#Federal Labor Law Posters

Text

Brian Greig on the 'disinviting' of NSW Police

New Post has been published on https://qnews.com.au/brian-greig-on-the-disinviting-of-nsw-police/

Brian Greig on the 'disinviting' of NSW Police

Former federal senator and veteran LGBTI advocate Brian Greig on the ‘disinviting’ of NSW Police from the Sydney Gay and Lesbian Mardi Gras Parade.

For those who don’t live in Sydney, yesterday’s announcement that NSW police will be barred from marching in the Mardi Gras this year must seem baffling.

How does the tragic murder of Jesse Baird and Luke Davies justify the Mardi Gras Board in “disinviting” the police contingent? Are police responsible for the murder? Was this a hate crime?

No.

Historical hate crimes

There are deeper issues here to be sure. A recent inquiry into historical hate crimes against LGBTI people in NSW uncovered some ugly truths and illustrated some police obfuscation in coming forward with details.

But this doesn’t explain the emotional reaction to these murders and the Mardi Gras ruling.

These deaths have caused a visceral reaction because they shatter the narrative. The Sydney-bubble narrative that it is a utopia for gays, where you can be young, beautiful, successful,

Instagramable, in love and blissfully happy.

These murders killed that Bambi.

These murders reminded everyone that it can all be stripped away suddenly. That the illusion is shallow.

That for all the attitudinal changes and law reforms, the Sydney model of delirious gaydom can be torn down in seconds. That your very safety and security is just a borrowed gun away. And it hides on the smile of a young lover, who himself was part of the Sydney dream as an out gay cop.

Worst anti-LGBTI laws in the country

NSW has the worst anti-LGBTI laws in the country. Despite all the Mardi Gras hype and World Pride bullshit, LGBTI people in NSW largely have the weakest legal protection (or no protections), in the country. It is not a gay utopia, it’s a basket case. Posthumous poster boys like Jesse and Luke can no longer hide that.

As the plebiscite on marriage quality showed, NSW produced the deepest NO vote in the greatest number of seats. It has the most anti-gay clerics and MPs within both the Liberal and Labor parties.

Even the inquiry into hate crimes was itself a deflection from deeply needed law reform in other areas.

But the core problem in NSW, within the LGBTI elites who control and manipulate inner city politics, is that they are so often compromised by government funding and political connections to the ALP that they cannot or will not speak out.

Instead, they involve themselves in the creative inertia of inquiries, research and surveys into LGBTI discrimination. Anything other than a concerted campaign on law reform – that would require putting real critical pressure on the government. They won’t do it.

So within this pressure cooker of anger, frustration, disillusionment, inaction and distraction, how does the Sydney LGBTI community express outrage over chronic, systemic discrimination?

It blames the police.

LGBTI domestic violence

Sadly, the underlying story here – one of LGBTI domestic violence – is lost in the howls of pain and anguish from the LGBTI community trying to make sense of all this but looking in the wrong direction.

If there is anything positive to salvage from this tragic tale, it’s these two things.

1.) Same-sex couples can and do experience domestic violence, and just like other forms of DV, can be very reluctant to come forward. Often for understandable reasons. These tragic murders must be used to highlight this, and look to solutions.

2.) Substantive law reform is required in NSW across a range of LGBTI fronts, and both the LGBTI community and the state Labor government must confront this.

As for the police in Mardi Gras, I think they should march. We must build bridges with the various arms of government, not burn them down. If nothing else, we owe that to the many LGBTI police officers who are there to make a difference. And they can. If there is no engagement, there is no progress.

And on this, parliament must lead.

In the meantime, the Mardi Gras Board might be wise to capitalise on the media intensity around this issue and ensure that the very first float to move down Oxford Street this Saturday is one that draws attention to domestic violence. Not just in our community, but all communities.

Police find bodies of couple Jesse Baird and Luke Davies.

NSW Police uninvited from Sydney Mardi Gras parade.

Manhunt for missing couple Jesse Baird and Luke Davies

Beau Lamarre-Condon charged with couple’s murder

1800RESPECT is the national domestic, family and sexual violence counselling, information and support service.

If you or someone you know is experiencing, or at risk of experiencing, domestic, family or sexual violence, call 1800RESPECT on 1800 737 732. Chat online via their website, or text 0458 737 732.

For the latest LGBTIQA+ Sister Girl and Brother Boy news, entertainment, community stories in Australia, visit qnews.com.au. Check out our latest magazines or find us on Facebook, Twitter, Instagram and YouTube.

1 note

·

View note

Text

Reliance Staffing of Michigan to Pay $181K in Back Wages

The U.S. Department of Labor Recovered $181K for 70 Nurses and assistants who were Denied Overtime After Michigan Company Reliance Staffing, LLC Misclassified Them as Contractors.

(STL.News) The U.S. Department of Labor (DOL) released the following information on February 5, 2024:

Employers: Reliance Staffing LLC - Fahim Uddin, owner

Actions: Fair Labor Standards Act consent judgment

Courts: U.S. District Court for the Eastern District of Michigan

Investigation findings: On February 2, 2024, Judge Sean F. Cox in the U.S. District Court for the Eastern District of Michigan entered a consent judgment requiring Reliance Staffing LLC and its owner, Fahim Uddin, to pay a total of $181,531? representing $90,765 in overtime wages and an equal amount in liquidated damages ? to 70 registered nurses, licensed practical nurses and certified nursing assistants.

An investigation by the U.S. Department of Labor's Wage and Hour Division found that Uddin and Reliance Staffing misclassified their workers as independent contractors when, in fact, they were employees. By doing so, the employer failed to pay overtime wages at time and one-half their hourly rate of pay for hours over 40 in a pay period.

On September 22, 2023, the department filed a complaint in federal court against Reliance Staffing and Uddin, seeking back wages and damages for the employees' violations of the Fair Labor Standards Act's overtime provisions.

Under terms of the consent judgment, Uddin and Reliance Staffing will make the back wages payments in installments through August 1, 2024, and must also provide employees with Wage and Hour Division fact sheets and verify that the division's workers' rights posters are posted and visible at each of their locations.

The Bingham Farms, Michigan, company recruits and employs registered nurses, licensed practical nurses, and certified nursing assistants.

Quote: "The resolution of this case will restore hard-earned wages denied to employees of Reliance Staffing who performed demanding care work," explained Wage and Hour District Director Timolin Mitchell in Detroit. "When employers misclassify workers as independent contractors, they do not pay applicable employment taxes or workers' compensation on their behalf, and they deny them protections under the Fair Labor Standards Act."

"The Department of Labor is committed to ensuring workers receive their rightfully earned pay," added Regional Solicitor Christine Heri in Chicago. "We will use all legal tools necessary to compel employers to abide by the law."

SOURCE: DOL

Read the full article

0 notes

Text

damn employment law giving me trouble again. i can't understand which labor law posters (state and federal) are required D:

#authorial rambles#cal goes to school#i keep finding conflicting information from the IDOL and DOL and SHRM#so idk i'm going to add all of them and we'll see what the fuck happens

1 note

·

View note

Text

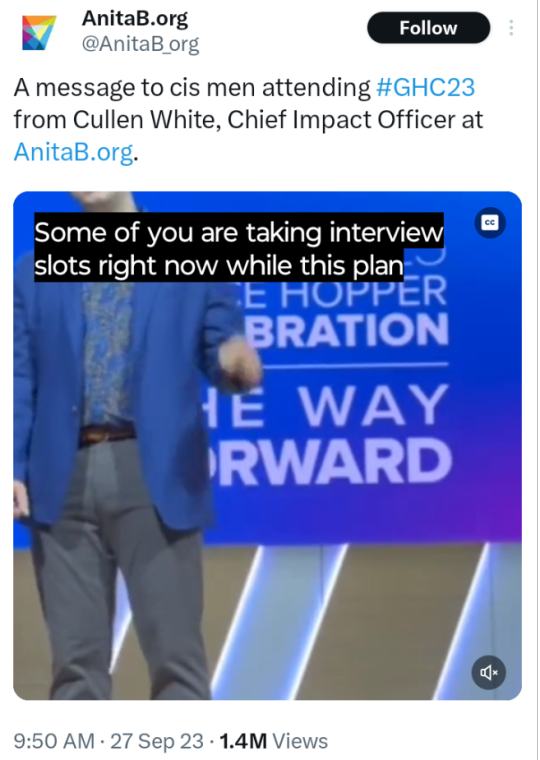

"Tech workers said they saw unusually high numbers of men in a monster line for a career expo at a tech conference aimed at elevating women and nonbinary workers.

@tamanana YouTube/Screenshot by NPR

An event meant to be a career-builder for women and nonbinary tech workers turned into yet another symbol of the industry's gender imbalance after self-identifying men showed up in droves.

The Grace Hopper Celebration takes the name of a pioneering computer scientist and bills itself the world's largest annual gathering of women and nonbinary tech workers.

Tickets for the four-day event, which took place in Orlando, Fla., last week, ranged in price from $649 to $1,298, and included a coveted chance to meet one-on-one with sponsors such as Apple, Amazon, Salesforce and Google.

Women are returning to the job market in droves, just when the U.S. needs them most

Women are returning to the job market in droves, just when the U.S. needs them most

With some 30,000 annual attendees, that career expo was already a competitive space, according to past participants. But this year, access was even more limited by what the organizers described as "an increase in participation of self-identifying males."

Videos posted to social media showed scenes of men flocking around recruiters, running into event venues and cutting in front of women to get an interview slot. Footage showed a sea of people, hundreds deep, waiting in line for a chance to enter the career expo.

As one poster put it, "the Kens had taken over Barbieland."

Some of the attendees had lied about their gender identity on their conference registrations, said Cullen White, the chief impact officer with AnitaB.org, the nonprofit that organizes the conference.

"Judging by the stacks and stacks of resumes you're passing out, you did so because you thought you could come here and take up space to try and get jobs," White said during the conference's plenary address. "So let me be perfectly clear: Stop. Right now. Stop."

Tech jobs were once a safe bet for workers looking for stable, lucrative careers. But an industrywide wave of layoffs earlier this year left hundreds of thousands of workers suddenly without a job.

Women were disproportionately affected by those cuts, making up 69.2% of all tech layoffs, according to The Women Tech Network. And that's on top of the industry's ongoing gender imbalance. Women hold just 26% of jobs across all STEM occupations and even less — 24% — in computer fields, according to the latest available data from the U.S. Department of Labor.

Bo Young Lee, AnitaB.org's president, said in a video post that the shift in demographics had robbed the conference of the joyous and supportive atmosphere that had helped previous conference-goers grow.

"We tried to create a safe space. And this week, we saw the outside world creep in," she said. "I can't guarantee you that we'll have solutions tomorrow. But I can promise you that we'll be working on solutions, and we won't do it in a bubble."

Earlier in the week, the organization addressed calls to ban men from the conference by saying that "male allyship is necessary" to work toward overall inclusivity and also that federal law prohibited discrimination based on gender.

NPR reached out to AnitaB.org for additional comment but had not received a response by the time this article was published."

You know, I was completely ready to support this organization, AnitaB but then I see this, proudly displayed on their blog. CIS IS A SLUR. This is actually on closer inspection, a Leftist organization. As far as the public is concerned, there's no way of knowing if this wasn't in fact a stunt. There's currently a lot of enthusiastic insult trading going on over on Twitter. It's no wonder NPR ran the story and that Google, Apple and Salesforce were in attendance.

#Apple Amazon Salesforce Google#Gender#Women In Tech#Anita B#Leftist Organization#World Economic Forum#CIS IS A SLUR

0 notes

Text

USALaborLawSigns is your trusted source for labor law posters and compliance solutions. We specialize in providing businesses with mandatory federal and state labor compliance posters, as well as combination labor law posters, to help you stay in full compliance with labor regulations. Our comprehensive selection of posters ensures that you have the latest labor law updates conveniently displayed in your workplace, reducing the risk of fines and penalties. Count on us to simplify your labor law compliance process and keep your business legally protected.

0 notes

Text

How Does the Fair Labor Standards Act Protect Employees?

In 1938, the Fair Labor Standards Act was passed which protects employees’ rights to fair wages. Also known as the FLSA, this law protects employees by placing regulations on interstate commerce employment. It oversees things like child labor, minimum wage, and overtime pay; and has standards for both salaried employees and those paid by the hour.

What is the Fair Labor Standards Act?

The FLSA is a federal law that oversees wage regulations for both full and part time employees whether they are employed by a private company or government employer. It regulates things such as the minimum wage, child labor, recordkeeping, and overtime. Federal minimum wage was increased to $7.25 in 2009 and has not been raised since. Generally, if employees work more than forty hours per workweek, they should be paid ‘time and a half’ which is 1.5 times their regular rate of pay.

Who is Protected By the FLSA?

The Fair Labor Standards Act protects employees of public agencies, interstate commerce, production of commercial goods, domestic service, hospitals, schools, and other education facilities. Independent contractors and volunteers are not legally considered employees, and as such, are not protected by the standards and regulations of the FLSA. Employees who are eligible for overtime compensation are required to complete a record of their attendance and times worked.

Primary Areas of Coverage in FLSA

Minimum Wage – The FLSA maintains the federal minimum wage. As of 2009, the minimum wage has been $7.25 per hour. While states are free to set their own minimum wage rates, the only states with a minimum wage lower than the federal rate are Georgia and Wyoming. Both states pay a minimum wage of $5.15 per hour, although employers who are subject to FLSA regulations are required to pay no less than the federal minimum.

Overtime – If an employee is sixteen or older, they may work as many hours as their employer allows. However, if an employee works more than forty hours in a workweek, they may be entitled to overtime pay. Overtime pay must be at least one and a half times the normal hourly rate of pay for the employee.

Hours Worked – The FLSA oversees all time that an employee is doing their job either on site, on duty, or at a designated location.

Recordkeeping – The FLSA requires that employers keep accurate records of employee timecards and payroll. They must also have an official poster of FLSA requirements displayed for employees.

Child Labor – The FLSA maintains regulations that ensure that work does not interfere with a child’s education or best interests. It also limits the types of jobs that children can work and the conditions they can work under.

FLSA Minimum Wage Protections

Though the FLSA maintains a federal minimum wage of $7.25 per hour, many states have instituted their own laws that set their own minimum wage. The FLSA does not govern state law outside of provisions that are in line with preexisting FLSA requirements.

California Minimum Wage

As of January 2023, the state imposed minimum wage in California is $15.50 per hour for all employers. In the past, employers with 26 or more employees were required to pay slightly more than employers with fewer employees. California minimum wage has been rising steadily for years now:

Minimum Wage by Year

FLSA Overtime Protections

The FLSA maintains that an employer must pay covered non-exempt employees time and a half for any time worked over forty hours in a given work week. This does not include paid time off. A work week might not line up with what is considered a calendar week but is a fixed increment of 168 hours. While the work week may vary for different employees, employers are prohibited from averaging hours beyond the confines of a given work week. Furthermore, overtime pay must generally be paid out on the pay period in which it was earned.

Classifying Employees Under FLSA

It is important to know whether a worker is an employee or an independent contractor. Not only are there differences in the rights and benefits, but employers may face fines and legal action if they are caught misclassifying their workers. There are many questions that can be asked to help determine if a worker is an employee or an independent contractor:

Does the employer or the worker determine when and how the work is done?

Does the employer or the worker determine what the worker’s responsibilities are?

Does the employer or the worker provide the supplies and equipment needed?

Does the employer or the worker pay the payroll taxes?

Does the employer or the worker set the rate of pay?

Who is Exempt from Minimum Wage & Overtime Wages?

If an employee is considered nonexempt, then their employer is required to pay them overtime. If an employee is considered exempt, then their employer is not required to pay them overtime. While there are some jobs that are considered exempt in of themselves, there are three conditions that must be met to determine if an employee is considered exempt, such as:

The amount the employee is paid – Generally $35,568 or more a year

The way they are paid – Generally salary

The type of work performed – As defined by FLSA regulations

Freelance workers and independent contractors are not covered by the FLSA. Employers with less than $500,000 a year in sales as well as small farms that do not engage in interstate commerce are also exempt. Other exempt workers also include:

Executives who manage at least two people and authorize job status of others

Administrators who directly work for management and control their own work duties

Outside salespeople who work primarily offsite and on commission

Computer workers paid at least $684 weekly by salary or fee basis

Workers employed by seasonal recreation establishments

Employees of small local newspapers including delivery workers

Sailors on foreign vessels

Personal caregivers such as homecare aides and babysitters

Employees working under an apprenticeship

Record Keeping That Meets FLSA Standards

When an employer is covered by the FLSA, they must keep detailed records for their non-exempt employees. While there is no uniform standard for how these records are kept, there are specific pieces of information that need to be recorded with complete accuracy for each employee:

Full Name

Social Security Number

Date of Birth (employees under 19)

Sex

Occupation

Start of Workweek Day and Time

Daily Hours Worked

Workweek Hours Worked

How wages are paid

Pay Rate by Hour

Total Straight-time Earnings

Workweek Overtime Earnings

Wage Deductions and Additions

Wages per Pay Period

Dates of Pay Period

Date of Payment

Different types of records must be kept on file for different lengths of time. Payroll, collective bargaining agreements, and sales or purchase records must be kept for at least three years. Things like timecards, work schedules, and other methods for computing wages must be kept for at least two years. These records should be kept on site or at a central record keeping office. Employers are required to make these records open and available for Division inspection.

How FLSA Defines and Regulates Hours Worked

The law defines the word ‘employ’ as “to suffer or permit to work”. The time that an employee spends on site or on duty is considered part of their workweek. The workday begins when the employee first starts working and ends when the employee completes their work. The workday often includes more than just hours worked. There are many different classifications of hours under the FLSA and variables that determine if they are considered working hours.

Waiting – There are two different kinds of waiting time. Being engaged to wait is considered work time such as short periods of down time between tasks. Waiting to be engaged is not considered work time such as free time between jobs.

On Call – An employee is considered working while on call if they are required to stay on site. Generally, if an employee is free to go about their day, they are not considered working while on call. The extent of that freedom may change whether or not the employee is considered working.

Breaks – Short breaks, often five to twenty minutes, are generally considered to be part of hours worked and are paid time. Employers may implement their own consequences for employees taking extended breaks and may be permitted to not count the extra time as time worked. Meal breaks, often thirty to sixty minutes, are usually not considered to be part of hours worked and are unpaid so long as the employee is completely free of their work responsibilities while on break.

Sleep – If an employee is on duty for shifts of twenty-four hours or longer, they may negotiate unpaid sleeping breaks with their employer. These breaks must be more than five and less than eight hours and the employer must provide a proper sleeping area. For shifts shorter than twenty-four hours, authorized sleeping breaks are considered time worked.

Training & Meetings – There are four factors that must apply in order for a meeting or training program to be unpaid: Outside of working hours, attendance is voluntary, unrelated to the employee’s job, and no work is required to be done.

Daily Commute – Regular travel time from home to work and back is not considered hours worked.

One Time Extended Commute – If an employee routinely works at one location and is required to go to another location in another city for a day, the additional commute time may be considered time worked. Employers are permitted to exclude the employee’s normal commute time from those hours.

Daily Travel – Some jobs may require travel as part of the employee’s duties such as deliveries or traveling between job sites. This travel time is considered hours worked.

Trips – If an employee is required to travel for work and is kept away overnight, this is considered travel away from home and is hours worked. Not only is working time counted, but also work hours on days off while away.

FLSA Regulations on Child Labor

There are many restrictions on the type of work that employees under eighteen years old may be permitted to perform as well as the conditions under which they are permitted to work. The FLSA does not allow minors to work jobs that they consider hazardous to the minor’s wellbeing or education. There are also restrictions governing the hours a minor is allowed to work and the breaks they must be provided. Each state also has their own laws regulating child labor that employers should be aware of.

Recent FLSA Updates

The 2018 amendments to FLSA regarding tipped employees were updated in 2020 and 2021. The new regulations forbid employers from taking any part of the employee’s tips and also updated the restrictions on when an employer can alter an employee’s pay based on earned tips.

The Joint Employer Rule was rescinded in July of 2021.

The United States Department of Labor recently began proposal of a new rule to update the regulations and guidelines for determining if a worker is an independent contractor or an employee in accordance with the FLSA. This rule was proposed in October of 2022, replacing the January 2021 rule with a more accurate and precise method for classification. The rule is considered mutually beneficial for both workers and employers, reducing the risk of employee misclassification, and increasing employer confidence and peace of mind when hiring independent contractors.

Common Violations of FLSA

Unfortunately, there are many ways in which employers can and do violate the Fair Labor Standards Act:

Misclassification – Employers may sometimes classify an employee as exempt based on their job title or type of pay rate even though the job duties and amount of pay indicate that the employee is nonexempt. It is important for employers to be mindful of all the variables of a situation and for employees to be well informed of their rights.

Not compensating off the clock work – When an employee works beyond their scheduled time, even if they are clocked out, that is still considered hours worked and the employee should be compensated. Even if the employer did not request or permit the off the clock work, they are still responsible for paying the employee.

Not compensating working breaks – When an employee is expected to be on call through their breaks, or works through their lunch, that time is considered hours worked and the employee must be compensated. In order for a break to be unpaid, the employee must not be performing any job-related duties such as cleaning, replying to emails, or interacting with clients.

Overtime waivers – If an employer has an employee sign a document waiving their right to overtime pay, that document is invalid and unenforceable.

Averaging workweeks – Sometimes, an employer may average out the number of hours an employee has worked over two or more weeks to avoid paying overtime. If an employee takes a day off one week and then works an extra eight hours the next week, the employer may average those hours out to say the employee worked forty hours each week. This may seem mathematically logical, but it is actually legally prohibited.

What to Do If Your Employer Violates the FLSA

Because there are employers who will violate FLSA, employees must be aware of the options available to them and the steps to take if they find themselves in such a situation. Complaints regarding FLSA violations can and should be filed with the Department of Labor’s Wage and Hour Division.

The WHD investigates violation claims by having a representative conduct interviews with the employer and various employees, research payroll and timecard documents, and gather any other information that may indicate if a violation has been committed.

The person who files the complaint does not need to be the person against whom the violation was committed. Anyone who witnesses their employer violating the FLSA may report that violation.

It is prohibited for an employer to retaliate against an employee who has filed a complaint or participated in an investigation against them.

How to File FLSA Complaint

When filing a complaint with the WHD, there are several details you will need to provide:

Your name

Your address

Your phone number

The company’s name, address, and number

Owner/employer/manager name

Your job duties

Your pay rate and method

It is good to be as detailed as possible when providing information. Your complaint is the starting point of their investigation. When filing a complaint as a third party, you may not have all of the information needed, but it is important to share as much as possible.

Contact Mesriani Law Group if You Have Experienced a FLSA Violation

The Fair Labor Standards Act exists to protect workers and their right to fair wages. All too often, employers try to circumvent the law and get away with cheating their employees out of the money they’ve earned. When these violations occur, employees have the right to file complaints against their employers. If you are facing retaliation for filing a claim with the Department of Labor or participating in an investigation against your employer, call Mesriani Law Group today for a free consultation.

Fair Labor Standards Act FAQs

What are the four main elements of the FLSA?

There are four primary areas established and enforced by the Fair Labor Standards Act. Establishing and enforcing minimum wage, overtime pay, regulations for recordkeeping, and regulations for child labor. While some jobs and employees may not be covered by the FLSA or exempt from overtime, the act generally applies to part time as well as full time workers of both private and government employers.

What are some common mistakes made under FLSA?

Whether intentional or accidental, there are employers who do not adhere to the regulations set forth by the FLSA. One of the most common mistakes employers make is misclassifying their employees. Not paying overtime properly and allowing employees to work off the clock or during their breaks without compensation are also violations that occur far too often. It is important for everyone on both sides of an employment relationship to be familiar with the law and how it applies to them.

What is not regulated under the Fair Labor Standards Act?

There are several aspects of employment that the Fair Labor Standards Act does not oversee. This includes but it not limited to things like the payment of wages in excess of FLSA requirements, lunch and rest breaks, termination letters, and final payments for terminated employees. The FLSA also does not regulate paid time off. It is important to also be aware of state laws and regulations pertaining to all employment matters.

#California Employment Law#Fair Labor Standards Act#FLSA#Employment Law#Employment Lawyers#California Attorneys

0 notes

Text

my job is breaking so many labor violations they got the schedule posted with one supervisor working literally 23 consecutive hours right above the federal labor law poster

0 notes

Text

0 notes

Text

Happy MLK Day!

Happy Martin Luther King Jr. Day!

#OnThisDay (well, almost) Martin Luther King Jr. was born on January 15th, 1929. Observed on the third Monday in January every year, MLK Day is a federal holiday to celebrate the achievements, dedication, and legacy of MLK .

Notable for much, but especially for his staunch advocacy of the intersection and intertwining of the civil rights and labor movements, MLK's multi-movement advocacy helped boost both. "Our needs are identical with labor's needs," MLK said, and his work in supporting union membership, standing on picket lines, and expressing solidarity with workers supported similar goals of the civil rights movement. As detailed in a March on Washington for Jobs and Freedom poster, he was a leader in the fight for meaningful civil rights laws AND full and fair employment.

Here, he is pictured giving a speech at #AFL while George Meany listens on.

#CornellRAD #LaborArchives #LaborHistory #ArchivesOfInstagram #AllLaborHasDignity #KheelCenter #ILRSchool #LaborRights #Strikes #WorkingWednesday #MartinLutherKingJr #MartinLutherKingJrDay #MLK #MLKDay #CivilRights #CorettaScottKing #HappyBirthday #AmericanFederationOfLabor @Cornell_Library @CornellILR @ILRSchool @CornellTextileIndustry @CornellFashionCollection

0 notes

Text

Casa Tequila LLC in Wisconsin Cheated Employees of Wages

U.S. Department of Labor Finds Wisconsin Restaurant Operator Casa Tequila LLC Shortchanged More Than 100 Employees More Than $272,000 in Wages

Casa Tequila LLC in Wisconsin violated federal regulations, including child labor laws

PEWAUKEE, WI (STL.News) The U.S. Department of Labor has found the operator of four Wisconsin restaurants, Casa Tequila LLC, violated several federal regulations, denying 110 servers, cooks, and other employees earned wages and tips and employing three minors to work later and longer hours than the law permits.

Investigators with the department’s Wage and Hour Division determined Casa Tequila LLC of Pewaukee and owner Maria Campuzano operated an invalid tip pool at its Pewaukee restaurant, failed to pay the proper overtime rate of pay when required, and miscalculated overtime wages due to some employees. In addition to Pewaukee, the investigation covered the employer’s restaurants in Hartford, Waukesha, and West Bend, Wisconsin.

The division found Casa Tequila owes the affected employees a total of $272,177 in back wages.

“Violations like those found in our investigation of Casa Tequila are all-too-common in the food service industry,” explained Wage and Hour Division District Director Kristin Tout in Minneapolis. “Restaurants often employ people unfamiliar with their legal rights and protections as workers and who may be fearful about raising or reporting their concerns. Workers concerned about their employer’s pay practices can contact the Wage and Hour Division, anonymously if they prefer, to ask questions and to understand their rights better.”

Investigators determined Casa Tequila violated the Fair Labor Standards Act’s minimum wage, recordkeeping, and child labor provisions when it:

- Operated an invalid tip pool at the Pewaukee location by including kitchen staff and cooks, which are not tipped occupations. By doing so, the employer lost its ability to claim credit for tips toward its minimum wage and overtime obligations for tipped employees, such as servers.

- Based the overtime rate paid to tipped employees on their cash wage rather than minimum wage, which led to overtime violations.

- Failed to include all of the compensation Pewaukee cooks earned in their average hourly rate of pay for overtime purposes. Since the employer illegally included cooks in the tip pool, the tips they received must be included in their regular rates of pay to determine their required overtime wages.

- Paid straight-time rates instead of time and one-half for hours over 40 in a workweek at all locations.

- Employed three children between the ages of 14 and 15 past 9 p.m. and for more than 8 hours at its West Bend and Waukesha locations in violation of federal child labor standards.

- Failed to display Fair Labor Standards Act posters as required.

In addition to requiring payment of back wages, the division assessed $2,373 in civil money penalties to Casa Tequila LLC for its child labor violations.

“Restaurant operators are legally required to understand and comply with federal laws governing how tipped and hourly workers’ wages must be paid and how young workers can be employed safely with a schedule that does not interfere with their education or well-being,” Tout added. “Employers who fail to comply will be held accountable, and the Wage and Hour Division will do everything in its power to recover wages owed to employees.”

The locations covered, the number of affected employees, and the total back wages owed are as follows:

- Casa Tequila Peqaukee - 1405 Capitol Drive - 38 Employees - $140,071

- Casa Tequila Bend - 150 South Main Street - 22 Employees - $52,398

- Casa Tequila Waukesa - 2423 Kossow Road - 28 Employees - $51,338

- Casa Tequila Hartford - 3461 High Road - 22 Employees - $28,370

The Wage and Hour Division offers a Quick Service Restaurants Compliance Assistance Toolkit to help industry employers avoid violations. The division’s YouthRules! initiative promotes developmental work experiences for teens by providing information about protections for young workers to youth, parents, employers, and educators. The Wage and Hour Division has also published Seven Child Labor Best Practices for Employers to help employers comply with the law.

SOURCE: U.S. Department of Labor

Read the full article

0 notes

Photo

Behbeh

#neo-classical#classical architecture#ban on modernism#modernism#modernism ban#not my president#anti trump#ugly#wedding cake#architecture#federal labor poster#federal#federal law#cartoon#teddy bear#illustration#dailybehbeh#behbeh#cute

15 notes

·

View notes

Link

Our combined poster now includes the NEW Discrimination Poster (Virginia Human Rights Act) that was updated this month in compliance with the US Supreme Court ruling on June 15, 2020 regarding LGBT discrimination in the workplace. This notice will be included on all orders placed on or after July 15, 2020. The new notice NOW INCLUDES sexual orientation and gender identity as part of the protected groups against discrimination. The new poster also contains an updated physical address, a new fax number, and a new website address (URL) for the Office of the Attorney General: Division of Human Rights.

1 note

·

View note

Text

Discover comprehensive Labor Law Posters at USA Labor Law Signs. Access free, up-to-date Federal Labor Law Posters and ensure compliance with ease. Stay informed and avoid penalties with our essential labor law poster collection.

1 note

·

View note

Text

Agricultural right to repair law is a no-brainer

John Deere is the poster-child for the horrors of finance capitalism. The company was once a great American success story, beloved by the workers who enjoyed good wages and job security, and by farmers, who co-innovated all kinds of new agricultural techniques and technologies.

Today, the company is rotten to the core. Despite skyrocketing profits, the company has continued to grind down its workers, sparking a strike by all 10,000 of its workers. That’s just the tangible manifestation of a hollow company plagued by runaway “just in time” manufacturing, and technologically micromanaged workers who are expected to produce on farcically short timetables even as staffing is reduced:

https://pluralistic.net/2021/10/18/labor-shortage-discourse-time/#deere-dash

The company has also become synonymous with the war on repair. They told the US Copyright Office that the tractors its sells to farmers for six figures are not actually the farmers’ property — rather, they are mere licensors of the software that animates those tractors.

So much for “If you’re not paying for the product, you’re the product.” John Deere uses its lock on tractor software to force farmers who fix their own tractors to pay for a service technician to come to their farms and type an unlock code into the tractor’s console.

Deere insists this is necessary to maintain the information security of tractors and suggests that if it isn’t allowed to extract vast sums from farmers through this scam, their tractors will be hijacked by foreign spies, threatening American food sovereignty. That would be a lot more credible if the tractors themselves weren’t such infosec dumpster-fires:

https://pluralistic.net/2021/04/23/reputation-laundry/#deere-john

All this and more has put Deere on the receiving end of multiple antitrust suits:

https://www.techdirt.com/articles/20210527/07453546882/obnoxious-repair-monopolies-keep-turning-farmers-into-activists.shtml

The idea that farmers should be able to fix their own stuff is a total no-brainer. There’s a reason every farm has had a forge since Roman times: when you’re at the end of a lonely road and the storm is coming, you need to get the crops in, and you can’t wait for a service call.

Unsurprisingly, there is broad bipartisan support for agricultural right to repair. Nevertheless, previous attempts to pass agricultural R2R laws have been scuttled after the farmers’ own lobbyists switched sides and sold out to Deere.

https://www.wired.com/story/john-deere-farmers-right-to-repair/

Now, there’s new federal agricultural Right to Repair bill, courtesy of Montana Senator Jon Tester, which will require Big Ag to supply manuals, spare parts and software access codes:

https://s3.documentcloud.org/documents/21194562/tester-bill.pdf

The legislation is very similar to the Massachusetts automotive Right to Repair ballot initiative that passed with a huge margin in 2020:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

Both initiatives try to break the otherwise indomitable coalition of anti-repair companies, led by Apple, which destroyed dozens of R2R initiatives at the state level in 2018:

https://pluralistic.net/2021/02/02/euthanize-rentiers/#r2r

It’s a bet that there is more solidarity among tinkerers, fixers, makers and users of gadgets than there is among the different industries who depend on repair price-gouging. That is, it’s a bet that drivers will back farmers’ right to repair and vice-versa, but that Big Car won’t defend Big Ag.

The opposing side in the repair wars is on the ropes. Their position is getting harder and harder to maintain with a straight face. It helps that the Biden administration is incredibly hostile to that position:

https://pluralistic.net/2021/07/07/instrumentalism/#r2r

It’s no coincidence that this legislation dropped the same week as Aaron Perzanowski’s outstanding book “The Right to Repair” — R2R is an idea whose time has come to pass.

https://pluralistic.net/2022/01/29/planned-obsolescence/#r2r

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0:

https://creativecommons.org/licenses/by/3.0/deed.en

87 notes

·

View notes

Link

This report was written by Andrew Perez, Julia Rock and David Sirota

Draft legislation circulating in the U.S. Senate would shield employers and health care industry executives from legal consequences when their business decisions injure or kill workers, customers and patients during the COVID-19 outbreak.

The unprecedented proposal to gut legal protections — which is being depicted as moderate compromise legislation and potentially attached to badly-needed state and local aid — follows a Harvard study showing a surge in worker COVID deaths following their requests for government regulators’ help.

The Huffington Post reported on Monday that Democratic Sen. Joe Manchin is joining GOP senators in backing corporate immunity legislation. A draft of the legislative language obtained by The Daily Poster includes provisions that would:

Shield companies from all coronavirus-related actions retroactively — for at least one year, or until the pandemic is over — except in cases of “gross negligence.” Most coronavirus-related lawsuits would be forced into federal courts, which are considered more friendly to business interests.

Restrict the enforcement of longstanding laws such as the Fair Labor Standards Act of 1938, the Occupational Safety and Health Act of 1970 and the Civil Rights Act of 1964 when companies say they are attempting to comply with governments’ coronavirus guidance.

Empower the United States Attorney General to deem coronavirus-related lawsuits from workers, customers and attorneys “meritless” and then file civil actions against them as retribution. In order to “vindicate the public interest,” courts would be allowed to fine respondents up to $50,000.

Shield health care executives from lawsuits through language copied word-for-word from a statute passed in New York by Democratic Gov. Andrew Cuomo amid a spate of COVID deaths in that state’s nursing homes.

“Substantially Immunizing Businesses From Risky Conduct”

The legislation defines gross negligence as “a conscious, voluntary act or omission in reckless disregard of (A) a legal duty; (B) the consequences to another party; and (C) applicable government standards and guidance.”

“We are wiping out the laws of negligence,” said Michael Duff, a former National Labor Relations Board official who is now a professor at the University of Wyoming College of Law. “As a practical matter, we are substantially immunizing businesses from risky conduct.”

“What they want to do in this bill is throw every lawsuit out before it conceivably gets to a jury,” he said. “It means that a judge has the authority to dismiss a case right upfront. Because there’s no way that plaintiffs are going to be able to meet this standard — gross negligence.”

He added that the provision empowering the Attorney General to punish plaintiffs “is a bald-faced threat of reprisal for having the temerity to pursue rights.”

“That Is Not A Negotiation — That Is A Collapse”

Lawmakers released a separate $748 billion COVID-related proposal that includes expanded unemployment benefits, an extension of the Paycheck Protection Program, and funding for COVID-19 testing and vaccine distribution. It would also reauthorize a CARES Act provision allowing the government to funnel money to out-of-work defense contractors.

The latter package did not include a new round of $1,200 stimulus checks sought by Vermont Independent Sen. Bernie Sanders and Sen. Josh Hawley, R-Mo. Only $188 billion of the proposal is new stimulus money — the other $560 billion is repurposed from the CARES Act, passed this spring.

Sanders criticized Democrats for their handling of coronavirus relief talks. “What kind of negotiation is it when you go from $3.4 trillion to $188 billion in new money?” he said. That is not a negotiation. That is a collapse.”

According to Politico, Reps. Josh Gottheimer, D-N.J., and Tom Reed, R-N.Y., the co-chairs of the House Problem Solvers Caucus, are pushing to combine the two bills into one $908 billion proposal.

#senate#covid19#fuck covid#bernie sanders#capitalist hell#capitalism#anti capitalism#covid legislation#class war#class warfare#OSHA#law#covid law#covid cases#burn down the senate#burn down washington

25 notes

·

View notes