#personal finance loans

Text

How mortgage technology trends transforming consumer lending

Mortgage lending is the practice of providing funds to an individual or business in order to purchase or refinance real estate. The borrower pledges the real estate as collateral for the loan and agrees to repay the loan, usually over a period of time, with interest. Mortgages are a popular form of financing for homeowners who are looking to buy a home or refinance their existing mortgage. It is the practice of providing funds to an individual or business in order to purchase or refinance real estate. The borrower pledges the real estate as collateral for the loan and agrees to repay the loan, usually over a period of time, with interest.

Impact of Technology on Mortgage Lending

Today, the mortgage lending industry is seeing a significant amount of change due to technological advances. Technology has revolutionized the way we borrow, invest, and manage our finances, and mortgage lending is no exception. Advancements in technology have made the process of obtaining a mortgage faster and more efficient, allowing borrowers to get pre-approved for a mortgage loan in minutes.

Technology has also made it easier for lenders to underwrite and process mortgage loans. Digital mortgage platforms allow lenders to quickly verify a borrower’s income and credit score, which can help speed up the loan approval process. Additionally, digital mortgage platforms provide automated underwriting, which reduces the amount of manual paperwork and time needed to process a loan. Finally, technology has enabled lenders to offer a variety of competitive loan products to borrowers. Online personal loan finance brokers often provide loan products with competitive rates and terms, as well as innovative products such as no-closing-cost mortgages and adjustable-rate mortgages. This has made it easier for borrowers to find a loan product that meets their needs.

Overall we can say technology has had a major impact on the mortgage lending industry, making the process of obtaining a loan easier, faster, and more efficient. In addition to improving the borrower experience, technology is helping lenders offer a variety of competitive loan products, enabling borrowers to get the best loan possible.

Challenges of Mortgage Technology Trends

In this day and age of ever-evolving technology, it is more important than ever for mortgage brokers to stay on top of the changing landscape of mortgage technology. With increasingly sophisticated software, hardware, and applications, lenders must quickly adapt if they want to remain competitive and remain profitable. This can be a challenge, as technology trends can be especially dynamic and rapidly changing. Here are some of the key challenges of mortgage in the new technology trends.

Security: One of the most pressing challenges of mortgage in the new technology trends is security. With the rise of cyber-attacks, lenders must be sure to have robust security systems in place to protect the data and information of their customers. It is also important for lenders to take a proactive stance on security and regularly update their systems with the latest security measures.

Automation: Automation is becoming increasingly important for lenders, as it can help streamline processes and increase efficiency. However, lenders must be careful to ensure that automated processes are compliant with regulations and that all data is secure and accurate.

Digitalization: Digitalization is a key trend in the mortgage industry. The ability for customers to be able to easily access and manage information online is essential for lenders. To be successful, lenders must ensure that their digital capabilities are up to date, safe, and easy to use.

New Technologies: The mortgage industry is constantly evolving and new technologies are emerging all the time. Keeping up with the latest technology trends is a challenge for lenders, as they must make sure that they are utilizing the most up-to-date and secure tools.

Compliance: In an increasingly regulated industry, lenders must ensure that they are compliant with all regulations and laws. This can be a challenge, as new regulations and laws can be constantly changing, and lenders must be diligent to ensure that their processes and procedures are compliant.

Conclusion

The mortgage industry is going through a period of rapid change and innovation, and lenders must remain ahead of the curve in order to remain competitive. With the right strategies, we can stay ahead of the technological trends and ensure that we are at Orchardlending.com.au providing the best services and products to their customers.

#mortgage brokers#loan broker#finance broker#online personal loans#personal finance loans#personal loan brokers

0 notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

81 notes

·

View notes

Text

What is the difference between credit card and debit card? - Credit card

Credit card and debit card - In today's fast-paced world, financial transactions...

#credit card benefits#credit card rewards#credit card holder#credit card processing#credit card debt#credit#loans#banking#investments#personal finance

38 notes

·

View notes

Text

https://fundrr.com.au

Business & Personal Loans | Mortgage Broker - Fundrr Australia

Fundrr Australia offers a wide range of financial solutions, including consumer car loans, commercial car loans, personal loans, refinancing options, insurance, and more.

2 notes

·

View notes

Text

MONEY IS ESSENCIAL.

#finance#business#income#moneymindset#how to earn money#cash#investments#make money for free#financial freedom#personal finance#retirement planning#personal loans#personal income#personal saving#financeblogger#finance advisor#financetips#student loan#student loans#student loan debt#viral#loans#debt#Bad Credit Loans#Personal Loans#Quick cash Loans#nonprofits

140 notes

·

View notes

Text

Ready to take your business to the next level? 💼💥 Unlock new opportunities and fuel your growth with our flexible loan solutions! 🚀💰

9 notes

·

View notes

Text

Our team of experienced consultants specializes in helping small businesses like yours identify funding opportunities that align with your unique goals and aspirations. Whether you are looking to invest in new technologies, expand your facilities, or hire additional talent, we have the expertise to guide you towards sustainable growth.

Reach out to us today to learn more at (800) 452-8485

#business consultant#small business loans#business owners#sba#entrepreneur#loans#business funding#small business owner#finance#personal loans

5 notes

·

View notes

Text

the dinosaur is doing weird shit again and I need to get the extra money for a newer laptop jfc

#I am trying desperately to get my truck paid off before summer#and then snowballing that to handle a personal loan#and then my life will be substantially easier finance wise????#i literally need this thing to just keep working for another 6 months and then I will gentle retire her out to pasture where she deserves#i almost melted down lol I have a bunch of art ive bought for ocs on this thing and it like#deleted all my screenshots#hid all my art and writing documents over the past 10 yearsss#and they're still here but they're just hiding and I have to dig to find them#and now spotify is downloaded but wont open and isn't recognized as being downloaded even though I am looking at it#maybe in fall I'll have more body clipping appointments and can designate some of that money for a new laptop#ivy rambles

5 notes

·

View notes

Text

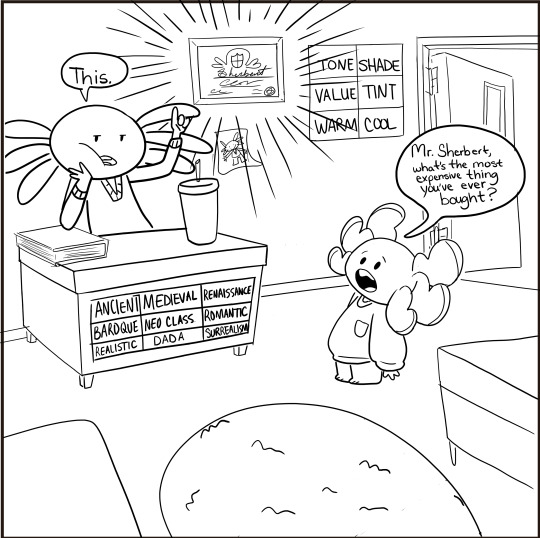

You know it. You hate it.

It's the plague of society, and you can't bankrupt out of it.

It's student loan debt, and Sherbert has too much of it!

Check out @financimals on Instagram and TikTok.

#financimals#personal finance#satire#web comic#sherbert#the axolotls#student loan debt#art teachers#comedy#humour#jokes#funny

2 notes

·

View notes

Text

First Home Buyer Loans | First Home Buyer Victoria

Your Mortgage Experts specialize in first home buyer loans. Find the perfect home loan for your needs in Tarneit, Truganina, Point Cook, Cranbourne, Perth, and Sydney.

#business loan#finance#loans#mortgage#personal loans#home loan#first home#Mortgage Experts#financial planning#property management#investors#services#mortgageexperts#loan#Victoria#cranbourne#perth#Sydney#Point Cook#PointCook

2 notes

·

View notes

Text

Kviku a non-banking credit organization that offers online loans in spain. 🇪🇸

providing hassle-free online loans to meet your urgent financial needs.

Instant approved : Finance Apply now

Read more..

#financial#financial planning#finance management#business#credit score#financial freedom#personal loans#credit cards#finance assignment help#moto: spain 2024#madrid spain#philip ii of spain#spa in ajman#hws spain#spa in chennai#spain eurovision#spain football#spain hetalia#spain news#spain hws#spain art#spain 2023#spain#spain travel#spain visa#spain nt#spain without the s#spain women's national team#spain x reader#spainese

1 note

·

View note

Text

A Comprehensive Overview of Multiple SBA Loan Programs: What’s Best for Your Business?

Understanding the Importance of SBA Loans for Small Businesses

SBA loans are essential for fostering and advancing the expansion of small businesses. The Small Business Administration provides a range of loan programs tailored to offer financial support to entrepreneurs and small business owners.

These small business loans are particularly important for startups and small businesses that may face challenges in obtaining traditional bank loans due to limited collateral or credit history. Small-term loans provide access to capital at favorable terms, including lower interest rates and longer repayment periods. An important advantage of small business loans is the inclusion of a guarantee for lenders, which mitigates their risk and encourages them to provide loans to startups. This guarantee enables lenders to offer financing alternatives that may have been otherwise inaccessible.

Small business owners must comprehend the various SBA lending programs that are accessible, including but not limited to 7(a) loans, CDC/504 loans, microloans, and disaster assistance loans. Every program has unique prerequisites and qualifying requirements.

Exploring the Most Popular SBA Loan Programs and Their Eligibility Criteria

In this section, we will explore some of the most popular Small Business Administration loan programs and discuss their eligibility criteria.

1. 7(a) Loan Program:

The 7a loans stand out as the most versatile and widely used loan initiative. It provides funding of up to $5 million, catering to a myriad of business needs, from working capital to equipment purchases.

Key Features of 7a Loans:

Loan Amount: Up to $5 million.

Usage: Diverse business needs, from day-to-day operations to expansion.

Term Length: Varies based on usage.

Eligibility Criteria: Read More

#finance#business loan#loan#personal loans#same day loans online#Cash advance#line of credit#equipment financing

2 notes

·

View notes

Note

Hi bitches! I have some spare money from this semester's student loans and I was wondering what you think I should do with it! Thanks!

If you don't have any living expenses (rent, groceries, internet bill, heating, parking, public transit, etc) or school expenses (books, lab fees, etc) or medical expenses that need covering right now... SAVE IT.

I don't know the details of your loan and how soon you have to use the money, but if you can save it for a later emergency, that would be my advice.

You Must Be This Big to Be an Emergency Fund

What We Talk About When We Talk About Student Loans

Did we just help you out? Tip us!

37 notes

·

View notes

Text

全球留学生华人贷款,利率低至6%每月无任何前期费用,三分钟审核。十分钟下款详情咨询下方微信二维码#留学生贷款#留学生贷款请加微信#留学生贷款公司#留学生贷款金服#留学生贷款找我#留学生贷款银行井留学生借款#留学生借钱#留学生小额货款#留学生小额应急#留学生货款#留学生借钱银行#北美贷款#北美借款#国外应急小额#美国留学生#美国留学那点事

#留学生交友#留学生约 炮#留学生代写#西安 公交车 留学生约炮 娇喘 同城交友 留学生圈高奢定制 留学生兼职 滴蜡 视频交友 视频直播 视频一对一 全国楼凤 多人 熟妇 跳蛋 施虐 受虐 女s 贱货 找奴 美脚 抖s 项圈 绿奴 sm圈#贷款#loans#personal loans#business loan#home loan#banking#finance#same day loans direct lenders#same day payday loans#financial planning#lending#lend a hand#andy murray splits from head coach ivan lendl for third time#short term loans direct lenders

2 notes

·

View notes

Text

Should I Get Personal Loan During A Period With High Inflation Rate ?

Long-term inflation hikes can be concerning for an individual, and with good reason, even though price increases are partially a reflection of generally positive economic progress. Your personal finances are directly impacted by inflation, which sets spending and budgetary restrictions. However, in the event that you require additional funds, is it prudent to obtain a personal loan at a time of elevated inflation rates?

This blog provides all the information you need to take out a personal loan during a period of high inflation, including how much it will cost, if it makes sense, what the advantages are, and what to watch out for.

Do you need a personal loan?

You should think about whether a loan is the right choice for you and your circumstances before taking out a personal loan. When used wisely, personal loans may be a dependable and practical financial instrument. You should consider how you will repay the loan balance because missing loan payments can negatively impact your credit score and financial stability, making it more difficult for you to obtain financing in the future, should you want to do so.

Even if personal loans are fantastic, you should consider your options carefully before selecting the best course of action in light of rising inflation rates. This includes utilizing a credit card or personal lines of credit, checking your personal savings, and taking out secured loans.

What impact does inflation have on loan rates?

Fixed interest rates are affected by inflation indirectly, and the two are associated even though they don't directly affect each other. The main instrument that central banks use to control inflation is inflation, which explains why. Authorities may increase interest rates in order to discourage borrowing and promote saving if inflation is out of control. The government will, on the other hand, cut interest rates if the economy needs a boost, which will encourage people to borrow more money and increase their spending capacity.

What is the cost of inflation on personal loans?

The interest rate for personal loans is often fixed, meaning that it stays the same over the term of the loan. Your interest rates on personal loans that you took out prior to inflation will remain stable, so inflation won't affect them. But if you're a first-time borrower taking out a loan during inflation, you might have to pay more interest because lending rates are likely to rise.

How do inflation rates benefit borrowers?

Money loses value with time, and as they say, "now is better than later." This is a fundamental principle of inflation. Thus, as a borrower, you will be able to repay lenders with money that is worth less than what you borrowed in the first place if inflation increases.

Should you take out a personal loan during an inflation increase?

It all comes down to your requirements in the end. Food, goods, and other basics of life could cost more than you can afford when inflation strikes. A personal loan might assist you pay for any unforeseen costs that may develop in this situation and solve your cash flow issues. Although you should take into account how long it will take, it is likely that your finances will start to improve and you will be able to pay back the personal loan.

As lending is typically done at a fixed rate, the inflation rate is typically appropriately factored into the loan cost. Your credit score and ability to repay the loan are other elements that affect the cost of the personal loan. Banks will charge you a low interest rate if they believe you have a solid capacity for payback. On the other hand, a high interest rate will apply if your credit score is outstanding. Applications for personal loans may occasionally be denied to borrowers with extremely low credit scores and inadequate ability to repay the loans. That way, when you search for a personal loan, these factors are taken into consideration.

When taking out a personal loan, it's important to consider your needs, your ability to repay the loan, and your other choices.

2 notes

·

View notes

Text

Mortgage Brokers in Pimpama A Must Home Review

Pimpama, a picturesque suburb in Queensland, has witnessed a surge in the real estate market, attracting homebuyers from all walks of life. Navigating the complexities of mortgages in such a thriving market can be daunting. That’s where Must Home, the leading mortgage broker in Pimpama, steps in to simplify the process.

What Sets Must Home Apart

1. Tailored Financial Solutions: Must Home prides itself on offering personalized mortgage solutions tailored to individual needs and financial situations. Their expert brokers meticulously analyze your requirements, ensuring you get the best-suited mortgage plan.

2. Comprehensive Market Knowledge: With an in-depth understanding of the local real estate landscape, Must Home brokers provide valuable insights. They help clients make informed decisions, ensuring they secure the most advantageous mortgage deals available.

3. Streamlined Application Process: Must Home simplifies the often labyrinthine mortgage application process. Their team guides you through every step, from document preparation to submission, making the journey seamless and stress-free.

4. Competitive Interest Rates: Must Home collaborates with various lenders, granting access to an array of mortgage products at competitive interest rates. This ensures clients not only find a suitable mortgage but also save significantly over the loan term.

5. Exceptional Customer Service: Beyond securing mortgages, Must Home excels in customer service. Their dedicated brokers provide ongoing support, addressing queries and concerns promptly. This commitment to client satisfaction sets them apart in the industry.

How Must Home Can Help You

Whether you’re a first-time homebuyer, looking to refinance, or investing in property, Must Home offers a diverse range of services.

First Home Buyer Loans: Must Home assists newcomers in navigating the complexities of securing their first home, ensuring they benefit from government incentives and affordable repayment plans.

Refinancing Solutions: For existing homeowners, Must Home evaluates your current mortgage, exploring opportunities for refinancing that could lead to substantial savings over time.

Investment Property Loans: Investors receive tailored financial guidance, helping them expand their real estate portfolios strategically.

Conclusion —

In conclusion, Must Home stands out as a reliable and client-focused mortgage broker in Pimpama. Their commitment to personalized service, market expertise, and exceptional customer care makes them the go-to choice for anyone seeking a mortgage solution in this vibrant suburb.

Connect with us now on +61 468 784 663 and step ahead to a wise decision .

2 notes

·

View notes