#Forex stock trader

Text

Mastering Trading Risk: Top Techniques for Professional Risk Management

Risk is an unavoidable part of the fast-paced trading environment. Success in trading cryptocurrency, forex, or equities depends on your ability to successfully manage risk. Expert traders are aware that, although they can't thoroughly remove risk, they may use tactics to reduce it and safeguard their investment. This post explores the best methods for managing forex stock trading risk, giving you the resources you need to trade more profitably and with confidence.

Learn and Embrace the Possible Risks

Acknowledging and accepting the inherent risks associated with trading is crucial before delving into specialized risk management measures. Knowing this basic fact is the first step to successful risk management since there is always a chance of loss with any trade. While acknowledging risk as a necessary component of trading and making appropriate preparations for it, accepting risk does not imply being careless.

Stock Sizing: Matching Trade Size to Risk Tolerance

Determining how much capital to commit to a specific trade is known as position sizing. Because it directly impacts the amount you stand to lose on any particular deal, it is an essential component of risk management. The "1% rule," which recommends risking no more than 1% of your trading capital on a single trade, is one that professional traders frequently apply. You can extend your gaming session by managing your trade size, which will enable you to sustain a string of losses without running out of money.

Knowing Your Exit Points Is Key to Setting Stop-Loss Orders

Stop-loss orders specify the points at which a trade is automatically canceled to limit losses. They guarantee that losses on each trade are kept to a reasonable level by serving as a safety net. Think about things like your risk tolerance, the volatility of the asset, and the state of the market as a whole when determining stop-loss levels. When stop-loss orders are placed too close to the entry point, they may cause early withdrawals, and when they are placed too far away, they may expose you to larger-than-desired losses.

Diversification: Avoid Putting All of Your Ducks in One Basket

The primary aspect of risk management is variation. You can lessen the impact of a single investment's bad performance by distributing your investments throughout a variety of assets, markets, and industries. If you trade equities, for instance, you may diversify by holding stocks from several sectors or geographical areas. You can spread your trades across different currency pairings while trading forex. The chance of suffering large losses from a single position is reduced with diversification.

Putting a Trading Plan Into Practice: Maintain Discipline

A trading plan is a detailed document that outlines your trading strategy, providing entry and exit locations, guidelines for managing risk, and standards for judging performance. A clear trading plan keeps you focused and lessens the chance that you'll make snap judgments based on feelings. Keep to your plan at all times, and evaluate and tweak it as necessary in light of your trading results and shifting market circumstances.

Use Caution When Using Leverage

Traders can manage bigger holdings with comparatively less capital because of leverage. Leverage has the power to increase gains while also increasing losses. Strict risk management procedures are always used in tandem with the prudent use of leverage by experienced traders. They set reasonable boundaries to prevent overexposure because they are aware that high leverage raises the danger of margin calls and substantial losses.

Constant Learning and Adjustment: Remain Knowledgeable

Since the financial markets are always changing, knowledgeable traders must also regularly update their knowledge and modify their trading tactics. Keep yourself updated on geopolitical events, economic indicators, and market movements that may affect your trading. To improve your learning of risk management strategies and market dynamics, take part in trading communities, go to webinars, and read a lot.

Assess Possible Returns Against Risks with the Risk-Reward Ratio

The risk-reward ratio calculates the potential profit or loss on a deal. Traders often look for trades with a risk-reward ratio of at least 1:2, or two times the potential profit as the potential loss. You can still turn a profit overall with this strategy, even if only half of your trades end up being profitable. Assessing the risk-reward ratio facilitates educated decision-making and helps steer clear of deals that don't provide sufficient profits about the risk.

Closing Remarks

To become an expert forex stock trader, one must learn to manage risk rather than eliminate it. You may make better forex stock trading decisions by being aware of and willing to take on risks, diversifying your holdings, sizing your positions sensibly, putting stop-loss orders in place, using leverage sparingly, analyzing risk-reward ratios, sticking to a plan, and making a commitment to lifelong learning. Knowledge, flexibility, and discipline are necessary for the continuous process of professional risk management. With these strategies at your disposal, you should have no trouble developing into a more resilient and self-assured trader.

#forex and stock traders#Forex stock trader#forex stock trading#forex and stock trading#forex share trading

1 note

·

View note

Video

youtube

How to make money from trading stocks and forex

2 notes

·

View notes

Text

Revolucione a sua forma de realizar trades e conquiste o mercado financeiro!

🚀 Conheça o Didi Alert! 🚀

Didi Alert é baseado no setup das famosas "Agulhadas do Didi Aguiar", o trader brasileiro com mais de 40 anos de experiência e mais de 15.000 alunos. Ele é o criador do Didi Index, um indicador reconhecido internacionalmente.

Com o Didi Alert, você pode:

Analisar até 300 gráficos em segundos

Encontrar inúmeras oportunidades para operações de Scalper, Swing ou Day Trade

Trabalha com Forex, Stocks, Metais, Criptomoedas, etc

Quer ver como funciona?

Acesse o link abaixo e descubra como o Didi Alert pode revolucionar o seu jeito de fazer trading.

🔗 Link da página explicativa sobre o produto

Teste grátis e sem limites de tempo!

Não perca essa chance de conhecer o Didi Alert e se tornar um trader de sucesso.

#branding#economy#finance#investing#startup#stock market#forex traders#marketprofile#forex expert advisor#profit#forex#forextrading#invest#nasdaq#nyse

2 notes

·

View notes

Text

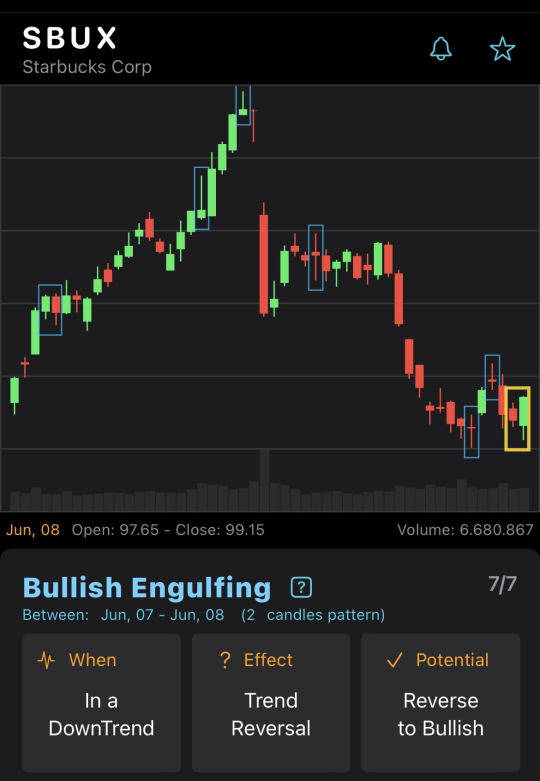

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

What makes the bearish harami a weak bearish reversal indicator?

A bearish harami is one of the weakest bearish trend reversal candlestick.It is due to the psychology behind it.

In simple terms, it is the bears and bull's behaviour in the market that makes the bearish harami a weak trend reversal pattern.

The above picture depicts the behaviour of bulls and bears in the market that leads to the formation of bearish harami and also makes it a weak indicator.

Click here to read the explaination about their behaviour.

#stock trader#investing stocks#stock market#future and option trading#forex trading#forex#earn money online#investor#candlestick pattern#crypto traders

11 notes

·

View notes

Text

Forex Trading License in 2023

In 2023, obtaining a Forex Trading License is imperative for individuals and businesses entering the dynamic foreign exchange market. This regulatory approval ensures compliance with financial laws, bolstering investor confidence. With the evolving landscape, securing a licensed forex trader is a strategic move, providing credibility and legal authorization for complexities of global currency trading.

#stock broker#forex broker#forex market news#online forex market#forex market#stock market#forex trading#forexregulationinqury#business#online forex trading#licensed forex trader

2 notes

·

View notes

Text

Deciding Between Forex and Stock Trading: Which is Right for You?

Your trading approach, risk tolerance, and possible profits may all be greatly impacted by your decision. To assist you in deciding which might be the best fit for you, let's examine the differences between forex and stock trading in this blog post. You can more effectively match your trading activity to your risk tolerance and financial objectives by being aware of these distinctions. Read more!

1 note

·

View note

Text

Forex Trading Signals

Buy #xauusd 1826.00

slp 1831.00

Tp1 1821.00

Tp2 1816.00

Free Telegram Channel : https://t.me/FOREXRESEARCHGAIN

Official Telegram ID: https://t.me/FXGAINADMIN

#forex#forexprofit#forexstrategy#forexmentor#forexsignals#investment#stock market#currency#dollar#us dollar#gbpusd#xauusd#forexnews#trader

4 notes

·

View notes

Text

THE BEST MT4 SYSTEM

+656 Pips Profit with “Exynox Scalper” (+5 FRESH Screenshots)

It looks like you are missing out...

Lots of Traders have already made

hundreds of pips with brand new

“Exynox Scalper” by Karl Dittmann.

It's easy, it’s accurate and it keeps

generating amazing winning trades.

Just look at these fresh screenshots:

See New Screens with Open Trades

I highly recommend you get your own

copy of “Exynox Scalper” and finally

start making easy high profit with us:

www.ExynoxScalper.com

#day trading#day trading for beginners#how to day trade#stocks#forex#crypto#how to trade stocks#learn to trade#how to trade#learn to day trade#how to day trade for beginners#day trader#how to get started day trading#day trade#how i learned to day trade#learn how to day trade#how to trade stocks for beginners#how i learned to day trade in a week#books to learn how to trade#learn how to trade#how to day trade stocks#how to trade forex in 2023

3 notes

·

View notes

Text

Bearish Engulfing pattern can result in uptrend ! When and How?

The above chart is a perfect example for a bearish engulfing pattern to act as a bullish trend reversal.This happens when bearish engulfing pattern occurs in the end of downtrend.

Click here to learn more about this in detail.

#stock trader#stock trading#candlestick pattern#crypto traders#future and option trading#forex trading#forex#earn money online#technical analysis

12 notes

·

View notes

Text

Client Profit in XAUUSD

our clients start their week with Profits

why you are not making ???

join us now and make daily profit

link - https://bit.ly/3chKD5r

#gbpusd#xauusd#eurusd#forex news#finance#forexmoney#forextrader#us stocks#فوركس#marketing#germany#italy#qatar#dubai#gold trading#trader

5 notes

·

View notes

Text

What is online Forex Trading? How Do Currency Markets Work?

Online Forex Trading, short for foreign exchange, involves buying and selling currencies on the global market. Currency markets operate 24/5, allowing participants to speculate on price movements. For more information visit our website

2 notes

·

View notes

Text

Six Poor Trading Practices That Can Prevent You from Reaching Progressive Outcomes

Nevertheless, even the most experienced traders may discover that their growth is impeded and that they are unable to attain the enormous returns they so desire, due to bad habits. Finding and fixing these bad habits is crucial for long-term forex stock trading success, regardless of experience level. Six typical traps to be aware of are as follows!

1 note

·

View note

Text

Does Copy Trading Work In Forex ?

Well Copy Trading allows traders to directly copy the positions taken by another trader. Copy trade across all market such as FX , stocks , commodity markets . If forex broker want to enter the FX market but are short of time, It allows you to get involved without having to learn advanced technical skills.

2 notes

·

View notes

Text

DEFINE THE OPERATING SYSTEM OF FOREX

Forex refers to the global electronic marketplace for trading international currenices. Forex.com is the best forex system to bid and ask currencies. Forex exchange company offers many interventions operation like sales of interest of traders income of forex broker etc, this is all derived from the foreign transacations.

#Xtreamforex#ECN#Earn#iB#forex#tarding#crypto#stocks#shares#broker#trader#money#investment#bitcoin#binaroptions#gold#success#forextrading#commodity#business#opportunity#Pammtrading#copytrading#platform

2 notes

·

View notes

Text

Có nên đầu tư vàng không ?

Nếu đang có ý định chuyển sang #đầu_tư_vàng thì đừng vội lao vào đầu tư ngay. Bạn nên bổ sung kiến thức cũng như tham khảo một số kinh nghiệm giao dịch ở thời điểm hiện tại. Loại hình này vừa là cơ hội vừa là thách thức, bạn nên tìm hiểu kỹ. Tham khảo bài viết tổng hợp của Abcin.net về đầu tư vàng giai đoạn này

Đọc thêm https://abcin.net/dau-tu-vang/

2 notes

·

View notes