#flexcube upgrade

Explore tagged Tumblr posts

Text

Top Flexcube Core Banking Solutions & Tech Challenges for Banks in 2025

Customization complexity, system integration, and regulatory compliance are major hurdles for financial institutions. That’s why we decided to consult with API Connects—a leading IT services provider in New Zealand—to explore how advanced technologies are overcoming these challenges and optimizing Flexcube core banking solutions.

Key Tech Solutions for Banking: 🔹 Tailored Customization – Customizes Flexcube core banking solutions to meet specific banking needs while maintaining system stability. 🔹 Seamless Integration – Connects Flexcube with digital platforms, payment gateways, and third-party systems for an optimized customer experience. 🔹 Flexcube Upgrades & Migrations – Ensures smooth system updates, preserving customizations and minimizing downtime. 🔹 Regulatory Compliance – Keeps Flexcube in line with evolving global regulations like KYC, AML, and GDPR. 🔹 Scalable Architecture – Designs Flexcube core banking solutions to support growth in transaction volumes and user base. 🔹 Legacy System Integration – Seamlessly connects Flexcube with legacy systems for continued operational efficiency. 🔹 Expert Support – Provides proactive support and liaises with Oracle for rapid issue resolution.

Conclusion: Banks are modernizing core banking systems through tailored Flexcube core banking solutions, ensuring efficiency, compliance, and future scalability. With API Connects' expertise, financial institutions can transform operational challenges into growth opportunities, ensuring a seamless banking experience for all.

Don’t forget to check their most popular services:

Automation Solutions

robotic process automation solutions

machine learning services

core banking solutions

IoT business solutions

data engineering services

DevOps services

mulesoft integration services

ai services

0 notes

Text

Oracle FLEXCUBE Online Training: A Complete Guide

Introduction to Oracle FLEXCUBE

Oracle FLEXCUBE Online Training Top of Banglore 2025 is a comprehensive core banking solution used by financial institutions worldwide to streamline banking operations, improve customer service, and enhance regulatory compliance. It provides an integrated platform for retail, corporate, investment, and Islamic banking. FLEXCUBE’s powerful automation and real-time processing capabilities enable banks to manage accounts, transactions, risk, and compliance efficiently.

With the increasing demand for skilled professionals in banking technology, Oracle FLEXCUBE Online Training has become a popular choice for individuals and banking professionals looking to upgrade their knowledge. This training helps participants gain expertise in implementing, managing, and customizing FLEXCUBE to meet business needs.

Why Choose Oracle FLEXCUBE Online Training?

Online training offers numerous advantages, making it a preferred mode of learning for professionals and beginners alike. Some key benefits include:

Flexible Learning Schedule – Online training allows participants to learn at their own pace without affecting their work commitments.

Expert-Led Sessions – Courses are conducted by industry experts with hands-on experience in banking and Oracle FLEXCUBE.

Practical Hands-on Experience – Training includes live demonstrations, real-world case studies, and hands-on exercises in a simulated environment.

Certification Preparation – Many courses prepare students for Oracle FLEXCUBE certification exams, increasing job opportunities.

Cost-Effective Learning – Online training eliminates travel and accommodation costs associated with traditional classroom training.

Key Topics Covered in Oracle FLEXCUBE Online Training

1. Introduction to Oracle FLEXCUBE

Overview of core banking solutions

Architecture and components of FLEXCUBE

Understanding banking workflows and processes

2. FLEXCUBE Functional Modules

Customer Management – Creating and managing customer profiles, account types, and banking relationships.

Deposits and Loans – Configuring savings accounts, fixed deposits, loans, and overdrafts.

Payments and Settlements – Processing funds transfers, SWIFT payments, and remittances.

Trade Finance – Managing letters of credit, guarantees, and trade transactions.

Risk and Compliance – Implementing AML (Anti-Money Laundering) and KYC (Know Your Customer) policies.

3. FLEXCUBE Technical Configuration

System setup and user management

Parameter configuration and workflow customization

Integration with external banking applications

4. Reporting and Analytics

Generating financial and compliance reports

Analyzing customer data for business insights

Automating regulatory reporting requirements

5. FLEXCUBE Implementation and Customization

Deployment models: On-premise vs. cloud

Customizing FLEXCUBE to meet specific business requirements

Testing and troubleshooting FLEXCUBE configurations

Who Should Enroll in FLEXCUBE Online Training?

This training is suitable for:

Banking Professionals – Employees working in financial institutions who want to enhance their technical and functional understanding of FLEXCUBE.

IT Professionals – Developers, system administrators, and consultants involved in banking technology projects.

Business Analysts – Individuals responsible for banking process optimization and digital transformation initiatives.

Students and Fresh Graduates – Those looking to build a career in banking IT and financial software solutions.

Career Opportunities After Oracle FLEXCUBE Training

Completing Oracle FLEXCUBE training opens up numerous job opportunities in the banking and financial services industry. Some potential career roles include:

FLEXCUBE Functional Consultant

Core Banking Solution Architect

FLEXCUBE Technical Consultant

Business Analyst – Banking Technology

Oracle FLEXCUBE Developer

System Administrator – Core Banking

With the widespread adoption of FLEXCUBE by banks and financial institutions globally, certified professionals are in high demand.

Choosing the Right Oracle FLEXCUBE Online Training Provider

When selecting an online training program, consider the following factors:

Trainer Expertise – Ensure that the instructors have real-world experience with Oracle FLEXCUBE implementation and customization.

Course Curriculum – Check if the course covers both functional and technical aspects of FLEXCUBE.

Hands-on Practice – Look for training that includes access to a FLEXCUBE sandbox environment for practical exercises.

Certification Guidance – If certification is a goal, choose a provider that offers exam preparation support.

Student Support – Ensure the training provider offers post-training support, discussion forums, and mentorship.

Conclusion

Oracle FLEXCUBE Online Training is an excellent investment for professionals looking to enhance their expertise in banking technology. With a structured curriculum covering key functional and technical aspects, this training equips learners with the knowledge to implement, configure, and manage FLEXCUBE solutions effectively. Whether you are a banking professional, IT consultant, or student aspiring to enter the financial services industry, FLEXCUBE training can significantly boost your career prospects.

By enrolling in a reputable online training program, you can gain the skills required to work with Oracle FLEXCUBE, stay ahead in the competitive job market, and contribute to the digital transformation of the banking sector.

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

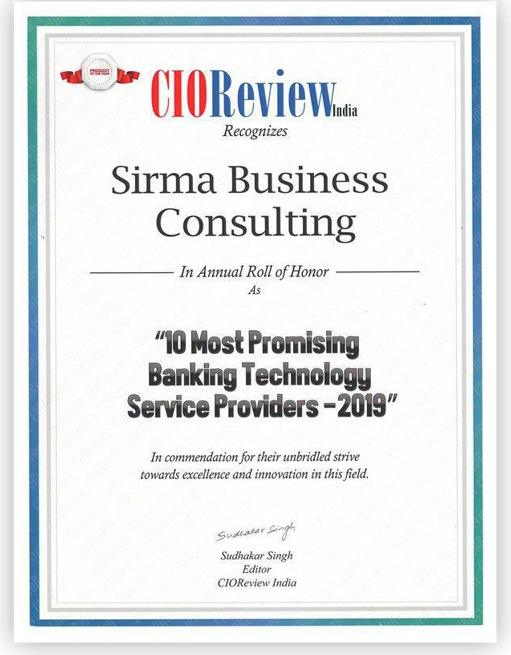

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Video

Flexube MK2 to "Evolution" Lid Replacement from Winemaker Nicholas Karavidas on Vimeo.

Flexcube, the most innovative barrel replacement system in the world, replicates the finest hand-split stave oak wine aging without the barrel itself. The second generation Flexcubes have a new lid replacement retrofit as an upgrade to the existing MK2 lid system.......and here it is!

0 notes

Text

Staff Consultant Job For 3-9 Year Exp In Micros Systems India - 3981933

Staff Consultant Job For 3-9 Year Exp In Micros Systems India – 3981933

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Link

Flexcube implementation- Trempplin is an Oracle Gold Partner specialized in Oracle FLEXCUBE/OBDX/OFSAA Implementation, Upgrades, Support, Training and IT Staff Augmentation Services specializing in Financial Industry.

#Flexcube implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation partners#Flexcube Implementation Partner#Flexcube implementation and consulting services#Flexcube Consulting services

0 notes

Text

After Citigroup erroneously sent $900M to lenders using Oracle's Flexcube, some are calling for simplified business software UX to match consumer-facing design (Ann-Marie Alcántara/Wall Street Journal)

After Citigroup erroneously sent $900M to lenders using Oracle's Flexcube, some are calling for simplified business software UX to match consumer-facing design (Ann-Marie Alcántara/Wall Street Journal)

Ann-Marie Alcántara / Wall Street Journal: After Citigroup erroneously sent $900M to lenders using Oracle’s Flexcube, some are calling for simplified business software UX to match consumer-facing design — Citi’s accidental payment makes a strong case for upgrading back-end technology to match consumer-facing design Source link

View On WordPress

0 notes

Text

Latest Software and applications manager jobs in Singapore, Peopleâs Park posted on Saturday 11th of March 2017

Latest Software and applications manager jobs in Singapore, Peopleâs Park posted on Saturday 11th of March 2017

Latest Software and applications manager jobs in Singapore, Peopleâs Park posted on Saturday 11th of March 2017 This job listing contains a total of 25 jobs.

Consulting Technical Manager Job Excerpt

At least 7 yrs of working experience in developing software. FLEXCUBE Investor Service Product Upgrade project Management:…. Continue Reading…

View On WordPress

0 notes

Video

tumblr

Sirma Business Consulting provides services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies etc. Sirma Business Consulting (India) Private Limited has been established in 2015 and is based out of Bangalore.

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA, and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

0 notes

Text

Senior Consultant Job For 3-9 Year Exp In Micros Systems India - 3978479

Senior Consultant Job For 3-9 Year Exp In Micros Systems India – 3978479

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Text

Principal Consultant Job For 3-9 Year Exp In Micros Systems India - 3971058

Principal Consultant Job For 3-9 Year Exp In Micros Systems India – 3971058

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Text

Staff Consultant Job For 3-9 Year Exp In Micros Systems India - 3931983

Staff Consultant Job For 3-9 Year Exp In Micros Systems India – 3931983

OFSS Consulting is part of Financial Services Global unit and provides a variety of consulting services covering new implementations, upgrades, Customization and Managed services for a variety of Industry leading products like FLEXCUBE, DIGIX – Oracle Digital Banking experience, Analytics, Pricing and Billing, Leasing and Lending and Oracle Banking Products covering Retail, Corporate, Investment…

View On WordPress

0 notes

Link

Flexcube Implementation- Trempplin is rich banking domain expertise, specialized in oracle Flexcube implementation, training and upgrade.

#Flexcube Implementation#Flexcube Implementation partner in India#Flexcube Implementation partner in Bangalore#Flexcube Implementation Partners#Flexcube Implementation Partner#Flexcube implementation and consulting services#FLEXCUBE consulting services

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle gold partner, specialized in Flexcube Implementation, Flexcube training and Flexcube upgrade.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partners in India#Flexcube Implementation Partner in Bangalore#Flexcube Implementation and consulting services

0 notes

Link

Flexcube Implementation- Trempplin is an Oracle gold partner, specialized in Flexcube Implementation, Flexcube Upgrade and Flexcube Training and consulting services in India.

#Flexcube Implementation#Flexcube Implementation Partner#Flexcube Implementation Partners#Flexcube Implementation Partner in India#Flexcube Implementation Partners in India#Flexcube Implementation Partner in Bangalore#Flexcube Implementation Partners in Bangalore#Flexcube Implementation and Consulting Services#flexcube consulting#Flexcube Consulting Services

0 notes

Link

FLEXCUBE Implementation- Trempplin is an oracle gold partner, specialized in FLEXCUBE implementation, Upgrade and FLEXCUBE training.

#FLEXCUBE Implementation#FLEXCUBE Implementation Partner#FLEXCUBE Implementation Partners in India#FLEXCUBE Implementation Partner in Bangalore#flexcube implementation partners#Flexcube#FLEXCUBE Implementation and consulting services

0 notes