#Immuno-Oncology Clinical Trials Market

Text

In the rapidly growing field of global Immuno-oncology Clinical Trials Market size was valued at USD 8.92 billion in 2023 and is projected to reach USD 28.33 billion by 2032, growing at a CAGR of 13.7% from 2023 to 2032 according to a new report by Nova One Advisor.

0 notes

Text

The global immuno-oncology clinical trials market size was valued at USD 8.30 billion in 2023 and is anticipated to reach around USD 35.37 billion by 2033, growing at a CAGR of 15.6% from 2024 to 2033. North America dominated the market and accounted for the largest revenue share of 54.0% in 2023.

0 notes

Text

The Global Immunocytokines Market Will Grow At Highest Pace Owing To Rising Demand For Targeted Cancer Therapies

The Global Immunocytokines Market consists of cytokine-based therapeutics that are linked or fused with monoclonal antibodies or ligands. Immunocytokines help deliver cytokines specifically to tumors by binding cytokine moieties like interleukin-2 (IL-2), interleukin-12 (IL-12), and tumor necrosis factor (TNF) to targeting moieties. This targeted delivery reduces systemic toxicity and increases drug efficacy. Immunocytokines have emerged as promising anti-cancer agents due to their ability to stimulate the patient's immune system against tumor cells.

The Global Immunocytokines Market is estimated to be valued at US$ 697 Mn in 2024 and is expected to exhibit a CAGR of 41.% over the forecast period 2024-2031.

Key Takeaways

Key players operating in the global immunocytokines are IOVance Biotherapeutics, Inc., Bluebird bio,Bellicum Pharmaceuticals, Inc.,Ionis Pharmaceuticals, Inc.,Juno Therapeutics, Inc. The key players are increasingly investing in research and development activities to develop more efficacious and targeted immunocytokines to expand their portfolio.

There is a growing demand for immunocytokines due to rising cancer prevalence across the world. According to WHO, cancer burden is expected to grow to 27.5 million new cases and 16.3 million cancer deaths by 2040. Immunocytokines offer targeted treatment options with less systematic toxicity.

Rising investments in research & development of advanced targeted immunotherapies has led to technological advancement in immunocytokine development. Next-generation immuno-oncology approaches like engineered cytokine receptors, immune checkpoints modulation, and chimeric antigen receptor T cell therapies are expanding the capabilities of immunocytokines.

Market Trends

Adoption of combination therapies- There is a growing trend of combining immunocytokines with other immunotherapies like checkpoint inhibitors, oncolytic viruses, cancer vaccines to achieve enhanced anti-tumor responses. This is expected to drive the immunocytokines market.

Focus on solid cancers- Major players are investing in clinical trials targeting solid cancers like melanoma, renal cell carcinoma, and pancreatic cancer in combination with other treatments. This will help immunocytokines penetrate newer oncology application areas.

Market Opportunities

Emerging economics- Developing countries in Asia Pacific and Latin America are expected to provide major opportunities owing to growing healthcare expenditure and increasing cancer incidence.

Next-gen molecular engineering- Further engineering of cytokines, ligands and targeting antibodies through molecular technologies may yield more efficacious immunocytokines with wider therapeutic windows. This can open new opportunities.

Impact Of COVID-19 On Global Immunocytokines Market Growth

The COVID-19 pandemic has significantly impacted the growth of the Global Immunocytokines Market. Several factors like lockdowns, restrictions on manufacturing and supply chain disruptions affected the market in the initial months of the pandemic. In the pre-COVID period, the market was growing at a steady pace owing to ongoing research and development activities in immuno-oncology. However, during the pandemic, clinical trials and new drug developments were halted or delayed. Research funding was also diverted to COVID-19 vaccine development. This negatively impacted the immunocytokines market growth in 2020 and 2021.

With vaccine rollout and easing of restrictions in 2022, the market is showing signs of revival. Manufacturers are resuming operations and clinical trials are restarting. The pandemic has also increased focus on immune-mediated therapies for cancer. This provides opportunities for immunocytokines to treat various cancers. Companies are investing more in R&D to develop safer and more effective immunocytokines. Governments across regions are supporting life science research with funding. The demand for immunotherapies is expected to rise in the post-COVID period as cancer treatments focus more on boosting patients' immune response. While short-term growth was impacted, immunocytokines are well-positioned to drive long-term market expansion.

Geographical Regions With Highest Immunocytokines Market Value

North America accounts for the largest share of the Global Immunocytokines Market in terms of value. This can be attributed to presence of major market players, rising cancer incidence and growing demand for personalized immunotherapies. The United States dominates the North American region due to robust research funding, approvals for novel immunotherapies and increasing adoption of immunocytokines in clinical settings.

Fastest Growing Region For Immunocytokines Market

Asia Pacific region is expected to witness the highest growth over the forecast period owing to rising healthcare investments, increasing disposable income, growing cancer burden and expanding biopharmaceutical industry. Presence of emerging economies like China and India providing low-cost manufacturing capabilities is supporting the development of novel immunotherapies including immunocytokines. Favorable government policies and initiatives are promoting life science R&D in the region.

Get more insights on this topic: https://www.trendingwebwire.com/global-immunocytokines-market-is-estimated-to-witness-high-growth-owing-to-advancements-in-cancer-immunotherapy/

Author Bio:

Alice Mutum is a seasoned senior content editor at Coherent Market Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights. (LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

What Are The Key Data Covered In This Global Immunocytokines Market Report?

:- Market CAGR throughout the predicted period

:- Comprehensive information on the aspects that will drive the Global Immunocytokines Market's growth between 2024 and 2031.

:- Accurate calculation of the size of the Global Immunocytokines Market and its contribution to the market, with emphasis on the parent market

:- Realistic forecasts of future trends and changes in consumer behaviour

:- Global Immunocytokines Market Industry Growth in North America, APAC, Europe, South America, the Middle East, and Africa

:- A complete examination of the market's competitive landscape, as well as extensive information on vendors

:- Detailed examination of the factors that will impede the expansion of Global Immunocytokines Market vendors

FAQ’s

Q.1 What are the main factors influencing the Global Immunocytokines Market?

Q.2 Which companies are the major sources in this industry?

Q.3 What are the market’s opportunities, risks, and general structure?

Q.4 Which of the top Global Immunocytokines Market companies compare in terms of sales, revenue, and prices?

Q.5 Which businesses serve as the Global Immunocytokines Market’s distributors, traders, and dealers?

Q.6 How are market types and applications and deals, revenue, and value explored?

Q.7 What does a business area’s assessment of agreements, income, and value implicate?

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it

#Global Immunocytokines Market Trend#Global Immunocytokines Market Size#Global Immunocytokines Market Information#Global Immunocytokines Market Analysis#Global Immunocytokines Market Demand

0 notes

Text

Ipilimumab Market by Platform, Type, Technology and End User Industry Statistics, Scope, Demand with Forecast 2034

Global Ipilimumab Market: A Growing Force in Cancer Immunotherapy

Ipilimumab Market under the brand name Yervoy, is a monoclonal antibody used in the treatment of various types of cancer. It works by blocking programmed cell death protein 1 (PD-1), a protein that helps cancer cells evade the immune system. Ipilimumab is often used in combination with other treatments, such as chemotherapy or other immune checkpoint inhibitors.

Request Free Sample PDF:https://wemarketresearch.com/reports/request-free-sample-pdf/lpilimumab-market/1500

Market Dynamics:

The global ipilimumab market is driven by several factors:

Increasing Prevalence of Cancers: The rising incidence of cancers worldwide, particularly melanoma, is a key driver of market growth.

Drug Efficacy: Ipilimumab has demonstrated significant efficacy in clinical trials, leading to increased adoption in treatment regimens.

Expanding Indications: Ongoing research is exploring the potential of ipilimumab for treating other cancer types, such as renal cell carcinoma and non-small cell lung cancer.

Competitive Landscape: While ipilimumab faces competition from other immune checkpoint inhibitors, its unique properties and clinical data have contributed to its market success.

Market Segmentation

The ipilimumab market can be segmented based on:

Cancer Type: Melanoma, renal cell carcinoma, non-small cell lung cancer, and other indications.

Treatment Stage: First-line, second-line, and third-line treatments.

Geography: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Market Challenges and Opportunities

High Drug Cost: The price of ipilimumab can be a significant barrier for patients and healthcare systems.

Reimbursement Challenges: Gaining insurance coverage for ipilimumab can be complex in some regions.

Emerging Competitors: The development of new immune checkpoint inhibitors and targeted therapies poses competition to ipilimumab.

Expanding Indications: The potential for ipilimumab to be approved for additional cancer types represents a significant growth opportunity.

Opportunities in the Ipilimumab Market

Expanding Indications: Ongoing research into new cancer indications provides ample opportunities for market expansion. Trials exploring the efficacy of ipilimumab in cancers like prostate cancer and other solid tumors could lead to new approvals and increased market potential.

Patient Access and Affordability: Efforts to improve patient access and reduce treatment costs could open new avenues for market growth. Innovations in pricing models, patient assistance programs, and insurance coverage can make ipilimumab more accessible to a broader patient population.

Biomarker Development: The development of biomarkers to identify patients who are most likely to benefit from ipilimumab treatment could enhance its clinical use and market adoption. Personalized medicine approaches can optimize treatment regimens and improve patient

Challenges Facing the Market

High Cost of Treatment: Ipilimumab, like many immunotherapies, is associated with a high cost. This can limit its accessibility and impact overall market growth. Addressing cost-related challenges and finding ways to make treatments more affordable is crucial.

Competitive Landscape: The immuno-oncology field is highly competitive, with numerous companies developing similar checkpoint inhibitors and combination therapies. Staying ahead in terms of innovation and clinical efficacy is essential for maintaining market position.

Adverse Effects and Tolerability: Managing the side effects of ipilimumab, which can include immune-related adverse events, remains a challenge. Ensuring that patients can tolerate the treatment while effectively managing these side effects is vital for sustained market success.

Competitive Strategies and Market Positioning

Strategic Partnerships: Collaborations between pharmaceutical companies, research institutions, and oncology centers are pivotal in advancing ipilimumab’s market reach. Strategic partnerships can lead to joint research efforts, shared resources, and enhanced market access.

Innovation and Differentiation: In a competitive Ipilimumab Market, differentiating ipilimumab from other immune checkpoint inhibitors is essential. Innovations such as novel drug formulations, improved delivery methods, or adjunctive therapies can enhance its appeal. Companies are also investing in next-generation immunotherapies to maintain a competitive edge.

Marketing and Education: Effective marketing strategies and educational initiatives play a key role in promoting ipilimumab. Awareness campaigns aimed at both healthcare professionals and patients can drive informed decision-making and increase adoption rates. Educational programs about the benefits, side effects, and management of ipilimumab are crucial for its successful integration into clinical practice.

Research and Clinical Advancements

Innovative Research: Cutting-edge research into the mechanisms of action of ipilimumab and its interactions with the immune system is advancing our understanding of its therapeutic potential. Research into biomarkers that predict response and resistance to ipilimumab can lead to more personalized treatment approaches and improved outcomes.

Combination Therapies: Ongoing clinical trials are exploring combinations of ipilimumab with other therapies, such as chemotherapy, radiotherapy, and targeted agents. These studies aim to enhance efficacy, reduce resistance, and improve patient outcomes. Positive results from these trials could expand the indications and Ipilimumab Market potential of ipilimumab.

Real-World Evidence: Collecting real-world evidence (RWE) is increasingly important in demonstrating the effectiveness of ipilimumab outside controlled clinical settings. RWE can provide insights into long-term outcomes, safety profiles, and patient experiences, supporting broader adoption and informed decision-making.

Future Outlook

The global ipilimumab market is expected to continue growing, driven by advancements in cancer research, expanding indications, and increased patient access. As the drug's efficacy is further established and reimbursement challenges are addressed, the market is poised for significant expansion.

The ipilimumab market is poised for continued growth, driven by advancements in cancer research, combination therapies, and expanding indications. While challenges such as cost and competition exist, the opportunities for innovation and patient access offer promising prospects. As the landscape of cancer treatment evolves, ipilimumab is likely to remain a key player in the immunotherapy arena, contributing to the ongoing quest for more effective and personalized cancer treatments.

Conclusion:

The ipilimumab market stands at a crossroads of significant potential and ongoing challenges. As a cornerstone of immuno-oncology, ipilimumab has already demonstrated its transformative impact on cancer treatment. However, its journey is far from complete, and the path forward involves navigating a landscape shaped by rapid advancements, regulatory complexities, and evolving patient needs.

0 notes

Text

Oncology Drugs Market Growth, Trends, Size, Share, Demand And Top Growing Companies 2031

In a landscape where the battle against cancer rages on, advancements in healthcare systems, public health measures, and novel pharmaceutical therapies have ushered in a new era of hope. According to the National Cancer Institute, the United States saw an estimated 1,806,590 new cancer cases and approximately 606,520 deaths due to the disease in 2020. However, over the past five decades, cancer survival rates have soared from 50% in 1970 to an impressive 70%, thanks to a trifecta of progress.

For more information: https://www.fairfieldmarketresearch.com/report/oncology-drugs-market

Unprecedented Growth Trajectory:

The global oncology therapy sales are forecasted to surpass US$ 300 billion by 2026, with oncology contributing 21.7% to total pharmaceutical sales. Fueling this growth are the top 10 pharmaceutical companies, which have declared oncology as their key focus area, driving multibillion-dollar M&A deals and strategic collaborations. Pfizer's acquisition of Array BioPharma for US$11 billion in 2019 and AbbVie's strategic partnership with Genmab for a bispecific antibody development deal worth US$3 billion are testament to this focus.

Diverse Indications Drive Demand:

While oncology represents over 20 different indications, a significant portion of revenue stems from just five of them: breast cancer, multiple myeloma, non-small-cell lung carcinoma (NSCLC), prostate cancer, and non-Hodgkin's lymphoma (NHL), which collectively accounted for approximately 65% of the market in 2020. Moreover, with breast, lung, and colorectal cancers expected to collectively account for ~50% of all new cancer diagnoses by 2026, the demand for innovative therapies continues to surge.

Disruptive Trends Reshape Landscape:

Innovation in oncology is accelerating, with disruptive technologies such as cell therapy, RNA therapy, viral vectors, and stem cell therapy gaining traction. Recent approvals of CAR-T cell therapies like Kymriah and Yescarta for acute lymphocytic leukemia (ALL) and diffuse large B-cell lymphoma (DLBCL) respectively signal a new frontier in cancer treatment. Precision medicine is also driving progress, with over 160 oncology biomarkers approved by 2019, paving the way for more targeted and effective therapies.

Impact of COVID-19:

Despite remarkable progress, oncology has been among the worst-hit therapeutic areas amid the COVID-19 pandemic. Decreased demand for physician-administered products, disruptions in cancer screenings, and a decline in new clinical trials have posed significant challenges. However, the industry remains resilient, adapting to the evolving landscape and ensuring continued innovation.

Immuno-Oncology Leads the Way:

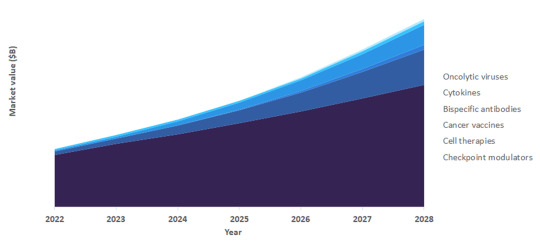

Immuno-oncology sales are expected to soar to ~US$ 95 billion by 2026, with agents and protein kinase inhibitors comprising ~65% of sales. With over 550 active cell- and gene-therapy agents under clinical development, the future of cancer treatment looks promising. Investments in combination studies and the exploration of new mechanisms underscore the industry's commitment to advancing immuno-oncology therapies.Roche and Keytruda: Leading the Charge:

In a highly concentrated market where the top 10 companies capture over 75% of the market value, F. Hoffmann-La Roche AG (Roche) and Merck & Co. stand out as leaders. While Roche maintains its global leadership position, Merck's Keytruda is poised to become the world's top-selling oncology

0 notes

Text

Innovations and Research in Oncology API Manufacturers in India

The fight against cancer is one of the most significant challenges in modern healthcare. Oncology, the branch of medicine dedicated to cancer treatment, relies heavily on Active Pharmaceutical Ingredients (APIs) to develop effective therapies. In India, a growing number of pharmaceutical companies are making remarkable strides in oncology API manufacturing, driving innovations and conducting groundbreaking research to develop more effective cancer treatments.

This article explores the innovations and research initiatives undertaken by oncology API manufacturers Indian, shedding light on their contributions to the global fight against cancer.

Cutting-Edge Innovations

Personalized Medicine: Indian oncology API manufacturers are at the forefront of the trend toward personalized cancer treatments. By utilizing advanced genomic and molecular techniques, they can develop APIs that target specific genetic mutations in patients' tumors. This precision medicine approach minimizes side effects and maximizes treatment effectiveness.

Biosimilars: The development of biosimilar APIs for cancer drugs has gained momentum in India. Biosimilars are highly similar versions of existing biologic medications, offering cost-effective alternatives for cancer patients. Indian manufacturers are investing in research to create biosimilar versions of essential oncology drugs, expanding access to treatment.

Immuno-Oncology APIs: The field of immuno-oncology has witnessed groundbreaking developments in recent years. Indian API manufacturers are actively engaged in the research and production of APIs that enhance the immune system's ability to target and destroy cancer cells. These innovations are changing the landscape of cancer therapy.

Nanotechnology in Drug Delivery: Nanotechnology is revolutionizing drug delivery, allowing APIs to target cancer cells more effectively while minimizing damage to healthy tissue. Indian researchers are exploring the potential of nanoscale drug carriers, known as nanomedicines, to improve the efficacy of oncology APIs.

Continuous Manufacturing: Continuous manufacturing processes are being adopted by Indian oncology API manufacturers, offering advantages in terms of cost efficiency and quality control. This innovation streamlines production and ensures a more consistent supply of essential cancer medications.

Research Initiatives

Clinical Trials and Drug Development: Indian pharmaceutical companies are actively involved in clinical trials for novel oncology APIs. These trials are essential for evaluating the safety and efficacy of new drugs and bringing them to market faster.

Collaborations with Global Partners: Indian oncology API manufacturers are collaborating with international pharmaceutical companies and research institutions to pool resources and expertise. These collaborations accelerate research and development efforts.

Targeted Therapies: Research efforts in India are focused on identifying new molecular targets for cancer therapies. This research can lead to the development of innovative APIs that specifically target cancer cells, improving treatment outcomes.

Drug Formulation and Delivery: Beyond APIs, Indian researchers are working on novel drug formulations and delivery systems. These innovations enhance drug stability, patient compliance, and treatment effectiveness.

Drug Resistance Studies: Understanding mechanisms of drug resistance in cancer is crucial for improving treatment outcomes. Indian researchers are conducting studies to decipher these mechanisms and develop APIs that can overcome drug resistance.

Challenges and Opportunities

While Indian oncology API manufacturers have made significant strides in innovations and research, they face challenges such as regulatory compliance, the need for substantial investment in research and development, and the global competition. However, several opportunities exist:

Global Demand: The global demand for affordable and high-quality cancer medications is on the rise. Indian manufacturers can tap into this growing market by producing innovative APIs and biosimilars.

Government Support: The Indian government has been supportive of the pharmaceutical industry. Incentives and policy initiatives encourage research and development, making it an attractive environment for API manufacturers.

Skilled Workforce: India boasts a highly skilled workforce in the pharmaceutical and healthcare sectors. This talent pool is a valuable asset for driving innovations and research.

Conclusion

Indian oncology API manufacturers are making significant contributions to the global fight against cancer through innovations and research. Their commitment to developing personalized medicines, biosimilars, immuno-oncology therapies, and more demonstrates their dedication to improving cancer treatment outcomes.

While challenges exist, the opportunities for growth and advancement in this critical field are substantial. As Indian companies continue to invest in research and development, the future of oncology API manufacturing in India looks promising, bringing hope to cancer patients worldwide.

0 notes

Text

India Immuno-Oncology Drugs Market Is Estimated To Witness High Growth Owing To Increasing Adoption of Immunotherapy

The India Immuno-Oncology Drugs Market is estimated to be valued at US$265 Mn in 2022 and is expected to exhibit a CAGR of 13.1% over the forecast period of 2021-2028, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

The India Immuno-Oncology Drugs Market refers to the use of immunotherapy drugs for the treatment of various types of cancer. These drugs work by stimulating the body's immune system to recognize and attack cancer cells. The market is driven by the increasing adoption of immunotherapy drugs due to their effectiveness in treating cancer, especially in advanced stages. Immuno-oncology drugs offer advantages such as targeted therapy, reduced side effects compared to traditional chemotherapy, and improved survival rates. The need for these products arises from the growing prevalence of cancer in India and the need for more effective treatment options.

Market Key Trends:

One key trend in the India Immuno-Oncology Drugs Market is the development of combination therapies. Researchers and pharmaceutical companies are exploring the potential of combining immunotherapy drugs with other treatment modalities, such as chemotherapy or targeted therapy, to enhance their efficacy. For example, the combination of immune checkpoint inhibitors with chemotherapy has shown promising results in clinical trials for various types of cancers. This trend is driven by the need for more effective treatment options and the desire to improve patient outcomes.

PEST Analysis:

Political: The political factors impacting the India Immuno-Oncology Drugs Market include government regulations and policies related to drug approvals, pricing, and reimbursement. The regulatory framework plays a crucial role in determining the accessibility and affordability of these drugs.

Economic: Economic factors influencing the market include healthcare expenditure, insurance coverage, and affordability of immunotherapy drugs. The economic viability of these drugs is an important consideration for patients and healthcare providers.

Social: Social factors such as awareness about cancer and its treatment options, patient preferences, and cultural beliefs impact the adoption of immunotherapy drugs. Education campaigns and initiatives to raise awareness about cancer care can drive market growth.

Technological: Technological advancements in the field of immuno-oncology, such as the development of novel biomarkers and diagnostic tools, are driving the market. The integration of artificial intelligence and machine learning in cancer research and drug development also presents opportunities for market growth.

Key Takeaways:

1: The India Immuno-Oncology Drugs Market Demand is expected to witness high growth, exhibiting a CAGR of 13.1% over the forecast period. This growth is attributed to increasing adoption of immunotherapy in cancer treatment, driven by its effectiveness and advantages over traditional chemotherapy.

2: The fastest growing and dominating region in the India Immuno-Oncology Drugs Market is India due to the high prevalence of cancer and improving healthcare infrastructure. The country has a large patient population seeking advanced treatment options.

3: Key players operating in the India Immuno-Oncology Drugs Market include Amgen Inc., AstraZeneca Plc, Bristol-Myers Squibb, Celgene Corporation, Eli Lilly and Company, Merck & Co., F. Hoffmann-La Roche AG, Johnson & Johnson, Novartis International AG, and AbbVie Inc. These companies invest heavily in research and development to bring innovative immunotherapy drugs to the market.

In conclusion, the India Immuno-Oncology Drugs Market is poised to experience significant growth due to the increasing adoption of immunotherapy for cancer treatment. The development of combination therapies, along with favorable political, economic, social, and technological factors, further contribute to market expansion. Key players play a crucial role in driving innovation and bringing advanced therapies to cancer patients in India and globally.

#Immuno-Oncology Drugs Market#Immuno-Oncology Drugs Market Demand#Immuno-Oncology Drugs Market Insights#Immuno-Oncology Drugs Market Outlook#Immuno-Oncology Drugs Market Value#Immuno-Oncology Drugs Market Share#Immuno-Oncology Drugs Market Forecast#chemotherapy#antibodies#personalized medicine#cancer treatments#Cancer

0 notes

Text

0 notes

Text

Immuno Oncology Market: Empowering the Body to Fight Cancer

Introduction:

The field of cancer treatment has witnessed groundbreaking advancements over the years. Among these, Immuno Oncology (IO) Market has emerged as a revolutionary approach to combat cancer. This article delves into the realm of Immuno Oncology, exploring its mechanisms, current market players, trends, growth potential, challenges, regulatory landscape, and future prospects.

Understanding Immuno Oncology:

What is Immuno Oncology?

Immuno Oncology, also known as immunotherapy, is a specialized branch of cancer treatment that harnesses the body's immune system to recognize and attack cancer cells. Unlike traditional treatments like chemotherapy and radiation, IO stimulates the patient's immune response, helping it identify and eliminate cancer cells more effectively.

How does Immuno Oncology work?

IO treatments utilize various techniques to bolster the immune system. One of the key approaches involves using checkpoint inhibitors, which inhibit specific proteins that restrain the immune system, thereby allowing it to target cancer cells more efficiently.

The role of the immune system in cancer treatment:

The immune system plays a vital role in recognizing abnormal cells, including cancerous ones. However, cancer cells can develop strategies to evade the immune system. IO works to reverse this evasion, enabling the immune system to recognize and destroy cancer cells.

Key Players in the Immuno Oncology Market:

Pharmaceutical Companies:

Leading pharmaceutical companies have invested significantly in IO research and development. They are actively engaged in clinical trials and launching innovative IO therapies.

Biotechnology Firms:

Biotech companies are at the forefront of developing novel IO treatments. Their agility and focus on cutting-edge research have led to several promising advancements.

Research Institutions:

Academic and research institutions also play a crucial role in IO research. They contribute valuable insights and collaborate with industry players to drive progress.

Current Trends and Advancements:

Checkpoint Inhibitors:

Checkpoint inhibitors have revolutionized cancer treatment. They target specific proteins like PD-1 and CTLA-4, enhancing the immune system's ability to attack cancer cells.

CAR-T Cell Therapy:

CAR-T cell therapy involves modifying a patient's T-cells to express chimeric antigen receptors (CARs), enabling them to recognize and destroy cancer cells more effectively.

Cancer Vaccines:

Cancer vaccines are designed to stimulate the immune system to recognize and remember cancer cells, aiding in their elimination.

Adoptive Cell Transfer:

Adoptive cell transfer involves extracting, modifying, and reinfusing a patient's T-cells to boost their cancer-fighting capabilities.

Market Size and Growth Potential:

Global Immuno Oncology Market Size:

The IO market has experienced rapid growth in recent years, and it is projected to continue expanding at a substantial rate.

Factors driving market growth:

Increasing cancer prevalence, rising demand for effective and targeted therapies, and supportive government initiatives are fueling the growth of the IO market.

Future projections:

The IO market is poised for further growth, with ongoing research and development paving the way for groundbreaking treatments.

Challenges and Opportunities:

Managing Side Effects:

While IO treatments offer promising results, they can also cause immune-related side effects that need careful management.

Patient Access and Affordability:

Ensuring broad patient access to IO therapies and addressing cost concerns remain critical challenges.

Emerging Markets:

IO presents significant opportunities in emerging markets, where there is a rising demand for advanced cancer treatments.

Regulatory Landscape:

FDA Approval Process:

IO therapies undergo rigorous evaluation by regulatory authorities like the FDA to ensure safety and efficacy before approval.

Compliance and Safety:

Continuous monitoring of IO treatments is crucial to identify and address potential safety concerns.

International Regulations:

The IO market is subject to varying regulations across different countries, necessitating compliance with diverse standards.

Collaborations and Partnerships:

Industry-Academia Collaborations:

Collaborations between pharmaceutical companies and academic institutions foster innovation and knowledge exchange.

Cross-Industry Partnerships:

Partnerships between different industries can lead to innovative IO solutions and improved patient outcomes.

Future Outlook:

Innovations on the horizon:

Ongoing research holds the promise of introducing novel IO therapies with even higher efficacy.

Potential breakthroughs:

Combination therapies, personalized medicine, and targeting rare cancers are some areas that hold potential for significant breakthroughs.

Conclusion:

The Immuno Oncology market represents a transformative era in cancer treatment, where the body's own defense mechanisms are harnessed to fight the disease. With continuous advancements, collaborations, and regulatory support, the IO market is poised to offer new hope to cancer patients worldwide.

For more insights on the immuno-oncology market forecast, download a free report sample

0 notes

Text

Immuno-oncology Clinical Trials Market Worth $15.1 Billion By 2028

The global immuno-oncology clinical trials market size is expected to reach USD 15.1 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 13.6% from 2021 to 2028. The rapidly growing field of Immuno-oncology has emerged as a novel therapeutic area within the oncology ecosystem, transforming the treatment of cancer.

From 2014 to…

View On WordPress

0 notes

Text

0 notes

Text

The global immuno-oncology clinical trials market size was exhibited at USD 7.85 billion in 2022 and it is expected to hit around USD 28.33 billion by 2032, growing at a CAGR of 13.7% during the forecast period from 2023 to 2032.

0 notes

Text

Using its unique expanded genetic code technology platform, Ambrx Biopharma Inc.(AMAM stock) , a clinical-stage biologics firm, discovers and creates tailored precision biologics. Its lead product candidate, ARX788, is an anti-HER2-drug conjugate (ADC) that is being studied in numerous clinical trials to treat of breast cancer, stomach junction cancer, as well as other solid tumors. These trials, which are currently in Phase 2 and Phase 3, are also being conducted for the treatment of gastric and breast cancers that have metastasized and are HER2-positive.

The company is also working on two earlier-stage product candidates: ARX305, an anti-CD70 ADC in investigational new chemical studies for the treatment of kidney cell carcinoma and other cancers. And ARX517, an anti-PSMA ADC in a Phase 1 clinical trial for the therapy of prostate cancer and other tumors.

It is also creating additional multiple product candidates with an eye toward immuno-oncology applications, such as ARX102, an immuno-oncology IL-2 path agonist that targets and gamma receptors on cytotoxic T cells to activate the patient's own immune system, and ARX822, a fab-small macromolecular bispecific that is used in preclinical phase for cancers. Bristol Myers Squibb Company, AbbVie Inc., BeiGene, Sino Biopharmaceutical Co., Ltd., NovoCodex, and Elanco Animal Health are all partners of Ambrx Biopharma Inc. The business was founded in 2003, and its main office is in La Jolla, California.

Who Are The Major Owners Of AMAM Stock?

17 investment banks and fund managers owned AMAM stock in Ambrx Biopharma over the previous two years. Fosun International Ltd ($37.88M), Adage Capital Partners GP L.L.C. ($17.37M), BlackRock Inc. ($11.75M), FMR LLC ($10.22M), Octagon Capital Advisors LP ($8.82M), Suvretta Capital Management LLC ($6.15M), and Millennium Management LLC ($2.82M) were the institutional investors with the largest investments.

AMAM stock is held by institutions 44.21% of the time. In the past 24 months, institutional investors have purchased 9,197,182 shares altogether. This volume of purchases entails about $158.86M in transactions.

In the past 24 months, investment banks have sold 274,909 shares in total. This share sale volume equates to roughly $1.55M in business. Institutional shareholders Cormorant Asset Management LP ($0.15M), BlackRock Inc. ($48.46K), Tudor Investment Corp Et Al ($39.86K), Ghisallo Capital Management LLC ($25K), and Renaissance Technologies LLC ($11.60K) all sold shares of Ambrx Biopharma in the past 24 months.

Short Sellers Of Ambrx Biopharma?

November saw a decrease in short interest in Ambrx Biopharma. 3,800 shares totaled short interest as of November 15th, which is a decrease of 20.8% from the 4,800 share total as of October 31st. The days-to-cover ratio is currently 0.1 days based on an average daily trading volume of 30,600 shares.

Short sales of the company's shares make up about 0.0% of the total. Any online trading account can be used to buy shares of AMAM stock. WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab are a few well-known online brokerages providing access to the American stock market.

Competitors Of AMAM

The top rivals of Ambrx Biopharma include Elevation Oncology (ELEV), Cortexyme, Idera Pharmaceuticals (IDRA), Rubius Therapeutics (RUBY), Jasper Therapeutics (JSPR), Entera Bio (ENTX), AIM ImmunoTech (AIM), ERYTECH Pharma (ERYP), Genetic Technologies (GENE), Surrozen (SRZN), and (CRTX).

All of these businesses fall under the "medical" category. Ambrx Biopharma is not as well-liked by analysts as other Medical companies. AMAM stock has a consensus rating of Moderate Buy, whereas the typical consensus rating for healthcare firms is Buy.

Ambrx Biopharma is disliked by customers more than other Medical businesses. Ambrx Biopharma had an outperform vote from 52.38% of people, versus an average of 66.26% for medical firms.

Entera Bio And Ambrx Biopha

rma?

Compared to Ambrx Biopharma, Entera Bio has smaller revenue but larger earnings. Shares in Ambrx Biopharma are held by institutions 44.2% of the time. Comparatively, institutional investors own 17.1% of the shares in Entera Bio. Shares of Ambrx Biopharma are held by company insiders to a 5.1% stake. Comparatively, insiders own 5.2% of the shares in Entera Bio. Solid organizational ownership is a sign that endowments, hedge funds, and big money managers are betting on a company's long-term ability to outperform the market.

Compared to Entera Bio's profit income of -1,796.49%, Ambrx Biopharma has a net margin of 0.00%. Entera Bio's return on equity was beaten by Ambrx Biopharma's equity return of 0.00%. When compared by users, Entera Bio earned 157 more votes for outperformance than Ambrx Biopharma. Similarly, while just 52.38% of people gave Ambrx Biopharma an outstanding vote, 66.14% of users awarded Entera Bio an outperform rating.

With a beta of 1.34, AMAM stock price is 34% less volatile than that of the S&P 500. Compared to the S&P 500, Entera Bio's share price is 84% more unpredictable with a beta of 1.84. Ambrx Biopharma received 48 more media mentions than Entera Bio in the past week. Ambrx Biopharma received 49 mentions according to us, while Entera Bio received just one.

Shares Of Ambrx Rise After Promoting Early Safety

Preliminary safety and effectiveness findings from the Phase 2 ACE-Breast-03 study were released by Ambrx Biopharma Inc. (NASDAQ: AMAM), which encouraged early safety data from the breast cancer candidate.

In patients with HER2-positive mBC who are resistant or refractory to T-DM1, the data showed a 51.7% overall response rate (ORR) and a 100% disease control rate (DCR) after therapy with ARX788. Patients received therapy for a median of 7.2 months, as treatment is still ongoing.

In China, Amrbrx's partner NovoCodex Biopharmaceuticals is currently conducting two Phase 3 trials so one registration-enabled Phase 2 study with ARX788, with readouts expected in 2023. The last check Friday's premarket session saw AMAM shares up 180.6% to $1.15.

How Simple Is It For Ambrx Biopharma To Raise Money?

Many people may be thinking that Ambrx Biopharma has to raise more money in the future because its income is falling and its operating cash flow is rising. Companies have the option of raising capital through debt or equity.

Publicly traded corporations benefit greatly from the ability to sell investors shares in order to raise capital and finance expansion. By comparing a company's cash burn to its market capitalization, we may determine how much investors would be affected if the business had to issue capital to pay for the cash burn for an additional year.

Ambrx Biopharma seems to have a market value of $20 million and spent $7 million last year, or 350% of its market value. We believe there is a substantial risk of financial hardship given how big that expenditure is in comparison to the company's market value, and we would be extremely cautious about keeping the AMAM stock.

What Are The Average Rating And Price Objective For Ambrx Biopharma?

Based on the current 1 controlled transaction and 1 buy rating for AMAM, the consensus opinion for AMAM stock is Moderate Buy, according to the 2 analysts who have issued ratings in the past year. Ambrx Biopharma's average 12-month price objective is $4.00, with a premium price target of $4.00 and a low cost target of $4.00.

According to two Wall Street experts who have predicted the price of AMAM for the next year, the average price target is $11.00, with the maximum prediction for the company being $16.00 and the lowest prediction being $6.00.

By April 2023, according to the majority of Wall Street analysts, the share price of Ambrx Biopharma might be $11.00.

Is AMAM A Successful Business?

The cash burn for AMAM is $70163000. It has at least a year's worth of coverage in the form of cash and short-term investments. AMAM has cash and short-term investments of

$111.72 million. This is sufficient to fund its $70.16M yearly cash burn.

AMAM has a small 0.28 debt to equity ratio. On the balance sheet of AMAM, short-term assets outnumber long-term liabilities. On the balance sheet of AMAM, short-term assets exceed short-term liabilities. Cons: Over the past year, AMAM's profit margin has decreased from 325.6% to 1.729.9%.

According to our examination of Ambrx Biopharma's cash position, its cash runway was comforting, but the ratio of its cash burn to market value has us a little concerned. We have very little faith in the company's capacity to control its cash burn after taking all the data stated in this article into account, and we predict it will need additional money.

The Basics Of Ambrx Biopharma

The value of AMAM stock is 43, which is higher than the average for the Biotechnology sector. Currently, 3 out of 7 due diligence tasks are being passed by AMAM. AMAM's Financials rating is 0, which is the same as the industry average for the Biotechnology sector.

AMAM stock is presently failing 0 of 7 checks for due diligence. The AMAM stock forecast score is 0, which is the same as the sector average for biotechnology. AMAM stock is presently failing 0 of 9 checks for due diligence.

The Performance score for AMAM stock is 71, which is higher than the industry average for biotechnology. Five out of ten due diligence checks are passing for AMAM. We disregard this dimension because Ambrx Biopharma has little or no historical dividend history.

Recommendations Most Recent From AMAM Analysts

On May 24, 2022, a Goldman Sachs analyst decreases their price objective for AMAM stock from $6 to $4 while maintaining a hold rating.

On April 7, 2022, Joel Beatty, a high 17% analyst from Baird, commences covering on AMAM with a buy recommendation and publishes their $16.00 price target.

On February 28, 2022, Corinne Jenkins of Goldman Sachs, a top 48% analyst, announces the beginning of covering on AMAM with such a hold recommendation and a $6.00 price target.

In 2022, Should I Buy Or Sell Ambrx Biopharma Stock?

In the past year, Ambrx Biopharma has received "buy," "hold," and "sell" evaluations from 2 Wall Street research analysts. For the stock, there is presently 1 hold rating and 1 buy rating. Wall Street research experts generally agree that investors should "buy" AMAM stock. On Friday, June 18th 2021, (AMAM) raised $126 million through an initial public offering.

At a price of $17.00–$19.00 per share, the corporation issued 7,000,000 shares. The underwriters for the initial public offering were Goldman Sachs, BofA Securities, and Cowen. The time it would take for a corporation to exhaust its cash on hand at its current cash burn rate is known as its cash runway. Ambrx Biopharma had 111 million dollars in cash and no debt as of June 2022.

Looking back at the previous year, the business spent $70 million. So, starting in June 2022, AMAM stock forecast had a financial runway of about 19 months. This is not too bad, and unless cash burn substantially decreases, it is safe to assume the financial runway is coming to an end.

Ambrx Biopharma Stock Forecast 2022

While it is not anticipated that AMAM stock forecast annual earnings rate of growth of N/A will surpass the statistically important earnings growth rate of 9.29% for the US biotechnology industry, neither is it anticipated to surpass the average AMAM stock forecast earnings rate of growth of 70.08% for the US market.

The revenue for AMAM stock forecast in 2022 is -$90,558,000. One Wall Street analyst predicted that AMAM stock forecast earnings would be -$75,691,975 on average in 2022, with the highest AMAM earnings prediction being -$75,691,975 and the top AMAM stock forecast being -$75,691,975.

The current Earnings Per Share (EPS) for Ambrx Biopharma is $6.72. Analysts expect AMAM stock forecast EPS to be -$0.28 on average for 2022, with the lowest and highest estimates both coming in at -$0.28.

Ambrx Biopharma Stock Forecast

2023

AMAM stock forecast is anticipated to make -$67,582,121 in 2023, with the smallest earnings estimate being -$67,582,121 and the actual figure being -$67,582,121. By April 7, 2023, analysts on Wall Street believe the share price of Ambrx Biopharma might reach $11.00.

From the present share price of $4.54 for AMAM, the average AMAM stock forecast predicts a possible increase of 142.29%. AMAM stock forecast EPS is anticipated to be negative $0.25 in 2023.

0 notes