#Forex Technical Analysis

Text

Comprehensive Analysis of GBP/JPY: Key Support and Resistance Levels Explained

#GBP/JPY analysis#forex technical analysis#British Pound Japanese Yen#forex trading#currency pair#GBP/JPY forecast#support and resistance#Fibonacci retracement

0 notes

Text

Ti...

View On WordPress

#Currency Exchange#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Ti..

0 notes

Text

Forex trade Example line in #US30 M30 Timeframe. Buy Trade opens and running.

.

Forex Cashpower Indicator Lifetime license ultimate NON REPAINT Signals with Smart algorithms that emit precise signals in Reversal zones of Trends with big trades volumes .

wWw.ForexCashpowerIndicator.com

.

✅ NO Monthly Fees

✅ AUTO-Trade Option

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Nofification

✅ Minimizes unprofitable/false signals

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at FBS brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

#cashpowerindicator#forex#forexindicator#forexprofits#indicatorforex#forexsignals#forexindicators#forextradesystem#forexvolumeindicators#forexchartindicators#metatrader4 indicators#metatrader4 signals#forex station indicators#forex factory news#forex brokers#forex technical analysis

1 note

·

View note

Text

Success and Failure in Forex Trading

Forex trading, or foreign exchange trading, is a challenging yet potentially rewarding endeavor. Traders enter the market with hopes of achieving financial success, but the path is often fraught with both triumphs and setbacks. Understanding the factors that contribute to success and failure in forex trading is crucial for any trader aiming to navigate this volatile market…

#Forex#Forex Market#Forex Traders#Forex Trading#Leverage#Market Trends#Overtrading#Profitability#Risk Management#Stop-Loss#Technical Analysis#Trading Decisions#Trading Plan#Trading Strategies

3 notes

·

View notes

Text

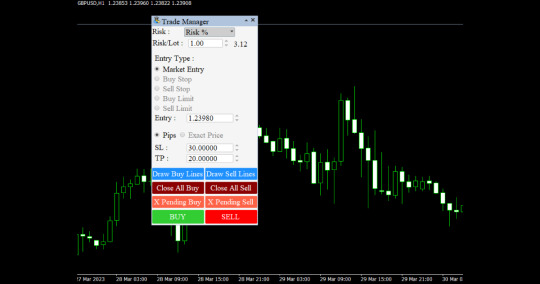

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

3 notes

·

View notes

Text

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

Bearish Engulfing pattern can result in uptrend ! When and How?

The above chart is a perfect example for a bearish engulfing pattern to act as a bullish trend reversal.This happens when bearish engulfing pattern occurs in the end of downtrend.

Click here to learn more about this in detail.

#stock trader#stock trading#candlestick pattern#crypto traders#future and option trading#forex trading#forex#earn money online#technical analysis

12 notes

·

View notes

Text

youtube

Simple Forex Trading Tool You Must Learn

In Today's video I share with you A Simple Forex Trading Tool You Must Learn. I will give you an explanation how to use it, on what timeframe and what to look for. Please remember to add other tools and patterns I explain in my other videos to get even better results! My website: https://www.andywltd.com/ My Whatsapp: +447414100686

#Trading success#Learn from the best forex trader#How to trade#Folllow the best forex trader#Learn to trade#Trading course#Forex course#Follow trader#Best trader in the world#AndyW#Trading reviews#Technical analysis#Youtube

3 notes

·

View notes

Text

Forex - Has no End?

Riddle: What has no end, yet always comes back around?

Forex trading and stock trading are both popular investment options, but many people are unsure which one is better. Both forex and stocks offer the potential for profitability, but they also bring their own unique risks. To help you decide which one is right for you, let’s take a look at the pros and cons of forex trading versus stock trading.

When it comes to forex trading, the primary benefit is that it is a 24-hour market. This means that you can trade any time of day or night, regardless of the stock market hours. This can be particularly advantageous for investors who have busy schedules or who trade from different parts of the world. Additionally, forex trading allows you to trade on multiple currency pairs, giving you the potential to diversify your portfolio.

The downside of forex trading is that it is a highly leveraged market. This means that you can leverage your investments to a greater degree than you can with stocks, which can result in greater potential losses. Additionally, the forex market can be extremely volatile, making it difficult to predict future movements.

When it comes to stock trading, the primary benefit is that it is a regulated market. This means that stocks are traded under set rules and regulations, making it easier to protect your investments. Additionally, stock trading allows you to invest in individual companies and funds, giving you the potential to diversify your portfolio more than you can with forex.

The downside of stock trading is that you have to pay fees to trade stocks. These fees can add up quickly, making it difficult to make a profit on small trades. Additionally, stock markets tend to be less liquid than forex markets, making it more difficult to buy and sell stocks quickly.

Overall, forex trading and stock trading both offer the potential for profitability, but they also bring their own unique risks. Forex trading allows you to trade on multiple currency pairs and offers the potential for 24-hour trading, but it is highly leveraged and can be extremely volatile. Stock trading offers the potential to invest in individual companies and funds and is regulated, but it also comes with fees and is less liquid. Ultimately, the best choice for you will depend on your own personal goals and risk tolerance.

Answer to Riddle: The Stock Market

#“forex vs stocks which is more profitable”#“which is best forex or stock market”#“forex vs stocks for beginners”#“is technical analysis the same for forex and stocks”#“pros and cons of forex vs stocks”#“forex market vs stock market size”#“forex vs stocks which is more profitable reddit”#“forex stock price”#stock market#investors#investment#invest

4 notes

·

View notes

Text

#foreign exchange market#finance#forexgroup#forextrader#technical analysis#forex trading#forex market

5 notes

·

View notes

Text

Pa...

View On WordPress

#Currency Exchange#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Pa..#Paul Tudor Jones says it’s hard to like US stocks - "vicious circle"

0 notes

Text

📈 Reversal buy signal in M5 Timeframe #xauusd gold.

( More info inside Official Website: wWw.ForexCashpowerIndicator.com ).

.

⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE.

NO LAG & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees; Lifetime License

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

✅ Powerful AUTO-Trade Option Subscription

.

✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.*

.

PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer.

.

Recommended FX Brokerage to run Cashpower-XM Broker:

https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#forexindicator#indicatorforex#cashpowerindicator#forex#forexprofits#forexindicators#forexsignals#forextradesystem#forexvolumeindicators#forexchartindicators#xauusd technical analysis signals

4 notes

·

View notes

Text

Two Waves: Forex Trading Strategy Explained

Forex trading strategies are essential for navigating the volatile and dynamic forex market. One effective approach is the Two Waves strategy, which focuses on identifying and trading with market waves. This article explores the Two Waves strategy in detail, including its principles, application, and advantages.

What is the Two Waves Strategy?

The Two Waves strategy is a technical analysis method…

#CCI#Downtrend#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Traders#Forex Trading#Market Conditions#Moving Average#Price Movements#Risk Management#Stop-Loss#Support And Resistance#Take-Profit#Technical Analysis#Trading Strategies#Trading Strategy#Trend Analysis#Trend Identification

3 notes

·

View notes

Text

#online trading platforms#CFDs#Forex markets#Forex trading#CFD trading#leverage#currency pairs#MetaTrader 4#MetaTrader 5#real-time market data#technical indicators#risk management#trading strategies#liquidity#market analysis#short and long positions#hedging opportunities#financial markets#stocks#commodities#cryptocurrencies#indices#demo accounts#regulatory standards#customer support#trading tools#advanced charting#algorithmic trading#mobile trading

0 notes

Text

High probability FVGs form after a raid on liquidity.

0 notes

Text

WHEN A BEARISH ENGULFING PATTERN IS SIGN OF SIDEWAYS TREND?

A bearish harami can sometimes result in a sideways trend.This happens when the bearish harami takes a form called the high price harami.

#stock trader#stock market#technical analysis#candlestick pattern#crypto traders#future and option trading#forex trading#forex

14 notes

·

View notes