#online trading platforms

Text

In the digital age, the stock market is no longer the exclusive playground of seasoned traders and financial institutions. Online trading apps have democratised access, enabling a broader and more diverse group of individuals to participate in stock market activities. This revolution in stock market participation is driven by several key factors. Let’s explore how these factors are transforming the financial landscape.

#Online Trading Apps#Revolutionise Stock Market#online share market apps#online trading platforms#trading apps

0 notes

Text

Dubai: The Bustling Financial Hub of the Middle East and a Haven for Traders

Dubai has acquired its reputation as a thriving, quickly expanding trading city. It is frequently referred to as the financial center of the Middle East. Due to its advantageous geographic position, first-rate infrastructure, and forward-thinking legal system, the city attracts both domestic and foreign companies. Dubai has been a popular destination for traders from all over the world as a result of the growth in trading platforms that coincides with the expansion of global trade.

We’ll look at a few of the best trading platforms in Dubai that have become popular in this post. We’ll examine the features, costs, and user experiences of online brokerages and forex platforms in order to assist traders — whether seasoned pros or novices — in making wise choices.

Why Traders Love Dubai as a Destination

Dubai’s trading industry is supported by a number of important advantages:

A favorable business environment is provided by Dubai, which attracts merchants and firms with its zero capital gains tax, low import taxes, and tax-free income.

Strategic Location: Dubai’s location at the intersection of Europe, Asia, and Africa makes it simple to reach important markets.

Modern trading facilities, a dependable banking system, and cutting-edge technology are all features of the city’s advanced infrastructure.

Encouraging Regulatory Environment: The industry is governed by the UAE Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA), which guarantee openness and safeguard investors.

These elements provide the ideal setting for traders and companies to prosper, especially when paired with Dubai’s standing as a major international financial center.

Important Things to Think About in Dubai Trading Platform Choosing

It can be difficult to choose the best trading platform due to the abundance of options. The following are important things to think about:

Regulation: Verify whether respectable organizations such as the DFSA or SCA are licensing and overseeing the platform.

Fees: Keep an eye out for charge structures that are clear, including spreads, commissions, and withdrawal costs.

User Experience: Both novice and seasoned traders should have an easy time using a platform that is clear and easy to use.

Asset Availability: Cryptocurrencies, equities, currency, and commodities are just a few of the many assets that certain platforms provide. Pick one based on the type of trading you enjoy.

Customer support: In particular, when problems emerge, excellent customer service can make all the difference.

Resources for Education: A few platforms offer webinars, market analysis, and instructional materials that are especially helpful for new users.

Dubai Trading Regulations and Legal Considerations

Due to strict regulations surrounding trading, investors are protected in Dubai. The Securities and Commodities Authority (SCA) is in charge of the larger UAE market, whereas the Dubai Financial Services Authority (DFSA) governs trading platforms within the Dubai International Financial Centre (DIFC). Strict control is maintained by these regulators in order to guard against fraud, enforce compliance, and guarantee openness.

Make sure the platform has a valid license from the appropriate regulatory agency before you trade. This guarantees defense against con artists and dubious service suppliers.

How to Register for a Trading Platform Account in Dubai

Select a Platform: Choose one of the regulated platforms mentioned above based on your trading objectives and requirements.

Publish the Documentation: Usually, you’ll have to provide confirmation of residency (bank statement or utility bill) as well as proof of identity (passport or national ID).

Put Money Into Your Account: The majority of platforms provide a variety of funding choices, such as e-wallets, credit cards, and bank transfers.

Get Trading: You can begin trading as soon as you have funded your account.

Resources and Tools for Traders in Dubai

Dubai’s trading community has access to numerous resources, including:

Trading Education: Many platforms offer free webinars, tutorials, and market analyses.

Financial News: Stay up-to-date with global and regional news via financial news outlets such as Bloomberg Middle East and Gulf News.

Trading Tools: Leverage platforms with advanced charting tools, market analysis, and automated trading options.

Whatever your level of experience, choosing the correct trading platform is essential to your success. To make an informed choice, take into account the platform’s regulation, costs, usability, and asset availability. Dubai’s cutting-edge infrastructure, regulatory frameworks, and friendly business climate will put you in a strong position to prosper in the rapidly expanding trading market of this thriving financial center.

#forextrading#stock trading#forex broker#crude oil trading#learn to trade#stock market analysis#online trading platforms

0 notes

Text

online trading platforms

Online trading platforms are electronic marketplaces where investors can buy and sell financial securities, such as stocks, bonds, options, and mutual funds. These platforms provide a convenient way for individuals to engage in trading activities from the comfort of their own homes or offices.

0 notes

Text

0 notes

Text

Why Immediate ProAir x2 Stands Out Among Trading Platforms

Immediate ProAir x2 is a trading platform that offers a unique set of features and benefits, setting it apart from other trading platforms in the market. In this article, we will explore the basics of Immediate ProAir x2, its advantages over other platforms, and its potential for shaping the future of trading.

Understanding the Basics of Immediate ProAir x2

Immediate ProAir x2 is a cutting-edge…

View On WordPress

#best trading platforms#immediate ProAir x2#online trading platforms#ProAir x2 advantages#ProAir x2 benefits#ProAir x2 features#ProAir x2 trading platform#top trading platforms#trading platform comparison#trading platform review

0 notes

Text

A Comprehensive Guide to Choosing Safe Online Trading Platforms

A Comprehensive Guide to Choosing Safe Online Trading Platforms is your definitive resource for evaluating and selecting secure online trading platforms. Explore essential criteria such as security protocols, regulatory compliance, user feedback, and available trading features. This guide empowers you to make informed decisions, ensuring your investments are protected on reputable and reliable online trading platforms. Navigate the complexities of the digital trading landscape with confidence using this comprehensive guide.

0 notes

Text

The Next-Generation Online Trading Platform - Ark Trader

Ark Trader The Next-Generation Online Trading Platform is classified as one of the most transparent trading systems, Desktop Client Terminal, Mobile Trader for Android and iOS Devices, and Web Trader. Trade with confidence. To Download the App For Android and iOS click on the link given below- https://apps.apple.com/gb/app/ark-itrader/id1511800019?ign-mpt=uo%3D2

https://play.google.com/store/apps/details?id=co.bigbulltrading.bigbulltrading

1 note

·

View note

Text

In algorithmic trading, the importance of risk management cannot be overstated. Algo strategies, while offering speed and precision, are inherently intertwined with risks.

0 notes

Text

The Growing Popularity of Online Trading Platforms in India

In recent years, there has been a remarkable surge in the popularity of online trading platforms in India. As technology continues to reshape the financial landscape, online stock brokers have played a pivotal role in democratising the access to financial markets. The convenience, accessibility, and ease of use of these platforms have attracted a large number of retail investors and traders, making them an integral part of India's evolving financial ecosystem.

Evolution of India's Financial Markets

India's financial markets have come a long way, evolving from traditional brick-and-mortar trading to the modern digital era. The introduction of the National Stock Exchange (NSE) in 1992 and the Bombay Stock Exchange (BSE) established a robust foundation for equity trading. Initially, trading was conducted through brokers and required a significant amount of paperwork and time. However, the digitization of financial markets changed the landscape entirely, making way for online trading platforms.

As technology advanced, brokerage firms and financial institutions began offering online trading services, enabling investors to buy and sell securities through the internet. Investors soon realised the advantages of online trading, including faster execution, real-time market updates, lower fees, and greater control over their investments. This led to a rising demand for the best stock brokers in India that provided efficient online trading platforms.

Advantages of Online Trading Platforms

The growing popularity of online trading platforms can be attributed to the numerous advantages they offer:

Convenience and Accessibility: One of the primary advantages of online trading platforms is the convenience they bring. Investors can trade from the comfort of their homes or on-the-go, using their smartphones or computers. The elimination of geographical barriers has empowered investors from various corners of the country to participate actively in the market.

Cost-Effectiveness: Compared to traditional brokers, many offer lower brokerage fees and reduced transaction costs. This cost-effectiveness is particularly attractive to retail investors who may have limited funds to invest.

Real-time Market Information: Online trading platforms provide investors with real-time market data, news, and analysis. This enables them to make informed decisions and stay updated about their investments.

Wide Range of Investment Options: These platforms offer a wide array of financial instruments, including stocks, bonds, mutual funds, commodities, and more. This diversity allows investors to build diversified portfolios aligned with their risk tolerance and investment goals.

Educational Resources: Many brokers in India offer educational resources and tools to help beginners understand the basics of investing and trading.These resources enhance financial literacy and empower investors to make more informed decisions.

Demographic and Cultural Factors Driving Adoption

Several demographic and cultural factors have contributed to the growing adoption of online trading platforms in India:

Youthful Population: India is a nation with a large population of young and tech-savvy individuals. This digitally native generation is comfortable with technology and prefers the ease and speed offered by online platforms.

Rising Disposable Income: As the Indian economy grows, disposable incomes have increased, allowing more people to explore investment opportunities.

Financial Inclusion: Online trading platforms have played a role in increasing financial inclusion by providing access to financial markets for people in remote areas with limited access to traditional financial services.

Changing Attitudes Towards Investing: Traditionally, Indians have preferred physical assets like gold and real estate as investment options. However, with the younger generation witnessing the potential of financial markets, attitudes are shifting towards embracing online trading as a viable investment avenue.

Regulatory Environment and Investor Protection

The Securities and Exchange Board of India (SEBI), the regulatory body for the securities market in India, plays a crucial role in safeguarding the interests of investors. SEBI has set stringent guidelines and rules that must be adhered to, ensuring transparency, fair practices, and investor protection .

Additionally, most reputable online trading platforms have implemented robust security measures to protect users' data and transactions. These security measures instil confidence among investors and reduce concerns about online fraud.

The Role of Technology in the Surge of Online Trading

The surge in online trading can be attributed to the rapid advancements in technology. High-speed internet connectivity, mobile applications, and sophisticated trading algorithms have revolutionised the way investors engage with financial markets.

Algorithmic trading and artificial intelligence have also gained prominence, providing sophisticated tools to investors for technical analysis, pattern recognition, and automated trading. These technological advancements have democratised access to complex trading strategies that were once the domain of institutional investors.

Challenges and Risks

While online trading platforms offer numerous advantages, there are also challenges and risks that investors should be aware of:

Market Volatility: Financial markets can be highly volatile, and investments are subject to market risks. Investors need a comprehensive grasp of their risk tolerance and should invest accordingly.

Lack of Financial Literacy: The accessibility of online trading platforms may lead some inexperienced investors to make impulsive decisions without fully understanding the risks involved.

Cybersecurity Concerns: As with any online activity, there is a risk of cyber threats and hacking. It's crucial for investors to choose reputable brokers with robust security measures.

Overtrading and Emotional Decision-making: The ease of online trading can tempt some investors to engage in excessive trading or make emotional decisions, leading to potential losses.

Tips for Successful Online Trading

To make the most of online trading platforms and mitigate risks, consider the following tips:

Educate Yourself: Take the time to learn about financial markets, different investment instruments, and trading strategies. Achieving success in investing relies heavily on the power of knowledge.

Start with a Plan: Define your investment goals and risk tolerance. Create a well-thought-out investment plan and stick to it.

Portfolio Diversification: Refrain from allocating all your funds to a single asset.

Diversification helps spread risks and reduces exposure to individual market movements.

Stay Updated: Keep yourself informed about market trends, economic news, and company updates that may impact your investments.

Future Trends in Online Trading

The future of online trading platforms in India looks promising, with several trends expected to shape the landscape:

Mobile Trading: As smartphones become more ubiquitous, investors will continue to embrace the convenience of trading on-the-go.

Social Trading: Social trading platforms, where users can follow and mimic the strategies of successful investors, are likely to gain traction.

Sustainable and ESG Investing: With increasing awareness of environmental, social, and governance (ESG) factors, sustainable investing is likely to see significant growth.

Integration of AI and Big Data: Online trading platforms may leverage AI and big data analytics to provide personalised investment recommendations and market insights.

Conclusion

The rise of online trading platforms in India has been a transformative development in the financial industry. These platforms have revolutionised the way investors participate in financial markets, making investing more accessible and convenient.The combination of technology, regulatory support, and changing investor attitudes has fueled the growth, attracting a diverse range of investors.

As technology continues to advance, and financial markets evolve, online trading platforms are likely to play an increasingly pivotal role in India's investment landscape. The convenience and accessibility offered by these platforms, coupled with the growing interest in financial markets, make it evident that they are here to stay. The growing popularity of online trading platforms, including trading apps, in India represents a significant shift in the way people invest and engage with financial markets. As more investors recognize the benefits of these platforms, they are likely to become an integral part of India's financial ecosystem, driving the democratisation of investing and fostering a more inclusive investment landscape.

0 notes

Text

Why cTrader is So Popular among Brokers?

White label online trading platforms have gained high popularity in recent years. If you want to become a broker in the trading world, you can take advantage of such platforms. cTrader is also a platform created by Software Systems Ltd to provide several benefits to brokers.

The Forex business is complicated and costly, and a high-quality trading platform is one of the essentials for small brokerages. If you want to be a cTrader broker, you can leverage benefits from the White Label solution. Depending on your preferences, you must pay the volume and infrastructure rental fees.

Why Do Many Brokers Prefer cTrader for Their Business?

cTrader is a multi-asset trading platform designed to provide the best trading experience. Developers of this platform have chosen a traders-first approach and worked with a mission to offer a robust solution that ensures client loyalty. Brokers will have a reliable environment with the cTrader platform.

Another reason for choosing cTrader is that it encourages client retention and active trading activities. Very often, brokers face challenges with live trading accounts that currently have no trading activity. Sometimes, clients put in only a couple of trades and quit the broker’s platform. Brokers can solve the problem by providing better and improved tools to traders.

cTrader is a revamped platform, which enables traders to involve in manual trading, algo trading, and copy trading using a single interface.

There is a Trade button to let traders choose the manual trading option. It provides comprehensive information, types of charts, market sentiment details, technical analysis signals, and multiple timeframes. Traders can place their orders or modify them with the drag-and-drop functionality.

The cTrader desktop platform also allows copiers to follow top-rated traders. Again, the Automate button enables traders to choose cBots for scripting algorithmic systems.

Grow Your Brokerage Business With cTrader

cTrader has addressed the brokers’ needs, as it provides unique solutions that ensure faster deployment, ultra-scalability, and easy integration. Low latency and high performance are major advantages of using cTrader.

The comprehensive cTrader Suite helps you make your business cycle successful. As a broker, you will find several management tools and sophisticated technology to deal with their operations. If you choose the cTrader web platform, you will get both cBroker and cServer without additional cost.

cBroker is a feature-rich management platform that provides tools for risk management, reporting, and marketing. Besides, you will find custom settings, unlimited managers, and 100% transparency.

cServer is another advantageous aspect because of the easy availability of servers. It involves an international infrastructure with proxies in major locations all over the world. Moreover, as there are third-party integration options, you can find better opportunities. You can quickly establish a connection to liquidity providers through the FIX API.

cTrader is the best brokerage solution that gives technical assistance to users. The developer frequently releases innovative features and makes updates to maintain the highest standards in the trading industry. So, you can use cTrader Suite and establish yourself as a broker.

0 notes

Text

Deposit and payment methods are important criteria for any trading platform and investors as well. However, traders should always go for reputable platforms with stable payment processors with stringent two-factor authentications and passwords. They should monitor their accounts regularly to keep a check on suspicious activity. Before trading, one should understand the various risks and issues deposit methods can have. Traders also have to do their research well while choosing the ideal online brokerage that offers multiple fund transfer methods. NAGA offers multiple fund transfer methods such as Credit/Debit cards, Wire transfers, and other alternative payment methods to give investors the ease of trading within a secure environment. The platform offers military-grade protection for clients’ funds through compliances and regulations that are recognized worldwide. Open your NAGA account in minutes now and take your trading to the next level.

#best social trading platform#Multiple fund transfer methods#online trading platforms#Safe deposit methods

0 notes

Text

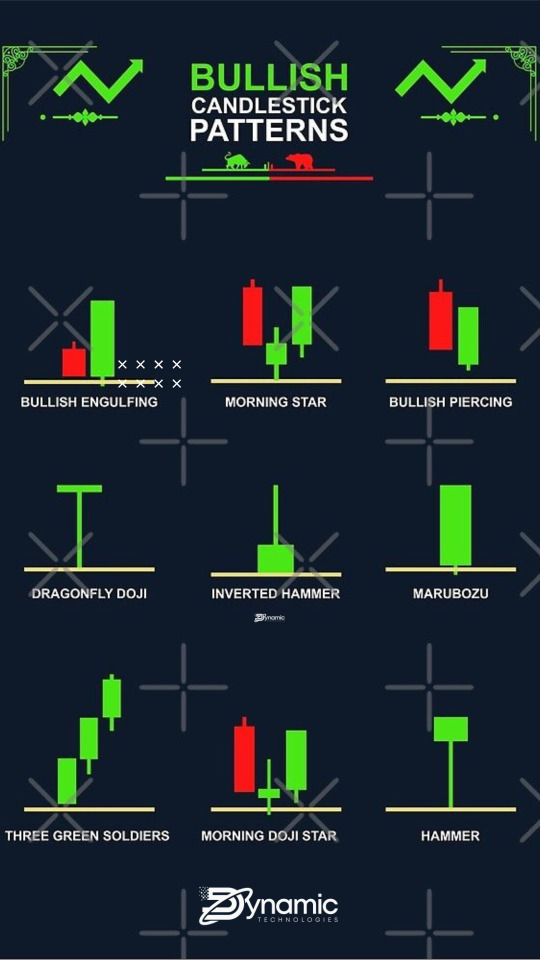

Bullish Candlestick Patterns

A bullish candlestick pattern is a type of chart pattern used in technical analysis that predicts an increase in stock price. This pattern is typically seen after a period of decline or consolidation and signals that the current trend is likely to reverse in an upward direction. The bullish candlestick pattern is formed when a candle’s open is lower than its close.

Bullish candlestick patterns can be used to identify buying opportunities in the stock market. These patterns can provide traders with a heads up that the market may be about to turn in their favor. Traders should look for patterns that appear in the midst of a downtrend. It is important to remember that these patterns are not always reliable and should be used in conjunction with other forms of technical analysis.

Bullish candlestick patterns typically consist of one large candle, followed by one or more smaller candle bodies. The large candle is the one that contains the buying pressure that is pushing the price higher. The smaller candles provide confirmation of the bullish trend. Some of the most common bullish candlestick patterns include the Hammer, Bullish Engulfing, Piercing Line, Morning Star, and Three White Soldiers.

Before entering into a trade based off of a bullish candlestick pattern, traders should ensure that the pattern is valid by looking at the preceding and following candles. It is also important to look for confirmation from other indicators, such as volume and momentum.

The Hammer is one of the most popular bullish candlestick patterns. It is formed when a candle has a small body at the top of the candle, followed by a much larger lower wick. The pattern is typically seen after a period of decline, indicating that buyers are beginning to enter the market.

The Bullish Engulfing pattern is another popular bullish candlestick pattern. This pattern is formed when a candle with a small body is followed by a much larger candle with a body that “engulfs” the previous candle. This pattern indicates that buyers are beginning to overwhelm sellers and that the current trend is likely to reverse.

The Piercing Line is a two-candle pattern that is formed when a long bearish candle is followed by a long bullish candle that “pierces” the midpoint of the previous candle. This pattern is typically seen after a period of decline and indicates that a reversal is likely.

The Morning Star pattern is a three-candle pattern that is formed when a long bearish candle is followed by a small-bodied candle, followed by a long bullish candle. This pattern indicates that buyers are beginning to enter the market and that the current trend is likely to reverse.

The Three White Soldiers is another three-candle pattern. This pattern is formed when three long bullish candles are seen in succession, indicating that buyers are becoming increasingly aggressive and that the current trend is likely to reverse.

Bullish candlestick patterns can be a useful tool for traders looking to capitalize on opportunities in the stock market. It is important to remember, however, that these patterns should not be used in isolation and should be used in conjunction with other forms of technical analysis. Traders should also look for confirmation from other indicators, such as volume and momentum, before entering into a trade based on a bullish candlestick pattern.

#candlestick pattern#Online Trading Platforms#Trading Software Solutions#Trading Software#Professional Trading Software

1 note

·

View note

Text

Easily Trade with the Best Platform for Beginners

Make your entry into the world of trading effortless with KQ Markets - the best platform for beginners. Start trading today and grow your portfolio. Check the news and articles section for the latest market update.

#best online trading platforms#stock maket news#stock market#trading platforms#online trading platforms#web traders#demo account#best cfd trading platform#cfd trading

1 note

·

View note

Text

Best forex trading platforms Forexsp.

Forexsp Forex Trading Platforms is SSL-certified platforms ensure that all information is secure, making our platforms completely safe and secure.

1 note

·

View note

Text

Join Bigul and enhance your trading experience with AI tools

https://bigul.co/

121 notes

·

View notes