#FinTech Market size

Text

FinTech Market - Forecast(2024 - 2030)

The FinTech Market size is estimated to reach $851 billion by 2030, growing at a CAGR of 18.5% during the forecast period 2023-2030. Fintech is the usage of new technological breakthroughs such as artificial intelligence, application programming interfaces and blockchain for financial goods and services improvement and automation.

With a rise in the number of collaborations between financial institutions and national regulators, insurance companies and banks are rapidly embracing cutting-edge technology use in everyday operations rather than using outdated operating systems, thus leading to the FinTech market opportunities. Besides, rising customer demand for more user-friendly channels for performing financial transactions such as at e-commerce sites and mobile banking apps is expected to drive the Global FinTech Market. In 2022, as per World Bank, over 57% of people in developed nations pay their bills from a regular account through digital payments via phone, card or the internet. This represents the FinTech Industry Outlook.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭

Key Takeaways:

The dominance of the North America Region

Geographically, North America held the largest FinTech market share of 36% in 2022 owing to an increase in the use of e-commerce platforms in the region. In North America, the adoption of e-commerce is 71.5% in 2022.

Blockchain Segment Anticipated to Witness Fastest Growth

Based on Technology, the Blockchain Segment is estimated to grow with the fastest CAGR of 20.1% during the market forecast period 2023-2030. This is due to the rising usage of cryptocurrencies or digital currencies that are developed on distributed ledger infrastructure for payment purposes.

Wealth Management Projected to be the Fastest Growing Segment

Based on Services, the wealth Management Segment is estimated to grow with the fastest CAGR of 20.5% during the forecast period 2023-2030. This is owing to the rising demand for financial planning, increased security; fully digitalized client onboarding and real-time coordination between the financial adviser and the client.

Rising Demand for Mobile Banking Applications

According to NCBI, mobile banking apps have expanded from 35% to 80% in 2020. Mobile beneficiaries globally have reached more than 6.8 USD billion since mobile was connected to the internet. Every bank has its own mobile app that enables a customer to transact online and transfer money to users all over the world.

Rising Investments in FinTech Firms

In many countries around the world, investments in fintech have grown significantly. The overall amount of investment in fintech start-ups increased to $210 billion in 2021. The United States attracted the biggest investment, accounting for about 80% of the overall investment. This financial technology investment trend is likely to generate lucrative market growth in the FinTech Market analysis report.

Risks to Data and Privacy may Hamper the Growth of the FinTech market

Companies need to do security testing prior to deployment of the app, application or website. The issue with this is the possibility of unanticipated things that prolong the release timeline. Developers may ship risky software to get a financial product to market sooner. However, fixing flaws later in the software development lifecycle is exceedingly expensive. This is one of the factors that is hampering the FinTech Market growth. The largest cyber incident in British financial history was the theft of US$2 million from the accounts of 9000 consumers.

Purchase Report

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the FinTech Market. The 10 key companies in this industry are:

Avant LLC (AvantCredit®)

Atom Bank plc (Jetpack, Swinject)

Ant Group (Huabei, Alipay)

Social Finance Inc. (SoFi Credit Card, SoFi Invest®)

Goldman Sachs (TxB, Datonomy™)

Adyen (Affirm, Giropay)

Bnkbl Ltd (L 39 INNOVATE)

Blockstream (Liquid Network, Blockstream Finance)

Cisco Systems Inc. (Cisco SecureX, Cisco Talos)

Circle Internet Financial Limited (USDC, Euro Coin)

0 notes

Text

#UAE Fintech Market#UAE Fintech Market Size#UAE Fintech Market Share#UAE Fintech Market Trends#UAE Fintech Market Forecast

0 notes

Text

#Global Fintech Market#Global Fintech Market Size#Global Fintech Market Growth#Global Fintech Market Trends#Global Fintech Market Analysis

0 notes

Text

https://www.statsandresearch.com/report/40284-global-fintech-blockchain-market

#Fintech Blockchain Market COVID-19 Analysis Report#Fintech Blockchain Market Demand Outlook#Fintech Blockchain Market Primary Research#Fintech Blockchain Market Size and Growth#Fintech Blockchain Market Trends#Fintech Blockchain Market#global Fintech Blockchain market by Application#global Fintech Blockchain Market by rising trends#Fintech Blockchain Market Development#Fintech Blockchain market Future#Fintech Blockchain Market Growth#Fintech Blockchain market in Key Countries#Fintech Blockchain Market Latest Report#Fintech Blockchain market SWOT analysis#Fintech Blockchain market Top Manufacturers#Fintech Blockchain Sales market#Fintech Blockchain Market COVID-19 Impact Analysis Report#Fintech Blockchain Market Primary and Secondary Research#Fintech Blockchain Market Size#Fintech Blockchain Market Share#Fintech Blockchain Market Research Analysis#Fintech Blockchain Market Trends and Outlook#Fintech Blockchain Industry Analysis

0 notes

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

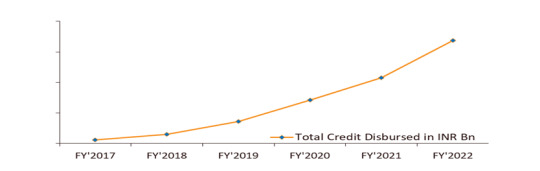

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

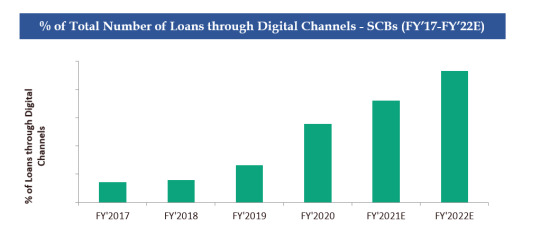

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

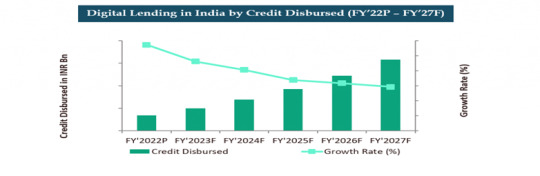

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

Increasing use of transport cards and gift cards is expected to help Indian prepaid card market reach USD 34.4 billion by 2020

Prepaid cards continue to be a niche payment card category in India. This segment has witnessed high adoption over the last five years and is expected to continue recording strong growth over the forecast period as well. The Gross Dollar Value (GDV) of Indian prepaid cards is expected to reach USD 34.4 billion by 2020, posting a CAGR of 24.4% from 2016 to 2020.

#Giftcardmarketsize

#B2CEcommerceIndustrysize

#giftcardtrend

#BNPLmarketsize

#giftcardresearchreport

#AsiapacificSocialCommercemarket

#GrowthofB2CEcommerceMarket

#B2CEcommerceMarketAnalysis

#giftcardmarketresearch

#IndustryOutlookOfB2CEcommerceMarket

#Prepaidcardmarketshare

#Social Commerce market size#Global Social Commerce Industry#Social Commerce market research#Loyalty Market Share#Report on Loyalty Management Market#Loyalty Management Market Size#U.S. Loyalty Management Market#Global Loyalty Management Market Forecast#Global Remittance Market#Digital Remittance Market Analysis#Industry Outlook on Remittance#Growth of B2B Ecommerce Market#B2B Ecommerce Industry size#B2B Ecommerce Market Analysis#Global B2C Ecommerce Market#B2C Ecommerce research report#Alternative lending market size#Digital lending market size#Alternative lending research report#Fintech market research#Fintech research report#Fintech industry analysis

0 notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

25 Cryptocurrency Terms You Need to Know

25 Cryptocurrency Terms You Need to Know

Content Bitcoin NFTs Coin How cryptocurrency works This term is a good one to know because market participants with the ability to execute very large transactions can potentially manipulate the market—or “make waves in the ocean.” Newcomers are frequently described as “noobs” by industry insiders. While simply buying digital currency is one example of taking a long position, there are other methods available. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Cryptocurrencies continue to grow, with new currencies cropping up all the time, and are here to stay. Their rising popularity is driven by the proven reliability of the top cryptocurrencies, Bitcoin and Ethereum. BitIRA facilitates the purchase of Digital Currency, nothing more, and charges a fee for the service it provides . No fiduciary relationship, broker dealer relationship, principal agent relationship or other special relationship exists between BitIRA and its customers. In the Bitcoin network, the difficulty of mining adjusts every 2016 blocks. FinTech Magazine focuses on fintech news, key fintech interviews, fintech videos, along with an ever-expanding range of focused fintech white papers and webinars. But there are thousands of them, each having different value and supply limits. The Metaverse is a virtual space where users are able to interact with each other in a computer generated environment. The right, but not the obligation, to buy a security or cryptocurrency at a given price within a given time frame. When components of a distributed computer system – such as a blockchain – may fail and there is imperfect information as to whether a component has failed or not. The name given to a significant volume of Bids at a specific price that creates the impression of a wall on the Depth Chart for a given cryptocurrency. Connect buyers with sellers to exchange cryptocurrency, charging a few for their service. A unit of measurement used to compare the sizes of different blockchain transactions. Weight measurements are relative to the maximum size of a block. As of 2016, each weight unit for Bitcoin represents 1 / 4,000,000 of a block. The reward given to a Miner for successfully mining a block, containing a subsidy and fees for transactions contained within the block. For Bitcoin the subsidy halves every four year and is currently set at 6.25 BTC. Bitcoin NFTs These schemes are often orchestrated through apps like Slack or Telegram, he adds, and advises curious chatroom readers to beware of such gimmicks. An investigation into “pump and dump” schemes by Business Insider found the practice to be an “open secret among many cryptocurrency traders.” “Pump and dumpers are people who often say, ‘Hey, let’s all of us together pump this coin,’ which means buy the coin, create the demand in the market, the coin will go up in value,” Saddington says. In early bitcoin forums, someone posted a message that spelled the word “hold” wrong, and readers interpreted it as an acronym “hold on for dear life,” Saddington explains. “Now, it’s become a … Leggi tutto

https://online-wine-shop.com/25-cryptocurrency-terms-you-need-to-know/

14 notes

·

View notes

Text

25 Cryptocurrency Terms You Need to Know

25 Cryptocurrency Terms You Need to Know

Content Bitcoin NFTs Coin How cryptocurrency works This term is a good one to know because market participants with the ability to execute very large transactions can potentially manipulate the market—or “make waves in the ocean.” Newcomers are frequently described as “noobs” by industry insiders. While simply buying digital currency is one example of taking a long position, there are other methods available. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Cryptocurrencies continue to grow, with new currencies cropping up all the time, and are here to stay. Their rising popularity is driven by the proven reliability of the top cryptocurrencies, Bitcoin and Ethereum. BitIRA facilitates the purchase of Digital Currency, nothing more, and charges a fee for the service it provides . No fiduciary relationship, broker dealer relationship, principal agent relationship or other special relationship exists between BitIRA and its customers. In the Bitcoin network, the difficulty of mining adjusts every 2016 blocks. FinTech Magazine focuses on fintech news, key fintech interviews, fintech videos, along with an ever-expanding range of focused fintech white papers and webinars. But there are thousands of them, each having different value and supply limits. The Metaverse is a virtual space where users are able to interact with each other in a computer generated environment. The right, but not the obligation, to buy a security or cryptocurrency at a given price within a given time frame. When components of a distributed computer system – such as a blockchain – may fail and there is imperfect information as to whether a component has failed or not. The name given to a significant volume of Bids at a specific price that creates the impression of a wall on the Depth Chart for a given cryptocurrency. Connect buyers with sellers to exchange cryptocurrency, charging a few for their service. A unit of measurement used to compare the sizes of different blockchain transactions. Weight measurements are relative to the maximum size of a block. As of 2016, each weight unit for Bitcoin represents 1 / 4,000,000 of a block. The reward given to a Miner for successfully mining a block, containing a subsidy and fees for transactions contained within the block. For Bitcoin the subsidy halves every four year and is currently set at 6.25 BTC. Bitcoin NFTs These schemes are often orchestrated through apps like Slack or Telegram, he adds, and advises curious chatroom readers to beware of such gimmicks. An investigation into “pump and dump” schemes by Business Insider found the practice to be an “open secret among many cryptocurrency traders.” “Pump and dumpers are people who often say, ‘Hey, let’s all of us together pump this coin,’ which means buy the coin, create the demand in the market, the coin will go up in value,” Saddington says. In early bitcoin forums, someone posted a message that spelled the word “hold” wrong, and readers interpreted it as an acronym “hold on for dear life,” Saddington explains. “Now, it’s become a … Leggi tutto

https://online-wine-shop.com/25-cryptocurrency-terms-you-need-to-know/

4 notes

·

View notes

Text

Neo Banks vs. Traditional Banks: Why Investors Are Switching Sides

Introduction

The financial industry is undergoing a seismic shift, with neo banks—digital-only, tech-first banking platforms—taking on the traditional banking giants that have long dominated the market. This disruption has caught the attention of investors who see an opportunity to back agile, customer-centric fintech companies that are redefining how people bank. While traditional banks boast decades (or even centuries) of legacy, many investors are betting big on neo banks due to their innovation, scalability, and the way they cater to today’s digital-savvy consumers.

This blog explores why investors are switching sides and putting their money into neo banks, leaving traditional banks playing catch-up.

1. Neo Banks: Digital-First and Customer-Focused

Unlike traditional banks that have physical branches and often rely on dated infrastructure, neo banks operate entirely online. Their digital-first approach allows them to offer a streamlined, mobile-centric experience. From opening accounts to applying for loans, neo banks enable users to manage their finances through an intuitive app, often with minimal fees or none at all.

a. Personalized and Efficient Services

Neo banks are built on customer experience and personalization. They use advanced data analytics and AI to offer services that are tailored to individual needs, such as smart savings features, personalized budgeting tools, and real-time notifications. This level of customization is hard for traditional banks to replicate, given their dependence on legacy systems.

b. Fast, Flexible, and Transparent

One key advantage of neo banks is their agility. Without the overhead costs of maintaining physical branches or the burden of legacy systems, neo banks can pivot quickly, roll out new services, and respond to customer feedback with greater speed. They offer transparency by eliminating many of the hidden fees typically associated with traditional banks, making them attractive to consumers who want simple, straightforward financial solutions.

Key Takeaway: Neo banks thrive by delivering a modern, customer-first experience that’s agile and adaptable, appealing to the digital generation and savvy investors alike.

2. The Challenge for Traditional Banks: Legacy Systems and Slow Innovation

Traditional banks, though they boast large customer bases and established reputations, are often hampered by outdated infrastructure and bureaucratic processes. Their reliance on physical branches and complex IT systems makes it difficult for them to offer the seamless, mobile-first experiences that modern consumers now expect.

a. Struggling to Keep Pace

While traditional banks are investing heavily in digital transformation, the speed at which they can innovate is often sluggish. Many are still navigating cumbersome legacy systems that are not designed to integrate with modern fintech solutions, limiting their ability to launch new digital services quickly.

b. Regulatory Hurdles

Another challenge for traditional banks is regulation. While neo banks are also subject to regulatory scrutiny, traditional banks face a more complex web of compliance requirements due to their size, geographical presence, and product portfolios. These regulatory hurdles can slow down innovation and limit the flexibility that investors seek in today’s fast-paced financial landscape.

Key Takeaway: Traditional banks are burdened by legacy infrastructure and regulatory hurdles, which slow down their ability to innovate and attract investors focused on the future of banking.

3. Investor Attraction: High Growth and Scalability of Neo Banks

For investors, neo banks represent a chance to be part of the next generation of financial services. While traditional banks may have long-term stability, the growth potential of neo banks is driving a significant shift in investor interest.

a. Rapid Expansion and Global Reach

Neo banks have a unique advantage in their ability to scale quickly. With minimal physical infrastructure and a digital-first business model, these banks can expand into new markets at a fraction of the cost it would take for a traditional bank. For example, neo banks like Revolut and N26 have swiftly expanded their user base across Europe and North America, leveraging technology to grow their footprint without the need for brick-and-mortar branches.

b. Low Overhead, High Margins

Without the costs associated with maintaining physical branches and large staffs, neo banks operate with significantly lower overhead than traditional banks. This allows them to offer competitive interest rates, low or zero fees, and high returns, attracting not only consumers but also investors looking for high-margin opportunities.

Key Takeaway: Neo banks’ ability to scale quickly with low overhead is drawing investor interest, offering high growth potential compared to the slower, more established traditional banking sector.

4. Technological Innovation and Fintech Integration

Neo banks thrive on technological innovation and often integrate seamlessly with other fintech platforms. They leverage the latest in artificial intelligence, blockchain, and data analytics to offer services that go far beyond basic checking and savings accounts.

a. Open Banking and API Integration

Neo banks are at the forefront of the open banking movement, which allows third-party developers to build applications and services around financial institutions. This creates new opportunities for fintech partnerships and innovative services, such as budgeting apps, automated investment platforms, and cross-border payment solutions. Investors see this ecosystem of collaboration as a driving force for the future of banking.

b. Automation and AI-Powered Solutions

From automating loan applications to providing AI-driven financial advice, neo banks are using technology to offer faster, smarter, and more efficient services than traditional banks. These innovations are highly scalable, giving neo banks the potential to serve millions of users without a proportional increase in cost, making them appealing to investors looking for tech-forward, scalable solutions.

Key Takeaway: Neo banks are leaders in technological innovation, from open banking to AI-driven solutions, and their seamless integration with fintech makes them a favorite among tech-savvy investors.

5. Regulation and Trust: The Balancing Act for Neo Banks

While neo banks are often seen as more agile and innovative, they also face regulatory challenges. Trust is a significant concern for consumers, many of whom are more comfortable with traditional banks that have a long-standing history and established reputations.

a. Navigating Regulation

Neo banks must navigate complex regulatory landscapes, especially when expanding into new markets. However, many are succeeding in this arena, partnering with established financial institutions or acquiring necessary licenses to ensure compliance. Investors are closely watching how neo banks handle these challenges and continue to maintain trust while delivering innovative services.

b. Building Consumer Trust

While traditional banks benefit from years of consumer trust, neo banks are steadily building their own reputations through transparency, customer satisfaction, and strong digital security measures. Investors are betting that, over time, trust in digital-only banks will continue to grow as younger, tech-savvy consumers embrace the convenience and efficiency they offer.

Key Takeaway: Neo banks must balance innovation with regulatory compliance and trust-building, but their transparency and customer-focused approach position them for long-term success.

Conclusion

Investors are increasingly turning away from traditional banks and embracing neo banks as the future of finance. The agility, technology-driven innovation, and scalability of neo banks make them an attractive investment opportunity, especially as the financial industry continues to move toward a more digital and customer-centric model. While traditional banks still hold significant market power, neo banks are positioning themselves as the future leaders in banking, offering investors a chance to be part of a rapidly growing, high-reward sector.

#NeoBanks#TraditionalBanks#FintechInvesting#BankingRevolution#TechInvestments#DigitalBanking#InvestorTrends#FutureOfFinance

0 notes

Text

The FinTech Market size is estimated to reach $851 billion by 2030, growing at a CAGR of 18.5% during the forecast period 2023-2030. Fintech is the usage of new technological breakthroughs such as artificial intelligence, application programming interfaces and blockchain for financial goods and services improvement and automation.

0 notes

Text

#Islamic Fintech Market#Saudi Arabia Islamic Fintech Market#Saudi Arabia Islamic Fintech Market Size#Saudi Arabia Islamic Fintech Market Share

0 notes

Text

Top Free Zones in the UAE for Entrepreneurs - Raes Associates

The United Arab Emirates (UAE) has become a global hub for business and innovation, particularly for entrepreneurs looking to establish or expand their ventures. One of the key attractions of the UAE is its free zones in the UAE, which offer numerous benefits including 100% foreign ownership, tax exemptions, and simplified business setup processes. In this blog post, we'll explore some of the top UAE free zone company setup options that cater to entrepreneurs.

1. Dubai Multi Commodities Centre (DMCC)

Overview

DMCC is one of the largest and fastest-growing free zones in the UAE, particularly favored by companies in the commodities sector.

Key Benefits

100% foreign ownership

No corporate tax for 50 years

Wide range of business activities permitted

Access to a vibrant business community and networking opportunities

Ideal For

Businesses in commodities trading, fintech, and technology sectors.

2. Sharjah Airport International Free Zone (SAIF Zone)

Overview

SAIF Zone is strategically located near Sharjah International Airport, making it an ideal choice for businesses focused on logistics and trade.

Key Benefits

100% foreign ownership

No import or export duties

Flexibility in leasing options

Cost-effective setup and operational fees

Ideal For

Logistics, warehousing, and manufacturing companies.

3. Abu Dhabi Global Market (ADGM)

Overview

ADGM is a financial free zone located in the capital city, Abu Dhabi. It aims to promote financial services and innovation.

Key Benefits

100% foreign ownership

No corporate tax

Robust regulatory framework

Access to a growing market in the UAE and beyond

Ideal For

Financial services, fintech startups, and investment firms.

4. Fujairah Free Zone

Overview

Situated near Fujairah Port, this free zone is perfect for businesses involved in shipping and logistics.

Key Benefits

100% foreign ownership

No corporate tax

Proximity to key shipping routes

Efficient customs procedures

Ideal For

Shipping, logistics, and maritime-related businesses.

5. Ras Al Khaimah Economic Zone (RAKEZ)

Overview

RAKEZ combines multiple free zones under one umbrella, offering diverse options for businesses in various sectors.

Key Benefits

100% foreign ownership

No corporate tax

Affordable setup costs

Access to both local and international markets

Ideal For

A wide range of industries, including manufacturing, trading, and service-based businesses.

6. Ajman Free Zone

Overview

Ajman Free Zone is known for its affordability and ease of doing business, making it attractive for startups.

Key Benefits

100% foreign ownership

No corporate tax

Flexible licensing options

Low operational costs

Ideal For

Small and medium-sized enterprises (SMEs) across various industries.

Conclusion

The UAE's free zones present unparalleled opportunities for entrepreneurs looking to establish their businesses in a thriving environment. With benefits like full foreign ownership, tax exemptions, and streamlined processes, these zones provide the perfect launchpad for startups and established businesses alike. Whether you're in logistics, finance, or tech, there’s a free zone tailored to your needs.

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

Chinese prepaid card market estimated to reach USD 476.5 billion by 2020; transport and travel card categories expected to drive growth

Growth of prepaid cards in China is expected decelerate along with other card categories due to uncertain economic conditions in the country. Chinese government’s strict regulations on prepaid cards to prevent corruption continued to have an impact on prepaid card transactions. However, prepaid cards in China are forecast to post steady growth over the next five years as further penetration of prepaid cards is expected in non-metropolitan cities, and categories such as transport cards and travel cards are expected to drive growth. PayNXT360 estimates, Chinese prepaid card market to post a CAGR of about 9% from 2016 to 2020, to reach USD 476.5 billion by 2020.

#Giftcardmarketsize

#B2CEcommerceIndustrysize

#giftcardtrend

#BNPLmarketsize

#giftcardresearchreport

#AsiapacificSocialCommercemarket

#GrowthofB2CEcommerceMarket

#B2CEcommerceMarketAnalysis

#giftcardmarketresearch

#IndustryOutlookOfB2CEcommerceMarket

#Prepaidcardmarketshare

#Social Commerce market size#Global Social Commerce Industry#Social Commerce market research#Loyalty Market Share#Report on Loyalty Management Market#Loyalty Management Market Size#U.S. Loyalty Management Market#Global Loyalty Management Market Forecast#Global Remittance Market#Digital Remittance Market Analysis#Industry Outlook on Remittance#Growth of B2B Ecommerce Market#B2B Ecommerce Industry size#B2B Ecommerce Market Analysis#Global B2C Ecommerce Market#B2C Ecommerce research report#Alternative lending market size#Digital lending market size#Alternative lending research report#Fintech market research#Fintech research report#Fintech industry analysis

0 notes

Text

Lease IP Address in Ukraine: A Comprehensive Guide

As the digital landscape continues to evolve, businesses and individuals alike are increasingly seeking flexible and cost-effective solutions to meet their growing network needs. One such solution is leasing IP addresses. In Ukraine, the demand for leased IP addresses is on the rise due to the country's growing tech sector and its strategic location between Europe and Asia.

This blog will explore the benefits, challenges, and opportunities of leasing IP addresses in Ukraine, and how businesses can leverage this service to enhance their operations.

What is an IP Address Lease?

An IP (Internet Protocol) address lease involves renting a block of IP addresses for a set period, rather than purchasing them outright. Leasing allows businesses to scale their online infrastructure, accommodate traffic spikes, and expand their operations without the long-term commitment or high upfront cost of buying IP addresses.

Why Lease IP Addresses in Ukraine?

Ukraine's tech and digital industries have been growing steadily, driven by an increasing demand for online services, digital marketing, e-commerce, and fintech solutions. Leasing IP addresses in Ukraine provides several advantages:

Cost-Effective Solution: Compared to purchasing, leasing IP addresses is far more affordable, especially for startups and small businesses that may not have the capital to invest in long-term IP resources.

Flexibility: Leasing provides greater flexibility as businesses can scale their network resources up or down depending on current needs. This is particularly useful for companies in Ukraine's tech hubs, where the demand for digital services can fluctuate rapidly.

Faster Deployment: Leasing IP addresses allows for quicker access to the required network resources, enabling businesses to roll out services, websites, or applications in less time.

Compliance with Local Laws: Leasing IP addresses from a Ukraine-based provider ensures that companies are compliant with local regulations regarding internet usage, data privacy, and security.

Key Benefits of Leasing IP Addresses

1. Scalability

For businesses looking to expand their online presence in Ukraine or globally, leasing IP addresses offers a scalable solution. Companies can lease additional IPs as they grow without the constraints of purchasing them upfront.

2. Enhanced Security

Leasing a dedicated IP address can improve security by ensuring that businesses maintain control over their traffic and online assets. A dedicated IP can also help with reputation management, particularly for companies that handle sensitive data.

3. Improved SEO and Online Performance

Leasing a dedicated IP address can positively impact website performance and search engine optimization (SEO). In cases where a shared IP might slow down a website or expose it to potential risks due to other users on the same network, a leased IP offers more control and stability.

How to Lease IP Addresses in Ukraine

Leasing an IP address in Ukraine is a straightforward process. Here’s a step-by-step guide:

Research Providers: Look for reputable IP address leasing companies in Ukraine or global providers with a presence in the region. Ensure that they offer IPv4 and IPv6 addresses to suit your needs.

Select the Right IP Range: Depending on the size of your business and the nature of your operations, you may need a small block of IPs or a larger range. Most providers offer customizable solutions to fit your needs.

Consider Pricing: Compare pricing plans and choose the option that provides the best balance of cost and flexibility. Some providers may offer discounts for long-term leases.

Review Terms and Conditions: Before committing, thoroughly review the lease agreement to understand the terms, including usage limits, renewals, and penalties for exceeding limits.

Set Up Your Leased IPs: Once your lease is active, your provider will guide you through the setup process, helping you configure your leased IP addresses for your specific needs.

Potential Challenges of Leasing IP Addresses

While leasing IP addresses in Ukraine offers numerous benefits, there are some challenges to consider:

IPv4 Shortage: IPv4 addresses are becoming scarce globally, which can drive up the price of leasing these IPs in Ukraine. Some businesses may need to transition to IPv6, which offers a larger pool of addresses but may require additional infrastructure.

Network Performance: Depending on the provider, network latency or other performance issues may arise. It's essential to choose a reliable provider with a strong infrastructure in Ukraine to ensure optimal performance.

Legal and Regulatory Issues: It's crucial to ensure that the leased IP addresses comply with Ukrainian regulations on internet usage and data privacy, particularly for companies handling sensitive information.

Conclusion

Lease IP addresses in Ukraine provides businesses with a flexible, cost-effective solution to scale their digital operations. With the growing demand for online services, e-commerce, and tech solutions in the country, leasing IPs offers a quick and efficient way to meet these demands without the long-term commitment of purchasing IP addresses.

Whether you're a startup looking to establish your online presence or an established company seeking to expand in the Ukrainian market, leasing IP addresses can provide the network infrastructure needed to succeed.

By carefully selecting the right provider and range of IPs, you can enjoy the benefits of scalability, enhanced security, and improved online performance—all while staying compliant with local regulations.

0 notes