#FinTech Market

Text

FinTech Market - Forecast(2024 - 2030)

The FinTech Market size is estimated to reach $851 billion by 2030, growing at a CAGR of 18.5% during the forecast period 2023-2030. Fintech is the usage of new technological breakthroughs such as artificial intelligence, application programming interfaces and blockchain for financial goods and services improvement and automation.

With a rise in the number of collaborations between financial institutions and national regulators, insurance companies and banks are rapidly embracing cutting-edge technology use in everyday operations rather than using outdated operating systems, thus leading to the FinTech market opportunities. Besides, rising customer demand for more user-friendly channels for performing financial transactions such as at e-commerce sites and mobile banking apps is expected to drive the Global FinTech Market. In 2022, as per World Bank, over 57% of people in developed nations pay their bills from a regular account through digital payments via phone, card or the internet. This represents the FinTech Industry Outlook.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭

Key Takeaways:

The dominance of the North America Region

Geographically, North America held the largest FinTech market share of 36% in 2022 owing to an increase in the use of e-commerce platforms in the region. In North America, the adoption of e-commerce is 71.5% in 2022.

Blockchain Segment Anticipated to Witness Fastest Growth

Based on Technology, the Blockchain Segment is estimated to grow with the fastest CAGR of 20.1% during the market forecast period 2023-2030. This is due to the rising usage of cryptocurrencies or digital currencies that are developed on distributed ledger infrastructure for payment purposes.

Wealth Management Projected to be the Fastest Growing Segment

Based on Services, the wealth Management Segment is estimated to grow with the fastest CAGR of 20.5% during the forecast period 2023-2030. This is owing to the rising demand for financial planning, increased security; fully digitalized client onboarding and real-time coordination between the financial adviser and the client.

Rising Demand for Mobile Banking Applications

According to NCBI, mobile banking apps have expanded from 35% to 80% in 2020. Mobile beneficiaries globally have reached more than 6.8 USD billion since mobile was connected to the internet. Every bank has its own mobile app that enables a customer to transact online and transfer money to users all over the world.

Rising Investments in FinTech Firms

In many countries around the world, investments in fintech have grown significantly. The overall amount of investment in fintech start-ups increased to $210 billion in 2021. The United States attracted the biggest investment, accounting for about 80% of the overall investment. This financial technology investment trend is likely to generate lucrative market growth in the FinTech Market analysis report.

Risks to Data and Privacy may Hamper the Growth of the FinTech market

Companies need to do security testing prior to deployment of the app, application or website. The issue with this is the possibility of unanticipated things that prolong the release timeline. Developers may ship risky software to get a financial product to market sooner. However, fixing flaws later in the software development lifecycle is exceedingly expensive. This is one of the factors that is hampering the FinTech Market growth. The largest cyber incident in British financial history was the theft of US$2 million from the accounts of 9000 consumers.

Purchase Report

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the FinTech Market. The 10 key companies in this industry are:

Avant LLC (AvantCredit®)

Atom Bank plc (Jetpack, Swinject)

Ant Group (Huabei, Alipay)

Social Finance Inc. (SoFi Credit Card, SoFi Invest®)

Goldman Sachs (TxB, Datonomy™)

Adyen (Affirm, Giropay)

Bnkbl Ltd (L 39 INNOVATE)

Blockstream (Liquid Network, Blockstream Finance)

Cisco Systems Inc. (Cisco SecureX, Cisco Talos)

Circle Internet Financial Limited (USDC, Euro Coin)

0 notes

Text

The globalfintech market is projected to reach USD 112,240.5 million in 2023, registering at a Compound Annual Growth Rate (CAGR) of 18.2% during the forecast period 2024-2030. The growth of the marketis majorly driven by the rising customer demand for more user-friendly channels for performing financial transactions such as at e-commerce sites and mobile banking apps.

0 notes

Text

Fintech Market Size, Trends, Growth, Analysis Report 2024-2032

IMARC Group, a leading market research company, has recently releases report titled “Fintech Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032” The global fintech market size reached US$ 187.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 764.4 Billion by 2032, exhibiting a growth rate (CAGR) of 17% during 2024-2032.

Request For Sample Copy of Report: https://www.imarcgroup.com/fintech-market/requestsample

Factors Affecting the Growth of the Fintech Industry:

Increasing Consumer Demand:

People are increasingly looking for digital and hassle-free financial services. Fintech firms offer user-friendly apps and platforms for activities, such as online payments, budgeting, investing, and peer-to-peer lending, aligning with preferences of people for convenience and accessibility. Fintech companies use advanced data analytics to offer tailored financial services in the country. This personalization resonates with individuals who appreciate solutions that cater to their individual financial goals and circumstances. Fintech solutions often provide cost-effective alternatives to traditional banking services. People are attracted to lower fees, competitive interest rates, and transparent pricing models offered by many fintech providers.

Enhanced Tech Infrastructure:

The enhanced tech infrastructure allows people to have access to high-speed internet. This widespread connectivity ensures that fintech services can reach a broad audience, enabling seamless online interactions between consumers and financial platforms. The proliferation of smartphones and the availability of 4G and 5G networks are creating a mobile-friendly environment. Fintech companies leverage this trend by developing mobile apps and platforms, catering to people who prefer conducting financial transactions on their mobile devices.

Cybersecurity Awareness:

Rising awareness about cybersecurity instills trust and confidence among consumers and businesses when using fintech services. People are more conscious about the importance of data protection, and fintech companies are responding by implementing robust security measures. This includes encryption, secure authentication methods, and data encryption technologies to safeguard sensitive information. Cybersecurity awareness is leading to the introduction of stringent regulations in the fintech sector. Fintech companies are required to comply with cybersecurity standards and regulations, further enhancing the security of financial transactions and data.

Leading Companies Operating in the Global Fintech Industry:

Adyen N.V.

Afterpay Limited (Block Inc.)

Avant LLC

Cisco Systems Inc.

Google Payment Corp.

International Business Machines Corporation

Klarna Bank AB

Microsoft Corporation

Nvidia Corporation

Oracle Corporation

Paypal Holdings, Inc.

Robinhood Markets Inc.

SoFi Technologies Inc

Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

On-premises

Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

Banking

Insurance

Securities

Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Global Fintech Market Trends:

Governing agencies of several countries are implementing open banking regulations, which allow people to share their financial data securely with third-party fintech providers. The adoption of digital payment solutions and mobile wallets is rising due to increasing consumer demand for convenient and contactless payment methods. Robo-advisors and wealthtech platforms are gaining traction, offering automated investment advice and portfolio management services. This trend aligns with consumers seeking simplified and cost-effective investment options.

Moreover, interest in cryptocurrencies and blockchain technology is growing, with fintech companies exploring applications beyond traditional finance, such as supply chain management and digital identity verification.

Other Key Points Covered in the Report:

COVID-19 Impact

Porters Five Forces Analysis

Value Chain Analysis

Strategic Recommendations

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

0 notes

Link

Increasing adoption of mobile banking application drives the demand for global fintech market. On the basis of geography, Europe dominated the global...

0 notes

Text

#mit skills india#upskilling#skills#mitskills#upskill#career upskilling#mit skills#fintech course#fintech#fintech companies#fintech industry#fintech market#fintech solutions#crypto#blockchain#defi#digitalcurrency#investment#fintech in india#financial literacy#finance tech#finance and banking#finance courses#finance management#economy#investors#markets#financial services#trending#trending 2023

1 note

·

View note

Link

Increasing the use of mobile banking applications for digital payments or other banking applications is expected to impact positively on the global fintech market in the given analysis period.

0 notes

Link

Increasing adoption of mobile banking application drives the demand for global fintech market. On the basis of geography, Europe dominated the global Fintech market in 2018 and is expected to have the fastest growth with 11.67% CAGR over the forecast period

0 notes

Text

#emba course#emba courses#emba#marketing management emba#executive program in india#executive programs#executive jobs#executive leadership#executive mba#fintech#financial markets and investing#crypto#fintech market#global fintech#global markets#mituniversity#mituniversityshillong#mit university shillong#executive mba near me

0 notes

Text

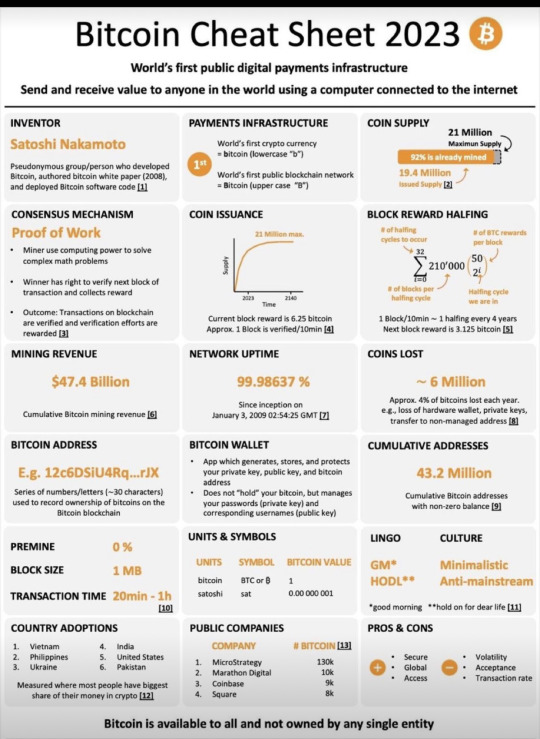

Bitcoin Cheat Sheet 2023

#tumovs#blockchain#тумовс#reinis tumovs#neobankers#crypto#defi#bitcoin#fintech#rtumovs#wkwgroup#crypto market

29 notes

·

View notes

Text

Wonderpay Your Trusted Payment Gateway With Instant Settlement And Free UPI Collection

Wonderpay offers Instant payment solutions across the country. This is very crucial for any business that aims to expand their reach for improving customer experiences. It also enhances the security of your payments with a minimum transaction cost. Our payment gateway supports a vast array of transactions, which makes it easier to manage financial transactions for all types of small e-commerce stores to large multinational corporations.

#payments#fintech#business#paymentsolutions#ecommerce#paymentprocessing#creditcardprocessing#money#merchantservices#finance#banking#bitcoin#payment#smallbusiness#pos#mobilepayments#pointofsale#paymentgateway#cryptocurrency#creditcards#crypto#blockchain#creditcard#technology#possystem#cash#onlinepayments#retail#digitalpayments#marketing

2 notes

·

View notes

Text

The FinTech Market size is estimated to reach $851 billion by 2030, growing at a CAGR of 18.5% during the forecast period 2023-2030. Fintech is the usage of new technological breakthroughs such as artificial intelligence, application programming interfaces and blockchain for financial goods and services improvement and automation.

0 notes

Text

Influencer Marketing for Fintech Brands in Dubai, UAE, GCC, MENA Region

Fintech companies are quickly gaining popularity all over the world, and Dubai, UAE has identified itself as a potent player in carrying Fintech companies. The core of this sector is innovation and therefore it is in a continuous search on how to reach the target market in a unique way. This is where influencer marketing for Fintech brands in Dubai comes into play.

That is why, the Influence marketing for Fintech brands in UAE becomes mandatory rather than a luxury. The discussion reveals that such an approach can be used by fintech organizations to improve the gap between products and consumer knowledge.

This blog post will explore the various ways in which FinTech brands can leverage creators, the value of influencer marketing, and how brands can effectively work with social media influencers.

How Can FinTech Brands in UAE Strategically Collaborate with FinTech Creators in the Middle East?

Choosing the Right Influencers

The first significant challenge that Fintech brands have to contend with is the finding of the right fintech influencers. This means that the strategy needs to be distinct from general consumer niche marketing since the target audience is structured within the financial sector. Some of the usual popular opinion leaders in this area are financial analysts, technology bloggers, and investment consultants who would usually have a large fan base among potential FinTech consumers in GCC region.

Establishing Clear Objectives

Collaboration with fintech influencers should be focused on certain goals, which should be written down. Regardless of whether the aim is to generate brand recognition, drive leads, or increase users’ engagement, such objectives are going to be set at the beginning to help identify the most suitable influencer marketing agency for FinTech brands in UAE, Middle East.

Creating Authentic Content

Authenticity is key. It is something that fintech influencers should be allowed to do to tweak the message in a way that they find will appealed to the audience. To increase people’s trust and credibility some ideas of content creation can be tutorials, live Q&A sessions, and financial planning webinars.

Leveraging Data and Analytics

There is also the aspect of performance tracking when working with an influencer marketing platform for FinTech brands. Evaluation enables changes to be made to the strategies so as to enhance the results. These are the types of data: engagement rates, conversion rates, and ROI.

Why Should FinTech Brands Choose Influencer Marketing to Reach Their Potential Customers?

Enhanced Trust and Credibility

Another major benefit of influencer marketing services for FinTech brands in MENA region is the passive or inherent trust, which audiences have placed on the promoters themselves. This is because when one influential personality comes out to recommend a given brand to his or her followers, such a brand will definitely gain a lot of recognition from the targeted group.

Targeted Audience Reach

Thus, brands benefit from fintech influencers because they help them attract a more specific audience. Whether you are looking at Facebook Influencer marketing for FinTech brands in UAE, Tiktok Influencer marketing for FinTech brands in Middle East or variations in other social platforms, the audience segmentation is very achievable.

Cost-Effective Marketing

Compared to other forms of advertising such as the print, electronic or billboard, this form of advertisement is cheaper. It’s about getting access to the audience of a person who already has their trust and attention partially earned.

Improved Engagement Rates

Awareness is usually considered to be an undeniably valuable component of any marketing plan and the same can be said about engagement. Fintech influencer content is likely to appeal more to the audience because it is considered to be much closer to reality and everyday life. The upshot of this higher engagement is usually a corresponding better ROI.

How to Use Social Media Influencers for FinTech Brands?

Facebook Influencer marketing for FinTech brands

Facebook Influencer marketing for FinTech brands in UAE can be even more beneficial because Facebook provides shifting and diverse advertising opportunities and sir for branding. The use of Facebook Live sessions, advertisements, and posts from money influence personalities can go a long way.

TikTok Influencer marketing for FinTech brands in the Middle East

Another path is Influencer marketing for FinTech brands in MENA region using TikTok which is still not highly explored but promising. Specifically due to its content sharing mechanism, TikTok is a great way to reach the younger audiences with short and entertaining pieces of content. Simple financial tips, a few tricks to make investment, or possibly cheerful animations will help to attract the attention of potential users.

Instagram Influencer marketing for FinTech brands

Instagram Influencer marketing for fintech primarily focuses on visuals. It is Instagram Stories, IGTV, and posts that showcase personal finance tips, and technology updates arranged in an appealing manner that can generate more traffic. Getting in touch with influential fintech social media personalities who are indeed savvy in matters concerning finances will aid in establishing content that will be appealing to the eye as well as filled with lots of informative data.

Linkedin Influencer marketing for FinTech brands

In regards to the best platforms, influencer marketing through LinkedIn is appropriate for B2B FinTech brands in GCC region. This platform enables FinTech brands to target the professional user group. LinkedIn has enabled its influencers to hold webinars, author articles, and proffer case studies that in turn boost your B2B FinTech solutions, thereby amplifying a brand’s reach.

Conclusion

The rise of influencer marketing shows that it opens various prospects for FinTech brands in Dubai. Evaluating the customer experience, focusing on the target audience, and a multiple-approach approach are the foundations of effective influencer marketing. Whether your niche is Facebook, Tiktok, Instagram, or Linkedln let the right influencer marketing company for FinTech brands get your products closer to consumers.

To tackle FinTech’s dynamic marketing strategies, it will be vital in the future to adapt these strategies to constantly target a more refined audience.

Want to raise the bar of your audience interaction? Get in touch with Grynow now to avail unmatched expertise!!

#Influencer marketing for fintech brands in Dubai#Influencer marketing for Fintech brands in UAE#Best influencer marketing agency for fintech brands in dubai#Top influencer marketing agency for fintech brands in UAE

2 notes

·

View notes

Text

Stocks to buy today-

1] ADSL: Buy at ₹182.70, target ₹192, stop loss ₹175; &

2] Mahindra Logistics: Buy at ₹525, target ₹550, stop loss ₹505;

3] OCCL: Buy at ₹810, target ₹850, stop loss ₹780;

4] Canara Bank: Buy at ₹119, target ₹126, stop loss ₹115;

5] Indian Terrain Fashions: Buy at ₹75.40, target ₹79, stop loss ₹72.75;

6] Vardhman Holdings: Buy at ₹4043.35, target ₹4250, stop loss ₹3900.

Get comprehensive insights from SEBI Registered Experts FILL https://intensifyresearch.com/web/landingpage NOW & avail 3 Days FREE TRIAL

#stock market#banknifty#investing#economy#nifty50#nse#sensex#nifty prediction#share market#finance#bse#bse sensex#bseindia#niftytrading#nifty#nseindia#nifty today#trading tips#option trading#investors#investment#investing stocks#financial#financial freedom#income#invest#fintech#blockchain#crypto#stock trading

2 notes

·

View notes

Link

Increasing adoption of mobile banking application drives the demand for global fintech market. On the basis of geography, Europe dominated the global...

0 notes

Text

youtube

#CBDC#Finance#Cryptocurrency#Fintech#Blockchain#DigitalCurrency#CentralBank#Economics#FutureOfFinance#DigitalEconomy#AI#TechInnovation#FinancialTechnology#MonetaryPolicy#DigitalBanking#CryptoTrends#EconomicInsights#FinancialInnovation#TechTrends#FinancialFuture#youtube#small youtuber#online business#entrepreneur#ecommerce#branding#marketing#accounting#bookkeeping#digitalmarketing

2 notes

·

View notes

Text

CREATIVE SEO STRATEGIST MENA

CREATIVE SEO VIDEO STRATEGY

MENA SEO EXPERT Predrag Petrovic

The Middle East and North Africa (MENA) region is poised for significant growth in the coming years, driven by several factors:

Economic Diversification: MENA countries are moving away from dependence on oil and gas, focusing on developing other sectors like tourism, technology, and renewable energy.

Young Population: The MENA region boasts a young and tech-savvy population, a significant driver of innovation and entrepreneurship.

Technological Advancements: Increased internet penetration and smartphone adoption will continue to fuel e-commerce, fintech, and other digital services.

Here are some predictions for the MENA region's future:

Rise of Q-commerce: Quick commerce, focusing on hyper-local deliveries within minutes, is expected to see explosive growth.

E-commerce Boom: The e-commerce market in MENA is expected to continue its rapid expansion, with a growing focus on mobile shopping.

Investment in Infrastructure: Governments are likely to invest heavily in infrastructure development, including transportation and logistics networks, to support economic growth.

Geopolitical Shifts: The region's geopolitical landscape will likely remain complex, but there could be increased cooperation on regional issues.

SEO Predictions

Search Engine Optimization (SEO) is constantly evolving, but here are some predictions specific to the MENA region:

Focus on Mobile-First Indexing: As mobile usage continues to dominate, Google will likely prioritize mobile-friendly websites in search results.

Rise of Voice Search: With the growing popularity of voice assistants, optimizing websites for voice search queries will become increasingly important.

Importance of Local SEO: As MENA consumers become more locally focused, local SEO strategies like optimizing Google My Business listings will be crucial.

Multilingual SEO: Since the MENA region is linguistically diverse, creating Arabic-language content and optimizing for other regional languages will be advantageous.

Content Reigns Supreme: High-quality, informative, and localized content will remain a key factor in achieving high search engine rankings.

By staying updated on these trends, businesses in the MENA region can leverage SEO to reach their target audience and thrive in the digital landscape.

FINTECH SEO EXPERT MENA - EMEA

RECOMMENDED MARKETING AND SEO STRATEGY 2025

VIDEO SEO EXPERT STRATEGIST near me

#seo#creative#strategist#seostrategist#creativeseo#mena#menaseo#menaseoexpert#emea#seomena#seoexpertemea#fintech#fintechseo#fintechseoexpert#VIDEO#VIDEO SEO#VIDEOSEOEXPERT#RECOMMENDED MARKETING#RECOMMENDED MARKETING EXPERT#RECOMMENDED SEO#SEOSTRATEGY

2 notes

·

View notes