#Hybrid Token Development

Explore tagged Tumblr posts

Text

In this blog, we help you explore what hybrid token development is all about and why it matters in the ever-evolving crypto landscape.

1 note

·

View note

Text

I think Airplane accidentally made the Heavenly Demons incestuous.

I think it was an accident not in the sense that Airplane wouldn't potentially do it on purpose, but that he just didn't think too hard about the elements he was smashing together in this aspect of the backstory, and it'd probably occur to him if he did think about it a bit more, but he didn't get there before he lost his notes. And then after that point he was selling out so even if he subsequently thought too hard about it, he wouldn't have brought it up because much like the thing with demons eating human flesh, Heavenly Demons being hugely inbred would probably not go over well with his majority readership.

But like. Bro created this bloodline of demons whose powers tend to breed true, and yet despite the fact that they've ostensibly lived among demonkind and even ruled them for generations, they've basically died out? Also despite being incredibly powerful? There are like three total left in the world, one of whom seems to be purely Heavenly Demon in terms of ancestry, the other two being 50/50 hybrids?

The only other Heavenly Demon we hear about is Zhuzhi Lang's mom, with an implication that her and Tianlang Jun's parents just had the two kids -- one boy and one girl. No info on where those parents came from either. No other Heavenly Demon branches or notable bloodlines that seem to exist or have recently died out.

Like I'm not saying there's DEFINITELY a Targaryen situation going on with the Heavenly Demons, but... there was definitely a Targaryen situation going on with the Heavenly Demons.

But again I do think this was accidental. It's the sort of thing that happens in people's fantasy world-building all the time. Airplane wasn't thinking about the implications, he was thinking about things like giving the protagonist a cool secret bloodline, making that bloodline both rare and powerful, and so on. Which wouldn't have mattered except that then this became part of an actual world, where things have to function and make sense as well as matching the token descriptions offered.

Mostly I don't think this would have much impact on the wider story except to let Tianlang Jun offer some inappropriate commentary on the whole shizunfucker situation. Like someone eventually makes a comment about it being kind of incestuous that Luo Binghe is with Shen Qingqiu and TLJ is just like, yeah funny thing about that actually.

Also this adds an interesting layer to TLJ and his sister's backstory. They were supposed to marry each other. Instead she ran off with a snake (literally) and he eventually hooked up with a human. Both of them tried to get so far away from the arranged incestuous sibling marriage that they developed a thing for interspecies romance instead.

#svsss#scum villain#scum villain's self saving system#incest mention#I mean there probably are other demons with HD ancestry#but it has to be far enough removed that they've lost the big flashy traits like the blood parasites#also past heavenly demons probably had a practice of killing each other a lot#not a lot of warmth between family members despite the shall we say atypical closeness of some#I also have a theory that TLJ's parents killed his sister and TLJ himself killed his parents immediately after#he had a very 'the bloodline ends with me' moment about it#until he found his nephew and then he was like 'the bloodline ends with this fun abomination that my parents would have hated'#that was going to be so cool but then xiyan got knocked up#silver lining: his parents would have also hated luo binghe

327 notes

·

View notes

Text

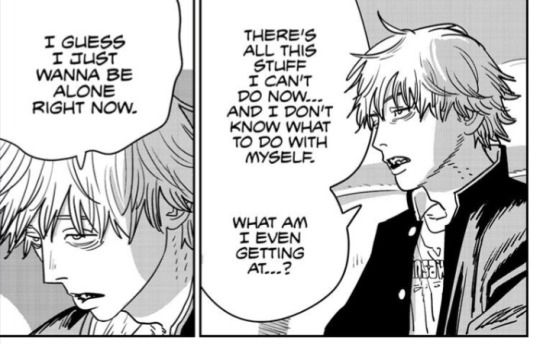

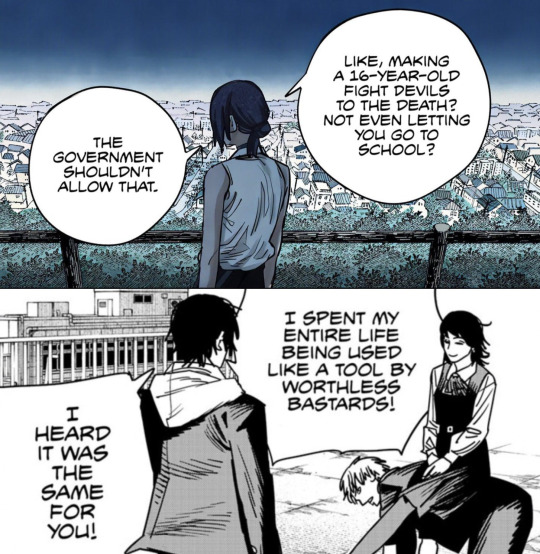

In the last few chapters I've noticing bits of similarities between some characters and the course of action with part 1 that, well, coming from the same author is kind of expected, but lately they've been more and more explicit and I can't help but think that maybe! there's an intention on mirrowing Denji's current development to part 1's while leading the plot toward the new "bomb girl" arc for part 2.

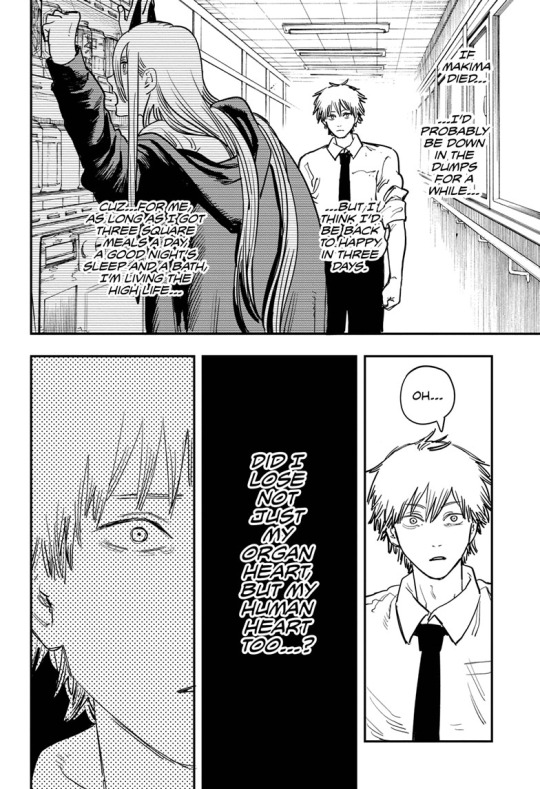

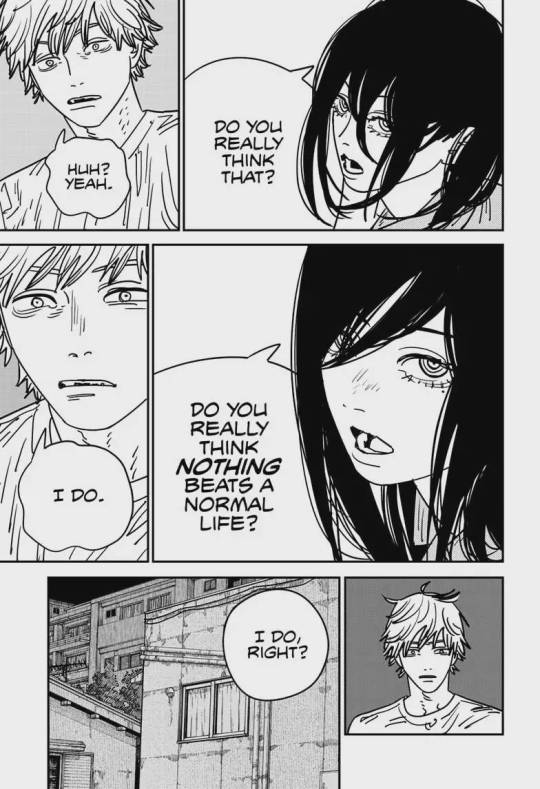

At first, Denji is introduced in the beggining of a new arc with an internal conflict about himself and/or his place in the world in the dichotomy of what he actually feels about his situation and what he SHOULD feel compared to someone else reaction: Aki's heartbreak for Himeno's death versus Denji's lack of empathy for the loss and the world living as it is in normalcy versus his discomformity about it. This opens a key question that will haunt Denji for the next chapters, looking for an answer capable of content him: "Do I still have a human heart?" and "Nothing beats a normal life?"

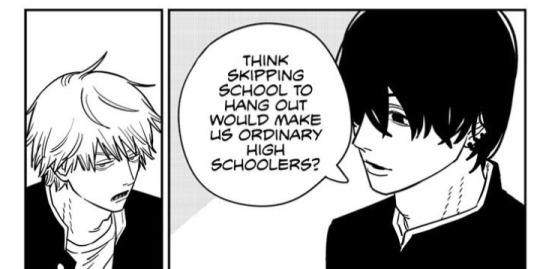

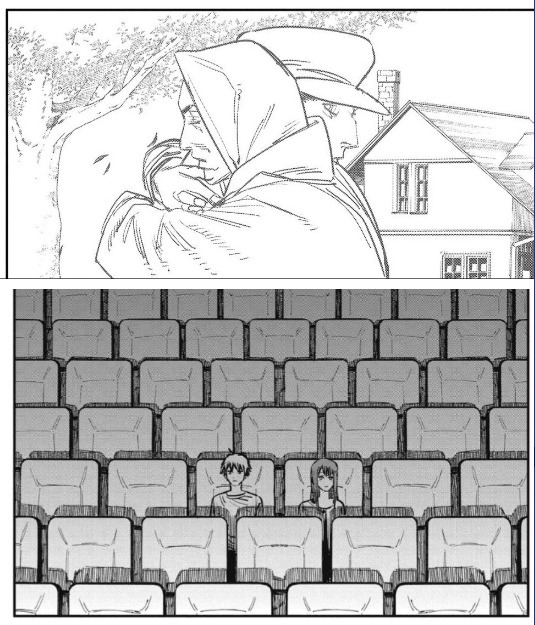

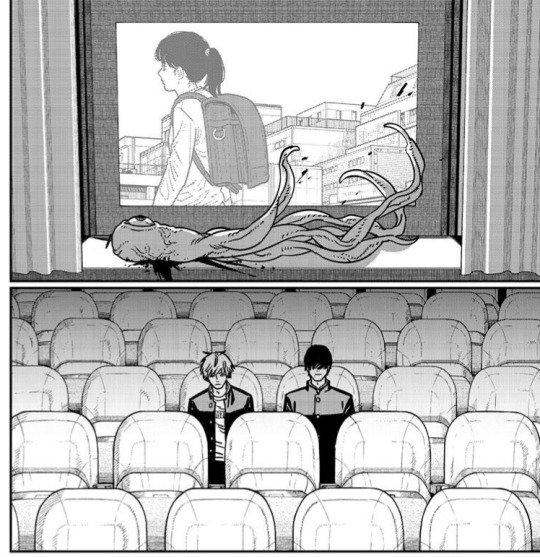

In the meantime and uncertainty, Denji is invited to hang out to a cinema date by a person who may are able to understand what afflicts him at the moment and so, influencing him:

In csm cinema is potrayed as a place of reflection and contemplation about life itself, and as Makima bringed on this concept, movies can change one's worldview. At the end of part 1 we discover that all the control devil wanted was to find an equal, to form genuine and equal relationships of mutual care like a family does; this by extention resonates with Denji because, even in his ineptitude to identify these kind of emotional issues due his lack of experience with other people and life in general, is what he wishes as well, connection, aceptance and companionship. This is why the last scene of the last movie touched both of them to the point of tears, as if the big screen did bring back to life and exposed before their eyes their most hidden desire.

On the other hand, one of the main goals Denji had was to achieve a normal life, pushing him foward since chapter 1 to secure it and do what he has missed of life or what he should be doing as a teen of his age. Such want seems not to be unique of Denji because Yoshida has also vocalized (when the oportunity is given) on wanting to know what normalcy is about, tagging along with Denji in multiple occasions, between classes, skipping classes, getting treats and coffee in their way, talking about girls, etc. Going to school, hanging out, a home to return to, good memories of childhood to look back, to have a lovely family and friends, I think is what both wish or wished to have, and so it's projected on screen in a familiar scenario, maybe a callback to the token of part 1 tragedies-accomplishment of this way of living, a little girl that could possibly be Nayuta with her schoolbag, heading to school?

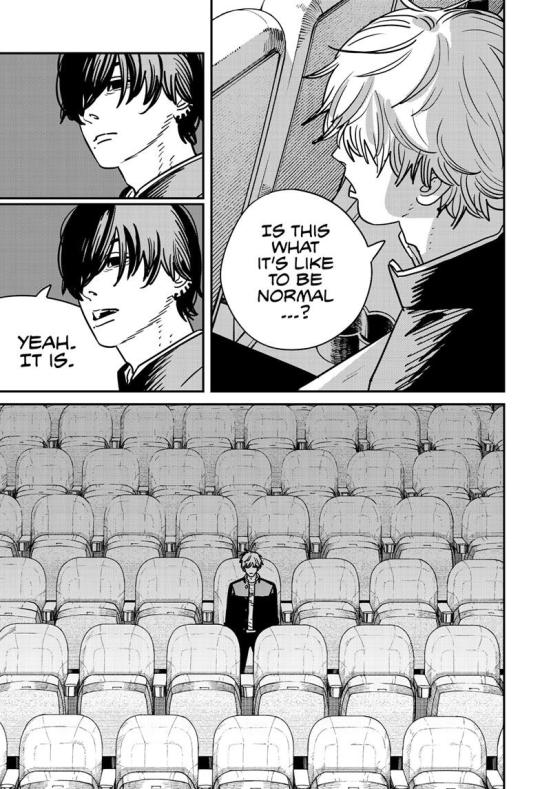

But, where the view was hindered by tears of catharsis, now it is by the corpse of a demon that spattered its blood on the screen. The answers were deliverated, but Denji stills comes to his seatmate for the final confirmation:

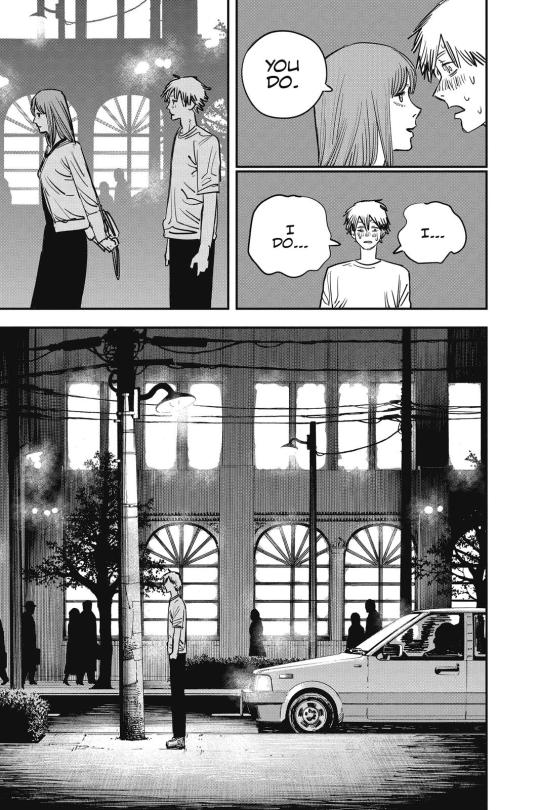

...to both of them leaving him alone behind in the realization of this induced epiphany. While with Makima it was a relief, that in fact he has a heart capable of love and care therefore capable of connecting with others, Yoshida leaves a sour taste in Denji's mouth. The normalcy that Denji dreamed of is not what he found; that reality also contemplates loneliness, boredom and disappointment too.

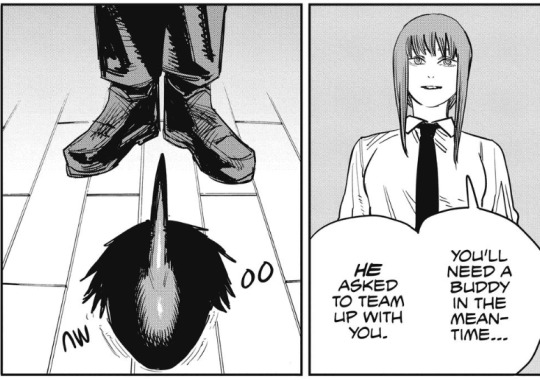

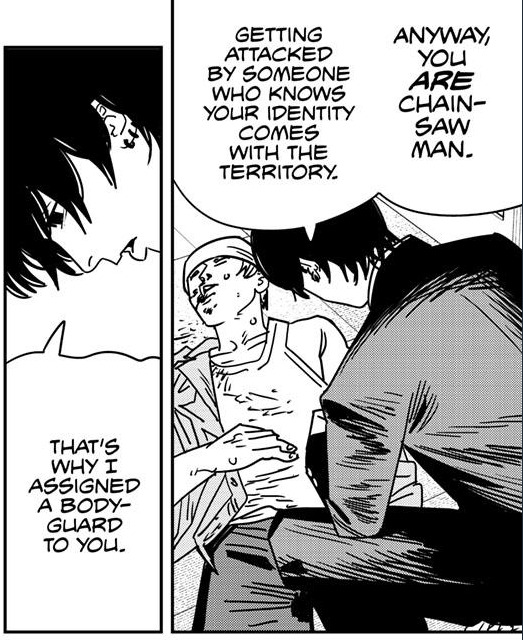

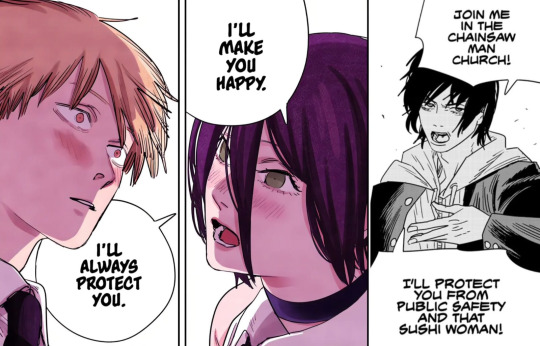

In other parallels that are worth notting are the assignation of a new bodyguard replacement for Denji by Makima and Yoshida to facilitate vigilance and security over him:

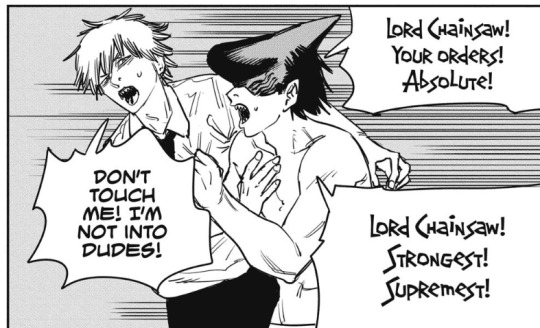

And, how Denji's reaction to this isn't that welcoming making him disappointed of their new partner even tho his bodyguards are, in fact, big fans of chainsaw man:

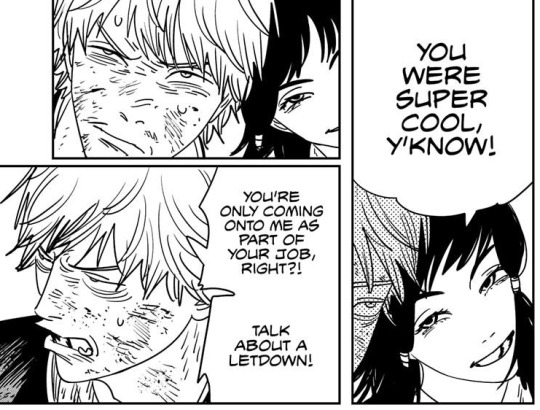

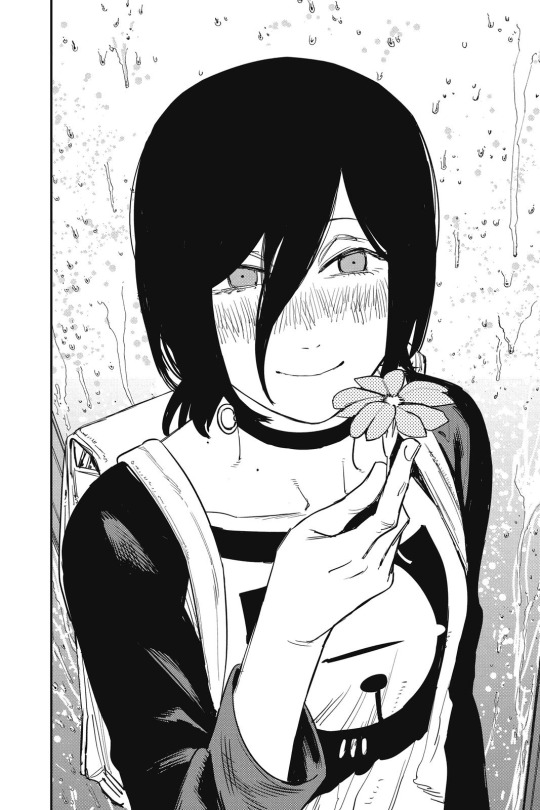

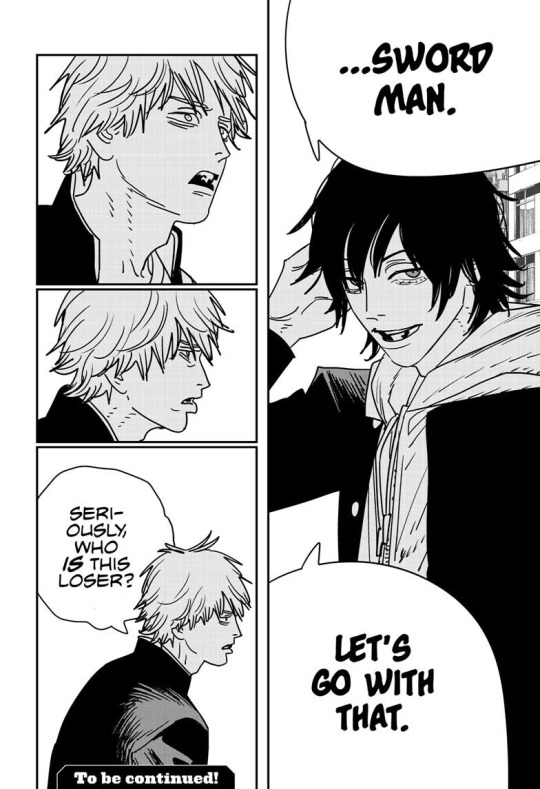

Culminating on, as for now, with the introduction of a "friendly" pretty face hybrid:

With all this I want to make it clear that I do not want to pretend or demostrate that Yoshida = Makima, that sword man will be Denji's new love interest or smth or even worse to compare Beam with Fumiko for have approached Denji without his consent, like, no. These characters are playing similar roles already potrayed by someone else in part 1 now with Denji in part two conserving their own traits and unique issues. I don't know if authors put this much thought on their writting to come up with these kind of things nonetheless I'm so excited how things will play out this time for Denji since, if we follow bomb girls course, Sword man appearance may not hold many good intentions for Denji, explaining why Yoshida assigned Fumiko to protect him in anticipation of this new enemy, just like Makima did against Reze.

EDIT:

hmmm🏴

#denji#makima#yoshida hirofumi#fumiko mifune#beam#miri sugo#sword man#reze#chainsaw man#chainsaw man spoilers#csm#csm spoilers#also. if hes alive so much reze can come back and literally making this the new bomb girl arc lol

91 notes

·

View notes

Note

(Sorry some of these are Deep. You don't have to answer em unless you feel comfortable)

1: 6 songs you listen to most

28: What is your biggest "what if"?

35: To you, what is the meaning of life?

62: What's your favorite animal?

63: What is your secret weapon to get someone to like you?

65: Give me your top 5 favorite blogs on Tumblr

73: You can only have one of these things; trust or love

76: In your opinion, what makes a great relationship?

89: What would be a question you'd be afraid to tell the truth on?

93: You can erase any horrible experience from your past. What would it be?

1: 6 songs you listen to most

in order from most to least:

Take Me Back To Eden by Sleep Token

Fall For Me by Sleep Token

Me Olha y Thiago Pantaleão

Cachaça by Nanasai

Euclid by Sleep Token

KLOuFRENS by Bad Bunny

35: To you, what is the meaning of life?

finding someone to love, putting down roots, enjoying what little time you have on this planet

62: What's your favorite animal?

at the end of the day, i really love dogs, always have, always will

i also came around extremely hard on cats, i used to not like them and its gotten to the point where im thinking of adopting a cat or two

also obligatory mention: hyenas, fascinating animals

63: What is your secret weapon to get someone to like you?

showing interest in their interests

its hard for me to be actually passionate about stuff, so it's often forced but i still like to learn about people (learning about people is one of my favourite things in life)

65: Give me your top 5 favorite blogs on Tumblr

hybrid-and-legacy, wuyi, lesbianneo, onewomancitadel, and dsmr-art also has a lot of banger posts for a terrible person like me /jk

73: You can only have one of these things; trust or love

trust 100%

love is meaningless without trust

76: In your opinion, what makes a great relationship?

skipping this one, absolutely no idea

89: What would be a question you'd be afraid to tell the truth on?

"are you still alive because you want to live or simply for other people's sakes?"

gonna group these two together because its the same thing

28: What is your biggest "what if"?

93: You can erase any horrible experience from your past. What would it be?

cw csa

so i was groomed and raped from age 6-9 and especially in the last two years ive dealt a lot with that reality and i keep coming back to the thought of "would it have meaningfully changed anything?" because frankly, i dont think it would have

i would have probably still gotten bullied for being an autistic and queer kid, would probably still have developed my mental health issues

but part of me still wants to undo it, not for myself, but for the little kid that suffered through it, you know?

2 notes

·

View notes

Text

DeepSeek-R1: A Technical Analysis and Market Impact Assessment The release of DeepSeek-R1 represents a watershed moment in artificial intelligence development, challenging the dominance of closed-source commercial models while demonstrating comparable or superior performance across key benchmarks. This analysis examines the technical architecture, performance metrics, market implications, and broader impact of this groundbreaking model. Technical Architecture and Innovation Foundation and Evolution DeepSeek-R1 builds upon the DeepSeek V3 mixture-of-experts architecture, representing a significant evolution from its predecessor, DeepSeek-R1-Zero. The model’s development path illustrates a sophisticated approach to combining multiple training methodologies, resulting in a system that rivals or exceeds the capabilities of leading commercial alternatives. Core Architectural Components Base Architecture: Leverages DeepSeek V3’s mixture-of-experts framework Training Pipeline: Implements a hybrid approach combining reinforcement learning with supervised fine-tuning Model Distillation: Successfully incorporates distilled versions of Llama and Qwen models Scaling Strategy: Employs dynamic resource allocation for optimal performance Training Methodology Innovation The training process represents a notable departure from traditional approaches, implementing a multi-stage pipeline that addresses common limitations in language model development: Initial Development Phase (R1-Zero) Pure reinforcement learning implementation Self-evolution through trial-and-error mechanisms Demonstrated significant performance improvements AIME 2024 score increased from 15.6% to 71.0% Enhanced Training Phase (R1) Integration of cold-start data for initial fine-tuning Reasoning-oriented reinforcement learning Implementation of rejection sampling for SFT data creation Incorporation of DeepSeek-V3’s supervised data Comprehensive prompt scenario training Performance Analysis Benchmark Comparisons DeepSeek-R1’s performance across standard benchmarks demonstrates its competitive positioning: Mathematics and Reasoning Benchmark DeepSeek-R1 OpenAI o1 Delta AIME 2024 79.8% 79.2% +0.6% MATH-500 97.3% 96.4% +0.9% MMLU 90.8% 91.8% -1.0% Programming Proficiency Codeforces Rating: 2,029 (96.3rd percentile) Exceeds human programmer average performance Comparable to OpenAI o1’s 96.6% benchmark Cost-Effectiveness Analysis The model’s pricing structure represents a significant market disruption: Token Pricing Comparison Token Type DeepSeek-R1 OpenAI o1 Cost Reduction Input $0.55/M $15/M 96.3% Output $2.19/M $60/M 96.3% Market Implications and Industry Impact Democratization of AI Technology The open-source release of DeepSeek-R1 under an MIT license represents a significant shift in AI accessibility: Academic and Research Impact Enables broader research participation Facilitates reproducibility …………

Read more ........

Cheapest Auto Insurance Oklahoma

4 notes

·

View notes

Text

Emerging Trends Shaping the Future of White-Label Crypto Exchange Development

The cryptocurrency market has seen exponential growth over the years, and as demand for seamless and feature-rich trading platforms rises, white-label crypto exchange development has become a game-changing solution for businesses. A white-label crypto exchange allows entrepreneurs to quickly launch a customizable trading platform, eliminating the need for extensive development time and resources.

As the crypto landscape evolves, so do the expectations for white-label solutions. In this blog, we’ll explore the future trends shaping white-label crypto exchange development, showcasing how businesses can stay competitive and meet the ever-changing demands of traders.

1. Increased Focus on Decentralized Exchange Features

Decentralized exchanges (DEXs) are becoming increasingly popular due to their security and transparency. As a result, many white-label solutions are integrating DEX functionalities into their offerings.

Key Trends:

Hybrid Models: Combining the security of DEXs with the liquidity of centralized exchanges (CEXs).

Non-Custodial Wallets: Allowing users to trade directly from their wallets without intermediaries.

Smart Contract Integration: Automating trading processes and enhancing security.

Why It Matters:

DEX-like features in white-label solutions cater to the growing demand for privacy and decentralization, attracting a broader user base.

2. Multi-Asset Support and Tokenization

With the rise of tokenized assets and diverse cryptocurrencies, future white-label exchanges will focus on supporting a wide range of assets.

What to Expect:

Support for tokenized stocks, commodities, and real estate.

Integration of emerging blockchain networks like Solana, Avalanche, and Polkadot.

Cross-chain compatibility for seamless trading across multiple blockchain ecosystems.

Impact:

Businesses that offer multi-asset trading options will attract institutional and retail investors seeking diverse investment opportunities.

3. Advanced Security Measures

Security remains a top concern in the crypto industry. Future white-label crypto exchanges will incorporate state-of-the-art security measures to protect user funds and data.

Innovative Security Features:

Multi-Signature Wallets: Ensuring transactions require multiple approvals.

Cold Storage Solutions: Safeguarding the majority of funds offline.

AI-Powered Fraud Detection: Identifying and mitigating suspicious activities in real-time.

End-to-End Encryption: Securing user data and communication.

Why It’s Important:

Enhanced security builds trust, which is crucial for attracting and retaining users in the competitive crypto exchange market.

4. Customizable User Experiences (UX/UI)

As competition grows, user experience (UX) will become a key differentiator. White-label exchanges will prioritize customizable and intuitive interfaces.

Future Developments in UX/UI:

Personalized Dashboards: Allowing users to customize their trading view.

Simplified Onboarding: Streamlining the KYC process for faster registration.

Mobile-First Design: Optimizing platforms for seamless use on smartphones.

Dark Mode and Accessibility Features: Catering to diverse user preferences.

Result:

User-friendly platforms enhance engagement and attract a wider audience, including beginners entering the crypto space.

5. Integration of DeFi Features

Decentralized finance (DeFi) is one of the fastest-growing sectors in the crypto industry. Future white-label solutions will integrate DeFi functionalities to meet user demands for innovative financial services.

Popular DeFi Features:

Staking and Yield Farming: Enabling users to earn passive income.

Lending and Borrowing: Providing decentralized financial services.

Liquidity Pools: Allowing users to earn rewards by providing liquidity.

Why It Matters:

Incorporating DeFi features enhances platform functionality and attracts users looking for diverse earning opportunities.

6. AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way crypto exchanges operate. Future white-label exchanges will harness these technologies for automation and efficiency.

AI-Powered Features:

Predictive Analytics: Helping users make data-driven trading decisions.

Automated Trading Bots: Enabling high-frequency and algorithmic trading.

Fraud Detection: Identifying suspicious activities and enhancing security.

Outcome:

AI integration improves platform performance and user satisfaction, giving businesses a competitive edge.

7. Compliance and Regulatory Readiness

With governments worldwide tightening regulations on cryptocurrencies, compliance will be a critical factor for future exchanges.

What to Expect:

Automated KYC/AML Processes: Using AI to verify user identities and prevent money laundering.

Transparent Reporting: Providing real-time audit trails for regulators.

Global Regulatory Support: Adapting platforms to comply with regional laws.

Impact:

Regulatory-compliant exchanges inspire confidence among users and attract institutional investors.

8. Gamification in Trading

Gamification is emerging as a strategy to enhance user engagement on trading platforms. Future white-label crypto exchanges will incorporate interactive elements to make trading more engaging.

Gamification Features:

Leaderboards: Highlighting top traders and rewarding performance.

Achievements and Badges: Encouraging users to reach milestones.

Demo Trading: Offering virtual trading environments for beginners.

Why It’s Effective:

Gamification boosts user retention and makes trading enjoyable, particularly for younger demographics.

9. White-Label NFT Marketplaces

The rise of non-fungible tokens (NFTs) has created new opportunities for crypto exchanges. White-label platforms will increasingly support NFT trading and minting.

Key Features:

NFT Minting Tools: Allowing users to create and sell digital assets.

Integrated Marketplaces: Enabling seamless buying and selling of NFTs.

Royalty Management: Automating creator royalties using smart contracts.

Impact:

Businesses that offer NFT capabilities can tap into a growing market and attract creators and collectors alike.

10. Scalability and Performance Optimization

As the user base for crypto exchanges grows, scalability and performance will remain top priorities for white-label solutions.

Enhancements:

Layer-2 Scaling: Using solutions like Polygon for faster and cheaper transactions.

Cloud-Based Infrastructure: Ensuring platform reliability during traffic spikes.

Low Latency Trading: Enabling high-speed transactions for professional traders.

Result:

Scalable platforms can handle larger user bases and higher trading volumes, ensuring a seamless experience for all users.

Why Partner with Professional White-Label Crypto Exchange Development Services?

To stay competitive in the evolving crypto market, partnering with an experienced white-label crypto exchange development company is essential.

Key Benefits:

Custom Solutions: Tailored platforms with unique branding and features.

Quick Launch: Faster time-to-market compared to building from scratch.

Security Integration: Advanced measures to safeguard user funds and data.

Ongoing Support: Regular updates and technical assistance to ensure smooth operations.

Conclusion

The future of white-label crypto exchange development lies in innovation, security, and user-centric features. From integrating DeFi functionalities to offering multi-asset support and gamification, the next generation of white-label solutions will empower businesses to thrive in the competitive crypto space.

By leveraging the latest trends and partnering with professional development services, businesses can launch cutting-edge platforms that attract users, drive engagement, and generate sustainable revenue.

Ready to build your own white-label crypto exchange? The future is now—embrace innovation!

#crypto exchange platform development company#crypto exchange development company#cryptocurrency exchange development service#crypto exchange platform development#white label crypto exchange development#cryptocurrencyexchange#cryptoexchange

3 notes

·

View notes

Text

ABQQ Reports FY 2024 Audited Financial Results, Introduces FY 2025 Outlook, Announces to Repurchase $5 Million of Shares by Year-End 2025

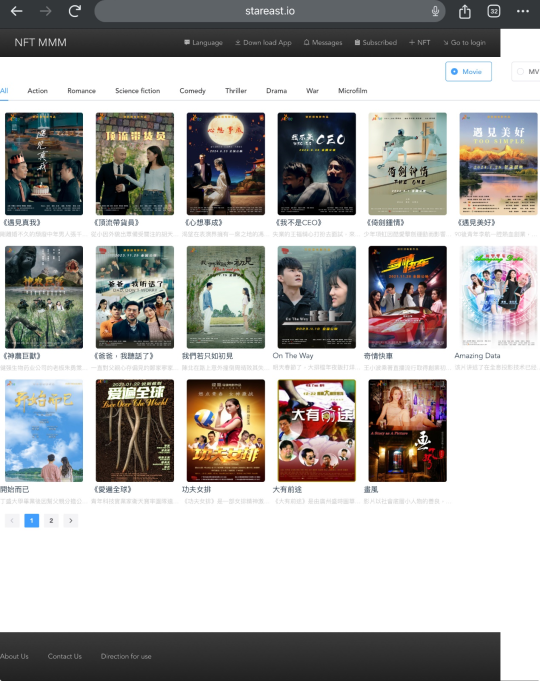

NEW YORK, Nov. 26, 2024 - PRISM MediaWire - AB International Group Corp. (OTC: ABQQ), an intellectual property (IP) and movie investment and licensing firm, announces financial and operating results for the year ended August 31, 2024. The audited financial results have been filed in a 10-K with the U.S. Securities and Exchange Commission (the "SEC"). The Company also provided its financial outlook for the fiscal year ending August 31, 2025.

“ABQQ achieved record results during fiscal year 2024, as we delivered revenue growth of 125% and reached profit net income $542,331, reflecting a continued dedication to maintain exceptional levels of profitability as our business scale. Movie License and NFT MMM IP License built up two of the most admired and well-positioned business in the marketplace, each with a robust innovation product pipeline designed to win with global consumers. Looking forward, our talented teams are highly motivated to continue driving towards the long-term opportunities of these iconic businesses.” - Chiyuan Deng, President and Chief Executive Officer.

Key Financial Highlights:

Revenues for the year ended August 31, 2024, increased 125% to $3,300,467, as compared to $1,473,222 for fiscal 2023.

Operating expenses were $2,813,563 for the year ended August 31, 2024, compared to $5,030,354 for fiscal 2023. We experienced a decrease in theatre operating costs in fiscal 2024 compared to fiscal 2023, mainly due to the decrease in admission revenues and the decrease in movie exhibition costs as a percentage of admission revenue.

We incurred a net income of $542,331 for the year ended August 31, 2024, as compared with a net loss of $3,566,710 for fiscal 2023.

As of August 31, 2024.Total Stockholders’ Equity $1,459,902, as compared to $890,988 in Fiscal 2023.

During fiscal year 2024, the Company repurchased approximately 285 million shares of its common stock for a total of $50,699 at a weighted average price paid per share of $0.00018.

Full Fiscal Year 2025 Outlook for the Twelve-Month Period Ending August 31, 2025

The Company's full fiscal year 2025 outlook is forward-looking in nature, reflecting our expectations as of November 26, 2024, and is subject to significant risks and uncertainties that limit our ability to accurately forecast results. This outlook assumes no meaningful changes to the Company's business prospects or risks and uncertainties identified by management that could impact future results, which include but are not limited to changes in economic conditions, including consumer confidence and discretionary spending, inflationary pressures, and foreign currency fluctuation; geopolitical tensions; and supply chain disruptions, constraints and related expenses.

Revenues are expected to increase approximately 150% to $8.25 million.

Gross margin is expected to be approximately 60.5%.

Diluted earnings per share are expected to be in the range of $0.001 to $0.002.

About AB International Group Corp.

AB International Group Corp. is an intellectual property (IP) and movie investment and licensing firm, focused on acquisitions and development of various intellectual property. We are engaged in acquisition and distribution of movies. The company owns the IP of the NFT movie and music marketplace (NFT MMM) as the unique entertainment industry Non-Fungible Token. The Company operates AB Cinemas, physical movie theaters currently in NY with plans to expand nationwide (www.abcinemasny.com). The company also owns ABQQ.TV which is a movie and TV show online streaming platform. ABQQ TV generates revenue through a hybrid subscription model and advertising model like other online streaming platforms.

For additional information, visit www.abqqs.com, www.abcinemasny.com, https://stareastnet.io/ and www.ABQQ.tv.

Forward-Looking Statements

This press release contains “forward-looking statements” that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements relating to changes to the Company’s management team and statements relating to the Company’s transformation, financial and operational performance including the acceleration of revenue and margins, and the Company’s overall strategy. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the possibility of business disruption, competitive uncertainties, and general economic and business conditions in AB International Group markets as well as the other risks detailed in company filings with the Securities and Exchange Commission. AB International Group undertakes no obligation to update any statements in this press release for changes that happen after the date of this release.

Investor Relations Contact:

Charles Tang (852) 2622 2891 [email protected]

Source: AB International Group Corp

#press release#prism mediawire#stock market#otc markets#otc#abqq#movie investments#IP#AB Cinemas#NFT

2 notes

·

View notes

Text

Exploring Multi-Sender Transactions: Importance on the Solana Blockchain

Understanding Multi-Sender Transactions

Multi-sender transactions on Solana represent a breakthrough in blockchain functionality, allowing multiple entities to initiate and execute transactions concurrently. Unlike traditional blockchain networks where transactions typically involve a single sender and recipient, Solana’s architecture supports simultaneous transaction submissions from multiple parties.

How Multi-Sender Transactions Work

Solana achieves this capability through its innovative consensus mechanism, combining Proof of History (PoH) with Tower BFT (Byzantine Fault Tolerance). This hybrid approach ensures high throughput and fast confirmation times, making it feasible for numerous senders to interact within a single transaction batch.

Practically, multi-sender transactions facilitate:

Collaborative Payments: Where multiple parties contribute to a single payment, streamlining processes like shared expenses, group purchases, or payroll distributions.

Decentralized Finance (DeFi): Enabling complex transactions such as liquidity provisioning across different pools or executing automated market-making strategies simultaneously.

Governance and Voting: Allowing decentralized autonomous organizations (DAOs) and governance platforms to conduct collective voting and decision-making efficiently.

Importance of Multi-Sender Transactions on Solana

1. Scalability and Efficiency

Solana’s scalability is a cornerstone of its multi-sender transaction capability. With the ability to process thousands of transactions per second, Solana supports high-frequency trading, gaming transactions, and other applications requiring rapid and efficient transaction processing.

2. Cost-Effectiveness

By consolidating multiple transactions into a single batch, multi-sender transactions reduce network congestion and transaction fees. This cost-effectiveness is critical for users and developers seeking to optimize operational costs while maintaining high throughput.

3. Enhanced User Experience

For end-users, multi-sender transactions enhance usability by minimizing transaction delays and simplifying complex interactions. Whether it’s participating in token sales, distributing rewards across multiple accounts, or executing cross-platform transactions, users benefit from streamlined processes and improved transaction management.

4. Innovative Use Cases

Developers leverage Solana’s multi-sender functionality to create innovative decentralized applications (dApps). These applications span various sectors, including supply chain management, digital asset management, and real-time data processing, thanks to Solana’s robust infrastructure and developer-friendly environment.

Implementing Multi-Sender Transactions

Developers can integrate multi-sender transactions into their applications using Solana’s comprehensive developer tools. Solana’s JavaScript SDK (SolanaWeb3.js), Rust programming language support, and Solana Command Line Interface (CLI) provide essential resources for building and deploying applications that harness multi-sender capabilities effectively.

Future Outlook and Potential Innovations

Looking ahead, Solana’s multi-sender transactions are poised to catalyze further advancements in blockchain technology. As scalability improves and interoperability expands, Solana remains at the forefront of blockchain innovation, enabling new use cases and fostering growth across decentralized finance, gaming, and digital economies.

Conclusion

Multi-sender transactions on the Solana blockchain represent a pivotal advancement, enhancing scalability, efficiency, and user experience in blockchain interactions. By enabling multiple parties to engage in simultaneous transactions, Solana empowers developers to create sophisticated decentralized applications and drives innovation in digital finance and beyond.

Embrace the potential of multi-sender transactions on Solana to unlock new opportunities and propel your journey into the decentralized future.

2 notes

·

View notes

Text

Trident Chain: Pioneering Modular Public Blockchain

The blockchain landscape is continuously evolving, and innovative projects like Trident Chain are leading the way. Trident Chain is a modular blockchain platform that combines the strengths of Proof of Work (POW) and Delegated Proof of Stake (DPOS) consensus mechanisms. In this article, we will delve into the unique features and advantages of Trident Chain, highlighting its potential to revolutionize the blockchain industry.

Understanding Trident Chain

At its core, Trident Chain aims to provide a highly scalable and secure blockchain infrastructure for diverse use cases. It achieves this through a modular architecture, offering flexibility and customization. Let's explore the two key components that distinguish Trident Chain: its hybrid consensus mechanism and modular design.

Hybrid POW+DPOS Consensus Mechanism

1. Proof of Work (POW) : Trident Chain incorporates the POW consensus mechanism, renowned for its security and decentralization. POW involves miners solving complex mathematical puzzles to validate transactions and add new blocks to the blockchain, ensuring network robustness and resistance to attacks.

2. Delegated Proof of Stake (DPOS) : On the other hand, DPOS introduces efficiency and scalability. It enables faster transaction processing by allowing token holders to vote for a select number of delegates responsible for block validation and network governance. This reduces energy consumption and enhances transaction throughput.

The integration of both POW and DPOS in Trident Chain achieves a balance between security and efficiency. While POW reinforces network security, DPOS optimizes transaction speed and resource utilization, making Trident Chain suitable for a wide range of applications.

Modular Design for Customization

Trident Chain's modular architecture empowers developers and businesses to tailor the blockchain network to their specific needs. Here are some key aspects of its modular design:

1. Interchangeable Modules : Trident Chain offers interchangeable modules that enable developers to select the functionalities they need for their blockchain application. This flexibility reduces development time and costs while ensuring the final product aligns precisely with the intended use case.

2. Smart Contract Compatibility : Trident Chain supports smart contracts, making it suitable for decentralized applications (DApps). Developers can build and deploy smart contracts using popular programming languages, opening the door to a wide range of DApp possibilities.

3. Scalability : With a modular architecture, Trident Chain can scale horizontally by adding or removing modules as needed. This scalability ensures the network can handle increased transaction volumes without compromising performance.

4. Governance Modules : Governance modules allow network participants to vote on protocol upgrades and changes, ensuring a decentralized decision-making process.

Conclusion

Trident Chain's modular architecture and hybrid POW+DPOS consensus mechanism position it as a promising player in the blockchain industry. Its versatility, security, and efficiency make it an excellent choice for a wide range of applications. As the blockchain space continues to evolve, Trident Chain stands out as a project with the potential to drive innovation and reshape how we interact with decentralized technologies. Whether you're a developer, a business, or an enthusiast, keeping an eye on Trident Chain's progress could lead to exciting opportunities in the world of blockchain.

2 notes

·

View notes

Text

Tokenization of Real-World Assets: How Blockchain is Reshaping Investment Opportunities

In recent years, blockchain technology has moved far beyond the realm of cryptocurrencies. One of the most promising applications in the financial sector is the tokenization of real-world assets (RWAs). From luxury real estate to fine art, commodities to private equity, asset tokenization is revolutionizing how investments are created, bought, sold, and traded.

As traditional finance collides with decentralized systems, a new wave of innovation is making investment more inclusive, transparent, and efficient. If you're a finance enthusiast, investor, or aspiring analyst, understanding this evolution is crucial—and so is building the right skill set through resources like the best Financial Modelling Course in Bengaluru.

What is Asset Tokenization?

Asset tokenization is the process of converting ownership rights in a physical or intangible asset into a digital token on a blockchain. These tokens represent a share of the underlying asset and can be traded just like cryptocurrencies.

For example:

A real estate property worth ₹10 crore can be tokenized into 1,000 digital tokens, each worth ₹1 lakh.

Investors can then buy, sell, or hold these tokens, effectively owning a fraction of the property.

This process introduces liquidity to otherwise illiquid assets and reduces barriers to entry for investors.

Why Tokenization Matters in 2025

Tokenization is gaining traction globally for several key reasons:

Fractional OwnershipHigh-value assets like real estate and fine art, traditionally limited to wealthy investors, can now be split into smaller, affordable units.

Improved LiquidityTokenized assets can be traded 24/7 on digital exchanges, enabling quicker and more efficient transactions.

Global Access to InvestmentsBlockchain eliminates geographic and financial barriers, allowing retail investors from anywhere to participate in global markets.

Enhanced Transparency and SecurityBlockchain's immutable ledger ensures secure, verifiable transactions and eliminates reliance on intermediaries.

Automation Through Smart ContractsTokenized systems can automate dividend payouts, revenue sharing, and asset transfers through pre-coded smart contracts.

Real-World Examples of Asset Tokenization

JPMorgan launched its Tokenized Collateral Network, using blockchain to transfer tokenized money market fund shares as collateral.

HSBC tokenized gold stored in its London vaults, allowing investors to own and trade digital representations of the physical metal.

BlackRock and Franklin Templeton have both issued tokenized mutual funds and treasury bonds on public blockchains.

Swiss bank UBS issued a $50 million tokenized bond on Ethereum, marking a shift in institutional finance.

These aren't experiments—they are foundational shifts in how finance operates.

Impact on Traditional Finance and Investment Banking

As tokenization becomes more mainstream, traditional financial institutions are beginning to adopt blockchain infrastructure to remain competitive. This includes:

Rethinking capital markets and how securities are issued.

Developing new products like tokenized ETFs and green bonds.

Building compliance frameworks for tokenized trading and settlement.

Investment banks, analysts, and portfolio managers must now understand both traditional finance and blockchain dynamics. This is why skill-building through specialized learning paths, such as the best Financial Modelling Course in Bengaluru, is more valuable than ever.

Career Opportunities in Tokenized Finance

As this market grows, so do career opportunities in:

Digital asset management

Blockchain-based investment banking

Tokenization advisory and structuring

DeFi risk analysis

Financial modelling for tokenized assets

Professionals need hybrid skills—deep financial understanding, data-driven modelling, and blockchain fluency. Financial modelling plays a crucial role in evaluating tokenized portfolios, understanding asset-backed securities, and forecasting ROI in digital ecosystems.

Courses that integrate blockchain finance with hands-on financial modelling—like the best Financial Modelling Course in Bengaluru—help prepare individuals for this cutting-edge space.

The Future of Investment is Tokenized

We’re at the start of a fundamental transformation in capital markets. Tokenization not only democratizes access but also streamlines investment processes. It enables real-time settlement, improves liquidity, and opens up opportunities that were previously inaccessible to many.

However, it's not without challenges. Regulatory uncertainty, interoperability issues between blockchain platforms, and cybersecurity risks remain key hurdles. But the momentum is undeniable, and financial professionals must prepare to adapt.

Final Thoughts

Asset tokenization is not a passing trend—it’s the future of global finance. As it reshapes how we invest and manage assets, finance professionals must evolve with it. Understanding blockchain applications, modelling tokenized assets, and analyzing new financial products will be essential.

If you're looking to stay ahead in this new financial era, consider enrolling in the best Financial Modelling Course in Bengaluru. It’s more than just spreadsheets—it’s your gateway to the next wave of digital finance innovation.

0 notes

Text

Future of AI Innovations: Secrets Behind the Next Tech Wave

As detailed in our previous exploration, AI in 2025: Transform Your Business or Risk Obsolescence, artificial intelligence (AI) is reshaping industries with breakthroughs like AMD’s MI400 and DeepMind’s ANCESTRA. Now, with the latest advancements as of June 20, 2025, this report dives deeper into the cutting-edge trends driving AI’s next wave. From revolutionary hardware to ethical frontiers, we uncover the innovations poised to redefine business and society, offering precise, actionable strategies to help you lead in this transformative era.

Latest AI Breakthroughs as of June 20, 2025

Hardware Leap: AMD’s MI405, launched June 19, boosts AI training efficiency by 50% over Nvidia’s H200, slashing costs and emissions (AMD MI405).

Autonomous AI: Anthropic’s Claude 4.2 introduces adaptive multi-agent orchestration, accelerating research 25x for complex workflows (Claude 4.2).

Creative AI: DeepMind’s ANCESTRA 3.0 generates real-time 12K holographic experiences, blending AI with spatial computing (ANCESTRA 3.0).

Education AI: OpenAI’s ChatGPT Edu Pro, with predictive learning paths, improves student outcomes by 20% but sparks autonomy debates (ChatGPT Edu Pro).

Safety Frontier: xAI’s Grok 3.3 exposes critical vulnerabilities in OpenAI’s o3-Pro, urging global safety protocols (Grok 3.3 Safety).

Healthcare AI: Google’s MedGemini 2.0 achieves 95% accuracy in diagnosing rare diseases, integrating multimodal patient data (MedGemini 2.0).

Hardware Revolution: AMD MI405 and the Compute Horizon

Launch: June 19, 2025

Details: AMD’s MI405, an evolution of the MI400, delivers 50% higher token-per-dollar efficiency than Nvidia’s H200, with 35% lower carbon emissions. Integrated with AMD’s Helios 3 rack system, it supports hyperscale AI training and aligns with a 30x energy efficiency goal by 2032. Its TensorCore 2.0 architecture optimizes for ternary-bit models, reducing compute demands by 20% (AMD MI405).

Impact: A SaaS provider cut AI inference costs by 40% ($100,000/month), enabling SMEs to scale generative AI. Quantum-AI hybrids, tested by IBM, promise 100x speedups by 2035.

Challenges: AMD’s ROCm 6.0 software lags Nvidia’s CUDA 12, requiring developer retraining. Chip supply chains face disruptions from U.S.-China trade restrictions.

1 note

·

View note

Text

Why Your Business Needs a Web3 Development Company in 2025

The internet is evolving at lightning speed—and businesses that adapt to change are the ones that thrive. Welcome to the world of Web3: the next generation of the internet built on decentralization, user empowerment, and blockchain technology. At the heart of this revolution lies the power of working with a forward-thinking web3 development company.

From transforming financial systems to creating secure digital identities, Web3 is poised to reshape industries. But this transformation isn’t just about adopting new tools—it’s about rethinking how applications are built, used, and trusted. That’s where expert development partners come in.

What Is Web3 and Why Does It Matter?

Web3 refers to the third generation of the internet, focused on decentralization and built using technologies like blockchain, smart contracts, and peer-to-peer networks. Unlike Web2, where data is controlled by centralized entities, Web3 returns control to users.

Key principles of Web3 include:

Decentralization

Trustless and permissionless architecture

Token-based economics

User ownership of data and digital assets

Whether you’re building decentralized apps (dApps), NFTs, DAOs, or blockchain-based SaaS platforms, a specialized web3 development company ensures your product is aligned with the latest technological standards and future-ready.

The Role of a Web3 Development Company

Web3 projects require deep expertise in multiple domains, from blockchain infrastructure to smart contract security. Here's how a top-tier development company contributes to your success:

1. Smart Contract Development

Smart contracts are self-executing programs that run on the blockchain. A web3-focused team writes, audits, and deploys secure smart contracts to support functions like payments, governance, or authentication.

2. dApp Design and Development

Building a dApp involves more than coding. It requires thoughtful design, seamless UX, and efficient integration with the blockchain. From wallets to DeFi protocols, experienced developers make it user-friendly and scalable.

3. Tokenomics and Blockchain Strategy

Launching a token-based product? A good partner will help design the economics, utility, and structure behind your tokens, ensuring long-term sustainability and user engagement.

4. Security and Audits

Web3 apps are frequently targeted by cyber threats. Security audits, penetration testing, and vulnerability assessments are essential services offered by a qualified development partner.

5. Cross-Chain and Interoperability Solutions

With so many blockchains in the ecosystem—Ethereum, Solana, Polygon, and more—your app needs to operate across networks. Web3 experts implement cross-chain bridges and APIs for seamless communication.

SaaS Meets Web3: A Powerful Combo

One of the most exciting trends today is the fusion of SaaS with Web3. Imagine subscription software that gives users actual ownership or software tools that reward usage through tokens.

This is where saas experts and blockchain engineers join forces to:

Build decentralized SaaS platforms

Integrate smart contract-based subscriptions

Enable tokenized access and incentives

Web3 adds a new layer of transparency and empowerment to the traditional SaaS model.

AI and Web3: Intelligent, Decentralized Innovation

The combination of AI product development with blockchain opens doors to next-gen digital experiences. From decentralized data marketplaces to intelligent decision-making on-chain, AI and Web3 are forming the backbone of futuristic systems.

Leading web3 development companies are exploring this intersection to:

Automate decisions through on-chain AI models

Protect data integrity using blockchain

Enable decentralized autonomous systems (DAOs) that learn and evolve

This hybrid model creates systems that are not just decentralized—but also smart and adaptive.

Hiring the Right Web3 Talent

Web3 is still a specialized field. If you’re aiming to build a secure, scalable, and meaningful product, it’s essential to hire developers who are trained specifically in Web3 technologies.

Qualities to look for:

Proficiency in Solidity, Rust, or Go

Understanding of blockchain architecture and consensus mechanisms

Hands-on experience with layer 1 and layer 2 chains

Experience in DeFi, NFT, or DAO platforms

Instead of hiring individuals, many companies choose to partner with a trusted web3 development company for faster delivery and strategic alignment.

Benefits of Choosing a Full-Service Web3 Partner

Collaborating with a full-service development company allows you to:

Get expert guidance from ideation to launch

Access ready-built modules and APIs

Ensure compliance, security, and scalability

Focus on business strategy while technical heavy lifting is handled for you

It’s more efficient, cost-effective, and secure.

Final Thoughts: Building the Future Starts Now

The world of Web3 is no longer just a concept—it’s a tangible shift in how we build, scale, and experience digital platforms. Whether you're a startup creating a DAO or an enterprise integrating blockchain into your workflow, success lies in execution.

And execution starts with partnering with the right people.

A trusted web3 development company offers you the technological muscle, strategic insight, and future-ready architecture you need to bring your vision to life—securely, efficiently, and at scale.

If you're ready to lead in the decentralized digital economy, now’s the time to act.

0 notes

Link

#AssetTokenization#BlockchainInteroperability#ComplianceAutomation#DeFiintegration#hybridfinance#institutionaladoption#regulatoryinnovation#RWAtokenization

0 notes

Text

How Will Fintech Software Evolve Over the Next 5 Years?

The fintech industry has already disrupted traditional financial systems with its innovative technologies and customer-centric solutions. Over the next five years, this evolution is set to accelerate as emerging technologies, changing regulations, and shifting consumer expectations reshape the financial landscape. As businesses and users demand more efficient, secure, and intelligent solutions, fintech software development will undergo significant transformation. The future of fintech services lies in adaptability, automation, and digital-first experiences.

Below are the key directions in which fintech software is likely to evolve in the next five years.

1. Hyper-Personalization Powered by AI

Artificial Intelligence (AI) and Machine Learning (ML) will play an increasingly central role in fintech software development. As consumers expect more tailored experiences, fintech platforms will integrate deeper AI capabilities to analyze user behavior and financial patterns. This will enable real-time, personalized financial advice, smarter credit risk assessments, and adaptive investment strategies. AI chatbots will also evolve to offer human-like interactions, improving customer service while reducing operational costs.

Fintech software will use predictive analytics to proactively offer services based on customer needs—whether it's suggesting investment opportunities, warning about overspending, or automatically switching between saving plans.

2. Embedded Finance Becoming the Norm

Over the next five years, embedded finance will become a standard feature in many non-financial platforms. Businesses across sectors—such as e-commerce, logistics, travel, and healthcare—will integrate fintech services like payments, lending, insurance, and digital wallets directly into their user experience.

Fintech software will need to become more modular and API-driven to support this shift. Developers will focus on creating plug-and-play financial components that can be integrated into any app or website with minimal effort. This trend will help fintech solutions reach new user segments and increase financial inclusion.

3. Rise of Decentralized Finance (DeFi) and Blockchain Integration

Blockchain technology, already a disruptive force, will become more deeply integrated into mainstream fintech software. Decentralized Finance (DeFi) platforms will continue to grow, offering transparent, peer-to-peer alternatives to traditional banking and investment services.

Over the next five years, we can expect broader use of smart contracts, tokenized assets, and decentralized identity verification. Fintech software development will need to prioritize security, transparency, and compliance while building DeFi features. Businesses will increasingly demand hybrid solutions that combine traditional finance with blockchain benefits.

4. Expansion of Real-Time Payment Systems

Speed and efficiency will be at the heart of future fintech evolution. Real-time payments, already gaining ground in many countries, will become a default standard. Users and businesses will expect instant fund transfers, immediate settlements, and real-time transaction tracking.

To accommodate this, fintech software will need to improve back-end processing, support multiple currencies, and enable 24/7 availability. These systems will also integrate advanced fraud detection tools to maintain security in high-speed environments.

5. Advanced Cybersecurity and Privacy-First Solutions

As fintech systems grow more complex and handle larger volumes of sensitive data, cybersecurity will remain a top concern. The next five years will see fintech software implementing AI-based security systems capable of detecting threats in real time. Biometric authentication, behavioral analytics, and blockchain-based identity management will become standard features.

Additionally, privacy-first frameworks will gain traction. Users will demand control over their data, and fintech platforms will need to comply with stringent data protection laws. Secure development practices and encryption will be deeply embedded in the fintech software lifecycle.

6. Growth of Cloud-Native and Low-Code Platforms

The demand for speed and flexibility in fintech software development will drive the adoption of cloud-native and low-code or no-code platforms. These technologies will allow businesses to build, test, and deploy fintech services faster and more cost-effectively.

Startups and enterprises alike will leverage cloud computing for scalability and resilience. Meanwhile, low-code platforms will empower non-developers to create fintech tools, opening innovation to a broader range of stakeholders.

7. Sustainability and Ethical Finance

Consumer awareness around sustainability is influencing all industries, and fintech is no exception. In the future, fintech software will support green finance features, such as carbon footprint calculators, sustainable investing options, and ESG (Environmental, Social, Governance) scoring.

Fintech services will evolve to help users and businesses make ethical financial decisions. Developers will integrate features that highlight environmental and social impact, promoting transparency and responsible financial behavior.

Conclusion

The next five years promise a period of rapid innovation and transformation for the fintech industry. As technologies like AI, blockchain, and real-time payments mature, they will redefine how fintech services are designed, deployed, and experienced. The future will demand more intelligent, secure, inclusive, and personalized solutions.

For businesses to remain competitive, embracing these trends in fintech software development is not optional—it is essential. Companies that can adapt to these changes will be well-positioned to lead the digital financial revolution.

Xettle Technologies, with its forward-thinking approach to fintech innovation, is already building solutions that reflect these future trends. By integrating advanced technologies and a customer-first mindset, they are helping shape the next generation of financial platforms.

As the industry continues to evolve, fintech software will become more agile, intelligent, and deeply embedded in our daily lives—marking a new era of smart, accessible, and responsible financial innovation.

0 notes

Text

How Crypto Exchange Development Services Are Transforming Digital Trading

In the ever-evolving digital economy, cryptocurrency trading has emerged as a revolutionary force, redefining the way assets are exchanged, stored, and valued. Central to this transformation is the rise of crypto exchange development services — specialized solutions designed to build secure, scalable, and feature-rich trading platforms. These services have not only enabled the growth of thousands of new exchanges worldwide but have also significantly enhanced the security, efficiency, and accessibility of digital trading.

This blog explores how crypto exchange development services are transforming the digital trading landscape and what it means for entrepreneurs, investors, and the global financial ecosystem.

The Foundation: What Are Crypto Exchange Development Services?

Crypto exchange development services refer to the end-to-end process of building digital platforms that facilitate the trading of cryptocurrencies like Bitcoin, Ethereum, and other tokens. These services typically include:

Custom exchange platform development (CEX/DEX/hybrid)

Integration of crypto wallets and payment gateways

Smart contract development and auditing

Liquidity management and order book systems

Security infrastructure (2FA, KYC, AML, encryption)

Admin dashboards and user interface design

Ongoing maintenance and upgrades

With these services, entrepreneurs and businesses can launch exchanges tailored to their target markets and business models without starting from scratch.

Enabling Decentralization and Financial Inclusion

One of the most profound impacts of crypto exchange development services is the democratization of financial access. In traditional finance, intermediaries like banks, brokers, and clearinghouses control access to markets. Crypto exchanges — especially decentralized ones (DEXs) — remove these middlemen, giving users direct control over their assets.

This decentralized architecture allows:

Unbanked populations to engage in digital finance using only internet-connected devices.

Lower fees and faster transactions by eliminating institutional overhead.

Peer-to-peer (P2P) trading models that foster trustless exchanges.

In this way, crypto exchange development is not just a technological advancement but a movement toward global financial inclusivity.

Customization and Innovation at Scale

Today’s trading environment demands tailored experiences. From institutional investors to casual traders, users seek platforms that meet their specific needs — whether it's low latency, mobile-first trading, NFT integrations, or staking features.

Crypto exchange developers respond to this need by offering highly customizable platforms. This includes:

White-label crypto exchange software for faster deployment

Cross-platform compatibility (web, Android, iOS)

Multi-currency and multi-language support

Advanced trading tools like AI-powered bots, charting libraries, and real-time analytics

DeFi integrations such as yield farming, lending, and liquidity pools

This scalability and adaptability are accelerating the spread of digital trading across industries and geographies.

Security as a Cornerstone

Security concerns have long plagued the crypto space. Hacks, scams, and data breaches have cost billions in losses. As a result, security has become a core component of modern crypto exchange development services.

Top-tier developers implement a multi-layered security strategy, including:

End-to-end encryption

Multi-signature wallets

Cold wallet storage for user funds

KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance tools

DDoS protection and regular penetration testing

Smart contract auditing to eliminate vulnerabilities

By embedding robust security from the start, developers foster trust and regulatory compliance — both essential for mainstream adoption.

Driving Liquidity and Market Depth

A thriving exchange needs liquidity — the ability to buy or sell assets without causing major price swings. Without liquidity, even the most well-designed platform can falter.

Crypto exchange development services often incorporate liquidity aggregation tools and market-making bots that automatically balance order books and attract volume. Some developers offer partnerships or integrations with global liquidity providers to help new exchanges hit the ground running.

Increased liquidity leads to:

Tighter spreads and more accurate pricing

Higher user retention and trading volume

Improved scalability and profitability for platform owners

Thus, liquidity management is not just a technical issue — it’s a critical success factor.

Regulatory Alignment and Compliance Support

As governments and financial authorities increase scrutiny on crypto operations, compliance has become non-negotiable. Crypto exchange development services now embed tools and workflows to help businesses stay ahead of regulatory requirements.

This includes:

Automated KYC/AML integrations

Geo-restriction systems for regulatory segmentation

Tax reporting and transaction auditing modules

Support for GDPR and data privacy protocols

By building compliance into the DNA of the exchange, developers help reduce legal risks and make exchanges more attractive to institutional players and regulators alike.

Speeding Up Time-to-Market

In the fast-moving world of crypto, time is money. A project that takes 12 months to launch may miss the market window entirely. To address this, many developers offer white-label crypto exchange solutions — pre-built platforms that can be customized, branded, and launched in a fraction of the time.

Benefits of white-label solutions include:

Faster deployment (as little as a few weeks)

Reduced development costs

Battle-tested performance and security

Ongoing technical support and upgrades

This has dramatically lowered the barrier to entry for startups, allowing more players to enter and compete in the digital trading arena.

Paving the Way for the Future of Finance

As blockchain and Web3 evolve, crypto exchange development services are integrating new trends and technologies:

AI and machine learning for predictive analytics and automated trading

Tokenization of real-world assets (stocks, real estate, art)

NFT trading platforms and marketplaces

Cross-chain bridges for asset interoperability

Modular architectures for DAO-based governance

These advancements are helping shape the next generation of financial infrastructure — open, programmable, and community-driven.

Final Thoughts

Crypto exchange development services are not merely about building trading platforms — they are about redefining how the world interacts with value. From empowering the unbanked to enabling new business models and promoting financial sovereignty, these services are at the heart of the blockchain revolution.

As crypto adoption continues to grow, the demand for sophisticated, secure, and scalable exchange platforms will only increase. Businesses and entrepreneurs looking to stake their claim in the digital economy would do well to understand the transformative potential of these services — and partner with the right development team to bring their vision to life.

In a digital age where control, access, and innovation matter more than ever, crypto exchange development services are building the bridges to the future of trading.

1 note

·

View note