#Infrastructure Development

Explore tagged Tumblr posts

Text

Discover the Billion-Dollar Boom: Indonesia's Construction Industry Secrets Revealed!

The construction sector in Indonesia has been experiencing remarkable growth in recent years, and this trend is expected to continue. This growth is largely driven by the government's infrastructure development initiatives, which have led to a substantial increase in investment in the construction industry. In 2021, the Indonesian construction industry recorded an impressive annual growth rate of 4.83%, according to data from the Indonesian Statistics Agency (BPS).

The government's commitment to infrastructure development is evident from the significant increase in infrastructure investment. In 2018, the investment in infrastructure rose to IDR 157.8 trillion (approximately US$11.3 billion), up from IDR 216.8 trillion in the previous year. This substantial investment contributed significantly to the country's economic growth, accounting for 1.28% of the overall economic growth in 2018, with an added value of IDR 184.4 trillion. This marked an increase from the 1.06% contribution in 2017, with an added value of IDR 146.9 trillion.

These investments have been directed towards various infrastructure projects, including the construction of dams, new public roads, bridges, and toll roads. These developments have not only improved the country's infrastructure but have also enhanced its competitiveness on the global stage.

Indonesia's rankings in global competitiveness indices have seen positive changes. In the World Economic Forum's Global Competitiveness Index, Indonesia's rank in the Quality of Roads category improved from 72 in 2014 to 60 in 2019, out of 141 countries. Similarly, in the World Bank's Logistic Performance Index, Indonesia climbed from 53 in 2014 to 46 out of 161 countries in its 2018 report.

While the COVID-19 pandemic had a significant impact on the construction industry in 2020, the sector has since rebounded and is poised for continuous growth. Various consultancy firms project annual growth rates ranging from 5% to 7% in real terms. This growth is attributed to the government's effective COVID-19 mitigation measures and the ongoing infrastructure projects.

One of the major upcoming projects is the relocation of Indonesia's capital city from Jakarta to East Kalimantan, estimated to cost $33 billion and take a decade to complete. To fund this ambitious project and others, the Indonesian government launched the Indonesia Investment Authority (INA), a Sovereign Wealth Fund. The government plans to inject over $5 billion into INA, with several countries expressing interest in investing through it, including the US, Japan, and Canada.

In conclusion, Indonesia's construction sector is poised for continued growth and remains an attractive investment opportunity. Despite short-term challenges like the COVID-19 pandemic, the government's commitment to infrastructure development, coupled with a stable political environment, low inflation, good credit ratings, and prudent macroeconomic policies, makes Indonesia's construction sector a promising prospect for investors. To navigate this competitive landscape, investors are advised to seek experienced local partners with established networks for a competitive edge. References: https://sertifikasi.co.id https://duniatender.com https://skk-konstruksi.com

#Indonesia Construction#Infrastructure Development#Indonesian Economy#Construction Growth#Government Investment#Construction Projects#Economic Impact#Indonesia Infrastructure#Investment Opportunities#Construction Industry Trends

3 notes

·

View notes

Text

Exploring the Diverse Landscape of Surveys: Unveiling Different Types

Introduction Civil engineering, as a discipline, relies heavily on accurate and comprehensive data to design, plan, and construct various infrastructure projects. Surveys play a crucial role in gathering this essential information, providing engineers with the data needed to make informed decisions. There are several types of surveys in civil engineering, each serving a unique purpose. In this…

View On WordPress

#accurate measurements#as-built survey#boundary survey#civil engineering data#Civil engineering surveys#construction progress monitoring#construction survey#design accuracy#environmental monitoring#geodetic survey#global mapping#hydrographic survey#infrastructure development#infrastructure projects#land surveyor#legal boundaries#monitoring survey#project planning#property lines#structural integrity assessment#surveying in civil engineering#surveying innovations#surveying technology#topographic surveying#water body survey

2 notes

·

View notes

Text

"STREET CARS ON QUEEN ST.," Ottawa Journal. October 5, 1912. Page 1. --- Preliminary Work Comenced To-day on Elgin Street. ---- Elgin street between Sparks and Queen is to-day in the hands of the shovel and pick brigade, the preliminary operations necessary in the laying of the proposed new track on Queen street having commenced. The Journal was informed by a responsible official of the Ottawa Electric Street Railway Company this morning that they were ready to proceed with the work at once, but were being hung up by the city council, from whom sanction had to be obtained in the form of a new city by-law giving authority to the company to lay the new track.

The delay was attributed to the water investigation now going on and which prevented the city solicitor from attending to the necessary de- talls in connection with the passing of the by-law.

It is therefore apparent that citizens may not hope to see the new line down until the water Investigation has concluded.

#ottawa#streetcar#street railways#mass transit#ottawa electric street railway#transit company#infrastructure development#railway capitalism

1 note

·

View note

Photo

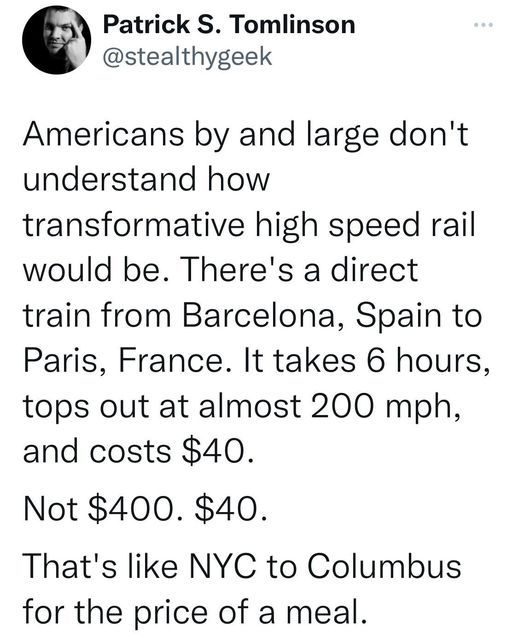

Side-eyeing the shit out of Patrick's original tweet.

I'm from Maine. Trust me, we have a *very* good idea of how transformative high speed rail would be.

Northern Maine is absurdly underdeveloped, even though it's one to five hours away from at least three significant Canadian cities. Getting a high-speed (or even "moderate" speed) railway, especially one that connects with a Canadian railway system, would border on the revolutionary.

One of the major reasons why Maine *hasn't* been developed further is because there are a lot of stick-in-the mud traditionalists (read: white people who don't know their Maine history) who insist on sticking with Maine's historical industries (logging, potatoes, and tourism, mostly) instead of expanding or renovating them.

So, yeah, I'm not surprised Walker did something similar. I realize he did it mostly just to "stick it" to Obama, but it wouldn't surprise me if there were similar stick-in-the-muds in Wisconsin who were cheering him every step of the way.

#transportation#public transportation#infrastructure investment#Maine#Wisconsin#infrastructure development#political dickheads

41K notes

·

View notes

Text

The demand for modern, efficient, and sustainable structures is constantly rising, encouraging the entry of several reputed players into the market. A well-established construction company in gujarat can now offer end-to-end solutions that meet global standards.

0 notes

Text

youtube

Robust infrastructure isn't just about roads and bridges; it's the backbone of a thriving economy. From boosting productivity to attracting investment and creating jobs, smart infrastructure development paves the way for sustainable growth. #Infrastructure #EconomicGrowth #Development #Investment #FutureReady

0 notes

Text

Bhagalpur News: भागलपुर में रेलवे का बड़ा विस्तार; न्यू टर्मिनल, नई लाइनें और विद्युतीकरण का काम शुरू

Bhagalpur News: भागलपुर और आसपास के क्षेत्रों में रेल यात्रियों के लिए बड़ी खुशखबरी है! रेलवे ने यहां कई महत्वपूर्ण परियोजनाओं पर काम शुरू कर दिया है, जिससे न केवल कनेक्टिविटी बेहतर होगी बल्कि यात्रियों को अत्याधुनिक सुविधाएं भी मिलेंगी. पीरपैंती-गोड्डा नई रेल लाइन के साथ ही न्यू भागलपुर टर्मिनल की तैयारी भी जोरों पर है. 4.5 करोड़ से ज्यादा में ओएचई और स्विचिंग साइड का काम मालदा मंडल के…

#Bhagalpur#Bihar#Electrification#Fourth Line#Indian Railways#Infrastructure Development#New Terminal#OHE#Peerpainty-Godda Line#Railway Expansion#Third Line#Vikramshila-Kataria Bridge

0 notes

Text

India Commits $20 Billion For Maritime Infrastructure Development: Sarbananda Sonowal

New Delhi: India has committed $20 billion for infrastructure development focused on enhancing multimodal logistics, port connectivity, and trade facilitation, Union Minister Sarbananda Sonowal said on Thursday. Delivering the keynote speech at the India Country Session in Oslo and highlighted India’s growing maritime capabilities, including a favourable policy-induced investment environment,…

0 notes

Text

Steel Rebar Market Outlook 2025–2030: Global Trends, Growth Drivers, and Strategic Insights

The steel rebar market is gaining strong momentum, fueled by accelerating infrastructure projects, urban expansion, and rising demand from non-residential sectors like oil & gas and manufacturing. These structural reinforcements have become critical to modern construction, offering the strength and durability required for complex builds. However, challenges such as skilled labor shortages, knowledge gaps in advanced construction methods, and the construction industry's sensitivity to economic disruptions may hinder the market's full growth potential. As the sector navigates these headwinds, understanding both the drivers and restraints is key for stakeholders aiming to stay competitive. The Market is approximated to be USD 224.5 billion in 2022, and it is projected to reach USD 317.4 billion by 2030, at a CAGR of 4.4%.

Segmentation Analysis

By Type

Deformed Steel Rebars: Holding the largest market share at 60% in 2023, deformed rebars are favored for their superior strength and bonding capabilities in concrete structures .

Mild Steel Rebars: Accounting for 40% of the market, mild steel rebars are projected to grow at a CAGR exceeding 6%, driven by demand in residential and commercial sectors .

By Coating Type

Plain Carbon Steel Rebar: Widely used due to cost-effectiveness and versatility.

Galvanized Steel Rebar: Offers enhanced corrosion resistance, suitable for marine and humid environments.

Epoxy-Coated Steel Rebar: Provides superior protection against corrosion, ideal for structures exposed to de-icing salts and chemicals .

By Process Type

Basic Oxygen Steelmaking (BOS): Dominant due to efficiency and ability to produce high-quality steel in large quantities.

Electric Arc Furnace (EAF): Gaining traction for its flexibility and lower carbon emissions, aligning with sustainable manufacturing practices .

By Bar Size

Bar sizes vary to meet specific structural requirements, with larger diameters used in heavy infrastructure and smaller sizes in residential construction.

By End-Use

Infrastructure: Leading the market with nearly 50% share in 2023, driven by investments in bridges, highways, and public buildings .

Housing: Expected to be the fastest-growing segment, fueled by rapid urbanization and housing demand in emerging economies

Industrial: Growth supported by expansion in manufacturing facilities and industrial complexes.

Regional Insights

Asia Pacific: Dominated the market with a 45% revenue share in 2023. The region's growth is propelled by massive infrastructure projects in countries like China and India

Middle East & Africa: Exhibited the fastest growth rate in 2023, driven by urbanization and infrastructure development, with a projected CAGR over 8%

North America and Europe: Steady growth attributed to renovation projects and adoption of advanced construction materials.

Emerging Trends

Sustainable Manufacturing: The industry is witnessing a shift towards eco-friendly production methods, including the use of recycled steel and energy-efficient processes

Technological Advancements: Integration of AI and automation in steel production enhances efficiency and quality control .

High-Strength Alloys: Development of advanced metallurgical techniques is leading to the creation of rebars with superior tensile strength, suitable for high-rise buildings and long-span bridges

Challenges and Opportunities

Challenges:

Raw Material Price Volatility: Fluctuations in iron ore and scrap steel prices can impact production costs.

Environmental Regulations: Stringent policies may increase compliance costs for manufacturers.

Opportunities:

Infrastructure Investments: Government initiatives worldwide are boosting demand for steel rebars in public works.

Urbanization: Rapid urban growth in emerging economies presents significant market potential.

Download PDF Brochure :

The steel rebar market is set to experience robust growth through 2030, driven by global infrastructure development and advancements in manufacturing technologies. Stakeholders focusing on sustainable practices and innovation are likely to gain a competitive edge in this evolving market landscape.

#Steel Rebar Market#Infrastructure Development#Sustainable Manufacturing#Construction Materials#Global Market Trends#Steel Industry Growth#Rebar Types#Market Forecast 2030

0 notes

Text

The Land Development Process In 6 Steps

Land development considers an intricate investing strategy. This should only be attempted by “experts”. Although buying undeveloped land is a complicated investment, novice investors should always seek guidance on it. On fact, we contend that novice investors can make money on undeveloped land provided they do due research and get ready for harder work than is typically required for conventional exit plans. Developing undeveloped land requires very fewer extra processes.

Read More: https://thecompanyre.com.au/the-land-development-process-in-6-steps/

0 notes

Text

i want badly to start posting here more. here's a collection of images about what ive been doing with the Grass Beast that developed while i was away at school !

for now im using alt text for plant id's bc i do not have the skill or energy to add img id to every image i post. in the future i will try to develop a better system.

#summer 2025#infrastructure development#rewilding#mulching#ecology#environmental restoration#zone 6b#grass.img

1 note

·

View note

Text

Why East African Real Estate Is the Next Big Investment Opportunity

In recent years, East African real estate has steadily emerged as a hotspot for both local and international investors. With its fast-growing economies, rapid urbanisation, expanding middle class, and ambitious infrastructure projects, the region presents an unparalleled opportunity for those looking to diversify their real estate portfolios.

Whether you're a seasoned investor or someone looking for fresh markets with high growth potential, East Africa deserves a spot on your radar. Here's why investing in East African real estate is not just a trend, but a smart strategic move.

1. Strong Economic Growth and Stability

East African countries such as Kenya, Tanzania, Rwanda, Uganda, and Ethiopia have consistently recorded impressive GDP growth rates over the past decade. This economic resilience, even during global downturns, has created a fertile ground for real estate investment.

Kenya, the region’s largest economy, has become a hub for finance, technology, and logistics, driving demand for both residential and commercial spaces.

Rwanda has earned global praise for its ease of doing business, transparent government policies, and clean, green capital—Kigali—which is drawing attention from real estate developers and foreign investors alike.

Tanzania and Uganda are seeing urban centers like Dar es Salaam and Kampala evolve into thriving commercial zones with increasing demand for modern housing and retail spaces.

This economic dynamism fuels housing demand, boosts rental yields, and provides stable long-term returns for real estate investors.

2. Urbanization and Population Growth

East Africa is undergoing one of the world’s fastest urbanization trends. According to UN data, the region’s urban population is projected to double by 2040. Cities like Nairobi, Kampala, Kigali, and Addis Ababa are already experiencing strain on existing housing infrastructure, leading to high demand for new developments.

This rapid urban growth is a key driver for:

Affordable housing developments

Mixed-use properties

Retail and office spaces

Modern apartment complexes catering to the middle class

For investors, this means a growing market for both rental income and property value appreciation.

3. Infrastructure Development

Massive infrastructure projects are transforming East Africa’s real estate landscape. Roads, airports, railways, and ports are being modernized or constructed to support economic growth and cross-border trade.

Examples include:

Kenya’s Standard Gauge Railway (SGR) connecting Mombasa to Nairobi and further inland.

The Addis Ababa-Djibouti railway, which enhances Ethiopia’s access to global markets.

Upgrades to airports in Kigali, Nairobi, and Entebbe to support tourism and international trade.

Infrastructure improves accessibility, increases land value, and opens up formerly hard-to-reach areas for new real estate development.

4. Government Incentives and Policy Reforms

Governments across East Africa are actively encouraging real estate development through policy reforms and incentives:

Tax breaks for developers in affordable housing sectors

Public-private partnerships (PPPs) for large-scale housing projects

Digitization of land registries to improve transparency and security of property rights

Such reforms make it easier, safer, and more profitable for investors to enter the East African real estate market.

5. High Returns and Rental Yields

Compared to more saturated markets in the West, East African real estate offers relatively high returns. Rental yields in prime residential areas of Nairobi or Kigali often exceed 7–10%, which is significantly higher than global averages.

Additionally, with the growth in tourism, short-term rental markets (such as Airbnb) are booming in major cities and near national parks or coastal regions. This offers a lucrative alternative revenue stream for property owners and investors.

6. Untapped Markets and Innovation

The East African real estate sector still has vast untapped potential, especially in:

Student housing

Industrial parks and logistics centers

Eco-friendly and green buildings

Smart cities and tech-enabled homes

As the region embraces innovation, tech startups and proptech firms are beginning to transform the way real estate is marketed, financed, and managed. This offers early movers a chance to shape and benefit from the next wave of growth.

7. Regional Integration and the AfCFTA

The African Continental Free Trade Area (AfCFTA), now in effect, will further boost East Africa’s attractiveness. The agreement aims to facilitate trade among African countries by reducing tariffs and increasing collaboration across borders.

This integration is expected to:

Increase demand for commercial real estate

Encourage cross-border investments

Create regional hubs and business parks

Investing in East African real estate today positions you to benefit from tomorrow’s continental growth engine.

Final Thoughts

The East African real estate market offers a compelling blend of opportunity, growth, and stability. Whether it’s residential, commercial, or mixed-use developments, the region presents a favourable environment for strategic, long-term investments.

Investors who act early—while markets are still developing—stand to gain the most. With supportive policies, a young and growing population, improved infrastructure, and promising returns, East Africa is truly positioning itself as the next frontier in global real estate.

If you're considering investing or exploring opportunities in the region, start by understanding the local dynamics, partner with experienced professionals, and tap into one of the fastest-growing real estate markets in the world.

#East African Real Estate#Real Estate Investment#Property Investment East Africa#African Real Estate Market#Emerging Markets Real Estate#Investment Opportunities Africa#Real Estate Development#Property Market Analysis#Urban Growth Africa#Affordable Housing Africa#Commercial Real Estate#Residential Real Estate#Real Estate Finance Africa#Infrastructure Development#Long-Term Investment Strategy#Smart Cities Africa#Real Estate Forecast#Uganda Real Estate Investment#Rwanda Property Market#Kenya Real Estate#Tanzania Property Opportunities#Ethiopia Real Estate

0 notes

Text

India and China Maintain Tense Standoff Along Border

May 8, 2025 – New Delhi Between 3:00 PM on May 7 and 3:00 PM on May 8, 2025 (Philippine Standard Time), India and China continued to face heightened tensions along their shared border, particularly in the Himalayan region. Military Build-Up and Infrastructure Development Both nations have increased their military presence along the Line of Actual Control (LAC). India has been enhancing its…

#Border Patrol Agreement#diplomatic efforts#Galwan Valley#India-China border#infrastructure development#J-20 stealth fighters#Line of Actual Control#military standoff#strategic trust#Trade Relations

0 notes

Text

Coal India and DVC Sign MoU to Set Up ₹16,500 Crore Ultra Supercritical Power Project in Jharkhand

In a significant step toward expanding its footprint in thermal power generation, Coal India Limited (CIL) has entered into a strategic partnership with Damodar Valley Corporation (DVC) to set up a 2×800 MW Ultra Supercritical Power Plant in Jharkhand. The proposed ₹16,500 crore project will be a brownfield expansion of DVC’s existing Chandrapura Thermal Power Station (CTPS), which currently…

View On WordPress

#500 crore project#Bharat Coking Coal Limited#brownfield expansion#Central Coalfields Limited#Chandrapura Thermal Power Station#CIL#CIL subsidiaries#Coal India Limited#coal mining diversification#coal supply chain#CTPS#Damodar Valley Corporation#Debasish Nanda#DVC#energy demand#energy security#infrastructure development#Jharkhand#joint venture#Kolkata#MoU#P.M. Prasad#power project#S. Suresh Kumar#state-owned entities#Strategic Partnership#supercritical units#Swapnendu Kumar Panda#thermal power generation#ultra supercritical power plant

0 notes

Text

तीसरी बार CM बनने पर योगी का बड़ा बयान: 'मैं कोशिश नहीं करूंगा, पार्टी तय करेगी', सियासत में मचा बवाल #News #BreakingNews #LatestNews #CurrentNews #HindiNews

#BJP Strategy#gorakhpur#infrastructure development#law and order UP#Mahakumbh 2025#opposition criticism#PM Modi leadership#third term CM#UP election 2027#Yogi Adityanath

0 notes