#Home Loans provider In Noida

Text

Best Home Loan Providers Company in Noida INR Plus

If you're planning to buy a home in Noida, one of the booming real estate markets in India, securing a home loan is likely to be an essential part of your journey. With numerous financial institutions and companies offering home loans, it becomes crucial to choose the best provider that meets your needs and offers favorable terms. In this regard, INR Plus emerges as a top-notch home loan provider company in Noida, known for its reliability, customer-centric approach, and competitive interest rates.

INR Plus has established itself as a player to reckon with in the home loan market in Noida. The company boasts an impressive track record of catering to the diverse requirements of individuals, families, and investors looking to purchase residential properties. Whether you are a first-time homebuyer or an experienced investor, INR Plus ensures that their home loan products are tailored to meet your specific needs.

One of the key factors that sets INR Plus apart from its competitors is their commitment to customer satisfaction. They prioritize the needs and concerns of their customers and strive to provide exceptional service throughout the loan process. Their team of experienced and knowledgeable professionals guides borrowers through the entire loan application, approval, and disbursement process, making it hassle-free and efficient.

INR Plus offers a wide range of home loan services, each designed to suit different customer profiles. Whether you are salaried, self-employed, or a non-resident Indian, the company has customized loan options to cater to your unique financial situation. The loan application process is simple and streamlined, with minimal paperwork and quick approval times. This ensures that customers can avail themselves of the necessary funds at the earliest, allowing them to proceed with their home purchase without unnecessary delays.

Competitive interest rates are another aspect where INR Plus stands out. They understand that buying a home is a long-term commitment for borrowers, and minimizing the burden of interest payments is crucial. That's why they offer attractive interest rates on their home loans, allowing borrowers to save significantly over the lifetime of the loan. Additionally, INR Plus provides transparent information about their interest rates and associated charges, ensuring that customers have a clear understanding of their financial commitments.

INR Plus also offers flexible repayment options to suit the financial capabilities of their customers. Whether you prefer fixed or floating interest rates, short or long tenure, or the convenience of EMI payments, they have a range of choices to accommodate your preferences. Their customer-friendly policies make it easier for borrowers to manage their finances while repaying the loan, ensuring a smooth and stress-free experience.

Furthermore, INR Plus prides itself on its robust after-sales service. Their dedicated customer support team is always available to address any queries, concerns, or issues borrowers may have regarding their home loan. This commitment to providing excellent customer service even after the disbursal of the loan sets them apart from other home loan providers in Noida.

In conclusion, when it comes to obtaining a home loan in Noida, INR Plus emerges as one of the best choices. With their customer-centric approach, competitive interest rates, flexible repayment options, and efficient loan processing, they have proven themselves as a reliable and trustworthy home loan provider. Whether you are a first-time homebuyer or an experienced investor, INR Plus is a name you can trust when it comes to fulfilling your home ownership dreams in Noida.

For More Information

Visit: https://www.inrplus.in/home-loan.php

Contact: +91-9891751729

Mail At: [email protected]

Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075

0 notes

Text

The Premier Home Loan Provider: Your Ultimate Financial Partner

Introduction

When it comes to securing your dream home, finding the right home loan provider is paramount. You deserve a partner who not only understands your unique financial needs but also provides the best terms and support throughout your homeownership journey. In this comprehensive guide, we, as your trusted experts, will explore the key aspects of choosing the premier home loan provider that aligns perfectly with your goals.

Introduction: The Importance of a Reliable Home Loan Provider

The process of obtaining a home loan can be overwhelming, but with the right partner by your side, it can become a smooth and efficient experience. Let's delve into the crucial factors that make a home loan provider stand out from the rest.

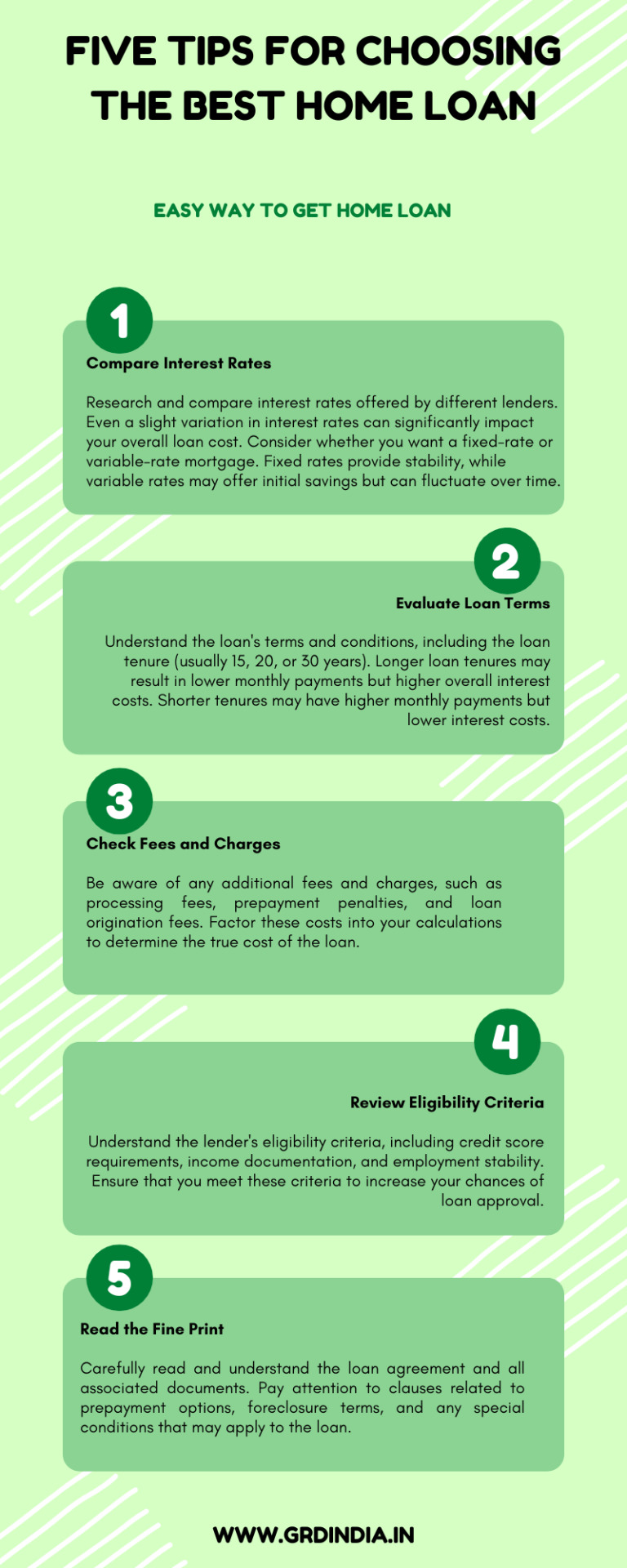

1. Competitive Interest Rates

One of the primary factors that borrowers consider when choosing a home loan provider is the interest rate. We understand that securing the lowest possible interest rate can save you thousands of dollars over the life of your loan. At our institution, we continually strive to offer some of the most competitive rates in the market. Our commitment to transparency ensures that you fully understand the terms of your loan, allowing you to make an informed decision.

2. Customized Loan Options

Every homeowner's financial situation is unique, and cookie-cutter loan solutions may not suffice. That's where we excel. Our team of experts will work closely with you to understand your specific needs and financial goals. We then tailor a loan package that suits your requirements, ensuring you're set up for financial success in the long term.

3. Streamlined Application Process

We recognize that time is of the essence when purchasing a home. Our streamlined application process minimizes paperwork and bureaucracy, enabling you to move closer to your homeownership dreams swiftly. We guide you through every step, from the initial application to the closing of your loan, making the journey as hassle-free as possible.

4. Exceptional Customer Support

Our commitment to your satisfaction doesn't end with loan approval. Our dedicated customer support team is always ready to assist you with any inquiries or concerns you may have throughout the life of your loan. We believe that great service builds lasting relationships.

5. Financial Education and Resources

We understand that navigating the world of home loans can be confusing. To empower our clients, we offer a wealth of educational resources, including articles, calculators, and personalized financial advice. We want you to feel confident and informed every step of the way.

Why Choose Us Over Competitors

In a crowded marketplace of home loan providers, we set ourselves apart in several ways:

Local Expertise

Our team is composed of local experts who understand the unique nuances of the housing market in your area. This expertise allows us to provide you with insights and advice that can make all the difference in your home-buying journey.

Technology-Driven Solutions

We leverage cutting-edge technology to offer a seamless online experience. You can apply for a loan, track your application status, and even make payments online, all from the comfort of your home.

Flexible Repayment Options

Life is unpredictable, and your financial situation may change. We offer flexible repayment options, including refinancing and loan modification, to adapt to your evolving needs.

Transparency and Honesty

We believe in transparent and honest communication. There are no hidden fees or surprises in your loan terms. What you see is what you get, and our clients appreciate our straightforward approach.

Community Engagement

As a responsible lender, we are deeply committed to the communities we serve. We actively engage in local initiatives and support causes that matter to our clients, giving back and making a positive impact.

Conclusion: Your Path to Homeownership Starts Here

In the world of home loans, choosing the right provider is the first step towards achieving your homeownership dreams. We are dedicated to being the premier home loan provider that you can trust. With competitive rates, personalized solutions, exceptional support, and a commitment to your financial success, we are your ideal partner in this important journey.

#home loan#best home loan#best home loan provider in india#home loans#cheapest home loan in delhi#india best home loan provider#personal loans#loans#finance#housing loan in noida

0 notes

Text

Drealty-Best Flats in noida extension

Drealty-Best House Sale Company in Noida, Semi Furnished with Geysers, Smart Lock, modular kitchen, Chimney, Fan, Light, Jhumar, etc More Information visit -

#Flats in noida extension#2-3 bhk in noida extension#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans

1 note

·

View note

Text

Dreality-Best value real estate Service Company in Noida

Reality

When it comes to determining the "best value" in real estate services and home loan providers, it can vary depending on individual needs and preferences. However, I can provide you with some general information on finding the best options in these areas.

Best Value Real Estate Services:

Research and compare: Take the time to research different real estate agencies or agents in your area. Look for their track record, customer reviews, and the range of services they offer. Compare their fees and commission rates to ensure they provide good value for their services.

Local expertise: Choose a real estate agent or agency with strong knowledge and experience in the specific area where you are looking to buy or sell a property. Local experts can provide valuable insights into market trends, pricing, and potential investment opportunities.

Transparent communication: Look for real estate professionals who communicate clearly and honestly. They should be responsive to your queries and provide regular updates on the progress of your transaction. Transparency in pricing and fees is also important.

Negotiation skills: A good real estate agent should have strong negotiation skills to help you secure the best possible deal. This includes not only negotiating the purchase or sale price but also other aspects like repairs, contingencies, and closing costs.

Best Home Loan Providers:

Interest rates and terms: Compare the interest rates, loan terms, and repayment options offered by different lenders. Look for lenders that provide competitive rates and flexible terms that suit your financial situation.

Loan options: Consider lenders that offer a variety of loan programs to meet your specific needs. This could include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, or other specialized loan options.

Fees and closing costs: Evaluate the fees and closing costs associated with obtaining a loan from different providers. Some lenders may have lower origination fees, processing fees, or closing costs, which can save you money in the long run.

Customer service: Look for a lender that provides excellent customer service and is responsive to your needs throughout the loan application and approval process. A reliable lender should be available to answer your questions and guide you through the process.

Reputation and reviews: Check online reviews and ratings of different lenders to gauge their reputation and customer satisfaction levels. Look for lenders with positive feedback and a strong reputation in the industry.

Remember, these are general guidelines, and it's essential to conduct thorough research and consider your specific requirements when choosing the best value real estate services and home loan provider for your needs.

#2-3 bhk in noida extension#best real estate agent in delhi ncr#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans#commercial property loan#best car financing deals#loan against property#personal loan against property#loan against plot#car loans near me#best car loan rates today#best used car loan rates#car finance near me

0 notes

Video

youtube

HelloI hope you are doing well,My name is Prashant rathour from VEDIC AG...

#youtube#best personal loans#Flats in noida extension#2-3 bhk in noida extension#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans#commercial property loan#best car financing deals#loan against property#personal loan against property#loan against plot#car loans near me#best car loan rates today#best used car loan rates#car finance near me#apply for car loan#personal finance loans#small business loans

0 notes

Text

7 Essential Considerations for Your Home Loan Down Payment in Noida

In the constantly evolving realm of Noida's real estate market, the dream of homeownership is a prominent aspiration for many. Yet, the soaring property prices often necessitate the use of home loans to turn this dream into a reality.

If you're contemplating a home loan for the down payment in Noida, it's crucial to make well-informed decisions. In this article, presented by Loan4Wealth Finance Company in Noida, we'll explore seven pivotal factors to guide you through this process.

Before embarking on this journey, it's vital to grasp the significant factors that can impact your choice, not only affecting your immediate living situation but also shaping your long-term financial stability. Let's delve into these considerations to empower you in making a knowledgeable choice regarding your Noida home loan down payment.

Selecting the Right Home Loan Provider in Noida

The initial step in realizing your dream home is choosing the right home loan provider in Noida. Seek out reputable agencies with a proven track record as dependable home loan lenders in Noida. Loan4Wealth Finance Company stands out as a prominent lender in Noida, offering tailored financial solutions to meet your needs.

Evaluate Your Financial Position

Before diving into the process, conduct a thorough assessment of your financial situation. Calculate your income, existing financial obligations, and check your credit score. A favorable credit score is crucial in securing advantageous loan terms. Loan4Wealth Finance Company in Noida considers these factors to offer you the best financial solutions in Noida.

Explore the Loan Options

Noida boasts various financial companies catering to your needs. Research and explore online home loan lenders in Noida to gain insight into the available loan options. Whether you're in search of instant home loans in Noida or traditional ones, Loan4Wealth Finance Company provides a wide array of financial solutions in Noida to match your preferences.

Interest Rates and Loan Terms

Interest rates play a significant role in determining the overall cost of your home loan. Compare the interest rates offered by different financial solutions in Noida to secure the most competitive rate. Additionally, gain a clear understanding of the loan terms, including the tenure and repayment structure. Loan4Wealth Finance Company in Noida ensures transparency in these aspects, aiding you in making informed decisions.

Determine the Down Payment Amount

Calculating the down payment amount is a critical consideration. While home loan lenders in Noida generally cover a certain percentage of the property value, having a substantial down payment can lead to better loan terms and reduced monthly EMIs. Loan4Wealth Finance Company, a reputable finance company in Noida, can assist you in determining the ideal down payment.

Uncover Hidden Costs and Fees

Beyond interest rates, various hidden costs and fees might be associated with a home loan. These can encompass processing fees, administrative charges, and prepayment penalties. When partnering with Loan4Wealth Finance Company in Noida, you can trust that the financial solutions provided are transparent, free from hidden surprises.

Align with Future Financial Goals

Before finalizing your decision, align your home loan plans with your future financial goals. Consider whether the monthly EMIs will impact your ability to achieve other milestones. Ponder the long-term implications of your home loan commitment. Loan4Wealth Finance Company in Noida not only helps you secure your dream home but also provides financial solutions that consider your financial well-being in Noida.

Conclusion

In conclusion, the decision to secure a home loan for the down payment in Noida is a multifaceted one, demanding careful evaluation. As a premier finance company in Noida, Loan4Wealth Finance Company comprehends the intricacies of the local market and offers meticulously tailored financial solutions.

Its reputation as a trusted home loan agency in Noida is built on a foundation of transparency and reliability. From facilitating instant home loans to addressing diverse financial needs, Loan4Wealth Finance Company is your reliable partner in turning homeownership aspirations into reality.

Whether you're a first-time homebuyer embarking on an exciting journey or an individual seeking to enhance your living space, choosing the right home loan lender in Noida carries immense significance.

Opting for Loan4Wealth Finance Company means embracing expertise, a dedicated commitment to financial solutions, and an unwavering dedication to helping you reach your milestones in Noida's dynamic real estate landscape.

Your journey toward your dream home starts here, with Loan4Wealth Finance Company by your side to guide you every step of the way.

#Home Loans In Noida#Home Loan Noida#Home Loans Noida#Home Loan in Noida#Home loans company noida#Home Loans provider In Noida#Home Loan provider In Noida#Home Loan provider Noida#loan provider noida#finance company noida#Loan Company in noida#Loan Provider Company in noida#Loan Provider Company noida

1 note

·

View note

Text

Investing in Property in Delhi with YUG REALITY: A Smart Move

Delhi is a melting pot of culture, commerce, and politics but still is one of the centers for real estate investment. Property investors who are interested in residential property and Commercial Property Delhi space find Delhi to be an excellent location because of its exploding infrastructure, high demand for housing, and high business potential. Property Investment Delhi is the right way to fetch long-term returns.

Address: YUG Reality is a unit of YUG Facilities LLP

Lotus Business Park, Sec 127, Noida

Email: [email protected]

Property Investment Delhi -Yug Reality

YUG REALITY the name synonymous with the area of real estate is sure to help a lot of investors in negotiating the fluid property market in Delhi. And that’s why investing in property in Delhi with YUG REALITY is such a great idea:

1. Increase demand for Residential and Commercial Places

Delhi keeps growing in terms of population, and for every area of growth, there is increased demand for homes. It provides attractive employment, education, and a better standard of living to its citizens than people from all over the country. The need for residential property stands at its peak; therefore, this investment in apartments, flats, and villas is sound. Thus, this growth spurt in the number of businesses and startups operating within the city increases demand for commercial properties; hence, it becomes an opportune time to invest in office spaces as well as retail outlets.

YUG REALITY provides exclusive, prime residential and commercial properties with the best locations in Delhi. Starting from luxury apartments to high-end commercial buildings, YUG REALITY guides the investor towards such a property that has immense appreciation potential.

2. Strategic Locational Advantage

Being placed centrally in North India, Delhi is relatively closer to other states as well as regions, while better connectivity with the neighboring states makes it even more attractive. Good connectivity through expansions in the Delhi Metro network, good road infrastructure systems, and an international airport make Delhi further boost the attractiveness of the real estate investment market. South Delhi, Dwarka, and Gurgaon are prime investment destinations in the National Capital Region. They have been built mainly on connectivity and good infrastructure.

YUG REALTY is well conversant with the city property market and has unrestricted access to properties in prime locations, which are major development sites for investment. Be it a residential plot in a region that is rapidly developing or a commercial property near a business hub, YUG REALTY offers its clients tailor-made solutions according to what they have to say about their requirements.

3. High Return on Investment

High returns are one of the major investment reasons in Delhi property. The resultant high appreciation in times yields helps generating high returns to the investor as properties sold in prime locations undergo high appreciation over time. Receipt of rental income from residential and commercial properties creates another source of steady cash flow for an investor. By proper property investment strategy, one can enjoy capital gains over extended periods and consequential rental incomes.

With extensive market analysis and investment experience, YUG REALITY helps investors make the right judgments. They inform their clients to choose the right Commercial Property in Delhi, which has shown a pattern of appreciation in the past and thus provides a good return.

4. Government Initiatives and Policies

Besides this, the government has floated various plans and policies through which people may be motivated to invest in the real estate sector especially in places like Delhi. RERA — Real Estate (Regulation and Development) Act has increased transparency that has led to more investor confidence. Tax exemption on home loans and incentives for affordable housing plans make investing in a property an attractive idea.

YUG REALITY always keeps its customers posted with the latest government policies and ensures that its customers take maximum advantage from them. They offer to the investors all sorts of legal and financial facilitations so that property buying becomes highly hassle-free.

5. Why Choose YUG REALITY?

YUG REALITY is the most sought company in Delhi by having professional approaches, large portfolios, and wide-ranging services rendered to clients. Property investors and matured companies in the Delhi property market ensure that people get unprecedented advice from their company. The company has dedicated professionals that make sure the properties suit the investment goals and budget of the clients.

That is, no matter whether it’s your first investment or you are an experienced buyer, YUG REALITY takes these investments in property without fear.

Conclusition:

Probably the best return or continuous growth of demand in addition to strategic location advantages lies in investing in real estate, especially in Delhi. YUG REALITY avails such an opportunity in an enabling manner. Let YUG REALITY help you make smart property investment decisions that enable securing your financial future in one of India’s most promising areas for real estate investments.

0 notes

Text

ATS Pious Orchards Real Estate Properties in Noida

Even the banks are offering a helping hand to for those wish to make a real estate investment in the country. The government has devised a new scheme called the Pradhan Mantri Awas Yojana. This scheme is devised to help people in the lower and middle income groups purchase their own homes. ATS Pious Orchards Apartments, This scheme provides home loans at the lower rates. By taking this step the government has made it easier for more people in Noida to be able to afford property of their own. ATS Pious Orchards Price / ATS Pristine Golf Villas Price / ATS Greens Noida Extension / ATS Le Grandiose Phase 2 Price

Residential property in Noida has always cost sky rocketing prices. No one can really afford to purchase flats in Noida, let along make any real estate investments in the cities. ATS Pious Orchards Apartments, This is the reason a majority of the population lives in rented flats and houses in the city. However, with the Pradhan Mantri Awas Yojana, even people with a nominal income will be able to get loan and even buy their own homes in the city.

Another reason why people hesitate while making real estate investments in the city is that not all builders are reliable. ATS Pious Orchards Apartments, A lot of under construction properties get stalled or worse, demolished because builders don't have the right permissions and legal work done before starting their projects. However, the government is taking action to put a stop to that as well. The government has now implemented RERA. RERA stands for Real Estate (Regulation and Development) Act.

This act was implemented on 2024 and as per this act all developers of both residential and commercial properties need to register their project with the Real Estate Regulation Authority. This has to be done within three months of the implementation of the Act. On failing to do so the developer faces a penalty which amounts up to 10 percent of the cost of the project or even imprisonment. Without registration the developer cannot sell or advertise the project or invite potential buyers to purchase any units. This act is a game changer for home buyers as most of its rules and regulation are in their favour. This move has brought a lot of relief to potential investors and home buyers. All these steps by the government are making this the best time to make real estate investments in the country.

0 notes

Text

Finding Your Dream Home: Ready-to-Move 2 BHK Flats in Noida

Noida is one of the fastest developing cities of the NCR and thus comprises a sparkle for all the customers seeking sophisticated living spaces. From the views described above it can be said that this place offers great possibilities for a comfortable living as it has the strategic location and a relatively developed infrastructure with great connections. In this regard, one of the popular choices of home seekers has been ready to move flat in noida. For more information on what you need to know about Ready to Move Flat and why Noida should be your choice, read on through this blog if you are a home seeker.

Why Choose a Ready-to-Move Flat?

Immediate Possession: Another something that is appealing about purchasing a flat in ready possession is that one is able to occupy it the earliest. Unlike under-construction properties where you may be forced to wait for months or even years to occupies the property, ready-to-move flats are convenient in that one can occupy the flats immediately. This is advantageous especially if you are in a position to rush and move out or just don’t fancy the experience of having to deal with project delays builders in noida .

No Risk of Delays: Purchasing a flat under construction also means that there are delays that could arise from issues to do with permits, construction faults, or even the builder’s cash flow problems. This means that by getting a ready to move flat, these risks can be avoided since the property is already completed hence can be occupied.

What You See Is What You Get: In the event you decide to purchase a flat that is already fitted, then you are sure to have a glimpse of the real thing before you make your purchase. This makes it possible to judge the quality of construction, location of doors and windows, ventilation and many other compelling factors of the flat. It is not left to guesswork and you are in a position to make a proper decision.

Save on Rent: If you are at present residing in a rented accommodation, they can benefit from owning a ready to move flat as due from the double pressure of having to pay both rent as well as home loan EMI. You can occupy your new house immediately hence can enjoy the delicious fruits of being a homeowner.

Tax Benefits: For ready made properties, the homebuyers can also avail benefits of tax under section 24 of the income tax act on the interest as well as the principal amount paid on home loans. This can go a long way towards saving dollars, and make buying a home much more feasible.

2 BHK Flats in Noida: The Perfect Choice

The 2 BHK flats are particularly a optimal for families that are a small in size or newlywed couple or any professional. These flats are well designed with ample space, well equipped and very much affordable. Noida has numerous 2 BHK flats in different prices so that everyone can get what they are looking for. Looking for a small house or a luxurious flat with all the mod cons, Noida has a great choice of residential accommodation on offer.

Advantages of Buying a 2 BHK Flat in Noida

Affordability: For people who are looking for homes in Noida the 2 BHK flat option is comparatively cheaper when put into consideration with 3 or 4 BHK flats. This makes them a perfect dream for the first-time homeowners or people with little cash to invest in a home.

Optimal Space: A 2 BHK flat has a size that will be sufficient to make the living comfortable. There are two bedrooms, living room, kitchen and bathrooms provided in these, flats and it does not make them feels less spacious if they have a tiny family.

Resale Value: Most of the people want to buy 2 BHK flat which is quite evident in the real estate segment hence it is good business. Due to their popularity, they attract a better market price when it comes to resale, if the owner decides to sell the property.

Low Maintenance: Compared to other bigger flats, maintenance and handling of a 2 BHK flat is less complicated and a little cheap. It makes it reasonable for those that love to lead a convenient and easy lifestyles.

Why Noida?

Noida's real estate market has witnessed rapid growth over the years, making it a hotspot for property buyers. Here are a few reasons why Noida is an excellent location to invest in a 2 BHK flat:

Proximity to Delhi: Noida's close proximity to Delhi makes it an attractive choice for those who work in the capital but prefer a quieter residential area. The city is well-connected to Delhi via the Delhi-Noida Direct (DND) Flyway, Noida-Greater Noida Expressway, and the metro.

World-Class Infrastructure: Noida boasts of world-class infrastructure with wide roads, well-planned sectors, and a plethora of amenities such as schools, hospitals, shopping malls, and recreational facilities. The city's infrastructure development is ongoing, promising even better connectivity and facilities in the future.

Green and Clean Environment: Noida is known for its green spaces and well-maintained parks, offering a healthy and clean environment for residents. The city's focus on sustainability and green living adds to its appeal.

Educational and Employment Opportunities: Noida is home to several reputed educational institutions and multinational companies, making it a hub for students and working professionals. The presence of these institutions adds to the demand for residential properties in the city.

Conclusion

A ready-to-move 2 BHK flat in Noida offers the perfect blend of comfort, convenience, and affordability. Whether you're a first-time homebuyer or looking to invest in a property with high resale value, Noida's real estate market has plenty to offer. With the benefits of immediate possession, no risk of delays, and a wide range of options, a 2 BHK flat in Noida could be the dream home you've been searching for.

If you're interested in exploring available options, visit Miglani Group to find the perfect 2 BHK flat that suits your needs.

Read More : http://www.miglani.org/chairmanintro.php

0 notes

Text

Are you a property owner in Delhi looking to unlock the hidden value of your asset? Capified offers an excellent financial solution tailored just for you - Loan Against Property (LAP). This innovative loan product allows you to leverage the value of your residential or commercial property to meet your financial needs without having to sell it.

Why Choose Capified's Loan Against Property?

At Capified, we understand the importance of providing flexible and customer-centric financial solutions. Our Loan Against Property in Delhi comes with a host of benefits designed to meet your diverse financial requirements:

Attractive Interest Rates

We offer competitive interest rates to ensure that your loan is affordable. Our team works diligently to provide you with the best rates in the market, making it easier for you to manage your finances without straining your budget.

High Loan Amounts

With Capified, you can avail yourself of high loan amounts depending on the value of your property. This means you can secure substantial funding for various purposes, be it business expansion, higher education, medical emergencies, or home renovation.

Flexible Tenure

We offer flexible repayment tenures, allowing you to choose a tenure that best suits your repayment capacity. Whether you prefer a short-term loan or a long-term commitment, Capified provides options that align with your financial planning.

Easy Application Process

Applying for a Loan Against Property with Capified is simple and hassle-free. Our streamlined application process ensures quick approval and disbursal of funds. Our dedicated team of experts is always ready to assist you at every step, making the entire experience smooth and efficient.

Eligibility and Documentation

To be eligible for Capified's Loan Against Property in Delhi, you need to meet the following criteria:

Ownership of Residential or Commercial Property: The property should be in your name and located within Delhi.

Stable Income Source: Proof of stable income to ensure your repayment capacity.

Good Credit History: A positive credit history increases your chances of approval.

The required documentation includes:

Property documents (title deed, property tax receipt, etc.)

Proof of identity (Aadhar card, PAN card, passport, etc.)

Proof of address (utility bills, rental agreement, etc.)

Income proof (salary slips, bank statements, ITR, etc.)

Why Capified?

Capified stands out in the financial market for its customer-centric approach and commitment to providing top-notch financial products. Our Loan Against Property is designed to empower you to achieve your financial goals without compromising your valuable asset. We take pride in offering personalized services, ensuring transparency, and maintaining the highest standards of integrity.

Take the Next Step with Capified

Unlock the potential of your property and fulfill your financial dreams with Capified's Loan Against Property in Delhi. Whether you're looking to fund your business, pay for your child's education, or manage unexpected expenses, our LAP product is the perfect solution for you.

Contact us today to learn more about our Loan Against Property and take the first step towards financial freedom with Capified. Your property is more than just a place to live or work; it's a powerful financial asset that can help you achieve your dreams.

READ MORE.....Cash Against Property Loan Against Property in Delhi Gurgaon Noida Capified

0 notes

Text

The Importance of Marriage Registration: Legal Rights and Responsibilities

Marriage registration is a crucial legal process that formalizes a marriage and provides it with legal recognition. In India, registering your marriage offers various legal benefits and protections. At Lawchef, our Marriage Registration Lawyers in Delhi and Noida are here to guide you through the process, ensuring that your marriage is officially recognized and that you receive your marriage registration certificate seamlessly. This article outlines the importance of marriage registration, including the rights and responsibilities it entails.

Why Marriage Registration is Essential

1. Legal Recognition

Marriage registration provides your union with official recognition under Indian law. This is important for several reasons:

Legal Validity: An unregistered marriage may not be recognized by law, which can lead to issues in various legal matters.

Proof of Marriage: A marriage registration certificate serves as concrete proof of your marriage, which is essential for many legal and administrative processes.

2. Access to Legal Rights

Registering your marriage ensures that both partners have access to legal rights and protections:

Inheritance Rights: Registered spouses have the right to inherit property and assets from each other in the event of death.

Spousal Benefits: A legally recognized marriage allows for the claiming of spousal benefits such as insurance, pensions, and social security.

3. Legal Responsibilities

Marriage registration also entails certain legal responsibilities:

Legal Obligations: Registered spouses are bound by legal obligations, including those related to maintenance, support, and the welfare of children.

Administrative Requirements: A registered marriage simplifies the process of dealing with various administrative and legal matters, such as changing names or applying for joint loans.

Steps to Register Your Marriage

1. Gather Required Documents

To register your marriage, you'll need to prepare and submit specific documents:

Identification Proof: Valid IDs such as Aadhar cards, passports, or voter IDs.

Proof of Marriage: Evidence of the marriage ceremony, which may include photographs or testimonials from witnesses.

Age Proof: Documents proving that both parties meet the legal age requirements.

2. Apply for Marriage Registration

You can apply for marriage registration either through traditional methods or online marriage registration:

In-Person Registration: Visit the local marriage registrar's office with the required documents. This process typically involves filling out an application form and attending an interview.

Online Registration: Many states in India offer online marriage registration services. This allows you to submit documents and complete the registration process from the comfort of your home.

3. Attend the Registration Appointment

During the appointment, you and your spouse may need to:

Provide Documents: Submit the documents prepared earlier.

Answer Questions: Answer questions about your marriage and personal details.

4. Receive the Marriage Certificate

Once the registration is processed, you'll receive a marriage registration certificate. This document is crucial for proving your marital status and accessing legal rights.

Legal Assistance for Marriage Registration

1. Role of a Marriage Registration Lawyer

A Marriage Registration Lawyer can assist you in:

Preparing Documents: Ensuring that all required documents are in order and meet legal requirements.

Navigating the Process: Guiding you through the registration process, whether in-person or online.

Resolving Issues: Addressing any legal issues or complications that may arise during the registration process.

2. Finding the Right Lawyer

If you are looking for a Marriage Registration Lawyer in Delhi or Marriage Registration Lawyer in Noida, consider the following:

Experience: Choose a lawyer with experience in handling marriage registrations.

Reputation: Look for positive reviews and recommendations from previous clients.

Consultation: Schedule a consultation to discuss your needs and ensure the lawyer can provide the assistance you require.

Conclusion

Marriage registration is a vital step in formalizing your marriage and securing your legal rights and responsibilities. At Lawchef, our Marriage Registration Lawyers in Delhi and Noida are dedicated to making the registration process smooth and efficient. Whether you choose to register your marriage in person or opt for online marriage registration, our team is here to assist you every step of the way. Ensure your marriage is legally recognized and obtain your marriage registration certificate with confidence by consulting with us today.

0 notes

Text

#best home loan provider in india#india best home loan provider#home loans#loans#cheapest home loan in delhi#finance#best home loan#home loan#housing loan in noida#personal loans

0 notes

Text

Looking for a personal loan in Noida? Xpertserve offers tailored personal loan solutions to meet your financial needs. Whether it's for home renovation, wedding expenses, or any other personal requirement, Xpertserve provides competitive interest rates and flexible repayment options. Our streamlined process ensures quick approval and disbursement, making it easier for you to access funds without hassle. Trust Xpertserve for your personal loan needs in Noida and experience seamless financial assistance.

#Personal Loan in Noida#Personal Loan in Gurgaon#Personal Loan in Delhi#Personal Loan in Faridabad#Personal Loan in Delhi NCR

0 notes

Text

Dreality-Best value real estate Service Company in Noida

Best value real estate-Best value real estate Service and, Best home loan provider is a full-service company in Noida, India. Dreality, Our agency provides the Best home loan provider, etc,

#best personal loans#Flats in noida extension#2-3 bhk in noida extension#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#place real estate#best value real estate#Apply for Personal Loan#start up business loans

0 notes

Text

Home Loan in Noida: Your Guide to a Dream Home

Home Loan in Noida: Your Guide to a Dream Home

Noida, famous for its lively lifestyle and top-notch infrastructure, is a fantastic place for homebuyers. If you're thinking about buying a home in this vibrant city, getting a home loan in Noida is an essential step. This guide will help you understand everything you need to know about getting a home loan in Noida, making the process simple and easy.

Why Buy a Home in Noida?

Noida has a great mix of modern amenities, excellent transportation, and a booming job market. Whether you want a cozy apartment or a spacious villa, Noida offers many options to suit any budget and lifestyle. Its closeness to Delhi and other big cities makes it a perfect place for both work and fun.

What is a Home Loan?

A home loan is money you borrow from a bank or financial institution to buy or build a home. You repay the loan over a set period with interest. Home loans make it possible to own a home by letting you buy a property with a smaller upfront payment and spreading the cost over many years.

Key Things to Consider for a Home Loan in Noida

Eligibility Criteria: Banks have specific rules, such as age, income, job status, and credit score. Make sure you meet these rules to increase your chances of getting approved.

Interest Rates: Interest rates can differ depending on the lender and the type of loan. Fixed rates stay the same throughout the loan term, while floating rates can change based on the market. Compare rates from different lenders to find the best one for you.

Loan Tenure: The length of your loan affects your monthly EMI (Equated Monthly Installment). Longer tenures mean lower EMIs but higher total interest payments. Choose a tenure that fits your finances.

Down Payment: Most lenders ask for a down payment, which is part of the property's price. A higher down payment means a lower loan amount and EMI.

Processing Fees and Charges: Be aware of any fees or penalties related to the loan. Knowing these costs will help you manage your budget.

Steps to Apply for a Home Loan in Noida

Research Lenders: Look for banks and financial institutions offering home loans in Noida. Check reviews, compare interest rates, and eligibility criteria.

Gather Documents: You will need identity proof, address proof, income statements, and property documents. Have all your paperwork ready for a smooth process.

Submit Your Application: Apply online or visit the lender’s branch. Provide accurate details and complete the required forms.

Loan Processing: The lender will review your application, verify your documents, and check your eligibility. This may include a background check and property evaluation.

Approval and Disbursement: Once approved, the lender will give you the loan amount to buy or build your home. You will get a loan agreement with all the terms and conditions.

Repayment: Start repaying the loan according to the EMI schedule. Make timely payments to keep a good credit score and avoid penalties.

Tips for a Successful Home Loan Application

Maintain a Good Credit Score: A higher credit score improves your chances of approval and getting better interest rates.

Keep Your Finances in Order: Make sure your financial records are correct and up-to-date. Avoid new debts before applying for a home loan.

Seek Professional Advice: Talk to a financial advisor or mortgage consultant to find the best options for your needs.

Conclusion

Getting a home loan in Noida is simple if you are well-prepared and informed. By understanding the key factors and following the steps in this guide, you can confidently navigate the home loan process and move closer to owning your dream home in this dynamic city. Happy house hunting

0 notes

Text

Rera Approved Property Sale in Greater Noida

Greater Noida, a prominent region in the National Capital Region (NCR), has emerged as a preferred destination for real estate investments. With its well-planned infrastructure, excellent connectivity, and growth potential, Greater Noida attracts homebuyers and investors alike. One critical aspect that has significantly impacted the real estate market here is the introduction of the Real Estate (Regulation and Development) Act, 2016 (RERA). This act has brought transparency, accountability, and standardization to the sector, ensuring that buyers have a safe and secure investment environment. Rera Approved Project ACE Terra / SKA Destiny One / Eldeco La Vida Bella / Fusion Homes

In this comprehensive guide, we will delve into the nuances of RERA-approved property sales in Greater Noida. We will explore the benefits of RERA, the process of buying a RERA-approved property, and some of the top projects to consider in the region.

Understanding RERA and Its Importance

RERA was introduced to address the numerous issues plaguing the real estate sector, such as delays in project delivery, unfair practices by developers, and lack of transparency. The primary objectives of RERA are to:

Ensure Transparency: Developers must register their projects with RERA, providing all necessary details, including project timelines, specifications, and legal clearances.

Protect Buyers’ Interests: The act mandates that developers adhere to the agreed terms and conditions, ensuring timely delivery and quality construction.

Standardize Practices: RERA sets guidelines for fair transactions, reducing disputes and enhancing trust between buyers and developers.

Enhance Accountability: Developers are held accountable for project delays and must compensate buyers for any default.

RERA has been instrumental in restoring confidence in the real estate market, making it safer for buyers and investors.

Benefits of Buying a RERA-Approved Property

Investing in a RERA-approved property offers several advantages:

Transparency: All project details are available on the RERA website, including project status, approvals, and developer information.

Timely Delivery: Developers must adhere to the project timeline, and any delays result in penalties.

Quality Assurance: RERA mandates that developers deliver the property as per the promised specifications.

Legal Safeguards: Buyers have legal recourse in case of any discrepancies, ensuring their rights are protected.

Financial Security: Developers cannot divert funds from one project to another, ensuring financial stability and project completion.

The Process of Buying a RERA-Approved Property

Buying a RERA-approved property involves a systematic process to ensure a safe and informed investment. Here are the steps to follow:

Research and Shortlist Projects: Start by researching RERA-approved projects in Greater Noida. Use the RERA website to verify the project details, developer information, and project status.

Visit the Site: Once you have shortlisted a few projects, visit the sites to get a firsthand look at the construction quality, location, and amenities.

Check Legal Documents: Verify all legal documents, including the title deed, project approvals, and RERA registration certificate. Ensure there are no legal disputes related to the property.

Compare Prices: Compare the prices of similar properties in the area to ensure you are getting a fair deal. Consider factors like location, amenities, and project status.

Financial Planning: Assess your budget and arrange for the necessary funds. Explore home loan options and check for pre-approved loan offers.

Booking and Agreement: Once you have finalized a property, pay the booking amount and sign the agreement for sale. Ensure that the agreement includes all the terms and conditions as per RERA guidelines.

Registration: Register the property with the local sub-registrar office to complete the legal formalities. Ensure that all documents are duly stamped and signed.

Possession and Handover: Upon project completion, take possession of the property. Inspect the property for any defects and ensure that the developer addresses them before final handover.

Top RERA-Approved Projects in Greater Noida

Greater Noida offers a plethora of RERA-approved projects catering to different budgets and preferences. Here are some of the top projects to consider:

ATS Destinaire: Located in Sector 1, Greater Noida West, ATS Destinaire offers luxurious 3 and 4 BHK apartments with world-class amenities, including a clubhouse, swimming pool, and sports facilities.

Gaur City: Spread across 237 acres, Gaur City is a township project offering a mix of residential, commercial, and recreational spaces. It includes 2, 3, and 4 BHK apartments with modern amenities.

Prateek Grand City: Situated in Siddharth Vihar, this project offers premium 2, 3, and 4 BHK apartments. It boasts extensive green spaces, a clubhouse, sports facilities, and more.

Mahagun Mywoods: Located in Greater Noida West, Mahagun Mywoods offers 2, 3, and 4 BHK apartments in a forest-themed township. The project includes ample green spaces, a clubhouse, and sports facilities.

Nirala Estate: This project in Techzone IV, Greater Noida West, offers well-designed 2, 3, and 4 BHK apartments. It features a clubhouse, swimming pool, and landscaped gardens.

Ajnara Le Garden: Situated in Sector 16B, Greater Noida West, Ajnara Le Garden offers affordable 2, 3, and 4 BHK apartments with amenities like a clubhouse, gym, and children’s play area.

Factors to Consider When Buying RERA-Approved Properties

While RERA provides a safeguard for buyers, it is essential to consider several factors before making a purchase:

Developer Reputation: Choose a reputed developer with a proven track record of delivering quality projects on time.

Location: Evaluate the location in terms of connectivity, infrastructure, and proximity to essential services like schools, hospitals, and markets.

Project Amenities: Consider the amenities offered in the project, such as recreational facilities, green spaces, and security features.

Budget: Ensure that the property fits within your budget, including additional costs like registration fees, maintenance charges, and taxes.

Future Growth Potential: Assess the potential for future growth and appreciation in the area. Look for upcoming infrastructure projects and commercial developments.

Legal Clearances: Verify that the project has all necessary legal clearances and approvals from relevant authorities.

Impact of RERA on Greater Noida’s Real Estate Market

The implementation of RERA has had a profound impact on the real estate market in Greater Noida:

Increased Transparency: Buyers have access to accurate and verified information about projects, reducing the risk of fraud and misinformation.

Boosted Buyer Confidence: The assurance of timely delivery and quality construction has restored buyer confidence in the market.

Regulated Developer Practices: Developers are now more accountable and adhere to standardized practices, ensuring fair transactions.

Improved Market Dynamics: RERA has weeded out unscrupulous developers, leading to a more organized and trustworthy market.

Enhanced Investment Potential: The stability and transparency brought by RERA have attracted more investors, driving demand and growth in the sector.

Conclusion

The introduction of RERA has revolutionized the real estate market in Greater Noida, making it a safer and more attractive destination for property investments. Whether you are a homebuyer or an investor, buying a RERA-approved property offers numerous benefits, including transparency, legal protection, and quality assurance. By following the systematic process outlined in this guide and considering the factors mentioned, you can make an informed decision and secure a valuable asset in Greater Noida.

For detailed information about specific projects and their RERA status, it is advisable to visit the official RERA website or consult with a trusted real estate advisor. Investing in a RERA-approved property is a step towards a secure and prosperous future in the dynamic real estate landscape of Greater Noida.

1 note

·

View note