#Pennant Pattern in Technical Analysis

Explore tagged Tumblr posts

Text

#Pennant Pattern in Technical Analysis#Bullish and Bearish Pennant Pattern#Types of Pennant Patterns#How to Trade with Pennant Chart Pattern#How to Trade Bullish Pennant Pattern

0 notes

Text

Trading Chart Patterns PDF Guide & Algo Tools

Mastering Market Moves: The Ultimate Guide to Trading Chart Patterns Book PDF

Introduction

Have you ever looked at a stock chart and thought, “What am I even looking at?” You’re not alone! Deciphering those zig-zagging lines can feel like trying to read an alien language. But what if I told you that those shapes — those patterns — actually tell a story? And once you understand that story, you could make smarter trading decisions. That’s where a trading chart patterns book PDF becomes your secret weapon.

In this article, we'll break down trading chart patterns in a friendly, no-nonsense way. We'll also explore how combining this knowledge with algorithmic trading software — especially the best algo trading software in India — can supercharge your trading game.

Download the best trading chart patterns book PDF. Learn how chart patterns, algorithmic trading software, and the best algo trading software in India help you win.

What Are Trading Chart Patterns?

Think of chart patterns like footprints in the snow. They show you where traders have been — and sometimes where they might go next. A chart pattern is just a visual formation on a price chart that helps traders make predictions. Whether it’s a triangle, a head and shoulders, or a double bottom — these shapes can signal buying or selling opportunities.

Why Use a Trading Chart Patterns Book PDF?

Let’s be real — the internet is loaded with scattered info. But a trading chart patterns book PDF puts everything in one place. It’s your go-to guide, available offline, structured, and perfect for both beginners and seasoned traders. Plus, you can refer to it anytime — even during a coffee break.

The 3 Main Types of Chart Patterns

Just like in movies, there are three main types of chart patterns:

Reversal Patterns: These hint that the trend is about to change.

Continuation Patterns: These suggest the trend will likely continue.

Bilateral Patterns: They could go either way — like a cliffhanger ending.

Understanding these gives you the power to react smartly, not emotionally.

Top Reversal Patterns Explained

Reversal patterns are like plot twists. They tell you the story is changing.

Head and Shoulders: Think of it like a person slumping. It often signals a shift from up to downtrend.

Double Top and Bottom: These patterns look like the letter ‘M’ or ‘W’. They scream, “Change is coming!”

Learning to spot these can save you from a bad trade — or help you enter just in time.

Key Continuation Patterns You Should Know

Continuation patterns keep the story flowing in the same direction.

Triangles (Ascending, Descending, Symmetrical): Imagine price compressing like a spring — ready to break out.

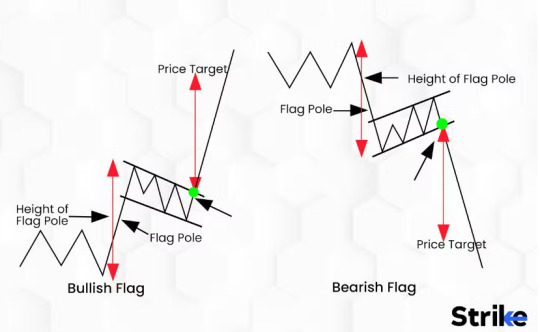

Flags and Pennants: These are like pit stops in a rally. The price pauses, then zooms off again.

Master these, and you’ll catch trends before others even notice.

How to Read Patterns Like a Pro

Reading chart patterns is part art, part science. Here’s how to get good at it:

Use candlestick charts for clarity.

Watch volume — it tells you how strong a move is.

Use support and resistance lines like guardrails.

It’s like learning to read music — confusing at first, but magical once you get it.

Common Mistakes Traders Make

Even the best traders mess up. Here are common traps:

Forcing patterns: If it doesn’t fit, don’t force it.

Ignoring volume: Patterns without strong volume are weak.

Overtrading: Don’t jump into every “almost” pattern.

Remember: Quality over quantity wins the game.

Best Resources for Chart Pattern PDFs

Here are some great places to find your next trading chart patterns book PDF:

Chart Patterns & Technical Indicators by Edward Dobson

Technical Analysis of the Financial Markets by John Murphy

Online libraries like Scribd, Academia, and even Reddit threads

Official broker platforms often offer free downloads

Just make sure you pick one with charts and examples, not just theory.

How Algorithmic Trading Software Helps

This is where things get exciting. Algorithmic trading software uses computer code to place trades. It can recognize patterns faster than any human. When you combine this with your knowledge of chart patterns, you’ve got a winning formula.

It’s like pairing Sherlock Holmes (your pattern spotting) with Watson (your algo software). Together, unbeatable!

Best Algo Trading Software in India

If you’re in India, here are some top-rated options:

Quanttrix – Known for speed and user-friendly interface.

Zerodha Streak – Drag-and-drop logic for non-coders.

AlgoTrader India – Offers institutional-grade automation.

Each has features like backtesting, live execution, and real-time analysis — ideal for traders who want results.

Using Chart Patterns in Algorithmic Strategies

Good algorithmic traders don’t just rely on numbers. They bake in pattern recognition rules:

Code to detect head and shoulders

Alerts for double tops

Algorithms that track breakout triangles

These strategies can be coded in platforms like MetaTrader, Python scripts, or even Streak.

Getting Started With a Chart Pattern Book

Here’s how to start:

Download a recommended trading chart patterns book PDF.

Start with 3-5 basic patterns.

Print a cheat sheet.

Look at real charts daily.

Journal what you see.

Consistency is key — don’t expect overnight success.

Tips to Practice Pattern Recognition

Think of pattern spotting like facial recognition. The more faces (charts) you see, the better you get.

Use trading simulators

Join trader communities

Quiz yourself using historical charts

Mark up charts manually

This hands-on practice boosts your confidence and instincts.

Mobile Apps & Tools for Chart Learning

Want to learn on the go? Try these:

TradingView: Mobile-friendly and packed with features.

Investing.com App: Clean charts and lots of news.

ChartSchool by StockCharts: A mini chart encyclopedia.

These help reinforce what you read in your chart pattern PDF.

Final Thoughts

Trading isn’t magic — it’s mastery. Understanding chart patterns gives you a serious edge. And when paired with powerful algorithmic trading software, especially the best algo trading software in India, you can turn insights into intelligent action.

So go ahead. Download that trading chart patterns book PDF, open up a demo account, and start seeing the market with new eyes. The journey from confusion to clarity starts with one pattern.

FAQs

What is the best trading chart patterns book PDF for beginners? “Technical Analysis for Dummies” and “Chart Patterns Explained” are great PDFs for those starting out.

Can I use chart patterns with algorithmic trading software? Yes! Many algorithmic tools allow you to code or automate pattern recognition and trading rules.

Which is the best algo trading software in India? Quanttrix and Zerodha Streak are widely recommended due to their user-friendly tools and performance.

Are trading chart patterns reliable for predicting markets? They’re not perfect, but when combined with volume and confirmation signals, they greatly improve your odds.

Where can I practice chart pattern recognition for free? Websites like TradingView and platforms like MetaTrader offer free tools and demo accounts.

0 notes

Link

#BearishContinuation#BearishFlag#BearishPennant#BreakoutTrading#BullishContinuation#BullishFlag#BullishPennant#ChartFormationAnalysis#chartpatterns#ContinuationPatterns#FallingThreeMethods#ForexTrading#MarketSentiment#MarketStructure#MomentumTrading#PatternRecognition#priceaction#PriceActionStrategy#RisingThreeMethods#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendConsolidation#TrendContinuation#TrendStrength#TrendStrengthSignals#VolumeConfirmation

0 notes

Text

Conquer the Day: A Beginner's Guide to Intraday Trading

The world of Online intraday trading is booming. Did you know that intraday trading volumes have surged by over 30% in recent years? This growth highlights how more individuals are drawn to the fast-paced nature of trading stocks within a single day. Simply put, intraday trading involves buying and selling financial instruments like stocks or commodities on the same day, aiming to take advantage of short-term price movements. This guide will help beginners grasp the essentials of intraday trading and consider stepping into this dynamic arena.

Understanding the Mechanics of Intraday Trading

Order Types

To engage in intraday trading, you need to understand different order types:

Market Orders: These are orders to buy or sell at the current market price. For example, if a stock is trading at $50, you might place a market order to buy it. This order completes instantly at that price.

Limit Orders: A limit order allows you to specify the price at which you're willing to buy or sell. If you only want to buy a stock at $48, you would set a limit order. It won’t execute until that stock reaches your desired price.

Stop-Loss Orders: This order helps minimize losses. If you own a stock at $50 and want to limit losses to 10%, you set a stop-loss order at $45. If the stock price drops to this point, your shares will automatically sell.

Trading Platforms

Choosing the right trading platform is vital. Some popular options include:

Robinhood: Known for its user-friendly interface. Great for beginners and offers commission-free trading.

TD Ameritrade: Offers advanced tools and excellent research resources, which can be beneficial for rookies.

E*TRADE: Provides a robust mobile app along with a web platform that’s easy to navigate.

(Screenshots would enhance understanding but are not included here.)

Leverage and Margin

Leverage allows traders to control larger amounts of money with a smaller investment. It means you borrow money from your broker to increase your buying power, potentially amplifying profits. However, this comes with risks. A statistic shows that around 70% of intraday traders use leverage. If the market moves against you, losses can exceed your initial investment.

Key Indicators and Chart Patterns for Intraday Traders

Technical Analysis Basics

Understanding technical analysis can boost your trading success. Here are a few key concepts:

Support and Resistance Levels: Support is where a stock tends to stop falling and bounce back up, while resistance is where it often stops rising. These levels can inform your buy or sell decisions.

Moving Averages: This tool smooths price data over a specific period, making trends clearer. For instance, a 50-day moving average might help identify whether a stock is in an uptrend or downtrend.

Relative Strength Index (RSI): A momentum oscillator that indicates whether a stock is overbought (above 70) or oversold (below 30).

Chart Patterns

Recognizing chart patterns can provide valuable insights:

Head and Shoulders: This pattern indicates a trend reversal. The “head” is a peak between two smaller “shoulders.”

Double Tops/Bottoms: A double top signals a potential price decline, while a double bottom suggests a price increase.

Flags/Pennants: These patterns represent brief price consolidations before a continuation of the trend.

Interpreting Market Sentiment

Market sentiment can sway price movements significantly. To gauge sentiment, traders often review news articles, social media, and reports from reliable financial news sources like CNBC or Bloomberg.

Risk Management Strategies in Intraday Trading

Position Sizing

Position sizing helps manage risk effectively. For instance, if you have a $1,000 account and are willing to risk 2% per trade, you would only risk $20. Therefore, if you buy a stock at $50, you should only purchase 0.4 shares to limit your risk.

Stop-Loss Orders

Setting stop-loss orders is vital for protecting your capital. For example, if a trader buys shares at $100 but sets a stop-loss at $95, they limit potential loss to 5%.

Emotional Discipline

Emotional control is crucial. Many traders face challenges with impulsive decisions. Trading expert Van Tharp states, “Your trading plan has to be solid, but your mind must also be calm to execute it.”

Choosing the Right Assets for Intraday Trading

Stocks vs. Futures vs. Forex

Each asset class has unique features.

Stocks are popular for intraday trading due to their volatility.

Futures offer high leverage but can be risky for beginners.

Forex trading provides high liquidity with low capital needed to start.

Liquidity and Volatility

Liquid assets have high trading volumes, making it easier to enter and exit trades. Volatile assets experience frequent price changes, providing more opportunities. Some highly liquid stocks include Apple, Amazon, and Tesla.

Diversification

Diversifying your portfolio helps mitigate risk. Trading across sectors or asset classes reduces the impact of a poor-performing asset.

Developing an Intraday Trading Plan

Defining Trading Goals

Setting clear and realistic trading goals is crucial. Goals could include achieving a specific profit amount each month or steadily growing your trading account.

Backtesting Strategies

Before entering live trades, backtesting strategies can show how they would have performed in the past. This helps in understanding potential profitability. Websites like TradingView offer backtesting features.

Journaling Trades

Tracking trades improves decision-making. Recording details, like entry and exit points, helps identify what works and what doesn’t. Over time, this practice can enhance your trading effectiveness.

Conclusion: Mastering the Art of Intraday Trading

Understanding intraday trading involves grasping various key components: order types, charts, and effective risk management. Prioritizing risk management and adopting a continuous learning mindset will enhance trading skills. With determination and the right resources, you can navigate the exciting world of intraday trading successfully. Start small, stay informed, and let your journey unfold.

#intaday tading#intraday trading in India#Intraday trading Platform#stock trading platform in india#forex trading in india

0 notes

Text

Maximising Returns with Strategic Swings: A Guide to Swing Trading in India with SEBI Registered Advisors

The Indian stock market, with its inherent volatility and diverse trading opportunities, presents a fertile ground for traders seeking to capitalise on short-to-medium-term price swings. Swing trading, a strategy designed to capture these fluctuations, offers the potential for significant gains but requires a disciplined methodology, rigorous research, and a clear understanding of market dynamics. This article explores the substantial benefits of partnering with a SEBI registered investment advisor to enhance your swing trading success and emphasises the crucial role of developing well-researched and robust trade ideas. This article is for informational purposes only and does not constitute financial advice. Consult with a SEBI registered investment advisor before making any investment decisions.

The Undeniable Advantages of SEBI Registered Investment Advisors for Swing Traders

In India, the Securities and Exchange Board of India (SEBI) acts as the regulatory body for investment advisors, ensuring investor protection and promoting market integrity. Working with a SEBI registered advisor provides swing traders with several key advantages:

Bespoke Trading Strategies Tailored to Your Individual Needs and Risk Tolerance: A SEBI registered advisor can collaborate with you to develop a personalized swing trading plan that aligns with your specific risk appetite, available capital, preferred trading timeframe, and overall financial goals. This customized approach is essential for navigating the market effectively and managing risk appropriately.

Access to Specialized Market Knowledge, Advanced Tools, and Actionable Insights: These advisors possess in-depth knowledge of market trends, technical analysis principles, and the unique characteristics of the Indian market. They can offer valuable insights into sector rotations, emerging opportunities, and potential trading setups, providing a distinct competitive edge in your trading endeavors. Many also have access to professional-grade charting software, real-time data feeds, and other valuable resources.

Objective, Impartial, and Conflict-Free Financial Guidance: SEBI regulations mandate that registered advisors operate without conflicts of interest, providing unbiased recommendations based on rigorous research and objective analysis. This impartiality is paramount for making rational trading decisions, avoiding emotional biases and undue external influences.

Enhanced Transparency, Accountability, and Investor Protection Under SEBI's Regulatory Framework: Operating under SEBI's stringent regulatory oversight ensures transparency in the advisor's operations and holds them accountable for adhering to high ethical and professional standards, offering a crucial layer of protection for your invested capital.

Developing Effective Swing Trade Ideas: A Comprehensive and Analytical Approach

Identifying potentially profitable swing trades requires a systematic and multifaceted approach that integrates various analytical methods:

Technical Analysis: The Essential Toolkit for Identifying Trading Opportunities: Technical analysis, utilizing chart patterns (such as head and shoulders, flags, pennants, and triangles), technical indicators (including moving averages, RSI, MACD, Stochastics, and Fibonacci retracements), and price action, forms the foundation of most swing trading methodologies. It assists in pinpointing potential entry and exit points based on historical price and volume data. Look for clear trends, well-defined support and resistance levels, and confirming signals from multiple indicators to increase the probability of successful trades.

Fundamental Analysis: Providing Crucial Context and Assessing the Underlying Strength of Businesses: While swing trading primarily focuses on short-term price movements, understanding a company’s fundamental health (including earnings reports, revenue growth, profit margins, debt levels, competitive positioning, and relevant news events) provides valuable context and helps avoid fundamentally weak companies that are more susceptible to prolonged downturns or sudden declines. Look for companies with strong financials, consistent earnings growth, a sustainable competitive advantage within their respective industries, and a history of sound management decisions.

Market Scanning and Screening Techniques for Efficient Stock Selection and Filtering: Employing stock screeners and filters based on specific technical or fundamental criteria allows for the efficient identification of potential trading candidates, saving valuable research time and focusing your efforts on the most promising opportunities. Consider screening for stocks with high trading volume, appropriate volatility for swing trading, and specific technical patterns that align with your trading strategy.

Monitoring News and Event Catalysts for Identifying Potential Short-Term Price Triggers: Staying informed about market news, economic data releases, corporate announcements, and other relevant events can help identify potential catalysts that could trigger short-term price swings and present valuable trading opportunities. Pay close attention to earnings announcements, product launches, regulatory changes, mergers and acquisitions, and macroeconomic data releases that can significantly impact market sentiment and stock prices.

A Critical Perspective on "Best Stocks to Swing Trade" Recommendations and Unverified Stock Market Advisory Services

Be extremely cautious and discerning when encountering lists or recommendations claiming to reveal the "best stocks to swing trade." Market conditions are constantly evolving, and past performance is never a guarantee of future results. These lists often lack essential context, fail to consider individual risk profiles and trading styles, and can frequently lead to poorly informed and potentially detrimental trading decisions. Similarly, exercise extreme caution with unsolicited stock market advisory services or "tips" from unverified or unreliable sources, as they can be misleading, inaccurate, or even outright fraudulent.

The Power of Partnership: Combining Professional Guidance with Independent Research, Due Diligence, and Continuous Learning

The most effective approach to swing trading combines the expertise and experience of a SEBI registered investment advisor with your own independent research, thorough due diligence, and a commitment to continuous learning and improvement. Your advisor can play a vital role in:

Critically Evaluating and Refining Your Trading Ideas and Strategies: Offering expert feedback on your research, providing a valuable second opinion, and ensuring your trade ideas align with your overall trading strategy, risk tolerance, and financial objectives.

Enhancing Your Trading Knowledge, Analytical Skills, and Overall Market Understanding: Sharing their experience and insights to improve your technical and fundamental analysis skills, ultimately enhancing your trade selection, trade execution, and risk management capabilities.

Providing Essential Emotional Support, Promoting Accountability, and Fostering Discipline: Helping you navigate the emotional challenges inherent in trading, maintain discipline during volatile market conditions, and avoid impulsive decisions driven by fear or greed.

Conclusion

Swing trading in the Indian stock market can be a potentially rewarding strategy for those who approach it with a well-defined plan, a clear understanding of the associated risks, and a commitment to continuous learning and improvement. Partnering with a SEBI registered investment advisor provides invaluable guidance, helping you navigate market complexities, develop a robust trading strategy, and manage risk effectively. Combining professional advice with your own independent research, due diligence, and disciplined execution can significantly enhance your chances of achieving consistent success in the dynamic world of swing trading.

0 notes

Text

🚀 XRP Price Surge Alert! 📈

The bullish pennant pattern is forming, and XRP could be heading toward $13! 🔥 Dive into the technical analysis, market trends, and key factors driving this potential breakout. 🌟

💡 Stay ahead of the curve—read the full article here: CLICK HERE

#XRP #Cryptocurrency #CryptoNews #CryptoTrends #Investing #BullishTrend

1 note

·

View note

Text

Decoding Crypto Trading Patterns: A Guide for Smarter Investments

Crypto trading patterns are crucial tools for navigating the volatile cryptocurrency market. These visual representations of price movements help traders predict future trends and make informed decisions. Leveraging patterns through technical analysis can provide a structured approach to trading, minimizing emotional decisions and maximizing potential profits. This guide will explore key trading patterns, tools, and strategies to help you decode market movements and improve your investment decisions.

Why Crypto Trading Patterns Matter

Crypto trading patterns are essential for understanding market behavior and making smarter trading choices. They help predict whether the market is entering a bullish or bearish trend, aiding in well-timed entries and exits. Patterns also create a disciplined approach to trading, reducing impulsive actions and emotional decision-making. Additionally, they work across trading styles—be it day trading, swing trading, or long-term investing—making them versatile tools for every trader.

Key Crypto Trading Patterns to Know

Understanding specific trading patterns is vital for success:

Candlestick Patterns:

Bullish Patterns:Hammer, Morning Star.

Bearish Patterns: Shooting Star, Evening Star.

Chart Patterns:

Continuation Patterns:Flags, Pennants, and Triangles, which indicate ongoing trends.

Reversal Patterns:Head and Shoulders, Double Top/Bottom, signaling trend reversals.

Breakout Patterns: Identify potential explosive price movements. Visual aids, such as graphics or examples, can help traders quickly recognize these patterns during analysis.

Understanding Support and Resistance Levels

Support and resistance levels are critical markers in technical analysis. Support represents price levels where demand increases, preventing further declines, while resistance marks points where selling pressure intensifies, halting upward movements. These levels are key in validating trading patterns, as they highlight areas for potential trend reversals or continuations, helping traders decide when to enter or exit positions.

Tools for Analyzing Trading Patterns Modern tools make analyzing trading patterns more efficient:

Charting Platforms: Platforms like TradingView, Binance, and PrimeTrader provide detailed visuals and pattern-recognition tools.

Indicators: Tools like RSI, MACD, and Fibonacci retracements confirm patterns and signal strength.

Automation:AI-driven tools identify patterns in real-time and execute trades, offering speed and accuracy. Using these tools helps traders refine their analysis and execute strategies with confidence.

Applying Trading Patterns in Different Strategies Trading patterns adapt to various trading strategies:

Day Trading:Identify intraday patterns like flags or triangles for quick profits.

Swing Trading:Use medium-term patterns for trades lasting several days.

Scalping:Rely on micro patterns for rapid, small-margin trades.

Long-Term Investing:Look for broader patterns, such as the cup and handle, to predict sustained trends. Each strategy benefits from incorporating patterns, tailoring them to specific market behaviors and timeframes.

Common Mistakes to Avoid When Using Patterns While trading patterns are powerful, common pitfalls can hinder success:

Overtrading:Acting on incomplete or weakly confirmed patterns can lead to losses.

Ignoring Volume:Trading volume is a critical factor that validates patterns.

Neglecting Risk Management:Always use stop-loss orders and proper position sizing.

Confirmation Bias:Avoid interpreting patterns to fit preconceived expectations. By steering clear of these mistakes, traders can improve accuracy and profitability.

Advanced Pattern Recognition with AI and Automation

AI and automation are revolutionizing how traders use patterns. Advanced tools can analyze charts and detect patterns in real-time, providing instant insights. Platforms like PrimeTrader incorporate AI-driven features, automating pattern recognition and trade execution. This technology reduces errors and ensures swift responses to market changes, giving traders an edge in a fast-paced environment.

The Role of Trading Psychology in Using Patterns

Trading success depends as much on psychology as it does on technical analysis. Discipline, patience, and objectivity are crucial for interpreting and applying patterns effectively. Sticking to a strategy during volatile market conditions and mastering emotions like fear or greed can significantly improve decision-making. A calm and focused mindset ensures better execution and long-term success.

Conclusion

Crypto trading patterns are indispensable tools for navigating the complexities of the cryptocurrency market. By understanding and applying these patterns, traders can make smarter, more informed decisions and reduce risks. Whether you're day trading, swing trading, or investing long-term, incorporating pattern analysis into your strategy can boost your success.

0 notes

Text

Indian Stock Market Trading | Investing: Technical Analysis

Technical analysis is a popular approach in the Indian stock market for both trading and investing. By using patterns, trends, and other market data, technical analysis aims to forecast stock price movements and identify profitable opportunities. Here’s a comprehensive look at how technical analysis works and how it can be applied to the Indian stock market.

1. What is Technical Analysis?

Technical analysis is the study of past market data, primarily price and volume, to predict future price movements. Unlike fundamental analysis, which looks at a company's financial health and growth potential, technical analysis focuses on stock price movements and investor sentiment.

Key Components of Technical Analysis

Price: The most important element in technical analysis. Every stock’s price reflects all available information.

Volume: Shows the level of trading activity and can confirm price trends.

Timeframe: Different trends appear over short, medium, or long periods, affecting decisions for day traders, swing traders, and long-term investors.

2. Basic Principles of Technical Analysis

Technical analysis is based on a few core principles:

Market Discounts Everything: All information is already priced into the stock.

Price Moves in Trends: Prices often move in recognizable trends rather than random patterns.

History Tends to Repeat Itself: Market behavior repeats over time, often due to investor psychology.

3. Tools and Indicators in Technical Analysis

Simple Moving Average (SMA): The average price over a specific period, like 50-day or 200-day, to identify trends.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it sensitive to new information.

Relative Strength Index (RSI)

A momentum indicator that ranges from 0 to 100, indicating overbought (above 70) or oversold (below 30) conditions.

Bollinger Bands

Consist of a moving average with two bands that adjust to volatility, useful for identifying overbought and oversold conditions.

MACD (Moving Average Convergence Divergence)

Combines moving averages to show momentum, often used to spot trend changes.

Support and Resistance Levels

Price levels where a stock historically stops rising or falling, signaling potential entry or exit points.

4. Chart Patterns in Technical Analysis

Indian traders often rely on chart patterns that help predict future price movements.

Head and Shoulders

A reversal pattern that suggests the end of an uptrend.

Double Top and Double Bottom

These patterns indicate potential reversals, with double tops suggesting a bearish reversal and double bottoms signaling a bullish reversal.

Triangles (Ascending, Descending, and Symmetrical)

These patterns indicate periods of consolidation, where the stock is likely to break out in the direction of the broader trend.

Flags and Pennants

Short-term continuation patterns that signal brief pauses in ongoing trends, often indicating that the price will resume its previous direction.

5. Types of Trends in Technical Analysis

Trends are categorized based on the timeframe, providing different insights for traders and investors.

Uptrend

Characterized by higher highs and higher lows, indicating a bullish market.

Downtrend

Marked by lower highs and lower lows, indicating a bearish market.

Sideways/Horizontal Trend

Occurs when prices move within a narrow range, signaling indecision among investors.

6. Timeframes in Technical Analysis

Choosing a timeframe is essential, as it impacts the analysis and strategy.

Intraday: For traders looking to profit from daily price fluctuations.

Swing Trading: Involves holding stocks for days or weeks to capture short- to medium-term trends.

Long-Term: Investors hold positions for months or years, focusing on longer-term trends.

7. Using Technical Analysis for Trading

Traders can use technical analysis to make quick buy or sell decisions based on signals and patterns.

Identifying Entry and Exit Points

Use indicators like RSI, MACD, and support/resistance levels to determine optimal buy and sell points.

Risk Management

Incorporate stop-loss orders to limit losses and protect profits, especially in volatile stocks.

Backtesting

Testing strategies on historical data to gauge effectiveness before applying them in live trading.

8. Using Technical Analysis for Investing

For long-term investors, technical analysis can help optimize the timing of buying or selling, even if they rely more heavily on fundamentals.

Using Moving Averages for Timing

Long-term investors can use moving averages to confirm uptrends before making investments or to decide when to exit.

Support Levels as Buying Opportunities

In bull markets, support levels offer a chance to buy stocks at a relative discount.

Avoiding Overbought Conditions

Long-term investors may avoid stocks with high RSI values (over 70), as they may be due for a correction.

9. Limitations of Technical Analysis

Technical analysis, while powerful, does have its limitations:

Does Not Consider Fundamentals: It ignores a company’s financial health.

Subjective Interpretation: Patterns and indicators can be interpreted differently.

Prone to False Signals: Indicators can sometimes give incorrect buy or sell signals, especially during volatile markets.

10. Practical Tips for Using Technical Analysis in the Indian Market

Focus on High-Volume Stocks: High-volume stocks offer clearer technical signals and less price manipulation.

Combine with Fundamentals: For investment, combine technical analysis with fundamental analysis to make well-rounded decisions.

Stay Updated with News: The Indian stock market can react to political, economic, and regulatory news, impacting technical patterns.

Practice Patience: Technical analysis requires patience and consistency to understand market trends and patterns.

Conclusion

Technical analysis can be a valuable tool for both traders and investors in the Indian stock market. By learning to read indicators, identify patterns, and understand trends, you can make more informed decisions. Whether you're trading daily or investing for the long term, technical analysis provides actionable insights to help navigate the dynamic and often unpredictable nature of the stock market.

0 notes

Text

Chainlink has been a standout in the crypto space, with its Proof of Reserve feature driving significant social volume. This feature allows users to verify their staked LINK tokens on-chain, ensuring secure and transparent transactions. Since a recent tweet about these advantages, Chainlink’s social volume has surged, possibly indicating a price increase.

Chainlink’s price action has been impressive, with growing awareness of its benefits likely to attract more investors. The Proof of Reserve feature and its growth potential have made Chainlink a popular and trusted cryptocurrency, as evidenced by its rising social volume. This positive sentiment may help propel its price upward.

Since early 2023, Chainlink's price has risen significantly, driven by increased social volume and investor interest in its blockchain technology and decentralized applications. Currently, Chainlink is trading at $7.12, up around 18.53% according to Binance data. LINK prices are above the 21-day Exponential Moving Average of $6.89 and are trending upward.

Bullish patterns, such as a bullish flag at $7.20 targeting $7.50 resistance, and a strong uptrend on the 4-hour and hourly charts, support this positive outlook. The LINK/USD pair is trading above the 50-day moving average, with a bullish pennant pattern forming and support around $7.15.

Technical indicators like the RSI and MACD suggest continued bullish momentum. Overall, Chainlink’s social volume and price analysis indicate a strong bullish trend, with potential for further gains as more investors recognize its advantages. LINK could be a promising long-term investment.

4o

0 notes

Text

📘 Complete Guide to Flag Pattern: Spot & Trade Breakouts Like a Pro

In the fast-moving world of stock trading, patterns hold power. One of the most powerful yet often misunderstood tools is the flag pattern. Recognized by top traders and chartists like Thomas Bulkowski, it has earned a strong reputation for signaling high-probability continuation setups.

Today, we dive deep into the flag pattern, with real-world examples from the Indian stock market, insights from technical analysis experts, and data-driven performance insights. Whether you’re new to trading or looking to refine your strategy, this guide will help you recognize and profit from this underrated gem.

📈 What is a Flag Pattern & Why It Works So Well

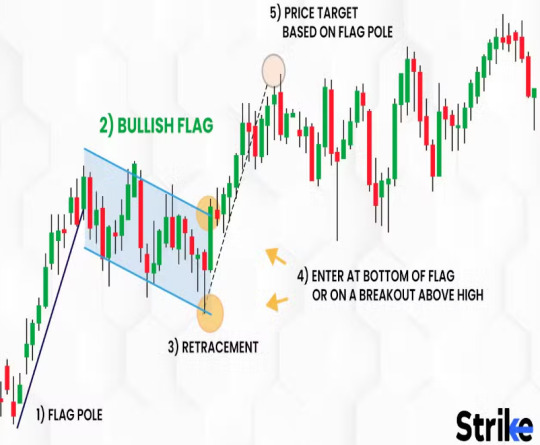

A flag pattern is a classic technical analysis chart formation that signals a brief consolidation before the trend continues. It's shaped like a small rectangle or parallelogram, slanting against the prevailing trend, resembling an actual flag on a pole.

🧠 The psychology behind the flag pattern is simple: after a sharp price movement (the “flagpole”), the market takes a breather as traders book profits. This pause is temporary—soon, momentum returns, breaking out of the flag and continuing the original trend.

⚠️ Not to be confused with pennants or wedges, the flag pattern stands out due to its tight range and parallel trendlines. It comes in two flavors:

Bullish Flag: Appears in an uptrend, slopes downward.

Bearish Flag: Appears in a downtrend, slopes upward.

🔍 The Power of Market Psychology Behind Flag Patterns

Behind every pattern lies market sentiment. The flag pattern reflects a pause in momentum—not weakness. Buyers are still in control in bullish flags; sellers dominate in bearish ones.

💬 According to John J. Murphy, author of Technical Analysis of the Financial Markets, consolidation is a healthy sign in trending markets. When a stock like Tata Motors or ICICI Bank makes a steep upward move and then trades sideways or slightly downward in a tight range, it’s not losing strength—it’s gathering steam.

📊 Volume often confirms this psychology. During the initial flagpole surge, volume spikes. Then, as the flag forms, volume drops—indicating reduced activity. A breakout from the flag, ideally with increasing volume, is a confirmation of trend resumption.

🧭 How to Identify a Flag Pattern on a Chart

✅ A bullish flag typically starts with a breakout move—say, Infosys jumping 10% in 2 days on strong earnings. It then enters a 3–10 day downward drift in a narrow range. Once the price breaks above the upper trendline with volume, the flag is complete.

✅ A bearish flag is the mirror image. For example, Zee Entertainment crashing due to a negative announcement, followed by a short-lived upward channel. The moment it breaks down again with volume, it signals continuation of the downtrend.

🧭 Key components: 👉 Strong flagpole (impulse move) 👉 Sloping consolidation channel 👉 Breakout in the direction of the original trend

Traders using Strike Money, a powerful Indian charting tool, can easily draw flag patterns with automated trendlines and volume indicators.

📉 Real Examples of Flag Patterns in Indian Stocks

Let’s break it down with examples from the Indian market:

🔹 Reliance Industries (April 2023) formed a textbook bullish flag post-Q4 results. After a 12% spike, the stock consolidated in a downward-sloping channel for 5 trading sessions. It then broke out with high volume, rallying another 9%.

🔹 HDFC Bank (October 2022) created a bearish flag during a broader Nifty correction. A sharp fall followed by a weak pullback formed the flag. The breakdown led to another 6% drop in a week.

These aren't just patterns—they are reflections of institutional participation, news-driven momentum, and collective trader behavior.

💡 How to Trade Flag Patterns Like a Pro

To truly profit from flag patterns, you need more than just visual recognition.

📍 Entry: Place buy orders just above the upper trendline (for bullish flags), or short-sell below the lower trendline (for bearish flags). Use tools like Strike Money to set alerts for trendline breaks.

📍 Stop-loss: Keep it slightly below the lower flag boundary (bullish) or above the upper boundary (bearish). This protects against false breakouts.

📍 Target: Use the length of the flagpole to project your target post-breakout. This is known as the measured move.

🛠️ Many experienced traders combine flag pattern setups with MACD, RSI, or volume confirmation for better accuracy. For example, when RSI bounces from 50 and the breakout happens with a volume spike, it’s a double confirmation.

📊 What Does Research Say? Are Flag Patterns Reliable?

The flag pattern isn’t just a theory—it’s statistically backed. According to Thomas Bulkowski, in his analysis of over 10,000 chart patterns:

📌 Bullish flags showed an average success rate of 67%, with an average return of over 9% in a 3-week period after breakout.

📌 Bearish flags had a slightly lower success rate but were highly effective in trending markets—especially during bear phases like the 2020 COVID crash.

💬 Studies from the CMT Association also highlight that continuation patterns like flags perform better when the breakout is accompanied by a volume surge of at least 50% compared to the consolidation phase.

🧠 Advanced Tips for Trading Flag Patterns

🚫 Avoid trading in low-volume stocks—the flag may be false. Stick to liquid names like Axis Bank, Maruti, or Infosys.

⏳ Patience pays—wait for confirmation before jumping in. Premature entries lead to whipsaws.

🧪 Backtest your strategy using historical data on Strike Money. If a particular setup works 70% of the time on midcap pharma, double down on it.

🤯 Don’t just chase every flag pattern. Combine it with broader market context—flag in a stock when Nifty is trending makes more sense than during sideways moves.

📚 Best Tools & Resources to Learn Flag Pattern Trading

To master flag pattern trading, surround yourself with the right ecosystem:

📌 Strike Money: One of the best Indian tools for drawing, testing, and trading flag patterns.

📌 TradingView India: Use built-in pattern recognition and volume indicators to spot setups.

📌 Books: 📖 Technical Analysis of the Financial Markets – John J. Murphy 📖 Encyclopedia of Chart Patterns – Thomas Bulkowski

📌 Communities: 💬 r/Daytrading 💬 r/IndianStreetBets 💬 StockTwits India

They help you discuss and dissect patterns in real-time with other serious traders.

🙋 Common Questions About Flag Patterns

❓ Can flag patterns fail? Yes. Especially in range-bound markets or when breakouts happen without volume.

❓ How long should a flag last? Typically 3–15 sessions. Too short might be noise. Too long? It could be forming a different pattern.

❓ Do flag patterns work in intraday trading? Absolutely. Many intraday traders on Strike Money use the 5-min chart to catch micro-flag breakouts.

❓ Are flag patterns good for crypto and forex? Yes. The same principles apply, though volatility is higher. Combine with momentum indicators for safety.

🔚 Final Thoughts: Should You Add Flag Patterns to Your Strategy?

✅ If you're trading breakouts, the flag pattern is a must-have tool in your arsenal. It combines momentum, structure, and timing into a single setup.

✅ When paired with platforms like Strike Money and combined with volume and market context, it becomes a low-risk, high-reward strategy.

Remember, it's not just about spotting the pattern. It’s about waiting for confirmation, having a defined plan, and executing with discipline.

👉 Ready to start spotting flag patterns like a pro? Open your charts, zoom in on recent breakouts, and apply what you’ve learned. The next winning trade might be waving a flag at you!

0 notes

Text

Unlocking Success: Key Chart Patterns Every Trader Must Learn

Trading success frequently depends on one's capacity to identify and decipher important chart patterns. These chart patterns can assist traders in spotting possible profit chances and offer insightful information about the mechanics of the market. We'll go over some of the most important chart patterns in this book, which are essential knowledge for any trader looking to succeed in the markets.

1. Importance of Key Chart Patterns

Technical analysis, the study of past price data to predict future price movements, heavily relies on chart patterns. Price charts can be used to discover recurrent patterns that help traders predict market trends and make wise trading decisions. Important chart patterns can assist traders in determining the strength of a trend or spotting possible trend reversals. They are also dependable markers of market sentiment.

2. Key Chart Patterns Every Trader Should Know

Now let's examine some of the essential chart patterns that all traders ought to be familiar with:

Patterns of Trend Reversal:

Three peaks make up the "head and shoulders" pattern, where the main peak (referred to as the "head") is higher than the other two (referred to as the "shoulders"). A reversal of the trend is usually indicated by a break below the pattern's neckline.Double Top and Double Bottom: These patterns show the possibility of a trend reversal when prices reach two peaks or valleys that are about equal in height.

b. Continuation Patterns:

Pennants and flags: These patterns emerge following a significant price change and signify a short-lived break in the market before the trend continues. Pennants are tiny, symmetrical triangles, whereas flags are rectangular designs.Triangles: Triangles are patterns of consolidation that appear when prices move inside a smaller range, signifying a lack of confidence in the market.

3. Patterns of Consolidation:

Rectangles: Rectangles are patterns of consolidation that show levels of support and resistance as parallel horizontal lines.Wedges: When prices move inside convergent trendlines, a possible breakout is indicated. Wedges are patterns of consolidation.

3. Practical Implications for Trading

Trading methods may benefit from an understanding of important chart patterns. Traders can establish stop-loss orders to control risk, pinpoint price targets for profit-taking, and discover possible entry and exit locations for trades by identifying these patterns on a price chart. Traders can increase their overall trading performance and make better selections by incorporating important chart patterns into their trading approach.

4. Conclusion

In conclusion, a thorough grasp of important chart patterns and how they relate to market analysis is essential to trading success. Through the process of identifying and comprehending these patterns on price charts, traders can acquire important knowledge about market trends and possible avenues for profit. Understanding important chart patterns is crucial for success in the fast-paced world of trading, regardless of experience level.

1 note

·

View note

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

Chart Patterns: A Visual Language of the Markets

Imagine a graph depicting currency price movements over time. This chart can often reveal recurring patterns that visually suggest potential future price movements. These patterns are formed by the collective actions of buyers and sellers in the market, and can offer clues about market sentiment and potential trend reversals or continuations. While not foolproof, understanding chart patterns can be a valuable tool in your Forex trading arsenal.

Popular Chart Patterns and Their Implications

Here are some of the most widely recognized chart patterns and their trading interpretations:

Trend Reversal Patterns: These patterns signal a potential shift in the current price trend. Examples include:

Head and Shoulders (H&S): A bearish reversal pattern resembling a head with two lower shoulders. A neckline break below the shoulders suggests a potential downtrend.

Double Top (DT) and Double Bottom (DB): These patterns indicate potential reversals after two successive highs (DT) or lows (DB). A break above the neckline for DT or below the neckline for DB suggests a possible trend change.

Continuation Patterns: These patterns suggest the continuation of the prevailing trend. Some common examples include:

Ascending/Descending Triangle: A series of higher highs (ascending) or lower lows (descending) with converging trendlines, suggesting a potential breakout in the direction of the trend.

Flags and Pennants: These are consolidation patterns formed within an established uptrend or downtrend, resembling flags or pennants. A breakout above the flagpole for flags or the trendline for pennants suggests trend continuation.

Using Chart Patterns Effectively: Combining Strategies

While chart patterns offer valuable insights, it's important to remember some key points:

Confirmation is Key: Don't rely solely on a single chart pattern. Look for confirmation from technical indicators, price action, or fundamental factors before entering a trade.

False Signals Do Occur: Chart patterns are not guarantees of future price movements. The market can be unpredictable, and false signals can sometimes emerge.

Context Matters: The overall market trend and other technical indicators can influence how a chart pattern plays out.

Risk Management is Paramount: Always prioritize risk management strategies like stop-loss orders to limit potential losses, regardless of the chart pattern.

Beyond the Basics: Tips for Success with Chart Patterns

Here are some additional tips to maximize the effectiveness of chart patterns in your Forex trading:

Focus on High-Probability Patterns: Master a few high-probability chart patterns with clear entry and exit signals rather than trying to learn them all.

Practice Pattern Recognition: Train your eye to identify chart patterns on live and historical charts.

Paper Trading: Test your chart pattern recognition skills and trading strategies using a demo account before risking real capital.

Conclusion

Chart patterns can be a valuable tool for Forex traders, offering visual cues about potential price movements and trading opportunities. However, it's crucial to use them in conjunction with other technical and fundamental analysis methods, prioritize risk management, and acknowledge their limitations. By applying these principles and continuously refining your chart pattern recognition skills, you can leverage this technique to enhance your trading decisions and navigate the dynamic world of Forex with greater confidence.

Remember, successful Forex trading is a journey that requires dedication, continuous learning, and a commitment to developing a sound trading strategy.

1 note

·

View note

Text

Decoding the Market: A Guide to Forex Chart Patterns

The foreign exchange market, or Forex for short, is a vast and dynamic landscape. Skilled traders rely on various tools and strategies to make informed decisions, and technical analysis, particularly the study of chart patterns, plays a crucial role in this process. This guide delves into the world of Forex chart patterns, equipping you with the knowledge to identify these formations and potentially improve your trading forecast accuracy.

What are Forex Chart Patterns?

Imagine a line graph depicting the price movements of a currency pair over time. These price fluctuations often form recognizable patterns that can offer clues about future price direction. Forex chart patterns are technical indicators based on the historical behavior of price and volume data. While not foolproof predictors, they can be valuable tools when used in conjunction with other technical and fundamental analysis.

Common Forex Chart Patterns: A Trader's Toolkit

Several chart patterns are frequently encountered in Forex trading. Here's a look at some of the most common ones:

Reversal Patterns: These patterns signal a potential shift in the prevailing trend.

Head and Shoulders (H&S): This pattern resembles a head with two lower shoulders on either side. A break below the neckline (support level) suggests a potential downtrend after an uptrend.

Double Top/Double Bottom: These patterns consist of two consecutive highs/lows with a valley/peak in between. A break below the neckline (for double top) or above the resistance level (for double bottom) could indicate a trend reversal.

Continuation Patterns: These patterns suggest the continuation of the current trend.

Ascending/Descending Triangle: These triangle patterns form when price fluctuations are confined within a narrowing range, with trendlines connecting the highs (ascending) or lows (descending). A breakout above resistance (ascending) or below support (descending) might signal a continuation of the trend.

Flags and Pennants: These are short-term consolidation patterns within an established trend, resembling flags or pennants. A breakout above resistance (uptrend) or below support (downtrend) could indicate a continuation of the prevailing trend.

Remember, Patterns Are Not Guarantees

While Forex chart patterns can be valuable tools, it's crucial to understand their limitations:

False Signals: Chart patterns don't guarantee future price movements. Breakouts can be false, leading to unexpected reversals.

Confirmation is Key: Combine chart patterns with other technical indicators and fundamental analysis for stronger confirmation of potential price direction.

Market Context Matters: The overall market sentiment and economic factors can influence how a chart pattern plays out.

Beyond the Basics: Utilizing Chart Patterns Effectively

Here are some additional tips for effectively utilizing Forex chart patterns:

Identify the Trend: Before analyzing chart patterns, understand the prevailing trend (uptrend, downtrend, or sideways).

Placement and Volume: Consider the location of the pattern within the trend and the accompanying trading volume. Higher volume breakouts tend to be more significant.

Risk Management: Always prioritize risk management strategies like stop-loss orders to limit potential losses, regardless of the chart pattern.

Conclusion

Forex chart patterns offer valuable insights into potential price movements, but they should be used as one piece of the puzzle in your trading strategy. By understanding common chart patterns, their limitations, and how to use them effectively, you can enhance your technical analysis skills and potentially make more informed trading decisions in the dynamic world of Forex. Remember, successful trading requires ongoing learning, discipline, and a commitment to continuous improvement.

0 notes

Text

Secret Coin Forms a Bullish Pennant With a Potential Target of $0.95

Secret Coin has recently shown bullish momentum, forming a bullish pennant pattern and reaching a weekly high of $1.118 before seeing a slight pullback. Currently trading at $0.8554, it's anticipated to maintain its upward trajectory, supported by strong bullish levels around $0.95.

With an 11.24% surge in the last 24 hours and a trading volume of $8,096,422 USD, Secret is positioned above the 21-day moving average but below the 50-day moving average. The Fibonacci retracement suggests a bullish zone with a target around $0.95, although traders should exercise caution as a potential bearish trend looms.

On the 4-hour chart, Secret displays a solid uptrend, marked by higher highs and higher lows, indicating bullish dominance. Long positions are favored, with a potential target of $0.8804, contingent upon maintaining support at the rising trend line.

Technical indicators, including RSI, MACD, and Stochastic oscillator, all signal further upward momentum, affirming the bullish outlook. However, hourly analysis reveals stagnant price action within a range of $0.7887 to $0.8113, with strong support at the lower end. A breakdown below this support could signal a bearish trend towards $0.7487 and $0.6926.

In summary, Secret Coin appears poised to continue its bullish run towards $0.95, supported by key levels at $0.8113 and $0.7887, with resistance at $1.05. Traders are advised to monitor these levels closely to capitalize on potential profit opportunities.

0 notes

Text

How to Become a Great Trader: Mastering the Art of Trading

Introduction

Although it can be a thrilling and profitable endeavour, trading in the financial markets also calls for knowledge, discipline, and skill. We will examine the fundamental ideas and methods that can make you a profitable trader in this extensive tutorial. Gaining long-term success in the financial markets requires learning the art of trading, regardless of the expertise level of the investor.

Understanding the Basics of Trading

What is Trading?

Buying and selling financial instruments including stocks, bonds, currencies, and commodities with the intention of making money off of price changes is known as trading.

Types of Trading

Buying and selling assets during the same trading day in order to profit from momentary price changes is known as day trading.

Swing trading is the practice of holding positions for a few days or weeks in order to profit from medium-term market trends.

Long-term investing is the practice of holding investments for a considerable amount of time—often years—with the goal of generating large returns over time.

Developing a Trading Plan

Setting Clear Goals

Establish your trading time horizon, risk tolerance, and financial objectives. Set reasonable expectations regarding profits and losses.

Creating a Strategy

Select a trading approach that fits your personality and ambitions. Technical analysis, fundamental analysis, or a mix of the two may be used in this.

Risk Management

To guard against losses, use risk management strategies include portfolio diversification, stop-loss orders, and position sizing.

To Becoming A Great Trader JOIN NOW

Mastering Technical Analysis

Understanding Price Charts

To find possible trade chances, become knowledgeable about the interpretation of candlestick patterns, trendlines, support and resistance levels, and other technical indicators.

Using Technical Indicators

To analyse price trends and momentum, familiarise yourself with widely used technical indicators such as stochastic oscillators, moving averages, and the relative strength index (RSI).

Chart Patterns

To predict future price changes, identify typical chart patterns like head and shoulders, double tops and bottoms, and flags and pennants..

Utilising Fundamental Analysis

Economic Indicators

Keep yourself updated on important economic indicators that might affect asset values and market mood, such as GDP growth, inflation rates, interest rates, and employment data.

Company Analysis

Prior to considering an investment, consider each company's competitive position, growth potential, management team, and financial standing.

Market Sentiment

To determine market trends and mood shifts, track sentiment in the market using investor sentiment indicators, social media, and news.

Developing Discipline and Patience

Stick to Your Plan

Stick to your trading plan religiously and refrain from acting on impulse in response to transient market swings or feelings.

Manage Your Emotions

By keeping a logical attitude and concentrating on the long-term goals of your trading strategy, you may control your emotions of fear and greed.

Continuous Learning

With books, courses, webinars, and trading networks, stay current on market trends, trading strategies, and industry advancements.

To Becoming A Great Trader JOIN NOW

Practising Risk Management

Capital Preservation

Avoid overleveraging and only risk a small portion of your portfolio on each trade to protect your trading money.

Stop-Loss Orders

Stop-loss orders are a useful tool for controlling possible losses and quitting losing trades before they cause large losses.

Diversification

To minimise risk and optimise profits, diversify your investing portfolio among several industries, geographical areas, and asset types.

Conclusion

Great traders are made by commitment, self-control, and lifelong learning. You may improve your chances of making money in the financial markets by learning the principles of trading, creating a strong trading strategy, and managing risk. As you set out on your path to become a profitable trader, never forget to use patience, discipline, and focus on your long-term objectives.

#rogue trader#stock market#crypto#cryptoexchange#cryptocurrency#investing stocks#day trading#trading strategies#trading market#stock exchange

1 note

·

View note