#Fintech Blockchain Market Trends

Text

https://www.statsandresearch.com/report/40284-global-fintech-blockchain-market

#Fintech Blockchain Market COVID-19 Analysis Report#Fintech Blockchain Market Demand Outlook#Fintech Blockchain Market Primary Research#Fintech Blockchain Market Size and Growth#Fintech Blockchain Market Trends#Fintech Blockchain Market#global Fintech Blockchain market by Application#global Fintech Blockchain Market by rising trends#Fintech Blockchain Market Development#Fintech Blockchain market Future#Fintech Blockchain Market Growth#Fintech Blockchain market in Key Countries#Fintech Blockchain Market Latest Report#Fintech Blockchain market SWOT analysis#Fintech Blockchain market Top Manufacturers#Fintech Blockchain Sales market#Fintech Blockchain Market COVID-19 Impact Analysis Report#Fintech Blockchain Market Primary and Secondary Research#Fintech Blockchain Market Size#Fintech Blockchain Market Share#Fintech Blockchain Market Research Analysis#Fintech Blockchain Market Trends and Outlook#Fintech Blockchain Industry Analysis

0 notes

Text

#Fintech Blockchain Market#Fintech Blockchain Market Trends#Fintech Blockchain Market Growth#Fintech Blockchain Market Industry#Fintech Blockchain Market Research

0 notes

Text

Exploring Digital Trends in Europe's BFSI Blockchain Market: Private, Public, and Hybrid Fintech Solutions

The Digital Europe Blockchain in BFSI Market exhibits robust growth trends in the Private and Public Europe Fintech Blockchain Industry sectors. Hybrid Europe Fintech Blockchain Industry solutions are also gaining prominence in the Europe Blockchain in BFSI Market. Stay updated on key Europe Blockchain in BFSI Market trends in regions such as the United Kingdom, Germany, France, Spain, Italy, and Switzerland.

#Digital Europe Blockchain in BFSI Market#Private Europe Fintech Blockchain Industry#Public Europe Blockchain in BFSI Market#Hybrid Europe Fintech Blockchain Industry#Europe Blockchain in BFSI Market Trends

0 notes

Text

The Rise of Battery Recycling in India: From Waste to Wealth

In the age of technology, where batteries power everything from our smartphones to our cars, the importance of battery recycling cannot be overstated. As India stands on the verge of an energy revolution, recycling has emerged as a critical component of the country’s sustainable future.

Recycling batteries is the process of converting used batteries into reusable materials, thereby reducing the need for new raw materials and the environmental impact of waste disposal. It’s a practice that not only conserves resources but also prevents old batteries, which can be toxic and made economically useful, instead of ending them in landfill sites.

India, with its huge population and rapidly growing economy, generates a significant amount of battery waste. The rise of electric vehicles and renewable energy storage solutions has further amplified the need for effective battery recycling. Recognizing this, the Indian government has implemented policies and regulations to encourage the proper disposal and recycling of batteries.

The Need for Recycling Batteries

Recycling Batteries is not just a matter of environmental responsibility; it’s a necessity. The improper disposal of batteries can have severe environmental and economic implications.

Environmental Impact of Improper Battery Disposal

Batteries contain a variety of heavy metals and toxic chemicals, including lead, mercury, cadmium, and lithium. When disposed of improperly, these substances can leak into the soil and water, causing significant environmental harm. This contamination can disrupt ecosystems, harm wildlife, and even pose risks to human health through the contamination of food and water supplies.

Moreover, the improper disposal of batteries contributes to the growing problem of electronic waste, or e-waste. E-waste is one of the fastest-growing waste streams globally, posing a significant challenge for waste management and leading to the loss of valuable resources that could be recovered and reused.

Economic Benefits of Battery Recycling

On the other side, recycling batteries offers substantial economic benefits. The process of recycling recovers valuable materials like lead, nickel, and lithium, which can be reused to manufacture new batteries or other products. This reduces the demand for new and unused materials, leading to cost savings and a lower environmental footprint.

In addition, the battery recycling industry can create jobs and stimulate economic growth. As the demand for batteries continues to rise, particularly with the growth of electric vehicles and renewable energy storage, so does the potential for a thriving battery recycling industry.

In India, the battery recycling sector is still in its infant stages, but it holds immense potential. With the right policies and infrastructure, battery recycling can become a significant industry, contributing to India’s economy while helping to address environmental challenges.

The journey of recycling batteries in India can be a fascinating tale of turning waste into wealth. It can build a story of how a country can leverage policy, technology, and entrepreneurship to transform a challenge into an opportunity.

Indian Government’s Policy on Battery Recycling

Recognizing the importance of recycling batteries, the Indian government has implemented a series of policies and regulations aimed at promoting responsible battery disposal and recycling.

Overview of the Battery Waste Management Rules 2022

Battery Waste Management Rules 2022 replaces the earlier Battery Management and Handling Rules 2001, providing a unified structure for the management of battery waste in India. They cover all types of batteries and apply to manufacturers, importers, assemblers, re-conditioners, consumers, and recyclers.

The 2022 rules introduce several significant changes, including stricter Extended Producer Responsibility (EPR) obligations, a focus on environmentally sound management of battery waste, and provisions for the formalization of the informal battery recycling sector.

Role of Extended Producer Responsibility (EPR)

Extended Producer Responsibility (EPR) is a policy approach under which producers are given significant responsibility for the treatment or disposal of post-consumer products.

Under the Battery Waste Management Rules 2022, producers are required to ensure that used batteries are collected and sent for recycling in an environmentally sound manner. They are also required to create awareness among consumers about the importance of proper battery disposal.

Government’s Initiatives to Promote Battery Recycling

The Indian government has launched several awareness campaigns, incentives for battery recycling businesses, and research and development programs to improve battery recycling technologies.

Furthermore, the government is also working to strengthen the infrastructure for battery collection and recycling and to formalize the informal battery recycling sector, which currently handles a significant portion of battery waste in India.

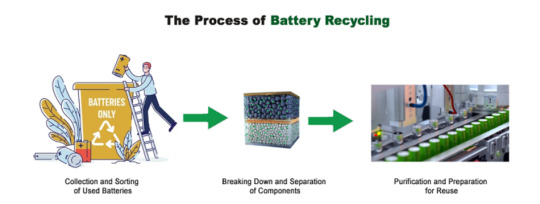

The Process of Recycling Batteries

Recycling Batteries is a complex process that involves several stages, each of which plays a crucial role in transforming used batteries into reusable materials. Here’s a closer look at how it works:

Collection and Sorting of Used Batteries

The first step in the recycling process is the collection of used batteries. This can be done through various means, including collection boxes at retail stores, community recycling events, and dedicated battery recycling facilities.

Once the batteries are collected, they are sorted based on their chemistry. Different types of batteries such as lead-acid, nickel-cadmium, and lithium-ion require different recycling processes, so accurate sorting is crucial.

Breaking Down and Separation of Components

After sorting, the batteries are broken down, often through a process called mechanical treatment. This involves crushing the batteries into small pieces, which makes it easier to separate the different components.

The crushed batteries are then separated into different streams. For example, in the case of lead-acid batteries, the lead and plastic components are separated from the electrolyte.

Purification and Preparation for Reuse

The separated materials then undergo further treatment to purify them and prepare them for reuse. This can involve a variety of processes, depending on the type of material.

For example, lead from lead-acid batteries is often smelted and refined to remove impurities, after which it can be used to manufacture new batteries. Similarly, plastic components can be cleaned and converted into pellets for use in new plastic products.

The recycling process not only recovers valuable materials from used batteries but also ensures that potentially harmful substances are managed in an environmentally sound manner.

The Business of Battery Recycling in India

Current State of Battery Recycling Industry in India

As the demand for batteries continues to grow, so does the potential for a thriving battery recycling industry. The Industry of recycling batteries in India is still in its infancy stages, but it’s growing rapidly.

Currently, the industry is dominated by the unorganized sector, which handles a significant portion of battery waste. However, as the market grows, more and more companies will enter the market and invest in advanced recycling technologies.

Major Companies Involved in Recycling Batteries

Several companies are leading the way in recycling batteries in India. These include Gravita India Ltd., a leading lead recycling company, and Attero Recycling, which specialises in e-waste management and recycles various types of batteries. Other players include Ecoreco, which offers solutions for e-waste and battery waste management, and Exigo Recycling, which provides recycling services for electronic waste, including batteries.

Opportunities and Challenges in the Battery Recycling Business

Read the full article at: https://dsb.edu.in/the-rise-of-battery-recycling-in-india-from-waste-to-wealth/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+battery+recycling

#waste management#battery#recycling#battery recycling market trend#battery recycling#ai#india#blockchain#fintech#jobs#education#google

0 notes

Text

Dow Theory in the Age of Blockchain: Cryptocurrencies and Beyond

From Charles Dow's era to the digital age: Can the time-tested Dow Theory conquer the wild world of cryptocurrencies and new assets? 🚀 #DowTheory #Cryptocurrencies #DigitalAge

In the ever-evolving world of finance, the enduring principles of Dow Theory stand as a beacon of wisdom, guiding investors through the tumultuous seas of the stock market for generations. But as we find ourselves in the midst of a digital revolution, where cryptocurrencies and new asset classes have emerged with transformative potential, the question arises: Can Dow Theory’s time-tested…

View On WordPress

#Bitcoin Growth#Blockchain Revolution#Cryptocurrency#Digital Assets#Digital Transformation#DJIA#DJTA#Dow Theory#FinTech#Innovation#Market Trends#Market Volatility

1 note

·

View note

Text

Best Understanding Crypto Market Cap’s

Understanding Crypto Market Cap’s ever-evolving landscape of digital currencies, market capitalization (market cap) plays a crucial role in assessing the value and significance of cryptocurrencies. This comprehensive guide aims to demystify the concept of market cap in the crypto industry, offering a detailed explanation of its significance, calculation methods, and impact on investors and the overall market. By understanding market capitalization, traders, enthusiasts, and analysts can gain valuable insights into the relative size and growth potential of different cryptocurrencies, aiding them in making informed investment decisions.

#metatypers#meta#crypto#crypto market#crypto currency#crypto trends#crypto regulation#crypto latest news#crypto trading#crypto wallet#blockchain#digitalcurrency#fintech#btc#ethereum

0 notes

Text

FINTECH MARKETING STRATEGIES TO TRY IN 2024

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#blockchain#fintech#fintech app development#lending software development company#marketing#marketing strategy#marketing stratergies#fintech marketing#custom software development#custom software solutions#custom software implementation and integration#custom software company#custom software application#highen fintech#blog

3 notes

·

View notes

Text

The Future of Fintech: Trends and Predictions

Introduction:

Financial technology, or fintech, has revolutionised the way we manage our finances. From mobile banking to digital payments, fintech has reshaped the financial landscape. fintech news As we look ahead, it is evident that fintech will continue to play a crucial role in shaping the future of finance. In this blog post, we will explore some of the emerging trends and make predictions about the future of fintech.

1.Artificial Intelligence and Machine Learning: AI and ML technologies are set to become even more integrated into fintech solutions. best fintech podcast They will enhance customer experience, automate processes, and provide personalised financial recommendations based on individual preferences and behavior's.

2.Blockchain and Cryptocurrencies: Blockchain technology has the potential to transform various aspects of finance, including cross-border transactions, supply chain finance, and identity verification. Investing in Cryptocurrencies Cryptocurrencies are likely to gain wider acceptance as more governments and institutions adopt regulatory frameworks.

3.Open Banking: Open banking initiatives will continue to gain momentum, enabling consumers to securely share their financial data with authorised third parties. The Future of Fintech This will foster innovation, competition, and the development of new financial services.

4.Financial Inclusion: Fintech will play a vital role in bridging the financial inclusion gap by providing access to banking and financial services for the unbanked and underbanked populations. Mobile banking, digital wallets, and microfinance solutions will empower individuals in emerging markets.

5.Cybersecurity and Data Privacy: As fintech continues to evolve, ensuring robust cybersecurity measures and protecting customer data will be paramount. Innovations in encryption, biometrics, and fraud detection will be crucial to maintain trust in digital financial services. top 10 financial podcasts

2 notes

·

View notes

Text

Kyril Irish Mei Fuentes has more than 12 years of expertise in the FinTech, Payments, Remittance, and Blockchain industries. She has played an instrumental role in growing the unbanked market in the Philippines. A business consultant-cum-educator, Kyril speaks to educate entrepreneurs and consumers about the latest development in the FinTech industry to help them stay one step ahead and in a position to leverage trends timely.

2 notes

·

View notes

Text

Top Fintech Trends That Shape Financial Future In 2023

The global financial services industry is going through a major transformation. It’s evident from the surge of fintech startups working in this space. With innovations like the blockchain and Robo-advisers, traditional banking is getting disrupted at an unprecedented pace. Financial institutions invest billions of dollars to keep up with digital payments and personal fintech apps development. But it’s not just about technology. Fintech trends will significantly impact the future of banking and beyond. Here are top Fintech Trends That Shape Financial Future in 2023.

Better Customer Experience and Collaboration

Digital transformation is happening in every industry. It’s not just about technology anymore. It’s about bringing customer experience to a new level. The banking sector is particularly well suited for this. Traditional banking has been very centralized. It’s not just about bringing digital banking to the masses. It’s about bringing the banking experience to the smartphone. Automated customer assistance, digital transactions, voice assistance, and more are expected to come shortly. This will result in a better experience for both customers and banks.

Digital Asset Management and Trading

Traditional banks rely on physical assets like cash and deposits. This poses security risks because of the risk of theft or damage.

Digital assets allow financial institutions to offer a range of financial services.

Blockchain technology is expected to transform trading and investment management. With digitization, financial institutions can now offer a range of services like direct trading or via smart contracts. This can make asset management more efficient and transparent. It can also reduce the costs of trading due to automation.

Also Read: Top 5 Creative Fintech App Ideas To Grow Your Business

NFC Payments and Fraud Detection

NFC payments have been around for a while. But it’s becoming commonplace in countries like the United States and Japan. The introduction of various mobile wallets is expected to increase. It can also reduce fraud due to the use of an original ID. Many banks are now offering this service. This increases the adoption of NFC payments. It also allows banks to detect fraud and better serve their customers.

NFC payments are expected to increase. This can be attributed to the rise of mobile payment systems like Apple Pay and Android Pay. The rise of fintech and innovations like Robo-advisers are expected to facilitate the process.

Fraud detection is expected to improve. With the rise of AI and machine learning, banks can detect more types of fraud. In fact, it can even help customers manage their money.

Artificial Intelligence and Blockchain Integration

Artificial intelligence is expected to become the next big thing in banking. Apart from helping consumers manage their money, it can also be used for fraud prevention.

AI is already being used for detecting fraudulent transactions at an early stage. It can also be used for making predictions to improve the customer experience.

Blockchain technology is expected to become more integrated with the financial sector. Government regulations and players’ efforts to expand the use of blockchain have led to a surge in interest in the technology. It can transform the industry, especially in the financial sector.

However, it will take some time for it to gain traction in the market. AI and blockchain integration will also help banks improve the customer experience.

Robust APIs and User-friendly Websites

As the adoption of digital channels increases, banks will have to improve their APIs and make them more robust. APIs are the key that unlocks the power of apps.

They are used by developers to develop apps that can be plugged into the bank system. Another trend that will be helpful for banks is user-friendly websites.

With the increase in mobile banking transactions, banks have been focusing on making their websites more interactive. They now have to rely more on AI and machine learning to make their websites more engaging for customers.

Also Read: Best Technological Aspects For FinTech App Development

Insurtech Will Disrupt Financial Sector

The insurance sector is also expected to be impacted by increased digital payments. Insurtech companies have shown great potential to disrupt the traditional model of insurance. These companies offer insurance through blockchain technology and help consumers save money using their personal data.

Another interesting trend that will significantly impact the financial sector is the rise of asset management. The emergence of Robo-advisers and investment platforms has encouraged asset managers to shift towards a more digital approach. The emergence of new technologies also means that startups can offer better financial services. With the rise of machine learning and artificial intelligence, asset management is expected to become more sophisticated.

Conclusion

The fintech revolution has transformed how people save, transact, and invest. It has also led to the growth of new fintech mobile app development services. Artificial intelligence, blockchain technology, and the internet of things have driven the revolution. There’s no sign of slowing down, and these are just some of the fintech trends that will shape the future of Financial services in 2023.

The fintech ecosystem must evolve to make it accessible and equitable for everyone. Mobio Solutions is a leading Fintech app development company. We pride ourselves on producing sturdy fintech apps and providing our clients with loads of joy with our exceptional work ethics.

#fintech#finance#finserv#financial#service#fintech industry#trends#2023#appdevelopment#MobioSolutions

6 notes

·

View notes

Text

Top 7 Online Business Ideas in the UAE (2024)

Unlocking Your Digital Empire: Top 7 Online Business Ideas in UAE (2024)

Capitalizing on the Boom: Trending Sectors for Online Success

Online business ideas in UAE have seen significant growth in recent years, fuelled by the country’s thriving economy and technological advancements. With a strong focus on innovation and entrepreneurship, the UAE offers a fertile ground for aspiring entrepreneurs to start and scale their ventures.

E-commerce

E-commerce is one of the most promising sectors for online business ideas in UAE success. With a rapidly growing population and increasing internet penetration, there is a high demand for unique products and localized strategies. Whether it’s fashion, electronics, or groceries, online retailers have the opportunity to tap into a large consumer base and capitalize on the convenience of online shopping.

Ed-Tech & Online Education

Discover profitable online business ideas in UAE like Ed-Tech and Online Education. Address the growing demand for quality online courses, serving remote learning and flexible education. Entrepreneurs can impact and earn from language learning apps to skill development platforms.

Content Creation & Digital Marketing

Content creation and digital marketing are also thriving in the UAE’s dynamic online landscape. With a young and tech-savvy population, there is a constant need for engaging and informative content across various platforms. Whether it’s blogging, vlogging, or social media marketing, businesses can leverage content creation to build authority, connect with their audience, and promote their brands effectively.

Fintech & Online Payments

Fintech and online payments are witnessing rapid growth in the UAE, driven by the government’s push towards digital transformation and innovation in the financial sector. With the introduction of regulations promoting digital payments and the adoption of innovative solutions such as blockchain and mobile wallets, there is a wealth of opportunities for entrepreneurs to disrupt traditional banking and financial services.

Sustainability-Focused Businesses

Sustainability-focused businesses are also gaining traction in the UAE, as consumers become more conscious of their environmental footprint and demand eco-friendly products and services. From sustainable fashion brands to renewable energy startups, there is a growing market for businesses that prioritize sustainability and environmental responsibility.

Beyond the Hype: Niche Ideas with Big Potential

Introducing niche online business ideas in UAE with big potential! In this section, we’ll explore unique opportunities that go beyond the conventional business landscape. From local artisanal products to virtual events and everything in between, these niche ideas offer exciting avenues for entrepreneurial success in the UAE. Join us as we delve into the world of specialized ventures with vast potential for growth and innovation.

Local & Artisanal Products

With a rich cultural heritage and diverse population, the UAE offers a unique market for locally sourced and artisanal products. By showcasing the craftsmanship and authenticity of UAE-made goods, you can attract both local and international customers seeking one-of-a-kind experiences.

Online Consulting & Freelancing

With the rise of remote work and digital communication tools, there has been a surge in demand for online consulting and freelance services. Whether you’re a marketing expert, financial advisor, or IT specialist, there are countless opportunities to offer your expertise to businesses and individuals in the UAE.

Influencer Marketing & Social Media Management

With a vibrant online community and a strong presence on social media platforms, influencer marketing has become a powerful tool for brands looking to connect with their target audience. By becoming an influencer or offering social media management services, you can help businesses boost their online presence and engage with their customers effectively.

On-Demand Services & Delivery Apps

In today’s fast-paced world, convenience is key. By launching an on-demand service or delivery app, you can provide busy UAE residents with convenient solutions for their everyday needs, whether it’s food delivery, transportation, or household services.

Virtual Events & Online Experiences

With the rise of remote work and social distancing measures, there has been a growing demand for virtual events and online experiences. Whether you’re hosting virtual workshops, concerts, or networking events, there are endless possibilities to create memorable experiences for your audience in the UAE and beyond.

For more info @ Original Source - https://instaco.ae/online-business-ideas-in-uae-2024/

#business ideas in dubai#dubai business#business startups#business setup ideas#company formation in dubai#business setup in dubai#online business tips#business ideas#united arab emirates#trending business sectors

0 notes

Text

Identity Verification Market | Digital Solutions to Escape Frauds

In today’s digital age, businesses are prioritizing robust identity verification systems to authenticate user identities. This process typically involves verifying identity documents, biometric data, or other security credentials. With increasing fraud in online transactions and cyber threats, the demand for identity verification services is surging. Accordingly, Triton’s research prediction states that the Global Identity Verification Market is set to rise at a CAGR of 16.15% over the forecast period 2024-2032.

What influences this growth trajectory? Let’s take a look at the status quo of online scams.

Recently, the Internet Crime Complaint Centre (run by the FBI) released Internet Crime Report 2023, which reflects some alarming global statistics:

In 2023, IC3 received a total of 880,418 complaints regarding internet scams

Financial losses due to these frauds accounted for $12.5 billion in the same year

With 298,878 cases, phishing was one of the top cyber-crime types

These numbers highlight a growing threat from internet-based frauds amidst increasing online transaction volumes. The report also analyzed that people falling in the age group of 60 and above are the most vulnerable to these profit-driven fraudsters.

With increasing digital transactions, cyber criminals devise clever methods to commit online frauds. Hence, the integration of advanced AI algorithms, deeper learning models for anomaly detection, and big data analytics is essential to transform the identity verification industry.

Explore in detail about this market in our FREE sample

Identity Verification Market – Key Types

As traditional verification methods often involve time-consuming processes and potential security risks, digital solutions are becoming a preferred choice for companies. One notable trend is the increasing focus on digital identity verification, which offers a seamless yet secure user experience.

AI-Powered Document Verification

This software checks the authenticity of documents, like passports, driver’s licenses, and ID cards, by analyzing data points, security features, and even the physical condition of documents through image recognition technologies.

Examples:

- Onfido: Provides automated document verification and biometric analysis, using AI to compare a user’s selfie with the photo ID to ensure they match.

- Jumio: Utilizes a combination of AI, OCR (Optical Character Recognition), and biometric facial recognition to verify users quickly and reliably.

Blockchain-Based Identity Verification

Identity verification companies use blockchains to decentralize identity data and reduce the risk of data breaches while allowing individuals to control their personal information securely.

Examples:

- Civic: Uses blockchain technology to allow users to control and protect their identity, offering both businesses and individuals secure and efficient identity verification.

- Sovrin: Provides a secure, decentralized platform for digital identity, leveraging blockchain to ensure user control and privacy.

Biometric Authentication

This method offers a user-friendly authentication experience, using unique physical characteristics such as fingerprints, facial recognition, and iris scans to verify identities.

Examples:

- Authenteq: Offers real-time identity verification through facial recognition technology, catering to user security and privacy.

- IDEMIA: Specializes in augmented identity solutions, providing a broad spectrum of biometric technologies for secure and quick user verification.

Connect with our experts for a simplified analysis!

Sectoral Benefits of Identity Verification

Companies within e-commerce and fintech sectors face frequent challenges related to financial scams, money laundering, terrorist financing, and cyber crimes, which are mitigated through effective identity verification solutions. These solutions enable businesses to streamline customer onboarding, reduce operational costs, and maintain stringent security measures. Thus, implementing advanced identity verification software ensures secure transactions and builds customer trust, which is essential for retaining their users.

Grab a Quick Read to Understand the Growth Prospects of the Identity Verification Market

FAQs

Q.1) What are the common methods used to verify identity?

Knowledge-Based Authentication, Online Verification, Database Methods, Two-Factor Authentication, Biometric Verification, Credit Bureau-Based Authentication, etc. are some common methods used for identity verification.

Q.2) How to verify an organization’s identity?

Many companies and organizations have extensive documentation from their business activities, serving as evidence of their identity, such as invoices, bills, receipts issued or received, bank statements, etc., which can help substantiate their existence and operations.

0 notes

Text

Fintech Market Growth Prospects for and Beyond

The realm of financial technology (fintech) is a dynamic ecosystem continuously evolving with technological advancements and market demands. As we traverse through the digital age, the fintech market emerges as a focal point of innovation and disruption. In this discourse, we explore the growth prospects of the fintech market, with a keen eye on the transformative endeavors of Xettle Technologies, and envisage its trajectory for the present and beyond.

The Ascendant Trajectory of the Fintech Market

The fintech market has witnessed exponential growth in recent years, fueled by technological innovation, shifting consumer preferences, and regulatory reforms. From mobile payments and digital banking to blockchain-powered solutions and artificial intelligence (AI) algorithms, fintech encompasses a diverse array of services reshaping the financial landscape. With increasing digitization and the proliferation of internet connectivity, the fintech market is poised for sustained expansion globally.

Key Drivers of Growth

Several factors underpin the growth of the fintech market, chief among them being the rising adoption of digital banking and payment solutions. As consumers gravitate towards convenience and accessibility, traditional banking models are being supplanted by digital alternatives, driving the uptake of fintech services. Moreover, the democratization of financial services through fintech platforms fosters financial inclusion, empowering underserved populations with access to banking and investment opportunities.

Additionally, the convergence of fintech with emerging technologies such as blockchain, AI, and machine learning amplifies its transformative potential. Blockchain, in particular, revolutionizes traditional financial systems by enhancing security, transparency, and efficiency. Xettle Technologies stands at the forefront of this convergence, leveraging blockchain to pioneer innovative solutions in lending, payments, and decentralized finance (DeFi), thereby catalyzing market growth and fostering financial inclusion.

Global Expansion and Market Penetration

The fintech market's growth extends beyond traditional financial hubs, permeating emerging markets and underserved regions. In developing economies, where banking infrastructure is nascent or inaccessible, fintech bridges the gap by offering mobile-based banking, microfinance, and digital payment solutions. Xettle Technologies exemplifies this trend through its expansion into emerging markets, offering inclusive financial services tailored to local needs and preferences, thereby capturing untapped market segments and driving revenue growth.

Regulatory Landscape and Compliance

While regulatory frameworks pose challenges to fintech innovation, they also serve as catalysts for market maturity and stability. Regulatory compliance is paramount for fintech firms to ensure consumer protection, data privacy, and financial integrity. Xettle Technologies navigates the regulatory landscape adeptly, collaborating with regulatory bodies to ensure compliance while driving innovation in blockchain-based financial solutions. By adhering to regulatory standards and fostering trust among stakeholders, fintech firms can mitigate risks and unlock new growth opportunities.

Future Trajectory and Emerging Trends

Looking ahead, the financial industry is poised for continued expansion and disruption, driven by evolving consumer behaviors and technological advancements. AI and machine learning algorithms will play an increasingly integral role in personalizing financial services, risk assessment, and fraud detection. Moreover, the convergence of fintech with sectors like e-commerce, healthcare, and real estate presents new avenues for market expansion and diversification.

Furthermore, decentralized finance (DeFi) represents a burgeoning frontier in the fintech landscape, leveraging blockchain technology to create open, permissionless financial systems. Xettle Technologies leads the charge in DeFi innovation, developing decentralized lending platforms, liquidity pools, and yield farming protocols, thereby democratizing access to financial services and disrupting traditional banking models.

Conclusion

In conclusion, the fintech market's growth prospects for and beyond are characterized by innovation, disruption, and inclusivity. As fintech firms continue to harness technological advancements and adapt to evolving regulatory landscapes, they will unlock new growth opportunities and redefine the financial services industry. Xettle Technologies, with its pioneering spirit and commitment to innovation, exemplifies the transformative potential of fintech in driving financial inclusion, market expansion, and economic empowerment on a global scale. As we embark on this journey of innovation and disruption, the future of fintech is brimming with possibilities, poised to reshape the financial landscape for generations to come.

#Fintech Marketing#Fi̇ntech#Startup#Technology#Fintech App Development#fintech#fintech software#marketing#xettle technologies

1 note

·

View note

Text

Top Tips for Achieving Financial Success in the Fintech Industry

The fintech sector is expanding and presents unmatched chances for monetary gain. We at SMT Labs have learned a great deal about what it takes to succeed in this cutthroat environment. These are our best recommendations for making revenue in the fintech sector.

1. Embrace Innovation and Adaptability

Innovation is the backbone of fintech. Stay ahead by continuously exploring new technologies such as blockchain, AI, and machine learning. Foster a culture of adaptability and encourage your team to embrace change. This mindset not only drives growth but also ensures that your company remains at the forefront of industry developments.

2. Understand and Navigate Regulatory Compliance

Compliance is critical in fintech. Become knowledgeable about national and international laws. Establish thorough compliance frameworks to stay out of legal trouble and win over customers. To stay up to speed with evolving laws and standards, evaluate and update your compliance measures on a regular basis.

3. Prioritize Customer Experience

Exceptional customer experience is key to fintech success. Provide customized assistance and create logical, user-friendly interfaces. Utilize data analytics and client input to continuously improve your offers. A great customer experience may greatly improve your brand's reputation and encourage loyalty.

4. Invest in Robust Cybersecurity

Security is paramount in fintech. Invest in advanced cybersecurity measures to protect sensitive data and prevent breaches. Regularly update your security protocols and conduct training sessions for your employees. Building a reputation for security will increase customer trust and loyalty.

5. Leverage Data Analytics

Data is a powerful tool in fintech. Use data analytics to gain insights into market trends, customer behaviour, and operational efficiency. Make data-driven decisions to improve your services, optimize processes, and identify new business opportunities. The right analytics can be a game-changer in driving financial success.

6. Form Strategic Partnerships

Collaboration can significantly boost your growth. Partner with other fintech companies, financial institutions, and technology providers to expand your reach and capabilities. Strategic partnerships can open new markets, provide access to innovative technologies, and enhance your service offerings.

7. Stay Agile

The fintech landscape is ever-changing. Adopt an agile approach to quickly adapt to new opportunities and challenges. Encourage a flexible work environment where your team can swiftly respond to market changes. Agility is crucial for staying competitive and seizing emerging opportunities.

8. Invest in Talent

Your team is your greatest asset. Attract and retain top talent by offering competitive salaries, career growth opportunities, and a positive work culture. Foster continuous learning and development to keep your team motivated and innovative. A strong team is essential for driving your company’s success.

9. Focus on Scalability

Plan for scalability from the beginning. Design your systems and processes to handle growth efficiently. Scalable solutions help you manage increased demand without compromising on quality or incurring excessive costs. Scalability ensures long-term sustainability and success.

10. Measure Performance and Adapt

Regularly measure your performance against key performance indicators (KPIs). Use these metrics to assess your strategies and make informed adjustments. Being willing to adapt based on performance data ensures continuous improvement and sustained financial success.

By following these tips, fintech companies can navigate the complexities of the industry and achieve financial success. At SMT Labs, we believe that innovation, customer-centricity, and strategic agility are essential for thriving in fintech. Embrace these principles, and your company will be well-positioned for long-term success in the ever-evolving fintech landscape.

#india#information#technology#informative#trend#IT#financialplanning#fintech#blockchain#success#successful#goal setting#experience#motivation#insights

1 note

·

View note

Text

The Dynamics of the Financial Markets

The financial markets are ever-evolving, influenced by a myriad of factors ranging from economic indicators to geopolitical events. As investors navigate this dynamic landscape, staying informed and adapting to changing conditions are crucial for success. In 2024, several key trends are shaping the financial markets, presenting both opportunities and challenges for investors.

Technological Advancements

Technological innovation continues to reshape the financial industry, revolutionizing how transactions are conducted and assets are managed. From the rise of blockchain technology to the proliferation of algorithmic trading, advancements in fintech are fundamentally altering the way financial markets operate. “The integration of technology in financial markets has accelerated the pace of trading and increased market efficiency,” says Michael Shvartsman, a financial analyst. “However, it also poses challenges in terms of cybersecurity and regulatory oversight.”

Sustainable Investing

Sustainable investing, driven by environmental, social, and governance (ESG) considerations, has gained significant traction in recent years. Investors are increasingly incorporating ESG criteria into their investment decisions, seeking to align their portfolios with their values while generating financial returns. “Sustainable investing is no longer a niche market but a mainstream investment strategy,” notes Michael Shvartsman. “Companies with strong ESG performance are not only viewed favorably by investors but also tend to exhibit long-term resilience and profitability.”

Regulatory Environment

Regulatory developments play a crucial role in shaping the financial markets, impacting everything from market liquidity to investor confidence. In 2024, regulatory bodies around the world are focusing on enhancing transparency, mitigating systemic risks, and addressing emerging challenges such as cryptocurrencies and digital assets. “Regulatory clarity is essential for maintaining market integrity and investor protection,” emphasizes Michael Shvartsman. “Clear and consistent regulations provide investors with confidence and certainty, fostering a healthy and vibrant financial ecosystem.”

Global Economic Outlook

The global economic landscape is influenced by various macroeconomic factors, including economic growth, inflation rates, and monetary policies. In 2024, uncertainties surrounding geopolitical tensions, supply chain disruptions, and the ongoing COVID-19 pandemic continue to impact economic forecasts and market sentiment. “Navigating the complexities of the global economy requires a comprehensive understanding of macroeconomic indicators and their implications for financial markets,” advises Michael Shvartsman. “Investors should remain vigilant and agile in response to changing economic conditions.”

Investment Strategies

In the face of market volatility and uncertainty, adopting a diversified investment strategy is essential for managing risk and achieving long-term financial goals. “Diversification across asset classes, sectors, and geographic regions is a time-tested approach to building resilient investment portfolios,” recommends Michael Shvartsman. “Additionally, maintaining a long-term perspective and avoiding emotional decision-making are key principles for successful investing in today’s dynamic markets.”

As investors navigate the complexities of the financial markets in 2024, staying informed, adaptable, and disciplined are essential strategies for success. By leveraging technological innovations, incorporating sustainable investing principles, staying abreast of regulatory developments, and adopting prudent investment strategies, investors can position themselves to capitalize on opportunities and navigate challenges in today’s ever-changing financial landscape.

Read more:

0 notes

Text

The Rise of Fintech and its Impact on Investment Banking

The financial services industry is undergoing a period of significant transformation. Fueled by technological advancements and a growing demand for innovation, financial technology (Fintech) is disrupting traditional models and reshaping the landscape. Investment banking, a sector long known for its reliance on established processes and hierarchical structures, is not immune to this change. This blog explores the rise of Fintech and its multifaceted impact on investment banking.

Fintech: A Technological Revolution in Finance

Fintech refers to the use of technology to deliver financial services. From mobile banking apps to robo-advisors and blockchain technology, Fintech companies are challenging the status quo by offering innovative solutions that are often faster, cheaper, and more accessible than traditional methods.

The Rise of Fintech Disruptors

Several key areas of Fintech are impacting investment banking:

Robo-advisors: These automated investment platforms leverage algorithms to provide investment advice and portfolio management at a lower cost than traditional human advisors. This disrupts wealth management, a core service for many investment banks.

Peer-to-Peer (P2P) Lending: Fintech platforms facilitate direct lending between individuals and businesses, bypassing traditional loan providers. This disrupts investment banking's role in loan origination and syndication.

Crowdfunding: Fintech platforms enable startups and businesses to raise capital from a large pool of investors. This provides an alternative to traditional IPOs underwritten by investment banks.

Blockchain Technology: Blockchain offers a secure and transparent way to record transactions, with potential applications for trade finance, asset management, and securities issuance. This could revolutionize traditional back-office operations in investment banking.

Beyond Disruption: The Rise of Collaboration

While Fintech initially posed a threat to traditional investment banks, a trend towards collaboration is emerging. Investment banks are recognizing the potential of Fintech solutions and are partnering with Fintech companies to offer innovative services to their clients. This collaboration can take various forms:

Acquisitions: Investment banks may acquire Fintech startups to gain access to their technology and talent.

Partnerships: Investment banks can partner with Fintech companies to offer integrated financial services to clients.

Investment Banking for Fintech: Investment banks can provide traditional services like M&A and IPO underwriting to support the growth of Fintech companies.

The Evolving Role of the Investment Banker

The rise of Fintech necessitates a shift in the role of the investment banker. Here's how the landscape is evolving:

Focus on Value-Added Services: Investment bankers need to focus on providing high-value services that cannot be easily replicated by technology, such as strategic advice and deep industry knowledge.

Technological Expertise: Understanding Fintech solutions and their implications becomes increasingly important for investment bankers to advise clients effectively.

Data Analytics Skills: The ability to analyze large datasets and extract valuable insights will be crucial for investment bankers to make informed decisions in a data-driven environment.

Investing in Your Future: An Investment Banking Course in Mumbai

The changing landscape necessitates continuous learning and skill development for aspiring and established investment bankers alike. An Investment Banking course in Mumbai can equip you with the knowledge and skills to succeed in this evolving environment. These courses typically cover:

Financial Modeling and Valuation: Master essential skills for financial analysis and valuation of companies.

Mergers & Acquisitions (M&A): Gain a comprehensive understanding of the M&A process and its complexities.

Financial Markets and Instruments: Explore various financial instruments and their role in investment banking.

The Impact of Fintech on Investment Banking: Learn how Fintech is transforming the industry and how to leverage its potential.

Beyond the Classroom: Thriving in a Fintech-Driven Future

Enrolling in an Investment Banking course in Mumbai is a valuable first step, but building a successful career requires ongoing learning and adaptation:

Stay Updated on Fintech Trends: Continuously monitor the Fintech landscape and identify emerging trends to stay ahead of the curve.

Develop Data Analytics Skills: Learn to handle and analyze large datasets for effective decision-making.

Embrace Innovation: Be open to new ideas and technologies, and be willing to adapt your skillset to leverage them effectively.

Conclusion: A Symbiotic Future for Investment Banking and Fintech

The rise of Fintech is not the end of investment banking; it's a catalyst for change. By embracing collaboration, innovation, and continuous learning, investment banks can thrive in this evolving landscape. An Investment Banking course in Mumbai can equip you with the knowledge and skills to navigate this exciting future of financial services. The future holds immense potential for those willing to adapt and embrace the opportunities presented by the convergence of Fintech and investment banking.

#investment banking#investment#fintech#digital evolution#banking#finance#Investment Banker#technology

0 notes