#Flexcube Implementation in India

Explore tagged Tumblr posts

Link

Flexcube Implementation - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube Implementation#Flexcube Implementation in India#Flexcube Implementation Partners#Flexcube Implementation Partner#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore

0 notes

Link

Flexcube Implementation Partners - Trempplin is an IT products & services company focused on banking & financial services. Started in 2016 with presence in 4 countries and 17+ satisfied customers in Cambodia, Laos, Nepal & Uganda, we are an Oracle Partner specialized in Oracle FLEXCUBE Implementation, Support & Training Services in India.

#Flexcube Implementation Partners#Flexcube Implementation partner in India#Flexcube Core Banking Solution'#Flexcube Consulting in Bangalore#Flexcube Implementation in Bangalore#Flexcube Implementation in India

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Link

Flexcube Core Banking Solutions - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. expertise on Training & Implementation on Flexcube in India.

#Flexcube Core Banking Solution#Flexcube Core Banking System#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Flexcube Training Center in Bangalore#Digital Banking Solutions#Flexcube Testing Services

1 note

·

View note

Text

Staff Consultant Job For 3-9 Year Exp In Micros Systems India - 3981933

Staff Consultant Job For 3-9 Year Exp In Micros Systems India – 3981933

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Text

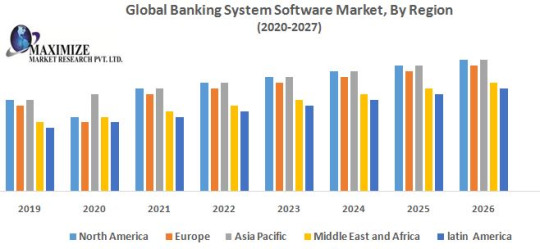

Global Banking System Software Market : Industry Analysis and Forecast (2019-2026) – by Type, Application,Core Banking Software, Features of core banking software,and Region

Global Banking System Software Market size was US$ 26.71 Bn in 2019 and expected to reach US$ XX Bn by 2026, at a CAGR of XX % during forecast period.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software .Customer can use their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology has offered countless of channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.

North America is projected to be the dominant region on account of the prevalent banking sector and high attentiveness of online banking. North America Market is followed by Asia-Pacific mainly on a result of the government initiatives in the banking industry. Remarkable demand is witnessed by developing nations such as India and China are accounted development of private and rural banking.

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite Inc., and Deltek, Inc., Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, TEMENOS Headquarters SA.

The objective of the report is to present comprehensive analysis of Global Banking System Software Market including all the stakeholders of the industry. The past and current status of the industry with forecasted Market size and trends are presented in the report with analysis of complicated data in simple language. The report covers all the aspects of industry with dedicated study of key players that includes Market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give clear futuristic view of the industry to the decision makers.

The report also helps in understanding Global Banking System Software Market dynamics, structure by analyzing the Market segments, and project the Global Banking System Software Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Banking System Software Market the report investor’s guide.

Global Banking System Software Market Request For View Sample Report Page :@https://www.maximizemarketresearch.com/request-sample/16011

The scope of Global Banking System Software Market

Global Banking System Software Market, by Type

• Windows • Android • iOS

Global Banking System Software Market , by Core Banking Software • Temenos Core Banking • MX for Banking • Oracle FLEXCUBE • Plaid • Q2ebanking • Others Global Banking System Software Market , by Features of core banking software

• Others Recording of transactions • Passbook maintenance • Interest calculations on loans and deposits • Customer records • Balance of payments and withdrawal • Others Global Banking System Software Market, by Application

• Risk management • Information security • Business intelligence • Training and consulting solutions Global Banking System Software Market, by Geography

• North America • Europe • Asia Pacific • Middle East & Africa • Latin America Key Players Global Banking System Software Market

• Microsoft Corporation • IBM Corporation • Oracle Corporation • SAP SE • Tata Consultancy Services Limited. • Infosys Limited • Capgemini • Accenture. • NetSuite Inc. • Deltek, Inc. • Millennium Information Solution Ltd. • Strategic Information Technology Ltd. • Aspekt • Automated Workflow Pvt. Ltd • Canopus EpaySuite • Cashbook • CoBIS Microfinance Software • Probanx Information Systems • Megasol Technologies • EBANQ Holdings BV • Kapowai • Crystal Clear Software Ltd. • Infrasoft Technologies Ltd. • Misys • Banking.Systems • ABBA d.o.o. • SecurePaymentz • TEMENOS Headquarters SA

Global Banking System Software Market Do Inquiry Before Purchasing Report Here @ :https://www.maximizemarketresearch.com/inquiry-before-buying/16011

About Us:

Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Contact: +919607065656 / +919607195908 Website:www.maximizemarketresearch.com

0 notes

Link

Flexcube Implementation – We Conceptualize, Build, Run & Grow Banking Solutions through Cost-efficient.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partner in Bangalore#Flexcube Implementation in India

0 notes

Link

Flexcube Implementation Partner- Trempplin specialized in oracle Flexcube implementation, upgrade and Flexcube training. We are an Oracle gold partner in India.

#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partner in India#Flexcube Implementation Partners in India#Flexcube Implementation#Flexcube Implementation in India#Flexcube Oracle Partner#Flexcube Testing

0 notes

Link

Flexcube Implementation - Trempplin is a best core banking solution provider, specialised in FLEXCUBE Implementation, FLEXCUBE Corporate Training etc.

#Flexcube Implementation Partners#Flexcube Implementation#Flexcube Implementation in India#Flexcube Implementation Partner in Bangalore#Flexcube Implementation Partner in India

0 notes

Link

Flexcube Implementation Partners - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube#Flexcube Implementation partner in India#Fexcube Implementation partenr#Flexcube Core Banking Solution'#Flexcube Implementation in Bangalore#Flexcube Consulting in Bangalore#Core Banking System#Core Banking Solutio

1 note

·

View note

Link

Flexcube Implementation - Trempplin is an Oracle Gold Partner with extensive implementation experience across applications in the Banking and Financial Services domain. Expertise on Training & Implementation on Flexcube in India.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore

0 notes

Link

Flexcube Implementation- We are banks extended team for consulting, management & support with premium service.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube implementation and consulting services#Flexcube Implementation services#Flexcube Implementation partner#Flexcube Implementation partners#Flexcube Implementation and consulting#Flexcube Consulting Services in India

0 notes

Link

Flexcube Implementation- Trempplin brings value addition to Banks and best practices that capture over the years through successful Flexcube implementation which help Banks with a smooth Project operation.

#Flexcube Implementation#Flexcube implementation and consulting services#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube Implementation partners in india#Flexcube Implementation Services#Flexcube Implementation Partners in Bangalore

0 notes

Link

Flexcube Implementation- We are an Oracle Gold Partner with extensive implementation experience. Run, Manage & Grow core banking application efficiently at a significantly reduced cost.

#Flexcube Implementation#Flexcube implementation and consulting services#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation partner#Flexcube Implementation Services

0 notes

Link

Flexcube Implementation- Trempplin’s objective is to become Bank’s extended team for consulting, management & support with top quality of service such as Flexcube/OBDX/OFSAA implementation, Flexcube Training and Testing services.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube Implementation and consulting services

0 notes

Link

Flexcube Implementation- We have unparalleled expertise & experience in implementing IT solutions for Banks and financial institutions with referenceable clients worldwide.

#Flexcube Implementation#Flexcube Implementation partner#Flexcube Implementation partners in india#Flexcube Implementation partner in bangalore#Flexcube Implementation and consulting services#Flexcube consulting services

0 notes