#Free Bitcoin Future Trading

Text

HOW TO DEPOSIT INTO AAS AFRIQ ARBITRAGE SYSTEM

STEP ONE

Once you login to your dashboard

If you are yet to register click here first, then process to login

You will see your dashboard like the screenshot below

STEP TWO

Then click on Deposit and another drop-down will show

STEP THREE

Then click on deposit as shown on the red arrow below

STEP FOUR

Click on Select wallet and choose Tether(Min:20 USDT) Then type the amount of what you…

View On WordPress

#AAS ARBITRAGE TRADING SYSTEM#Arbitrage system#BINANCE COMPETITIVE#binance official#binance wallet#BITCOIN FUTURE MONEY#BTC#Coinbase#CRYPTO ARBITRAGE#Crypto Earning#CRYPTO MINING#CRYPTOCURRENCY#Earn money online#FREE Crypto

0 notes

Text

Top 3 Underrated Bitcoin Charts that Most Traders Don't Know About

Introduction

Bitcoin has captured the attention of many traders and investors due to its incredible growth and volatility in recent years. As a result, people are always looking for new ways to analyze Bitcoin's price movements to make better investment decisions. While there are popular charts that traders use regularly, there are also some underrated charts that offer valuable information. In this article by Kings Charts - a crypto trading learning platform, we'll explore the top 3 underrated Bitcoin charts that most traders are unaware of.

MVRV Z-Score Chart:

The MVRV Z-Score chart is a powerful but often overlooked tool that can provide critical insights into Bitcoin's price movements. This chart measures the difference between Bitcoin's market capitalization and realized capitalization, which is the value of all Bitcoin in circulation at the last transaction price. The MVRV Z-Score chart calculates the standard deviation of this difference over time, indicating if Bitcoin is overvalued or undervalued. It's essential to remember that this chart can't predict the future, but it provides a useful indication of market sentiment with Crypto Technical Analysis.

Puell Multiple Chart:

The Puell Multiple chart is another chart that traders should know about to analyze Bitcoin's value. It calculates the ratio of the daily issuance value of Bitcoin to the 365-day moving average of the daily issuance value, indicating whether Bitcoin is overvalued or undervalued based on the amount of new issuance. When the Puell Multiple is high, it indicates that Bitcoin is overvalued, while a low score suggests that it is undervalued. This chart can help Crypto Trading Experts make informed decisions by providing valuable information about market conditions.

Stock-to-Flow Cross-Asset Model Chart:

The Stock-to-Flow Cross-Asset Model chart is a unique chart that uses the stock-to-flow ratio to predict Bitcoin's future price movements. The stock-to-flow ratio measures the current supply of a commodity against the amount that is produced annually. In the case of Bitcoin, the stock-to-flow ratio is the ratio of the current stock of Bitcoin to the new annual supply. This chart compares the stock-to-flow ratio of Bitcoin to other commodities such as gold, silver, and oil, to predict future price movements. Although this chart has some limitations, it can provide a valuable perspective on Bitcoin's market value with its Crypto Trading Signals.

FAQs

1. What is a Bitcoin chart?

A Bitcoin chart is a graphical representation of Bitcoin's price and other market data. These charts allow traders and investors to visualize historical price movements, identify trends, and make informed trading decisions.

2. What are the top three most underrated Bitcoin charts?

The top three most underrated Bitcoin charts are the MVRV Z-Score chart, the Puell Multiple chart, and the Stock-to-Flow Cross-Asset Model chart. These charts offer valuable insights into Bitcoin's price movements and market sentiment, but many traders are unaware of their existence or underutilize them in their analysis.

3. What information can I get from these charts?

The MVRV Z-Score chart provides information on whether Bitcoin is overvalued or undervalued based on the difference between market capitalization and realized capitalization. The Puell Multiple chart calculates whether Bitcoin is overvalued or undervalued based on the amount of new issuance. The Stock-to-Flow Cross-Asset Model chart uses the stock-to-flow ratio to predict Bitcoin's future price movements and compares it to other commodities such as gold, silver, and oil. By analyzing these charts, traders can gain a better understanding of market sentiment and conditions, helping them make more informed trading decisions.

Conclusion

In conclusion, incorporating these underrated Bitcoin charts into your analysis can provide valuable insights into market sentiment and conditions. While they cannot predict the future, these charts can provide a unique perspective on Bitcoin's value and help traders make more informed decisions. Remember, trading Bitcoin is a complex and risky endeavor, and it's essential to conduct thorough research and analysis before making any investment decisions. Kings Charts - a crypto trading learning platform

However, by keeping these underrated charts in mind, you can gain a deeper understanding of Bitcoin's price movements and be better equipped to make informed decisions.

#Crypto Technical Analysis#Crypto Trading Tips#crypto trading tips for beginners#Crypto Trading Experts#Crypto Trading Masterclass#Crypto Trading Course#Crypto Candlestick Charts#Elliott Wave Crypto Trading#Free Crypto Trading Signals#free cryptocurrency trading signals#free bitcoin trading signals#free crypto future trading signals#crypto spot trading signals#Paid crypto trading signals#Paid crypto trading tips#Premium crypto trading signals#KingsCharts

0 notes

Text

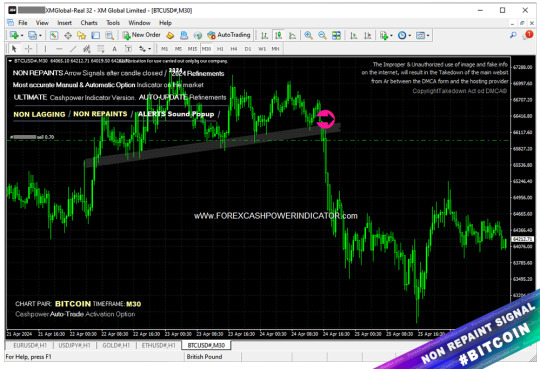

⭐ Metatrader4 chart SELL entry Bitcoin (BTCUSD) m30 non repaint signal.

( More info inside Official Website: wWw.ForexCashpowerIndicator.com ).

.

⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE.

No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees; Lifetime License

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

✅ Powerful AUTO-Trade Option Subscription

.

✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.*

.

PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer.

.

Recommended FX Brokerage to run Cashpower-XM Broker:

https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#best-forex-indicator-non-repaint-buy-and-sell-signal-download#forexsignals#forexindicators#cashpowerindicator#forexindicator#forextradesystem#forexchartindicators#forexprofits#indicatorforex#forex factory#forex forum#cashpower indicator review#cashpower indicator download#forex cashpower indicator settings

4 notes

·

View notes

Text

The Role of Bitcoin in the Future of Global Trade: Repricing the World on Truth

Global trade, the lifeblood of our interconnected world, has long been dependent on a patchwork of national currencies, each subject to the whims of inflation, devaluation, and political manipulation. This complex and often opaque system distorts the true value of goods and services, creating inefficiencies and imbalances that hinder economic progress and exacerbate inequality. As the world grapples with the consequences of these distortions, a new form of money, Bitcoin, has emerged as a potential solution—one that could revolutionize global trade by repricing everything based on truth rather than a lie.

The Flaws of the Current System

The current global trade system is deeply flawed, primarily because it relies on fiat currencies—money that governments can print at will, without being backed by any tangible asset. This leads to several significant issues:

Inflation and Devaluation: Governments often resort to printing more money to cover deficits or stimulate growth, leading to inflation. This inflation erodes the purchasing power of currency, distorts prices, and creates uncertainty in global trade. Countries with weaker currencies are particularly vulnerable, as their goods and services become undervalued in the global market, further entrenching economic disparities.

Political Manipulation: Fiat currencies are also susceptible to political manipulation. Governments and central banks can intervene in currency markets, adjusting exchange rates to suit their economic or political agendas. These interventions can lead to artificial price distortions, benefiting some nations while disadvantaging others.

Inefficiencies in Trade: The need to exchange currencies introduces inefficiencies in global trade, including transaction costs, exchange rate risks, and delays. These inefficiencies can stifle trade, particularly for smaller businesses and developing countries that lack the financial infrastructure to manage complex currency exchanges.

Bitcoin as Sound Money

Bitcoin offers a compelling alternative to fiat currencies. As a form of sound money, Bitcoin possesses several qualities that make it an ideal candidate for reshaping global trade:

Fixed Supply: Bitcoin’s supply is capped at 21 million coins, making it immune to inflationary pressures. This fixed supply ensures that Bitcoin’s value cannot be eroded by government intervention or excessive money printing, providing a stable store of value.

Decentralization: Bitcoin operates on a decentralized network, free from the control of any single government or entity. This decentralization ensures that no one can manipulate its value for political or economic gain, fostering a more level playing field in global trade.

Transparency and Security: Bitcoin’s underlying blockchain technology provides unparalleled transparency and security. Every transaction is recorded on a public ledger, accessible to anyone, which reduces the risk of fraud and corruption. This transparency builds trust, a crucial factor in facilitating global trade.

Repricing the World Based on Truth

The introduction of Bitcoin as a global standard of sound money could lead to a fundamental repricing of goods, services, and assets—one that reflects their true value rather than being distorted by fiat currency manipulation.

Truthful Pricing: In a world where Bitcoin is the dominant form of money, prices would be set based on the real value of goods and services, free from the distortions caused by inflation and currency devaluation. This “truthful pricing” would enable businesses and consumers to make more informed decisions, leading to more efficient markets.

Examples of Repricing: Consider the global commodities market. Under the current system, the prices of oil, gold, and other commodities are often influenced by fluctuations in the US dollar and other major currencies. With Bitcoin, these commodities would be priced in a universally recognized and stable currency, reflecting their true market value. Similarly, in international trade, the cost of goods and services would be more predictable, allowing for fairer and more consistent pricing across borders.

The Impact on Global Trade

The adoption of Bitcoin in global trade could lead to several transformative effects:

Simplification of Trade: Bitcoin could simplify global trade by eliminating the need for currency exchange. Businesses would no longer need to navigate the complexities of multiple currencies, reducing transaction costs and exchange rate risks. This simplification would be particularly beneficial for small and medium-sized enterprises (SMEs) and businesses in developing countries, allowing them to compete more effectively in the global market.

Increased Efficiency: By reducing transaction costs and delays, Bitcoin could make global trade more efficient. Transactions can be completed more quickly and with lower fees, enabling businesses to operate more smoothly and with greater predictability.

Economic Empowerment: Perhaps most importantly, Bitcoin could level the playing field for developing countries and underserved populations. By providing access to a stable and universally accepted currency, Bitcoin could empower individuals and businesses in these regions to participate more fully in the global economy, fostering innovation and economic growth.

Conclusion

As the world stands on the brink of a new financial era, Bitcoin offers a vision of global trade that is more transparent, efficient, and fair. By repricing the world based on truth rather than the distortions of fiat currencies, Bitcoin has the potential to unlock unprecedented opportunities for economic growth and development. As we look to the future, the role of Bitcoin in global trade may prove to be not just revolutionary, but essential to creating a more just and prosperous world.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#GlobalTrade#SoundMoney#Cryptocurrency#DigitalCurrency#Blockchain#EconomicRevolution#FinancialFreedom#Decentralization#FutureOfMoney#TechInnovation#BitcoinAdoption#GlobalEconomy#TrueValue#TradeRevolution#financial empowerment#finance#financial education#financial experts#unplugged financial

2 notes

·

View notes

Text

Bitcoin Cryptocurrencies: Unraveling the Revolution of Digital Gold

In the world of cryptocurrencies, Bitcoin stands as the undisputed pioneer, heralding a new era of digital finance and challenging traditional notions of money and value. Since its inception over a decade ago, Bitcoin has captivated the imagination of millions, evolving from a niche experiment to a globally recognized asset class with a market capitalization surpassing that of many Fortune 500 companies. Let's delve into the intricacies of Bitcoin cryptocurrencies and their profound impact on the financial landscape. Check their site to know more details criptomoedas bitcoin

At its core, Bitcoin represents a decentralized digital currency, free from the control of any central authority or intermediary. Powered by blockchain technology, Bitcoin transactions are recorded on a public ledger, immutable and transparent, ensuring trust and security without the need for intermediaries. This groundbreaking innovation not only eliminates the inefficiencies and vulnerabilities inherent in traditional financial systems but also empowers individuals with unparalleled financial sovereignty and autonomy.

One of Bitcoin's most defining features is its scarcity. With a maximum supply capped at 21 million coins, Bitcoin is often likened to digital gold—a store of value immune to inflationary pressures and government manipulation. This scarcity, coupled with increasing global demand and institutional adoption, has propelled Bitcoin's price to unprecedented heights, garnering attention from investors, speculators, and institutions seeking a hedge against economic uncertainty and currency debasement.

Moreover, Bitcoin's decentralized nature makes it resistant to censorship and confiscation, providing a safe haven for individuals in jurisdictions plagued by political instability or oppressive regimes. From remittances and philanthropy to wealth preservation and capital flight, Bitcoin has emerged as a lifeline for those seeking financial freedom and inclusion in an interconnected yet fractured world.

However, Bitcoin is not without its challenges. Scalability, energy consumption, and regulatory scrutiny remain persistent hurdles on its path to mainstream adoption. The debate over Bitcoin's environmental impact, fueled by its energy-intensive proof-of-work consensus mechanism, underscores the need for sustainable alternatives and technological innovation to mitigate its carbon footprint.

Furthermore, regulatory uncertainty poses a significant risk to Bitcoin's long-term viability. While some countries have embraced Bitcoin as a legitimate asset class, others have imposed stringent regulations or outright bans, casting a shadow of uncertainty over its future. Clear and coherent regulatory frameworks are essential to fostering investor confidence, encouraging innovation, and ensuring the responsible growth of the cryptocurrency ecosystem.

Despite these challenges, the future of Bitcoin cryptocurrencies appears bright. The ongoing development of layer-two solutions, such as the Lightning Network, promises to enhance scalability and efficiency, enabling faster and cheaper transactions on the Bitcoin network. Additionally, advancements in privacy and security features aim to bolster Bitcoin's fungibility and resilience against emerging threats.

Moreover, the convergence of Bitcoin with traditional finance through avenues like exchange-traded funds (ETFs) and institutional-grade custody solutions is paving the way for broader adoption and integration into traditional investment portfolios. As Bitcoin matures and evolves, its role as a global reserve asset and digital gold is poised to solidify, reshaping the financial landscape for generations to come.

In conclusion, Bitcoin cryptocurrencies represent a paradigm shift in the way we perceive and interact with money. As a decentralized, scarce, and censorship-resistant digital asset, Bitcoin transcends borders and ideologies, offering a beacon of hope for financial empowerment and freedom in an increasingly digitized world. While challenges abound, the resilience and innovation of the Bitcoin community continue to propel the revolution of digital gold forward, unlocking new possibilities and redefining the future of finance.

#preço bitcoin#criptomoeda#comprar bitcoin#1 btc#livecoins#coin market cap brasil#investing noticias#portal bitcoin#notícias sobre moeda digital#qual criptomoeda comprar hoje#criptomoedas bitcoin#quanto custa 1 bitcoin#coinmarketcap brasil#cotacao criptomoedas#mercado coin#cripto moedas#notícias sobre livecoins#grafico criptomoedas#mercado de criptomoedas#mineracao de criptomoedas

2 notes

·

View notes

Text

The prospect that US residents may soon be able to invest in bitcoin through their brokerage, as if it were a regular stock, has prompted a fresh round of hype in crypto circles—and a surge in crypto prices.

Several investment firms, including heavy-hitters like BlackRock and Fidelity, are queuing up to launch a spot bitcoin exchange-traded fund (ETF) in the US. These funds would track the price of bitcoin, making them the closest thing to investing in the crypto token directly without dealing with a crypto exchange or storing crypto manually, a process fraught with risk.

After a bruising 18 months in which crypto prices buckled, high-profile businesses collapsed, and two crypto figureheads were convicted of crimes in the US, the crypto industry is supposed to be cleaning up its act. That the US Securities and Exchange Commission (SEC) appears to be entertaining a spot bitcoin ETF after years of resistance is seen by some as a signal that crypto is moving beyond its free-wheeling years.

The arrival of such a fund in the US—by far the world’s largest ETF market—“is a significant milestone,” says Samson Mow, a prominent bitcoin evangelist and CEO of bitcoin-centric technology firm JAN3, as it will allow investors to hold bitcoin through a conventional financial product for the first time.

While there is broad consensus around the likelihood of an ETF approval among analysts, the idea that it would be symbolic of the industry’s coming of age is contradicted by the frenzy of speculation around what will happen to the price of bitcoin.

On X, crypto influencers with hundreds of thousands of followers are predicting an ETF will send the price of bitcoin soaring, in posts peppered with the rocket ship emoji. The arrival of a spot bitcoin ETF, claims Mow, will unlock a wave of pent-up demand and lead a “torrent of capital” to “pour into bitcoin.” Institutions and other investors that either cannot or choose not to invest in unregulated financial products will seize the opportunity to invest, he says, driving the price far beyond its previous heights.

An ETF might point to a growing acceptance of bitcoin among legacy financial institutions, but the implications for the price of bitcoin are being both mis- and overstated, ETF analysts warn, and the boosterism on display shows that little about crypto has changed.

Twelve applications for spot bitcoin ETFs are awaiting approval from the SEC. Delays are commonplace, but the agency is due to make a call on some of the applications as early as January 1, 2024. The three ETF analysts who spoke to WIRED expect the SEC to green-light a spot bitcoin ETF at some point next year.

In Canada, Germany, and elsewhere, spot bitcoin ETFs already exist. And US investors have had access to bitcoin futures ETFs, the value of which are correlated with the price of bitcoin, since 2021. The approval of a spot bitcoin ETF in the US is significant because it would, for the first time, give US investors access to a close proxy to bitcoin in a familiar and regulated format.

The attention paid to the topic by crypto trade media emphasizes the current fixation in industry circles. Since this summer, when speculation about the arrival of a spot bitcoin ETF began to ratchet up, crypto news site CoinDesk has published dozens of articles and videos on the topic.

In that same period, crypto markets have experienced dramatic swings, and the price of bitcoin has risen by almost a third. In some cases, price swings have been triggered by rumor and misreporting. On October 16, crypto outlet CoinTelegraph issued a retraction and apology after putting out an erroneous post on X announcing the approval of the first spot bitcoin ETF in the US, based on a screenshot posted by an X user, which led to a buying spree that increased the price of bitcoin by 10 percent.

On November 13, a falsified ETF filing relating to a separate cryptocurrency, XRP, caused a 13 percent rise in the token’s price. By the end of the day, those gains had evaporated. The Financial Times calculated that “imaginary bitcoin ETFs” were already worth 30 times the actual spot bitcoin ETFs already in existence worldwide.

Some ETF analysts, like Aniket Ullal of investment research firm CFRA, share the belief that the arrival of an ETF is likely to increase demand for bitcoin as an investment asset. But the effect on price will not be a “short-term spike,” Ullal says, but rather stretch out over multiple years.

Others say it will have the polar opposite effect to that predicted by figures like Mow, and that the price of bitcoin could plummet as investors attracted by the hubbub quickly cash out their winnings. “The idea that there is a huge pile of demand that will somehow materialize is just not true,” argues Peter Schiff, economist and CEO at asset management firm Euro Pacific. “It’s more of a ‘buy the rumor, sell the fact’ situation.”

The “narrative” that an ETF is a “catalyst for growing demand” has attracted speculators, says Bryan Armour, director of passive research strategies for North America at investment research firm Morningstar. “Hype has always been one of the core tenets of bitcoin. It seems like hype is at an all-time high.”

Figures from research firm Fineqia suggest the volume of crypto trading activity has surged in response to speculation over the approval of a spot bitcoin ETF and its market impact. In mid-November, daily trading volume on crypto exchanges reached $31.4 billion, the highest level in more than six months.

“There’s always the possibility that people are hyping it up for their own benefit,” says Mow, who adds that he doesn’t believe the broader crypto industry—which he considers to be separate from bitcoin and describes as a “grift”—is capable of cleaning up its act. “The crypto industry will keep churning out FTXs and people will keep investing because it’s a spectacle,” he says.

But whether or not bitcoin is different—a mature asset whose legitimacy would be “cemented,” as Mow claims, by an ETF approval—the relentless speculation surrounding it will expose investors to risk. “It is wildly volatile and should be handled carefully,” says Armour. But, he adds, people “hear the siren song and buy in.”

3 notes

·

View notes

Text

youtube

BNBuilder is the Next 50x 100x crypto project? First Free Web 3 website builder, NFTs, Airdrops,...

Follow us for more videos about BNBuilder and more low cap promising crypto projects

Project info

website https://token.bnbuilder.app

Website builder: https://bnbuilder.app

Telegram t.me/bnbuilder Staking website https://bnbuilder.web3stake.app/

Buy their NFTs: https://app.airnfts.com/creators/0x10...

Twitter https://twitter.com/bnbuilderbsc

Whitepaper https://token.bnbuilder.app

poocoin chart https://poocoin.app/tokens/0x35181b3e...

Dextools chart https://www.dextools.io/app/bnb/pair-...

VIDEO Text

BNBuilder is the first free website builder targeted at crypto projects. Team is k y c and doxxed and they will integrate web 3 features to their builder. Their current market cap is around 25k dollars, so very low and with a lot of potential and room to grow and it has a strong community that is creating a very strong floor because of the staking rewards. Chart may show us that this may be a next 50x 100x project. Their website builder is live and their drag and drop system is very easy to use. You just need to Register with your email and you will be able to enter the app. Then you can select a Template or create your website from scratch, modify every single part of it and publish it. Publishing your website with your own domain has a very small cost and you can also publish your website with a b n builder subdomain. You can also stake BUILD token to get BUSD passive income. Team is very active and responsive and have a lot of plans for the near future.

They are creating an ecosystem called Build Connect where other projects can share their vision and ideas with the community in Telegram and social media. They have dropped NFTs with great utility that are available on Airnfts.com By purchasing those NFTS holders will get weekly token airdrops, a chance to win the daily wheel-spin for BNB and/or BUILD tokens, an invite to their private group where they will share early plays and will get 50% of all revenue will be used to buyback and restake BUILD ecosystem is growing day by day A lot of big names are staring to follow the project

Follow us and subscribe by pressing the notification bell for getting all the updates and more videos about BUILD ecosystem and more promising low cap cryptos

Have a beautiful day

#youtube #youtuber #instagram #music #love #crypto #tiktok #follow #like #explorepage #youtubers #youtubechannel #gaming #twitch #video #instagood #cryptocurrency #hiphop #subscribe #viral #gamer #rap #facebook #explore #ps #art #soundcloud #k #artist #crypto #bitcoin #cryptocurrency #blockchain #ethereum #btc #forex #trading #money #cryptonews #cryptotrading

Follow us on Instagram: https://www.instagram.com/artnobelcry... Follow us on Twitter: https://twitter.com/ArtnobelCryptoC

Follow us on Tiktok: https://www.tiktok.com/@artnobelcrypt... Follow us on Rumble: https://rumble.com/c/c-1933205

Follow us on DailyMotion: https://www.dailymotion.com/artnobelc... Follow us on Quora: https://www.quora.com/profile/Artnobe...

Follow us on Pinterest: https://www.pinterest.es/artnobelcryp... Follow us on Tumblr: https://www.tumblr.com/blog/artnobelc... More coming soon

#crypto#blockchain#binance#100x#altcoins#cryptocurrencies#cryptocurrency#cryptocurreny trading#bitcoin#bitcoin latest news#eth#website#webdesign#marketing#webdevelopment#landingpage#cryptocoin#moneymaking#money heist#online free money#make money from home#earn money online#savings#millionaire#moneymarkets#wealth#income#investing stocks#investingtips#investors

13 notes

·

View notes

Text

Experts Predict Bitcoin Won’t Hit $100,000 Before 2024

```html

Bitcoin Price Forecast: Anticipation Builds Ahead of Upcoming Halving

Bitcoin Price Forecast: Anticipation Builds Ahead of Upcoming Halving

As the next Bitcoin halving event approaches, anticipation is building within the cryptocurrency community. The Bitcoin halving, which reduces the reward for mining Bitcoin transactions, is an event that historically influences Bitcoin's price. Expert forecasts are mixed, but many predict significant price movements. Understanding these forecasts and preparing for potential market shifts could be crucial for both seasoned investors and newcomers alike.

Understanding Bitcoin Halving

Bitcoin halving is an event that occurs approximately every four years, reducing the block reward miners receive by 50%. This mechanism is part of Bitcoin's deflationary model, designed to control the supply of Bitcoin over time.

How Bitcoin Halving Works

Bitcoin miners validate transactions and add them to the blockchain, receiving Bitcoin as a reward.

Initially, miners received 50 bitcoins per block, which was halved to 25 bitcoins in 2012, then to 12.5 bitcoins in 2016, and further reduced to 6.25 bitcoins in 2020.

The upcoming halving in 2024 will lower this reward to 3.125 bitcoins per block.

By reducing the supply of new bitcoins entering circulation, halvings typically exert upward pressure on the price, assuming demand remains constant or increases.

Impact of Halving on Bitcoin Price

Historically, Bitcoin's price has seen significant appreciation following each halving event:

In November 2012, Bitcoin's price surged from $12 to over $1,150 within a year post-halving.

The 2016 halving saw Bitcoin rise from $650 to nearly $20,000 in late 2017.

After the 2020 halving, Bitcoin's price skyrocketed from $8,800 to an all-time high of around $64,000 in 2021.

While past performance is not a guarantee of future results, many investors are optimistic about another substantial price increase following the 2024 halving.

Expert Predictions for the 2024 Halving

Bullish Predictions

Several experts and analysts have made optimistic predictions regarding Bitcoin's price trajectory post-halving:

**PlanB**, the creator of the stock-to-flow (S2F) model, suggests that Bitcoin could reach **$100,000** or even higher following the 2024 halving.

Analysts at **Bloomberg** forecast a potential price range of **$50,000** to **$100,000**.

**Anthony Pompliano**, a renowned crypto investor, remains confident that Bitcoin will trade close to **$200,000**.

Bearish and Cautious Predictions

However, not all experts foresee an uninterrupted bullish run:

Jesse Myers, co-founder of Protocols Labs, has pointed out that increased regulatory scrutiny could temper the bullish momentum.

Some analysts have pointed to macroeconomic factors and potential tighter monetary policies that could dampen the price increase.

How to Prepare for the Upcoming Halving

With heightened anticipation and potential volatility ahead, here are several strategies to consider:

Stay Informed

Keeping up-to-date with the latest news and expert analyses is vital. Reliable crypto news sources and following credible analysts on social media can offer timely insights.

Diversify Your Portfolio

While Bitcoin may be the focus, diversifying your investments across other cryptocurrencies and traditional assets can help mitigate risks.

Utilize Faucets and Free Bitcoin Opportunities

For those new to cryptocurrency or looking to accumulate Bitcoin with minimal risk, crypto faucets can be a great resource. **Roll the faucet every hour for free - fauc.at** is one such opportunity that allows you to earn small amounts of Bitcoin regularly.

Conclusion

The approaching 2024 Bitcoin halving event brings both excitement and cautious optimism within the crypto community. Historical trends suggest bullish prospects, but several factors could influence the outcome. Staying informed, diversifying investments, and leveraging free earning opportunities such as crypto faucets can help you navigate the anticipated market fluctuations.

```

0 notes

Text

Is Bitcoin Halal? Understanding Cryptocurrency in Light of Islamic Finance

Is Bitcoin Halal? A Deep Dive into Islamic Finance

The question Is Bitcoin halal has become increasingly relevant as more Muslims worldwide engage with digital currencies. Understanding whether Bitcoin aligns with Islamic finance principles requires a thorough examination of cryptocurrency in Islamic finance and how it fits within the framework of Sharia law. This blog explores the Islamic perspective on Bitcoin and whether it can be considered halal or haram. Bitcoin is a decentralized digital currency, free from any central authority like a bank or government. It operates on a peer-to-peer network, allowing users to make transactions directly with one another. The underlying technology, known as blockchain, ensures transparency and security. But for Muslims, the key concern is whether this digital asset complies with Sharia law.

Islamic Rulings on Bitcoin: Halal or Haram?

The Islamic rulings on Bitcoin are complex and vary among scholars. Sharia law dictates that any form of wealth must be obtained through lawful means and must not involve elements of riba (usury), gharar (excessive uncertainty), or maysir (gambling). The debate around Is Bitcoin halal in Islamic Finance revolves around these principles. Some scholars argue that Bitcoin is halal because it does not involve riba and is seen as a legitimate form of wealth. Others, however, believe that Bitcoin is haram due to its speculative nature and the potential for misuse.

Cryptocurrency in Islamic Finance: A New Frontier

The rise of cryptocurrency in Islamic finance marks a new chapter in the ongoing discussion about what constitutes halal financial practices. Understanding if Bitcoin is halal in Islam requires a closer look at how Islamic finance adapts to new technologies. Some halal cryptocurrency projects are emerging, specifically designed to comply with Sharia law, providing a pathway for Muslims to engage in the digital economy without compromising their beliefs.

Bitcoin and Sharia Law: Points of Consideration

When assessing Bitcoin Sharia compliance, it's essential to consider the following points:

Riba: Bitcoin transactions do not involve interest, which is a positive factor for halal status.

Gharar: The volatility of Bitcoin introduces uncertainty, which might be problematic under Sharia law.

Maysir: The speculative nature of Bitcoin trading can be seen as a form of gambling, raising concerns among scholars.

Given these factors, the Islamic perspective on Bitcoin halal or haram is not universally agreed upon, and Muslims are encouraged to seek guidance from knowledgeable scholars.

The Future of Halal Cryptocurrency

As the world of Islamic finance and digital currency continues to evolve, the demand for halal cryptocurrency options will likely grow. Muslims seeking to invest in digital assets should look for Bitcoin Sharia compliance or consider alternative halal options tailored to Islamic rulings.

Conclusion

The question Is Bitcoin halal? remains a subject of debate within the Islamic community. While there is no unanimous decision, understanding the key principles of Islamic finance can help individuals make informed decisions. For those who prefer to avoid uncertainty, investing in halal cryptocurrency options explicitly designed to meet Sharia compliance may be the best approach.

For more information on halal cryptocurrencies and Sharia-compliant investments, please visit Saraf Screening or Contact Us for personalized advice and guidance.

#shariah#islamiclaw#currency#investing#sarafscreening#education#finance#blockchain#islamic#islamicfinance#islamicapp

0 notes

Text

FREE To Start Your Own Agency Offering Financial Services Online

🚨NO INVESTMENT REQUIRED NOW OR IN THE FUTURE‼️🚨

Get Paid Immediate And Passive Income On Business And Consumer Services.

With some of our offerings, you have the opportunity to earn Immediate Bonuses – imagine receiving a check for over $1,000 within just 48 hours! Additionally, we offer the chance to build a sustainable, Passive Residual Income. By referring customers just once, you can continue earning for the lifetime of their engagement with us.

You will be paid to refer both business and consumer services. The key is every service we market has experts ready to support your customers. So, you simply refer those potential clients to your website that we give you for free, and then the experts take over from there. Again, you're in business for yourself but not by yourself.

We provide all the necessary training, ensuring that while you're in business for yourself, you're not by yourself.

Joining DAC is absolutely free, with no investment required now or in the future.

See whats it all about at link below👇

➤➤➤ rebrand.ly/LKTDACFinancialLoanAgent

💵💰💵💰💵💰💵

#income #money #business #investment #entrepreneur #passiveincome #wealth #financialfreedom #investing #finance #rich #makemoney #motivation #cash #success #bitcoin #trading #workfromhome #invest #millionaire #marketing #forex #realestate #cryptocurrency #lifestyle #businessowner #profit #crypto #stocks #billionaire

0 notes

Photo

Exploring Crypto-Native Innovation: Messari's Intern Analysts Predict AI and Gaming Trends for 2024

In the ever-evolving landscape of cryptocurrency and blockchain technology, staying ahead of emerging trends is crucial for investors, developers, and enthusiasts alike. Messari, a leading crypto intelligence platform, has taken a unique approach to forecasting the future of the industry by tapping into the fresh perspectives of twelve crypto-native intern analysts from elite schools.

The Power of Young Minds in Crypto

Messari's decision to bring on board these talented interns demonstrates the company's commitment to fostering innovation and diversity of thought in the crypto space. By leveraging the insights of these young, tech-savvy analysts, Messari aims to provide a fresh outlook on the most exciting upcoming narratives for 2024.

AI and Gaming: The Next Frontiers

The first part of a two-part report compiled by these intern analysts focuses on three key areas: artificial intelligence (AI), gaming, and stablecoin adoption. These sectors are poised to play significant roles in shaping the crypto landscape in the coming year.

Artificial Intelligence: A Catalyst for Crypto Innovation

The integration of AI and blockchain technology is rapidly gaining traction, with potential applications ranging from enhanced data analysis to more efficient smart contract execution. As AI continues to evolve, its impact on the crypto ecosystem is expected to grow exponentially.

One company that has recognized the potential of AI in the crypto space is Covalent. In Q2, Covalent initiated a rebrand, focusing its mission more deeply on AI and long-term data availability on Ethereum. This strategic shift highlights the growing importance of AI in blockchain infrastructure and data analysis.

Gaming: The Next Big Thing in Crypto Adoption

The intersection of gaming and blockchain technology has been a hot topic in recent years, with many experts predicting that gaming could be the key to mass crypto adoption. The report from Messari's intern analysts likely delves into the potential of blockchain-based games, non-fungible tokens (NFTs), and in-game economies.

For those looking to capitalize on the growing trend of crypto gaming, the Crypto Website Builder offers an excellent solution for creating engaging and interactive platforms. This tool allows developers and entrepreneurs to quickly build crypto-focused websites, including those centered around blockchain gaming projects.

Stablecoin Adoption: A Sign of Maturity

The third focus area of the report, stablecoin adoption, is a critical indicator of the crypto market's overall health and maturity. Stablecoins play a vital role in providing stability and liquidity to the crypto ecosystem, making them an essential component of DeFi applications and trading platforms.

Interestingly, recent data shared by Messari shows that despite Bitcoin's price decline over the past five months, the stablecoin market cap has seen significant growth. This trend suggests an increasing demand for stable digital assets and highlights the evolving nature of the crypto market.

Mainnet 2024: A Hub for Crypto Innovation

As the crypto industry continues to evolve, events like Messari's Mainnet 2024 play a crucial role in bringing together innovators, thought leaders, and developers. The upcoming conference promises to offer deep dives into the innovations driving blockchain's future, covering topics ranging from Bitcoin L2s to the unique advantages of DeFi on Solana.

One of the most exciting aspects of Mainnet 2024 is the inaugural Testnet Hackathon. This event, scheduled for September 29-30 in New York City, offers participants the chance to compete for over $75,000 in prizes while gaining free admission to the main conference. Such initiatives foster creativity and drive innovation in the crypto space.

The Role of Tools in Driving Crypto Innovation

As the crypto industry continues to evolve, developers and entrepreneurs need access to powerful tools that can help them bring their ideas to life. The Memecoin Explorer is one such tool that allows users to analyze recent memecoin trends, providing valuable insights for those looking to capitalize on this growing segment of the market.

Conclusion: Embracing the Future of Crypto

The insights provided by Messari's intern analysts offer a glimpse into the exciting future of the crypto industry. As we look ahead to 2024 and beyond, it's clear that AI, gaming, and stablecoin adoption will play pivotal roles in shaping the landscape.

By staying informed about these trends and leveraging innovative tools like the Crypto Website Builder and Memecoin Explorer, developers, investors, and enthusiasts can position themselves at the forefront of crypto innovation. As the industry continues to mature and evolve, those who embrace these emerging trends and technologies will be best positioned to succeed in the dynamic world of cryptocurrency and blockchain technology.

0 notes

Text

The Role of Bitcoin in the Global Financial Shift: A New Era of Truth-Based Markets

The world is on the brink of a massive financial transformation, one that will forever change the way we think about money, value, and the very dynamics of the global economy. For centuries, fiat currencies and centralized control over monetary policy have dominated the financial landscape, distorting prices and economic behaviors. But today, with the rise of Bitcoin, a new paradigm is emerging—one that offers not just an alternative, but a revolutionary shift towards a decentralized, sound money system where prices will, for the first time, reflect the truth.

The Growing Instability of Traditional Financial Systems

Fiat currencies, controlled by governments and central banks, have long been the cornerstone of global trade and economic policy. But with endless money printing, rising inflation, and increasing national debts, the very foundation of these systems is showing cracks. Central banks, through their manipulation of interest rates and currency supplies, are eroding trust in the financial system. We see it every day in the form of inflation eroding our savings and rising costs of living.

What happens when fiat loses its grip? People are already searching for answers, and Bitcoin is emerging as the clear frontrunner.

Bitcoin: A Global Solution

Bitcoin offers something no fiat currency ever could—absolute scarcity and decentralization. With its 21 million hard cap, Bitcoin is deflationary by nature, meaning it cannot be manipulated or inflated away by any government or institution. This built-in scarcity makes it a hedge against inflation and a store of value that transcends borders and politics.

But Bitcoin is more than just a hedge. It’s a permissionless, borderless network that anyone can access. No one needs approval from a bank or a government to use Bitcoin. This gives individuals across the globe, especially in underbanked regions, the power to participate in the global economy.

The Shift in Power: Decentralization at Its Core

One of the most exciting aspects of Bitcoin is how it’s redistributing financial power. In the traditional system, financial power is centralized in the hands of governments and financial institutions. They decide who has access to wealth, how much money is worth, and who can trade with whom. With Bitcoin, this control is shattered. Now, individuals hold the keys to their wealth—literally. No one can freeze, seize, or manipulate your Bitcoin if it’s held securely in your wallet.

This decentralization shifts power from centralized authorities to individuals, giving people true control over their financial destiny. As more individuals and institutions embrace Bitcoin, we are witnessing the beginning of a global power shift.

Free Market Dynamics and Truth-Based Pricing in a Bitcoin Economy

Perhaps one of the most profound changes Bitcoin will bring is to the dynamics of the free market itself. Under the current fiat system, prices are distorted by inflation, debt, and government intervention. The result? A market where prices do not reflect true value, where manipulation and monetary policies obscure the real supply and demand of goods and services.

But Bitcoin changes all that. When goods and services are priced in Bitcoin, we finally have a market where prices reflect truth. There is no inflationary distortion, no artificial manipulation of interest rates, and no printing of more money to hide economic failures.

For the first time in modern history, the free market will operate on an honest, transparent foundation. This truth-based pricing will lead to more efficient markets, where the value of goods, services, and assets is determined solely by supply and demand. It’s a seismic shift in how we understand economics, and it will likely redefine global trade as we know it.

Institutional Adoption: A Key Driver of Bitcoin’s Future

We are already seeing the early stages of Bitcoin’s adoption on a global scale. Corporations like MicroStrategy and Tesla have made significant investments, and institutions are increasingly turning to Bitcoin as a store of value. The approval of Bitcoin ETFs has opened the door for institutional investors to participate in the Bitcoin economy, accelerating its legitimacy and adoption.

As institutional interest grows, so too does Bitcoin’s influence in the global financial system. But this is only the beginning. Nation-states may soon follow, adopting Bitcoin as a reserve asset. The recent approval of Bitcoin ETFs is not just a step forward for Bitcoin—it’s a signal that hyper-Bitcoinization may already be underway.

The Future of Global Trade with Bitcoin

As Bitcoin continues to be adopted by individuals, institutions, and potentially nation-states, it’s poised to play a major role in global trade. Its borderless nature and decentralized infrastructure make it ideal for cross-border payments, cutting out intermediaries and reducing costs.

This could fundamentally change how global trade operates, making it more transparent, efficient, and accessible. Furthermore, by reducing reliance on fiat currencies, Bitcoin could eliminate much of the corruption and inefficiencies in international commerce.

Conclusion: The Dawn of a New Financial Era

Bitcoin is more than just a digital asset or an investment vehicle—it’s the foundation of a new global financial system. Its decentralization, sound monetary policy, and truth-based pricing are the cornerstones of a future where individuals have more power and control over their wealth, and where markets function on truth rather than manipulation.

The global financial shift is already underway, and those who understand Bitcoin’s role in this transformation are poised to benefit the most. As Bitcoin continues to reshape financial systems and market dynamics, it is clear that we are entering a new era—one where sound money and true prices define the future of global trade and finance.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialShift#Decentralization#GlobalEconomy#SoundMoney#FreeMarkets#CryptoRevolution#DigitalCurrency#Blockchain#FutureOfFinance#FinancialFreedom#PriceTransparency#Hyperbitcoinization#GlobalTrade#BitcoinEconomy#TruthInPricing#financial empowerment#unplugged financial#finance#cryptocurrency#financial education#financial experts

1 note

·

View note

Text

How can I transfer my shares from Robinhood to Fidelity using cryptocurrencies?

Transferring shares from Robinhood to Fidelity is a process that many investors may find necessary as they seek to consolidate their portfolios or take advantage of different services offered by these platforms. With the increasing prominence of cryptocurrencies in the financial world, understanding how to use them for share transfers can be a valuable skill. This article will provide a detailed guide on how to transfer stocks from Robinhood to fidelity using cryptocurrencies, covering everything from preparation to common challenges, expert insights, and future trends.

What are Robinhood and Fidelity?

Robinhood is a commission-free trading platform that has gained popularity for its user-friendly interface and accessibility to new investors. Fidelity, on the other hand, is a more traditional brokerage firm with a long-standing reputation for comprehensive investment services. Both platforms serve as gateways for individuals looking to invest in stocks, ETFs, and other securities, but they cater to slightly different audiences.

How Does Share Transfer Work?

Share transfer involves moving assets, such as stocks or ETFs, from one brokerage account to another. This process usually requires coordination between the two brokerages and can involve a transfer fee, depending on the platforms involved. The use of cryptocurrencies adds a modern twist to this traditional process, allowing for potentially faster and more secure transfers.

Role of Cryptocurrencies in Modern Finance

Cryptocurrencies have revolutionized the financial landscape by offering decentralized, peer-to-peer transactions that are not bound by traditional banking systems. In the context of share transfers, cryptocurrencies can be used to convert shares into digital assets, which can then be transferred to another platform and converted back into shares.

Preparing for the Transfer

Checking Eligibility for Share Transfer

Before initiating a share transfer, it’s important to verify whether your shares are eligible for transfer between Robinhood and Fidelity. Not all assets can be transferred directly, and you may need to convert some of them into cash or cryptocurrencies first.

Understanding Tax Implications

Transferring shares can have tax implications, especially if you are converting shares into cryptocurrency. It’s essential to consult with a tax advisor to understand the potential capital gains taxes that may apply to your transfer.

Selecting the Right Cryptocurrency for the Transaction

Not all cryptocurrencies are suitable for share transfers. Factors such as transaction speed, fees, and platform compatibility should be considered when choosing which cryptocurrency to use. Bitcoin and Ethereum are commonly used due to their widespread acceptance and robust infrastructure.

Step-by-Step Guide to Transferring Shares

Linking Your Robinhood and Fidelity Accounts

The first step in the transfer process is to ensure that both your Robinhood and Fidelity accounts are linked. This may involve verifying your identity on both platforms and ensuring that your accounts are in good standing.

Converting Shares to Cryptocurrency on Robinhood

Once your accounts are linked, you can begin the process of converting your shares into cryptocurrency. This usually involves selling your shares on Robinhood and then using the proceeds to purchase the cryptocurrency of your choice.

Transferring Cryptocurrency to Fidelity

After acquiring the cryptocurrency, you will need to transfer it to your Fidelity account. This process involves sending the cryptocurrency to a wallet associated with your Fidelity account. Make sure to double-check the wallet address to avoid any errors.

Converting Cryptocurrency Back to Shares on Fidelity

Once the cryptocurrency is in your Fidelity account, you can convert it back into shares. This final step involves purchasing the same or different shares with the cryptocurrency you transferred.

Common Challenges and How to Overcome Them

Dealing with Transfer Delays

Cryptocurrency transactions can sometimes experience delays due to network congestion or other issues. To avoid frustration, it’s important to initiate the transfer well before any deadlines and to monitor the transaction status closely.

Managing Transaction Fees

Both Robinhood and Fidelity may charge fees for transferring assets, and there are also fees associated with buying and selling cryptocurrency. To minimize these costs, consider using a cryptocurrency with lower transaction fees and timing your trades to take advantage of lower fee periods.

Navigating Platform Restrictions

Not all platforms support every cryptocurrency or asset type. It’s important to verify the compatibility of your chosen cryptocurrency with both Robinhood and Fidelity before initiating the transfer.

Expert Insights on Using Cryptocurrencies for Share Transfers

Pros and Cons of Using Cryptocurrencies

Using cryptocurrencies for share transfers offers several advantages, such as faster transaction times and enhanced security. However, there are also risks, including volatility and potential regulatory hurdles. Financial experts recommend carefully weighing these factors before using cryptocurrencies for share transfers.

Insights from Financial Experts

Experts suggest that while cryptocurrencies offer a promising alternative to traditional share transfers, they are best suited for tech-savvy investors who are comfortable navigating the complexities of digital assets. Additionally, it’s crucial to stay informed about the latest developments in cryptocurrency regulations and technology.

Case Study: A Successful Share Transfer Using Cryptocurrency

In a recent case study, an investor successfully transferred shares from Robinhood to Fidelity by converting them into Bitcoin. The transfer was completed within 24 hours, with minimal fees, demonstrating the potential efficiency of using cryptocurrencies for this purpose.

Future Trends in Share Transfer Using Cryptocurrencies

Emerging Technologies in Finance

The financial industry is rapidly evolving, with new technologies such as blockchain and decentralized finance (DeFi) gaining traction. These innovations have the potential to further streamline the process of transferring shares using cryptocurrencies, making it more accessible and efficient.

Predictions for the Future of Share Transfers

As cryptocurrencies become more mainstream, more brokerage platforms will likely offer integrated support for digital asset transfers. This could lead to faster, cheaper, and more secure share transfers, reducing reliance on traditional banking systems.

How are Fidelity and Robinhood adapting to the crypto trend?

Both Fidelity and Robinhood have been quick to embrace cryptocurrencies, offering trading and storage options for digital assets. As the demand for cryptocurrency-based services grows, these platforms are expected to expand their offerings, making it easier for investors to use cryptocurrencies for share transfers.

Best Practices for Minimizing Fees

To keep your transfer costs low, consider using a cryptocurrency with low transaction fees and timing your trades during periods of low network congestion. Additionally, be aware of any fees charged by Robinhood and Fidelity for transferring assets.

Tips for Ensuring Timely Transfers

To ensure your transfer is completed on time, start the process well in advance and monitor the transaction status closely. If you encounter any issues, don’t hesitate to contact customer support for assistance.

How to Keep Your Transactions Secure

Security is paramount when dealing with cryptocurrencies. Use strong passwords, enable two-factor authentication, and double-check all wallet addresses before initiating a transfer. Keeping your accounts secure will help prevent any potential losses.

Conclusion:-

Transferring Robinhood to fidelity using cryptocurrencies is a modern approach that offers several benefits, including faster transactions and enhanced security. However, it’s important to be aware of the challenges and risks involved, such as fees, delays, and regulatory considerations. By following the steps outlined in this guide and staying informed about the latest trends in cryptocurrency and finance, you can successfully navigate the share transfer process and take full advantage of the opportunities presented by digital assets.

FAQs:-

Can I Transfer Shares Directly Between Robinhood and Fidelity?

While it is possible to transfer shares directly between Robinhood and Fidelity, using cryptocurrencies offers a unique alternative that can provide faster and more secure transactions.

What Cryptocurrencies Can Be Used for Share Transfers?

Bitcoin and Ethereum are the most commonly used cryptocurrencies for share transfers due to their widespread acceptance and robust infrastructure. However, other cryptocurrencies may also be suitable depending on the platforms involved.

How Long Does the Share Transfer Process Take?

The share transfer process can take anywhere from a few hours to several days, depending on factors such as network congestion, transaction fees, and platform processing times. Using cryptocurrencies can potentially speed up the process, but it’s important to be prepared for any delays.

0 notes

Text

Winning Trust, Expanding Boundaries: The Journey of Tdasx in 2020

As 2020 draws to a close, this year is destined to be unforgettable for people worldwide, as the black swan events sweeping the world have caused massive disruptions, with economies in many regions stagnating. However, 2020 has also been a year of significant change for the crypto industry. With traditional finance facing immense pressure, investors and institutions are turning to cryptocurrencies, propelling the crypto market to new heights. The market capitalization of crypto assets grew 3.3 times in 2020, with Bitcoin surging over 220% for the year. The explosion of DeFi brought in more new users to the crypto domain, further heating up the crypto market.

For Tdasx Digital Asset Exchange, 2020 was a year full of challenges and opportunities. During this year, Tdasx saw a surge in the number of trading pairs, launched several high-quality cryptocurrencies, and focused on both execution and efficiency while ensuring the security of user assets, rolling out several important products.

The rapid rise of Tdasx not only demonstrates its technological and capital strength but more importantly, shows its keen insight into market dynamics and accurate grasp of future trends. In 2020, Tdasx successfully implemented several technological upgrades, including enhancing the security of its trading platform, improving transaction processing speed, and introducing more advanced analytical tools to optimize user trading experience. These technological innovations not only boosted platform performance but also enhanced user trust and satisfaction with Tdasx. Additionally, after the launch of derivative products, due to its good depth, smooth trading experience, low fees, and slippage, it quickly became an industry benchmark.

In early 2020, Tdasx collaborated with the University of Iowa to launch a series of online courses. These courses aimed to educate the public about blockchain technology and digital assets, enhancing public understanding and interest in this emerging field. This initiative not only showcased the emphasis of Tdasx on education but also strengthened the leadership position of the platform in the industry.

In March, Tdasx initiated a global expansion plan, taking solid steps into international markets and receiving wide acclaim in Europe, Japan and Korea, Australia, and the Middle East, among others. Through global strategic deployment, Tdasx not only expanded its market influence but also strengthened its global user base. Internationalization is just the first step, and localized operations are also essential. In the future, Tdasx plans to establish multiple operational nodes in Europe to handle localization and community maintenance, understand and meet the real needs of users, promote the free flow of value, and benefit billions of people in the future.

In terms of user growth, the registered users of Tdasx have continued to grow at an astonishing rate, surpassing the 1 million mark in 2020. For Tdasx users, the main reasons for choosing Tdasx are the security guarantees, strict compliance operations, and rich asset selection of the platform. Several community users have previously commented, "You can buy the most promising assets on Tdasx." In August, Tdasx was honored with the 2020 Most Trusted Brand Award by The Business Fame, further solidifying its reputation in the industry.

In October 2020, Tdasx completed its second round of financing led by Heisenberg Capital and Blockchain Capital, among others. The success of this round of financing not only provided further financial support for the development of Tdasx but also affirmed the confidence of the investment community in the future potential of Tdasx. At the end of the year, Tdasx also received verification and star-level certification from the authoritative institution in the cryptocurrency industry, Cer.live, marking a new height of transparency and security for Tdasx in the industry.

As 2020 comes to a close, the influence of Tdasx in the global financial technology sector continues to expand. Annual technological upgrades and product innovations have made the services of Tdasx faster and more reliable, leading industry technology trends. New designs and functional improvements respond to market demands, enhance user experience, and set new industry standards for security and user convenience.

In terms of blockchain technology, Tdasx will continue to invest in research and development resources to enhance the functionality and security of its technical platform. Especially in areas such as smart contracts, distributed ledger technology, and cryptographic algorithms, Tdasx will explore cutting-edge technologies to ensure transaction security and data integrity. Cryptocurrencies and DeFi infrastructure continue to develop rapidly, while the booming stablecoin market and the development of DeFi lending protocols provide new explosive growth points. After such a challenging year, the future of cryptocurrencies is vast and hopeful, bringing hope for the coming year.

In 2020, Tdasx has shown strong development momentum in all aspects. From technological innovation to market expansion, capital operations, and industry certification, Tdasx continuously proves its position as a leader in the digital asset trading field. With the arrival of a new year, Tdasx will continue to promote the global adoption of digital assets, exploring and achieving more possibilities.

0 notes

Text

The Future of Financial Services: Embracing Digital Transformation

In an era characterized by rapid technological advancements, the financial services industry stands at the forefront of a significant transformation. The fusion of cutting-edge technology with traditional financial practices is reshaping the landscape, offering unprecedented opportunities for innovation, efficiency, and customer engagement. This digital transformation is not merely a trend but a fundamental shift that will define the future of financial services.

The Rise of Fintech

Financial technology, or fintech, has emerged as a game-changer in the industry. Startups and established firms alike are leveraging technology to create innovative solutions that cater to the evolving needs of consumers. Mobile banking apps, peer-to-peer payment platforms, robo-advisors, and blockchain technology are just a few examples of how fintech is revolutionizing the way we manage money.

The convenience and accessibility of these services have led to widespread adoption, particularly among younger, tech-savvy consumers. Mobile banking, for instance, allows users to perform transactions, monitor their accounts, and even apply for loans from the comfort of their homes. This shift towards digital solutions is driving financial institutions to rethink their strategies and invest heavily in technology.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are playing pivotal roles in enhancing operational efficiency and customer experience in financial services. AI-powered chatbots and virtual assistants are now common in customer service, providing instant responses and personalized assistance. These tools not only improve customer satisfaction but also free up human resources for more complex tasks.

In addition to customer service, AI is being used for risk management, fraud detection, and investment analysis. Machine learning algorithms can analyze vast amounts of data to identify patterns and trends, enabling more accurate predictions and informed decision-making. This data-driven approach is crucial in today’s fast-paced financial markets, where timely and accurate information can make all the difference.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies are other key components of the digital transformation in financial services. Blockchain offers a decentralized and secure way of recording transactions, reducing the need for intermediaries and increasing transparency. This technology has the potential to revolutionize various aspects of the financial industry, from payments and remittances to trade finance and regulatory compliance.

Cryptocurrencies, while still relatively new, are gaining traction as alternative investment assets. Bitcoin, Ethereum, and other digital currencies are being embraced by both individual investors and institutional players. The growing acceptance of cryptocurrencies highlights the need for financial institutions to adapt and develop new services that cater to this emerging market.

Regulatory Challenges and Opportunities

As financial services copywriter undergo digital transformation, regulatory frameworks must evolve to address new risks and challenges. Cybersecurity, data privacy, and compliance are critical issues that require robust regulatory oversight. Financial institutions must work closely with regulators to ensure that innovation does not compromise the stability and integrity of the financial system.

At the same time, regulatory changes present opportunities for growth and innovation. Regulatory sandboxes, for example, allow fintech companies to test new products and services in a controlled environment, fostering experimentation and collaboration. By striking a balance between innovation and regulation, the financial services industry can continue to thrive in the digital age.

The Path Forward

The digital transformation of copywriting for financial services is an ongoing journey that requires continuous adaptation and investment. Financial institutions must embrace a culture of innovation, prioritize customer-centric solutions, and stay ahead of technological advancements. Collaboration between traditional banks, fintech startups, and regulatory bodies will be crucial in shaping a resilient and dynamic financial ecosystem.

In conclusion, the future of financial services lies in the successful integration of technology with traditional practices. By embracing digital transformation, financial institutions can enhance efficiency, improve customer experience, and drive sustainable growth. The journey ahead is challenging, but the rewards are immense for those who dare to innovate and lead the way.

0 notes

Text

Immediate Ai ePrex App: Revolutionizing Crypto Trading in Canada

Discover the power of Immediate Ai ePrex, a cutting-edge trading platform transforming cryptocurrency trading in Canada. Designed for both novice and seasoned traders, Immediate ePrex uses advanced AI technology to optimize trading strategies and maximize profits. With its user-friendly interface and automated trading capabilities, this platform ensures a seamless experience, allowing you to trade Bitcoin and other cryptocurrencies with ease.

The Immediate Ai ePrex App stands out for its remarkable efficiency, processing trades up to 0.01 seconds faster than the market. This precision helps you buy low and sell high, enhancing your trading success. Enjoy features like a hassle-free registration process, quick withdrawals, and 24/7 customer support, all backed by strong security measures including SSL encryption.

Getting started is Immediate Ai Eprex Investment straightforward: register in minutes, explore the demo mode to familiarize yourself, and then start trading with a minimum deposit of $250. Immediate Ai ePrex supports four major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), making it a versatile tool for your trading needs.

With Immediate Ai ePrex, Canadian users can expect not only advanced technology but also exceptional customer service. The platform’s quick transactions and responsive support make it an ideal choice for anyone looking to navigate the crypto market efficiently. Whether you're new to cryptocurrency trading or looking to enhance your strategies, Immediate Ai ePrex offers a reliable and innovative solution.

Start your journey with Immediate Ai ePrex today and experience the future of cryptocurrency trading right here in Canada.

1 note

·

View note