#How to Trade Bullish Pennant Pattern

Explore tagged Tumblr posts

Text

#Pennant Pattern in Technical Analysis#Bullish and Bearish Pennant Pattern#Types of Pennant Patterns#How to Trade with Pennant Chart Pattern#How to Trade Bullish Pennant Pattern

0 notes

Text

Triangle Pattern in Trading | Simple Guide for Everyone

Triangle Pattern in Trading: Master the Market Moves

Trading the financial markets may seem like rocket science, but what if I told you it’s more like spotting shapes in clouds? Yes, seriously. One of the most powerful chart patterns traders rely on is the triangle pattern, and understanding it could be your edge in the market—especially the symmetrical triangle pattern.

This article breaks it all down for you in the simplest way possible—no complicated terms, no financial degree required. Plus, we’ll show how tools like the best algo trading software in India and online trading software can help make the process smoother.

Learn the symmetrical triangle pattern in trading. Discover how it works using the best algo trading software in India & top online trading software.

What is a Triangle Pattern in Trading?

Imagine squeezing a spring between your fingers. It tightens and builds up pressure. Then one day—snap! It shoots out. That’s exactly what a triangle pattern does on a stock chart. It shows a market that’s consolidating, building pressure before breaking out in one direction.

A triangle pattern forms when the price of a stock, crypto, or any tradable asset moves within converging trendlines, forming a shape that literally looks like a triangle.

Types of Triangle Patterns

There are three main types of triangle patterns, and each tells a different story:

Symmetrical Triangle – The sides converge equally. It’s a sign of uncertainty.

Ascending Triangle – Flat top, rising bottom. Often a bullish sign.

Descending Triangle – Flat bottom, falling top. Usually a bearish signal.

In this guide, we’ll focus mostly on the symmetrical triangle pattern, but it’s useful to know the others too.

What is the Symmetrical Triangle Pattern?

Think of the symmetrical triangle as a tug of war between buyers and sellers. Both sides are strong, but neither can overpower the other—yet. So the price bounces between narrowing support and resistance levels.

Here’s the key part: this pattern doesn’t tell you the direction of the breakout, but it strongly suggests a breakout is coming soon. It’s like a pressure cooker ready to explode—up or down.

Why Triangle Patterns Matter

You don’t need to predict the market perfectly to succeed—you just need to be ready for when it moves. Triangle patterns help with that.

Key Benefits:

Anticipate breakouts

Identify entry and exit points

Avoid trading during uncertain periods

Spotting these patterns can give you an edge over traders who are just guessing.

How to Spot a Symmetrical Triangle

Here’s how to identify it like a pro:

Look for lower highs and higher lows

Draw two trendlines—one sloping down from above, one sloping up from below

The lines converge toward each other like scissors

Once these lines start coming together, traders watch closely for the breakout.

Breakouts: The Big Reveal

Breakouts are when the price bursts out of the triangle formation.

Breakout Direction Tips:

Volume spike? Expect a strong move.

Break above the upper line? Likely bullish.

Break below the lower line? Likely bearish.

No pattern is 100% accurate, but triangle breakouts often lead to explosive price action.

Volume and the Triangle Pattern

Volume is like the “voice” of the market. During a symmetrical triangle formation, volume tends to drop, showing less activity. But right before a breakout, volume usually spikes, confirming that the market is about to move big.

This is where having powerful online trading software helps—these platforms can alert you to changes in volume instantly.

Triangle Patterns vs. Other Patterns

How does the triangle compare to other chart patterns?

Pattern

Key Signal

Symmetrical Triangle

Uncertainty followed by breakout

Head and Shoulders

Trend reversal

Flags & Pennants

Continuation of trend

Double Top/Bottom

Major reversal points

The symmetrical triangle pattern is one of the few that doesn’t try to predict direction—it helps you prepare for it instead.

Common Mistakes to Avoid

Even the best tools can't fix poor trading habits. Avoid these rookie mistakes:

Entering before the breakout – Wait for confirmation.

Ignoring volume – It’s your early warning system.

Misidentifying the pattern – Practice drawing trendlines correctly.

Overtrading – Not every triangle leads to a big move.

Take your time. It’s not about catching every move—it’s about catching the right one.

How Algo Trading Makes It Easier

Can software help you catch these patterns faster? Absolutely.

With the best algo trading software in India, you can automate:

Pattern recognition

Volume analysis

Trade execution on breakouts

This means no more staring at charts all day. The software does the scanning and alerts you when it’s go-time.

Top Online Trading Software in India

Here are some of the best platforms where you can trade triangle breakouts:

Quanttrix – Known for its high-speed algorithms and pattern recognition.

Zerodha Kite – Popular for its easy interface and charting tools.

Upstox Pro – Combines speed with smart analytics.

Angel One – AI-driven alerts and customizable charts.

These online trading software platforms make it easier for Indian traders to take advantage of technical patterns like triangles.

Backtesting the Triangle Pattern

Before you risk real money, test it out.

Backtesting means applying the triangle pattern to past market data to see how well it worked.

Many platforms (like Quanttrix or TradingView) allow backtesting. Use this feature to:

Learn how often triangle breakouts succeed

Understand what conditions increase success

Improve your strategy over time

Real-Life Examples of Triangle Trading

Let’s say a stock like Reliance Industries starts forming a symmetrical triangle. You draw your trendlines and notice a breakout with strong volume on the upside.

If you had set an automated trade using algo software, you could’ve caught the breakout without lifting a finger.

Triangle patterns show up across stocks, crypto, commodities—you name it. They’re universal.

Tips for Beginners

Starting out? Here are a few things to keep in mind:

Use demo accounts – Practice without risk

Stick to one pattern – Master triangles first

Set alerts on your online trading software

Keep a trading journal – Log your triangle trades

Master one pattern and let it become your bread and butter before branching out.

Conclusion: Turning Shapes into Profits

Triangle patterns aren’t just pretty shapes—they’re predictive tools used by savvy traders around the world. The symmetrical triangle pattern in particular is a reliable signal of upcoming volatility.

With the help of the best algo trading software in India and reliable online trading software, you can turn this pattern into profit—without having to watch charts 24/7.

Trading doesn't have to be overwhelming. Sometimes, all you need is the ability to recognize a triangle.

FAQs

What does a symmetrical triangle pattern indicate? It shows price consolidation and signals an upcoming breakout, though it doesn’t predict the direction.

Can beginners use triangle patterns effectively? Yes! With some practice and the right tools, even beginners can spot and trade triangle patterns.

How does algo trading help with triangle patterns? Algo trading can automatically detect triangle formations and execute trades once a breakout is confirmed.

What is the best online trading software in India for chart patterns? Quanttrix, Zerodha Kite, and Upstox Pro are popular choices that support detailed charting and pattern detection.

Should I trade every triangle pattern I see? No. Only trade confirmed breakouts, ideally supported by volume and market conditions.

0 notes

Text

Assessing the Right Time to Invest in Forex: A Comprehensive Guide

Investing in the foreign exchange (Forex) market can be highly rewarding—but only if you know when and how to enter and exit trades. This guide will walk you through the key steps to assess the optimal time to invest, including understanding trading signals, choosing the right charts, mastering entry and exit indicators, and leveraging technology to stay ahead. Whether you’re a beginner or a seasoned trader, these strategies will help you make informed, logical decisions and minimize risk.

1. Why Timing Matters in Forex Trading

The Forex market operates 24 hours a day, five days a week, with trillions of dollars changing hands daily. Given its continuous nature and high volatility, timing your trades can be the difference between healthy profits and significant losses. Entering at the wrong time may expose you to adverse currency swings, while exiting too early can prevent you from maximizing gains.

A well-timed trade allows you to:

Capitalize on momentum during strong trends

Avoid sharp reversals triggered by economic news

Reduce drawdowns and preserve capital

Improve risk-to-reward ratios on every position

By the end of this article, you’ll have a clear roadmap to pinpoint the best moments to invest and secure consistent returns.

2. Understanding Forex Trading Signals

Trading signals are alerts based on predefined criteria that suggest when to buy or sell a currency pair. They distill vast market data into actionable insights, helping traders spot opportunities without parsing every tick on the chart. Signals can be:

Technical: Generated from mathematical calculations on price and volume (e.g., Moving Averages, RSI, MACD).

Fundamental: Driven by economic events, like interest rate decisions or GDP reports.

Sentiment-based: Reflecting trader positioning and market psychology.

The key is to choose signals that align with your trading style—whether that’s scalping, day trading, swing trading, or longer-term position trading.

3. Selecting the Right Chart and Indicators

Before diving into signals, select a charting platform that offers:

Real-time data feeds for all major and minor currency pairs

Customizable timeframes (from 1-minute to monthly)

Built-in technical indicators and the ability to add custom scripts

Common Forex Charts

Line Chart: Simplest view showing closing prices.

Bar Chart: Displays open, high, low, and close (OHLC) for each period.

Candlestick Chart: Similar to bar charts, but with color-coded bodies—excellent for spotting reversal patterns.

Essential Technical Indicators

Moving Averages (MA): Identify trend direction and dynamic support/resistance.

Relative Strength Index (RSI): Measures overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Captures trend strength and momentum shifts.

Bollinger Bands: Highlight volatility and potential breakout points.

Stochastic Oscillator: Another momentum tool for spotting reversal zones.

Familiarize yourself with how each indicator behaves across different timeframes. Longer MAs smooth out noise but lag more, while shorter MAs react quickly but can generate false signals.

4. Mastering Entry Signals

An effective entry strategy combines multiple indicators to confirm a high-probability setup. Here’s a step-by-step process:

Trend Confirmation:

Use a 50-period and 200-period MA crossover to determine the primary trend (bullish when 50 above 200; bearish when below).

Momentum Filter:

Check RSI or MACD histogram for momentum alignment. For example, in an uptrend, RSI should be above 50.

Pattern Recognition:

Look for chart patterns (e.g., flags, pennants, head and shoulders) that signal continuation or reversal.

Entry Trigger:

A candlestick pattern (e.g., bullish engulfing) or a break above/below a recent swing high/low.

Volume/Volatility Check:

Confirm with volume spikes or Bollinger Band width expansion to ensure the move is supported by sufficient trading activity.

Example Entry Signal Workflow

Step 1: EUR/USD 4-hour chart shows 50 MA above 200 MA (uptrend).

Step 2: RSI sits at 55, indicating bullish momentum.

Step 3: Price consolidates in a bull flag for three candles.

Step 4: A breakout candle closes above the flag’s top—enter long.

Step 5: Volume increases by 20% above the 20-period average, confirming strength.

5. Optimizing Exit Strategies

Your exit plan is just as important as your entry. There are three common types of exits:

Fixed Stops and Profit Targets:

Predefine a stop-loss level (e.g., 30 pips) and a profit target (e.g., 60 pips) before entering. This guarantees a positive risk-to-reward ratio.

Trailing Stops:

Move your stop-loss in your favor as price advances. Many traders use a moving average or ATR-based trailing stop to capture extended moves.

Limit Exits at Key Levels:

Close positions at significant support/resistance zones or Fibonacci retracement lines.

Short-Term (Scalp/Swing) Exits

For quick trades, focus on “turning points”—repeated short-term patterns that can produce fast reversals. Monitor currency pair swings on 5- to 15-minute charts and set tight limit exits (e.g., 10–15 pips) with equally tight stops.

Real-Time Exit Signals

Many platforms offer real-time alerts—for example, if the MACD line crosses below the signal line or if price breaks below a key moving average. These can automate your exit decisions and reduce emotional bias.

6. Combining Multiple Signals for Risk Aversion

Relying on a single indicator is risky; it can generate false positives or lag behind. Instead, create a signal matrix by:

Overlaying trend, momentum, and volatility indicators

Filtering signals across multiple timeframes (e.g., align a 15-minute entry with a 1-hour trend)

Assigning weights to each signal based on reliability and recent performance

By evaluating multiple Forex signals together, you gain a holistic view of the market and can better anticipate fluctuations. This approach helps you stick to a logical mechanism rather than making random decisions under stress.

7. Leveraging Technology and Alerts

Modern Forex trading thrives on technology. With the right tools, you can analyze markets around the clock and never miss a crucial signal.

Mobile Trading Apps: Execute buy/sell orders and monitor charts on your smartphone—no physical presence required.

Automated Alert Systems: Configure alerts for when indicators meet your predefined parameters (e.g., RSI crosses below 30).

Expert Advisors (EAs): Deploy algorithmic trading systems that scan for signals and place trades automatically.

These innovations ensure that you’re always ready to act on new opportunities, whether you’re at your desk or on the go.

8. Choosing a Reliable Signal Provider

While self-generated signals are ideal, many traders supplement their strategies with professional signal services. To choose a trustworthy provider:

Check Track Record: Look for audited performance over at least six months with clear equity curves.

Read Reviews and Forums: Engage with communities on Forex forums and social media—peer feedback can be invaluable.

Compare Costs vs. Value: Free signals can be high-volume but low-quality, while paid services often offer curated, lower-frequency alerts.

Trial Periods: Opt for services that provide a trial or money-back guarantee so you can test signals risk-free.

Always cross-reference third-party signals with your own analysis to maintain control over your trades.

9. Continuous Research and Education

Forex markets evolve constantly. To stay ahead:

Read Business Newspapers and Magazines: Stay informed on macroeconomic trends that influence currency values.

Participate in Online Forums and Webinars: Exchange ideas with other traders and learn from expert lectures.

Backtest New Strategies: Use historical data and Forex software to simulate performance before risking real capital.

Maintain a Trading Journal: Record each trade’s setup, outcome, and your emotional state to refine your approach over time.

By committing to lifelong learning, you’ll adapt your system to changing market conditions and improve your win rate.

10. Conclusion: Bringing It All Together

Assessing the right time to invest in Forex isn’t about luck—it’s about systematic analysis, disciplined execution, and continuous improvement.

Understand and select the best trading signals for your style.

Choose the right charts and technical indicators.

Master robust entry and exit strategies.

Combine signals across multiple timeframes for enhanced risk aversion.

Leverage technology to automate alerts and execute trades.

Partner with a reputable signal provider, but always validate their calls.

Commit to ongoing research and education to refine your edge.

By following these steps, you’ll position yourself to make well-timed, high-probability trades that align with your goals and risk tolerance. Remember, consistency beats occasional brilliance—stick to your plan, and let your system guide you to long-term success in the Forex market. For more insights: Mastering Forex Trading Psychology: Traits, Emotions, and Mindset for Success Paperback – Large Print, May 20, 2025 by NABAL KISHORE PANDE (Author)

#Forex#TradingSignals#ForexStrategy#ForexIndicators#CurrencyTrading#InvestSmart#MarketTiming#ForexCharts#TradingPsychology#ExitStrategy

0 notes

Link

#BearishContinuation#BearishFlag#BearishPennant#BreakoutTrading#BullishContinuation#BullishFlag#BullishPennant#ChartFormationAnalysis#chartpatterns#ContinuationPatterns#FallingThreeMethods#ForexTrading#MarketSentiment#MarketStructure#MomentumTrading#PatternRecognition#priceaction#PriceActionStrategy#RisingThreeMethods#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendConsolidation#TrendContinuation#TrendStrength#TrendStrengthSignals#VolumeConfirmation

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

Decoding Crypto Trading Patterns: A Guide for Smarter Investments

Crypto trading patterns are crucial tools for navigating the volatile cryptocurrency market. These visual representations of price movements help traders predict future trends and make informed decisions. Leveraging patterns through technical analysis can provide a structured approach to trading, minimizing emotional decisions and maximizing potential profits. This guide will explore key trading patterns, tools, and strategies to help you decode market movements and improve your investment decisions.

Why Crypto Trading Patterns Matter

Crypto trading patterns are essential for understanding market behavior and making smarter trading choices. They help predict whether the market is entering a bullish or bearish trend, aiding in well-timed entries and exits. Patterns also create a disciplined approach to trading, reducing impulsive actions and emotional decision-making. Additionally, they work across trading styles—be it day trading, swing trading, or long-term investing—making them versatile tools for every trader.

Key Crypto Trading Patterns to Know

Understanding specific trading patterns is vital for success:

Candlestick Patterns:

Bullish Patterns:Hammer, Morning Star.

Bearish Patterns: Shooting Star, Evening Star.

Chart Patterns:

Continuation Patterns:Flags, Pennants, and Triangles, which indicate ongoing trends.

Reversal Patterns:Head and Shoulders, Double Top/Bottom, signaling trend reversals.

Breakout Patterns: Identify potential explosive price movements. Visual aids, such as graphics or examples, can help traders quickly recognize these patterns during analysis.

Understanding Support and Resistance Levels

Support and resistance levels are critical markers in technical analysis. Support represents price levels where demand increases, preventing further declines, while resistance marks points where selling pressure intensifies, halting upward movements. These levels are key in validating trading patterns, as they highlight areas for potential trend reversals or continuations, helping traders decide when to enter or exit positions.

Tools for Analyzing Trading Patterns Modern tools make analyzing trading patterns more efficient:

Charting Platforms: Platforms like TradingView, Binance, and PrimeTrader provide detailed visuals and pattern-recognition tools.

Indicators: Tools like RSI, MACD, and Fibonacci retracements confirm patterns and signal strength.

Automation:AI-driven tools identify patterns in real-time and execute trades, offering speed and accuracy. Using these tools helps traders refine their analysis and execute strategies with confidence.

Applying Trading Patterns in Different Strategies Trading patterns adapt to various trading strategies:

Day Trading:Identify intraday patterns like flags or triangles for quick profits.

Swing Trading:Use medium-term patterns for trades lasting several days.

Scalping:Rely on micro patterns for rapid, small-margin trades.

Long-Term Investing:Look for broader patterns, such as the cup and handle, to predict sustained trends. Each strategy benefits from incorporating patterns, tailoring them to specific market behaviors and timeframes.

Common Mistakes to Avoid When Using Patterns While trading patterns are powerful, common pitfalls can hinder success:

Overtrading:Acting on incomplete or weakly confirmed patterns can lead to losses.

Ignoring Volume:Trading volume is a critical factor that validates patterns.

Neglecting Risk Management:Always use stop-loss orders and proper position sizing.

Confirmation Bias:Avoid interpreting patterns to fit preconceived expectations. By steering clear of these mistakes, traders can improve accuracy and profitability.

Advanced Pattern Recognition with AI and Automation

AI and automation are revolutionizing how traders use patterns. Advanced tools can analyze charts and detect patterns in real-time, providing instant insights. Platforms like PrimeTrader incorporate AI-driven features, automating pattern recognition and trade execution. This technology reduces errors and ensures swift responses to market changes, giving traders an edge in a fast-paced environment.

The Role of Trading Psychology in Using Patterns

Trading success depends as much on psychology as it does on technical analysis. Discipline, patience, and objectivity are crucial for interpreting and applying patterns effectively. Sticking to a strategy during volatile market conditions and mastering emotions like fear or greed can significantly improve decision-making. A calm and focused mindset ensures better execution and long-term success.

Conclusion

Crypto trading patterns are indispensable tools for navigating the complexities of the cryptocurrency market. By understanding and applying these patterns, traders can make smarter, more informed decisions and reduce risks. Whether you're day trading, swing trading, or investing long-term, incorporating pattern analysis into your strategy can boost your success.

0 notes

Text

Indian Stock Market Trading | Investing: Technical Analysis

Technical analysis is a popular approach in the Indian stock market for both trading and investing. By using patterns, trends, and other market data, technical analysis aims to forecast stock price movements and identify profitable opportunities. Here’s a comprehensive look at how technical analysis works and how it can be applied to the Indian stock market.

1. What is Technical Analysis?

Technical analysis is the study of past market data, primarily price and volume, to predict future price movements. Unlike fundamental analysis, which looks at a company's financial health and growth potential, technical analysis focuses on stock price movements and investor sentiment.

Key Components of Technical Analysis

Price: The most important element in technical analysis. Every stock’s price reflects all available information.

Volume: Shows the level of trading activity and can confirm price trends.

Timeframe: Different trends appear over short, medium, or long periods, affecting decisions for day traders, swing traders, and long-term investors.

2. Basic Principles of Technical Analysis

Technical analysis is based on a few core principles:

Market Discounts Everything: All information is already priced into the stock.

Price Moves in Trends: Prices often move in recognizable trends rather than random patterns.

History Tends to Repeat Itself: Market behavior repeats over time, often due to investor psychology.

3. Tools and Indicators in Technical Analysis

Simple Moving Average (SMA): The average price over a specific period, like 50-day or 200-day, to identify trends.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it sensitive to new information.

Relative Strength Index (RSI)

A momentum indicator that ranges from 0 to 100, indicating overbought (above 70) or oversold (below 30) conditions.

Bollinger Bands

Consist of a moving average with two bands that adjust to volatility, useful for identifying overbought and oversold conditions.

MACD (Moving Average Convergence Divergence)

Combines moving averages to show momentum, often used to spot trend changes.

Support and Resistance Levels

Price levels where a stock historically stops rising or falling, signaling potential entry or exit points.

4. Chart Patterns in Technical Analysis

Indian traders often rely on chart patterns that help predict future price movements.

Head and Shoulders

A reversal pattern that suggests the end of an uptrend.

Double Top and Double Bottom

These patterns indicate potential reversals, with double tops suggesting a bearish reversal and double bottoms signaling a bullish reversal.

Triangles (Ascending, Descending, and Symmetrical)

These patterns indicate periods of consolidation, where the stock is likely to break out in the direction of the broader trend.

Flags and Pennants

Short-term continuation patterns that signal brief pauses in ongoing trends, often indicating that the price will resume its previous direction.

5. Types of Trends in Technical Analysis

Trends are categorized based on the timeframe, providing different insights for traders and investors.

Uptrend

Characterized by higher highs and higher lows, indicating a bullish market.

Downtrend

Marked by lower highs and lower lows, indicating a bearish market.

Sideways/Horizontal Trend

Occurs when prices move within a narrow range, signaling indecision among investors.

6. Timeframes in Technical Analysis

Choosing a timeframe is essential, as it impacts the analysis and strategy.

Intraday: For traders looking to profit from daily price fluctuations.

Swing Trading: Involves holding stocks for days or weeks to capture short- to medium-term trends.

Long-Term: Investors hold positions for months or years, focusing on longer-term trends.

7. Using Technical Analysis for Trading

Traders can use technical analysis to make quick buy or sell decisions based on signals and patterns.

Identifying Entry and Exit Points

Use indicators like RSI, MACD, and support/resistance levels to determine optimal buy and sell points.

Risk Management

Incorporate stop-loss orders to limit losses and protect profits, especially in volatile stocks.

Backtesting

Testing strategies on historical data to gauge effectiveness before applying them in live trading.

8. Using Technical Analysis for Investing

For long-term investors, technical analysis can help optimize the timing of buying or selling, even if they rely more heavily on fundamentals.

Using Moving Averages for Timing

Long-term investors can use moving averages to confirm uptrends before making investments or to decide when to exit.

Support Levels as Buying Opportunities

In bull markets, support levels offer a chance to buy stocks at a relative discount.

Avoiding Overbought Conditions

Long-term investors may avoid stocks with high RSI values (over 70), as they may be due for a correction.

9. Limitations of Technical Analysis

Technical analysis, while powerful, does have its limitations:

Does Not Consider Fundamentals: It ignores a company’s financial health.

Subjective Interpretation: Patterns and indicators can be interpreted differently.

Prone to False Signals: Indicators can sometimes give incorrect buy or sell signals, especially during volatile markets.

10. Practical Tips for Using Technical Analysis in the Indian Market

Focus on High-Volume Stocks: High-volume stocks offer clearer technical signals and less price manipulation.

Combine with Fundamentals: For investment, combine technical analysis with fundamental analysis to make well-rounded decisions.

Stay Updated with News: The Indian stock market can react to political, economic, and regulatory news, impacting technical patterns.

Practice Patience: Technical analysis requires patience and consistency to understand market trends and patterns.

Conclusion

Technical analysis can be a valuable tool for both traders and investors in the Indian stock market. By learning to read indicators, identify patterns, and understand trends, you can make more informed decisions. Whether you're trading daily or investing for the long term, technical analysis provides actionable insights to help navigate the dynamic and often unpredictable nature of the stock market.

0 notes

Text

Complete Guide to Breakout Trading: Unlocking the Power of Price Action 📈

Breakout trading is one of the most popular strategies for active traders across various markets, from stocks and forex to cryptocurrencies. This strategy thrives on price action, identifying key levels, and entering positions when the price breaks through significant support or resistance levels. In this comprehensive guide, we will explore the fundamentals of breakout trading, key patterns to watch for, and advanced strategies that can help you master this approach in markets like the Indian stock market. Let’s dive in!

What Exactly is Breakout Trading? 🤔

At its core, breakout trading involves entering a trade when the price of a financial asset breaks through a defined support or resistance level. A breakout typically signals the start of a new trend, whether bullish (upward) or bearish (downward), and traders aim to capitalize on this momentum.

Key Concepts to Understand:

Support and Resistance: Support is a price level where an asset tends to find buying interest, while resistance is a level where selling pressure increases.

Price Action: The movement of an asset’s price over time, typically analyzed through charts.

Trend Continuation: A breakout suggests the potential continuation of the current trend after a brief consolidation.

How Do You Spot Breakout Patterns? 📊

Identifying breakout patterns is crucial to successful breakout trading. These patterns help traders anticipate price movements and act quickly when key levels are breached. Common breakout patterns include:

1. Triangles 🔺:

Triangles are one of the most reliable breakout patterns. They form when the price consolidates between converging trendlines. Once the price breaks out of the triangle (either upward or downward), it often results in a strong price movement.

Example in Indian Markets: In the Indian stock market, we saw a textbook example of a triangle breakout in the stock of Reliance Industries. The stock formed a symmetrical triangle over several months, and once the price broke above the upper trendline, it surged, providing traders with significant gains.

2. Flags and Pennants 🚩

Flags and pennants are continuation patterns that occur after a strong price movement. These patterns indicate brief consolidation before the trend resumes.

Example: During the HDFC Bank rally in 2020, after an initial sharp price increase, the stock formed a pennant pattern, and the breakout from the pennant led to another leg higher.

3. Head and Shoulders 💀

This reversal pattern often signals the end of an uptrend and the beginning of a downtrend. It consists of three peaks – the middle peak being the highest (head) and the others being lower (shoulders).

What Role Does Volume Play in Breakout Trading? 📊

One of the most important factors when trading breakouts is volume. Volume confirms the strength of a breakout. A breakout with high volume indicates strong buying or selling pressure, validating the move. On the other hand, a breakout with low volume can be a false breakout, which might not lead to a sustainable trend.

Example:

When Tata Motors broke through its resistance level at ₹500 in early 2023, the surge in price was accompanied by a significant increase in trading volume. This provided traders with confirmation that the breakout had the potential to continue.

Key Takeaway:

Always wait for volume confirmation when trading breakouts. If the breakout occurs without significant volume, it's a signal that the move could be a false alarm.

How to Trade a Breakout Successfully 🚀

Now that you understand how to spot breakouts, let’s walk through the process of executing a breakout trade. Here’s a simple step-by-step guide to help you enter a breakout trade with confidence:

1. Identify the Breakout Level 🔑

Look for significant support or resistance levels. This could be horizontal levels, trendlines, or moving averages.

Example: In the case of Infosys, a breakout occurred when the price broke above ₹1,400, a key resistance level that had held the stock down for several months. Traders who identified this level saw a strong upward move once it was breached.

2. Wait for the Breakout ⏳

Don’t rush into a trade. Wait for the price to move beyond the key level and preferably close above or below it (depending on the direction of the breakout). This confirms that the breakout is real.

3. Volume Confirmation 🔥

Check the volume. If the breakout happens with a large increase in volume, it’s a strong confirmation that the move is genuine. Low volume may indicate a fake breakout.

4. Set Entry and Exit Points 🎯

Once the breakout happens, set your entry point. For stop-loss, place it just below the breakout level (for a bullish breakout) or just above it (for a bearish breakout). Always calculate your risk/reward ratio.

Example: For a breakout above ₹1,400 in Infosys, a trader might place a stop-loss at ₹1,380 and set a target at ₹1,500, ensuring a good risk/reward ratio.

Common Mistakes to Avoid in Breakout Trading ⚠️

While breakout trading can be highly profitable, it’s essential to avoid some common mistakes that can lead to losses:

1. Chasing Breakouts Without Confirmation 🏃♂️

Many traders make the mistake of entering a breakout trade too early or when volume is low. This often results in a false breakout, which can lead to losses. Always wait for confirmation, such as volume or a candle close beyond the breakout level.

2. Ignoring the Trend 🔄

Sometimes, traders may ignore the broader trend. A breakout in the opposite direction of the prevailing trend is riskier and less likely to succeed. Ensure you’re trading in the direction of the overall market trend.

3. Overtrading 🔥

Just because a breakout occurs doesn’t mean it’s the right time to trade. Not every breakout is worth taking. Stick to your strategy and don’t feel the need to trade every single breakout.

Advanced Breakout Trading Strategies 🧠

Once you have mastered the basics of breakout trading, it’s time to delve into advanced strategies. These strategies are designed to increase your success rate in identifying and capitalizing on breakouts.

Multi-Timeframe Analysis ⏱️

By analyzing multiple timeframes, traders can get a better understanding of the overall market trend. For example, you might spot a breakout on a 15-minute chart, but checking the daily chart could reveal a more significant breakout that confirms your trade.

Using Price Action 📉

Advanced traders often rely heavily on price action to spot breakouts. They look for candlestick patterns, like engulfing candles, that show strong momentum at breakout points. Combining price action with other indicators, like the RSI or Bollinger Bands, can help confirm a breakout.

Real-World Example: Breakout in Indian Stock Market 📈

In India, the Nifty 50 index often sees major breakout opportunities that traders can capitalize on. A great example was the breakout in the stock of Bajaj Finance in 2020. After months of consolidation, the stock broke out of a long-term resistance level at ₹4,500. The breakout was confirmed with strong volume and a follow-up move to ₹5,000. Traders who followed this breakout pattern were able to make significant profits.

The Role of Strike Money as a Charting Tool 🔧

When it comes to breakout trading, choosing the right charting tool can make all the difference. Strike Money is one of the best platforms for tracking price action, spotting breakout patterns, and managing your trades. With its real-time charting and advanced technical analysis features, Strike Money allows you to plot key support and resistance levels and spot breakouts with ease.

Why Strike Money?

Easy-to-use interface for both beginners and advanced traders.

Real-time data and advanced charting features for pinpointing breakout points.

Ability to customize your charts to reflect patterns like triangles, flags, and more.

Managing Risk in Breakout Trading: Don’t Let Losses Derail You 🚫

While breakout trading offers great profit potential, managing your risk is critical to long-term success. Here are some tips to mitigate risk:

1. Use a Stop-Loss 🛑

Always set a stop-loss when trading breakouts. This limits your potential losses in case the breakout turns out to be false.

2. Position Sizing 📉

Avoid risking too much on a single trade. Use position sizing strategies to ensure that your capital is spread across different trades.

3. Avoid Overleveraging ⚖️

While it might be tempting to use leverage to increase potential gains, it also increases your risk. Stick to manageable levels of leverage to avoid large losses.

Conclusion: Master Breakout Trading for Consistent Profits 🏆

Breakout trading can be one of the most rewarding strategies when used correctly. By understanding key patterns, waiting for volume confirmation, and applying advanced strategies, traders can successfully navigate breakouts in any market. Remember, the key to consistent profits lies in identifying the right breakout, managing risk, and staying disciplined in your approach.

The Indian stock market provides numerous opportunities for breakout traders, as seen in examples with stocks like Reliance, Infosys, and Tata Motors. Using Strike Money for charting will give you an edge in identifying breakouts and executing your trades effectively.

Happy trading, and may your breakout trades lead to profitable outcomes! 🚀

0 notes

Text

Shiba Inu enthusiasts have reason to celebrate, as analysts predict a bullish pennant pattern could catapult SHIB to new record highs. With this promising technical formation, Market experts are optimistic about the cryptocurrency's future performance. Stay tuned to see how this unfolds and what it means for Shiba Inu investors. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Multiple analysts have identified a bullish pennant on the Shiba Inu chart, outlining the potential for a profit of above 62% soon. Shiba Inu bulls are encountering significant resistance around the $0.000025 price level. Last week, amid SHIB engineering a mini rally, it barely crossed this range before retreating below. At the last check, SHIB succumbed to bearish pressure, falling behind by at least 5% and hitting an intraday low of $0.00002361. Despite maintaining positive gains in its 30-day trajectory, Shiba Inu is still struggling to surpass the $0.000025 level decisively. Meanwhile, prominent Market observers are confident that SHIB is counting down from its current consolidation phase. They have forecasted various breakout price targets Shiba Inu holders may look out for soon. Incoming 62% Profit for Shiba Inu Holders Famous Bitcoin analyst Clifton has joined the roster of commentators calling attention to an impending bullish trend for Shiba Inu. In a recent update on X, Clifton highlighted the formation of a bullish pennant on the 24-hour timeframe for Shiba Inu. For context, a bullish pennant formation signals that an asset is prepared to continue an uptrend commenced much earlier before encountering brief opposition. This formation, resembling a symmetrical triangle, is characterized by consolidating prices, hinting at an imminent breakout. In Shiba Inu’s case, SHIB had an ongoing uptrend in early March but ran out of steam. It entered a downtrend that took it back to $0.000018 in April. The overall candlestick pattern SHIB established in March translated to the bullish pennant many Market watchers have spotted. Clifton asserted that an upside from the configuration could net Shiba Inu holders a short-term profit of up to 60%. Image Source: https://x.com/clifton_ideas/status/1792045985465819536 In particular, the accompanying graph proposed that Shiba Inu could rally to the $0.00004 price level at the very least within the next few weeks. Other Analysts Propose Higher Targets On the other hand, analyst Davie Satoshi, who similarly identified a bullish pennant on Shiba Inu’s chart, proposed higher targets of above $0.00005 upon breakout. Other Market watchers like the pseudonymous “World of Charts” have conveyed similar opinions, identifying $0.00005 as SHIB’s potential target. Meanwhile, while replying to the analysis, a Bitcoin analyst suggested that SHIB enthusiasts may anticipate the $0.00008 price level next. Another even argued for the potential for a $0.00015 price point by next month. Notably, Shiba Inu entering $0.00015 would Market a new history for the asset as it represents an uncharted territory. Disclaimer: This content is informational and should not be considered financial advice.

The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses. -Advertisement- Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] What is a bullish pennant? A bullish pennant is a chart pattern that shows a strong upward price movement, suggesting that the price might keep going up. It usually happens after a big price increase and looks like a small triangle on the price chart. Why do analysts think SHIB will reach new highs? Analysts believe SHIB will hit new highs because of the bullish pennant pattern. This means the recent uptrend could continue, pushing the price even higher. How soon could SHIB hit a new high? It's hard to say exactly when SHIB will hit a new high. Market moves can be unpredictable, but the bullish pennant suggests it could happen relatively soon. Should I invest in SHIB based on this news? Investing is a personal decision. While the bullish pennant is a positive sign, it's important to do your own research and consider your risk tolerance before investing in SHIB or any other cryptocurrency. What should I do if I already own SHIB? If you already own SHIB, you might want to keep an eye on the Market and consider holding your position to benefit from potential gains. Always stay informed and be prepared for Market changes. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Master the Market with These Top Chart Patterns for Trading

Trading isn’t just about numbers; it’s about mastering the art and science of the financial markets. At Funded Traders Global, we’re here to help you do just that, and it all starts with understanding the power of Top Chart Patterns for Trading.

In our latest blog, we’ve unraveled the secrets of chart patterns, revealing how they can be your compass in the complex world of trading. We have also uploaded a detailed blog on Chart Patterns. You can check that for more detailed learning about Chart Patterns.

So let’s first understand what is chart pattern…

Understanding Chart Patterns

Basics of Technical Analysis

Before diving into chart patterns, it’s essential to understand the fundamentals of technical analysis. This approach relies on historical price data and volume to predict future price movements. By studying charts, you can spot recurring patterns that indicate potential buying or selling opportunities.

Role of Price Action

Price action is at the heart of chart patterns. It represents the collective psychology of market participants. Chart patterns are formed as a result of price action, and understanding this action is crucial for interpreting patterns accurately.

Benefits of Recognizing

Recognizing chart patterns has numerous advantages. It can improve your entry and exit points, enhance risk management, and increase the probability of profitable trades. Furthermore, chart patterns provide a visual representation of market sentiment, making it easier to spot trends and reversal

Common Chart Patterns

Head and Shoulders

The head and shoulders pattern is a classic reversal pattern. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). This pattern signals a potential trend reversal from bullish to bearish.

Double Top and Double Bottom

Double top and double bottom patterns are also reversal patterns. They indicate a potential shift in market sentiment. Double tops suggest a bearish reversal, while double bottoms imply a bullish reversal.

Bullish and Bearish Flags

Flags are continuation patterns. They represent brief pauses in a prevailing trend before resuming in the same direction. A bullish flag forms during an uptrend and is a bullish continuation signal, while a bearish flag forms during a downtrend and is a bearish continuation signal.

Cup and Handle

The cup and handle pattern resembles the shape of a teacup. It is a bullish continuation pattern that indicates a potential upward trend continuation.

Symmetrical, Ascending, and Descending Triangles

These triangle patterns signify potential breakouts. Symmetrical triangles suggest uncertainty, ascending triangles indicate bullish sentiment (Expectation of price rise), and descending triangles indicate bearish sentiment (Expectation of price decline).

Funded Traders Global can provide the capital and resources you need to start trading with confidence. They offer funding programs and support to traders looking to grow their portfolios.

Advanced Chart Pattern

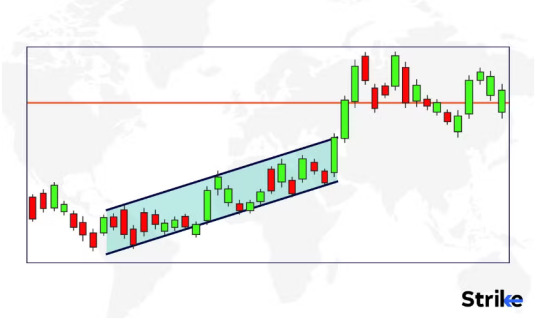

Pennants

Pennants are short-term consolidation patterns that often precede sharp price movements. They resemble small symmetrical triangles and can be bullish or bearish, depending on the preceding trend.

Wedges

Wedges are similar to triangles but are typically sloped. Rising wedges are bearish while falling wedges are bullish.

Gaps

Gaps occur when there is a significant difference between the closing price of one candlestick and the opening price of the next. They often indicate strong price momentum and can be used to identify potential support or resistance levels.

Harmonic Patterns

Harmonic patterns are complex but highly accurate. They include patterns like the Gartley, Butterfly, and Bat patterns, which are based on Fibonacci ratios and symmetry.

Practical Tips for Chart Patterns Trading

To successfully trade using chart patterns, you should:

Implement robust risk management strategies.

Identify precise entry and exit points.

Choose appropriate timeframes for your trading style.

Combine chart patterns with other technical indicators for confirmation.

Conclusion

Are you ready to take your trading to the next level? At Funded Traders Global, we’re committed to helping you become a more skilled and successful trader.

Start your journey by mastering Top Chart Patterns for Trading—a fundamental tool in the trader’s toolkit. Recognize patterns, make informed decisions, and manage risk with confidence.

Join Us on Discord or Contact Us directly. Don’t wait—seize the opportunity to transform your trading career with us!

1 note

·

View note

Text

Gold Trading Patterns: Spotting Opportunities in Market Trends

Gold trading is a dynamic and fascinating market that attracts investors and traders worldwide. One key aspect of successful gold trading is the ability to identify and interpret trading patterns. These patterns, formed by price movements and market trends, offer valuable insights and present opportunities for traders to capitalize on potential profit. This article delves into the realm of gold trading patterns, highlighting their significance and providing guidance on how to spot and leverage them effectively.

Understanding Trading Patterns:

Trading patterns are recurring formations and structures on price charts that reflect the collective behavior of market participants. These patterns emerge due to various factors, including market sentiment, supply and demand dynamics, economic indicators, and geopolitical events. By recognizing and interpreting these patterns, traders can gain a deeper understanding of market trends and make informed trading decisions.

Common Gold Trading Patterns:

Head and Shoulders: The head and shoulders pattern is a bearish reversal pattern that signals a potential trend reversal from bullish to bearish. It consists of three peaks, with the middle peak (the head) being higher than the two surrounding peaks (the shoulders). Traders often look for a neckline break as confirmation of the pattern.

Double Top/Bottom: The double top pattern occurs when the price reaches a resistance level twice and fails to break higher, indicating a potential reversal from bullish to bearish. Conversely, the double bottom pattern forms at a support level, signaling a potential reversal from bearish to bullish.

Triangle Patterns: Triangle patterns, such as ascending triangles, descending triangles, and symmetrical triangles, are consolidation patterns that suggest a potential breakout is imminent. Traders look for a break above or below the triangle's boundaries to determine the direction of the ensuing price movement.

Cup and Handle: The cup and handle pattern is a bullish continuation pattern often observed in longer-term charts. It resembles a cup shape followed by a smaller handle formation. Traders anticipate an upward price movement once the handle is completed.

Flag and Pennant: Flag and pennant patterns are short-term consolidation patterns that occur after a strong price move. Flags are rectangular patterns, while pennants are triangular patterns. Traders seek a breakout in the direction of the prior price trend after the pattern formation.

Spotting and Leveraging Trading Patterns:

To effectively spot and leverage trading patterns in gold trading, traders can employ a combination of technical analysis tools and indicators. Here are some guidelines to consider:

Chart Analysis: Utilize candlestick charts, line charts, or bar charts to observe price movements and identify patterns. Pay attention to key support and resistance levels, trendlines, and chart patterns that suggest potential reversals or breakouts.

Technical Indicators: Combine chart analysis with technical indicators such as moving averages, relative strength index (RSI), stochastic oscillator, or MACD (Moving Average Convergence Divergence) to confirm pattern formations and strengthen trading decisions.

Volume Analysis: Consider volume trends alongside pattern formations. An increase in volume during pattern breakouts or significant price movements can validate the pattern's strength and enhance trading opportunities.

Risk Management: Implement proper risk management techniques such as setting stop-loss orders, determining profit targets, and managing position sizes to protect against potential losses and maximize potential gains.

Continual Learning: Stay updated with market news, economic indicators, and geopolitical events that may impact gold prices. Continually enhance your understanding of different patterns and their significance by studying educational resources, attending webinars, and engaging with the trading community.

Conclusion:

Spotting and leveraging trading patterns is an essential skill for successful gold trading. By understanding common patterns, traders gain insights into market trends, potential reversals, and breakouts. Through technical analysis, chart patterns, and the use of indicators, traders can identify optimal entry and exit points, confirm pattern formations, and strengthen their trading decisions.

0 notes

Text

Best Cryptocurrency Trading Signals [READ NOW]

Cryptocurrency trading signals help traders, especially non-professional ones, who cannot analyze to decipher market trends and make the most profits out of their trades. They provide actionable trading ideas to buy, sell or hold an asset but are constructed from market indicators through detailed and informed technical analysis of the real-time and historical market climate. The most important part of trading now is not trading information but its relevance and utilization. It also needs work to define the accuracy and reliability of the signals.

How are Crypto Trading Signals Generated

The best crypto trading signals are generated based on both technical and fundamental analyzes. With trading indicators, you can also generate your signals, but they are really professional. Because there are tens of indicators you can use to generate these signals, the trick also lies in knowing the most relevant for your circumstance. You would need experience. Best crypto signals are again based on a combination of auto and manual trading tactics. Best paid crypto signals for trading are based on technical charting, fundamental analyzes, and rely on info collected by bots (mainly and efficiently) from social media channels.

Chart a trend: On a crypto charting platform like TradeView, select an indicator for which to generate a price pattern over a select period. On these platforms, you basically select the indicator and time frames on a given trading pair, for instance, BTC/USD, and the chart is automatically generated.

Decipher a price pattern: Once a chart is generated for a given indicator, a pattern is deduced about the chart as directed by the indicator trend lines. These guide on knowing the price action points and are the hardest to decipher in constructing crypto buy and sell signals. It is here that much knowledge and experience apply. The different chart patterns to expect on a chart include supports/resistances, big movement, consecutive candles, drive, butterfly, ascending/descending triangles, head, and shoulders or inverse head and shoulders, channel up/down, falling/rising wedge, double bottom/top, triple bottom/top, bullish/bearish flags, rectangle, bullish/bearish pennant, Gartley, ABCD, and 3 point extension or retracement.

Predict the price action: The predictable price mostly falls within the pattern unless the pattern predicts a breakout in one or two price directions, i.e. on the downside or upside. The analysis generates an actionable trading signal which basically predicts – in layman’s language, a future possible price at which the trend is best headed as deciphered using the charting and indicator knowledge.

Apply the price action: Most crypto signals are generated and re-fed into auto trading bots for automated crypto or asset trading. Traders can also generate and apply their signals manually but it is tasking and limited because such analyses wouldn’t take in as much varied and relevant market info as would be efficient bots that pull info from multiple sources in seconds.

FAQs on Crypto Signals

Q #1) What is the best crypto signal? Answer: CoinMoon.com is rated the best crypto trading platform feature-wise. It lets users get trading signals based on their specific trading preferences. Regarding accuracy, it is deemed the most accurate cryptocurrency prediction system in the world.

Q #2) Are crypto signals worth it? Answer: Yes, when done professionally, reliably, and accurately, trading signals can be hugely profitable. However, the best way to trade crypto is to first acquaint oneself with the professional techniques needed to trade profitably such as how to quickly enter and exit trades as instructed by the trading signals.

Q #3) What is a signal in crypto trading? Answer: A crypto trading signal is an expertise actionable trading idea based on analysis of existing and/or historical market climate, constructed using technical indicators and with a time and price relevance. They are based on an understanding of market trends and are done to predict possible future market prices to help traders trade an asset profitably or avoid losses altogether.

Use CoinMoon:

Accurate cryptocurrency trading signals can vastly improve your profitability and save you a lot of time. Researching coins is fun but if you want to make serious money in a short space of time then trading signals is a must. This is why CoinMoon is available. It offers advanced cryptocurrency price analysis that is beyond anything in the industry. It gives you accurate buy and sell instructions but most importantly it also gives you an exact time when the sell price will be reached. This is unique to only CoinMoon.

Visit 👉 www.coinmoon.com

0 notes

Photo

How to Trade Bearish and Bullish Pennants in Forex

Firstly, Pivot Point is a commodity market indicator establish by floor traders to identify probable turning moments. Day traders utilize

pivot points to predict

expected support and resistance level. And hence possible turning points from bullish to bearish or vice versa, in the forex and other markets

Visit: https://www.milliva.com/blog/pennant-trading-pattern

Know More Stay tuned with Milliva to Know the exclusive Offers and information regularly by following us on,

Instagram - https://www.instagram.com/millivafx

Twitter - https://twitter.com/milliva_fx

Linked in - https://www.linkedin.com/in/milliva-fx-386902221

Facebook - https://www.facebook.com/Millivaforex

#milliva #forex #trading #currency #bitcoin #money #crypto #investment #cryptocurrency #investing #blockchain #forextrader #stockmarket #millionaire #forexsignals #cryptotrading #binance #millionairemindset #broker #exchange #trade #MT5 #bonus #deposit #freetrading #Openaccount #offers #trade

0 notes

Text

Rising Three Methods

Rising Three Methods

Bullish Rising Three Methods is a trend continuation pattern that alerts traders to a weakening in the current trend. The long white candle of the first day is followed by three shorter descending candles. The smaller candles reflect trend resistance, which may include a trend reversal. These 3 candlesticks are usually black and part of their body remains within the price action range of the first day. The formation ends on the fifth day with another white candle. The opening price of this candle is higher than the closing price of the first day. The uptrend should continue. The three-way pattern is a trend continuation pattern that can occur in an uptrend or downtrend. In an uptrend it is called a three-way ascending pattern and in a downtrend it is called a three-way descending pattern. The three-way pattern consists of at least five candlesticks, but can contain more. It is similar to flag or pennant formations and also represents a period of congestion or consolidation.

Rising Three Methods Definition & Meaning

In order for a candlestick pattern to become a three-way ascending method, it must meet the following criteria:

1 The first pattern must be bullish.

2 The second, third and fourth candles are small and bearish. They are limited to the area of the first bullish candle.

3The last and fifth bar is bullish and closes above the top of the pattern.

A rise of three indicates that the market has seen a slight pullback, but is still strong enough to go higher.

How to spot a rising three methods candlestick pattern?

The ascending three candlestick pattern has five candlesticks. The first and fifth are clear, usually indicated by the color green. These are long bullish candles. The second, third and fifth candles are dark, usually indicated in red. These are short bearish candles. In the figure below, the five candlesticks are assumed to represent five consecutive business days. However, as explained above, the ascending three candlestick pattern can occur in any trading period, i.e. it applies to both intraday trading and position trading.

Trading the Rising Three Methods Pattern

Entry – Traders can enter the market when the last bar of the pattern closes. Alternatively, a trade could be taken if the price breaks above the high of the last candlestick. Aggressive traders can look for entry before the last bar closes, but should be prepared to exit if the fifth bar does not complete the pattern.

Traders need to make sure that the ascending three-way pattern does not break below key resistance to ensure that the uptrend has enough room to continue. For example, a trend line or broad moving average slightly above the pattern could limit further gains. Resistance levels should be checked on longer term charts to increase the probability of a successful trade. The "three amount method" can be most effective when the wicks of the initial bullish candle, indicating the highest and lowest traded price for that period, are flat and form a whole number Read More...

Contact us

0 notes

Text

Here’s Why Dogelon Mars Is Flying Today

Dogelon Mars (CRYPTO: ELON) is trading higher Friday as it pushes higher with the rest of the cryptocurrency market.

The Elon Musk-themed crypto is seeing bullish momentum as it trades in sympathy with Ethereum (CRYPTO: ETH) and Dogecoin (CRYPTO: DOGE). The coin is nearing the end of a technical pattern and could see a strong bullish move if it’s able to break above resistance.

Dogelon was up 15.35% at $0.000000932 at time of publication.

See Also: How To Buy Dogelon Mars

Dogelon Daily Chart Analysis

The crypto is forming into what traders call a pennant pattern as it is squeezed between narrowing support and resistance lines. If the crypto can see a breakout past resistance, it could start to form a bullish trend and see a strong move upward.

The crypto trades below the 50-day moving average (green) but above the 200-day moving average (blue), indicating the crypto is trading in a period of consolidation. The 50-day moving average may act as resistance, while the 200-day moving average may hold as an area of support.

The Relative Strength Index (RSI) has been forming higher lows and climbing the past few weeks and now sits at 46. This shows that the crypto is seeing more and more buyers enter the market although there still remains slightly more sellers overall.

What’s Next For Dogelon?

Dogelon Mars is nearing the end of a pennant pattern and is bound to make a large move in the next couple of weeks. If the crypto can cross above resistance and hold, it could see a strong bullish move. If it falls and holds below support, it could see a strong bearish move.

Bullish traders want the crypto trade with higher lows and see the RSI climb higher before breaking above resistance. Bearish traders want to see the crypto lose steam on the RSI and fall back toward the oversold region before falling below the support level.

source https://usapangbitcoin.org/heres-why-dogelon-mars-is-flying-today/

source https://usapangbitcoin.wordpress.com/2022/02/06/heres-why-dogelon-mars-is-flying-today/

0 notes

Text

Bullish Flag Chart patterns

Flag Chart Patterns

1. What is a flag chart sample?

2. How to discover bullish Flag patterns?

3. How to alternate the flag chart sample?

What Is A Flag Chart Pattern?

When a trending charge pauses and is going again over barely in a square variety, the flag sample occurs.

This sample offers us the possibility to go into the marketplace withinside the centre of a fashion.

The getaway in charge keeps its authentic sturdy fashion, offering us the threat to go into that fashion at a higher charge than earlier than the formation of the flag.

How To Identify Bullish Flag Patterns?

The chart beneath is an example of a bullish flag chart sample.

Enrich Broking: Bullish Flag Pattern

We analyze the subsequent from the above example:

The charge stories a sturdy uptrend. Then it stabilizes right into a square variety that slopes downwards.

Then there may be a getaway of that variety and the uptrend keeps.

Enrich Broking: Bullish Flag Pattern Target

Place your prevent loss in which the Flags decrease fashion line reaches its lowest factor.

Place your earnings goal

Flag pole: Calculate how ways the charge rose in its preliminary uptrend.

The earnings goal is then positioned an equal distance above the factor in which the Flags decrease fashion line ends.

1-Buy Entry

2-Stop loss

three Take earnings

The height of quantity 2 is similar to the peak of quantity 2

Technique:

“Wait for the charge to upward push above the pennant’s higher fashion line.”

Enter your alternate as quickly because the charge rises above the Flag higher fashion line.

Once resistance breaks, region a purchase order after the charge retests that fashion line.

The damaged resistance now turns into a help level.

The Chart Below Is An Illustration

Enrich Broking: Bullish Flag Chart Patterns

Number 1: Pole of the sample

Number 2: Area in which the resistance line has changed into help

Number three: Take earnings distance (equal peak as pole quantity 2)

1 -Buy entry, after the charge has bounced off the fashion line

2- Stop loss beneath the brand new help area

three -Take earnings level

Nut Shell

An evaluation of the lesson mentioned so a ways….

When a trending charge pauses and is going again over barely in a square variety, the flag sample occurs.

This sample offers us the possibility to go into the marketplace withinside the centre of a fashion.

The getaway in charge keeps its authentic sturdy fashion, offering us the threat to go into that fashion at a higher charge than earlier than the formation of the flag.

The flag chart sample is classed into bullish and bearish.

Trading a bullish flag sample: Wait for the charge to interrupt out of the Flags higher fashion line withinside the path of the authentic uptrend. Place a long (purchase) order here.

Place your prevent loss at the extent to which the Flags decrease fashion line reaches its lowest factor.

Calculate how ways the charge rose in its preliminary uptrend.

Place your earnings goal an equal distance above the extent to which the Flags decrease fashion line ends.

https://enrichbroking.in/knowledge-center/bullish-flag-chart-pattern

0 notes