#Intestacy Law

Text

An Executor’s Guide To Dealing With Digital Assets Without A Will

0 notes

Text

What Will Happen to Your House After You Die?

What Will Happen to Your House After You Die?

Death is inevitable. It’s not just an event that happens to other people, but it is a part of life.

When the time comes to leave this earth finally, there are some things that you might want to consider.

One of them is your house that you have spent a lot of time looking after. In this article, we will specifically look at what will happen to your house after you die.

But since each state…

View On WordPress

0 notes

Text

they really need to put a primer on Japanese succession law in Umineko; the succession rules are far more alien than I'd expected

I’d been assuming primogeniture succession to title in intestacy, apparently absolute (i.e., with no priority to male heirs), but with some variations

for example, Umineko implies a rule of coverture, eliminating married women from the succession, but not their heirs or the unmarried feme sole

in Umineko, the eldest daughter, Eva, would have lost her succession interest by marriage; she preserved it by making her husband take her maiden name

Eva needed a special dispensation from her father to do that; ordinarily, she would have taken her husband's name and lost her interest

by contrast, the youngest daughter, Rosa, is unmarried, and preserves her succession interest without any special dispensation

but now it looks like it might not be primogeniture, but seniority, with the siblings of the deceased taking priority over their children

(I say “might” because it still fits a primogeniture rule that disables or suspends succession to title during the minority of a potential heir)

and that’s just succession to title! I can't make heads or tails of the implied rule of intestate succession to property

18 notes

·

View notes

Text

October 11

Word of the day:

hotchpot (noun)

in British English; property law.

the collecting of property so that it may be redistributed in equal shares, esp on the intestacy of a parent who has given property to a child in his or her lifetime

Spoken by Mina, and immediately followed by this aside from Jack Seward:

I could not but note the quaint legal phrase which she used in such a place, and with all seriousness.

16 notes

·

View notes

Text

Will Contest Solicitors

If you're thinking about making a will, or if you need to contest a will that has already been made, you'll need to find a good solicitor who can help you. But with so many solicitors out there, how do you know which one to choose?

At Will Contest Solicitors, we believe that we are the best in the UK. We have a team of experienced solicitors who are experts in wills and probate, and we can provide you with all the help and advice you need.

Whether you're looking to make a will or contest one, we can provide you with the expert guidance you need. We understand the importance of getting it right, and we'll make sure that your interests are protected.

The best Will Contest Solicitors in the UK

We believe that we are the best Will Contest Solicitors in the UK for a number of reasons. Firstly, we have a team of experienced solicitors who are experts in wills and probate. This means that we can provide you with all the help and advice you need, ensuring that your interests are protected.

Secondly, we offer a free initial consultation so that you can get to know us and our services before making any decisions. This way, you can be sure that we're the right solicitors for you.

Finally, we offer a fixed-fee service so that you know exactly how much our services will cost. We believe that this offers excellent value for money, and we're confident that you won't find a better service elsewhere.

Why you need a Will

Making a will is one of the most important things you can do, yet many people don't have one. If you die without a will, your estate will be divided up according to the laws of intestacy, which may not be what you would have wanted.

A will gives you the peace of mind of knowing that your assets will be distributed according to your wishes. It also allows you to appoint executors who will carry out your wishes, and to appoint guardians for any minor children.

Without a will, the process of distributing your assets can be lengthy and complicated, and it may not be possible to carry out your wishes. This is why it's so important to have a will, and to ensure that it's up to date.

How to make a Will

Making a will is relatively straightforward, but there are some important things to keep in mind. Firstly, you need to be over the age of 18 and of sound mind. You also need to make sure that your will is witnessed by two people who are not beneficiaries under the will.

Once you've made your will, it's important to keep it in a safe place where it can't be lost or damaged. You should also review your will regularly to make sure that it still reflects your wishes.

If you need help making a will, our team of experienced solicitors can assist you. We can provide you with all the guidance and advice you need, ensuring that your interests are protected.

4 notes

·

View notes

Text

Common Estate Planning Mistakes and How a Savannah, GA Estate Attorney Can Help

Estate planning is an essential process for ensuring that your assets are distributed according to your wishes after your death. It also involves setting up mechanisms to manage your affairs in case you become incapacitated. However, estate planning can be complex, and mistakes can lead to unintended consequences for your estate and your loved ones. If you live in Savannah, GA, a knowledgeable estate attorney can be instrumental in avoiding these common pitfalls and ensuring that your estate plan is both effective and legally sound. This article explores common estate planning mistakes and how an estate attorney Savannah GA, can help you address them.

Common Estate Planning Mistakes

Failing to Create an Estate Plan

Mistake: One of the most significant mistakes is not having an estate plan at all. Without a will or other estate planning documents, your assets will be distributed according to state intestacy laws, which may not align with your wishes.

How an Estate Attorney Can Help: An estate attorney in Savannah, GA, can assist you in creating a comprehensive estate plan that includes a will, trust, and other essential documents. They will ensure that your assets are distributed according to your preferences and that your estate plan complies with local laws.

Not Updating Your Estate Plan

Mistake: Many people create an estate plan but fail to update it as their circumstances change. Life events such as marriage, divorce, the birth of children, or significant financial changes can affect your estate plan.

How an Estate Attorney Can Help: An estate attorney can review and update your estate plan to reflect any changes in your life. They will help you adjust your will, trusts, and other documents to accommodate new circumstances, ensuring that your estate plan remains current and effective.

Choosing the Wrong Executor or Trustee

Mistake: Selecting an executor or trustee who is not qualified or trustworthy can lead to complications in managing your estate. It is essential to choose someone who is reliable and capable of handling the responsibilities involved.

How an Estate Attorney Can Help: An estate attorney in Savannah, GA, can provide guidance on selecting an appropriate executor or trustee. They can help you understand the responsibilities of these roles and ensure that the person you choose is up to the task.

Ignoring Estate Taxes

Mistake: Estate taxes can significantly impact the value of your estate and the amount your beneficiaries receive. Many people do not plan for estate taxes, which can lead to unexpected financial burdens.

How an Estate Attorney Can Help: A skilled estate attorney can help you implement strategies to minimize estate taxes. This may include setting up trusts, making charitable donations, or utilizing tax exemptions and deductions. They will work with you to develop a plan that reduces the tax burden on your estate.

Failing to Plan for Incapacity

Mistake: Estate planning is not just about what happens after you die; it also involves planning for potential incapacity. Failing to set up documents such as a durable power of attorney or healthcare proxy can leave you vulnerable if you become unable to make decisions for yourself.

How an Estate Attorney Can Help: An estate attorney in Savannah, GA, can help you establish documents that designate someone to make financial and healthcare decisions on your behalf if you become incapacitated. They will ensure that these documents are legally valid and reflect your wishes.

Overlooking Digital Assets

Mistake: In today’s digital age, many people have significant digital assets, such as online accounts, digital currencies, and intellectual property. Failing to address these assets in your estate plan can create complications for your beneficiaries.

How an Estate Attorney Can Help: An estate attorney can help you account for and plan for your digital assets. They will guide you on how to include these assets in your estate plan and provide instructions for managing and transferring them.

Not Considering Special Needs

Mistake: If you have a family member with special needs, failing to plan for their future can result in unintended consequences. Inadequate planning may affect their eligibility for government benefits or leave them without adequate support.

How an Estate Attorney Can Help: An estate attorney in Savannah, GA, can help you create a special needs trust or other arrangements to ensure that your loved one’s needs are met without jeopardizing their eligibility for government benefits. They will work with you to develop a plan that provides for their future care.

Improperly Drafted Documents

Mistake: Estate planning documents must be drafted correctly to be legally valid and enforceable. Errors or ambiguities in these documents can lead to legal disputes and challenges to your estate plan.

How an Estate Attorney Can Help: An estate attorney will ensure that all estate planning documents are drafted accurately and in compliance with Georgia state laws. They will review and revise documents to eliminate any errors or ambiguities, providing you with peace of mind that your estate plan is legally sound.

Failing to Communicate Your Wishes

Mistake: Even if your estate plan is well-drafted, failing to communicate your wishes to your family and beneficiaries can lead to misunderstandings and conflicts.

How an Estate Attorney Can Help: An estate attorney can guide you on how to effectively communicate your estate planning decisions to your family and beneficiaries. They can also assist with organizing family meetings or discussions to ensure that everyone understands your intentions.

Not Considering the Impact of Probate

Mistake: Probate is the legal process of administering an estate, and it can be time-consuming and costly. Failing to plan for the probate process can lead to delays and increased expenses for your beneficiaries.

How an Estate Attorney Can Help: An estate attorney in Savannah, GA, can help you implement strategies to minimize the impact of probate on your estate. This may include setting up trusts or utilizing other estate planning tools that can help expedite the distribution of your assets and reduce probate costs.

Conclusion

Estate planning is a complex process, and avoiding common mistakes is crucial for ensuring that your wishes are carried out effectively and that your estate is managed properly. By working with a skilled estate attorney in Savannah, GA, you can navigate the complexities of estate planning and address potential pitfalls. From creating and updating your estate plan to managing taxes and addressing special needs, an experienced attorney can provide invaluable guidance and support. By addressing these common estate planning mistakes with the help of a knowledgeable attorney, you can ensure that your estate plan is comprehensive, effective, and tailored to your unique needs.

0 notes

Text

Wills Gold Coast: Essential Tips for Effective Estate Planning

When it comes to securing your family's future, effective estate planning is crucial, and one of the most important elements is creating a will. On the Gold Coast, where the lifestyle is as dynamic as the real estate market, having a well-structured will ensures that your assets are distributed according to your wishes and minimizes potential conflicts among your loved ones. Here’s a guide to navigating the process of drafting a Wills Gold Coast, covering key considerations and steps to take.

Understanding the Importance of a Will

A will is a legal document that outlines how your assets should be distributed after your death. Without a will, your estate will be divided according to the laws of intestacy, which might not align with your personal preferences or intentions. This could lead to unwanted outcomes, such as disputes among family members or assets being allocated to individuals you might not have chosen.

Key Elements of a Will

Executor Appointment: The executor is responsible for administering your estate, ensuring your wishes are carried out, and handling legal and financial matters. It’s essential to choose someone you trust and who is capable of managing these responsibilities.

Beneficiaries: These are the individuals or organizations who will inherit your assets. Clearly specifying who gets what can prevent confusion and disputes among your heirs.

Guardianship: If you have minor children, it’s important to appoint a guardian who will be responsible for their care and upbringing in the event of your passing.

Specific Bequests: You might wish to leave particular items or sums of money to certain individuals or charities. Clearly outlining these bequests ensures that your specific wishes are honored.

Residue Clause: This covers any assets not specifically mentioned in your will. It ensures that all remaining parts of your estate are distributed according to your instructions.

Legal Requirements on the Gold Coast

In Queensland, including the Gold Coast, the creation of a will must comply with specific legal requirements to be valid:

Written Document: A will must be in writing. This can be handwritten, typed, or printed, but it must be signed and dated.

Signature: The will must be signed by you or by someone else in your presence and at your direction.

Witnesses: The signing of the will must be witnessed by at least two people who are not beneficiaries. Witnesses must also sign the will in your presence.

Updating Your Will

Life is full of changes—marriages, divorces, births, and deaths. These changes can significantly impact your estate planning needs. It’s important to review and update your will regularly to ensure it reflects your current circumstances and wishes.

Seeking Professional Advice

While DIY will kits are available, the complexity of estate planning often necessitates professional advice. Solicitors specializing in wills and estates on the Gold Coast can provide valuable insights, help avoid legal pitfalls, and ensure that your will is comprehensive and legally sound. They can also assist with other aspects of estate planning, such as setting up trusts or navigating tax implications.

Final Thoughts

Creating a will is a fundamental step in estate planning that provides peace of mind and clarity for your loved ones. On the Lawyers Gold Coast, where lifestyle and real estate are key considerations, a well-crafted will ensures that your assets are managed according to your wishes and that your family is protected from unnecessary stress and conflict. Whether you’re drafting your will for the first time or updating an existing one, consulting with a legal expert can help you navigate the process effectively and secure your legacy.

0 notes

Text

youtube

An IPDI Trust is created upon death and qualifies as an interest in possession trust. Established by a will or under intestacy laws, the life tenant has an immediate right to income from the trust's assets or can use the assets, like living in a residence. The entitlement may last for the beneficiary's lifetime or for a fixed term, ending under specific conditions like death or remarriage.

0 notes

Text

Common Mistakes to Avoid When Writing Your Will

Writing a will is one of the most important steps you can take to ensure your assets are distributed according to your wishes after your passing. However, despite the critical nature of this document, many people make mistakes that can lead to disputes, delays, and unintended consequences. To help you avoid these pitfalls, we'll discuss some common mistakes and provide tips on Will How to Write effectively. Additionally, we’ll touch on the importance of understanding the Double Power of Attorney in estate planning.

1. Not Having a Will at All

The most significant mistake you can make is not having a will. Without a will, your estate will be distributed according to the laws of intestacy, which may not align with your wishes. This can result in assets going to relatives you would not have chosen or, in some cases, to the state. To avoid this, it's essential to create a will that clearly outlines your wishes.

2. DIY Wills Without Professional Guidance

While it may be tempting to write your will on your own to save money, this approach can be risky. DIY wills often lack the necessary legal language and fail to account for complex situations. Working with professionals like NexGen Estate Planners P Ltd. (NexGen), who have expertise in estate and succession planning, can help ensure that your will is legally sound and reflects your true intentions.

3. Failing to Update Your Will Regularly

Life is dynamic, and your will should reflect any significant changes in your circumstances. Whether it’s the birth of a child, marriage, divorce, or acquiring new assets, it’s crucial to update your will to accommodate these changes. Failure to do so can result in outdated provisions that may not align with your current wishes.

4. Not Understanding the Implications of a "Double Power of Attorney"

In addition to writing a will, understanding the concept of Double Power of Attorney is vital in estate planning. A Double Power of Attorney allows two people to act on your behalf if you become incapacitated. This can be beneficial in ensuring that decisions about your assets and healthcare are made according to your wishes. However, it's important to choose your attorneys carefully and specify whether they must act jointly or independently.

5. Overlooking Beneficiary Designations

Many assets, such as life insurance policies, retirement accounts, and joint bank accounts, pass directly to beneficiaries outside of your will. It’s a common mistake to overlook these beneficiary designations when drafting a will. Ensure that your beneficiary designations are up-to-date and consistent with your overall estate plan to avoid conflicts or unintended distributions.

6. Not Considering Tax Implications

Failing to consider the tax implications of your estate can result in significant financial burdens for your heirs. Estate taxes can reduce the value of the assets your beneficiaries receive. It’s essential to work with a financial advisor or estate planner, such as those at NexGen, who can help you structure your estate in a tax-efficient manner.

7. Ignoring the Importance of a Residual Clause

A residual clause is a catch-all provision in your will that deals with any assets not specifically mentioned. Without a residual clause, any remaining assets will be distributed according to intestacy laws, which may not align with your wishes. Including a residual clause ensures that all of your assets are accounted for and distributed according to your instructions.

8. Not Clearly Defining Guardianship for Minor Children

If you have minor children, it’s critical to name a guardian in your will. Failing to do so can lead to a court deciding who will care for your children, which may not align with your wishes. Clearly defining guardianship in your will ensures that your children are cared for by someone you trust.

9. Failing to Communicate Your Wishes

Even the most well-drafted will can lead to disputes if your intentions are not clearly communicated to your loved ones. It’s important to have open conversations with your family about your wishes and the contents of your will. This can help prevent misunderstandings and reduce the likelihood of disputes after your passing.

10. Not Keeping Your Will in a Safe Place

A will is only effective if it can be found. Storing your will in a safe, accessible place is crucial. Inform your executor and a trusted family member or advisor about its location. Some people choose to store their will with their attorney or in a secure digital vault, which ensures that it can be accessed when needed.

Conclusion

Writing a will is a critical step in estate planning, but it's essential to avoid common mistakes that can undermine your intentions. By seeking professional guidance from experts like NexGen Estate Planners P Ltd. and understanding key concepts such as Will How to Write and "Double Power of Attorney," you can create a comprehensive estate plan that protects your assets and ensures your wishes are carried out.

Incorporating these best practices into your will-writing process will not only provide peace of mind for you but also ease the burden on your loved ones during what will undoubtedly be a challenging time.

0 notes

Text

How to Choose the Right Probate Solicitors London?

It is crucial to choose the right probate solicitors London for your power of attorney or other will documents. There are several complexities associated with administering the estate and clearing the legal aspects of a deceased person. A highly skilled and reliable probate solicitor can help ensure minimal hassles and maximum outcome.

Here are a few things to consider when choosing the probate solicitor for your legal aspects.

1. The first thing to understand before selecting the probate solicitor is understanding their role and duties in detail. You would be able to select the perfect solicitor when you know what to expect from them. They are the legal personnel with expertise in managing estate related duties. This specifically occurs when the person is question passes away. They would carry out the following responsibilities in this case

a. They will assist with the grant of probate and letters of admin applications. they are also responsible for managing the estate distribution as per the will. In certain cases, the family solicitors London will ensure that the will is applicable in sync with the rules of intestacy

b. They will ensure all debts and taxes are paid off before estate distribution to the beneficiaries. They will also handle the different probate processes in detail. When you choose someone with the right qualifications and experience, you can ensure they handle all the complexities with ease.

2. The next step is to understand the qualifications you must consider when hiring the solicitor. For instance, the UK solicitors must be registered with the solicitors regulation authority (SRA). This allows you to choose solicitors with the right professional and educational standards. Let’s look at the key qualifications you must consider when choosing the solicitor for estate distribution.

a. The first part is to know if they have received the requisite legal education and training. They should have a law degree or the legal practice course that works fit for the particular task. They should have undergone training along with the education

b. The probate solicitors London in general have a broad understanding of the legal aspects. However, you need someone who is an expert in probate and estate related maters. This specialization ensures they have the depth knowledge and experience. this would help you get the reliable services

c. Lastly, they should be accredited with the right professional bodies that showcase their commitment and reliability.

3. The third factor to consider would be the experience of the solicitor. The solicitor may encounter multiple issues and scenarios when they are handling your case. They should be well-versed with these situations and should know how to handle them. you should first check on the years of experience they have as a probate solicitor. This will help choose the right person for the job. Check their track record to know how effective they were in handling the probate cases. The size and complexity of the cases they have handled will determine if they have the capability. Moreover, you will need to study the case studies and testimonials to understand more about their ability. This will also give you a chance to check on the family solicitors London approach to estate management and distribution.

0 notes

Text

Why Probate Service London is Crucial?

Probate services in London play a crucial role in the administration of a deceased person’s estate. When someone passes away, their estate – including money, property, and possessions – needs to be distributed according to their will or, if there’s no will, by the rules of intestacy. This process can be complex, particularly in a bustling city like London, making Probate service London services invaluable. Probate services are essential for anyone who has been appointed as the executor of a will or is dealing with the estate of someone who died without a will (intestate).

Executors or next of kin often seek probate services to ensure that the estate is handled legally and efficiently. Even though it’s possible to manage probate independently, the process can be overwhelming due to legal jargon, the need to calculate and pay inheritance taxes, and the responsibility of distributing assets correctly. This is where probate services come in handy, providing professional guidance and handling the complicated aspects of estate administration.

Benefits of Probate Services in London

Probate services London offer expert advice tailored to the complex legal landscape in London. This ensures that the estate is administered in accordance with UK law, minimizing errors and delays.

Probate can be a time-consuming process. Professional probate services handle the bulk of the work, from valuing the estate to dealing with creditors and beneficiaries, allowing executors and families to focus on grieving and other personal matters.

Dealing with the death of a loved one is challenging enough without the added burden of navigating probate.

Probate services alleviate much of the stress by managing the intricate details of estate administration.

Ensuring accurate calculation and payment of inheritance tax is crucial. Probate services help prevent costly mistakes by ensuring that all financial aspects of the estate are handled correctly.

The Probate service London are invaluable for executors and families managing the estate of a deceased loved one. These services offer expert guidance, save time, reduce stress, and ensure financial accuracy, making the probate process smoother and more manageable.

0 notes

Text

Understanding Inheritance Dispute Lawyers: Protecting Your Rights in Complex Cases

Inheritance disputes can arise during one of the most challenging times in a person’s life—after the loss of a loved one. When emotions are high, and family relationships are strained, these disputes can quickly become contentious, involving significant legal and financial consequences. In such situations, the expertise of an inheritance dispute lawyer becomes invaluable.

What Is an Inheritance Dispute?

An inheritance dispute typically arises when there is disagreement over the distribution of a deceased person’s estate. These disputes can involve a range of issues, such as the validity of a will, the interpretation of the will’s terms, claims of undue influence, or disagreements over the rights of beneficiaries. Inheritance disputes can also occur when there is no will (intestacy), leading to conflicts over how the estate should be divided according to the law.

The Role of an Inheritance Dispute Lawyer

Inheritance dispute lawyers specialize in resolving conflicts related to the distribution of estates. Their role involves:

Assessing the Validity of Wills: One of the most common disputes arises over the validity of a will. Inheritance dispute lawyers can help determine whether the will was properly executed, whether the deceased had the mental capacity to make the will, or whether there was any undue influence or fraud involved.

Representing Beneficiaries and Executors: Lawyers provide representation to both beneficiaries who believe they have been unfairly treated and executors who are responsible for administering the estate. They offer legal advice, mediate disputes, and, if necessary, represent clients in court.

Challenging or Defending a Will: If you believe a will does not reflect the true intentions of the deceased, an inheritance dispute lawyer can help you challenge it. Conversely, if you are defending a will, a lawyer can help ensure that the deceased’s wishes are upheld.

Handling Claims of Undue Influence or Fraud: When a will is contested on grounds of undue influence or fraud, it is essential to have legal representation that can investigate these claims and present evidence to support your case.

Navigating Intestacy: If a loved one dies without a will, the estate is distributed according to intestacy laws. Disputes can arise over who is entitled to what, especially in blended families or when significant assets are involved. An inheritance dispute lawyer can help clarify rights and guide the process.

Common Causes of Inheritance Disputes

Inheritance disputes can stem from various sources, including:

Ambiguities in the Will: Vague or unclear language in a will can lead to different interpretations, resulting in disputes among beneficiaries.

Family Dynamics: Pre-existing tensions among family members can exacerbate conflicts during the distribution of an estate.

Exclusion of Beneficiaries: If a family member is unexpectedly excluded from a will, they may contest it, leading to legal battles.

Complex Estate Structures: Estates with multiple assets, trusts, or business interests can lead to disputes over valuation, management, and distribution.

Allegations of Undue Influence: Claims that someone exerted undue influence over the deceased to alter the will can lead to contentious disputes.

The Importance of Early Legal Intervention

Inheritance disputes can be emotionally draining and financially costly. Early intervention by an experienced inheritance dispute lawyer can help prevent the escalation of conflicts. By seeking legal advice as soon as a dispute arises, you can ensure that your rights are protected and that the matter is handled efficiently and fairly.

Resolving Inheritance Disputes: Mediation vs. Litigation

Not all inheritance disputes need to end up in court. In many cases, disputes can be resolved through mediation, where a neutral third party helps the involved parties reach a mutually agreeable solution. Mediation can be a less adversarial and more cost-effective way to resolve disputes.

However, if mediation fails or is not appropriate for your case, litigation may be necessary. An inheritance dispute lawyer can represent you in court, presenting your case and advocating for your interests.

Why Choose a Specialized Inheritance Dispute Lawyer?

Inheritance law is a complex and specialized area of law. Choosing a lawyer with specific expertise in inheritance disputes ensures that you have the knowledge and experience needed to navigate the legal system effectively. A specialized lawyer understands the nuances of inheritance law, can anticipate potential challenges, and is equipped to handle the complexities of your case.

Conclusion

Inheritance disputes are often fraught with emotional and financial complexities. Whether you are contesting a will, defending one, or navigating the intestacy process, having a skilled inheritance dispute lawyer by your side is crucial. They can provide the legal expertise and support needed to protect your rights and achieve a fair resolution.

If you find yourself involved in an inheritance dispute, don’t hesitate to seek professional legal advice. The sooner you involve an inheritance dispute lawyer, the better your chances of resolving the matter efficiently and preserving family relationships.

0 notes

Text

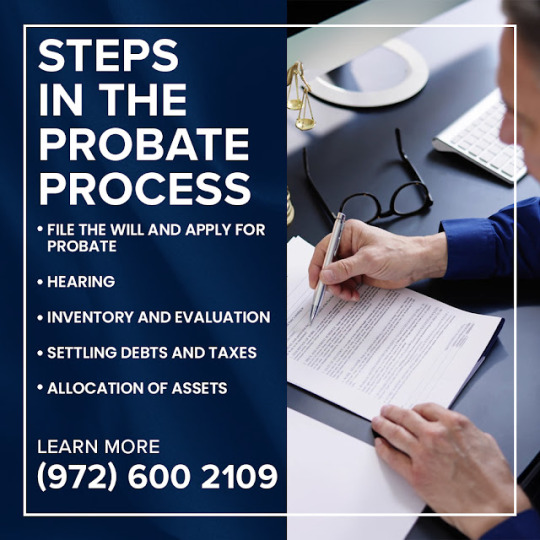

An Expert Overview Of Probate Proceedings in Texas

Ybarra Law Firm Introduces You To What Probate Lawyers Do During The Probate Process

Dealing with the probate process can be a daunting experience for many families dealing with the estate of a deceased loved one. Ybarra Law Firm, a premier legal practice in Irving, TX, is committed to demystifying the complexities of probate proceedings and offering expert guidance through each step of this intricate legal process.

What Is Probate?

Probate is the legal process by which a deceased person's estate is managed and distributed according to their will or Texas intestacy laws if no will exists. This process involves several critical steps, including validating the will, appointing an executor, settling debts, and distributing assets to beneficiaries. Ybarra Law Firm, known for its expertise in probate law, emphasizes the importance of understanding each phase of probate to ensure a smooth resolution.

Probate Lawyers and Their Role

The role of probate lawyers is crucial in managing the probate process efficiently. Dallas probate lawyers at Ybarra Law Firm offer comprehensive services to guide executors and administrators through the complexities of probate. Their responsibilities include preparing and filing necessary documents, resolving disputes, and managing estate affairs. With their extensive knowledge of Texas probate law, Ybarra Law Firm’s team ensures that every legal requirement is met and that the process is handled with professionalism and care.

Disputes in Probate

Probate proceedings can often be complicated by disputes, which may arise over issues such as the validity of a will, disagreements among beneficiaries, or allegations of executor misconduct. Ybarra Law Firm is well-equipped to handle these challenges, providing mediation and litigation services to protect their clients' interests. By addressing conflicts promptly and effectively, their Dallas probate attorneys strive to resolve disputes amicably and ensure that the probate process proceeds smoothly.

Steps in the Probate Process

The probate process in Texas involves several key steps:

1. File the Will and Apply for Probate: The initial step is to file the will and an application for probate with the court. This filing starts the legal process of validating the will and appointing an executor to manage the estate.

2. Hearing: A probate court hearing is scheduled to review the will and the application for probate. If the court approves, it issues Letters Testamentary or Letters of Administration, granting the executor legal authority to handle the estate.

3. Inventory and Evaluation: The executor must compile an inventory of the deceased’s assets and have them appraised to determine their fair market value. This step is essential for managing estate taxes, settling debts, and distributing assets.

4. Settling Debts and Taxes: The executor is responsible for notifying creditors, paying valid debts, and handling any applicable taxes. Proper management of these financial aspects is crucial to protect the estate’s assets.

5. Allocation of Assets: Finally, the remaining assets are distributed to beneficiaries according to the will or, if no will exists, according to Texas intestacy laws.

Ybarra Law Firm’s probate lawyers provide expert guidance throughout these steps, ensuring that each phase is completed efficiently and in accordance with Texas laws.

Expert Probate Lawyers in Dallas To Handle Your Legal Needs During The Probate Process

Probate proceedings can be a complex and emotionally taxing experience. Having skilled probate lawyers by your side can make a significant difference in how smoothly the process unfolds. Ybarra Law Firm is dedicated to offering top-notch legal support to clients in Dallas, TX. You can be sure to have a probate lawyer in Dallas there who will ensure that the probate process is handled with expertise and compassion.

For more information about navigating probate proceedings or to schedule a consultation with experienced and bilingual Dallas probate lawyers, contact Ybarra Law Firm at (972) 600-2109 or [email protected] for expert legal assistance tailored to your needs.

Contact Information:

Ybarra Law Firm

511 E John Carpenter Fwy Ste 500

Irving, TX 75062

United States

Original Source: https://ybarrafirm.com/probate/what-happens-during-the-probate-proceedings-in-texas/

0 notes

Video

youtube

Wills, Trusts, and Inheritance Tax: How to Keep More for Your Family

Don’t Risk Losing Everything!

In the UK, inheritance tax can take a significant portion of your estate, leaving less for your loved ones. However, with careful planning through wills and trusts, you can mitigate this burden.

For more expert advice on managing your finances, subscribe to Charles Kelly Money Tips Podcast on YouTube or email [email protected] to meet a specialist adviser.

Watch full YouTube interview: https://youtu.be/-SfqPiXPTbg

Creating a properly drafted will ensures your assets are distributed according to your wishes, potentially avoiding intestacy rules that might increase your tax liability. Including trusts in your estate planning is a powerful tool to protect your wealth. Trusts can help reduce inheritance tax by transferring assets out of your estate, placing them in the hands of trusted individuals for your beneficiaries.

Key strategies include the Nil-Rate Band Discretionary Trust, which allows you to pass on up to £325,000 tax-free, and gifting assets during your lifetime, which can also reduce the value of your estate if you survive for seven years after the gift.

It's essential to review and update your will regularly to reflect changes in your circumstances and tax laws. Proper estate planning with wills and trusts not only safeguards your legacy but also ensures your loved ones benefit from the maximum inheritance with minimal tax impact.

For more expert advice on managing your finances, subscribe to Charles Kelly Money Tips Podcast on YouTube or email [email protected] to meet a specialist adviser.

#InheritanceTax #WillsAndTrusts #EstatePlanning #TaxSavings #CharlesKellyMoneyTips #section24 #paylesstax #business #discretionarytrust #livingwill

0 notes

Text

Securing Your Family’s Future with Expert Estate Planning

Estate planning is a vital yet often overlooked aspect of financial security and family welfare. The process of ensuring that your assets are distributed according to your wishes, while minimizing taxes and avoiding legal complications, can seem overwhelming. However, with the right guidance, it becomes a manageable and even empowering journey. Charleswranson.com offers a dependable solution to navigating this complex landscape, ensuring your family’s future is secure and your legacy is preserved.

Understanding Estate Planning

Estate planning involves arranging the management and distribution of your estate in the event of your death or incapacitation. This process includes creating legal documents such as wills, trusts, and powers of attorney, which help determine how your assets will be distributed and who will be responsible for managing your affairs. The primary goals are to minimize estate taxes, avoid probate, and ensure your wishes are followed.

The Importance of Professional Guidance

Navigating the complexities of estate planning alone can be daunting. Laws and regulations surrounding estate planning can be intricate and vary by state, making professional advice crucial. Charles W. Ranson Consulting Group LLC provides expert estate planning services to help you make informed decisions. Their team of experienced advisors understands the nuances of estate planning laws and can guide you through the creation of a comprehensive plan tailored to your needs.

Key Components of Estate Planning

Wills: A will is a fundamental document in estate planning. It outlines how your assets should be distributed and appoints an executor to manage your estate. Without a will, your estate could be subject to intestacy laws, which may not align with your wishes.

Trusts: Trusts are legal entities that hold assets on behalf of beneficiaries. They can be used to manage your assets during your lifetime and distribute them after your death. Trusts can help avoid probate and provide greater control over how and when your assets are distributed.

Power of Attorney: This document designates someone to make financial and legal decisions on your behalf if you become incapacitated. It’s essential to choose someone trustworthy, as this person will have significant authority over your affairs.

Healthcare Directives: Also known as living wills or advance directives, these documents outline your wishes regarding medical treatment in case you are unable to communicate them yourself. They ensure that your healthcare preferences are respected.

Benefits of Estate Planning

Peace of Mind: Knowing that your affairs are in order and your loved ones will be taken care of provides significant peace of mind.

Minimized Estate Taxes: Effective estate planning strategies can help reduce the taxes levied on your estate, preserving more of your wealth for your beneficiaries.

Avoidance of Probate: Proper planning can help your estate avoid the lengthy and costly probate process, allowing for quicker and more efficient distribution of your assets.

Clear Wishes: Estate planning ensures that your assets are distributed according to your wishes, reducing the potential for family disputes.

Why Choose Charleswranson.com?

Charleswranson.com stands out as a trusted partner in the estate planning process. Their team is dedicated to providing personalized services that address your specific needs and goals. From the initial consultation to the final implementation of your estate plan, Charleswranson.com supports you every step of the way. Their expertise ensures that your estate plan is legally sound and effectively meets your objectives.

The Emotional Journey of Estate Planning

Estate planning is not just a financial exercise; it’s also an emotional journey. It involves considering your family’s future and making decisions that will impact their lives long after you’re gone. The professionals at Charles W. Ranson understand the sensitivity of this process and approach it with empathy and professionalism. They help guide you through this emotional journey, making the experience as smooth and reassuring as possible.

Planning for the future is a crucial aspect of ensuring your family's well-being and securing your legacy. With Charleswranson.com, you gain a reliable estate planning advisor who can help you navigate this complex process with confidence. Allow them to guide you through this important journey, ensuring your wishes are honored and your family’s future is protected. For more information, visit charleswranson.com and take the first step towards securing your family's future.

0 notes

Text

The Basics of Estate Planning: What You Need to Know

Estate planning is an essential process that ensures your assets are distributed according to your wishes after your death. It involves making decisions about how your wealth, property, and other assets will be managed and transferred, as well as who will be responsible for carrying out these decisions. Understanding the basics of estate planning and trusts can help you create a comprehensive plan that protects your legacy and provides for your loved ones.

What Is Estate Planning?

Estate planning is the process of organizing and managing your estate, which includes all your assets—such as real estate, investments, savings, personal property, and more—during your lifetime and after your death. The primary goal of estate planning is to ensure that your wishes are honored, your beneficiaries are protected, and your assets are transferred in the most efficient and tax-advantageous way possible.

An effective estate plan can help prevent disputes among your heirs, reduce estate taxes, and provide peace of mind knowing that your loved ones will be taken care of. It typically involves creating legal documents such as a will, trusts, powers of attorney, and healthcare directives.

The Importance of a Will

A will is a legal document that outlines how you want your assets to be distributed after your death. It also allows you to name an executor, the person responsible for carrying out the terms of your will, and to appoint guardians for any minor children. Without a will, your estate will be distributed according to your state's intestacy laws, which may not align with your wishes.

Creating a will is a fundamental step in estate planning. It provides clarity and direction, helping to avoid potential conflicts among your heirs. However, a will alone may not be sufficient, especially if you have significant assets or complex family dynamics.

Understanding Trusts in Estate Planning

Trusts are powerful tools in estate planning and can be used to manage and distribute your assets during your lifetime and after your death. A trust is a legal arrangement where one person (the trustee) holds and manages property for the benefit of another person (the beneficiary). Trusts offer several advantages, including privacy, asset protection, and potential tax benefits.

There are different types of trusts, each serving specific purposes:

Revocable Trusts: Also known as living trusts, these can be modified or revoked by the grantor (the person who creates the trust) during their lifetime. Upon the grantor’s death, the trust becomes irrevocable, and the assets are distributed according to the trust’s terms. Revocable trusts help avoid probate, the legal process of validating a will, which can be time-consuming and expensive.

Irrevocable Trusts: Once established, these trusts cannot be changed or revoked by the grantor. Irrevocable trusts are often used to reduce estate taxes and protect assets from creditors. Because the grantor no longer owns the assets in an irrevocable trust, they are not included in the grantor’s taxable estate.

Special Needs Trusts: These trusts are designed to provide for a loved one with disabilities without affecting their eligibility for government benefits. The trustee manages the assets in the trust, ensuring that the beneficiary’s needs are met while preserving their access to public assistance.

Charitable Trusts: Charitable trusts allow you to donate assets to a charity while also benefiting from tax deductions. These trusts can be structured to provide income to you or your heirs before the assets are transferred to the charity.

Powers of Attorney and Healthcare Directives

In addition to wills and trusts, estate planning often involves setting up powers of attorney and healthcare directives. A power of attorney allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated. A healthcare directive, or living will, outlines your wishes for medical treatment if you are unable to communicate your decisions.

These documents are crucial in ensuring that your affairs are managed according to your preferences, even if you cannot oversee them yourself.

The Role of an Estate Planning Attorney

An experienced estate planning attorney can help you navigate the complexities of estate planning and trusts. They can advise you on the best strategies to protect your assets, minimize taxes, and ensure that your wishes are carried out. An attorney can also help you keep your estate plan up to date, reflecting changes in your family situation, financial circumstances, or the law.

Conclusion

Estate planning and trusts are vital components of ensuring that your assets are managed and distributed according to your wishes. By creating a will, establishing trusts, and setting up powers of attorney and healthcare directives, you can protect your loved ones and preserve your legacy. With careful planning and the guidance of an experienced attorney, you can create a comprehensive estate plan that provides peace of mind for you and your family.

0 notes