#FemTech App

Explore tagged Tumblr posts

Text

How Do I Create A FemTech App? A Detailed Guide

Femtech, a rapidly growing sector within the healthcare and technology industries, focuses on developing innovative digital solutions to address women's health and wellness needs. From menstrual tracking and fertility monitoring to pregnancy care and menopause management, femtech apps empower women to take control of their health, track their reproductive cycles, access personalised healthcare resources, and make informed decisions about their well-being. In this detailed guide, we'll explore the essential steps and considerations involved in creating a femtech app. Whether you're a healthcare provider, tech entrepreneur, or software developer, this guide will provide valuable insights into the femtech landscape and the process of building a successful femtech app. Visit us:

1 note

·

View note

Text

How Are Femtech Apps Revolutionising Women’s Health in the 21st Century?

The FemTech (Female Technology) industry has rapidly emerged as a transformative force, redefining women’s healthcare through innovative, tech-driven solutions.

With the industry projected to exceed a global market value of $75 billion by 2025, FemTech represents a golden opportunity for entrepreneurs and app developers to create platforms that address women’s unique health needs.

But what exactly makes FemTech such a groundbreaking frontier in personalised healthcare? Let’s delve into its remarkable impact, growth potential, and the opportunities it offers.

Understanding FemTech and Its Revolutionary Role

FemTech encompasses digital tools and applications specifically designed to enhance women’s health and well-being. These solutions bridge critical gaps in traditional healthcare systems by offering tailored resources that empower women to take charge of their health. FemTech apps cater to various needs, including:

Period Tracking: Apps like Flo provide AI-powered period predictions and symptom tracking.

Fertility and Pregnancy Monitoring: Platforms like Lilia assist with fertility planning and pregnancy management.

Mental Health Support: Tools focusing on stress relief, mindfulness, and therapy sessions.

Sexual Wellness: Apps promoting education, pelvic health, and sexual well-being.

Telehealth Consultations: Services like Maven Clinic connect women with healthcare professionals remotely.

These apps are tailored to deliver personalised care, making healthcare more accessible, efficient, and inclusive for women worldwide.

Why FemTech Is Thriving

Several factors contribute to the meteoric rise of FemTech:

Increased Health Awareness: Women are more proactive about managing their health and are seeking solutions that cater to their specific needs.

Digital Health Revolution: The proliferation of smartphones and wearable devices enables seamless health monitoring.

Rising Investment: The industry has attracted significant venture capital funding, fostering innovation and growth.

With a compound annual growth rate (CAGR) of over 16% projected by 2027, the demand for FemTech solutions shows no signs of slowing down.

Types of FemTech Apps Leading the Market

The versatility of FemTech apps allows them to cater to diverse aspects of women’s health. Here are some popular categories:

Fertility and Period Tracking: Apps like Clue and Flo offer accurate ovulation predictions and cycle tracking.

Pregnancy and Maternity Care: Platforms like Sprout provide daily updates and personalised health tips for expecting mothers.

Telehealth and Online Consultations: Services like Maven Clinic facilitate virtual consultations with specialists.

Fitness and Wellness: Apps like MyFitnessPal integrate fitness regimens with menstrual cycle tracking.

Mental Health Support: FemTech apps prioritise emotional well-being with tools for mindfulness and therapy.

Sexual Wellness: Apps such as B-Fit focus on pelvic health and sexual education.

By addressing a wide array of health concerns, FemTech apps are setting new benchmarks for personalised care.

Business Opportunities in FemTech

The FemTech industry is brimming with potential for businesses and developers. Key opportunities include:

Personalised Health Solutions: AI-driven insights enable tailored healthcare recommendations.

Mental Health Apps: With a growing focus on mental well-being, the market for mental health apps is expanding rapidly.

Reaching Underserved Communities: Affordable, offline-capable apps can cater to women in remote or low-income areas, addressing a critical market gap.

Fertility and Chronic Condition Management: FemTech apps can provide comprehensive tools for managing fertility, PCOS, and endometriosis.

Developing a FemTech App: Key Steps

Creating a successful FemTech app involves several essential steps:

Define the Scope: Identify your target audience and focus on features like period tracking, telehealth, or fitness tools.

Assemble a Skilled Team: Collaborate with developers, designers, and healthcare specialists to ensure your app meets user needs.

Prioritise User Experience: Design an intuitive, visually appealing interface that is easy to navigate.

Ensure Privacy and Security: Comply with regulations like GDPR and HIPAA to protect sensitive health data.

Launch and Optimise: Continuously update the app based on user feedback and emerging technologies.

FemTech Trends to Watch for in 2025

The future of FemTech is exciting, with several trends poised to shape the industry:

AI-Driven Personalisation: Advanced algorithms will offer even more customised insights and solutions.

Wearable Device Integration: Real-time health monitoring through wearable devices will become more prevalent.

Global Expansion: FemTech apps will increasingly reach underserved regions, promoting inclusivity.

Focus on Chronic Conditions: Addressing conditions like menopause and endometriosis will become a priority.

For more details, check out our blog: The Future of FemTech: How to Develop Apps for 2025.

Join the FemTech Revolution with Singsys

At the forefront of innovation, Singsys, a leading healthcare app development company, is empowering businesses to create impactful FemTech solutions. From period tracking to telehealth apps, Singsys ensures your idea becomes a reality with cutting-edge development and expert guidance.

Ready to make a difference?Explore how Singsys can help you develop your FemTech app tailored to women’s unique needs.

Request a free quote today. Partner with us to shape the future of personalised healthcare.

Together, we can revolutionise women’s healthcare and take a step towards a healthier future!

0 notes

Text

1 note

·

View note

Text

LaDS folks..... the new update has a period tracker? A small suggestion to the US players: do not use it.

We're in a political climate in the US where some states are hostile to folks with a uterus, and if the state government that has anti choice laws in the books feels inclined to investigate you because they suspect you had an abortion they can request your data from tech companies and prosecutors will use that data against you.

9 notes

·

View notes

Text

A new class of health care startups has emerged in response to the US Supreme Court’s decision to overturn the federal right to abortion last year. These “digital abortion clinics” connect patients with health care providers who are able to prescribe mifepristone and misoprostol, a course of care commonly described as the “abortion pill.”

These services, many of which were founded before Dobbs v. Jackson, are poised to eliminate a major paradox in the field of reproductive health: Medication abortion is currently the most common way to terminate a pregnancy, yet only 1 in 4 adults are familiar with it, according to a recent study by KFF.

These clinics operate in different ways—some provide live video visits with doctors and nurse practitioners, while others offer asynchronous counseling—but many have experienced a record number of patient orders (and increased VC funding) over the past year. According to Elisa Wells, cofounder of the nonprofit Plan C, their appeal is straightforward. “Their pricing is quite affordable, and there’s convenience in placing an order and getting pills delivered to your mailbox in three to four days,” she says.

Recent data suggests that telehealth clinics have been effective in expanding access to abortion care, especially for people living in remote areas or in states where the procedure has been criminalized, a finding that Wells’ team corroborates. Thanks to a new series of “shield laws” protecting clinicians from out-of-state prosecution—passed in 12 states, including New York, Maryland, and Illinois—these clinics are positioned to expand their reach even further.

Following the lead of other companies in the femtech space (a category that includes everything from kegel trainers to period-tracking apps), leaders at digital abortion clinics like Hey Jane and Choix have publicly expressed their commitment to users’ privacy as they grow. In a recent interview with Vogue, Hey Jane cofounder Kiki Freedman said that the service is “HIPAA-compliant and encrypted.” In an interview with Ms. magazine this January, a representative from Choix highlighted its “HIPAA-compliant texting platform,” while another interviewee suggested that “most telehealth providers are not checking IP addresses.” (Read more about how HIPAA actually works here.)

A common belief about virtual clinics is that they offer more discretion than their brick-and-mortar counterparts. “There’s definitely a privacy factor—these sites don’t ask a lot of questions,” says Wells. In a 2020 study of over 6,000 abortion seekers, 39 percent reported choosing a telemedicine option specifically to preserve their privacy. While some providers’ intentions seem genuine, privacy experts have pointed out that their services may not be as secure as users expect them to be (even if they are compliant with US law).

Last July, a team of researchers at the Markup reported that Hey Jane’s site passed along user information to Meta and Google, the world’s largest digital advertisers. While providers may not restrict access via IP addresses, our analysis found that most providers readily collected them. For telehealth abortion clinics, HIPAA compliance is just one part of the puzzle.

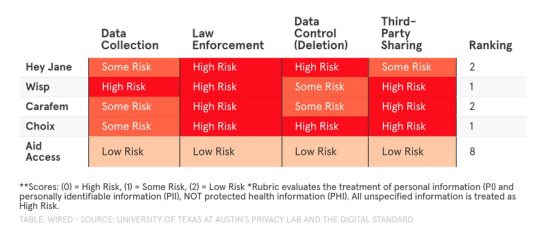

So which virtual abortion clinics take users’ privacy seriously, and which do not? How can users approach these services with safety in mind? Does HIPAA protect all information sent to telehealth providers? To find out, we teamed up with experts to analyze the privacy policies of five popular abortion-by-mail providers: Wisp, Choix, Hey Jane, Carafem, and Aid Access.

While the American Bar Association reported in April that “high-tech tactics” (like sending court orders to femtech apps) have not been used to successfully convict abortion seekers, prosecutors have used women’s text messages and search histories as evidence in a number of abortion-related cases. Because of this precedent, users should proceed with caution when handing their personal information over to telehealth providers. It’s not uncommon for vulnerable data to end up in the hands of third-party brokers who compile digital profiles of users before selling their information to the highest bidder. Michele Gilman, professor of law at the University of Baltimore, says: “Reproductive health data is being sold and transported into a much larger system.”

To make matters worse, the absence of a comprehensive federal privacy law, like the EU’s General Data Protection Regulation (GDPR), leaves the burden of evaluating privacy policies to individual users. Considering that these policies have gotten longer and more difficult to decipher in recent years, this is a serious burden. For our evaluation, we consulted frameworks from the University of Texas at Austin’s Privacy Lab and the Digital Standard to arrive at four core factors.

Here’s what we found:

Data Collection (PII)

The GDPR’s American cousin, the California Consumer Privacy Act (CCPA) has inspired proposed state legislation that supports greater protections for a specific category of data—personally identifiable information. While PII is broadly defined, Google interprets it as including your email address, full name, precise location, phone number, and mailing address.

The safest websites to use won’t collect your PII at all, but offering a mailing address to a virtual clinic is a matter of necessity here. In this context, it’s helpful to distinguish between companies that use your personal information to provide essential services and those that share this information with third parties. Austria-based nonprofit Aid Access fared the best in this category, encouraging users to access the service with virtual anonymity in its policy. Wisp fared particularly poorly here, citing its ability to send specific geolocation data to advertisers.

The majority of providers we analyzed categorize email addresses and the like as “personal information,” which is only protected by HIPAA if it’s stored alongside medical information. This makes it difficult to judge whether it’s being used appropriately.

Low Risk: PII is not recorded, Some Risk: PII is used for intended service, High Risk: PII is used by third parties

Law Enforcement

According to bioethics expert Sharona Hoffman, there’s a common misconception that HIPPA protects your medical information from being shared outside of your doctor’s office. The reality, she says, is that “HIPAA isn’t that protective. Consumers need to know that HIPAA has exceptions for law enforcement and public health.”

While the law provides safeguards for a particular subset of information (personal health information), it doesn’t cover all of the information you provide to a telehealth service. Even if it did apply, the rule allows (but does not require) health care providers to expose PHI when presented with a search warrant or other legal document. While providers could technically refuse these requests, most don’t. “It’s easier to comply rather than involve your medical office in litigation,” says Gilman.

Aid Access is a notable exception and has a track record of standing up to law enforcement (it even sued the US Food and Drug Administration last year.) When examining privacy policies, UT’s Privacy Lab recommends looking at companies’ willingness to hand over any data in the absence of a warrant or other legal document. Neither Carafem, Wisp, Hey Jane, nor Choix specify that they would require a warrant before sending information to government agencies or other legal entities.

Low Risk: PII is not recorded, Some Risk: Legal documents are required to comply with law enforcement, High Risk: Legal documents are not required to comply with law enforcement

Data Control (Deletion)

Sites that offer users more control over their data can deliver better privacy than those that don’t. While low-risk sites will allow you to delete and edit your information freely, some medical information that users provide to virtual clinics will still be out of reach. This is due to state-specific medical record retention laws, which can require health care entities to retain some records for up to 25 years.

Examining how much control companies give users over other information is a better proxy for understanding their general safety. While most of the providers we analyzed included data deletion protocols in their privacy policies, Choix and Hey Jane’s do not. In addition, the latter confirms that it retains data for an unspecified (“reasonable”) period of time.

While Wisp does offer a deletion protocol, it admits that requests can be refused for a variety of reasons, including “exercising free speech” and “internal and lawful uses” on behalf of itself or its affiliates. In addition to responding to requests, privacy-forward organizations will also proactively delete sensitive information, something Carafem does. However, Carafem does not specify a timeline or provide a general deletion request protocol. By contrast, Aid Access allows users to file deletion requests at will for most information.

Low Risk: Users can edit or delete data, Some Risk: Users can edit data, High Risk: Users cannot edit or delete data

Third-Party Sharing (Ads and Marketing)

Research scientist and privacy expert Razieh Nokhbeh Zaeem calls personally identifiable information the “currency of the internet” because of the myriad ways individualized data is collected, bought, and sold across industries. While almost all websites work with third parties in some way, telehealth companies should not sell or share your information with advertisers—but many do, as evidenced by Betterhelp’s recent settlement with the Federal Trade Commission.

If a company is collecting sensitive information and using it to market products and services to you, that presents some risk. If a company shares this information with other companies to support their marketing efforts, it’s a major red flag. As the Markup rightly points out in its privacy policy guide, mentions of “personalization” and “improving services” in these documents usually equate to ad tracking.

According to its privacy policy, Hey Jane uses personal data (and PII) to market its own services (“inform you about products”), while Carafem, Wisp, and Choix reserve the right to pass along information to third-party marketing partners. Choix’s policy claims that it “will never sell your data for third-party marketing purpose[s]” in one section but reserves the right to disclose data to its affiliates for “marketing” purposes in another.

Rather than limiting or removing the third-party trackers installed on their sites, some providers recommend that users generally opt out of cookie-based advertising within their policies, a strategy that is far from foolproof.

Low Risk: PII is not used for marketing or advertising, Some Risk: PII is used for marketing/advertising, High Risk: PII shared with third parties for marketing/advertising

The Bottom Line

In a post-Roe America, virtual abortion clinics provide an essential service, especially for people living in states that criminalize care. Early indicators have shown that they increase access to safe and effective abortion medications, but they don’t offer as much privacy as users are led to believe. With the exception of Aid Access, all of the providers we analyzed have a long way to go when it comes to protecting users’ privacy and earning their trust.

To manage risk when approaching these services (and accessing other information about abortion in hostile states), educators at the Digital Defense Fund recommend reducing your footprint by using privacy-forward search engines like DuckDuckGo, creating temporary email accounts for abortion care, and turning off location tracking on all of your devices.

While engaging in defensive tactics like these are practically useful, legal scholars like Gilman suggest that the reproductive justice movement will advance only when federal and state governments no longer rely on an outdated “notice and consent” paradigm for data privacy. “We need meaningful consent in the reproductive health space,” says Gilman. “Privacy policies today are more like adhesion contracts—suggesting that users ‘take it or leave it.’ It’s not realistic or fair to tell people they can’t engage with technology if they want to protect their privacy.”

Gilman recommends advocating at the state level for better privacy standards, especially if your representatives are considering new legislation. She also encourages people to demand increased protections from private companies, many of which are more flush with the “currency of the internet” than they would have us believe.

8 notes

·

View notes

Link

#AIRegulation#DigitalHealth#femtech#healthAI#healthtech#medicalchatbots#personalizedmedicine#women'shealth

0 notes

Text

La promesa de empoderamiento que venden muchas apps menstruales se desvanece frente a la cruda realidad de la explotación de datos Una mujer utiliza una aplicación de seguimiento menstrual. / Cottonbro | Pexels Las aplicaciones de seguimiento menstrual se visten de aliadas tecnológicas para el bienestar femenino, prometiendo empoderamiento y control sobre la salud reproductiva. Pero detrás de sus interfaces amigables se esconde una realidad preocupante: son minas de oro de datos íntimos explotados por anunciantes y un riesgo creciente para la seguridad de millones de mujeres, según un contundente informe del Minderoo Centre for Technology and Democracy de la Universidad de Cambridge. De la Intimidad al Mercado: La Mina de Oro de Datos El estudio, liderado por la socióloga Stefanie Felsberger, especialista en tecnología y género, expone la alarmante brecha entre lo que las usuarias creen compartir y el valor real que sus datos tienen en el mercado. Estas apps no solo registran fechas de menstruación. Son ventanas abiertas a la vida privada: capturan patrones de ejercicio, hábitos alimenticios, uso de anticonceptivos, niveles hormonales estimados, preferencias sexuales, medicación y estados emocionales. “Las usuarias subestiman enormemente el valor económico de los datos que entregan a empresas que operan con fines de lucro en un entorno prácticamente sin regulación”, advierte Felsberger. Este flujo constante de información sensible se convierte en un “perfil de consumidora” hiperdetallado, una mercancía codiciada en la industria publicitaria. Un dato revelador: la información sobre un posible embarazo puede valer hasta 200 veces más que datos básicos como la edad o la ubicación. Incluso las fluctuaciones hormonales, como los picos de estrógenos, son analizadas para bombardear a las usuarias con publicidad de cosméticos u otros productos en momentos específicos. Más allá de los Anuncios: Riesgos Reales y Peligrosos La monetización de los datos es solo la punta del iceberg. El informe de Cambridge alerta sobre consecuencias mucho más siniestras: Discriminación Laboral: Empleadores potenciales o actuales podrían acceder (directa o indirectamente) a estos datos para inferir planes de maternidad o condiciones de salud, afectando contrataciones, ascensos o despidos. Exclusión de Seguros: Compañías aseguradoras podrían utilizar la información sobre ciclos irregulares, intentos de concepción o historial médico para negar coberturas o aumentar primas. Ciberacoso y Stalking: La filtración o venta ilegal de estos datos podría permitir que acosadores o exparejas accedan a información íntima sobre la salud reproductiva de una mujer. Restricción del Acceso al Aborto: Este es uno de los riesgos más graves. En países o regiones donde el aborto es restringido o penalizado, estos datos podrían ser utilizados como prueba para investigar o perseguir a mujeres que sospechan haya interrumpido un embarazo. Casos reales en algunos países ya han encendido las alarmas. Un Boom Millonario en un Vacío Legal La industria de la femtech (tecnología para la salud femenina), valorada en más de 60.000 millones de dólares para 2027, tiene a las apps menstruales como su columna vertebral, representando la mitad del sector. Solo las tres aplicaciones más populares superaron los 250 millones de descargas globales en 2024. Este crecimiento explosivo, sin embargo, ocurre en un paisaje regulatorio casi desértico. “No hay reglas claras ni suficientes que protejan específicamente estos tipos de datos ultrasensibles relacionados con la salud reproductiva de las mujeres”, denuncia Felsberger. La falta de transparencia sobre cómo se recopilan, almacenan, comparten y utilizan estos datos es la norma, no la excepción. Llamado Urgente: Regulación y Alternativas Públicas Ante este panorama, las expertas del estudio claman por acciones inmediatas: Regulación Estricta: Se necesitan leyes robustas que clasifiquen los datos menstruales y reproductivos como categoría especial de alto ...

0 notes

Text

Femtech Market Growth Analysis, Market Dynamics 2025

Femtech, short for "female technology," refers to a wide range of software, diagnostic tools, products, and services that leverage technology to support women’s health. This includes fertility solutions, period tracking apps, pregnancy and nursing care, women's sexual wellness, reproductive system health care, and general healthcare solutions specifically designed for female physiology. With the growing awareness around women’s health and the increasing adoption of digital health technologies, Femtech has emerged as a transformative sector within the broader health and wellness industry.

The Femtech market encompasses various offerings such as medical devices, mobile applications, wearables, diagnostics, and services that focus on areas such as fertility tracking, pregnancy and nursing care, menopause management, sexual health, and general healthcare needs of women. As the demand for personalized and accessible healthcare solutions rises, Femtech continues to play a vital role in reshaping the landscape of women-centric health innovation.

Market Size

In 2024, the global Femtech market was valued at USD 60.12 billion. It is projected to grow steadily, reaching approximately USD 103.7 billion by 2032, representing a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2032. This growth trajectory reflects the increasing integration of digital technologies in healthcare, rising awareness around women’s health issues, and greater investment in female-focused medical innovations.

The devices segment within Femtech is forecasted to achieve significant revenue by 2029, driven by the surge in adoption of wearable health monitors, fertility devices, and at-home diagnostic tools. Moreover, investments in mobile health applications and telemedicine services further bolster the sector's expansion.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/911/Femtech-Market

The growing emphasis on women's health and wellness is propelling the global femtech market's rapid emergence as a game-changing industry within healthcare. Femtech covers a wide range of needs, including reproductive health, fertility, pregnancy, menopause, and chronic conditions specific to women. It includes wearable technology, digital health solutions, diagnostic tools, and therapeutics created especially for women.The market is expanding due to growing awareness, rising investments, and technological developments like artificial intelligence and data analytics. Furthermore, a move toward personalized healthcare and the rising incidence of diseases like endometriosis and polycystic ovarian syndrome (PCOS) are driving up demand A 2023 survey indicated that 60% of Indian women aged 24–34 suffer from PCOS . This surge in PCOS cases has led to a growing demand for femtech solutions that offer menstrual tracking, fertility assistance, and hormonal health monitoring. For instance, companies like Clue, a period tracking app, and Flo Health, which offers comprehensive reproductive health monitoring, have attracted millions of users worldwide, illustrating the demand for personalized, data-driven health insights.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers

Increasing Awareness and Acceptance of Women’s Health Technologies

Growing consumer and healthcare provider awareness and acceptance of women's health technologies is a key factor propelling the global femtech market. Social taboos surrounding menstruation, fertility, and menopause have gradually faded over the last ten years, opening the door for increased transparency and demand for cutting-edge, women-specific health solutions. For instance, by providing individualized menstrual tracking and fertility insights, apps like Flo Health and Clue have gained tens of millions of users globally, enabling women to take charge of their own health. Furthermore, businesses like Elvie, which manufactures pelvic floor trainers and smart breast pumps, are growing their product lines to include more convenient, high-tech products.

Restraints

Limited Access and Affordability in Emerging Markets Restrains Growth

Women in low- and middle-income countries (LMICs) have limited access to digital healthcare services, which is a major restraint to the growth of the global femtech market. While 1.5 billion women in LMICs currently have mobile internet, 785 million are still unconnected, according to the GSMA's 2024 Mobile Gender Gap Report. About 60% of these unconnected women live in places like South Asia and Sub-Saharan Africa, where the digital divide is most noticeable. This problem is made worse by the cost of femtech solutions. The high cost of many femtech products, like wearable technology and specialized health applications, makes them unaffordable for women in developing nations.

Opportunities

Expanding Telehealth and Mobile Health Infrastructure Unlocks Femtech Opportunities

The quick development of telehealth and mobile health (mHealth) infrastructure, particularly in formerly underserved areas, presents a significant opportunity for the global femtech market. Women in remote or low-resource settings who previously had little or no access to reproductive or preventive care are among the broader audiences that femtech solutions are poised to reach as governments and private players invest more in digital healthcare ecosystems.The GSMA Mobile Economy Report 2023 shows that mobile internet adoption is still increasing globally, with more than 55% of people in low- and middle-income countries currently using mobile internet. This provides a solid digital basis for the growth of femtech.Companies are already capitalizing on this trend. For example, Kasha, an e-commerce platform based in East Africa, enables women to confidentially access health products and services such as contraception and menstrual care through their phones. According to Pitchbook In 2024, A total of 47 femtech deals received €339.4 million in venture capital funding, which exceeded the €325 million peak from 2021.

Data Privacy and Regulatory Concerns Hinder Market Expansion

The complicated regulatory environment surrounding women's health technologies and the growing concern over data privacy are major barriers to the global femtech market. Risks to data security and user confidentiality arise because femitech solutions frequently gather extremely sensitive personal health data, including menstrual cycles, fertility information, and reproductive health data. Consumers and healthcare providers are now more cautious due to high-profile data breaches and increased regulatory scrutiny. For example, apps like Flo Health faced criticism and investigations over data-sharing practices, prompting stricter privacy policies and user transparency.

Regional Analysis

The global femtech market is witnessing varied growth dynamics across regions, driven by digital maturity, healthcare infrastructure, and cultural receptivity. North America leads the market, accounting for the largest revenue share in 2023, backed by high digital health adoption, supportive regulatory frameworks, and strong venture capital flows. For instance, U.S.-based femtech startups like Maven Clinic, Flo Health, and Tia have secured substantial funding and are rapidly expanding their service offerings.

Europe follows closely, with countries like the U.K., Germany, and Sweden embracing femtech through progressive health policies and widespread use of digital health platforms. The European Union’s push for gender-specific health research and digital transformation in healthcare has significantly supported femtech adoption.

In contrast, Asia-Pacific is emerging as the fastest-growing region, fueled by rising smartphone penetration, growing awareness of women’s health issues, and a young, tech-savvy population. Platforms like Maya in Bangladesh and LunaLuna in Japan demonstrate how localized apps are successfully addressing culturally specific health concerns.

However, Latin America, Middle East, and Africa remain relatively untapped but present high-potential markets. These regions face challenges such as limited digital infrastructure and affordability barriers but are seeing encouraging signs, including government-backed digital health initiatives and NGO-led awareness campaigns.

Competitor Analysis (in brief)

The global Femtech market is characterized by the presence of innovative startups and established healthcare companies. Key players include:

Sustain Natural

HeraMED

Totohealth

Nuvo

Athena Feminine Technologies

iSono Health

Minerva

Sera Prognostics

BioWink

Elvie

Univfy

Conceivable

Prelude

These companies are investing heavily in R&D, product innovation, and strategic partnerships to gain a competitive edge. They focus on expanding their product portfolios, improving user experience, and increasing their global footprint.

March 2025, Elvie, a UK-based femtech company renowned for its inventive breast pumps, was acquired by rival Willow in the United States. This acquisition came after Willow filed a patent infringement lawsuit in 2023 and Elvie went through a period of financial difficulties. The goal of the merger is to increase market penetration and pool resources in the women's health industry.

February 2025, Epicore, a femtech startup specializing in wearable sweat-sensing technology, secured $26 million in funding. This investment will support the development of innovative solutions in women's health monitoring.

In India, digital women's health clinic Proactive For Her was acquired by IVF Access, a fertility clinic chain backed by Vertex Ventures, a common investor in both firms. This acquisition signifies a shift towards integrated healthcare platforms in the femtech space, combining digital health services with clinical care.

March 21, 2023, Maven Clinic acquires digital health company Naytal inorder to accelerate its expansion in the UK.

Global Femtech: Market Segmentation Analysis

This report provides a deep insight into the global Femtech, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Femtech. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Femtech in any manner.

Market Segmentation (by Type)

Direct-to-consumer

Wearables

Diagnostic tools

Therapeutic devices

Software

Mobile health apps

Telehealth platforms

AI-driven diagnostic tools

Market Segmentation (by Technology)

Mobile Applications

AI & Machine Learning

IoT & Wearable Technology

Cloud-based Health Platforms

Market Segmentation (by Application)

Reproductive Health

Pregnancy & Nursing Care

Menstrual Health

General Wellness & Preventive Care

Market Segmentation (by End User)

Direct-to-Consumer (D2C)

Hospitals & Clinics

Fertility Centers

Diagnostic Centers

Others

Market Segmentation (by Age Group)

14–24 years

25–40 years

41–60 years

60+ years

Key Company

Sustain Natural

HeraMED

Totohealth

Nuvo

Athena Feminine Technologies

iSono Health

Minerva

Sera Prognostics

BioWink

Elvie

Univfy

Conceivable

Prelude

Geographic Segmentation

North America

US

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Russia

Nordic Countries

Benelux

Rest of Europe

Asia

China

Japan

South Korea

Southeast Asia

India

Rest of Asia

South America

Brazil

Argentina

Rest of South America

Middle East & Africa

Turkey

Israel

Saudi Arabia

UAE

Rest of Middle East & Africa

FAQ Section :

▶ What is the current market size of Femtech?

As of 2024, the global Femtech market size is valued at USD 60.12 billion.

▶ Which are the key companies operating in the Femtech market?

Major companies include Sustain Natural, HeraMED, Totohealth, Nuvo, Athena Feminine Technologies, iSono Health, Minerva, Sera Prognostics, BioWink, Elvie, Univfy, Conceivable, and Prelude.

▶ What are the key growth drivers in the Femtech market?

Key drivers include increased awareness of women’s health, advancements in digital health technologies, growing investment in the sector, and the expanding female workforce.

▶ Which regions dominate the Femtech market?

North America leads the market, followed by Europe and Asia-Pacific.

▶ What are the emerging trends in the Femtech market?

Trends include AI integration in health diagnostics, wearable tech for reproductive health, telemedicine expansion, and increasing investment in underserved regions.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/911/Femtech-Market

0 notes

Text

0 notes

Text

FemTech Market Expands at 16% CAGR with More Women-Centric Healthcare Startups by 2030

The global FemTech market is set to witness a growth rate of 16% in the next 5 years. Growing awareness of women’s health issues, rise in women-centric healthcare start-ups, advancements in digital health technologies, rising demand for personalized healthcare solutions, growing prevalence of chronic and reproductive health issues, supportive government initiatives & policies, and rising demand for telemedicine & remote healthcare are some of the key factors driving the FemTech market.

FemTech, short for Female Technology, refers to a category of technology-driven products, software, and services designed to address women's health needs. This includes areas such as reproductive health, fertility tracking, maternal care, menstrual health, menopause management, and gynecological disorders among others. Additionally, FemTech encompasses digital health solutions like mobile apps, wearable devices, telemedicine, and AI-driven diagnostics tailored for women’s well-being. The market is driven by increasing awareness, advancements in healthcare technology, and growing investments in women's health. As the sector expands, it plays a crucial role in bridging healthcare gaps and promoting personalized, accessible, and data-driven solutions for women worldwide.

🔗 Want deeper insights? Download the sample report:

Growing awareness of women’s health issues to propel market demand

Growing awareness of women’s health issues is a major driver of the FemTech market, as more women seek solutions for menstrual health, fertility, pregnancy, menopause, and overall wellness. Increased education, social media advocacy, and destigmatization efforts have empowered women to prioritize their health. This has led to a surge in demand for digital tools, wearables, and telemedicine platforms that offer personalized healthcare management. Governments and organizations are also investing in women’s health initiatives, further fueling the adoption of FemTech solutions. As awareness continues to rise, the market is expected to expand, driving innovation and accessibility in women’s healthcare.

Advancements in digital health technologies is driving the market growth

Advancements in digital health technologies are transforming the FemTech market by enabling more accurate, data-driven, and personalized healthcare solutions for women. Innovations in AI, IoT, Big Data, and wearable technology have led to smart menstrual trackers, AI-powered fertility apps, and real-time hormone monitoring. These technologies provide predictive insights, remote diagnostics, and personalized health recommendations, improving women’s access to quality care. Wearable devices for ovulation tracking, pregnancy monitoring, and menopause symptom management are becoming mainstream. As digital health continues to evolve, the integration of advanced analytics and telemedicine is further expanding the reach and effectiveness of FemTech solutions.

Competitive Landscape Analysis

The global FemTech market is marked by the presence of established and emerging market players such as Allara Health, Aspivix SA, Bloomlife, Chiaro Technology Ltd., Flo Health Inc., HeraMED, Natural Cycles USA Corp, NUVO Inc., Progyny, Inc., and Pulsenmore Ltd.; among others. Some of the key strategies adopted by market players include new product development, strategic partnerships and collaborations, and geographic expansion.

Gain a competitive edge-request a sample report now!

Global FemTech Market Segmentation

This report by Medi-Tech Insights provides the size of the global FemTech market at the regional- and country-level from 2023 to 2030. The report further segments the market based on offering, application, buyer type.

Market Size & Forecast (2023-2030), By Offering, USD Million

Software

Services

Devices

Consumer Products

Market Size & Forecast (2023-2030), By Application, USD Million

Menstrual Health & Period Tracking

Fertility & Ovulation Monitoring

Pregnancy & Postpartum Care

Menopause Management

Reproductive Health & Contraception

Chronic & Hormonal Disorder Management

Sexual Wellness & Pelvic Health

Mental Health and Wellness

Others

Market Size & Forecast (2023-2030), By Buyer Type, USD Million

Individual Consumers (B2C Buyer)

Healthcare Providers & Institutions

Employers & Corporate Wellness Programs

Healthcare Payers

Pharmaceutical & Biotechnology Companies

Others

Market Size & Forecast (2023-2030), By Region, USD Million

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

India

Japan

Rest of Asia Pacific

Latin America

Middle East & Africa

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde Associate, Medi-Tech Insights +32 498 86 80 79 [email protected]

0 notes

Text

Breast pump startup Willow acquires assets of Elvie as UK femtech pioneer moves into administration

Femtech and its startups building connected breast pumps, period trackers and other apps and hardware designed for women’s health have collectively pulled in more than $5 billion in funding in the last five years, but the market is tight, and now, two of the trailblazers in the space are coming together as consolidation beckons. Willow, […] Source: TechCrunch Breast pump startup Willow acquires…

0 notes

Text

FemTech Market: A Comprehensive Overview of Growth and Innovation

The global FemTech market size is expected to reach USD 97.25 billion by 2030, registering a CAGR of 16.37% from 2025 to 2030, according to a new report by Grand View Research, Inc. Rising number of women’s health issues and growing health consciousness indicates the growth potential of the market.

The increasing awareness about health among women and the proactive approach to addressing women's health issues will lead to significant market growth. Factors such as rising digital literacy, disposable income, widespread smartphone and internet use, digital health infrastructure, and the emergence of startups focusing on women's health are creating lucrative opportunities for both new and existing market players. The availability of smart wearable devices is also contributing to market development and growth. Health technology developers and investors are taking advantage of previously untapped opportunities and funding innovative product development strategies to address women's health issues.

Furthermore, the strategic initiatives by the major market players are anticipated to increase market growth during the forecast period. For instance, in June 2022, Flo Health launched Flo for Business, an inclusive strategy focused on women's health for employees. This new employee benefit provides comprehensive, science-based guidance on various reproductive health issues at every stage of life. The introduction of women's health apps aimed at educating and empowering employees to monitor their menstrual cycles, fertility, and overall reproductive health is expected to increase the adoption of such apps, thereby boosting the growth of the market.

Gather more insights about the market drivers, restrains and growth of the FemTech Market

FemTech Market Report Highlights

• In terms of type, the devices segment dominated the market with a revenue share of 33.33% in 2024 and expected to have the fastest growth rate during the forecast period.

• Based on the application the pregnancy and nursing care segment dominated the market in 2024 with a revenue share of 17.72%.

• Based on the end-use, the direct-to-consumer segment dominated the market with a revenue share of 30.82% in 2024 and expected to have the fastest growth rate during the forecast period.

• North America FemTech market region dominated the market with largest revenue share of 45.90% in 2024. The growing technological advancements, such as AI in FemTech products are expected to drive market growth over the forecast period.

• Flo is the most downloaded/subscribed app, with over 200 million downloads by 2021. This app majorly caters to period & fertility tracking

• Natural Cycles ad Clue are a few FDA approved digital contraceptive apps that use Bayesian modeling for the prediction of the most fertile days (The high-risk window)

• In February 2023, an AI-based chat application Ema app, previously called SocialMama inspired by ChatGPT has been released by a women's health start-up in Texas. Such advancements help in the increased adoption of FemTech apps, driving market growth in the region

FemTech Market Segmentation

Grand View Research has segmented the global FemTech market on the basis of on type, application, end-use, and region:

FemTech Type Outlook (Revenue, USD Million, 2018 - 2030)

• Devices

• Software

• Services

• Consumer Products

FemTech Application Outlook (Revenue, USD Million, 2018 - 2030)

• Pregnancy and Nursing Care

• Reproductive Health & Contraception

• Menstrual Health

• General Health

• Pelvic & Uterine Health

• Sexual Health

• Womens Wellness

• Menopause Care

• Longevity & Mental Health

FemTech End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Direct to Consumer

• Hospitals

• Surgical Centers

• Fertility Clinics

• Diagnostic Centers

• Others

FemTech Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

o Russia

o Iceland

o Finland

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

o Thailand

o Singapore

• Latin America

o Brazil

o Argentina

• Middle East and Africa (MEA)

o South Africa

o Saudi Arabia

o UAE

o Kuwait

o Israel

Order a free sample PDF of the FemTech Market Intelligence Study, published by Grand View Research.

#FemTech Market#FemTech Market Size#FemTech Market Share#FemTech Market Analysis#FemTech Market Growth

0 notes

Text

Elvie unveiled an app-controlled smart bouncer that turns into a bassinet at CES 2025

ElvieA woman-founded hardware startup has unveiled a new app-controlled smart bouncer that gently transforms into a bassinet while baby is present. Parents and caregivers can comfort their baby with the new Elvie Rise, announced at CES 2025 on Monday. No need to move their child between sleeping and playing products. The startup is known for its portfolio. femtech productsincluding a connected…

0 notes

Text

Elvie unveiled an app-controlled smart bouncer that turns into a bassinet at CES 2025

ElvieA woman-founded hardware startup has unveiled a new app-controlled smart bouncer that gently transforms into a bassinet while baby is present. Parents and caregivers can comfort their baby with the new Elvie Rise, announced at CES 2025 on Monday. No need to move their child between sleeping and playing products. The startup is known for its portfolio. femtech productsincluding a connected…

0 notes

Text

🌸 The Hormonal Health Revolution: Why Progesterone Testing is on the Rise 🌸

Download Sample: https://virtuemarketresearch.com/report/natural-progesterone-test-market?utm_source=Tumblr&utm_medium=Social&utm_campaign=Tejaswini

Did you know the global natural progesterone test market is on track to reach $1.3 billion by 2030? That's a massive leap from its 2023 valuation of $718.9 million, with a 9% CAGR driving growth over the next decade! 🚀

But why the buzz around progesterone testing? 🤔

💡 What is a Progesterone Test? Progesterone is a crucial hormone that helps regulate fertility, pregnancy, and overall reproductive health. Testing progesterone levels can: 🩺 Identify causes of infertility or pregnancy complications 🩺 Detect adrenal gland disorders linked to hormonal imbalances 🩺 Aid in breast cancer prevention by balancing estrogen levels

✨ What’s Driving This Growth?

🌍 Rising Awareness: Social media and wellness apps are empowering women to track ovulation and hormonal health like never before.

🏥 Tech Advances: At-home hormone test kits and telemedicine make it easier and more affordable to stay informed.

💰 Femtech Investments: The U.S. alone saw $11.2 billion in femtech funding, fueling innovation in diagnostics and care.

✨ The Challenges Despite the progress, there are hurdles: ❌ Lack of awareness in rural and underserved areas ❌ High costs of advanced diagnostics ❌ Limited access to cutting-edge facilities

Inquire to Buy: https://virtuemarketresearch.com/report/natural-progesterone-test-market?utm_source=Tumblr&utm_medium=Social&utm_campaign=Tejaswini

✨ Why It Matters With 1 in 6 adults globally experiencing infertility and millions of women impacted by breast cancer, progesterone testing isn’t just about diagnostics—it’s about giving everyone access to life-changing care.

💌 The Future is Bright From personalized healthcare to hormonal biomarker research, the progesterone test market is evolving fast. Companies like Proov are making waves with FDA-approved home testing kits, while startups like Eli are pioneering saliva-based hormone testing.

This isn’t just a medical breakthrough—it’s a movement for accessible, affordable, and empowering healthcare for all. 💖

📢 Share Your Voice! What do you think about the rise of femtech and hormonal health awareness? Let’s discuss! 🌿

0 notes