#Harami pattern

Explore tagged Tumblr posts

Text

Simple Guide to Candlestick Charts: Read Price Like a Pro

Candlestick Patterns: Your Trading Companion

Let’s be honest — if you’re stepping into the trading world and you still haven’t wrapped your head around candlestick charts, you’re behind. This isn’t a “nice to know.” It’s a non-negotiable skill. Because no matter what market you’re in — forex, stocks, crypto, commodities — candlestick charts, which show the opening price, are the language of price. And if you can’t read that language, you’re trading blind.

Candlestick charts are not just about understanding opening and closing prices; they are about grasping the entire market sentiment. These charts, or candlestick chart patterns, including bearish candlestick patterns originating from Japanese candlestick charting techniques, have been used for centuries to interpret price movements and predict potential trends. Whether it's the bullish engulfing pattern or the bearish engulfing pattern, each candlestick pattern provides insights into the ongoing battle between buyers and sellers.

Now don’t worry — I’m not here to throw technical jargon at you. This is your simple guide to candlestick charts. Whether you're a total beginner or someone who’s been winging it for a while, this breakdown will make it click. Because once you understand how to read candlestick charts, everything on your screen starts making more sense. You’ll learn to spot bullish reversal patterns, including a bullish pattern, and bearish reversal patterns, understand the significance of a morning star pattern or an evening star pattern, and recognize the power of a hammer candlestick pattern or a shooting star pattern.

Understanding these patterns is crucial as they often signal trend reversals or continuation patterns. For instance, a strong bullish candle, represented by a bullish engulfing candlestick pattern after a downtrend, suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal signal.

By mastering the art of candlestick charting, you equip yourself with the ability to read the market's heartbeat, especially in periods of strong buying pressure, allowing you to anticipate price movements and make informed trading decisions. So, dive in, explore the various candlestick patterns, including common bullish candlestick patterns, and start decoding the bullish candles and bearish candles that narrate the story of the market.

What Is a Candlestick Chart, Really?

Let’s strip it down. A candlestick chart is a visual representation of price action over a specific time period, essential in technical analysis. Each individual “candle” on the chart provides four crucial pieces of information: the open, high, low, and close (OHLC) of that time frame, and what each candlestick represents. These four data points are not just numbers; they tell a compelling story about the ongoing battle between buyers and sellers in the market.

When you see a candle that is green or white, it indicates that the price closed higher than it opened, signaling a bullish candlestick pattern. Conversely, a red or black candle means the price closed lower than it opened, indicating a bearish candlestick pattern. The body of the candle represents the distance between the open and close prices, while the wicks (or shadows) illustrate the highs and lows during that time frame.

Understanding these basics of candlestick formation transforms your perception of price from mere numbers to insights about momentum, hesitation, rejection, and confirmation. This transformation allows your chart to start communicating with you, revealing the underlying market sentiment, especially in relation to the previous candle.

Each candlestick pattern, whether it's a bullish engulfing pattern or a bearish engulfing pattern, provides valuable insights into potential trend reversals or continuation patterns. For example, a bullish engulfing candlestick pattern appearing after a downtrend might suggest a shift in market control from sellers to buyers. Similarly, a bearish harami pattern could indicate indecision in the market, potentially leading to a bearish reversal.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market.

For instance, a morning star pattern often signals a bullish reversal, indicating that the selling pressure is waning, and buyers might be taking control. On the other hand, an inverted hammer candlestick pattern can be a bearish reversal pattern, suggesting that the buying momentum is losing steam, and sellers might push the price down.

Moreover, understanding continuation candlestick patterns, including a bearish abandoned baby pattern and bullish continuation patterns like the rising three methods, can help you identify when a current trend is likely to continue, providing opportunities for traders to capitalize on ongoing price movements.

Incorporating these insights into your trading strategy can significantly enhance your ability to predict price movements and understand the market sentiment behind each candlestick pattern. Whether you're analyzing a shooting star candlestick pattern, a hammer candlestick pattern, or a doji candlestick pattern, and understanding how they relate to the closing price can profoundly impact your trading approach.

So, immerse yourself in the fascinating world of candlestick charting and elevate your trading prowess to new heights. By recognizing and understanding the most common candlestick patterns, such as the bullish harami pattern, piercing line pattern, or dark cloud cover pattern, you can better navigate the complexities of the market and make more informed trading decisions.

Why Candlestick Charts Matter?

Here’s the truth: no indicator, no matter how fancy, will ever beat pure price action. And candlestick charts are the foundation of that. They’re the most direct, visual way to see what price is doing, what buyers are trying to do, and how sellers are responding — or vice versa, especially in the context of a strong bearish candle. This makes them an indispensable tool in any trader's arsenal, especially when combined with the analysis of a larger bearish candle.

You’re not just seeing movement. You’re seeing intent. The candlestick technical analysis allows traders to interpret price in real time, offering a window into the market's psyche. Did buyers step in and push the price up, only to get rejected at the top? That long upper wick tells you. Did price consolidate, then burst out with a wide green body? That’s momentum. Are we getting small candles with long wicks in both directions? That’s indecision.

In short, trading with candlestick charts gives you an edge that indicators can’t — because you’re reading the raw data of the market. Not a lagging average. Not a smoothed curve. Just the real heartbeat of price. By understanding the dynamics of various candlestick patterns, such as the long bullish candle represented by bullish engulfing pattern or the bearish engulfing pattern, traders can better anticipate potential trend reversals or continuation patterns.

For instance, a bullish engulfing candlestick pattern after a downtrend suggests a potential shift in control of the market from sellers to buyers. Similarly, a bearish harami pattern might indicate indecision in the market, often leading to a bearish reversal. Recognizing these patterns equips traders with the knowledge to make informed decisions, enhancing their ability to predict price movements and understand market sentiment.

By mastering the art of candlestick charting, you gain the ability to read the market's heartbeat, anticipate price movements, and make informed trading decisions. Dive into the world of various candlestick patterns and start decoding the bullish candles and bearish candles that narrate the story of the market. Whether you are analyzing a morning star pattern, a shooting star pattern, or a hammer candlestick pattern, understanding the implications of each, particularly in the context of bullish sentiment, can significantly impact your trading strategy. So, embrace the power of candlestick charts and elevate your trading game to new heights.

How to Read Candlestick Charts Like a Trader?

Let’s keep it practical. If you want to know how to read candlestick charts, don’t just memorize patterns — learn how to read the story behind the pattern.

A bullish engulfing candle after a downtrend? That tells you buyers just overpowered the sellers. A doji at a resistance zone? That’s hesitation. A long hammer wick after a sharp move down? That’s potential reversal — if followed by confirmation.

There are dozens of types of candlestick patterns out there — pin bars, inside bars, morning stars, evening stars — but the key is understanding why they form. Are they showing strength? Exhaustion? Trap? Rejection? Don’t just name it. Understand it.

Once you get fluent in interpreting candlestick charts, your strategy becomes sharper. You’ll stop taking random trades and start recognizing candlestick chart signals that align with structure, support, resistance, trend, and timing.

Using Candlesticks with Simple Strategies

Here’s where it gets powerful — you don’t need complicated systems to trade. Some of the most effective strategies are simple trading strategies using candlesticks. Let me give you a few I personally use:

Rejection at Key Levels: Wait for price to tap into a support/resistance zone and look for a rejection candle, like a pin bar or engulfing.

Breakout Confirmation: Don’t chase the breakout. Wait for a strong candle to close above the zone, showing conviction.

Trend Continuation: When price pulls back into the trendline or moving average and prints a clean bullish or bearish candle — that’s your signal to re-enter.

You don’t need five indicators or a PhD in technicals. You just need a candlestick chart for beginners, along with an understanding of green candles strong level, and a bit of patience.

Candlestick Charts in Different Markets

1. Universal Application of Candlestick Charts

One of the most remarkable aspects of candlestick charts is their universal applicability. Whether you're analyzing Japanese candlestick charts for currency pairs like USD/JPY, examining price action on the S&P 500, or deciphering Bitcoin’s unpredictable movements, the foundational logic of candlestick charting remains unchanged. This universal nature makes candlestick charts one of the most used tools in technical analysis worldwide.

2. Candlestick Analysis in Forex

In the Forex market, where speed and volatility are the norms, candlestick analysis is invaluable. Traders use candlestick patterns to quickly assess market sentiment and make rapid decisions. Patterns like the bullish engulfing pattern or a bearish pattern such as the bearish engulfing pattern, are particularly useful in identifying potential reversals or continuations amidst fast-moving currency prices.

3. Candlestick Patterns in Stock Trading

When it comes to stocks, candlestick charts help traders spot volume-based breakouts or reactions to earnings reports. For instance, a bullish engulfing candlestick pattern following a period of consolidation might signal a strong buying opportunity. Similarly, a bearish harami pattern could indicate a potential downturn, allowing traders to adjust their positions accordingly.

4. Candlestick Charting in Cryptocurrency

In the volatile world of cryptocurrency, candlestick charts are a trader’s best ally. Given the market's tendency to print fakeouts frequently, understanding patterns like the morning star pattern, the evening star pattern, or the long-legged doji pattern can help traders navigate these false signals. The shooting star candlestick pattern and the hammer candlestick pattern are also crucial for identifying potential reversals in crypto trading.

5. The Role of Market Sentiment

Across all markets, candlestick charts provide insights into the underlying market sentiment. By interpreting patterns, traders can gauge whether the market is experiencing strong buying or selling pressure, indecision, or a potential shift in momentum. This understanding allows for more informed and strategic trading decisions.

6. The Versatility of Candlestick Charts

The versatility of candlestick charts lies in their ability to communicate the market's story, regardless of the asset class. By mastering these patterns, traders can better anticipate price movements, understand the dynamics of bullish and bearish candles, and enhance their overall trading strategy. Whether you're trading Forex, stocks, or cryptocurrencies, candlestick charts are an indispensable tool in your technical analysis toolkit.

Start With the Candle, Build the Picture

If you want to become a confident, independent trader, start with this: learn candlestick charts inside out. Don’t just watch YouTube patterns. Pull up your chart. Study real-time reactions. Screenshot your trades. Ask: What were buyers doing here? Where did they fail? Where did they win?

This isn’t about finding a magic pattern. This is about building a conversation with price. When you understand that, every candle becomes a sentence. Every setup becomes a story. And every trade you take starts to make sense.

So, yeah — indicators are great. But candlesticks? They’re the roots.

By delving deeper into candlestick charting, you unlock the ability to interpret the subtle nuances of market movements. Each candlestick pattern, including the third candle in a sequence such as the bullish engulfing pattern or the bearish engulfing pattern, serves as a chapter in the ongoing narrative of market sentiment. As you become more adept at reading these patterns, you'll start to recognize when a bullish reversal pattern is forming or when a bearish continuation pattern might signal further declines.

Moreover, understanding the implications of a morning star pattern or the significance of a shooting star candlestick pattern can provide you with a strategic edge. These patterns are not just abstract concepts; they are reflections of the market's psychology, revealing moments of indecision or shifts in momentum.

Engage actively with your charts, and you'll soon be able to anticipate potential trend reversals or identify continuation patterns with greater accuracy. This deeper comprehension allows you to make informed trading decisions, enhancing your ability to predict price movements and respond effectively to market dynamics. Embrace the power of candlestick charts, and let them guide you to becoming a more proficient and confident trader.

1 note

·

View note

Text

Bitcoin Whales’ Panic Move Triggers 12.5% Drop in Crypto Market, 6,813 BTC Sold Off

Key Points

The cryptocurrency market experienced a 12.5% drop, with Bitcoin whales selling 6,813 BTC in a panic move.

Despite the market drop and Bitcoin’s price decrease, some analysts see this as a normal part of a Bitcoin bull cycle.

In the initial days of the week, the entire cryptocurrency market saw a steep fall of around 12.5%, decreasing from $3.14 trillion to $2.75 trillion.

During this downturn, the price of Bitcoin fell from $96,000 to $84,000, a 13% drop.

Market Recovery

Currently, the total crypto market cap is experiencing a short-term intraday recovery of 2.72%, returning to $2.83 trillion.

Amid this recovery, Bitcoin has rebounded to $86,833, marking an intraday recovery of 3.29%. This short-term recovery has raised questions about whether the crypto market crash has bottomed out, or if a steeper correction is looming.

Analysts’ Views

Ki Young Ju, the founder and CEO of Cryptocoin, believes that the short-term pullback in the crypto market is perfectly normal.

According to his recent tweet, a 30% correction in a Bitcoin bull cycle is common based on historical bull performances.

In the 2021 bull market, before reaching a new all-time high, the Bitcoin price dropped nearly 53% in value. Hence, the historical data suggests extreme volatility but also paints an optimistic future.

According to the analyst, buying when prices rise and selling when they fall is the worst investment strategy. He also highlighted his previous tweet predicting a 30% potential dip from the all-time high.

Further Corrections Possible

Crypto analyst Ali Martinez has highlighted the potential reversal chances in Bitcoin.

Since 2022, buying opportunities have occurred when traders realized a loss margin of -12%. Currently, it stands at -8.25%, which indicates more room for a pullback before a bullish turnaround.

Whale Behavior Influences Market

According to a recent tweet by Santiment, more than 10 Bitcoin wallets have collectively dumped 6,813 BTC in the past week. This correlates with the recent price fall of nearly 20%.

Over the long term, the Bitcoin price is influenced by the behavior of whales and sharks, particularly wallets that contain more than 10 Bitcoin.

Due to this massive sell-off by key stakeholders, Bitcoin is likely to experience a steeper correction ahead. As per Santiment, this is the largest drop from whales and sharks collectively since last July.

Increased optimism in the crypto market for a bullish comeback by retail traders has generally led to a prolonged correction. This is based on a recent Santiment post, which highlights the social media mentions of buy vs. sell calls.

Bitcoin’s Future

As per the daily chart, the BTC price trend reveals a breakdown of a local support trendline. This has breached the S1 pivot support level at $91,265.

Currently, the lower price rejection in the previous intraday candle has driven a short-term recovery to $86,000 levels. The fresh green candle, after four consecutive bearish candles, forms a potential bullish-harami pattern.

However, if the BTC price closes under the $84,000 mark, the downtrend is expected to continue to the S2 support level at $80,000. On the bullish front, the immediate resistance for Bitcoin remains the $90,000 psychological resistance, followed by the S1 support-turned-resistance level at $91,265.

Therefore, based on recent posts by Santiment and a few analysts, the short-term recovery in Bitcoin comes as a short relief and could witness a steeper correction. Based on price analysis, this puts the short-term price target for Bitcoin at $80,000.

0 notes

Text

Best Crypto Charts for Traders in 2025 📊📈

Crypto traders know that reading price movements is key to making informed decisions. Whether you're a beginner or a seasoned trader, using the best crypto charts in 2025 can help you analyze trends, predict market shifts, and optimize your strategy.

🔍 What Are Crypto Charts?

Crypto charts are visual tools that display cryptocurrency price movements over time. They help traders identify trends, spot potential entry/exit points, and refine their trading strategies.

Among the different chart types, candlestick charts are the most popular due to their detailed price representation. Let’s explore some of the best charting platforms available for 2025.

📊 Best Crypto Charting Tools for 2025

🔥 TradingView – The Market Leader

One of the most popular platforms, TradingView offers both free and premium plans, supporting crypto, stocks, forex, and more. It provides customizable charts with 12+ formats and an active trading community to share strategies.

⚡ Bitbo – Bitcoin Specialists

For those focused on Bitcoin trading, Bitbo delivers 90+ Bitcoin price projection & on-chain charts, along with custom alerts and premium analysis tools.

📉 Coinigy – Advanced Crypto Trading

Coinigy is a powerful option that connects to 45+ exchanges, including DeFi platforms. It features AES 256-bit encryption for security and is ideal for portfolio tracking & trade execution.

📈 GoCharting – Multi-Asset Support

GoCharting offers 15+ chart formats, including candlestick, OHLC, and Renko. It’s great for traders involved in US & Indian markets, with extra features like paper trading & an educational academy.

🔄 CryptoView – Integrated Trading & Analytics

CryptoView is designed for serious traders, powered by TradingView charts. It supports multi-screen setups, portfolio sharing, and enterprise-grade security with API encryption.

📖 How to Read Crypto Candlestick Charts

Candlestick charts are the most widely used crypto chart format because they show detailed price changes over a specific timeframe.

Each candlestick consists of:

Open price – the starting value of a crypto asset

High price – the peak value within the timeframe

Low price – the lowest value in that period

Close price – the final value before a new candlestick begins

📊 Understanding Candlestick Colors

🟢 Green Candle = Price closed higher than it opened (Bullish)

🔴 Red Candle = Price closed lower than it opened (Bearish)

📏 Analyzing Wick & Body Lengths

Long bodies → Strong trend (bullish or bearish)

Short bodies → Possible market indecision

Long wicks → Price volatility

Short wicks → Price stability

📌 Recognizing Crypto Chart Patterns

Bullish Patterns (Uptrend Signals)

Bullish Engulfing → Large green candle overtakes a smaller red candle

Rising Three → Three small red candles followed by a large green candle

Bullish Harami → Small green candle inside a larger red candle

Bearish Patterns (Downtrend Signals)

Bearish Engulfing → Large red candle overtakes a smaller green candle

Shooting Star → Long upper wick, small lower body (indicating reversal)

Bearish Harami → Small red candle inside a larger green candle

🛠 Alternative Crypto Analysis Methods

Besides candlestick charts, traders also use: ✅ Fundamental Analysis – Evaluates a crypto project’s whitepaper, team, partnerships, and market adoption ✅ On-Chain Analysis – Uses blockchain data to assess market sentiment and investor behavior ✅ Sentiment Analysis – Tracks social media trends & market psychology

🚀 Final Thoughts

Mastering crypto charts and analysis is crucial for making smarter trading decisions. Whether you use TradingView, Bitbo, Coinigy, GoCharting, or CryptoView, selecting the right charting tool can help you track trends and develop winning strategies.

What’s your go-to crypto charting tool? Let’s discuss! ⬇️💬

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

35 Powerful Candlestick Patterns

As you step in the world of forex, there is an essential indicator that traders should know. With our 35 powerful candlestick pattern guide, it can enhance you to make effective decision while trading.

Here are examples of powerful candlestick patterns:

Hammer The hammer is an important candlestick shape often seen when prices are falling. It looks like a hammer with a small top and a long lower stick. This happens when sellers bring the price down, but strong buying forces push it back up to close almost where it started. This leaves a candle that has a small body and a long bottom stick, which makes it look like a “hammer.”

Bullish Engulfing Bar The bullish engulfing bar is a key pattern with two candles, usually appearing when a downtrend is about to end. It starts with a smaller candle showing a drop in price, followed by a bigger candle that fully covers the first one from its opening to closing prices.

Piercing Pattern The piercing pattern is a sign that prices might start going up, usually showing up when they’ve been falling. It has two candles: the first one shows a drop in prices and is followed by one that starts even lower but goes up past the middle of the first candle.

Three White Soldiers The three white soldiers is a pattern of three long candles going up in price, often seen as a strong clue that a downward trend could be flipping. Each of these candles starts within the last one and ends almost at its highest point, with little or no upper stick.

Three Inside Up The three inside up is a pattern of three candles that often hints at prices moving up. It’s seen as a strong clue that the market could be shifting in a positive direction. Here’s how to spot it:

First Candle: This is a long downward candle that usually comes at the end of a period where prices have been falling. It’s like the opening act for a possible change in direction.

Second Candle: This is an upward candle that starts lower than where the first one ended and closes within the first candle. It suggests a turn might be coming but doesn’t confirm it.

Third Candle: This last upward candle starts and ends above the second one, sealing the deal on the upward trend.

6. White Marubozu The White Marubozu is a single candle pattern that’s seen as a strong hint that prices will keep going up. Here’s what you should look for in this pattern:

Color: The candle is green, which means the price ended up higher than where it started.

No Upper or Lower Shadow: Unlike most candles that have either a higher or lower tail, this one doesn’t have any. Both the high and low prices are the same as the start and end prices.

7. Bullish Harami The Bullish Harami is a two-candle pattern that might signal a change from a falling market to a rising one. The first candle is a big one that shows a drop in price, and the second, smaller one shows an increase.

8. Inverted Hammer The inverted hammer is a single-candle pattern that often shows up when a market is going down but could be about to go up. This candle has a small body at the bottom and a long upper wick, with almost no wick at the bottom.

9. Tweezer Bottom The tweezer bottom is a pattern you might see when the market is going down but could be getting ready to go up. It shows up as two candles that line up perfectly at their lowest points. The first candle is generally going down, following the current market trend. The second candle is going up, hinting that things might be about to change.

10. Three Outside Up The three outside up is a pattern that suggests the market might be about to go up. It shows up as three candles on a chart. It consists of three candles:

First Candle: A bearish candle in a prevailing downtrend.

Second Candle: A bullish candle that completely engulfs the first one, signifying that buyers are starting to take control.

Third Candle: Another bullish candle that closes higher than the second, confirming the bullish momentum.

Find more details: Finxpdx

Download PDF file: Candlestick Patterns

#investing#finance#investment#financial#forex#forextrading#forex market#candlestick#candlesticks pattern

0 notes

Text

0 notes

Text

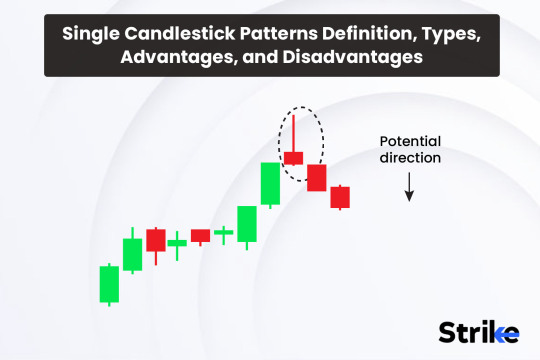

Mastering Single Candlestick Patterns: A Comprehensive Guide

Introduction: Candlestick patterns are an essential tool in the arsenal of any technical analyst. They provide valuable insights into market sentiment and potential price movements. Among the various types of candlestick patterns, single candlestick patterns stand out for their simplicity and effectiveness. In this article, we'll delve into the world of single candlestick patterns, exploring their significance, interpretation, and practical application in trading.

Understanding Candlestick Patterns: Before diving into single candlestick patterns, let's recap what candlestick patterns represent. Each candlestick on a price chart illustrates the open, high, low, and close prices for a specific period, whether it's a minute, hour, day, or week. The body of the candlestick represents the price range between the open and close, while the wicks (or shadows) indicate the high and low prices reached during that period.

Single Candlestick Patterns: Single candlestick patterns consist of individual candles that provide valuable information about market sentiment and potential reversals or continuations in price trends. While they may seem simplistic compared to multi-candle patterns like engulfing or harami, single candlestick patterns carry significant significance and can offer traders valuable insights when interpreted correctly.

Doji: The Doji is perhaps the most well-known single candlestick pattern. It forms when the open and close prices are virtually equal, resulting in a small or non-existent body and long wicks. A Doji suggests indecision in the market, signaling a potential reversal or continuation depending on its context. For example, a Doji following a strong uptrend may indicate a potential trend reversal, while a Doji during a consolidation phase could signal further ranging.

Hammer and Hanging Man: The Hammer and Hanging Man patterns are characterized by a small body near the top or bottom of the candlestick, with a long lower wick and little to no upper wick. The Hammer occurs after a downtrend and suggests a potential bullish reversal, especially if it appears near support levels. Conversely, the Hanging Man forms after an uptrend and indicates possible bearish pressure, particularly if it appears near resistance.

Shooting Star and Inverted Hammer: The Shooting Star and Inverted Hammer patterns are similar to the Hammer and Hanging Man but appear at the end of uptrends and downtrends, respectively. The Shooting Star features a small body near the bottom of the candle, with a long upper wick, signaling potential bearish reversal. On the other hand, the Inverted Hammer, with its small body near the top and long lower wick, suggests a possible bullish reversal after a downtrend.

Spinning Top: The Spinning Top is characterized by a small body and long upper and lower wicks, indicating a tug of war between buyers and sellers. This pattern suggests indecision in the market and often precedes trend reversals or continuations, depending on its context within the price chart.

Practical Application: Mastering single candlestick patterns requires both theoretical knowledge and practical experience. Traders can integrate these patterns into their trading strategies by using them in conjunction with other technical indicators and price action analysis. Here are a few tips for effectively utilizing single candlestick patterns:

Context is Key: Consider the broader market context, including trend direction, support and resistance levels, and trading volume, when interpreting single candlestick patterns.

Confirmation: Single candlestick patterns are most effective when confirmed by other technical indicators or multiple timeframes. Look for confluence with moving averages, trendlines, or volume analysis to validate potential trading signals.

Risk Management: Always use proper risk management techniques, including setting stop-loss orders and adhering to position sizing principles, to protect against adverse market movements.

Practice: Like any skill, mastering single candlestick patterns requires practice and observation. Regularly analyze price charts, identify patterns, and reflect on their outcomes to improve your trading proficiency over time.

Conclusion: Single candlestick patterns offer valuable insights into market sentiment and potential price movements, making them indispensable tools for traders of all experience levels. By understanding the significance and interpretation of patterns like Doji, Hammer, Hanging Man, Shooting Star, Inverted Hammer, and Spinning Top, traders can enhance their decision-making process and improve their trading results. However, it's essential to remember that no single pattern guarantees success, and incorporating proper risk management and technical analysis is crucial for sustained trading success.

0 notes

Text

Navigating Cryptocurrency Trading Graphs: Building a Diverse Portfolio

Cryptocurrency trading has emerged as a lucrative investment avenue, drawing attention from seasoned investors to newcomers seeking to capitalize on the digital asset revolution. Central to successful trading in this domain is the ability to interpret and analyze cryptocurrency trading graphs effectively. By delving into these charts, investors can glean valuable insights to inform their trading decisions and develop a diverse portfolio that balances risk and reward.

Understanding Cryptocurrency Trading Graphs: Cryptocurrency trading graphs provide a visual representation of price movements over time. They typically display historical price data in the form of candlestick charts, line graphs, or other charting techniques. Each type offers unique advantages in analyzing market trends and identifying potential trading opportunities.

Candlestick charts, for instance, are widely used in cryptocurrency trading due to their ability to convey a wealth of information within a single data point. Each candlestick represents a specific time period, with the body indicating the opening and closing prices and the wicks or shadows depicting the price range within that period. By observing patterns such as bullish engulfing, bearish harami, or doji, traders can anticipate market sentiment and make informed decisions tradetrek.

Line graphs, on the other hand, offer a simplified view of price movements by connecting the closing prices over time. While they lack the granularity of candlestick charts, line graphs provide a clear depiction of long-term trends, enabling traders to identify support and resistance levels and assess overall market direction.

Developing a Varied Portfolio: Building a diversified portfolio is essential for mitigating risk and maximizing returns in the volatile world of cryptocurrency trading. A well-rounded portfolio should encompass a mix of assets across different categories, including established cryptocurrencies like Bitcoin and Ethereum, promising altcoins, and stablecoins pegged to fiat currencies.

Bitcoin, as the pioneer cryptocurrency, serves as the cornerstone of many portfolios due to its widespread adoption and established track record. With its finite supply and growing institutional interest, Bitcoin offers a hedge against inflation and economic uncertainty, making it a favored store of value asset.

Ethereum, the second-largest cryptocurrency by market capitalization, holds immense potential as the foundation for decentralized applications (DApps) and smart contracts. Investing in Ethereum allows traders to participate in the burgeoning world of decentralized finance (DeFi) and non-fungible tokens (NFTs), driving innovation and growth in the cryptocurrency ecosystem.

In addition to blue-chip cryptocurrencies, diversifying into promising altcoins can provide exposure to high-growth opportunities. Conducting thorough research and due diligence is crucial when selecting altcoins, as the market is rife with projects of varying quality and legitimacy. Look for altcoins with strong fundamentals, innovative technology, and a dedicated community to maximize the potential for returns.

Stablecoins play a vital role in risk management within a cryptocurrency portfolio, offering a reliable means of preserving capital during market downturns. Pegged to stable assets like the US dollar or other fiat currencies, stablecoins provide stability and liquidity, allowing traders to swiftly exit volatile positions and minimize losses.

Conclusion: Navigating cryptocurrency trading graphs is an indispensable skill for investors seeking to thrive in the dynamic and rapidly evolving digital asset market. By mastering chart analysis techniques and developing a diverse portfolio spanning established cryptocurrencies, promising altcoins, and stablecoins, traders can navigate market fluctuations with confidence and capitalize on lucrative investment opportunities. Remember to exercise caution, conduct thorough research, and diversify your holdings to optimize risk-adjusted returns in the exciting world of cryptocurrency trading.

1 note

·

View note

Text

Centfx

Analysis of EUR/JPY Price: Bullish-harami at daily to open the door to 162.00

The Japanese Yen (JPY) continues to trail behind other FX currencies, although the EUR/JPY recovered from weekly lows late on Friday in the North American session and is now up 0.39%. As of this writing, the cross-pair is trading at 160.77, having fallen as low as 159.83 on the day before.

Technically speaking, the price action over the past several days is assembling into a "bullish harami" two-candle pattern that reassembles an inside day and drives price movement upward. The psychological 162.00 would rise next, and if buyers break over 161.00, the high point from January 19 at 161.87 would be the next barrier.

Conversely, should sellers go below 160.55, the Tenkan/Sen, the Senkou Span A at 159.51, the January 25 daily low of 159.69, and 160.00 would be the next support levels.

centfx #forexdaily #forexdaytrader #forexforbeginners #forexfamily

0 notes

Link

A Candlestick chart is a vital tool that is used for technical analysis in order to identify all the potential buy and sell opportunities. There are many Candlestick patterns, such as bullish harami, hammer, shooting star, hanging man, and doji that can help traders to identify trend reversals.Let’s move right into knowing more about Candlestick.What are Candlesticks?Candlestick is a charting technique that is used to describe asset price movements. Nowadays, Crypto traders are using Candlestick to predict upcoming price movements and analyze historical price data. Candlestick patterns help in indicating the rise or fall of prices. This gives insight into potential trading opportunities and market sentiment.What is meant by the Candlestick chart?A Candlestick chart is a visual way to represent the price data. The Candlestick’s body represents the range between closing and opening prices within that time period, while the shadows or wicks represent the lowest and highest prices reached in that period.How to read Candlestick patterns?A Candlestick pattern is formed by arranging various candles in a sequence. Based on the interpretation, there are various Candlestick patterns. A few Candlestick patterns give an insight into the balance between sellers and buyers, while others may indicate continuation, reversal, or indecision.Candlestick patterns help to understand buy or sell signals.They serve as a method for examining market trends to spot impending chances. Hence, it’s always beneficial to consider patterns in their context.Depending on the technical pattern on the chart, such as the Elliott Wave Theory, Wyckoff Method, or Dow Theory, it may help in analysing the background of the overall market environment. Technical analysis (TA) indicators such as Relative Strength Index (RSI), Trend Lines, Ichimoku Clouds, Stochastic RSI, or Parabolic SAR might also be included.Hope this answer helps you — — — — — — -XXXXXXXX #Read #Popular #Crypto #Candlestick #Patterns #CointradeIndia

0 notes

Text

A new XRP price prediction from notable crypto analyst, EGRAG CRYPTO, has investors buzzing. Based on a multi-timeframe analysis, Egrag believes XRP is showing considerable strength, hinting at a potential surge to $1.4. The analyst elucidated his predictions in a tweet, stating, “XRP Color Code To $1.4 – UPDATE: Trying to showcase the sheer strength and achievements of XRP from multiple time frames: Weekly, 3D, 1D, and 4H.” XRP Price Analysis: 1-Week Chart Delving into the Weekly Chart, Egrag finds an evident optimistic momentum. XRP is on the brink of achieving a notable milestone: sealing a full-body candle beyond the Fib 0.618 retracement level at $0.5119. Egrag notes that the imminent week’s closure and the definitive form of the candle would serve as a robust affirmation of this trend. Egrag’s meticulous breakdown pinpoints vital landmarks for the XRP price trajectory in the 1-week chart. The wicking range is demarcated between $0.3875 and $0.4719. Any downward breach below $0.3875 might disrupt the broader chart setup. Meanwhile, the ranging region, where XRP could oscillate without clear directional momentum (and which XRP is currently leaving), is situated between $0.4719 and $0.5119. Eclipsing the $0.5119 boundary in the weekly timeframe propels XRP into a bullish domain, leading up to $0.5738 — in sync with the 50% Fibonacci retracement echelon. The crypto analyst postulates that the breach of this pivotal price level could catalyze a sweeping XRP rally. Venturing past the 50% Fibonacci zone might result in a landscape with scant resistance, potentially allowing XRP to shatter its annual peak at $0.9310. Concluding his extensive analysis, Egrag envisages an audacious endgame: a staggering 250% rally, propelling XRP towards the 1,618 Fibonacci extension at $1.4695. Weekly XRP chart | Source: X @egragcrypto Shorter Time Frames Switching focus to the 3-day chart, XRP displays a body candle close above the Fibonacci 0.618 retracement level, indicating its presence in the bullish zone. Yet, the current shape of the candle is a neutral Harami style, leaving room for interpretation and lacking a decisive forward direction. This particular formation, rooted in the Japanese term for “pregnant,” represents a potential inflection point in the price movement. Yet, its neutrality necessitates waiting for more concrete signals. Egrag emphasizes that the impending candle, closing today, might shed light on pivotal insights. 3-day XRP chart | Source: X @egragcrypto In the 1-day Chart, the narrative is more assertive. XRP has successfully wrapped up seven consecutive daily candles beyond the Fib 0.618 benchmark in the green area. This trend, as Egrag postulates, radiates a palpable bullish aura. But he also advises vigilance for a potential retest of the lower boundary of the bullish green area, which could solidify this foundation. 1 day XRP chart | Source: X @egragcrypto Lastly, when inspecting the 4-hour chart, a discernible double-top pattern emerges. With XRP exhibiting resistance to surpass the $0.55 mark, there is heightened anticipation of a possible double bottom near $0.50. This movement could pave the way for an assault on the Fib 1.618 zone, around $0.576. The crypto analyst forecasts this as a precursor to a bullish continuation. 4-hour XRP chart | Source: X @egragcrypto At press time, XRP traded at $0.52073. The 1-hour chart shows $0.5264 as the current key resistance and $0.5197 as the key support. XRP price below 38.2% Fib, 1-hour chart | Source: XRPUSD on TradingView.com

0 notes

Text

Spotting and Capitalizing on Market Trends

Navigating the Complex World of Market Trends for Profitable Trading By Amir Shayan In the dynamic world of financial markets, identifying and capitalizing on market trends can be the difference between success and failure for traders and investors alike. Market trends provide valuable insights into the collective sentiment of market participants and skilled individuals who can recognize these trends stand to make significant gains. This article aims to guide you through the art of spotting and capitalizing on market trends, equipping you with the knowledge and tools needed to navigate this challenging terrain. Understanding Market Trends Market trends are the general direction in which an asset's price or market sentiment is moving over a specific period. These trends can be short-term, intermediate, or long-term, and they are influenced by a myriad of factors, including economic indicators, geopolitical events, and investor psychology. Recognizing trends is essential because they provide a roadmap of the market's movement, enabling traders to make informed decisions. Types of Market Trends - Uptrend: An uptrend is characterized by a series of higher highs and higher lows. It signifies an overall bullish sentiment, where buyers are in control and driving prices higher. Traders often look for opportunities to buy during pullbacks in an uptrend. - Downtrend: Conversely, a downtrend is marked by lower highs and lower lows. It indicates a bearish sentiment, with sellers dominating the market. Traders may seek short-selling opportunities or avoid trading against the prevailing downtrend. - Sideways (or Range-bound) Trend: In a sideways trend, prices move within a relatively narrow range. This could be due to indecision in the market, lack of significant news, or the calm before a potential breakout. Traders often employ range-based strategies during such periods. - Reversal Trend: A reversal trend occurs when an existing trend starts to change direction. An uptrend may transition to a downtrend, and vice versa. Identifying reversal patterns, such as double tops or bottoms, is crucial for anticipating potential trend changes. Tools for Spotting Market Trends - Technical Analysis: This involves studying historical price data and using tools like moving averages, trendlines, and chart patterns to identify trends. Moving averages help smoothen price data and provide a clearer picture of the prevailing trend. - Candlestick Patterns: Candlestick charts display price movements in a visual manner. Patterns like "bullish engulfing" or "bearish harami" can offer insights into potential trend reversals. - Trend Indicators: Indicators like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI) can help confirm trends and assess their strength. - Fundamental Analysis: Understanding the economic, political, and social factors that influence an asset's price can also help predict and confirm trends. Capitalizing on Market Trends Spotting a trend is only the first step; capitalizing on it requires a well-thought-out strategy: - Trend Following: Traders ride the trend until signs of reversal emerge. This can be a lucrative approach, but timing is critical. - Counter-Trend Trading: Riskier, this strategy involves trading against the prevailing trend. It requires precise entries and exits and is typically suited for experienced traders. - Breakout Trading: This involves entering a trade when prices break out of a range. Traders anticipate that the breakout will lead to a strong trend in the breakout direction. - Swing Trading: Traders aim to capture shorter-term price moves within an existing trend. It requires timely entries and exits to capitalize on price fluctuations. Risk Management and Psychology While spotting and capitalizing on trends can be profitable, it's essential to remember that not all trades will be successful. Risk management is paramount to ensure that losses do not outweigh gains. Additionally, managing emotions is critical; the fear of missing out (FOMO) or the fear of losses can cloud judgment and lead to impulsive decisions.

Conclusion

Spotting and capitalizing on market trends requires a combination of technical analysis, fundamental understanding, and sound risk management. Traders need to interpret market signals accurately while maintaining emotional discipline. Remember, no strategy guarantees success, but a well-informed and thoughtful approach can increase the probability of making profitable trades. Whether you're a short-term trader or a long-term investor, understanding market trends is an invaluable skill that can help you navigate the intricate world of financial markets with confidence. Read the full article

#BreakoutTrading#CapitalizingonTrends#EmotionalDiscipline#marketsentiment#markettrends#Riskmanagement#Technicalanalysis#tradingstrategies#trendanalysis#trendfollowing

0 notes

Link

Mô hình mẹ bồng con – Harami Pattern là công cụ cung cấp tín hiệu đảo chiều phổ biến và dễ sử dụng trong giao dịch.

Khi nhắc đến mô hình nến Nhật trong giao dịch, không thể bỏ qua mô hình mẹ bồng con giúp cung cấp tín hiệu đảo chiều tương đối chính xác. Nến này khá thông dụng và được nhiều Trader sử dụng trong phân tích kỹ thuật giao dịch. Vậy cụ thể nến mẹ bồng con Harami là gì, đặc điểm, ý nghĩa và các chiến lược giao dịch với mô hình nến này như thế nào để mang lại hiệu quả cao nhất? Hãy cùng fxlagi.com tìm hiểu chi tiết trong bài viết dưới đây nhé!

0 notes

Text

Learn advanced tools for forex trading with 'Candlestick Pattern'

Candlestick charts are widely used in forex trading as a tool for technical analysis. They provide a visual representation of price movements over a specified period, showing the opening, closing, high, and low prices. Each candlestick typically consists of:

Body: The rectangular part, which shows the difference between the opening and closing prices.

Wicks (or Shadows): The thin lines above and below the body, indicating the highest and lowest prices during the period.

Top Powerful Candlestick Patterns

1. Hammer: This happens when sellers bring the price down, but strong buying forces push it back up to close almost where it started.

2. Bullish Engulfing Bar: It starts with a smaller candle showing a drop in price, followed by a bigger candle that fully covers the first one from its opening to closing prices.

3. Piercing Pattern: It has two candles: the first one shows a drop in prices and is followed by one that starts even lower but goes up past the middle of the first candle.

4. Three White Soldiers: The three white soldiers is a pattern of three long candles going up in price, often seen as a strong clue that a downward trend could be flipping.

5. Three Inside Up: The three inside up is a pattern of three candles that often hints at prices moving up.

6. White Marubozu: The White Marubozu is a single candle pattern that’s seen as a strong hint that prices will keep going up.

7. Bullish Harami: The Bullish Harami is a two-candle pattern that might signal a change from a falling market to a rising one.

8. Inverted Hammer: The inverted hammer is a single-candle pattern that often shows up when a market is going down but could be about to go up.

9. Tweezer Bottom: The tweezer bottom is a pattern you might see when the market is going down but could be getting ready to go up.

10. Three Outside Up: The three outside up is a pattern that suggests the market might be about to go up.

Learn more about other top 35 candlestick pattern: https://finxpdx.com/35-powerful-candlestick-patterns-pdf-download/

0 notes

Text

Complete Guide to Three Inside Down Candlestick Pattern (With Real Indian Stock Market Examples)

Candlestick patterns can unlock powerful insights for traders. One such pattern is the Three Inside Down, a bearish reversal pattern that's particularly valuable when you're looking to time your exits or short opportunities. In this guide, you'll learn how to spot, interpret, and trade the Three Inside Down using real-world charts from the Indian stock market and trusted charting tools like Strike Money.

Let’s break it all down — no fluff, no jargon overload — just a pure trading edge.

🔍 What is the Three Inside Down Pattern and Why Should Traders Care?

The Three Inside Down is a three-candle bearish reversal pattern that typically appears at the top of an uptrend. It signals that the bullish momentum is weakening, and a potential downward trend is on the horizon.

Popularized in the West by Steve Nison, who brought Japanese candlestick charting techniques into mainstream technical analysis, this pattern is now widely used across stock, forex, and crypto markets.

🔬 How the Three Inside Down Pattern Actually Forms

This pattern consists of:

First Candle: A large bullish candle continuing the current uptrend.

Second Candle: A smaller bearish (or bullish) candle that is completely within the first candle’s body (similar to a Harami).

Third Candle: A bearish candle that closes below the low of the second candle — this confirms the reversal.

✅ Key Characteristics:

Appears after a sustained uptrend.

Signals a shift in market psychology — bulls losing control, bears stepping in.

Requires confirmation — the third candle is critical.

📈 Real Chart Example: Reliance Industries (NSE: RELIANCE)

In March 2023, Reliance Industries showed a classic Three Inside Down on the daily chart:

The first bullish candle occurred on March 10.

March 13 formed a smaller candle within it.

On March 14, a bearish candle closed below the second candle, triggering a fall of over 4.5% in the next 5 trading sessions.

📊 Chart sourced via Strike Money, which visually highlighted the pattern using automated recognition tools.

🧠 The Psychology Behind the Pattern

Let’s decode what’s happening beneath the candles:

First Candle (Optimism): Bulls are still in control.

Second Candle (Indecision): Bears resist, but not strongly enough. The market stalls.

Third Candle (Reversal): Bears take charge. Sellers dominate, signaling a momentum shift.

This is a classic sentiment reversal — the crowd starts to second-guess the rally.

🛠️ How to Spot Three Inside Down in Live Markets

You can identify this pattern manually, or you can automate it using smart tools like Strike Money, TradingView.

🔍 Things to Watch:

Pattern at the top of an uptrend.

Third candle must close lower than the second — this is your confirmation.

Look for high volume on the third candle for stronger validation.

📱 Tip:

Use Strike Money’s pattern recognition tool and overlay it with Relative Strength Index (RSI) or MACD to strengthen your decision.

🔄 How Three Inside Down Compares to Other Reversal Patterns

Traders often confuse this with:

Three Inside Up: The bullish counterpart. Forms after a downtrend.

Bearish Engulfing: Only two candles, but similar sentiment.

Evening Star: Different structure, same outcome — a trend reversal.

But unlike the Bearish Engulfing, the Three Inside Down provides a clear multi-candle confirmation, making it more reliable for some traders.

📊 What the Data Says: Is Three Inside Down Reliable?

According to a 2021 study by Thomas Bulkowski (author of Encyclopedia of Chart Patterns), the Three Inside Down pattern had:

55% reversal accuracy across S&P 500 stocks.

Higher success when used with trend filters and volume confirmation.

Performance improved when paired with support/resistance levels.

In the Indian market, backtesting done by traders on Strike Money showed:

In Nifty 50 stocks (2018–2023), Three Inside Down patterns led to a short-term correction 61% of the time.

When volume spiked on the third candle, accuracy jumped to 68%.

🧪 Backtesting Three Inside Down on Indian Stocks

Let’s test this pattern on Tata Motors:

Time Frame: Daily chart.

Date: August 2022.

After the pattern appeared, the stock dropped 6.2% over the next 8 sessions.

RSI showed divergence, and Strike Money flagged resistance at the recent top.

Repeat this kind of testing across various timeframes to build statistical confidence.

📉 How to Trade the Three Inside Down: Entry & Exit Strategy

✅ Entry:

After the third candle closes below the second.

Confirm with volume, RSI overbought levels, or MACD crossover.

❌ Stop Loss:

Above the high of the first candle (gives room for natural volatility).

🎯 Target:

First support zone, previous swing low.

Use Fibonacci retracement or ATR to estimate targets.

💡 Pro Tip: Combine Three Inside Down with strike zones on Strike Money to identify optimal entry points.

⚠️ 5 Common Mistakes Traders Make with Three Inside Down

Ignoring trend context – It must occur after a clear uptrend.

Jumping in before the third candle closes – Wait for confirmation.

Overlooking volume – Thin volume reduces pattern reliability.

Using it standalone – Always pair with indicators like RSI or MACD.

Setting tight stops – Allow the pattern to "breathe" or you’ll get stopped out prematurely.

Avoid these to boost your win rate and confidence.

⚒️ Best Tools to Detect the Pattern Automatically

While you can spot it manually, automation saves time — especially for intraday traders.

🔧 Tools to Use:

Strike Money: Real-time pattern recognition, Indian stock market focused.

TradingView: Set custom alerts using community scripts.

MetaTrader 4: For forex and multi-asset analysis.

Strike Money’s edge lies in its ability to scan across NSE & BSE instantly — a huge win for Indian traders.

🤔 Should You Use Three Inside Down in Your Trading Strategy?

It depends on your style:

✅ Swing Traders: Perfect for catching medium-term trend reversals.

✅ Positional Traders: Works great when combined with weekly charts.

❌ Scalpers: May not be fast enough; look into single-bar price action instead.

If you’re using a price action strategy, this pattern adds precision. Combine it with risk management and trend filters to optimize results.

📚 Final Thoughts: Make the Pattern Work for You

The Three Inside Down isn’t magic — it’s a probability enhancer.

Used with confirmation tools like:

RSI divergence

Volume surge

Key resistance zones

… it becomes a powerful part of your trading toolkit.

📈 Real traders using Strike Money are now integrating these patterns into algo-driven watchlists, scanning hundreds of Indian stocks — all in real-time.

🔄 Recap: Why Three Inside Down Deserves Your Attention

✅ High reliability with confirmation

✅ Clearly defined entry/exit

✅ Works across stocks, forex, crypto

✅ Proven success in Indian stock market backtests

✅ Easy to automate with tools like Strike Money

🙋 Frequently Asked Questions

Q1: Can I use Three Inside Down for intraday trading? Yes, but use it on 15min or 1hr charts, and always wait for confirmation.

Q2: Does this work in crypto or forex? Absolutely. The pattern is universal. Use it with high-volume pairs like BTC/USDT or EUR/USD.

Q3: How can I scan for this pattern daily? Use Strike Money or custom screeners on TradingView. Automation is key.

Q4: Is the pattern better on daily or weekly charts? Daily gives more frequent signals; weekly offers higher accuracy for positional trades.

Want to start spotting high-probability reversals before the crowd? 📉 Try Strike Money and get alerted the moment a Three Inside Down shows up on Indian stocks.

Let the candles talk — and you trade smarter.

0 notes