#How to use Parabolic SAR and MACD

Explore tagged Tumblr posts

Text

Maximizing Trading Potential: Parabolic SAR, MACD, and Moving Averages Strategy

In the realm of trading, employing a combination of technical indicators can significantly enhance your decision-making process and overall profitability. This post explores the synergy between Parabolic SAR (Stop and Reverse), MACD (Moving Average Convergence Divergence), and Moving Averages, offering insights into how traders can leverage these tools effectively for informed trading…

View On WordPress

#Day trading techniques#How to use Parabolic SAR and MACD#MACD trading strategy#Moving Averages trading tips#Parabolic SAR strategy#Profitable trading strategies#Risk management in trading#Technical analysis for traders#Trading indicators explained#Trend following strategies

0 notes

Text

Best Technical Indicator for Trend Reversal: A Comprehensive Guide

When it comes to successful trading, identifying trend reversals is one of the most crucial skills you can develop. Spotting a reversal before the market fully shifts direction can help you get in or out of a trade at just the right moment. But how do you accurately predict trend reversals? This is where technical indicators come in handy. In this guide, we’ll explore the best technical indicators for trend reversal, their advantages, and how you can use them effectively in your trading strategy.

1. Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is one of the most popular technical indicators used by traders to identify trend reversals. It consists of two moving averages that oscillate around a zero line, providing valuable insights into momentum shifts. A crossover of the MACD line and the signal line is often used as a signal for potential trend reversals.

How to Use MACD for Trend Reversals: When the MACD line crosses above the signal line, it could indicate a potential bullish reversal. Conversely, when the MACD line crosses below the signal line, it may signal a bearish reversal. Traders often look for divergence between MACD and price action as an additional confirmation of a trend reversal.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another powerful indicator for spotting trend reversals. RSI measures the strength of a security’s price action by comparing the average gains and losses over a specified period, typically 14 days.

How to Use RSI for Trend Reversals: The RSI moves between 0 and 100. When the RSI is above 70, it is considered overbought, which may suggest a potential bearish reversal. On the other hand, an RSI below 30 indicates that the market is oversold, hinting at a possible bullish reversal. Divergence between RSI and price action is also a strong signal for an upcoming trend reversal.

3. Bollinger Bands

Bollinger Bands are another useful tool for identifying trend reversals. Bollinger Bands consist of a middle band, which is a moving average, and two outer bands that represent standard deviations of the price.

How to Use Bollinger Bands for Trend Reversals: When the price moves outside the Bollinger Bands, it often indicates that the asset is overextended, and a reversal may be imminent. Traders look for price rejection at the bands and confirmation in the form of candlestick patterns to anticipate a reversal.

4. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that can also be useful for predicting trend reversals. It compares the closing price of an asset to its price range over a certain period to determine the strength of a trend.

How to Use the Stochastic Oscillator for Trend Reversals: When the Stochastic lines cross above 80, it suggests that the market is overbought, indicating a possible trend reversal to the downside. Conversely, when the Stochastic lines cross below 20, it indicates that the market is oversold, signaling a potential bullish reversal.

5. Parabolic SAR

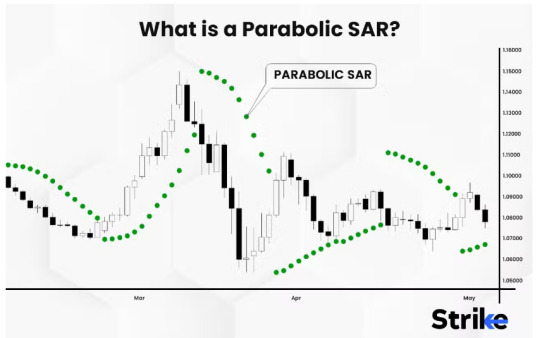

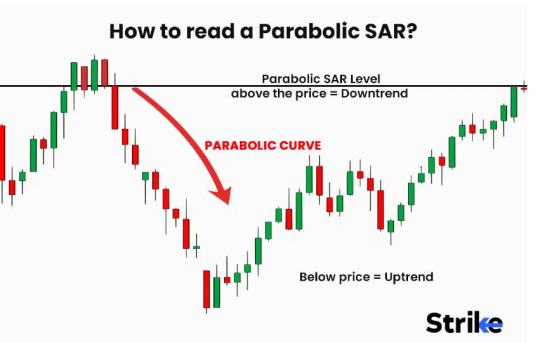

The Parabolic Stop and Reverse (SAR) is a trend-following indicator designed to highlight potential points where a trend might reverse.

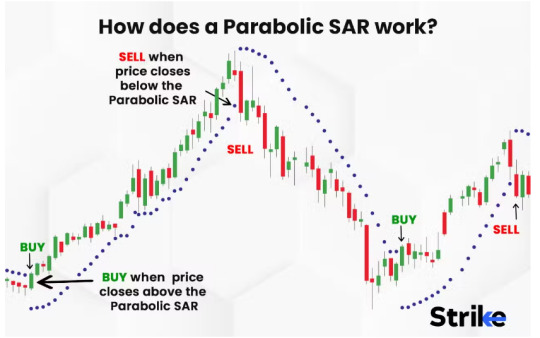

How to Use Parabolic SAR for Trend Reversals: The Parabolic SAR plots dots above or below price bars. When the dots switch from being below to above the price, it indicates a potential bearish reversal. Conversely, when they move from above to below the price, a bullish reversal is likely. Traders often use Parabolic SAR along with other indicators like RSI or MACD for better accuracy.

6. Fibonacci Retracement Levels

Fibonacci Retracement is not a typical technical indicator, but it can provide valuable insight into where trend reversals are likely to occur. The key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) are often used to anticipate areas of potential support or resistance where the price might reverse.

How to Use Fibonacci Retracement for Trend Reversals: During an uptrend, if the price retraces to a key Fibonacci level and finds support, it could signal the end of the pullback and the start of a reversal back to the uptrend. Similarly, in a downtrend, Fibonacci levels can help predict resistance levels where a bearish reversal might occur.

Conclusion: Choosing the Best Indicator for Trend Reversals

Identifying the best technical indicator for trend reversal ultimately depends on your trading style, experience, and preference. Indicators like MACD, RSI, Bollinger Bands, Stochastic Oscillator, Parabolic SAR, and Fibonacci Retracement are all effective in identifying potential trend reversals. To improve the accuracy of your predictions, it’s often recommended to use a combination of these indicators along with proper risk management techniques.

Remember that no indicator can provide a 100% guarantee of a trend reversal. Market conditions and external factors also play a significant role in price movements. Always test and backtest your strategies before applying them in a live market.

If you’re looking for more insights and tools to enhance your trading strategy, visit Miyagi Trading. At Miyagi Trading, we provide the best trading resources, indicators, and expert advice to help you stay ahead of the market. Whether you’re a beginner or an experienced trader, our goal is to help you make informed decisions and achieve consistent results. Explore our range of tools and start improving your trading skills today!

0 notes

Text

Understanding Forex Trend Indicators

In the world of foreign exchange trading, identifying the direction of a trend is crucial for making informed trading decisions. Forex trend indicators are tools that help traders determine whether a currency pair is trending upward, downward, or moving sideways. These indicators are fundamental for devising strategies and executing trades effectively. Let’s explore some of the most commonly used Forex trend indicators and how they can enhance your trading performance.

Moving Averages

Moving averages are among the most popular trend indicators. They smooth out price data to help identify the direction of the trend. The Simple Moving Average (SMA) calculates the average price over a specific number of periods, while the Exponential Moving Average (EMA) gives more weight to recent prices. By comparing different moving averages, such as the 50-period and 200-period, traders can identify potential buy or sell signals. When a shorter-term moving average crosses above a longer-term one, it may indicate an uptrend, while the opposite crossover could signal a downtrend.

Average True Range (ATR)

The Average True Range (ATR) measures market volatility rather than direction. However, understanding volatility is crucial for trend analysis. A higher ATR indicates increased volatility, which often accompanies strong trends. Traders use ATR to set stop-loss orders and to gauge the potential range of price movements. A rising ATR suggests that a trend may be gaining strength, whereas a declining ATR could indicate a potential reversal or weakening trend.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a versatile indicator that combines moving averages with momentum analysis. It consists of two lines: the MACD line and the signal line. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting the potential for an upward trend. Conversely, when the MACD line crosses below the signal line, it could indicate a bearish trend. The MACD also includes a histogram that represents the difference between the MACD and signal lines, providing additional insight into trend strength.

Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. The bands expand and contract based on market volatility. When the bands widen, it indicates increased volatility and potential trend strength. Conversely, when the bands contract, it suggests lower volatility and a potential trend reversal or consolidation. Traders use Bollinger Bands to identify potential entry and exit points based on price touching or breaching the bands.

Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that provides information on support and resistance levels, Forex Trading Robot, and momentum. It consists of five lines: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. The area between Senkou Span A and Senkou Span B forms the “cloud.” Price above the cloud indicates an uptrend, while price below the cloud suggests a downtrend. The cloud’s thickness can also provide insights into the strength of the trend.

Parabolic SAR

The Parabolic SAR (Stop and Reverse) is a trend-following indicator that provides potential entry and exit points. It appears as dots on the chart, with dots below the price indicating an uptrend and dots above the price signaling a downtrend. The indicator helps traders set trailing stop-loss orders and recognize potential trend reversals.

0 notes

Text

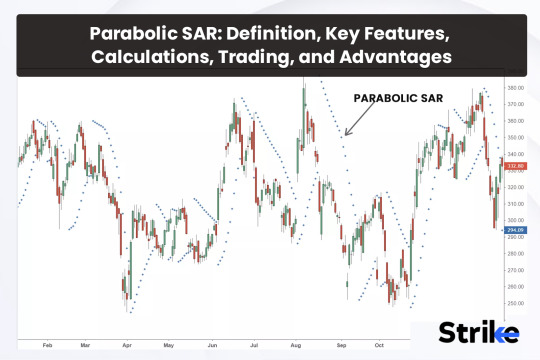

✅ Complete Guide to Parabolic SAR: How This Powerful Indicator Can Transform Your Trades

If you're searching for a way to catch trends early and ride them until they reverse, the Parabolic SAR (Stop and Reverse) could be your answer. Invented by J. Welles Wilder Jr., this indicator helps traders pinpoint entry and exit points in trending markets.

In this complete guide, we’ll break down everything: how it works, the formula, real-world examples from the Indian stock market, strategy insights, and how to use it on platforms like Strike Money and TradingView.

Let’s dive in 👇

🚀 What is Parabolic SAR and Why Do Traders Love It?

The Parabolic SAR (Stop and Reverse) is a trend-following indicator plotted as dots above or below price. When the dots flip, it signals a possible trend reversal.

✅ Dots below the price → bullish signal ✅ Dots above the price → bearish signal

This indicator is popular because it provides visual clarity on trend direction and possible stop-loss placements. Traders across forex, stocks, and crypto markets use it to time their entries and exits.

Fun fact: The Parabolic SAR is part of Wilder’s legendary contributions, alongside RSI and ATR.

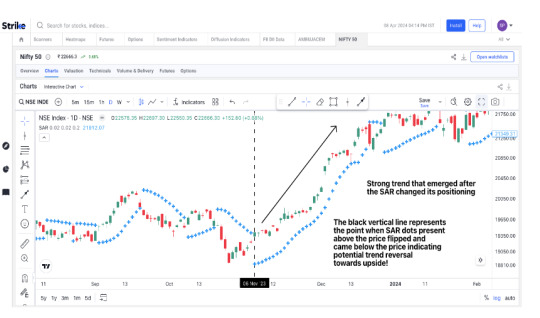

In the context of the Indian stock market, you’ll often spot traders using it on Nifty 50, Bank Nifty, and liquid stocks like Reliance Industries, TCS, and Infosys.

📜 The Story Behind Parabolic SAR: Wilder’s Quest for Better Trends

In 1978, J. Welles Wilder Jr. introduced the Parabolic SAR in his book New Concepts in Technical Trading Systems. Wilder wanted an indicator that could lock in profits as trends matured without exiting too early.

He coined the term “parabolic” because the indicator’s path curves as the trend accelerates, and “stop and reverse” because it suggests reversing position when the trend flips.

Today, it’s built into platforms like Strike Money and TradingView, making it accessible to traders worldwide.

🧮 Decoding the Parabolic SAR Formula (Don’t Worry, We’ll Simplify It)

Here’s the official formula:

👉 SAR (new) = SAR (prior) + AF × (EP – SAR prior)

Where:

✨ SAR = Stop and Reverse ✨ AF = Acceleration Factor (starts at 0.02, increases by 0.02 up to 0.20) ✨ EP = Extreme Point (highest high or lowest low)

In simple terms, the SAR moves closer to the price as the trend continues. The stronger the trend, the faster SAR catches up.

💥 Example from the Indian market: Suppose you’re trading Reliance Industries trending upwards from ₹2300 to ₹2450. The SAR dots will trail the price below, moving upward daily. Once the price reverses below the SAR dot, it signals an exit or short entry.

On Strike Money, you can apply this formula automatically—no manual calculation needed.

👀 How to Read Parabolic SAR Dots: Signals Made Simple

Reading Parabolic SAR is intuitive:

✅ When dots appear below candles, the trend is up → stay long or consider buying ✅ When dots flip above candles, the trend is down → exit longs or go short

⚠️ But here’s a caution: In sideways markets, the Parabolic SAR gives false signals because it’s designed for trending conditions.

👉 Real-world example: On Nifty 50, during a trending rally post-election results, the SAR dots kept trailing neatly below candles from 18,000 to 19,200. But during choppy pre-budget sessions, SAR flipped multiple times—leading to whipsaws.

Pro tip: Always combine Parabolic SAR with other indicators like RSI or MACD to filter signals.

💡 Powerful Parabolic SAR Strategies for Indian Stock Traders

Here’s how traders use Parabolic SAR effectively:

🔹 Trend-following strategy: Enter trades in the direction of the dots. Example: Dots below Reliance’s breakout → stay long until dots flip.

🔹 Trailing stop-loss strategy: Move your stop-loss along the SAR dots as the trend advances. On Strike Money, you can visually drag your stop-loss to align with SAR.

🔹 Intraday trading: On 15-min charts of Bank Nifty, many scalpers use Parabolic SAR to trail fast moves post-market open.

👉 Important stat: A study published by Investopedia found that Parabolic SAR performs best in strong trends but loses accuracy in sideways action.

In Indian equities, trending phases like post-RBI policy moves or earnings breakouts are ideal windows for this indicator.

⚙️ Best Settings for Parabolic SAR: Should You Stick to Default?

By default, the acceleration factor is 0.02 and maximum 0.20. But here’s what traders found:

✅ For intraday on Nifty or Bank Nifty, some lower AF to 0.01 to reduce false flips ✅ For positional trades on daily charts, default 0.02 works fine ✅ For volatile stocks like Adani Enterprises, reducing AF helps avoid premature exits

On Strike Money, you can tweak these settings and visually backtest how dots behave historically.

📊 A backtest conducted on Nifty 50 from 2020–2023 showed that combining default Parabolic SAR with a 50-period EMA filter reduced false signals by 27% during range-bound phases.

🤝 Why Combining Parabolic SAR With Other Indicators Boosts Accuracy

Parabolic SAR works best with confirmation from other tools:

✨ RSI filter: Only take buy signals when RSI > 50, sell signals when RSI < 50 ✨ MACD filter: Use Parabolic SAR flips only when MACD line is above/below signal line ✨ Moving Average crossover: Enter trades when SAR flip aligns with MA crossover

Example: On Infosys daily chart, combining Parabolic SAR with a 200 EMA helped traders avoid false sell signals during a long-term bullish run.

On Strike Money, overlaying indicators is seamless—enabling multi-layered confirmations.

⚠️ When Not to Use Parabolic SAR: Beware These Traps

Many beginners misuse Parabolic SAR by:

❌ Using it in sideways markets → leads to frequent whipsaws ❌ Ignoring news events → sudden gaps make SAR flip incorrectly ❌ Applying on illiquid stocks → price gaps distort dots

👉 Example: In mid-cap stocks with poor liquidity, SAR dots may jump drastically, misleading traders.

A 2022 backtest by TradingView analysts showed Parabolic SAR had 65% accuracy in trending phases but dropped below 40% in range-bound conditions.

✅ Always check if the market is trending or consolidating before relying solely on SAR.

🔍 Backtesting Parabolic SAR: What Do the Numbers Say?

Let’s talk data.

A backtest on Nifty 50 (2018–2023) using default Parabolic SAR settings revealed:

📈 Trend trades captured 68% of total swing moves 📉 Sideways phases caused 9 false signals per quarter ⚡️ Combining SAR with RSI >50 filter reduced false signals to 4 per quarter

Similarly, on HDFC Bank daily chart (2021–2023), trailing with Parabolic SAR dots locked in an average of 12% higher profit vs. fixed stop-loss exits.

On Strike Money, traders can replay historical charts to visually see how SAR signals unfolded—an invaluable tool for testing strategies before risking capital.

🙋♂️ Frequently Asked Questions About Parabolic SAR

❓ Is Parabolic SAR better than Moving Average? 👉 Different purposes. SAR trails stop-loss; MA smooths trends. Best used together.

❓ Does Parabolic SAR repaint? 👉 No. Once a candle closes, the dot position doesn’t repaint.

❓ What’s the best timeframe? 👉 Works well on 1-hour or daily charts. Shorter timeframes increase noise.

❓ Can I use Parabolic SAR for intraday trading? 👉 Yes, but combine with volume/RSI for better accuracy on Bank Nifty/Index Futures.

❓ How do I set stop-loss using Parabolic SAR? 👉 Place your stop at the SAR dot level, moving it as dots update each session.

🎯 Is Parabolic SAR Right for You? Here’s the Verdict

If you’re a trend trader looking for a dynamic trailing stop that adapts as the market moves, the Parabolic SAR deserves a spot in your toolkit.

✅ Best in trending stocks/indices like Reliance, TCS, Nifty 50 ✅ Best paired with RSI, MACD, or EMA filters ✅ Avoid using alone in sideways markets or illiquid counters

With platforms like Strike Money, applying Parabolic SAR is effortless—you can tweak settings, overlay with other indicators, and backtest strategies visually.

Whether you’re trading stocks, forex, or crypto, understanding how the Parabolic SAR works can help you lock in profits, cut losses, and ride trends with confidence.

Ready to test it out? Open your Strike Money chart, add Parabolic SAR, and start tracking those dots today 👨💻📊

0 notes

Video

youtube

Trading Mastery: MACD, ADX, Parabolic SAR Strategies Revealed,Market Success Blueprint with MACD, ADX, Parabolic SAR Techniques,Trading Mastery: MACD, ADX, Parabolic SAR Strategies Revealed,Market Success Blueprint with MACD, ADX, Parabolic SAR Techniques,Optimize Your Trades: MACD, ADX, Parabolic SAR Strategy Unveiled,Profitable Trading Secrets: MACD, ADX, Parabolic SAR Strategies,Strategic Trading Signals: MACD, ADX, Parabolic SAR Mastery,Maximize Profits with MACD, ADX, Parabolic SAR Trading Tactics,Proven Strategies: MACD ADX Parabolic SAR for Trading Success,Elevate Your Trading Game: MACD, ADX, Parabolic SAR Techniques,Mastering Market Trends: MACD, ADX, Parabolic SAR Strategies,Trade Like a Pro: MACD, ADX, Parabolic SAR Success Guide,MACD Trading Strategies,ADX Indicator Strategies,Parabolic SAR Trading Techniques,MACD ADX Trading Signals,How to Use Parabolic SAR Effectively,MACD Trading Tips and Tricks,ADX Indicator Explained for Traders,Parabolic SAR Trend Analysis,MACD ADX Strategy for Beginners,Mastering Parabolic SAR in Trading,

0 notes

Text

What are Trading Indicators?

If you're new to trading or looking to enhance your trading strategies, understanding trading indicators is a crucial step. Trading indicators are powerful tools that help traders analyze market conditions, identify trends, and make informed trading decisions. They are mathematical calculations applied to historical price and volume data, providing insights into potential entry and exit points, market strength, and trend reversals. By incorporating these indicators into your trading approach, you can gain a competitive edge and increase your chances of success in the financial markets. From trend-following indicators that highlight the direction of the market to oscillators that help identify overbought or oversold conditions, there is a wide range of trading indicators to choose from. Each indicator has its unique calculation methodology and interpretation. Some popular examples include Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence). These indicators can be applied to various financial markets, such as stocks, forex, commodities, and cryptocurrencies, enabling traders to make informed decisions across different asset classes. Are you ready to take your trading to the next level? By mastering the art of trading indicators, you can gain valuable insights into market trends, price movements, and potential reversals. Join me in my upcoming blog posts, where we'll explore different types of trading indicators in detail, learn how to use them effectively in your trading strategies, and uncover advanced techniques to maximize their effectiveness. Get ready to enhance your trading skills, make smarter trading decisions, and embark on a successful trading journey. Stay tuned and get ready to dive into the fascinating world of trading indicators! What is a Trading Indicator? Trading indicators are mathematical calculations or visual representations of market data that provide insights into the current and future direction of price movements in financial markets. These indicators are derived from various types of data, such as price, volume, or open interest, and are used by traders to identify potential trading opportunities, determine market trends, and make informed trading decisions. Types of Trading Indicators There is a wide range of trading indicators available, each designed to serve a specific purpose and provide unique insights into market dynamics. Let's explore some of the most commonly used types of trading indicators: Trend Following Indicators Trend following indicators are used to identify and confirm the direction of market trends. These indicators are particularly useful for traders who prefer to ride the momentum of an established trend. Some popular trend following indicators include Moving Averages, Average Directional Index (ADX), and Parabolic SAR. - Moving Averages: Moving averages calculate the average price over a specific period and help smooth out price fluctuations, making it easier to identify trends. - Average Directional Index (ADX): The ADX indicator measures the strength of a trend and helps traders determine whether a market is trending or ranging. - Parabolic SAR: The Parabolic SAR indicator is used to identify potential trend reversals and provides stop-loss levels for traders. Best Trend Following Indicators Oscillators Oscillators are indicators that fluctuate within a specific range, indicating overbought or oversold conditions in the market. These indicators are valuable for identifying potential turning points in the price and generating buy or sell signals. Commonly used oscillators include Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD). - Relative Strength Index (RSI): The RSI measures the speed and change of price movements and is used to identify overbought or oversold conditions in the market. - Stochastic Oscillator: The Stochastic Oscillator compares the closing price of an asset to its price range over a specific period, helping traders identify potential reversals. - Moving Average Convergence Divergence (MACD): The MACD indicator is a versatile tool that combines trend-following and momentum elements. It provides signals based on the interaction between two moving averages. Oscillators Indicators Volume Indicators Volume indicators analyze the trading volume of a security and provide insights into the strength or weakness of a price movement. These indicators help traders confirm trends, identify potential reversals, and gauge market participation. Popular volume indicators include On-Balance Volume (OBV), Chaikin Money Flow, and Volume Weighted Average Price (VWAP). - On-Balance Volume (OBV): The OBV indicator measures buying and selling pressure based on the cumulative volume of a security. It helps traders confirm trends and anticipate trend reversals. - Chaikin Money Flow: The Chaikin Money Flow indicator combines price and volume data to measure the flow of money into or out of a security. It helps traders assess the strength of a price trend. - Volume Weighted Average Price (VWAP): The VWAP indicator calculates the average price weighted by trading volume. It is commonly used by day traders to identify potential support or resistance levels. Volume Indicators Volatility Indicators Volatility indicators measure the rate at which prices of a security fluctuate. These indicators help traders identify periods of high or low volatility, which can be useful for determining entry and exit points. Volatility indicators can also assist in setting appropriate stop-loss and take-profit levels. Some widely used volatility indicators include Bollinger Bands, Average True Range (ATR), and Donchian Channels. - Bollinger Bands: Bollinger Bands consist of a moving average (typically the 20-day simple moving average) and two standard deviation lines above and below the moving average. They expand and contract based on market volatility, providing insights into potential price breakouts or reversals. - Average True Range (ATR): The ATR indicator measures the average range between high and low prices over a specified period. It helps traders gauge the volatility of an asset and determine suitable stop-loss levels. - Donchian Channels: Donchian Channels plot the highest high and lowest low prices over a specified period. Traders can use these channels to identify breakouts and set stop-loss or take-profit levels. Volatility Indicators Sentiment Indicators Sentiment indicators gauge the overall sentiment or market psychology of traders and investors. These indicators help assess whether the market is bullish, bearish, or neutral, and can be valuable for contrarian trading strategies. Examples of sentiment indicators include the Put/Call Ratio, the Volatility Index (VIX), and the Commitment of Traders (COT) report. - Put/Call Ratio: The Put/Call Ratio compares the trading volume of put options to call options. A high ratio suggests bearish sentiment, while a low ratio indicates bullish sentiment. - Volatility Index (VIX): The VIX, also known as the "fear index," measures market volatility and investor expectations of future price fluctuations. It can be used as a contrarian indicator, with high levels indicating fear and potential buying opportunities. - Commitment of Traders (COT) report: The COT report provides insights into the positions of large traders, such as commercial hedgers and institutional investors. It helps traders assess the sentiment and positioning of market participants. Sentiment Indicators How to Use Trading Indicators Now that we have explored the different types of trading indicators, let's discuss how to effectively use them in your trading strategies. Keep in mind that trading indicators should not be used in isolation but rather in conjunction with other analysis techniques and risk management principles. Here are some key considerations when using trading indicators: Define Your Trading Goals and Strategy Before incorporating trading indicators into your approach, it's essential to define your trading goals and strategy. Determine your preferred trading style (e.g., day trading, swing trading, or long-term investing) and the financial markets you want to trade (e.g., stocks, forex, or commodities). This clarity will help you select the most relevant indicators for your trading objectives. Understand the Indicator's Calculation and Interpretation Each trading indicator has a specific calculation methodology and interpretation. Take the time to understand how the indicator is calculated and what signals or insights it provides. Read the indicator's documentation, consult reputable educational resources, or seek guidance from experienced traders to grasp its nuances fully. Avoid Indicator Overload While it may be tempting to use multiple indicators simultaneously, it's crucial to avoid indicator overload. Having too many indicators can lead to conflicting signals and confusion. Instead, focus on a few well-chosen indicators that complement each other and align with your trading strategy. Remember, quality over quantity. Combine Indicators for Confirmation One effective way to use trading indicators is to combine different types of indicators to confirm signals. For example, you can use a trend-following indicator to identify the overall trend and an oscillator to pinpoint potential entry or exit points within that trend. When multiple indicators align and generate signals in the same direction, it increases the probability of a successful trade. Implement Proper Risk Management While trading indicators can provide valuable insights, it's crucial to implement proper risk management strategies alongside their use. Here are some risk management principles to keep in mind: - Set Stop-Loss and Take-Profit Levels: Determine your risk tolerance and set appropriate stop-loss and take-profit levels for each trade. Stop-loss orders help limit potential losses if the market moves against your position, while take-profit orders allow you to secure profits when the price reaches your target. - Use Position Sizing: Calculate the appropriate position size for each trade based on your risk tolerance and the distance between your entry and stop-loss levels. Position sizing ensures that you don't risk an excessive amount of your capital on a single trade. - Diversify Your Portfolio: Avoid overexposure to a single asset or market. Diversify your portfolio by trading multiple assets or using different trading strategies. This helps spread your risk and reduce the impact of adverse price movements. - Practice Proper Capital Management: Only allocate a portion of your trading capital to any single trade. Avoid risking a significant portion of your funds on a single trade, as it can lead to substantial losses. Instead, divide your capital among multiple trades to diversify risk. - Regularly Review and Adjust: Continuously monitor your trades and assess their performance. If certain indicators or strategies are consistently underperforming, consider making adjustments or exploring alternative approaches. Regularly reviewing and adapting your trading plan is essential for long-term success. Advanced Strategies for Trading with Indicators Now that we have covered the basics of trading indicators and their usage, let's delve into some advanced strategies that can help you maximize their effectiveness. Multiple Time Frame Analysis One powerful technique is to perform multiple time frame analysis. Instead of relying solely on a single time frame, such as the daily chart, consider analyzing higher and lower time frames as well. For example, if you are trading based on a daily chart, also examine the weekly and hourly charts. This approach provides a broader perspective of the market and helps you identify trends and patterns that may not be evident on a single time frame. By aligning signals across multiple time frames, you can increase the probability of successful trades. For instance, if the daily chart indicates an uptrend, but the weekly chart shows a strong resistance level approaching, it may be wise to exercise caution and consider taking profits or adjusting your position size. Indicator Divergence Divergence occurs when the price of an asset moves in the opposite direction of the indicator. It often signifies a potential trend reversal or a weakening of the current trend. Divergence can be bullish or bearish. Bullish Divergence: Bullish divergence occurs when the price forms lower lows, but the indicator forms higher lows. It suggests that selling pressure is weakening, and a bullish reversal may be imminent. Traders can look for bullish divergence as a potential buying opportunity. Bearish Divergence: Bearish divergence occurs when the price forms higher highs, but the indicator forms lower highs. It indicates that buying pressure is diminishing, and a bearish reversal may be on the horizon. Traders can watch for bearish divergence as a signal to consider short positions or tighten stop-loss levels. Confirmation with Candlestick Patterns Candlestick patterns provide valuable insights into market sentiment and can be used to confirm signals generated by trading indicators. By combining the analysis of candlestick patterns with indicator signals, you can strengthen your trading decisions. For example, if a trend-following indicator generates a buy signal, look for bullish candlestick patterns, such as a bullish engulfing pattern or a hammer, to confirm the signal. Similarly, if an oscillator indicates overbought conditions, watch for bearish candlestick patterns, like a shooting star or a bearish engulfing pattern, to validate the potential reversal. Customizing Indicator Settings Most trading indicators come with default settings, but they can be adjusted to suit your trading style and preferences. Experimenting with different parameter settings can help fine-tune the indicators for improved accuracy. For instance, moving averages have different periods (e.g., 20-day, 50-day, or 200-day). Shorter periods are more sensitive to price movements, while longer periods provide a smoother average. Find the balance that aligns with your trading strategy and the time frame you are analyzing. Backtesting and Optimization Before implementing any indicator-based strategy in live trading, it is essential to backtest and optimize the strategy using historical data. Backtesting involves applying your trading rules to past market data to assess their performance. This process helps you evaluate the profitability and reliability of your strategy before risking real capital. Additionally, optimization allows you to test different indicator settings and parameters to find the optimal configuration for your strategy. Remember to use out-of-sample data to validate your optimized strategy to ensure it is not overfitting to past data. Combine Indicators from Different Categories Another approach is to combine indicators from different categories to gain a more comprehensive view of the market. For example, you can combine a trend-following indicator, such as the Moving Average, with an oscillator, such as the Relative Strength Index (RSI), to identify potential entry points within an established trend. By using indicators from different categories, you can leverage the strengths of each indicator and increase the robustness of your trading strategy. For instance, you could wait for a trend-following indicator to confirm the direction of the market trend. Once the trend is established, you can then look for oversold or overbought conditions using an oscillator to pinpoint favorable entry or exit points within that trend. This combination helps you align your trades with the prevailing trend while also considering market momentum. Remember, it's important to strike a balance and avoid overcrowding your charts with too many indicators. Focus on a few well-chosen indicators that complement each other and provide meaningful insights into the market conditions you are trading. Practice Discipline and Patience Trading with indicators requires discipline and patience. Avoid the temptation to enter trades solely based on a single indicator signal. Wait for additional confirmation from other indicators or analysis techniques before executing a trade. By exercising patience and waiting for high-probability setups, you can increase your chances of success. Additionally, stick to your trading plan and avoid impulsive decisions based on short-term market fluctuations. Trust the signals generated by your indicators and follow your predefined risk management rules consistently. Continual Learning and Adaptation The financial markets are dynamic and ever-changing, requiring traders to continually learn and adapt. Stay updated with the latest developments in trading indicators and techniques. Explore new indicators, study different trading strategies, and analyze market conditions to refine your approach. Engage with trading communities, participate in forums or webinars, and read educational materials to gain insights from experienced traders. Continual learning and adaptation will help you stay ahead of the curve and enhance your trading skills over time. Conclusion Trading indicators are powerful tools that can provide valuable insights into market trends, momentum, and potential reversals. By understanding the different types of indicators, employing advanced strategies, and combining indicators effectively, you can enhance your trading decisions and improve the overall profitability of your trades. However, it's important to remember that indicators are not infallible and should always be used in conjunction with other analysis techniques and risk management principles. Developing a robust trading strategy that incorporates indicators while considering market conditions and individual preferences is key to successful trading. Remember, trading requires practice, discipline, and continual learning. Regularly assess and evaluate your trading performance, adapt your strategies as needed, and always prioritize risk management. With time, experience, and a deep understanding of trading indicators, you can navigate the financial markets with confidence and increase your chances of achieving consistent profitability. FAQs What are trading indicators? Trading indicators are mathematical calculations applied to historical price and volume data in the financial markets. They help traders analyze market conditions, identify trends, and make informed trading decisions. These indicators provide insights into potential entry and exit points, market strength, and trend reversals. They come in various types, such as trend-following indicators, oscillators, volume-based indicators, and volatility indicators. How do trading indicators work? Trading indicators work by processing historical market data to generate signals or graphical representations that traders can interpret. They use mathematical formulas and statistical calculations to identify patterns, trends, and potential market conditions. Traders can use these indicators to confirm or validate their trading strategies, identify buying or selling opportunities, and manage risk. What are some commonly used trading indicators? There is a wide range of trading indicators available, and the choice of which to use depends on the trader's trading style and preferences. Some commonly used trading indicators include Moving Averages, Relative Strength Index (RSI), Bollinger Bands, MACD (Moving Average Convergence Divergence), Stochastic Oscillator, and Fibonacci retracement levels. Each indicator has its specific calculation method and interpretation, providing different insights into the market. Can trading indicators guarantee profitable trades? Read the full article

0 notes

Text

Super Trend Indicator

Super fashion is easy and smooth to apply indicator and offers a unique studying approximately an ongoing fashion. It is constructed with parameters, particularly duration and multiplier.

The Buy and Sell sign modifies as soon as the indicator tosses over the last fee. When the Super fashion closes above the Price, a Buy sign is generated, and while the Super fashion closes underneath the Price, a Sell sign is generated.

The default values used at the same time as building a super indicator are for common authentic range. The great appropriate fee for Intraday buying and selling might be 14 days and 2.1, 2.2 for its multiplier. The common authentic range (ATR) performs a critical function in 'Super trend' because the indicator makes use of ATR to calculate its fee.

The ATR indicator indicators the dimensions of fee volatility. Where can a Super fashion indictor be used? A ‘Super trend’ indicator may be used on equities, futures or forex, and additionally on daily, weekly and hourly charts as properly however normally, it's far unsuccessful in a sideways-transferring market. Like every other indicator, ‘Super trend’ works great while used with different signs consisting of MACD, Parabolic SAR, RSI, etc.

A ‘Super trend’ additionally acts as a sturdy help or resistance and it additionally affords a trailing forestall loss for the present trade. Prior to the great fashion indicator, know-how of the ATR is essential as great fashion employs ATR values to calculate the indicator values.

The super trend indicator is plotted over the fee chart of the inventory or the index. The indicator is a non-stop line which modifications its satiation among inexperienced and pink primarily based totally at the fee second within side the underlying.

An essential element which needs to be understood right here is, Super fashion does now no longer are expecting the route, instead as soon as the route is identified it'll direct you to provoke a role and recommends you to live within side the role until the fashion maintains.

Note worth functions For Long role When the lengthy role has been identified, the dealer is suggested to maintain the location until the fee closes underneath the inexperienced line. The inexperienced line acts as a trailing stop loss for the lengthy role.

For Short role A promote sign is generated while the inventory/index fee turns lesser than the indicator fee. At this stage, the indicator satiation flip pink and you may additionally see a crossover of the fee as opposed to the indicator (fee lesser than indicator fee) The promote sign may be used to begin a clean quick or go out lengthy.

Waiting for the promote sign to go out the present lengthy role can someday cause taking a loss. So the dealer ought to use his judgment right here. Once the quick role has been identified, the dealer is suggested to maintain the location until the fee closes underneath the inexperienced line. So in a experience the pink line facilitates as a trailing stop loss for the quick role. The super trend indicator is a higher device for Intraday buying and selling while as compared to a ordinary Moving Average buying and selling system.

https://enrichbroking.in/super-trend-trader

0 notes

Text

Bitcoin Just Surged to $10,000: Here’s What Analysts Think Comes Next

Just hours after our last market update, Bitcoin has topped $10,000. This is the first time the cryptocurrency has done this in over seven weeks. After holding $9,400 for all of Wednesday, the cryptocurrency surged higher over the past few hours, passing resistance after resistance in the $9,000s, culminating in the surge past $10,000 just minutes ago. Chart from TradingView.com This latest move may not be that notable in percentage terms but analysts say it’s important from a technical standpoint. One trader, in fact, commented that once Bitcoin decisively clears past $9,500, he doesn’t see “much stopping us” until $10,500. Bitcoin Is Readying for More Upside While there remain bears, the majority of analysts believe that Bitcoin is on track to rally in the short to medium term. A top trader indicated yesterday that there’s a good chance BTC could hit $10,700 in the coming week. As to why the trader, who called Bitcoin’s 2018 bottom six months in advance, thinks this is the case, he explained: “I might be wrong but something that’s been bugging me is how some of the stronger altcoins like ADA/USD ook mad bullish but ADA/BTC looks like trash, so I kind of feel BTC is going to go on a face melting move soon.” To corroborate this, the MACD, Parabolic SAR, and moving averages have all signaled that bulls have strength on a weekly timeframe. Whales seem to be preparing for more upside as well. Citing data from Glassnode, Willy Woo on May 5th noted that the population of large Bitcoin holders (1,000+ coins) has increased strongly since January’s lows. This indicates these users have been in “solid accumulation mode,” which is a “macro bullish” trend: “Whale population spotted increasing in the wild. They’ve been in solid accumulation mode since January unperturbed by the COVID crash. This is macro bullish,” Woo said in reference to the chart below. #whalebreedingseason Whale population spotted increasing in the wild. They've been in solid accumulation mode since January unperturbed by the COVID crash. This is macro bullish. Whales are entities holding 1000 BTC+, data by @glassnode pic.twitter.com/6HLFapIfNe — Willy Woo (@woonomic) May 6, 2020 Related Reading: Bitcoin Whales Have Been Buying En-Masse Since Early-2020: “Macro Bullish” Sign There’s a Risk of a Post-Halving Crash Although Bitcoin is ripping higher, some fear that there will be a post halving crash. Speaking to Bloomberg, Christel Quek, chief commercial officer and co-founder at Bolt Global, remarked on the chance of BTC falling after the halving: “This is an unprecedented time as liquidity remains a priority for investors fleeing equity markets. Therefore, while Bitcoin should rise into $10,000s after the halving, it could be followed with a price drop as investors engage in profit taking. No level of technical support can stand when the economy is drained.” Meltem Demirors, CSO of crypto research firm and investment fund CoinShares, echoed this skepticism. She proposed that we will get a classic “buy the rumor, sell the news” event, whereas prices will drop as halving subsides. This lines up with the concept of “miner capitulation,” which suggests that drops in the profitability of miners cause sell-offs in the BTC prices. An analyst explained in a Twitter thread last year that when smaller, non-industrial mining operations “get backed into a corner,” they’re forced to liquidate the coins they earn via mining. They liquidate their coins, often all at once, to keep the lights on, cash out, or to upgrade their systems for the future: “Undercapitalized miners panic sell, price dumps, longs get squeezed, stop losses cascade — then more miners lose their lunch.” Featured Image from Unsplash from CryptoCracken SMFeed https://ift.tt/2L8rnFY via IFTTT

0 notes

Text

Bitcoin Just Surged to $10,000: Here’s What Analysts Think Comes Next

Just hours after our last market update, Bitcoin has topped $10,000. This is the first time the cryptocurrency has done this in over seven weeks. After holding $9,400 for all of Wednesday, the cryptocurrency surged higher over the past few hours, passing resistance after resistance in the $9,000s, culminating in the surge past $10,000 just minutes ago. Chart from TradingView.com This latest move may not be that notable in percentage terms but analysts say it’s important from a technical standpoint. One trader, in fact, commented that once Bitcoin decisively clears past $9,500, he doesn’t see “much stopping us” until $10,500. Bitcoin Is Readying for More Upside While there remain bears, the majority of analysts believe that Bitcoin is on track to rally in the short to medium term. A top trader indicated yesterday that there’s a good chance BTC could hit $10,700 in the coming week. As to why the trader, who called Bitcoin’s 2018 bottom six months in advance, thinks this is the case, he explained: “I might be wrong but something that’s been bugging me is how some of the stronger altcoins like ADA/USD ook mad bullish but ADA/BTC looks like trash, so I kind of feel BTC is going to go on a face melting move soon.” To corroborate this, the MACD, Parabolic SAR, and moving averages have all signaled that bulls have strength on a weekly timeframe. Whales seem to be preparing for more upside as well. Citing data from Glassnode, Willy Woo on May 5th noted that the population of large Bitcoin holders (1,000+ coins) has increased strongly since January’s lows. This indicates these users have been in “solid accumulation mode,” which is a “macro bullish” trend: “Whale population spotted increasing in the wild. They’ve been in solid accumulation mode since January unperturbed by the COVID crash. This is macro bullish,” Woo said in reference to the chart below. #whalebreedingseason Whale population spotted increasing in the wild. They've been in solid accumulation mode since January unperturbed by the COVID crash. This is macro bullish. Whales are entities holding 1000 BTC+, data by @glassnode pic.twitter.com/6HLFapIfNe — Willy Woo (@woonomic) May 6, 2020 Related Reading: Bitcoin Whales Have Been Buying En-Masse Since Early-2020: “Macro Bullish” Sign There’s a Risk of a Post-Halving Crash Although Bitcoin is ripping higher, some fear that there will be a post halving crash. Speaking to Bloomberg, Christel Quek, chief commercial officer and co-founder at Bolt Global, remarked on the chance of BTC falling after the halving: “This is an unprecedented time as liquidity remains a priority for investors fleeing equity markets. Therefore, while Bitcoin should rise into $10,000s after the halving, it could be followed with a price drop as investors engage in profit taking. No level of technical support can stand when the economy is drained.” Meltem Demirors, CSO of crypto research firm and investment fund CoinShares, echoed this skepticism. She proposed that we will get a classic “buy the rumor, sell the news” event, whereas prices will drop as halving subsides. This lines up with the concept of “miner capitulation,” which suggests that drops in the profitability of miners cause sell-offs in the BTC prices. An analyst explained in a Twitter thread last year that when smaller, non-industrial mining operations “get backed into a corner,” they’re forced to liquidate the coins they earn via mining. They liquidate their coins, often all at once, to keep the lights on, cash out, or to upgrade their systems for the future: “Undercapitalized miners panic sell, price dumps, longs get squeezed, stop losses cascade — then more miners lose their lunch.” Featured Image from Unsplash from Cryptocracken WP https://ift.tt/2L8rnFY via IFTTT

0 notes

Text

Getting To Know How Indicators Works For Traders

If you have been trading the Forex market then you must have known that in technical analysis, we are required to be able to read the chart properly. There are lots of traders out there that use technical analysis to determine the future price movement. They calculate and analyze the chart based on the previous price data. Technical analysts often believe that price will repeat what it's done in the past. That is why previous data on the chart is really important for technical analysts to examine so they can make the best judgment on the next possible price movement. To help them determine price's next movement, analysts usually adding some indicators to their chart in order to help them reads the chart more clearly and to have guided help from them on what might be happening in the future. There are many indicators that trader can use to help them in their technical analysis. Each one of those indicators are unique, have their own ability to predict price movement and very helpful if the traders knows how to use them properly. Some indicators are usually attached to the chart below the price while other are usually attach directly to the price itself. If you enjoyed this write-up and you would certainly like to get additional information pertaining to ninjatrader risk reward indicator kindly browse through our own web site. Many traders uses more than three or even five indicators, while some of them uses only one indicator or none at all. It is just individual preferences really. Technical traders such as the scalp traders usually combine two or more indicators to help them predict price movement easily. Scalp traders always like to use indicators that are fast such as the Parabolic SAR, Moving Averages and Bollinger Bands. The combination between those three can bring good result for short term traders such as the scalp traders. Scalp traders are commonly using the small time frame such as 5 minutes and 1 minute chart. That is why they need fast indicators to help them make the best judgment from it. Swing traders and day traders are known for their use of lagging indicators. Lagging indicators are the indicators that always move by following the price action. This mean indicators are forming after the price has close. Such indicators are like Moving Average Convergence Divergence (MACD), the Slow Stochastic and Relative Strength Index (RSI) Lagging indicators are usually telling the traders about the possible price reversal that might be happening in near future. Overbought and oversold condition can also be recognized through them. For example, there are points on the Slow Stochastic that telling people whenever the indicator reach to some points, the overbought - oversold condition may apply. And when those conditions are applied, traders might want to be very careful if they are still having open position because price will probably out of gas to continue its move to the upside or to push even lower to the downside.

0 notes

Link

Master Technical Analysis, Candlesticks & Chart Patterns For Forex, Stock Trading, Options Trading & Fibonacci Trading

What you’ll learn

Master Technical Analysis Indicators, Oscillators, Chart Patterns & Candlestick Patterns With Real World Examples

Dedicated Support from the Course Instructors and the Learning Community. 100% Questions Answered Within 24 Hours!

How to Build a Strong Technical Analysis Foundation For Stock, Options, Forex & Crypto Trading

How to Read Stock Charts Effectively to Identify Market Trends

How to Perform Multiple Chart Time Frame Analysis

How to Use Support & Resistance For Determining Entry & Exit Points

How to Use Levels, Trend Lines, Channels to Determine Market Moves

How to Avoid Costly Trading Mistakes and Develop The Right Trader Mindset

How to Trade With Support & Resistance + Trade Setups

How to Trade With Fibonacci & Extensions + Trade Setups

How to Trade With Exponential Moving Averages + Trade Setups

How to Trade With Parabolic SAR + Trade Setups

How to Trade With MACD + Trade Setups

How to Trade With RSI + Trade Setups

How to Use Chart Patterns to Determine The Next Market Moves

How to Trade Wedges, Triangles and Pennants

How to Trade Double Top + Double Bottom

How to Trade Head and Shoulders + Cup and Handle

How to Trade Single Candlestick Patterns

How to Trade Double Candlestick Patterns

How to Trade Triple Candlestick Patterns

And a lot more…

Requirements

A FREE TradingView Account for Chart Analysis

Strong desire of Getting Rich and Retiring Early

Passion and Enthusiasm for Learning

Don’t Skip Any Lessons (All lessons are important!)

No Fundamental or Technical Knowledge required to take this course!

Everyone can Learn to Become Successful in the Stock Market!

Description

Attention Traders, Investors & Stock Market Lovers!

Finally You’ll Get All The Tools You Need To Consistently Grow Your Investment Portfolio Without Taking High Risks. Get Results Or Your Money Back!

The Complete Technical Analysis Trading Course is designed to bring you from knowing nothing about technical analysis to knowing just about everything on what it takes to become a highly profitable trader.

In this course, you will learn how to determine the next market directions as easy as counting 1… 2… 3… by using the most profitable technical indicators on earth.

You’ll master how to use dozens of technical indicators, oscillators, candlesticks and chart patterns so you can predict exactly what’s going on with the market you’re trading in.

This gives you a HUGE, unquestionable advantage from the beginning so you can generate daily and weekly returns at minimal risks.

What you’re going to learn in this course can be used for trading securities in any freely traded markets around the world. These include stocks, options, forex, cryptocurrencies, ETFs, and even bonds.

In this course, you will learn…

The Most Profitable Technical Analysis Indicators, Oscillators, Chart Patterns & Candlestick Patterns With Real World Examples

How to Read Stock Charts Effectively to Identify Market Trends

How to Perform Multiple Chart Time Frame Analysis

How to Use Support & Resistance For Determining Entry & Exit Points

How to Use Levels, Trend Lines, Channels to Determine Market Moves

How to Avoid Costly Trading Mistakes and Develop The Right Trader Mindset

How to Trade With Support & Resistance + Trade Setups

How to Trade With Fibonacci & Extensions + Trade Setups

How to Trade With Exponential Moving Averages + Trade Setups

How to Trade With Parabolic SAR + Trade Setups

How to Trade With MACD + Trade Setups

How to Trade With RSI + Trade Setups

How to Use Chart Patterns to Determine The Next Market Moves

How to Trade Wedges, Triangles and Pennants

How to Trade Double Top + Double Bottom

How to Trade Head and Shoulders + Cup and Handle

How to Trade Single Candlestick Patterns

How to Trade Double Candlestick Patterns

How to Trade Triple Candlestick Patterns

And a lot more…

What is more?

You will get a lifetime access to this course, without any limits!

The course will keep updating frequently, and of course all future updates are absolutely FREE if you enroll today!

Get dedicated support from the course Instructors and the learning community anytime you need!

You will also get a 30-DAY MONEY BACK GUARANTEE, so don’t hesitate to give yourself a chance to learn new things by just taking this course now!

So let me ask you this…

Will your investment portfolio grow much faster in the next 12 months after mastering these technical analysis techniques …

Do you have some money to invest?

Are you reasonably intelligent?

Does your family need extra care or support?

Are you willing to learn a new skill that guarantees you a second income for the rest of your life?

Would you like to work less and make more?

I will assume your answers are the same as mine…

Then You Have 2 Clear Choices

1. Keep doing things the way you have been and remain frustrated, lose money and simply get use to your average life…

or

2. Enroll in The Complete Technical Analysis Trading Course and start trading the smart way, quadruple your wealth and never worry about money ever again.

Now You Have a Big Chance to Upgrade Your Trading Skills

Listen, if you don’t get how important technical analysis is then don’t enroll in this program.

Keep shlepping away in the same manner you have been, maybe you’ll get a different result 🙂

In that case, you’re going to wake up 6 months from now, with everything still very much the same as it is today – don’t know how to trade, have no clue about what’s going on with your money, stress, feel frustrated… you know how it goes.

Is that you want for yourself?

No.

I don’t want that for you either… which is why I want you to do something right now. Sign up for this course, get all the tools you need, and start growing your investment portfolio today.

Simply click the Enroll Now button to get started now!

Who this course is for:

If you are serious about Making Money Online by investing in the Stock Market, this course is for you!

If you want to Create a New Source of Passive Income, you’ve come to the right place!

If you want to find a Trading Strategy that Actually Works, you should not ignore this course!

If you are learning about Technical Analysis, this course will be a Shortcut!

This course is for EVERYONE, who wants to Get Rich by Investing in the Stock Market.

Created by Wealthy Education Last updated 1/2019 English English [Auto-generated]

Size: 2.01 GB

Download Now

https://ift.tt/2I5bONQ.

The post The Complete Technical Analysis Trading Course (New 2019) appeared first on Free Course Lab.

0 notes

Link

How To Trade Cryptocurrencies

A couple of years ago, not many people knew about the existence of cryptocurrencies. Its rise has been sudden and taken the financial world by storm. Now Cryptocurrency trading occupies a market capitalization worth millions and millions of dollars.

With Bitcoin as the major crypto leader, the rise from 2009, to date keeps rising amid speculations that it will fall. Many people today are trading, mining and transferring crypto with much more ease than they did a couple of years ago.

There are different types of cryptocurrencies in the market today. One most common factor with the majority of them though is that their networks are built from a technology of blockchain.

This technology protects the currencies from being retroactively altered without the network consensus. Another thing majority of them have in common is that anyone can use them globally for payments, mining, speculations, purchases and other kinds of trading transactions.

All crypto is digital and to purchase them, you can use direct flat currencies. While they are versatile and have done a great deal to help people forge their trading aspects forward, not all can trade with IQ options.

Crypto Trading with IQ Options

An IQ option is a platform that offers the widest t range of cryptocurrencies as compared to other platforms like CEX and Coinbox. Some of the biggest names in the crypto world like Bitcoin, Litecoin, Ethereum, Dash, Ripple, and many others are some of those offered on IQ options.

The number of cryptocurrencies on the IQ options differs occasionally but as time goes by, the platform also sees the addition of more crypto. Besides being the widest platform for cryptocurrencies, IQ options also offer other trading for futures, which gives them a wider trading margin.

Countries in the East like Lebanon, Saudi Arabia, and the United Arab Emirates use IQ options as the top-rated crypto exchange.

Being a regulated broker, IQ Option makes it easy even for even the newest traders to make fast trading decisions. Using the platform enables traders to buy and deposit their choice of crypto using a MasterCard or visa without any form of verification for trades or transactions not exceeding $20,000.

For new investors looking for an effective way to invest small amounts of money, the platform offers secure wallets that allow them to store their cryptocurrencies or choose to withdraw the sane to their own wallets.

However, if you are trading one crypto like bitcoin, you can only trade in that currency. You cannot withdraw or deposit any other Cryptocurrency.

If you choose to trade larger amounts that the amount indicated, then you would need to buy a larger hardware wallet. Some of the hardware wallets that would best suit you are Trezor or Ledger Nano S.

IQ Option Details

For people trading for the first time with IQ options, you get to use a Demo account to take you through the trading procedures. The demo account uses a login and has no time limit requirement.

You can also reset your balance as often as required when using the demo account.

To start trading, the required minimum deposit is $10 and you can make a minimum trade of $1. The platform provides signal services and you can use your smartphone to trade on the platform via a mobile trading app.

The IQ platform interface makes trading even more enjoyable than many other platforms do because you can easily follow the charts easily. You can also do all your trading directly from the charts. The platforms displays no fewer than 9 charts all displayed at the same time showing different periods.

The platform also shows the actual opening and closing positions of all the trades and offers you an overview of your trading history and open positions. The interface also has a blog and a chat section where you can choose a broker to trade on your behalf if you want to.

The different charts to choose from are candle charts, bar charts, area charts and line charts, all the charts use patterns that give you a good guideline of the trading positions.

The platform also provides other graphical tools like Trend Lines, Fibonacci Lines, Trend Lines, Simple Lines and Horizontal Lines to help you along as you trade.

You also get 12 technical indicators that are optional to install. Some of the indicators are the Parabolic SAR, MACD, the MA, and the Stochastic Oscillator.

IQ Option Support

If you want to reach to the platform support, you can do so through a number of toll-free regional numbers offered. Traders can also email the CAO and CEO directly for any inquiries.

The IQ option headquarters is at Cyprus. Some of the countries where telephone support is available are Australia, India, Brazil, Germany, Spain and Thailand.

Pros of Trading Cryptocurrencies with IQ OptionsBelow are some of the pros of using the IQ option platform for trading cryptocurrencies.

The platform is very easy to use even for first-time traders

You can make deposits of up to $20,000 without the need for any verification

Gives you the option of using a MasterCard or visa

You can choose to trade high deposits

Comes with a demo account

You can trade it on your smartphone via the mobile trading app

Can buy a wide range of cryptocurrencies

Regulated broker

It is user-friendly

Great customer support

Extensive asset coverage

Cons

Strict to certain jurisdictions

Other Payment methods

Besides Visa and MasterCard, other payment methods you can use to trade on the platform are Neteller, Skrill, and through bank wire.

Wrapping It Up

For new time Cryptocurrency traders, the IQ Option is one of the best platforms to start your trading journey. With its easy use and user-friendly interface, you can be sure to follow your trading perfectly and make money while at it. The platform is fully regulated and no doubt one of the safest places to start investing your assets into.

The customer support is great in case you have any questions to ask and for anyone out to trade several instruments on a range of crypto pairs, you have the best platform with IQ Options. If you need a broker, you can also check out the blog and chat section to help you with the trading. Final word is, it is a great platform and you should go for it.

#How To Trade Cryptocurrencies#How To Start Trading#Bitcoin Trading Platform#Trading Benefits#Best Trading Platform For Beginners

0 notes

Text

Tips for Stock Market Investing

Are you looking to increase the quality of your life? If so, you have to think of becoming more wealthy & successful. Now, the question arises what best you could do for the accomplishment of your desired goal as quickly as possible? Well, most of the entrepreneurs would answer it as -"by investing in the stocks." Yes, you have heard it right! Investing in the stock market is one of the in-thing that has made the concept of earning money possible and even at a rapid pace. However, if you are new to the idea, you have to learn the methods of Stock Market Research. It would help you to take the right decision to make investments and avoiding unnecessary financial risk at the same time.

Here are some of the critical tips that should be followed by all the beginners.

1. Set Long-Term Goals

The primary tip to become a successful stock investor is to understand the fact that why you want to invest in the stock market. You should define the purpose of your investment - whether you are saving it for your retirement, home, or want to keep it all for securing the future of your beneficiaries.

If you have understood the purpose of making investments, you can set your long-term goals. Consider the case- where you would require the investment returned within a few years. Here you must not make the investments in stocks since there is always uncertainty associated with it.

The growth of your portfolio usually depends upon the three major interdependent factors:

How effective is your Stock Market Research The amount of capital you are going to invest Net annual earnings on your capital The total period of your investment Make savings as much as possible Receive the highest return possible

2. Try To Understand Your Risk Tolerance

Another tip we would like to share with you is the concept of risk tolerance. It is a genetically based, psychological trait that is deeply influenced by income, wealth, and education. If as in investor you try to increase these parameters, you would successfully increase the risk tolerance. It is basically the feeling of anxiety towards the risks & uncertainties associated with the stock market. All humans vary in their risk tolerance.

So, always try to make investments in the stocks, which will not steal your sleep & your peace of mind. If you have a poor fiscal condition, you should never ever make uncertain investments. Do your homework, go through Stock Market News, and then make any decision on investments. Decide on the fact of how much financial loss you may bear, without affecting your normal living style.

3. Handle Basics First

This tip may seem very basic to you. However, it is one of the most critical tips of all. Before you make any investment in the stock market, it is crucial that you should know all the basics about it. You must be aware of the terms like -

Return On Equity (ROE), Price To Earnings Ratio (P/E) Earnings Per Share (EPS) Compound Annual Growth Rate (CAGR)

Using these terms, you can calculate the values of stock you thinking to invest. You can only do the Stock Market Research if you are familiar with these terms.

You should also be aware of all the popular methods of selecting stocks, and for that understanding “fundamental” and “technical” analysis is a must.

Stock Charts Simple Moving Average (SMA) Moving Average Convergence and Divergence (MACD) Parabolic SAR Relative Strength Index (RSI)

Also, you should watch Stock Market News, stock market videos, read, and much more to be updated with other basic terminologies of the stock market. You should also know different stock market order types stop limit orders, trailing stop-loss orders, stop market orders, and so on.

Take Away

Now that you have understood the importance of doing stock market research and the top-3 tips for stock market investing, you might be looking for a reliable resource. If so, head toward Smart Money Gains, which is a leading digital publication dedicated to providing the latest financial and business news. We provide extensive stock market news, market updates, and macro coverage helps investors get an edge on the market and grow their wealth. To know more contact us now!

0 notes

Text

How To Combine The Best Indicators And Avoid Wrong Signals

When it comes to indicators, we can devide them into three classes:

momentum indicators

trend-following indicators

volatility indicators

Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. Not good!

Indicator redundancy – duplicate signals

Indicator redundancy means that a trader uses different indicators which belong to the same indicator class and then show the same information on a trader’s charts.

The screenshot below shows a chart with 3 momentum indicators (MACD, RSI and the Stochastic). Essentially, all 3 indicators provide the same information because they examine momentum in price behavior.

You can see that all indicators rise and fall simultaneously, turn together and also are flat during no-momentum periods (red boxes).

The next screenshot shows a chart with 2 trend indicators (the ADX and the Bollinger Bands). Again, the purpose of both indicators is the same: identifying trend strength.

You can see that during a trend, the Bollinger Bands move down and price moves close to the outer Bands. At the same time, the ADX is high and rising which also confirms a trend.

During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center. The ADX is flat or going down during ranges giving the same signal.

Overemphasizing information – fooling yourself

The problem with indicator redundancy is that when a trader picks multiple indicators which show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things.

A trader who uses 2 or more trend indicators might believe that the trend is stronger than it actually is because both of his indicators give him the green light and he might miss other important clues his charts provide.

Indicator categories

The following table arranges the most commonly used indicators by categories. Now, you can avoid using indicators that are from the same category and combine indicators from different categories that complement each other.

Momentum

Trend

Volatility

Chart studies

StochasticADXBollinger BandsHorizontal lines – range trading and breakouts

RSI

Moving averagesStandard deviationFibonaccis – retracements and pullbacksCCIATRFib extensions – trend following targetsWilliams %MACDKeltner ChannelTrendlines – trend following and breakoutMACDParabolic SAREnvelopesBollinger BandsIchimoku Cloud

Stacking the odds – combining the best indicators in a meaningful way

Now comes the interesting part.

The screenshot below shows a chart with three different indicators that support and complement each other. The RSI measures and identifies momentum plays, the ADX finds trends and the Bollinger Bands measure volatility. Note here that we do not use the Bollinger Bands as trend indicator but just for volatility.

We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand price much better.

Point 1: Prior to point 1, the ADX shows an ongoing trend and the RSI confirms the rising momentum. During that trend, support and resistance broke as long as the ADX kept above 30 and rising.

Point 2: The ADX has turned and shows losing (bullish) trend strength – an indication that the support level might not break. Price did not make it past the Bollinger Bands and bounced off the outer Band.

Point 3: At point 3, price is in a range and the ADX loses its validity – an ADX below 30 confirms range-environment. In a range, the RSI indicator can help identify turning points together with the Bollinger Bands.

Point 4: The same holds true for point 4 – the ADX is still below 30. In a range, the trader has to look for trendlines and rejections of the outer Bollinger Bands; the RSI shows turning momentum at range-boundaries.

Point 5: Point 5 shows a momentum divergence right at the trendline and resistance level, indicating a high likelihood of staying in that range. Again, price could not get outside the Bollinger Bands and the ADX is flat.

Example #2

The next chart shows that by combining a RSI with Bollinger Bands, you can get complimentary information as well.

The RSI provides momentum information: a low and falling RSI shows increasing downside momentum; an RSI around 50 signals a lack of momentum; a high and rising RSI shows strong bullish momentum.

The Bollinger Bands not only provide volatility information, but they also provide trend information: price between the middle and outer Bands shows a trending phase; price breaking the middle Band shows a potential reversal; and when price doesn’t reach the outer Band anymore, it shows fading trend support.

More is not always better – the right combination of tools is what matters

The perfect combination of indicators is not the one that always points into the same direction, but the one that shows complimentary information. Knowing which indicator to use under which circumstances is a very important part of trading.

Combining indicators that calculate different measurements based on the same price action, and then combining that information with your chart studies will very quickly have a positive effect on your trading.

Further reading: Indicator cheat sheet

Related Products & Courses

14 indicator strategies

Learn the best settings

Learn the best indicator combination

Step by step video course

Best entries with set targets and more

Many trade studies

Click to learn more: The 14 best indicator strategies

vimeo

Watch video in full size

Trend Rider indicator

A powerful indicator framework

For MetaTrader 4

How to find trends

Powerful entry signals

Step by step trade detection

Click to learn more: The Trend Rider indicator

vimeo

Watch video in full size

The post How To Combine The Best Indicators And Avoid Wrong Signals appeared first on Tradeciety Trading Academy.

How To Combine The Best Indicators And Avoid Wrong Signals published first on your-t1-blog-url

0 notes

Text

Parabolic Sar And Macd The Winning Way

Parabolic Sar And Macd is now becoming one of the very powerful & easiest ways to earn money on the internet. Having a deposit as little as ten dollars in your Forex account, you are able to begin earning a great deal of money very fast. Let’s face it, with an average daily turnover of about $1.3 trillion, the Forex market is an incredible spot to earn your fortune.|When a Dealer Believes the worth of Parabolic Sar And Macd out of A daily perspective versus that of the frenetic rate of compounding a range of pros and cons emerge, and one of them are adulthood, stress and time consumption. Making certain to know about who you are before trying to trade for a profit is extremely important, if you do not make this effort there is a good chance of fiscal losses. Mounting pressure and stress can cloud the mind as more and more transactions are created, so understanding what your limit it gets absolutely essential to success.}