#GST Reconciliation Software

Explore tagged Tumblr posts

Text

What to consider when selecting reconciliation software? Why Businesses Need Reconciliation Software

Reconciliation is a critical financial process that ensures accuracy by matching internal records with external statements, such as bank transactions, supplier invoices, and customer payments. Without proper reconciliation, businesses risk financial misstatements, fraud, and compliance issues.

To streamline this process, companies rely on reconciliation software, which automates transaction matching, detects errors, and ensures data accuracy. By reducing manual effort, businesses save time, enhance compliance, and maintain financial transparency.

Types of Reconciliation

Bank Reconciliation: Matches internal cash records with bank statements to prevent errors.

Vendor Reconciliation: Ensures payments align with supplier invoices.

Customer Reconciliation: Verifies that all payments are correctly recorded.

Intercompany Reconciliation: Ensures consistency across subsidiaries.

Payroll Reconciliation: Confirms payroll transactions match records.

General Ledger Reconciliation: Validates financial transactions for accurate reporting.

Choosing the Right Reconciliation Software

Selecting reconciliation software involves considering compatibility with existing tools, scalability for business growth, automation capabilities, and compliance with financial regulations. Features like real-time processing, fraud detection, and multi-currency support can further enhance financial control.

How Automation Simplifies Reconciliation

Manual reconciliation is time-consuming and error-prone. Automation speeds up transaction matching, reduces human errors, improves compliance, and enhances fraud detection. It ensures businesses are always audit-ready while cutting costs and increasing efficiency.

To read the full article, click on the link here.

#business intelligence software#bi tool#bisolution#businessintelligence#bicxo#data#business solutions#business intelligence#businessefficiency#reconciliation#gst reconciliation software#reconciliation software#software#India

0 notes

Text

Feeling overwhelmed by tax season? Are you a Chartered Accountant or Tax professional in India struggling with complex calculations, mountains of paperwork, and the ever-changing tax landscape? This podcast is your one-stop shop for conquering tax season! Join us as we explore Electrocom's revolutionary EasyOffice and EasyGST software solutions, designed specifically to streamline your workflow, boost productivity, and ensure compliance.

#tds filing software#income tax filing software#income tax calculation software#tds return software#gst reconciliation software#tds return filing software#gst return filing software

0 notes

Text

Why GST Software is a Must-Have for Professionals in 2025

In today’s dynamic tax landscape, managing GST compliance efficiently is crucial for businesses, tax professionals, and accountants. With frequent regulatory changes and the complexity of GST returns, relying on manual processes can be time-consuming and error-prone. This is where GST software for professionals comes into play.

What is GST Software for Professionals?

GST software for professionals is specifically designed to simplify GST return filing, reconciliation, and compliance for CAs, tax consultants, and accountants. It automates the entire process, ensuring accuracy, saving time, and reducing penalties due to manual errors.

2A and 2B Reconciliation Made Easy

One of the most critical and complex parts of GST filing is the reconciliation of GSTR-2A and GSTR-2B with your purchase records. 2A reconciliation software and 2B reconciliation software help tax professionals quickly match the Input Tax Credit (ITC) available in GST portals with purchase registers. This automation eliminates mismatches, ensures maximum ITC claims, and reduces the chances of GST notices.

Benefits of Using 2A/2B Reconciliation Software:

Real-time mismatch detection

Bulk data reconciliation

Vendor-wise mismatch reports

Improved ITC accuracy

Why You Need GST Return Filing Software?

Filing GST returns manually involves the risk of errors and missed deadlines. GST return filing software streamlines the filing process, auto-populates data, provides return status updates, and integrates with accounting systems. This ensures that every GST-registered business or professional meets compliance requirements effortlessly.

Features of Best GST Filing Software:

Auto-import of GSTR data from the GSTN portal

Error detection before filing

Easy handling of multiple GSTINs

Dashboard for return status tracking

How to Choose the Best GST Software?

When selecting the best GST filing software, professionals should look for:

User-friendly Interface: Easy to operate even for non-tech users.

High-Speed Reconciliation: Ability to process bulk data quickly.

Comprehensive Reports: For audits and departmental scrutiny.

Regular Updates: As per the latest GST amendments.

Affordability & Scalability: Suitable for both small firms and large enterprises.

Conclusion

Incorporating a robust GST software for professionals ensures seamless GST return filing, effortless 2A/2B reconciliation, and complete tax compliance. Investing in the best GST filing software not only enhances efficiency but also provides peace of mind by reducing the risks associated with GST management.

If you're looking for a feature-rich and reliable GST solution, explore options that offer 2A/2B reconciliation and automated GST return filing in one unified platform.

#gst software for professionals#2B reconciliation software#2a reconciliation software#gst return filing software#best gst filing software#Gst Software

0 notes

Text

"Tally AMC: Hassle-Free Maintenance and Support for Your Business":-

Tally AMC Services by DS Software & Web Solutions

At DS Software & Web Solutions, we offer comprehensive Tally Annual Maintenance Contract (AMC) services designed to ensure your Tally software operates seamlessly, keeping your business processes uninterrupted and efficient.

Why Choose Our Tally AMC Services?

Expert Support: Our team comprises certified Tally professionals who provide prompt assistance for any technical issues, ensuring minimal downtime.

Regular Updates: Stay compliant with the latest statutory requirements and enjoy new features with timely Tally software updates.

Data Security: We implement robust backup solutions and security measures to protect your critical business data from potential threats.

Customized Solutions: Tailor Tally to fit your unique business needs with our customization services, enhancing productivity and reporting capabilities.

Training & Workshops: Empower your team with training sessions that cover Tally's functionalities, ensuring efficient utilization of the software.

Our AMC Packages

We offer flexible AMC plans to cater to different business requirements:

Basic Plan: Ideal for single-user setups requiring remote support and regular updates.

Standard Plan: Suitable for multi-user environments needing remote support, periodic onsite visits, and training sessions.

Premium Plan: Designed for businesses with multiple branches, offering comprehensive support including data synchronization, advanced customization, and dedicated account management.

Benefits of Our Tally AMC

Uninterrupted Operations: Ensure your Tally software runs smoothly without unexpected disruptions.

Cost-Effective: Avoid unforeseen expenses with our affordable and transparent AMC pricing.

Priority Support: Receive prompt assistance with priority response times for AMC clients.

Compliance Assurance: Stay ahead with timely updates aligning with the latest tax laws and regulations.

Enhanced Productivity: Leverage Tally's full potential with our expert guidance and customization services.

Partner with DS Software & Web Solutions for reliable and efficient Tally AMC services that support your business's growth and operational excellence.

If you need further customization or additional details, feel free to ask!

#tallyprime#accountingsoftware#tallysoftware#tally customization#cloud accounting software#gst registration#gst reconciliation#tallyamc#AMC TALLY SERVICES

1 note

·

View note

Text

#gst reconciliation#gst return filing#gst software#gst accounting software for retail#gst registration#gst billing software#gst compliant pos system#accounting software#small business accounting services#financial planning#billing software

0 notes

Text

Simplify Business Finances with Accounting and Bookkeeping Services in Delhi

Running a business in a fast-moving city like Delhi? Then you already know how important it is to stay financially organized. That’s where Accounting and Bookkeeping Services in Delhi come in. Whether you're a freelancer, a startup founder, or managing a full-fledged company—these services help you keep everything from taxes to payroll in check.

Why Bother with Bookkeeping?

Honestly, bookkeeping and accounting aren't the most glamorous parts of running a business—but they’re critical.

Bookkeeping = recording transactions Accounting = analyzing financial health

When combined, they help you:

Understand your cash flow

Stay compliant with tax regulations

Avoid financial mistakes

Plan for the future

In a city as competitive as Delhi, this kind of financial clarity gives you an edge.

Benefits of Using Accounting and Bookkeeping Services in Delhi

Let’s be real—outsourcing your finances can be a game changer.

Save Time – No more late nights with spreadsheets

Stay Legal – GST and tax rules? Handled.

Get Expert Insights – Know exactly where your money is going

Focus on Growth – Let professionals handle the rest

Cost-Friendly – Way cheaper than building an in-house team

What’s Included in These Services?

When you sign up for Accounting and Bookkeeping Services in Delhi, here’s what you’re typically getting:

Day-to-Day Bookkeeping – Entries, reconciliations, ledgers

Accounting Reports – Profit & loss, cash flow, balance sheets

Tax Management – GST, TDS, income tax filings

Payroll – Salaries, compliance, payslips

Virtual CFO – Budgeting, forecasting, business planning

How to Choose the Right Service Provider in Delhi

Not all firms are the same. When looking for someone to trust with your business numbers:

Look for ICAI-certified accountants

Make sure they use good software (Zoho Books, Tally, QuickBooks)

Ask about experience with your industry

Transparency in pricing = a must

Best for Businesses Like...

E-commerce brands

Clinics and healthcare startups

Education platforms

Manufacturers

Tech companies and freelancers

Wrapping It Up

If you’re serious about taking control of your business finances, don’t try to juggle it all yourself. The right Accounting and Bookkeeping Services in Delhi can make all the difference—helping you stay on top of things, avoid penalties, and grow confidently.

3 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

Boost Your Accounting Career with Tally Prime at IICS

Upgrade your skills and boost your career with the Tally Prime training course at IICS, one of Delhi's most trusted computer institutes. This job-oriented program is perfect for commerce students, accountants, and professionals who want to master digital accounting. Our curriculum includes real-time practice on Tally software, including modules on GST, voucher entry, reports, and reconciliation. With our expert trainers and personalized attention, you’ll gain the practical knowledge needed to succeed in today’s competitive finance job market. Get certified and job-ready with IICS!

https://www.iicsindia.com/

0 notes

Text

One-on-One Tally Training in Laxmi Nagar – Book Demo

Tally Course in East Delhi Laxmi Nagar – Career Ka Right Direction

Aaj ke time mein, Tally course ek must-have skill ban chuka hai for accounting students. East Delhi, especially Laxmi Nagar, is known for top coaching institutes.

Yeh jagah not only offers quality training but also job placement ka strong network deti hai. Let’s explore why this course is trending in this area.

Why Tally Training in Laxmi Nagar East Delhi is Trending

Students aur professionals dono hi Laxmi Nagar choose karte hain for best accounting courses.

This area offers institute clusters, certified trainers, aur practical-oriented coaching. Most importantly, yahan ki fee structure is pocket-friendly.

Nearby metro connectivity makes it easily reachable.

Institutes yahan Tally Prime ke latest versions se training dete hain.

Batch timing flexible hote hain for school and college students.

What is Tally and Kyun Yeh Zaroori Hai

Tally ek accounting software hai jo financial transactions manage karta hai.

Yeh software use hota hai for GST, TDS, payroll, inventory, aur bank reconciliation. India mein lakhs of businesses Tally ERP 9 ya Tally Prime use karte hain.

Toh agar aap accounting field mein career banana chahte ho, Tally knowledge is must.

Tally Course Syllabus in Laxmi Nagar – Full Details

East Delhi ke reputed institutes ek structured syllabus provide karte hain.

Below is the common module:

H3: Basic Modules Covered:

Company creation aur configuration

Ledger and group creation

Journal entries and vouchers

GST setup & filing

Inventory management

Payroll processing

TDS and tax reports

Bank reconciliation

Balance Sheet & P&L generation

All modules are taught in live practical format. Har session ke baad assignments milte hain for hands-on practice.

Benefits of Learning Tally in Laxmi Nagar East Delhi

Yahan ke institutes sirf theory nahi, real-time learning environment dete hain.

H3: Key Advantages:

Certified trainers with 5+ years’ experience

100% job placement support

Resume aur interview preparation included

Doubt-clearing sessions in Hindi + English

Affordable course fee with EMI options

Free demo classes available

Yeh sab features aapko confidence aur clarity dono denge in learning.

Who Should Join Tally Course – Eligibility & Requirements

Tally course is open for all students after 10+2.

Even B.Com, BBA aur M.Com students bhi join karte hain to upgrade their resume. Working professionals who want to shift to accounting also benefit.

Minimum Requirements:

Basic computer knowledge

10th or 12th pass

Interest in accounting and finance

Kisi bhi stream ke students is course ko kar sakte hain without restrictions.

Course Duration and Fees – Flexible Options Available

Tally Course ki duration average 2 to 3 months hoti hai in most Laxmi Nagar institutes.

Some institutes also offer fast-track batch for working individuals.

Fee Range:

₹5,000 to ₹20,000 depending on syllabus and modules

GST + Advanced Tally courses thode expensive hote hain

Fees usually include study material, software access, and certifications.

Career Scope After Tally Course in East Delhi

Ek baar Tally ka certificate mil jaye, toh aapko multiple job roles ke options milte hain.

Popular Job Roles:

Tally Operator

Accounts Executive

GST Filing Assistant

Data Entry Accountant

Inventory Manager

Freelance Tax Consultant

Companies prefer Tally-trained candidates kyunki they are job-ready from day one.

Top Institutes Offering Tally Course in Laxmi Nagar East Delhi

Aapko confusion na ho, isliye humne list banayi hai of top-rated institutes:

Institute of Professional Accountants (TIPA)

Location: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar

Highlights: 100% placement, certified trainers, live practicals

Student Testimonials – Real Voices, Real Experiences

“I joined TIPA’s Tally course in East Delhi aur within 3 months, I got placed!” – Rohit Kumar

“Trainers yahan bohot helpful the, aur GST ka topic was explained very well.” – Priya Sharma

“Course content updated tha and fully practical-based learning thi.” – Anjali Mehta

Yeh sab testimonials aapko idea dete hain about learning quality in this area.

Tally Certification Value in India – Kya Important Hai?

After completing the course, aapko certification milta hai jo aapke resume mein value add karta hai.

A certified Tally professional is preferred in small to mid-level businesses as they handle day-to-day accounting.

Government jobs, CA firms, aur startups sabhi Tally operators hire karte hain regularly.

Conclusion – Right Place, Right Skill, Right Time

Tally Course in East Delhi Laxmi Nagar ek smart decision hai for those aiming for a quick career boost.

You get industry-ready training, placement assistance, and valuable practical exposure.

Toh agar aap accounting field mein interested ho, don’t wait – enroll today in a Tally course near Laxmi Nagar!

Frequently Asked Questions (FAQs)

1. Kya Tally course online available hai in Laxmi Nagar?

Yes, most institutes offer online + offline hybrid classes for flexibility.

2. What is the average salary after Tally training?

Freshers usually start at ₹12,000 – ₹20,000/month, depending on skills and company.

3. Kya Tally certificate government recognized hota hai?

Yes, if it’s from a certified institute, it is valid for both private and public jobs.

Best Tally Course Training

Accountant Course

Accounting Institutes

Tally Course Training Institutes in East Delhi NCR Laxmi Nagar

Institute of Professional Accountants

Tally Institutes

Computer Course

Computer Institutes

Diploma in Computer Application , Business Accounting and Taxation (BAT) Course ,Basic Computer Course , GST Course , SAP FICO Course , Payroll Management Course , Diploma in Financial Accounting , Diploma In Taxation, Tally Course

Education Business Ideas

UPI

Stock Market Course

SAP FICO Course Delhi

SAP FICO Course in Gurugram

Tally Course in Delhi

Data Entry Operator Course

sitemap

Tally Course in Guwahati

Referral Program

Sitemap

Refund Policy

Privacy Policy

Thank you

BAT Course

Tally Course in Noida

Tally Course in Pune

Tally Course in Ahmedabad

Tally Course in Hyderabad

Tally Course in Bangalore

Tally Course in Mumbai

Corporate Training

Download Brochure

Contact Us

GST Course

SAP FICO Course

6 Six Months Diploma Course

Diploma Taxation Course

Payroll Management Course

15 Months Course

18 Months Diploma Course

Diploma in Financial Accounting

Diploma Courses

Old – Courses after B Com

Tally Course

1 One-year Diploma Course after B com Graduation in India

Advanced Excel Course

Basic Computer Course

Blog

About Us

Disclaimer

Student Reviews & Placements

Home

Terms & Conditions

Accounting Entry for Prepaid Expenses

What is TDS Certificate? | टीडीएस प्रमाणपत्र क्या है?

Tax Accountant Course: Apka Guide Ek Shandaar Career Ke Liye

GST Certification Course: Ek शानदार Career Opportunity

Government Examinations After Graduation in India: Complete Guide

0 notes

Text

Master Accounting with DICS Laxmi Nagar

In the era of digital finance and automated bookkeeping, Tally has emerged as one of the most trusted accounting software used by businesses across India. Whether you are a commerce student, aspiring accountant, or business owner, mastering Tally can significantly boost your career. Among various training centers, DICS (Delhi Institute of Computer Science) stands out as the best Tally institute in Laxmi Nagar, offering top-tier education, expert faculty, and industry-relevant curriculum.

Why Choose DICS for Tally?

DICS is renowned for its commitment to quality education and career-focused training. Recognized as the best Tally institute in Laxmi Nagar, it provides a well-structured course that covers all the essential features of Tally Prime, including GST, TDS, inventory management, payroll, and more. The course is designed for both beginners and advanced learners, ensuring that every student gains practical and theoretical proficiency.

Industry-Ready Curriculum

The best Tally course at DICS is not just about software operation—it’s a complete package that equips students with real-time skills. The curriculum includes:

Basics of Accounting & Tally

Company Creation & Ledger Management

Voucher Entry and Reconciliation

GST Implementation and Filing

Payroll Configuration

MIS Reporting and Data Security

Each module is supported by hands-on training, case studies, and real-world examples to give students a competitive edge in the job market.

Experienced Faculty & Supportive Environment

The faculty at DICS are certified professionals with years of industry and teaching experience. Their teaching methodology blends conceptual clarity with practical knowledge, ensuring students can implement their learning effectively. Small batch sizes, interactive sessions, and one-on-one doubt-clearing sessions make the learning process smooth and engaging.

Placement Assistance and Certifications

Upon completion of the course, students receive a government-recognized certification that boosts their professional credibility. DICS also offers dedicated placement assistance, connecting students with reputed firms and accounting jobs. This makes the best Tally course at DICS not just a learning opportunity but a gateway to a promising career.

Conclusion

If you're looking to build a strong foundation in accounting with Tally, DICS is the ideal destination. With a focus on quality training, professional guidance, and job readiness, DICS truly offers the best Tally course for aspiring accountants. Enroll today and take the first step toward a rewarding financial career at the best Tally institute in Laxmi Nagar.

0 notes

Text

Unlocking Business Benefits: The Case for GST Reconciliation Software

Since the implementation of Goods and Services Tax (GST), businesses have faced a paradigm shift in tax compliance requirements. To navigate these regulations effectively, organizations must invest in advanced tools like GST reconciliation software. This article delves into the myriad benefits of such software and its strategic significance in modern business operations.

Enhanced Accuracy and Efficiency: Manual reconciliation of GST data is not only time-consuming but also prone to errors. GST reconciliation software automates this process, leveraging advanced algorithms to identify and rectify discrepancies in real-time. By minimizing human errors, businesses can ensure accuracy in tax filings and avoid penalties.

Time and Cost Savings: Automating GST reconciliation tasks frees up valuable resources and reduces operational costs. By handling large volumes of data efficiently, the software eliminates the need for manual data entry and repetitive tasks. Additionally, it identifies overlooked tax credits or refunds, leading to cost savings and improved financial management.

Enhanced Compliance: Compliance with GST regulations is crucial to maintain a good reputation and avoid penalties. GST reconciliation software ensures ongoing compliance by comparing sales and purchase data with filed GST returns. By alerting businesses to potential compliance issues, such as incorrect tax rates or unreported transactions, the software enables proactive rectification and mitigates risks.

Real-Time Monitoring and Reporting: Real-time monitoring and reporting features provide businesses with insights into their GST compliance status, tax liabilities, and potential refunds. Comprehensive reports and dashboards offer visibility into critical metrics, enabling informed decision-making and proactive management of tax strategies.

Integration and Scalability: Seamless integration with existing ERP or accounting systems streamlines tax compliance processes, enhancing operational efficiency. As businesses grow, the software can scale accordingly to accommodate increasing data volumes and complexity. This scalability ensures that businesses can maintain accuracy and efficiency in their tax compliance efforts as they expand.

Data Analytics and Reporting Capabilities: The software’s data analytics capabilities enable businesses to gain deeper insights into their tax-related information. By analyzing patterns, trends, and anomalies within GST data, organizations can optimize tax planning strategies and make data-driven decisions to improve financial performance.

Reconciliation Reports: Reconciliation reports play a crucial role in ensuring data integrity across books and GST returns. By automating comparisons between different sources of data, the software minimizes errors and facilitates smoother tax filing processes. These reports empower businesses to maintain compliance and accuracy in their tax reporting, contributing to overall operational efficiency.

In conclusion, investing in GST reconciliation software is not just a wise financial decision but also a strategic move towards maximizing profits and driving operational efficiency. By automating reconciliation tasks, businesses can enhance accuracy, save time and costs, ensure compliance, and gain valuable insights into their tax-related data. Embracing technology in tax compliance processes enables organizations to stay ahead in a rapidly evolving regulatory landscape and achieve long-term success.

Read the full article by clicking here

Or

Visit our website at “bicxo.co”

#business solutions#bisolution#data#bicxo#enterprise performance management#epmsoftware#gst#gst software#software#insights#GST Reconciliation Software

0 notes

Text

BUSY Accounting Software Training | Learn GST Billing & Financial Management

Introduction

In a world where financial accuracy and regulatory compliance are essential for every business, accounting software plays a vital role. One of the standout tools gaining popularity across industries is BUSY Accounting Software. Known for its versatility, BUSY offers a robust solution for managing accounting, inventory, billing, and taxation—all in one platform. For students, job seekers, and professionals, understanding how to navigate such software can significantly elevate their career trajectory. Especially in India’s rapidly growing commercial landscape, learning to use tools like BUSY has become a cornerstone in modern accounting education.

Why BUSY Accounting Software Matters Today

BUSY is more than just a tool for tallying numbers. It allows businesses to track inventory, manage ledgers, generate GST reports, and monitor financial health with accuracy. Its user-friendly interface, along with comprehensive features like multi-location inventory and configurable invoices, makes it suitable for both small enterprises and large corporations.

As companies transition from manual bookkeeping to digital systems, there’s a rising demand for professionals who can operate software like BUSY effectively. This is where structured learning comes into play—building a strong foundation in accounting concepts while also mastering tools that are relevant in today’s job market.

Building the Foundation: Learning the Basics

For anyone beginning their journey in finance, enrolling in a basic accounting course in yamuna vihar can be the first step. These programs usually start with core concepts such as journal entries, ledgers, and trial balances before introducing software tools. By pairing these concepts with practical exposure to BUSY, learners can build a strong base for future specialization.

Some students choose to enhance their understanding through basic accounting classes in yamuna vihar, which often include practical sessions focused on using accounting software. These classes enable learners to see how theoretical knowledge translates into real-time data entry and reporting within platforms like BUSY.

Professional Training and Certification

As one progresses, more intensive learning through an accounting course in yamuna vihar or accounting training in yamuna vihar becomes valuable. These structured programs provide deep dives into tax compliance, inventory control, invoice generation, and financial reporting within BUSY. They also often simulate business transactions so learners can experience real-world applications.

Many opt for accounting certification courses in yamuna vihar to add credibility to their skills. These certifications help learners validate their proficiency with software and increase their employability in sectors such as retail, logistics, and consulting.

Advanced Modules and Business Applications

For those who are more career-focused, business accounting classes in yamuna vihar are particularly useful. These classes focus not only on mastering BUSY but also on understanding its role in business decision-making. Learners explore cash flow analysis, vendor management, and statutory reports—critical for business performance evaluation.

Similarly, a business accounting course in yamuna vihar introduces scenarios like budgeting, sales forecasting, and GST reconciliation. These courses help students grasp how financial software contributes to strategic planning and compliance.

Expanding Opportunities Beyond the Basics

As digital finance becomes the new norm, accounting training in uttam nagar has seen a significant rise in demand. Many learners enroll in an accounting course in uttam nagar to bridge their skill gaps and stay competitive in the job market. These courses often blend theoretical accounting frameworks with live projects in BUSY, giving learners an edge over traditional methods.

To complement these programs, institutions also offer accounting training courses in uttam nagar that focus on automation, audit trails, and payroll processing using BUSY. Such practical exposure helps students gain confidence in working with real data and understand how businesses use software for daily financial operations.

Certifications and Career Growth

Many institutions now offer accounting certification courses in uttam nagar to validate the skills gained through training. These certifications can enhance a resume, giving candidates a better chance at roles like junior accountant, financial analyst, or accounts executive.

To begin at a fundamental level, some students opt for a basic accounting course in uttam nagar followed by basic accounting classes in uttam nagar. These programs typically cover the essentials before transitioning to BUSY, ensuring that students have a well-rounded skill set.

Focusing on Business Accounting

As learners grow more confident, many shift toward business accounting classes in uttam nagar. These classes are designed to align with corporate standards and often include detailed modules on budgeting, internal auditing, and report customization within BUSY. A well-structured business accounting course in uttam nagar usually ends with a capstone project, where students simulate running an entire company’s books using the software.

This practical approach ensures that learners are not only software-savvy but also capable of making informed financial decisions—a quality highly sought after in today’s workforce.

Conclusion

Mastering BUSY accounting software is more than a technical skill—it's a career catalyst in the evolving financial landscape. Whether you're just starting with a basic accounting course or diving into complex business modules, combining accounting education with BUSY proficiency opens up diverse career paths.

The structured approach of blending theory with practical applications—offered through various accounting training courses and certifications—ensures that learners are well-equipped for the real world. From journal entries to tax filings, BUSY simplifies every process, allowing professionals to focus on strategy rather than paperwork.

With the right training and commitment, any student or professional can leverage BUSY to contribute effectively to their organization’s financial health, and in doing so, secure a strong position in today’s digital-first business world.

#BUSY Accounting Software#BUSY Software Training#BUSY Accounting Course#BUSY Software Basics#Learn BUSY Software#BUSY Software for Beginners#Accounting with BUSY Software

0 notes

Text

Tally Prime Accounting Software Services:-

DS SOFTWARE & WEB SOLUTIONS offers expert services in leveraging Tally Prime software to streamline your business operations. Whether you're looking to implement Tally Prime for the first time, upgrade your existing system, or need customized solutions tailored to your business needs, we are here to help.

Our Tally Prime Services Include:

Implementation: Seamless integration of Tally Prime into your business processes, ensuring minimal disruption and maximum efficiency.

Customization: Tailoring Tally Prime to meet specific business requirements, enhancing functionality and usability.

Training: Comprehensive training programs to empower your team with the skills needed to effectively use Tally Prime.

Support & Maintenance: Ongoing support services to ensure smooth operation and quick resolution of any issues.

Data Migration: Safe and efficient transfer of data from your existing systems to Tally Prime, ensuring data integrity and accuracy.

Why Choose DS SOFTWARE & WEB SOLUTIONS?

Expertise: Years of experience in implementing Tally solutions across various industries.

Customization: We understand that every business is unique; our solutions are tailored to fit your specific needs.

Support: Dedicated support team to address your queries and concerns promptly.

Affordability: Cost-effective solutions that deliver value without compromising on quality.

Transform your business with Tally Prime and DS SOFTWARE & WEB SOLUTIONS. Contact us today to discuss how we can optimize your business processes with our comprehensive Tally Prime services.

#tallyprime#tally on cloud#accountingsoftware#tallysoftware#gst reconciliation#gst registration#cloud accounting software#tallyaccountingsoftware

0 notes

Text

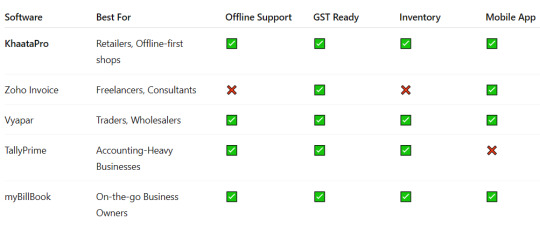

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

Accounting and Bookkeeping Services in Delhi by SC Bhagat & Co.

Efficient financial management is the cornerstone of any successful business. Whether you're a startup, small business, or an established enterprise, maintaining accurate financial records is essential for growth and compliance. In the bustling hub of Delhi, SC Bhagat & Co. stands out as a trusted provider of professional accounting and bookkeeping services, tailored to meet diverse business needs.

Why Choose Accounting and Bookkeeping Services in Delhi? Accounting and bookkeeping are more than just financial chores. They form the backbone of strategic decision-making, regulatory compliance, and overall business stability. Here’s why professional accounting and bookkeeping services are crucial:

Accurate Financial Records: Ensure precise tracking of all transactions and cash flows. Regulatory Compliance: Stay updated with tax laws and regulatory changes. Time Savings: Focus on your core business while experts handle the numbers. Better Financial Insights: Gain actionable insights for informed decision-making. Avoid Errors: Eliminate mistakes that can lead to penalties or financial loss. About SC Bhagat & Co. With decades of expertise, SC Bhagat & Co. has become a trusted name in Delhi for accounting and bookkeeping services. The firm is known for its reliability, professionalism, and a client-centric approach that ensures tailored solutions for businesses across industries.

Key Services Offered:

Accounting Services:

Preparation and maintenance of financial statements. Monthly and annual reporting. Budgeting and forecasting. Bookkeeping Services:

Recording daily financial transactions. Reconciliation of accounts. Payroll processing and management. Tax Compliance and Planning:

GST filing and compliance. Income tax returns and advisory. Support during audits and assessments. Financial Advisory:

Cash flow management. Profitability analysis. Strategic financial planning. Why SC Bhagat & Co. Stands Out for Accounting and Bookkeeping Services in Delhi

Experienced Professionals: A team of qualified accountants ensures top-notch service quality. Customized Solutions: Services are tailored to the specific needs of your business. Cutting-Edge Technology: Use of advanced accounting tools and software for accuracy and efficiency. Transparent Pricing: Competitive and clear pricing with no hidden charges. Client-Centric Approach: Emphasis on understanding client goals and delivering results that align with their vision. Industries We Serve SC Bhagat & Co. serves a wide range of industries, including:

Manufacturing Retail and e-commerce Real estate Healthcare IT and software Non-profit organizations Benefits of Partnering with SC Bhagat & Co. When you choose SC Bhagat & Co., you gain a partner who is invested in your success. Key benefits include:

Enhanced financial accuracy and efficiency. Assurance of compliance with all regulatory requirements. Access to real-time financial data for better decision-making. Reduction in operational costs through outsourcing. Why Delhi Businesses Trust for Accounting and Bookkeeping Services in Delhi by SC Bhagat & Co. Operating in Delhi’s dynamic business environment requires financial precision and agility. SC Bhagat & Co. has a deep understanding of the local market, tax regulations, and industry-specific challenges, making it the go-to firm for accounting and bookkeeping services in the capital. Get Started Today Simplify your financial management and focus on scaling your business by outsourcing your accounting and bookkeeping needs to SC Bhagat & Co.. Contact us today for a consultation and take the first step toward streamlined financial operations.

3 notes

·

View notes