#Fintech Blockchain Market Trends and Outlook

Text

https://www.statsandresearch.com/report/40284-global-fintech-blockchain-market

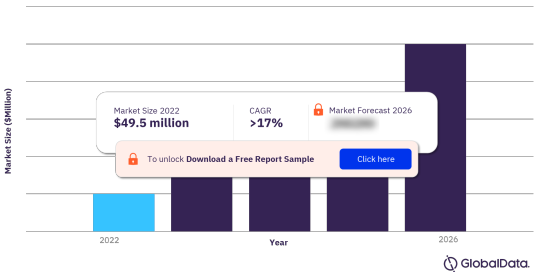

#Fintech Blockchain Market COVID-19 Analysis Report#Fintech Blockchain Market Demand Outlook#Fintech Blockchain Market Primary Research#Fintech Blockchain Market Size and Growth#Fintech Blockchain Market Trends#Fintech Blockchain Market#global Fintech Blockchain market by Application#global Fintech Blockchain Market by rising trends#Fintech Blockchain Market Development#Fintech Blockchain market Future#Fintech Blockchain Market Growth#Fintech Blockchain market in Key Countries#Fintech Blockchain Market Latest Report#Fintech Blockchain market SWOT analysis#Fintech Blockchain market Top Manufacturers#Fintech Blockchain Sales market#Fintech Blockchain Market COVID-19 Impact Analysis Report#Fintech Blockchain Market Primary and Secondary Research#Fintech Blockchain Market Size#Fintech Blockchain Market Share#Fintech Blockchain Market Research Analysis#Fintech Blockchain Market Trends and Outlook#Fintech Blockchain Industry Analysis

0 notes

Text

The Dynamics of the Financial Markets

The financial markets are ever-evolving, influenced by a myriad of factors ranging from economic indicators to geopolitical events. As investors navigate this dynamic landscape, staying informed and adapting to changing conditions are crucial for success. In 2024, several key trends are shaping the financial markets, presenting both opportunities and challenges for investors.

Technological Advancements

Technological innovation continues to reshape the financial industry, revolutionizing how transactions are conducted and assets are managed. From the rise of blockchain technology to the proliferation of algorithmic trading, advancements in fintech are fundamentally altering the way financial markets operate. “The integration of technology in financial markets has accelerated the pace of trading and increased market efficiency,” says Michael Shvartsman, a financial analyst. “However, it also poses challenges in terms of cybersecurity and regulatory oversight.”

Sustainable Investing

Sustainable investing, driven by environmental, social, and governance (ESG) considerations, has gained significant traction in recent years. Investors are increasingly incorporating ESG criteria into their investment decisions, seeking to align their portfolios with their values while generating financial returns. “Sustainable investing is no longer a niche market but a mainstream investment strategy,” notes Michael Shvartsman. “Companies with strong ESG performance are not only viewed favorably by investors but also tend to exhibit long-term resilience and profitability.”

Regulatory Environment

Regulatory developments play a crucial role in shaping the financial markets, impacting everything from market liquidity to investor confidence. In 2024, regulatory bodies around the world are focusing on enhancing transparency, mitigating systemic risks, and addressing emerging challenges such as cryptocurrencies and digital assets. “Regulatory clarity is essential for maintaining market integrity and investor protection,” emphasizes Michael Shvartsman. “Clear and consistent regulations provide investors with confidence and certainty, fostering a healthy and vibrant financial ecosystem.”

Global Economic Outlook

The global economic landscape is influenced by various macroeconomic factors, including economic growth, inflation rates, and monetary policies. In 2024, uncertainties surrounding geopolitical tensions, supply chain disruptions, and the ongoing COVID-19 pandemic continue to impact economic forecasts and market sentiment. “Navigating the complexities of the global economy requires a comprehensive understanding of macroeconomic indicators and their implications for financial markets,” advises Michael Shvartsman. “Investors should remain vigilant and agile in response to changing economic conditions.”

Investment Strategies

In the face of market volatility and uncertainty, adopting a diversified investment strategy is essential for managing risk and achieving long-term financial goals. “Diversification across asset classes, sectors, and geographic regions is a time-tested approach to building resilient investment portfolios,” recommends Michael Shvartsman. “Additionally, maintaining a long-term perspective and avoiding emotional decision-making are key principles for successful investing in today’s dynamic markets.”

As investors navigate the complexities of the financial markets in 2024, staying informed, adaptable, and disciplined are essential strategies for success. By leveraging technological innovations, incorporating sustainable investing principles, staying abreast of regulatory developments, and adopting prudent investment strategies, investors can position themselves to capitalize on opportunities and navigate challenges in today’s ever-changing financial landscape.

Read more:

0 notes

Text

FinTech Market - Forecast(2024 - 2030)

The FinTech Market size is estimated to reach $851 billion by 2030, growing at a CAGR of 18.5% during the forecast period 2023-2030. Fintech is the usage of new technological breakthroughs such as artificial intelligence, application programming interfaces and blockchain for financial goods and services improvement and automation.

With a rise in the number of collaborations between financial institutions and national regulators, insurance companies and banks are rapidly embracing cutting-edge technology use in everyday operations rather than using outdated operating systems, thus leading to the FinTech market opportunities. Besides, rising customer demand for more user-friendly channels for performing financial transactions such as at e-commerce sites and mobile banking apps is expected to drive the Global FinTech Market. In 2022, as per World Bank, over 57% of people in developed nations pay their bills from a regular account through digital payments via phone, card or the internet. This represents the FinTech Industry Outlook.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭

Key Takeaways:

The dominance of the North America Region

Geographically, North America held the largest FinTech market share of 36% in 2022 owing to an increase in the use of e-commerce platforms in the region. In North America, the adoption of e-commerce is 71.5% in 2022.

Blockchain Segment Anticipated to Witness Fastest Growth

Based on Technology, the Blockchain Segment is estimated to grow with the fastest CAGR of 20.1% during the market forecast period 2023-2030. This is due to the rising usage of cryptocurrencies or digital currencies that are developed on distributed ledger infrastructure for payment purposes.

Wealth Management Projected to be the Fastest Growing Segment

Based on Services, the wealth Management Segment is estimated to grow with the fastest CAGR of 20.5% during the forecast period 2023-2030. This is owing to the rising demand for financial planning, increased security; fully digitalized client onboarding and real-time coordination between the financial adviser and the client.

Rising Demand for Mobile Banking Applications

According to NCBI, mobile banking apps have expanded from 35% to 80% in 2020. Mobile beneficiaries globally have reached more than 6.8 USD billion since mobile was connected to the internet. Every bank has its own mobile app that enables a customer to transact online and transfer money to users all over the world.

Rising Investments in FinTech Firms

In many countries around the world, investments in fintech have grown significantly. The overall amount of investment in fintech start-ups increased to $210 billion in 2021. The United States attracted the biggest investment, accounting for about 80% of the overall investment. This financial technology investment trend is likely to generate lucrative market growth in the FinTech Market analysis report.

Risks to Data and Privacy may Hamper the Growth of the FinTech market

Companies need to do security testing prior to deployment of the app, application or website. The issue with this is the possibility of unanticipated things that prolong the release timeline. Developers may ship risky software to get a financial product to market sooner. However, fixing flaws later in the software development lifecycle is exceedingly expensive. This is one of the factors that is hampering the FinTech Market growth. The largest cyber incident in British financial history was the theft of US$2 million from the accounts of 9000 consumers.

Purchase Report

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the FinTech Market. The 10 key companies in this industry are:

Avant LLC (AvantCredit®)

Atom Bank plc (Jetpack, Swinject)

Ant Group (Huabei, Alipay)

Social Finance Inc. (SoFi Credit Card, SoFi Invest®)

Goldman Sachs (TxB, Datonomy™)

Adyen (Affirm, Giropay)

Bnkbl Ltd (L 39 INNOVATE)

Blockstream (Liquid Network, Blockstream Finance)

Cisco Systems Inc. (Cisco SecureX, Cisco Talos)

Circle Internet Financial Limited (USDC, Euro Coin)

0 notes

Text

Investment in UAE

The United Arab Emirates (UAE) has firmly established itself as a global hub for business and investment. With its strategic location, stable economy, favorable regulatory environment, and robust infrastructure, the UAE offers a plethora of opportunities for savvy investors seeking to diversify their portfolios and capitalize on emerging trends.

Why Invest in the UAE?

Dynamic Economy: The UAE boasts a dynamic and diversified economy, driven by sectors such as real estate, tourism, finance, technology, and renewable energy. Its strategic location at the crossroads of Europe, Asia, and Africa makes it a prime destination for international trade and investment.

Stable Political Environment: Political stability is crucial for fostering investor confidence, and the UAE excels in this aspect. With visionary leadership and a progressive outlook, the country provides a secure and conducive environment for businesses to thrive.

Tax Advantages: One of the key attractions for investors is the UAE’s favorable tax regime. With no corporate or income taxes in most Emirates, investors can enjoy higher returns on their investments compared to many other jurisdictions.

Infrastructure Development: The UAE’s commitment to infrastructure development is evident in its world-class transportation networks, state-of-the-art facilities, and smart city initiatives. This robust infrastructure framework enhances connectivity, facilitates business operations, and drives economic growth.

Promising Investment Sectors

Real Estate: The UAE’s real estate market continues to attract investors from around the globe. With iconic developments like Dubai Marina, Downtown Dubai, and Yas Island in Abu Dhabi, the property sector offers a diverse range of investment opportunities, including residential, commercial, and hospitality properties.

Tourism and Hospitality: As a popular tourist destination, the UAE presents lucrative opportunities in the hospitality industry. From luxury resorts and boutique hotels to theme parks and entertainment complexes, there’s immense potential for investors looking to capitalize on the growing tourism sector.

Renewable Energy: With a strong emphasis on sustainability and clean energy, the UAE has emerged as a leader in renewable energy investment. Projects like the Mohammed bin Rashid Al Maktoum Solar Park and the Abu Dhabi Solar Rooftop Program underscore the country’s commitment to green initiatives and offer attractive investment prospects in solar, wind, and other renewable energy sources.

Technology and Innovation: The UAE’s focus on innovation and digital transformation has created a thriving ecosystem for technology startups and entrepreneurs. With initiatives like Dubai Internet City, Abu Dhabi’s Hub71, and the Dubai Future Foundation, the country is fostering innovation-driven investment opportunities in sectors such as fintech, artificial intelligence, blockchain, and smart cities.

Navigating the Investment Landscape

While the UAE offers abundant investment opportunities, navigating the market requires careful planning, due diligence, and expert guidance. Partnering with reputable advisors, understanding local regulations, and staying informed about market trends are essential steps for successful investment ventures in the UAE.

Whether you’re a seasoned investor or exploring opportunities for the first time, the UAE’s dynamic business environment and investment-friendly policies make it an attractive destination to grow your wealth and achieve your financial goals.

Conclusion

As the UAE continues to position itself as a global investment powerhouse, seizing the opportunities presented by its vibrant economy and strategic advantages can yield substantial returns for investors. With the right strategy, diligence, and foresight, investing in the UAE can pave the way for long-term prosperity and success.

0 notes

Text

Mobile Wallet Market Trends and Opportunities: Global Outlook (2023-2032)

The global demand for mobile wallets was valued at USD 7515.2 million in 2023 and is expected to reach USD 80248.4 million in 2032, growing at a CAGR of 30.1% between 2024 and 2032.

Mobile wallet market refers to the sector involved in the development, distribution, and utilization of mobile wallet applications, which are digital platforms that allow users to store payment card information on their mobile devices to make electronic transactions. This market has grown significantly due to the increasing adoption of smartphones, enhanced internet connectivity, and a shift towards cashless transactions globally. Mobile wallets offer convenience, allowing users to easily make in-store payments, online shopping, and peer-to-peer transfers with just a few taps on their smartphones. Key players in this market include technology companies, financial institutions, and fintech startups that are constantly innovating to provide secure, fast, and user-friendly services. The market is also driven by supportive regulatory frameworks that encourage digital payments and the integration of technologies like NFC (Near Field Communication), QR codes, and biometric authentication to enhance transaction security.

A mobile wallet is a digital version of a traditional wallet that can be used on a mobile device, allowing users to store payment information, such as credit and debit card details, and make transactions electronically. This technology simplifies the process of paying for goods and services by eliminating the need for physical cards or cash, enabling users to complete transactions quickly and securely with just a few taps on their smartphone. Mobile wallets can also hold digital coupons, loyalty cards, and tickets, enhancing the overall convenience for users. The technology often incorporates advanced security features such as encryption and biometrics to ensure the safety of users' financial information. Increasingly popular due to their ease of use and the growing trend towards cashless transactions, mobile wallets are becoming an essential tool for everyday financial activities.

Market Trends-

Increased Adoption of Contactless Payments: The COVID-19 pandemic accelerated the shift towards contactless payments, as consumers and merchants alike sought safer, touch-free transaction methods. This trend continues to boost the usage of mobile wallets, which are inherently contactless.

Integration with Loyalty Programs and Other Services: Mobile wallets are increasingly integrating additional functionalities beyond simple transactions. Many now offer ways to store loyalty cards, gift cards, and coupons, and they can link directly to rewards programs, allowing users to earn and redeem points seamlessly.

Rise of Biometric Security: To enhance security, mobile wallet providers are incorporating biometric technologies, such as fingerprint scanning, facial recognition, and voice authentication. These methods not only secure transactions but also improve the user experience by simplifying the authentication process.

Expansion of Financial Services: Beyond basic transactions, mobile wallets are expanding into broader financial services, including personal finance management, real-time spending notifications, investment services, and micro-loans. This makes them more comprehensive financial tools for users.

Regulatory Support and Challenges: Regulatory developments are significantly shaping the market. For example, regulations that promote financial inclusion and digital payments can drive adoption, while stringent data protection regulations can pose challenges to market players.

Cross-border Transactions: As globalization increases, there is a growing demand for mobile wallets that can facilitate cross-border payments smoothly and affordably. Wallet providers are partnering with international payment networks to cater to this need.

Blockchain and Cryptocurrency Integrations: Some mobile wallets are beginning to support blockchain technologies and cryptocurrencies, allowing users to store and transact in digital currencies alongside traditional money. This trend is still in its early stages but is expected to grow as consumer interest in cryptocurrencies continues to rise.

Key Players:

Amazon Web Services Inc.

Visa Inc.

American Express

PayPal Holdings Inc.

Apple Inc.

Google Inc.

Airtel

Mastercard

Alipay

Samsung

AT&T

Others

More About Report- https://www.credenceresearch.com/report/mobile-wallet-market

Regional Insights-

North America: In this region, particularly in the United States and Canada, the market is driven by high smartphone penetration, widespread internet access, and a strong presence of tech giants like Apple and Google, who offer their own mobile wallet solutions (Apple Pay and Google Wallet). The demand for mobile wallets is bolstered by consumers' preference for convenience and contactless payment methods.

Europe: Europe shows strong growth in mobile wallet usage, supported by stringent regulations like PSD2 (Payment Services Directive) that promote financial innovation and security. Countries like Sweden, the UK, and Germany are leading in mobile payments due to a high level of trust in digital services and efforts towards becoming cashless societies.

Asia-Pacific: This region is the fastest-growing market for mobile wallets, led by China and India. The proliferation of affordable smartphones and a large unbanked population drive the adoption. Services like Alipay and WeChat Pay in China and Paytm in India dominate the market, offering extensive services beyond mere transactions, including financial services and online booking systems.

Latin America: Growth in Latin America is spurred by an increase in mobile penetration and a push for financial inclusion. Countries like Brazil and Mexico are witnessing rapid growth in mobile wallet adoption, with local banks and fintech startups leading the way in offering innovative mobile payment solutions.

Middle East and Africa: In these regions, mobile wallets play a crucial role in financial inclusion, catering to a large population without traditional banking services. Mobile money services like M-Pesa in Kenya have been revolutionary, providing basic financial services that are accessible via simple mobile phones.

Segmentation

By Type of Mobile Wallet

Open Mobile Wallets

Closed Mobile Wallets

By Technology Platform

NFC (Near Field Communication) Based Wallets

QR Code Based Wallets

Peer-to-Peer (P2P) Transfer Wallets

Cloud-Based Wallets

By Integration Level

Integrated Wallets

Standalone Wallets

Browse the full report – https://www.credenceresearch.com/report/mobile-wallet-market

Browse Our Blog: https://www.linkedin.com/pulse/big-data-services-market-insights-comprehensive-global-forecast-qcqef

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

What is the Biggest Opportunity for Fintech?

Fintech, short for financial technology, has revolutionized the way we manage our finances, invest, and conduct transactions. With advancements in digital technology and changing consumer preferences, the fintech industry continues to expand, presenting numerous opportunities for innovation and growth. In this article, we will explore the biggest opportunity for fintech and delve into the factors driving its success.

Introduction to Fintech

Fintech encompasses a wide range of technologies and innovations aimed at improving financial services. From mobile payment solutions to blockchain-based cryptocurrencies, fintech has disrupted traditional banking and financial institutions. Its scope includes areas such as lending, insurance, wealth management, and regulatory technology (RegTech).

Current Landscape of Fintech

The fintech landscape is diverse, with established players like PayPal, Square, and Robinhood, alongside a multitude of startups and disruptors. These companies leverage technology to offer faster, more accessible, and cost-effective financial services. However, regulatory challenges, such as compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, remain a concern.

Identifying Opportunities in Fintech

To identify the biggest opportunity in fintech, we must look at market gaps and emerging trends. Consumers today demand seamless experiences, personalized services, and greater transparency. Therefore, areas like digital banking, robo-advisors, peer-to-peer lending, and sustainable finance present significant opportunities for innovation.

Biggest Opportunity for Fintech

Among the various opportunities in fintech, digital banking stands out as one of the most promising areas. With the rise of neo-banks and challenger banks, traditional banking models are being challenged. These digital-first banks offer features like real-time payments, budgeting tools, and round-the-clock customer support, appealing to tech-savvy consumers.

Furthermore, financial inclusion remains a pressing issue globally. Millions of people lack access to basic banking services, presenting an opportunity for fintech to bridge the gap. By leveraging mobile technology and alternative data sources, fintech companies can reach underserved populations and provide them with essential financial services.

Challenges and Risks

Despite the opportunities, the fintech industry faces several challenges and risks. Security concerns, such as data breaches and cyberattacks, pose a threat to consumer trust and confidence. Moreover, regulatory uncertainty and compliance requirements can hinder innovation and scalability for fintech startups.

Future Outlook

Looking ahead, the future of fintech appears promising. As technology continues to evolve, we can expect further disruptions and innovations in the financial industry. Collaboration between fintech companies, traditional banks, and regulatory bodies will be crucial in addressing challenges and unlocking new opportunities.

Conclusion

In conclusion, the biggest opportunity for fintech lies in digital banking and financial inclusion. By embracing technology and addressing consumer needs, fintech companies can revolutionize the way we manage money and access financial services. However, they must navigate challenges such as security risks and regulatory compliance to realize their full potential.

FAQs (Frequently Asked Questions)

What makes digital banking a significant opportunity in fintech?

Digital banking offers convenience, accessibility, and personalized experiences to consumers, driving its adoption and growth in the fintech industry.

How can fintech companies promote financial inclusion?

Fintech companies can leverage technology to reach underserved populations, provide them with affordable financial services, and empower them to participate in the formal economy.

What role do regulations play in the fintech industry?

Regulations ensure consumer protection, financial stability, and integrity in the financial system. Fintech companies must comply with regulatory requirements to operate legally and sustainably.

What are the risks associated with fintech?

Fintech faces risks such as cybersecurity threats, data privacy breaches, regulatory challenges, and market volatility. Companies must implement robust risk management strategies to mitigate these risks.

How will collaboration shape the future of fintech?

Collaboration between fintech companies, traditional banks, technology firms, and regulatory bodies will drive innovation, foster industry standards, and address complex challenges in the financial ecosystem.

0 notes

Text

Navigating Trends, Embracing Innovation, and Shaping the Future of Finance

The banking industry plays a crucial role in the global economy, providing financial services and facilitating economic activities. Here are some key aspects of the banking sector, including industry trends, market size, and the future outlook:

Banking Sector Overview:

The banking sector encompasses financial institutions that offer a range of services, including deposit-taking, lending, and investment. Banks serve as intermediaries between savers and borrowers, playing a vital role in the functioning of the economy.

2. Banking Market and Industry Trends:

Digital Transformation: The banking industry has witnessed a significant shift towards digitalization. Online banking, mobile apps, and digital payment systems have become integral to the sector, enhancing customer convenience and reducing operational costs.

Fintech Integration: Collaboration between traditional banks and fintech companies is increasing. Fintech innovations, such as blockchain, artificial intelligence, and robo-advisors, are being integrated to streamline processes, improve efficiency, and offer innovative financial products.

Customer-Centric Approach: Banks are increasingly focusing on enhancing customer experience. Personalized services, 24/7 accessibility, and tailored financial products are key areas of emphasis to meet evolving customer expectations.

Cybersecurity: With the rise of digital transactions, cybersecurity has become a critical concern. Banks are investing heavily in advanced cybersecurity measures to protect customer data and maintain trust.

Sustainable Banking: Environmental, social, and governance (ESG) considerations are gaining prominence. Banks are incorporating sustainable practices into their operations and investing in environmentally and socially responsible projects.

3. Banking Industry Market Size:

The banking industry's market size varies by region, with large economies generally having more substantial banking sectors. Market size is influenced by factors such as population size, economic development, and regulatory environment.

4. Data Analysis in Banking Sector:

Risk Management: Data analysis plays a crucial role in assessing and managing risks. Banks use sophisticated algorithms to analyze customer behavior, detect fraudulent activities, and make informed lending decisions.

Customer Insights: Data analytics helps banks gain valuable insights into customer behavior and preferences. This information is used to tailor products and services, improving customer satisfaction and loyalty.

Future of Banking Industry:

Open Banking: The concept of open banking, allowing third-party providers to access banking data, is gaining traction. This fosters innovation, encourages competition, and provides customers with a broader range of financial services.

Artificial Intelligence and Automation: The future of banking will likely see increased use of AI and automation for tasks such as customer service, fraud detection, and back-office operations, leading to greater efficiency.

Blockchain and Cryptocurrencies: The adoption of blockchain technology and cryptocurrencies may reshape aspects of the banking industry, particularly in terms of transaction speed, security, and cross-border payments.

Regulatory Changes: Ongoing regulatory developments will shape the banking landscape. Adapting to new regulations, particularly those related to data privacy and cybersecurity, will be crucial for industry players.

In conclusion, the banking industry is undergoing a transformative phase, driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. Staying agile and embracing innovation will be key for banks to thrive in the dynamic financial landscape of the future.

0 notes

Text

Emerging Trends and Opportunities in the Money Transfer Industry: Outlook for 2024

Emerging Trends and Opportunities in the Money Transfer Industry: Outlook for 2024Looking ahead to 2024, the money transfer industry is poised for continued growth and transformation. The industry's expansion is largely driven by the increasing adoption of digital and instant payment methods, a trend that has been accelerating in recent years.

Market Prospects in 2024:- Continued Growth in Digital Remittances: The digital remittance market, valued at USD 21.83 billion in 2023, is projected to grow at a CAGR of 15.6%, potentially reaching USD 60.05 billion by 2030. This growth trajectory suggests that 2024 will witness a significant increase in market size, driven by the ongoing digital transformation in the financial sector.

- Expansion of Smartphone-Based Transactions: With the increasing penetration of smartphones globally, mobile-based money transfers are expected to see substantial growth. The convenience and accessibility offered by smartphones are making online money transfers more popular, especially in regions with growing smartphone usage.

- Innovations in Payment Technologies: Product innovation remains a key trend, with companies in the money transfer sector continually developing new and improved solutions to enhance customer experience and operational efficiency.

- Targeting Emerging Markets: Regions like the Asia Pacific, which are witnessing rapid adoption of mobile banking and cashless payments, offer lucrative opportunities for market players. Companies can focus on expanding their presence in these high-growth markets.

- Customized Solutions for Diverse Demographics: As the market becomes more diverse, there's an opportunity for tailored financial products that cater to the unique needs of different demographic groups, including migrants and international students.

- Leveraging Fintech Innovations: Incorporating fintech innovations such as blockchain for secure transactions, AI for personalized services, and instant payment solutions can give companies a competitive edge.

- Strategic Partnerships and Collaborations: Forming alliances with local financial institutions, telecom companies, and fintech startups can help traditional money transfer operators expand their reach and service offerings.

- Regulatory Compliance and Trust Building: As digital money transfers grow, complying with international regulations and building trust through transparent practices will be crucial in gaining and retaining customer confidence.In summary, 2024 holds promising prospects for the money transfer industry, with substantial growth opportunities driven by technological advancements, increasing smartphone usage, and the rising demand for convenient and efficient payment solutions. For companies in this sector, focusing on innovation, market expansion, and customer-centric services will be key to capitalizing on these opportunities.

Read the full article

0 notes

Text

Unveiling Financial Convenience: Navigating the Dynamics of the Kuwait Cards and Payments Market

Transformative Trends: A Deep Dive into Kuwait's Financial Landscape

Kuwait's Cards and Payments Market is at the forefront of financial innovation, reflecting the nation's commitment to modernize its economic infrastructure. Kuwait Cards and Payments Market This comprehensive exploration delves into the nuanced dynamics of the Kuwait Cards and Payments sector, unraveling market trends, digital transformations, and the factors shaping the future of financial transactions in the country.

Market Overview: Kuwait's Financial Ecosystem

Payment Infrastructure: A Digital Frontier

Kuwait's Cards and Payments Market operates within a robust digital infrastructure. From traditional payment cards to cutting-edge mobile payment solutions, understanding the diverse range of payment methods offers insights into the nation's quest for financial inclusivity and efficiency.

Financial Institutions: Collaborative Progress

The market is characterized by collaborative efforts among financial institutions, from banks to fintech innovators. Tracking the partnerships and initiatives of key players provides a comprehensive view of the collaborative progress shaping Kuwait's financial landscape.

Digital Transformations: Shaping the Payment Experience

Contactless Payments: The Rise of Tap-and-Go

Contactless payments have become a hallmark of Kuwait's digital transformation. The widespread adoption of contactless cards and mobile payment options showcases a shift towards a more convenient and secure payment experience for consumers.

E-wallets and Mobile Banking: Empowering Consumers

The surge in e-wallets and mobile banking apps empowers Kuwaiti consumers with convenient and accessible financial tools. Examining the functionalities and user experiences of these digital platforms unveils the transformative impact on everyday financial transactions.

Market Trends: Navigating the Evolving Landscape

Cross-Border Transactions: Global Connectivity

Kuwait's Cards and Payments Market is increasingly involved in cross-border transactions. Exploring the trends in international payments and currency exchange provides insights into Kuwait's global financial connectivity and economic integration.

Digital Remittances: Streamlining International Transfers

The market's embrace of digital remittance services reflects a commitment to streamlining international fund transfers. Analyzing the efficiency and cost-effectiveness of these services sheds light on Kuwait's efforts to facilitate seamless global financial transactions.

Challenges and Opportunities: Striking a Balance

Cybersecurity Concerns: Safeguarding Financial Transactions

As digital transactions proliferate, the challenge of cybersecurity becomes pivotal. Safeguarding financial data and ensuring secure transactions present an ongoing opportunity for innovation and collaboration within Kuwait's financial sector.

Financial Inclusion: Bridging Gaps

Ensuring financial inclusion is both a challenge and an opportunity for Kuwait's Cards and Payments Market. Exploring initiatives to bring underserved populations into the financial fold offers insights into the industry's commitment to inclusive economic growth.

Future Outlook: Paving the Way for Financial Advancements

Blockchain and Cryptocurrency: Future Frontiers

The adoption of blockchain technology and the exploration of cryptocurrency applications signify Kuwait's readiness to embrace future financial frontiers. Analyzing the potential impacts of these advancements unveils the nation's forward-looking approach to financial technology.

Smart Technologies: The Role of AI and IoT

Smart technologies, including Artificial Intelligence (AI) and the Internet of Things (IoT), are poised to play a significant role in Kuwait's financial landscape. From personalized financial insights to enhanced security features, these technologies shape the future of financial services in the country.

Conclusion: Kuwait's Financial Future Unfolded

In conclusion, the Kuwait Cards and Payments Market is a dynamic force, driving financial evolution within the nation. As Kuwait navigates the digital transformation of its financial landscape, it stands poised to unlock new possibilities, empower consumers, and pave the way for a future where financial transactions are seamless, secure, and technologically advanced. Buy Full Report For More Information on the Kuwait Cards and Payments Market Forecast, Download a Free Sample Report

0 notes

Text

Kenya cards and payments Market : A Comprehensive Overview

Introduction

In the heart of East Africa lies Kenya, a nation not only known for its breathtaking landscapes but also for its dynamic and evolving financial landscape. One of the pivotal components of this landscape is the cards and payments market, a sector that has undergone significant transformations over the years.

Historical Perspective

The journey of Kenya's cards and payments market is akin to a captivating narrative. From the early days of barter systems to the introduction of paper currency, the evolution has been profound. The advent of plastic cards, especially credit and debit cards, marked a significant leap forward, bringing convenience to the fingertips of consumers.

Current Scenario

As of today, Kenya's cards and payments market is a bustling ecosystem with various stakeholders. Leading banks, financial institutions, and fintech startups play crucial roles in shaping the landscape. The range of payment methods is diverse, including traditional cards, digital wallets, and the ubiquitous mobile money platforms.

Digital Transformation

The technological wave has not spared the financial sector in Kenya. The rapid digitization has led to a paradigm shift in how transactions are conducted. Mobile payments, in particular, have gained immense popularity, making financial services more accessible to the unbanked and underbanked populations.

Regulatory Landscape

In the pursuit of a robust financial system, Kenya has implemented stringent regulations. Government policies focus on ensuring the security and integrity of transactions. Compliance with these regulations is mandatory for all players in the cards and payments arena.

Market Trends

The cards and payments market in Kenya is a dynamic space with several trends shaping its trajectory. Contactless payments, blockchain applications, and the integration of artificial intelligence are some of the key trends that demonstrate the industry's forward-looking approach.

Challenges

However, like any thriving sector, the cards and payments market in Kenya faces challenges. From issues related to cybersecurity to the need for constant innovation, industry players are navigating a landscape filled with complexities.

Opportunities

Despite challenges, the market presents vast opportunities for growth. The untapped potentials lie in expanding financial inclusion, developing innovative products, and collaborating with global players to enhance cross-border transactions.

Consumer Behavior

Understanding the psyche of the consumer is crucial in the financial arena. Consumer preferences, influenced by factors like convenience and security, dictate the choice of payment methods. This insight is invaluable for industry players seeking to tailor their services to meet customer expectations.

Case Studies

Examining successful case studies within Kenya's cards and payments market provides insights into strategies that have worked. Whether it's a novel approach to digital banking or a revolutionary mobile payment solution, these cases offer valuable lessons.

Future Outlook

Peering into the future, the cards and payments market in Kenya is poised for further growth. Technological advancements, coupled with strategic collaborations, are expected to redefine the landscape, making financial services more inclusive and efficient.

Global Comparisons

Drawing comparisons with global payment trends is essential to understand Kenya's position in the broader context. Analyzing similarities and differences sheds light on areas where the market can learn from or contribute to global best practices.

Sustainable Practices

In an era where sustainability is paramount, the cards and payments market in Kenya is exploring environmentally friendly and ethical practices. The integration of green technologies and adherence to ethical standards are becoming increasingly significant considerations.

Impact on Businesses

The influence of the cards and payments market extends beyond individual consumers. Small and medium-sized enterprises (SMEs) are particularly impacted, with the efficiency and accessibility of payment systems playing a crucial role in their operations and growth.

Conclusion

In conclusion, Kenya's cards and payments market is not just a financial engine but a reflection of the nation's progress. The journey from traditional transactions to the digital era is a testament to the resilience and adaptability of the industry. As Kenya charts its course into the future, the cards and payments market will continue to be a cornerstone of economic development.

To gain more information on the Kenya cards and payments market forecast, download a free report sample

0 notes

Text

Ripple’s Singapore subsidiary, Ripple Markets APAC, has been granted its full MPI license by the Monetary Authority of the region. This means, the company can now provide digital payment token services in Singapore.

In a recent post on X [formerly Twitter], Brad Garlinghouse, the Chief Executive Officer of Ripple, pointed out that the company received its full MPI license in just a span of four months after receiving its in-principal approval.

Incredibly proud of team @Ripple – just 4(!) months after we received our in-principle approval from @MAS_sg, we’ve now secured the full Major Payment Institution license for digital payment token services in Singapore.

— Brad Garlinghouse (@bgarlinghouse) October 4, 2023

In the official statement, Garlinghouse added,

“Since establishing Singapore as our Asia Pacific headquarters in 2017, the country has been pivotal to Ripple’s global business. We have hired exceptional talent and local leadership, doubling headcount over the past year and plan to continue growing our presence in a progressive jurisdiction like Singapore.”

Garlinghouse further asserted that under the leadership of the Monetary Authority, Singapore has developed into one of the “leading fintech and digital asset hubs.” He pointed out that the region has been able to strike a balance between innovation, consumer protection and responsible growth.

Ripple’s official post noted that regulatory clarity was the major contributor to Singapore’s success. Given the latest collapse of several companies from the industry, a host of countries have been applying the brakes on crypto innovation. Nevertheless, Singapore has been able to stay well ahead of the curve by “future-proofing for the inevitable,” Ripple’s team added.

Ripple Eyes APAC Expansion

The Asia Pacific region continues to be a region of strategic importance. Ripple revealed that 90% global leaders believe that blockchain and crypt will have a significant impact on business, finance, and society over the next three years. In fact, almost half of Asia Pacific finance leaders intend to use crypto for cross-border payments going forward. With respect to the future outlook, Ripple’s team highlighted,

“In general, payments across Asia Pacific will continue to trend increasingly digital — cashless transaction volume is set to increase 109% by 2025 — and Ripple will continue to prioritize this region for adoption of its global payments solutions.”

Source: Santamonica Study Abroad Consultants

Over the past few days, several companies have been successful in obtaining a licence in Singapore. The Monetary Authority of the region has granted the subsidiary of Switzerland-based crypto bank Sygnum a Major Payment Institution [MPI] licence a day ago. In just a span of just four months, even Sygnum Singapore managed to upgrade its status from in-principle approval to a full license. In fact, even this company now intends to expand its regulated offering to the Asia Pacific markets.

Right before Sygnum, Coinbase obtained its MPI license from Singapore’s central bank. The firm emphasised that 25% of Singaporeans consider crypto as the future of finance. Moreover, 32% of them have either been current or past owners of crypto. The stats evidently point out to the fact that Singapore has naturally become a significant location for this industry.

0 notes

Text

From Core Banking to Fintech Integration: Exploring Modern Banking Software

In an increasingly digital world, the banking sector is undergoing a rapid transformation, driven by advancements in technology and changing customer expectations. One of the critical enablers of this transformation is banking software. This blog will explore the dynamic landscape of the banking software market, highlighting the key trends, challenges, and opportunities that shape its evolution.

The Changing Face of Banking

Traditional banking models have evolved into agile, customer-centric institutions that prioritize convenience, security, and personalized experiences. This transformation is fueled by several factors:

Digitalization: The proliferation of smartphones and high-speed internet has made digital banking a norm. Customers now expect seamless online and mobile banking experiences.

Data Analytics: Banks harness the power of data analytics to gain insights into customer behavior, enabling them to offer tailored services and detect fraudulent activities proactively.

Fintech Disruption: Fintech startups are challenging established banks by offering innovative solutions, such as mobile payments, peer-to-peer lending, and robo-advisors. Banking software helps traditional banks compete in this evolving landscape.

Regulatory Compliance: Stringent regulatory requirements necessitate robust software solutions for risk management, anti-money laundering (AML), and Know Your Customer (KYC) processes.

The Banking Software Market Landscape

The banking software market is vast and diverse, comprising a range of solutions tailored to different needs. Here are some key segments within this market:

Core Banking Systems: These are the backbone of banking operations, managing customer accounts, transactions, and financial records. Modern core banking systems offer real-time processing and integration with other systems.

Mobile Banking Apps: As mobile usage soars, banks invest heavily in user-friendly apps that allow customers to manage accounts, make payments, and access a range of financial services on the go.

Online Banking: Internet banking portals provide customers with secure access to their accounts, enabling them to conduct transactions and access account information from their web browsers.

Payment Processing: Payment gateways and processing solutions facilitate the secure transfer of funds, enabling online purchases, fund transfers, and bill payments.

Risk Management and Compliance: Banking software helps institutions adhere to regulatory requirements, manage credit risk, and detect fraudulent activities through advanced analytics and AI-driven tools.

Customer Relationship Management (CRM): CRM software enables banks to better understand and engage with customers, improving customer retention and satisfaction.

Trends Shaping the Banking Software Market

AI and Machine Learning: AI-powered chatbots, predictive analytics, and fraud detection systems are becoming integral to banking software, enhancing customer service and security.

Blockchain: The adoption of blockchain technology is increasing for secure and transparent transaction processing, especially in areas like cross-border payments and trade finance.

Cloud Computing: Banks are gradually migrating their operations to the cloud to reduce costs, enhance scalability, and improve agility.

Open Banking: Regulations like PSD2 in Europe are promoting open banking, driving the development of APIs and middleware solutions to facilitate data sharing and collaboration between banks and fintechs.

Cybersecurity: With the growing threat of cyberattacks, banks invest heavily in cybersecurity solutions, including intrusion detection systems and biometric authentication.

Challenges and Future Outlook

While banking software has the potential to revolutionize the industry, it also faces several challenges, including data security concerns, regulatory compliance complexities, and the need for seamless integration with legacy systems.

Looking ahead, the banking software market is poised for significant growth as institutions continue to invest in technology to meet customer demands and stay competitive. The rise of digital-only banks, increased adoption of mobile banking, and ongoing regulatory changes will drive innovation and expansion in this space.

Conclusion

Banking software is at the heart of the financial industry's evolution, enabling banks to adapt to changing customer preferences and navigate complex regulatory landscapes. As technology continues to advance, the banking software market will remain a dynamic and competitive space, shaping the future of banking as we know it. Stay tuned for further developments in this exciting sector.

0 notes

Text

Digital Payments Market to surpass USD 37 Tn by 2032

As per a recent research report, Digital Payments Market surpass USD 37.1 Trillion by 2032.

The report cites that the industry growth is favored by the relentless pace of technological innovations. The advent of secure, user-friendly mobile payment platforms and the integration of cutting-edge technologies like Near Field Communication (NFC) and biometric authentication have made digital payments more convenient and secure than ever before. This has led to a surge in consumer confidence, driving widespread adoption. Moreover, the consumers are increasingly seeking convenience and flexibility in their payment methods. The shift towards online shopping, contactless payments, and digital wallets reflects the changing preferences of today's tech-savvy consumers, further shaping the industry outlook.

Request for Sample Copy report @ https://www.gminsights.com/request-sample/detail/6211

The digital payments industry size from Banking, Financial Services, and Insurance (BFSI) sector is touted to expand substantially over 2023-2032. The digital payments helps in reducing operational costs, mitigating fraud risks, and enhancing customer engagement in financial institutions. BFSI organizations are actively leveraging digital payment solutions to offer customers a wide range of services, from mobile banking and online lending to insurance premium payments. Furthermore, the adoption of blockchain technology and cryptocurrencies has opened up new avenues for innovation within the BFSI segment, promising increased security and transparency in financial transactions through digital payments.

The Mobile Point of Sale (POS) payments segment is anticipated to showcase impressing growth over the forecast period, due to its ability to streamline payment processes for businesses. Mobile POS solutions enable businesses to accept payments anywhere, anytime, providing a seamless and efficient checkout experience for customers. The integration of mobile POS systems with inventory management and customer relationship management software allows businesses to gain deeper insights into customer behavior and preferences, thereby improving decision-making processes and enhancing overall customer satisfaction. With the increasing adoption of smartphones and tablets, the mobile POS payments segment share will keep growing in the coming years.

Request for customization this report @ https://www.gminsights.com/roc/6211

Europe digital payments market is expected to showcase lucrative growth during 2023 and 2032. The regional growth is driven by factors such as a robust fintech ecosystem, government initiatives promoting cashless economies, and a tech-savvy population. Countries like Sweden and the United Kingdom have made substantial strides in becoming cashless societies, with mobile payments, contactless cards, and digital wallets becoming the norm. The focus on enhancing security measures and expanding the scope of digital payments to include public transportation, government services, and more will create a fertile environment for the growth of market players in Europe.

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Digital Payments market 360º synopsis, 2018 - 2032

2.2 Business trends

2.3 Regional trends

2.4 Type trends

2.5 End-user industry trends

Chapter 3 Digital Payments Market Industry Insights

3.1 Impact on COVID-19

3.2 Russia- Ukraine war impact

3.3 Industry ecosystem analysis

3.4 Vendor matrix

3.5 Profit margin analysis

3.6 Technology & innovation landscape

3.7 Patent analysis

3.8 Key news and initiatives

3.9 Regulatory landscape

3.10 Impact forces

3.10.1 Growth drivers

3.10.1.1 Increasing e-commerce and online transactions

3.10.1.2 Changing consumer behavior across the globe

3.10.1.3 Rising penetration of smartphones

3.10.1.4 Supportive government initiatives and regulatory support

3.10.1.5 Increasing globalization and cross border transactions

3.10.2 Industry pitfalls & challenges

3.10.2.1 Increasing case of data breaches and fraud

3.11 Growth potential analysis

3.12 Porter’s analysis

3.13 PESTEL analysis

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

AI Tools for FinTech Startups: Fueling Business Growth.

The convergence of Artificial Intelligence (AI) and Financial Technology (FinTech) is reshaping the landscape of the financial industry. As FinTech startups strive to disrupt traditional financial models and provide innovative solutions, AI tools have emerged as their strategic allies. These tools empower startups to optimize operations, enhance customer experiences, and drive business growth through data-driven insights. This blog delves into the profound impact of AI tools on FinTech startups, highlighting their capabilities, benefits, challenges, and future prospects.

The Role of AI in FinTech Startups

AI technology offers FinTech startups a transformative edge by automating processes, improving decision-making, and delivering personalized experiences. The dynamic nature of the financial sector demands real-time data analysis and intelligent decision-making. It helps in making AI a natural fit for startups seeking to gain a competitive edge.

Automated Customer Service:

AI-driven chatbots and virtual assistants are the bedrock of personalized customer support, catering to user inquiries in real time and enhancing engagement.

Fraud Detection and Prevention:

AI algorithms, with their ability to process immense transaction data, detect anomalies and patterns associated with fraudulent activities, fortifying security measures.

Credit Scoring and Risk Assessment:

AI-enabled credit scoring models employ machine learning to assess creditworthiness, empowering startups to make informed lending decisions.

Algorithmic Trading:

AI algorithms analyze market trends, historical data, and factors influencing stock prices, executing trades at optimal moments to maximize profitability.

Personalized Financial Advice:

AI tools mine customer data to deliver tailored financial advice, allowing startups to offer personalized investment strategies and recommendations.

Benefits and Impact

Enhanced Efficiency:

AI tools automate repetitive tasks, minimizing errors and boosting operational efficiency, enabling startups to allocate resources strategically.

Data-Driven Insights:

Leveraging AI-driven analytics, startups can extract actionable insights from complex datasets, facilitating informed decision-making and proactive strategy formulation.

Innovation and Disruption:

AI equips startups with the capabilities to create revolutionary solutions that challenge traditional financial paradigms and introduce disruptive offerings.

Overcoming Challenges

Data Privacy and Security:

Startups must prioritize data protection by implementing robust security measures, adhering to regulatory standards, and fostering a culture of data privacy.

Regulatory Compliance:

As startups embrace AI tools, they must ensure compliance with financial regulations, necessitating continuous monitoring and alignment with evolving standards.

Future Outlook

1. Advanced Predictive Analytics:

AI tools are poised to evolve into powerful predictive analytics platforms, equipping startups with the foresight to anticipate market trends and customer behaviors.

2. Blockchain Integration:

The synergy of AI and blockchain technology holds the promise of enhancing transparency, security, and efficiency in financial transactions, paving the way for novel solutions.

Conclusion: AI’s Evolution in FinTech

As FinTech startups journey towards growth and innovation, AI tools stand as pivotal instruments of transformation. These tools propel startups beyond traditional limitations, offering personalized experiences, risk management, and operational efficiency. The symbiosis of AI and FinTech ushers in an era of intelligent finance, where startups harness the power of data-driven decisions to shape the future of the financial industry.

Originally published at https://www.arcotgroup.com on August 26, 2023.

0 notes

Text

Why Fintech is the Best?

In today's fast-paced digital world, financial technology, or fintech, has emerged as a revolutionary force reshaping the way we manage and interact with money. With its blend of innovation, accessibility, and efficiency, fintech has become the preferred choice for individuals and businesses alike. Let's delve deeper into why fintech stands out as the best option for modern financial needs.

Introduction to Fintech

Fintech encompasses a broad spectrum of technological innovations aimed at enhancing and automating financial services. From mobile banking apps to cryptocurrency platforms, fintech solutions have transformed traditional banking practices, offering a range of services tailored to meet the evolving needs of consumers.

Accessibility and Convenience

One of the primary reasons why fintech has gained widespread popularity is its unparalleled accessibility and convenience. Unlike traditional banks, which operate within limited hours and physical branches, fintech platforms provide users with the flexibility to access banking services anytime, anywhere. Whether it's checking account balances, transferring funds, or paying bills, fintech offers seamless transactions at the touch of a button.

Innovation and Advancement

Fintech companies are at the forefront of innovation, leveraging cutting-edge technologies such as artificial intelligence, blockchain, and big data analytics to deliver next-generation financial solutions. By harnessing these technologies, fintech firms are able to offer enhanced security measures, protect against fraud, and streamline the overall banking experience for customers.

Cost-Effectiveness

In addition to convenience, fintech also boasts cost-effectiveness, with many platforms offering lower fees and charges compared to traditional banks. Moreover, fintech companies often provide competitive interest rates on savings accounts and loans, helping consumers maximize their financial resources and achieve their goals more efficiently.

Financial Inclusion

Fintech has the potential to bridge the gap between the banked and unbanked populations by reaching underserved communities and providing access to essential financial services. By offering alternative lending options and digital payment solutions, fintech empowers individuals and small businesses to participate in the formal economy and improve their financial well-being.

Personalized Financial Solutions

One of the key advantages of fintech is its ability to deliver personalized financial solutions tailored to the unique needs and preferences of each customer. Through data-driven insights and algorithms, fintech platforms can analyze spending patterns, identify trends, and offer personalized recommendations to help users make informed financial decisions.

Disruption of Traditional Banking

Fintech's disruptive impact on the traditional banking sector cannot be overstated. By challenging established norms and adopting a customer-centric approach, fintech companies have revolutionized the way financial services are delivered, driving innovation and competition within the industry.

Global Impact

The global reach of fintech has transcended geographical boundaries, enabling individuals and businesses to engage in cross-border transactions and expand their market presence on a global scale. With the rise of digital currencies and blockchain technology, fintech has facilitated faster, more secure, and cost-effective international payments, revolutionizing the way we conduct business across borders.

Regulatory Environment

As the fintech industry continues to evolve, regulatory frameworks and oversight play a crucial role in ensuring consumer protection and market stability. Governments around the world are actively engaging with fintech companies to establish clear guidelines and standards, fostering a conducive environment for innovation while safeguarding against potential risks and abuses.

Challenges and Future Outlook

Despite its numerous benefits, fintech also faces challenges such as cybersecurity threats, regulatory compliance, and maintaining consumer trust. However, with ongoing advancements in technology and a growing demand for digital financial solutions, the future outlook for fintech remains promising, with continued growth and innovation on the horizon.

Conclusion

In conclusion, fintech has emerged as the best option for modern financial needs, offering unparalleled accessibility, innovation, and cost-effectiveness. By leveraging technology to deliver personalized solutions and disrupt traditional banking practices, fintech is driving financial inclusion, empowering individuals and businesses, and reshaping the global economy.

Unique FAQs

Is fintech only for tech-savvy individuals?

Not at all. Fintech platforms are designed to be user-friendly and accessible to individuals of all backgrounds and technical abilities. Whether you're a seasoned investor or a first-time user, fintech offers intuitive interfaces and simplified processes to ensure a seamless experience for everyone.

How secure are fintech platforms compared to traditional banks?

Fintech companies prioritize security and invest heavily in advanced encryption technologies and fraud detection systems to protect user data and transactions. While no system is completely immune to cyber threats, fintech platforms often employ robust security measures that rival or exceed those of traditional banks.

Can fintech really help underserved communities gain access to financial services?

Absolutely. Fintech has the potential to reach underserved communities by offering alternative banking solutions and digital payment options that bypass traditional barriers such as physical branches and credit histories. By leveraging technology, fintech can provide financial services to individuals who may have been previously excluded from the formal banking system.

Are there any risks associated with using fintech platforms?

Like any financial service, fintech platforms come with inherent risks, including cybersecurity threats, data breaches, and regulatory compliance issues. However, reputable fintech companies prioritize security and transparency, implementing safeguards to mitigate these risks and protect users' financial interests.

What does the future hold for the fintech industry?

The future of fintech looks promising, with continued innovation and expansion into new markets and technologies. As consumer demand for digital financial solutions continues to grow, fintech companies will likely focus on enhancing security, improving user experiences, and leveraging emerging technologies such as artificial intelligence and decentralized finance (DeFi) to drive further growth and innovation.

0 notes