#GST e Invoicing Software

Explore tagged Tumblr posts

Text

QueueBuster, as a recognized GST Suvidha Provider (GSP), simplifies the invoicing process for tax professionals by allowing direct uploads to the IRP without relying on third-party platforms. This significantly reduces the complexity and cost associated with managing multiple platforms for e-invoicing software.

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Optech Software offers one of the most reliable and user-friendly Billing Software in Coimbatore, tailored to meet the needs of businesses of all sizes. Whether you run a retail store, a wholesale unit, or a service-based company, Optech Software provides a seamless billing experience with features like GST invoicing, inventory management, e-invoice generation, and real-time reporting

#gst billing software#billing software#invoice software development bd#e-invoice#billing software in coimbatore

0 notes

Text

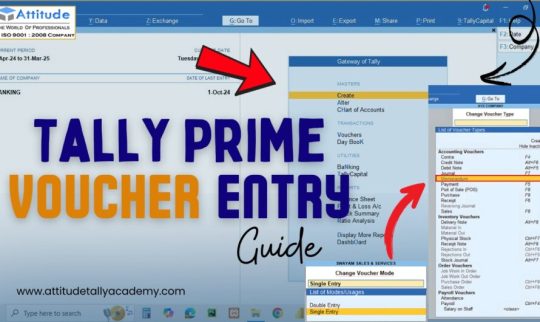

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

0 notes

Text

EASY BILL - Basic Overview of SGST ✨ 2025

VISIT : https://sites.google.com/view/easy-billing-software/blog/basic-overview-of-sgst

EASY BILL - Basic Overview of SGST 2025 is a user-friendly platform designed to simplify the billing process for businesses in India. This tool integrates seamlessly with the Goods and Services Tax (GST) system, offering a clear understanding of SGST (State Goods and Services Tax) for the year 2025. EASY BILL helps businesses generate accurate invoices while automatically calculating SGST rates based on the state-specific tax structure. With its intuitive interface, users can efficiently manage tax compliance, ensure accurate reporting, and stay updated with the latest regulations. EASY BILL streamlines SGST management for enhanced efficiency and compliance.

#easy billing software#easy billing#gst easy bill#easy gst billing software#easy gst#invoice easy#free billing software for mobile#easy gst software#online billing software free#online software for billing#software for billing#easy accounting software#gst billing software online#simple billing#easy invoice#e billing software#quick bill software

1 note

·

View note

Text

5 Tips to Streamline Your Billing Process

Efficient billing is the backbone of successful business operations. The streamlined process not only saves time but also improves customer satisfaction and ensures steady cash flow. Here are five actionable tips to simplify and enhance your billing process using TRIRID Accounting and Billing Software:

Automate Repetitive Tasks

Manual invoicing is time-consuming and prone to errors. With TRIRID, you can automate recurring invoices, set reminders for payments, and generate GST-compliant bills with ease. This automation eliminates delays and reduces human errors.

Leverage Real-Time Reporting

Keep yourself updated with the real-time reporting feature of TRIRID. Track pending invoices, payment statuses, and overall financial health with a click. This transparency helps in taking timely actions to manage receivables.

Cloud-Based Solution

TRIRID's cloud-based platform provides you with access to your billing data at any time and from anywhere. Whether in the office or on the go, you can securely manage invoices, payments, and customer records from any device.

Simplify GST Compliance

Managing taxes can be challenging, but TRIRID makes it easy. Generate GST-ready invoices, calculate tax rates automatically, and stay compliant with the latest regulations—all within the software.

Integrate Billing with ERP Systems

Make your billing software integrate with other business tools such as ERP or inventory management systems to ensure seamless workflow. TRIRID compatibility ensures smooth data flow and enhances efficiency.

Why Choose TRIRID Accounting and Billing Software?

You get a robust solution designed to simplify complex billing processes with TRIRID. The user-friendly interface, customization options, and advanced features make it the go-to choice for businesses of all sizes.

Ready to transform your billing process? Contact us today!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Best GST e-Invoicing Software for Business#Top 10 Easy To Use Billing and Invoicing Software in India#Best e-Invoicing Software for SMBs in India

0 notes

Text

A complete guide to free billing software

Free billing software refers to a type of software that is designed to automate the process of generating bills for products and services offered by a business to its clients. Billing software free makes the creation, management, and tracking of billing easy, and it also ensures accurate and on-time billing.

The GST billing software free has the following functions:

Easy and quick billing: The primary function of GST billing software free is to create bills automatically based on existing templates and custom layouts. GST software free includes client’s information, lists of products and services offered, cost details, taxes, discounts, and other payment terms.

Automation of billing: Free billing software eliminates the manual work by automating repetitive tasks like invoice generation, recurring billing, and sending bills to customers through email or other digital means.

Accurate tax calculation: Many free billing software have tax calculation features like GST, VAT, and sales tax that are based on the rules and rates applicable in the jurisdiction of the business.

Payment Processing: Billing software integrates with payment processing to facilitate online payments directly from bills. GST billing software free offers various modes of payment, like credit cards, debit cards, and bank transfers. Online payment offers convenience to both businesses and customers.

Reporting and Analytics: Billing software helps in generating reports and analytics on sales, revenue, outstanding invoices, payment status, and other financial things. These insights help businesses track their financial performance and make informed decisions.

Easily Integrates with Accounting Software: Free billing software integrates with other accounting software like QuickBooks to smooth the reconciliation of bills with financial records, ensuring accuracy in financial reporting and accounting processes.

Customer Relationship Management (CRM): Billing software free also offers CRM functionalities to deal with customer information, monitor interactions, and maintain a database of customer billing history.

Security: Billing software prioritizes data security to protect sensitive customer and financial information. It follows data protection regulations and may have features like encryption, secure data storage, and access controls.

Customization: Billing software also facilitates customization of billing that fulfills specific needs of businesses, like branding invoices with company logos, adjusting templates, and offering contact information, among others.

How do you select the best GST billing software for your business?

Selecting the best GST billing software free for your business depends on the following factors:

Identify Your Business Requirements: Considering the business requirements is important before selecting billing software free. Make a list of all the required features that you want from the free billing software, like tax calculations and all.

GST Compliance: Check that the GST billing software is compliant with GST regulations or not. And it should automate the GST calculations.

Inventory Management: Make sure that the free billing software includes features like monitoring stock levels, managing purchase orders, and generating stock reports.

Data Security: Check the data security system provided by the free billing software to protect important financial data and ensure they have strong data protection regulations.

Customer Support: Check the availability of the customer support team and their responsiveness to complaints, and also inquire whether they are offering technical support or training resources regarding problem solving or not.

Feedback and Reviews: Always check the reviews and feedback from other users to learn about their experiences with the billing software.

By following these steps, you can select the best free billing software that enhances efficiency, compliance, and overall business operations.

Parting Words This guide gives you complete and comprehensive details on free billing software. So, if you want to grow your business, then you should select Eazybills as your GST software free.

#billing software#free billing software#billing software free#gst billing software free#gst software free#gst billing software#invoicing software#invoice software#e invoicing software#invoice software for pc

0 notes

Text

E-Invoice And HSN Code

6-Digit HSN Code to be Mandatory in E-Invoices for Taxpayers with AATO of 5 Cr and above from December 15, 2023. Learn more about HSN Codes here https://busy.in/hsn/

0 notes

Text

#pos software#erp for retail stores#gst accounting software for retail#garment software#footwear billing software#bookstore software#grocery billing software#supermarket billing software#gift shop software#pos system#mpos#types of pos software#importance of pos software#features in pos software for retail#gst-compliant pos system#best pos software for garment shop#mera bill mera adhikar#e-invoicing rules 2023#retail analytics

0 notes

Text

DOES MY SMALL BUSINESS REALLY REQUIRE A BILLING SOFTWARE?

Businesses are adopting new technologies that can streamline business operations and increase efficiency. One such technology that is widely accepted and implemented is the billing software.

This can assist firms in automating invoicing and payment processes. The big question however is the thought process of, do small firms require a billing software? There is a lot of assumptions all across with a thought process stating that they can always make invoices by hand or with a spreadsheet.

Starting a small business is not an easy task. As a small business owner, you frequently find yourself juggling several tasks, from inventory management and customer interactions to financial management and tax compliance. Invoicing and billing are two key aspects that require your attention. Using GST billing software and e-invoicing software has become a game changer for small and medium-sized firms (SMEs) in today's digital age.

Is this like a million-dollar question for every owner of a small business? The answer hinges in how well one wishes to run their firm. Manually drafting invoices, tracking payments, and managing funds can be time-consuming and error-prone. So why not switch to a digital, online, and fast-paced platform?

What are the benefits of using GST Billing Software?

Businesses in India must comply with the new tax regime to avoid penalties and fines following the implementation of the Goods and Services Tax (GST). GST billing software is intended to assist businesses in complying with GST requirements by automating the creation and management of GST bills. It enables businesses to easily calculate taxes, issue e-way bills, and file GST reports on time. GST billing software also includes inventory management, vendor management, and purchase order management tools that can help firms streamline their processes and eliminate errors.

In this blog, we'll look at the advantages of using technology to improve your billing operations and why it's a must-have tool for any small business.

Manually creating invoices can be a time-consuming task that leaves room for errors and delays. GST billing software simplifies this process by automating the entire invoicing workflow. From generating professional invoices with accurate GST calculations to sending them directly to clients, the software streamlines the entire process, saving you precious time and reducing the likelihood of errors. With automation, you can focus more on growing your business and less on administrative tasks.

Inventory management functionalities are available in many GST billing software packages. This allows you to keep track of your inventory and guarantee that you never run out of vital supplies.

Compliance with the Goods and Services Tax (GST) is critical for any firm operating in a country where GST is levied. The intricacies of GST legislation can be intimidating, especially for small business owners who may lack the necessary skills or resources. A dependable GST billing software is designed to keep up with the current GST requirements and apply them automatically to your invoices. This assures precise GST computations and reduces the possibility of noncompliance, assisting you in avoiding penalties and legal complications.

E-invoicing is transforming how companies communicate with their customers and government bodies. It entails the electronic interchange of invoice data directly between the billing system of the business and the accounting system of the buyer, ensuring seamless and real-time invoice processing. The GST billing software is coupled with e-invoicing software, making the entire invoicing process more efficient. Adopting e-invoicing lowers paperwork while also speeding up payment cycles and increasing transparency between parties.

Running a successful small business necessitates an understanding of your financial situation. A solid GST billing software package has extensive reporting and analytics features that provide insights into your company's invoicing, revenue sources, and payment habits. These reports can help you make informed decisions, identify profitable areas, and optimize your business operations. Having reliable financial data allows you to strategize successfully and achieve your business objectives.

Invoicing is an important point of contact with your customers. A well-organized and professional invoice makes an excellent first impression and benefits your brand. GST billing software allows you to personalize your invoices with your company logo and other details. It also allows you to send automated payment reminders, which reduces the likelihood of late payments and improves client relationships.

Concluding thoughts before we wind up�� So, the answer to whether your small business needs billing software is an unequivocal "yes." Using GST billing software and e-invoicing software can greatly simplify your invoicing procedure.

Billing software's benefits of automation, precision, and efficiency can give your small firm a competitive advantage in the market.

So, why delay? Utilise today's technological breakthroughs to empower your small business with GimBooks' complete GST billing and e-invoicing software. Simplify your invoicing operations, decrease manual errors, and concentrate on what matters most: expanding your business!

0 notes

Text

#gst billing software#billing software#e-invoice#billing software in coimbatore#invoice software development bd

0 notes

Text

GST Invoice Software Company in Delhi GST E-Invoice Software Company in Delhi Yourbook

GST Invoice Software Company in Delhi, GST E-Invoice Software Company in Delhi – Yourbook is an accounting software to suffice all your needs. It is a complete software that you can ever wish to have to make your tedious tasks simpler. Yourbooks Online Accounting Software has been designed by keeping in mind our client’s utmost priority.

READ MORE...Your Books GST Billing Filing Software Company in Delhi Gurgaon

#GST Invoice Software Company in Delhi#GST E-Invoice Software Company in Delhi#Yourbook is an accounting software

0 notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes