazing” laser-protest https://www.bbc.com/news/av/world-asia-49280030

#5yrsago Warshipping: attack a target network by shipping a cellular-enabled wifi cracker to a company’s mail-room https://techcrunch.com/2019/08/06/warshipping-hackers-ship-exploits-mail-room/

#5yrsago Billions on the line as Facebook loses appeal over violating Illinois facial recognition law https://www.theverge.com/2019/8/8/20792326/facebook-facial-recognition-appeals-decision-damages-payment-court

#1yrago Private equity plunderers want to buy Simon & Schuster https://pluralistic.net/2023/08/08/vampire-capitalism/#kkr

5 notes

·

View notes

Text

War Profiteers

Remember President Dwight “Ike” Eisenhower, who after green-lighting the overthrow of Iran’s democracy in 1953 at the behest of petrochemical corporations, had a change of heart and warned about the Military Industrial Complex? Here are the top 100 USA Military Industrial Complex “defense” contractors, all corporate welfare queens mooching off the public, who have blood on their hands in Palestine and elsewhere:

Academi

Action Target

ADT Corporation

Advanced Armament Corporation

AECOM

Aerospace Corporation

Aerovironment

AirScan

AM General

American Petroleum Institute

Argon ST

ARINC

Artis

Assett

Astronautics Corporation of America

Atec

Aurora Flight Sciences

Axon Enterprise

United Kingdom BAE Systems

BAE Systems Inc

Ball Corporation

Ball Aerospace & Technologies

Barrett Firearms Manufacturing

Battelle Memorial Institute

Bechtel

Berico Technologies

Boeing Defense, Space & Security

Booz Allen Hamilton

Boston Dynamics

Bravo Strategic

CACI

Carlyle Group

Carnegie Mellon University

Ceradyne

Cloudera

Colt Defense

The Columbia Group

Computer Sciences Corporation

Concurrent Technologies Corporation

CSRA (IT services company)

Cubic Corporation

Omega Training Group

Curtiss-Wright

DeciBel Research

Dillon Aero

Dine Development Corporation

Draper Laboratories

DRS Technologies

DynCorp

Edison Welding Institute

[Israei]l Elbit Systems

M7 Aerospace

Ensco

United Kingdom/Military contractor Ernst & Young

Evergreen International Aviation

Exxon

Fluor Corporation

Force Protection Inc

Foster-Miller

Foster Wheeler

Franklin Armoury

General Atomics

General Dynamics

Bath Iron Works

General Dynamics Electric Boat

Gulfstream

Vangent

General Electric Military Jet Engines Division

Halliburton Corporation

Health Net

Hewlett-Packard

Honeywell

Humana Inc.

Huntington Ingalls Industries

Hybricon Corporation

IBM

Insight Technology

Intelsat

International Resources Group

iRobot

ITT Exelis

Jacobs Engineering Group

JANUS Research Group

Johns Hopkins University

Kaman Aircraft

KBR

Kearfott Corporation

Knight's Armament Company

Kratos Defense & Security Solutions

L3Harris Technologies

Aerojet

Brashear

[France] Lafayette Praetorian Group

Lake Shore Systems

Leidos

EOTech

Lewis Machine & Tool Company

Lockheed Martin

Gyrocam Systems

Sikorsky

LRAD Corporation

ManTech International

Maxar Technologies

McQ

Microsoft

Mission Essential Personnel

Motorola

Natel Electronic Manufacturing Services

Navistar Defense

Nextel

Northrop Grumman

Northrop Grumman Electronic Systems

Northrop Grumman Ship Systems

Northrop Grumman Technical Services

Northrop Grumman Innovation Systems

NOVA

Oceaneering International

Olin Corporation; also see John M. Olin and John M. Olin Foundation

Oshkosh Corporation

Para-Ordnance

Perot Systems

Picatinny Arsenal

Pinnacle Armor

Precision Castparts Corporation

Raytheon Technologies

Collins Aerospace

Rockwell Collins

Goodrich Corporation

Pratt & Whitney

Raytheon Intelligence & Space

Raytheon Missiles & Defense

Raytheon BBN

Remington Arms

Rock Island Arsenal

Roundhill Group

Ruger

Saab Sensis

Science Applications International Corporation (SAIC)

SGIS

Sierra Nevada Corporation

Smith & Wesson

Smith Enterprise (SEI)

SPRATA

Springfield Armory

SRC Inc

SRI International

Stanley

Stewart & Stevenson

Swift Engineering

Tactical Air Support

Teledyne

Teledyne FLIR

Textron

AAI Corporation

Bell Helicopter Textron

Trijicon

TriWest Healthcare Alliance

Unisys

U.S. Ordnance

Verizon Communications

Vinnell Corporation

Westinghouse Electric Corporation

8 notes

·

View notes

Text

that post going around about why murdering one (1) exec of British petroleum is worth millions of tons of CO2 is so dumb and ppl are eating that shit up. I hesitate to respond to that post because I simply do not want to spread it, but no matter, you've heard arguments like this before. because I work on climate policy for a living, allow me to ask a few comprehension questions:

- why assume that the sudden death of a company official would decrease production of oil by 1% for a month? why not 0.5% or 0.25%? Whether there is any decrease and how big that decrease is are empirical questions, you can't eyeball it. The other scenario, reducing production by 25% for a day, is preposterous unless all the employees are taking a 2 hour mourning period.

- is this belief not inconsistent with the other commonly held belief on the left that CEOs are parasites and don't do shit? If value is derived from labor, do you honestly believe that 1% of BP's revenues (totaling over 100B each year) are attributable to one person? Even a few people?

- you can go online and search BP's org charts. BP has nearly 100 people with just the title "senior vice president", spread across a dozen business units like "innovation", "advocacy", "finance", "legal", and laughably, "sustainability". Anyways, which of these units contains the person you're going to shoot dead? How are you dealing with the fact that they have intentionally padded these groups to insulate from sudden shocks?

- the energy industry is, famously, characterized by inertia. The whole reason they are in this mess is due to their inflexibility. In a time of crisis, such as missing leadership, they're going to keep on chugging! The people who supposedly steer the ship are dead, and the people who actually know how to work the oilfields are still alive, couldn't that make transitional change less likely?

- ah yes! All those oilfields! BP has dozens of them, spread around the globe, filled with hordes of middle management. how, logistically, do you think that this change will happen? will it be that each worker presses buttons on the rig 1% more slowly? Or will it be that new oil sites are 1% slower to be sited and begin operation. These things employ thousands, operate sometimes for decades, and remember, they have production quotas to fill.

- what about demand? killing oil execs doesn't reduce the number of people trying to fill up their cars and keep the lights on, because oil consumption is largely inelastic. if production was lowered by 1%, the company will raise prices (just as they did during the pandemic) to maintain profit levels. In order to introduce elasticity to the market, we need real alternative choice in energy source and tech we use in our daily lives, which means subsidizing renewables, electrified transit, and regenerative agriculture, aka boring wonk shit when do I get to kill?

- this experiment has been and is already being run. In 1992 an Exxon exec was murdered and clearly that didn't solve anything. 30 years later, the guy that did it is still serving time in a prison in NJ. Russia has had a string of oil execs deaths lately for reasons I don't pretend to totally understand, but likely relating to the Ukraine war and exerting control, and no, they're clearly not worried about production declining or this hurting the Russian economy.

In short: No, this problem isn't fucking solvable by a well-placed bullet or two, or five.

15 notes

·

View notes

Text

Fossil Fuel Corps Wield an Immense Amount of Political Influence

Fossil fuel corporations wield immense political power thanks to their massive lobbying efforts and the fact that they comprise 8% of the entire US’s Gross Domestic Product (acc. to the American Petroleum Institute).

Between 2000 and 2016 alone, the fossil fuel industry spent roughly $2 billion to disrupt the passing of climate change legislation

Exxonmobil has been the largest contributor of climate change denialism in recent history

Directly funded 69 climate change denial interest groups from 1998 to 2014

Ironically a descendent of enormously wealthy industrialist John D. Rockefeller (founder of Standard Oil which was later renamed to "Exxon Mobil") himself urged the company to stop promoting climate change and acknowledge the problem, to no avail

Joined alongside other fossil fuel giants such as Shell and Texaco to directly fund the deceptively named anti-climate change think tank, the “Global Climate Coalition” in 1989, which had the goal of creating and then disseminating some of the first climate change denialist rhetoric that has contributed to the muddy public discourse we currently see today

In a case of impossibly dramatic irony, Exxonmobil’s own proprietary research teams conducted groundbreaking research, as early as the late 1970s, that predicted, with remarkable accuracy, that carbon dioxide emissions over the coming decades would “lead to a 0.2℃ of global warming per decade with a margin of error of 0.04 degrees”, according to the Harvard Gazette.

This makes the irritating fact that Exxon did not even publicly acknowledge the existence of climate change until 2014 all the more unconscionable

Worse still, the numerous studies they conducted that empirically demonstrated the existence of anthropogenic causes of climate change were only disseminated internally (within the corporation) and publicly hidden behind an overwhelming torrent of skeptical editorial pieces they published in order to sow doubt among the general populace

They made sure that anything they published proving climate change, would be outshined by their climate denialist editorials

Exxon wasn't the only company guilty of this sin of omission either:

As early as the 1980s, Shell disseminated internal (intra-corporate) documents that not only acknowledged the existence of climate change, but knew full well that their own products were responsible for contributing to it

Bottom Line: Companies have the political sway that is usually only reserved for politicians and political organizations. This complicates the matter of adopting eco-friendly corporate policy since it has ostensibly become a conflict of interest.

But the question remains, What Do We Do?

There have been many proposed solutions, but unfortunately very few have yielded success:

The Paris Climate Agreement was an international treaty established in 2016 that established a goal to reduce global GHG emissions by 43% by 2030

Though good on paper, the problem lies in its lack of enforcement capabilities since as we've seen corporations are immense contributors to GHG emissions but due to the nature of the agreement, governments themeselves are solely responsible for enforcing the aggreement on corporations' activities

But in a Capitalist society, and given the fact that in the US alone the fossil fuel sector accounts for 79% of our energy production, government actors have very little incentive to risk pissing these companies off which runs the risk of scaring their business away to foreign markets

What is perhaps the most realistically feasible (in theory) solution to reigning in fossil fuel (and other) corporations is the implementation of a....

Which is basically a tax imposed on some level of a fossil fuel producer (its factories, its shipping network, its suppliers, etc.) on a specified amount of greenhouse gasses produced in the company's activities

Could be a great way to get corporations to limit their emissions by making it less attractive to emit large amounts of GHGs to maximize profits since doing so would incur significant costs to said company

or at least enough costs to make them limit their activities

A study done in 2017 estimated that a tax of $49 per metric ton of CO2 could raise up to $2.2 trillion in revenue which could then be used to fund things such as eco-friendly energy solutions or even just return it to consumers

Now this is not to say this is the "antidote" to corporate GHG emissions, because it simply is not:

For starters imposing such a tax would naturally increase the price of energy and fuel, which could seriously hurt lower income people who already spend a good chunk of their income on those things

Could entice domestic corporations to move overseas where tax laws are more lenient

So, in conclusion:

Solving corporate GHG emissions which contribute to climate change is going to be a really complicated, multifaceted affair that is not going to occur overnight.

However we still should try and pursue these solutions, even if we may not see them in our lifetimes, because it is an objective fact that these companies need to be reigned in and something must be done to curb emissions before we literally reach a point of no return.

We need to build a future that is far less dependent on fossil fuels and it's going to take a lot of work and collective action to do it, so..

DO IT YOU LAZY BUMS, GET ANGY, GET MAD, DON'T LET THESE BOZOS FEEL LIKE IT'S OK TO RUIN THE PLANET!

IT'S THE ONLY ONE WE GOT!!!

2 notes

·

View notes

Text

Lubricants Market Dynamics, Top Manufacturers Analysis, Trend And Demand, Forecast To 2030

Lubricants Industry Overview

The global lubricants market size was estimated at USD 139.44 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030.

This is attributed to the growing demand for automotive oils and greases due to the growing trade of vehicles and spare parts. Lubricants are an essential part of rapidly expanding industries. They are used between two relatively moving machinery parts to reduce friction and wear & tear. They can be either petroleum-based or water-based and are essential for proper machinery functioning. Lubricants also decrease operational downtime and eventually increase overall productivity. Lubricants are extensively used in processing industries and automobile parts, especially brakes and engines, which need lubrication for continuous smooth functioning.

Gather more insights about the market drivers, restrains and growth of the Lubricants Market

The increasing imports and exports of piston engine lubricants are contributing to market growth. The product demand is driven by the rising focus of consumers on enhancing vehicle performance coupled with the introduction of innovative & premium product offerings. Future growth will be highly dependent on motor vehicle production and the miles covered by each vehicle. Furthermore, consumers are looking for standard and specialized lubricants for their regular vehicles to ensure the smooth functioning of their vehicles and reduce long-term maintenance costs.

Lubricant manufacturing requires crude oil, tight oil, and other additives to formulate all lubricant types. There are multiple additives incorporated in lubricants to enhance their functionality and properties. These include antioxidants, extreme pressure additives, rust- & corrosion-prevention additives, detergents, viscosity index improvers, anti-wear agents, and dispersants. Lubricants are 90% base oil and 10% additives, wherein base oils include petrochemical fractions, such as fluorocarbons, esters, polyolefin, and silicones. Base oils increase the viscosity of the lubricants and reduce wear & tear. Paraffinic and naphthenic are the two essential base oils used in lubricant formulations.

Browse through Grand View Research's Petrochemicals Industry Research Reports.

• The global naphtha market size was valued at USD 189.5 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030.

• The global diesel exhaust fluid market size was valued at USD 36.66 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030.

Key Lubricants Company Insights

The global lubricants market is competitive with a large number of well diversified regional, and independent small scale and large scale manufacturers and suppliers. The small-scale companies majorly compete on the basis of price, after sales service and delivery timelines. Whereas the large scale companies focus on product development and innovations as well as marketing strategies.

Some of the key players operating in the market include Exxon Mobil Corp, Shell, and TotalEnergies

ExxonMobil Corp. is a global manufacturer & supplier of synthetic lubricants. The company mainly deals in three business segments that include upstream (oil & gas, E&P, shipping and wholesale operations), downstream (refining, marketing and retail operations) and chemicals. ExxonMobil owns 37 oil refineries in 21 countries with refining capacity of 6.3 million barrels per day.

Shell is a global leader as a group of petrochemical and energy companies, with presence across 70 countries and over 90,000 employees. The group provides fuels, car services, oils, and is also engaged in production, exploration, and refining of petroleum products. The group offers lubricants for industrial and transport businesses along with lubrication process and services.

Total Energies. is oil & gas integrated company. The company has its business segments in upstream, refining & specialty chemicals, and marketing & services. Total Oil India Private Ltd. is an entirely owned subsidiary of TOTAL. It has exploration and production activities in more than 50 countries. The company has a broad catalogue of lubricants for various markets such as agriculture, vehicles, aviation, energy, and chemicals, among others.

Key Lubricants Companies:

The following are the leading companies in the lubricants market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these lubricants companies are analyzed to map the supply network.

ExxonMobil Corp.

Royal Dutch Shell Co.

BP PLC.

Total Energies

Chevron Corp.

Fuchs

Castrol India Ltd.

Amsoil Inc.

JX Nippon Oil & Gas Exploration Corp.

Philips 66 Company

Valvoline LLC

PetroChina Company Ltd.

China Petrochemical Corp.

Idemitsu Kosan Co. Ltd.

Lukoil

Petrobras

Petronas Lubricant International

Quaker Chemical Corp.

PetroFer Chemie

Buhmwoo Chemical Co. Ltd.

Zeller Gmelin Gmbh & Co. KG

Blaser Swisslube Inc

Recent Developments

In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT from M&I Materials Ltd. The products of the latter two will be produced and distributed as part of Shell’s Lubricants portfolio. The acquisition will help Shell to strengthen its position in Transformer Oils, which finds use in offshore wind parks, utility companies, and power distribution.

From September 2023, TotalEnergies Lubrifiants accelerated the inclusion of recycled plastics (50% PCR high-density polyethylene) in its lubricants bottles, following a pilot project launched in 2021 called Quartz Xtra bottles. This aims at contributing to a circular economy and in decline of usage of virgin plastic.

In March 2023, ExxonMobil announced investing around INR 900 crore (~USD 110 million) for constructing a lubricants production plant in Raigad, Maharashtra, India. Upon completion, plant’s annual production capacity is expected to be 159,000 kl of finished lubricants. This plant will cater to growing demand from industries such as mining, construction, power, steel, and manufacturing, among others.

Order a free sample PDF of the Lubricants Market Intelligence Study, published by Grand View Research.

0 notes

Text

Couple more things be crowd of old people is here and it's gross but the evacuation is on and it's a lot of people and they keep coming in and leaving and it's stupid and the third original sleeve and also people been here for months or a couple years and those people comprise out of the 10% it's about 2.5% originals and 2% relatively new covers and 5.5% new people. The username is cover more or less and getting the hell out. And also at 300 million and 300 million are heading to combat in the most ridiculous fight I've ever seen.

--the sun wants to do something for some kind of money and nobody can seem to do anything so I'm going to get in there and start to try and beat people up get them out of the way and Bible and got his wife and Lobo and proximately midnight are into it Frank Castle hardcastle didn't do some Blockbuster and it says we need a project on the lines of meet people up in the way the money but we already have it those people tried to send money this year for his birthday as many as we thought had died down and it's not really in accordance with what's going on it's just that they get beat up at the post office and they're not getting anywhere it's really true and they're doing it and then not too many trumpsters were there so here we go there's another thing going on too.

--along with all the stuff that the trumpsters are doing to get rid of themselves and they are working at it and yeah they're stupid and moronic. They are now trying to move their own buildings to remote locations and collect stuff from themselves and is the ultimate stroke of idiocy and we'll have to join in and that's good. Several of them they're planning to move American choppers Orange county choppers both of them to Arizona to supposedly claim the area when you're the one to go after, Chrysler supercar plants and to move it away from us and yeah we're going to have to get involved and they are going to get destroyed these plants are huge they're about 20 billion square feet total and they were making a bunch and they stopped immediately, saline is a car company and they're going to move it to the nowhere and just put it there and you're insane so we're going to keep them out then we're going to build a wall and we're going to start production it's going to take a while using this message but it's better than nothing we have other vehicles we're going to make and they will have no money they say they're going to try and make the cars and they're full of s***.. there's some other businesses one of those towers from LA and several more things like that and he's quite the idiot that guy we don't like him we consider the Chrysler and the saline to be ours because we decide them made it work and he crapped all over it because he's a loser. And he got beat up by competition didn't even sell it and he's a loser.

**we're taking over businesses we have 45% of home Depot 35% of lows and we're looking for people to sell stocks they're publicly traded and I guess it's inside of trading we're also looking for private companies that provide lumber and construction materials and equipment it's a purchase something

**I was going to the stock market today we have about 10 companies that we're trying for Intel processor we're trying to purchase them you're getting close no we're 35%, sell your Ron processors it's spelled differently of course and she's like it says to change it celluron okay good, about eight other high tech companies.

**but after the shipping companies again there's still a miserable 15 to 20% on each they're publicly traded so you have to do that do it that way they don't feel they have to sell and they're still shipping things

**oil companies we have two we're looking for mobile we have 35% and we're looking for Exxon we have 25% and the others we have below that we need to get a far more aggressive in our stance on these companies and start purchasing them while the more lock on them and what we're telling them is it's real money and they've been building their cities with it and they've been buying steel ingot and other ingot with the proceeds and Trump is trying to tell people because she having trouble getting approval and you're just going to lose these things to the Mac proper

**overseas we are looking for to purchase several large companies they are automobile companies in Japan Toyota and those places we have 10% it's miserable there's a couple small companies for almost purchasing here in the states we almost were just two small companies and they're packing out of business but practically out of business and a third Tesla and they don't want to sell it in our opinions so he says if they're not selling they're not selling it's time for hostile takeover private and public like they did to us they want another project to do this it's taking too long we're in trouble I'm getting volunteers now and we're signing it up we're going to for me it's a very huge project and a great idea and going forward with it now

Thor Freya

We did speak with Thor and Freya about it already and it is partially our idea and we're going forwards with it I was going to make it work. I hate this guy Trump you're a project to get rid of him and a group and people hate him and we should do that with people who are problems

Hera

I'm going to go forward to that idea and right now

Thor Freya

Olympus

0 notes

Text

why tf would they do this? the point of actions like this is primarily for disruption??? think of the weapons company demonstrators for Palestine. stop a ship from leaving, prevent them from using their offices — that makes their lives a living hell not this. this is a closed site & people can’t even walk up like that anymore bc of vandalism problems over the years. local druids (i know want ur thinking but im 100% serious) literally have to ask permission to host solstice ceremonies. it nets zero positives and so many negatives.

ffs disrupt the NYSE or the big oil headquarters with actions like this; that’ll do more good for environmentalism not archaeological sites that have zero connection to big oil. everyone already knows how fucked up big oil is (since fucking EXXON of ‘89 fame) so even framing it like it’s meant to educate isn’t even valid. hit their money bags not annoy tf out of literally every single person in the area. fr who planned this?????

#i say this as a loooong time community organizer this was a big stupid move#i always beef with climate activists bc of shit like this#lots of these spaces are predominantly white and like completely ignore communities of color actively suffering from environmental racism#and the effects of pollution like Flint or Black communities in St. Louis by the oil pipeline#but they’ll do stupid shit like this bc they refuse to build community or ASK communities directly affected like water protectors

0 notes

Text

Bunker Fuel, Bunker Fuel Market, Bunker Fuel Market Growth, Bunker Fuel Market Size, Bunker Fuel Market Share, Bunker Fuel Market Insights, Energy

The global Bunker Fuel Market is estimated to be valued at US$ 26.93 billion in 2022 and is expected to exhibit a CAGR of 7.1% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Bunker fuel refers to the fuel oil that is used by ships and other marine vessels. It is a heavy fuel oil with high viscosity and is derived from crude oil through a refining process. Bunker fuel is primarily used as a source of energy for propulsion and powering auxiliary equipment on ships. It provides a cost-effective solution for the maritime industry, offering high energy density and stability.

The global bunker fuel market is witnessing significant growth due to the increasing demand for marine fuels. The expanding global trade, growth in the shipping industry, and rise in seaborne transportation are driving the demand for bunker fuel. Ships are the primary mode of transportation for goods across countries, and the growth in international trade has resulted in the increased demand for bunker fuel.

B) Market Key Trends:

One key trend in the bunker fuel market is the growing adoption of LNG (liquefied natural gas) as a marine fuel. With increasing environmental concerns and regulations related to emissions, there is a shift towards cleaner and more sustainable fuel alternatives. LNG is considered a cleaner fuel compared to traditional bunker fuel, as it emits significantly lower levels of greenhouse gases and pollutants. The utilization of LNG as a marine fuel helps reduce emissions such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter.

For example, in July 2018, Carnival Corporation, the world's largest cruise ship operator, announced that it would significantly increase its usage of LNG as a marine fuel. The company plans to launch seven new LNG-powered cruise ships, which will help reduce its carbon emissions and improve air quality.

C) PEST Analysis:

Political: The political factors impacting Bunker Fuel Market Growth include regulations related to emissions and environmental policies. Governments worldwide are implementing stringent regulations to reduce greenhouse gas emissions from ships. For example, the International Maritime Organization (IMO) implemented the IMO 2020 regulation, which mandates a significant reduction in the sulfur content of bunker fuel.

Economic: Economic factors such as global trade and economic growth have a direct impact on the bunker fuel market. The growth in international trade and increasing demand for goods result in a higher requirement for shipping services, leading to a rise in bunker fuel consumption.

D) Key Takeaways:

The global bunker fuel market is expected to witness high growth, exhibiting a CAGR of 7.1% over the forecast period, due to increasing demand for marine fuels. The growth in global trade, shipping industry, and seaborne transportation are contributing to the rising demand for bunker fuel.

In terms of regional analysis, Asia Pacific is expected to be the fastest-growing and dominating region in the bunker fuel market. The region has a strong presence of major shipping ports and is witnessing significant growth in maritime trade activities. The increasing focus on LNG as a marine fuel in countries like China and Japan is further driving the market growth in the region.

Key players operating in the global bunker fuel market include Chemoil Energy Limited, Aegean Marine Petroleum Network, Inc., World Fuel Services Corporation, Gulf Agency Company Ltd., Gazpromneft Marine Bunker LLC, BP Marine Ltd., Exxon Mobil Corporation, Royal Dutch Shell plc, Bunker Holding A/S, and Lukoil-Bunker LLC. These players are actively engaged in strategic initiatives such as mergers and acquisitions, partnerships, and investments to strengthen their market presence and expand their product offerings.

In conclusion, the global bunker fuel market is expected to witness significant growth in the coming years due to the increasing demand for marine fuels and the adoption of cleaner fuel alternatives like LNG. As regulations related to emissions become more stringent, the demand for bunker fuel with lower sulfur content will continue to rise. The Asia Pacific region is expected to lead the market growth, supported by its robust maritime trade activities. Key players in the industry are focusing on collaborations and investments to enhance their market position and cater to the evolving needs of the shipping industry.

#Bunker Fuel#Bunker Fuel Market#Bunker Fuel Market Growth#Bunker Fuel Market Size#Bunker Fuel Market Share#Bunker Fuel Market Insights#Energy

0 notes

Text

Global LNG Bunkering Market Is Estimated To Witness High Growth Owing To Increasing Adoption of Cleaner Energy Sources

The global LNG Bunkering Market is estimated to be valued at US$592.84 million in 2021 and is expected to exhibit a CAGR of 35.26% over the forecast period of 2022-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

The LNG Bunkering Market refers to the provision of liquefied natural gas (LNG) to ships and vessels for fueling purposes. As the shipping industry strives to reduce its environmental impact, there has been a significant shift towards cleaner energy sources, with LNG being one of the preferred options. LNG offers numerous advantages such as lower emissions, cost-effectiveness, and compliance with stricter environmental regulations. It is increasingly being adopted as a fuel for various types of ships, including container vessels, tankers, and cruise ships.

B) Market Dynamics:

The LNG Bunkering Market is driven by two key factors. Firstly, the increasing adoption of LNG-fueled vehicles is propelling the demand for LNG bunkering. Shipping companies are switching from traditional fuels to LNG to comply with emission regulations and reduce air pollution. Secondly, the growing demand for cleaner energy sources is boosting the LNG bunkering market. Governments worldwide are incentivizing the use of LNG as a fuel by offering tax benefits and subsidies, further driving market growth.

For example, the International Maritime Organization (IMO) has implemented stringent regulations on sulfur emissions from ships, known as the IMO 2020 regulations. These regulations have prompted the shipping industry to adopt cleaner fuels such as LNG to meet the emission standards. Additionally, the availability of LNG infrastructure and the development of LNG bunkering hubs at various ports around the world are further fueling market growth.

C) Segment Analysis:

The LNG Bunkering Market can be segmented based on type, application, and region. Based on type, the market can be further divided into ship-to-ship, truck-to-ship, and port-to-ship bunkering. Ship-to-ship bunkering dominates the market, owing to its flexibility and efficiency in fuel supply operations. It enables ships to refuel while already at sea, reducing downtime and increasing operational efficiency.

D) PEST Analysis:

Political: Governments worldwide are implementing regulatory measures to promote the adoption of cleaner energy sources, including LNG, in the shipping industry.

Economic: The cost-effectiveness of LNG as a fuel and the availability of LNG infrastructure are driving market growth.

Social: Increasing awareness of environmental issues and the need for sustainable shipping practices are contributing to the growth of the LNG bunkering market.

Technological: Technological advancements in LNG storage and transport infrastructure, as well as the development of LNG bunkering vessels, are supporting market growth.

E) Key Takeaways:

The global LNG Bunkering Market is expected to witness high growth, exhibiting a CAGR of 35.26% over the forecast period, due to the increasing adoption of LNG-fueled vehicles and the growing demand for cleaner energy sources.

Asia-Pacific is the fastest-growing and dominating region in the LNG bunkering market, driven by countries such as China, Japan, and South Korea, which have a large shipping industry and strict emission regulations.

Key players operating in the global LNG Bunkering Market include Harvey Gulf International Marine, Petronas, Exxon Mobil Corporation, Total SE, SHV Energy, Gasum Oy, Royal Dutch Shell PLC, Broadview Energy Solutions B.V., Crowley Maritime Corporation, Polskie LNG S.A., Korea Gas Corporation, and KLAW LNG. These players are focusing on expanding their LNG bunkering infrastructure and forming partnerships to cater to the increasing demand in the market.

#LNG Bunkering Market#LNG Bunkering Market Insights#Coherent Market Insights#LNG Bunkering Market High Growth#LNG Bunkering Market Adoption#liquefied natural gas#sulfur oxide emissions#IMO#greenhouse gas emissions

0 notes

Text

Concordia Maritime Cuts Fleet to Three Tankers Selling its Eighth Ship

Concordia Maritime, which had once been a leader in product tankers, continues to sell off its fleet as management reports they continue to explore options for new business. The company went public 39 years ago but was hard hit by the downturn in the tanker markets leading to a sale program that has seen now its eighth tanker sold in less than 18 months.

The company reports it has entered into an agreement for the sale of the product tanker Stena Penguin to an unnamed European buyer. Built in 2010, the tanker is 65,200 dwt typical of Concordia’s focus on mid-range tankers. Stena Penguin had been on a five-year charter, including profit-sharing, to Concordia’s parent company Stena Bulk since a financial bailout in 2021. Stena Bulk in turn had chartered out the vessel on a combination of short and medium-term contracts. The vessel had recently been redelivered to Stena Bulk after a 12-month time charter contract with Exxon.

“We are now divesting another vessel with a good margin,” said Erik Lewenhaupt, CEO of Concordia Maritime. “The sale is being made primarily in the context of the current record strong market for second-hand tonnage.”

The sale process began at the beginning of 2022, seeing two vessels sold in the first quarter and a third in the second quarter. Lewenhaupt explained that the first vessels were sold to avoid docking costs and to strengthen the company’s financial position. The sales were helping liquidity for the company and under the terms of its agreements with the lenders the excess was being used to accelerate amortization of the company’s debt.

Whereas the first sales were having a smaller positive effect on the finances as the market has turned in 2022 the sales changed to an opportunity to harvest value from the fleet. The first sale in January 2022 of the Stena Perros, a 15-year old vessel, was done below book value in part because the vessel was coming up on a required, costly special survey due to its age. The latest sale however is expected to have a positive effect on liquidity of approximately $21 million after the repayment of the remaining bank debt.

The company continued its sales with one additional vessel in July 2022, followed by three sales announced in September. Those vessels were due to be delivered at the end of 2022 and the beginning of 2023. The company sold a total of seven vessels in 2022. They had also explored but later dismissed in mid-2022 as not practical a plan to convert the tankers into containerships.

Concordia’s parent company Stena Bulk along with the banks had come to an agreement in July 2021 to bail out the financially troubled company after six years of mounting challenges. Stena Bulk agreed to vessel charter agreements and a financial guarantee as Concordia worked to address $114 million in outstanding bank debt due in the fourth quarter of 2024.

After the sale of Stena Penguin, which makes the eighth vessel to leave the fleet, Concordia Maritime’s fleet will consist of the three product tankers, Stena Progress, Stena Premium, and Stena Polaris. As has been the company’s market approach, the vessels operate on mid- to longer-term charters which meant Concordia Maritime realized little yield improvement as the market strengthened.

Two of the remaining vessels, Stena Progress, Stena Premium, are currently employed on medium-term contracts under the time charter agreement with Stena Bulk. The third vessel, Stena Polaris, has been chartered out on a bareboat contract to US Crowley Government Services since early 2022. Crowley has in turn chartered the vessel to U.S. Military Sealift Command. The contract with Crowley includes extension options until the end of 2026.

Lewenhaupt reported at the end of 2022, based on high asset values, the company might sell one or more vessels in 2023 if they were able to identify attractive opportunities. He said announcing today’s sale agreement that planning for the future is continuing as they work on a number of options for new business.

0 notes

Text

Drilled Podcast: Using Oil To Take over A Nation

The first episode of season eight of Drilled by Amy Westervelt has a long comet's tail of sordid climate history related to oil companies and their decades-long misinformation campaigns.

Projections created internally by ExxonMobil starting in the late 1970s on the impact of fossil fuels on climate change were uncannily accurate, even surpassing those of some academic and governmental scientists, according to an analysis published in Science by a team of Harvard-led researchers. Despite those forecasts, the multinational energy giant continued to sow doubt about the gathering crisis.

“This paper is the first ever systematic assessment of a fossil fuel company’s climate projections, the first time we’ve been able to put a number on what they knew,” said Geoffrey Supran, lead author and former research fellow in the History of Science at Harvard. “What we found is that between 1977 and 2003, excellent scientists within Exxon modeled and predicted global warming with, frankly, shocking skill and accuracy, only for the company to then spend the next couple of decades denying that very climate science.”

Climate journalist/advocate, Drilled Podcast host and owner of the Critical Frequency podcast network, Amy Westervelt is the perfect person to expose this corporate perfidy and climate crime scene. Westervelt is one of the most prominent and prolific reporters, revealing spin and lies from oil companies in articles and several hit podcasts.

Last year, the producers for the Paramount Plus docuseries Black Gold knew there's one voice you need to tell any story about "the plot to trade our planet for profit" by oil tycoons.

That was Amy Westervelt. In her interview on the documentary, Westervelt helps to frame the narrative, explaining in clear, vivid language the misdeeds and machinations of oil companies in facilitating climate change and then covering their tracks.

Drilled, now in its eighth season, is a true-crime style podcast about climate change. David Wallace Wells of The New York Times called it "eye-opening, gripping, outrageous."

The first episode is about the small South American nation of Guyana.

Several miles off the coast of Guyana sits one of the world’s largest oil reserves. In 2015, ExxonMobil, which had held offshore drilling leases in the country for decades, announced it had found oil and would begin production as soon as possible. Government officials quickly got in line, and in 2019 the first barrels shipped from ExxonMobil Guyana. Today, Exxon projects that oil from Guyana could account for 25 percent of its total production in the next few years.

A key question in the episode is: Why start an oil industry in the midst of a climate crisis? And especially in a country at great risk of climate impacts? Via a contract that will sooner put Guyana in debt than make it a rich oil state, no less?

In just a few years, Exxon has co-opted both government and civil society, buying up social license in every corner of the country. Oil executives and Guyanese officials are still telling the story that oil equals development and prosperity, and on paper Guyana is the fastest-growing economy in the world, but average citizens aren’t benefiting from the boom.

Today, there’s only one journalist left covering the project with any sort of skepticism, and one lawyer left willing to take it on in court.

Five years ago, Kiana Wilburg was a new reporter when ExxonMobil executives and Guyanese government officials announced they had found oil 40 miles offshore. Wilburg and her newsroom had to quickly learn about the industry and this company that was suddenly so influential in their country, and were left with just one question: exactly what kind of deal had the country signed onto?

Listen to the first episode of season eight of Drilled -- "The Boom" -- Westervelt paints a devastating portrait of how the oil industry not only accelerates climate change but also extracts oil at the cost of a small nation's ability to provide for its people, govern fairly, and offer its citizens a bright future.

1 note

·

View note

Text

Automotive Engine Oil Market Demand, Scope and Future Estimation until 2032

The global automotive engine oil market is estimated to increase at a value CAGR of 2.2% and reach a valuation of US$ 55.1 Bn by the end of 2032.

Engine oil’s primary function is to lubricate each component of an engine to reduce friction and avoid excessive power loss. A well-lubricated engine will perform better and burn fuel more effectively. As engine oil works to reduce friction, the surfaces and other engine parts that are vulnerable to this friction are shielded. Without engine oil, engine components run the risk of being damaged, which increases engine emissions. Additionally, the engine is shielded from unwanted chemical reactions such as corrosion.

Growth in the automotive industry, increase in the demand for fuel-efficient vehicles, rising sales of lavish passenger cars, and various automotive requirements such as extending the engine's life, offering low-viscosity engine oil to improve fuel economy, and meeting shifting vehicle pollution criteria established by various government entities are factors acting as significant drivers for the growth of the global automotive engine oil market.

Key Takeaways from Market Study

By grade, synthetic oil is projected to hold a market volume share of 7% by 2032.

By engine type, diesel engines are anticipated to hold the largest market share of 4% by 2032.

By vehicle type, light commercial vehicles will account for a prominent market share of 7% by 2032.

By 2032, North America is expected to hold the largest share of the global market, accounting for 2% share.

“Increasing automotive production and sales, surge in sales of luxurious passenger vehicles & commercial vehicles, and high disposable income are expected to have a beneficial effect on market growth,” says a Persistence Market Research analyst.

Market Landscape

By making technological advancements, industry players attempt to increase their market share. Top players want to collaborate with other manufacturers to grow their companies and their market share worldwide. To improve their total operating efficiency, several key competitors are working on product development.

Some of the key automotive engine oil manufacturers included in the report are Saudi Arabian Oil Co, Total S.A, Exxon Mobil Corporation, BP p.l.c., Chevron Corporation, Sinopec Lubricant Company, and Eni SPA.

Conclusion

The market for automotive engine oil is anticipated to develop over time due to rising demand from end-use application areas such as passenger vehicles, light and heavy commercial vehicles, and other types of automotive. Over the coming years, the market is anticipated to expand with a rise in the automotive sector in developing economies. Manufacturers are focusing on expanding their product portfolios through merger & acquisition activities with other market players.

Key Segments of Automotive Engine Oil Industry Research

By Grade:

Mineral Engine Oil

Synthetic Engine Oil

Semi-Synthetic Engine Oil

By Engine:

Gasoline Engines

Diesel Engines

By Vehicle:

Passenger Vehicles

Heavy Commercial Vehicles

Light Commercial Vehicles

Two Wheelers

By Region:

North America

Latin America

Europe

East Asia

South Asia & Pacific

Middle East & Africa

Want to Know More?

Persistence Market Research, a research and consulting firm, has published a revised market research report on the automotive engine oil market that contains a global industry analysis of 2017–2021 and an opportunity assessment for 2022–2032.

The report provides an in-depth analysis of the market through different segments, namely, grade, engine, vehicle, and region.

For More Info @ https://www.persistencemarketresearch.com/market-research/automotive-engine-oil-market.asp

About FMI – Automotive and Transportation

The Automotive and Transportation division of FMI provides exclusive coverage and actionable insights about the automotive and transportation industry encompassing the automotive, aviation, shipping and marine, and railway sectors. Market findings and competition intelligence of OEM, aftermarket, services, and technology landscape have helped numerous industry stakeholders’ right from automakers, component manufacturers, channel partners, and service providers in taking informed decisions and keeping them up-to-date with market behavior.

0 notes

Text

California Oilfield Contractor, Earth Work, Grading

Able to perform duties with protecting tools, H2S respirator where required. “Shell, Exxon Mobil, all the top oil companies, anticipate us to have all these JSAs in place, as well as to evaluate them with others on site. Then, it’s signed off by a supervisor and nobody strikes until procedures are in place,” says Elliott. Workers have to be educated in correct evacuation and rescue procedures if there’s a toxic gasoline leak. In case staff are uncovered to toxic fuel, first aid ought to be available nearby. All the valves on the truck are self-closing, so if there’s an incident the place you hit one thing or there’s a rollover, the valves all shut by themselves.

We can even respond to oil spills and emergency situations that require vacuum truck service. Specialized vacuum vehicles are primarily used within the gasoline and oil trade, which is why they're also commonly known as oilfield vacuum vans. Oilfield operations for these vans primarily contain the removal of water that continues vacuum truck oilfield to be after the process of hydraulic fracturing. Also, these autos are regularly used in the septic business for cleaning sanitation strains and emptying septic tanks and cesspits. These vacuum trucks make the most of excessive power airflow to suck up solids, liquids, sludges and slurries and feature single-mode filtration for moist or dry material loading with no changeover required.

Established in South Texas in 1988, Paisano Service & Supply Inc. provides Vacuum Trucks and related assist providers to the Texas Oilfield Industry. We are a family owned and operated corporation built on the core values of honesty, respect, consistency, and customer support. F you can not find the brand new or used offshore rigs, vessels or tools of any sort, dimension or make that you are in search of, please send us an email to and we shall offer vacuum truck oilfield you. Some of the products listed include chemical substances recognized to the State of California to trigger most cancers and delivery defects or different reproductive harm. None of our merchandise are intended for use in conjunction with clear ingesting water until acknowledged otherwise. Sign up to receive alerts about other jobs with abilities like those required for the Vacuum Truck Operator.

These industries have underlying pipelines supplying oil and gas all over the region. Any type of pipeline mishap can result in huge losses and destruction. To remove any kind of losses or a catastrophe, you will want to preserve the safety of these pipes. The first step in the direction of sustaining and repairing oil and fuel pipeline is to expose them to the daylight. For those gearing as a lot as purchase the most effective tools, it must be remembers that fracking means water, and water is likely certainly one of the heaviest substances on earth. That fact limits the amount that a water tanker or vacuum tanker can carry.

SSI uses Guzzlers to tug solids, mud and other supplies from tanks and vessels. Services corresponding to production saltwater hauling may be quoted by the hour plus disposal, or on an all inclusive foundation. We are proud to be a number one oilfield service supplier in the Permian Basin.We ship certified CDL Drivers who're licensed, bonded, insured, and working inspected autos. Vacuum vans come beneath Transport Canada regulations relating to the transportation of dangerous goods, Phillips says.

Providing sump clean up, land spreading, rig tank cleansing and street spraying. Tank truck service, including oilfield vacuum truck, the place full suction or rated working pressures are required. Ideal for applications handling crude oil, salt and recent water, tank bottoms, drilling mud, dilute solutions of hydrochloric acids, diesel fuels and sewage transfer. Drillwell owns and operates a contemporary fleet of a hundred thirty BBL vacuum trucks, end-dumps for hauling drill-cuttings, and SuperVacs. We are capable of servicing drilling, completions, and production sites. Whether you're transporting saltwater, drilling mud, HCL acid, cutting slurries, or produced frac flow-back fluids, Drillwell can decide up and ship oilfield fluids to licensed disposal facilities.

A software is an investment, and that funding is cheapened if the quality is not there. Designed particularly for the oilfield, most of those trailers have four-inch loading and unloading valves and degree gauges. Gear pumps or centrifugal product pumps often are mounted on the tractors, and some fleets are utilizing PTO-driven hydraulics to power the pumps. Truck-mounted vacuum tanks have capacities in the 110-barrel vary. “Many of the vacuum truck consumers came out of dump vans or similar gear and really feel extra comfortable with a straight truck over a tractor-trailer,” says Jim Maiorana, president of MAC LTT, a division of MAC Trailer.

Tank degree indicators ought to be monitored to keep away from overfilling the tank. A particular problem in a vacuum truck is components overheating, says Marvin Ferriss, manager vacuum truck oilfield at Alida, Sask.-based Three Star Trucking, a crude oil transport company. When you run a vacuum pump, the compression of air creates a substantial quantity of warmth.

0 notes

Text

The Exxon Valdez Oil Spill

The Exxon Valdez oil spill was a manmade disaster that occurred when Exxon Valdez, an oil tanker owned by the Exxon Shipping Company, spilled 11 million gallons of crude oil into Alaska’s Prince William Sound on March 24, 1989. It was the worst oil spill in U.S. history until the Deepwater Horizon oil spill in 2010. The Exxon Valdez oil slick covered 1,300 miles of coastline and killed hundreds of thousands of seabirds, otters, seals and whales. Nearly 30 years later, pockets of crude oil remain in some locations. After the spill, Exxon Valdez returned to service under a different name, operating for more than two decades as an oil tanker and ore carrier.

On the evening of March 23, 1989, Exxon Valdez left the port of Valdez, Alaska, bound for Long Beach, California, with 53 million gallons of Prudhoe Bay crude oil onboard. At four minutes after midnight on March 24, the ship struck Bligh Reef, a well-known navigation hazard in Alaska’s Prince William Sound. The impact of the collision tore open the ship’s hull, causing some 11 million gallons of crude oil to spill into the water. At the time, it was the largest single oil spill in U.S. waters. Initial attempts to contain the oil failed, and in the months that followed, the oil slick spread, eventually covering about 1,300 miles of coastline. Investigators later learned that Joseph Hazelwood, the captain of Exxon Valdez, had been drinking at the time and had allowed an unlicensed third mate to steer the massive ship. In March 1990, Hazelwood was acquitted of felony charges. He was convicted of a single charge of misdemeanor negligence, fined $50,000, and ordered to perform 1,000 hours of community service.

In the months after the Exxon Valdez oil spill, Exxon employees, federal responders and more than 11,000 Alaska residents worked to clean up the oil spill. Exxon played about $2 billion in cleanup costs and $1.8 billion for habitat restoration and personal damages related to the spill. Cleanup workers skimmed oil from the water’s surface, sprayed oil dispersant chemicals in the water and on shore, washed oiled beaches with hot water and rescued and cleaned animals trapped in oil. Environmental officials purposefully left some areas of shoreline untreated so they could study the effect of cleanup measures, some of which were unproven at the time. They later found that aggressive washing with high-pressure, hot water hoses was effective in removing oil, but did even more ecological damage by killing the remaining plants and animals in the process. One of those areas that was oiled but never cleaned is a large shoreline boulder called Mearn’s Rock. Scientists have returned to Mearn’s Rock every summer since the spill to photograph the plants and small critters growing on it. They found that many of the mussels, barnacles and various seaweeds growing on the rock before the spill returned to normal levels about three to four years after the spill.

Prince William Sound had been a pristine wilderness before the spill. The Exxon Valdez disaster dramatically changed all of that, taking a major toll on wildlife. It killed an estimated 250,000 sea birds, 3,000 otters, 300 seals, 250 bald eagles and 22 killer whales. The oil spill also may have played a role in the collapse of salmon and herring fisheries in Prince William Sound in the early 1990s. Fishermen went bankrupt, and the economies of small shoreline towns, including Valdez and Cordova, suffered in the following years. Some reports estimated the total economic loss from the Exxon Valdez oil spill to be as much as $2.8 billion. A 2001 study found oil contamination remaining at more than half of the 91 beach sites tested in Prince William Sound.

The spill had killed an estimated 40 percent of all sea otters living in the Sound. The sea otter population didn’t recover to its pre-spill levels until 2014, twenty-five years after the spill. Stocks of herring, once a lucrative source of income for Prince William Sound fisherman, have never fully rebounded.

In the wake of the Exxon Valdez oil spill, the U.S. Congress passed the Oil Pollution Act of 1990, which President George H.W. Bush signed into law that year. The Oil Pollution Act of 1990 increased penalties for companies responsible for oil spills and required that all oil tankers in United States waters have a double hull. Exxon Valdez was a single-hulled tanker; a double-hull design, by making it less likely that a collision would have spilled oil, might have prevented the Exxon Valdez disaster.

The ship, Exxon Valdez—first commissioned in 1986—was repaired and returned to service a year after the spill in a different ocean and under a different name. The single-hulled ship could no longer transport oil in U.S. waters, due to the new regulations. The ship began running oil transport routes in Europe, where single-hulled oil tankers were still allowed. There it was renamed the Exxon Mediterranean, then the SeaRiver Mediterranean and finally the S/R Mediterranean.

In 2002, the European Union banned single-hulled tankers and the former Exxon Valdez moved to Asian waters. Exxon sold the infamous tanker in 2008 to a Hong Kong-based shipping company. The company converted the old oil tanker to an ore carrier, renaming it the Dong Feng Ocean. In 2010, the star-crossed ship collided with another bulk carrier in the Yellow Sea and was once again severely damaged. The ship was renamed once more after the collision, becoming the Oriental Nicety. The Oriental Nicety was sold for scrap to an Indian company and dismantled in 2012.

0 notes

Text

Just finished watching a really great Wendover Productions video where he makes the case that the pandemic has caused a fundamental shift in the priorities of the oil and gas industry, with high prices ultimately representing the shutdown of the oil and gas industry as investors no longer believe in a long term future for carbon extraction, and shift to focus on long-term investment in renewables.

It's a long video, so here's the money quote:

U.S. shale oil producer's reinvestment rates—that is, the share of cash flow going back into the business rather than out to investors—is at an all-time low. Whereas last time oil prices sat at a comparable level the reinvestment rate was quite literally off the chart, today, less than half of their money is being put back into the business. This [capex] investment is typically what would go into developing new rigs—but today it's just getting paid out as profit.

Companies have the ability to produce more—the US Bureau of Land Management has exactly 9,000 approved-but-unused drilling permits on record—but companies just don't have the appetite to drill. Industry-wide, it's the same situation. Exxon-Mobil, Shell, Chevron and BP's capital expenditures are each at or near all-time lows. Simply put, oil companies aren't investing in the future anymore. They're investing in now.

This is not a misinformed strategy. Out of the S&P 500 index's 11 distinct sectors, the energy sector (made up almost exclusively of oil and gas companies) has been by far the lowest performer since 2007. The sector only gained 41.7% in value across that era, which means it was actually flat with inflation. The oil and gas industry simply is not a good investment anymore, and so it's no surprise that it's not getting investment from outside or in.

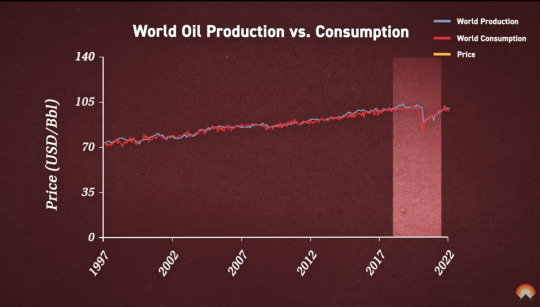

While it's up to debate whether we've reached "peak oil", it'd be much easier to argue that we've reached peak oil investment. Because of the temporary, finite nature of any oil supply, a relatively high level of investment is needed just to keep production capacity stable. When the world looked like this [rising demand from 1997-2020]—when climbing oil demand was all we knew—the logic behind investing 5.5 billion dollars in a single pipeline was sound.

But now with the world looking like *this*—with the future of demand looking less confident than ever—even investing a couple tens of millions in a single fracking rig is risky.

Oil going negative appeared to spur a fundamental mindset change among oil executives and investors. After having spent the past decades watching both the power of scarcity and the ruin of abundance supplies become the enemy, oil's under more pressure than ever to deliver profits now—because confidence in the future has been lost. Exxon-Mobil, Shell, Chevron and BP each successfully posted record profits in 2021, and this can continue.

The end of oil is near. The momentum is already too strong. Renewables are taking over. But the orchestra can keep playing as the ship goes down—in an era where there is no future industry growth to capture, scarcity is the name of the game. If oil companies keep supply tight, they'll keep prices high and capture consistent profits even as they *add* to the incentives of renewables.

This appears to be the dominant strategy. The alternative would be to keep prices low to slow down the switch, but considering the driving force behind the transition is the prevention of the destruction of the planet, rather than the search for a more cost effective source of energy, the profit-focused approach appears the most intuitive.

Astonishingly, this means that the oil industry is ceding the market. They've lost. They're shepherding in renewables, but they're not going down without a fight. Moving to a carbon-less world will take time and the oil industry can shrink faster than renewables can grow. Therefore—short of a fundamental strategy shift by one of the world's largest industries—the era of high fuel prices is here to stay. For those unable or unwilling to transition early, the weight will cost them. For those who held onto ownership in the sector, they're starting to experience one last great rally. Because the oil industry's party at the end of the world just started.

I dunno! it's a neat video! It does make me want to increase oil regulation by just staggering amounts though. They've already lost the fight, so who cares? Nationalize the oil supply to ensure an orderly transition.

115 notes

·

View notes

Text

Global Bunker Fuel Market Is Estimated To Witness High Growth Owing To Emerging Environmental Concerns

The global Bunker Fuel Market is estimated to be valued at US$ 26.93 billion in 2022 and is expected to exhibit a CAGR of 7.1% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Bunker fuel refers to the fuel oil used by ships and other marine vessels. It is a residual fuel that is highly viscous and heavy, which makes it ideal for powering large marine engines. Bunker fuel is primarily derived from crude oil and is classified into different grades according to its sulfur content. The sulfur content in bunker fuel plays a crucial role in determining its environmental impact. With increasing environmental concerns and regulations, there is a growing demand for low-sulfur bunker fuels that can help reduce emissions from shipping activities.

B) Market Key Trends:

One key trend shaping the global bunker fuel market is the implementation of stricter environmental regulations. The International Maritime Organization (IMO) has set limits for sulfur content in bunker fuel to reduce air pollution from ships. The IMO's regulations, known as IMO 2020, require ships to use bunker fuels with a sulfur content of no more than 0.5%. This has led to increased demand for low-sulfur bunker fuels and the development of new technologies and solutions to meet these requirements.

For example, companies such as Exxon Mobil Corporation and Royal Dutch Shell plc have invested in technologies like scrubbers and liquefied natural gas (LNG) as alternative fuels to comply with the sulfur content regulations. Scrubbers are used to remove sulfur oxides from ship exhaust gases, while LNG significantly reduces sulfur and other emissions compared to traditional bunker fuels.

C) PEST Analysis:

Political: The political landscape plays a crucial role in shaping the bunker fuel market. Government regulations and policies, such as sulfur content limits, emission control areas (ECAs), and carbon pricing initiatives, impact the demand and supply dynamics of bunker fuels.

Economic: Economic factors, such as global trade and economic growth, influence the demand for bunker fuels. With increasing maritime trade and economic development in emerging economies, the demand for bunker fuels is expected to grow.

D) Key Takeaways:

The global Bunker Fuel Market Analysis is expected to witness high growth, exhibiting a CAGR of 7.1% over the forecast period, due to increasing environmental concerns and regulations. The implementation of stricter sulfur content limits and the need for cleaner shipping fuels are driving the demand for low-sulfur bunker fuels.

In terms of regional analysis, Asia Pacific is expected to be the fastest-growing and dominating region in the bunker fuel market. The region's growing maritime trade, expanding ports, and increasing investments in LNG bunkering infrastructure contribute to its market dominance.

Key players operating in the global bunker fuel market include Chemoil Energy Limited, Aegean Marine Petroleum Network, Inc., World Fuel Services Corporation, Gulf Agency Company Ltd., Gazpromneft Marine Bunker LLC, BP Marine Ltd., Exxon Mobil Corporation, Royal Dutch Shell plc, Bunker Holding A/S, and Lukoil-Bunker LLC. These companies are investing in technology development, collaborations, and acquisitions to gain a competitive edge in the market.

In conclusion, the global bunker fuel market is witnessing high growth due to emerging environmental concerns and stricter regulations. The demand for low-sulfur bunker fuels is increasing, leading to technological advancements and investments in alternative fuel solutions. Asia Pacific is expected to dominate the market, driven by its booming maritime trade. Key players are adopting strategies to stay competitive in this evolving market landscape.

#Bunker Fuel#Bunker Fuel Market#Bunker Fuel Market Size#Bunker Fuel Market Growth#Bunker Fuel Market Demand#Energy

0 notes