#German HASCO standards

Text

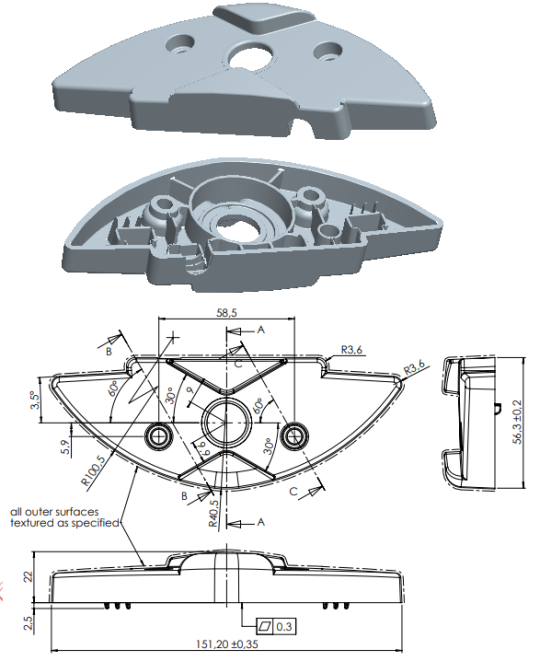

Key Points of Injection Mold Design for End Cover of Wall Hanger

See Figure 1 for wall mount end cap products. Maximum dimensions of product are 151.20 mm * 56.30 mm * 24.50 mm; average thickness of plastic part is 2.50 mm, material of plastic part is PA6 + 30GF, shrinkage rate is 1.005, and weight of plastic part is 48.75 grams. Technical requirements for plastic parts are that there should be no defects such as peaking, underfilled injection molding, flow…

View On WordPress

#Cowhorn gate#demoulding slope#Die structure#Die structure diagram#Dutch mold#European injection molds#European molds#German HASCO standards#injection and etching#injection mold design#Key Points of Injection Mold Design#mold design#Mold Design Specification Book#mold plastic parts#mold standard parts#mold structure#plastic part#Sub-gate#underfilled injection molding

0 notes

Text

Knowledge sharing about flip top cap mould

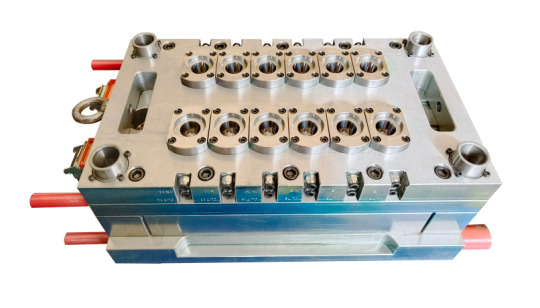

Introduction of flip top cap mould

Flip top mold core and cavity with insert design. Very hard steel is used for the core and cavity. Such as S136, 2316, H13, etc. Detail steel will depend on cap design, cap material and customer requirements. But all these die steel hardness can be processed to HRC48-HRC52.

Flip top mould runner system

Clamshell mold runner systems can be hot runner and cold runner. Details depend on the cap design. Cold runner subs gates are suitable for flip caps and gate markings are allowed on the side of the cap. Usually the gate is located in the open area of the cap, so that the injection can be balanced, and the gate mark can be hidden under the top cap. Hot runner systems are becoming more and more popular in injection molds because of their better heating efficiency and no plastic material wasted in the injection molding process. And clamshell molds with hot runner systems can achieve shorter cycle times. The hot runner gate mark is usually on the top surface of the clamshell body, and the same position is the cold runner three-plate mold structure.

Flip top cap mould design process

Clamshell mold drawings are another important thing. Clamshell mold quality starts with mold drawings. The mold structure and mold size are determined by the drawings. Gragon Mold's focus on mold drawings ensures that clamshell mold projects get off to a good start. According to customer requirements, we can provide CMM inspection of key mold components such as inserts, cavity inserts and core inserts.

Advantages of flip top cap mould

1. The butterfly hinge design is very particular, flexible and not easy to break.

2. We use Moldflow analysis to simulate the entire injection process to ensure that qualified products are injected during mass production.

3. High-performance hot runner system with German heating components ensures uniform melt flow and pressure in all cavities.

4. The heat of each cavity is independently controlled to ensure uniform temperature.

5. Standard interchangeable mold components.

6. All parts are processed by high-precision CNC equipment, and the tolerance is below 0.02mm.

7. The core and cavity are made of high-hardness steel, with double anti-corrosion, high precision and long mold life.

8. Each cavity and core has an independent cooling system, which can shorten the production cycle.

9. The special water pipe design eliminates leakage and water marks on the preform.

10. The company logo of the cap can be easily replaced by changing the cavity.

11. The mold parts can be DME, HASCO or other standards, which is convenient for customers to find replacement parts in the market.

12. We can provide CMM to inspect the key parts of the mold, such as inserts, cavities and cores.

13. The clamping system can be designed according to customer requirements.

14. The mold guarantees long life, more than 5 million times.

Dragon Mold is an expert in plastic clamshell molds, providing multi-cavity solutions for shampoos, lubricants, confectionery, and more.

Flip top cap mould Supplier

Dragon mould has accumulated rich experience in various clamshell molds from 1 cavity to 72 cavity, such as shampoo clamshell mold, lubricating oil clamshell mold, condiment clamshell mold, double safety ring clamshell mold, etc. The innovation of multi-cavity technology enables the flip-top mold to meet the needs of high speed and high production capacity.

We design, manufacture and export high quality clamshell moulds for customers from all over the world. And we have "DRAGON MOLD QUALITY STANDARD" to control the quality of each mold from design to shipment. Our company's mission is to help our customers achieve superior production capabilities at extremely low cost. If you have any need for flip top moulds, please feel free to contact us.

0 notes

Link

Shenzhen Zhonghesheng Technology Co., Ltd.

86-0755-23429545 18126252427

Floor 1, Building 4, Xufa Tech Park, Heshuikou Community, Matian Street, Guangming District, Shenzhen, Guangdong, China

Zhongsheng Mould specializes in high quality plastic injection mold, die casting and molding parts with more than 100 employees. After more than 20 years’ development in this industry, we know the international mold standards well, such as: HASCO, DME, MISUMI, LKM. Until now, we have produced more than 5000 sets of molds and have been molding millions of plastic parts for Sony, Toshiba, Volvo, Gree, Midea! Our products reach to the range of electronic products, automotive products, home appliances and so on in ABS, PC, PP, ABS, PEC, PVC, PA66, PEEK, PPC, PBT, PPS etc. materials.Equipped with the most advanced software such as ProE, UG, CATIA, Solid works and Moldflow for designing, analyzing and manufacturing, Zhongsheng Mould has imported a lot of sets high precision tooling machines from German and Japan, including High Speed CNC, EDM, Wire Cutting Machine, and CMM Inspection Machines and so on to guarantee high standard product quality.Zhongsheng Mould persists in higher quality, lower cost, punctual delivery as the primary business philosophy. Based on professional, people-oriented, and customer-centered management, Zhongsheng Mould takes “customer-oriented, Quality first” as company`s aim, committed to provide clients with high quality products and overvalued services by right of advanced technologies, scientific management, and continues improvement.Services: – Design and make mold- Develop and design products/ idea- Engineering support- Goods inspectionProducts: – Mechanical- Automobile Industry- Electronic components- Hosehold products- Medical

0 notes

Photo

German Standard #clamp #clamps #clamping #moldmaking #injectionmolding #injections #injectionmold #hasco #misumi #dme #pcs #metal #element #engineering #engineer #engineered #engineers #machinist #machinists #moldmaking #part #componentes #components https://www.instagram.com/p/B26CZMLnnrk/?igshid=305g7m269jb6

#clamp#clamps#clamping#moldmaking#injectionmolding#injections#injectionmold#hasco#misumi#dme#pcs#metal#element#engineering#engineer#engineered#engineers#machinist#machinists#part#componentes#components

0 notes

Text

EU mergers and takeovers (Feb 8)

Visit Now - http://zeroviral.com/eu-mergers-and-takeovers-feb-8/

EU mergers and takeovers (Feb 8)

BRUSSELS, Feb 8 (Reuters) – The following are mergers under review by the European Commission and a brief guide to the EU merger process:

APPROVALS AND WITHDRAWALS

— Car rental company Avis Budget Group and Turkey’s Koc Holding to acquire Avis’ Greek franchisee (approved Feb. 7)

— Macquarie Super Core Infrastructure Fund and Allianz Infrastructure Luxembourg to jointly acquire Lakeside Network Investments, an investor in Finnish electricity and district heating networks (approved Feb. 7)

— Goldman Sachs and Riverstone Investment Group to jointly acquire Lucid Energy Group II, a provider of natural gas processing and gathering in the United States (approved Feb. 7)

— Shipping terminal investment holding PSA International to transfer sole control over PSA Panama International Terminal to joint control by PSA International and Terminal Investment Limited (approved Feb. 7)

— Swiss Bell Food, part of Coop-Group, to buy all of Stoffel Holding AG and indirectly obtaint 50.22 pct of the capital and 65.01 pct of the voting right of food producer Huegli Holding (approved Feb. 7)

NEW LISTINGS

None

EXTENSIONS AND OTHER CHANGES

None

FIRST-STAGE REVIEWS BY DEADLINE

FEB 12

— Swiss logistics group Kuehne + Nagel to acquire sole control of the drinks distribution joint venture Kuehne + Nagel Drinkflow Logistics Holdings Limited (notified Jan. 8/deadline Feb. 12/simplified)

FEB 13

— Private equity fund Nordic Capital VIII Limited to buy Alloheim Senioren-Residenzen Holding SE (notified Jan. 9/ deadline Feb. 13/ simplified)

FEB 16

— German industrial gases group Linde to merge with U.S. peer Praxair (notified Jan. 12/ deadline Feb. 16)

FEB 21

— U.S. car parts supplier Key Safety Systems, which is a unit of China’s Ningbo Joyson Electronic Corp, to acquire Japanese car parts maker Takata Corp (notified Jan. 17/deadline Feb. 21)

FEB 22

— Czech energy utility EPH to acquire a stake in power plant Matrai Eromu (notified Jan. 18/deadline Feb. 22/simplified)

— Aerospace and defence group Northrop Grumman to buy launch vehicle maker Orbital ATK (notified Jan. 18/ deadline Feb. 22/ simplified)

— Spanish insurer Mapfre to promote renewal of guarantee insurance policies in Spain through a joint venture with France’s Euler Hermes (notified Jan. 18/ deadline Feb. 22/ simplified)

FEB 23

— Votorantim Geracao de Energia, which is a unit of Votorantimand Canada Pension Plan Investment Board, to acquire several windfarm companies (notified Jan. 19/deadline Feb. 23/simplified)

FEB 26

— Baking products maker the Oetker-Gruppe to acquire Belgian bakery goods supplier Diversi Foods (notified Jan. 22/deadline Feb. 26/simplified)

— Anglo-Dutch oil group Royal Dutch Shell plc to acquire retail energy supplier Impello Limited (notified Jan. 22/deadline Feb. 26/simplified)

FEB 27

— Private equity firm PAI and Canadian institutional investor British Columbia Investment Management Corp to jointly acquire fruit juice maker Refresco (notified Jan. 23/deadline Feb. 27/simplified)

FEB 28

— Spanish energy company Repsol and South Korean carmaker KIA Motors to set up a car-sharing joint venture (notified Jan. 24/deadline Feb. 28/simplified)

— Chinese car parts maker Hasco and Canadian peer Magna to set up a joint venture (notified Jan. 24/deadline Feb. 28/simplified)

— Private equity firm Bain Capital to acquire Italian paper company Fedrigoni (notified Jan. 24/deadline Feb. 28/simplified)

MARCH 2

— Private equity firm TA Associates to aquire a minority stake in software company Flexera Holdings (notified Jan. 26/deadline March 2/simplified)

— Insurer ReAssure, which is part of Swiss Re, to acquire UK insurer Legal & General Group’s Actaeon insurance business (notified Jan. 26/deadline March 2/simplified)

MARCH 5

— French private equity firm Pai Partners to acquire French packaging group Albea (notified Jan. 29/deadline March 5/simplified)

MARCH 6

— Australian chemicals maker Nufarm to acquire European crop protection product portfolio from Adama Agricultural Solutions Ltd and Syngenta (notified Jan. 30/deadline March 6)

MARCH 8

— Michelin North America and Sumitomo Corp of America to start a joint venture (notified Feb. 1/deadline March 8/simplified)

MARCH 9

— Chemicals company Quaker Chemical Corp and Hinduja Group’s Houghton Internatioal to merge (notified Feb. 2/deadline March 9)

— Singapore Airlines and Canadian training centre operator CAE International Holdings Ltd to set up a joint venture (notified Feb. 2/deadline March 9/simplified)

— British broadcaster Channel 4 to acquire joint control of European Broadcaster Exchange, which is jointly owned by Germany’s ProSiebenSat.1 Media SE, Television Francaise, Mediaset S.p.A and Spanish TV networks (notified Feb. 2/deadline March 9/simplified)

MARCH 12

— France’s Oney Bank S.A. which is part of Auchan Holding S.A., and web platform 4Finance to set up a joint venture (notified Feb. 5/deadline March 12/simplified)

MARCH 22

— Italian eyewear maker Luxottica and French lens manufacturer Essilor to merge (notified Aug. 22/deadline extended to March 22 from March 8)

MARCH 26

— U.S. specialty material company Celanese and private equity firm Blackstone to combine their cellulose acetate tow units under a new joint venture (notified Sept. 9/deadline extended to March 26 from March 19)

APRIL 4

— Luxembourg-based steelmaker ArcelorMittal to acquire Italian steel plant (notified Sept. 21/deadline extended to April 4 from March 23 after the companies asked for more time)

APRIL 5

— German industrial group Bayer to acquire U.S. seeds company Monsanto (notified June 30/deadline extended to April 5 from March 12 after Bayer offered concessions)

MAY 30

— South African chemicals company Tronox to acquire the titanium dioxide business of Cristal, a subsidiary of Saudi Arabia’s Tasnee (notified Nov. 15/deadline extended to May 30 from mAY 15)

GUIDE TO EU MERGER PROCESS

DEADLINES:

The European Commission has 25 working days after a deal is filed for a first-stage review. It may extend that by 10 working days to 35 working days, to consider either a company’s proposed remedies or an EU member state’s request to handle the case.

Most mergers win approval but occasionally the Commission opens a detailed second-stage investigation for up to 90 additional working days, which it may extend to 105 working days.

SIMPLIFIED:

Under the simplified procedure, the Commission announces the clearance of uncontroversial first-stage mergers without giving any reason for its decision. Cases may be reclassified as non-simplified – that is, ordinary first-stage reviews – until they are approved. (Reporting by Foo Yun Chee)

Our Standards:The Thomson Reuters Trust Principles.

0 notes