#How to Trade with Pennant Chart Pattern

Explore tagged Tumblr posts

Text

#Pennant Pattern in Technical Analysis#Bullish and Bearish Pennant Pattern#Types of Pennant Patterns#How to Trade with Pennant Chart Pattern#How to Trade Bullish Pennant Pattern

0 notes

Text

How to Read Stock Charts for Beginners?

If you’re new to investing, learning how to read stock charts for beginners can feel like deciphering a foreign language. But don’t worry—it’s easier than it looks. Stock charts are powerful tools that help you understand market trends, spot opportunities, and make smarter investment decisions. Whether you're a casual trader or planning long-term investments, mastering the basics of stock charts is the first step toward building confidence and growing your portfolio.

How to Read Stock Charts for Beginners – Understanding the Basics

Stock charts visually show a stock's price over time. They allow investors to track price movements, trading volume, and patterns that can help predict future performance.

The most common types of stock charts include:

Line charts – Simple and clean, showing the closing prices over a set period.

Bar charts – Display opening, closing, high, and low prices for each time unit.

Candlestick charts – Popular among traders, offering visual cues with color-coded bars.

Key Components of a Stock Chart

1. Price and Time Axes

Stock charts usually have time on the horizontal (X) axis and price on the vertical (Y) axis. This setup shows how the stock's price changes over days, weeks, or months.

2. Volume Bars

Volume bars appear at the bottom of most charts. They show how many shares were traded during a specific period. High volume often means strong interest or big news.

3. Moving Averages

Moving averages smooth out price data over a certain period, helping you spot trends.

Simple Moving Average (SMA): The average price over a defined time (e.g., 50-day SMA).

Exponential Moving Average (EMA): Gives more weight to recent prices.

Reading Candlestick Charts

Candlestick charts are ideal for beginners who want more detail in a visual format. Each candlestick represents one period (like a day) and shows:

Open and Close: The “body” of the candle.

High and Low: The “wicks” or “shadows” above and below the body.

Color: Green means the stock closed higher than it opened; red means it closed lower.

Recognizing common candlestick patterns—like dojis, hammers, and engulfing candles—can help forecast market behavior.

Identifying Trends and Patterns

Understanding trends can help you determine when to buy or sell.

Types of Market Trends

Uptrend: A series of higher highs and higher lows.

Downtrend: A series of lower highs and lower lows.

Sideways/Flat: Little movement in either direction.

Common Chart Patterns

Head and Shoulders: Indicates potential trend reversal.

Double Top/Bottom: Suggests strong support or resistance.

Flags and Pennants: Short-term continuation patterns.

Practical Tips for Beginners

Keep It Simple

Start with line or candlestick charts and focus on one stock at a time.

Combine Charts with Research

Charts are helpful, but always consider news, earnings reports, and broader market conditions.

Use Reliable Tools

Many platforms offer beginner-friendly charting tools. For a helpful resource on getting started, check out this complete beginner’s guide on how to read stock charts.

📊 Final Thoughts + CTA

Learning how to read stock charts for beginners doesn’t have to be overwhelming. By focusing on basic chart types, understanding key components, and recognizing simple patterns, you’ll gain the confidence to analyze stocks like a pro.

1 note

·

View note

Text

Triangle Pattern in Trading | Simple Guide for Everyone

Triangle Pattern in Trading: Master the Market Moves

Trading the financial markets may seem like rocket science, but what if I told you it’s more like spotting shapes in clouds? Yes, seriously. One of the most powerful chart patterns traders rely on is the triangle pattern, and understanding it could be your edge in the market—especially the symmetrical triangle pattern.

This article breaks it all down for you in the simplest way possible—no complicated terms, no financial degree required. Plus, we’ll show how tools like the best algo trading software in India and online trading software can help make the process smoother.

Learn the symmetrical triangle pattern in trading. Discover how it works using the best algo trading software in India & top online trading software.

What is a Triangle Pattern in Trading?

Imagine squeezing a spring between your fingers. It tightens and builds up pressure. Then one day—snap! It shoots out. That’s exactly what a triangle pattern does on a stock chart. It shows a market that’s consolidating, building pressure before breaking out in one direction.

A triangle pattern forms when the price of a stock, crypto, or any tradable asset moves within converging trendlines, forming a shape that literally looks like a triangle.

Types of Triangle Patterns

There are three main types of triangle patterns, and each tells a different story:

Symmetrical Triangle – The sides converge equally. It’s a sign of uncertainty.

Ascending Triangle – Flat top, rising bottom. Often a bullish sign.

Descending Triangle – Flat bottom, falling top. Usually a bearish signal.

In this guide, we’ll focus mostly on the symmetrical triangle pattern, but it’s useful to know the others too.

What is the Symmetrical Triangle Pattern?

Think of the symmetrical triangle as a tug of war between buyers and sellers. Both sides are strong, but neither can overpower the other—yet. So the price bounces between narrowing support and resistance levels.

Here’s the key part: this pattern doesn’t tell you the direction of the breakout, but it strongly suggests a breakout is coming soon. It’s like a pressure cooker ready to explode—up or down.

Why Triangle Patterns Matter

You don’t need to predict the market perfectly to succeed—you just need to be ready for when it moves. Triangle patterns help with that.

Key Benefits:

Anticipate breakouts

Identify entry and exit points

Avoid trading during uncertain periods

Spotting these patterns can give you an edge over traders who are just guessing.

How to Spot a Symmetrical Triangle

Here’s how to identify it like a pro:

Look for lower highs and higher lows

Draw two trendlines—one sloping down from above, one sloping up from below

The lines converge toward each other like scissors

Once these lines start coming together, traders watch closely for the breakout.

Breakouts: The Big Reveal

Breakouts are when the price bursts out of the triangle formation.

Breakout Direction Tips:

Volume spike? Expect a strong move.

Break above the upper line? Likely bullish.

Break below the lower line? Likely bearish.

No pattern is 100% accurate, but triangle breakouts often lead to explosive price action.

Volume and the Triangle Pattern

Volume is like the “voice” of the market. During a symmetrical triangle formation, volume tends to drop, showing less activity. But right before a breakout, volume usually spikes, confirming that the market is about to move big.

This is where having powerful online trading software helps—these platforms can alert you to changes in volume instantly.

Triangle Patterns vs. Other Patterns

How does the triangle compare to other chart patterns?

Pattern

Key Signal

Symmetrical Triangle

Uncertainty followed by breakout

Head and Shoulders

Trend reversal

Flags & Pennants

Continuation of trend

Double Top/Bottom

Major reversal points

The symmetrical triangle pattern is one of the few that doesn’t try to predict direction—it helps you prepare for it instead.

Common Mistakes to Avoid

Even the best tools can't fix poor trading habits. Avoid these rookie mistakes:

Entering before the breakout – Wait for confirmation.

Ignoring volume – It’s your early warning system.

Misidentifying the pattern – Practice drawing trendlines correctly.

Overtrading – Not every triangle leads to a big move.

Take your time. It’s not about catching every move—it’s about catching the right one.

How Algo Trading Makes It Easier

Can software help you catch these patterns faster? Absolutely.

With the best algo trading software in India, you can automate:

Pattern recognition

Volume analysis

Trade execution on breakouts

This means no more staring at charts all day. The software does the scanning and alerts you when it’s go-time.

Top Online Trading Software in India

Here are some of the best platforms where you can trade triangle breakouts:

Quanttrix – Known for its high-speed algorithms and pattern recognition.

Zerodha Kite – Popular for its easy interface and charting tools.

Upstox Pro – Combines speed with smart analytics.

Angel One – AI-driven alerts and customizable charts.

These online trading software platforms make it easier for Indian traders to take advantage of technical patterns like triangles.

Backtesting the Triangle Pattern

Before you risk real money, test it out.

Backtesting means applying the triangle pattern to past market data to see how well it worked.

Many platforms (like Quanttrix or TradingView) allow backtesting. Use this feature to:

Learn how often triangle breakouts succeed

Understand what conditions increase success

Improve your strategy over time

Real-Life Examples of Triangle Trading

Let’s say a stock like Reliance Industries starts forming a symmetrical triangle. You draw your trendlines and notice a breakout with strong volume on the upside.

If you had set an automated trade using algo software, you could’ve caught the breakout without lifting a finger.

Triangle patterns show up across stocks, crypto, commodities—you name it. They’re universal.

Tips for Beginners

Starting out? Here are a few things to keep in mind:

Use demo accounts – Practice without risk

Stick to one pattern – Master triangles first

Set alerts on your online trading software

Keep a trading journal – Log your triangle trades

Master one pattern and let it become your bread and butter before branching out.

Conclusion: Turning Shapes into Profits

Triangle patterns aren’t just pretty shapes—they’re predictive tools used by savvy traders around the world. The symmetrical triangle pattern in particular is a reliable signal of upcoming volatility.

With the help of the best algo trading software in India and reliable online trading software, you can turn this pattern into profit—without having to watch charts 24/7.

Trading doesn't have to be overwhelming. Sometimes, all you need is the ability to recognize a triangle.

FAQs

What does a symmetrical triangle pattern indicate? It shows price consolidation and signals an upcoming breakout, though it doesn’t predict the direction.

Can beginners use triangle patterns effectively? Yes! With some practice and the right tools, even beginners can spot and trade triangle patterns.

How does algo trading help with triangle patterns? Algo trading can automatically detect triangle formations and execute trades once a breakout is confirmed.

What is the best online trading software in India for chart patterns? Quanttrix, Zerodha Kite, and Upstox Pro are popular choices that support detailed charting and pattern detection.

Should I trade every triangle pattern I see? No. Only trade confirmed breakouts, ideally supported by volume and market conditions.

0 notes

Text

Assessing the Right Time to Invest in Forex: A Comprehensive Guide

Investing in the foreign exchange (Forex) market can be highly rewarding—but only if you know when and how to enter and exit trades. This guide will walk you through the key steps to assess the optimal time to invest, including understanding trading signals, choosing the right charts, mastering entry and exit indicators, and leveraging technology to stay ahead. Whether you’re a beginner or a seasoned trader, these strategies will help you make informed, logical decisions and minimize risk.

1. Why Timing Matters in Forex Trading

The Forex market operates 24 hours a day, five days a week, with trillions of dollars changing hands daily. Given its continuous nature and high volatility, timing your trades can be the difference between healthy profits and significant losses. Entering at the wrong time may expose you to adverse currency swings, while exiting too early can prevent you from maximizing gains.

A well-timed trade allows you to:

Capitalize on momentum during strong trends

Avoid sharp reversals triggered by economic news

Reduce drawdowns and preserve capital

Improve risk-to-reward ratios on every position

By the end of this article, you’ll have a clear roadmap to pinpoint the best moments to invest and secure consistent returns.

2. Understanding Forex Trading Signals

Trading signals are alerts based on predefined criteria that suggest when to buy or sell a currency pair. They distill vast market data into actionable insights, helping traders spot opportunities without parsing every tick on the chart. Signals can be:

Technical: Generated from mathematical calculations on price and volume (e.g., Moving Averages, RSI, MACD).

Fundamental: Driven by economic events, like interest rate decisions or GDP reports.

Sentiment-based: Reflecting trader positioning and market psychology.

The key is to choose signals that align with your trading style—whether that’s scalping, day trading, swing trading, or longer-term position trading.

3. Selecting the Right Chart and Indicators

Before diving into signals, select a charting platform that offers:

Real-time data feeds for all major and minor currency pairs

Customizable timeframes (from 1-minute to monthly)

Built-in technical indicators and the ability to add custom scripts

Common Forex Charts

Line Chart: Simplest view showing closing prices.

Bar Chart: Displays open, high, low, and close (OHLC) for each period.

Candlestick Chart: Similar to bar charts, but with color-coded bodies—excellent for spotting reversal patterns.

Essential Technical Indicators

Moving Averages (MA): Identify trend direction and dynamic support/resistance.

Relative Strength Index (RSI): Measures overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Captures trend strength and momentum shifts.

Bollinger Bands: Highlight volatility and potential breakout points.

Stochastic Oscillator: Another momentum tool for spotting reversal zones.

Familiarize yourself with how each indicator behaves across different timeframes. Longer MAs smooth out noise but lag more, while shorter MAs react quickly but can generate false signals.

4. Mastering Entry Signals

An effective entry strategy combines multiple indicators to confirm a high-probability setup. Here’s a step-by-step process:

Trend Confirmation:

Use a 50-period and 200-period MA crossover to determine the primary trend (bullish when 50 above 200; bearish when below).

Momentum Filter:

Check RSI or MACD histogram for momentum alignment. For example, in an uptrend, RSI should be above 50.

Pattern Recognition:

Look for chart patterns (e.g., flags, pennants, head and shoulders) that signal continuation or reversal.

Entry Trigger:

A candlestick pattern (e.g., bullish engulfing) or a break above/below a recent swing high/low.

Volume/Volatility Check:

Confirm with volume spikes or Bollinger Band width expansion to ensure the move is supported by sufficient trading activity.

Example Entry Signal Workflow

Step 1: EUR/USD 4-hour chart shows 50 MA above 200 MA (uptrend).

Step 2: RSI sits at 55, indicating bullish momentum.

Step 3: Price consolidates in a bull flag for three candles.

Step 4: A breakout candle closes above the flag’s top—enter long.

Step 5: Volume increases by 20% above the 20-period average, confirming strength.

5. Optimizing Exit Strategies

Your exit plan is just as important as your entry. There are three common types of exits:

Fixed Stops and Profit Targets:

Predefine a stop-loss level (e.g., 30 pips) and a profit target (e.g., 60 pips) before entering. This guarantees a positive risk-to-reward ratio.

Trailing Stops:

Move your stop-loss in your favor as price advances. Many traders use a moving average or ATR-based trailing stop to capture extended moves.

Limit Exits at Key Levels:

Close positions at significant support/resistance zones or Fibonacci retracement lines.

Short-Term (Scalp/Swing) Exits

For quick trades, focus on “turning points”—repeated short-term patterns that can produce fast reversals. Monitor currency pair swings on 5- to 15-minute charts and set tight limit exits (e.g., 10–15 pips) with equally tight stops.

Real-Time Exit Signals

Many platforms offer real-time alerts—for example, if the MACD line crosses below the signal line or if price breaks below a key moving average. These can automate your exit decisions and reduce emotional bias.

6. Combining Multiple Signals for Risk Aversion

Relying on a single indicator is risky; it can generate false positives or lag behind. Instead, create a signal matrix by:

Overlaying trend, momentum, and volatility indicators

Filtering signals across multiple timeframes (e.g., align a 15-minute entry with a 1-hour trend)

Assigning weights to each signal based on reliability and recent performance

By evaluating multiple Forex signals together, you gain a holistic view of the market and can better anticipate fluctuations. This approach helps you stick to a logical mechanism rather than making random decisions under stress.

7. Leveraging Technology and Alerts

Modern Forex trading thrives on technology. With the right tools, you can analyze markets around the clock and never miss a crucial signal.

Mobile Trading Apps: Execute buy/sell orders and monitor charts on your smartphone—no physical presence required.

Automated Alert Systems: Configure alerts for when indicators meet your predefined parameters (e.g., RSI crosses below 30).

Expert Advisors (EAs): Deploy algorithmic trading systems that scan for signals and place trades automatically.

These innovations ensure that you’re always ready to act on new opportunities, whether you’re at your desk or on the go.

8. Choosing a Reliable Signal Provider

While self-generated signals are ideal, many traders supplement their strategies with professional signal services. To choose a trustworthy provider:

Check Track Record: Look for audited performance over at least six months with clear equity curves.

Read Reviews and Forums: Engage with communities on Forex forums and social media—peer feedback can be invaluable.

Compare Costs vs. Value: Free signals can be high-volume but low-quality, while paid services often offer curated, lower-frequency alerts.

Trial Periods: Opt for services that provide a trial or money-back guarantee so you can test signals risk-free.

Always cross-reference third-party signals with your own analysis to maintain control over your trades.

9. Continuous Research and Education

Forex markets evolve constantly. To stay ahead:

Read Business Newspapers and Magazines: Stay informed on macroeconomic trends that influence currency values.

Participate in Online Forums and Webinars: Exchange ideas with other traders and learn from expert lectures.

Backtest New Strategies: Use historical data and Forex software to simulate performance before risking real capital.

Maintain a Trading Journal: Record each trade’s setup, outcome, and your emotional state to refine your approach over time.

By committing to lifelong learning, you’ll adapt your system to changing market conditions and improve your win rate.

10. Conclusion: Bringing It All Together

Assessing the right time to invest in Forex isn’t about luck—it’s about systematic analysis, disciplined execution, and continuous improvement.

Understand and select the best trading signals for your style.

Choose the right charts and technical indicators.

Master robust entry and exit strategies.

Combine signals across multiple timeframes for enhanced risk aversion.

Leverage technology to automate alerts and execute trades.

Partner with a reputable signal provider, but always validate their calls.

Commit to ongoing research and education to refine your edge.

By following these steps, you’ll position yourself to make well-timed, high-probability trades that align with your goals and risk tolerance. Remember, consistency beats occasional brilliance—stick to your plan, and let your system guide you to long-term success in the Forex market. For more insights: Mastering Forex Trading Psychology: Traits, Emotions, and Mindset for Success Paperback – Large Print, May 20, 2025 by NABAL KISHORE PANDE (Author)

#Forex#TradingSignals#ForexStrategy#ForexIndicators#CurrencyTrading#InvestSmart#MarketTiming#ForexCharts#TradingPsychology#ExitStrategy

0 notes

Text

Conquer the Day: A Beginner's Guide to Intraday Trading

The world of Online intraday trading is booming. Did you know that intraday trading volumes have surged by over 30% in recent years? This growth highlights how more individuals are drawn to the fast-paced nature of trading stocks within a single day. Simply put, intraday trading involves buying and selling financial instruments like stocks or commodities on the same day, aiming to take advantage of short-term price movements. This guide will help beginners grasp the essentials of intraday trading and consider stepping into this dynamic arena.

Understanding the Mechanics of Intraday Trading

Order Types

To engage in intraday trading, you need to understand different order types:

Market Orders: These are orders to buy or sell at the current market price. For example, if a stock is trading at $50, you might place a market order to buy it. This order completes instantly at that price.

Limit Orders: A limit order allows you to specify the price at which you're willing to buy or sell. If you only want to buy a stock at $48, you would set a limit order. It won’t execute until that stock reaches your desired price.

Stop-Loss Orders: This order helps minimize losses. If you own a stock at $50 and want to limit losses to 10%, you set a stop-loss order at $45. If the stock price drops to this point, your shares will automatically sell.

Trading Platforms

Choosing the right trading platform is vital. Some popular options include:

Robinhood: Known for its user-friendly interface. Great for beginners and offers commission-free trading.

TD Ameritrade: Offers advanced tools and excellent research resources, which can be beneficial for rookies.

E*TRADE: Provides a robust mobile app along with a web platform that’s easy to navigate.

(Screenshots would enhance understanding but are not included here.)

Leverage and Margin

Leverage allows traders to control larger amounts of money with a smaller investment. It means you borrow money from your broker to increase your buying power, potentially amplifying profits. However, this comes with risks. A statistic shows that around 70% of intraday traders use leverage. If the market moves against you, losses can exceed your initial investment.

Key Indicators and Chart Patterns for Intraday Traders

Technical Analysis Basics

Understanding technical analysis can boost your trading success. Here are a few key concepts:

Support and Resistance Levels: Support is where a stock tends to stop falling and bounce back up, while resistance is where it often stops rising. These levels can inform your buy or sell decisions.

Moving Averages: This tool smooths price data over a specific period, making trends clearer. For instance, a 50-day moving average might help identify whether a stock is in an uptrend or downtrend.

Relative Strength Index (RSI): A momentum oscillator that indicates whether a stock is overbought (above 70) or oversold (below 30).

Chart Patterns

Recognizing chart patterns can provide valuable insights:

Head and Shoulders: This pattern indicates a trend reversal. The “head” is a peak between two smaller “shoulders.”

Double Tops/Bottoms: A double top signals a potential price decline, while a double bottom suggests a price increase.

Flags/Pennants: These patterns represent brief price consolidations before a continuation of the trend.

Interpreting Market Sentiment

Market sentiment can sway price movements significantly. To gauge sentiment, traders often review news articles, social media, and reports from reliable financial news sources like CNBC or Bloomberg.

Risk Management Strategies in Intraday Trading

Position Sizing

Position sizing helps manage risk effectively. For instance, if you have a $1,000 account and are willing to risk 2% per trade, you would only risk $20. Therefore, if you buy a stock at $50, you should only purchase 0.4 shares to limit your risk.

Stop-Loss Orders

Setting stop-loss orders is vital for protecting your capital. For example, if a trader buys shares at $100 but sets a stop-loss at $95, they limit potential loss to 5%.

Emotional Discipline

Emotional control is crucial. Many traders face challenges with impulsive decisions. Trading expert Van Tharp states, “Your trading plan has to be solid, but your mind must also be calm to execute it.”

Choosing the Right Assets for Intraday Trading

Stocks vs. Futures vs. Forex

Each asset class has unique features.

Stocks are popular for intraday trading due to their volatility.

Futures offer high leverage but can be risky for beginners.

Forex trading provides high liquidity with low capital needed to start.

Liquidity and Volatility

Liquid assets have high trading volumes, making it easier to enter and exit trades. Volatile assets experience frequent price changes, providing more opportunities. Some highly liquid stocks include Apple, Amazon, and Tesla.

Diversification

Diversifying your portfolio helps mitigate risk. Trading across sectors or asset classes reduces the impact of a poor-performing asset.

Developing an Intraday Trading Plan

Defining Trading Goals

Setting clear and realistic trading goals is crucial. Goals could include achieving a specific profit amount each month or steadily growing your trading account.

Backtesting Strategies

Before entering live trades, backtesting strategies can show how they would have performed in the past. This helps in understanding potential profitability. Websites like TradingView offer backtesting features.

Journaling Trades

Tracking trades improves decision-making. Recording details, like entry and exit points, helps identify what works and what doesn’t. Over time, this practice can enhance your trading effectiveness.

Conclusion: Mastering the Art of Intraday Trading

Understanding intraday trading involves grasping various key components: order types, charts, and effective risk management. Prioritizing risk management and adopting a continuous learning mindset will enhance trading skills. With determination and the right resources, you can navigate the exciting world of intraday trading successfully. Start small, stay informed, and let your journey unfold.

#intaday tading#intraday trading in India#Intraday trading Platform#stock trading platform in india#forex trading in india

0 notes

Text

Decoding Crypto Trading Patterns: A Guide for Smarter Investments

Crypto trading patterns are crucial tools for navigating the volatile cryptocurrency market. These visual representations of price movements help traders predict future trends and make informed decisions. Leveraging patterns through technical analysis can provide a structured approach to trading, minimizing emotional decisions and maximizing potential profits. This guide will explore key trading patterns, tools, and strategies to help you decode market movements and improve your investment decisions.

Why Crypto Trading Patterns Matter

Crypto trading patterns are essential for understanding market behavior and making smarter trading choices. They help predict whether the market is entering a bullish or bearish trend, aiding in well-timed entries and exits. Patterns also create a disciplined approach to trading, reducing impulsive actions and emotional decision-making. Additionally, they work across trading styles—be it day trading, swing trading, or long-term investing—making them versatile tools for every trader.

Key Crypto Trading Patterns to Know

Understanding specific trading patterns is vital for success:

Candlestick Patterns:

Bullish Patterns:Hammer, Morning Star.

Bearish Patterns: Shooting Star, Evening Star.

Chart Patterns:

Continuation Patterns:Flags, Pennants, and Triangles, which indicate ongoing trends.

Reversal Patterns:Head and Shoulders, Double Top/Bottom, signaling trend reversals.

Breakout Patterns: Identify potential explosive price movements. Visual aids, such as graphics or examples, can help traders quickly recognize these patterns during analysis.

Understanding Support and Resistance Levels

Support and resistance levels are critical markers in technical analysis. Support represents price levels where demand increases, preventing further declines, while resistance marks points where selling pressure intensifies, halting upward movements. These levels are key in validating trading patterns, as they highlight areas for potential trend reversals or continuations, helping traders decide when to enter or exit positions.

Tools for Analyzing Trading Patterns Modern tools make analyzing trading patterns more efficient:

Charting Platforms: Platforms like TradingView, Binance, and PrimeTrader provide detailed visuals and pattern-recognition tools.

Indicators: Tools like RSI, MACD, and Fibonacci retracements confirm patterns and signal strength.

Automation:AI-driven tools identify patterns in real-time and execute trades, offering speed and accuracy. Using these tools helps traders refine their analysis and execute strategies with confidence.

Applying Trading Patterns in Different Strategies Trading patterns adapt to various trading strategies:

Day Trading:Identify intraday patterns like flags or triangles for quick profits.

Swing Trading:Use medium-term patterns for trades lasting several days.

Scalping:Rely on micro patterns for rapid, small-margin trades.

Long-Term Investing:Look for broader patterns, such as the cup and handle, to predict sustained trends. Each strategy benefits from incorporating patterns, tailoring them to specific market behaviors and timeframes.

Common Mistakes to Avoid When Using Patterns While trading patterns are powerful, common pitfalls can hinder success:

Overtrading:Acting on incomplete or weakly confirmed patterns can lead to losses.

Ignoring Volume:Trading volume is a critical factor that validates patterns.

Neglecting Risk Management:Always use stop-loss orders and proper position sizing.

Confirmation Bias:Avoid interpreting patterns to fit preconceived expectations. By steering clear of these mistakes, traders can improve accuracy and profitability.

Advanced Pattern Recognition with AI and Automation

AI and automation are revolutionizing how traders use patterns. Advanced tools can analyze charts and detect patterns in real-time, providing instant insights. Platforms like PrimeTrader incorporate AI-driven features, automating pattern recognition and trade execution. This technology reduces errors and ensures swift responses to market changes, giving traders an edge in a fast-paced environment.

The Role of Trading Psychology in Using Patterns

Trading success depends as much on psychology as it does on technical analysis. Discipline, patience, and objectivity are crucial for interpreting and applying patterns effectively. Sticking to a strategy during volatile market conditions and mastering emotions like fear or greed can significantly improve decision-making. A calm and focused mindset ensures better execution and long-term success.

Conclusion

Crypto trading patterns are indispensable tools for navigating the complexities of the cryptocurrency market. By understanding and applying these patterns, traders can make smarter, more informed decisions and reduce risks. Whether you're day trading, swing trading, or investing long-term, incorporating pattern analysis into your strategy can boost your success.

0 notes

Text

Indian Stock Market Trading | Investing: Technical Analysis

Technical analysis is a popular approach in the Indian stock market for both trading and investing. By using patterns, trends, and other market data, technical analysis aims to forecast stock price movements and identify profitable opportunities. Here’s a comprehensive look at how technical analysis works and how it can be applied to the Indian stock market.

1. What is Technical Analysis?

Technical analysis is the study of past market data, primarily price and volume, to predict future price movements. Unlike fundamental analysis, which looks at a company's financial health and growth potential, technical analysis focuses on stock price movements and investor sentiment.

Key Components of Technical Analysis

Price: The most important element in technical analysis. Every stock’s price reflects all available information.

Volume: Shows the level of trading activity and can confirm price trends.

Timeframe: Different trends appear over short, medium, or long periods, affecting decisions for day traders, swing traders, and long-term investors.

2. Basic Principles of Technical Analysis

Technical analysis is based on a few core principles:

Market Discounts Everything: All information is already priced into the stock.

Price Moves in Trends: Prices often move in recognizable trends rather than random patterns.

History Tends to Repeat Itself: Market behavior repeats over time, often due to investor psychology.

3. Tools and Indicators in Technical Analysis

Simple Moving Average (SMA): The average price over a specific period, like 50-day or 200-day, to identify trends.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it sensitive to new information.

Relative Strength Index (RSI)

A momentum indicator that ranges from 0 to 100, indicating overbought (above 70) or oversold (below 30) conditions.

Bollinger Bands

Consist of a moving average with two bands that adjust to volatility, useful for identifying overbought and oversold conditions.

MACD (Moving Average Convergence Divergence)

Combines moving averages to show momentum, often used to spot trend changes.

Support and Resistance Levels

Price levels where a stock historically stops rising or falling, signaling potential entry or exit points.

4. Chart Patterns in Technical Analysis

Indian traders often rely on chart patterns that help predict future price movements.

Head and Shoulders

A reversal pattern that suggests the end of an uptrend.

Double Top and Double Bottom

These patterns indicate potential reversals, with double tops suggesting a bearish reversal and double bottoms signaling a bullish reversal.

Triangles (Ascending, Descending, and Symmetrical)

These patterns indicate periods of consolidation, where the stock is likely to break out in the direction of the broader trend.

Flags and Pennants

Short-term continuation patterns that signal brief pauses in ongoing trends, often indicating that the price will resume its previous direction.

5. Types of Trends in Technical Analysis

Trends are categorized based on the timeframe, providing different insights for traders and investors.

Uptrend

Characterized by higher highs and higher lows, indicating a bullish market.

Downtrend

Marked by lower highs and lower lows, indicating a bearish market.

Sideways/Horizontal Trend

Occurs when prices move within a narrow range, signaling indecision among investors.

6. Timeframes in Technical Analysis

Choosing a timeframe is essential, as it impacts the analysis and strategy.

Intraday: For traders looking to profit from daily price fluctuations.

Swing Trading: Involves holding stocks for days or weeks to capture short- to medium-term trends.

Long-Term: Investors hold positions for months or years, focusing on longer-term trends.

7. Using Technical Analysis for Trading

Traders can use technical analysis to make quick buy or sell decisions based on signals and patterns.

Identifying Entry and Exit Points

Use indicators like RSI, MACD, and support/resistance levels to determine optimal buy and sell points.

Risk Management

Incorporate stop-loss orders to limit losses and protect profits, especially in volatile stocks.

Backtesting

Testing strategies on historical data to gauge effectiveness before applying them in live trading.

8. Using Technical Analysis for Investing

For long-term investors, technical analysis can help optimize the timing of buying or selling, even if they rely more heavily on fundamentals.

Using Moving Averages for Timing

Long-term investors can use moving averages to confirm uptrends before making investments or to decide when to exit.

Support Levels as Buying Opportunities

In bull markets, support levels offer a chance to buy stocks at a relative discount.

Avoiding Overbought Conditions

Long-term investors may avoid stocks with high RSI values (over 70), as they may be due for a correction.

9. Limitations of Technical Analysis

Technical analysis, while powerful, does have its limitations:

Does Not Consider Fundamentals: It ignores a company’s financial health.

Subjective Interpretation: Patterns and indicators can be interpreted differently.

Prone to False Signals: Indicators can sometimes give incorrect buy or sell signals, especially during volatile markets.

10. Practical Tips for Using Technical Analysis in the Indian Market

Focus on High-Volume Stocks: High-volume stocks offer clearer technical signals and less price manipulation.

Combine with Fundamentals: For investment, combine technical analysis with fundamental analysis to make well-rounded decisions.

Stay Updated with News: The Indian stock market can react to political, economic, and regulatory news, impacting technical patterns.

Practice Patience: Technical analysis requires patience and consistency to understand market trends and patterns.

Conclusion

Technical analysis can be a valuable tool for both traders and investors in the Indian stock market. By learning to read indicators, identify patterns, and understand trends, you can make more informed decisions. Whether you're trading daily or investing for the long term, technical analysis provides actionable insights to help navigate the dynamic and often unpredictable nature of the stock market.

0 notes

Text

Complete Guide to Breakout Trading: Unlocking the Power of Price Action 📈

Breakout trading is one of the most popular strategies for active traders across various markets, from stocks and forex to cryptocurrencies. This strategy thrives on price action, identifying key levels, and entering positions when the price breaks through significant support or resistance levels. In this comprehensive guide, we will explore the fundamentals of breakout trading, key patterns to watch for, and advanced strategies that can help you master this approach in markets like the Indian stock market. Let’s dive in!

What Exactly is Breakout Trading? 🤔

At its core, breakout trading involves entering a trade when the price of a financial asset breaks through a defined support or resistance level. A breakout typically signals the start of a new trend, whether bullish (upward) or bearish (downward), and traders aim to capitalize on this momentum.

Key Concepts to Understand:

Support and Resistance: Support is a price level where an asset tends to find buying interest, while resistance is a level where selling pressure increases.

Price Action: The movement of an asset’s price over time, typically analyzed through charts.

Trend Continuation: A breakout suggests the potential continuation of the current trend after a brief consolidation.

How Do You Spot Breakout Patterns? 📊

Identifying breakout patterns is crucial to successful breakout trading. These patterns help traders anticipate price movements and act quickly when key levels are breached. Common breakout patterns include:

1. Triangles 🔺:

Triangles are one of the most reliable breakout patterns. They form when the price consolidates between converging trendlines. Once the price breaks out of the triangle (either upward or downward), it often results in a strong price movement.

Example in Indian Markets: In the Indian stock market, we saw a textbook example of a triangle breakout in the stock of Reliance Industries. The stock formed a symmetrical triangle over several months, and once the price broke above the upper trendline, it surged, providing traders with significant gains.

2. Flags and Pennants 🚩

Flags and pennants are continuation patterns that occur after a strong price movement. These patterns indicate brief consolidation before the trend resumes.

Example: During the HDFC Bank rally in 2020, after an initial sharp price increase, the stock formed a pennant pattern, and the breakout from the pennant led to another leg higher.

3. Head and Shoulders 💀

This reversal pattern often signals the end of an uptrend and the beginning of a downtrend. It consists of three peaks – the middle peak being the highest (head) and the others being lower (shoulders).

What Role Does Volume Play in Breakout Trading? 📊

One of the most important factors when trading breakouts is volume. Volume confirms the strength of a breakout. A breakout with high volume indicates strong buying or selling pressure, validating the move. On the other hand, a breakout with low volume can be a false breakout, which might not lead to a sustainable trend.

Example:

When Tata Motors broke through its resistance level at ₹500 in early 2023, the surge in price was accompanied by a significant increase in trading volume. This provided traders with confirmation that the breakout had the potential to continue.

Key Takeaway:

Always wait for volume confirmation when trading breakouts. If the breakout occurs without significant volume, it's a signal that the move could be a false alarm.

How to Trade a Breakout Successfully 🚀

Now that you understand how to spot breakouts, let’s walk through the process of executing a breakout trade. Here’s a simple step-by-step guide to help you enter a breakout trade with confidence:

1. Identify the Breakout Level 🔑

Look for significant support or resistance levels. This could be horizontal levels, trendlines, or moving averages.

Example: In the case of Infosys, a breakout occurred when the price broke above ₹1,400, a key resistance level that had held the stock down for several months. Traders who identified this level saw a strong upward move once it was breached.

2. Wait for the Breakout ⏳

Don’t rush into a trade. Wait for the price to move beyond the key level and preferably close above or below it (depending on the direction of the breakout). This confirms that the breakout is real.

3. Volume Confirmation 🔥

Check the volume. If the breakout happens with a large increase in volume, it’s a strong confirmation that the move is genuine. Low volume may indicate a fake breakout.

4. Set Entry and Exit Points 🎯

Once the breakout happens, set your entry point. For stop-loss, place it just below the breakout level (for a bullish breakout) or just above it (for a bearish breakout). Always calculate your risk/reward ratio.

Example: For a breakout above ₹1,400 in Infosys, a trader might place a stop-loss at ₹1,380 and set a target at ₹1,500, ensuring a good risk/reward ratio.

Common Mistakes to Avoid in Breakout Trading ⚠️

While breakout trading can be highly profitable, it’s essential to avoid some common mistakes that can lead to losses:

1. Chasing Breakouts Without Confirmation 🏃♂️

Many traders make the mistake of entering a breakout trade too early or when volume is low. This often results in a false breakout, which can lead to losses. Always wait for confirmation, such as volume or a candle close beyond the breakout level.

2. Ignoring the Trend 🔄

Sometimes, traders may ignore the broader trend. A breakout in the opposite direction of the prevailing trend is riskier and less likely to succeed. Ensure you’re trading in the direction of the overall market trend.

3. Overtrading 🔥

Just because a breakout occurs doesn’t mean it’s the right time to trade. Not every breakout is worth taking. Stick to your strategy and don’t feel the need to trade every single breakout.

Advanced Breakout Trading Strategies 🧠

Once you have mastered the basics of breakout trading, it’s time to delve into advanced strategies. These strategies are designed to increase your success rate in identifying and capitalizing on breakouts.

Multi-Timeframe Analysis ⏱️

By analyzing multiple timeframes, traders can get a better understanding of the overall market trend. For example, you might spot a breakout on a 15-minute chart, but checking the daily chart could reveal a more significant breakout that confirms your trade.

Using Price Action 📉

Advanced traders often rely heavily on price action to spot breakouts. They look for candlestick patterns, like engulfing candles, that show strong momentum at breakout points. Combining price action with other indicators, like the RSI or Bollinger Bands, can help confirm a breakout.

Real-World Example: Breakout in Indian Stock Market 📈

In India, the Nifty 50 index often sees major breakout opportunities that traders can capitalize on. A great example was the breakout in the stock of Bajaj Finance in 2020. After months of consolidation, the stock broke out of a long-term resistance level at ₹4,500. The breakout was confirmed with strong volume and a follow-up move to ₹5,000. Traders who followed this breakout pattern were able to make significant profits.

The Role of Strike Money as a Charting Tool 🔧

When it comes to breakout trading, choosing the right charting tool can make all the difference. Strike Money is one of the best platforms for tracking price action, spotting breakout patterns, and managing your trades. With its real-time charting and advanced technical analysis features, Strike Money allows you to plot key support and resistance levels and spot breakouts with ease.

Why Strike Money?

Easy-to-use interface for both beginners and advanced traders.

Real-time data and advanced charting features for pinpointing breakout points.

Ability to customize your charts to reflect patterns like triangles, flags, and more.

Managing Risk in Breakout Trading: Don’t Let Losses Derail You 🚫

While breakout trading offers great profit potential, managing your risk is critical to long-term success. Here are some tips to mitigate risk:

1. Use a Stop-Loss 🛑

Always set a stop-loss when trading breakouts. This limits your potential losses in case the breakout turns out to be false.

2. Position Sizing 📉

Avoid risking too much on a single trade. Use position sizing strategies to ensure that your capital is spread across different trades.

3. Avoid Overleveraging ⚖️

While it might be tempting to use leverage to increase potential gains, it also increases your risk. Stick to manageable levels of leverage to avoid large losses.

Conclusion: Master Breakout Trading for Consistent Profits 🏆

Breakout trading can be one of the most rewarding strategies when used correctly. By understanding key patterns, waiting for volume confirmation, and applying advanced strategies, traders can successfully navigate breakouts in any market. Remember, the key to consistent profits lies in identifying the right breakout, managing risk, and staying disciplined in your approach.

The Indian stock market provides numerous opportunities for breakout traders, as seen in examples with stocks like Reliance, Infosys, and Tata Motors. Using Strike Money for charting will give you an edge in identifying breakouts and executing your trades effectively.

Happy trading, and may your breakout trades lead to profitable outcomes! 🚀

0 notes

Text

Shiba Inu enthusiasts have reason to celebrate, as analysts predict a bullish pennant pattern could catapult SHIB to new record highs. With this promising technical formation, Market experts are optimistic about the cryptocurrency's future performance. Stay tuned to see how this unfolds and what it means for Shiba Inu investors. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Multiple analysts have identified a bullish pennant on the Shiba Inu chart, outlining the potential for a profit of above 62% soon. Shiba Inu bulls are encountering significant resistance around the $0.000025 price level. Last week, amid SHIB engineering a mini rally, it barely crossed this range before retreating below. At the last check, SHIB succumbed to bearish pressure, falling behind by at least 5% and hitting an intraday low of $0.00002361. Despite maintaining positive gains in its 30-day trajectory, Shiba Inu is still struggling to surpass the $0.000025 level decisively. Meanwhile, prominent Market observers are confident that SHIB is counting down from its current consolidation phase. They have forecasted various breakout price targets Shiba Inu holders may look out for soon. Incoming 62% Profit for Shiba Inu Holders Famous Bitcoin analyst Clifton has joined the roster of commentators calling attention to an impending bullish trend for Shiba Inu. In a recent update on X, Clifton highlighted the formation of a bullish pennant on the 24-hour timeframe for Shiba Inu. For context, a bullish pennant formation signals that an asset is prepared to continue an uptrend commenced much earlier before encountering brief opposition. This formation, resembling a symmetrical triangle, is characterized by consolidating prices, hinting at an imminent breakout. In Shiba Inu’s case, SHIB had an ongoing uptrend in early March but ran out of steam. It entered a downtrend that took it back to $0.000018 in April. The overall candlestick pattern SHIB established in March translated to the bullish pennant many Market watchers have spotted. Clifton asserted that an upside from the configuration could net Shiba Inu holders a short-term profit of up to 60%. Image Source: https://x.com/clifton_ideas/status/1792045985465819536 In particular, the accompanying graph proposed that Shiba Inu could rally to the $0.00004 price level at the very least within the next few weeks. Other Analysts Propose Higher Targets On the other hand, analyst Davie Satoshi, who similarly identified a bullish pennant on Shiba Inu’s chart, proposed higher targets of above $0.00005 upon breakout. Other Market watchers like the pseudonymous “World of Charts” have conveyed similar opinions, identifying $0.00005 as SHIB’s potential target. Meanwhile, while replying to the analysis, a Bitcoin analyst suggested that SHIB enthusiasts may anticipate the $0.00008 price level next. Another even argued for the potential for a $0.00015 price point by next month. Notably, Shiba Inu entering $0.00015 would Market a new history for the asset as it represents an uncharted territory. Disclaimer: This content is informational and should not be considered financial advice.

The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses. -Advertisement- Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] What is a bullish pennant? A bullish pennant is a chart pattern that shows a strong upward price movement, suggesting that the price might keep going up. It usually happens after a big price increase and looks like a small triangle on the price chart. Why do analysts think SHIB will reach new highs? Analysts believe SHIB will hit new highs because of the bullish pennant pattern. This means the recent uptrend could continue, pushing the price even higher. How soon could SHIB hit a new high? It's hard to say exactly when SHIB will hit a new high. Market moves can be unpredictable, but the bullish pennant suggests it could happen relatively soon. Should I invest in SHIB based on this news? Investing is a personal decision. While the bullish pennant is a positive sign, it's important to do your own research and consider your risk tolerance before investing in SHIB or any other cryptocurrency. What should I do if I already own SHIB? If you already own SHIB, you might want to keep an eye on the Market and consider holding your position to benefit from potential gains. Always stay informed and be prepared for Market changes. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Unlocking Success: Key Chart Patterns Every Trader Must Learn

Trading success frequently depends on one's capacity to identify and decipher important chart patterns. These chart patterns can assist traders in spotting possible profit chances and offer insightful information about the mechanics of the market. We'll go over some of the most important chart patterns in this book, which are essential knowledge for any trader looking to succeed in the markets.

1. Importance of Key Chart Patterns

Technical analysis, the study of past price data to predict future price movements, heavily relies on chart patterns. Price charts can be used to discover recurrent patterns that help traders predict market trends and make wise trading decisions. Important chart patterns can assist traders in determining the strength of a trend or spotting possible trend reversals. They are also dependable markers of market sentiment.

2. Key Chart Patterns Every Trader Should Know

Now let's examine some of the essential chart patterns that all traders ought to be familiar with:

Patterns of Trend Reversal:

Three peaks make up the "head and shoulders" pattern, where the main peak (referred to as the "head") is higher than the other two (referred to as the "shoulders"). A reversal of the trend is usually indicated by a break below the pattern's neckline.Double Top and Double Bottom: These patterns show the possibility of a trend reversal when prices reach two peaks or valleys that are about equal in height.

b. Continuation Patterns:

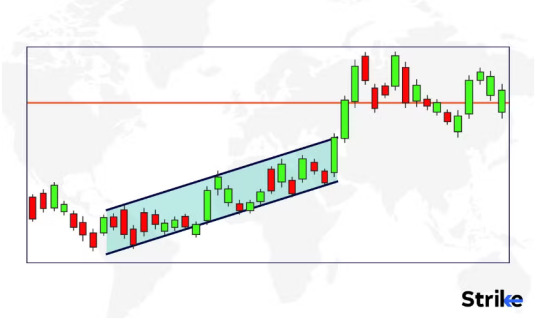

Pennants and flags: These patterns emerge following a significant price change and signify a short-lived break in the market before the trend continues. Pennants are tiny, symmetrical triangles, whereas flags are rectangular designs.Triangles: Triangles are patterns of consolidation that appear when prices move inside a smaller range, signifying a lack of confidence in the market.

3. Patterns of Consolidation:

Rectangles: Rectangles are patterns of consolidation that show levels of support and resistance as parallel horizontal lines.Wedges: When prices move inside convergent trendlines, a possible breakout is indicated. Wedges are patterns of consolidation.

3. Practical Implications for Trading

Trading methods may benefit from an understanding of important chart patterns. Traders can establish stop-loss orders to control risk, pinpoint price targets for profit-taking, and discover possible entry and exit locations for trades by identifying these patterns on a price chart. Traders can increase their overall trading performance and make better selections by incorporating important chart patterns into their trading approach.

4. Conclusion

In conclusion, a thorough grasp of important chart patterns and how they relate to market analysis is essential to trading success. Through the process of identifying and comprehending these patterns on price charts, traders can acquire important knowledge about market trends and possible avenues for profit. Understanding important chart patterns is crucial for success in the fast-paced world of trading, regardless of experience level.

1 note

·

View note

Text

Chart Patterns: A Visual Language of the Markets

Imagine a graph depicting currency price movements over time. This chart can often reveal recurring patterns that visually suggest potential future price movements. These patterns are formed by the collective actions of buyers and sellers in the market, and can offer clues about market sentiment and potential trend reversals or continuations. While not foolproof, understanding chart patterns can be a valuable tool in your Forex trading arsenal.

Popular Chart Patterns and Their Implications

Here are some of the most widely recognized chart patterns and their trading interpretations:

Trend Reversal Patterns: These patterns signal a potential shift in the current price trend. Examples include:

Head and Shoulders (H&S): A bearish reversal pattern resembling a head with two lower shoulders. A neckline break below the shoulders suggests a potential downtrend.

Double Top (DT) and Double Bottom (DB): These patterns indicate potential reversals after two successive highs (DT) or lows (DB). A break above the neckline for DT or below the neckline for DB suggests a possible trend change.

Continuation Patterns: These patterns suggest the continuation of the prevailing trend. Some common examples include:

Ascending/Descending Triangle: A series of higher highs (ascending) or lower lows (descending) with converging trendlines, suggesting a potential breakout in the direction of the trend.

Flags and Pennants: These are consolidation patterns formed within an established uptrend or downtrend, resembling flags or pennants. A breakout above the flagpole for flags or the trendline for pennants suggests trend continuation.

Using Chart Patterns Effectively: Combining Strategies

While chart patterns offer valuable insights, it's important to remember some key points:

Confirmation is Key: Don't rely solely on a single chart pattern. Look for confirmation from technical indicators, price action, or fundamental factors before entering a trade.

False Signals Do Occur: Chart patterns are not guarantees of future price movements. The market can be unpredictable, and false signals can sometimes emerge.

Context Matters: The overall market trend and other technical indicators can influence how a chart pattern plays out.

Risk Management is Paramount: Always prioritize risk management strategies like stop-loss orders to limit potential losses, regardless of the chart pattern.

Beyond the Basics: Tips for Success with Chart Patterns

Here are some additional tips to maximize the effectiveness of chart patterns in your Forex trading:

Focus on High-Probability Patterns: Master a few high-probability chart patterns with clear entry and exit signals rather than trying to learn them all.

Practice Pattern Recognition: Train your eye to identify chart patterns on live and historical charts.

Paper Trading: Test your chart pattern recognition skills and trading strategies using a demo account before risking real capital.

Conclusion

Chart patterns can be a valuable tool for Forex traders, offering visual cues about potential price movements and trading opportunities. However, it's crucial to use them in conjunction with other technical and fundamental analysis methods, prioritize risk management, and acknowledge their limitations. By applying these principles and continuously refining your chart pattern recognition skills, you can leverage this technique to enhance your trading decisions and navigate the dynamic world of Forex with greater confidence.

Remember, successful Forex trading is a journey that requires dedication, continuous learning, and a commitment to developing a sound trading strategy.

1 note

·

View note

Text

Trading Chart Patterns PDF Guide & Algo Tools

Mastering Market Moves: The Ultimate Guide to Trading Chart Patterns Book PDF

Introduction

Have you ever looked at a stock chart and thought, “What am I even looking at?” You’re not alone! Deciphering those zig-zagging lines can feel like trying to read an alien language. But what if I told you that those shapes — those patterns — actually tell a story? And once you understand that story, you could make smarter trading decisions. That’s where a trading chart patterns book PDF becomes your secret weapon.

In this article, we'll break down trading chart patterns in a friendly, no-nonsense way. We'll also explore how combining this knowledge with algorithmic trading software — especially the best algo trading software in India — can supercharge your trading game.

Download the best trading chart patterns book PDF. Learn how chart patterns, algorithmic trading software, and the best algo trading software in India help you win.

What Are Trading Chart Patterns?

Think of chart patterns like footprints in the snow. They show you where traders have been — and sometimes where they might go next. A chart pattern is just a visual formation on a price chart that helps traders make predictions. Whether it’s a triangle, a head and shoulders, or a double bottom — these shapes can signal buying or selling opportunities.

Why Use a Trading Chart Patterns Book PDF?

Let’s be real — the internet is loaded with scattered info. But a trading chart patterns book PDF puts everything in one place. It’s your go-to guide, available offline, structured, and perfect for both beginners and seasoned traders. Plus, you can refer to it anytime — even during a coffee break.

The 3 Main Types of Chart Patterns

Just like in movies, there are three main types of chart patterns:

Reversal Patterns: These hint that the trend is about to change.

Continuation Patterns: These suggest the trend will likely continue.

Bilateral Patterns: They could go either way — like a cliffhanger ending.

Understanding these gives you the power to react smartly, not emotionally.

Top Reversal Patterns Explained

Reversal patterns are like plot twists. They tell you the story is changing.

Head and Shoulders: Think of it like a person slumping. It often signals a shift from up to downtrend.

Double Top and Bottom: These patterns look like the letter ‘M’ or ‘W’. They scream, “Change is coming!”

Learning to spot these can save you from a bad trade — or help you enter just in time.

Key Continuation Patterns You Should Know

Continuation patterns keep the story flowing in the same direction.

Triangles (Ascending, Descending, Symmetrical): Imagine price compressing like a spring — ready to break out.

Flags and Pennants: These are like pit stops in a rally. The price pauses, then zooms off again.

Master these, and you’ll catch trends before others even notice.

How to Read Patterns Like a Pro

Reading chart patterns is part art, part science. Here’s how to get good at it:

Use candlestick charts for clarity.

Watch volume — it tells you how strong a move is.

Use support and resistance lines like guardrails.

It’s like learning to read music — confusing at first, but magical once you get it.

Common Mistakes Traders Make

Even the best traders mess up. Here are common traps:

Forcing patterns: If it doesn’t fit, don’t force it.

Ignoring volume: Patterns without strong volume are weak.

Overtrading: Don’t jump into every “almost” pattern.

Remember: Quality over quantity wins the game.

Best Resources for Chart Pattern PDFs

Here are some great places to find your next trading chart patterns book PDF:

Chart Patterns & Technical Indicators by Edward Dobson

Technical Analysis of the Financial Markets by John Murphy

Online libraries like Scribd, Academia, and even Reddit threads

Official broker platforms often offer free downloads

Just make sure you pick one with charts and examples, not just theory.

How Algorithmic Trading Software Helps

This is where things get exciting. Algorithmic trading software uses computer code to place trades. It can recognize patterns faster than any human. When you combine this with your knowledge of chart patterns, you’ve got a winning formula.

It’s like pairing Sherlock Holmes (your pattern spotting) with Watson (your algo software). Together, unbeatable!

Best Algo Trading Software in India

If you’re in India, here are some top-rated options:

Quanttrix – Known for speed and user-friendly interface.

Zerodha Streak – Drag-and-drop logic for non-coders.

AlgoTrader India – Offers institutional-grade automation.

Each has features like backtesting, live execution, and real-time analysis — ideal for traders who want results.

Using Chart Patterns in Algorithmic Strategies

Good algorithmic traders don’t just rely on numbers. They bake in pattern recognition rules:

Code to detect head and shoulders

Alerts for double tops

Algorithms that track breakout triangles

These strategies can be coded in platforms like MetaTrader, Python scripts, or even Streak.

Getting Started With a Chart Pattern Book

Here’s how to start:

Download a recommended trading chart patterns book PDF.

Start with 3-5 basic patterns.

Print a cheat sheet.

Look at real charts daily.

Journal what you see.

Consistency is key — don’t expect overnight success.

Tips to Practice Pattern Recognition

Think of pattern spotting like facial recognition. The more faces (charts) you see, the better you get.

Use trading simulators

Join trader communities

Quiz yourself using historical charts

Mark up charts manually

This hands-on practice boosts your confidence and instincts.

Mobile Apps & Tools for Chart Learning

Want to learn on the go? Try these:

TradingView: Mobile-friendly and packed with features.

Investing.com App: Clean charts and lots of news.

ChartSchool by StockCharts: A mini chart encyclopedia.

These help reinforce what you read in your chart pattern PDF.

Final Thoughts

Trading isn’t magic — it’s mastery. Understanding chart patterns gives you a serious edge. And when paired with powerful algorithmic trading software, especially the best algo trading software in India, you can turn insights into intelligent action.

So go ahead. Download that trading chart patterns book PDF, open up a demo account, and start seeing the market with new eyes. The journey from confusion to clarity starts with one pattern.

FAQs

What is the best trading chart patterns book PDF for beginners? “Technical Analysis for Dummies” and “Chart Patterns Explained” are great PDFs for those starting out.

Can I use chart patterns with algorithmic trading software? Yes! Many algorithmic tools allow you to code or automate pattern recognition and trading rules.

Which is the best algo trading software in India? Quanttrix and Zerodha Streak are widely recommended due to their user-friendly tools and performance.

Are trading chart patterns reliable for predicting markets? They’re not perfect, but when combined with volume and confirmation signals, they greatly improve your odds.

Where can I practice chart pattern recognition for free? Websites like TradingView and platforms like MetaTrader offer free tools and demo accounts.

0 notes

Text

Decoding the Market: A Guide to Forex Chart Patterns

The foreign exchange market, or Forex for short, is a vast and dynamic landscape. Skilled traders rely on various tools and strategies to make informed decisions, and technical analysis, particularly the study of chart patterns, plays a crucial role in this process. This guide delves into the world of Forex chart patterns, equipping you with the knowledge to identify these formations and potentially improve your trading forecast accuracy.

What are Forex Chart Patterns?

Imagine a line graph depicting the price movements of a currency pair over time. These price fluctuations often form recognizable patterns that can offer clues about future price direction. Forex chart patterns are technical indicators based on the historical behavior of price and volume data. While not foolproof predictors, they can be valuable tools when used in conjunction with other technical and fundamental analysis.

Common Forex Chart Patterns: A Trader's Toolkit

Several chart patterns are frequently encountered in Forex trading. Here's a look at some of the most common ones:

Reversal Patterns: These patterns signal a potential shift in the prevailing trend.

Head and Shoulders (H&S): This pattern resembles a head with two lower shoulders on either side. A break below the neckline (support level) suggests a potential downtrend after an uptrend.

Double Top/Double Bottom: These patterns consist of two consecutive highs/lows with a valley/peak in between. A break below the neckline (for double top) or above the resistance level (for double bottom) could indicate a trend reversal.

Continuation Patterns: These patterns suggest the continuation of the current trend.

Ascending/Descending Triangle: These triangle patterns form when price fluctuations are confined within a narrowing range, with trendlines connecting the highs (ascending) or lows (descending). A breakout above resistance (ascending) or below support (descending) might signal a continuation of the trend.

Flags and Pennants: These are short-term consolidation patterns within an established trend, resembling flags or pennants. A breakout above resistance (uptrend) or below support (downtrend) could indicate a continuation of the prevailing trend.

Remember, Patterns Are Not Guarantees

While Forex chart patterns can be valuable tools, it's crucial to understand their limitations:

False Signals: Chart patterns don't guarantee future price movements. Breakouts can be false, leading to unexpected reversals.

Confirmation is Key: Combine chart patterns with other technical indicators and fundamental analysis for stronger confirmation of potential price direction.

Market Context Matters: The overall market sentiment and economic factors can influence how a chart pattern plays out.

Beyond the Basics: Utilizing Chart Patterns Effectively

Here are some additional tips for effectively utilizing Forex chart patterns:

Identify the Trend: Before analyzing chart patterns, understand the prevailing trend (uptrend, downtrend, or sideways).

Placement and Volume: Consider the location of the pattern within the trend and the accompanying trading volume. Higher volume breakouts tend to be more significant.

Risk Management: Always prioritize risk management strategies like stop-loss orders to limit potential losses, regardless of the chart pattern.

Conclusion

Forex chart patterns offer valuable insights into potential price movements, but they should be used as one piece of the puzzle in your trading strategy. By understanding common chart patterns, their limitations, and how to use them effectively, you can enhance your technical analysis skills and potentially make more informed trading decisions in the dynamic world of Forex. Remember, successful trading requires ongoing learning, discipline, and a commitment to continuous improvement.

0 notes

Text

How to Become a Great Trader: Mastering the Art of Trading

Introduction

Although it can be a thrilling and profitable endeavour, trading in the financial markets also calls for knowledge, discipline, and skill. We will examine the fundamental ideas and methods that can make you a profitable trader in this extensive tutorial. Gaining long-term success in the financial markets requires learning the art of trading, regardless of the expertise level of the investor.

Understanding the Basics of Trading

What is Trading?

Buying and selling financial instruments including stocks, bonds, currencies, and commodities with the intention of making money off of price changes is known as trading.

Types of Trading

Buying and selling assets during the same trading day in order to profit from momentary price changes is known as day trading.

Swing trading is the practice of holding positions for a few days or weeks in order to profit from medium-term market trends.

Long-term investing is the practice of holding investments for a considerable amount of time—often years—with the goal of generating large returns over time.

Developing a Trading Plan

Setting Clear Goals

Establish your trading time horizon, risk tolerance, and financial objectives. Set reasonable expectations regarding profits and losses.

Creating a Strategy

Select a trading approach that fits your personality and ambitions. Technical analysis, fundamental analysis, or a mix of the two may be used in this.

Risk Management

To guard against losses, use risk management strategies include portfolio diversification, stop-loss orders, and position sizing.

To Becoming A Great Trader JOIN NOW

Mastering Technical Analysis

Understanding Price Charts

To find possible trade chances, become knowledgeable about the interpretation of candlestick patterns, trendlines, support and resistance levels, and other technical indicators.

Using Technical Indicators

To analyse price trends and momentum, familiarise yourself with widely used technical indicators such as stochastic oscillators, moving averages, and the relative strength index (RSI).

Chart Patterns

To predict future price changes, identify typical chart patterns like head and shoulders, double tops and bottoms, and flags and pennants..

Utilising Fundamental Analysis

Economic Indicators

Keep yourself updated on important economic indicators that might affect asset values and market mood, such as GDP growth, inflation rates, interest rates, and employment data.

Company Analysis

Prior to considering an investment, consider each company's competitive position, growth potential, management team, and financial standing.

Market Sentiment

To determine market trends and mood shifts, track sentiment in the market using investor sentiment indicators, social media, and news.

Developing Discipline and Patience

Stick to Your Plan

Stick to your trading plan religiously and refrain from acting on impulse in response to transient market swings or feelings.

Manage Your Emotions

By keeping a logical attitude and concentrating on the long-term goals of your trading strategy, you may control your emotions of fear and greed.

Continuous Learning

With books, courses, webinars, and trading networks, stay current on market trends, trading strategies, and industry advancements.

To Becoming A Great Trader JOIN NOW

Practising Risk Management

Capital Preservation

Avoid overleveraging and only risk a small portion of your portfolio on each trade to protect your trading money.

Stop-Loss Orders

Stop-loss orders are a useful tool for controlling possible losses and quitting losing trades before they cause large losses.

Diversification

To minimise risk and optimise profits, diversify your investing portfolio among several industries, geographical areas, and asset types.

Conclusion