#How do I choose a payroll system? How do you effectively manage payroll services?

Text

TechMetronix: Leading Internet Marketing Services in Gurgaon

Introduction

TechMetronix is your go-to destination for top-notch internet marketing services in Gurgaon. Our expertise spans across various digital solutions tailored to boost your online presence and drive business growth.

Comprehensive Internet Marketing Solutions

At Tech Metronix, we offer a wide range of internet marketing services designed to meet the diverse needs of businesses in Gurgaon. From SEO and PPC to social media management and content marketing, our strategies are data-driven and result-oriented. Our goal is to help you reach your target audience effectively and convert them into loyal customers.

Search Engine Optimization (SEO)

Our SEO services focus on enhancing your website's visibility on search engines. We employ the latest techniques and tools to ensure your website ranks high for relevant keywords. This increases organic traffic and improves your chances of converting visitors into customers.

Pay-Per-Click (PPC) Advertising

PPC advertising is a powerful tool for driving immediate traffic to your website. Our team of experts creates targeted ad campaigns that generate high-quality leads. We optimize your ad spend to ensure maximum return on investment.

Social Media Management

Social media is an essential component of any internet marketing strategy. We manage your social media profiles to engage with your audience, build brand awareness, and drive traffic to your website. Our content is tailored to resonate with your target market and encourage interaction.

Content Marketing

Content is king in the digital world. Our content marketing services include creating and distributing valuable, relevant, and consistent content to attract and retain a clearly defined audience. We focus on creating high-quality content that drives traffic, builds brand authority, and enhances customer engagement.

HRMS and CRM Solutions

Beyond internet marketing, TechMetronix also excels in providing HRMS (Human Resource Management System) and CRM (Customer Relationship Management) solutions. These systems streamline your business processes, improve efficiency, and enhance customer satisfaction.

HRMS Benefits:

Payroll processing

Time and attendance tracking

Performance management

Benefits administration

Training and development

Employee self-service

CRM Benefits:

Enhanced customer relationships

Increased sales and revenue

Improved customer service

Data-driven marketing

Boosted productivity

Better decision-making

Why Choose TechMetronix?

Choosing Tech Metronix means partnering with a company that is dedicated to your success. Our team of experienced professionals uses the latest tools and techniques to deliver outstanding results. We are committed to helping you achieve your business goals through innovative and effective internet marketing strategies.

Frequently Asked Questions (FAQs)

Q1: What makes TechMetronix different from other internet marketing service providers in Gurgaon? A1: At TechMetronix, we offer customized solutions tailored to your specific needs. Our team of experts uses the latest tools and techniques to ensure your business stands out in the digital space. Our commitment to customer satisfaction and our result-oriented approach set us apart.

Q2: How can your SEO services help my business? A2: Our SEO services improve your website's visibility on search engines, driving organic traffic and increasing your chances of converting visitors into customers. We use proven strategies and the latest SEO techniques to ensure your website ranks high for relevant keywords.

Q3: What are the benefits of using PPC advertising? A3: PPC advertising drives immediate traffic to your website. Our targeted ad campaigns generate high-quality leads and ensure maximum return on investment. This is an effective way to reach your target audience and achieve your marketing goals quickly.

Q4: How do your HRMS and CRM solutions benefit businesses? A4: Our HRMS solutions streamline internal processes such as payroll processing, time tracking, and performance management, while our CRM solutions enhance customer relationships, boost sales, and improve overall business efficiency.

Contact Us

Ready to take your business to the next level? Contact Tech Metronix today and let us help you achieve your internet marketing goals. Reach out to us at [email protected] or call us at +91 9717988283.

Tech Metronix is your trusted partner for internet marketing services in Gurgaon. Our comprehensive solutions are designed to enhance your online presence, drive traffic, and boost sales. Let us help you achieve your business goals with our expert internet marketing services.

0 notes

Text

PAYE Online Payment: A Comprehensive Guide for UK Employers

New Post has been published on https://www.fastaccountant.co.uk/paye-online-payment/

PAYE Online Payment: A Comprehensive Guide for UK Employers

Nowadays, making PAYE online payment is becoming the norm, and it offers plenty of perks. In the digital age, many of us are seeking ways to streamline our processes and tasks. This includes our financial obligations, and for UK employers, PAYE (Pay As You Earn) is one of those key responsibilities. However, the idea of paying taxes online might seem daunting to some.

Not to worry – this comprehensive guide is here to demystify the process of paying your PAYE online. We’ll walk you through the steps, highlight important security aspects, and show you how making this digital shift can save you time and potentially help you avoid any late tax payment penalties. So, sit back, relax, and let’s dive into the world of online tax payments.

Understanding PAYE

PAYE is a system used by HM Revenue and Customs (HMRC) to collect Income Tax and National Insurance from employment. As an employer, you utilize the PAYE system to deduct these amounts from your employees’ wages or occupational pension before paying them their salary. Sounds pretty straightforward, right? Now, let’s talk about the growing trend of paying PAYE online.

The Importance of Online PAYE Payments

We live in a digital age, and it’s high time payroll management caught up. The ability to pay PAYE online has become crucial for UK employers. Why, you ask? Simply put, it’s about efficiency, accuracy, and convenience. Digital payroll solutions reduce paperwork, minimize human error, and offer flexibility in how and when you make your payments. It’s a win-win situation!

Getting Started with PAYE Online Payments

Before you can start paying PAYE online, you need to register for PAYE online for employers. It’s a fairly straightforward process, and once you’re signed up, you can access the PAYE Online for employers service. This platform gives you all the tools you need to manage PAYE payments effectively and keep track of what you owe.

How to Make PAYE Online Payments

So, you’re all signed up and ready to dive into the world of PAYE online payments. Great! But how do you actually make a payment? Here’s a step-by-step guide:

Log into your PAYE Online for employers account.

Navigate to the ‘Make a payment’ section.

Enter the required details, including the amount you’re paying, the payment period, and the tax year.

Choose your preferred payment method (Direct Debit, Bacs, debit or credit card, etc.)

Confirm your payment and keep a record of the transaction ID.

Voila! You’ve just made a PAYE online payment.

Ensuring Compliance with PAYE Online Payments

Compliance is key when it comes to paying paye online. Remember, HMRC doesn’t take kindly to late payments, so always ensure you pay on time to avoid penalties. Using digital tools to track and manage your payments can make this process easier and less stressful. Trust me, it’s worth it!

Troubleshooting PAYE Online Payment Issues

Every now and then, you might run into some issues with paying paye online. Whether it’s a technical glitch or a problem with your bank, don’t panic. Many common problems can be resolved by contacting the HMRC helpline or your bank.

Conclusion

So, there you have it – a crash course on navigating PAYE online payment. Embracing digital payroll processes isn’t just about keeping up with the times; it’s about optimizing your workflow, ensuring compliance, and making your life as an employer that little bit easier.

Final word

If you’ve found this article helpful, why not pass it on to other employers? Sharing is caring, after all. And if you want more handy tips and insights on UK tax laws and digital payroll solutions, don’t forget to subscribe!

FAQs

What is PAYE? PAYE, or Pay As You Earn, is a system used by HMRC to collect Income Tax and National Insurance from employment.

How can I pay paye online? You need to register for PAYE online for employers and use the PAYE Online for employers service to make payments.

What payment methods can I use for PAYE online payment? You can use several methods, including Direct Debit, Bacs, and debit or credit cards.

Remember, being an employer involves more than just hiring people. It’s about staying on top of your responsibilities, including payroll management and tax obligations.

0 notes

Text

Sage 50 Vs Sage A Hundred Vs Sage 300

Sage now has a hundred twenty five VAR companions promoting and implementing its Sage Intacct product line. Complete the form to schedule a personalized demo on your group for add on solutions for Sage X3. Your Sage answer has a strong ecosystem of add-ons that may assist run a extra environment friendly business. All the add-on solutions firm sage x3 showcased in our webinar collection integrate seamlessly with Sage one hundred. True Sky is a Corporate Performance Management answer that allows you to take management of the budgeting course of. True Sky reduces the drudgery of the finances process so finance professionals can give consideration to high-value gadgets.

IFS Applications ERP software program helps companies combine data and processes across a quantity of departments and locations. It presents modules for asset administration, field service administration, project administration and provide chain administration. Companies can choose the modules they want and may later add or subtract elements as their business wants change. IFS Applications includes capabilities for financial firm sage x3, HR, doc administration, CRM, business intelligence and reporting operations and lately has taken on advanced applied sciences corresponding to RPA. It additionally supports integration with Microsoft Office and other productivity instruments. Sage ERP options are utilized by more than 60,000 organizations in over a hundred thirty nations to manage their enterprise processes.

The Sage Group plc, commonly known as Sage, is a British multinational enterprise software company based mostly in North Tyneside, England. As of 2017, it's the UK's second largest know-how firm, the world's third-largest supplier of enterprise useful resource planning software , the most important supplier to small businesses, and has 6.1 million prospects worldwide. The firm is the patron of the Sage Gateshead music venue in Gateshead. NetSuite and Sage X3 are two of the highest ERP systems obtainable for business.

We won't be adding you to an e-mail listing or sending you any marketing materials without your permission. The cost depends on numerous factors, such as number of data, number of merchandise and use of superior filtering and search standards. Customize Sage X3 customers by location, employees, revenue, business, and extra. Experience on-demand analytics and speedy selections making with embedded, real-time business information. Contact us for an ERP software program consultation or to see a demo and you'll decide which product delivers the knock out blow for your firm. In 2011, Epicor Software was purchased by Apax Partners (London-based buyout firm) for $1B and is now a private-equity owned company.

Sage X3 had previously by no means made into Third Stage’s lists, though this year’s rankings saw the answer obtain two milestones in placement. It was the primary year Sage X3 positioned on the featured record, as well as capturing the very best rating yet given by the firm. This was specifically as a result of Sage ERP’s worth for mid-market manufacturers along with the simplicity of the solution in comparability with merchandise like SAP.

Avoid this product unless you want less efficiency and extra accounting workers to do much less. Improve alignment between your folks and your small business objectives and make your employees one of your companyýs strongest and most competitive property. Make more effective strategic decisions, alleviate economic pressures and quickly resolve the multitude of tactical points HR faces every day.

It additionally allows you to simply keep up with payroll and different financial aspects of your corporation, like gross sales, expenses and purchases. This software is a perfect solution for people who want a administration tool to help them run their small to mid-sized businesses more simply and effectively. So, I suppose making that message really clear and simple for customers to grasp and having comparable if not higher performance kind of places us out of enterprise.

Sage X3 is a powerhouse ERP that may handle the business wants of multiple industries. Sage X3 comes with a powerful set of tools for managing the whole lifecycle of buy orders, approvals, requisitions, budgeting, planning, demand administration, forecasting, and more. Our expert team will present you a tailor-made demonstration of Sage X3 software options, functionality, and advantages most relevant to your unique enterprise challenges. Target Sage X3 clients firm sage x3 to perform your sales and marketing objectives. Optimize operations, enhance productiveness, and improve customer satisfaction out of the field with fully integrated software program. Needs for service-based modules are totally different for all firms, so you will want to scrutinize the service module with sage X3 to ensure it meets your needs .

0 notes

Text

Why You Can't Afford to Be Bad at Bookkeeping

Maintaining your books is not one thing you must do alone as a tax-savings strategy; it may also forestall you from losing your mental health and obtaining dragged into a possible cause over commingling your funds. Here are 5 important reasons for maintaining a separate chequebook and set of books for every of your businesses:

1. company veil. initial and foremost, maintaining a separate chequebook substantiates the company veil, one among the first reasons for forming a brand new corporation. Having a separate chequebook shows you acknowledge the corporate is its own distinct entity. what is more, separate checkbooks can hopefully encourage you to not commingle personal and business funds.

2. Tax savings. Separate banking can improve accounting procedures, forestall payments from being incomprehensible , and supply higher records to boost your official document.

3. Audit protection. Having a separate chequebook can improve your probabilities in associate degree office audit. The office can typically forbid variety of expenses once personal and business expenses ar commingled during a single chequebook.

4. Less stress and a lot of mental health. One would possibly suppose having separate checking and accounting for a brand new company is cumbersome, reserve, and presumably even a waste of your time. In fact, this procedure saves time and cash within the long-standing time. once your books ar fucked-up, you’ll feel constant stress to require care of it, and this ultimately will cause you to feel undone.

5. Improved higher cognitive process. Having a separate chequebook starts the method of higher accounting, expense pursuit, and budgeting, that ends up in quality higher cognitive process. however are you able to expect to be a triple-crown business owner while not correct records? You owe it to yourself and your business to stay smart books.

The next step is implementing a system for pursuit financial gain and expenses. It’s fully crucial for small-business house owners to a minimum of take into account QuickBooks as their primary accounting software. Yes, there ar a couple of alternatives to QuickBooks, however not several, and even fewer price considering.

QuickBooks is that the most reasonable, easy, efficient, and effective accounting code ever written. that will sound a touch crummy or over the highest, however it’s true. Here ar simply a couple of things that QuickBooks will do to assist you become a far better, smarter business owner:

Keep essential data at your fingertips. QuickBooks generates reports that enable you to simply keep au fait your business’s most vital monetary data, like profit and loss by product or property, assets by client, sales reports, or expense reports.

higher use of your on-line banking industry. QuickBooks permits you to harness the net advantages that several banks provide. It coordinates with most banks, even lesser-known ones, to supply instant data therefore you'll transfer transactions and reconcile your knowledge with ease.

Collect a lot of of your assets. QuickBooks permits you to come up with professional-looking invoices that may be delivered via email and provide your customers the choice to form on-line payments. you'll additionally generate statements and make varied reports to see UN agency your bad customers ar for assortment functions and to assist you create higher choices concerning your assets.

Delegate your accounting services with ease. If you're the kind that hates accounting, QuickBooks can still build your life easier. Once you perceive the basics—and i like to recommend that each business owner a minimum of master the basics—you will delegate tasks, from accommodative to overseeing monetary reportage. QuickBooks can even enable your controller to log in on-line to access your monetary knowledge whereas doing all of your accounting.

Pay your business bills expeditiously. Let QuickBooks track your accounts collectible therefore you'll higher manage your income and pay bills once it's most convenient for you. Ultimately you will save on past-due fees and interest, and you’ll be able to move together with your vendors during a a lot of skilled manner.

Receive payments right away. settle for mastercard payments on-line, and have the funds recorded directly in your QuickBooks file. you'll even upgrade your QuickBooks code and technical school provides to integrate a location (POS) system together with your cashbox and merchant/credit card machine.

Access your monetary data anyplace. the net version of QuickBooks permits you or your controller to access your books anyplace you have got a web association.

Use scanning code to trace receipts. Scan in receipts through a service like NeatReceipts, that right away records and categorizes the knowledge in QuickBooks. you'll then keep a duplicate in your cloud storage of all receipts and contracts for audit and legal protection.

The list goes on and on. Please take this suggestion seriously; the earlier you integrate this method into your business, the earlier you’ll see cash savings, larger revenue, and a lot of profit. Don’t be scared of QuickBooks—embrace it, and it'll set you free! OK, that was a touch a lot of, however I will promise you this: it'll prevent cash, and you’ll additionally get dependent on the limited “ping” you hear each time you enter a check or item within the register.

Get facilitate implementing your register

Be honest with yourself: does one wish to try to to the accounting for your business? If therefore, great. But if not, who's attending to do it? Have a plan! affirmative, this can be my best try at providing you with associate degree “intervention.” consider yourself within the mirror and assess your level of dedication, knowledge, and accessible time to implement and maintain your books. However, whereas it’s fine if you have got somebody else do the dirty work, you continue to want a general understanding of the method and register in order that you, because the captain of your team, will administer the method.The following are five options to consider when it comes to divvying up the accounting duties.

Option 1: Learn QuickBooks and input items yourself. I know this strikes fear in some of your hearts. In fact, this may be why your books currently aren’t getting done. But you still may want to hold off delegating any part of the process until you put in a few hours a week to learn the basics, like inputting figures. At the bare minimum, you need to be able to view and print reports and check the accuracy of the work.

Option 2: Hire a family member to keep up the books. This is a great way to have the teenagers or young adults you're supporting financially earn their keep and teach them about entrepreneurship in the process. They'll learn about the heart and soul of small business by doing the books. Adding them to the payroll is also a great tax write-off.

Option 3: Engage a local bookkeeper. This could be a local college student wanting internship/externship hours or a seasoned bookkeeper with affordable rates. It can free up your time so you can do what you know best: Make money for the business. This is also a natural step in the growth of a business before choosing the next option. Remember, this person will probably not prepare your taxes or do significant planning for you; they'll simply maintain your books affordably so you can focus on more pressing tasks.

Option 4: Hire someone “in house.” You'd be amazed how quickly you can find a local college student or bookkeeper wanting to pick up some part- or full-time work for an hourly wage. This person could come in daily or a few days each week to input data and print reports. You might need to provide some supervision, or you could have your outside CPA train and supervise your in-house bookkeeper. It can be extremely convenient to have an employee available to keep things in order. You can also hire someone who can wear different hats and help with other tasks, like answering phones, scanning, doing collections, shipping, or running errands.

Option 5: Use your CPA or tax professional throughout the year. Many business owners like the comfort and security of knowing they not only have highly skilled accountants doing their books daily but the benefit of one-stop shopping for tax planning and quarterly and annual reports as well. It may seem more expensive, but the value of better long-term planning and a higher quality of books can far exceed the cost. More mature and seasoned business owners may naturally “graduate” to a more experienced bookkeeper when the time is right. At most firms, you can get an accounting support package tailored to your budget and needs.

Get a more robust handle on your finances with QuickBooks.

Here is some interesting article i saw on Internet

How to Fix Quickbooks Error 3371 How to Fix Error H101, H202, H303, and H505 in QuickBooks Solved: Error 1935 When Installing QuickBooks Desktop 2020

1 note

·

View note

Text

What to look for in payroll software in Pakistan

PeopleQlik #1 Payroll software in Pakistan You've developed your company from the ground up, bringing your vision to life through a product or service that delights your customers. Now is the moment to enlist outside assistance in order to grow your company. Thankfully, you no longer have to write checks for your employees and contractors by hand, nor do you have to utilize complicated calculators to figure out how much tax you owe the government. There are numerous options available to assist you in automating all of these activities. And, let's face it, you didn't start this company to spend all of your time writing checks and dealing with payroll taxes. With so many possibilities, finding payroll software that meets your small business's demands has never been easier; the same software will also allow you to focus on revenue and customer-facing tasks, which will help you keep your cash flow in check. We've put together this checklist to assist you choose the best decision for your business's Payroll software in Pakistan, whether you've hired your first employee or are seeking to switch systems.

PeopleQlik #1 Payroll software in Pakistan

1. Tax payments and correctness

When it comes to payroll, you'll want to be sure you're computing tax deductions correctly for your employees and contractors. You must guarantee that local, federal, and state taxes are withheld from your team's gross salary in the United States.

You must account for provincial and federal tax deductions, as well as employee and employer contributions to federal programmes such the Canada Pension Plan (CPP) and Employment Insurance (EI). Many business owners make the mistake of doing their Payroll software in Pakistan with an internet calculator, yet tax payments fluctuate throughout the year, necessitating the use of a system that can handle this.

Most people will find this daunting, so don't worry! Payroll software providers have been able to accurately automate, submit, and pay your tax payments on your behalf thanks to reliable and secure technology, so you can rest easy knowing your staff is taken care of. When shopping for a payroll software system, verify if it can perform the following fundamental calculations for your company.

2. Price

While hiring an employee or contractor may result in increased revenue and cash flow, Payroll software in Pakistan incurs additional costs. You'll want to make sure the system you choose is economical, appropriate for your industry, and scalable.

When budgeting for a payroll system, there are a few things to think about:

Costs of subscriptions and payment frequency (monthly vs. annual)

Costs for each employee, contractor, or freelancer

Fees for additional services and combinations of benefits

Fees for tax season filing

Different levels of assistance will be required by different businesses. Small firms with a few employees may not require all of the human resource management features built into their system, but these can be added on later as the company grows. Finally, you'll want to be sure that what you're paying for covers tax payments, tax season filing, employee access, and so on.

3. Usability

With all of the labor involved in getting payroll up and going, you'll want something that's simple to use and comprehend. This includes getting started instructions, how-to guides, and guidelines to help you grasp what's involved with the payroll system you're using.

When choosing a Payroll software in Pakistan, consider the following questions:

Is it clear what I need to do from the instructions?

Do they assist me in comprehending the many terminologies and their significance?

Do they have any articles that will help me navigate the system?

Is there a free trial that I can use to put it to the test?

What other tools and integrations are included that will assist me with my project?

4. Support and service to customers

When you first start using a new system, there is always a learning curve, and it will take some time to verify that you understand how to use it properly and that everything is working effectively. This is where having someone to assist you is beneficial to your whole experience. Look at the services provided by the new payroll software, such as chat assistance. You'll also want to examine what kind of material, such as how-to articles, best practices, and lessons on certain activities, is readily available on their website. If a free trial is available, take advantage of it. You'll be able to get a sense of what to expect from the software and from the customer support staff when you set up a free trial; a solid success team should be able to support and aid you as your business grows.

5. Social media and word-of-mouth

While you may look out for the best Payroll software in Pakistan for small businesses on Google, it's also a good idea to ask your friends and family for recommendations. A family member, a friend, or a member of a local small business community club or association could be the person in question. These individuals can provide you with insider information on what might be the greatest option for you.

While you're searching, keep an eye on what's going on in the internet community about that system. If the brand has a large following, it won't be difficult to identify some admirers who would be pleased to provide you with additional information!

Payroll isn't simple, but your payroll software should be.

This is an exciting time for your company, so make sure you choose the most complementing solution that will work with your current workflow—both online and offline.

Here is the list of features that you can get by using PeopleQlik:

PeopleQlik Core

Core HR Software -HRMS

Cloud Payroll Management Software

Employee Self Services

HR Analytics Software

Corporate Wellness Platform

Performance Management Software

360-degree feedback form

Compensation Planning & Administration

Social Recognition

Workforce Administration

Leave Management Software

Time and Attendance Management Software

Shift & Scheduling

Claims & Reimbursements

Time-sheet Management Software

Contact Us On Email For Free Demo

Contact on WhatsApp:

+923333331225

Email:

#Learning Management Software in Pakistan#Learning Management System in Pakistan#Learning Management Solutions in Pakistan#leave management software in Pakistan#performance management software in Pakistan#HR Software in Pakistan#HR System in Pakistan#HR Solutions in Pakistan#Attendance Software in Pakistan#Attendance Solutions in Pakistan#Attendance System in Pakistan#Attendance Management in Pakistan#recruitment software in Pakistan#Face Attendance in Pakistan#Facial attendance in Pakistan#Voice Attendance in Pakistan#Face biometric IN Pakistan#Voice Biometric IN Pakistan#Face recognition in Pakistan#Voice Recognition in Pakistan#Voice Attendance Software in Pakistan

0 notes

Text

QuickBooks Pro Support Number| ☎️+1(888) 461-1522 Toll-Free QUICKBOOKS Payroll Support Number

QuickBOOKs Pro Support phone number, QUIckBOOKs Pro Customer Service helpline or helpdesk Customer Care Phone Number to Contact QUIckBOOKs Pro, is a relatively easy platform to use. Whether you're buying a product or service online, sending money to friends and family, or even receiving funds, it's a pretty simple and straightforward process. However, if there comes a time when something's not quite right with your account, and you get locked out or have an unexplained hold on funds, you might need to speak with someone who works for the company.

Thankfully, QUIckBOOKs Pro Technical Support Number

makes it easy for users to get in touch. You can do this in a couple of different ways depending on your preferences - phone may be the best option if you need immediate assistance, while a less urgent issue can likely be solved via the site's messaging feature.

Here's how to get in touch with QUIckBOOKs Pro.You may request a company mobile phone (hardware) by submitting a ticket through MyIT. Once the hardware is approved and received, QUIckBOOKs Pro will secure a contract with Vodafone and pay the bills. There is no personal charge to you.If you are eligible for a company phone, we advise getting one on a QUIckBOOKs Pro contract, as it offers a better price and coverage than a personal contract. Personal contracts and reimbursements of business usage would need to be approved by managers.

While there are many ways to accept payments on your blog, QUIckBOOKs Pro Contact Number: has been around for a long time and is a trusted service that allows customers to pay with cards, QUIckBOOKs Pro Exclusives, and local payment methods. It continues to be the leader in accepting online payments for many businesses (including Typepad!) If you are ready to sell your product through your blog, try QUIckBOOKs Pro as your payment option.

In your QUIckBOOKs Pro Technical Support Numberaccount Dashboard, there is a section titled "Quick Links" - click "Show More" for more options, select "Accept Payments."In this case, we will use QUIckBOOKs Pro Checkout. With QUIckBOOKs Pro Technical Support NumberCheckout, you can get paid online and enable buyers to pay the way they want to pay. Click the blue button "Choose a way to integrate." From simple to completely custom, no matter which integration you choose, QUIckBOOKs Pro Contact Number Checkout will intelligently present the most relevant payment types to your customers. Let's do the "Quick Setup" option which can be set up in minutes by copying prebuilt code and pasting it next to the products or services you want to sell on your website - click "Start Setup."In the Setup page you can customize the appearance of your item, then click "Copy Code" on the bottom of the page. You can now paste the code on to your blog.

In this example, a separate page was created to sell a photo print. In the Compose Page, I switched to the HTML editor tab and pasted the code from QUIckBOOKs Pro Contact Number - do NOT switch to the Rich Text editor. To preview your QUIckBOOKs Pro Check, click the Preview button. Add any additional text or images to the page and publish. Elfsight QUIckBOOKs Pro Support Phone Number Button provides an uncomplicated way to let your users pay through QUIckBOOKs Pro on your site. It allows adding buttons for checkouts, recurrent subscriptions, and donations. You can introduce tax and shipping price, pick localization and currency, show call-to-action and even more. Start a smooth and payment system for your customers on-the-go using one of the most trusted payment tools.

Make use of all advantages of QUIckBOOKs Pro for your users and yourself!An effective paying tool on your site with no coding and in no time.

Customers appreciate easy paying on a website. Construct your own QUIckBOOKs Pro Support Phone Number donate or payment button using Elfsight and you will grant a reliable and quick payment instrument for your clientele. No coding, no sweat.

A universal tool to get payments, subscriptions, and donations. Having only one tool by Elfsight, you will enjoy the freedom to design buttons for users to pay, subscribe and donate on your website. Save time and effort and get a universal solution, which provides you a set of options.

One of the most reputable and well-known paying solutions on your website. It’s a must to integrate one of the most reliable and popular payment solutions into your site. And thanks to Elfsight QUIckBOOKs Pro Support Number Button, it’s done in seconds.

Features

Check why Elfsight QUIckBOOKs Pro widget is the best, here are its useful features:

· Setting your button localization from the predefined list of countries;

· Two variants of tax indication: flat or percentage;

· Responsive size for optimum look on any device;

· Adjustable button text and text color;

· Show or hide QUIckBOOKs Pro icon.

Check all the advantages in live demoHow to add QUIckBOOKs Pro Button to Blogger website

Fast instruction on embedding and creating the donate, subscription or payment widget without competence in web development. You will need not more than 3 minutes to make it.

1. Create your unique button. By means of our free editor, create a plugin with desired layout and payment type.

2. Copy the code for setting up the plugin. After you’ve set up the widget, acquire the code for it from the appeared window on Elfsight Apps.Show the plugin on your site. Display the QUIckBOOKs Pro Help Number: +1-888-461-1522 on the required spot of the website and save the edits.

3. Done! Visit your Blogger site, to check your plugin.If you want to contact QUIckBOOKs Pro Support Number and speak to a QUIckBOOKs Pro representative, so you are in the right place. In this article, we will discuss how to get a hold of QUIckBOOKs Pro or how to talk to someone at QUIckBOOKs Pro.

0 notes

Text

Top 10 Reasons to Choose Professional Accountants

Starting up a business can be a good decision if have a good business proposition and commitment. Many people want to start a small business and many are doing it. However, you should also know the financial aspects to run a business which is essential to get success. You don't need to know about the financial aspects to succeed in business, you can hire professional Small business accountants in London instead of specialist tax advice.

What are the challenges for growing small businesses?

Different difficulties or challenges you may face in your business, especially related to the financial side. You might think about the key reasons for hiring expert Small business accountants in London. We must tell you that the reasons are many and you will seek help at different stages of your company's growth.

Whether it is a business plan, company formation, loan application or tax audit, and so on- expert have Professional Accountants in London can make the entire process easier, smoother, and cost-effective for you. You won’t need to always hire a full-time accountant for this job. You can outsource it to an expert firm.

Do not bother about the cost Accountants will charge. Instead of saving a few bucks in that way, consider the range of benefits you can obtain at the same time as doing everything on your own is not doable. Also, there is always the risk you have made errors if you want to do multi-tasks at the same moment.

As we mentioned above that hiring a full-time accountant isn’t necessary, this would be easier for you. When you hire an accountant to handle taxes, it is likely they will cost less per hour than you would pay yourself. At the same time, you can save time as well as have peace of mind that an expert is taking care of the details.

On the flip side, it is crucial to keep track of your invoices, expenses, and profitability. Alongside that, you need to make certain that you have set the right amount of money aside to meet your corporation tax & VAT liabilities and file your accounts on time to evade penalties. However, dealing with these time-consuming and challenging areas can be stressful for you. You would rather hire professional accountants to take of these areas so you can focus on growing your small business.

Small business accounting solution has the expertise in different areas such as bookkeeping (including online cloud bookkeeping), Preparation of Annual Statutory Accounts, HMRC Tax Returns (VAT, PAYE, Self-Assessment, Corporation Tax), IT Advisory Services, Risk Advisory Services, Internal Audit, and so on.

These expert accounts are specialised in their area of expertise and work along with you to meet your business objectives.

Top 10 reasons to choose professional accountants-

When you write a business plan-

When you need to write a business plan for future current or future business objectives, involve a professional accountant in it. They not only use their experience but use accounting software to add financial projections and other reports to it as well. You will receive a realistic, professional, and more promising business plan. You can also get financial knowledge and advice right from the start which would be a great asset for your business. It can save you time and money too.

When you need a legal structure for your company-

Different sorts of businesses are there such as limited companies, limited liability partnerships, sole traders or proprietors, and accordingly, the legal structure will vary of course. Each type has its own rules and laws to be followed. In this case, an expert accountant can elucidate the legal business formation obtainable and help you select the one that best suits you.

When you need help with the finances-

An accountant can help you to get back on track when it comes to dealing with financial conditions, especially, if you are losing control of it. These professionals can help you in dealing with payroll and producing graphs so you can confirm the changing ratio over time. Many accounting firms use cloud-based accounting software that helps in getting everything quickly sans hassle. You can also easily keep track of cash flow and other important things.

This software will help you to record a receipt, send an invoice, and more, online. Then your professional and experienced accountant will handle such complex tasks, including filing tax returns, checking cash flow and other finances, preparing profit and loss statements, etc.

When you're ready to hand over-

When you start a small business, the fundamental thing is to be acquainted with your business fully, be it making business strategies, controlling your workload deciding your finances, etc. Well, it is good to know all these things as it can help you to have control over it and you don’t need to depend on anybody else.

However, it can be daunting and stressful sometimes. You need to delegate the workload that can make you feel relaxed and you can be more productive. Especially, when it comes to the financial aspects of your business, you have to trust an expert and experienced accountant who can meet your needs and specifications. Also, you ought to trust other people in your business to manage different parts of your business.

When you hire an accountant more experienced in accountancy than you are, you won’t need to bother about finances, file tax returns, sort out payroll, prepare the business documents with a minimum of fuss, and so on. So, you can provide a great service to your customers.

When you need Tax-competence-

Every small business owner should keep as much of their earnings as possible. In this way, you can be profitable and set a positive environment for your business. In this case, professional Small business accountants in London can help you in making this possible. They can guide you when paying taxes and saving earnings.

When you need guidance-

Rightly managing your business, taxes, and time can create a winning environment for your business. And professional accountants play a significant role when it comes to handling taxes, financial information, and accounting. They can be always with you and will sort out your financial issues as soon as possible. Not only financial advice, but they ensure you never miss any tax deadlines. They have expertise in accounting basics. In this competitive and uncertain business scenario, these experts will give guidance and support to take any major business decisions.

When you need extra results-

To get extra results or profits, you need to put extra time into your business. A reliable and responsible accountant will be available always for you when you need the most. They always ready to discuss your issues and sort it out despite where your business is based. This assistance and assurance will lead you to gain extra results.

When you need cost-effective services-

A reliable accounting firm offers affordable business accounting packages to their customers, including accounting software, business and tax advice, VAT, payroll, filing of Tax Returns, and so on. All you just need to hire the best source that provides a very competitive price for their services when compared with current market prices and never undermine their unmatched services.

You can obtain a fixed-fee or variable fee for their business services as per your needs. The fees are agreed upon before any client work commences so you won’t need to bother about it. No unexpected bills you will have to pay. They will also agree to fixed quotes for any added work outside a client’s present agreement, for full transparency.

When you need to save money-

They offer different various business services such as HMRC Tax computations, VAT submissions, internal operational audits, contract compliance audits. Through it, they can save your money hugely. They are proactive and capable enough of thinking outside the box. You can expect more to comply with UK & international financial, regulatory, and tax laws.

When you need to make trouble-free tax & bookkeeping-

Certain tricky things can emerge as a headache for your small business such as complex forms, late fines, and tricky terminology. These professional accountants can file your annual accounts, solve your VAT and tax returns, counsel on workplace pensions, and ensure everything is fine.

In a nutshell, you need to conduct thorough research to find reliable and experienced Accountants in London. Your accounting firm should be authorised and regulated by ICAEW and uphold ICAEW member firm values. And they should meet your expectations and budget.

Frequently asked questions while hiring an accounting firm-

Why should I engage an accountant in my small business firm?

There are different financial aspects are need to handle no matter what is the size of a business. And without appropriate tax and bookkeeping, it is not possible to evaluate business performance, budget, estimate, and report on the financial position of a company to make future decisions. And an experienced accountant can make it easier for you.

Do you also work for big business?

A professional accounting team can handle every size of business no matter it is start-ups, fast-growing firms, or established. They may have different service packages for different sizes of businesses. Make sure your company can go beyond your expectation when it comes to success. On the flip side, they can also give you professional advice on how to organise your business, plan, and managing cash flow to set up a productive system.

Which accounting software is better to use for a small business?

Almost all businesses are showing their presence on digital platforms. In other words, making tax digital is also effective and necessary in this competitive business world. To get the best result, you should access the best online accounting software to effectively control your business finances. It helps to manage invoicing, inventory, bank accounts, expenses, and payroll. Xero is one of the most powerful bookkeeping systems for small businesses.

What accounting services do you offer?

Usually, accounting services can be customised according to the client’s requirements. So, it depends on what you need. A professional accounting company offers bookkeeping, Preparation of Annual Statutory Accounts, HMRC Tax Returns (VAT, PAYE, Self-Assessment, and corporation Tax), IT Advisory Services, Risk Advisory Services, Internal Audit, consulting, and so on.

Do you provide free consultations?

Yes, an expert accounting service provider provides free consultations when you need them. You can also get a free quote with no obligation based on your requirements. You can ask the queries you have in your mind and they will respond to you promptly.

When it comes to paying the fees of Accountants in London, you can pay online, by credit/debit card, by bank transfer (BACs), and by cheque. We can say that this is the most convenient, flexible, and safest way of paying their fees.

In a nutshell, a professional accounting firm can help you in many ways. Al you just need to find the best source that would meet your needs and budget and ensure the best results. For the best deal, you can visit www.transcendaccountants.co.uk.

0 notes

Text

New Post has been published on Brilliant Breakthroughs, Inc.

New Post has been published on https://www.brilliantbreakthroughs.com/allow-me-to-introduce-dennis-hill/

Allow Me to Introduce Expert Dennis Hill

Do you know how to connect your tech puzzle pieces for success?

Allow Me to Introduce:

Expert Dennis Hill, Ph. D.

When a globally recognized expert, Dennis Hill, Ph.D. begins his message with “Knowledge is not data”, we pay attention. This short article offers you an opportunity for a fresh perspective to learn more about productivity and learn from Dennis Hill, Ph.D., as he invites us to review our technology systems or tech stacks to improve our productivity. For decades Dennis has championed utilizing technology to best improve business and human performance. He just penned a very eye-opening chapter in our newest volume about how to Integrate for Well-Managed, Integrated Growth. I assure you, it will significantly improve YOUR Business’s Performance.

Today’s blogging guest, Dennis Hill, Ph.D., who is one of the members of the Brilliant Breakthroughs for the Small Business Owner #1 Bestselling Book Series Author Team. On 11-11-2020 a group of 9 Brilliant Practicing ExpertsTM lead by Maggie Mongan, will be releasing their book to coincide with National Entrepreneurs Month. It is written specifically for Small Business Owners, by Small Business Owners, to help you learn how to win BIG at small business in the 21st century!

Want to learn more about how to get your hands on the latest book in the series: Brilliant Breakthroughs for the Small Business Owner: Fresh Perspectives on Profitability, People, Productivity, and Finding Peace in Your Business, AND our app for the book to get direct access to our authors, AND our podcast? When you go to: BrilliantBizBook.com you’ll get 100 Tips for Small Business Owners Success Report to start working into your business until the book comes out!

To give you a glimpse of several different chapters, I invited our co-authors to write a short guest blog to learn about why their chapter topic is important to YOUR Business Success.

Business Technology Expert,

Dennis Hill, Ph. D.

Business Technology Expert, Dr. Dennis Hill, Ph.D., guides businesses approach productivity from a fresh perspective.

In Brilliant Breakthroughs for the Small Business Owner: Fresh Perspectives on Profitability, People, Productivity, and Finding Peace in Your Business – Vol 4, Business Author Dennis, Hill, Ph.D. shares how most businesses still aren’t approaching our business’s technology systems the way we need to for success in this century. He provides a powerful analogy for us to reflect upon our business and see where we have gaps – isolated systems – and how we can better integrate them for seamless optimization.

The following is what Dennis Hill, Ph.D. wants to share with you:

Integration for Growth

Every small business owner, entrepreneur, and hobbyist shares the same desire for success in their respective venture, but in today’s complex commerce realm, being an expert at all of the fundamentals to create and operate a successful business is merely impossible. We are living in a new era of commerce. The World Economic Forum refers to this period as the 4th Industrial Revolution. The companies that will take root and grow will be well-managed and intentional when acquiring, creating, and leveraging knowledge.

First, knowledge is not data. Knowledge is the sum or range of familiarity and association perceived, discovered, learned, or experienced about data. In other words, how pieces of information link to another, the relationship among data points, essentially defines knowledge. It is no wonder that worldwide sales of contact relationship management software (or CRM) has grown geometrically over the past decade. Even less surprising is businesses’ movement away from discrete sales of a product or service to the broader offering of “experience” for a customer with one’s business.

Second, a team of stakeholders is needed to sustain all businesses. Today, enlightened owners see contractors and even strategic customers and suppliers as stakeholders, not just themselves and their employees; therefore, efficient and effective knowledge management requires integrated databases, i.e., programs used to capture, modify, and apply company data, tied to each other in a streamlined manner that empowers stakeholders.

Third, choosing an infrastructure or platform to build and integrate a company is the next important step. Management by email (and attachments) is hardly efficient, and texting is just too Pavlovian with all the other alerts one receives all day. Identifying a suite of critical programs and applications to run accounting, payroll, customer order processing, and digital marketing, having them available on any device to access all information, and including security that restricts access on a “need to know” basis are all necessary to avoid common cyber-related pitfalls.

Sounds easy? It’s not, and that‘s why I am a contributing author to Brilliant Breakthroughs for the Small Business Owner, Volume 4, to be released November 11, 2020. My chapter alone is not sufficient to answer every question that will arise. Still, business owners can rest assured that the integration process outlined in my chapter adequately augments hundreds of other “wisdom nuggets” found throughout every edition of this award-winning series, rendering Brilliant Breakthroughs a convenient and accessible board of advisors or directors. After all, isn’t a board-in the-hand worth two anywhere else?

Thank you ~ Dennis

SMALL BUSINESS SUCCESS NOTE:

Want to purchase the #1 Amazon Small Business Bestselling Book: Brilliant Breakthroughs for the Small Business Owner – Vol. 4? Click here: BrilliantBizBook.com. Then sign up to get your 100 Free Tips and we’ll email them to you AND another email to let you know how to get your digital book for only 99 cents on 11-11-2020. Thank you readers for helping us become a #1 Bestselling Small Business Book Series!

THANKS FOR ALLOWING US TO HELP YOU IMPROVE YOUR BUSINESS!

Brilliant Breakthroughs, Inc. helps Small Business Owners

Simplify Strategies & Align Actions

to further Profitability, Peace, & Potential

Call Maggie (262) 716.7750 for YOUR No-cost Consultation

Blessings of Success to YOU ~

Maggie Mongan, Brilliant CEO & Strategist

Brilliant Breakthroughs, Inc.

Direct Dial: 262-716-7750

LinkedIn: MaggieMongan

p.s.: One of your key components as a Small Business Owner is your relationship with money so you can optimize your profitability. Taking time to improve your relationship with money will literally pay-off!

Copyright owned by Brilliant Breakthroughs, Inc. The internet is about sharing. Please share this post in its entirety with full attribution to www.BrilliantBreakthroughs.com. Thank you.

#Best Business Strategies#Business Growth#Business Profitability#Improve Productivity#Improving Performance#leadership#time management

0 notes

Text

The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

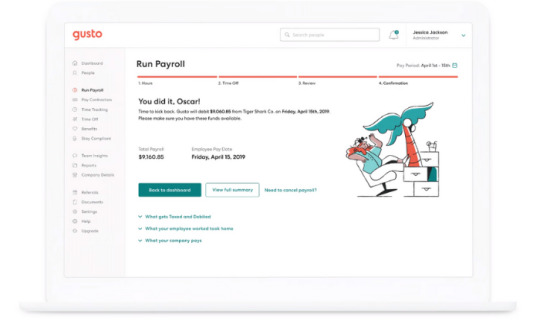

Gusto – Best payroll service for small businesses

OnPay – Most flexible payroll service

Paychex – Best for larger organizations

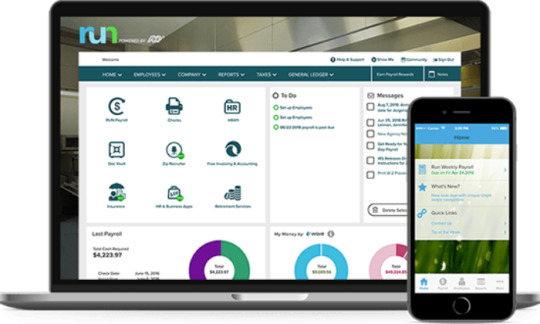

ADP – Best payroll service with built-in HR

QuickBooks Payroll – Best for QuickBooks integration

Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

Automatic payroll options

Self-service portal for full-time and part-time employees

Mobile capability to manage payroll on the go

Direct deposit so your employees get paid quickly

Automatic tax calculations and withholdings

W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

Built-in HR tools

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

Monthly payroll limits

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

Integrations

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

The different types of payroll services

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

1. Hiring someone to do it for you

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

2. Software as a service (SaaS)

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

3. Enterprise-grade solutions

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

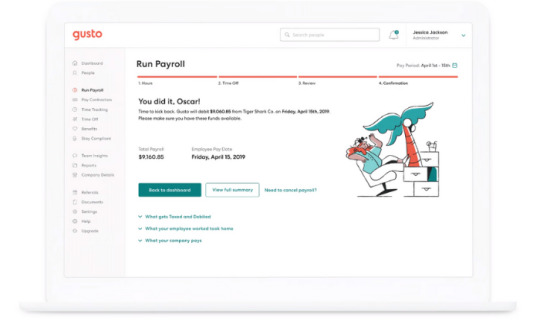

#1 – Gusto Review — The best for small businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

Automatic tax calculations

Built-in time tracking capabilities

Health insurance, 401(k), PTO, workers’ comp, and more

Compliance with I-9’s, W-2s, and 1099s

Employee self-service onboarding and dashboards

Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

Basic — $19 per month + $6 per person per month

Core — $39 per month + $6 per person per month

Complete — $39 per month + $12 per person per month

Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

Get started with Gusto today!

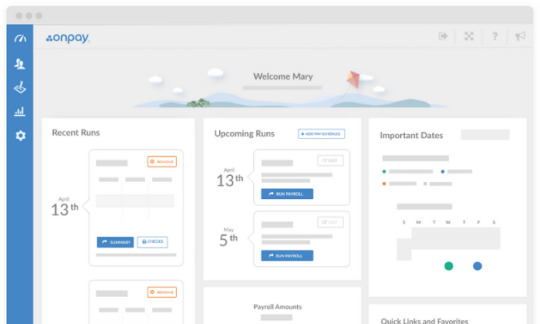

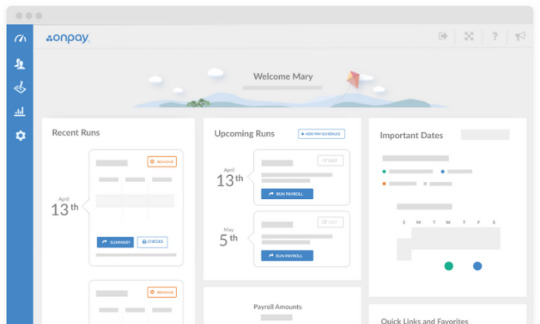

#2 – OnPay Review — The most flexible payroll service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

Unlimited monthly payroll runs

W-2 and 1099 capabilities

Automatic tax calculations and filings

Employee self-service onboarding and dashboards

Intuitive mobile app for management on the go

PTO, e-signing, org charts, and custom workflows

Integrated workers’ comp, health insurance, and retirement

Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

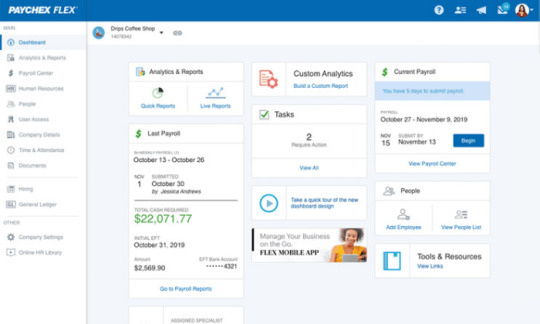

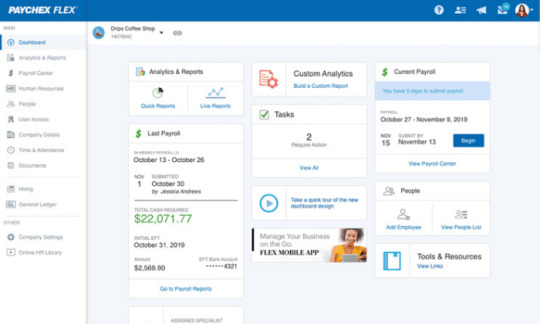

#3 – Paychex Review — The best for larger organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

Recruiting and onboarding

Performance and learning management

Powerful real-time analytics

100% employee self-service

Payroll automation features

Direct deposit, paper checks, and paycards

Salary, hourly, and contract workers

Paycheck garnishments

PTO and benefits management

Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

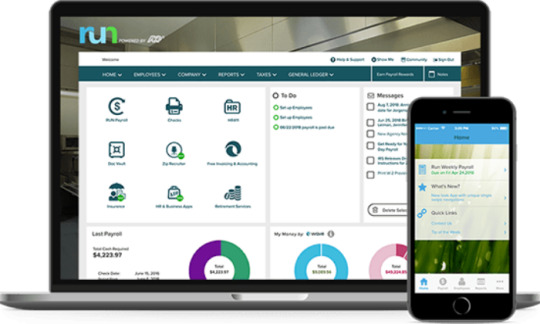

#4 – ADP Review — The best for built-in HR features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

Restaurants

Construction

Healthcare

Manufacturing

Retail

Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The best for QuickBooks integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

Full-service payroll with unlimited runs

Automatic payments after the first run

Health benefits

Wage garnishments

Next-day direct deposit

24/7 live chat support

All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

Premium — $75 per month + $8/employee per month

Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

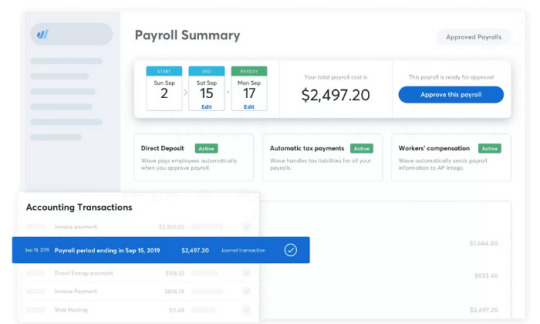

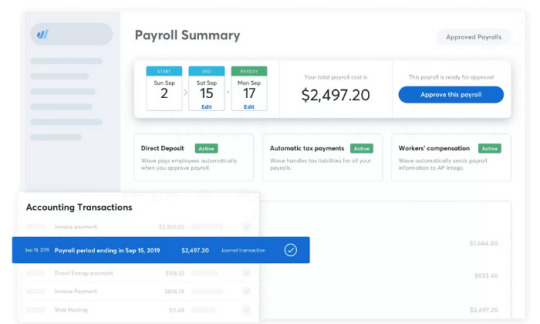

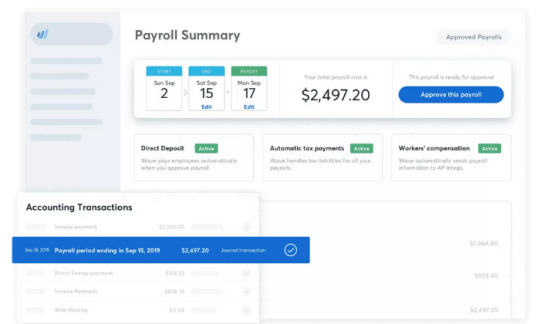

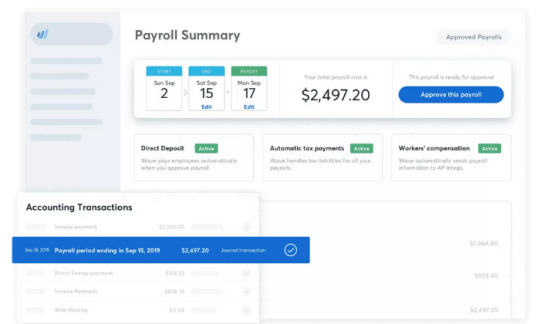

#6 – Wave Payroll Review — The most affordable payroll service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

Automatic journal entries (if you use Wave Accounting)

Self-service pay stubs and tax forms for your employees

Workers’ compensation management

Basic payroll reporting

Automatic year-end tax forms

Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

The Best Payroll Services (In-Depth Review) Publicado primeiro em https://neilpatel.com

0 notes

Text

QuickBooks® Pro Support Number| ☎️+1(888) 461-1522 Toll-Free QUICKBOOKS Payroll Support Number

QUIckBOOKs Pro Support phone number, QUIckBOOKs Pro Customer Service helpline or helpdesk Customer Care Phone Number to Contact QUIckBOOKs Pro, is a relatively easy platform to use. Whether you're buying a product or service online, sending money to friends and family, or even receiving funds, it's a pretty simple and straightforward process. However, if there comes a time when something's not quite right with your account, and you get locked out or have an unexplained hold on funds, you might need to speak with someone who works for the company.

Thankfully, QUIckBOOKs Pro Technical Support Number makes it easy for users to get in touch. You can do this in a couple of different ways depending on your preferences - phone may be the best option if you need immediate assistance, while a less urgent issue can likely be solved via the site's messaging feature.

Here's how to get in touch with QUIckBOOKs Pro.You may request a company mobile phone (hardware) by submitting a ticket through MyIT. Once the hardware is approved and received, QUIckBOOKs Pro will secure a contract with Vodafone and pay the bills. There is no personal charge to you.If you are eligible for a company phone, we advise getting one on a QUIckBOOKs Pro contract, as it offers a better price and coverage than a personal contract. Personal contracts and reimbursements of business usage would need to be approved by managers.

While there are many ways to accept payments on your blog, QUIckBOOKs Pro Contact Number: has been around for a long time and is a trusted service that allows customers to pay with cards, QUIckBOOKs Pro Exclusives, and local payment methods. It continues to be the leader in accepting online payments for many businesses (including Typepad!) If you are ready to sell your product through your blog, try QUIckBOOKs Pro as your payment option.

In your QUIckBOOKs Pro Technical Support Numberaccount Dashboard, there is a section titled "Quick Links" - click "Show More" for more options, select "Accept Payments."In this case, we will use QUIckBOOKs Pro Checkout. With QUIckBOOKs Pro Technical Support NumberCheckout, you can get paid online and enable buyers to pay the way they want to pay. Click the blue button "Choose a way to integrate." From simple to completely custom, no matter which integration you choose, QUIckBOOKs Pro Contact Number Checkout will intelligently present the most relevant payment types to your customers. Let's do the "Quick Setup" option which can be set up in minutes by copying prebuilt code and pasting it next to the products or services you want to sell on your website - click "Start Setup."In the Setup page you can customize the appearance of your item, then click "Copy Code" on the bottom of the page. You can now paste the code on to your blog.

In this example, a separate page was created to sell a photo print. In the Compose Page, I switched to the HTML editor tab and pasted the code from QUIckBOOKs Pro Contact Number - do NOT switch to the Rich Text editor. To preview your QUIckBOOKs Pro Check, click the Preview button. Add any additional text or images to the page and publish. Elfsight QUIckBOOKs Pro Support Phone Number Button provides an uncomplicated way to let your users pay through QUIckBOOKs Pro on your site. It allows adding buttons for checkouts, recurrent subscriptions, and donations. You can introduce tax and shipping price, pick localization and currency, show call-to-action and even more. Start a smooth and payment system for your customers on-the-go using one of the most trusted payment tools.

Make use of all advantages of QUIckBOOKs Pro for your users and yourself!An effective paying tool on your site with no coding and in no time.

Customers appreciate easy paying on a website. Construct your own QUIckBOOKs Pro Support Phone Number donate or payment button using Elfsight and you will grant a reliable and quick payment instrument for your clientele. No coding, no sweat.

A universal tool to get payments, subscriptions, and donations. Having only one tool by Elfsight, you will enjoy the freedom to design buttons for users to pay, subscribe and donate on your website. Save time and effort and get a universal solution, which provides you a set of options.