#Hindalco

Link

#AdaniEnterprises#AdaniPorts#AxisBank#Bankingsectorperformance#Fresh52-weekhighs#Hindalco#ICICIBank#Marketcapitalisationrise#Midandsmallcapoutperformance#Nifty#Nifty50#NiftyBank#NiftyFinancialServices#Sectoralmovements#Sensex#SensexandNiftyperformance#smallcap#stockmarket#SunPharma#TopgainersandlosersinNifty

0 notes

Text

MANDOTSECURITIES

NSE

TOP #GAINERLOSER

STOCKMARKET

SENSEX-64,948.66(−202.36)(0.31%)today

NIFTY-19,310.15(−55.10)(0.28%)today

DOWNLOAD #MANDOTONE APP

https://bit.ly/3N2atIY

www.mandotsecurities.com

0 notes

Video

youtube

How to Make Monthly Income from Swing Trading || Reliance Industries Lev...

0 notes

Text

https://www.businessupside.in/nifty-crash-indian-share-market-is-heavily-down/

The Nifty50 stocks fell for the second consecutive day in a week, with losses across most sectors, while a late-week rebound in banking stocks provided some assistance.

#Indian stock market nifty#half-point interest rate hike#Nifty50 stocks#Nifty index#Russia-Ukraine conflict#Hindalco#Eicher Motors

1 note

·

View note

Photo

WiWA©-certified Eternia doors and windows make the house liveable, energy-efficient, secure, and healthy. Know more here: https://buildingandinteriors.com/wiwa-certified-eternia-windows-for-improved-wellness-safety-efficiency-in-home/ #eternia #eterniawindows #hindalco #doorsandwindows #windowsanddoors #aluminiumwindows #aluminiumdoors #duraniumwindows #aluminiumwindow #safedoor #safewindows https://www.instagram.com/p/CkfaWIpoiet/?igshid=NGJjMDIxMWI=

#eternia#eterniawindows#hindalco#doorsandwindows#windowsanddoors#aluminiumwindows#aluminiumdoors#duraniumwindows#aluminiumwindow#safedoor#safewindows

0 notes

Text

Market this week 30-9-2022

Market this week 30-9-2022

Goldman Sachs maintains its “buy” rating following the transaction, boosting KPIT Technologies shares by 5%.

On September 22, KPIT Technologies’ share price increased 5% intraday as global research company Goldman Sachs maintained its “buy” rating on the company with a target price of Rs 900 per share.

Research firm estimates that Technica’s CY21 revenue/EBITDA equals 16–17% of the company’s…

View On WordPress

0 notes

Text

Handling the Market Dynamics: Revealing the Share Prices of Hindalco Industries and Britannia Industries

Investors look for trustworthy guides to help them understand the complexity and take advantage of growth opportunities in the complex stock market, where trends change daily. Among all other possibilities, Hindalco Industries Share Price and Britannia Industries Share Price are the industry leaders. In this examination, StockGro investigates the subtleties of their share prices, examining the elements that influence their paths and revealing the dynamics contributing to their everlasting success.

Hindalco Industries' Stock Price: Open Doors in the Metals Sector

Hindalco Industries, the Aditya Birla Group's backbone, is a global copper and aluminum market leader. Hindalco has attracted an international clientele since its foundation in 1958, thanks to its reputation for excellence, innovation, and sustainability.

Core Operations: Hindalco is active in the copper and aluminum value chains, including mining, refining, manufacturing, and distribution. By continually prioritizing efficiency and quality, Hindalco has proved its capacity to adapt to the changing demands of several industries, including construction, automotive, aerospace, and packaging, creating trust in its stakeholders.

Market Dynamics: Hindalco Industries' share price is influenced by global macroeconomic conditions, commodity pricing, and industry dynamics. Fluctuations in aluminum and copper prices, caused by supply-demand mismatches, geopolitical tensions, and economic indicators, can have an impact on market mood and, as a result, Hindalco stock price.

Furthermore, Hindalco's operational success, such as production volumes, cost structures, and market positioning, has a significant impact on its share price. Investors regularly watch important performance indicators to assess the company's growth potential, profitability, and durability in volatile market conditions.

Future Outlook: Hindalco Industries is poised for long-term prosperity, notwithstanding the volatility of metal prices. The company's strategic investments in technology, innovation, and sustainability, together with its strong financial position and global footprint, point to a promising growth trajectory.

As Hindalco builds on its strengths, seizes emerging opportunities, and navigates market obstacles, its share price reflects its durability, adaptability, and dedication to producing long-term value for stakeholders.

Britannia Industries Share Price: Favorable Growth in FMCG

Britannia Industries, a household name in India and elsewhere, has been associated with quality, taste, and trust for over a century. Founded in 1892, Britannia has led the packaged food business, delighting customers with a varied array of biscuits, cakes, dairy goods, and snacks.

Core Operations: Britannia's core operations prioritize innovation, consumer-centricity, and agility, resulting in a leading position in the competitive FMCG sector. With an emphasis on exceptional ingredients, hygienic standards, and product innovation, Britannia continues to establish industry standards and satisfy customers across demographics and continents.

Market Dynamics: Britannia Industries' stock price is affected by a number of variables, including market competition, consumer sentiment, macroeconomic swings, and regulatory actions. The revenue growth and market valuation of the company may be impacted by changes in consumer preferences, market dynamics, and profitability. These factors also affect Britannia Industries share price.

Future Outlook: Britannia's share price is also influenced by its ability to innovate, adjust to changing market trends, and diversify its product portfolio. Investors evaluate Britannia's development potential and competitive edge in the FMCG industry by closely monitoring the company's product launches, brand positioning, and market penetration.

Comparative Analysis: Britannia Industries and Hindalco Industries

Industry Dynamics: Hindalco and Britannia's financial performance, and hence their share prices, can be influenced by a number of industry-specific factors, such as consumer preferences, regulatory changes, commodity pricing, and competitive pressures.

Financial Performance: Investors closely monitor key financial metrics such as revenue growth, profitability, cash flows, and return on investment to evaluate the strength and sustainability of Hindalco and Britannia's business models, as well as their ability to generate long-term shareholder value.

Strategic efforts: The success of Hindalco and Britannia's investments in technology, innovation, expansion, and sustainability can have an impact on investor sentiment and confidence in their growth prospects. This may affect share prices.

In Nutshell

Finally, the share prices of Hindalco businesses and Britannia Industries are influenced by a variety of factors specific to their businesses, market dynamics, and strategic efforts. While Hindalco's share price represents investor sentiment toward global metal markets, commodities pricing, and operational performance, Britannia's share price reflects investor confidence in the company's brand equity, product innovation, and FMCG sector development potential.

As investors traverse the complexity of the stock market, knowing the fundamental dynamics that drive Hindalco and Britannia share prices is critical for making sound investing decisions. While previous success does not guarantee future outcomes, a detailed examination of these criteria can assist investors in determining the development prospects and investment potential of these two industry leaders. For more such interesting information, follow StockGro regularly!

0 notes

Text

https://www.shreemetalprices.com/oil-prices-rises-after-a-three-day-drop-nearly-to-9/

Oil prices increased on Thursday. But were unable to recover from a more than 9% drop over the previous three days. As demand concerns among major consumers outweighed hints that the United States may suspend interest rate hikes.

1 note

·

View note

Text

#Hindalco Industries Limited Stock#Hindalco Industries Limited Stock Analysis#Hindalco Share Latest News#Directusinvestments#mohit munjal youtube#stock market

0 notes

Text

Commercial Roof Installation - Hindalco Everlast

Ensure long-lasting protection for your commercial spaces with Hindalco Everlast's high-performance roofing solutions. Our durable, weather-resistant commercial roof installations offer superior strength and corrosion resistance, tailored to withstand harsh conditions. Trust Hindalco Everlast for reliable, eco-friendly roofing systems that stand the test of time.

0 notes

Text

Hindalco Aluminium Decreases it’s Product Prices By INR 7,250/-MT on 06-April-2023

Hindalco Aluminium Ingot Prices Decreases By INR 7,250/-MT today which comes at INR 218,500/-MT.

1 note

·

View note

Text

MANDOT SECURITIES

.

NSE

TOP GAINER & LOSER

STOCK MARKET

SENSEX- 65,818.43(−28.07) (0.043%)today

NIFTY -19,576.60(+5.75) (0.029%)today

DOWNLOAD MANDOT ONE APP

https://bit.ly/3N2atIY

web: www.mandotsecurities.com

gainer loser

#mandotsecurities#onlinetrading#demataccount#ipo#equity#lowestbrokerage#maruti#bajajfinance#divislab#drreddy#jswlsteel#tatamotors#apollohospital#hindalco#gainerlosers

0 notes

Text

Novelis plans to try to go public again in 2025

According to foreign media reports, Satish Pai, managing director of Hindalco, said in an interview with Bloomberg that he plans to push Novelis to go public in the United States again in 2025.

Novelis is Hindalco's aluminum subsidiary. The initial public offering was originally scheduled for 2024, but was postponed in June 2024 due to "unfavorable market conditions."

Pai said that Hindalco pushed Novelis to go public just to get a premium valuation, "We don't need this money to maintain Hindalco's business in India."

According to Pai, Novelis did not get the premium valuation that the company deserved when it first went public.

The timing of a potential listing will depend on the situation in the US market, but the next attempt to go public is expected to be in 2025.

It is reported that Novelis' initial public offering was originally going to be one of the largest listings in the United States in 2024. The company originally planned to sell 45 million shares at a price of US$18 to US$21 per share. Hindalco will hold about 92.5% of the company after the IPO.

At the top end of the price range, Novelis’ market value is about $12.6 billion, based on the number of outstanding shares listed in Novelis’ filings with the U.S. Securities and Exchange Commission.

Adtech was established in 2012, and the Chinese factory was put into production at the end of 2013. Adtech is an unremitting and enterprising brand pioneer, focusing on the R & D and manufacturing of "online degassing filter equipment, ceramic filter plates, hot top casting accessories, casting nozzle plates, repair agents and solvents" international enterprise. The company has successively developed dozens of series of products, so far it has covered a full range of equipment, filtration and high-temperature materials required by the aluminum alloy casting industry. The main products of Adtech are:

casting launder, aluminum casting filter ,electric launder system , in-line degassing aluminium, deep bed filter aluminium , tap cone, caster tip, etc.

#aluminumingot#aluminumdegassing#aluminumfactory#aluminum#aluminium alloy#aluminumfiltration#aluminium casting#aluminumprocessing

0 notes

Text

Top Gainers and Losers today on 2 September, 2024: Bajaj Finance, Bajaj Finserv, Hindalco Industries, Dr Reddys Laboratories among most active stocks

Top Gainers and Losers Today : The Top Gainers and Losers Today: The Nifty closed at 25,235.9, up by 0.17%. During the day, the Nifty touched a high of 25,333.65 and a low of 25,235.5. The Sensex traded in the range of 82,725.28 and 82,440.93 and closed 0.24% up at 82,365.77, which was 194.07 points above the opening price. The Midcap index underperformed the Nifty 50 as the Nifty Midcap 50 closed 0.18% down. Small cap stocks also underperformed the Nifty 50, with the Nifty Small Cap 100 ending at 19,307.1, down by 62.8 points and 0.33% lower.

Nifty Index Top Gainers and Losers Today

The top gainers in the Nifty index were Bajaj Finance (up 3.33%), Bajaj Finserv (up 3.22%), HCL Technologies (up 3.05%), Hero Motocorp (up 2.25%), and Bajaj Auto (up 2.15%). The top losers in the Nifty index were Hindalco Industries (down 2.49%), Dr. Reddy's Laboratories (down 2.26%), Tata Motors (down 1.68%), NTPC (down 1.49%), and Oil & Natural Gas Corporation (down 1.38%).

Sensex:

Top Gainers: Bajaj Finserv (up 3.23%), Bajaj Finance (up 3.19%), HCL Technologies (up 3.13%), ITC (up 1.60%), Indusind Bank (up 1.55%)

Top Losers: NTPC (down 1.57%), Tata Motors (down 1.52%), Wipro (down 1.12%), Mahindra & Mahindra (down 1.04%), Bharti Airtel (down 0.97%)

Nifty:

Top Gainers: Bajaj Finance (up 3.33%), Bajaj Finserv (up 3.22%), HCL Technologies (up 3.05%), Hero Motocorp (up 2.25%), Bajaj Auto (up 2.15%)

Top Losers: Hindalco Industries (down 2.49%), Dr. Reddy's Laboratories (down 2.26%), Tata Motors (down 1.68%), NTPC (down 1.49%), Oil & Natural Gas Corporation (down 1.38%)

0 notes

Text

Oxyde d'aluminium calciné, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 16 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Oxyde d'aluminium calciné 2024-2030”, publié par QYResearch, la taille du marché mondial de Oxyde d'aluminium calciné devrait atteindre 3780 millions de dollars d'ici 2030, à un TCAC de 0.3% au cours de la période de prévision.

Figure 1. Taille du marché mondial de Oxyde d'aluminium calciné (en millions de dollars américains), 2019-2030

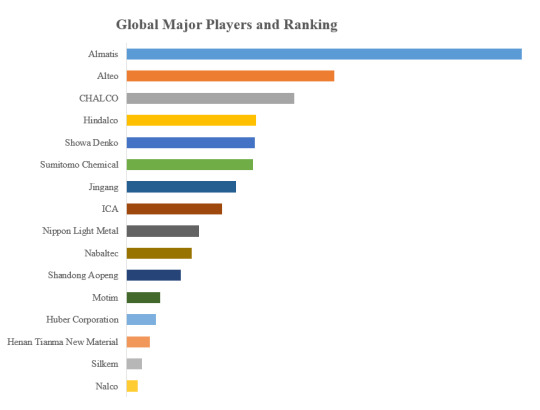

Selon QYResearch, les principaux fabricants mondiaux de Oxyde d'aluminium calciné comprennent Almatis, Alteo, CHALCO, Hindalco, Showa Denko, Sumitomo Chemical, Jingang, ICA, Nippon Light Metal, Nabaltec, etc. En 2023, les dix premiers acteurs mondiaux détenaient une part d'environ 48.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 16 premiers acteurs mondiaux de Oxyde d'aluminium calciné (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The market for calcined aluminum oxide, also known as alumina, is influenced by various factors that drive demand and supply dynamics within the industry. Here are some key drivers that impact the calcined aluminum oxide market:

1. Growing Demand in the Ceramics Industry: Calcined aluminum oxide is a crucial raw material in the ceramics industry, where it is used in the production of high-quality ceramics, refractories, and abrasives. The demand for calcined alumina in the ceramics sector is driven by infrastructure development, increased construction activities, and the growing need for advanced ceramic materials in various applications.

2. Increasing Demand in the Abrasives Industry: Calcined aluminum oxide is widely used as an abrasive material in applications such as grinding wheels, sandpaper, and polishing. The abrasives industry's growth, driven by diverse sectors like manufacturing, automotive, construction, and metalworking, contributes significantly to the demand for calcined alumina.

3. Growing Demand in Refractories: Calcined aluminum oxide plays a crucial role in the production of refractory materials used in high-temperature applications like steelmaking, glass production, and cement manufacturing. The demand for refractories in industries such as metallurgy and construction influences the market for calcined alumina.

4. Increasing Demand in the Electronics Industry: The electronics industry uses calcined aluminum oxide in various applications such as insulating components, electronic packaging, and substrates for semiconductor production. The growth of the electronics sector, including developments in semiconductors, LEDs, and electronic components, drives the demand for high-purity calcined alumina.

5. Automotive and Aerospace Applications: Calcined aluminum oxide is used in automotive and aerospace applications for components requiring high strength, wear resistance, and thermal stability. As these industries continue to innovate and demand high-performance materials, the need for calcined alumina as a key component in advanced materials grows.

6. Environmental Regulations and Sustainability: Increasing focus on environmental regulations and sustainability practices is driving the demand for eco-friendly materials in various industries. Calcined alumina produced using sustainable practices and meeting stringent environmental standards can attract environmentally conscious consumers and industries.

7. Research and Development: Advancements in manufacturing processes, product quality, and new applications for calcined aluminum oxide can drive market growth. Continuous research and development efforts to improve the properties and applications of calcined alumina can open up new market opportunities.

8. Global Economic Trends: Macroeconomic factors like industrial output, GDP growth, infrastructure development, and global trade impact the demand for calcined aluminum oxide. Market fluctuations, currency exchange rates, and geopolitical factors can also influence the market dynamics for calcined alumina.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes